Abstract

This study investigates the impact of the creative industries on regional resilience and productive entrepreneurship. We control for the localized effects of digitalization in this relationship. We do so by linking the regional resilience theory with the literature on the creative industries, digitalization and productive entrepreneurship. The unit of our analysis is the European Union’s regions (from the 2008 Great Recession crisis to the 2015 recovery period). We empirically tested our framework in the context of the European Union with datasets from Eurostat Regional Statistics and the European Social Survey (ESS). Our analysis is focused on the Nomenclature of Territorial Units for Statistics (NUTS) 3 regions, which includes 1397 industry performance observations from 314 NUTS-3 regions and 11 European countries (Bulgaria, the Czech Republic, Denmark, Finland, France, Hungary, Italy, the Netherlands, Portugal, Romania, and Slovakia) for the period 2008–2015. Our findings demonstrate that regions with a higher share of employment in the creative industries are more likely to withstand a short-term economic shock than regions with a lower share of employment in the creative industries. Our results also indicate the importance of digitalization in the period of recovery from crises, and demonstrate that the creative industries play an important part in this process. This study offers a number of policy implications.

Similar content being viewed by others

1 Introduction

Digitalization is a vital element of current business activities, providing technological opportunities to compete in the new business reality (Belitski et al., 2023; Hess et al., 2020; Kraus et al., 2022). Digitalization can be defined as “the sociotechnical process of applying digitizing techniques to broader social and institutional contexts that render digital technologies infrastructure” (Tilson et al., 2010, p. 749). Over the last decade, the economic sectors have witnessed a new phase of digitalization, facing radical innovations and disruptive consequences for the global economy and society (Autio et al., 2018; Haefner & Sternberg, 2020; Santarelli et al., 2022). At the same time, the current digitalization stage has created new inclusion opportunities in terms of who can participate in entrepreneurial activities, as well as how the new stakeholders can contribute at the broader regional and national levels (Nambisan et al., 2019; Zhang et al., 2023).

A growing number of studies are focusing more on the spatial aspects of digitalization, investigating geographical differences in the digital divide, unemployment challenges, the opportunities provided by digital technologies in rural regions, and their impact on regional economic growth (Pick & Nishida, 2015; Townsend et al., 2017; Tranos, 2012). This stream of research has mainly investigated industrial businesses (Akerman et al., 2015; Ghosh et al., 2022). However, prior research on the economic development of regions (e.g., Audretsch & Belitski, 2021; García-Tabuenca et al., 2011; Henry, 2007; Piergiovanni et al., 2012; Porfírio et al., 2016) emphasized the important contribution of the creative industries and the need to further investigate this sector’s potential to foster regional economic growth and productive entrepreneurship.

Various scholars and international organisations have already started examining the socio-economic significance of the creative industries, investigating their contribution to the gross domestic product (GDP), exports, employment, social inclusion, and cultural exchange and development (e.g., Innocenti & Lazzeretti, 2019; UNCTAD, 2008, 2018, 2022; European Commission, 2021; O'Connor, 2015). However, since the Fourth Industrial Revolution began in 2011 (Schwab, 2017), research has intensified in terms of examining the implications for the creative industries. Studies have particularly focused on the rapid adoption of digital technologies into business models, changes in the way creative products and services are delivered, and how these changes affect economic processes at the national and industry levels (e.g., Landoni et al., 2020; Li, 2020; Mangematin et al., 2014; Peukert, 2019; Searle, 2011).

Prior studies also claimed that the 2008 Great Recession accelerated research on the creative industries, highlighting their dynamics, remarkable contribution to economic growth, and the sector’s greater resilience to economic crises compared to other economic sectors (De Propris, 2013; Protogerou et al., 2022; UNCTAD, 2010). However, only a few theoretical and empirical studies examined the resilience of creative industries during crises (e.g., the 2008 Great Recession, the COVID-19 pandemic), mainly taking the perspective of organisational and individual resilience (e.g., Khlystova et al., 2022a; Protogerou et al., 2022; Cruz & Teixeira, 2021; Rozentale, 2014; Andres & Round, 2015; Seman & Carrol, 2017). However, little empirical evidence exists regarding the role of digitalization in the creative industries and its link to regional resilience.

This stream of literature made some points about the link between the geographical factors (concentration, location/relocation) of the creative industries and the additional sources of resilience provided to regions by this sector during crises (Andres & Round, 2015; Cooke & De Propris, 2011; Donald et al., 2013; Pratt & Hutton, 2013). Studies on the regional factors of resilience (e.g., Brakman et al., 2015; Capello et al., 2015; Martin, 2012) have mainly focused on the a-spatial impact of crises and the most affected economics sectors (e.g., industrial sector, gold jewellery) (e.g., De Marchi et al., 2014; Pal et al., 2014), while the role of the creative sector has been under-researched.

Prior studies extensively examined the context of the US and European creative industries’ resilience or their performance (specific creative sub-sectors, cities, or countries within the European Union) through the lens of employment issues during the 2008 Great Recession (e.g., Currid-Halkett & Stolarick, 2013; Felton et al., 2010; Gabe et al., 2013), or focused on firm formation during and after the 2008 Great Recession (e.g., Andres & Round, 2015; Christopherson, 2013; Cruz & Teixeira, 2021; De Propris, 2013; Indergaard, 2013; Jakob, 2013; Protogerou et al., 2022; Rozentale, 2014). However, research remains rather scarce in terms of understanding the value and effects of digitalization in the creative industries on resilience and productive entrepreneurship at regional levels in times of crisis. Therefore, the objective of this study is to investigate the impact of the creative industries on regional resilience and productive entrepreneurship, considering the localized effects of digitalization in this relationship across European Union regions from the 2008 Great Recession crisis to the recovery in 2015.

We first link the role of digitalization in regional resilience and productive entrepreneurship, further elaborating on the contribution of the creative industries to these two concepts. In doing so, we have developed a theoretical framework that allows us to investigate the creative industries’ influence on regional resilience and productive entrepreneurship through the lens of digitalization. We empirically tested our framework using the context of the European Union with datasets from Eurostat Regional Statistics (Eurostat, 2020) and the European Social Survey (ESS). Our analysis focuses on the Nomenclature of Territorial Units for Statistics (NUTS) 3 regions and includes 1397 industry performance observations from 314 NUTS-3 regions and 11 European countries (Bulgaria, the Czech Republic, Denmark, Finland, France, Hungary, Italy, the Netherlands, Portugal, Romania, and Slovakia) for the period 2008–2015. This paper is organised as follows. The next section develops the theoretical framework and research hypotheses. Section 3 outlines the data and methodology. Section 4 presents the empirical results of the study. Section 5 discusses the findings, while Sect. 6 concludes.

2 Theoretical framework and hypotheses development

2.1 Antecedents of regional resilience and productive entrepreneurship

To date, resilience theory has been used to explore how individuals, organisations, regions, and countries respond and recover from exogenous shocks (e.g., crises, financial shocks, environmental jolts) (Bhamra et al., 2011; Coutu, 2002; Linnenluecke, 2017; Martin, 2012; Meyer, 1982; Sullivan-Taylor & Branicki, 2011; Williams & Vorley, 2014). In order to explore the role of entrepreneurship in regional resilience, it is important to understand its theoretical developments. The resilience concept is widely used in the regional studies and economic geography literature (e.g., Bristow, 2010; Cellini & Torrisi, 2014; Christopherson et al., 2010; Fingleton et al., 2015; Martin et al., 2015; Williams & Vorley, 2014). Nevertheless, there are a number of different definitions for the term “regional resilience” (Table 1).

These definitions demonstrate the dynamics of resilience and highlight the capacities regions need to have to withstand, adapt, and recover after crises. However, it is important to highlight that the resilience concept should not be considered synonymous with sustainability, which involves the consideration of economic, social, and environmental pressures (Heim et al., 2023). The concept of resilience encompasses different stages, broadly described as withstanding, adaptation, and, finally, recovery (Kahl & Hundt, 2015; Martin & Sunley, 2015). Many studies have investigated how regions react, respond, and adapt to uncertainty, taking into account that regions are the manifestation of economic and social relations between economic agents (Eraydin, 2016; Martin, 2012; Pike et al., 2010). For example, Dawley et al. (2010) extensively examined the processes of resilience, especially when regions should be able to respond to uncertainty, specifically adaptation, and make decisions about whether to follow or leave the strategies that were considered successful in the past to pursue new alternative paths, namely adaptability.

