Abstract

To which extent do equity and housing hedge against inflation? Despite the extensive literature, there is only little consensus. This paper presents evidence on this question from the Jordà–Schularick–Taylor Macrohistory Database covering 16 countries from 1870 to 2020. The results depend on the time horizon and period considered. Within a 1-, 5-, and 10-year horizon, housing at least partially hedges against inflation. The nominal return–inflation relation is higher in the post-war period. In the long run, housing hedges excessively in the whole sample and perfectly in the post-war period. Equity provides no hedge within 1 year in the entire period, and the returns tend to decrease with inflation in the post-war period. The hedge improves slightly with a longer time horizon and is perfect in the long run in the post-war period. Thus, housing is at least weakly superior in hedging against inflation. The results are robust to a non-housing consumption price index and an asset price appreciation approach.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

For a majority of households, housing and equities are the most important real assets. They represent more than half of the total assets in household balance sheets (see Jordà et al. 2019). Thus, changes in the real value of those assets have important implications for a large fraction of households and, as a consequence, for the whole economy. As both assets are real assets or claims on them, their nominal returns should keep pace with inflation and in this way hedge against general price shocks. However, Fama and Schwert (1977) found that the nominal return on equity declines if inflation increases, whereas the nominal return on housing keeps pace with inflation. The finding of a negative relationship between equity returns and inflation has established a strand of the literature, often called the ‘stock-return inflation puzzle’.Footnote 1 As the estimated relation between inflation and the nominal return on housing is in line with theory, this relation has received less attention. A lack of data additionally explains the sparse knowledge on the housing returns–inflation relation. Given the fact that a much larger share of the population owns residential real estate than equities (see, e.g., Kuhn et al. 2020), this sparse knowledge is unfortunate. Besides, even though there is extensive literature on hedging against inflation, there is only little consensus and an ongoing debate in finance and economics on the subject.

The Macrohistory Database built by Jordà–Schularick–Taylor (JST) (Jordà et al. 2017, 2019) provides the opportunity to shed new light on the equity return–inflation relation, and, more importantly, to compare the relative performance of equity and housing as inflation hedges. The database provides transaction-based annual return rates on housing and equity as well as Consumer Price Indices (CPIs) of 16 countries from 1870 to 2020. Based on these data, Jordà et al. (2019) perform a preliminary analysis of the relations by presenting the rolling decadal correlations between the CPI and both nominal equity and housing returns on the country’s average. The present study aims to examine these relationships in more detail, e.g., in terms of magnitude and time horizon. To the best of my knowledge, besides the initial analysis of Jordà et al. (2019), this study is the only one so far using the JST Macrohistory Database to measure return–inflation relations.

To examine the return–inflation relation in the short and medium run, the study presents results from pooled linear regressions of nominal returns on CPI inflation rates. These regressions run on an annual frequency as well as on a 5- and a 10-year moving average in line with Boudoukh and Richardson (1993). On both, the 1-year and 10-year horizon, the study also examines differences in various periods, prices and yields, and between countries and nonlinearities in inflation. Cointegration analyses examine the long-run relations and vector error correction models (VECMs) illustrate the dynamics between nominal returns and inflation. The estimates refer to both the country level and the panel as a whole.Footnote 2 The chosen methods allow a one-to-one comparison with many other studies. The following definitions are stated for the extent of hedging. Nominal returns that increase one-to-one with inflation fully hedge against inflation. Those that increase less or more than one-to-one provide a partial or excessive hedge, and those that decrease with increasing inflation are a hazard rather than a hedge. Inflation-independent nominal returns provide no hedge at all.

The estimation results can be summarized as follows. In the short run housing hedges, at least partly, against inflation for the panel estimates and in virtually all countries. In the medium run, the countries’ average and the pooled estimated relationship are higher in comparison to the short run. Post-1950, in the short and medium run, the panel estimates cannot reject a one-by-one relation at the 5% level. Equity, in turn, does not provide a hedge against inflation in the short run and in the post-1950 period sample equity is rather a hazard. In the medium run, the countries’ average and the pooled estimated equity return–inflation relationship increase on average in comparison to the short run. 30-year rolling regressions show that the hedging property of housing increase steadily over time. Equity is especially from the late 1960 s till the 1980 s a hazard and the ability to hedge against inflation has increased since the late 1980 s. A quadratic specification of the regression does not change the explanatory power of the model notably. In the long run, housing is an excessive hedge in the whole period and a perfect hedge or even slightly excessive in the post-1950 period. Equity hedges partially against inflation in the whole period and perfectly in the post-1950 period. The impulse response functions (IRFs) of the VECMs show that the transition to the new equilibrium takes about 15 years on average across all countries, periods, and assets, except for post-1950 equity returns and prices. Post-1950 equity returns and prices need 30 years or more to reach the new equilibrium. Lastly, the decomposition into yields and prices shows that the asset price–inflation relation is weakly stronger than the asset yield–inflation relation.

Based on pooled OLS (POLS) estimation, the hypothesis that equity and housing hedge equally well against inflation in the short and medium run must be rejected at the 5% level for the whole period. Thus, housing is superior to equity in hedging against inflation in the short and medium run. Moreover, in the medium run, inflation accounts for a large fraction of the variation in housing returns, but not in equity returns. The results are robust when addressing the critique of Anari and Kolari (2002) that the simultaneous causality bias can arise regarding housing, as the rent determines the yield of housing and a large fraction of the CPI.

