Abstract

Despite the key role of multinational enterprises (MNEs) in both international markets and domestic economies, there is no consensus on their impact on their host economy. In particular, do MNEs stimulate new domestic firms through knowledge spillovers? Here, we look at the impact of MNEs on the entry and exit of domestic industries in Irish regions before, during, and after the 2008 Financial Crisis. Specifically, we are interested in whether the presence of MNEs in a region results in knowledge spillovers and the creation of new domestic industries in related sectors. To quantify how related an industry is to a region’s industry basket we propose two cohesion measures, weighted closeness and strategic closeness which capture direct linkages and dense inter-industry links between local industries respectively. We use a dataset of government-supported firms in Ireland (covering 90% of manufacturing and exporting) between 2006 and 2019. We find that domestic industries are both more likely to enter and less likely to leave a region if they are related to so-called ‘overlapping’ industries containing both domestic and MNE firms. In contrast, we find a negative impact on domestic entry and survival from cohesion to ‘exclusive MNE’ industries, suggesting that domestic firms are unable to ‘leap’ and thrive in MNE-proximate industries likely due to a technology or know-how gap. Finally, the type of cohesion matters. During the economic recovery (2015–2019), it is strategic rather than weighted closeness to overlapping industries that is associated with both domestic industry entry and survival.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The avenues through which regions can generate economic prosperity and growth has long occupied a central position in the global research agenda. Foundational theories emerging from evolutionary economic geography suggest that regions grow by combining existing capabilities to create new economic activity (Nelson and Winter 1982). As it is costly to develop new activities that require capabilities that are unavailable in a region, regions tend to diversify into economic activities that are related to their current capabilities in a path dependent manner (Frenken and Boschma 2007; Hidalgo et al. 2007). They may also look outwards to access new capabilities through external actors such as suppliers in neighbouring regions, migrants or foreign direct investment. In particular, attracting MNEs is seen as a key channel to import new capabilities and generate knowledge spillovers via technology (Markusen and Venables 1999; Arnold and Javorcik 2009) and skill transfer (Görg and Strobl 2005b; Balsvik 2011). These spillovers are thought to enrich a region’s capability base and thereby enhance domestic diversification opportunities.

MNEs are generally viewed as beneficial to a host economy as they transfer financial resources (Iammarino and McCann 2013), create new market opportunities (Crescenzi et al. 2015) and influence the productivity and innovation of co-located domestic firms through spillover effects (Iammarino and McCann 2013). Spillover effects can emerge through a variety of channels including demonstration effects, competition effects and labour mobility (Blomström and Kokko 1998). These are most often captured empirically through supply-chain linkages, but we focus on inter-sectoral labour mobility here in order to better proxy for knowledge spillovers (Balsvik 2011; Görg and Strobl 2005b). These spillover effects may not always materialise, however, as MNEs actively protect their know-how and skills to prevent competition (Alcacer and Delgado 2016), or the capability gap may be too large between domestic and MNE firms and workers limiting absorptive capacity (Kokko et al. 1996; Blomström and Kokko 1998).

In this study, we are interested in whether cohesion to MNEs in related sectors leads to knowledge spillovers that drive new domestic industry entries at a regional level. While a huge number of studies have investigated the effect of MNEs within an industry (Gorg and Strobl 2001; Harris and Robinson 2003; Crescenzi et al. 2015), there have been fewer studies focusing on inter-industry impacts. These include the impact of supply-chain linkages to MNEs on domestic entry (Ayyagari and Kosová 2010), and the cohesion of MNE entries to the local knowledge base (Elekes et al. 2019). Here we focus specifically on the role of inter-industry knowledge spillovers from local MNEs for domestic industry entry.

Further, we are interested in whether MNEs have a protective effect on regional domestic industry survival. Within the evolutionary economic geography literature, resilience is studied from an evolutionary perspective in which it is defined as a region’s ability to successfully diversify into new growth paths when faced with an economic shock (Simmie and Martin 2010). The current consensus is that the more variety and the more closely an industry is related to a region’s industrial basket, the more likely it is to survive (Nelson and Winter 1982; Neffke et al. 2011; Balland et al. 2015). In terms of inter-industry spillover effects from MNE to domestic industries at a regional level, Szakálné Kanó et al. (2019) found that the greater the variety of MNEs within a region’s industrial portfolio the higher the chance of firm survival and the greater the region’s resilience. Here we extend this literature, focusing on the impact of cohesion to MNEs in terms of knowledge or skill linkages on domestic industry exits.

In order to quantify the potential for knowledge spillovers, encompassing a range of potential mechanisms, we deploy the skill-relatedness metric developed by Neffke and Henning (2013). Skill-relatedness is a pair-wise measure of industry skill-similarity based on inter-industry labour mobility, and is used to build a cohesion measure which quantifies the degree of relatedness between an industry and the wider existing industrial basket of a region. Examples of such measures include the closeness measure (Neffke et al. 2011) and the product space density (Hidalgo et al. 2007), which have been widely used to study regional industrial diversification and structural change (Neffke et al. 2011; O’Clery et al. 2018; Boschma et al. 2013). These measures, however, fail to consider the connectivity of related industries both between each other and with other industries in the region. In other words, they do not consider the high-order linkages that form a densely connected group of related industries in a region. Here we introduce a new measure, strategic closeness, which captures cohesion to industries which are themselves well-connected thus quantifying relatedness between sectors in a region.

We carry out our analysis on a subset of government-supported Irish firms that covers the vast majority of manufacturing and exporting firms in Ireland. Knowledge spillovers from MNEs are most likely to occur amongst these firms as they represent the most productive and complex part of an economy (Kokko 1994). Unlike previous studies, we separately investigate the impact of so-called ‘overlapping industries’—those that have both MNE and domestic employment in a region—and MNE-only industries (‘exclusive MNE industries’) on domestic industry entry and exit. We focus on three distinct periods, before the Financial Crisis (2006–2009), the recession (2010–2014) and the recovery period (2015–2019) which coincided with the Brexit referendum of 2016.

We find that cohesion to overlapping industries is positively associated with both entry and survival of government-supported domestic export and manufacturing industries. In contrast, we find that if a domestic industry is proximate to MNE-only industries it reduces the industry’s chance of entry and survival. Our results suggest that domestic industries are unable to benefit from spillovers in this case due to a large technological and know-how gap. Hence, while it is difficult for domestic firms to ’leap’ into these more complex and cognitively distant MNE dominated industries, once they have successfully entered and coexist with MNEs, overlapping industries appear to successfully induce further new entries via knowledge spillovers. In the most recent period studied, 2015–2019, we observe domestic export firms entering MNE-exclusive industries. Although we show no causal link, this coincides with significant financial support injected in 2017–2018 to enhance firm diversification and generate new domestic-MNE links in response to Brexit fears. During this period, it seems that domestic industries manage to make larger cognitive ‘leaps’ and break into MNE dominated industries. Finally, we find that the type of cohesion matters. The presence of densely connected overlapping industries is associated with both more entries and better survival of domestic export and manufacturing activities in the recovery period.

We briefly provide an overview of the structure of the rest of the paper. Following a comprehensive literature review, we introduce the data and definitions of industry entries and exits as well as present some preliminary statistics and trends in the data. We then focus on the methodological development of the closeness measure of Neffke et al. (2011) and the introduction of a new cohesion measure, the strategic closeness, before adapting both measures to account for domestic and MNE industries separately. We then present our econometric model, and our results. Finally, the paper concludes by discussing some potential policy implications of our work.

2 Literature

2.1 MNEs as agents of structural change

Regional diversification is often depicted as a branching process in which a region develops new economic activities by drawing on and recombining capabilities, particularly know-how and skills embedded in workers, that are present within the region (Hidalgo et al. 2007; Frenken and Boschma 2007). This is because search costs rapidly rise as the gap between the regionally available skills and know-how and those that are required for the new economic activity widens. Furthermore, new activities unrelated to the existing knowledge base of a region tend to have a lower probability of survival (Nelson and Winter 1982; Neffke et al. 2011). Hence, related diversification (diversification into industries that are cognitively similar within a region) is the dominant channel for industrial diversification, while unrelated diversification (diversification into industries that are cognitively dissimilar) is rare (Frenken et al. 2007; Pinheiro et al. 2018). What is less clear within this literature is the role that external actors (e.g. suppliers and customers in neighbouring regions or foreign direct investment) play in the development paths of regions.