Regions create and develop different settings (such as infrastructure, policy, business environment, etc.), which determine their capacity, productivity, competitiveness, and growth (Christopherson et al., 2010), and in turn, mechanisms they use to navigate resilience (Rocchetta & Mina, 2019). The prior research also argued about the different factors which affect the resilience of regions, shifting from the institutional context and settings (Eraydin, 2016; Duval et al., 2007; Christopherson et al., 2010; Gherhes et al., 2018) to the availability of highly skilled workforces, the business environment (support, networks, opportunities), entrepreneurship, and spillovers as a result of cooperation between businesses and industries in a region (Caiazza et al., 2015, 2020; Menter, 2022; Pendall et al., 2010; Spithoven & Merlevede, 2022).

Williams and Vorley (2014, p. 259) argued that “the entrepreneurial acumen of economic agents (e.g., firms or individuals) affects the dynamism and responsiveness in relation to the adaptive cycle, which consequently, determines the regional resilience”. A number of studies also pointed out that the resilience of a region is linked to the firms within that region (Demmer et al., 2011; Herbane, 2010, 2019; Sullivan-Taylor & Branicki, 2011). The literature emphasizes the importance of firms being innovative, flexible, and creative, which can also be characterized as a productive entrepreneurship activity (Simmie & Martin, 2010; Smallbone et al., 2012).

In this study, productive entrepreneurship is defined as “any entrepreneurial activity that contributes directly or indirectly to the net output of the economy or to the capacity to produce additional output” (Baumol, 1996, p. 30). There is a large body of entrepreneurship literature that emphasizes that talents, knowledge flow, innovations, finance, and spillovers constitute productive entrepreneurship (Acs et al., 2013; Baumol, 2010; Khlystova et al., 2022b; Kraus et al., 2021; Nicotra et al., 2018; Stam, 2015). In recent studies, productive entrepreneurship is also proxied and examined through the high-growth firms available in a region (Bos & Stam, 2014; Stam & Bosma, 2015; Wurth et al., 2022). In addition, policymakers have recognized productive entrepreneurship as an important conduit to foster economic growth in regions (Goswami et al., 2019; Hall & Sobel, 2018). For example, if firms demonstrate resilient behaviour (Weick & Sutcliffe, 2001) and are high-growth oriented, they can continue to create knowledge and innovation, employment growth, and in turn enhance resilience and productive entrepreneurship (Coad et al., 2014; Dawley et al., 2010). Therefore, we argue that productive entrepreneurship and regional resilience are interconnected and that this is an important conduit to regional resilience.

2.2 The role of digitalization in regional resilience and productive entrepreneurship

Over the last decade, research on regional resilience has developed gradually (Boschma, 2015; Christopherson et al., 2010; Davies, 2011; Fröhlich & Hassink, 2018; Nyström, 2018). An extensive number of studies have applied the regional resilience concept to explain different economic disruptions and external shocks (Cuadrado-Roura & Maroto, 2016; Giannakis & Bruggeman, 2017). In particular, the concept of regional resilience has been investigated from the perspective of the industrial composition of regions. Many studies have analysed how industries in regions can learn from each other and enhance regional resilience (Boschma, 2015; Landman et al., 2022; Pike et al., 2010; Xiao et al., 2018).

A number of studies claimed that regional specialization matters because it enables regions to be resilient and competitive (Amoroso et al., 2022; Essletzbichler, 2007; Tóth et al., 2022). For instance, Wolfe (2010) argued that in order to overcome challenges and achieve economic growth, regions should be able to collaborate and implement changes using existing regional infrastructure and resources in cooperation with related industries. Thus, benefits would be created for related industries in terms of skills, knowledge space, capabilities, and a supportive local environment (Basilico et al., 2022; Boschma, 2015; Kogler et al., 2023). Essletzbichler (2007) and Fagerberg and Srholec (2022) also argue that the diverse industrial structures of regions increase the stability of regional economic growth. However, these conditions depend on the specialization of a region.

Literature on digitalization for entrepreneurship highlights the critical role of digital technologies acting as external enablers of entrepreneurship towards new opportunities for entrepreneurs, ways the goods and services are created, produced, and promoted as well as the formation of the connections between entrepreneurial ecosystem (EE) stakeholders and regions (Burtch et al., 2018; Elia et al., 2020; von Briel et al., 2018; Zhang et al., 2023). Some studies argue that the digitalization phenomenon also contributes to new entrepreneurial opportunities, ventures and knowledge creations with no attachments to specific locations or boundaries (Autio et al., 2018; Voelker et al., 2017). For example, Holm and Østergaard (2015) conducted a study on the Danish information and communication technologies (ICT) sector and argued that regions represented by small and young ICT companies were more adaptable to the technological bubble shock (dot.com bubble shock) and grew more than other regions. Digital technologies are considered an important component of innovation, growth, business resilience, and new product creation (Ayres & Williams, 2004; Li, 2020; Mangematin et al., 2014). A number of prior studies have shown that companies that adopted digital technologies (e.g., the Internet of Things, artificial intelligence, blockchains, cloud computing) in their business activities tend to be more productive and demonstrate higher performance. Digital technologies support the corporate strategies of companies, transform the way existing industries operate, and can even change organisational forms of businesses (Adarov & Stehrer, 2020; Hutchby, 2001; Oliner & Sichel, 2000; Spiezia, 2013; Sung, 2015).

Digital technologies offer more diversity for industries and opportunities, skills, and knowledge spillovers across industries (Holm & Østergaard, 2015; Jacobs, 1969; Van Oort & Atzema, 2004). This can be a source of regional resilience, as digital technologies can be used to explore and exploit new market opportunities and enhance the resource base of regions and industries. By contrast, the findings of Fingleton et al. (2012) suggest that regions that specialize in manufacturing are less resilient than regions that specialize in services. If a region specialises in knowledge-intensive or technologically-intensive services, more opportunities are provided for other industries to grow and improve their performance, making those industries more adaptable to exogenous factors (Boschma, 2015). For instance, Neffke et al., (2011, 2012) found that local industries that are technologically related to other industries within a region are less likely to exit the market. Furthermore, many studies have confirmed that another potential benefit of technological relatedness is the rise of new high-growth industries built on the existing capacities and resources of a region (Bathelt & Boggs, 2003; Belussi & Sedita, 2009; Buenstorf & Klepper, 2009; Frenken et al., 2007; Klepper, 2007). Thus, regional resilience can be ensured by developing industrial capacities and technological infrastructure as well as facilitating input–output relationships of industries within a region. We hypothesize:

H1a

Digitalization facilitates regional resilience.

Digital technologies shape entrepreneurial activity by creating new business ventures, business models, digital start-ups, and spillovers (Anderson, 2012; Elia et al., 2020; Von Briel et al., 2018; Zhang et al., 2023), affecting the economies and entrepreneurial opportunities across companies and regions (Autio et al., 2018; Nambisan, 2017; Nambisan et al., 2017; Zammuto et al., 2007). Considering that nowadays most economies are exposed to digitalization, it is useful to examine productive entrepreneurship through the prism of digitalization.

The entrepreneurship literature has recognised that digitalization significantly decreased the boundaries for entrepreneurial activity, making it more flexible and diverse, and easier for firms to enter the market (Ghazy et al., 2022; Nambisan, 2017; Yoo et al., 2010). For example, Friesenbichler and Hölzl (2020) suggested that high market entry facilitates the formation of high-growth firms in regions. The authors also argued that the technological base of a region might provide additional opportunities and a conducive business environment for firms’ growth. In addition, studies have found that digital tools help increase the productivity of firms (Sircar & Choi, 2009; Tambe & Hitt, 2014; Tavana et al., 2009). However, the availability of IT skills is also important to succeed in the digitalization era (Black et al., 2021; Falck et al., 2021). For instance, prior studies examined the benefits of adopting various digital tools to minimize market entry and innovation barriers (e.g., 3D printing, crowdfunding systems) (Fischer & Reuber, 2011; Hatch, 2014; Mollick, 2014). In addition, digital technologies and skills make it easier to recognise diverse market opportunities (Acemoglu & Autor, 2011; Qian & Acs, 2013; Siegel & Renko, 2012), including new approaches in market analysis using, for example, artificial intelligence, word mining, and data processing (Li et al., 2016).