These findings corroborate the initial insights from the 1-year horizon correlation analysis by Jordà et al. (2019). They find that housing returns comove robustly positively with inflation, and equity returns comove apart from the interwar period negatively with inflation. Besides these initial insights from the JST Macrohistory Database, there is plenty of literature on inflation hedging. Arnold and Auer (2015) give an overview of the state of scientific knowledge on inflation hedging for major asset classes and Madadpour and Asgari (2019) for the ‘stock-return inflation puzzle’. Instead of giving a broad literature overview here, I refer to both surveys and discuss my findings in terms of those surveys. In summary, the equity return–inflation relation is considered to be negative to non-existent in the short run and positive at horizons of at least 5 years. However, these results still lack consensus because the particular studies differ along several dimensions, such as methodologies, time horizons, data sources, country coverage, sampling periods, and frequencies. The present results support previous results by applying common methods for various time horizons with reference to one data source of 16 countries, all with a similar sample period and a uniform frequency.

The consensus concerning the housing return–inflation relation is even vaguer. In addition to the problems encountered in the review of the stock return–inflation relation, there are two more problems: a frequent mix of commercial and residential real estate and deficient information in general. The few studies relying on transaction-based housing returns are comparable to the analysis at hand. Brounen et al. (2013) investigate the inflation, house price, and rent relationship in Amsterdam from 1814–2008. They find housing protects against inflation, especially in the long run. Anari and Kolari (2002) and Christou et al. (2018) investigate the house price–inflation relation in the USA in the post-war period. They find also housing hedges, at least to some extent, in the long run. The present paper supports these findings using what Jordà et al. (2019) claim to be the longest and most comprehensive cross section total housing return panel. Additionally to the confirmation of previous results concerning housing returns, the study examines differences between time horizons, considered periods, and yield and price gains and tests the hypothesis that both housing and equity hedge equally against inflation in the short and medium run, which is rejected.

Due to high transaction costs and the absence of organized markets, housing is poorly readily and frequently tradeable, and, therefore, an inept hedging instrument in the very short run. These frictions imply that the present study is more relevant for investment decisions with a longer time horizon. These are, in particular, the households’ existential investment decisions: diversifying life-cycle savings and the decision to become a homeowner. The former is inherently a lifetime investment decision; for the latter, note that Brounen et al. (2013) report that on average homeowners inhabit the same house for 12 years and according to Marlay and Fields (2010) more than 90%, 65%, and 45% of homeowners lived in their current home for more than 1 year, 5 years, and 10 years, respectively in the USA in 2004.Footnote 3 The holding period of housing imply that the frequency of the data is sufficient for the investigation of the housing return–inflation relation as the asset is rarely traded more frequently. The relevance of the present study for households is reinforced by the mentioned fact that equity and housing are their most important real assets.

The remainder reads as follows: The next section considers the theoretical reasoning behind inflation hedging and introduces the reader to the properties of the data. The section thereafter considers the short and medium run, including all examined decompositions and nonlinearities. Thereafter, the paper presents the results of the cointegration (long-run) exercises. Section 5 presents impulse response of VECM estimates that highlight the dynamics of the adjustment of nominal returns in response to an inflation shock. Section 6 and the respective Tables in the Appendix address the concern of a rent-induced simultaneity bias by repeating the whole analysis with two different approaches. One subtracts rents from the CPI, and the other from the returns. Section 7 concludes.

2 Preliminaries

2.1 Theory

Given the identity that the real return factor (\(1+\rho _t\)) equals the nominal return factor divided by the inflation factor (\((1+r_t)/(1+\pi _t)\)), the real return rate is approximately the nominal return rate minus the inflation rate:

In case, an asset’s real return is independent of the inflation rate, the asset hedges perfectly against inflation. Alike, the dependency of the real return rate on the inflation rate measures the extent of the hedging ability of the asset. Given the approximated identity, it reads

and hence, given any appropriate measure of inflation and any asset’s realized nominal return rates, one can assess the historical ability of the asset to hedge against inflation. This is the basis of the definitions mentioned above. A change in the nominal return in the change of inflation greater than one defines an excessive hedge, equal to one a perfect hedge, between zero and one a partial hedge, equal to zero no hedge, and smaller than zero defines a hazard. The same holds for the price index elasticity of the assets’ performance index. Note that the ability to hedge against inflation depends only on the relationship between returns and inflation but not on the relationship’s direction. Thus, causality does not play a role in the ability to hedge, nor does the study make any claims about causality generally.

The potential of an asset to hedge against inflation depends on the asset type. Cash, for example, has a nominal return of zero (\(r_t=0\) \(\forall \) t). Thus, the change of the nominal return in the change of inflation is always zero and cash does not hedge against inflation. The return on a nominal bond in t was stated in \(t-1\) and thereby, the asset cannot hedge against unexpected inflation. Yet, a buyer can demand compensation for the expected devaluation due to inflation.Footnote 4 In this case, an asset is called an ex-ante hedge against inflation. Potentially, housing and equity hedge also against unexpected inflation. The intuition behind the relation to unexpected inflation is straightforward. Since housing and equity are real assets or claims on them, the nominal values of such assets and the nominal yields from operations relating to these assets are expected to keep pace with inflation. In this case, an asset is an ex-post hedge against inflation.

The potential to hedge against expected and unexpected inflation motivates the research question:Footnote 5 which of the two major real assets, housing and equity, has performed better in the past as a hedge against inflation? Since this question is primarily of interest at the household level, the CPI is the natural choice for measuring inflation. Another interpretation of the object under investigation is more academic, namely the verification of the relationship between inflation and real economic values, and between the real economy and interrelated of the classical dichotomy.

The two assets differ primarily in four points. First, housing yields are the rents paid by tenants or imputed to homeowners, which are included in the CPI basket. Dividends, the yield of equity, are paid by firms that operate in all sectors of the economy. Accordingly, they should keep pace with the GDP deflator whereas rents should raise one-to-one with the costs of housing. Second, dividends are paid after net reinvestments, housing rents are measured before net reinvestments. Thus, only housing yields equal the rental rate of capital, while the rental rate of equity capital equals the yield plus the not explicitly accounted part of capital gains created by newly installed net capital. Third, shareholders are net debtors on average, and bonds are issued nominally. Thus, shareholders benefit from unexpected inflation. The return on housing is not leveraged as it is measured as the rental income plus gains from house price changes. Fourth, housing operations, but not the operations of many companies, are spatially tied to the corresponding currency area. Therefore, the response of the real exchange rate to an inflation shock plays a role in whether the return on equity keeps pace with inflation. The reverse conclusion gives the reason why a domestic asset analysis is sufficient. The validity of the purchasing power parity theory determines mainly whether foreign assets protect against domestic inflation, which is yet another research question.Footnote 6

2.2 Data

This section starts with a description of the data source and, in addition, the preparation and manipulation. Then, the existence of the necessary condition of integrated time series for cointegration analysis is tested. The section ends with a short visual data examination.

