Abstract

This paper examines the inflation-hedging capability of listed real estate (LRE) companies in the US from 1975 to 2023, and in three other economies—the UK, Japan, and Australia—from 1990 to 2023. By using a Markov switching vector error correction model (MS-VECM), we identify that the short-term hedging ability moves towards being negative or zero during turbulent periods. In stable periods, LRE provides good protection against inflation. In the long term, LRE offers a good hedge against expected inflation and shows a superior inflation hedging ability than stocks. Additionally, we identify inflation-hedging portfolios by minimizing the expected shortfall. This inflation-hedging portfolio allocation methodology suggests that listed real estate stocks should play a significant role in investor portfolios.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Due to central banks’ response to the COVID-19 pandemic and a huge stimulus that increased levels of money supply, together with the subsequent consequences of military confrontations, the world is experiencing large price swings in energy and commodity markets and a possibility of a global recession. In September 2022, the year-on-year US inflation rose to 8.2%. In response, Central banks, such as the Federal Reserve or the Bank of England, quickly tightened their monetary policy, attempting to curb the massive inflation by imposing higher interest rates. As of the end of 2022, the engaged policies did not appear to be adequate in terms of curbing inflationary pressures; hence further tightening is likely. With those inflationary pressures, it becomes more important to take a fresh look at real estate's inflation hedging capability by using state-of-the-art estimation techniques. Against this background, this paper aims to broaden our understanding of the inflation-hedging characteristics of real estate relative to other asset classes. Such properties should particularly benefit long-term institutional investors (especially pension funds, which usually operate under inflation-linked liability constraints) and individual investors, for whom real-term capital preservation is a minimal objective.

Some assets are more suited to hedging inflation than others, depending on the country, sector, or time horizon. Real estate has often been perceived as the asset class which can deliver an adequate inflation hedge due to its two mechanisms: (1) Rent or lease payments (tenant leases contain rent escalation clauses and/or pass expense increases through to tenants) and (2) Land values and building costs typically rise with inflation (Ruhmann & Woolston, 2011). However, empirical evidence, especially for listed real estate, is mixed. Gyourko and Linneman (1988) find that REITs may protect against expected inflation but not against unexpected inflation. In contrast, Park et al. (1990) find that equity REITs are negatively associated with expected and unexpected inflation. Titman and Warga (1989) argue that REITs act as a paradoxical hedge against inflation because they are catalysts rather than reactants to a change in inflation rates. In particular, the contemporaneous return on equity REITs anticipates future inflation rates.

This paper extends the literature in two ways. First, we allow for non-linear inflation-hedging characteristics. Most previous literature combines the Fama and Schwert (1977) framework (which distinguishes the expected and unexpected inflation components) and the cointegration technique (which differentiates long-term equilibrium and short-term dynamics) (e.g., Hoesli & Hamelink, 1997; Hoesli et al., 2008; Liu et al., 1997; and many others). However, all these studies assume a stable relationship, which may be violated by the change in monetary policy and business cycles. For instance, Glascock et al. (2002) show that the relation between REIT returns and inflation can be influenced by monetary policies. Demary and Voigtländer (2009) argue that the office sector partially protects against inflation because worsening economic perspectives (inflation) alleviate the demand for office space. National and Low (2000) find that the inflation-hedging characteristics of assets differ in distinct inflationary environments, indicating time-varying inflation-hedging characteristics. Given the long-lasting low-interest-rate environment and the increased uncertainty in the global economy, the inflation-hedging characteristics of real estate may differ from previous periods.

Second, this project compares the hedging characteristics across asset classes, including real estate, stocks, silver, and gold, using an inflation-hedging portfolio. The hedging ability of other assets, such as infrastructure (Bitsch et al., 2010; Wurstbauer & Schäfers, 2015), stocks (Bodie, 1976), gold (Lucey et al., 2017), and white precious metals (Bampinas & Panagiotidis, 2015; Bilgin et al., 2018) has been intensively studied in the literature. Regarding real estate, many studies also exist, as highlighted above, and the literature has often focused on whether differences exist across property types (Hoesli, 1994; Ganesan & Chiang, 1998; National & Low, 2000). However, there is still a lack of conclusive evidence regarding the inflation-hedging capabilities across different asset classes, i.e., in a diversified portfolio. Most of the research has been done within a mean–variance framework. However, using variance as the risk measure may not be what corresponds best to investors' objectives, as variance treats both upside and downside risk as the same. Because investors usually consider the upside risk to be favorable, the use of variance appears to be unsuitable (Sukcharoen & Leatham, 2016). In reality, listed real estate returns are non-normal (Giannotti & Mattarocci, 2013; Hutson & Stevenson, 2008). Using listed real estate (LRE) performance in the EU area, Lizieri et al. (2022) also show that the mean–variance approach often yields extreme and unrealistic asset allocations to listed real estate. Given that investors may only consider downside risk, we use a more realistic measurement of risk – the expected shortfall, which focuses on the risk of being far below the expected real return (i.e., the downside risk). A shortfall probability risk measure for portfolio optimizations has been conducted before, for example, by Leibowitz and Henriksson (1989), Leibowitz and Kogelman (1991), Lucas and Klaassen (1998), Smith and Gould (2007), and Brière and Signori (2012). In this paper, we apply this measurement to construct an inflation-hedging portfolio.

Using 1975 to 2023 data for LRE companies in the US, and data for 1990–2023 for three other economies – the UK, Japan, and Australia –, our paper confirms the effectiveness of listed real estate to hedge against inflation. First, LRE assets provide a reliable hedge against inflation in the long term, but mainly against its expected component. In all four regions, listed real estate shows positive long-term inflation-hedging capability against expected inflation. Second, in stable periods, LRE may provide an adequate level of protection against inflation in the short term. However, the level of protection decreases during periods of economic turmoil. Third, the inflation-hedging ability largely comes from the capital value increase rather than the dividend yield. Fourth, when we use the housing rent adjusted inflation index (Ambrose et al., 2022), LRE shows a better hedging ability compared to using the classic unadjusted inflation index. This indicates that the hedging ability of listed real estate may have been underestimated in the literature, as prior studies mainly use an unadjusted inflation index, which tends to underrepresent rent changes between leases and underestimate the volatility due to valuation smoothing and significant time lagsFootnote 1 in the official rent measure (Ambrose et al., 2022).

Finally, we demonstrate that LRE can play a significant role in the inflation-hedging portfolio of an investor, even when inflation-linked government bonds are included. The average allocations to LRE for the US, UK, Australia, and Japan over the entire period are 8.32%, 10.87%, 32.15%, and 8.55%, respectively. Those weights are higher than those in the mean–variance portfolio for all countries and higher than those in lower partial moment portfolios for the US, Japan, and Australia. The inflation-hedging portfolio also provides a higher risk-adjusted return than when the mean–variance approach is implemented for the US and Japan.

The remainder of the paper is organized as follows. Section “Literature Review” discusses the literature. We next discuss the data and methods that we use to test the inflation-hedging ability of the various asset classes, followed by the presentation of our results. We then present a battery of robustness tests. The subsequent section discusses inflation-hedging portfolios and compares those with traditional mean–variance and lower partial moment portfolios (Byrne & Lee, 2004). A final section concludes.

