Abstract

The main purposes of this paper are: (1) to review three alternative methods for deriving option pricing models (OPMs), (2) to discuss the relationship between binomial OPM and Black–Scholes OPM, (3) to compare Cox et al. method and Rendleman and Bartter method for deriving Black–Scholes OPM, (4) to discuss lognormal distribution method to derive Black–Scholes OPM, and (5) to show how the Black–Scholes model can be derived by stochastic calculus. This paper shows that the main methodologies used to derive the Black–Scholes model are: binomial distribution, lognormal distribution, and differential and integral calculus. If we assume risk neutrality, then we don’t need stochastic calculus to derive the Black–Scholes model. However, the stochastic calculus approach for deriving the Black–Scholes model is still presented in Sect. 6. In sum, this paper can help statisticians and mathematicians understand how alternative methods can be used to derive the Black–Scholes option model.

Similar content being viewed by others

Notes

In this section, we follow the notations used by Cox et al. (1979).

To sell the call option means to write the call option. If a person writes a call option on stock A, then he or she is obliged to sell at exercise price X during the contract period.

Here, we distinguish udS and duS, and count them as two possible outcomes.

This uses the property that the variance of a variable Q can be calculated by: E(Q)2 – [E(Q)]2, where E(·) denotes the expected value.

Here, Taylor series expansion is used: \( e^{x} = 1 + x + \frac{{x^{2} }}{2!} + \frac{{x^{3} }}{3!} + \cdots \).

\( e^{{r\Delta t}} = 1 + r\Delta t \) and \( e^{{2r\Delta t}} = 1 + 2r\Delta t \) when higher powers of \( \Delta t^{2} \) are ignored. The solution to u and d implies that \( u = 1 + \sigma \sqrt{\Delta t} + \frac{1}{2}\sigma^{2}\Delta t \), \( d = 1 - \sigma \sqrt{\Delta t} + \frac{1}{2}\sigma^{2}\Delta t \). All of these expansions satisfy Eq. (19).

The details of program presentation for stock price, call option price, and also put option price using both binomial model and Black–Scholes model are shown in Chapter 18 in Lee et al. (2013a).The Excel VBA Code for binomialBS_OPM.xls can be found in Appendix 18A in Lee et al. (2013a). The readers can read them if interested. Due to space limit, we only present the illustrative decision trees for call options using binomial model and Black–Scholes model in the main text.

Please note that notation T used here is the number of periods rather than calendar time.

We first solve equality \( S_{0} H^{{ +^{i} }} H^{{ -^{T - i} }} = X \). This yields \( i = \frac{{\ln (X/S_{0}) - T\ln (H^{ - } )}}{{\ln H^{ + } - \ln H^{ - } }} \). To get a, the minimum integer value of i for which \( S_{0} H^{{ +^{i} }} H^{{ -^{T - i} }} > X \) will be satisfied, we should note a as: \( a = 1 + INT\left[ {\frac{{\ln (X/S_{0}) - T\ln (H^{ - } )}}{{\ln H^{ + } - \ln H^{ - } }}} \right] \).

In “Appendix”, we will use de Moivre–Laplace theorem to show that the best fit between the binomial and normal distributions occurs when the binomial probability (or pseudo probability in this case) is \( \frac{1}{2} \).

Using Taylor expansion, we have \( e^{x} = 1 + x + \frac{{x^{2} }}{2!} + O(x^{2} ) \).

Now that \( x = e^{y} \), then \( dx = d(e^{y} ) = e^{y} dy = xdy \).

The second equality is obtained by substituting the PDF of normal distribution into \( \int_{{\ln ({\text{a}})}}^{\infty } {f(y)e^{y} dy} \) and does the appropriate transformation.

Black and Scholes have used two alternative methods to derive this equation. In addition, the careful derivation of this equation can be found in Chapter 27 of Lee et al. (2013a), which was written by Professor A.G. Malliaris, Loyola University of Chicago. Beck (1993) has proposed an alternative way to derive this equation, and raised questions about the methods used by Black and Scholes. In the summary of his paper, he mentioned that the traditional derivation of the Black–Scholes formula is mathematically unsatisfactory. The hedge portfolio is not a hedge portfolio since it is neither self-financing nor riskless. Due to compensating inconsistencies, the final result obtained is nevertheless correct. In his paper, these inconsistencies, which abound in the literature, were pointed out and an alternative, more rigorous derivation avoiding these problems is presented.

