Abstract

In practice, the supplier often offers the retailers a trade credit period \(M\) and the retailer in turn provides a trade credit period \(N\) to her/his customer to stimulate sales and reduce inventory. From the retailer’s perspective, granting trade credit not only increases sales and revenue but also increases opportunity cost (i.e., the capital opportunity loss during credit period) and default risk (i.e., the percentage that the customer will not be able to pay off his/her debt obligations). Hence, how to determine credit period is increasingly recognized as an important strategy to increase retailer’s profitability. Also, the selling items such as fruits, fresh fishes, gasoline, photographic films, pharmaceuticals and volatile liquids deteriorate continuously due to evaporation, obsolescence and spoilage. In this paper, we propose an economic order quantity model for the retailer where (1) the supplier provides an up-stream trade credit and the retailer also offers a down-stream trade credit, (2) the retailer’s down-stream trade credit to the buyer not only increases sales and revenue but also opportunity cost and default risk, and (3) the selling items are perishable. Under these conditions, we model the retailer’s inventory system as a profit maximization problem to determine the retailer’s optimal replenishment decisions under the supply chain management. We then show that the retailer’s optimal credit period and cycle time not only exist but also are unique. We deduce some previously published results of other researchers as special cases. Finally, we use some numerical examples to illustrate the theoretical results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the classical economic order quantity (EOQ) inventory model, it was assumed that the retailer must pay for the items immediately after the items are received. However, in practice, the retailer usually provides to his/her customer a permissible delay in payments to attract new customers to stimulate sales and reduce inventory. During the credit period, the retailer can accumulate the revenue on sales and earn interest on the accumulative revenue via share market investment or banking business. However, if the customer cannot pay off the purchase amount during the credit period then the retailer charges to the customer interest on the unpaid balance. The permissible delay in payments produces two benefits to the supplier: (1) it attracts new customers who consider trade credit policy to be a type of price reduction; and (2) it may be applied as an alternative to price discount because it does not provoke competitors to reduce their prices and thus introduce permanent price reductions. However, the strategy of granting credit terms adds not only an additional cost but also an additional dimension of default risk (i.e., the event in which the buyer will be unable to pay off its debt obligations) to the supplier.

In this regard, a number of research papers appeared which deal with the EOQ problem under the condition of permissible delay in payments. Goyal (1985) is the first person to consider the economic order quantity (EOQ) inventory model under the condition of trade credit. Chand and Ward (1987) analyzed Goyal’s model under assumptions of the classical economic order quantity model, obtaining different results. Shinn et al. (1996) extended Goyal (1985) model and considered quantity discount for freight cost. Hwang and Shinn (1997) developed the optimal pricing and lot sizing for the retailer under condition of permissible delay in payments. Chung (1998) presented the DCF (discounted cash flow) approach for the analysis of the optimal inventory policy in the presence of trade credit. Liao et al. (2000) developed an EOQ model for stock-depend demand rate when a delay in payment is permissible. Teng (2002) assumed that the selling price is not equal to the purchasing price to modify Goyal’s model (1985). Shinn and Hwang (2003) determined the retailer’s optimal price and order size simultaneously under the condition of order-size-dependent delay in payments. They assumed that the length of the credit period is a function of the retailer’s order size, and also the demand rate is a function of the selling price. Chung and Haung (2003) extended this problem within the economic production quantity (EPQ) framework and developed an efficient procedure to determine the retailer’s optimal ordering policy. Chung and Haung (2003) extended Goyal’s model (1985) to cash discount policy for early payment. Salameh et al. (2003) extended this issue to the continuous review inventory model.

However, the perishability of goods is a realistic phenomenon. In real-life situations, there are certain products such as volatile liquids, medicines, food stuff, blood bank and materials in which the rate of deterioration due to vaporization, damage, spoilage, dryness, etc. is very large. Therefore, the loss due to deterioration should not be ignored. Aggarwal and Jaggi (1995) developed inventory model with an exponential deterioration rate under the condition of permissible delay in payments. Chu et al. (1998) extended Goyal’s (1985) model to allow for deteriorating items. Chung et al. (2001) extended this issue to the varying rate of deterioration. Jamal et al. (1997) and Chang and Dye (2001) extended this issue with allowable shortage. Liao et al. (2000) and Sarker et al. (2000) developed a model to determine an optimal ordering policy for deteriorating items under inflation, permissible delay in payments and allowable shortage. Chang et al. (2001) proposed an EOQ model with varying rate of deterioration and linear trend demand under permissible delay in payments. Chang et al. (2003) and Chung and Liao (2004) dealt with the problem of determining the EOQ for exponentially deteriorating items under permissible delay in payments depending on the ordering quantity. Chang (2004) extended this issue to inflation and finite time horizon. Huang (2004) investigated that the unit selling price and the unit purchasing price are not necessarily equal within the EPQ framework under a supplier’s trade credit policy. Shawky and Abou-el-ata (2001) investigated the production lot-size model with both restrictions on the average inventory level and trade credit policy using geometric programming and Lagrange approaches. Mahata and Goswami (2006) presented a fuzzy EPQ model for deteriorating items when delay in payment is permissible. Mishra et al. (2013) proposed an inventory model for deteriorating items with time-dependent demand and time-varying holding cost under partial backlogging. Teng et al. (2005) developed the optimal pricing and lot sizing under permissible delay in payments by considering the difference between the selling price and the purchase cost and demand is a function of price. Shah and Shah (1998) developed a probabilistic inventory model when delay in payment is permissible. They developed an EOQ model for deteriorating items in which time and deterioration of units are treated as continuous variables and demand is a random variable. There are several interesting and relevant papers related to trade credit such as Jamal et al. (2000), Arcelus et al. (2003), Abad and Jaggi (2003), Chang (2004), Chung et al. (2005), Chung and Liao (2006), Mahata and Goswami (2007), Chung and Huang (2007) and Huang (2007a) and their references.