As the number and importance of MNEs has risen globally, many governments have developed industrial policies aimed at attracting FDI and other kinds of MNE engagement. This is as MNEs are seen as key generators of income, innovation and growth for the host economy. Examples of potential mechanisms through which MNEs bestow a beneficial effect on host countries’ economies include directly via financial resources (spending on local suppliers, capital investment, employment, tax revenue), technology (R&D), know-how in terms of management and training the workforce, as well as through linkages to value chains (Iammarino and McCann 2013). Furthermore, market access spillovers from MNEs to domestic firms are also important as they connect regions to global markets (and thereby induce domestic exporting activity) (Crescenzi et al. 2014). Our focus here, knowledge spillovers from MNEs to domestic firms have been suggested to primarily occur along three channels: demonstration effects where domestic firms gain knowledge by imitating MNE firms, competition effects, and knowledge transfer through labour mobility (Blomström and Kokko 1998). This dimension is particularly important with respect to regional industrial dynamics, and the import of know-how into a local labour force.

Spillover effects to the domestic host economy may not always materialize and may even be negative (Görg and Greenaway 2004; Crespo and Fontoura 2007). This can be attributed to MNE characteristics, which include actively protecting their know-how to reduce knowledge leakages to domestic competitors (Alcacer and Delgado 2016), or out-competing domestic firms on the labour market by providing better employment conditions to workers (Aitken et al. 1996; Barry et al. 2005). A related branch of literature has specifically investigated how the ‘absorptive capacity’ of domestic firms influences spillover effects (Kokko et al. 1996; Blomström and Kokko 1998). The absorptive capacity of a firm is defined as a firm’s ability to recognize valuable new knowledge, integrate it into the firm and use it productively (Zahra and George 2002). Various authors have argued that the lack of spillovers from MNEs to domestic firms is due to a wide skill or technology gap between the two groups (Kokko 1994; Girma and Wakelin 2002). Empirical studies have shown that the strength of MNE-domestic spillover effects rise as the size and productivity of domestic firms increases (Békés et al. 2009).

There have been a variety of empirical studies investigating how MNEs influence their host economy. These studies vary in the country they study, which aspect of economic development they consider (e.g., employment growth, industrial diversification, or firm productivity and innovation), and how they define MNE presence (FDI, value added to GDP, or measures related to R&D expenditure, sectoral output, foreign equity, sales, employment etc.). As a result of diverging research findings, perhaps owing to the heterogeneous research designs employed, there is currently no consensus within the literature on the impact of MNEs on a host region. We list some of these studies in Table 1.

We focus here specifically on inter-industry spillovers. Within this burgeoning literature, we highlight a few studies of particular relevance which focus on domestic industry entry and cohesion to MNEs as proxied by inter-industry linkages. Görg and Strobl (2002) and Ayyagari and Kosová (2010) find that the presence of related MNEs (supply-chain linkages) is positively associated with domestic entries in the manufacturing and service sectors respectively. Lo Turco and Maggioni (2019) looked at product entries, finding that cohesion to MNEs enhances entry, particularly for more productive, established and local selling firms. Finally, Smarzynska Javorcik (2004); Békés et al. (2009) focus on firm productivity, similarly finding that cohesion to MNEs via supply-chain linkages promotes productivity, particularly for larger firms and those focused on the domestic market.

We choose Ireland due to the country’s profile as a highly developed open economy (O’Leary and van Egeraat 2018) with substantial MNE presence and an FDI-oriented industrial policy. In fact, Ireland is one of the world’s most active countries in terms of industrial policy. Key objectives include promoting export-led growth (Breathnach et al. 2015), generating industry-university R&D partnerships (Barry 2014b), and developing better linkages between industries (Barry 2014a; O’Leary and van Egeraat 2018). Some of the strategies developed to foster linkages and knowledge spillovers between domestic and MNE activities include the development of collaborative R&D infrastructure and clusters (Department of Jobs, Enterprise and Innovation 2014), which have been linked to the emergence of industrial clusters (O’Connor et al. 2017).

Various authors have investigated the role of MNEs on the Irish economy, however the impact of MNEs on domestic activities remains unclear. Studies have found that the presence of MNEs within the same sector influences the entry rate, productivity and employment growth of domestic firms (Görg and Strobl 2005a). Specifically, for productivity and employment growth, benefits have only been observed in high-tech domestic sectors (Görg and Strobl 2003). In contrast, Barry et al. (2003) found a negative effect of MNEs on domestic exporting firms’ wages and productivity. Most related to our work, Gorg and Strobl (2001) suggested that related MNEs support domestic industry entrance through supply chain linkages, but Di Ubaldo et al. (2018) found a negative (or non-existent for R&D-active firms) impact of MNE supply chain linkages on domestic firm productivity.

Our study differs in five key aspects to previous work. First, we focus on cohesion between new domestic export sectors and existing MNE activities as captured by inter-industry labour mobility patterns, a proxy for a broad range of potential knowledge spillovers. Secondly, we decompose MNE industries into two sets - overlapping industries (those with also domestic presence) and exclusive MNE industries. This enables us to distinguish the role of these distinct sets particularly with respect to their capability gap to domestic firms. Thirdly, we investigate which type of cohesion to MNEs matters. Specifically, as we outline below, we develop a new cohesion to capture the complex structure of linkages present between industries in a region. Fourthly, we conduct our analysis at a granular industry-region level, unlike the majority of studies which focus on industries at the national level, or regions neglecting the industry dimension. Finally, we investigate the role of MNEs in three different economic eras: before and after the 2008 financial crisis, and during a recent period (2015–2019) characterised by rapid domestic growth and Brexit.

2.2 Regional resilience

Regional resilience has become a prominent focus area in the research and policy agenda, featuring in the target indicators of the Sustainable Development Goals. Indeed, Target 1.5 aims to ‘By 2030 build the resilience of the poor and those in vulnerable situations, and reduce their exposure and vulnerability to climate-related extreme events and other economic, social and environmental shocks and disasters’ (Bahadur et al. 2015). A growing literature investigates the determinants of a region’s ability to adapt to an external shock such as the Financial Crisis (Martin et al. 2016; Crescenzi et al. 2016; Fratesi and Rodríguez Pose 2016; Xiao et al. 2018). However, despite the growing popularity of resilience in the research and policy agenda, there are concerns over the usefulness of the concept stemming from lack of clarity on its definition (Martin 2012); the appropriate theoretical and empirical frameworks to measure and analyze it (Bristow and Healy 2015; Diodato and Weterings 2015; Faggian et al. 2018); its determinants (Martin 2012); and tools to design or implement appropriate policies.

While the concept of resilience is multidimensional and has been interpreted in various ways, there are three main conceptual approaches: engineering, ecological, and adaptive (Simmie and Martin 2010; Martin and Sunley 2015). Scholars advocating an engineering-based approach emphasise the ability of an economic system to return to its stable or pre-crisis equilibrium state after a crisis. The ecological-based view concerns the magnitude of a shock that a system can weather without shifting to a new equilibrium state. The evolutionary approach departs from these equilibrium-based frameworks and defines resilience as the ability of an economy to successfully diversify and branch out into new growth paths, thereby countering economic decline (Martin and Gardiner 2019; Boschma 2015). In this study we adopt the latter approach and study regional resilience through industry exits, defining the exit of an industry from a region via a drop in employment below a threshold (Neffke et al. 2011). Employment-based measures are thought to reflect the societal impacts of a crisis more readily than output variables such as GDP or GVA (Diodato and Weterings 2015).

