Abstract

Much of the existing research on PhD entrepreneurship is focused on Academic Spin-Offs (ASOs) within the parent institution’s formal intellectual property (IP) structure. Cross-level analysis of a survey administered to 23,500 PhD students in Italy shows the heterogeneity of PhD students’ entrepreneurial activities, which, in addition to ASOs, include start-ups, corporate spin-offs and other types of businesses. We examine the types of drivers that matter most for different forms of PhD entrepreneurial ventures. Our findings reveal two forces at play: a technology-push model where PhD students rely on IP and support from the parent university, and a demand-led model that involves support from industry and sources of external finance. This study highlights the strategic alignment among the determinants of PhD entrepreneurship at the micro, meso and macro levels. These determinants include the individual PhD student’s choices, the interactions with different stakeholders and reconciliation of the tensions represented by the organizational and institutional resources and infrastructures.

Plain English Summary

PhD students’ entrepreneurial activities are widespread and diverse. There is no single set of recommended models related to embarking on entrepreneurial activity. While it is often assumed that PhD students will become university academics or researchers in public or private institutions, entrepreneurship is prominent among PhDs and exhibits different characteristics. This paper explores the heterogeneity of PhD students' entrepreneurial pursuits in Italy based on extensive survey data. The findings reveal that the various types of PhD entrepreneurship exhibit distinct motivations, resources needs and university and business links. Consequently, there is no one-size-fits-all approach for potential entrepreneurs interested in launching an academic spin-offs, start-ups, or corporate spin-offs. The key finding from this study is that support for PhD entrepreneurial activity must be customized to the specific needs of the particular venture and the PhD student’s characteristics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper examines new firm formation activity by PhD students as they transit from academia to the entrepreneurial business world. PhD entrepreneurship is a particular phenomenon whose peculiarity has mostly been overlooked by the literature. However, since 2010, the global academic labour market has changed and doctoral graduates are finding it increasingly difficult to secure a position in academia (Roach & Sauermann, 2010). Research on the characteristics of, drivers of and obstacles to PhD students’ start-up activities is limited and better knowledge about this phenomenon would be informative for the design of appropriate support mechanisms and initiatives to encourage students’ entrepreneurial activities (Muscio & Ramaciotti, 2019). Arguably, PhD entrepreneurship is one of the main ways to achieve commercialization of academic inventions and promote further innovation. Compared to tenured academic staff, PhD students are generally younger, more risk-prone and more motivated to become an entrepreneur. PhD entrepreneurship is more likely than other forms of entrepreneurship to result in a knowledge-based business start-up and to generate high-skilled job positions that regenerate regional economic structures and reinforce the pivotal role of the university in the regional innovation system (Etzkowitz, 2017; Philpott et al., 2011).

PhD students have access to university research resources, research commercialization channels and training and support, all of which help to develop business competence and enable participation in entrepreneurial networks during the doctoral study period (Battaglia et al., 2022; Bienkowska & Klofsten, 2012; Hahn et al., 2017; Roach & Sauermann, 2010; Treanor et al., 2021). PhD students benefit from formal links based on Intellectual Property (IP) and/or more informal and interpersonal relationships with supervisors and other academic researchers, availability of research/office spaces and other facilities and participation in various networks. Links to the parent university can enable access to ‘unique technological knowledge’ not otherwise easily available, but which might be an important basis for the development and commercialization of technological innovations (Bolzani et al., 2020). The nature of and conditions surrounding PhD students’ entrepreneurial activities and the relationship between a new venture and the parent university will have an effect on the type of venture and the processes and outcomes involved. Nevertheless, empirical analyses of the factors associated with the doctoral student’s decision about the form of entrepreneurship are scarce.

New firm creation by universities is a particular phenomenon (Fryges & Wright, 2014). A rather narrow definition of academic entrepreneurship is a firm that exploits university IP or patented inventions generated by university research (Di Gregorio & Shane, 2003a, 2003b). However, there is a large share of university venture creation that does not involve formal disclosure of IP to the parent university (Fini et al., 2010; Aldridge & Audretsch, 2011). New firm creation can be defined as Academic Spin-Offs (ASOs) and Start-Ups (SUPs). In both cases, the new venture might be founded by an individual who is a (former) university employee or is a university student (see Djokovic & Souitaris, 2008). ASOs have been defined further as ‘new ventures based on university-developed knowledge, either founded by academics or with an equity participation of the parent university, or both’ (Bolzani et al., 2021, p. 591). SUP are more likely to have financial and other links with an external organization. A third type of new business is Corporate Spin-Offs (CSO) which involve university students and university staff. According to Parhankangas and Arenius (2003, p. 464) a CSO is a ‘new business formation based on the business ideas developed within the parent firm being taken into a self-standing firm’. CSOs are likely to benefit from relations with the parent firm, which might have implications for the firm’s growth (Bruneel et al., 2013; Fryges & Wright, 2014). The final type of firm creation, which we describe as ‘Other’, has involvement of self-employed students and staff, including professionals such as consultants, architects or lawyers. While ASOs have attracted public policy attention in several countries, these other types of firm formation (SUP, CSO, Other), which are outside the formal university IP system have been rather overlooked (c.f., Fini et al., 2010), with the result that the motivations and drivers linked to these forms of entrepreneurial firms have been rarely investigated.

Muscio & Ramaciotti (2019) describe PhD entrepreneurship activity as heterogenous. For instance, PhD students may create start-ups that provide independent professional services (e.g., independent legal or engineering consultancy). However, most of the empirical literature on PhD entrepreneurship focuses on ASOs, which are based on university IP and are seemingly becoming much more frequent in Italy (Bolzani et al., 2014). This is partly because students’ entrepreneurial activity is often not recorded by the university because unlike ventures created by university faculty, it is not based on university IP. This paper tries to fill a gap in the literature by investigation the different forms of PhD entrepreneurship and their rationales and environment. Following Sandberg and Alvesson (2011), we adopt a ‘gap-spotting’ approach to the formulation of our research question. In the context of PhD entrepreneurship heterogeneity, we identify a research gap in relation to the levels at which university entrepreneurship activities take place (Audretsch & Belitski, 2022; Cunningham et al., 2019; Hayter et al., 2018; O’Kane et al., 2021). That is, we study the macro-institutional, meso-organizational and micro-individual levels. As Hayter et al. (2018) note, research on academic entrepreneurship has yet to make the ‘vertical connection’ between micro- and macro-level phenomena from an ecosystem perspective. Studying the differences in the forms of PhD entrepreneurship activity addresses this gap in our knowledge. We start by analysing the characteristics of different forms of PhD entrepreneurial ventures (i.e., ASOs, SUPs, CSOs, and Other) and their respective drivers and determinants. We then explore the nature of the strategic alignment of the three levels of factors potentially associated to university entrepreneurship: the micro—individual level (skills and competences); the meso—organizational level (infrastructure, resources and processes) and the macro – institutional level.

Support for the creation of knowledge intensive firms (in which PhD play a role) is a major focus for the public administrations in many countries (Ramaciotti et al., 2016). In addition, many universities have tried to adapt PhD programmes to respond to shifting societal expectations and to facilitate new venture creation by both staff and students (Battaglia et al., 2022; Bienkowska et al., 2016; Boh et al., 2016; Klofsten et al., 2021). However, we need to know more about: a) what types of institutional, organizational and individual level support s would foster PhD firm formation; and b) how support mechanisms could translate PhD students’ entrepreneurial activities into new ventures. We need more information on the types of macro-institutional, meso-organizational and micro-individual factors that determine different types of PhD entrepreneurial firm creation.

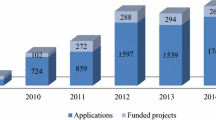

We conduct an empirical analysis of PhD entrepreneurship in Italy where the ASO formation has increased significantly since the 1990s (Fini et al., 2009), following the introduction of a new regulatory framework focused specifically on supporting scientific and technological research, knowledge transfer and researcher mobility (Law 297/1999 and Ministerial Decree 593/2000) (Civera et al., 2020). The case of Italy is relevant also because of the changing nature of its scientific labour market. In the past, most doctoral graduates were interested in a career in academia (Roach & Sauermann, 2017). The literature on PhD employment outcomes shows that this is a declining phenomenon (Conti & Visentin, 2015) and the current preference is for more diversified career options (Muscio & Shibayama, 2023). Some of this preference is based on necessity, some is based on the opportunities available to entrepreneurial and highly skilled researchers (Civera et al., 2020; Rizzo, 2015a, 2015b; Horta, et al., 2016; Meoli et al., 2018).