The following procedure has closely related to Kutner (1988). Therefore, we strongly suggest the readers read his paper.

The solution is obtained as an application of the general Fourier integral. See Churchill (1963, pp. 154–155) for more details.

The lower limit exists since if \( u < 0,\,f(u) = 0 \). Therefore, we require \( u + 2\eta \sqrt{v} \geq 0\), i.e. \( \eta \ge - {u \mathord{\left/ {\vphantom {u {2\sqrt{v} }}} \right. \kern-0pt} {2\sqrt{v} }} \).

References

Aït-Sahalia Y, Lo AW (1998) Nonparametric estimation of state-price densities implicit in financial asset prices. J Finance 53(2):499–547

Amin KI, Jarrow RA (1992) Pricing options on risky assets in a stochastic interest rate economy. Math Finance 2(4):217–237

Amin KI, Ng VK (1993) Option valuation with systematic stochastic volatility. J Finance 48(3):881–910

Ash RB, Doleans-Dade C (1999) Probability and measure theory, 2nd edn. Academic Press, London

Bailey W, Stulz RM (1989) The pricing of stock index options in a general equilibrium model. J Financ Quant Anal 24(01):1–12

Bakshi GS, Chen Z (1997a) An alternative valuation model for contingent claims. J Financ Econ 44(1):123–165

Bakshi GS, Chen Z (1997b) Equilibrium valuation of foreign exchange claims. J Finance 52(2):799–826

Bates DS (1991) The crash of ‘87: was it expected? The evidence from options markets. J Finance 46(3):1009–1044

Bates DS (1996) Jumps and stochastic volatility: exchange rate processes implicit in deutsche mark options. Rev Financ Stud 9(1):69–107

Beck TM (1993) Black–Scholes revisited: some important details. Financ Rev 28(1):77–90

Beckers S (1980) The constant elasticity of variance model and its implications for option pricing. J Finance 35(3):661–673

Benninga S, Czaczkes B (2000) Financial modeling. MIT Press, Cambridge

Billingsley P (2008) Probability and measure, 3rd edn. Wiley, New York

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Buetow GW, Albert JD (1998) The pricing of embedded options in real estate lease contracts. J Real Estate Res 15(3):253–266

Carr P, Wu L (2004) Time-changed Lévy processes and option pricing. J Financ Econ 71(1):113–141

Chen RR, Palmon O (2005) A non-parametric option pricing model: theory and empirical evidence. Rev Quant Financ Acc 24(2):115–134

Chen RR, Lee C-F, Lee HH (2009) Empirical performance of the constant elasticity variance option pricing model. Rev Pac Basin Financ Mark Policies 12(2):177–217

Churchill RV (1963) Fourier series and boundary value problems, 2nd edn. McGraw-Hill, New York

Costabile M, Leccadito A, Massabó I, Russo E (2014) A reduced lattice model for option pricing under regime-switching. Rev Quant Financ Acc 42(4):667–690

Cox JC, Ross SA (1976) The valuation of options for alternative stochastic processes. J Financ Econ 3(1):145–166

Cox JC, Ross SA, Rubinstein M (1979) Option pricing: a simplified approach. J Financ Econ 7(3):229–263

Davydov D, Linetsky V (2001) Pricing and hedging path-dependent options under the CEV process. Manag Sci 47(7):949–965

Duan JC (1995) The GARCH option pricing model. Math Finance 5(1):13–32

Garven JR (1986) A pedagogic note on the derivation of the Black–Scholes option pricing formula. Financ Rev 21(2):337–348

Geman H, Madan DB, Yor M (2001) Time changes for Lévy processes. Math Finance 11(1):79–96

Grenadier SR (1995) Valuing lease contracts: a real-options approach. J Financ Econ 38(3):297–331

Heston SL (1993) A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev Financ Stud 6(2):327–343

Heston SL, Nandi S (2000) A closed-form GARCH option valuation model. Rev Financ Stud 13(3):585–625