A range of studies have investigated the relationship between the industrial portfolio of a region and industry exits (Neffke et al. 2011; Essletzbichler 2015; Szakálné Kanó et al. 2019). Studies have found that a region with a high variety of industries is better able to adapt to sector-specific shocks (Boschma 2015; Szakálné Kanó et al. 2019). Furthermore, Balland et al. (2015) showed that regions with a high degree of relatedness to existing technologies in which the region does not have comparative advantage (competitive presence) had a greater capacity to weather technological crisis. Overall, there is evidence in the literature to support both industry variety and relatedness as key factors in industrial resilience.

Here, we are primarily interested in whether cohesion to MNE industries enhances domestic industry survival and regional resilience. MNE-domestic linkages have a protective effect on domestic industries in times of crisis via a number of mechanisms. Similar to above, knowledge spillovers can occur through demonstration effects, labour mobility and competition channels. Primarily, knowledge and experience built up by MNEs on external shocks may transfer to domestic firms (Fainshmidt et al. 2017) via demonstration effects and labour mobility. Labour mobility may also assist via reallocation of workers between sectors in a region (Diodato and Weterings 2015). An alternative mechanism, productivity gained from technological and knowledge spillovers is expected to reduce the average cost of domestic production which in turn may help firms to survive in the face of economic shocks (Görg and Strobl 2003).

Very few empirical studies have investigated the role of MNEs in regional resilience. Closest to our work, Szakálné Kanó et al. (2019) showed that a greater variety of MNE industries reduces the likelihood of domestic firm exit, using data on Hungarian regions. This effect was particularly strong for regions undergoing economic transition. Focusing on Ireland, Görg and Strobl (2003) found that the presence of MNEs in the same industry increases domestic firm chance of survival through technological spillovers. This was only significant for high-tech sectors, while no effect of MNE presence was found for low-tech sectors. We add to this literature by investigating if the cohesion to MNE industries, measured at an industry-region level, provides a protective effect.

2.3 Industrial cohesion

In this study, our aim is to investigate how the presence of MNE (and domestic) industries within a region’s industrial basket impacts the entry (or exit) of an industry. We are therefore interested in measuring the capability or knowledge-distance between an industry and a region’s current industry basket. Within the literature, cohesion is defined as the degree of relatedness amongst industries within a region and a measure of the opportunity for knowledge spillovers (Neffke et al. 2011; Frenken et al. 2007). Cohesion measures are typically used to quantify the degree of structural change induced by an industry as it enters or leaves a region. When an industry enters (or exits) a region, it brings new (or removes current) capabilities. Hence, according to which industries enter or exit, and how they are related to the current industrial portfolio, they differently impact the region through changes in the combined total of the region’s capabilities.

Cohesion measures are typically derived from the structure of an industry network, also referred to as an ‘industry space’ (Neffke et al. 2017; Hausmann et al. 2007). This is a network where nodes represent industries and edge-weights correspond to the degree of capability-overlap between industry pairs. The advantage of using an industry network is that it allows for the topological structure resulting from the relatedness amongst all industry pairs to be analysed via a complex systems approach. To construct an industry network, a measure of relatedness amongst industries is required. Since the true level of capability overlap cannot be directly measured, an outcomes-based approach is taken to infer the degree of relatedness. This type of approach varies according to the data source considered and capability type. For example, the co-location of industry pairs on patents has been used to measure the degree of technological-relatedness (Ellison et al. 2010; Jaffe 1989) and supply chain (IO) linkages have been used to estimate the degree of supplier-buyer sharing or similarity between industries (Acemoglu et al. 2015).

In this study we adopt the skill-relatedness index which is based on labour mobility between industries (Neffke and Henning 2013) as we primarily focus on knowledge spillovers and labour pooling between MNEs and domestic firms. By using labour mobility to infer skill-relatedness we assume that if two industries share a high degree of skills and knowledge, workers will more freely move between them. This is because a worker’s skill set from one of these industries will also be highly valued within the other industry and thereby be most likely to switch to this industry (compared to others). Various authors have argued that the skill-relatedness index is the best approach to model regional growth due to the key role of tacit know-how and skills embedded within workers.

One of the first cohesion measures was introduced by Neffke et al. (2011). The authors defined the closeness of an industry as the count of the number of related industries (neighbours in the industry network) present within a region’s industrial portfolio. This effectively captures how connected or embedded an industry is to other industries in the region. The authors found that for manufacturing industries in Sweden, industries that enter a region have a higher closeness, while those that exit have a lower closeness. Another well-known cohesion measure is the density (or related employmentFootnote 1) measure. This metric measures the strength of relatedness (edge weight) between an industry and its neighbours relative to the strength of relatedness to all sectors. It has been used in various applications to predict regional industry diversification and employment growth (Neffke et al. 2011; Neffke and Henning 2013; O’Clery et al. 2018; Boschma et al. 2013; Hausmann et al. 2007). In all of these studies, industries that have a higher density are found to be more likely to enter a region.

Both of these variables are one-step measures in the sense that they only consider direct neighbours in the network. Consequently, all neighbours are treated homogeneously. What these measures fail to capture is the importance of the connectivity and embeddedness of their neighbours (the greater industry network structure). Various authors have argued that it is not only the presence of a related industry but also the assemblage of these industries, as well as other industries present in the region, that generate collective efficiency and further knowledge spillovers (Marshall 1920). Hence, spillovers are generated from the presence of a cluster of densely connected economic activity around an industry (Porter 2011). Therefore, being more deeply embedded into the industry network enhances the chance of spillovers. A number of influential studies have also argued that economic activity that is more distant from an industry has shown to enhance innovation, however the economic activities cannot be too cognitively distant that learning cannot occur (Nooteboom 1999; Frenken et al. 2007). In this study, we develop a new cohesion measure that captures both the presence of related industries as well as their connectivity to other industries within a region. The measure therefore captures the impact of higher-order linkages that may occur through the broader concentration and inter-connectivity of economic activity but is not too skill-distant from an industry.

Another cohesiveness measure, related variety, has also been widely adopted within the literature (Frenken et al. 2007; Szakálné Kanó et al. 2019). A region with a high related variety has employment spread over a variety of industries within a few sectors, while one with low related variety has employment spread over industries within different sectors. The authors hypothesised that regions benefit from employment distributed in a variety of industries as more variety implies more potential for spillovers. However, the variety should primarily occur amongst industries in the same sector as limited spillovers occur amongst industries in different sectors. The measure is directly computed at a region level and is based on an entropy-calculation for employment distributed within industries spread across sectors.

A central disadvantage of the related variety measure is that it relies on the hierarchical structure of the standard industrial classification system as a measure of relatedness. Thereby, when considering the related variety of a region, all industries within the same sector (2-digit industry class) are assumed to have the same relatedness. Secondly and most importantly for our study, the measure is calculated at a regional level making it less suited to our application. Our new metric, however, does capture some of the ideas behind related variety in that it identifies the presence of groups of related industries - although in our case we quantify relatedness via the skill-relatedness measure rather than the official industrial classification - in a region. The key difference, however, is that it enables us to look at the cohesion of a particular industry to these groups, resulting in an industry-region level variable.

3 Data and definitions

3.1 Industry data

For this study, we use data covering the majority of exporting and manufacturing firms within the Irish economy. The data derives from the Irish Department of Business, Enterprise, and Innovation Annual Business Survey of Economic Impact, and includes firms assisted by the three Irish enterprise development agencies: Industrial Development Authority (IDA) Ireland, Enterprise Ireland, and Údarás na Gaeltachta.

The dataset covers the period 2006–2019, and includes total employment (in assisted firms) at an industry-region-year level of aggregation. This is further broken down by firm ownership-type level (either Irish or foreign). Industries correspond to 4-digit NACE 2 industry level, and regions are at NUTS level 3. Further data descriptors across region, time and ownership type are presented in Table 8 in Appendix 1.