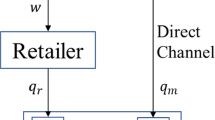

All the above inventory models implicitly assumed one-level trade credit financing, i.e., it is assumed that the supplier would offer the retailer a delay period and the retailer could sell the goods and accumulate revenue and earn interest within the trade credit period. They implicitly assumed that the customer would pay for the items as soon as the items are received from the retailer. That is, they assumed that the supplier would offer the retailer a delay period but the retailer would not offer any delay period to his/her customer. In most business transactions, this assumption is unrealistic. Usually the supplier offers a credit period to the retailer and the retailer, in turn, passes on this credit period to his/her customers. Recently Huang (2003) presented an inventory model assuming that the retailer also permits a credit period to its customer which is shorter than the credit period offered by the supplier, to stimulate the demand. Huang (2006) extended Huang (2003) model to investigate the retailer’s inventory policy under two levels of trade credit and limited storage space. Mahata and Goswami (2007) developed an inventory model to determine an optimal ordering policy for deteriorating items under two-level trade credit policy in the fuzzy sense. Huang (2007b) incorporated Huang (2003) model to investigate the two-level trade credit policy in the EPQ frame work. Mahata and Mahata (2011) developed a fuzzy economic order quantity model for deteriorating items under retailer partial trade credit financing in a supply chain. Mahata (2012) proposed an EPQ model for deteriorating items under retailer partial trade credit policy. Kreng and Tan (2010) modify Huang (2003) model by developing optimal wholesaler’s replenishment decisions in the EOQ model under two levels of trade credit policy depending on the order quantity. Min et al. (2010) developed an inventory model for deteriorating items under stock-dependent demand and two-level trade credit. Ho et al. (2008) developed an integrated supplier–buyer inventory model with the assumption that demand is sensitive to retail price and the supplier adopts a two-part trade credit policy. Liao (2008) developed an EOQ model with non-instantaneous receipt and exponentially deteriorating items under two-level trade credit financing. Tsao (2009) developed an EOQ model under advance sales discount and two-echelon trade credits. Teng and Chang (2009) extended the Huang (2007a) model by relaxing the assumption \(N<M\). Teng (2009) provided the optimal ordering policies for a retailer to deal with bad credit customers as well as good credit customers. Min et al. (2010) proposed an EPQ model under stock-dependent demand and two-level trade credit. Later, Kreng and Tan (2011) obtained the optimal replenishment decision in an EPQ model with defective items under trade credit policy. After, Teng et al. (2011) obtained the optimal ordering policy for stock-dependent demand under progressive payment scheme. Thangam (2014) developed retailer’s inventory system in a two-level trade credit financing with selling price discount and partial order cancelations. Further, Teng et al. (2012) extended the demand pattern from constant to increasing in time. Recently, Ouyang and Chang (2013) built up an EPQ model with imperfect production process and complete backlogging. Chen et al. (2013) established the retailer’s optimal EOQ when the supplier offers conditionally permissible delay in payments link to order quantity. In all these articles described above, the EOQ/EPQ inventory models are studied only from the perspective of the buyer whereas in practice the length of the credit period is set by the seller. So far, how to determine the optimal length of the credit period for the seller has received very little attention by the researchers such as Chern et al. (2013), and Teng and Lou (2012). See Table 1 for contribution of deferent authors.

In this paper, we propose an EOQ model for the retailer to obtain his/her optimal credit period and cycle time taking into account the following factors: (1) the supplier grants to the retailer an up-stream trade credit of \(M\) years while the retailer offers a down-stream trade credit of \(N\) years to the buyer, (2) the retailer’s down-stream trade credit to the buyer not only increases sales and revenue but also opportunity cost and default risk, and (3) the selling items are perishable such as fruits, fresh fishes, gasoline and photographic films. Under these conditions, we formulate the retailer’s objective functions under different possible cases. Some theorems are developed to determine retailer’s optimal ordering policies. By applying concave fractional programming, we prove that there exists a unique global optimal solution to the retailer’s replenishment cycle time. Similarly, using calculus we show that the retailer’s optimal down-stream credit period not only exists but also is unique. Furthermore, we deduce some previously published results of other researchers as special cases. Finally, we use some numerical examples to illustrate the theoretical results.

Notation and assumptions

The following notation and assumptions are used in the paper.

Notation

- \(A\) :

-

ordering cost per order

- \(c\) :

-

unit purchasing cost per item

- \(s\) :

-

unit selling price per item of good quality with \(s>c\).

- \(h\) :

-

stock-holding cost per unit per year excluding interest charges

- \(r\) :

-

annual compound interest paid per dollar per year.

- \(I_{\rm e}\) :

-

interest earned per dollar per year.

- \(I_{\rm c}\) :

-

interest charged per dollar per year.

- \(I(t)\) :

-

inventory level in units at time \(t\)

- \(\theta \) :

-

constant deterioration rate, where \(0\le \theta <1\).

- \(M\) :

-

up-stream credit period in years offered by the supplier.

- \(N\) :

-

down-stream trade credit period in years offered by the retailer (a decision variable).

- \(D=D(N)\) :

-

the market annual demand rate in units which is a concave and increasing function of \(N\).

- \(T\) :

-

replenishment cycle time in years (a decision variable).

- \(Q\) :

-

order quantity.

- \({\rm TP}(N,T)\) :

-

annual total profit, which is a function of \(N\) and \(T\).

- \(N^*\) :

-

optimal down-stream credit period in years.

- \(T^*\) :

-

optimal replenishment cycle time in years.

- \({\rm TP}^*\) :

-

optimal annual total profit in dollars.

Assumptions

The following assumptions are made to establish the mathematical inventory model.

-

1.

The time to deterioration of a product follows an exponential distribution with parameter \(\theta \), i.e., the deterioration rate is a constant fraction of the on-hand inventory.

-

2.

Similar to the assumption in Chern et al. (2013) and Teng and Lou (2012), we assume that the demand rate \(D(N)\) is a positive exponential function of the retailer’s down-stream credit period \(N\) as \(D(N)=K{\rm e}^{aN}\), where \(K\) and \(a\) are positive constants with \(0<a<1\). For convenience, \(D(N)\) and \(D\) will be used interchangeably.

