Abstract

Ameliorating and deteriorating products, or, more generally, items that change value over time, present a high sensitiveness to the surrounding environment (e.g., temperature, humidity, and light intensity). For this reason, they should be properly stored along the supply chain to guarantee the desired quality to the consumers. Specifically, ameliorating items face an increase in value if there are stored for longer periods, which can lead to higher selling price. At the same time, the costumers’ demand is sensitive to the price (i.e., the higher the selling price the lower the final demand), sensitiveness that is related to the quality of the products (i.e., lower sensitiveness for high-quality products). On the contrary, deteriorating items lose quality and value over time which result in revenue losses due to lost sales or reduced selling price. Since these products need to be properly stored (i.e., usually in temperature- and humidity-controlled warehouses) the holding costs, which comprise also the energy costs, may be particularly relevant impacting on the economic, environmental, and social sustainability of the supply chain. Furthermore, due to the recent economic crisis, companies (especially, small and medium enterprises) face payment difficulties of customers and high volatility of resources prices. This increases the risk of insolvency and on the other hand the financing needs. In this context, supply chain finance emerged as a mean for efficiency by coordinating the financial flow and providing a set of financial schemes aiming at optimizing accounts payable and receivable along the supply chain. The aim of the present study is thus to investigate through a systematic literature review the two main themes presented (i.e., inventory management models for products that change value over time, and financial techniques and strategies to support companies in inventory management) to understand if any financial technique has been studied for supporting the management of this class of products and to verify the existing literature gap.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Age-value products, or ameliorating items, are a particular class of items characterized by an increasing value over time (e.g., cheese, wine, spirits), if appropriately stored since they present a high sensitiveness to the surrounding environment (e.g., humidity, temperature). Since these products need to be properly stored (i.e., usually in temperature-controlled warehouses) the holding costs, including energy costs, related to their aging phase, may be particularly relevant (Marchi et al. 2020a). By deciding to stock an item for longer periods, the product matures, which means higher value and higher selling price (Zanoni et al. 2019; Gonen et al. 2021). A peculiar aspect of these products is that they can be sold after a convenient aging period, but the longer the aging, the higher their value, but also the higher the holding costs. Moreover, inventory management is influenced by the pricing of the item itself, as the selling price of the item represents a crucial and influential factor in the customer behavior: generally, the higher the selling price, the higher the decrease in the demand rate. However, the relationship between demand rate and price is affected by the aging of the product: e.g., the higher the value of the product, the lower the demand sensitiveness over the price. Thus, the optimal aging period aims at balancing the increase of value, that can be cashed when selling the products, and the holding expenses. The same trade-of interest deteriorating items: in fact, the longer the storage periods the lower the quality of the final products, which results in losses of revenues and increased waste, impacting the sustainability of the supply chain.

Furthermore, due to the economic crisis, the payment difficulties of customers and the high volatility of prices, companies are facing, on one hand, the risk of insolvency, and, on the other hand, increased financing necessity. In this context, supply chain finance (SCF) emerged as a mean for efficiency and was firstly introduced by Pfohl and Gomm (2009) as follows: “SCF is the inter-company optimization of financing as well as the integration of financing processes with customers, suppliers, and service providers in order to increase the value of all participating companies”. The task of SCF is to save capital cost through better mutual adjustment or financing concepts within the supply chain. The success of SCF depends on the cooperation between the actors in a supply chain, which can result in several benefits, e.g., lower debt costs, new opportunities to obtain loans (especially for weak supply chain players) or reduced working capital within the supply chain. Concretely, supply chain finance is a set of solutions (vendor-based, buyer-based or other joint solutions) that optimizes cash flow, for instance, by allowing companies to extend their payment terms to their suppliers. SCF results in a profitable situation for the overall supply chain but also to all the participating companies.

Companies show a widespread and growing interest in the inventory management of items that change value over time, and in the financing techniques to support supply chain partners in improving the overall performances. The present study is therefore developed with the aim of introducing and discussing inventory problems for the class of products changing their value over time with the focus on ameliorating and deteriorating items, supported by supply chain finance techniques (e.g., warehouse financing), and to verify the existing literature gap. The literature review was conducted in parallel but separately for the two topics (i.e., inventory management of items changing their value over time, and supply chain finance in inventory models) to ensure rigorous and precise research, to carry out content analyses as detailed as possible and to identify the existing theoretical gap for each topic.

The structure of the paper is the follow: Sect. 2 introduce the conceptual framework and the research questions that drive the analyses, Sect. 3 provides the review methodology (i.e., defines keywords and protocol) used to identify the relevant papers, Sects. 4 and 5 analyze, through descriptive and content analyses, the research streams on inventory management of ameliorating and deteriorating items, and on supply chain finance in inventory models, respectively, finally, in Sect. 6, the discussion of the results and the main conclusions are reported.

2 Conceptual framework

This section outlines the research questions and the conceptual framework driving the definition of the literature sample (until 2020) and the sequent content analysis. Four research questions (RQs) have been defined, related to both the topics, i.e., inventory management of ameliorating and/or deteriorating products and supply chain finance:

RQ1. Which background or supply chain context most characterizes inventory models for ameliorating and/or deteriorating items? Which type of Supply Chain Structure has been considered? And which actors are mainly involved?

RQ2. Which are the most relevant peculiarities and characteristics of this class of items? Which types of products (e.g., wine, cheese, etc.) are mostly studied in the developed models? And finally, how it is modelled the amelioration and/or deterioration rate?

RQ3. What environmental or contextual conditions are most favorable to supply chain finance? Which financial practices are most prevalent? Which impacts do they have on supply chains, and which are the implications for inventory management?

RQ4. Has any case study been conducted? Or only numerical examples are presented?

These RQs guided the definition of the conceptual framework, necessary to provide a structured methodology for the evaluation, selection, and discussion of the articles. The following dimensions were examined for the classification and for the content analysis: supply chain structure (e.g., number of echelon, and number of actor for echelon), assumptions of the model (e.g., demand type, and number of products in the model), methodological aspects (i.e., objective function and solution technique) and the specific factors considered in the model in terms of deterioration and/or amelioration rate and financial techniques to support the decision-making process. Figure 1 shows the framework used for the classification of the articles.

3 Review methodology

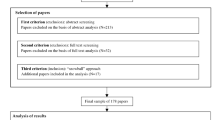

To conduct an accurate study and identify the relevant research gap, the literature search was, firstly, conducted separately, and only then jointly discussed. This work is focused on inventory management, hence, for both research areas the following keywords were kept: “Inventory”, “Supply chain management” and “Production planning and control”. Then, the specific keywords and protocol results for the two research streams (i.e., inventory management of ameliorating/deteriorating items, and supply chain finance mechanisms) are later discussed in detail.

The keywords analysis was conducted as follows. First, the articles must satisfy the search string in the title, abstract or keywords list. In the second step, all documents not belonging to the 'article' type (i.e., conference paper, note, review, book chapter, letter, editorial, etc.) were excluded. For obvious reasons, also journals belonging to different subject areas such as ‘Medicine’, ‘Psychology’, ‘Social Sciences’, ‘Neuroscience’, ‘Arts and Humanities’, ‘Nursing’, etc., were not included in this review focusing primarily on decision sciences and operations management. Several articles were later discarded after reading the abstract because not relevant to the research. The selected articles were read in their entirety and analyzed to identify additional articles from the references that could be relevant for this review through a snowball or cross-reference search (i.e., article cited in or citing the ones of the sample).