The dataset includes approximately 80% of all manufacturing employment and 7% of services employment within Ireland. Furthermore, it accounts for 90% of total merchandise exports as well as 70% of services exports (which comprise of approximately half of total Irish exports) (Breathnach et al. 2015). It also includes approx. 63% of the employment in all foreign-owned firms in Ireland. The dataset therefore covers both the majority of domestic and foreign manufacturing and exporting firms. As these firms are typically highly productive, complex and export-focused there is a higher likelihood of MNE-domestic knowledge spillovers occurring amongst them (Kokko 1994; Békés et al. 2009). These firms also act as leading drivers of economic development thus also offering an important indicator of regional economic prosperity.

3.2 Industry presences, entries and exits

We start by dividing our 14-year time-span into three time periods, namely 2006–2009, 2010–2014 and 2015–2019. Each of these periods can be associated with a distinct economic era in Ireland. The 2006–2009 period falls largely before the 2008 financial crisis started to take effect. A recession then characterised the 2010–2014 time period (Conefrey et al. 2018). Finally, the 2015–2019 period was characterised by fast growth of the domestic economy and Irish industrial policy support for both domestic and MNE firms in response to Brexit (Roche et al. 2016, Chapter 1).

In this study, we investigate the entry and exit of domestic export and manufacturing industries with respect to their cohesion to three mutually exclusive sets of existing industries within a region. These sets are ‘exclusive MNE’ industries in which only MNE firms are active, ‘exclusive domestic’ industries in which only domestic firms are active and ‘overlapping’ industries in which both MNE and domestic industries are active.

We define the presence, entry and exit of an industry j in region r at time t as follows:

-

An MNE industry is present if there are more than 5 employees in foreign-owned firms (\(X_M(j,r,t)=1\) and otherwise 0), while a domestic industry is present if there are more than 5 employees in Irish-owned firms (\(X_D(j,r,t)=1\) and otherwise 0).

-

A domestic industry entrant is an industry that had less than 5 employees in the beginning of the time period, and then becomes present in the industrial portfolio of a region at the end of the time period \((X_{D}(j,r,t)=0 \cap X_{D}(j,r,t+1)=1)\).

-

A domestic industry exit is an industry that had more than 5 employees in the beginning of the time period and then was no longer present in the industrial portfolio of the region at the end of the time period \((X_{D}(j,r,t)=1 \cap X_{D}(j,r,t+1)=0)\).

Similarly,

-

An exclusive MNE industry is an industry in which only MNE firms are active, \(X_{excl D}(j,r,t) = 1\) if \(X_{M}(j,r,t)=1 \cap X_{D}(j,r,t+1)=0\).

-

An exclusive domestic industry is an industry in which only domestic firms are active, \(X_{excl D}(j,r,t) = 1\) if \(X_{D}(j,r,t)=1 \cap X_{M}(j,r,t+1)=0\).

-

An overlapping industry is an industry in which both MNE and domestic firms are active, \(X_{overlap}(j,r,t) = 1\) if \((X_{M}(j,r,t)=1 \cap X_{D}(j,r,t+1)=1)\).

We choose 5 employees as our threshold measure to indicate the presence of an industry within a region (Neffke et al. 2018), and hence less well established and potentially dormant industries are removed.

As a preliminary step, we first investigate the magnitude of domestic regional structural change following the approach of Neffke et al. (2011). Figure 1 shows the dynamics of domestic industries over the entire period in our study. Regarding all industry-region combinations within our dataset, only 87% present within 2006 still exists in 2019. Taking the reverse perspective, 85% of domestic industries in 2019, already existed in 2006. For comparison, Neffke et al. (2011) found that 78% of industries present within 1998 in Sweden were still present in 2002 and 68% of industries present in 2002 were still present in 1998. Slightly lower levels of churn are not unexpected in our case as we consider just a subset of Irish firms (i.e., those supported by government agencies).

Graph showing the domestic structural change in Irish regions between 2006 and 2019. The solid line shows, for all regions in Ireland, the share of domestic industries that belong to the original set of domestic industries in 2006 as a percentage of the total amount of domestic industries in each consecutive year. The dotted line shows the share of domestic industries in each preceding year that still existed in 2019

In Fig. 2, we illustrate the number of new domestic industries entering into exclusive MNE industries within each year.Footnote 2 We observe a sharp increase in entries within the 2017 and 2018 period. We observe that, in 2017, due to high levels of uncertainty and fear of loss of UK markets by Irish exporting firms, the Irish government made a large amount of capital available to Irish firms, particularly SMEs, supported by government agencies (Department of Jobs, Enterprise and Innovation 2017). This investment and a range of corresponding policies aimed to both provide adequate support to Irish exporting firms (Brennan and Minihan 2017), and enhance the diversification of export markets and promote domestic entry into existing markets (Enterprise Ireland 2016; Hamilton 2018).

3.3 Skill-relatedness matrix

We use a second dataset to measure the skill-relatedness between industry pairs, following (Neffke et al. 2017). O’Clery et al. (2019) previously constructed this relatedness measure for Irish industries using an anonymised administrative dataset from Ireland’s Central Statistics Office. The dataset contains the employment recordsFootnote 3 of each registered employee within the Irish formal economy. The dataset covers the 2005–2016 period.Footnote 4

The skill relatedness matrix is constructed by following workers as jump between industries (4-digit NACE 1.1 industry codes). Entry (i,j) in this matrix corresponds to the average number of workers that transitioned between industry i and j per year between 2005-2016 normalised by the number that would have been expected to switch at random given the size of the industries. We convert the matrix to NACE 2 using the methodology of Diodato (2018). More details on the construction of the matrix and conversion steps can be found in the Appendix 2 and Appendix 1, respectively.

The matrix \(A_{SR}\) is the adjacency matrix of the skill-related industry network. We visualize the network shown in Fig. 3. Each node represents an industry and each edge a skill relatedness linkage (as encoded in \(A_{SR}\)). A spring algorithm called ‘Force Atlas’ in Gephi is used to generate the spatial layout of nodes with more related industries positioned closer together. We have added a general labelling of groups of industries on the network for orientation, as well as coloured the nodes by the percentage of MNE employment. We observe that MNEs are concentrated mainly within the finance and high-tech manufacturing sectors.

A visualization of percentage of MNE employment in each industry on the skill-relatedness network for Ireland. Each node represents an industry and each edge a skill relatedness linkage. Nodes are coloured according to the percentage of MNE employment within each industry. The network layout was generated using ‘Force Atlas’ in Gephi—a spring algorithm in which related industries are positioned closer together

4 Measuring the cohesiveness of an industry

Here we introduce the weighted closeness and strategic closeness of an industry to the existing industrial basket of a region.

4.1 Weighted closeness

The weighted closeness (WC) of an industry is similar to the closeness measure of Neffke et al. (2018) in that it captures the number of related industries (to that industry) that are present in a region. This measure quantifies the cohesion of an industry to the industrial basket of a region as the number of related industries present in the region weighed by their relatedness.

Let the relatedness between industries be encoded in matrix \(A_{SR}\)Footnote 5. the WC measure is then given by,

where \(X(j,r,t)=1\) if industry j is present in region r at time t (and otherwise 0).

Similar to closeness (Neffke et al. 2018), weighted closeness only considers the presence of directly related industries, and does not take into account the wider ‘global’ structure of the industry network. Furthermore, although we weigh the presence of each directly related neighbour by its relatedness, the presence of each neighbour is treated homogeneously. Hence, the measure does not consider the connectivity of these neighbouring industries to other related industries within the network. Next, we introduce a new measure that is able to capture these higher-order connections.

4.2 Strategic closeness

We propose a new measure, strategic closeness (SC), which does not only consider directly related industries (as in the case of the WC) but also their connectivity to both each other and other industries present within the region. In other words, the measure picks up the presence of higher order connections (of two steps away) in the local industrial basket. An industry with high SC is not only related to industries in the region but these industries are themselves highly connected to both each other and other industries in the region. These are in a sense ‘strategic’ or highly embedded neighbours. These more distant industries increase the variety of skills and know-how an industry has access to, and are thought to promote innovation (Frenken et al. 2007; Nooteboom 1999).