Literature Review

There have been numerous studies examining various aspects of LRE's ability to serve as an inflation hedge. One strand of the literature focuses on protecting against expected and unexpected inflation in the short run (e.g., Chen & Tzang, 1988; Gyourko & Linneman, 1988; Murphy & Kleiman, 1989; Titman & Warga, 1989; Chan et al., 1990; Park et al., 1990; Yobaccio et al., 1995; Hardin et al., 2012; Fang et al., 2022; and Connolly & Stivers, 2022), while others investigate the long-term relationship using cointegration techniques (e.g., Chatrath & Liang, 1998; Glascock et al., 2002; Bahram et al., 2004; Hoesli et al., 2008; Lee & Lee, 2012; Lee et al., 2011; and Fehrle, 2023).Footnote 2 The findings are mixed. For instance, Chen and Tzang (1988) show that REITs can protect against inflation expectations up to some extent. Glascock et al. (2002) find significant negative coefficients for general and expected inflation and a negative but non-significant coefficient for unexpected inflation. They find evidence of cointegration between REIT returns and the generic CPI as well as with its expected and unexpected components. Innovations in REIT returns lead to negative changes to both expected and unexpected inflation (which would be consistent with a real output model for a given level of money). In contrast to this, Chatrath and Liang (1998) and Bahram et al. (2004) support the traditional notion that REITs do not hedge against inflation (in contrast to direct real estate).

Lee et al. (2011) investigate the long-run inflation-hedging properties of real estate stocks in East Asian developing countries. They report that LRE was not capable of hedging inflation in the long run. Fehrle (2023) investigates the hedging ability of equity and housing against inflation. He concludes that the hedging ability is strongly time dependent. Further, he notes that housing is superior, albeit only marginally, to equity in terms of hedging against inflation capability. The study by Fang et al. (2022) decomposes inflation into energy, food, and core components and finds that these components have markedly different properties concerning asset pricing. They demonstrate that traditional inflation hedging instruments such as stocks, currencies, commodities, and REITs only succeed in hedging energy inflation, while in the case of core inflation they tend to be less successful. Following Fang et al. (2022), Connolly and Stivers (2022) find the existence of a complex relationship between REIT equity returns. The authors establish a strong negative relationship during phases of weaker economic growth, such as periods in the 1980s and early 1990s when stagflation was more of a concern.

The mixed results may be explained by different observation periods. Considering the structural break in the US, Hardin et al. (2012) split the sample period into two subperiods (1980–1992 and 1993–2008). Based on dividend yield composition, the authors demonstrate that, although inflation illusion and hedging effects exist in REITs, inflation illusion appears to predominate throughout the entire sample period. Similar to Hardin et al. (2012), Lee and Lee (2012) demonstrate that REITs act as a hedge against expected inflation only after a structural break in 1993, where a tax reform made large-scale investments in REITs more desirable to institutional investors. Moreover, they emphasize that the hedging capability of REITs is driven by large capitalization which implies that small-cap REITs fail to hedge against inflation once isolated from the influence of large REITs.

Our paper extends the literature by combining Vector Error Correction Model (VECM) with a Markov-regime switching process. We follow Beckmann and Czudaj (2013), who analyze whether gold possesses the ability to hedge against inflation but from a new perspective. By using data from four major global economies, they allow for non-linearities while they also discriminate between long-run and time-varying short-run dynamics. A Markov switching vector autoregressive model (MS-VAR) has also been used by Chiang et al. (2020), who observe the dynamic relationships between housing market returns and stocks in the US. They identify a significant regime-dependent autocorrelation between stock and housing returns in both low-volatility and high-volatility regimes.

Our paper is also related to the listed real estate literature on optimal portfolio composition. An abundant amount of literature has investigated portfolio optimizations in a mean–variance framework advocating that real estate holdings improve the mean–variance efficiency of a diversified portfolio (Fogler, 1984; Firstenberg et al., 1988; and Ennis & Burik, 1991). By using US REIT data, several studies demonstrate that the risk-return trade-off for U.S. investors can be mitigated (Burns & Epley, 1982; Ennis & Burik, 1991; Miles & McCue, 1982). Several studies demonstrate the benefits of diversifying into international real estate using a variety of data (Giliberto, 1990; Eichholtz, 1996; Conover et al., 2002).Footnote 3 Others focus on the performance of different asset types (Lee & Stevenson, 2005; Chiang et al., 2008; Newell and Marzuki, 2016).

Fewer studies follow the approach of expected shortfall by finding the optimal portfolio (Leibowitz and Henriksson, 1989; Leibowitz & Kogelman, 1991; Lucas & Klaassen, 1998; Smith & Gould, 2007; Brière & Signori, 2012). Only Brière and Signori (2012) determine the allocation of their portfolio by minimizing the shortfall probability, with the constraint that returns are above a minimum target return in an inflation-hedging context. They conclude that the portfolio allocation depends on the time horizon as well as the minimum return target. According to Leibowitz and Kogelman (1991), downside risk is determined by the shortfall probability relative to a minimum return threshold. Providing both a threshold and a shortfall probability allows them to determine the maximum allocation to risky assets based on a shortfall constraint. Additionally, they examine how the risky asset allocation is affected by changes in volatility, equity risk premium, return thresholds, and shortfall probabilities.

Data and Method

Data Description

Data were compiled for the US, the UK, Japan, and Australia. We use monthly data from 1975 to March 2023 for the US, sourced from Refinitiv Datastream. For the three other countries, LRE monthly total return indexes, available from 1990 to March 2023, were obtained from the European Public Real Estate Association (EPRA). Stock total return indexes are obtained from Refinitiv Datastream. Specifically, these are the S&P 500 index for the US, the FTSE 250 index for the UK, the Nikkei 500 index for Japan, and the S&P/ASX 200 index for Australia. Additionally, we also include the price of gold, silver, and oil in US Dollars, along with the total return index of the S&P GSCI Agriculture and the real three-month Treasury Bill rates, which is a proxy for the risk-free rate, as well as the nominal GDP.Footnote 4Footnote 5 Our key variables, namely expected inflation and unexpected inflation, are derived from the seasonally adjusted consumer price indexes (CPI) obtained from Refinitiv Datastream for the respective countries.

Table 1 displays the corresponding summary statistics of our data. The highest average total return is recorded in the US with 10.64% annually, while Australia, the UK, and Japan follow with annual rates of 8.01%, 4.05%, and 1.31%, respectively. The US faces the highest average expected inflation rate of 1.12% per month, while Japan comes across with the lowest rate of 0.05% per month. In the US, the average monthly unexpected inflation rate is -0.007%, while Japan underwent a rate of monthly unexpected inflation of -0.005%.

Inflation Decomposition

We decompose the observed inflation (\({I}_{t}\)) into expected inflation (\(E{I}_{t}\)) and unexpected inflation (\(U{I}_{t}\)). Expected inflation is the inflation element that economic agents expect to arise. It is what they have already embedded in their economic choice. Unexpected inflation is the surprise component of inflation that people haven't incorporated in their pricing and costing. We follow Fama and Schwert's (1977) framework to make the decomposition. We can define inflation based on the prior anticipated inflation rate, adjusted for differences between actual inflation and the prior expectation for each period. This leads to a univariate time series approach using Box-Jenkins / ARIMA (1,0,1) procedures to inflation:

where \(\alpha\), ρ, and ϴ are parameters. The fitted value for \(E{I}_{t}\) is taken as the expected inflation and the residual, \({e}_{t},\) is interpreted as unexpected inflation.