If not stated otherwise, the data are from the JST Macrohistory Database release 6 (see generally Jordà et al. (2017) and in particular for asset return rates Jordà et al. (2019)). This database brings together macroeconomic data from various sources and hitherto unavailable variables on asset return rates. The database covers 18 economies from 1870 to 2020 on an annual basis. Albeit, for some countries individual data points for return rates are missing and in their entirety for Canada and Ireland. Table 1 illustrates the availability of the time series used in this study and how to deal with missing values is discussed below.

Two points should be made regarding housing returns. First, the return rates include imputed rents of owner-occupied properties. The imputation is important, as an own-occupied property is by definition a perfect hedge against increasing rental rates. Second, the rent series rely on the rent component of CPIs. This is critical because it potentially creates a simultaneous causality bias. To address the potential bias, the study presents two robustness checks. The first one employs a consumer price index without expenditures on housing and the second one with nominal returns that include only capital gains using asset price indices, simply put, the latter refers to the asset price–inflation relation exercises. Further, in the case of cointegration estimation, the estimators are consistent despite simultaneous causality.

To ensure comparability between housing and equity in the short and medium run, the study covers the same periods for both asset return rates within a country. As a consequence, some available data are omitted. The growth rates of the CPI at time t result in the inflation rate at time t. The performance index at time t is constructed as the reciprocal of the cumulative product of returns factors (\(1+r_t\)) from 2020 to the first missing data point. As a means to avoid omitting too much data, the assessment takes the maximum of every index. In the same way as the construction of the performance index, a price and yield index is constructed from data on relative price and yield changes. Note that the data availability of those relative changes is poorer than of return rates.

Table 2 reports p values of the ADF-\(\chi \)-Fisher and Hadri test for the whole panel of the natural logarithm of the housing performance index (HPI), equity performance index (EPI), and CPI as well as the price and yield indices of housing and equity. The tests only dismiss the usability of the equity yield index for the long-run analysis.

Figure 1 shows the used indices normed to zero in the year all indices became available. Note first that the EPI of Finland starts with the HPI even though the data availability is longer. Yet, during the earlier period, the unit root tests reject the hypothesis of a unit root. Note second, in Germany around the time of the hyperinflation in 1923, the EPI kept pace with consumer prices. Unfortunately, no data are available for the German return on housing during that time. Knoll et al. (2017) describe a striking house price behavior during that period as a result of persistent rental controls, resulting in negative nominal return rates. Figure 2 illustrates the used return and inflation rates. It turns out that the return on equity is highly volatile in comparison to the return on housing and inflation.

3 Hedging in the short and medium run

3.1 Benchmark

To examine the short- and medium-run relationship between return rates and the inflation rate, I regress

where \(r_{ixt}\) is the return on housing (\(x=H\)) and equity (\(x=E\)) and \(\pi _{it}\) the inflation rate of country i at the time t. Note that \(\beta _x\) equals the change of the nominal return of asset x in the change in inflation and thereby, represents the hedging ability of asset x. The 1-year regression (M = 1) represents the short run and the 5- (M=5) and 10-year (M = 10) moving averages represent the medium run. The estimator of the parameters \({\hat{\theta }} = [{\hat{\alpha }}_{H}, {\hat{\alpha }}_{E}, {\hat{\beta }}_{H}, {\hat{\beta }}_{E}]\) is calculated via POLS. As fixed and random effects models are inappropriate for small \(N(=16)\), regressing model (1) via POLS seems the most suitable estimator for heterogeneous panels in the static case. The estimator’s variance–covariance estimates are cross section dependency, heteroskedasticity, and autocorrelation consistent by applying Driscoll and Kraay’s (1998) estimator with \((4T/100)^{2/9}\) lags. Finally, I test the hypothesis: \(H_0: \beta _{H} = \beta _{E}\) against \(\beta _{H} \not = \beta _{E}\). The statistic is \(t_j=({\hat{\beta }}_{H}-{\hat{\beta }}_{E})/{\hat{\sigma }}_{({\hat{\beta }}_H-{\hat{\beta }}_E)}\) with \({\hat{\sigma }}_{({\hat{\beta }}_{H}-{\hat{\beta }}_{E})}^2={\widehat{Var}}({\hat{\beta }}_{H})+{\widehat{Var}}({\hat{\beta }}_{E})-2{\widehat{Cov}}({\hat{\beta }}_{H},{\hat{\beta }}_{E})\).

The rows in Table 3 represent the assets \(x \in \{H,E\}\) for the respective time horizons \(M \in \{1, 5, 10\}\). The corresponding column presents the point estimates of the parameters \(\beta _x\) of Eq. (1) (\({\hat{\beta }}_x\)), the standard deviations of \({\hat{\beta }}_{x}\) (\(\hat{\sigma }_{\beta _x}\)), the adjusted coefficients of determination (\(R^{2}_{\textrm{adj},x}\)), the p value of the hypothesis \(H_0: \beta _H=\beta _E\), (\(P_{\beta _H=\beta _E}\)), and the number of data points (NT).

