Abstract

Documenting the interlinkages among assets that are widely used to hedge against inflation is crucial for investors, as the necessity to protect the investment portfolio is stronger under inflationary conditions. For this purpose, we investigate the volatility spillovers between treasury inflation-protected securities (TIPS) and a battery of other assets perceived as inflation hedges, including bonds, gold, real estate, oil and equities. The applied methodology comprehends the time-varying parameter vector autoregressive (TVP-VAR) extension of the Diebold and Yilmaz (Int J Forecast 28:57–66, 2012, 10.1016/j.ijforecast.2011.02.006) approach for the period 1/1/2010–3/31/2022. Our results indicate that the assets under consideration are moderately interconnected and subjected to several exogenous shocks, such as the US–China trade war, the COVID-19 pandemic and the Russia–Ukraine war. Furthermore, we assess the hedging effectiveness of TIPS against each asset by estimating hedge ratios and optimal portfolios weights, before and after the spread of COVID-19 pandemic, by using conditional variance estimations (DCC-GARCH). The empirical findings show that the short position in the volatility of TIPS is proved to be an excellent hedge for all the sampled assets, with the exception of short-term Treasury bonds, and their hedging ability was improved during COVID-19.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Inflation, as it is known, is a percentage that measures the positive increase in the price of goods and services in an economy throughout time caused by economic shocks, including, but not limited to, changes in the demand and supply of goods and services, cost of material and labor. It is considered to be one of the most important macroeconomic factors as it heavily influences the economic stability, growth and welfare of countries. According to Friedman (1970), inflation is always a money issue, indicating that this phenomenon occurs due to a significant increase in the money supply, which does not affect the output level of the economy. On the other hand, inflation-targeting is used by most central banks in order to maintain inflation rates at desirable levels, 2% as a rule of thumbFootnote 1. In this way, the positive impact of this phenomenon is unleashed, which is an output increase by using unused resources, lowering unemployment and encourage borrowing which boosts the overall spending in the economy. However, long-term inflation, even at optimal levels, can compromise the profitability of investments especially in the case of low nominal portfolio returns. The real returns erode even further in cases when central banks fail to anchor inflation at 2% target, but, instead, spikes unexpectedly higher during periods of expansionary monetary policies. In June 2021, the inflation rate in the US jumped to 5.4%Footnote 2 within a year, following the quantitative easing programs during 2020, as part of the COVID-19 relief measures. Another example is the inflation spike subsequent to the quantitative easing program in order to ease the crisis caused by the subprime crisis of 2008 (Papathanasiou et al. 2020).

During inflationary periods, investors prefer to rebalance their portfolios and include assets that offer protection against the rising levels of inflation in order to ensure the profitability of their investments, when measured in real terms. For that reason, the need for the inclusion of inflation-hedging instruments within a portfolio arises. Most of the literature has focused on the ability of gold (Shahbaz et al. 2014; Aye et al. 2016; Conlon et al. 2018), oil (Casassus et al. 2010), equities (Brière and Signori 2013; Ciner 2015), real estate (Salisu et al. 2020; Taderera and Akinsomi 2020) and bonds (Spierdijk and Umar 2015) to hedge against inflation. However, some studies indicate that the aforementioned assets are not able to fully hedge the effects of inflation (Spierdijk and Umar 2015; Van Hoang et al. 2016; Chang 2017; Iqbal 2017).

During the last two decades, TIPS are considered a financial tool which provides strong hedging potential against inflation (Hunter and Simon 2005; Laatsch and Klein 2005). The principal amount of these securities is adjusted on a quarterly basis according to the value of the US Consumer Price Index (CPI) indicator which measures the inflation rate of the US economy. Thus, the bond holder receives at maturity a principal amount that is adjusted for the effects of inflation. Additionally, TIPS pay semiannual coupons. These are also adjusted on the coupon date in order to maintain the analogy between the coupon and the principal amount. Mkaouar et al. (2017) stress the necessity for inflation-indexed bonds and their ability to deal with inflation risk and improve the overall performance of long-term investment portfolios, even when inflation is at desired levels. They conclude that TIPS are highly profitable and superior inflation-hedge when compared with other, commonly used, alternatives. Numerous other studies point out the diversification benefits of TIPS when combined with other assets and highlight TIPS as an ideal instrument for the construction of an efficient portfolio (Kothari and Shanken 2004; Tang et al. 2018; Chopra et al. 2021). Contrariwise, some studies have provided evidence against the effectiveness of inflation linked bonds in inflation hedging and diversification (Dempster and Artigas 2010; Swinkels 2012; Huang and Zhong 2013; Kwak and Lim 2014).

Latest research endeavors have focused on the connectedness of financial markets around the globe and the generated spillover effects with the use of the Diebold and Yilmaz (2012) framework. A big portion of the literature has dealt with the connectedness observed among equities, bonds, gold, oil and real estate. To begin with, multiple papers prove the existence of volatility spillovers from equities, acting as a net transmitter of shocks to other markets (Duncan and Kabundi 2013; Wang et al. 2016; Zhang 2017; Kang et al. 2019; Zhang et al. 2019, 2021; Elsayed et al. 2020; Mandaci et al. 2020; Tiwari et al. 2021; Asadi et al. 2022; Papathanasiou et al. 2022b). On the contrary, bonds (Duncan and Kabundi 2013; Tiwari et al. 2018; Elsayed et al. 2022) and real estate (Liow 2015; Liow et al. 2018) have often cited as markets receiving the transmitted spillovers. The empirical findings regarding oil and gold are not clear, as Maghyereh et al. (2016), Mensi et al. (2019, 2021), Bouri et al. (2022) and Papathanasiou et al. (2022a) document large in magnitude volatility spillovers diffused from the aforementioned assets, whereas Kang and Lee (2019), Zeng et al. (2020), Chen et al. (2022), Dai et al. (2022), Li et al. (2022) and Zhao et al. (2022) find evidence that these assets constitute primarily net receivers. Even though there are numerous studies examining TIPS as an inflation hedge, there is little evidence of its connectedness with other asset classes. Thus, we intend to shed light on the diversification benefits of TIPS and its contribution to the decision-making process of investors. Documenting the interactions of TIPS with assets considered as inflation hedges is imperative for investors, as the necessity to protect the investment portfolio is stronger under inflationary environments.