Reasons for changes in unexpected inflation can be manifold. Examples are changes in monetary policy. If a central bank abruptly changes its monetary policy – such as altering interest rates or money supply – this can lead to unexpected inflation (Fisher, 1930). But also supply and demand shocks (Blanchard & Quah, 1989), fiscal policy changes (Sargent & Wallace, 1981), exchange rate fluctuations and economic forecasts can affect the unexpected component of inflation (Taylor, 2000). Unexpected inflation is considered to be more costly to the economy because investors may request a higher premium for high uncertainty in the future (Fama & Schwert, 1977).

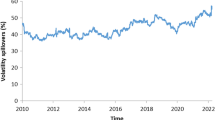

When we look at crises such as the COVID-19 pandemic, which caused a supply and demand shock, or the global financial crisis (GFC), which caused a period of massive turbulence in global financial markets and banking systems, we notice a significantly increased volatility of expected and unexpected inflation. This is also shown in Appendix 1, where the decomposition of inflation is illustrated. Between 2007 and 2008, the standard deviation of expected inflation in the US stood at 1.90%, while that of unexpected inflation was 0.52%. Compared to the overall observation period, these figures indicate that the volatility of both expected and unexpected inflation during 2007–2008 was approximately twice as high. The fluctuations in both expected and unexpected inflation highlight the complexities policymakers encounter when adjusting their strategies. Stabilizing these indicators during crises is vital for upholding economic confidence and stability.

Appendix 1 further shows that the average of expected inflation is always higher than the average of the unexpected component in each country. While the US experienced the highest average of expected and unexpected inflation, Japan realized the lowest inflation numbers.

Stationarity and Cointegration

Using the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test for stationarity, we show that all US series are I(1), indicating stationarity in first differences. Similarly, the series for the UK, Japan, and Australia are I(1) and therefore, in first-difference stationary. The results are shown in Appendix 2. Considering that the variables are I(1) series, we further perform the cointegration test using the trace test.

The trace test investigates the null hypothesis of r cointegrating vectors against the alternative hypothesis of n cointegrating vectors. To determine ranks and estimate coefficients, maximum likelihood estimation is used. Accordingly, likelihood ratio tests are as follows:

where T is the sample size and λ represents the estimated eigenvalues of the reduced rank of the matrix π.Footnote 6 In the process, the sequential test strategy begins with r = 0 and is continued until the null hypothesis for the 5% significance level cannot be rejected for the first time. The related value of r ultimately corresponds to the cointegration rank. In this way, there are (n-r) stochastic trends in the system.

Markov-Switching Vector Error Correction Model (MS-VECM)

Markov-switching models are key tools for exploring transitions between different states within a dataset, especially time series data with non-stationary traits (Hamilton, 1989). This study focuses on financial indicators, such as returns of various assets, and economic indicators like the short-term treasury bill rate, GDP, and inflation. These variables function as regime indicators, capturing shifting dynamics within the data. Whether observed or latent, these indicators encapsulate changes in the underlying economic context and can instigate switches between the model's different regimes.Footnote 7 Following Beckmann and Czudaj (2013), a MS-VECM is used to examine the relationship between the price of assets and expected and unexpected inflation.

The parameters of this model are designed to take a constant value in each regime and to shift discretely from one regime to the other with different switching probabilities. Switches between states are assumed to follow an exogenous stochastic process. Consider an M-regime pth order MS-VECM, which in general allows for regime shifts in the vector of intercept terms, the autoregressive part, the long-run matrix, and the variance–covariance matrix of the errors:

where \(\Delta\) denotes the difference operator, \({Y}_{t}\) represents a K-dimensional vector of time series, \({Y}_{t}=\left[{R}_{t},E{I}_{t},U{I}_{t},{X}_{t}\right]\) and \({R}_{t}\) is a vector of asset returns, including stocks, LRE, commodities, silver, and gold. \({X}_{t}\) are economic control variables such as GDP, real interest rates, and oil prices. \(v\left({s}_{t}\right)\) denominates a K-dimensional vector of regime-dependent intercept terms. \({\varepsilon }_{t}\) is a vector of error terms with a regime-dependent variance–covariance matrix \(\sum ({s}_{t})\), \({\varepsilon }_{t}\sim NIID(0,\sum ({s}_{t})\)). \(\Gamma \left(L\right)\left({s}_{t}\right)\) is the K × K matrix for the state-dependent short-run dynamics. (Beckmann & Czudaj, 2013). The stochastic regime-generating process is assumed to be an ergodic, homogenous, and irreducible first-order Markov chain with a finite number of regimes,\({s}_{t}\in \left\{1,\dots ,M\right\}\), and constant transition probabilities:

The first expression of Eq. (4) gives the probability of switching from regime i to regime j at time t + 1 which is independent of the history of the process. \({p}_{ij}\) is the element in the ith row and the jth column of the M × M matrix of the transition probabilities P. In this paper, we consider two regimes.

Empirical Results

Long-Term Hedging Properties

Based on the Johansen cointegration test, we identify two cointegration relationships in the US, the UK, and Japan. For Australia, no rank could be determined, hence Australia does not have a co-integrating relationship. Table 2 reports long-term relationships (β-vectors). In each model with a cointegration matrix, the first vector is normalized to the LRE returns, while the second vector is normalized to the general stock market performance.

We find significant long-term relationships between the performance of listed real estate markets and expected inflation in the US, UK, and Japan (Table 2). In the long term, LRE can positively hedge against expected inflation in these countries. A one percent increase in expected inflation is related to a 1.754 percent, a 1.711 percent, and a 11.182Footnote 8 percent increase in the LRE total return in the US, the UK, and Japan, respectively.

In the US, the UK, and Japan, LRE is not significantly related to unexpected inflation in the long-term relationship. This is consistent with most prior literature, which also finds mixed results in terms of the hedging ability of real estate against unexpected inflation. For instance, Limmack and Ward (1988) found that office and retail properties offered no significant hedge against unexpected inflation.

Moreover, we find a significantly negative long-term coefficient between stock returns and expected and/or unexpected inflation, indicating that general stocks do not provide an effective long-term hedge against inflation. This finding is in line with previous literature. For instance, using Swiss data, Hoesli (1994) shows that real estate hedges better in the long run than stocks. When the inflation rate is divided into expected and unexpected inflation, stocks exhibit negative coefficients for both expected and unexpected inflation. Meanwhile, the coefficient for expected inflation is positive for real estate.

Concerning other long-term equilibrium relationships, we find a positive long-term relationship between LRE returns and oil prices in the UK. Furthermore, we observe a negative long-term relationship between the gold price and LRE returns in Japan. Moreover, we find a negative long-term elasticity of interest rates on LRE returns in the US, the UK, and Japan, which can be explained by the fact that increasing capital costs lead to lower demand for real estate and, therefore, to lower returns. Besides, we find a negative relationship between LRE returns and GDP in the US, the UK, and Japan.Footnote 9

Short-Term Hedging Properties

The MS-VECM representation given in Eq. (3) has been estimated for each country while enabling each parameter to switch between two regimes, including the intercept, the autoregressive elements, the residual variance–covariance matrix, and, most notably, the adjustment parameters to deviations from long-run relationships.

The short-term relationships and the matrices of transition are reported for both regimes in Table 3. The MS-VECM model identifies the transmission matrix from one regime to another for each country. In the US, the probability of staying in Regime 1 is 94.1%, while the probability of switching to Regime 2 is 5.9%. It suggests the dominance of the first regime. Switching from Regime 2 to Regime 1 shows a probability of 20.6%, while staying in Regime 2 shows a probability of 79.4%. The associated probabilities for the UK, Japan, and Australia are comparable.