The review protocol describes the method used in the review for the definition of the sample size: i.e., decisions about the article selection, inclusion criteria, search strategy and data extraction. The main sources used for the review were Scopus and ScienceDirect, two of the largest and most popular online databases of peer-reviewed literature. Table 1 shows the steps and the results of the literature search for both the research streams: the application of the protocol produced 59 relevant articles concerning inventory models for items changing their value over time (“Total AMEL”), while the final sample size of articles related to supply chain finance is 53 (“Total SCF”).

The “Venn diagram” depicted in Fig. 2 allows to understand all possible logical relationships between a finite set of different sets. In our case, it will allow to investigate the commonality between the two topics by defining how many of these articles fall under both research streams and how many are only in one. As is evident from the graph, 40 articles fall under both topics (14 from the sample of the inventory models for items changing value over time, and 26 from the sample of SCF), while 45 deal only with ameliorating or deteriorating products and finally just 27 concern the topic of supply chain finance. Almost all the articles related to amelioration and deterioration do not deal with the other search string (45 out of 59, respectively 76% of the articles), meanwhile the vast majority (almost half, i.e., 49%) of articles dealing with supply chain finance also consider ameliorating/deteriorating items (in most cases only deterioration of products).

4 Inventory management of ameliorating and deteriorating items

“Ameliorating items” are rarely examined in inventory models literature. In fact, the greatest part of literature deals with product that preserves the value over time or deteriorates. The following keywords have been added to the one previously defined for the inventory management research area: “Ameliorating”, “Maturing”, “Aging”, “Deteriorating”, “Deterioration” and “Perishable” (Table 2).

4.1 Descriptive analysis

The application of the review protocol defined 59 articles relevant to this review. In this paragraph, some simple statistical analyses are presented to show and further investigate the research results. Figure 3 shows the evolution over time of the articles under review regarding “ameliorating items” and/or “deterioration items”. For simplicity, only articles published since 1990 have been included in the graph. This topic is certainly gaining increasing interest from researchers in recent years, especially since 2008.

Furthermore, Table 3 shows the publication trend of the journals. The top three journals relevant for this research are: “Computers and Industrial Engineering” that published 7 selected articles, “European Journal of Operational Research” and “Mathematical and Computer Modelling” which published five articles. It is interesting to observe that the first five journals (that have published three or more articles) cover almost half of the publications selected for this review (45.3%). Most of the papers belong to the following subject areas: “Mathematics”, “Computer science” and “Decision Sciences”. The subject areas of “Engineering” and “Business, Management and Accounting” were also relevant to the research.

Subject Area: [1] Engineering, [2] Mathematics, [3] Decision sciences, [4] Computer science, [5] Business, Management and Accounting, [6] other.

A further analysis on the main keywords used by the authors of the selected articles was conducted. This analysis has the purpose to investigate which are the aspects that mostly interested researchers in their study. Table 4 shows only the keywords mentioned at least two times. The most significant keywords were related to inventory (keywords starting with “inventory” followed by different words, e.g., “inventory”, “inventory control”, “inventory management”, etc.), deterioration (words starting with “deteriorate-” that can end differently, e.g., “deteriorate”, “deteriorating”, “deterioration”, etc.), amelioration (words starting with “ameliorat-” that can end differently, e.g., “amelioration”, “ameliorating items”, etc.), partial backlogging, Weibull (i.e., “Weibull distribution”, “Weibull deterioration”), perishablility (, e.g., “perishables”, “perishable products”, etc.). The most commonly ones are: “Inventory”, “Deterioration”, “Amelioration” and “Partial backlogging”, cited by the authors in 47%, 35%, 25% and 25% of the articles, respectively. Another interesting observation is that many researchers who have developed deteriorating and/or ameliorating inventory models have assumed a rate of deterioration/amelioration function of time and temperature, following a two- or three-parameter Weibull distribution.

The analysis of the keywords was the starting point for the content analysis, reported below, allowing to understand on which aspects the researchers focused most. All these aspects will be explored with more details in the following section.

4.2 Content analysis

As mentioned earlier, this section will review the content of the selected papers about aging inventory, including both amelioration and deterioration. The first existing models in literature for the inventory management and optimization were developed in the early 1900s which assumed that products have infinite shelf life and maintain their value over the years. These are, in fact, the assumptions of the first Economic Order Quantity (EOQ) model, developed by (Harris 1913). In the last few decades, the importance of the introduction of deterioration has been understood and more and more researchers have turned their attention into studying different types of inventory policies for deteriorated/defective/perishable items. The first one that included deteriorating items was (Whitin 1953), who considered that fashion items deteriorate after a certain storage period. Later, Ghare and Schrader (1963) modelled a negative exponential decaying inventory model and Misra (1975) developed an economic production lot size model with deteriorating inventory. The type of demand has always played a very important role in inventory models. Recently, several researchers have explored different situations depending on the demand rate: Hariga and Benkherouf (1994) introduced an inventory model for deteriorating items with exponential time-varying demand (i.e., demand rates change exponentially with time over a known and finite planning horizon), Cheng and Wang (2009) considered a trapezoidal-type demand rate (i.e., demand rate is modelled as a piecewise linearly function). The demand rate for the latter increases with the time up to certain period, then stabilizes and becomes constant, and finally it approximately decreases to a constant or zero value, and then begins the next replenishment cycle. Such type of demand pattern is generally seen in the case of any fad or seasonal goods coming to market. While Jaggi et al. (2015) considered a ramp type demand under fuzzy environment, (i.e., the demand increases linearly at the beginning and then the market grows into a stable stage such that the demand becomes constant until the end of the replenishment cycle), which is very common when some fresh fruit come to the market. Finally, an inventory model for deteriorating item with frequency of advertisement and selling price dependent demand was developed (Shaikh 2017). A classic assumption made in most inventory models is that, when there is shortage, either complete backordering or complete lost sale is assumed: this assumption is not always plausible for customer during stockout. Wee (1993) formulated an economic production plan policy for deteriorating items with partial backordering. Next, Chang and Dye (1999) developed an EOQ model for time-varying demand and partial backlogging. Cheng et al. (2011) extended Cheng and Wang’s model including shortages: i.e., they developed an optimal policy for deteriorating items with trapezoidal type demand and partial backlogging. Another important contribution is given by Yang and Wee (2000), that introduced an integrated approach for deteriorating items by developing a mathematical model for a single-vendor single-buyer system, later expanded to a multiple-buyers inventory policy (Yang and Wee 2002). Chen and Chang (2010) developed optimal ordering and pricing policies for deteriorating items in one-vendor multi-retailer supply chain. These articles proposed lot size models focused on coordinated inventory replenishment decisions between vendors and buyers for the improvement of the supply chain performance. These so-called JELS (joint economic lot size) models determine order, production, and shipment quantities with the aim of minimizing total system costs or maximizing overall profits, and thus optimizing the whole supply chain rather than the individual actor. The type of supply chain structure considered is therefore a certainly distinctive aspect of the models. From the pie chart in Fig. 4, it emerges that most of the models consider a single actor perspective (“SA”, 42), i.e., uncoordinated system (for instance, EOQ model), a few single-vendor single-buyer supply chain (“SV SB”, 11), while lastly a very small number of researchers developed single-vendor multi-buyer (“SV MB”, 3) as well as single-supplier single-vendor single-buyer (“SS SV SB”, 3) supply chain models.