This research contributes to both theory and practice. First, in recognizing the interrelated nature of ‘strategic alignment’ at three levels (Audretsch & Belitski, 2022), it adds to theoretical work on university entrepreneurship. Second, our empirical investigation of the range of typologies and contexts of PhD student entrepreneurial endeavours should be informative for policy and management about how to exploit the potential provided by the ‘entrepreneurial university’ to improve the economy and increase the number of doctoral graduates who found knowledge intensive firms. Third, our examination of PhD entrepreneurship extends the academic entrepreneurship literature by identifying the different paths towards university-based venture creation.

2 Literature review

2.1 Different forms of university entrepreneurship and three levels of entrepreneurship

Work on the drivers and determinants of academic engagement and entrepreneurial activities at the macro-institutional, meso-organizational and micro-individual levels is increasing (Cunningham et al., 2019; Cunningham & O’Reilly, 2018; Geuna & Muscio, 2009; Abreu et al., 2016; Hayter et al., 2017; Hayter et al., 2018; Markman et al., 2008; Meissner et al., 2022; Muscio et al., 2022; Perkmann et al., 2013; Rasmussen et al., 2014). The stream of work on the ‘entrepreneurial university’ has grown (Rothaermel et al., 2007) and the idea of the entrepreneurial university includes both the production of scientific knowledge and the development of human capital and, also, broader socio-economic development (Cunningham et al., 2019; Guerrero et al., 2015; Klofsten et al., 2019: Miller et al., 2018). Concepts such as the triple helix model (Etzkowitz et al., 2000) and the university entrepreneurial ecosystem (Miller & Acs, 2017; Prokop, 2021; Prokop & Kitagawa, 2022; Wright et al., 2017) highlight the nature and diversity of the interactions between universities and their external environment.

Audretsch and Belitski’s (2022) ‘strategic alignment’ model of the entrepreneurial university distinguishes three influences on university entrepreneurship. First, at the macro level, the external institutional environment includes policy, regulatory and legal frameworks conducive to academic entrepreneurship (Audretsch & Link, 2012; Audretsch & Belitski, 2022; Fini et al., 2011). Second, at the meso organizational level, work on entrepreneurial university considers their organizational characteristics and sees universities as engines of regional and national economic growth and social development (Audretsch, 2014; Bergmann et al., 2018; Etzkowitz et al., 2000; Guerrero & Urbano, 2019; Guerrero et al., 2016). Third, at the micro level, the model includes the factors influencing individual choices, such as individual characteristics, experience and skills. It has been shown that the student’s or researcher’s characteristics (e.g., demographic characteristics) have a major influence on their attitude and their decision to engage in commercial and entrepreneurial activities (Haeussler and Colyvas, 2011; Meoli et al., 2020).

We investigate the strategic alignment among the cross-level interactions between factors influencing an individual’s choices of logic (Hayter, 2015; Rizzo, 2015a, 2015b) and the mechanisms and structures involved in the organizational architecture and university management (Bergmann et al., 2018; Cunningham et al., 2022). We consider the underlying macro institutional environment, which includes the policy environment and the regulatory and legal frameworks (Bercovitz and Feldman, 2006). We apply the three levels of strategic alignment model to our review of the relevant literature. First, we identify the macro-level determinants of university entrepreneurship. Second, we focus on the meso-level factors and highlight the linkages between entrepreneurial activity and the characteristics of the entrepreneurial university. Third, we focus on micro-level determinants, that is, the individual PhD student’s characteristics as, motivations and funding sources and the dynamics of career formation through PhD entrepreneurship. Based on the literature, we formulate and empirically test a set of hypotheses related to different forms of PhD entrepreneurship related to the three levels of determinants.

2.2 Macro-level: Institutional conditions and external environment

The academic entrepreneurship literature suggests that the underlying macro institutional environment, including the policy, regulatory and legal frameworks affect university venture formation.

2.2.1 Institutional conditions

Business start-up activity is influenced by the socio-economic context (Audretsch & Lehmann, 2005; Civera et al., 2020; Clarysse et al., 2005). As Agostino and colleagues (2020, p. 185) put it: ‘The idea that historical, cultural and institutional factors may play a decisive role in conditioning and steering the economic success or decline of countries, regions and individual firms, has been extensively considered by the literature, from both the general perspective of economic development […] and that of entrepreneurship and new business creation’.

There is a strand of work that focuses on the strength of formal institutions for shaping the incentives for business creation. It describes the contextual and firm level barriers to and the constraints related to new business formation (e.g., Colombo & Piva, 2012; Klapper et al., 2006). Both the academic community and policy makers have investigated the impact of local conditions on economic activity and there is a well-established debate over the regional level institutional factors that influence entrepreneurial activities. A favourable business environment is important for business creation and academic entrepreneurship (Friedman & Silberman, 2003). O’Shea et al. (2005) contend that the regional knowledge infrastructure and industry composition play a crucial role in spinoff activity. Feldman and Desrochers (2004) suggest that universities in environments with a weak entrepreneurial infrastructure find it more difficult to achieve academic spinoffs. Baldini (2010) suggested that a favourable economic environment is correlated positively to university spinoff activity and, also, that the spinoff process benefits more from high levels of regional innovation than from the activities of the parent university. Along similar lines, Di Gregorio and Shane (2003a, 2003b) argue that universities in regions with abundant sources of venture capital are more likely to generate spinoffs due to easier access to finance.

The Institutional Quality Index (IQI)Footnote 1 provides an analytical framework that includes synthetic indicators for institutional quality. Nifo and Vecchione (2014) assess the size of the impact of institutions on a range of socio-economic issues such as migration and entrepreneurship. The IQI builds on the World Governance Indicators (WGI), proposed by Kaufmann et al. (2010).Footnote 2 Agostino et al. (2020) employ the IQI to examine the impact of regulatory quality on business creation in Italy, based on degree of openness of the economy, business environment and ability of local administrators to promote and protect business activity. They find that local institutional quality positively affects entry rates, but, in times of economic crises, its impact on business creation loses importance.

2.2.2 Patenting

Academic entrepreneurship involves questions about the ownership of the IP derived from publicly funded university research. For instance, should the university be the patent owner, or should the patent belong to the individual inventor? Tangible forms of technology transfer, such as patents and licenses, have increased since the 1980s and research has focused more on the institutional dimensions of the transfer of knowledge and technology from universities (Bercovitz and Feldman, 2006; Grimaldi et al., 2011; Rothaermel et al., 2007). Institutional changes create tensions between ‘facilitating the diffusion of new knowledge as a public good and controlling its private ownership and value’ (Ambos et al., 2008, p. 1426).

The macro determinants of entrepreneurship activity include the institutional structure and policies related to patenting and licensing, including ‘reward systems, entrepreneurial/academic culture, IP policies’ (Moray & Clarysse, 2005, p. 1012). Innovation policies and their impact on the dynamics and diffusion of innovation were highlighted by the implementation of the US Bayh-Dole Act in 1980 (Mowery and Sampat, 2005; Van Looy et al., 2004). Bradley et al. (2013) point to the emergence of a patent-centric, linear model of technology transfer in most US research universities. However, OECD (2003) suggests that adoption of a Bayh–Dole-type law in Europe would not be sufficient for similarly successful research commercialization. Lissoni et al. (2008) show that the majority of university-based patented inventions in France, Italy and Sweden are assigned to private firms, while in the US, 69% of university-based inventions are assigned to the relevant university. Baldini (2009) and Baldini et al., (2006) discuss the obstacles to university patenting activity in Italy, where the so-called professor’s privilege law was introduced in 2001, goes against international trends. Professor’s privilege in Italy applies only to academic staff not PhD students or post-docs (Mandell, 2022). In July 2023, the professor’s privilege law was abolished in favour of university ownership of IP rights in Italy.

Most common formal arrangements between an ASO and the parent university are related to the university’s IP system. Universities are aware of ASO creation since it explicitly involves university IP and financial involvement. Some universities offer additional, informal support, such as technical know-how, office and lab space, access to industry networks and access to finance (Bolzani et al., 2021) and, especially, in the case of new ventures founded by academics who choose to remain university employees.