This study investigates the connectedness between TIPS and various financial assets that are assumed to offset the effects of inflation, such as short-term (1–3 years), medium-term (7–10 years), long-term (20+ years) Treasury bonds, gold, real estate, oil and equities. We also encompass basic macroeconomic and financial variables within the system, which might have affected the channel of the diffused shocks. Volatility spillovers are analyzed by implementing the time-varying parameter vector autoregressive (TVP-VAR) model of Antonakakis et al. (2020), which is based on the framework of Diebold and Yilmaz (2012), for the period 1/1/2010–3/31/2022. This framework has recently been applied in the works of Balcilar et al. (2021), Bouri et al. (2021) and Zhang et al. (2021). Moreover, we provide portfolio strategies with TIPS in order to quantify the diversification benefits that can be added to portfolios consisting of the remaining sampled assets. For this reason, we construct hedge ratios and optimal portfolio weights, by using conditional variance estimations (DCC-GARCH), in the spirit of Guhathakurta et al. (2020). As the COVID-19 pandemic heavily influenced asset price volatilities, we divide the sample period into pre-COVID-19 (1/1/2010–12/31/2019) and COVID-19 (1/1/2020–3/31/2022) periods and shed light on the ability of TIPS to perform as a hedging instrument against the risk deriving from volatility diffusion. In this way, investors would be aware of possible changes in their asset allocation in order to maximize portfolio effectiveness.

Our main objective is to provide sufficient evidence, which will help answer the following research questions:

- RQ1:

-

Are TIPS and other assets commonly used as inflation hedges interconnected?

- RQ2:

-

Has COVID-19 strengthened their interconnection?

- RQ3:

-

What are the added diversification benefits from the inclusion of TIPS in an investment portfolio containing: (a) bonds, (b) gold, (c) real estate, (d) oil and (e) equities?

- RQ4:

-

Did TIPS evolve into a more effective hedging tool during COVID-19?

Our initiative contributes to the existing financial literature in two ways. First, we consider TIPS as an alternative instrument that can be used for optimal asset allocation, by analyzing its connectedness with other major markets for the first time. Our study is motivated by the increasing demand for alternative assets that do not have the trend to move simultaneously with other assets during unstable market conditions, especially in periods where inflation is constantly on the rise and the need for tools that can counterbalance the negative effects of inflation is, also, exigent. For this purpose, we implement the innovative empirical approach of Antonakakis et al. (2020), which enhances the framework of Diebold and Yilmaz (2012). This model provides more accurate parameter estimates by allowing variances to vary overtime, while it is less affected by outliers. Moreover, it does not require the setting of a rolling window size since it utilizes all the attainable information from our sample. Secondly, we provide evidence of the hedging effectiveness of TIPS and their potential contribution to portfolio risk-reduction, by taking into consideration a variety of asset classes, including short-term, medium-term, long-term Treasury bonds and real estate, which have not been investigated extensively. Therefore, exploring the spillover transmission mechanism of TIPS and other assets is necessary in order to discover potential interconnectedness or new hedging opportunities to improve the portfolio diversification during inflationary environments.

Investigating the connectedness among assets provides invaluable input into the decision making of policy makers, governments and regulators for organizing a framework to ensure financial stability. Knowing the direction and magnitude of volatility spillovers of each asset is crucial for investors when determining the optimal allocation and hedging strategies. Finally, our analysis and the estimated portfolio weights provide superior insights to investors for minimizing the risk of portfolio by the use of TIPS.

The rest of this paper is organized as follows: "Data and methodology" in section describes our data sample and the framework used in this study. "Empirical results" in section discusses the outcome of our analysis, and in "Conclusions" in section, a conclusion is provided.

Data and methodology

Data

Sample description

We use several Exchange Traded Funds (ETFs) as proxies that represent each asset class under consideration, as in Kang et al. (2021) and Papathanasiou et al. (2022b). In this way, our sampled ETFs ensure exposure to a basket of assets. We choose iShares ETFs for being one of the world’s global leaders, offering ETFs among the largest in market capitalization. Treasury inflation-protected securities (TIPS) are represented by iShares TIPS Bond ETF (TIP), which seeks to track the performance of Bloomberg Barclays US Treasury Inflation-Protected Securities Index. With regards to short-, medium- and long-term US bonds, we use iShares 1–3 Year Treasury Bond ETF (SHY), iShares 7–10 Year Treasury Bond ETF (IEF) and iShares 20+ Year Treasury Bond ETF (TLT), respectively. Those seek to track the performance of the ICE US Treasury Year Bond Indexes for 1 to 3, 7 to 10, and 20 or more years of maturity of US Treasury bonds, respectively. The exposure to gold and real estate is replicated by iShares Gold Trust (IAU) and iShares US Real Estate ETF (IYR), which track the performance of the price of gold and the US equities in the real estate sector, respectively. As proxies for oil and equities, we take into account the United States Oil Fund LP (USO) and the SPDR S&P 500 ETF Trust (SPY) which correspond the performance of oil and S&P-500 index, respectively. Finally, we also include in our sample commonly used in the literature (Zhang et al. 2019; Umar et al. 2020) macroeconomic and financial variables, such as the Volatility Index (VIX) and the Economic Policy Uncertainty Index (EPU), which might have contributed to the channel of volatility spillovers. Table 1 presents the ETFs considered in the study, along with their corresponding tickers.

As per Luo and Ji (2018), Umar et al. (2020), Yousaf and Ali (2020) and Samitas et al. (2022b), the daily frequency of returns provides a good proxy of the asset volatilities and, therefore, provides the highest explanatory power of the estimated models. Our data covers the period between 1/1/2010 and 3/31/2022 and is obtained from Bloomberg and Thomson Reuters Data Stream. The selected timeframe is of great interest and is regarded as a highly volatile one due to several negative financial shocks (e.g., European debt crisis, Brexit referendum, US-China trade war, COVID-19 pandemic). Our dataset comprises 3,086 daily observations. Following Forsberg and Ghysels (2007), we define the asset price volatility as the absolute returnFootnote 3Vit = |lnPit − lnPit−1|, where Pit is the daily closing price on day t.

Preliminary analysis

The descriptive statistics for the daily return series are presented in Table 2. As it can be seen, based on the estimated coefficients, 50% of the distributions exhibit negative (positive) skewness, indicating a left-tailed (right-tailed) and asymmetric distribution of returns. Although the return distributions of all the daily series are leptokurtic, some asset classes exhibit very high kurtosis, namely gold, real estate, oil and TIPS. Moreover, the normality hypothesis testing of Jarque–Bera (1980) shows that the sample data are not normally distributed. Finally, the augmented Dickey and Fuller (1979) test ensures the absence of unit roots in the time series of the selected assets in our sample.