-

3.

The longer the retailer’s down-stream credit period, the higher the default risk to the retailer. For simplicity, we may assume that the rate of default risk giving the retailer’s down-stream credit period \(N\) is assumed as \(F(N)=1-{\rm e}^{-bN}\), where \(b\) is the coefficient of the default risk, which is a positive constant.

-

4.

The retailer offers the buyer a credit period of R. Hence, the retailer’s net revenue received after default risk and opportunity cost is:

$$\begin{aligned} sD(N)[1-F(N)]{\rm e}^{-rN}=sK{\rm e}^{aN}{\rm e}^{-bN}{\rm e}^{-rN}=sK{\rm e}^{[a-(b+r)]N}. \end{aligned}$$ -

5.

If \(T\ge M\), then the retailer settles the account at time \(M\) and pays for the interest charges on items in stock with rate \(I_{\rm c}\) over the interval \([M,T]\). If \(T\le M\), then the retailer settles the account at time \(M\) and there is no interest charge in stock during the whole cycle. On the other hand, if \(M>N\), the retailer can accumulate revenue and earn interest during the period from \(N\) to \(M\) with rate \(I_{\rm e}\) under the up-stream and down-stream trade credit conditions.

-

6.

Replenishment rate is instantaneous.

-

7.

In today’s time-based competition, we may assume that shortages are not allowed to occur.

Based on the above assumptions and notation, we are ready to build up the mathematical model.

Mathematical formulation of the model

Let \(I(t)\) be the inventory level at any time \(t\,\,(0\le t\le T)\). Initially, the stock level is \(Q\). During the replenishment cycle \([0,T]\), the inventory level is depleted by demand and deterioration, and hence governed by the following differential equation:

with the boundary conditions \(I(0)=Q\) and \(I(T)=0\). The solution of the differential Eq. (1) with the boundary condition \(I(T)=0\) is

Using the boundary condition \(I(0)=Q\), the retailer’s order quantity is

The retailer’s holding cost (excluding interest charges) per cycle, denoted by HC, is

From the values of \(N\) and \(M\), we have two potential cases: (1) \(N\le M\), and (2) \(N\ge M\). Let us discuss them separately.

Case 1: \(N\le M\)

Based on the values of \(M\) (i.e., the time at which the retailer must pay off the purchase amount to the supplier to avoid interest charge) and \(T+N\) (i.e., the time at which the retailer receives the payment from the last customer), we have two possible sub-cases. If \(T+N>M\) (i.e., there is an interest charge), then the retailer pays off all units sold by \(M-N\) at time \(M\), keeps the profits, and starts paying for the interest charges on the items sold after \(M-N\), which is shown in Fig. 1. If \(T+N\le M\) (i.e., there is no interest charge), then the retailer receives the total revenue at time \(T+N\), and will pay off the total purchase cost at time \(M\). The graphical representation of this case is shown in Fig. 2. Now, let us discuss the detailed formulation in each sub-case.

Sub-case 1-1: \(M\le T+N\)

In this sub-case, the supplier’s up-stream credit period \(M\) is shorter than the customer last payment time \(T+N\). Hence, the retailer cannot pay off the purchase amount at time \(M\), and must finance all items sold after time \(M-N\) at an interest charged \(I_{\rm c}\) per dollar per year. As a result, the interest charged per cycle is \((c/s)I_{\mathrm{c}}\) times the area of the triangle BCD as shown in Fig. 1. Notice that (1) the vertical axis in Figs. 1, 2, 3 represents the cumulative revenue, not cumulative sale volume, and (2) the slope of the increasing line in Figs. 1, 2, 3 is \(sD\). Therefore, the interest charged per year is given by \(\frac{cI_{\mathrm{c}}D}{2T}(T+N-M)^2\), which is similar to Eq. (3) in Teng and Lou (2012).

On the other hand, the retailer sells deteriorating items at time \(0\), but receives the money at time \(N\). Thus, the retailer accumulates revenue in an account that earns \(I_{\mathrm{e}}\) per dollar per year from \(N\) through \(M\). Therefore, the interest earned per cycle is \(I_{\mathrm{e}}\) multiplied by the area of the triangle NMB as shown in Fig. 1. Hence, the interest earned per year is similar to Eq. (4) of Teng and Lou (2012) as \(\frac{sI_{\mathrm{e}}D}{2T}(M-N)^2\).

The retailer’s ordering cost per cycle is \(A\) dollars, and the purchase cost per cycle is \(cQ\) dollars. Hence, the retailer’s annual total profit can be expressed as follows:

\({\rm TP}_1(N,T)=\) net annual revenue after default risk and opportunity cost \(-\) annual purchase cost \(-\) annual ordering cost \(-\) annual holding cost excluding interest cost \(-\) interest charged \(+\) interest earned, i.e.,

Next, we discuss the other sub-case in which \(M\ge T+N\).

Sub-case 1.2: \(M\ge T+N\)

In this sub-case, the retailer receives the total revenue at time \(T+N\), and is able to pay off the total purchase cost at time \(M\). Hence, there is no interest charge while the interest earned per cycle is \(I_{\mathrm{e}}\) multiplied by the area of the trapezoid on the interval \([N,M]\) as shown in Fig. 2. Consequently, the retailer’s annual interest earned is

Hence, similar to (5), we know that the retailer’s annual total profit is

Finally, we formulate the retailer’s annual total profit for the case of \(N\ge M\) below.

Case 2.: \(N\ge M\)

Since \(N\ge M\), there is no interest earned for the retailer. In addition, the retailer must finance the entire purchase cost at time \(M\), and pay off the loan from time \(N\) to time \(T+N\). Consequently, the interest charged per cycle is \((c/s)I_{\mathrm{c}}\) multiplied by the area of the trapezoid on the interval \([M,T+N]\), as shown in Fig. 3. Thus, the interest charged per year is given by

Hence the retailer’s annual total profit is

Therefore, the retailer’s objective is to determine the optimal credit period \(N^*\) and cycle time \(T^*\) such that the annual total profit \({\rm TP}_i(N,T)\) for \(i=1,2\) and 3 is maximized. In the next section, we characterize the retailer’s optimal credit period and cycle time in each case, and then obtain the conditions in which the optimal \(T^*\) is in either \(T+N\le M\) or \(T+N\ge M\).