At the same time, some authors point to the importance of entrepreneurial activities that are outside the formal university IP system (Calvo et al., 2013; Fini et al., 2010; Martinelli et al., 2008). PhD students’ venture creation takes different forms and does not necessarily involve the parent university. Since universities have no formal involvement in the creation of SUPs, CSOs or Other types of ventures, few studies focus on these types of ventures. Despite these other types being more frequent than ASOs, the investigation of these forms of ventures has been under-represented as the parent university tends not to hold any record, and most information on them comes from surveys (see Fini et al., 2010). Some PhD student start-ups are based on technology owned by a corporate partner, which can result in a CSO not linked to the parent university. The absence of studies of this type of entrepreneurial venture in the scientific literature overlooks a very important part of the contribution of universities to local development. An exception in this context is Bonaccorsi et al. (2014) which investigates the impact of local and external university knowledge on the creation of knowledge intensive firms in Italy, including ASOs, SUPs and CSOs.

2.3 Meso-level: Organizational resources and architecture of the entrepreneurial university

2.3.1 Organizational structure for research commercialization and entrepreneurship

Many universities are developing structures focused on the commercialization of research (Muscio et al., 2016). University policies can influence creation of ASOs (Caldera and Debande, 2010; Markman et al., 2005; Meoli & Vismara, 2016; Muscio et al., 2016) and SUPs, by academics and students (Boh, et al., 2016; Muscio & Ramaciotti, 2019).

There seem to be two clear organizational trends at the university level. First, universities are seeking to increase their licensing revenue through technology transfer activities and many have established Technology Transfer Offices (TTOs) (Siegel et al., 2003). While the contribution of TTOs to academic entrepreneurial activity has been questioned (Clarysse et al., 2011; Muscio, 2010; Horner et al., 2019; O’Kane et al., 2021), it is generally acknowledged that, depending on their size and experience, TTOs have a positive influence on ASO activity (Powers & McDougall, 2005). Second, many universities are creating incubators to assist faculty members and students to start new firms (Breznitz & Zhang, 2019). University incubators provide business opportunities in relation to university research with commercial potential (see Markman et al., 2005).

Student start-ups are attracting more scholarly attention and universities are beginning to invest in supportive entrepreneurship environments and activities (Boh et al., 2016; Breznitz & Zhang, 2019; Duruflé et al., 2018; Hayter et al., 2017; Marzocchi et al., 2019; Mason et al., 2013; Radko et al., 2023; Wright et al., 2017). Alongside tangible organizational units, such as incubators and TTOs, the wider university ecosystem can provide a ‘supportive organizational culture’ to encourage entrepreneurial activity by both staff and students (Djokovic & Souitaris, 2008, p. 238), provide resources and enhance the competencies of faculty and students interested in commercializing university technology (Boh et al., 2016).

Incubators and accelerators support the development and growth of new ventures including those on university campuses (Cunningham et al., 2022; Miller & Acs, 2017). The impact of incubation strategies at the organizational level has been discussed (Clarysse et al., 2005; Pettersen et al., 2015). Also, the combination and alignment of entrepreneurial support across different organizations, including government agencies, incubators/accelerators and universities, are crucial for the establishment of high-technology firms (Breznitz & Zhang, 2021). This highlights the importance of appropriate university policies and the alignment with local conditions and stakeholders or ‘co-production of business assistance’ in incubators (Rice, 2002, p. 170). McAdam et al. (2016) describe ‘university incubation’ as crucial for regional economic growth. University incubators are central to wider university commercialization processes involving academic staff, TTOs, funders, policy maker and business founders (McAdam et al., 2016).

2.4 Micro-level: Individual incentives for university entrepreneurship –PhD students’ new firm formation as career paths

For PhD students, understanding different paths to commercialization of their PhD research is essential for their career choice (Roach & Sauermann, 2010). Studies show that individual academic entrepreneurs’ motivations and growth ambitions (Hayter, 2015) and access to funding and resources (Wright et al., 2004) are critical success factors for academic entrepreneurial activities.

2.4.1 Career intentions

The individual choice to undertake doctoral studies and then to start a new venture during the PhD course, may be intrinsically linked. New venture creation can provide the doctoral student with opportunities to pursue a career as an entrepreneur (Meoli & Vismara, 2016; Muscio et al., 2022). During their university studies, PhD students can work on the initial stages of the business creation without incurring the opportunity costs related to a paid job; this makes it easier to assess whether it will be worth working in the venture full-time after graduation (Boh et al., 2016).

Academic entrepreneurial activity has different motivations. Meoli & Vismara (2016), show that, if the university provides inadequate support, academics will choose to start a new firm in preference to other means of commercialization activities. The type of academic entrepreneurship activity chosen reflects the tensions arising from scarce resources. Horta et al. (2016) show that the creation of high-tech ventures is a response to ‘skilled unemployment’ in the surrounding region, implying a form of necessity-driven academic entrepreneurship (Civera et al., 2020; Rizzo, 2015a, 2015b).

Muscio et al. (2022) identified different types of PhD start-ups, based on the connection to the university labs and the employment status of the PhD graduates. They argue that PhD students mitigate the risks and reconcile the tensions between academia and the entrepreneurial world, by maintaining their university employment. This reduces the risks involved in entrepreneurial activity. In the case of ASOs, for instance, PhD students may contribute their technical expertise related to relatively fundamental scientific problems and work on research within a spinoff context that is similar to their academic research context. It has been shown, also, that the primary contribution of graduate students to ASO formation is their role as ‘catalysts’ and ability to convince faculty members to establish a spinoff company and contribute their time and leadership skills as co-founders or CEOs (Hayter et al., 2017).

Socialization, notably during their PhD training, plays a role in influencing academics to become entrepreneurs (Stuart & Ding, 2006; Bercovitz and Feldman, 2008). As they become immersed in a new commercial context with its own priorities and norms (Fini et al., 2022), PhD students may feel less compelled to conform to academic imperatives (Mangematin, 2000). It has been suggested, also, that PhD students who plan to get a job in the private sector tend to adhere to private sector recruitment criteria rather than academic norms (e.g., scientific publication) (Mangematin, 2000; Roach & Sauermann, 2010).

2.4.2 Sources of research funding

PhD students with different career intentions may have different sources of funding for their PhD programme. PhD funding and its sources can influence the doctoral student’s professional plans and outcomes (Horta et al., 2018; Mangematin, 2000). As Horta et al., (2018, p. 545) argue, even the award of PhD funding can work as a ‘credential that signals to future employers what doctoral students may achieve after concluding their doctoral studies’. Doctoral graduates are more likely to benefit from research funding from private organizations and the impact of the funding can stimulate other career pathways (Horta et al., 2018; Marini, 2022). The main sources of funding for doctoral students in Italy are doctoral grants from the national or regional government and research project grants funded by private organizations.Footnote 3 In the Italian context, Marini (2022) shows that entrepreneurial behaviour is the predominant route for diversified PhD career pathways.

The effect of different sources of research funding on the types of industry engagement and research commercialization at the university level have been investigated extensively (e.g., Geuna, 2001; Gulbrandsen & Smeby, 2005; Nilsson et al., 2010; Perkmann et al., 2013). Some (Di Gregorio & Shane, 2003a, 2003b; Muscio et al., 2016; Van Looy et al., 2011) suggest that privately funded research as opposed to government funded research is more likely to have commercial orientation. The governments in many countries encourage private financing and investment in university research (Becker, 2015). Some studies suggest that university public funding supports ASO creation. Ramaciotti and Rizzo (2015, p. 507) found that, in Italy, the number of ASOs generated by a university was ‘positively and significantly influenced by the amount of public income received’, while income from industry ‘does not play a significant role’). Muscio et al. (2013) argued that public funding influences the university’s propensity to create ASOs, due to its complementarity with commercial and technology transfer activities and significant government efforts to promote the commercialization of academic research. Similarly, Malo (2009) shows that publicly funded research leads to the creation of new firms. Public support for university research may act as an incentive for private investors to co-invest in ventures originating from university research.

Constraints on academic funding fundamentally shape the individual scientist’s motivation to become an entrepreneur. At the individual level, as noted by Rizzo (2015a, 2015b), scientists’ access to external resources, especially from the private sector, has a major influence on the decision to start a business. Festel (2012) also provides evidence that, in many cases, ASOs are established with the specific purpose of attracting external funding from investors. These results are confirmed by Castillo Holley and Watson (2017, p. 54), whose survey on 30 life sciences academics found that ‘all interviewees mentioned funding needs as the primary driver of research commercialization; with institutional policies being the second major driver’. Given these findings on the impact of research funding at the university and individual levels, we next investigate the outcomes of research funding at the individual PhD student level.