Hillegeist SA, Keating EK, Cram DP, Lundstedt KG (2004) Assessing the probability of bankruptcy. Rev Acc Stud 9(1):5–34

Hull JC (2014) Options, futures, and other derivatives, 9th edn. Prentice Hall, Englewood Cliffs

Hull J, White A (1987) The pricing of options on assets with stochastic volatilities. J Finance 42(2):281–300

Joshi MS (2003) The concepts and practice of mathematical finance, vol 1. Cambridge University Press, Cambridge

Kou SG (2002) A jump-diffusion model for option pricing. Manag Sci 48(8):1086–1101

Kou SG, Wang H (2004) Option pricing under a double exponential jump diffusion model. Manag Sci 50(9):1178–1192

Kutner GW (1988) Black–Scholes revisited: some important details. Financ Rev 23(1):95–104

Lee JC (2001) Using Microsoft Excel and decision trees to demonstrate the binomial option pricing model. Adv Invest Anal Portf Manag 8:303–329

Lee C-F, Lin CSM (2010) Two alternative binomial option pricing model approaches to derive Black–Scholes option pricing model. In: Lee C-F, Lee J, Lee AC (eds) Handbook of quantitative finance and risk management. Springer, Berlin, pp 409–419

Lee JC, Lee C-F, Wei KJ (1991) Binomial option pricing with stochastic parameters: a beta distribution approach. Rev Quant Financ Acc 1(4):435–448

Lee C-F, Wu TP, Chen RR (2004) The constant elasticity of variance models: new evidence from S&P 500 index options. Rev Pac Basin Financ Mark Policies 7(2):173–190

Lee C-F, Finnerty J, Lee J, Lee AC, Wort D (2013a) Security analysis, portfolio management, and financial derivatives. World Scientific, Singapore

Lee C-F, Lee J, Lee AC (2013b) Statistics for business and financial economics, 3rd edn. Springer, Berlin

Lin CH, Lin SK, Wu AC (2014) Foreign exchange option pricing in the currency cycle with jump risks. Rev Quant Finan Acc. doi:10.1007/s11156-013-0425-1

Marcus AJ, Shaked I (1984) The valuation of FDIC deposit insurance using option-pricing estimates. J Money Credit Bank 16(4):446–460

Melino A, Turnbull SM (1990) Pricing foreign currency options with stochastic volatility. J Econom 45(1):239–265

Melino A, Turnbull SM (1995) Misspecification and the pricing and hedging of long-term foreign currency options. J Int Money Finance 14(3):373–393

Merton RC (1973) Theory of rational option pricing. Bell J Econ Manag Sci 4(1):141–183

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Finance 29(2):449–470

Merton RC (1977) An analytic derivation of the cost of deposit insurance and loan guarantees: an application of modern option pricing theory. J Bank Finance 1(1):3–11

Merton RC (1978) On the cost of deposit insurance when there are surveillance costs. J Bus 51:439–452

Psychoyios D, Dotsis G, Markellos RN (2010) A jump diffusion model for VIX volatility options and futures. Rev Quant Financ Acc 35(3):245–269

Rendleman RJ, Bartter BJ (1979) Two-state option pricing. J Finance 34(5):1093–1110

Rubinstein M (1994) Implied binomial trees. J Finance 49(3):771–818

Scott LO (1987) Option pricing when the variance changes randomly: theory, estimation, and an application. J Financ Quant Anal 22(4):419–438

Scott LO (1997) Pricing stock options in a jump-diffusion model with stochastic volatility and interest rates: applications of Fourier inversion methods. Math Finance 7(4):413–426

Stein EM, Stein JC (1991) Stock price distributions with stochastic volatility: an analytic approach. Rev Financ Stud 4(4):727–752

Wiggins JB (1987) Option values under stochastic volatility: theory and empirical estimates. J Financ Econ 19(2):351–372

Williams JT (1991) Real estate development as an option. J Real Estate Finance Econ 4(2):191–208

Wu CC (2006) The GARCH option pricing model: a modification of lattice approach. Rev Quant Financ Acc 26(1):55–66

Author information

Authors and Affiliations

Corresponding author

Appendix: The relationship between binomial distribution and normal distribution

Appendix: The relationship between binomial distribution and normal distribution

In this “Appendix”, we will use the de Moivre–Laplace theorem to prove that the best fit between the binomial and normal distributions occurs when the binomial probability is \( \frac{1}{2} \).

de Moivre–Laplace theorem

As n grows larger and approaches infinity, for k in the neighborhood of np we can approximate

Proof

According to Stirling’s approximation (or Stirling’s formula) for factorials approximation, we can replace the factorial of large number n with the following:

Then \( \left( {\begin{array}{*{20}c} n \\ k \\ \end{array} } \right)p^{k} q^{n - k} \) can be approximated as shown in the following procedures.