The digitization of entrepreneurial activity allowed economic agents to explore new market opportunities and entry and increase the value of products and services as well as their quality. Some studies argue that the adoption of digital tools into business models and processes allowed entrepreneurs to engage with a broader number of stakeholders and conduct business focusing on collective capabilities, ideas, and capacities rather than individual capabilities (Autio et al., 2018; Autor et al., 1998; Nambisan, 2017). Considering that firms have linkages when developing products, this can in turn facilitate spillovers between them (Audretsch et al., 2022; Frenken et al., 2007). In addition, focusing on digitalization’s impact on entrepreneurial activity, it was found that investments in ICT and skills were associated with spillover formation and an increase in productivity in regions (Corrado et al., 2017). Therefore, such regions are more likely to attract high-growth firms. In addition, Kenney and Zysman (2016, 2019) argued that firms located in industries with digital skills and capabilities are more likely to become a conduit for technologies and ideas to market (e.g., platform business models). We hypothesize:

H1b

Digitalization facilitates productive entrepreneurship in regions.

2.3 Creative industries, regional resilience, and productive entrepreneurship

The extant literature on the creative industries encompasses different definitions of creative industries, highlighting their sociological, anthropological, and economic perspectives (UNCTAD, 2022; DCMS UK, 2001; Khlystova et al., 2022a). Drawing on the UK’s Department for Digital, Culture, Media and Sport (DCMS), we consider the creative industries as “those industries which have their origin in individual creativity, skill, and talent and which have a potential for wealth and job creation through the generation and exploitation of intellectual property” (DCMS, 2019, p. 7).

A number of studies conducted by international organisations and the academic community have demonstrated that the creative industries are a driver of sustainable development, entrepreneurship, and innovation (Audretsch & Belitski, 2021; Cooke & De Propris, 2011; Florida, 2002; Khlystova et al., 2022a; UNCTAD, 2010, 2018; UNESCO, 2021). Chaston and Sadler-Smith (2012) also argued that the creative industries are especially important for regions affected by economic shocks and recessions in traditional industries (e.g., manufacturing, agriculture) because of the high availability of creative talents, skills, and ideas (De Propris, 2013; Piergiovanni et al., 2012; Sundbo, 2011).

Considering the relationship between regional resilience and the creative industries, prior research highlighted the unique characteristics of the creative industries, which are flexibility, innovation, sustainability, and entrepreneurship (Felton et al., 2010; Herbane, 2019; Khlystova et al., 2022a; OECD, 2014). This brings us to the argument that these characteristics mean the creative industries are particularly resilient to external shocks and challenges. Studies on regional economics indicated that regions that accelerate a high number of skilled workforce in skills-intensive economic sectors (such as the creative industries) perform better and foster regional growth (Brakman et al., 2015; Chapain et al., 2010; Duranton & Puga, 2014). Drawing on the idea of the highly skilled workers and talents in a region, Florida (2002) suggested the “economic geography of talent” hypothesis, arguing that highly qualified people (such as the creative class) live in close spatial locations and ensure high levels of productive entrepreneurship in the regions where they concentrate (Boschma & Fritsch, 2009; Nicotra et al., 2018).

Prior studies have confirmed that the creative industries have made a substantial contribution to attracting a highly skilled workforce and that these industries are more innovative per se than, for example, the manufacturing and services sectors (e.g., finances, research, other professional services) (Bakhshi et al., 2008; Chapain et al., 2010). This suggests that regions dominated by the creative industries can demonstrate resilience to external shocks by producing creative goods and services based on the input–output relationships with other sectors within a region, facilitating more diversification (Boschma, 2015; Dissart, 2003). For instance, DCMS together with NESTA investigated how the creative industries can contribute to the UK’s economy through their products and services and found that this sector is also affecting other economic sectors via cross-sector innovations and knowledge spillovers (Chapain et al., 2010; DCMS, 2008; De Propris, 2013).

Prior research also indicated that this sector is more likely to produce new knowledge, spillovers, and demonstrate creativity because of the nature of this sector (Audretsch & Belitski, 2021; Boschma & Fritsch, 2009; Florida, 2004; Venturelli, 2005), which can in turn facilitate productive entrepreneurship in regions (Audretsch & Caiazza, 2016). Entrepreneurial activity has been seen as a driver of economic growth and resilience in regions (Audretsch & Belitski, 2017, 2021; Malecki, 2018; Simmie & Martin, 2010; Williams & Vorley, 2014). Audretsch and Keilbach (2005) found a direct link between entrepreneurship capital, which is a specific type of human capital referring to the capacity of a region to generate entrepreneurial activity, and regional economic growth (Piergiovanni et al., 2012). We hypothesize:

H2

Creative industries facilitate (a) regional resilience and (b) productive entrepreneurship to a greater extent than other industries.

2.4 Creative industries and digitalization

In recent years, the creative industries and digitalization have had a reciprocal impact, shaping the interactions between economic agents and the sector’s performance (UNESCO, 2022). Prior studies also indicated that the creative industries aimed to improve business performance and increase the number of innovation opportunities by implementing various digital tools in their business models, as well as in the creation and delivery of products and services (Gordijn & Akkermans, 2001; Li, 2020; Peukert, 2019; Sung, 2015). However, while prior research has examined how digitalization affects new business formations, e-leadership, firms’ agility, and innovation performance (Li et al., 2016; Škare & Soriano, 2021; Zhou et al., 2021; Fernandez-Vidal, 2022; Usai et al., 2021), little attention has been paid to the creative sector. We argue that the creative industries provide a good setting to examine regional resilience since they include a wide range of activities, from digitally intense creative sub-sectors (such as IT, computers, and video games) to creative sub-sectors that have been gradually modified by digital technologies (such as advertising and publishing).

Recent studies conducted by the United Nations Conference on Trade and Development (UNCTAD) emphasized that firms and organisations involved in the process of cultural products creation (e.g., music, films, and games) had become more engaged with social media, platforms, 3D technologies, and new software (UNCTAD, 2019, 2022). As a result, high exposure to digital tools and innovations has modified the value of the creative industries and the way they work. This has significantly decreased the boundaries between the creative industries and the digital economy, introducing a new manifestation of the creative economy known as “Creative industry 4.0.” (UNCTAD, 2022). Consequently, the creative industries have become more interactive and hyperlinked, making this sector even more competitive and entrepreneurial-oriented (UNESCO, 2018).

Prior studies have argued that digitalization positively affects entrepreneurial activity and creativity, especially in the creative industries, contributing to companies’ growth during crises and external shocks (Belitski et al., 2023; Florida, 2002; Khlystova et al., 2022a). Information technology (IT) tools adapted to the needs of the creative industries enhance entrepreneurial and innovation opportunities, for instance by creating new ways to deliver creative products and services, attracting more attention from potential customers, and reducing the time required to develop and run new products (Iansiti & Lakhani, 2014; Marion et al., 2015; McMullen et al., 2021; Prokůpek, 2020; Townsend et al., 2017). For example, Bourreau et al. (2013) empirically examined the performance of French record companies that adopted digital tools and demonstrated that those companies are more efficient in terms of their creative output. Peukert and Reimers (2018) also investigated the benefits of digitalization in the book publishing industry and demonstrated that digital self-publishing platforms could increase the welfare of authors and publishers as well as increase sales. Using a case of pictorial art, Bekar and Haswell (2013) also pointed out that digital technologies helped artists promote their works via online galleries and websites, facilitating sales. Therefore, we argue that since digitalization has become an integral part of the creative industries, it can moderate and improve the industry’s performance even in times of uncertainty. We hypothesize:

H3

Digitalization positively influences the impact of the creative industries on regional resilience and productive entrepreneurship.

The theoretical framework is illustrated in Fig. 1.

3 Method

3.1 The data

We use data from NUTS-3 European regions during the period of 2008–2015, which covers the Great Recession and the European debt crises, as well as the recovery stage (Brakman et al., 2015; Cainelli et al., 2019). This period allows us to investigate the recovery patterns of industries within each of the 314 NUTS-3 regions and how they withstood the shock. Our main source of data for the dependent variables is Eurostat Regional statistics (Eurostat, 2020) for 2008–2015, merged with European Social Survey (ESS) for the years 2008–2010, 2012, 2014, and 2015 (ESS, 2016), resulting in 1397 NUTS-3-year observations.

We also used the McKinsey Global Institute (MGI) approach (Manyika et al., 2015) to create the Digitalization Index based on the Eurostat (2020) data for NUTS-2 regions during 2008–2015. Indicators related to ethnic minority and [migrant] tolerance were aggregated using individual data by NUTS-2 regions from the ESS (2016) and matched to Eurostat Regional statistics at NUTS-2 levels. Our dependent variables include the measures of regional concentration of high-growth firms and regional resilience, which are split between withstanding and recovery from external shocks, as suggested in prior research (Brakman et al., 2015). Our final dataset yields 1397 observations across 11 European countries (Bulgaria, the Czech Republic, Denmark, Finland, France, Hungary, Italy, the Netherlands, Portugal, Romania, and Slovakia) for the period 2008–2015 (see “Appendix”).