Methodology

The time-varying parameter vector autoregressive model (TVP-VAR)

We study volatility spillovers by using the time-varying parameter vector autoregressive (TVP-VAR) model of Antonakakis et al. (2020), which is an extension of the connectedness framework that was proposed by Diebold and Yilmaz (2012).

The TVP-VAR framework can be described as:

with

where the sample space of the information available at time t−1 is denoted with Ωt−1, zt−1 represents the vector of lagged dependent variables. The time-varying coefficients are calculated in a N \(\times\) Np matrix denoted as \(A_{t}^{\prime }\) and the error terms are represented by N × 1 vectors of εt and ξt. Moreover, the variance–covariance matrices of the error terms εt and ξt are provided in the Np × Np matrices Σt and Ξt, respectively.

The implementation of the connectedness framework requires the estimation of the time-varying coefficients and variance–covariance matrices defined above. The H-step-ahead generalized forecast error variance decompositions can be obtained by:

where \(\psi_{ij,t}^{2,g}\)(H) = \(\Sigma_{ij,t}^{{ - \frac{1}{2}}}\)Ah,tΣtεij,t, \(\Sigma_{j = 1}^{N} \tilde{\theta }_{ij,t}^{g} (H) = 1\) and \(\Sigma_{i,j = 1}^{N} \tilde{\theta }_{ij,t}^{N} (H) = N\).

Therefore, the total connectedness index is derived as:

The total directional connectedness from market i to all other markets j can be estimated as:

By the same fashion, the total directional connectedness market i received from all other markets j is computed as:

The net total directional connectedness is defined as the difference between the transmitted spillovers by market i and the shocks received from markets j:

Hedge ratios and portfolio weights

In the next section, we estimate hedge ratios, along with optimal portfolio weights, by using conditional variance estimations (DCC-GARCH), in order to evaluate the hedging ability of TIPS. The hedge ratio for a $1 long position in TIPS and a $1 short position in the remaining assets is derived from the following formula:

where β expresses the hedge ratio, \(h_{{{\text{tips}},{\text{ asset}},t}}\) the conditional covariance between TIPS and other assets and \(h_{{{\text{asset, asset, }}t}}\) the conditional variance of the assets’ returns. For the calculation of hedge ratios for a $1 long position in the remaining assets and a $1 short position in TIPS, \(h_{{{\text{asset, asset, }}t}}\) is replaced by \(h_{{{\text{tips, tips, }}t}}\) . A hedge ratio close to zero indicates that TIPS (other assets) is a cheap hedge in contrast to the alternative asset that is compared to.

The optimal weights for constructing the minimum-risk portfolio, consisting of TIPS and other assets, are provided by using the formula of Kroner and Ng (1998):

where \(w_{{{\text{tips, asset, }}t}}\) is the weight of TIPS in a $1 portfolio consisting of TIPS and other assets and \(h_{{{\text{tips, asset, }}t}} ,\;h_{{{\text{tips, tips, }}t}} ,\;h_{{{\text{asset, asset, }}t}}\) defined as above. The optimal weight for other assets is equal to (1−wij,t).

Finally, the hedging effectiveness (HE) of a portfolio including TIPS and other assets is obtained by the following formula:

where \(h_{{{\text{unhedged}}}} \;{\text{and}}\;h_{{{\text{hedged}}}}\) are the variance of unhedged and hedged positions, respectively.

Empirical results

Volatility spillover analysis

Table 3 provides us with the coefficients of the average dynamic connectedness obtained by the TVP-VAR model of Antonakakis et al. (2020) for the period 1/1/2010–3/31/2022. According to the Schwarz information criterion, the optimal lag length is equal to 2 for a 10-day forecast horizon.

Our results indicate moderate volatility spillovers among the asset classes with an average total connectedness value of 43.5%. Large in magnitude volatility spillovers (7–14%) from TIPS to all other markets are documented. These high values of pairwise directional connectedness are expected to a certain extent, as inflation, embedded in TIPS, has a major impact on the global economic environment, affecting every sector of the economy, such as the extraction of raw materials (gold, oil) and manufacturing (real estate). By extension, shocks from real estate and oil to TIPS are also intense (14% and 12%, respectively), since the former markets are one of the primarily main forces of inflation in the economy and TIPS should adjust their principal value as inflation rises. In addition, Treasury bonds are also largely influenced by TIPS, irrespective of their terms to maturity, probably due to the fact that bonds are prone to the aforementioned price adjustment of TIPS as prices rise. Furthermore, a strong bidirectional relationship between Treasury bonds (short-, medium-, long-term) and real estate is reported, as volatility spillovers range from 7 to 14% in every possible combination. This can be attributed to the fact that when interest rates are low, capital flows into properties through cheap banking loans and investors are obtaining higher returns with leverage. As demand increases and supply decreases, the rise of interest rates makes maintaining property investments costlier, forcing investors to pursue investments that will provide them with higher returns, such as bonds. Moreover, a significant unidirectional relationship from Treasury bonds to gold is documented; probably attributable to the fact that interest rate plays an essential role in determining the intrinsic price of gold. When interest rates rise, investing in gold becomes less attractive since it does not offer any interest. As concerns equities, besides the high pairwise directional connectedness to TIPS, we also provide evidence of large volatility spillovers transmitted to medium-term (13%) and long-term (11%) Treasury bonds, consistent with the findings of Samitas et al. (2022a). The remaining values of connectedness are less than 7% and could be considered negligible.

The last row of Table 3 provides us with the estimated values of net directional connectedness of each asset class. Our analysis shows that TIPS are the leading net contributor of volatility spillovers to other assets (28%). We also receive indications of VIX having a strong spillover effect (22%), as in Kang et al. (2021). Equities (16%), oil (8%) and real estate (5%) form the remaining net senders of shocks within the channel. On the contrary, gold is a massive net receiver of spillover effects from other markets (− 44%), primarily due to the shocks absorbed from TIPS (14%). One possible driving force behind this scenario could be the fact that typically the price of gold rises when the cost of living increases due to inflation, establishing in this way gold as a net recipient throughout the sample period. Finally, EPU (− 13%), long-term (− 9%), short-term (− 7%) and medium-term (− 6%) Treasury bonds constitute the remaining net receivers. These results confirm the role of equities (Duncan and Kabundi 2013; Wang et al. 2016; Zhang 2017; Kang et al. 2019; Zhang et al. 2019, 2021; Elsayed et al. 2020; Mandaci et al. 2020; Tiwari et al. 2021; Asadi et al. 2022; Papathanasiou et al. 2022b) and oil (Maghyereh et al. 2016; Mensi et al. 2019, 2021; Bouri et al. 2022; Papathanasiou et al. 2022a) as net contributors of volatility spillovers. On the other hand, our findings are in contrast to the findings of Liow (2015) and Liow et al. (2018) who point out real estate as a net recipient of shocks. Perhaps these diverging results bear upon the selected assets incorporated in our study or the time period under investigation.