2.5 Strategic alignment of entrepreneurial drivers and forms of PhD entrepreneurial ventures

Our aim in this paper is to gain a better understanding of the drivers of different forms of PhD student entrepreneurial ventures and to identify possible ‘strategic alignment’ (Audretsch & Belitski, 2022) across the macro-institutional, meso-organizational and micro-individual level of the determinants associated with university entrepreneurship (Cunningham et al., 2019; O’Kane et al., 2021).

At the macro-institutional level, PhD students are likely to face tensions between the realms of open science and proprietary technology (Dasgupta & David, 1994). It has been shown that academics who engage in patenting and firm creation activity based on their research, must reconcile their different s incentive systems and social structures as they move from the publicly funded research to industry research (Balconi et al., 2004). It has been shown that academic entrepreneurs tend to publish rather than patent their research outcomes and there seems to be no evidence of a trade-off between academic spin-offs and patenting activity (Link & Ruhm, 2011). The ambidextrous nature (Ambos et al., 2008) and the tensions within the entrepreneurial university create pressure to respond to different academic and commercial demands and is more salient at the individual than at the organizational level.

At the macro-institutional level, we discussed regulatory frameworks and institutional factors as drivers of academic entrepreneurship. In general, patenting is fundamental for startup survival and growth (Krabel & Mueller, 2009; Muscio et al., 2016; Stuart & Ding, 2006; Van Looy et al., 2011) since venture creation involves exploitation of a specific invention (D’Este et al., 2012). While patenting can be seen as evidence of technological advancements, university patenting can be considered as driving the commercialization of academic knowledge (Baldini et al., 2007) and a signal to private investors of high-growth opportunities (Zhang et al., 2019).

According to the literature (Agostino et al., 2020), the business environment available to new entrepreneurs is significant for business creation and, especially, those types of business activities that do not benefit directly from university support (c.f. ASOs). However, it should be noted that PhD entrepreneurship is a special case. According to Muscio and Ramaciotti (2019), since PhD students are usually younger and less risk averse than tenured academics, they might be more motivated than academic staff to start an entrepreneurial venture, regardless of the local economic and business conditions. In fact, compared to other forms of entrepreneurship, PhD entrepreneurship is more likely to result in knowledge-intensive start-ups and creation of high-skilled jobs, which contribute to the regeneration of the regional economic context, further legitimating the role of the university in the regional system.

Among the meso-organizational factors affecting universities and likely to affect venture creation, survival and growth are the organizational architecture including incubators and TTOs. PhD students who form ASOs are more likely to face institutional tensions between the public and private nature of their research. In this context, PhD students who engage in patenting and firm creation activity at the university must reconcile the different incentive systems and social structures as they engage in the publicly funded academic research (Kitagawa, 2014; Mangematin, 2000; Roach & Sauermann, 2010; Stephan et al., 2007; Thune, 2009).

ASO founders can count on better relationships with the parent institution, through formal and informal relationships and support, for example, via the TTO, which SUP and other non-university forms of venture founders may not benefit from. Calvo et al. (2013) compare ASO founders and founders of start-ups with no links to the university. They found that ASO founders are younger with less experiences, but they are more technologically specialized with higher level of involvement with their venture firm, than the founders of non-university ventures. It might be expected that SUPs, CSOs and Other types of PhD entrepreneurial ventures are linked more closely to businesses or private labs and incubators, and they are driven more by a problem-solving (demand-driven) and market-oriented approach.

At the micro-level, we can expect individual characteristics, such as the student’s capacity to attract funding or her/his employment conditions, to influence the choice among different types of business creation opportunities. We would expect those PhD students with a job in academia will want to maintain this position and will likely opt to establish an ASO. Those students with no academic job will be more likely to choose business-driven types of venture creation that do not involve academic institutions.

As discussed above, recent studies (Horta et al., 2018; Marini, 2022; Muscio & Shibayama, 2023) examine how different types of funding during the PhD programme affect the PhD student’s career choice. We can expect that PhD students who receive public funding may be more incentivized to pursue an ASOs. Also, we would expect those PhD students who received industry funding and have industry research collaboration experience (e.g., consultancy, contract research) will be more inclined to pursue a SUP, CSO or Other form of venture opportunities.

Building on the literature review, we propose the following hypotheses about the different levels of determinants influencing PhD entrepreneurship and the variety of forms of PhD venture firms.

In terms of the macro-institutional incentive mechanisms related to the micro-individual level of PhD entrepreneurship, we hypothesize that:

-

Hypothesis 1a (H1a): Patenting is more likely to be associated to the student’s opportunity to establish a ASOs.

-

Hypothesis 1b (H1b): The student’s access to the regional business environment is likely to promote all types of entrepreneurship activity.

We hypothesize about the meso-level influence of the university’s organizational support mechanisms for forms of PhD ventures:

-

Hypothesis 2a (H2a): TTO support is likely to encourage doctoral students to pursue ASOs.

-

Hypothesis 2b (H2b): Access to private labs is likely to promote non-ASO venture creation, in particular.

In terms of the micro-level individual agencies of PhD entrepreneurs, we hypothesize that:

-

Hypothesis 3a (H3a): PhD students establishing ASOs moderate the risk of starting up a business by opting for a hybrid career trajectory based on retaining their university employment.

-

Hypothesis 3b (H3b): Doctoral students who receive public funding are more likely to pursue ASO opportunities.

-

Hypothesis 3c (H3c): Doctoral students who receive private funding are more likely to pursue non-ASO venture creation with the involvement of private stakeholders.

3 Study methodology and context

3.1 Study context

In Italy, creation of ASOs and SUPs has increased significantly since the 1990s (Fini et al. 2009), following the introduction of a regulatory framework focused on supporting scientific and technological research knowledge transfer and researcher mobility (Law 297/1999 and Ministerial Decree 593/2000) (Meoli & Vismara, 2016). Since 2010, spin-off activity by academics in Italy has increased and most academic institutions have policies related to the regulation of academic entrepreneurship practices. However, little policy attention has been paid to PhD entrepreneurship (Muscio et al., 2016, 2022). Universities are required to provide documentation of their technology transfer activities and, typically, report its content on their websites, where they list their academic spin-offs and activities, such as patenting and licensing. Despite the benefit derived from an academic affiliation and access to university resources, ASOs are less successful than other types of new ventures (Meoli & Vismara, 2016).

3.2 Methodology and data

We build on previous work (Muscio & Ramaciotti, 2019; Muscio et al., 2022; Muscio & Shibayama, 2023) and investigate PhD start-ups in Italy, using original data derived from the responses to a questionnaire survey administered in 2014–2015, that included doctoral students and graduates in all scientific-disciplinary fields (in Italian Settore Scientifico Disciplinare—SSD)Footnote 4 who were awarded a doctoral degree by an Italian academic institution in the period 2008–2014. The authors supervised the administration of the survey, which was conducted by the Italian consortium of universities, research institutions and the Ministry of University and Research (MUR) (CINECA). The survey was administered to 23,500 students, corresponding to 50% of the total population of PhD candidates in the years 2008–2014. Survey responses were cleaned and anonymized by the Italian National Institute of Statistics (ISTAT). We received 11,908 completed questionnaires and after further cleaning, obtained a final sample of 9,286 responses, a 39% response rate. We compared the distribution of responses by SSD with a survey of the PhD population carried out by ISTATFootnote 5; the difference between the 2008 and 2010 cohorts and our sample in each SSD was always below the 5% threshold, demonstrating good data representativeness.

The survey questionnaire asked about the PhD course, the parent institution, the student’s occupational status and the student’s entrepreneurial activity. It also asked for information on family background and personal characteristics. Additional information on the university attended and its research rating was extracted from MUR databases.

4 Results

Almost half (45%) of responses were collected from students enrolled in mega universities (> 40,000 students); 41% were from a large university (15,000–40,000), and 14% were from small and medium-sized universities. Table 1 presents summary information on PhD entrepreneurial activity in Italy; 7.7% of students had started a business (SUP), mostly in the area of social sciences and humanities. ASOs were the most common business type (57.3% of cases). However, ASOs tend to be more common in life sciences and hard sciences due to their reliance on university IP.