To better understand the two regimes, Fig. 1 illustrates the switching process for the US, UK, Japan, and Australia. The blue line shows the probability of switching to Regime 1, and the grey area indicates that the probability of Regime 1 is larger than 50%. For comparison purposes, we also illustrate the LRE return in each graph (dashed line). As shown in Fig. 1, it is quite obvious that Regime 1 captures the stable periods and Regime 2 the times of turbulence, particularly for the US, the UK, and Australia. For instance, turbulent periods like the 1979 oil crisis, the GFC, the dot-com bubble, or the COVID-19 pandemic appear to lead to a switching process to Regime 1. Meanwhile, we also see a remarkable decrease in LRE returns in Regime 2. However, for Japan, we see that this is not obvious. In the case of Japan, specific economic development can provide an explanation. The collapse of the asset price bubble in Japan in 1991 resulted in a period of economic stagnation. Between 1995 and 2007, the nominal GDP fell from 5.33 trillion to 4.36 trillion US Dollars. From the early 2000s, the Bank of Japan set out to encourage economic growth through quantitative easing, which indicates the special role of Japan as an economy. Additionally, in 2006, the Bank of Japan concluded its quantitative easing strategy and increased the operating target for money market operations from essentially zero percent to approximately 0.25 percent. This move marked the end of a five-year period of zero interest rates.

We report the estimation coefficients in Table 3. For the US, we see a significant positive short-term impact of expected inflation on LRE performance in Regime 1 (stable periods), but the impact becomes insignificant during the turbulent period. In contrast, unexpected inflation has a significant negative impact on LRE returns in both Regime 1 (stable periods) and Regime 2 (turbulent periods). But the impact is more negative during the turbulent period. In the UK, expected inflation has a significant positive impact on LRE returns in the short term in Regime 1 (stable periods), but a non-significant impact in Regime 2 (turbulent periods). The hedging ability is accordingly lost in times of turbulences. For Japan, we see a positive significant short-term impact of expected inflation on LRE in Regime 1, but perverse hedging capabilities in Regime 2. For Australia, we see a positive significant short-term impact of expected inflation on LRE in Regime 1, but no hedging attributes in Regime 2.

To provide a better intuitive overview, we illustrate the restrictedFootnote 10 time-varying short-term impact of expected and unexpected inflation on LRE returns based on the smoothed transmission probability and the coefficient in each regime:

We depict the time-varying coefficients if at least one coefficient in Equation is significant in Regimes 1 and 2. Hence, we show the time-varying coefficients of expected and unexpected inflation in the US (Figs. 2a and 2b), those of expected and unexpected inflation in the UK (Fig. 2c and 2d), that of expected inflation in Japan (Figs. 2e), and that of expected inflation in Australia (Fig. 2f).

Time-Varying Short-Term Impact of Inflation on Real Estate Equity Returns a U.S. Time-Varying Coefficient of EI. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). b. U.S. Time-Varying Coefficient of UI. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). An increase in unexpected inflation by one standard deviation would lead to a decrease in real estate returns by 1.396 standard deviations. c. U.K. Time-Varying Coefficient of EI. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). d. U.K. Time-Varying Coefficient of UI. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). e. JPN Time-Varying Coefficient of EI. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). f. AUS Time-Varying Coefficient of EI. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6)

First, in the US, UK, Japan, and Australia, we find that during stable periods, LRE provides good protection against expected inflation in the short term. However, the relationship becomes negative or zero during turbulent periods. As shown in Fig. 2a, the coefficient in the US varies between 0.45 and 0.00 for expected inflation. In Regime 1 (stable periods), the coefficient remains positive. But in Regime 2 (e.g., 1979, 2007 and 2009–2010), the coefficient becomes negative or zero. In the UK, as shown in Fig. 2c, the coefficient of expected inflation varies from 4.50 to 0.00 and behaves similarly to that for the US. While in Regime 1 (stable periods) the coefficient remains positive, Regime 2 leads to coefficients of zero (e.g., 1992, 1993, and 2007–2009). Figure 2e shows the coefficient of expected inflation in Japan, varying between -20 and 60.Footnote 11 While in Regime 1 (stable periods) the coefficient remains positive, Regime 2 leads to negative coefficients (e.g., 1993–1997). As illustrated in Fig. 2f, in Australia, the coefficient of expected inflation varies from 1.40 to 0.00. While in Regime 1 (stable periods) the coefficient remains positive, Regime 2 leads to zero coefficients (e.g., 2008–2009 and 2020).

Overall, our analysis shows that the short-term inflation-hedging ability of LRE can be perverse during turbulent periods. During the more steady environment of stable periods, the change in the inflation rate is largely determined by the expected component. LRE provides good inflation hedging because 1) the rental income can be adjusted according to inflation; and 2) the spreads between the cap rate and base rate often narrow because investors perceive a lower risk in investing in real estate due to the general belief that real estate assets can hedge against inflation.Footnote 12 However, during turbulent times, due to the high levels of uncertainty, investors normally charge a higher risk premium. As a result, the asset value will decrease, and the short-term inflation-hedging ability of LRE will become insignificant or even negative.

Of course, because each country has different turbulent periods due to their different economic conditions, the coefficients look different. Additionally, varying levels of inflation across countries also play a significant role. For example, Japan has undergone a prolonged period of low inflation. Moreover, the divergent growth of the LRE market and differences in lease contract practices can contribute to distinct responses to inflationary shocks.

If we compare the short-term hedging ability of LRE with that of stocks, we can see that LRE provides better inflation hedging effectiveness than stocks also in the short term. Figure 3 compares the time-varying coefficients of EI and UI for stocks and LRE returns for the US, UK, Japanese, and Australian markets. The red dotted line shows the coefficient for LRE, and the blue line indicates the coefficient for stocks. In the US, compared to stocks, LRE reacts more positively to expected and unexpected inflation, especially during stable periods (Figs. 3a and 3b). We can see a significant positive coefficient for expected inflation for LRE, while stocks show a significant negative impact. Furthermore, the hedging characteristics of LRE is of lesser magnitude than for stocks (Fig. 3a). In the UK (Fig. 3c), LRE also shows better hedging properties concerning expected inflation, as compared to stocks. Regarding unexpected inflation, LRE and stocks have insignificant relationships, while stocks exhibit larger magnitudes. Overall, LRE provides better inflation-hedging abilities than stocks in the US and UK. However, LRE in Japan and Australia show mixed results in the short-term inflation hedging properties compared to stocks.

Time-Varying Coefficients of LRE and Stocks. a. U.S. Time-Varying Coefficient of EI b. U.S. Time-Varying Coefficient of UI c. U.K. Time-Varying Coefficient of EI d. U.K. Time-Varying Coefficient of UI e. Japan Time-Varying Coefficient of EI f. Japan Time-Varying Coefficient of UI g. Australia Time-Varying Coefficient of EI h. Australia Time-Varying Coefficient of UI

Robustness Tests

Alternative Inflation Disaggregation

We also examine the hedging qualities of LRE against four specific manifestations of inflation. Following Fang et al. (2022), we decompose the overhead inflation to Energy, Food, and Core by using their corresponding CPI. Furthermore, we extend those three measurements by using the Housing CPI. By conducting the same methodology as in Markov-Switching Vector Error Correction Model (MS-VECM) section, we get results for the long and short run. Table 4 displays the long-run results, while Fig. 4 illustrates the short-run effects.