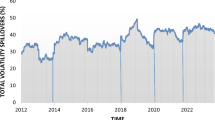

Total dynamic connectedness ranges between 36 and 57% during the sample period, as presented in Fig. 1. As shown, the connectedness plot does not demonstrate intense variations for the period mostly covered. More specifically, total connectedness fluctuates around its mean value for approximately the first half of the sample period, indicating that the sampled markets remained relatively unaffected by several extraneous shocks occurring during 2010–2016, such as the European sovereign debt crisis, the great fall in oil prices and the enforcement of capital controls in Greece. An underlying reason for this stable behavior of connectedness could be attributed to the fact that inflation rates were maintained at optimal levels, not only in the US, but in the Euro area also. However, after the first quarter of 2016, total connectedness started an upward move, from 39 to 48% by the end of 2017. This increase in volatility spillover can be attributed to the unstable period provoked by the UK’s European Union membership referendum and the subsequent Brexit negotiations. Furthermore, total connectedness strengthened even further with the beginning of the US–China trade war, reaching 52% in the mid-2018. After the mid-2018, volatility spillovers gradually started to decrease until the end of 2019, where the outbreak of COVID-19 pandemic sparked off volatilities again from 40% (December 2019) to 54% (August 2021). The vaccination procedures to prevent the spread of the disease resulted in the short-term attenuation of connectedness. However, during the last month of the sample period, we observe a rise in volatility spillovers from 50 to 57%, reaching their peak, undoubtedly due to the start of the Russia–Ukraine war, along with the concomitant rise in inflation rates due to conflict. These results are aligned with the existing literature reporting that connectedness strengthens during turbulent periods (Umar et al. 2020; Wen and Wang 2020; Balcilar et al. 2021; Samitas et al. 2021; Zhang et al. 2021; Kumar et al. 2022; Mensi et al. 2022; Papathanasiou et al. 2022c; Yousaf and Yarovaya 2022). More specifically, we find evidence that the impact of COVID-19 on volatility spillovers exceeded the one caused by the European financial crisis, as outlined by Gunay (2021) and Zhang and Hamori (2021).

Total dynamic connectedness. Note In the figure above, the total volatility spillovers among treasury inflation-protected securities, short-term treasury bonds, medium-term treasury bonds, long-term treasury bonds, gold, real estate, oil, equities, volatility index (VIX) and economic policy uncertainty index (EPU) are illustrated for the period 1/1/2010–3/31/2022. y-axis depicts total volatility spillovers estimated with TVP-VAR method and x-axis time

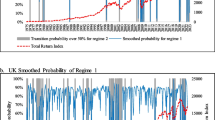

We also present the directional dynamic volatility spillovers for each asset (to, from, net) in Figs. 2, 3 and 4, respectively. As it is evident, TIPS were the biggest contributor of volatility spillovers to other assets during the Brexit referendum, followed by equities. On the other hand, the role of equities in the transmission mechanism expanded during the US–China trade war, affecting long-term Treasury bonds and real estate, which in turn multiplied spillovers to other markets. Moreover, TIPS and oil accelerated their transmitted shocks to other markets during the outbreak of COVID-19, showing that investors are in quest of alternative assets acting as safe-havens during periods of turmoil, as pointed out by Conlon et al. (2018), Bouri et al. (2020) and Akhtaruzzaman et al. (2021). Finally, during the first month of the Russia–Ukraine war, we observe medium-term Treasury bonds to turn into a major sender of volatility spillovers and equities, along with VIX, to be the key factors of the shock diffusion within the system.

Total directional connectedness “to” others. Note In the figure above, the total directional connectedness “to” others is illustrated for treasury inflation-protected securities, short-term treasury bonds, medium-term treasury bonds, long-term treasury bonds, gold, real estate, oil, equities, volatility index (VIX) and economic policy uncertainty index (EPU) for the period 1/1/2010–3/31/2022. y-axis depicts directional volatility spillovers to other markets estimated with TVP-VAR method and x-axis time

Total directional connectedness “from” others. Note In the figure above, the total directional connectedness “from” others is illustrated for treasury inflation-protected securities, short-term treasury bonds, medium-term treasury bonds, long-term treasury bonds, gold, real estate, oil, equities, volatility index (VIX) and economic policy uncertainty index (EPU) for the period 1/1/2010–3/31/2022. y-axis depicts directional volatility spillovers from other markets estimated with TVP-VAR method and x-axis time

“Net” total directional connectedness. Note In the figure above, the net total directional connectedness is illustrated for treasury inflation-protected securities, short-term treasury bonds, medium-term treasury bonds, long-term treasury bonds, gold, real estate, oil, equities, volatility index (VIX) and economic policy uncertainty index (EPU) for the period 1/1/2010–3/31/2022. y-axis depicts net directional volatility spillovers estimated with TVP-VAR method and x-axis time

Portfolio strategies

We investigate the implications of our findings for portfolio diversification by computing hedge ratios and optimal weights, with the usage of conditional variance estimations (DDC-GARCH). Table 4 shows the estimated values for each TIPS-other asset pair for the period before COVID-19 (1/1/2010–12/31/2019). In panel A, we present the results of taking a long position in the volatility of TIPS and a short position in the volatility of other assets. As shown, hedge ratios vary from 0.01 to 3.14. The cheapest hedging strategies for a $1 long position in the volatility of TIPS are obtained by taking a short position in the volatility of real estate and oil (1 cent). The costs of hedging the volatility of TIPS are relatively low, with the exception of short-term Treasury bonds, where $3.14 is necessary to hedge portfolio risk. However, the effectiveness provided by the aforementioned hedging strategies fluctuates at low levels (5–39%), as only the short position in the volatility of short-term Treasury bonds can ensure a risk reduction benefit of 95%.