Another feature often introduced and analyzed by researchers is trade credit, an alternative source of financing for buying firms. In early 80’, Goyal (1985) developed a mathematical model for determining the economic order quantity under conditions of permissible delay in payments. Later, Aggarwal and Jaggi (1995) extended Goyal’s model with trade credit policy for deteriorating items. Lately, few other studies addressed the deteriorating issue together with other relevant issues, such as inflation (e.g., Sarker et al. 2000; Chern et al. 2008) and quantity discount (Taleizadeh et al. 2013). Significant studies considering all the aspects just mentioned (i.e., deterioration, shortages, and trade credit) have been conducted by Vandana et al. (2016) with a quadratic, time-dependent demand, and Shaikh et al. (2018) that consider a price and advertisement dependent rate of demand.

Despite the growing and justified interest in the topic of deterioration, researchers did not take much attention to the opposite situation, which is represented by ameliorating items. Most of the models found in literature describes the amelioration process as the increase in quantity over time: examples of this type of products are fast-growing animals, such as broilers, ducks, pigs, etc. Only a few research studies consider the amelioration as the increase over time in value and quality of the items during their maturing/aging process. Hwang (1997) firstly formulated an inventory model considering the effect of amelioration only. Then, two years later, Hwang (1999) extended the inventory model for items under the combined effect of amelioration and deterioration: demand and deterioration cause a decrease in inventory, while the amelioration causes the opposite effect. In both models, a constant demand and the two parameters Weibull distribution for both the amelioration and deterioration rates were considered. Next, Mondal et al. (2003) developed an inventory system for ameliorating items with price dependent demand rate. Further, Moon et al. (2005) developed inventory models for ameliorating items with time varying demand over a finite planning horizon, considering the effects of inflation and time value of money. Sana et al. (2009) studied an economic production quantity (EPQ) model in which demand rate is a function of stock-level, sales price, and advertisement. However, the two-parameter Weibull distribution may not always be applicable in real life as some items do not start to deteriorate/ameliorate at the beginning, but only after a certain storage time. In this kind of context, the three-parameter Weibull distribution is more practical. The first one that introduced and developed a general EOQ model using a three-parameter Weibull distribution was Philip (1974). Subsequently, Yang (2012) explored two-warehouse inventory models with partial backlogging under inflation with the deterioration rate following the three-parameter Weibull distribution. Finally, Mondal et al. (2019) proposed two inventory models for ameliorating and deteriorating items under three parameter Weibull distribution for crisp and interval environments, respectively. Other noteworthy contributions exist. Law and Wee (2006) developed an integrated production-inventory model considering both ameliorating and deteriorating effects taking account of multiple deliveries, partial backordering, and time discounting. Wee et al. (2008) elaborated an optimal replenishment inventory strategy to consider both ameliorating and deteriorating effects, the time value of money and a finite planning horizon. Ji (2008) investigated the influences of inflation and time-value of money on the inventory system, by proposing an EOQ model, for both ameliorating and deteriorating items with partial backlogging. Valliathal and Uthayakumar (2010) presented another production inventory model for ameliorating/deteriorating items under time dependent demand with non-linear shortage cost under inflation and time discounting. Three years later, they extended the model to items with ramp type of demand (Valliathal and Uthayakumar 2013). Vandana and Srivastava (2017) formulated an inventory model for ameliorating/deteriorating items with trapezoidal-type demand rate, considering inflation, time discounting and completely backlogged shortages. Mahata and De (2016) introduced retailer partial trade credit policy in the inventory model of ameliorating items for price dependent demand rate. Sana (2010) extended the EOQ model for multiple items considering constant deteriorating and ameliorating rate. Vandana and Sana (2020) developed an inventory model for ameliorating/deteriorating items with single vendor and multi-buyers. Zanoni et al. (2019) analyzed and developed inventory models for two specific maturing/aging items that acquire value over time, i.e., wine and cheese: they considered the aging effect as an increase of the value (i.e., the price) of the items over the years. In their models, they assumed that the increase of product value over time is homogeneous, so no product deterioration is considered.

Below, a comparative study of existing literature related to the inventory models of ameliorating and deteriorating items is proposed. Table 5 provides a review of only those models that considered the ameliorative effect, while Table 6 focuses on those articles that have only considered deterioration. The tables below show the supply chain structure considered in the different models, their relevant assumptions (such as number of products and type of demand), furthermore the system factors considered (such as type of amelioration rate, deterioration aspect, allowance for shortage/backorder, inclusion of lost sales) and finally the trade credit option, which is highly relevant to the second research stream of this study. The table does not include the ‘case study’ aspect, as none of the articles selected from the literature sample included it. In fact, each of them only provided numerical analyses and discussed sensitivity analyses to gain managerial insights.

5 Supply chain finance

The objective of this section is to give an overview about the existing literature concerning the coordination of the financial flow along the supply chain. There is substantial literature regarding financial strategies in supply chains: therefore, a relevant sample of literature was extracted for this research, to conduct a detailed analysis, covering the theoretical gap between the two research topics. This literature review is focused on inventory model with supply chain finance techniques, since the warehouse financing still lack of research studies. Table 7 shows the keywords defined which conduct to the final sample of articles reviewed consisting of 53 papers (Table 1).

5.1 Descriptive analysis

In this paragraph, some statistical analyses about the literature sample related to supply chain finance in inventory management models are presented. The publication trend of the examined articles shows that this topic is recent and has been studied and deepened by researchers only in the last 15 years (Fig. 5).

Table 8 below shows the publication trend of the journals. It is interesting to observe that the first three journals (i.e., “International Journal of Production Economics”, “Computers and Industrial Engineering”, “Journal of the Operational Research Society”) cover almost half of the publications selected for the review (42%). The topic has interested many journals focused primarily on the following Subject Areas: “Decision Science”, “Engineering” and “Business, Management and Accounting”. Compared to the first research stream regarding the aging inventory, the research area “Economics, Econometrics and Finance” is also considered.

A further analysis was conducted to investigate the keywords most frequently used by the authors. Table 9 shows only the keywords mentioned at least two times in the selected articles. This analysis made it possible to identify the relevant aspects to focus on in the content analysis. The most significant keywords are related to inventory (words starting with “inventory” followed by different words, e.g., “inventory”, “inventory model”, “inventory management” etc.), finance (words starting with “finance-”, e.g., “finance”, “financial flows”, etc.), trade credit, supply chain (e.g., “supply chain management”, “supply chain system”, etc.), deterioration (words starting with “deteriorate-”, e.g., “deteriorate”, “deteriorating”, “deterioration”, etc.), warehouse (“warehouse financing”, “two-warehouse”, etc.), permissible delay in payments. It can be deduced that trade credit/permissible delay in payments are the financing policies mainly considered and integrated into the inventory models, while warehouse financing is mentioned only 2 times.