The SC measure models regional diversification as a diffusive process (Frenken and Boschma 2007), and can be seen as a multi-step generalisation of the aforementioned WC measure. Intuitively, it can best be understood by considering a random walker on the industry network. The random walker is initially positioned on the network with a uniform probability distribution across all industries present within the region’s portfolio and is then allowed to move on the network. The walker jumps from one industry to another with probability proportional to the edge weight (relatedness) connecting them. After the first jump, only if the industry that the walker is now positioned at is present within the industrial basket of the region is the walker able to make a second jump. If the industry is not present the walker is removed. After the second jump, the probability distribution of the walker (across all nodes) corresponds to the cohesion measure that takes into account both the presence and inter-connectivity of ‘neighbours of neighbours’ in the network.

More formally, the industry network is defined via adjacency matrix \(A_{SR}\) with entries corresponding to the relatedness between industry pairs. We define the degree vector \(\mathbf {d}\), where d(i) calculates the sum of all edge-weights that are connected to node i. This is given as \(d(i) = \sum _j A_{SR}(i,j)\). The diagonal matrix of degrees is then defined as \(D = \text {diag}(\mathbf {d})\). A random walker process on the industry network can now be defined as an associated Markov chain in which the probability of leaving a node is split amongst the edges of a node according to their relative weight. The transition probability for an edge connecting industry i and j is given by \(A_{SR}(i,j)/d(i)\). In general, a random walker wandering on a network is modelled by:

where \(\mathbf {p}_{\tau }\) \(\in\) \(\mathbb {R}^N\) a probability vector representing the probability of finding a random walker at node i at time step \(\tau\). Note that given an initial probability vector \(\mathbf {p}_0\), the process can also be described as

Now, we define the starting probability of a random walker for region r and at the base period (\(t_{base}\)) as the uniform distribution across all industries that are present in the region, this is given as:

Using Eqs. 3 and 4, we now model the first step of the our random walker process as:

where : denotes all elements of the vector.

We then remove all the walkers that are positioned on industries that are not present within the industrial basket of the region. We do this by multiplying the probability vector of the random walker after one step with the binary vector, denoted \(\mathbf {X}(:,r,t_{base})\), indicating which industries are present in the region as defined in Sect. 3.2. We then allow the walker to take a second step. This is given as:

Finally, we define the strategic closeness of industry i as

We illustrate the additional information gained from using the SC measure alongside the WC measure in Fig. 4. Here we show the industrial portfolio of a mock region displayed on an industry network. For this example, an unweighted industry network is used. Nodes in blue represent industries that are present within the region, while those in grey are absent. We observe that both node A and node B are directly related to four other industries that are present within the region and hence both of these industries have the same WC. However, we can easily see that industry B is directly connected to industries that are themselves both inter-connected and connected to other industries present in the region. Industry B is therefore connected to a larger agglomeration of related industries which could provide access to a larger range of capabilities and opportunities to develop a variety of linkages. Hence, industry B has a higher SC cohesion value than industry A (which has an SC of zero as its related industries are not connected to each other or other industries present in the region).

The comparison of two industries’ (A and B) cohesion to the industrial portfolio of their region using the weighted closeness and strategic closeness metrics. The network represents a toy industrial network on which the mock region’s industrial portfolio is shown. Each node represents an industry and each edge the level of relatedness between the corresponding two industries. Blue nodes are industries that are present within the region, while grey ones are absent

4.3 Cohesion to domestic and MNE industries

Here we adapt WC and SC to account for the presence of exclusive domestic industries, exclusive MNE industries and overlapping industries separately.

First, we adapt the weighted closeness measure to include only exclusive domestic industries within the industry portfolio of a region. This is given by,

where \(X_{excl D}(j,r,t)=1\) if industry j contains only domestic employment in region r at time t. This measure captures the cohesiveness of industry i to exclusive domestic industries in region r. The measure is analogously defined with respect to the presence of exclusive multinational industries (denoted as \(WC_{excl M}(i,r,t)\)) and the presence of overlapping industries (denoted as \(WC_{overlapping}(i,r,t)\)) within a region.

We similarly adapt the strategic closeness measure to capture the presence of different types of industries in a region. In the case of exclusive domestic industries, the starting probability of the random walker on industry i within region r at base time t is defined as

and then

where \(\mathbf {p0_{excl D}}\), D, \(A_{SR}\) and \(\mathbf {X}_{excl D}\) are defined as before. The strategic closeness of industry i is then given as \(SC_{excl D}(i,r,t)\). The measure is similarly defined for the strategic closeness to exclusive multinational industries (and denoted \(SC_{excl M}(i,r,t)\)) and for the strategic closeness to overlapping industries (denoted as \(SC_{overlap}(i,r,t)\)) within a region.

4.4 Correlation analysis

In Table 2 we show the descriptors of our dependent and explanatory variables. We also show the pairwise correlation between the various cohesion measures and the domestic industry entry and exit variables in Table 3. We see a positive but small correlation between the entry of domestic industries and the various cohesion measures. In accordance with the literature, this suggests that the more cohesive an industry the higher the likelihood of its entrance. On the other hand we see a negative relationship between the exit of domestic industries and the various cohesion measures (except for the cohesion to exclusive MNEs). Once again, this agrees with the dominant view in the literature and suggests that the less cohesive an industry the higher its chance of exit. In contrast, we find a positive relationship between exits and the WC and SC to exclusive MNEs showing that the less cohesive an industry to these types of industries the higher its chance of survival. We now further investigate these relationships controlling for various effects using econometric models.

5 Econometric framework

Our aim is to investigate the relationship between domestic industry entry (and exit) and the cohesiveness of the industry to exclusive MNE, exclusive domestic or to overlapping industries in the region across three distinct periods. To detect these relationships we set up a panel probit regression model in a similar frame to Neffke et al. (2011) and Szakálné Kanó et al. (2019).

For our first model, we investigate the relationship between domestic industry entrants and their cohesion to the different types of industries within the industry portfolio of the region. We run a fixed effects panel probit model for each of the three time-periods separately. The model is given by:

where \(\phi (\cdot )\) is the cumulative distribution function of the standard normal distribution, and \(Z(i,r,(t-1))\) is the value of the explanatory variable (cohesiveness measure) included in the model. This can be the cohesion to exclusive MNEs (\(WC_{excl M}\), \(SC_{excl M}\)), exclusive domestic industries (\(WC_{excl D}\), \(SC_{excl D}\)) or overlapping industries (\(WC_{overlap}\), \(SC_{overlapping}\)). \(\beta\) is then coefficient of the cohesion explanatory variable. \(X_M\) indicates whether an MNE industry is already present, with corresponding coefficient vector \(\omega\). \(\gamma (i)\) and \(\tau (r)\) are industry and region fixed effects, respectively. Through these fixed effects we control for within-region and within-industry variance. Regional fixed effects account for the number of MNE or domestic industries present within a region. We also include a coefficient term to absorb other dependencies that we have not controlled for. Furthermore, we include a standard robust error term. In this model we only consider domestic industries which are not yet present within a region as an observation.

In our second model, we investigate the relationship between the exit of domestic industries and their cohesion to exclusive MNEs, exclusive domestic or to overlapping industries within a region. Using a very similar model as previously, we run a fixed effect panel probit model for the various time periods, given by:

where variables are similarly defined as in the first model. Here we only consider domestic industries that are already present within a region as an observation.

6 Results

6.1 Domestic industry entrance

The results of our econometric model in Eq. 10 are reported in Tables 4 and 5. Each table is also sub-divided into three sections horizontally representing the three time periods we investigate independently.

Recall that the consensus within the regional branching literature is that the presence of related industries enhances industry entry. This is as regions grow by building on existing expertise and fostering new economic activities in related industries (Frenken et al. 2007; Neffke et al. 2011; Boschma and Gianelle 2014).

Here, we focus on the relationship between entry of domestic exporting and manufacturing industries and the existing local MNE presence in the form of overlapping and MNE-exclusive sectors. First we consider the pre and post recession periods, and further down we consider the recession period itself.