Time-Varying Short-Term Impact of Inflation on Real Estate Equity Returns. a.U.S. Time-Varying Coefficient of Food Inflation. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). b.U.S. Time-Varying Coefficient of Core Inflation. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). c. U.K. Time-Varying Coefficient of Energy Inflation. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). d. Japan Time-Varying Coefficient of Food Inflation, Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). e. Japan Time-Varying Coefficient of Core Inflation. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). f. Japan Time-Varying Coefficient of Housing Inflation. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6). g. Australia Time-Varying Coefficient of Energy Inflation. Note: The time-varying coefficient is calculated by multiplying the smoothed probability of Regime 1 with the coefficient of expected or unexpected inflation in Regime 1 plus the smoothed probability of Regime 2 multiplied by the coefficient of expected or unexpected inflation in Regime 2. If the estimated coefficient in Eq. (3) is statistically insignificant, it is restricted to zero in the estimation of time-varying coefficient (Eqs. 5 and 6)

In the long run, LRE is a good hedge against energy inflation. For Japan, the hedging capability against energy inflation is perverse. By investigating the effects of food inflation on LRE, we identify hedging characteristics for the UK and Japan in the long run. In the case of core inflation, LRE might be a good protection in Japan. For the US and UK, we do not find any significant hedging capability. This is consistent with the work by Fang et al. (2022). They find that currencies, commodities, and real estate also mostly hedge against energy but not core inflation.

Turning to the short-term hedging properties, the hedging capability of LRE is getting negative during stable periods for food and core inflation in US. In Japan LRE provides good protection against energy, food, and housing inflation during stable periods in the short term. However, for Japan, the relationships become zero or negative during the turbulent period. As shown in Fig. 4, the coefficient in the US varies between 0.000 and -9.000 for energy inflation. In Regime 1 (stable periods), the coefficient remains zero, but in Regime 2, the coefficient becomes negative.

As illustrated in Fig. 4, in the UK, LRE acts as a significant perverse hedge for energy inflation in the short term. In Australia, the short-term relationship between energy inflation and LRE is positive. Connecting to Connolly and Stivers (2022), they find that the relation between REIT returns and core-inflation shocks is never significantly different during weaker economic periods.

Income and Capital Returns

To dig deeper into the relationship between LRE returns and inflation, we extend our analysis by incorporating two additional variables: capital and income returns. This allows us to examine the relative contribution of income and capital returns in hedging inflationary pressures.

Our analysis reveals that the price appreciation component demonstrates a significant and effective long-term hedge against expected inflation. However, we find no discernible hedging capabilities in the long run for income returns, as indicated in Table 5. This indicates that the long-term hedging ability of LRE comes from capital appreciation. In other words, although sometimes rents may not keep up with inflation due to some restrictions in lease contracts during high inflation periods, the cap rates may compress, or more precisely, the spreads narrow, given investors’ expectations regarding future inflation risk. Investors may perceive a lower risk for real estate assets partially as the result of a widespread belief in real estate’s inflation-hedging properties when they expect a high inflation risk.

In the short term, our investigation uncovers hedging capabilities for price returns with respect to expected inflation (Fig. 5), and for income returns with respect to unexpected inflation (Fig. 6). Moreover, we observe a negative relationship between the hedging capability of price returns and the unexpected component of inflation, with this negative association becoming more pronounced during periods of heightened turbulence, as depicted in Fig. 5. This indicates that rental revenues can protect investors against short-term unexpected inflation risk, given the characteristics of the lease structure. Cap rates may compress when investors expect high inflation in the near future. However, when inflation rises more than expected or becomes more volatile, the cap rate may still increase due to the high uncertainty for the future. As a result, price returns may be negatively related to unexpected inflation, especially during the turbulent period.

Overall, our results indicate that capital returns effectively hedge against expected inflation both in the long term and during stable periods in the short term. Meanwhile, income returns serve as a hedge against unexpected inflation only during stable periods over the short term. These findings shed light on the differential hedging characteristics of income and capital return components in relation to inflation, providing valuable insights for investors and policymakers.

Housing Rent Modified Inflation Index

In recognizing the existence of alternative measures of inflation, we employ the Penn State/ACY Alternative Inflation Index as a substitute measure. This index, initially introduced by Ambrose et al. (2015) and subsequently refined by Ambrose et al. (2022), incorporates their Marginal Rent Index, which captures house price changes based on marginal rents, presenting a distinct perspective on inflation dynamics. Although housing rent is the most important component of price indexes (around 33% of CPI), the existing CPI rent index underrepresents rent changes between leases, and also underestimates the volatility due to valuation smoothing and significant time lags (Ambrose et al., 2022). The ACY index is based on a landlord-based net rent income index with several advantages. The NRI is based on market prices, reflects new and existing leases, and is updated monthly. Given data availability, the tests are only conducted for the US.

Our findings indicate that LRE exhibits stronger protective characteristics against the ACY inflation index and ACY core inflation index, compared to their unadjusted counterparts. Table 6 exhibits the long-term relationships, indicating that the coefficients based on the ACY indices demonstrate a higher degree of hedging for LRE, as compared to the conventional inflation measures. In the short-term, we observe no hedging capabilities when the classic CPI indexes are used to measure inflation. By contrast, there are positive hedging capabilities discernible when ACY indices are used, as depicted in Fig. 7.

This is in line with our expectations. When housing rent is better reflected in the CPI index, LRE shows a better hedging ability. In other words, the hedging ability of LRE may have been underestimated in previous literature due to the problem associated with rent components. This underscores the importance of considering housing rent-adjusted inflation measures when evaluating the inflation-hedging effectiveness of LRE.

Lower Frequency Test

To enhance the robustness of our findings, we augment our analysis by including quarterly data for the US, spanning from 1975 to the first quarter of 2023. The long-term relationship with expected inflation remains robust, as shown in Table 7. A one percent increase in expected inflation is associated with a 2.076 percent increase in the return, higher than the coefficient based on the monthly data. In contrast, the results based on quarterly data also indicate a significant negative relationship with unexpected inflation.

Moreover, in the short term, our analysis fails to reveal any significant evidence of hedging capabilities against either expected or unexpected inflation. The divergent results may be caused by the reduced number of observations when using quarterly data. The short-term equation encompasses 12 endogenous variables, two to four error correction terms, and two regimes. Given the limited number of observations (around 190) in relation to the numerous endogenous variables, the efficiency of the nonlinear Markov regime-switching model may be compromised, leading to an increase in the standard error of the parameters.

Inflation-Hedging Portfolios

In this section, we construct an inflation-hedging portfolio. We examine the case of an investor wishing to hedge inflation over her investment horizon with a minimum target return. The optimal allocations are determinted by minimizing the shortfall probability under the constraint that real returns exceed the investor's desired target (Brière & Signori, 2012).

where \({R}_{T}=({R}_{1T}, {R}_{2T}, \dots , {R}_{nT})\) is the annualized return of the n assets in the portfolio over the investment horizon T; \(w=({w}_{1}, {w}_{2}, \dots , {w}_{n})\) is the part of the capital invested in the asset I; \({\pi }_{T}\) is the annual inflation rate during that horizon T; and \(\overline{R}\) is the minimum target return in excess of inflation. E is the expectation operator concerning the probability distribution P of the asset returns.