5.2 Content analysis

In recent decades, in parallel with the growing interest in supply chain management, the inclusion of the cash flows has also been of great interest to researchers. Trade credits and late payments are the two mostly studied SCF strategies in inventory related literature. In traditional inventory models (i.e., economic order or production quantity models), it is often assumed that the supplier receives the payment as soon as the buyer receives the goods: assumption, for example, of the first economic order quantity (EOQ) model by Harris (1913). The first ones that introduced the idea of trade credit financing were Haley and Higgins (1973), who investigated the relationship between inventory policy and trade credit policy in the context of the basic lot-size model, determining the optimal order quantity and optimal payment time for firms while minimizing total costs. Since then, many researchers have incorporated the concept of trade credit financing into their inventory models. About ten years later, Goyal (1985) formulated a single item inventory model under the conditions of permissible delay in payments. Moving the focus on products that change their value over time, many researchers extended Goyal’s trade credit policy model for deteriorating items: the first attempt was made by Aggarwal and Jaggi (1995). In the models cited so far, shortages have not been considered. Later, Jamal et al. (1997) first developed the ordering policy, e.g., the general EOQ model, for deteriorating items considering allowable shortage, and permissible delay in payment. More recently, Ouyang et al. (2009a, b), Chen et al. (2014) and Chung et al. (2015) obtained interesting results in their inventory models considering deteriorating items under trade credit financing. Lately, few other studies addressed the trade credit policy together with other relevant issues, such as inflation and frequency of advertisement. Sarker et al. (2000) developed a model for deteriorating products under inflation, permissible delay in payments and allowable shortage. Sana (2008) introduced an EOQ model with a varying demand followed by advertising expenditure and selling price under permissible delay in payments.

The models discussed so far assumed that the supplier would offer the buyer a delay period (e.g., a trade credit), but the buyer would not offer the trade credit period to his customer. These are all called single level trade credit financing inventory models: but in most business transactions, this assumption is debatable. Huang (2003) firstly assumed that also the buyer offers a trade credit policy to his customers. In his model, the supplier offers the buyer a permissible delay of M periods, and the buyer also provides its customers a permissible delay of N periods, respectively, with the aim of determining the optimal ordering policy for the retailer. These types of inventory models are known as “two levels trade credit”. After Huang (2003), a very large number of works have been done by different researchers. Teng et al. (2007), Huang and Hsu (2008), Liao and Chung (2009), and Liao et al. (2017) proposed retailer’s inventory policies under two levels of trade credit under different assumptions. Finally, Chung et al. (2018) proposed an inventory model that incorporate all the concepts about the two levels of trade credit, cash discount and quantity discount. The pie chart below, Fig. 6, shows in percentage how many articles consider the different SCF solutions in the selected sample. More than half of the articles propose a model with single trade credit offered by the vendor to the buyer, a significant proportion offer the financing solution of two-level trade credit, while a few develop models with partial trade credit (single- or two-level).

Recently, Chung and Huang (2006), Chung and Huang (2007), Liao and Huang (2010), Liang and Zhou (2011), Liao et al. (2012), Yen et al. (2012), Liao et al. (2013b) modified Huang’s model by introducing limited warehouse capacity and developing a two-warehouse inventory model for single deteriorating items under permissible delay in payments: a rented warehouse (with a higher unit holding cost) is used to store units exceeding the capacity of the owned warehouse. The models developed determine the optimal cycle time, while demand is constant, and shortages are not allowed. Liao et al. (2013a), Jaggi et al. (2017a), Jaggi et al. (2019), Jaggi et al. (2014) proposed some extensions while considering non-constant demand rate (i.e., price or time dependent), and admissible shortages or lost sales. Similarly, Tiwary et al. (2022) considered the two-warehouse context with a two-level trade credit for imperfect quality and deteriorating items. Further, Bhunia et al. (2014) introduced a two-warehouse inventory model for deteriorating items under permissible delay in payment considering constant demand and partial backlogging. Very recently, Shaikh (2017), Shaikh et al. (2019) and Shaikh and Cárdenas-Barrón (2020) extended the model of Bhunia et al. (2014), developing an inventory model for deteriorating item considering a demand dependent on frequency of advertisement and selling price under mixed trade credit policy. Shaikh and Cárdenas-Barrón (2020), Chung et al. (2021) and Mahato and Mahata (2021) discussed optimal ordering policy for deteriorating items under order-size-dependent trade credit, which introduces two main shortcomings: (1) the vendor needs to fully gather information from the buyer to set an appropriate order quantity threshold (e.g., market demand, warehouse capacity, cost structure); (2) the trade credit with a single order quantity threshold forces the buyer to make two extreme choices: to enjoy delay in payment by making the order quantity greater than or equal to the predetermined quantity or to pay the full purchase amount immediately when the order quantity is less than the predetermined quantity. More flexible trade credit terms based on different trade credit periods and different quantities thresholds could solve these shortcomings. Later than 2020, and thus excluded from the literature sample, two additional extensions were presented by Jayaswal et al. (2021) and Mittal and Sharma (2021) which considered learning effects, and growing items (i.e., items that increase in quantity over time), respectively.

Below, a comparative study of existing literature related to trade credit is proposed. First, the supply chain structure has been omitted from the aspects highlighted in the table below, as the entire sample of articles analyses contexts of single-vendor single-buyer supply chain (“SV SB”). Table 10 shows the relevant aspects considered in the different models analyzed: i.e., their relevant assumptions (such as the number of products and the type of demand), the factors considered (such as deterioration rate, allowance for shortage/backorder, inclusion of lost sales) and the typology of trade credit policy (trade credit, late payment, etc.). In conclusion, no case studies are reported in the sample examined, which is why this aspect has not been included in the table below. Instead, each of them provided numerical analyses to show the applicability of the developed models, and in most of the cases a sensitivity analysis of key parameters has been incorporated to draw managerial insight on the optimal solution.

In the inventory models discussed so far, the focus was on trade credit in a supplier–buyer supply chain, where the supplier offers a short-term loan to its own buyer: this is one of the two well-known modes of supply chain finance. The other one is bank credit finance, where the buyer obtain a loan directly from a banking institution, with a higher interest rate. However, this research focuses on another innovative financing practice, where the buyer gives a part of its own stock as a guarantee to the banking institutions, while requesting a loan: this financing technique is called “Warehouse Financing” (WF). According to this practice, therefore, the goods are provided as a guarantee for the loan and, if the buyer would not be able to repay the loan amount, a quantity of stock material equal to the amount owed will be given to the bank. Among the benefits, this allows banking institutions to lower the interest rates charged to the retailers, that will consequently reduce the financial component of the holding costs. Warehouse financing is not widely discussed in literature, but recently it is gaining interest among the financing mechanisms with a supply chain-oriented perspective. Lin et al. (2018) developed a model under confirming warehouse financing (CWF) to find the optimal mode to coordinate the supply chain: CWF is an innovative method of channel finance to solve the retailer’s capital constraint. They demonstrated that it showed great benefit in freeing up cash flow for both suppliers and their retailers. However, when demand is uncertain and affected by retailers’ sales efforts, CWF, which typically requires complete buyback by the vendor, fails to properly coordinate the supply chain. Conversely, Marchi et al. (2020b) extended the inventory theory by combining the operation management with two specific financial techniques: the warehouse financing practice and the use of futures contracts. The supplier can adopt one of these two financial techniques to mitigate the risks related to the frequent fluctuations and high volatility of raw material prices. The two financial policies are included in the traditional joint economic lot size model under two different coordination policies (i.e., traditional policy based on the Hill’s model, and the Consignment Stock agreement), as means for hedging stocks. Their results highlighted that both the financing practices allow the reduction of the total cost of the supply chain. Up to now, articles related to warehouse financing are very few, but it is a topic that will surely interest many research studies in the future and that present a huge potential especially for ameliorating items.