Concerning the return on housing, it turns out that the \({\hat{\beta }}_H \pm 2{\hat{\sigma }}_{\beta _H}\)-confidence intervals of the estimates neither include the zero nor the one for all time horizons. Concerning the return on equity, it turns out that the \({\hat{\beta }}_E\pm 2{\hat{\sigma }}_{\beta _E}\)-confidence intervals of the estimates include the zero for the 1- and 5-year horizon. For the 10-year horizon the \({\hat{\beta }}_E\pm 2{\hat{\sigma }}_{\beta _E}\)-confidence intervals exclude the zero. Both the point estimates for housing and equity increase with the considered time horizon. The housing return–inflation relation increases from 0.45 to 0.74 from the 1-year to the 10-year horizon and the equity return–inflation relation from 0.12 to 0.36. Similarly, from the 1-year to the 10-year horizon, the adjusted R-square for the return on housing regression increases from 0.11 to 0.42 and for the return on equity from 0.00 to 0.06. Finally, the null must be rejected on a 5% significance level that both investment types hedge against inflation to the same extent for all time horizons considered.

3.2 Nonlinearities in time

Pre- and post-1950 The dummy \(\mathbb {1}_{t\ge 1950}\), which is 1 for \(t\ge 1950\) and zero else, enables the differentiation between the post-war period from the previous period in the following regression:

The parameter estimation and inference are identical to the procedure in the benchmark section, and the results are presented by Table 4.

The rows in Table 4 represent again the assets \(x \in \{H,E\}\), now only for time horizons \(M \in \{1, 10\}\) for the sake of brevity. The columns differentiate between the point estimates of the hedging abilities of the assets before (\({\hat{\beta }}_{1x}={\hat{\beta }}_x^{<1950}\)) and after 1950 (\({\hat{\beta }}_{x}^{\ge 1950}={\hat{\beta }}_{1x}+{\hat{\beta }}_{2x}\)) and the estimators’ variances (\(\sigma ^{\cdot }_{\beta _x}\)). The column \(P_{\beta _{2x}=0}\) displays the p value of the test that the post-1950 period is the same as the pre-1950 period (\(H_0: \beta _{2x} = 0\)). The remaining columns display as previously, the adjusted coefficients of determination (\(R^{2}_{\textrm{adj},x}\)), the p value of the hypothesis \(H_0: \beta ^{\cdot }_H=\beta ^{\cdot }_E\) (\(P_{\beta ^{\cdot }_H=\beta ^{\cdot }_E}\)), here for the respective period, and the number of data points (NT).

Concerning the return on housing, it turns out that the \({\hat{\beta }}_H \pm 2{\hat{\sigma }}_{\beta _H}\)-confidence intervals of the estimates neither include the zero nor the one for the pre-1950 period for both time horizons, yet for the post-1950 they include the one for both time horizons with point estimates of 0.84 within 1 year and 0.91 within 10 years. Concerning the return on equity, the \({\hat{\beta }}_E\pm 2{\hat{\sigma }}_{\beta _E}\)-confidence intervals of the estimates include the zero for both periods and horizons. The housing return–inflation relation point estimates increase with the considered time horizon and from the pre- to the post-1950 period. The estimates of the different periods are also significantly different (p value \(<0.01\)). Concerning the equity return–inflation relation, this is not the case. The point estimates decrease from the pre- to the post-1950 period within 1 year and remain similar within the 10-year moving average regression. Statistically, for both time horizons, the differences between the pre- and post-1950 periods are not significant. The adjusted R-squares are higher within the range of 0.02 and 0.1 points in comparison to the benchmark regressions. Finally, except for the pre-1950 within-1-year estimates, the null must be rejected on a 5% significance level that both investment types hedge against inflation to the same extent.

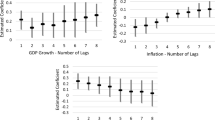

30-year rolling regression To examine different changes over time in the return–inflation relation, I plot in Fig. 3 a rolling regression with a window of 30 years for the within-1-year (panel a) and the 10-year moving average regression (panel b). Within 1 year, in the beginning, both assets do not hedge against inflation, but the return–inflation relation increases until the late 1960s for both assets. In the 1970s the relationship between the equity return and inflation becomes negative, with point estimates near \(-1\). This relation turned in the 2000s where the hedging ability become unclear as the \(95\%\) confidence interval includes both ± 1. The housing return–inflation relation increases further after the late 1960s and peaks in the early 2010s with being a perfect hedge (\({\hat{\beta }}_H\approx 1\)). Afterward, the relationship declines but remains positive.

The 10-year moving average plot evolves similarly to the within-1-year plot. Both assets do not hedge against inflation at the beginning of the sample but the relation increase. The increase in the equity return–inflation relation is less strong, but also the drop during the 1970s is less severe. The equity hedging ability in the medium run improves from the 1980s on and peaks at \({\hat{\beta }}_H\approx 2\) in the mid-2010s. The housing return–inflation relation increases the whole time and is an excessive hedge at the end.

3.3 Nonlinearities in inflation

To examine nonlinear behavior within the inflation rate, I plot a bivariate histogram (within the 0.05 and 0.95 percentile) in Fig. 4. Additionally, I plot the regression line from the results following Table 3, and the results from a regression where I added a quadratic term (\(\pi _{it+1-\tau }^{2}\)) to Eq. 1. Panels (a) and (b) show the within-1-year specification for housing and equity, respectively, and panels (c) and (d) for the within-10-years specification. Especially in the short run, the explanatory content of the quadratic term is small as the adjusted R-squared increases only slightly. Note also that in the medium run, the increase in the explanatory power by adding the quadratic term in the equity return–inflation relation lies in \({\bar{\pi }}_t \in [0;0.05]\) where most of the data is dense, the fit decreases outside the 0.05 and 0.95 percentile in comparison to the linear specification.

3.4 Differences in yields and price gains

To decompose the returns–inflation relation into yield and price fractions, I use the model Eq. (1) but now \(r^{j}_{ixt}\) represents the relative change of the price (\(j=p\)) or the yield (\(j=y\)) of the assets.