We present optimal portfolios using the shortfall probability approach for the US, UK, Japan, and Australia for a minimum target return of 3% and an investment horizon of T (T = 2 years, rebalancing every two years).Footnote 13 Our analysis encompasses a diverse set of assets, incorporating LRE, stocks, oil, gold, silver, agricultural commodities, and inflation-linked government bonds. In refining our investment portfolios, we strategically add inflation-linked government bonds to our existing assets. We use the Bloomberg Global Inflation-Linked Total Return Index for the respective countries. Since the availability of the selected inflation-linked indexes is limited, the portfolios for the US and the UK start in 1998, for Japan in 2004, and for Australia in 2012. Figure 8 illustrates the calculated weights over time for each country.Footnote 14 As expected, the weights for LRE vary over time. In the four regions, we find higher weights for LRE from 2004 to 2005 and from 2012 to 2015, compared to other periods. This might be explained by the rapid growth of LRE in these regions during the abovementioned periods. It is interesting to note that even in the mean–variance setting, inflation-linked government bonds always play a noticeable role in the portfolio. This can be explained by the fact that inflation-linked bonds can achieve a desirable risk-adjusted return (Campbell et al., 2009; Pflueger & Viceira, 2011).

Portfolio Optimizations [Rebalancing Every 2 Years]. a. Weights of Shortfall Probability, Mean–Variance, and Lower Partial Moments for the US. b. Weights of Shortfall Probability and Mean–Variance for the UK. c. Weights of Shortfall Probability and Mean–Variance for Japan. d. Weights of Shortfall Probability and Mean–Variance for Australia

In all four countries, the inflation-hedging portfolio indicates materially higher weights for LRE compared to the standard mean–variance portfolios, while the LPM optimization gives a slightly higher weighting to LRE in the UK. This is in line with the desired inflation-hedging properties of LRE. For instance, for the US, over the 2012 to 2019 period, the mean–variance portfolio suggests 4.69% for US LRE, but the inflation-hedging portfolio suggests 14.35%. On average, over the entire sample period, the inflation-hedging portfolios indicate 8.32%, 10.87%, 8.55%, and 32.15% weights for the US, the UK, Japan, and Australia, respectively. Meanwhile, the mean–variance portfolios suggest only 4.74%, 8.68%, 1.32%, and 18.65%, respectively, for the four countries.

Moreover, the inflation-hedging portfolios provide higher expected returns than the mean–variance portfolios. Table 8 reports summary statistics for the portfolios, averaged across all years. As shown in Table 8, inflation-hedging portfolios achieve an average annual expected return between 5.67% (Australia) and 8.61% (UK), while the average annual expected return of the mean–variance portfolio is less than that of the inflation-hedging portfolios. If we consider risk, as measured by the variance, the inflation-hedging portfolios also achieve a higher Sharpe ratio than the mean–variance portfolios in the UK, Japan, and Australia. If we measure the risk by the probability of shortfall, as shown in Table 8, in the US, the UK, and Australia, the inflation-hedging portfolio achieves a lower probability of shortfall, meanwhile a higher average expected return than the mean–variance portfolio. This can be explained by the fact that the mean–variance portfolio uses variance as the risk measure, which may not be what corresponds best to investors' objectives, as variance treats both upside and downside risk as the same. An inflation-hedging portfolio focuses on minimizing the downside inflation risk, and, therefore, can outperform the mean–variance one.

When compared to the LPM portfolio, the inflation-hedging portfolio shows a more comparable performance, but the LPM portfolio slightly outperforms the inflation-hedging portfolio. This is in line with our expectations because of the desirable attributes of the LPM portfolio. First, similar to the inflation-hedging portfolio, LPM also separates the analysis of upside and downside risk, focusing on negative returns. Second, LPM additionally provides flexibility by allowing adjustments of risk aversion levels, while an inflation-hedging portfolio does not allow for this. Therefore, LPM proves to be more robust in dealing with non-symmetric or non-normally distributed returns. However, we also find that, except for Japan, the inflation-hedging portfolio achieves a lower likelihood of falling below the minimum target return. Thus, the inflation-hedging portfolio still has merit for investors who want to hedge against inflation and minimize the likelihood of not reaching the minimum target return.

Conclusion

Since 2022, inflation has again become a global concern. Hence, investors need to understand the inflation-hedging ability of the different asset classes. Using 1975 to 2023 data for LRE companies for the US, and three other economies – the UK, Japan, and Australia – from 1990 to 2023, our paper analyzes whether listed real estate can be used to hedge against inflation. Overall, our study confirms the desired inflation-hedging properties of LRE. Our main findings can be summarized as follows.

First, listed real estate is a good hedge against inflation, but mainly against expected inflation and in the long term. We furthermore note, that the long-term hedging ability of LRE comes from value appreciation. Moreover, because most commercial leases are long-term, the hedging capability of listed real estate assets is particularly striking over a long-time horizon. Additionally, in the long term, LRE provides better hedging against inflation than stocks.

Second, the short-term hedging ability moves toward being negative during turbulent periods. In stable periods, LRE provides good protection against inflation, but the ability becomes negative or zero in times of turbulence. On the other hand, this will also indicate that if deflation happens during turbulent periods, LRE performance will not be adversely affected by deflation. From an investor's perspective, the efficiency of LRE as an inflation hedge is highly dependent on the time horizon.

Third, the inflation hedging ability of LRE also varies across countries. In all four economies, although LRE provides long-term hedging against expected inflation, we see no hedging or perverse hedging characteristics against unexpected inflation. Expected inflation shows the highest long-term elasticity to real estate equity returns in Japan, amounting to 11.182%. In the short term, LRE in the US, the UK, and Australia provide short-term positive inflation hedging against expected inflation, by a 0.430, 4.630, and 1.320 percent increase, respectively, with a one percent increase in expected inflation.

Fourth, the disaggregation of inflation into energy, food, core, and housing CPIs indicates that LRE is adequately hedged against core, food, and housing inflation in Japan. In Australia, we observe positive hedging characteristics concerning the energy inflation. Furthermore, we observe perverse hedging effects for food and core inflation in the US, and energy inflation in the UK.

Fifth, we show that in the long-run the hedging quality comes from value appreciation and not from income returns. In the short-run, we find hedging capabilities for price returns against expected inflation, for income returns against unexpected inflation.

Sixth, our robustness tests incorporating a rent-adjusted inflation index reveal a superior hedging ability for LRE compared to when an unadjusted inflation index is used. This finding suggests that the hedging potential of LRE might have been downplayed in previous studies, which primarily utilized an unadjusted inflation index.

Finally, our inflation-hedging portfolios provide more realistic and less extreme allocations to listed real estate than when the standard mean–variance approach is used. The mean–variance approach uses variance as the risk measurement, which may not correspond best to investors' objectives. Instead, the inflation-hedging portfolio uses the expected shortfall as the risk measure, which focuses on the risk of being far below the expected real return (i.e., the downside risk). Based on an inflation-hedging portfolio composed of LRE, stocks, oil, gold, silver, agricultural commodities, and inflation-linked government bonds, LRE plays a significant role in an investor's portfolio. The average percentages of the portfolios for the US, UK, Japan, and Australia over the entire period are 8.32%, 10.87%, 8.55%, and 32.15%, respectively, clearly highlighting the benefits of holding listed real estate for investors. The inflation-hedging portfolio also shows a desirable performance. It provides a higher Sharpe ratio than the mean–variance approach for the UK, Japan, and Australia. It also achieves a lower shortfall probability in the US, UK, and Australia and a higher average expected return than the mean–variance portfolio in all four regions. When compared to the LPM portfolio, the inflation-hedging portfolio shows a more comparable performance, but the LPM portfolio slightly outperforms the inflation-hedging portfolio. However, we also find that, except for Japan, the inflation-hedging portfolio achieves a lower likelihood of falling below the minimum target return. Thus, the inflation-hedging portfolio still has merit for investors who want to hedge against inflation and minimize the likelihood of not reaching the minimum target return.