Let \( x = \frac{k - np}{{\sqrt{npq} }} \), we obtain:

As k → np, we get \( \tfrac{k}{n} \to p \). Then Eq. (123) can be approximated as:

We are considering the term in exponential function, i.e.

Here, we are using the Taylor series expansions of functions ln(1 ± x):

Then we expand Eq. (125) respect to x and obtain:

Since we have p + q = 1 when we ignore the higher order of x, Eq. (126) can be simply approximated to:

Then we replace Eq. (127) in the exponential function in Eq. (124), we obtain:

Although term \( - \frac{1}{{6\sqrt{npq} }}x^{3} (p - q) \to 0 \) as n → ∞, the term \( - \frac{1}{{6\sqrt{npq} }}x^{3} (p - q) \) will be exactly zero if and only if p = q. Under this condition, \( \left( {\begin{array}{*{20}c} n \\ k \\ \end{array} } \right)p^{k} q^{n - k} \simeq \frac{1}{{\sqrt{2\pi pq} }}\exp ( - \frac{1}{2}x^{2} ) = \frac{1}{{\sqrt{2\pi pq} }}\exp [ - \frac{{(k - np)^{2} }}{2npq}] \). Thus, it is shown that the best fit between the binomial and normal distribution occurs when \( p = q = \frac{1}{2} \).

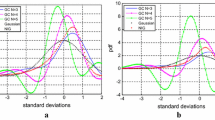

If p ≠ q, then there exists an additional term \( - \frac{1}{{6\sqrt{npq} }}x^{3} (p - q) \). It is obvious that \( \sqrt{pq} = \sqrt{p(1 - p)} \) will reach maximum if and only if \( p = q = \frac{1}{2} \). Therefore, when n is fixed, if the difference between p and q becomes larger, the absolute value of an additional term \( - \frac{1}{{6\sqrt{npq} }}x^{3} (p - q) \) will be larger. This implies that the magnitude of absolute value of the difference between p and q is an important factor to make the approximation to normal distribution less precise. We use the following figures to demonstrate how the absolute number of differences between p and q affect the precision of using binomial distribution to approximate normal distribution.

From Figs. 5 and 6, we find that when p ≠ q, the absolute magnitude does affect the estimated continuous distribution as indicated by red solid curves. For example, when n = 30, the red solid curve when p = 0.9 is very much different from p = 0.5. In other words, when p = 0.9, the red solid curve is not as similar to the normal curve as p = 0.5. If we increase n from 30 to 100, the solid red curve from p = 0.9 is less different from the solid red curve when p = 0.5. In sum, both the magnitude of n and p will affect the shape of using normal distribution to approximate binomial distribution.

From Eqs. (15) and (16) in the text, we can define the binomial OPM and the Black–Scholes OPM as follows:

Both Cox et al. and Rendlemen and Bartter tried to show the binomial cumulative functions of Eq. (15) will converge to the normal cumulative function of Eq. (16) when n approaches infinity. In this “Appendix”, we have mathematically and graphically showed that the relative magnitude between p and q is the important factor to determine this approximation when n is constant. In addition, we also demonstrate the size of n which also affects the precision of this approximation process.

Rights and permissions

About this article

Cite this article

Lee, CF., Chen, Y. & Lee, J. Alternative methods to derive option pricing models: review and comparison. Rev Quant Finan Acc 47, 417–451 (2016). https://doi.org/10.1007/s11156-015-0505-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-015-0505-5

Keywords

- Black–Scholes option pricing model

- Binomial option pricing model

- Lognormal distribution method

- Stochastic calculus