Table 5 presents the results. The table reads similar to Table 4. The rows represent again the assets \(x \in \{H,E\}\) for the time horizons \(M \in \{1, 10\}\). The columns present the point estimates of the price–inflation and yield–inflation relations (\({\hat{\beta }}_{x}^{p}\) and \({\hat{\beta }}_{x}^{y}\)) and the corresponding standard deviations (\(\hat{\sigma }^{p}_{\beta _{x}}\) and \(\hat{\sigma }^{y}_{\beta _{x}}\)). The column \(P_{\beta ^p_{x}=\beta ^y_x}\) presents the p values of the hypothesis that the yield and price–inflation relation are equal. The remaining columns display as previously, the adjusted coefficients of determination, now for the yield and price regression separately (\(R^{2,p}_{\textrm{adj},x}\) and \(R^{2,y}_{\textrm{adj},x}\)), the p value of the hypothesis \(H_0: \beta _H=\beta _E\) (\(P_{\beta _H=\beta _E}\)), again for the price and yield regression separately, and the number of data points (NT).

Both, the inflation relation with house prices and yields \({\hat{\beta }}_H^{j} \pm 2{\hat{\sigma }}^{j}_{\beta _H}\)-confidence intervals of the estimates neither include the zero nor the one for both time horizons. For equity this only holds for the 10-year horizon, within 1 year, the confidence intervals for both prices and yields include the zero. The asset price–inflation relation is higher than the yield–inflation relation, albeit, only statistically significant concerning housing. Similarly, the adjusted R-squares of the price regressions are higher. Yet, the adjusted R-squares for both asset regressions are \(\pm 0.01\) in comparison to the benchmark R-squares. Finally, except for the yield–inflation relation estimates within 1 year, the null must be rejected on a 5% significance level that the yield or the price part of the return of both assets keeps pace with inflation to the same extent. The yield–inflation relation p value of the hypothesis within 1 year is 0.06.

3.5 Country level

The regression to estimate the return–inflation relation on the country level reads

Note that the only difference to Eq. (1) is the country-specific estimator \({\hat{\theta }}_{i}\). I apply ordinary least squares (OLS) for the estimation. The variance–covariance estimates of the OLS estimators are heteroskedasticity and autocorrelation consistent by applying the Newey–West estimator with \((4T/100)^{2/9}\) lags. Pesaran and Smith (1995) report that pooling gives potentially misleading estimates in the dynamic case, while the group mean estimator (GME) (\(\hat{\theta }_{GME} = (1/N)\sum _{i}^{N}{\hat{\theta }}_i\)) is consistent. Therefore, to apply a common estimator for all models, i.e., including the cointegration analyses and VECMs below, I report here also the GME results. Chudik and Pesaran (2019) show that \(\hat{\Omega }_{GME}=(1/(N-1))\sum _{i}^{N}({\hat{\theta }}_i-\hat{\theta }_{GME})({\hat{\theta }}_i-{\hat{\theta }}_{GME})'\) is a consistent estimator of the variance–covariance matrix of the GME, even if the individual estimators \({\hat{\theta }}_i\) are weakly cross-correlated. POLS estimates are presented for reference only.

Table 6 presents the within-1-year point estimates of the parameters \(\beta _{ix}\) of Eq. (3) (\({\hat{\beta }}_x\)), the standard deviations of the estimators \({\hat{\beta }}_{ix}\) (\({\hat{\sigma }}_{\beta _x}\)), the adjusted R-squared (\(R^{2}_{\textrm{adj},H}\)), both for the housing and equity regression. The remaining columns are the p value of the hypothesis \(H_0: \beta _H=\beta _E\) (\(P_{\beta _H=\beta _E}\)), and the number of data points (T). Table 7 displays the same for the 10-year horizon.

Concerning the return on housing, it turns out that the \({\hat{\beta }}_H \pm 2{\hat{\sigma }}_{\beta _H}\)-confidence intervals of the estimates do not include the zero for all countries, except for Belgium and barely for Switzerland. The interval of seven countries as well as of the GME includes the one. Concerning the return on equity, it turns out that the \({\hat{\beta }}_E\pm 2{\hat{\sigma }}_{\beta _E}\)-confidence intervals of the estimates all include the zero, except for Denmark, which includes the one. For half of the countries and the POLS estimation, the null must be rejected on a 5% level that both investment types hedge against inflation to the same extent. Both R-squares are small, and the one concerning equity tends to be smaller.

The point estimates of the 10-year moving average return–inflation relation (\({\hat{\beta }}_x\)) of both return rates increase once again in comparison to the short run. The adjusted R-squared of the return on housing regression is greater than 0.7 in Australia, Italy, Japan, and Portugal. Over the 10-year horizon, the return rate of housing in Germany is an outlier with a negative point estimation for the inflation relationship. Similarly, Switzerland is the only country with a negative point estimate of the return rate of equity. The \({\hat{\beta }}_x\pm 2{\hat{\sigma }}_{\beta _x}\)-confidence intervals include the zero for the negative point estimates for Germany and Switzerland.

4 Hedging in the long run

4.1 Estimation strategy

The procedure for the long run differs from the short and medium one. The focus is on testing for cointegration. Therefore, I first verified above that the asset indices \(PI_{ix}, x \in \{H,E,H^{p},E^{p},H^{y}\}, i \in \{\text {ISO}\}\), and the CPIs (\(CPI_i\)) are integrated of first-order (I(1)). The superindices p and y represent the pure price and yield indices. The dividend indices (equity yields) in total are not I(1), and thus, tests for a cointegrated relationship with the CPIs are misleading. I apply two procedures to the probably integrated time series. In the first procedure, the cointegration relationship is unity by assumption, in the second one, the magnitude of the relationship has to be estimated. Figure 1 qualifies for three specifications in presence of a cointegrated relationship i) a one-by-one relationship with trend, ii) an excessive relationship without trend, and iii) an arbitrary relationship with trend.