Theoretical results and optimal solution

To solve the problem, we apply the existing theoretical results in concave fractional programming. We know from Cambini and Martein (2009) that the real value function

is (strictly) pseudo-concave, if \(f(x)\) is non-negative, differentiable and (strictly) concave, and \(g(x)\) is positive, differential and convex. For any given \(N\), by applying (11), we can prove that the retailer’s annual total profit \({\rm TP}_i(N,T)\) for \(i=1,2\) and 3 is strictly pseudo-concave in \(T\). As a result, for any given \(N\), there exists a unique global optimal solution \(T_i^*\) such that \({\rm TP}_i(N,T)\) is maximized. Similar to Sect. 3, we discuss the case of \(N\le M\) first, and then the case of \(N\ge M\).

Optimal solution for the case of N ≤ M

By applying the concave fractional programming as in (11), we can prove that the retailer’s annual total profit \({\rm TP}_i(N,T)\) for \(i=1\), and 2 is strictly pseudo-concave in \(T\). Consequently, we have the following theoretical results.

Theorem 1

For any given \(N\),

-

(a)

\({\rm TP}_1(N,T)\) is a strictly pseudo-concave function in \(T\), and hence exists a unique maximum solution \(T_1^*\).

-

(b)

If \(M\le T_1^*+N\), then \({\rm TP}_1(N,T)\) is maximized at \(T_1^*\).

-

(c)

If \(M\ge T_1^*+N\), then \({\rm TP}_1(N,T)\) is maximized at \(M-N\).

Proof

Let us use (5) to define

and

Taking the first-order and second-order derivatives of \(f_1(T)\), we have

and

Therefore, \({\rm TP}_1(N,T)=\frac{f_1(T)}{g_1(T)}\) is a strictly pseudo-concave function in \(T\), which completes the proof of Part (a) of Theorem 1. The proof of Parts (b) and (c) immediately follows from Part (a) of Theorem 1. This completes the proof of Theorem 1.

To find \(T_1^*\), taking the first-order partial derivative of \({\rm TP}_1(N,T)\), setting the result to zero, and re-arranging terms, we get

For any given \(T\), taking the first-order partial derivative of \({\rm TP}_1(N,T)\) with respect to \(N\), setting the result to zero, and re-arranging terms, we have

Taking the second-order partial derivative of \({\rm TP}_1(N,T)\) with respect to \(N\), and re-arranging terms, we obtain

To identify whether \(N_1^*\) is 0 or positive, let us use (17) to define the discrimination term

Theorem 2

For any given \(T>0\), if \([a-(b+r)]^2s-a^2c\le 0\), and \(cI_{\mathrm{c}}\Big [\Big \{a(T+N-M)+2\Big \}^2-2\Big ]-sI_{\mathrm{e}}\Big [2-\Big \{2-a(M-N)\Big \}^2\Big ]\ge 0\), then we obtain

-

(a)

\({\rm TP}_1(N,T)\) is a strictly concave function in \(N\), and hence exists a unique maximum solution \(N_1^*\).

-

(b)

If \(\Delta _{N_1}\le 0\), then \({\rm TP}_1(N,T)\) is maximized at \(N_1^*=0\).

-

(c)

If \(\Delta _{N_1}>0\), then there exists a unique solution \(N_1^*>0\) such that \({\rm TP}_1(N,T)\) is maximized.

Proof

From (17), let us define

Applying (19) and simplifying (17), we obtain

and

Notice that in general both up-stream and down-stream credit periods are less than a year. Hence, we may assume without loss of generality that \(1-(M-N-1)^2\ge 0\).

The fact that \(T+N\ge M\), we have

\(\frac{{\rm d}B(R)}{{\rm d}R}<[a-(b+r)]^2sK{\mathrm{e}}^{aN}\le 0\), if \([a-(b+r)]^2s-a^c\le 0\) and \(cI_{\mathrm{c}}\Big [\Big \{a(T+N-M)+2\Big \}^2-2\Big ]-sI_{\mathrm{e}}\Big [2-\Big \{2-a(M-N)\Big \}^2\Big ]\ge 0\).

This completes the proof of Part (a) of Theorem 2.

If \(\Delta _{N_1}\le 0\), then \(B(0)\le 0\), \(B(N)<0\) for all \(N>0\), and \({\rm TP}_1(N,T)\) is a decreasing function in \(N\). Hence, the retailer’s optimal down-stream credit period is \(N_1^*=0\), which completes the proof of Part (b).

Finally, if \(\Delta _{N_1}>0\), then \(B(0)>0\), and \(\lim _{N\rightarrow \infty }B(N)=-\infty \). By applying the Mean-value Theorem and Part (a) of Theorem 2, we know that there exists a unique \(N_1^*>0\) such that \(B(N_1^*)=0\). Consequently, \({\rm TP}_1(N,T)\) is maximized at the unique point \(N_1^*>0\), which satisfies (17). This completes the proof of Part (c) of Theorem 2.

Likewise, applying the concave fractional programming to \({\rm TP}_2(N,T)\), we obtain the following results:

Theorem 3

For any given \(N\),

-

(a)

\({\rm TP}_2(N,T)\) is a strictly pseudo-concave function in \(T\), and hence exists a unique maximum solution \(T_2^*\).

-

(b)

If \(M\ge T_2^*+N\), then \({\rm TP}_2(N,T)\) is maximized at \(T_2^*\).

-

(c)

If \(M\le T_2^*+N\), then \({\rm TP}_2(N,T)\) is maximized at \(M-N\).

Proof

Let us use (7) to define

and

Taking the first-order and second-order derivatives of \(f_2(T)\), we have

and

Therefore, \({\rm TP}_2(N,T)=\frac{f_2(T)}{g_2(T)}\) is a strictly pseudo-concave function in \(T\), which completes the proof of Part (a) of Theorem 3. The proof of Parts (b) and (c) immediately follows from Part (a) of Theorem 3. This completes the proof of Theorem 3.