Other advance SCF solutions are presented by Panda et al. (2017) which proposed two hybrid contract-bargaining processes (i.e., backward, and forward) consisting of quantity discount and compensation on deterioration cost, aiming at channel coordination and benefit sharing in a three-echelon supply chain. Khan et al. (2020) developed an inventory model under full or partial advance payment for deteriorating products where shortages are allowed, and demand is price and stock dependent. Furthermore, the vendor gives to buyers an instant cash discount due to the advance payment. More recently, Khan et al. (2022) presented an inventory model that involves non-instantaneous deterioration, nonlinear stock-dependent demand, and partially backlogged shortages by considering the length of the waiting time under a hybrid prepayment and cash-on-delivery scheme. The vendor requires a certain segment of the purchasing price in advance of delivery, after the order has been placed, and asks for the rest of the purchasing price when the order is delivered, i.e., cash-on-delivery.

6 Discussion and conclusions

The aim of the present study was to systematically review the field of inventory management while considering items that change their value over time (i.e., ameliorating/deteriorating items) and supply chain finance. The analyses conducted in the previous sections allow to answer the research questions defined. Firstly, it is possible to observe that both the research streams are still underexamined and that the focus is mainly on simple supply chains. For the deterioration/amelioration inventory models 71% of the studies focuses on a single actor perspective, 23% on a two-echelon supply chain (18% single vendor single buyer, 5% single vendor multi buyer) and only a 5% considers a three-echelon supply chain (single supplier, single vendor, and single buyer). While all the inventory models with supply chain finance present a single vendor single buyer structure. Furthermore, most of the models focuses on a single item. Only two studies considered multi-items. One of the aspects that mainly differentiate the background is the demand which can be constant over the period, or a function of time, stock, price, advertisement, credit period, permissible delay in payment. Few studies also consider shortages/backorders and lost sales. Since no case studies have been detected (i.e., only numerical examples have been proposed to validate the models and to gather managerial insights), the models developed are general and can be applied to different context. No peculiarities and characteristics of specific class of items are investigated. Deterioration and amelioration rates are mainly considered as constant rate or modelled as a two-parameter Weibull distribution. More than half of the articles propose a model with single trade credit offered by the vendor to the buyer, a significant proportion offer the financing solution of two-level trade credit, while a few develop models with partial trade credit (single- or two-level). If we consider the sample with ameliorating (deteriorating) items, only 2 (11) studies over 25 (30) consider a trade credit policy. Hence, the integration of financial strategies in supply chain for ameliorating and deteriorating items has received few attentions by researchers.

From the results of the analyses, the main research point that should be investigated deals with the specific class of items considered. Inventory models of ameliorating and deteriorating items, due to the change of their value over time, should considers a quality or value dependent demand more than a price dependent demand, since if the value of the items increases, the customers are more inclined to face even higher price. Furthermore, for this specific items, advanced supply chain finance mechanisms present great potential. For instance, warehouse financing can be very appropriate for ameliorating items, since the more the storage time the more the value of the products and hence the guarantee for the financing which means lower interest rate. While the cash-on-delivery can represent a solution for improving the responsibility of the actors for providing a product with the required quality to the final customer. A further solution can be the reverse factoring among the buyer-based financing mechanisms, in which the buyer arranges for early payments to its supplier (Marchi et al. 2020c), which can be invested for higher quality of the products. At the same time, also shared investment can be considered to improve the performance of the supply chain (Marchi et al. 2016; Marchi et al. 2018) and guarantee the required surrounding environment to those items.

References

Abdoli M (2016) Inventory model with variable demand rate under stochastic inflation for deteriorating and ameliorating items with permissible delay in payment. Int J Oper Res 27(4):375–388. https://doi.org/10.1504/IJOR.2016.10000138

Aggarwal SP, Jaggi CK (1995) Ordering policies of deteriorating items under permissible delay in payments. J Oper Res Soc 46(5):658–662. https://doi.org/10.1057/jors.1995.90

Agi MAN, Soni HN (2020) Joint pricing and inventory decisions for perishable products with age-, stock-, and price-dependent demand rate. J Oper Res Soc 71(1):85–99. https://doi.org/10.1080/01605682.2018.1525473

Aljazzar SM, Jaber MY, Goyal SK (2016) Coordination of a two-level supply chain (manufacturer–retailer) with permissible delay in payments. Int J Syst Sci Oper Logist 3(3):176–188. https://doi.org/10.1080/23302674.2015.1078858

Bhunia AK, Jaggi CK, Sharma A, Sharma R (2014) A two-warehouse inventory model for deteriorating items under permissible delay in payment with partial backlogging. Appl Math Comput 232:1125–1137. https://doi.org/10.1016/j.amc.2014.01.115

Chang HJ, Dye CY (1999) An EOQ model for deteriorating items with time varying demand and partial backlogging. J Oper Res Soc 50(11):1176–1182. https://doi.org/10.1057/palgrave.jors.2600801

Chang CT, Goyal SK, Teng JT (2006) On ‘An EOQ model for perishable items under stock-dependent selling rate and time-dependent partial backlogging’ by Dye and Ouyang. Eur J Oper Res 174(2):923–929. https://doi.org/10.1016/j.ejor.2005.04.024

Chen J (2011) An inventory model for ameliorating and deteriorating fresh agricultural items with ripeness and price dependent demand. In: Proc.—2011 Int. Conf. Inf. Technol. Comput. Eng. Manag. Sci. ICM 2011, vol. 4, pp 228–231, https://doi.org/10.1109/ICM.2011.263

Chen TH, Chang HM (2010) Optimal ordering and pricing policies for deteriorating items in one-vendor multi-retailer supply chain. Int J Adv Manuf Technol 49(1–4):341–355. https://doi.org/10.1007/s00170-009-2377-0

Chen SC, Cárdenas-Barrón LE, Teng JT (2014) Retailer’s economic order quantity when the supplier offers conditionally permissible delay in payments link to order quantity. Int J Prod Econ 155:284–291. https://doi.org/10.1016/j.ijpe.2013.05.032

Chen L, Chen X, Keblis MF, Li G (2019) Optimal pricing and replenishment policy for deteriorating inventory under stock-level-dependent, time varying and price-dependent demand. Comput Ind Eng 135(June 2018):1294–1299. https://doi.org/10.1016/j.cie.2018.06.005

Cheng M, Wang G (2009) A note on the inventory model for deteriorating items with trapezoidal type demand rate. Comput Ind Eng 56(4):1296–1300. https://doi.org/10.1016/j.cie.2008.07.020