3.2 The dependent variables

The extant literature measures regional resilience using the dynamics of regional capacities needed to withstand, adapt, and recover after crises. The resilience concept itself encompasses different stages that are described as withstanding, adaptation, and recovery from crises (Kahl & Hundt, 2015; Martin & Sunley, 2015). In our study, we use withstanding a crisis and recovery from the crisis as two measures to analyse the regional resilience dynamics and the immediate (withstanding) and post hoc response to the crisis (recovery).

Our first dependent variable is withstanding crisis. It is a binary variable that equals one if employment in a region r at time t (which is the first year of crisis) is greater than the employment in region r at time t − 1 (pre-crisis year), zero otherwise. Note that the corresponding employment data are available for every year before and during the crisis from Eurostat (2020) by NUTS-3 regions, which makes these data suitable for this paper. Prior research used employment to assess a region’s resilience to shocks (Fingleton et al., 2012, 2015), and for the European NUTS-2 region during the Great Recession (Brakman et al., 2015). We analyse two exogenous shocks to create the withstanding crisis indicator for 2008–2009 and 2012 as the years of the financial crisis in Europe (Cainelli et al., 2019). Measured this way, withstanding crisis was calculated for the first year of the 2008 Great Recession, and for 2012 as the recession emerged again in 2012. The descriptive statistics demonstrate that 9 percent of all regions between 2008 and 2012 withstood the crisis. This means that employment in 9 percent of the regions in our sample in 2008 and 2012 did not decrease from the pre-crisis levels in 2007 and 2011, respectively. This allows us to conclude that regions have withstood the crisis. Brakman et al. (2015) argue that this is a short-term measure of evaluating the response to the financial crisis. Withstanding crisis was used in Model 1, which analyses the immediate response to crises.

Our second dependent variable is recovery from the crisis. It is a binary variable that equals one if employment in a region r at time t (which is the first year after the end of the crisis) is greater than the employment in region r at time t (last year of crisis), zero otherwise. For example, if employment in 2010 (the first year after the financial crisis) is greater than employment in 2009 (the last year of the crisis), then the value of one is given to “recovery”. The variable is calculated for the first year after the crisis: 2011 (post hoc of the 2008 Great Recession) and 2013 as the first year after the financial crisis of 2012 (Cainelli et al., 2019). Recovery from the crisis was used in Model 2, which analyses the post hoc response to crises. Our third dependent variable is the rate of high-growth firms, which is the number of firms in a region that demonstrated at least 10% employment growth over the last 3 years divided by all active firms (Stam & Van de Ven, 2021; Belitski et al., 2023). Our third dependent variable is included in both Models 1 and 2 in a system of equations.

3.3 The explanatory variables

To test our H1, we operationalize digitalization in regions drawing on the McKinsey Global Institute (MGI) approach to the calculation of the digitalization index (Manyika et al., 2015). We used Eurostat (2020) data from NUTS-2 regions to construct a scale variable of digitization intensity for a region. We create a Cronbach alpha (0.91) integrated indicator, using the following variables as a proxy for regional digitalization at the NUTS-3 level from Eurostat (2020), which is available for the entire period of our study from 2008 to 2015. The index includes four variables related to the use of online services and social networks which represent the digital capabilities of residents and the e-commerce infrastructure development of a region. The first variable is the percentage of residents participating in social networks in a region – year. The second variable is the percentage of residents using the internet – online banking in a region – year. The third variable is the percentage of residents who sell goods or services online in a region – year. Finally, the fourth variable is the proportion of e-commerce – online purchases of goods or services by residents in a region – year in total purchases. This indicator is applied for online purchases by households in the last four weeks (before completing the survey at a certain point in time) and aims to evaluate the residents who are most persistent in online shopping.

To test our H2 and H3, we used the share of employees in the arts and entertainment industries in total employment in the NUTS-3 region at time t. This variable was recently used in the analysis of the role that the creative sector plays in the entrepreneurial ecosystems in European NUTS-3 regions (Audretsch & Belitski, 2021).

3.4 The control variables

We introduced the following control variables related to regional resilience and regional concentration of high-growth firms. Firstly, the level of tertiary education as a proxy for human capital in a region (Chowdhury et al., 2019) is measured as a percentage of residents of a region with a tertiary degree. Secondly, we measured regional culture and tolerant attitudes toward foreigners by aggregating individual answers at the NUTS-2 level from the EES dataset using the question “Allow few migrants vs. ethnic majority?”, measured from 1 to 4, with 1 meaning allow many to come and live here, and 4 meaning allow none, where 4 is related to low regional tolerance to other cultures, while 1 indicates high tolerance. We used tolerance of foreigners rather than tolerance of gay and bohemian populations, as in Florida (2002).

Thirdly, we used the ethnic minority indicator, which is an aggregate measure by region NUTS-2 of people who answered “yes” or “no” to the question of whether they were a minority member rescaled around zero, with negative values demonstrating low ethnic diversity and larger values demonstrating high ethnic diversity. This measure of ethnic diversity, normalized around zero, is more representative than the population share of ethnic minorities in each city; it is based on cultural diversity proxy following Florida et al. (2008), who linked it to regional economic development. Drawing on Campos and Kuzeyev (2007), Patsiurko et al., 2012), and Luiz (2015), we aggregated individual data at the NUTS-2 level from EES (2016).

Fourthly, we used gross value added per capita in a region—year as a proxy for the economic development of a region (Audretsch & Belitski, 2021; Audretsch et al., 2015). It is taken in constant 2010 prices in logarithms and at NUTS-3 level city-region. Fifthly, we used employment by sector in total employment control as industry-specific effects in the NUTS-3 region. This includes the percentage of people employed in science, real estate, ICT, trade and transportation, construction, manufacturing, and agriculture in the NUTS 3 region in a time t. Finally, we included the rate of unemployment at the NUTS-3 level (Audretsch et al., 2015) and the logarithm of the total population in the NUTS-3 region (Fritsch et al., 2019) as a proxy for labour market structure and the market size of a region. All dependent and explanatory variables (except for digitalization, which is at NUTS-2) are at the NUTS-3 city-region level, while some control variables taken from ESS are at the NUTS-2 regional level. In addition, we used country and the NUTS-2 regional fixed effects and year fixed effects. Table 2 introduces descriptive statistics and Table 3 presents correlations.

3.5 Methodology

Given the potential interdependence of regional resilience – withstanding and recovery from crises and the regional concentration of high-growth firms and their residuals, we simultaneously model these variables in Models 1 and 2. Factors that are in the residuals may equally affect the share of high-growth firms in a region (Audretsch & Belitski, 2021) and the ability of a region to withstand and recover from the exogenous shock (Kahl & Hundt, 2015; Martin & Sunley, 2015). A standard way of modelling jointly determined indicators is a system of equations called seemingly unrelated regression equations (SUREs), where all six equations are linked only by their errors (Zellner, 1962) and apply it for a mixed process estimator with multilevel random effects and coefficients using “cmp” option in STATA 15, which applies the Geweke, Hajivassiliou, and Keane (GHK) algorithm (Roodman, 2009).

The model below represents a system of Eq. (1):

where \(E_{{\left( {ij, t,c} \right)}}\) is productive entrepreneurship proxied as the rate of high-growth firms in the NUTS-3 region (r) at time t. \(R_{{\left( {i,r, t, c} \right)}}\) is a measure of regional resilience, proxied by a withstanding crisis (Model 1) and recovery from the crisis (Model 2) of a region NUTS-3 (r) in time t. \(x_{r,t,c}\) is a vector of our variables of interest: regional digitalization, gross regional value added per capita, employment share by each industry in a region r and time t. \(z_{r,t}\) is a vector of control variables for a region r, time t. Moreover, we include three additional vectors \(\rho_{c}\) is the NUTS-2 region (c) fixed effects over time t, \(\rho_{i}\) is the set of sectoral controls for employment described in the control variables section; \(\lambda_{t}\) is a vector of time-fixed (entity invariant effects) over each time period t across all industry i, region r. The error term is denoted by \(u_{i,r,t}\) for industry i, region r, at time t. \(u_{i,r,t}\) is assumed to be identically and independently distributed with mean zero and constant variance σ2. The equations are related to each other having errors that are jointly normally distributed and therefore inter-dependent.