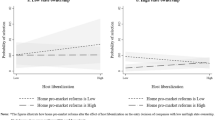

We start with the impact of overlapping industries on entries. For the first (2006–2009) and third (2015–2019) non-recession periods we observe a positive and significant relationship between new domestic entries and cohesion to overlapping industries. This holds for both weighted and strategic closeness in the first period, and strategic closeness in the third. These industries are the more complex industries within a region’s industrial basket, mostly consisting of medium-high tech manufacturing, information and telecommunication as well as professional service activities. Well-known examples include Ireland’s world-renowned baby food sector, which includes both domestic and foreign-owned global industry leaders. In particular, powdered milk has grown rapidly due to Ireland’s large dairy sector. It appears that domestic firms tend to enter new industries proximate to existing dynamic sectors, already home to a mix of domestic and foreign-owned enterprises.

We note that in the third post-recession period, domestic industry entries are associated with strategic closeness to overlapping industries (and not weighted closeness). Hence, during economic recovery, cohesion to a cluster of overlapping industries (which are strongly connected to each other in a region’s industrial basket) is associated with a higher probability of domestic industry entry. This result highlights the important role of dense linkages between these dynamic sectors in enhancing the domestic export diversification potential of a region.

Turning to MNE-exclusive industries, we observe the opposite effect. Specifically, for the first 2006–2009 period, we find that a domestic firm is unlikely to enter an industry that is close or strategically close to related MNE-only industries. These industries are highly complex and less related to the region’s domestic skill-base. For domestic industries to enter MNE-only industries (or those proximate to them) they need to make large cognitive ‘leaps’ to bridge the capability gap.

Although we cannot disentangle the exact reasons why domestic firms are failing to enter industries linked to complex MNE-dominated industries, our findings very much relate to those on firm absorptive capacity (Kokko et al. 1996; Blomström and Kokko 1998), also thought to be factor in Irish domestic firm productivity (Barrios et al. 2004; Di Ubaldo et al. 2018) (absorptive capacity is proxied in both cases by the presence of R&D activity). Other possible reasons include: a potential lack of appropriate training and skill development of Irish workers to be able to work and learn from more complex industries dominated by MNEs, a lack of incentives for MNEs to engage in R&D collaboration with domestic firms (McGuirk et al. 2015), as well as potentially less strategic investment decisions by government agencies to encourage domestic firms to enter into MNE markets (Conefrey et al. 2018; Cortinovis et al. 2020).

What is particularly striking about the recovery period is the strong significant and positive relationship between domestic industry entrance into MNE-only industries. Although we show no causal link, our analysis might be picking up the Irish response to Brexit, and particularly the effect of two schemes that aimed to support domestic firms. These are the ‘Global Sourcing Initiative’ which aimed to create business opportunities for Irish-owned companies with MNEs and the ‘Market Discovery Fund’ which supported Irish-owned exporting firms to move into new products.

We now consider the crisis period (2010–2014). During this period there is no significant relationship between industry entrance and cohesion to overlapping or exclusive MNE industries. It appears that entries into industries characterised by relatedness to complex sectors ceased during this difficult period. However, we observe a positive and significant relationship for both weighted and strategic closeness to exclusive domestic industries which are dominated by low tech manufacturing and agriculture-related sectors. Our results suggest that in a time of recession, new domestic export and manufacturing activities enter into regions where there is densely connected existing (exclusive) domestic activity. This contrasts with more entries into regions with related overlapping industries in non-recession periods as seen above.

We show results combining WC and SC in a single model in Table 10 in Appendix 4. We generally find that our results hold. Our cohesion measures remain significant when controlling for the other cohesion measure, demonstrating empirically that these measures pick up different dimensions of cohesion.

Overall, we observe that both before and after the recession period cohesion to overlapping industries is associated with a higher probability of entry. In contrast, cohesion to MNE-only industries is associated with a lower probability of entry pre-crisis. Post crisis, however, domestic entries are associated with MNE-exclusive industries, perhaps due to various schemes aimed at generating strong domestic-MNE links in response to Brexit.

6.2 Domestic industry exit

The results of our second econometric model in Eq. 11 are shown in Tables 6 and 7 for the cohesion measures WC and SC, respectively.

Within both the regional branching and resilience literature it is generally accepted that industries which are less related to a region’s industrial basket are more likely to exit (Neffke et al. 2011). Hence, relatedness amongst industries provides a protective shield against industry exit in response to economic shocks (Essletzbichler 2015; Balland et al. 2015).

Here we focus on the presence of MNE activity and the survival of domestic government supported export and manufacturing industries, particularly during the crisis period. Again, we look at the distinct impact of overlapping and MNE-exclusive industries.

As before, we first examine the role of overlapping industries. In the first (2006–2009) period, we see a significant and negative effect of the presence of MNEs within an industry on exit of the domestic counterpart. Hence, co-existing with MNEs within an industry (and therefore being an overlapping industry) enhances domestic resilience—but only in the pre-recession period. This corresponds with the findings of Görg and Strobl (2003) who find a positive impact of MNEs on domestic manufacturing plants in high tech sectors between 1973–1996.

Similar to entries and co-existence with MNEs, cohesion to overlapping industries also plays a key role in domestic industry survival. We find a negative and significant relationship between weighted closeness (within the first two periods) and strategic closeness (within the latter two periods) and domestic industry exit. Hence, the more cohesive an industry is to these dynamic industries the more likely it is to survive. The protective role of these industries during the recession period, a time when industry exits peaked, accentuates their importance.

We again observe, similar to entries, that in the latter recovery period it is only the relationship between domestic entries and strategic closeness to overlapping industries that remains significant (and no longer that of weighted closeness). This again highlights the importance of the dense linkages between related sectors and thereby the formation of a cluster or concentration of related and dynamic activities for the survival of domestic industries.

Next, we turn to MNE exclusive sectors. In contrast to the protective effect of overlapping MNEs, in the recession period we observe a significant and positive effect of both weighted and strategic closeness to MNE-exclusive industries. Hence, government supported domestic exporting and manufacturing activities that were related to MNE-only industries were more likely to exit, highlighting the fragility of domestic firms operating in sectors most distant from the broader domestic capability base and perhaps dependent on their role in international supply chains.

We also show the results for the SC variable when controlling for the corresponding WC measure in Table 11 in Appendix 4. As before, our cohesion measures remain significant when controlling for the other cohesion measure.

Overall, it appears that cohesion to overlapping industries has a protective effect in a crisis. Cohesion to exclusive MNE industries, however, was associated with an increased probability of exit during this period.

7 Conclusions and policy implications

It is well-established that regions grow by learning how to recombine complementary capabilities to move into more complex and sophisticated economic activities. The growth trajectory of a region is therefore conditioned on its’ current capability base. With the rise of multinational enterprises globally, an issue of key concern is whether and how MNEs can act successfully as a channel to ‘import’ new capabilities to a region and promote local domestic diversification.

Focusing on a set of government-supported Irish firms active in manufacturing and exports, we find a strong role for so-called overlapping industries - those that have both domestic and MNE employment in a region. Specifically, domestic industries are both more likely to enter and less likely to leave a region if they are closely related to these industries. These are some of the most dynamic domestic sectors, home to global brands such as Glanbia, the Irish baby food manufacturer. While we cannot separate the role of MNEs from domestic firms within this subset of industries in terms of new entries, we can deduce that there exists a set of related sectors in which domestic firms already successfully thrive alongside MNEs, and it is this set that is driving new entries.

In contrast to overlapping industries, we find a negative impact from ‘exclusive MNE’ industries. In particular, we find that cohesion of a domestic industry to MNE-only industries both reduces its chances of entry into a region as well as reduces its chance of survival in a crisis. These results suggest that domestic firms are unable to ‘leap’ into MNE-proximate industries, likely due to a technology or know-how gap that is too large to bridge. Furthermore, those that do are less likely to survive, suggesting weak ties.

Finally, the type of cohesion matters. We differentiate between simple relatedness and strategic relatedness, or the presence of ‘higher order’ connections between industries in a region. Our results show that, specifically in the recovery period, strategic closeness to overlapping industries is highly significant for both the entry and survival of domestic industries, while weighted closeness is not, in a multivariate setting. Hence, entries tend to occur in industries proximate to regional ‘clusters’, or groups of existing interconnected overlapping industries. Similarly, exits are negatively correlated with strategic closeness to overlapping industries, further suggesting that deep embeddedness in a regional network of related industries is key to success.