To analyze PhD entrepreneurship and the role played by the institutional, organizational, and individual factors, we designed the following model:

where subscript \(i\) is the student, j is the university where student \(i\) completed his/her PhD degree, \(s\) is the student’s SSD and \(t\) is PhD graduation year.

The dependent variable \(y\) varies depending on the type of business promoted by the student and can indicate: any type of business in specification #1, ASO in specification #2, SUP in specification #3, CSO in specification #4, and Other such as consultancy firm and professional services in specification #5. The vector K includes a set of individual-level control variables drawn from the literature on student start-up activity (Abreu & Grinevich, 2013; Åstebro et al., 2012; Muscio & Ramaciotti, 2019; Krabel & Mueller, 2009), such as, gender, age, work experience before PhD study and parents’ entrepreneurship. The vector X includes a set of indicators related to the parent university, including number of faculty members, used as a time variant proxy for university size, and a time-invariant indicator for research quality measured at the SSD and university levels (e.g. Di Gregorio & Shane, 2003a, 2003b; Landry et al., 2006). All the specifications include a set of dummies for the SSD of the PhD programme attended.

Table 2 defines the variables included in the regressions and Table 3 presents the descriptive statistics.

Table 4 presents the results of the linear probability regressions as in model (1). Columns (1) estimates the likelihood of the PhD student starting any type of business. Columns (2), (3), (4) and (5) report the results for the probability of the student being involved, respectively in an ASO, a SUP, a CSO, and/or Other. The results in Table 4 presents the marginal effects. The second part of Table 4 presents the results for a subset of cases specializing in life and hard sciences. Table 5 presents a set of regressions based on factor analysis with the variables used to test the hypotheses. The factor analysis provided a smaller set of variables which we used to rerun the econometric exercise to test the impact of the three levels of determinants (macro, meso and micro) on entrepreneurial activity. The regressions include three factors, one for each dimension.

We observe, first, that, overall, the macro-, meso- and micro- determinants are, to different extents, all associated to student entrepreneurship. However, notable differences emerge if we examine the factors associated to different forms of student ventures (Columns 2–5 in Table 4). The results are largely confirmed when the analysis focused just on the LHS area.

We can see that patent application is associated positively to establishment of an ASO but does not determine other venture types not linked explicitly to university knowledge. This supports H1a and confirms the findings in Hahn et al. (2019), that IP is not a determinant of innovative SUP sales. Institutional quality measured in terms of the business environment, is not relevant for entrepreneurship, which rejects H1b and suggests that PhD entrepreneurship may be a response to difficult local career opportunities and employment conditions, as noted by Horta et al. (2018) and Muscio & Ramaciotti (2019).

H2a and H2b are confirmed by the finding that the presence at the parent institution of a university TTO focused on promoting university entrepreneurship is beneficial for ASOs, whereas ASOs, SUPs and CSOs are supported by business incubators. Access to private labs is associated specifically to private forms of business ventures, especially CSOs. The Other category includes all those businesses that are not technology-based, such as professional services (e.g., lawyers, accountants, architects, civil engineers) and self-employed individuals (e.g., VAT registered). In this category, funding and entrepreneurial services promoted by the TTO are beneficial, while incubation services are associated negatively to these non-technology-based business ventures. In other words, those entrepreneurs who are technology-driven ‘self-select’ into incubation services.

In the case of H3, we find that the creation of ASOs tends to be associated with holding an academic position, which supports this hypothesis. While ASOs receive the official endorsement and support from the parent university, this shows that students who are interested in founding an ASO mitigate the entrepreneurial risk by obtaining or remaining in an academic post. In the case of funding, capability to attract funding to support the business venture has an overarching impact on most business types. Public funding supports all types of ventures apart from CSOs which receive financial support from the parent organization. Those venture in the Other category, ventures are more exposed to market forces and entrepreneurial risk and are more likely to benefit from private funding. In fact, access to private resources is linked to all types of non-ASO ventures.

In terms of individual level factors, the results for the control variables confirm the findings in the literature: in most cases, the general personal characteristics of the student and his/her family background affect the probability of becoming an entrepreneur. While being younger or a man is sometimes positively associated to the probability of becoming an entrepreneur, we found that having a parent who is an entrepreneur increases the probability of the student becoming an entrepreneur, in all cases (Muscio et al., 2022). University size and ranking have no impact on entrepreneurial activity, which is in line with university level analyses of academic entrepreneurship in Italy, such as Muscio et al. (2016).

The results of the models including the variables obtained from the factor analysis largely confirm the results presented in Table 4. Macro level factors (patenting) primarily affect ASOs creation and are detrimental to Other business types. Meso- and micro-level factors have a transversal positive impact on all types of businesses.

5 Concluding remarks

The objective of this paper was to provide a better understanding of the drivers of different forms of PhD student entrepreneurial ventures and to identify possible strategic alignment (Audretsch & Belitski, 2022) among the macro-institutional, meso-organizational and micro-individual level determinants of PhD entrepreneurial activities. Our study makes the following contributions. First, it adds to our understanding of the variety of typologies and contexts of academic entrepreneurial firms, such as formal ASOs, SUPs, CSOs and Other types. These forms of businesses reflect the different relationships between founders (PhD student) and parent organization. This typology of PhD entrepreneurship complements existing typologies of ASOs and CSOs (Fryges & Wright, 2014). Second, we contribute to cross-level analysis of the factors driving PhD student entrepreneurial activity, employing the strategic alignment model of the entrepreneurial university. We highlight the strategic choices made by a specific group of individual actors (PhD students), interacting with different stakeholders, resources and infrastructures at the organizational and institutional levels, which create dynamic and selective cross-level ‘congruence’ (Audretsch & Belitski, 2022). We emphasized the importance of understanding the heterogeneity of PhD entrepreneurial activity, which relates to the combination of specific factors at each of the three levels, for each type of entrepreneurial firm.

PhD entrepreneurship takes different forms with distinctive characteristics. At the organizational level, much PhD entrepreneurial activity is not recorded by the parent academic institution unless it is part of the formal IP structure. There is a need to understand the specific nature of different venture types and the support mechanisms that are effective for each type. Based on the responses to a survey of PhD students in Italy, we carried out three levels of analysis and investigated how institutional, organizational and individual level factors are associated with the creation of different types of business creation by the PhD students. Our findings show the diversity of PhD entrepreneurship processes and that different types of resources and support are associated in different ways with each type of businesses, namely, ASO, SUP, CSO and Other. Our analyses show that institutional, organizational and individual level factors are at play and determine different types of PhD entrepreneurial firm characteristics. Some determinants have a more positive impact on specific types of businesses. ASOs are distinctive in terms of their determining factors. While ASO activity tends to be associated with patenting and use of TTOs by those students with a post in a university lab (i.e., a safety net through employment in academia), there are other more ‘market-driven’ business activities, such as CSOs or SUPs, which benefit from private funding and access to private labs for experimental developments. CSOs and Other types of businesses are especially sensitive to the local business context and benefiting from an entrepreneurial culture and environment. Access to public research funding and availability of incubation services are associated positively, in most cases, to more than one type of business activity (ASO, SUP, CSO, and Other).

At the individual level, PhD students need to consider their career intentions and build their capabilities and networks accordingly. In the technology-push model, young academics rely on their IP and on what the parent institution can offer in the effort to bring their knowledge and discoveries to the market, exploiting research funding and the TTO. In the demand-led model, support comes from industry and external sources of finance. These models correspond to the different career paths (Fritsch & Krabel, 2012): university researchers with patents and access to public funding and university support, and more risk-taking graduates who rely on external business support and direct entry to the market. It would be useful to examine the determinants of USPs, CSOs and Other in more detail to get a better understanding of student entrepreneurship.

Our findings suggest that PhD students and their entrepreneurial activities cannot be treated homogeneously in terms of the support needed and received. This has implications for managers and for policy. University managers and, especially those engaged in strategic planning, research commercialization and student career services, should ensure that their organizational resources and support mechanisms are aligned to research orientations, funding sources, student demographics and students’ career plans. The heterogenous factors related to PhD entrepreneurship have implications for the design and implementation of university support and strategies to encourage PhD entrepreneurial activity. These support mechanisms should be tailored to the specific types of entrepreneurial firm and the individual PhD student’s characteristics. In particular, universities should provide customized support through TTOs and incubators to cater for the specific types and needs of PhD entrepreneurial activity.