To find \(T_2^*\), taking the first-order partial derivative of \({\rm TP}_2(N,T)\), setting the result to zero, and re-arranging terms, we get

To identify which one is the optimal solution (i.e., either \(T_1^*\) or \(T_2^*\)), let us define the discrimination term

combining Theorems 1 and 3, and Eq. (8), we can prove the following theoretical results:

Theorem 4

For any given \(N\),

-

(a)

If \(\Delta _T>0\), then the retailer’s optimal cycle time is \(T_2^*\).

-

(b)

If \(\Delta _T=0\), then the retailer’s optimal cycle time is \(M-N\).

-

(c)

If \(\Delta _T<0\), then the retailer’s optimal cycle time is \(T_1^*\).

Proof

From (28), let us define

Then we have from (29) that

We have

If \(\Delta _T<0\), then \(G(M-N)=\frac{\Delta _T}{(M-N)^2}<0\). By applying the Mean-value Theorem and Theorem 2, we know that there exists a unique \(T_2^*\in (0,M-N)\) such that \(G(T_2^*)=0\).

\({\rm TP}_2(T)\) is maximized at the unique point \(T_2^*\), which satisfies (28).

Let us use (16) to define

From (29) we get

From Theorem 1 and (34), we know that \(J(T)<0\) for all \(T\ge M-N\). Hence for all \(T\ge M-N\), \({\rm TP}_1(T)\) is decreasing and maximized at \(M-N\). Using (8), we obtain that if \(\Delta _T<0\), then

As a result, if \(\Delta _T<0\), then \({\rm TP}_2(N,T)\) is maximized at \(T_2^*\). Thus, we complete the proof of Part (a) of Theorem 4. Using the analogous argument, one can prove the rest of Theorem 3. This completes the proof of Theorem 4.

Next, we discuss the optimal trade credit for \({\rm TP}_2(N,T)\). For any given \(T\), taking the first-order partial derivative of \({\rm TP}_2(N,T)\) with respect to \(N\), setting the result to zero, and re-arranging terms, we have

Taking the second-order partial derivative of \({\rm TP}_2(N,T)\) with respect to \(N\), and re-arranging terms, we obtain

To identify whether \(N_2^*\) is 0 or positive, let us use (36) to define the discrimination term

We have the following result. \(\square \)

Theorem 5

For any given \(T>0\), if \([a-(b+r)]^2s-a^2c\le 0\), and \(s\Big (M-N-\frac{T}{2}\Big )\le 2\), then we obtain

-

(a)

\({\rm TP}_2(N,T)\) is a strictly concave function in \(N\), and hence exists a unique maximum solution \(N_2^*\).

-

(b)

If \(\Delta _{N_2}\le 0\), then \({\rm TP}_2(N,T)\) is maximized at \(N_2^*=0\).

-

(c)

If \(\Delta _{N_2}>0\), then there exists a unique solution \(N_2^*>0\) such that \({\rm TP}_2(N,T)\) is maximized.

Proof

Using (36) we define

Applying (38) and simplifying (36), we get

and

Notice that in general both up-stream and down-stream credit periods are less than a year. Hence, we may assume without loss of generality that \(1-a(M-N-T/2)\ge 0\).

Re-arranging (37), and the fact that \(T+N\le M\), we have

This completes the proof of Part (a) of Theorem 5.

If \(\Delta _{N_2}\le 0\), then \(E(0)\le 0\), \(E(N)<0\) for all \(N>0\), and \({\rm TP}_2(N,T)\) is a decreasing function in \(N\). Hence, the retailer’s optimal down-stream credit period is \(N_2^*=0\), which completes the proof of Part(b).

Finally, if \(\Delta _{N_2}>0\), then \(E(0)>0\), and \(\lim _{N\rightarrow \infty }E(N)=-\infty \). By applying the Mean-value Theorem and Part(a) of Theorem 5, we know that there exists a unique \(N_2^*>0\) such that \(E(N_1^*)=0\). Consequently, \({\rm TP}_2(N,T)\) is maximized at the unique point \(N_2^*>0\), which satisfies (36). This completes the proof of Part(c) of Theorem 5. \(\square \)

Optimal solution for the case of N ≥ M

Again, applying the concave fractional programming, one can obtain that the retailer’s annual total profit \({\rm TP}_3(N,T)\) is strictly pseudo-concave in \(T\). Consequently, we have the following theoretical results.

Theorem 6

For any given \(N\), \({\rm TP}_3(N,T)\) is a strictly pseudo-concave function in \(T\), and hence exists a unique maximum solution \(T_3^*\).

Proof

From (10), let us define

and

Taking the first-order and second-order derivatives of \(f_3(T)\), we have

and

Therefore, \({\rm TP}_3(N,T)=\frac{f_3(T)}{g_3(T)}\) is strictly pseudo-concave function in \(T\), which completes the proof of Theorem 6.

To find \(T_3^*\), taking the first-order partial derivative of \({\rm TP}_3(N,T)\) with respect to \(T\), setting the result to zero, and re-arranging terms, we get

For any given \(T\), taking the first-order partial derivative of \({\rm TP}_3(N,T)\) with respect to \(N\), setting the result to zero, and re-arranging terms, we yield

Taking the second-order partial derivative of \({\rm TP}_3(N,T)\) with respect to \(N\), and re-arranging terms, we obtain

For simplicity, let us define another discrimination term

\(\square \)

Theorem 7

For any given \(T>0\), if \([a-(b+r)]^2s-a^2c\le 0\), then we get

-

(a)

\({\rm TP}_3(N,T)\) is a strictly concave function in \(N\), and hence exists a unique maximum solution \(N_3^*\).

-

(b)

If \(\Delta _{N_3}\le 0\), then \({\rm TP}_3(N,T)\) is maximized at \(N_3^*=0\).

-

(c)

If \(\Delta _{N_3}>0\) , then there exists a unique solution \(N_3^*>0\) such that \({\rm TP}_3(N,T)\) is maximized.