4 Econometric results

4.1 Withstanding crisis

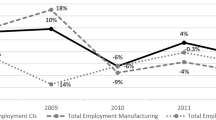

Table 4 reports Model 1, namely the regression results for all industries with two dependent variables in the system of equations: withstanding crisis (columns 1–8, Table 4), and rate of high-growth firms (columns 9–16, Table 4). Each column in Table 4 introduces the interaction term of digitalization with a share of employment in each sector in region r, which represents a relative specialisation of each region.

Our results do not support H1a, which states that digitalization facilitates regional resilience, as the coefficient of digitalization is positive but insignificant. Our results partly support H1b, which states that digitalization facilitates productive entrepreneurship in regions when interacted with the share of employment in science (β = 0.06, p < 0.01) (column 10, Table 4), ICT (β = 0.05, p < 0.01) (column 12, Table 4) and agriculture (β = 0.04, p < 0.01) (column 16, Table 4). Our results demonstrate that digitalization increases the rate of high-growth firms in regions that are more specialised in ICT, science, and agriculture.

Our H2a, which states that creative industries facilitate withstanding crises to a greater extent than other industries, is supported. The coefficients of the creative industry variable (percentage of employed in arts and entertainment in total employment in NUTS-3 region) are positive and significant across all specifications and are in the range 0.009–0.01 (p < 0.05) (column 1–8, Table 4). A direct economic interpretation of the size of the effect of the creative industries on the likelihood of withstanding a crisis is not possible from Table 4 as the estimation is non-linear. The results demonstrate that regions with a higher share of employment in the creative industries are more likely to withstand a short-term economic shock than regions with a lower share of employment in creative industries.

Our H2b, which states that creative industries facilitate productive entrepreneurship to a greater extent than other industries, is supported as the coefficient of employment in creative industries is positive (β = 0.01, p < 0.05) (column 9, Table 4). The relationship is conditional on the level of digitalization in a region (β = 0.010, p < 0.01) (column 9, Table 4). Interestingly, the effect disappears for interaction with other sectors in a region.

Our results partly support H3, which states that digitalization positively influences the impact of the creative industries on regional resilience and productive entrepreneurship. Digitalization does not affect the relationship between employment in the creative industries and a region’s ability to withstand crisis (resilience), with the interaction coefficient statistically insignificant (β = 0.003, p > 0.10) (column 1, Table 4). However, digitalization positively influences the impact of creative industries on productive entrepreneurship (β = 0.010, p < 0.01) (column 9, Table 4). The estimation with a continuous dependent variable allows us to provide an economic interpretation of the coefficient, which means that an increase in digitalization by one standard deviation and an increase in employment in creative industries by one percent is associated with an increase in a rate of high-growth firms by one percentage point. Our results demonstrate that the creative industries enhance the propensity to withstand crises independently of the level of digitalization in a region. At the same time, the creative industries rely on digitalization to facilitate the rate of high-growth firms.

4.2 Recovery from crisis

Table 5 reports Model 2, namely the regression results for all industries with two dependent variables in the system of equations: recovery from crisis (columns 1–8, Table 5), and a rate of high-growth firms (columns 9–16, Table 5). Each column in Table 5 introduces the interaction term of digitalization with the share of employment in each sector in region r, which represents a relative specialisation of each region.

In contrast to the results in Table 4, which did not support H1a, Model 2 does support H1a. Our H1a, which states that digitalization facilitates regional resilience, is partly supported for the specification with the creative industries (β = 0.04, p < 0.05) (column 1, Table 5), while it is not statistically significant for other specifications in Model 2, which include interaction coefficients other than the creative industries. Our result demonstrates the importance of digitalization in the period of recovery from the crisis and shows that the creative industries play an important part in this process, supporting H3 (β = 0.008, p < 0.05) (column 1, Table 5).

In contrast to the findings in Table 4, our H1b, which states that digitalization facilitates productive entrepreneurship in regions, is partly supported, with the coefficients of digitalization positive and significant for specifications with employment in the creative industries (β = 0.03, p < 0.10) (column 9, Table 5), science (β = 0.06, p < 0.01) (column 10, Table 5), real estate (β = 0.01, p < 0.10) (column 11, Table 5), ICT (β = 0.05, p < 0.01) (column12, Table 5), manufacturing (β = 0.04, p < 0.10) (column 15, Table 5), and agriculture (β = 0.04, p < 0.01) (column 16, Table 5). The differences in the results for digitalization across different sectors may be explained by the different levels of digital saturation that a sector needs to achieve before it is able to generate high-growth firms.

Our H2a, which states that the creative industries facilitate recovery from crisis to a greater extent than other industries, is not supported. This result is in contrast to Model 1, where we found that employment in the creative industries increases the likelihood of withstanding a crisis, but not the recovery from it. The condition when employment in the creative industries can contribute to the recovery from the crisis is the level of digitalization of a region, with the coefficient positive and significant, supporting H3 (β = 0.008, p < 0.05) (column 1, Table 5).

Our H2b, which states that creative industries facilitate productive entrepreneurship to a greater extent than other industries, is supported as the coefficient of employment in creative industries is positive (β = 0.01, p < 0.05) (column 9, Table 5). This result is consistent with the findings in Model 1 (Table 4). The relationship is conditional on the level of digitalization in a region (β = 0.010, p < 0.01) (column 9, Table 5), supporting H3 on the complementarity between the creative industries and digitalization.

Overall, our findings from Table 5 demonstrate that regions with a higher share of employment in the creative industries facilitate the rate of high-growth firms conditional on digitalization. However, there the share of employment in creative industries has no direct effect on recovery from shock. This result is distinct from the result of Model 1, where the creative industries demonstrated their ability to withstand a crisis. Our findings also show that digitalization becomes more important in recovery from crises for regions with a higher specialization in the creative industries, where the creative sector leverages the short-term economic shock of the crisis. The effect of digitalization is stronger for the creative industries when recovering from a crisis than for any other sectors (columns 1–9, Table 5).

4.3 Post hoc analysis

Based on the outcomes of SURE estimation (1) and Models 1 and 2, we plotted the moderating effects of employment in the creative industries and digitalization, predicting the level of three main variables of interest: withstanding crisis (Fig. 2), corresponding to column 1 (Table 4); recovery from crisis (Fig. 3), in the form of predictive margins corresponding to column 1 (Table 5); and the rate of high-growth firms (Fig. 4), corresponding to column 9 (Tables 4 and 5). Predictive margins demonstrate how the relationship between employment in the creative industries and an increase in the digitalization of a region affect regional resilience (Figs. 2, 3) and productive entrepreneurship (Fig. 4). Using the predictive margins shown, we interpret our findings and conclusions related to our hypotheses.

Figure 2 demonstrates that while an increase in employment in the creative industries from 5 to 18% increases the propensity of withstanding crises (from 0.1 to 0.6) for regions with a low level of digitalization, it also increases the propensity of withstanding crises (from 0.6 to 0.95) for regions with a high level of digitalization. A higher level of digitalization in a region shifts the line of the creative industries upwards, while we evidence that an increase in the creative industries facilitates withstanding a crisis, supporting H2a.

Figure 3 demonstrates that an increase in employment in the creative industries from 5 to 18% increases the propensity of recovery from crisis (from 0.05 to 0.2) for regions with high levels of digitalization. For regions with low levels of digitalization, an increase in the creative industries is associated with a negative propensity for recovery. This is an interesting finding which demonstrates that a combination of digitalization and employment in the creative industries is able to help regions to recover from crisis and enhance their resilience rather than employment in the creative industries per se, supporting H3.

Finally, Fig. 4 demonstrates that an increase in employment in the creative industries (from 5 to 18%) increases the predicted rate of high-growth firms in a region (from 50 to 90%) for regions with a high level of digitalization. We find the complementarity between the level of digitalization and the share of employment in creative industries facilitates the rate of high-growth firms, supporting H3.

5 Discussion

This empirical study investigated the creative industries’ impact on regional resilience and productive entrepreneurship, controlling for the effect of digitalization in this relationship. We examined the European Union regions (NUTS-3 level) from the 2008 Great Recession crisis to the recovery period. Having reported the findings of the study, this section conceptualizes how the creative industries can serve as a source of productive entrepreneurship growth, new value creation, and regional resilience.