In previous work we identified two distinct export clusters in the Irish economy (O’Clery 2015), visualised in the Product Space network of Hidalgo et al. (2007). One of these clusters, located centrally in the network, contained industries with both Irish and MNE activities such as food and agriculture, while the other cluster was more peripheral, containing very complex sectors such as chemicals, pharmaceuticals and electronics. We hypothesised at the time that the ‘distance’ between these sectors would likely prevent domestic firms emerging in MNE sectors due to the huge capability gap. Our findings here very much accord with this hypothesis. Specifically, we find that the ‘rich get richer’ in the sense that overlapping industries in a region tend to attract further related industries. On the other hand, domestic entries into MNE dominated industries are not only rare but decrease in likelihood the closer the target industry is to MNE activities. The only exception to this dynamic is a recent cluster of entries into MNE-exclusive sectors, which might be explained by government-led efforts to stimulate and boost domestic-MNE links in response to Brexit.

There are a number of clear policy implications from our study. Firstly, our study suggests that industrial policy should distinguish types of MNEs, looking closely at sectoral concentrations and the potential for linkages to the domestic economy. Crucially, it suggests that policy should prioritise MNEs in overlapping industries, or those proximate to overlapping industries, as these have the greatest likelihood of inducing domestic transformation. This idea is somewhat at odds with a general strategy aimed at increasing the industrial or export complexity of a nation, or focusing on taxation income alone, irrespective of the domestic capability base. These findings are particularly salient within a context of finite investment resources and a potential global re-organisation of MNE activities resulting from international agreements on MNE taxation.

Secondly, in line with a burgeoning literature, methods from network science and data science can provide invaluable novel insights into the structure and dynamics of economic processes. In this case, we harness data on inter-sectoral labour mobility and network science to quantify the cohesion between industries. Establishing a mathematical model for cohesion, and differentiating types of cohesion, is key to predicting which industries are well-placed to enter a region, providing an evidence base for industrial policies such as grant funding, training and R&D programmes, and infrastructure investment. Such modelling is rarely conclusive on its own, but forms part of a package of analysis which can be used to develop informed and strategic investments.

Thirdly, our data suggests a possible connection between domestic industry entry in the final period and various schemes designed to generate stronger domestic-MNE links in response to Brexit. One scheme in particular, the ‘Global Sourcing Initiative’, aimed to stimulate new domestic-MNE partnerships via one-to-one meetings. Over 450 such meetings were held in 2017 during a single two-day event. Another scheme, the ‘Market Discovery Fund’, supported Irish-owned exporting firms to move into new products and geographies, and effectively doubled the size of the IDA (Investment and Development Agency) budget between 2016 and 2017. While we do not establish any statistical or causal relation between domestic entry and these schemes here, this would undoubtedly be an interesting and worthwhile avenue to pursue for future work. Furthermore, it would also be interesting to investigate the survival of these Brexit era entries to see whether their survival is comparable, better or worse than entries during other periods. These questions are important for a wider literature which studies leapfrogging, or unrelated diversification, which is known to be rare (Pinheiro et al. 2018). A better understanding of the conditions under which firms can ‘leap’ into sectors that are distant from the underlying capabilities of the local economy is a key priority for evidence-based industrial policy.

Finally, we note that there are some limitations to this study. Most obviously, we study the dynamics of a particular subset of Irish firms, namely those that are supported by government agencies. It is possible that our results are influenced by some characteristics of this set relative to other firms. For example, its entirely plausible that domestic firms that are somehow related to multi-nationals may be more likely to receive government assistance by virtue of either exporting or important links to MNE firms. Yet, in this case, our results distinguishing the effect of overlapping industries from MNE exclusive industries remain potent and suggest that any effort to support domestic firms in or proximate to MNE exclusive sectors has had a limited effect. Another possible issue is that the industries we observe as new entries are in fact just entries of existing domestic firms into this dataset, perhaps motivated by the various Brexit schemes mentioned above. Examination of a subset of firm level data for domestic firms entering MNE exclusive sectors in 2017–2018 (not shown due to privacy concerns) suggests that less than 5% of firms entered with more than 5 employees during this time, and so this is not likely a major driver of entries. A fuller analysis of all Irish firms is warranted to generalise the observed patterns, should such data be made available to researchers in the future.

Additionally, our data does not include services outside the exporting sector which are increasingly a large part of economic activity and employment both in Ireland and globally. Due to the knowledge intensive nature of these activities, we would expect that the relationships found here would both generalise and become stronger for service industries (Diodato et al. 2018) but this remains to be tested. Finally, as discussed above, we are limited by the aggregate nature of our data, particularly in disentangling the influence of overlapping industries. Firm level data would enable a deeper analysis in future work.

Notes

Related employment is very similar to the density measure but also considers the employment size of each industry.

In Appendix 3 we show that there is an increase in entries across all regions which is inline with the policy aim of increasing growth in regions particularly outside of Dublin (Enterprise Ireland 2016)

The employment records are constructed from SPP35 annual tax returns filed by employers on their employees to the Irish Revenue Commissioners.

Note that there is an overlap in the time period to the above mentioned dataset. As the datasets differ and the skill-relatedness value has been shown to remain relatively constant across smaller time periods Neffke et al. (2017), we do not consider this to be a problem.

While we use the skill-relatedness measure of Neffke and Henning (2013) within our analysis, the cohesion measures can be used with any type of relatedness measure.

This corresponds to a ratio \(\tilde{SR}>1\).

References

Acemoglu, D., Akcigit, U., & Kerr, W. (2015). Networks and the macroeconomy: An empirical exploration. National Bureau of Economic Research: Technical Report.

Aitken, B., Harrison, A., & Lipsey, R. E. (1996). Wages and foreign ownership: A comparative study of Mexico, Venezuela, and the United States. Journal of International Economics, 40, 345–371.

Alcacer, J., & Delgado, M. (2016). Spatial organization of firms and location choices through the value chain. Management Science, 62, 3213–3234.

Arnold, J. M., & Javorcik, B. S. (2009). Gifted kids or pushy parents? Foreign direct investment and plant productivity in indonesia. Journal of International Economics, 79, 42–53.

Ayyagari, M., & Kosová, R. (2010). Does FDI facilitate domestic entry? Evidence from the Czech Republic. Review of International Economics, 18, 14–29.

Bahadur, A., Lovell, E., Wilkinson, E., Tanner, T. (2015). Resilience in the SDGs: Developing an indicator for Target 1.5 that is fit for purpose. Technical Report. Overseas Development Institute.

Balland, P. A., Rigby, D., & Lipsey, R. E. (2015). The technological resilience of US cities. Cambridge Journal Of Regions, Economy And Society, 8, 167–184.

Balsvik, R. (2011). Is labor mobility a channel for spillovers from multinationals? Evidence from Norwegian manufacturing. The Review of Economics and Statistics, 93, 285–297.

Barrios, S., Dimelis, S., Louri, H., & Strobl, E. (2004). Efficiency spillovers from foreign direct investment in the EU periphery: A comparative study of Greece, Ireland, and Spain. Review of World Economics, 140, 688–705.

Barrios, S., Görg, H., & Strobl, E. (2011). Spillovers through backward linkages from multinationals: Measurement matters. European Economic Review, 55, 862–875. https://doi.org/10.1016/j.euroecorev.2010.10.002.

Barry, F. (2014a). Diversifying external linkages: The exercise of Irish economic sovereignty in long-term perspective. Oxford Review of Economic Policy, 30, 208–222.

Barry, F. (2014b). Outward-oriented economic development and the Irish education system. Irish Educational Studies, 33, 213–223.

Barry, F., Görg, H., & Strobl, E. (2003). Foreign direct investment, agglomerations, and demonstration effects: An empirical investigation. Review of World Economics, 139, 583–600.