In terms of the implications for policymakers and practitioners, in Italy, Central Government recently implemented the EU-funded National Resilience and Recovery Plan (NRRP) which includes funding for scholarships for industrial PhD degrees.Footnote 6 This is aimed at encouraging academic research by research students that satisfies market needs. For these policy initiatives to have meaningful impact, strategic alignment is required between government policy, university strategies, types of PhD programmes being offered and students’ career intentions. The importance of doctoral student entrepreneurship must be acknowledged through the provision of international frameworks for higher education and innovation policies, such as HEInnovate.Footnote 7 There are opportunities for industry partners to engage in and facilitate the creation of CSOs with doctoral students based on alignment of their strategic activities. Mustar et al. (2006) note that there is a tension between the need for appropriate public policy, the needs of individual venture firms and their parent organizations. When organizational strategies and individual agencies align through PhD entrepreneurship, it may be possible to reconcile such a tension by the dynamic strategic alignment processes across the three levels.

This study has some limitations. First, despite the large sample size, it is based on cross-sectional data, which has limitations in terms of identification of causal effects. Also, although an individual-level study, we can draw no conclusions about students’ access to policy schemes supporting entrepreneurship. This suggests directions for further research, which should focus on obtaining a more fine-grained understanding of the perceived risks for individual actors engaged in start-up processes during doctoral programmes, in different business development phases and in different types of businesses. For instance, specific growth trajectories of different types of firms over time need further investigation. Also, individual PhD students’ motivations and career plans and dynamics could be collected using a qualitative methodology. Second, our study refers only to the context of Italy. Each national research system and higher education system has specific conditions. Future studies should investigate different national contexts, to examine the influence of different stakeholders and sub-national conditions. Third, future work could consider different levels such as university department or research area (Rasmussen, et al., 2014). However, this study adds to the academic entrepreneurship literature and works on the diverse forms of PhD entrepreneurship, associated with a set of determining factors at play across the macro, meso and micro levels.

Data Availability

The data is available from the corresponding author upon request.

Notes

The IQI builds on 5 measures evaluating regional corruption, governance, regulation, law enforcement and social participation.

The scheme was proposed in the context of the Knowledge for Change Programme promoted by The World Bank.

ISTAT estimates that 67.7% of PhDs receive either private or government funding. Muscio and Shibayama (2023) note that in the case of industry scholarships, the university and the business or business association concerned sign an agreement to provide 50% of the funding required. The student’s research topic must be approved by the funder, the student supervisor and the student depending on the conditions attached to the university PhD programme call. In the case of research project funding (e.g., Horizon Europe or MUR-PRIN funding), applicants to the PhD course are provided with explicit details about project activities and funding conditions in the call.

SSD are a set of disciplinary areas defined by the Italian National University Council (CUN) and adopted by all Italian universities. They aresimilar to the OECD (2002) Frascati Manual classifications. The 14 SSD are: Mathematics and Computer Science, Physics, Chemistry, Geology, Biology, Medicine, Agriculture and Veterinary, Civil Engineering and Architecture, Industrial Engineering, Humanities, Sociology, philosophy and psychology, Law, Economics and Statistics, Political Sciences.

‘Indagine ISTAT sui rendimenti occupazionali dei dottori di ricerca’ from https://www.istat.it/it/archivio/8555.

The NRRP provides generous resources to policy measures designed to compensate for the economic and social impact of the pandemic. As part of this strategy, in 2022 the Italian Government provided co-funding for 15,000 scholarships for industry PhDs (450 M Euros over a 3-year period) to ensure academic research carried out by PhD students was matched to market needs.

HEInnovate is a reflexive tool developed by the European Commission and the OECD for higher education institutions keen to explore their innovation potential. https://www.heinnovate.eu/en accessed 24 November 2023.

References

Abreu, M., Demirel, P., Grinevich, V., & Karatas-Ozkan, M. (2016). Entrepreneurial practices in research-intensive and teaching-led universities. Small Business Economics, 47(3), 695–717. https://doi.org/10.1007/s11187-016-9754-5

Abreu, M., & Grinevich, V. (2013). The nature of academic entrepreneurship in the UK: Widening the focus on entrepreneurial activities. Research Policy, 42, 408–422. https://doi.org/10.1016/j.respol.2012.10.005

Agostino, M., Nifo, A., Trivieri, F., & Vecchione, G. (2020). Rule of law and regulatory quality as drivers of entrepreneurship. Regional Studies, 54(6), 814–826. https://doi.org/10.1080/00343404.2019.1648785

Ambos, T. C., Mäkelä, K., Birkinshaw, J., & D’Este, P. (2008). When does university research get commercialized? Creating ambidexterity in research institutions. Journal of Management Studies, 45, 1424–1447. https://doi.org/10.1111/j.1467-6486.2008.00804.x

Åstebro, T., Bazzazian, N., & Braguinsky, S. (2012). Startups by recent university graduates and their faculty: Implications for university entrepreneurship policy. Research Policy, 41(4), 663–677. https://doi.org/10.1016/j.respol.2012.01.004

Audretsch, D. B. (2014). From the entrepreneurial university to the university for the entrepreneurial society. Journal of Technology Transfer, 39, 313–321. https://doi.org/10.1007/s10961-012-9288-1

Audretsch, D. B., & Belitski, M. (2022). A strategic alignment framework for the entrepreneurial university. Industry and Innovation, 29(2), 285–309. https://doi.org/10.1080/13662716.2021.1941799

Audretsch, D. B., & Lehmann, E. E. (2005). Does the knowledge spillover theory of entrepreneurship hold for regions? Research Policy, 34(8), 1191–1202. https://doi.org/10.1016/j.respol.2005.03.012

Audretsch, D. B., & Link, A. N. (2012). Entrepreneurship and innovation: Public policy frameworks. Journal of Technology Transfer, 37(1), 1–17. https://doi.org/10.1007/s10961-011-9240-9

Balconi, M., Breschi, S., & Lissoni, F. (2004). Networks of Inventors and the role of academic: An exploration of Italian patent data. Research Policy, 33(1), 127–145. https://doi.org/10.1016/S0048-7333(03)00108-2

Baldini, N. (2009). Implementing Bayh-Dole-like laws: Faculty problems and their impact on university patenting activity. Research Policy, 38(8), 1217–1224. https://doi.org/10.1016/j.respol.2009.06.013

Baldini, N., Grimaldi, R. & Sobrero, M. (2006). Institutional changes and the commercialization of academic knowledge: a study of Italian universities’ patenting activities between 1965 and 2002. Research Policy, 35, 518–532. https://doi.org/10.1016/j.respol.2006.01.004

Baldini, N. (2010). University spinoffs and their environment. Technology Analysis & Strategic Management, 22(8), 859–876.

Baldini, N., Grimaldi, R., & Sobrero, M. (2007). To patent or not to patent? A survey of Italian inventors on motivations, incentives, and obstacles to university patenting. Scientometrics, 70(2), 333–354. https://doi.org/10.1007/s11192-007-0206-5

Battaglia, D., Cucino, V., Paolucci, E., & Piccaluga, A. (2022). Fostering the development of the entrepreneurial university: How PhD students create new ventures and are involved in technology transfer activities. Studies in Higher Education, 47(5), 1010–1022. https://doi.org/10.1080/03075079.2022.2055325

Becker, B. (2015). Public R&D policies and private R&D investment: A survey of the empirical evidence. Journal of Economic Surveys, 29(5), 917–942. https://doi.org/10.1111/joes.12074

Bergmann, H., Geissler, M., Hundt, C., & Grave, B. (2018). The Climate for Entrepreneurship at Higher Education Institutions. Research Policy, 47(4), 700–716. https://doi.org/10.1016/j.respol.2018.01.018

Bercovitz, J., & Feldman, M. (2008). Academic entrepreneurs: Organizational change at the individual level. Organization Science, 19(1), 69–89. https://doi.org/10.1287/orsc.1070.0295

Bercovitz, J., & Feldmann, M. (2006). Entpreprenerial universities and technology transfer: A conceptual framework for understanding knowledge-based economic development. Journal of Technology Transfer 31, 175–188. https://doi.org/10.1007/s10961-005-5029-z

Bienkowska, D., & Klofsten, M. (2012). Creating entrepreneurial networks: Academic entrepreneurship, mobility, and collaboration during PhD education. Higher Education, 64(2), 207–222. https://doi.org/10.1007/s10734-011-9488-x

Bienkowska, D., Klofsten, M., & Rasmussen, E. (2016). PhD students in the entrepreneurial university – perceived support for academic entrepreneurship. European Journal of Education, 51(1), 56–72. https://doi.org/10.1111/ejed.12160