Results noticeably diverge when the mirror portfolios are taken into consideration. The average hedge ratios range from 0.02 to 2.04, indicating that it is costlier to hedge the volatilities of the remaining assets by taking a short position in the volatility of TIPS. The less expensive hedging strategy is with real estate, as it requires 2 cents in TIPS volatility to hedge against $1 in the real estate volatility. On the contrary, $2.04 is needed in the case of long-term Treasury bonds for the same trading strategy. By extension, the optimal portfolio weights fluctuate between 0.04 and 0.96. The lowest weight (0.04) implies that for a $1 portfolio, 4 cents should be invested in the volatility of short-term Treasury bonds and the remaining 96 (1–0.04) cents should be invested in the volatility of TIPS. Thus, we can infer that investments in short-term Treasury bonds, medium-term Treasury bonds and real estate are required to be larger in amount than investments in oil, equities, gold and long-term Treasury bonds. The results of hedging effectiveness denote that the volatility of other assets can be reduced significantly, as the hedging strategies by exploiting TIPS in a portfolio provide a risk reduction gain between 56% and 92%. On the contrary, TIPS are proven a weak hedge to cut off the volatility risk of short-term Treasury bonds (2%).

Huge changes in the hedging ability of TIPS after the spread of COVID-19 are reported in Table 5. As we can see in Panel A, the hedge ratios are generally lower, indicating that investors need less money to hedge against the volatility of TIPS. However, the hedging effectiveness of portfolios comprising a long position in the volatility of TIPS and a short position in the volatility of the remaining assets was lower after COVID-19. This suggests that the traditional inflation hedges of our sample became even less effective to hedge against the risk deriving from TIPS price volatility. Short-term Treasury bonds retained their hedging ability in the disposal of long position TIPS investors, as the short position in their volatility can curtail risk by 96%.

When the short position in the volatility of TIPS is taken into account (Panel B), the hedging costs of gold, real estate and oil are higher compared to the equivalent before COVID-19, whereas the hedging costs of Treasury bonds and equities have lowered after COVID-19. The range of hedge ratios has declined from 0.07 to 1.52. The most expensive strategy is still with long-term Treasury bonds, requiring $1.52 in TIPS volatility as a hedge. On the other hand, TIPS are a cheap tool for long position short-term Treasury bond investors, as 7 cents are needed to hedge against $1 in their volatility. Hedging efficiency in most cases rose, indicating that TIPS turned into a more efficient hedging tool during COVID-19. The highest hedging effectiveness can be achieved by holding a long position in the volatility of gold and a short position in the volatility of TIPS, as it produces 99% efficiency. Finally, TIPS are still an inappropriate choice for long position short-term Treasury bond investors in order to reduce their portfolio risk.

Conclusions

Motivated by the incessant need for assets that improve the diversification of portfolios, we examine the volatility spillover effects between TIPS and other traditional inflation hedges, including bonds, gold, real estate, oil and equities. We also encompass influential macroeconomic and financial variables within the transmission channel which might have played an essential role to the diffusion of shocks. Connectedness is analyzed by carrying out the time-varying parameter vector autoregressive (TVP-VAR) advanced modification of the Diebold and Yilmaz (2012) framework, covering the period 1/1/2010–3/31/2022. Furthermore, we explore portfolio hedging strategies with TIPS by computing hedge ratios and optimal weights, by using conditional variance estimations (DCC-GARCH). We split the sample period into pre-COVID-19 (1/1/2010–12/31/2019) and COVID-19 (1/1/2020–3/31/2022) periods in order to investigate changes in the ability of TIPS to act as a hedging tool during the coronavirus pandemic. Our purpose behind this approach is to provide investors with explicit hedging schemes in the context of COVID-19 for an optimal asset allocation to be accomplished.

Our results show moderate volatility transmissions among the assets under investigation, with TIPS being the largest net sender of volatility spillovers to other assets, followed by VIX, equities, oil and real estate. Contrastingly, gold forms the major net recipient of spillover effects, with EPU, long-term, short-term and medium-term Treasury bonds following. The spillover results support the view that equities (Duncan and Kabundi 2013; Wang et al. 2016; Zhang 2017; Kang et al. 2019; Zhang et al. 2019, 2021; Elsayed et al. 2020; Mandaci et al. 2020; Tiwari et al. 2021; Asadi et al. 2022; Papathanasiou et al. 2022b) and oil (Maghyereh et al. 2016; Mensi et al. 2019, 2021; Bouri et al. 2022; Papathanasiou et al. 2022a) contribute by sending shocks to other markets within the transmission mechanism. On the other hand, our findings are contrary to the findings of Liow (2015) and Liow et al. (2018) who document real estate as a net receiver of volatility spillovers. Dynamic connectedness showed accretion during periods of turmoil, such as the US–China trade war, COVID-19 and the Russia–Ukraine war, indicating that volatility spillovers are prone to extraneous shocks, as cited by the literature (Umar et al. 2020; Wen and Wang 2020; Balcilar et al. 2021; Samitas et al. 2021; Zhang et al. 2021; Kumar et al. 2022; Mensi et al. 2022; Papathanasiou et al. 2022c; Yousaf and Yarovaya 2022). Moreover, the empirical results indicate that the short position in the volatility of TIPS is proved to be an efficient hedge for all the sampled assets, with the exception of short-term Treasury bonds, and their hedging ability was enhanced during COVID-19.

This study concludes the following remarks. First, policy-makers, governments and regulators should take into consideration the dynamic interactions among the markets observed, especially during crisis periods where connectedness tends to intensify, in order to establish pertinent frameworks to prevent financial instabilities. Second, our empirical results provide a great source of information to investors as we produce patterns that allow the minimization of risk by using TIPS, without hindering the performance of portfolios. More specifically, as gold and long-term Treasury bonds are found to be markets that primarily receive the diffused shocks within the channel, investors possessing a long position in the volatility of these assets should exploit TIPS in order to protect their investments from outward risk spillovers and accomplish a remarkable overall portfolio risk reduction. Lastly, market participants should reshape their hedging strategies by altering their asset allocation, as COVID-19 has a vast impact on portfolio effectiveness. Future research should engage with hedging strategies followed by market participants by examining multi-asset investment portfolios and encompassing cash in portfolio analysis, as the potential role of cash in asset allocation should be recognized.

Notes

More information can be found on: https://www.federalreserve.gov/faqs/economy_14400.htm.

More information can be found on: https://www.bloomberg.com/news/articles/2021-07-13/u-s-consumer-prices-increased-in-june-by-more-than-forecast.

The advantages of using the absolute return as a measure of volatility have been outlined by Forsberg and Ghysels (2007).