Proof

From (49) let us define

Using (51), we get

and

Re-arranging (50), and the fact that \(N\ge M\), we have

This completes the proof of Part(a) of Theorem 7.

If \(\Delta _{N_3}\le 0\), then \(Z(0)\le 0\), \(Z(N)<0\) for all \(N>0\), and \({\rm TP}_3(N,T)\) is a decreasing function in \(N\). Hence, the retailer’s optimal down-stream credit period is \(N_3^*=0\), which completes the proof of Part(b).

Finally, if \(\Delta _{N_3}>0\), then \(Z(0)>0\), and \(\lim _{N\rightarrow \infty }Z(N)=-\infty \). By applying the Mean-value Theorem and Part(a) of Theorem 7, we know that there exists a unique \(N_3^*>0\) such that \(Z(N_1^*)=0\). Consequently, \({\rm TP}_3(N,T)\) is maximized at the unique point \(N_3^*\), which satisfies (49). This completes the proof of Part(c) of Theorem 7. \(\square \)

Special cases

In this section, we obtain some previously published results of other authors as special cases.

Firstly, if there is no deterioration (i.e., the deterioration rate is approaching to zero), then the proposed model becomes for non-deteriorating items. From calculus, we get

Consequently, the retailer’s order quantity per cycle in (3) becomes

Similarly, we can obtain

As a result, we know that the retailer’s holding cost excluding interest charge per cycle in (4) is simplified to \(\frac{hDT^2}{2}\). Hence the retailer’s annual total profit in (5) is reduced to

Similarly, if there is no deterioration, then we get

and

This simplified problem with \(r=0\) has been solved by Teng and Lou (2012).

In fact, several previous models are indeed special cases of the proposed inventory model here.

-

(i)

When \(\theta \rightarrow 0\) and \(r=0\), then the proposed model is reduced to that in Teng and Lou (2012)

-

(ii)

When \(\theta \rightarrow 0\), \(M=0\) and \(r=0\), then the proposed model is the same as that in Lou and Wang (2013).

-

(iii)

When \(\theta \rightarrow 0\), \(a=0\), \(b=0\) and \(r=0\), then the proposed model is simplified to that in Teng and Goyal (2007).

-

(iv)

When \(\theta \rightarrow 0\), \(N=0\), \(a=0\), \(b=0\) and \(r=0\), then the proposed model is similar to that in Teng (2002).

-

(v)

When \(\theta \rightarrow 0\), \(N=0\), \(s=c\), \(a=0\), \(b=0\) and \(r=0\), then the proposed model is reduced to that in Goyal (1985).

Numerical examples

To illustrate the results, let us apply the proposed method to solve the following numerical examples.

Example 1

Let us assume \(a=2\)/year, \(b=1\)/year, \(r=0.05\)/year, \(K=3600\) units/year, \(s=\$2.4\)/unit, \(c=\$1\)/unit, \(A=\$15\)/order, \(h=\$0.5\)/unit/year, \(M=60\) days (i.e., \(M=2/12=1/6\) years), \(\theta =0.05\), \(I_\mathrm{c}=\$0.06/\$/\)year, \(I_{\mathrm{e}}=\$0.05/\$/\)year. We check the following common condition first: \([a-(b+r)]^2s-a^2c = -1.834<0\). Using software LINGO 12.0, we have the maximum solution to \({\rm TP}_i(N,T)\) for \(i=1, 2\), and \(3\) as follows: {\(N_1^*= 0.05803522\) years, \(T_1^*=0.1086314\) years, and \({\rm TP}_1^*=\$4853.930\)}; {\(N_2^*=0.05012718\) years, \(T_2^*=0.1059186\) years, and \({\rm TP}_2^*=\$4854.393\)}; and {\(N_3^*=0.1666667\) years, \(T_3^*=0.09879093\) years, and \({\rm TP}_3^*=\$4794.598\)}.

Consequently, the retailer’s optimal solution is:

Example 2

Using the same data as those in Example 1 except \(M=40\) days (i.e., \(M=40/365\) years), we obtain the following results: {\(N_1^*= 0.05691158\) years, \(T_1^*=0.1089933\) years, and \({\rm TP}_1^*=\$4829.881\)}; {\(N_2^*=0.01181305\) years, \(T_2^*=0.09777599\) years, and \({\rm TP}_2^*=\$4820.379\)}; and {\(N_3^*=0.109589\) years, \(T_3^*=0.1045846\) years, and \({\rm TP}_3^*=\$4819.184\)}.

Consequently, the retailer’s optimal solution is:

Example 3

Using the same data as those in Example 1 except \(b=0.7\)/year, and \(M=20\) days (i.e., \(M=20/365\) years), we obtain the following results: {\(N_1^*=0.05479452\) years, \(T_1^*=0.1104654\) years, and \({\rm TP}_1^*=\$4964.215\)}; {\(N_2^*=0\) years, \(T_2^*=0.05479452\) years, and \({\rm TP}_2^*=\$4723.789\)}; and {\(N_3^*=0.4427386\) years, \(T_3^*=0.07498528\) years, and \({\rm TP}_3^*=\$5696.765\)}.

Consequently, the retailer’s optimal solution is:

Conclusions

In this paper, we have developed an EOQ model for the retailer to obtain its optimal credit period and cycle time in a supply chain in which reflecting the following facts: (a) the supplier provides an up-stream trade credit and the retailer also offers a down-stream trade credit, (b) the selling items are perishable such as fruits, fresh fishes, gasoline and photographic films and (c) down-stream credit period increases not only demand but also opportunity cost and default risk. Then we have proved that the optimal trade credit and cycle time exist uniquely. Moreover, we have shown that the proposed model is a generalized case for non-deteriorating items and several previous EOQ models. In fact, the proposed inventory model forms a general framework that includes many previous models as special cases such as Goyal (1985), Teng (2002), Teng and Goyal (2007), Teng and Lou (2012), Lou and Wang (2013) and others. Finally, numerical examples are given to illustrate the proposed method.