Barry, F., Görg, H., & Strobl, E. (2005). Foreign direct investment and wages in domestic firms in Ireland: Productivity spillovers versus labour-market crowding out. International Journal of the Economics of Business, 12, 67–84.

Blomström, M., & Kokko, A. (1998). Multinational corporations and spillovers. Journal of Economic Surveys, 12, 247–277.

Boschma, R. (2015). Towards an evolutionary perspective on regional resilience. Regional Studies, 49, 733–751.

Boschma, R., & Gianelle, C. (2014). Regional branching and smart specialisation policy (s3 policy brief series no. 06/2014). Institute for Prospective and Technological Studies, Joint Research Centre.

Boschma, R., & Iammarino, S. (2009). Related variety, trade linkages, and regional growth in Italy. Economic Geography, 85, 289–311. https://doi.org/10.1111/j.1944-8287.2009.01034.x.

Boschma, R., Minondo, A., & Navarro, M. (2013). The emergence of new industries at the regional level in Spain: A proximity approach based on product relatedness. Economic Geography, 89, 29–51.

Breathnach, P., van Egeraat, C., & Curran, D. (2015). Regional economic resilience in Ireland: The roles of industrial structure and foreign inward investment. Regional Studies, Regional Science, 2, 497–517. https://doi.org/10.1080/21681376.2015.1088792.

Brennan, J., & Minihan, M. (2017). Market diversification the key to post-brexit success. The Irish Times. https://www.irishtimes.com/news/politics/donohoe-unveils-300m-brexit-loan-scheme-for-small-businesses-1.3250926

Bristow, G., & Healy, A. (2015). Crisis response, choice and resilience: Insights from complexity thinking. Cambridge Journal of Regions, Economy And Society, 8, 241–256.

Békés, G., Kleinert, J., & Toubal, F. (2009). Spillovers from multinationals to heterogeneous domestic firms: Evidence from Hungary. The World Economy, 32, 1408–1433. https://doi.org/10.1111/j.1467-9701.2009.01179.x.

Conefrey, T., O’Reilly, G., & Walsh, G. (2018). Modelling external shocks in a small open economy: The case of Ireland. National Institute Economic Review, 244, R56–R63.

Cortinovis, N., Crescenzi, R., & van Oort, F. (2020). Multinational enterprises, industrial relatedness and employment in European regions. Journal of Economic Geography, 20, 1165–1205.

Crescenzi, R., Gagliardi, L., & Iammarino, S. (2015). Foreign multinationals and domestic innovation: Intra-industry effects and firm heterogeneity. Research Policy, 44, 596–609.

Crescenzi, R., Luca, D., & Milio, S. (2016). The geography of the economic crisis in Europe: National macroeconomic conditions, regional structural factors and short-term economic performance. Cambridge Journal of Regions, Economy and Society, 9, 13–32.

Crescenzi, R., Pietrobelli, C., & Rabellotti, R. (2014). Innovation drivers, value chains and the geography of multinational corporations in Europe. Journal of Economic Geography, 14, 1053–1086.

Crespo, N., & Fontoura, M. P. (2007). Determinant factors of fdi spillovers—What do we really know? World Development, 35, 410–425.

Csáfordi, Z., Lőrincz, L., Lengyel, B., & Kiss, K. M. (2020). Productivity spillovers through labor flows: Productivity gap, multinational experience and industry relatedness. The Journal of Technology Transfer, 45, 86–121.

Department of Jobs, Enterprise and Innovation (2014). Ireland’s Smart Specialisation Strategy for Research and Innovation. Technical Report. Department of Jobs, Enterprise and Innovation. Dublin, Ireland. https://s3platform.jrc.ec.europa.eu/documents/20182/223684/IE_RIS3_201407_Final.pdf/0eb95bcb-2f73-4232-889a-811a0feaef60

Department of Jobs, Enterprise and Innovation (2017). Building stronger business. https://enterprise.gov.ie/en/Publications/Publication-files/Building-Stronger-Business-Responding-to-Brexit-by-competing-innovating-and-trading.pdf

Di Ubaldo, M., Lawless, M., & Siedschlag, I. (2018). Productivity spillovers from multinational activity to indigenous firms in Ireland. Technical Report. ESRI working paper.

Diodato, D. (2018). A network-based method to harmonize data classifications. Technical report 18.43. Papers in Evolutionary Economic Geography.

Diodato, D., & Weterings, A. B. R. (2015). The resilience of regional labour markets to economic shocks: Exploring the role of interactions among firms and workers. Journal of Economic Geography, 15, 723–742.

Diodato, D., Neffke, F., & O’Clery, N. (2018). Why do industries Coagglomerate? How Marshallian externalities differ by industry and have evolved over time. Journal of Urban Economics, 106, 1–26.

Elekes, Z., Boschma, R., & Lengyel, B. (2019). Foreign-owned firms as agents of structural change in regions. Regional Studies, 53, 1603–1613.

Ellison, G., Glaeser, E. L., & Kerr, W. R. (2010). What causes industry agglomeration? Evidence from coagglomeration patterns. American Economic Review, 100, 1195–1213.

Enterprise Ireland (2016). Market discovery fund. https://www.enterprise-ireland.com/en/funding-supports/Company/Esetablish-SME-Funding/Market-Discovery-Fund.html

Essletzbichler, J. (2015). Relatedness, industrial branching and technological cohesion in US Metropolitan Areas. Regional Studies, 49, 752–766.

Eurostat (2008). Correspondance table NACE Rev 1.1 to NACE Rev 2. Technical Report. European Commission.

Faggian, A., Gemmiti, R., Jaquet, T., & Santini, I. (2018). Regional economic resilience: The experience of the Italian local labor systems. The Annals of Regional Science, 60, 393–410.

Fainshmidt, S., Nair, A., & Mallon, M. R. (2017). Mne performance during a crisis: An evolutionary perspective on the role of dynamic managerial capabilities and industry context. International Business Review, 26, 1088–1099.

Fratesi, U., & Rodríguez Pose, A. (2016). The crisis and regional employment in Europe: What role for sheltered economies? Cambridge Journal of Regions, Economy and Society, 9, 33–57.

Frenken, K., & Boschma, R. A. (2007). A theoretical framework for evolutionary economic geography: Industrial dynamics and urban growth as a branching process. Journal of Economic Geography, 7, 635–649.

Frenken, K., Van Oort, F., & Verburg, T. (2007). Related variety, unrelated variety and regional economic growth. Regional Studies, 41, 685–697.

Girma, S., Wakelin, K., 2002. Are there regional spillovers from fdi in the UK?. In Trade, investment, migration and labour market adjustment (pp. 172–186). Springer.

Görg, H., & Greenaway, D. (2004). Much ado about nothing? Do domestic firms really benefit from foreign direct investment? The World Bank Research Observer, 19, 171–197.

Gorg, H., & Strobl, E. (2001). Multinational companies and productivity spillovers: A meta-analysis. The Economic Journal, 111, F723–F739.

Görg, H., & Strobl, E. (2002). Multinational companies and indigenous development: An empirical analysis. European Economic Review, 46, 1305–1322. https://doi.org/10.1016/S0014-2921(01)00146-5.

Görg, H., & Strobl, E. (2003). Multinational companies, technology spillovers and plant survival. Scandinavian Journal of Economics, 105, 581–595.

Görg, H., & Strobl, E. (2005a). Foreign direct investment and local economic development: Beyond productivity spillovers. In Does foreign direct investment promote development (pp. 137–55).

Görg, H., & Strobl, E. (2005b). Spillovers from foreign firms through worker mobility: An empirical investigation. Scandinavian Journal of Economics, 107, 693–709.

Haller, S. A. (2014). Do domestic firms benefit from foreign presence and import competition in Irish services sectors? The World Economy, 37, 219–243. https://doi.org/10.1111/twec.12120.

Hamilton, P. (2018). Market diversification the key to post-brexit success. The Irish Times. https://www.irishtimes.com/special-reports/competing-for-the-future/market-diversification-the-key-to-post-brexit-success-1.3667833