References

Akhtaruzzaman, Md., S. Boubaker, B.M. Lucey, and A. Sensoy. 2021. Is gold a hedge or a safe-haven asset in the COVID-19 crisis?. Economic Modelling 102: 105588. https://doi.org/10.1016/j.econmod.2021.105588.

Antonakakis, N., I. Chatziantoniou, and D. Gabauer. 2020. Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. Journal of Risk and Financial Management 13: 84. https://doi.org/10.3390/jrfm13040084.

Asadi, M., D. Roubaud, and A.K. Tiwari. 2022. Volatility spillovers amid crude oil, natural gas, coal, stock, and currency markets in the US and China based on time and frequency domain connectedness. Energy Economics 109: 105961. https://doi.org/10.1016/j.eneco.2022.105961.

Aye, G.C., T. Chang, and R. Gupta. 2016. Is gold an inflation-hedge? Evidence from an interrupted Markov-switching cointegration model. Resources Policy 48: 77–84. https://doi.org/10.1016/j.resourpol.2016.02.011.

Balcilar, M., D. Gabauer, and Z. Umar. 2021. Crude oil futures and commodity markets: New evidence from a TVP-VAR extended joint connectedness approach. Resources Policy 73: 102219. https://doi.org/10.1016/j.resourpol.2021.102219.

Bouri, E., S.J.H. Shahzad, D. Roubaud, L. Kristoufek, and B. Lucey. 2020. Bitcoin, gold, and commodities as safe havens for stocks: New insight through wavelet analysis. The Quarterly Review of Economics and Finance 77: 156–164. https://doi.org/10.1016/j.qref.2020.03.004.

Bouri, E., X. Lei, N. Jalkh, Y. Xu, and H. Zhang. 2021. Spillovers in higher moments and jumps across US stock and strategic commodity markets. Resources Policy 72: 102060. https://doi.org/10.1016/j.resourpol.2021.102060.

Bouri, E., B. Lucey, T. Saeed, and X.V. Vo. 2022. The realized volatility of commodity futures: Interconnectedness and determinants. International Review of Economics & Finance 73: 139–151. https://doi.org/10.1016/j.iref.2021.01.006.

Brière, M., and O. Signori. 2013. Hedging inflation risk in a developing economy: The case of Brazil. Research in International Business and Finance 27: 209–222. https://doi.org/10.1016/j.ribaf.2012.04.003.

Casassus, J., D. Ceballos, and F. Higuera. 2010. Correlation structure between inflation and oil futures returns: An equilibrium approach. Resources Policy 35: 301–310. https://doi.org/10.1016/j.resourpol.2010.07.005.

Chang, K.L. 2017. Does REIT index hedge inflation risk? New evidence from the tail quantile dependences of the Markov-switching GRG copula. The North American Journal of Economics and Finance 39: 56–67. https://doi.org/10.1016/j.najef.2016.11.001.

Chen, J., Z. Liang, Q. Ding, and Z. Liu. 2022. Extreme spillovers among fossil energy, clean energy, and metal markets: Evidence from a quantile-based analysis. Energy Economics 107: 105880. https://doi.org/10.1016/j.eneco.2022.105880.

Chopra, M., C. Mehta, and A. Srivastava. 2021. Inflation-linked bonds as a separate asset class: Evidence from emerging and developed Markets. Global Business Review 22: 219–235. https://doi.org/10.1177/0972150918807015.

Ciner, C. 2015. Are equities good inflation hedges? A frequency domain perspective. Review of Financial Economics 24: 12–17. https://doi.org/10.1016/j.rfe.2014.12.001.

Conlon, T., B.M. Lucey, and G.S. Uddin. 2018. Is gold a hedge against inflation? A wavelet time-scale perspective. Review of Quantitative Finance and Accounting 51: 317–345. https://doi.org/10.1007/s11156-017-0672-7.

Dai, Z., H. Zhu, and X. Zhang. 2022. Dynamic spillover effects and portfolio strategies between crude oil, gold and Chinese stock markets related to new energy vehicle. Energy Economics 109: 105959. https://doi.org/10.1016/j.eneco.2022.105959.

Dempster, N., and J.C. Artigas. 2010. Gold: Inflation hedge and long-term strategic asset. The Journal of Wealth Management 13: 69–75. https://doi.org/10.3905/jwm.2010.13.2.069.

Dickey, D.A., and W.A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–431. https://doi.org/10.2307/2286348.

Diebold, F.X., and K. Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006.

Duncan, A.S., and A. Kabundi. 2013. Domestic and foreign sources of volatility spillover to South African asset classes. Economic Modelling 31: 566–573. https://doi.org/10.1016/j.econmod.2012.11.016.

Elsayed, A.H., S. Nasreen, and A.K. Tiwari. 2020. Time-varying co-movements between energy market and global financial markets: Implication for portfolio diversifications and hedging strategies. Energy Economics 90: 104847. https://doi.org/10.1016/j.eneco.2020.104847.

Elsayed, A.H., G. Gozgor, and C.K.M. Lau. 2022. Risk transmissions between bitcoin and traditional financial assets during the COVID-19 era: The role of global uncertainties. International Review of Financial Analysis 81: 102069. https://doi.org/10.1016/j.irfa.2022.102069.

Forsberg, L., and E. Ghysels. 2007. Why do absolute returns predict volatility so well?. Journal of Financial Econometrics 5: 31–67. https://doi.org/10.1093/jjfinec/nbl010.

Friedman, M. 1970. A theoretical framework for monetary analysis. Journal of Political Economy 78: 193–238.

Guhathakurta, K., S.R. Dash, and D. Maitra. 2020. Period specific volatility spillover based connectedness between oil and other commodity prices and their portfolio implications. Energy Economics 85: 104566. https://doi.org/10.1016/j.eneco.2019.104566.

Gunay, S. 2021. Comparing COVID-19 with the GFC: A shockwave analysis of currency markets. Research in International Business and Finance 56: 101377. https://doi.org/10.1016/j.ribaf.2020.101377.

Huang, J., and Z. Zhong. 2013. Time variation in diversification benefits of commodity, REITS, and TIPS. The Journal of Real Estate Finance and Economics 46: 152–192. https://doi.org/10.1007/s11146-011-9311-6.

Hunter, D.M., and D.P. Simon. 2005. Are TIPS the “real” deal? A conditional assessment of their role in a nominal portfolio. Journal of Banking & Finance 29: 347–368. https://doi.org/10.1016/j.jbankfin.2004.05.010.