Assuming a one-by-one relationship, I follow Hamilton (1994, Chapter 19.2) and execute an Augmented Dicky–Fuller (ADF) test for the series of the differences of \(PI_{ix}\) and \(CPI_i\) by using the model

where \(\Delta \) is the difference operator, \(\delta _{ix}\) a deterministic trend, and \(\phi _{ix}\) the AR(1) coefficient.

To estimate the magnitude of the relationship, I execute an Engle–Granger cointegration test using the following model:

Both approaches will be to test the null hypothesis that there is no cointegration, \(H_0: \phi _{ix}=1\) under the alternative hypothesis \(|\phi _{ix}|<1\). I report the p values from \(t_{1i}=({\hat{\phi }}_{ix}-1)/{\hat{\sigma }}_{\phi _{ix}}\) and \(t_{2i}=T_i({\hat{\phi }}_{ix}-1)\) ADF statistics.

The panel structure for parameter estimation is used by applying the GME, as the POLS estimator is inconsistent in the dynamic case (see Pesaran and Smith 1995). The panel cointegration tests also apply to the null hypothesis that there is no cointegration (\(H_0: \phi _{ix}=1\) for all i). There are two alternative hypotheses, one for individual (group mean) AR coefficients, (\(H_1: |\phi _{ix}|<1\) for all i) and one for a common (pooled) AR coefficient (\(H_1: |\phi _{ix}|=|\phi _{x}|<1\) for all i). The known-by-assumption relationship tests are the Im, Pesaran, and Shin and the Levin, Lin, and Chu test, respectively. Pedroni’s (2004) Group and Panel ADF test apply to test the cointegration of the estimated relationship.Footnote 7 Additionally, to the full sample results of the return rates, I also report for the post-1950 periods (subindex \(\ge 1950\)).Footnote 8

4.2 Results

Table 8 presents the full periods p values of the hypothesis that there is no one-by-one cointegration between nominal return rates and inflation, and, additionally, estimates of the key parameters of Eq. (4). Tables 9 and 10 report the same for Eqs. (5) and (6) without and with trend, respectively. The tables present the country-level results for the performance indices as well as the GMEs for the performance indices, asset price indices, and rental indices and all those indices for the post-1950 sample. Appendix B lists the country-level results for prices, yields, and the post-1950 sample.

The results in Table 8 show that in the case of perfect hedges, the hypothesis that there is no cointegration can only be rejected for housing for Germany, Switzerland, Great Britain, and the USA at the 5% level and for equity only for the USA. Concerning the whole panel, the hypothesis of an unit root for the whole sample cannot be rejected at the 5% level, neither for returns nor for prices or yields. However, the hypothesis for the post-1950 time can be rejected at the 5% level for all panel tests made, except the Im, Pesaran, and Shin for housing returns.

Dropping the assumption of a perfect hedge delivers further insights. First, regarding the GME for the housing indices-CPI relationships without trend (Table 9), the hypothesis for the whole sample that there is no cointegration can be rejected (returns and yields at the 5% and prices at the 10% level) and housing provides an excessive hedge. Similarly, the null hypothesis for equity prices at the 10% level can be rejected. By assuming a trend (Table 10), the hypothesis of no cointegration between the HPI and CPI for Germany, Switzerland, Great Britain, and the USA can be rejected at the 10% level. Housing hedges partially in Germany and Switzerland and excessively in Great Britain and the USA. Concerning the EPI-CPI relationship, the no cointegration hypothesis can be rejected for Australia, Germany, and Portugal as well as for the whole panel at the 5% level in the trend specification. Further, the hypothesis can be for Italy, and the USA rejected at the 10% level. With a CPI increase by 1%, the EPI increases by 0.84% on average ceteris paribus in the whole panel, by 0.33% in Australia, 0.92% in Germany, 0.70% in Italy, 0.15% in Portugal and 0.97% in the USA. Further, the group ADF test rejects the no cointegration hypothesis for the post-1950 housing returns with a relationship slightly above one. As a consequence, and due to the rejection based on the Levin, Lin, and Chu test in the perfect hedge test, one can claim that housing hedges against inflation nearly perfectly in the post-1950 period.

The summary of the long-time horizon reads as follows: the hypothesis of no cointegrated relationships between the performance indices and the CPI can be rejected in both samples at the 5% level in general. In the whole sample, the no cointegration hypothesis can only be rejected assuming imperfect hedges, where housing is an excessive and equity a partial hedge. However, in the post-1950 period, the no cointegration hypothesis for all indices can be rejected (returns, prices, rents) assuming perfect hedges, except the Im, Pesaran, and Shin for housing returns. Without this assumption and estimating the magnitude of the nominal return–inflation relation it turns out, housing is superior in hedging against inflation in the long run.

5 Dynamics

Up to this point, the results focus on the return–inflation relationship within different discrete-time horizons, namely 1 year (short run), 5 and 10 years (both medium run), as well as in the long run via cointegration testing. It turns out, the results depend on the time horizon. To illustrate this time dependency and additionally the transmissions, I estimate VECMs according to:

The choice of the country-specific long-run relationships \({\bar{\beta }}_{ix}\), trend \({\bar{\delta }}_{ix}\), and the number of lags depends on the group cointegration test results. In the full sample, the country-specific long-run relationships, trend, and lag length are from Table 9 and Eq. (5) for all housing indices and equity prices and from Table 10 for the equity performance index. In the post-1950 period, the assumption of a perfect hedge holds throughout the whole panel for all indices except for the housing performance index and equity yield index. Given the assumption of a perfect hedge holds, the long-run parameters and the lag structure follow Table 8 and Eq. (4). For the housing performance index, the long-run parameters and the lag structure are from Table 10, whereas for the equity yields, no long-run relationship is assumed at all, both for the full and the post-1950 sample. Thus, I assume, the dynamics follow a VAR(1).