Boh, W. F., De-Haan, U., & Strom, R. (2016). University technology transfer through entrepreneurship: Faculty and students in spinoffs. Journal of Technology Transfer, 41(4), 661–669. https://doi.org/10.1007/s10961-015-9399-6

Bolzani, D., Fini, R., Grimaldi, R., & Sobrero, M. (2014). University spin-offs and their impact: Longitudinal evidence from Italy. Economia e Politica Industriale, 41, 237–263. https://doi.org/10.3280/POLI2014-004011

Bolzani, D., Marabello, S., & Honig, B. (2020). Exploring the multi-level processes of legitimacy in transnational social enterprises. Journal of Business Venturing, 35(3)

Bolzani, D., Rasmussen, E., & Fini, R. (2021). Spin-offs’ linkages to their parent universities over time: The performance implications of equity, geographical proximity, and technological ties. Strategic Entrepreneurship Journal, 15(4), 590–618

Bonaccorsi, A., Colombo, M. G., Guerini, M., & Rossi-Lamastra, C. (2014). The Impact of Local and External University Knowledge on the Creation of Knowledge-Intensive Firms: Evidence from the Italian Case. Small Business Economics, 43(2), 261–287. https://doi.org/10.1007/s11187-013-9536-2

Bradley, S., Hayter, C. S., & Link, A. N. (2013). Methods and models of university technology transfer. Foundations and Trends in Entrepreneurship, 9(6), 571–650. https://doi.org/10.1561/0300000048

Breznitz, S. M., & Zhang, Q. (2019). Fostering the growth of student start-ups from university accelerators: An entrepreneurial ecosystem perspective. Industrial and Corporate Change, 28(4), 855–873. https://doi.org/10.1093/icc/dtz033

Breznitz, S. M., & Zhang, Q. (2021). Entrepreneurship education and firm creation. Regional Studies, 56(6), 940–955. https://doi.org/10.1080/00343404.2021.1878127

Bruneel, J., van de Velde, E., & Clarysse, B. (2013). Impact of the Type of Corporate Spin-Off on Growth. Entrepreneurship Theory and Practice, 37(4), 943–959. https://doi.org/10.1111/j.1540-6520.2012.00517.x

Caldera, A., & Debande, O. (2010). Performance of spanish universities in technology transfer: An empirical analysis. Research Policy, 39(9), 1160–1173. https://doi.org/10.1016/j.respol.2010.05.016

Calvo, N., Rodeiro, D., & Soares, I. (2013). Are USOs more supported to compete than spin-offs not linked to universities? A dynamic overview and proposal of model of USOs support. International Journal of Innovation and Learning, 14(3–4), 271–288. https://doi.org/10.1504/IJIL.2013.056229

Castillo Holley, A., & Watson, J. (2017). Academic Entrepreneurial Behavior: Birds of more than one feather. Technovation, 64–65(July), 50–57. https://doi.org/10.1016/j.technovation.2017.07.001

Civera, A., Meoli, M., Vismalra, S. (2020). Engagement of academics in university technology transfer: Opportunity and necessity academic entrepreneurship. European Economic Review, 123. https://doi.org/10.1016/j.euroecorev.2020.103376.

Clarysse, B., Tartari, V., & Salter, A. (2011). The impact of entrepreneurial capacity, experience and organizational support on academic entrepreneurship. Research Policy, 40(8), 1084–1093. https://doi.org/10.1016/j.respol.2011.05.010

Clarysse, B., Wright, M., Lockette, A., van de Velde, E., & Vohora, A. (2005). Spinning out new ventures: A typology of incubation strategies from European Research Institutions. Journal of Business Venturing, 20(2), 183–216. https://doi.org/10.1016/j.jbusvent.2003.12.004

Colombo, M. G., & Piva, E. (2012). Firms’ genetic characteristics and competence-enlarging strategies: A comparison between aca- demic and non-academic high-tech start-ups. Research Policy, 41(1), 79–92. https://doi.org/10.1016/j.respol.2011.08.010

Conti, A., & Visentin, F. (2015). A revealed preference analysis of PhD students’ choices over employment outcomes. Research Policy, 44(10), 1931–1947. https://doi.org/10.1016/j.respol.2015.06.009

Cunningham, J. A., Lehmann, E. E., & Menter, M. (2022). The organizational architecture of entrepreneurial universities across the stages of entrepreneurship: A conceptual framework. Small Business Economics, 59(1), 11–27. https://doi.org/10.1007/s11187-021-00513-5

Cunningham, J. A., Lehmann, E. E., Menter, M., & Seitz, N. (2019). The impact of university focused technology transfer policies on regional innovation and entrepreneurship. Journal of Technology Transfer, 44(5), 1451–1475. https://doi.org/10.1007/s10961-019-09733-0

Cunningham, J. A., & O’Reilly, P. (2018). Macro, Meso and Micro Perspectives of Technology Transfer. Journal of Technology Transfer, 43(3), 545–557. https://doi.org/10.1007/s10961-018-9658-4

Dasgupta, P., & David, P. A. (1994). Toward A New Economics of Science. Research Policy, 23(5), 487–521. https://doi.org/10.1016/0048-7333(94)01002-1

D’Este, P., Mahdi, S., Neely, A., & Rentocchini, F. (2012). Inventors and Entrepreneurs in Academia: What Types of Skills and Experience Matter? Technovation, 32(5), 293–303. https://doi.org/10.1016/j.technovation.2011.12.005

Di Gregorio, D., & Shane, S. (2003a). Why do some universities generate more start-ups than others? Research Policy, 32(2), 209–227. https://doi.org/10.1016/S0048-7333(02)00097-5

Di Gregorio, D., & Shane, S. (2003b). Why do some universities generate more start ups than others. Research Policy, 32, 209–227.

Djokovic, D., & Souitaris, V. (2008). Spinouts from academic institutions: A literature review with suggestions for further research. Journal of Technology Transfer, 33(3), 225–247. https://doi.org/10.1007/s10961-006-9000-4

Duruflé, G., Hellmann, T., & Wilson, K. (2018). Catalysing entrepreneurship in and around universities. Oxford Review of Economic Policy, 34(4), 615–636.

Etzkowitz, H. (2017). Innovation Lodestar: The entrepreneurial university in a stellar knowledge firmament. Technological Forecasting and Social Change, 123(4), 122–129. https://doi.org/10.1016/j.techfore.2016.04.026

Etzkowitz, H., Webster, A., Gebhardt, C., & Terra, B. R. C. (2000). The future of the university and the university of the future: Evolution of ivory tower to entrepreneurial paradigm. Research Policy, 29(2), 313–330. https://doi.org/10.1016/S0048-7333(99)00069-4

Feldman, M. P., & Desrochers, P. (2004). Truth for its own sake: Academic culture and technology transfer at Johns Hopkins University. Minerva, 42(2), 105–126.

Festel, G. (2012). Academic spin-offs, corporate spin-outs and company internal start-ups as technology transfer approach. The Journal of Technology Transfer, 38(4), 454–470. https://doi.org/10.1007/s10961-012-9256-9

Fini, R., Grimaldi, R., Santoni, S., & Sobrero, M. (2011). Complements or substitutes? The role of universities and local context in supporting the creation of academic spin-offs. Research Policy, 40(8), 1113–1127. https://doi.org/10.1016/j.respol.2011.05.013

Fini, R., Grimaldi, R., & Sobrero, M. (2009). Factors fostering academics to start up new ventures: an assessment of Italian founders’ incentives. The Journal of Technology Transfer, 34, 380–402

Fini, R., Lacetera, N., & Shane, S. (2010). Inside or outside the IP system? Business Creation in Academic, Research Policy, 39(8), 1060–1069. https://doi.org/10.1016/j.respol.2010.05.014

Fini, R., Meoli, A., & Sobrero, M. (2022). University graduates’ early career decisions and interregional mobility: Self-employment versus salaried job. Regional Studies, 56(6), 972–988. https://doi.org/10.1080/00343404.2022.2069236

Friedman, J., & Silberman, J. (2003). University technology transfer: Do incentives, management and location matter? The Journal of Technology Transfer, 28, 17–30.