Data Availability

The data that support the findings of this study are available upon request from the corresponding author.

Notes

Ambrose et al. (2015) indicate that the BLS rent index lags the contemporaneous market rent by approximately one year because of its sampling and index construction method.

A comprehensive summary of the existing literature can be found in Arnold and Auer (2015).

A comprehensive summary of the existing literature can be found in Worzala and Sirmans (2003).

Because GDP is only available on a quarterly basis, we use temporal disaggregation. Temporal disaggregation methods are used to disaggregate and interpolate a low frequency time series to a higher frequency series. Using real GDP provides similar results.

To obtain the real three-month Treasury Bill rates, we employ a deflation process on the corresponding nominal rates.

The coefficients of the co-integrating relationships (co-integration vectors) and of the error correction term are contained in the matrix \(\pi\), with \(\pi =\alpha \beta {\prime}\), where \(\beta\) represents a (n × r) matrix of the r co-integrating vectors. The (n × r) matrix \(\alpha\) contains the so-called loading parameter, i.e., those coefficients that describe the contribution of the r long-term relationships in the individual equations. \({\zeta }_{t}={Y}_{t}-\beta {X}_{t}\), where \({\zeta }_{t}\) is called the error correction term. The coefficient \(\beta\) is the cointegrating coefficient, and it represents the long-term relationship between \({X}_{t}\) and \({Y}_{t}\).

We use the Expectation–Maximization (EM) algorithm to estimate the parameters of the Markov-switching model and to identify the different states or regimes by maximizing the data likelihood function. In our case, the EM algorithm is used to estimate the parameters that govern the probability of switching from one state (or regime) to another, as well as the parameters of each individual state.

The large coefficient in Japan is caused by the low standard deviation of expected inflation in that country. If we use economic interpretation by multiplying the coefficient with the standard deviation of the variable, we can conclude that a one standard deviation increase in expected inflation leads to an increase in LRE returns by 0.868 standard deviation.

The negative long-term relationship between GDP and LRE is contradictory to our expectation, which may be due to the merged crises during the sample period. To test our argument, we add a crisis dummy into the long-term relationship equations, and the coefficients for GDP become positive. However, the coefficients for expected and unexpected inflation in the long-term relationships remain very robust. So, we keep our baseline model as the one without a crisis dummy. Detailed results are available upon request.

If the estimated coefficient is statistically insignificant, we restrict this coefficient to be zero.

The extreme large coefficient in Japan is caused by the low standard deviation of expected inflation in Japan. An increase in expected inflation by one standard deviation might lead to an increase in LRE returns by 0.429 standard deviations.

Our analysis based on dividend yields and price appreciate index confirm these arguments. The detailed results and discussions are in 4.3.2.

The results pertaining to the average weight of LRE in an optimal portfolio composition over a 2-year, 5-year, 10-year, and 30-year investment horizon for the US are shown in Appendix 3. In addition, the results for a variety of minimum target returns are presented for the US. As shown in Appendix 3, the weight for listed real estate varies between 2.67% and 8.32% as the investment horizon changes.

Appendix 4 shows the portfolio return distributions for the inflation hedging portfolios for each economy.

References

Ambrose, B. W., Coulson, N. E., & Yoshida, J. (2015). The repeat rent index. Review of Economics and Statistics, 97(5), 939–950.

Ambrose, B. W., Coulson, N. E., & Yoshida, J. (2022). Housing rents and inflation rates. Journal of Money, Credit and Banking, 55(4), 975–992.

Arnold, S., & Auer, B. R. (2015). What do scientists know about inflation hedging? North American Journal of Economics and Finance, 34, 187–214.

Bahram, A., Arjun, C., & Kambiz, R. (2004). REIT investments and hedging against inflation. Journal of Real Estate Portfolio Management, 10(2), 97–112.

Bampinas, G., & Panagiotidis, T. (2015). Are gold and silver a hedge against inflation? A two century perspective. International Review of Financial Analysis, 41, 267–276.

Beckmann, J., & Czudaj, R. (2013). Gold as an inflation hedge in a time-varying coefficient framework. North American Journal of Economics and Finance, 24, 208–222.

Bilgin, M. H., Gogolin, F., Lau, M. C. K., & Vigne, S. A. (2018). Time-variation in the relationship between white precious metals and inflation: A cross-country analysis. Journal of International Financial Markets, Institutions and Money, 56, 55–70.

Bitsch, F., Buchner, A., & Kaserer, C. (2010). Risk, return and cash flow characteristics of infrastructure fund investments. EIB Papers, 15, 106–136.

Blanchard, O., & Quah, D. (1989). The dynamic effects of aggregate demand and supply disturbances. American Economic Review., 79(4), 655–673.

Bodie, Z. (1976). Common stocks as a hedge against inflation. Journal of Finance, 31, 459–470.

Brière, M., & Signori, O. (2012). Inflation-hedging portfolios: Economic regimes matter. Journal of Portfolio Management, 38, 43–58.

Burns, W. L., & Epley, D. R. (1982). The performance of portfolios of REITs + stocks. Journal of Portfolio Management, 8(3), 37–42.

Byrne, P., & Lee, S. (2004). Different risk measures: Different portfolio compositions? Journal of Property Investment & Finance, 22(6), 501–511.

Campbell, J. Y., Shiller, R. J., & Viceira, L. M. (2009). Understanding inflation-indexed bond markets. NBER Working Paper Series.

Chan, K. C., Hendershott, P. H., & Sanders, A. B. (1990). Risk and return on real estate: Evidence from equity REITs. Real Estate Economics, 18(4), 431–452.

Chatrath, A., & Liang, Y. (1998). REITs and inflation: A long-run perspective. Journal of Real Estate Research, 16(3), 311–326.

Chen, K., & Tzang, D. (1988). Interest-rate sensitivity of real estate investment trusts. Journal of Real Estate Research, 3(3), 13–22.

Chiang, K. C., Kozhevnikov, K., Lee, M. L., & Wisen, C. H. (2008). Further evidence on the performance of funds of funds: The case of real estate mutual funds. Real Estate Economics, 36(1), 47–61.

Chiang, M. C., Sing, T. F., & Wang, L. (2020). Interactions between housing market and stock market in the United States: A Markov switching approach. Journal of Real Estate Research, 42(4), 552–571.

Connolly, R. A., & Stivers, C. T. (2022). returns and inflation shocks with economic state dependencies. Working Paper.

Conover, M., Friday, S., & Sirmans, S. (2002). Diversification benefits from foreign real estate investments. Journal of Real Estate Portfolio Management, 8(1), 17–25.

Demary, M., & Voigtländer, M. (2009). The inflation hedging properties of real estate. ERES Conference.

Eichholtz, P. (1996). The stability of the covariances of international property share returns. Journal of Real Estate Research, 11(2), 149–158.

Ennis, R. M., & Burik, P. (1991). Pension fund real estate investment under a simple equilibrium pricing model. Financial Analysts Journal, 47(3), 20–30.

Fama, E. F., & Schwert, G. W. (1977). Asset returns and inflation. Journal of Financial Economics, 5, 115–146.