For future research, we can extend the inventory model in several ways. For example, one immediate possible extension could be allowable shortages, cash discounts, etc. We can also extend the fully trade credit policy to the partial trade credit policy in which a seller requests its credit-risk customers to pay a fraction of the purchase amount at the time of placing an order as a collateral deposit, and then grants a permissible delay on the rest of the purchase amount. Finally, we could consider the effect of inflation rates on the economic order quantity.

References

Abad PL, Jaggi CK (2003) A joint approach for setting unit price and the length of the credit period for a seller when end demand is price sensitive. Int J Prod Econ 83:115–122

Aggarwal SP, Jaggi CK (1995) Ordering policies of deteriorating items under permissible delay in payments. J Oper Res Soc 46:658–662

Arcelus FJ, Shah NH, Srinivasan G (2003) Retailer’s pricing, credit and inventory policies fordeteriorating items in response to temporary price/credit incentives. Int J Prod Econ 81–82:153–162

Cambini A, Martein L (2009) Generalized convexity and optimization: theory and application. Springer, Berlin Heidelberg

Chang CT (2004) An EOQ model with deteriorating items under inflation when supplier credits linked to order quantity. Int J Prod Econ 88:307–316

Chang HJ, Dye CY (2001) An inventory model for deteriorating items with partial backlogging and permissible delay in payments. Int J Syst Sci 32:345–352

Chang HJ, Hung CH, Dye CY (2001) An inventory model for deteriorating items with linear trend demand under the condition of permissible delay in payments. Prod Plan Control 12:274–282

Chang CT, Ouyang LY, Teng JT (2003) An EOQ model for deteriorating items under supplier credits linked to ordering quantity. Appl Math Model 27:983–996

Chand S, Ward J (1987) A note on economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 38:83–84

Chen S-C, Teng J-T, Skouri K (2013) Economic production quantity models for deteriorating items with up-stream full trade credit and down-stream partial trade credit. Int J Prod Econ (in press)

Chern M-S, Pan Q, Teng J-T, Chan Y-L, Chen S-C (2013) Stackelberg solution in a vendor-buyer supply chain model with permissible delay in payments. Int J Prod Econ 144(1):397–404

Chung KJ (1998) A theorem on the determination of economic order quantity under conditions of permissible delay in payments. Comput Oper Res 25:49–52

Chung KJ (2011) The simplified solution procedures for the optimal replenishment decisions under two levels of trade credit policy depending on the order quantity in a supply chain system. Expert Syst Appl 38:13482–13486

Chung KJ, Chang SL, Yang WD (2001) The optimal cycle time for exponentially deteriorating products under trade credit financing. Eng Econ 46:232–242

Chu P, Chung KJ, Lan SP (1998) Economic order quantity of deteriorating items under permissible delay in payments. Comput Oper Res 25:817–824

Chung K-J, Cárdenas-Barrón LE (2013) The simplified solution procedure for deteriorating items under stock-dependent demand and two-level trade credit in the supply chain management. Appl Math Model 37:4653–4660

Chung KJ, Goyal SK, Huang YF (2005) The optimal inventory policies under permissible delay in payments depending on the ordering quantity. Int J Prod Econ 95:203–213

Chung KJ, Haung TS (2007) The optimal retailer’s ordering policies for deteriorating items with limited storage capacity under trade credit financing. Int J Prod Econ 106:127–145

Chung KJ, Huang YF (2003) The optimal cycle time for EPQ inventory model under permissible delay in payments. Int J Prod Econ 84:307–318

Chung KJ, Liao JJ (2004) Lot-sizing decisions under trade credit depending on the ordering quantity. Comput Oper Res 31:909–928

Chung KJ, Liao JJ (2006) The optimal ordering policy in a DCF analysis for deteriorating items when trade credit depends on the order quantity. Int J Prod Econ 100:116–130

Goyal SK (1985) Economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 36:335–338

Ho CH (2011) The optimal integrated inventory policy with price-and-creditlinked demand under two-level trade credit. Comput Ind Eng 60:117–126

Ho CH, Ouyang LY, Su CH (2008) Optimal pricing, shipment and payment policy for an integrated supplier-buyer inventory model with two-part trade credit. Eur J Oper Res 187:496–510

Huang YF (2003) Optimal retailer’s ordering policies in the EOQ model under trade credit financing. J Oper Res Soc 54:1011–1015

Huang YF (2004) Optimal retailer’s replenishment policy for the EPQ model under supplier’s trade credit policy. Prod Plan Control 15:27–33

Huang YF (2006) An inventory model under two-levels of trade credit and limited storage space derived with out derivatives. Appl Math Model 30:418–436

Huang YF (2007) Economic order quantity under conditionally permissible delay in payments. Eur J Oper Res 176:911–924

Huang YF (2007) Optimal retailer’s replenishment decisions in the EPQ model under two levels of trade credit policy. Eur J Oper Res 176:1577–1591

Huang YF, Chung KJ (2003) Optimal replenishment and payment policies in the EOQ model under cash discount and trade credit. Asia-Pacific J Oper Res 20:177–190

Huang YF, Hsu KH (2008) An EOQ model under retailer partial trade credit policy in supply chain. Int J Prod Econ 112:655–664

Hwang H, Shinn SW (1997) Retailer’s pricing and lot sizing policy for exponentially deteriorating product under the condition of permissible delay in payments. Comput Oper Res 24:539–547

Jaggi CK, Goyal SK, Goel SK (2008) Retailer’s optimal replenishment decisions with credit-linked demand under permissible delay in payments. Eur J Oper Res 190:130–135

Jaggi C, Kapur PK, Goyal SK, Goel S (2012) Optimal replenishment and credit policy in EOQ model under two-levels of trade credit policy when demand is influenced by credit period. Int J Syst Assur Eng Manag 3:352–359

Jamal AMM, Sarker BR, Wang S (1997) An ordering policy for deteriorating items with allowable shortages and permissible delay in payment. J Oper Res Soc 48:826–833

Jamal AMM, Sarker BR, Wang S (2000) Optimal payment time for a retailer under permitted delay of payment by the wholesaler. Int J Prod Econ 66:59–66