Fritsch, M., & Krabel, S. (2012). Ready to leave the ivory tower? Academic scientists’ appeal to work in the private sector. Journal of Technology Transfer, 37, 271–296. https://doi.org/10.1007/s10961-010-9174-7

Fryges, H., & Wright, M. (2014). The origin of spin-offs – A typology of corporate and academic spin-offs. Small Business Economics, 43(2), 245–259. https://www.jstor.org/stable/43553746.

Geuna, A. (2001). The changing rationale for European university research funding: Are there negative unintended consequences? Journal of Economic Issues, 35(3), 607–632. https://doi.org/10.1080/00213624.2001.11506393

Geuna, A., & Muscio, A. (2009). The governance of university knowledge transfer: A critical review of the literature. Minerva, 47(1), 93–114. https://doi.org/10.1007/s11024-009-9118-2

Grimaldi, R., Kenney, M., Siegel, D., & Wright, M. (2011). 30 years after Bayh–Dole: Reassessing academic entrepreneurship. Research Policy, 40(8), 1045–1057. https://doi.org/10.1016/j.respol.2011.04.005

Guerrero, M., & Urbano, D. (2019). Effectiveness of technology transfer policies and legislation in fostering entrepreneurial innovations across continents: An overview. Journal of Technology Transfer, 44(5), 1347–1366. https://doi.org/10.1007/s10961-019-09736-x

Guerrero, M., Cunningham, J. A., & Urbano, D. (2015). Economic impact of entrepreneurial universities’ activities: An exploratory study of the United Kingdom. Research Policy, 44(3), 748–764

Guerrero, M., Urbano, D., Fayolle, A., Klofsten, M., & Mian, S. (2016). Entrepreneurial Universities: Emerging Models in the New Social and Economic Landscape. Small Business Economics, 47, 551–563. https://doi.org/10.1007/s11187-016-9755-4

Gulbrandsen, M., & Smeby, J. C. (2005). Industry funding and university professors’ research performance. Research Policy, 34(6), 932–950. https://doi.org/10.1016/j.respol.2005.05.004

Haeussler, C., & Colyvas, J. A. (2011). Breaking the ivory tower: academic entrepreneurship in the life sciences in uk and germany. Research Policy, 40(1), 41–54. https://doi.org/10.1016/j.respol.2010.09.012

Hahn, D., Minola, T., & Eddleston, K. A. (2019). How do Scientists Contribute to the Performance of Innovative Start-ups? An Imprinting Perspective on Open Innovation. Journal of Management Studies, 56(5), 895–928. https://doi.org/10.1111/joms.12418

Hahn, D., Minola, T., van Gils, A., & Huybrechts, J. (2017). Entrepreneurial education and learning at universities: Exploring multilevel contingencies. Entrepreneurship and Regional Development, 29(9–10), 945–974. https://doi.org/10.1080/08985626.2017.1376542

Hayter, C. S., Lubynsky, R., & Maroulis, S. (2017). Who is the academic entrepreneur? The role of graduate students in the development of university spinofs. Journal of Technology Transfer, 42, 1–18. https://doi.org/10.1007/s10961-016-9470-y

Hayter, C. S. (2015). Public or private entrepreneurship? Revisiting motivations and definitions of success among academic entrepreneurs. Journal of Technology Transfer, 40, 1003–1015. https://doi.org/10.1007/s10961-015-9426-7

Hayter, C. S., Nelson, A. J., Zayed, S., et al. (2018). Conceptualizing academic entrepreneurship ecosystems: A review, analysis and extension of the literature. The Journal of Technology Transfer, 43, 1039–1082. https://doi.org/10.1007/s10961-018-9657-5

Horner, S., Jayawarna, D., Giordano, B., & Jones, O. (2019). Strategic choice in universities: Managerial agency and effective technology transfer. Research Policy, 48(5), 1297–1309. https://doi.org/10.1016/j.respol.2019.01.015

Horta, H., Cattaneo, M., & Meoli, M. (2018). PhD funding as a determinant of PhD and career research performance. Studies in Higher Education, 43(3), 542–570. https://doi.org/10.1080/03075079.2016.1185406

Horta, H., Meoli, M., & Vismara, S. (2016). Skilled unemployment and the creation of academic spin-offs: A recession-push hypothesis. Journal of Technology Transfer., 41, 798–817. https://doi.org/10.1007/s10961-015-9405-z

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2010). The worldwide governance indicators: Methodology and analytical issues. Policy Research Working Paper Series Number 5430. The World Bank, Washington, DC.

Kitagawa, F. (2014). Collaborative doctoral programmes: Employer engagement, knowledge mediation and skills for innovation. Higher Education Quarterly, 68(3), 328–347. https://doi.org/10.1111/hequ.12049

Klapper, L., Laeven, L., & Rajan, R. (2006). Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82, 591–629. https://doi.org/10.1016/j.jfineco.2005.09.006

Klofsten, M., Fayolle, A., Guerrero, M., Mian, S., Urbano, D., & Wright, M. (2019). The entrepreneurial university as driver for economic growth and social change—Key strategic challenges. Technology Forecasting and Social Change, 141, 149–158. https://doi.org/10.1016/j.techfore.2018.12.004

Klofsten, M., Jones-Evans, D., & Pereira, L. (2021). Teaching science and technology PhD students in entrepreneurship-potential learning opportunities and outcomes. The Journal of Technology Transfer, 46(2), 319–334. https://doi.org/10.1007/s10961-020-09784-8

Krabel, S., & Mueller, P. (2009). What drives scientists to start their own company? An empirical investigation of Max Planck Society scientists. Research Policy, 38(6), 947–956. https://doi.org/10.1016/j.respol.2009.02.005

Landry, R., Amara, N., & Rherrad, I. (2006). Why are some university researchers more likely to create spin-offs than others? Evidence from Canadian Universities, Research Policy, 35(10), 1599–1615. https://doi.org/10.1016/j.respol.2006.09.020

Link, A. N., & Ruhm, C. J. (2011). Public knowledge, private knowledge: The intellectual capital of entrepreneurs. Small Business Economics, 36(1), 1–14. https://doi.org/10.1007/s11187-009-9179-5

Lissoni, F., Llerena, P., McKelvey, M., & Sanditov, B. (2008). Academic patenting in Europe: New evidence from the KEINS database. Research Evaluation, 17(2), 87–102. https://doi.org/10.3152/095820208X287171

Malo, S. (2009). The contribution of (not so) public research to commercial innovations in the field of combinatorial chemistry. Research Policy, 38(6), 957–970. https://doi.org/10.1016/j.respol.2009.03.002

Mandell, I. (2022). The Ecosystem: Italy must live a little longer with professor’s privilege. Science|Business, https://sciencebusiness.net/news/start-ups/ecosystem-italy-must-live-little-longer-professorsprivilege. Accessed 28 Mar 2023

Mangematin, V. (2000). PhD job market: Professional trajectories and incentives during the PhD. Research Policy, 29(6), 741–756. https://doi.org/10.1016/S0048-7333(99)00047-5

Marini, G. (2022). The Employment Destination of PhD-Holders in Italy: Non-Academic Funded Projects as Drivers of Successful Segmentation”. European Journal of Education, 57, 289–305. https://doi.org/10.1111/ejed.12495

Markman, G., Phan, P., Balkin, D., & Gianiodis, P. (2005). Entrepreneurship and university-based technology transfer. Journal of Business Venturing, 20(2), 241–263. https://doi.org/10.1016/j.jbusvent.2003.12.003

Markman, G. D., Siegel, D. S., & Wright, M. (2008). Research and technology commercialization. Journal of Management Studies, 45(8), 1401–1423. https://doi.org/10.1111/j.1467-6486.2008.00803.x

Martinelli, A., Meyer, M., & Von Tunzelmann, N. (2008). Becoming an entrepreneurial university? A case study of knowledge exchange relationships and faculty attitudes in a medium-sized, research-oriented university. The Journal of Technology Transfer, 33, 259–283

Marzocchi, C., Kitagawa, F., & Sánchez-Barrioluengo, M. (2019). Evolving missions and university entrepreneurship: Academic spin-offs and graduate start-ups in the entrepreneurial society. Journal of Technology Transfer, 44(1), 167–188. https://doi.org/10.1007/s10961-017-9619-3

Mason, C., & Brown, R. (2013). Creating good public policy to support high-growth firms. Small Business Economics, 40(2), 211–225

McAdam, M., Miller, K., & McAdam, R. (2016). Situated regional university incubation: A multi-level stakeholder perspective. Technovation, 50–51, 69–78. https://doi.org/10.1016/j.technovation.2015.09.002