The short-run dynamics estimation is also country-specific. To use the panel structure, the GME applies, as Rebucci (2010) and Canova and Ciccarelli (2013) suggest.Footnote 9

Figure 5 plots generalized IRFs of the GME VECMs. Note two points. First, the full sample estimate excludes German data as the hyperinflation (1923) is an extreme outlier and thus, would dominate the results.Footnote 10 Second, neither the assets (housing and equity) nor the differences in their components (prices, yields, and total returns) are one-by-one comparable due to different data availability. Consequently, also the inflation dynamic differs from panel to panel.

The IRF of the HPI and EPI to an inflation shock is plotted in panels (a) and (b) of Fig. 5 for the full sample with straight lines and dashed for the post-1950 period. The same applies to panels (c) and (d) for asset prices and panels (e) and (f) for yields. The dynamics match the discrete-time horizon estimates. Concerning the full sample, housing hedges in the short run partly and the HPI intersects the CPI approximately after 10 years. Equity is not a hedge against inflation shocks in the short run and the transition ends approximately after 15 years. In the post-1950 period, housing is a good hedge even in the short run. Equity tends to be a hazard in the short run post-1950, after 15 years the negative effect of the inflation shock vanishes, and after more than 30 years equity is a perfect hedge against inflation. The IRFs of the price and yield decompositions are similar, except that the equity yield has no long-run relationship with the CPI.

6 Robustness

The return on housing combines rental income and changes in house prices. Jordà et al. (2019) reports the former relies on the rent components of the cost of living of CPIs. This results potentially in a simultaneous causality bias for the short and medium-term analysis, while the cointegration estimates are consistent, even in the case of simultaneous causality. Two approaches address the problem in the short and medium run. The first subtracts out the rent component from the CPI (non-housing CPI), and the latter subtracts out yields from the asset return (asset price index).

6.1 Non-housing CPI

Interpreting the change of nominal rents as an equivalent to the housing costs component \(\pi ^h_t\) of inflation, one can construct a non-housing inflation index by \(\pi ^{xh}_t=\tfrac{\pi _t-h \pi ^{h}_t}{1-h}\), where h is the average weight of housing costs of the OECD.stats (2020) CPI of the respective country.

The estimates of the results can be found in Tables 11, 12, 13, 14 and 15 and Figs. 6 and 7 in the Appendix. In the benchmark, the return on housing–inflation relations decreases by 0.10\(-\)0.15, yet the \({\hat{\beta }}_H \pm 2 {\hat{\sigma }}_{\beta _H}\) intervals still do not include the zero. Further, the hypothesis of an equal return–inflation relationship of both housing and equity can be rejected at the 5% level. Hence, housing is evidently superior in hedging against inflation even when the housing inflation component, which housing hedges perfectly by definition, is subtracted from the CPI. It is worth mentioning that the \(R^2_{\textrm{adj}}\) for housing in the medium run remains high. Qualitatively, the robustness applies to all results in Tables 11, 12, 13, 14 and 15 and Figs. 6 and 7.

6.2 Asset price indices

Using asset price indices rules out the simultaneous causality of housing costs and CPI from two perspectives. First, new house prices compose the costs of new land and construction, both are not included in the CPI.Footnote 11 Second, asset prices are not a direct component of CPIs and rely fundamentally on claims on future rents and thus, also affect the contemporaneous CPI neither directly nor indirectly.

Neither in the short- and medium-run analysis (Table 5) nor in the cointegration analysis and VECM, the house prices–inflation relation is lower than the housing rents–inflation relation. In cases where the relations were not similar, the price–inflation relation was higher than the rent–inflation relation. Thus, the results are not driven by a potential rental-rate-induced simultaneous causality bias.

7 Conclusion

As housing and equity are real assets or represent claims on them, theoretically they should keep pace with inflation and should offer an ex-post hedge against general price shocks. The present paper confronts this proposition with data from the JST Macrohistory Database and the study contributes thereby to the asset return–inflation literature. The database covers housing and equity return rates and CPIs for 16 countries from 1870 to 2020. The assessment conducts for different time horizons, in fact, the short and medium run (within 1 year and 5 and 10 years) and the long run (cointegration). IRFs of VECMs illustrate the transmissions. Further, decompositions of the results into different periods, prices and yields, and on the country level and, additionally, a check for nonlinearity in inflation, provide deeper insights.

To summarize, housing hedges against inflation at least partly in the short run. In the medium run, the relationship is higher in comparison to the short run and housing is a perfect hedge in the post-1950 period. In the long run, housing is an excessive hedge in the full sample and a perfect hedge in the post-1950 sample. The IRFs show that the transition to the new equilibrium takes about 15 years. Equity does not provide a hedge against inflation in the short run and in the post-1950 sample equity tends actually to be a hazard. Noteworthy, during the time of the hyperinflation in Germany, equity return rates kept pace instantaneously with inflation. In the medium run, the equity return–inflation relationship estimates increase on average and also the POLS compared to the short run. The equity return–inflation relationship also tends to be smaller in the post-1950 period in the medium run. However, the latter reverses in the long run, where equity hedges on average 84% against inflation in the full sample and perfectly in the post-1950 sample. The IRFs of EPIs to an inflation shock visualize the time needed to reach the new equilibrium and is longer than of HPIs in the post-1950 period and similar in the whole sample. Based on POLS estimation, the hypothesis that equity and housing are equally good inflation hedges in the short and medium run must be rejected at the 5% level. Thus, in the short and medium run housing is a superior hedge against inflation in comparison to equity and a weak superiority in the long run. Lastly, it is important to note that inflation accounts for a large fraction of the variation of the return on housing in the medium run, e.g., the coefficient of determination of the housing return–inflation relation is 0.42 in the 10-year moving average POLS regression in comparison to 0.06 of the coefficient of determination of the equity return–inflation relation.

The findings concerning equity confirm previous findings; concerning housing, they set a benchmark for future studies. The results are robust to a potential rent-induced simultaneous causality bias as they are also valid for pure price analyses and a non-housing CPI, and the long-run estimates are consistent even in the presence of a simultaneous causality.