Fang, X., Liu, Y., & Roussanov, N. (2022). Getting to the core: Inflation risks within and across asset classes. Working Paper Series, No. w30169.

Fehrle, D. (2023). Hedging against inflation: housing versus equity. Empirical Economics. https://doi.org/10.1007/s00181-023-02449-z

Firstenberg, P. M., Ross, S. A., & Zisler, R. C. (1988). Real estate: The whole story. Journal of Portfolio Management, 14(3), 22.

Fisher, I. (1930). In: The Theory of Interest. The Macmillan Co.

Fogler, H. R. (1984). 20% in real estate: Can theory justify it? The Journal of Portfolio Management, 10(2), 6–13.

Ganesan, S., & Chiang, Y. (1998). The inflation-hedging characteristics of real and financial assets in Hong Kong. Journal of Real Estate Portfolio Management, 4, 55–67.

Giannotti, C., & Mattarocci, G. (2013). Risk measurement choice in selecting REITs: Evidence from the US market. Journal of Real Estate Portfolio Management, 19, 137–153.

Giliberto, M. (1990). Equity real estate investment trusts and real estate returns. Journal of Real Estate Research, 5(2), 259–263.

Glascock, J. L., Lu, C., & So, R. W. (2002). REIT returns and inflation: Perverse or reverse causality effects? Journal of Real Estate Finance and Economics, 24, 301–317.

Gyourko, J., & Linneman, P. (1988). Owner-occupied homes, income-producing properties, and REITs as inflation hedges: Empirical findings. Journal of Real Estate Finance and Economics, 1, 347–372.

Hamilton, J. D. (1989). A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica, 57, 357–384.

Hardin, W. G., Jiang, X., & Wu, Z. (2012). REIT stock prices with inflation hedging and illusion. Journal of Real Estate Finance and Economics, 45(1), 262–287.

Hoesli, M. (1994). Real estate as a hedge against inflation: Learning from the Swiss case. Journal of Property Valuation and Investment, 12, 51–59.

Hoesli, M., & Hamelink, F. (1997). An examination of the role of Geneva and Zurich housing in Swiss institutional portfolios. Journal of Property Valuation and Investment, 15, 374–391.

Hoesli, M., Lizieri, C., & Macgregor, B. (2008). The inflation hedging characteristics of US and UK investments: A multi-factor error correction approach. Journal of Real Estate Finance and Economics, 36, 183–206.

Hutson, E., & Stevenson, S. (2008). Asymmetry in REIT returns. Journal of Real Estate Portfolio Management, 14, 105–124.

Lee, M. T., & Lee, M. L. (2012). Long-run inflation-hedging properties of United State equity real estate investment trusts (REITs): Before and after the structural break in the 1990s. African Journal of Business Management, 6(6), 2162–2168.

Lee, M. T., Lee, M. L., Lai, F. T., & Yang, T. H. (2011). Do real estate stocks hedge inflation in the long run? Evidence from three East Asian emerging markets. Journal of Real Estate Literature, 19(2), 345–372.

Lee, S., & Stevenson, S. (2005). The consistency of private and public real estate within mixed-asset portfolios. Working Papers in Real Estate & Planning. 08/05. Working Paper (pp. 14). Reading: University of Reading.

Leibowitz, M., & Henriksson, R. D. (1989). Portfolio optimization with shortfall constraints: A confidence-limit approach to managing downside risk. Financial Analysts Journal, 45, 34–41.

Leibowitz, M., & Kogelman, S. (1991). Asset allocation under shortfall constraints. Journal of Portfolio Management, 17, 18–23.

Limmack, R. J., & Ward, C. W. R. (1988). Property returns and inflation. Land Development Studies, 5, 47–55.

Liu, C. H., Hartzell, D. J., & Hoesli, M. E. (1997). International evidence on real estate securities as an inflation hedge. Real Estate Economics, 25, 193–221.

Lizieri, C., Mansley, N., & Wang, Z. (2022). Real estate in a mixed-asset portfolio: The impact of market uncertainty and uncertainty aversion. EPRA Report.

Lucas, A., & Klaassen, P. (1998). Extreme returns, downside risk and optimal asset allocation. Journal of Portfolio Management, 25, 71–79.

Lucey, B. M., Sharma, S. S., & Vigne, S. A. (2017). Gold and inflation(s)–A time-varying relationship. Economic Modelling, 67, 88–101.

Miles, M., & McCue, T. (1982). Historic returns and institutional real estate portfolios. Real Estate Economics, 10(2), 184–199.

Murphy, J. A., & Kleiman, R. T. (1989). The inflation-hedging characteristics of equity REITs: An empirical study. Quarterly Review of Economics and Business, 29(3), 95–102.

National, T.-F., & Low, S.-H. (2000). The inflation-hedging characteristics of real estate and financial assets in Singapore. Journal of Real Estate Portfolio Management, 6, 373–385.

Newell, G., & Marzuki, M. J. B. (2016). The significance and performance of UK-REITs in a mixed-asset portfolio. Journal of European Real Estate Research, 9(2), 171–182.

Park, J. Y., Mullineaux, D. J., & Chew, I.-K. (1990). Are REITs inflation hedges? Journal of Real Estate Finance and Economics, 3, 91–103.

Pflueger, C. E., & Viceira, L. M. (2011). Inflation-indexed bonds and the expectations hypothesis. Annual Review of Financial Economics, 3(1), 139–158.

Ruhmann, S., & Woolston, C. (2011). US Private core real estate investing. NEPC.

Sargent, T. J., & Wallace, N. (1981). Some unpleasant monetarist arithmetic. Federal Reserve Bank of Minneapolis, vol. 5 (Fall).

Smith, G., & Gould, D. (2007). Measuring and controlling shortfall risk in retirement. Journal of Investing, 16, 82–95.

Sukcharoen, K., & Leatham, D. (2016). Mean-variance versus mean–expected shortfall models: An application to wheat variety selection. Journal of Agricultural and Applied Economics, 48(2), 148–172.

Taylor, J. B. (2000). Low inflation, pass-through, and the pricing power of firms. European Economic Review, 44(7), 1389–1408.

Titman, S., & Warga, A. (1989). Stock returns as predictors of interest rates and inflation. Journal of Financial and Quantitative Analysis, 24, 47–58.

Worzala, E., & Sirmans, C. F. (2003). Investing in international real estate stocks: A review of the literature. Urban Studies, 40(5–6), 1115–1149.

Wurstbauer, D., & Schäfers, W. (2015). Inflation hedging and protection characteristics of infrastructure and real estate assets. Journal of Property Investment and Finance, 33, 19–44.

Yobaccio, E., Rubens, J., & Ketcham, D. (1995). The inflation hedging properties of risk assets. The case of REITs. Journal of Real Estate Research, 10, 279–296.

Acknowledgements

The authors thank the European Public Real Estate Association (EPRA) for funding. They alone are responsible for any errors.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Figure9

Appendix 2

Table 9

Appendix 3

Table 10

Appendix 4

Figure 10

Portfolio Return Distribution. Note: Appendix 4 plots the distribution of portfolio returns for our inflation hedging portfolios. Panel a) is the distribution of US portfolio returns. Panel b) is based on the portfolio returns of the UK. Panel c) and d) are based on the portfolio returns of Japan and Australia, respectively

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Muckenhaupt, J., Hoesli, M. & Zhu, B. Listed Real Estate as an Inflation Hedge Across Regimes. J Real Estate Finan Econ (2023). https://doi.org/10.1007/s11146-023-09964-x

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-023-09964-x