Khouja M, Mehrez A (1996) Optimal inventory policy under different supplier credit policies. J Manuf Syst 15:334–339

Kreng VB, Tan SJ (2010) The optimal replenishment decisions under two levels of trade credit policy depending on the order quantity. Expert Syst Appl 37:5514–5522

Kreng VB, Tan SJ (2011) Optimal replenishment decision in an EPQ model with defective items under supply chain trade credit policy. Expert Syst Appl 38:9888–9899

Liao JJ (2008) An EOQ model with non-instantaneous receipt and exponentially deteriorating items under two-level trade credit policy. Int J Prod Econ 113:852–861

Liao HC, Tsai CH, Su CT (2000) An inventory model with deteriorating items under inflation when a delay in payment is permissible. Int J Prod Econ 63:207–214

Lou KL, Wang WC (2013) Optimal trade credit and order quantity when trade credit impacts on both demand rate and default risk. J Oper Res Soc (to be appear)

Mahata GC, Goswami A (2006) Production lot-size model with fuzzy production rate and fuzzy demand rate for deteriorating item under permissible delay in payments. Opsearch 43(4):358–375

Mahata GC, Goswami A (2007) An EOQ model for deteriorating items under trade credit financing in the fuzzy sense. Prod Plan Control 18(8):681–692

Mahata GC, Mahata P (2011) Analysis of a fuzzy economic order quantity model for deteriorating items under retailer partial trade credit financing in a supply chain. Math Comput Model 53:1621–1636

Mahata GC (2012) An EPQ-based inventory model for exponentially deteriorating items under retailer partial trade credit policy in supply chain. Expert Syst Appl 39:3537–3550

Min J, Zhou YW, Zhao J (2010) An inventory model for deteriorating items under stock-dependent demand and two-level trade credit. Appl Math Model 34:3273–3285

Mishra VK, Singh LS, Kumar R (2013) An inventory model for deteriorating items with time-dependent demand and time-varying holding cost under partial backlogging. J Ind Eng Int 9(4):1–5

Ouyang LY, Chang CT (2013) Optimal production lot with imperfect production process under permissible delay in payments and complete backlogging. Int J Prod Econ 144(2):610–617

Salameh MK, Abboud NE, El-Kassar AN, Ghattas RE (2003) Continuous review inventory model with delay in payments. Int J Prod Econ 85:91–95

Sarker BR, Jamal AMM, Wang S (2000) Supply chain model for perishable products under inflation and permissible delay in payment. Comput Oper Res 27:59–75

Shah NH, Shah YK (1998) A discrete-in-time probabilistic inventory model for deteriorating items under conditions of permissible delay in payments. Int J Syst Sci 29:121–126

Shawky AI, Abou-el-ata MO (2001) Constrained production lot-size model with trade-credit policy: a comparison geometric programming approach via Lagrange. Prod Plan Control 12:654–659

Shinn SW, Hwang HP, Sung S (1996) Joint price and lot size determination under conditions of permissible delay in payments and quantity discounts for freight cost. Eur J Oper Res 91:528–542

Shinn SW, Hwang H (2003) Optimal pricing and ordering policies for retailers under order-size-dependent delay in payments. Comput Oper Res 30:35–50

Singh S, Gupta V, Goel A (2013) Two level of trade credit. Procedia Technol 10:227–235

Teng JT (2002) On the economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 53:915–918

Teng JT, Chang CT, Goyal SK (2005) Optimal pricing and ordering policy under permissible delay in payments. Int J Prod Econ 97:121–129

Teng JT (2009) Optimal ordering policies for a retailer who offers distinct trade credits to its good and bad credit customers. Int J Prod Econ 119:415–423

Teng JT, Chang CT (2009) Optimal manufacturer’s replenishment policies in the EPQ model under two-levels of trade credit policy. Eur J Oper Res 195:358–363

Teng JT, Goyal S (2007) Optimal ordering policies for a retailer in a supply chain with up-stream and down-stream trade credits. J Oper Res Soc 1252–1255

Teng JT, Lou KR (2012) Seller’s optimal credit period and replenishment time in a supply chain with up-stream and down-stream trade credits. J Global Optim 53:417–430

Teng JT, Min J, Pan Q (2012) Economic order quantity model with trade credit financing for non-decreasing demand. Omega 40:328–335

Teng J-T, Yang H-L, Chern M-S (2013) An inventory model for increasing demand under two levels of trade credit linked to order quantity. Appl Math Model 37:7624–7632

Teng J-T, Krommyda IP, Skouri K, Lou K-R (2011) A comprehensive extension of optimal ordering policy for stock-dependent demand under progressive payment scheme. Eur J Oper Res 215(1):97–104

Thangam A (2014) Retailer’s inventory system in a two-level trade credit financing with selling price discount and partial order cancellations. J Ind Eng Int 10(3):1–12

Thangam A, Uthayakumar R (2009) Two-echelon trade credit financing for perishable items in a supply chain when demand depends on both selling price and credit period. Comput Ind Eng 57:773–786

Tsao YC (2009) Retailer’s optimal ordering and discounting policies under advance sales discount and trade credits. Comput Ind Eng 56:208–215

Wang WC, Teng JT, Lou KR (2014) Seller’s optimal credit period and cycle time in a supply chain for deteriorating items with maximum lifetime. Eur J Oper Res 232(2):315–321

Wu J, Chan YL (2014) Lot-sizing policies for deteriorating items with expiration dates and partial trade credit to credit-risk customers. Int J Prod Econ

Acknowledgments

The author would like to thank the editor and the anonymous referees for their positive and constructive comments that improved the quality of the paper to a great extent. This research work is fully supported by the University Grants Commission (UGC), INDIA, for providing a Minor Research Project (MRP, UGC) under the research Grant No. PSW-204/13-14.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Mahata, G.C. Retailer’s optimal credit period and cycle time in a supply chain for deteriorating items with up-stream and down-stream trade credits. J Ind Eng Int 11, 353–366 (2015). https://doi.org/10.1007/s40092-015-0106-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40092-015-0106-x