Cheng M, Zhang B, Wang G (2011) Optimal policy for deteriorating items with trapezoidal type demand and partial backlogging. Appl Math Model 35(7):3552–3560. https://doi.org/10.1016/j.apm.2011.01.001

Chern M-S, Yang H-L, Teng J-T, Papachristos S (2008) Partial backlogging inventory lot-size models for deteriorating items with fluctuating demand under inflation. Eur J Oper Res 191(1):127–141. https://doi.org/10.1016/j.ejor.2007.03.053

Chou S-Y, Chouhuang WT, Lin JS-J, Chu P (2008) An analytic solution approach for the economic order quantity model with Weibull ameliorating items. Math Comput Model 48(11–12):1868–1874. https://doi.org/10.1016/j.mcm.2008.03.003

Chung K, Huang T (2006) The optimal cycle time for deteriorating items with limited storage capacity under permissible delay in payments. Asia-Pac J Oper Res 23:347–370. https://doi.org/10.1142/S0217595906000814

Chung KJ, Huang TS (2007) The optimal retailer’s ordering policies for deteriorating items with limited storage capacity under trade credit financing. Int J Prod Econ 106(1):127–145. https://doi.org/10.1016/j.ijpe.2006.05.008

Chung KJ, Liao JJ, Ting PS, Der Lin S, Srivastava HM (2015) The algorithm for the optimal cycle time and pricing decisions for an integrated inventory system with order-size dependent trade credit in supply chain management. Appl Math Comput 268:322–333. https://doi.org/10.1016/j.amc.2015.06.039

Chung KJ, Liao JJ, Ting PS, Der Lin S, Srivastava HM (2018) A unified presentation of inventory models under quantity discounts, trade credits and cash discounts in the supply chain management. Revista De La Real Academia De Ciencias Exactas, Físicas y Naturales Serie A Matemáticas 112(2):509–538. https://doi.org/10.1007/s13398-017-0394-7

Chung K-J, Liao J-J, Srivastava HM, Lee S-F, Lin S-D (2021) The EOQ model for deteriorating items with a conditioal trade credit linked to order quantity in a supply chain system. Mathematics. https://doi.org/10.3390/math9182311

Dem H, Singh SR (2013) A production model for ameliorating items with quality consideration. Int J Oper Res 17(2):183–198. https://doi.org/10.1504/IJOR.2013.053622

Ghare PN, Schrader GF (1963) A model for exponentially decaying inventories. J Ind Eng 15:238–243

Gonen LD, Tavor T, Spiegel U (2021) The positive effect of aging in the case of wine. Mathematics 9:1012. https://doi.org/10.3390/math9091012

Goyal SK (1985) On ‘economic order quantity under conditions of permissible delay in payments’ by Goyal. J Oper Res Soc 36(11):1069–1070. https://doi.org/10.1057/jors.1985.187

Goyal SK, Singh SR, Dem H (2013) Production policy for ameliorating/deteriorating items with ramp type demand. Int J Procure Manag 6(4):444–465. https://doi.org/10.1504/IJPM.2013.054753

Gupta M, Tiwari S, Jaggi CK (2020) Retailer’s ordering policies for time varying deteriorating items with partial backlogging and permissible delay in payments in a two-warehouse environment. Ann Oper Res 295(1):139–161. https://doi.org/10.1007/s10479-020-03673-x

Haley CW, Higgins RC (1973) Inventory policy and trade credit financing. Manag Sci 20(4 pt 1):464–471. https://doi.org/10.1287/mnsc.20.4.464

Hariga MA, Benkherouf L (1994) Optimal and heuristic inventory replenishment models for deteriorating items with exponential time-varying demand. Eur J Oper Res 79(1):123–137. https://doi.org/10.1016/0377-2217(94)90400-6

Harris FW (1913) How many parts to make at once. Fact Mag Manag 10(2):135–136

Huang YF (2003) Optimal retailer’s ordering policies in the EOQ model under trade credit financing. J Oper Res Soc 54(9):1011–1015. https://doi.org/10.1057/palgrave.jors.2601588

Huang YF, Hsu KH (2008) An EOQ model under retailer partial trade credit policy in supply chain”. Int J Prod Econ 112(2):655–664. https://doi.org/10.1016/j.ijpe.2007.05.014

Hwang H-S (1997) A study on an inventory model for items with Weibull ameliorating. Comput Ind Eng 33(3–4):701–704. https://doi.org/10.1016/s0360-8352(97)00226-x

Hwang H-S (1999) Inventory models for both deteriorating and ameliorating items. Comput Ind Eng 37(1):257–260. https://doi.org/10.1016/S0360-8352(99)00068-6

Hwang HS (2004) A stochastic set-covering location model for both ameliorating and deteriorating items. Comput Ind Eng 46(2):313–319. https://doi.org/10.1016/j.cie.2003.12.010

Jaggi CK, Pareek S, Khanna A, Sharma R (2014) Credit financing in a twowarehouse environment for deteriorating items with price-sensitive demand and fully backlogged shortages. Appl Math Model 38(21–22):5315–5333. https://doi.org/10.1016/j.apm.2014.04.025

Jaggi CK, Pareek S, Goel SK, Nidhi (2015) An inventory model for deteriorating items with ramp type demand under fuzzy environment. Int J Logist Syst Manag 22(4):436–463. https://doi.org/10.1504/IJLSM.2015.072748

Jaggi CK, Cárdenas-Barrón LE, Tiwari S, Shafi AA (2017a) Two-warehouse inventory model for deteriorating items with imperfect quality under the conditions of permissible delay in payments. Sci Iran 24(1):390–412. https://doi.org/10.24200/sci.2017.4042

Jaggi CK, Tiwari S, Goel SK (2017b) Credit financing in economic ordering policies for non-instantaneous deteriorating items with price dependent demand and two storage facilities. Ann Oper Res 248(1–2):253–280. https://doi.org/10.1007/s10479-016-2179-3

Jaggi CK, Tiwari S, Gupta M, Wee HM (2019) Impact of credit financing, storage system and changing demand on investment for deteriorating items. Int J Syst Sci Oper Logist 6(2):143–161. https://doi.org/10.1080/23302674.2017.1355024

Jamal AMM, Sarker BR, Wang S (1997) An ordering policy for deteriorating items with allowable shortage and permissible delay in payment. J Oper Res Soc 48(8):826–833. https://doi.org/10.1057/palgrave.jors.2600428

Jayaswal MK, Mittal M, Sangal I (2021) Ordering policies for deteriorating imperfect quality items with trade-credit financing under learning effect. Int J Syst Assur Eng Manag 12(1):112–125. https://doi.org/10.1007/s13198-020-01038-y

Ji LQ (2008) The influences of inflation and time-value of money on an EOQ model for both ameliorating and deteriorating items with partial backlogging. Int. Conf Wirel Commun Netw Mob Comput Wicom 2008:25–28. https://doi.org/10.1109/WiCom.2008.1577

Khan MA, Shaikh AA, Panda GC, Konstantaras I, Cárdenas-Barrón LE (2020) The effect of advance payment with discount facility on supply decisions of deteriorating products whose demand is both price and stock dependent. Int Trans Oper Res 27:1343–1367. https://doi.org/10.1111/itor.12733