Iqbal, J. 2017. Does gold hedge stock market, inflation and exchange rate risks? An econometric investigation. International Review of Economics & Finance 48: 1–17. https://doi.org/10.1016/j.iref.2016.11.005.

Jarque, C.M., and A.K. Bera. 1980. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters 6: 255–259. https://doi.org/10.1016/0165-1765(80)90024-5.

Kang, S.H., and J.W. Lee. 2019. The network connectedness of volatility spillovers across global futures markets. Physica a: Statistical Mechanics and Its Applications 526: 120756. https://doi.org/10.1016/j.physa.2019.03.121.

Kang, S.H., G.S. Uddin, V. Troster, and S.M. Yoon. 2019. Directional spillover effects between ASEAN and world stock markets. Journal of Multinational Financial Management 52–53: 100592. https://doi.org/10.1016/j.mulfin.2019.100592.

Kang, S., J.A. Hernandez, P. Sadorsky, and R. Mclver. 2021. Frequency spillovers, connectedness, and the hedging effectiveness of oil and gold for US sector ETFs. Energy Economics 99: 105278. https://doi.org/10.1016/j.eneco.2021.105278.

Kothari, S.P., and J. Shanken. 2004. Asset allocation with inflation-protected bonds. Financial Analysts Journal 60: 54–70.

Kroner, K.F., and V.K. Ng. 1998. Modeling asymmetric comovements of asset returns. The Review of Financial Studies 11: 817–844. https://doi.org/10.1093/rfs/11.4.817.

Kumar, A., N. Iqbal, S.K. Mitra, L. Kristoufek, and E. Bouri. 2022. Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. Journal of International Financial Markets, Institutions and Money 77: 101523. https://doi.org/10.1016/j.intfin.2022.101523.

Kwak, M., and B.H. Lim. 2014. Optimal portfolio selection with life insurance under inflation risk. Journal of Banking & Finance 46: 51–71. https://doi.org/10.1016/j.jbankfin.2014.04.019.

Laatsch, F.E., and D.P. Klein. 2005. The nominal duration of TIPS bonds. Review of Financial Economics 14: 47–60. https://doi.org/10.1016/j.rfe.2004.06.001.

Li, J., R. Liu, Y. Yao, and Q. Xie. 2022. Time-frequency volatility spillovers across the international crude oil market and Chinese major energy futures markets: Evidence from COVID-19. Resources Policy 77: 102646. https://doi.org/10.1016/j.resourpol.2022.102646.

Liow, K.H. 2015. Volatility spillover dynamics and relationship across G7 financial markets. The North American Journal of Economics and Finance 33: 328–365. https://doi.org/10.1016/j.najef.2015.06.003.

Liow, K.H., W.-C. Liao, and Y. Huang. 2018. Dynamics of international spillovers and interaction: Evidence from financial market stress and economic policy uncertainty. Economic Modelling 68: 96–116. https://doi.org/10.1016/j.econmod.2017.06.012.

Luo, J., and Q. Ji. 2018. High-frequency volatility connectedness between the US crude oil market and China’s agricultural commodity markets. Energy Economics 76: 424–438. https://doi.org/10.1016/j.eneco.2018.10.031.

Maghyereh, A.I., B. Awartani, and E. Bouri. 2016. The directional volatility connectedness between crude oil and equity markets: New evidence from implied volatility indexes. Energy Economics 57: 78–93. https://doi.org/10.1016/j.eneco.2016.04.010.

Mandaci, P.E., E.C. Cagli, and D. Taskin. 2020. Dynamic connectedness and portfolio strategies: Energy and metal markets. Resources Policy 68: 101778. https://doi.org/10.1016/j.resourpol.2020.101778.

Mensi, W., S. Hammoudeh, I.M.W. Al-Jarrah, K.H. Al-Yahyaee, and S.H. Kang. 2019. Risk spillovers and hedging effectiveness between major commodities, and Islamic and conventional GCC banks. Journal of International Financial Markets, Institutions and Money 60: 68–88. https://doi.org/10.1016/j.intfin.2018.12.011.

Mensi, W., J.A. Hernandez, S.M. Yoon, X.V. Vo, and S.H. Kang. 2021. Spillovers and connectedness between major precious metals and major currency markets: The role of frequency factor. International Review of Financial Analysis 74: 101672. https://doi.org/10.1016/j.irfa.2021.101672.

Mensi, W., I. Yousaf, X.V. Vo, and S.H. Kang. 2022. Asymmetric spillover and network connectedness between gold, BRENT oil, and EU subsector markets. Journal of International Financial Markets, Institutions and Money 76: 101487. https://doi.org/10.1016/j.intfin.2021.101487.

Mkaouar, F., J.L. Prigent, and I. Abid. 2017. Long-term investment with stochastic interest and inflation rates: The need for inflation-indexed bonds. Economic Modelling 67: 228–247. https://doi.org/10.1016/j.econmod.2016.12.017.

Papathanasiou, S., I. Dokas, and D. Koutsokostas. 2022a. Value investing versus other investment strategies: A volatility spillover approach and portfolio hedging strategies for investors. The North American Journal of Economics and Finance 62: 101764. https://doi.org/10.1016/j.najef.2022.101764.

Papathanasiou, S., D. Koutsokostas, and G. Pergeris. 2022b. Novel alternative assets within a transmission mechanism of volatility spillovers: The role of SPACs. Finance Research Letters 47: 102602. https://doi.org/10.1016/j.frl.2021.102602.

Papathanasiou, S., D. Vasiliou, A. Magoutas, and D. Koutsokostas. 2022c. Do hedge and merger arbitrage funds actually hedge? A time-varying volatility spillover approach. Finance Research Letters 44: 102088. https://doi.org/10.1016/j.frl.2021.102088.

Papathanasiou, S., Papanastasopoulos, A., and D. Koutsokostas. 2020. The impact of unconventional monetary policies on unique alternative investments: The case of fine wine and rare coins. In Recent advances and applications in alternative investments, IGI Global, 120–142. https://doi.org/10.4018/978-1-7998-2436-7.

Salisu, A.A., I.D. Raheem, and U.B. Ndako. 2020. The inflation hedging properties of gold, stocks and real estate: A comparative analysis. Resources Policy 66: 101605. https://doi.org/10.1016/j.resourpol.2020.101605.