Understanding the role and benefits of the creative industries for regional development is beneficial since the creative workforce can be a driver of productivity, income, human capital, and inclusiveness of regions (Florida et al., 2008; Stolarick & Florida, 2006). Our results extend the prior studies of Audretsch and Belitski (2021), Audretsch et al. (2010), Audretsch et al. (2021), and Malecki and Spigel (2017) by demonstrating that the creative industries facilitate productive entrepreneurship, which can boost regional economic development. This study advances our understanding of the role of the creative industries in regional development and dynamics (Florida et al., 2008; García-Tabuenca et al., 2011; Mellander & Florida, 2006; Stolarick & Florida, 2006) by elaborating that the creative industries are an important contributor for regions to withstand and recover from crises, contributing to regional resilience. However, the level of digitalization in the region is a crucial condition for this. We argue that fostering the development of creative industries and increasing the level of digitalization in regions can provide a new path to reconsidering how regions can facilitate resilience and recover faster in times of crisis.

Our findings also contribute to the existing literature on digitalization for entrepreneurship (e.g., Burtch et al., 2018; von Briel et al., 2018; Zhang et al., 2023) by showing the important role of digitalization for entrepreneurial activity in regions. More specifically, our findings demonstrate that digitalization facilitates productive entrepreneurship at the stage of recovery from a crisis in combination with the creative industries (e.g., Fingleton et al., 2012; Florida, 2002; Friesenbichler & Hölzl, 2020; Holm & Østergaard, 2015; Tambe & Hitt, 2014). Regions specialised in the creative industries and with a high level of digitalization can be a source of resilience and foster the performance of other industries and firms located in such regions by facilitating innovations, IT, and creative skills. Thus, we can conclude that resilience and productive entrepreneurship outcomes are dependent on the specialization of regions.

Prior research has acknowledged that the spatial distribution of economic activities is a general problem of regions based on the prices, demand, and supply of products and services, as well as the value creation (Dziembowska-Kowalska & Funck, 2000; Gjestland et al., 2006). This study moves to a discussion that this may create additional constraints for regions that are either limited to labour-intensive sectors (e.g., agriculture, construction) or less/not specialized in the creative sector. Such situations would inhibit regional economic development and response strategies in times of crisis because of the lack of diversified skills and transferred knowledge, which increases regions’ ability to innovate and learn from knowledge-intensive sectors (e.g., creative industries, science, ICT, services) as well as engage in knowledge spillovers with such industries (Basilico et al., 2022; Boschma, 2015; Kogler et al., 2023; Zhang et al., 2023).

Elaborating on the spatial differences in resources and infrastructure between regions, several studies argued that some regions rely on digital technologies to a greater extent than others (Castellacci et al., 2020; Li et al., 2016). Therefore, we suggest that the dispersion of digitalization in regions may be connected to the different effects on regional resilience and productive entrepreneurship (Berlingieri et al., 2020). Based on our findings, we contend that recognising the creative industries’ digitalization joint contribution to the development of productive entrepreneurship can provide further insights to foster regional resilience and shape response strategies to exogenous shocks.

Furthermore, the extant entrepreneurship literature suggests that the amount and concentration of entrepreneurial activities depends on different settings (e.g., regulation, availability of resources, culture, personal/institutional trust, competition, corruption level, unemployment rate, etc.) within countries and regions (e.g., in developed and developing countries) (Audretsch et al., 2019; Belitski et al., 2016; Chowdhury et al., 2019; Khlystova et al., 2022b; Zhang et al., 2023). This opens the discussion on the opportunities and challenges entrepreneurs can face in different institutional contexts (Belitski et al., 2022). On the one hand, the concentration of creative entrepreneurs can advance the resilience and entrepreneurship capacity of less prosperous regions by generating new ideas and innovations, attracting more knowledge, and increasing regional productivity (Boix-Domenech & Soler-Marco, 2017; Fahmi & Koster, 2017). On the other hand, such changes in the regional distribution and transfer of knowledge, highly-skilled workforce, and sectoral specialization might increase the inequality within regional economies (Liu & Xie, 2013) as there is still a debate in the creative industries’ literature about the limited role of this sector in job creation (Bagwell, 2008; Stam et al., 2008). In addition, there is still a debate in the digital creative economy literature about the difficulties some creative sub-sectors (e.g., crafts, pictorial art) face when implementing IT tools into business models or digitizing creative goods and services. In addition, the digital divide between regions can affect the creative industries’ outcomes and new developments in this sector (Towse & Handka, 2013; UNCTAD, 2022).

6 Conclusions, policy implications, and limitations of the study

The aim of this paper was to empirically examine the effect of the creative industries on regional resilience and productive entrepreneurship controlling for the role of digitalization in this relationship. We used the example of the European Union (NUTS-3 level) during the period of the 2008 Great Recession and its recovery period. Our study extends prior research on digitalization (Autio et al., 2018; Dosi & Nelson, 2013), regional resilience (Boschma, 2015; Hassink, 2010), and productive entrepreneurship (Audretsch & Belitski, 2021; Audretsch et al., 2015; Belitski & Desai, 2016) by developing a model to capture and compare the joint effect of the creative sector and digitalization on regional resilience and productive entrepreneurship (Dharmani et al., 2021; Khlystova et al., 2022a; Li, 2020). Furthermore, by empirically investigating the interplay between digitalization and the creative industries, our results contribute to the debate about the additional value and impact on regional performance the creative industries can provide in terms of regional economic development, entrepreneurship growth, and resilience (Audretsch & Belitski, 2021; Boschma, 2015; Boschma & Fritsch, 2009; Dissart, 2003; Florida, 2004; Malecki, 2018; Simmie & Martin, 2010; Williams & Vorley, 2014), as well as how digital technologies can empower industries and regions in times of external shocks and uncertainty.

This study provides several policy implications. Our findings can be used in developing the regional policy of smart growth in Europe to unlock the opportunities of digitalization in the creative industries in order to foster productive entrepreneurship and resilience in regions (Andres & Chapain, 2013; Cooke & De Propris, 2011). It can be applied when allocating resources for the creative industries and digital transformation in regions. Policymakers should also focus on reducing the digital divide between regions to maximize the benefits of digitalization across all economic sectors and move towards more sustainable growth (UNESCO, 2022). Our findings can be further considered when distributing financial resources and supporting small and medium-sized creative firms, as well as aiming at increasing the digital capabilities of creative businesses (European Commission, 2021). Another implication is the importance of diversifying the specialization of regions to balance knowledge and labour-intensive sectors. This would provide more balance in terms of knowledge flow, human capital, innovations, and spillovers between industries, facilitating the related variety of regions (Boschma, 2015). This, in turn, may further strengthen regional competitiveness and resilience, as well as enhance value creation, especially in the creative industries (Dobusch & Schüßler, 2014; Roberge et al., 2017). Policymakers may also use this in order to attract more high-growth firms to regions by increasing the attractiveness and competitiveness of regions (Basilico et al., 2022).

This study has some limitations. Firstly, while our study focused on the European Union, the database included 11 European Union countries, which is not the complete list of all the EU countries. We acknowledge that a higher number of observations and the control of regional differences in the status of the creative industries could provide more accurate results. Secondly, this study needs more detailed industry data to better examine the effects of digitalization and creative industries on regional resilience and productive entrepreneurship. We also acknowledge that the geographical distribution and localization of the creative industries may vary from region to region (Boix et al., 2016), which may affect regional performance as well (Boschma & Fritsch, 2009; Clifton & Cooke, 2009; Tödtling et al., 2013). Finally, the data on digitalization was only available at the NUTS-2 level, and it would be beneficial to extend this data to the city level.

Our results may not be generalisable to all countries and regions, for example developing countries and transition economies. Future research could investigate the creative industries–digitalization interaction for resilience for such regions together with response strategies. This study also calls for further research to understand how the creative industries can facilitate resilience and productive entrepreneurship in regions with limited infrastructure and low levels of digitalization and knowledge availability. In addition, future studies could also examine the mechanisms to increase the level of productive entrepreneurship for regional economic development and resilience, considering the context of investigated countries and regions.

References

Acemoglu, D., & Autor, D. (2011). Skills, tasks and technologies: Implications for employment and earnings. Handbook of labor economics (Vol. 4, pp. 1043–1171). Elsevier.

Acs, Z. J., Boardman, M. C., & McNeely, C. L. (2013). The social value of productive entrepreneurship. Small Business Economics, 40(3), 785–796.

Adarov, A. & Stehrer, R. (2020). New productivity drivers: Revisiting the role of digital capital, FDI and integration at aggregate and sectoral levels (No. 178). wiiw Working Paper.

Akerman, A., Gaarder, I., & Mogstad, M. (2015). The skill complementarity of broadband internet. The Quarterly Journal of Economics, 130(4), 1781–1824.