Khan MA, Shaikh AA, Cárdenas-Barrón LE, Mashud AHM, Trevino-Garza G, Céspedes-Mota A (2022) An inventory model for non-instantaneously deteriorating items with nonlinear stock-dependent demand, hybrid payment scheme and partially backlogged shortages. Mathematics. https://doi.org/10.3390/math10030434

Khanra S, Sana SS, Chaudhuri K (2010) An EOQ model for perishable item with stock and price dependent demand rate. Int J Math Oper Res 2(3):320–335. https://doi.org/10.1504/IJMOR.2010.032721

Law S-T, Wee H-M (2006) An integrated production-inventory model for ameliorating and deteriorating items taking account of time discounting. Math Comput Model 43(5–6):673–685. https://doi.org/10.1016/j.mcm.2005.12.012

Li J, Mao J (2009) An inventory model of perishable item with two types of retailers. J Chin Inst Ind Eng 26(3):176–183. https://doi.org/10.1080/10170660909509134

Liang Y, Zhou F (2011) A two-warehouse inventory model for deteriorating items under conditionally permissible delay in payment. Appl Math Model 35(5):2221–2231. https://doi.org/10.1016/j.apm.2010.11.014

Liao J, Chung K-J (2009) An EOQ model for deterioration items under trade credit policy in a supply chain system. J Oper Res 52(1):46–57

Liao JJ, Huang KN (2010) Deterministic inventory model for deteriorating items with trade credit financing and capacity constraints. Comput Ind Eng 59(4):611–618. https://doi.org/10.1016/j.cie.2010.07.006

Liao JJ, Huang KN, Chung KJ (2012) Lot-sizing decisions for deteriorating items with two warehouses under an order-size-dependent trade credit. Int J Prod Econ 137(1):102–115. https://doi.org/10.1016/j.ijpe.2012.01.020

Liao JJ, Huang KN, Chung KJ (2013a) Optimal pricing and ordering policy for perishable items with limited storage capacity and partial trade credit. IMA J Manag Math 24(1):45–61. https://doi.org/10.1093/imaman/dps003

Liao JJ, Chung KJ, Huang KN (2013b) A deterministic inventory model for deteriorating items with two warehouses and trade credit in a supply chain system. Int J Prod Econ 146(2):557–565. https://doi.org/10.1016/j.ijpe.2013.08.001

Liao JJ, Huang KN, Chung KJ, Ting PS, Der Lin S, Srivastava HM (2017) Lot-sizing policies for deterioration items under two-level trade credit with partial trade credit to credit-risk retailer and limited storage capacity. Math Methods Appl Sci 40(6):2122–2139. https://doi.org/10.1002/mma.4127

Lin Q, Su X, Peng Y (2018) Supply chain coordination in confirming warehouse financing. Comput Ind Eng 118(Feb):104–111. https://doi.org/10.1016/j.cie.2018.02.029

Mahata GC (2015) Retailer’s optimal credit period and cycle time in a supply chain for deteriorating items with up-stream and down-stream trade credits. J Ind Eng Int 11(3):353–366. https://doi.org/10.1007/s40092-015-0106-x

Mahata GC, De SK (2016) An EOQ inventory system of ameliorating items for price dependent demand rate under retailer partial trade credit policy. Opsearch 53(4):889–916. https://doi.org/10.1007/s12597-016-0252-y

Mahato C, Mahata GC (2021) Sustainable ordering policies with capacity constraint under order-size-dependent trade credit, all-units discount, carbon emission, and partial backordering. Process Integr Optim Sustain 5:875–903. https://doi.org/10.1007/s41660-021-00183-6

Marchi B, Ries JM, Zanoni S, Glock CH (2016) A joint economic lot size model with financial collaboration and uncertain investment opportunity. Int J Prod Econ 176:170–182. https://doi.org/10.1016/j.ijpe.2016.02.021

Marchi B, Zanoni S, Ferretti I, Zavanella LE (2018) Stimulating investments in energy efficiency through supply chain integration. Energies 11(4):858. https://doi.org/10.3390/en11040858

Marchi B, Zanoni S, Jaber MY (2020a) Energy implications of lot sizing decisions in refrigerated warehouses. Energies 13:1739. https://doi.org/10.3390/en13071739

Marchi B, Zavanella LE, Zanoni S (2020b) Joint economic lot size models with warehouse financing and financial contracts for hedging stocks under different coordination policies. J Bus Econ 90(8):1147–1169. https://doi.org/10.1007/s11573-020-00975-1

Marchi B, Zanoni S, Jaber MY (2020c) Improving supply chain profit through reverse factoring: a new multi-suppliers single-vendor joint economic lot size model. Int J Fin Stud 8(2):23. https://doi.org/10.3390/ijfs8020023

Misra RB (1975) Optimum production lot size model for a system with deteriorating inventory. Int J Prod Res 13(5):495–505. https://doi.org/10.1080/00207547508943019

Mittal M, Sharma M (2021) Economic ordering policies for growing items (poultry) with trade-credit financing. Int J Appl Comput Math. https://doi.org/10.1007/s40819-021-00973-z

Mondal B, Bhunia AK, Maiti M (2003) An inventory system of ameliorating items for price dependent demand rate. Comput Ind Eng 45(3):443–456. https://doi.org/10.1016/S0360-8352(03)00030-5

Mondal R, Shaikh AA, Bhunia AK (2019) Crisp and interval inventory models for ameliorating item with Weibull distributed amelioration and deterioration via different variants of quantum. Math Comput Model Dyn Syst. https://doi.org/10.1080/13873954.2019.1692226

Moon I, Giri BC, Ko B (2005) Economic order quantity models for ameliorating/deteriorating items under inflation and time discounting. Eur J Oper Res 162(3):773–785. https://doi.org/10.1016/j.ejor.2003.09.025

Ouyang LY, Teng JT, Goyal SK, Te Yang C (2009a) An economic order quantity model for deteriorating items with partially permissible delay in payments linked to order quantity. Eur J Oper Res 194(2):418–431. https://doi.org/10.1016/j.ejor.2007.12.018

Ouyang LY, Ho CH, Su CH (2009b) An optimization approach for joint pricing and ordering problem in an integrated inventory system with order-size dependent trade credit. Comput Ind Eng 57(3):920–930. https://doi.org/10.1016/j.cie.2009.03.011

Panda S, Modak NM, Cárdenas-Barrón LE (2017) Coordination and benefit sharing in a three-echelon distribution channel with deteriorating product. Comput Ind Eng 113:630–645. https://doi.org/10.1016/j.cie.2017.09.033

Pfohl HC, Gomm M (2009) Supply chain finance: optimizing financial flows in supply chains. Logist Res 1(3–4):149–161. https://doi.org/10.1007/s12159-009-0020-y

Philip GC (1974) A generalized EOQ model for items with Weibull distribution deterioration. AIIE Trans 6(2):159–162. https://doi.org/10.1080/05695557408974948

Sana SS (2008) An EOQ model with a varying demand followed by advertising expenditure and selling price under permissible delay in payments: for a retailer. Int J Model Identif Control 5(2):166–172. https://doi.org/10.1504/IJMIC.2008.022022