Samitas, A., S. Papathanasiou, and D. Koutsokostas. 2021. The connectedness between Sukuk and conventional bond markets and the implications for investors. International Journal of Islamic Middle Eastern Finance and Management 14: 928–949. https://doi.org/10.1108/IMEFM-04-2020-0161.

Samitas, A., S. Papathanasiou, D. Koutsokostas, and E. Kampouris. 2022a. Are timber and water investments safe-havens? A volatility spillover approach and portfolio hedging strategies for investors. Finance Research Letters 47: 102657. https://doi.org/10.1016/j.frl.2021.102657.

Samitas, A., S. Papathanasiou, D. Koutsokostas, and E. Kampouris. 2022b. Volatility spillovers between fine wine and major global markets during COVID-19: A portfolio hedging strategy for investors. International Review of Economics & Finance 78: 629–642. https://doi.org/10.1016/j.iref.2022.01.009.

Shahbaz, M., M.I. Tahir, I. Ali, and I.U. Rehman. 2014. Is gold investment a hedge against inflation in Pakistan? A co-integration and causality analysis in the presence of structural breaks. The North American Journal of Economics and Finance 28: 190–205. https://doi.org/10.1016/j.najef.2014.03.012.

Spierdijk, L., and Z. Umar. 2015. Stocks, bonds, T-bills and inflation hedging: From great moderation to great recession. Journal of Economics and Business 79: 1–37. https://doi.org/10.1016/j.jeconbus.2014.12.002.

Swinkels, L. 2012. Emerging market inflation-linked bonds. Financial Analysts Journal 68: 38–56. https://doi.org/10.2469/faj.v68.n5.2.

Taderera, M., and O. Akinsomi. 2020. Is commercial real estate a good hedge against inflation? Evidence from South Africa. Research in International Business and Finance 51: 101096. https://doi.org/10.1016/j.ribaf.2019.101096.

Tang, M.L., S.N. Chen, G.C. Lai, and T.P. Wu. 2018. Asset allocation for a DC pension fund under stochastic interest rates and inflation-protected guarantee. Insurance: Mathematics and Economics 78: 87–104. https://doi.org/10.1016/j.insmatheco.2017.11.004.

Tiwari, A.K., J. Cunado, R. Gupta, and M.E. Wohar. 2018. Volatility spillovers across global asset classes: Evidence from time and frequency domains. The Quarterly Review of Economics and Finance 70: 194–202. https://doi.org/10.1016/j.qref.2018.05.001.

Tiwari, A.K., B.R. Mishra, and S.A. Solarin. 2021. Analyzing the spillovers between crude oil prices, stock prices and metal prices: The importance of frequency domain in USA. Energy 220: 119732. https://doi.org/10.1016/j.energy.2020.119732.

Umar, Z., D. Kenourgios, and S. Papathanasiou. 2020. The static and dynamic connectedness of environmental, social, and governance investments: International evidence. Economic Modelling 93: 112–124. https://doi.org/10.1016/j.econmod.2020.08.007.

Van Hoang, T.H., A. Lahiani, and D. Heller. 2016. Is gold a hedge against inflation? New evidence from a nonlinear ARDL approach. Economic Modelling 54: 54–66. https://doi.org/10.1016/j.econmod.2015.12.013.

Wang, G.-J., C. Xie, Z.-Q. Jiang, and H.E. Stanley. 2016. Who are the net senders and recipients of volatility spillovers in China’s financial markets?. Finance Research Letters 18: 255–262. https://doi.org/10.1016/j.frl.2016.04.025.

Wen, T., and G.-J. Wang. 2020. Volatility connectedness in global foreign exchange markets. Journal of Multinational Financial Management 54: 100617. https://doi.org/10.1016/j.mulfin.2020.100617.

Yousaf, I., and S. Ali. 2020. The COVID-19 outbreak and high frequency information transmission between major cryptocurrencies: Evidence from the VAR-DCC-GARCH approach. Borsa Istanbul Review 20: S1–S10. https://doi.org/10.1016/j.bir.2020.10.003.

Yousaf, I., and L. Yarovaya. 2022. Static and dynamic connectedness between NFTs, Defi, and other assets: Portfolio implication. Global Finance Journal 53: 100719. https://doi.org/10.1016/j.gfj.2022.100719.

Zeng, T., M. Yang, and Y. Shen. 2020. Fancy Bitcoin and conventional financial assets: Measuring market integration based on connectedness networks. Economic Modelling 90: 209–220. https://doi.org/10.1016/j.econmod.2020.05.003.

Zhang, D. 2017. Oil shocks and stock markets revisited: Measuring connectedness from a global perspective. Energy Economics 62: 323–333. https://doi.org/10.1016/j.eneco.2017.01.009.

Zhang, W., and S. Hamori. 2021. Crude oil market and stock markets during the COVID-19 pandemic: Evidence from the US, Japan, and Germany. International Review of Financial Analysis 74: 101702. https://doi.org/10.1016/j.irfa.2021.101702.

Zhang, D., L. Lei, Q. Ji, and A.M. Kutan. 2019. Economic policy uncertainty in the US and China and their impact on the global markets. Economic Modelling 79: 47–56. https://doi.org/10.1016/j.econmod.2018.09.028.

Zhang, H., J. Chen, and L. Shao. 2021. Dynamic spillovers between energy and stock markets and their implications in the context of COVID-19. International Review of Financial Analysis 77: 101828. https://doi.org/10.1016/j.irfa.2021.101828.

Zhao, W.L., F. Ying, and J. Qiang. 2022. Extreme risk spillover between crude oil price and financial factors. Finance Research Letters 46: 102317. https://doi.org/10.1016/j.frl.2021.102317.

Author information

Authors and Affiliations

Contributions

All authors have participated in (a) conception and design, or analysis and interpretation of the data; (b) drafting the article or revising it critically for important intellectual content; and (c) approval of the final version.

Corresponding author

Ethics declarations

Conflict of Interest

All authors have participated in (a) conception and design, or analysis and interpretation of the data; (b) drafting the article or revising it critically for important intellectual content; and (c) approval of the final version. o This manuscript has not been submitted to, nor is under review at, another journal or other publishing venue. o The authors have no affiliation with any organization with a direct or indirect financial interest in the subject matter discussed in the manuscript

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Papathanasiou, S., Kenourgios, D., Koutsokostas, D. et al. Can treasury inflation-protected securities safeguard investors from outward risk spillovers? A portfolio hedging strategy through the prism of COVID-19. J Asset Manag 24, 198–211 (2023). https://doi.org/10.1057/s41260-022-00292-y

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-022-00292-y