Amoroso, S., Diodato, D., Hall, B. H., & Moncada-Paternò-Castello, P. (2022). Technological relatedness and industrial transformation: Introduction to the special issue. The Journal of Technology Transfer, 48(2), 469–475.

Anderson, C. (2012). Makers: The new industrial revolution. Random House.

Andres, L., & Chapain, C. (2013). The integration of cultural and creative industries into local and regional development strategies in Birmingham and Marseille: Towards an inclusive and collaborative governance? Regional Studies, 47(2), 161–182.

Andres, L., & Round, J. (2015). The creative economy in a context of transition: A review of the mechanisms of micro-resilience. Cities, 45, 1–6.

Ayres, R. U., & Williams, E. (2004). The digital economy: Where do we stand? Technological Forecasting and Social Change, 71(4), 315–339.

Audretsch, D. B., & Belitski, M. (2021). Towards an entrepreneurial ecosystem typology for regional economic development: The role of creative class and entrepreneurship. Regional Studies, 55(4), 735–756.

Audretsch, D. B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: Establishing the framework conditions. The Journal of Technology Transfer, 42, 1030–1051.

Audretsch, D. B., Belitski, M., Caiazza, R., & Guenther, C. (2022). Technology adoption over the stages of entrepreneurship. Interantional Journal of Entrepreneurial Venturing, 14(4/5), 379.

Audretsch, D. B., Belitski, M., & Desai, S. (2015). Entrepreneurship and economic development in cities. The Annals of Regional Science, 55(1), 33–60.

Audretsch, D. B., Belitski, M., & Desai, S. (2019). National business regulations and city entrepreneurship in Europe: A multilevel nested analysis. Entrepreneurship Theory and Practice, 43(6), 1148–1165.

Audretsch, D. B., Belitski, M., & Korosteleva, J. (2021). Cultural diversity and knowledge in explaining entrepreneurship in European cities. Small Business Economics, 56(2), 593–611.

Audretsch, D., & Caiazza, R. (2016). Technology transfer and entrepreneurship: Cross-national analysis. The Journal of Technology Transfer, 41, 1247–1259.

Audretsch, D., Dohse, D., & Niebuhr, A. (2010). Cultural diversity and entrepreneurship: A regional analysis for Germany. The Annals of Regional Science, 45(1), 55–85.

Audretsch, D. B., & Keilbach, M. (2005). Entrepreneurship capital and regional growth. The Annals of Regional Science, 39(3), 457–469.

Autio, E., Nambisan, S., Thomas, L. D., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95.

Autor, D. H., Katz, L. F., & Krueger, A. B. (1998). Computing inequality: Have computers changed the labor market? The Quarterly Journal of Economics, 113(4), 1169–1213.

Bagwell, S. (2008). Creative clusters and city growth. Creative Industries Journal, 1(1), 31–46.

Bakhshi, H., McVittie, E., & Simmie, J. (2008). Creating Innovation: Do the creative industries support innovation in the wider economy? Nesta.

Bathelt, H., & Boggs, J. S. (2003). Toward a reconceptualization of regional development paths: Is Le’pzig’s media cluster a continuation of or a rupture with the past? Economic Geography, 79(3), 265–293.

Baumol, W. J. (1996). Entrepreneurship: Productive, unproductive, and destructive. Journal of Business Venturing, 11(1), 3–22.

Baumol, W. J. (2010). The microtheory of innovative entrepreneurship. Princeton University Press.

Basilico, S., Cantner, U., & Graf, H. (2022). Policy influence in the knowledge space: a regional application. The Journal of Technology Transfer, 48(2), 591–622.

Bekar, C., & Haswell, E. (2013). In Handbook on the digital creative economy (pp. 9–19). Edward Elgar Publishing.

Belitski, M., Cherkas, N., & Khlystova, O. (2022). Entrepreneurial ecosystems in conflict regions: evidence from Ukraine. The Annals of Regional Science, 1–22.

Belitski, M., Chowdhury, F., & Desai, S. (2016). Taxes, corruption, and entry. Small Business Economics, 47(1), 201–216.

Belitski, M., & Desai, S. (2016). Creativity, entrepreneurship and economic development: City-level evidence on creativity spillover of entrepreneurship. The Journal of Technology Transfer, 41(6), 1354–1376.

Belitski, M., Korosteleva, J., & Piscitello, L. (2023). Digital affordances and entrepreneurial dynamics: New evidence from European regions. Technovation, 119, 102442.

Belussi, F., & Sedita, S. R. (2009). Life cycle versus multiple path dependency in industrial districts. European Planning Studies, 17(4), 505–528.

Berlingieri, G., Calligaris, S., Criscuolo, C. & Verlhac, R. (2020). Laggard firms, technology diffusion and its structural and policy determinants. OECD Science, Technology and Industry Policy Papers, No. 86, OECD Publishing, Paris (2020). https://doi.org/10.1787/281bd7a9-en

Bhamra, R., Dani, S., & Burnard, K. (2011). Resilience: The concept, a literature review and future directions. International Journal of Production Research, 49(18), 5375–5393.

Black, S. E., Muller, C., Spitz-Oener, A., He, Z., Hung, K., & Warren, J. R. (2021). The importance of STEM: High school knowledge, skills and occupations in an era of growing inequality. Research Policy, 50(7), 104249.

Boix, R., Capone, F., De Propris, L., Lazzeretti, L., & Sanchez, D. (2016). Comparing creative industries in Europe. European Urban and Regional Studies, 23(4), 935–940.

Boix-Domenech, R., & Soler-Marco, V. (2017). Creative service industries and regional productivity. Papers in Regional Science, 96(2), 261–279.

Bos, J. W., & Stam, E. (2014). Gazelles and industry growth: A study of young high-growth firms in The Netherlands. Industrial and Corporate Change, 23(1), 145–169.

Boschma, R. (2015). Towards an evolutionary perspective on regional resilience. Regional Studies, 49(5), 733–751.

Boschma, R. A., & Fritsch, M. (2009). Creative class and regional growth: Empirical evidence from seven European countries. Economic Geography, 85(4), 391–423.

Bourreau, M., Gensollen, M., Moreau, F., & Waelbroeck, P. (2013). “Selling less of more?” The impact of digitization on record companies. Journal of Cultural Economics, 37(3), 327–346.

Brakman, S., Garretsen, H., & van Marrewijk, C. (2015). Regional resilience across Europe: On urbanisation and the initial impact of the Great Recession. Cambridge Journal of Regions, Economy and Society, 8(2), 225–240.

Bristow, G. (2010). Resilient regions: Re-‘place’ing regional competitiveness. Cambridge Journal of Regions, Economy and Society, 3(1), 153–167.

Buenstorf, G., & Klepper, S. (2009). Heritage and agglomeration: The Akron tyre cluster revisited. The Economic Journal, 119(537), 705–733.

Burtch, G., Carnahan, S., & Greenwood, B. N. (2018). Can you gig it? An empirical examination of the gig economy and entrepreneurial activity. Management Science, 64(12), 5497–5520.

Campos, N. F., & Kuzeyev, V. S. (2007). On the dynamics of ethnic fractionalization. American Journal of Political Science, 51(3), 620–639.

Cainelli, G., Ganau, R., & Modica, M. (2019). Industrial relatedness and regional resilience in the European Union. Papers in Regional Science, 98(2), 755–778.

Caiazza, R., Belitski, M., & Audretsch, D. B. (2020). From latent to emergent entrepreneurship: The knowledge spillover construction circle. The Journal of Technology Transfer, 45, 694–704.

Caiazza, R., Richardson, A., & Audretsch, D. (2015). Knowledge effects on competitiveness: From firms to regional advantage. The Journal of Technology Transfer, 40, 899–909.

Capello, R., Caragliu, A., & Fratesi, U. (2015). Spatial heterogeneity in the costs of the economic crisis in Europe: Are cities sources of regional resilience? Journal of Economic Geography, 15(5), 951–972.

Castellacci, F., Consoli, D., & Santoalha, A. (2020). The role of e-skills in technological diversification in European regions. Regional Studies, 54(8), 1123–1135.

Cellini, R., & Torrisi, G. (2014). Regional resilience in Italy: A very long-run analysis. Regional Studies, 48(11), 1779–1796.

Chapain, C., Cooke, P., De Propris, L., MacNeill, S. & Mateos-Garcia, J. (2010). Creative clusters and innovation. Putting creativity on the map. London: NESTA.