Sana SS (2010) Demand influenced by enterprises’ initiatives—a multi-item EOQ model of deteriorating and ameliorating items. Math Comput Model 52(1–2):284–302. https://doi.org/10.1016/j.mcm.2010.02.045

Sana SS, Sarkar BK, Chaudhuri K, Purohit D (2009) The effect of stock, price and advertising on demand—an EOQ model. Int J Model Identif Control 6(1):81–88. https://doi.org/10.1504/IJMIC.2009.023533

Sarkar B (2012) An EOQ model with delay in payments and time varying deterioration rate. Math Comput Model 55(3–4):367–377. https://doi.org/10.1016/j.mcm.2011.08.009

Sarker BR, Jamal AMM, Wang S (2000) Supply chain models for perishable products under inflation and permissible delay in payment. Comput Oper Res 27(1):59–75. https://doi.org/10.1016/S0305-0548(99)00008-8

Shaikh AA (2017) An inventory model for deteriorating item with frequency of advertisement and selling price dependent demand under mixed type trade credit policy. Int J Logist Syst Manag 28(3):375–395. https://doi.org/10.1504/IJLSM.2017.086949

Shaikh AA, Cárdenas-Barrón LE (2020) An EOQ inventory model for non-instantaneous deteriorating products with advertisement and price sensitive demand under order quantity dependent Trade credit. Revista Investigacion Operacional 41(2):168–187

Shaikh AA, Bhunia AK, Cárdenas-Barrón LE, Sahoo L, Tiwari S (2018) A fuzzy inventory model for a deteriorating item with variable demand, permissible delay in payments and partial backlogging with Shortage Follows Inventory (SFI) policy. Int J Fuzzy Syst 20(5):1606–1623. https://doi.org/10.1007/s40815-018-0466-7

Shaikh AA, Cárdenas-Barrón LE, Bhunia AK, Tiwari S (2019) An inventory model of a three parameter Weibull distributed deteriorating item with variable demand dependent on price and frequency of advertisement under trade credit. RAIRO-Oper Res 53:903–916. https://doi.org/10.1051/ro/2017052

Singh SR, Vishnoi M (2013) Supply chain inventory model with pricedependent consumption rate with ameliorating and deteriorating items and two levels of storage. Int J Procure Manag 6(2):129–151. https://doi.org/10.1504/IJPM.2013.052466

Tadj L, Sarhan AM, El-Gohary A (2008) Optimal control of an inventory system with ameliorating and deteriorating items. Appl Sci 10:243–255

Taleizadeh AA, Nematollahi M (2014) An inventory control problem for deteriorating items with back-ordering and financial considerations. Appl Math Model 38(1):93–109. https://doi.org/10.1016/j.apm.2013.05.065

Taleizadeh AA, Wee HM, Jolai F (2013) Revisiting a fuzzy rough economic order quantity model for deteriorating items considering quantity discount and prepayment. Math Comput Model 57(5–6):1466–1479. https://doi.org/10.1016/j.mcm.2012.12.008

Tayal S, Singh SR, Sharma R (2016) An integrated production inventory model for perishable products with trade credit period and investment in preservation technology. Int J Math Oper Res 8(2):137–163. https://doi.org/10.1504/IJMOR.2016.074852

Teng JT, Chang CT, Chern MS, Chan YL (2007) Retailer’s optimal ordering policies with trade credit financing. Int J Syst Sci 38(3):269–278. https://doi.org/10.1080/00207720601158060

Tiwary S, Cárdenas-Barrón LE, Malik AI, Jaggi CK (2022) Retailer’s credit and inventory decisions for imperfect quality and deteriorating items under two-level trade credit. Comput Oper Res 138:105617. https://doi.org/10.1016/j.cor.2021.105617

Tuan HW, Lin SC, Julian P (2017) Improvement for amelioration inventory model with Weibull distribution. Math Probl Eng. https://doi.org/10.1155/2017/8946547

Valliathal M, Uthayakumar R (2010) The production inventory problem for ameliorating/deteriorating items with non-linear shortage cost under inflation and time discounting. Appl Math Sci 4(5–8):289–304

Valliathal M, Uthayakumar R (2013) A study of inflation effects on an EOQ model for Weibull deteriorating/ameliorating items with ramp type of demand and shortages. Yugosl J Oper Res 23(3):441–455. https://doi.org/10.2298/YJOR110830008V

Vandana R (2020) Trade credit policy between supplier–manufacturer–retailer for ameliorating/deteriorating items. J Oper Res Soc China 8(1):79–103. https://doi.org/10.1007/s40305-018-0203-9

Vandana A, Sana SS (2020) A Two-echelon inventory model for ameliorating/deteriorating items with single vendor and multi-buyers. Proc Natl Acad Sci India Sect A Phys Sci 90(4):601–614. https://doi.org/10.1007/s40010-018-0568-5

Vandana, Sharma BK (2016) An inventory model for non-instantaneous deteriorating items with quadratic demand rate and shortages under trade credit policy. J Appl Anal Comput 6(3):720–737. https://doi.org/10.11948/2016047

Vandana, Srivastava HM (2017) An inventory model for ameliorating/deteriorating items with trapezoidal demand and complete backlogging under inflation and time discounting. Math Methods Appl Sci 40(8):2980–2993. https://doi.org/10.1002/mma.4214

Wee HM (1993) Economic production lot size model for deteriorating items with partial back-ordering. Comput Ind Eng 24(3):449–458

Wee H-M, Lo S-T, Yu J, Chen HC (2008) An inventory model for ameliorating and deteriorating items taking account of time value of money and finite planning horizon. Int J Syst Sci 39(8):801–807. https://doi.org/10.1080/00207720801902523

Whitin TM (1953) The theory of inventory management. Princeton University Press, Princeton

Yang HL (2012) Two-warehouse partial backlogging inventory models with three-parameter Weibull distribution deterioration under inflation. Int J Prod Econ 138(1):107–116. https://doi.org/10.1016/j.ijpe.2012.03.007

Yang PC, Wee HM (2000) Economic ordering policy of deteriorated item for vendor and buyer: an integrated approach. Prod Plan Control 11(5):474–480. https://doi.org/10.1080/09537280050051979

Yang PC, Wee HM (2002) A single-vendor and multiple-buyers production inventory policy for a deteriorating item. Eur J Oper Res 143(3):570–581. https://doi.org/10.1016/S0377-2217(01)00345-9

Yen GF, Chung KJ, Chen TC (2012) The optimal retailer’s ordering policies with trade credit financing and limited storage capacity in the supply chain system. Int J Syst Sci 43(11):2144–2159. https://doi.org/10.1080/00207721.2011.565133

Zanoni S, Zavanella LE, Ferretti I (2019) Inventory models for maturing and ageing items: cheese and wine storage. Int J Logist Syst Manag 34:233–252. https://doi.org/10.1504/IJLSM.2019.102215

Funding

Open access funding provided by Università degli Studi di Brescia within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Marchi, B., Zavanella, L.E. & Zanoni, S. Supply chain finance for ameliorating and deteriorating products: a systematic literature review. J Bus Econ 93, 359–388 (2023). https://doi.org/10.1007/s11573-022-01108-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11573-022-01108-6