Chaston, I., & Sadler-Smith, E. (2012). Entrepreneurial cognition, entrepreneurial orientation and firm capability in the creative industries. British Journal of Management, 23(3), 415–432.

Chowdhury, F., Audretsch, D. B., & Belitski, M. (2019). Institutions and entrepreneurship quality. Entrepreneurship Theory and Practice, 43(1), 51–81.

Christopherson, S. (2013). Hollywood in decline? US film and television producers beyond the era of fiscal crisis. Cambridge Journal of Regions, Economy and Society, 6(1), 141–157.

Christopherson, S., Michie, J., & Tyler, P. (2010). Regional resilience: Theoretical and empirical perspectives. Cambridge Journal of Regions, Economy and Society, 3(1), 3–10.

Clifton, N., & Cooke, P. (2009). Creative knowledge workers and location in Europe and North America: A comparative review. Creative Industries Journal, 2(1), 73–89.

Coad, A., Daunfeldt, S. O., Hölzl, W., Johansson, D., & Nightingale, P. (2014). High-growth firms: Introduction to the special section. Industrial and Corporate Change, 23(1), 91–112.

Cooke, P., & De Propris, L. (2011). A policy agenda for EU smart growth: The role of creative and cultural industries. Policy Studies, 32(4), 365–375.

Corrado, C., Haskel, J., & Jona-Lasinio, C. (2017). Knowledge spillovers, ICT and productivity growth. Oxford Bulletin of Economics and Statistics, 79(4), 592–618.

Coutu, D. L. (2002). How resilience works. Harvard Business Review, 80, 46–55.

Cruz, S. C. S., & Teixeira, A. A. (2021). Spatial analysis of new firm formation in creative industries before and during the world economic crisis. The Annals of Regional Science, 67(2), 385–413.

Cuadrado-Roura, J. R., & Maroto, A. (2016). Unbalanced regional resilience to the economic crisis in Spain: A tale of specialisation and productivity. Cambridge Journal of Regions, Economy and Society, 9(1), 153–178.

Currid-Halkett, E., & Stolarick, K. (2013). Baptism by fire: Did the creative class generate economic growth during the crisis? Cambridge Journal of Regions, Economy and Society, 6(1), 55–69.

Davies, S. (2011). Regional resilience in the 2008–2010 downturn: Comparative evidence from European countries. Cambridge Journal of Regions, Economy and Society, 4(3), 369–382.

Dawley, S., Pike, A., & Tomaney, J. (2010). Towards the resilient region? Local Economy, 25(8), 650–667.

DCMS UK (2001). Creative Industries Mapping 2001. Available at; https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/183544/2001part1-foreword2001.pdf Accessed 23 February 2022.

DCMS (2008). Creative Britain: New Talents for the New Economy. London: DCMS. Available At: https://static.a-n.co.uk/wp-content/uploads/2016/12/Creative-Britain-new-talents-for-the-new-economy.pdf Accessed December 2022

DCMS (2019) DCMS sector economic estimates methodology. London: Department for Digital, Culture, Media and Sport. Available at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/fle/829114/DCMS_Sectors_Economic_Estimates_-_Methodology.pdf Accessed November 2022.

De Marchi, V., Lee, J., & Gereffi, G. (2014). Globalization, recession and the internationalization of industrial districts: Experiences from the Italian gold jewellery industry. European Planning Studies, 22(4), 866–884.

De Propris, L. (2013). How are creative industries weathering the crisis? Cambridge Journal of Regions, Economy and Society, 6(1), 23–35.

Demmer, W. A., Vickery, S. K., & Calantone, R. (2011). Engendering resilience in small-and medium-sized enterprises (SMEs): A case study of Demmer Corporation. International Journal of Production Research, 49(18), 5395–5413.

Dissart, J. C. (2003). Regional economic diversity and regional economic stability: Research results and agenda. International Regional Science Review, 26(4), 423–446.

Dharmani, P., Das, S., & Prashar, S. (2021). A bibliometric analysis of creative industries: Current trends and future directions. Journal of Business Research, 135, 252–267.

Dobusch, L., & Schüßler, E. (2014). Copyright reform and business model innovation: Regulatory propaganda at German music industry conferences. Technological Forecasting and Social Change, 83, 24–39.

Donald, B., Gertler, M. S., & Tyler, P. (2013). Creatives after the crash. Cambridge Journal of Regions, Economy and Society, 6(1), 3–21.

Dosi, G., & Nelson, R. R. (2013). The evolution of technologies: An assessment of the state-of-the-art. Eurasian Business Review, 3(1), 3–46.

Duranton, G., & Puga, D. (2014). The growth of cities. Handbook of Economic Growth, 2, 781–853.

Duval, R., Elmeskov, J. & Vogel, L. (2007). Structural policies and economic resilience to shocks. Economics Department Working Paper 567. Paris: Organisation for Economic Cooperation and Development.

Dziembowska-Kowalska, J., & Funck, R. H. (2000). Cultural activities as a location factor in European competition between regions: Concepts and some evidence. The Annals of Regional Science, 34(1), 1–12.

Elia, G., Margherita, A., & Passiante, G. (2020). Digital entrepreneurship ecosystem: How digital technologies and collective intelligence are reshaping the entrepreneurial process. Technological Forecasting and Social Change, 150, 119791.

Eraydin, A. (2016). The role of regional policies along with the external and endogenous factors in the resilience of regions. Cambridge Journal of Regions, Economy and Society, 9(1), 217–234.

ESS (2016) European Social Survey. Data and Documentation. Rounds 4, 5, 6, 7, 8 . Available at: https://www.europeansocialsurvey.org/data/ Accessed 15 February 2022.

Essletzbichler, J. (2007). Diversity, stability and regional growth in the United States, 1975–2002. Applied evolutionary economics and economic geography, p. 203.

European Commission (2021). Transforming the creative and cultural industries with advanced technologies Sectoral Watch: Technological trends in the creative industries. Available at: https://ati.ec.europa.eu/sites/default/files/2021-10/Leaflet%20Technological%20trends%20in%20the%20creative%20industries.pdf Accessed 28 March 2022.

Eurostat (2020). Regional statistics by NUTS classification. European Commission. Available at: https://ec.europa.eu/eurostat/web/regions/data Accessed 26 January 2021.

Fahmi, F. Z., & Koster, S. (2017). Creative industries and regional productivity growth in the developing economy: Evidence from Indonesia. Growth and Change, 48(4), 805–830.

Falck, O., Heimisch-Roecker, A., & Wiederhold, S. (2021). Returns to ICT skills. Research Policy, 50(7), 104064.

Fagerberg, J., & Srholec, M. (2022). Capabilities, diversification and economic dynamics in European Regions. The Journal of Technology Transfer, 48(2), 623–644.

Felton, E., Gibson, M. N., Flew, T., Graham, P., & Daniel, A. (2010). Resilient creative economies? Creative industries on the urban fringe. Continuum, 24(4), 619–630.

Fernandez-Vidal, J., Gonzalez, R., Gasco, J., & Llopis, J. (2022). Digitalization and corporate transformation: The case of European oil and gas firms. Technological Forecasting and Social Change, 174, 121293.

Fischer, E., & Reuber, A. R. (2011). Social interaction via new social media:(How) can interactions on Twitter affect effectual thinking and behavior? Journal of Business Venturing, 26(1), 1–18.

Fingleton, B., Garretsen, H., & Martin, R. (2012). Recessionary shocks and regional employment: Evidence on the resilience of UK regions. Journal of Regional Science, 52(1), 109–133.

Fingleton, B., Garretsen, H., & Martin, R. (2015). Shocking aspects of monetary union: The vulnerability of regions in Euroland. Journal of Economic Geography, 15(5), 907–934.

Florida, R. (2002). The rise of the creative class (Vol. 9). Basic books.

Florida, R. (2004). The rise of the creative class. Revised paperback ed. New York: Basic Books.

Florida, R., Mellander, C., & Stolarick, K. (2008). Inside the black box of regional development—human capital, the creative class and tolerance. Journal of Economic Geography, 8(5), 615–649.

Foster, K. A. (2007). Snapping Back: What Makes Regions Resilient? National Civic Review, 184(1), 27–29.

Frenken, K., Van Oort, F., & Verburg, T. (2007). Related variety, unrelated variety and regional economic growth. Regional Studies, 41(5), 685–697.

Fritsch, M., Pylak, K., & Wyrwich, M. (2019). Persistence of Entrepreneurship in Different Historical Contexts (No. 2019–003). Friedrich-Schiller-University Jena.