Different characteristics between housing and equity, e.g., the close spatial ties between housing operations and the respective currency area in contrast to the ability of equity to operate internationally, provide explanatory approaches for future studies to solve the ‘short-term stock-return inflation puzzle’.

Notes

Madadpour and Asgari (2019) give a review of this literature by exploring 158 research articles.

The duration of living in the current owner-occupied residence also serves to assign a weighting to the selected intervals of the short and medium term.

Irving Fisher was the first who stated the hypothetical relationship between nominal returns and expected inflation, which is the basis of the named to him Fisher equation (Fisher 1930).

Note that the choice of an ex-post hedge analysis instead of an ex-ante is also a matter of data availability and quality as realizations can be quantified more precisely than expectations.

Taylor (2002) studies the purchasing power parity theory with JST Macrohistory Database-related data.

According to Pedroni (2019), the GME is far more common.

As a lot of data are missing in the pre-1950 period, I do not the exercise for this period.

I am not aware of any suitable methodology for constructing confidence intervals for GME-VECM IRFs.

While the dynamic looks similar the initial shock is larger by far.

According to Jordà et al. (2019), the database’s imputed rents are based on observed market rents and not on a user cost approach.

References

Anari A, Kolari J (2002) House Prices and Inflation. Real Estate Econ 30(1):67–84. https://doi.org/10.1111/1540-6229.00030

Arnold S, Auer BR (2015) What do scientists know about inflation hedging? North Am J Econ Finance 34:187–214. https://doi.org/10.1016/j.najef.2015.08.005

Boudoukh J, Richardson M (1993) Stock returns and inflation: a long-horizon perspective. Am Econ Rev 83(5):1346–1355

Brounen D, Eichholtz P, Staetmans S, Theebe M (2013) Inflation Protection from Homeownership: long-run evidence, 1814–2008. Real Estate Econ 42(3):662–689. https://doi.org/10.1111/1540-6229.12023

Canova Fabio, Ciccarelli Matteo (2013) Panel vector autoregressive models: a survey. In: VAR models in macroeconomics-new developments and applications: essays in honor of Christopher A. Sims. Emerald Group Publishing Limited, pp 205–246. https://doi.org/10.1108/s0731-9053(2013)0000031006

Christou C, Gupta R, Nyakabawo W, Wohar ME (2018) Do house prices hedge inflation in the US? A quantile cointegration approach. Int Rev Econ Finance 54:15–26. https://doi.org/10.1016/j.iref.2017.12.012

Chudik A, Hashem Pesaran M (2019) Mean group estimation in presence of weakly cross-correlated estimators. Econ Lett 175:101–105. https://doi.org/10.1016/j.econlet.2018.12.036

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560. https://doi.org/10.1162/003465398557825

Fama EF, William Schwert G (1977) Asset returns and inflation. J Financ Econ 5(2):115–146. https://doi.org/10.1016/0304-405x(77)90014-9

Fisher I (1930) The theory of interest

Hamilton J (1994) Time series analysis. Princeton University Press. https://www.ebook.de/de/product/3239264/james_hamilton_paterson_time_series_analysis.html

Jordà Ò, Schularick M, Taylor AM (2017) Macrofinancial history and the new business cycle facts. NBER Macroecon Annu 31(1):213–263. https://doi.org/10.1086/690241

Jordà Ò, Knoll K, Kuvshinov D, Schularick M, Taylor AM (2019) The rate of return on everything, 1870–2015. Q J Econ 134(3):1225–1298. https://doi.org/10.1093/qje/qjz012

Knoll K, Schularick M, Steger T (2017) No price like home: global house prices, 1870–2012, appendix. Am Econ Rev 107(2):331–353

Kuhn M, Schularick M, Steins UI (2020) Income and Wealth Inequality in America, 1949–2016. J Polit Econ 128(9):3469–3519. https://doi.org/10.1086/708815

Madadpour S, Asgari M (2019) The puzzling relationship between stocks return and inflation: a review article. Int Rev Econ 66(2):115–145. https://doi.org/10.1007/s12232-019-00317-w

Marlay MC, Fields AK (2010) Seasonality of moves and the duration and tenure of residence, 2004. Household Economic Studies

OECD.stats (2020) Consumer price indices. https://stats.oecd.org/OECDStat_Metadata/ShowMetadata.ashx?Dataset=PRICES_CPI &ShowOnWeb=true &Lang=en

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom Theory. https://doi.org/10.1017/s0266466604203073

Pedroni P (2019) Panel cointegration techniques and open challenges. In: Panel data econometrics. Elsevier, pp. 251–287https://doi.org/10.1016/b978-0-12-814367-4.00010-1

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econom 68(1):79–113. https://doi.org/10.1016/0304-4076(94)01644-f

Rebucci A (2010) Estimating VARs with long stationary heterogeneous panels: a comparison of the fixed effect and the mean group estimators. Econ Model 27(5):1183–1198. https://doi.org/10.1016/j.econmod.2010.03.001

Taylor AM (2002) A century of purchasing-power parity. Rev Econ Stat 84(1):139–150. https://doi.org/10.1162/003465302317331973

Acknowledgements

The study arose from an empirical exercise as part of my oral doctoral examination at the University of Augsbur. I am grateful to chairwoman Kerstin Roeder as well as to my PhD advisors Alfred Maußner and Burkhard Heer for initial ideas and a fruitful discussion. Additionally, I would like to thank Johannes Huber, Tatiana Kirsanova, Jaime Montana, and Lorenzo Ranaldi for their valuable comments and the Fundação para a Ciência e a Tecnologia (FCT) grant PTDC/EGE-ECO/28596/2017 ‘Rethinking Fiscal Policy in the Global Economy’ for financial support. The paper also benefited from valuable comments at the 27th International Conference on Macroeconomic Analysis and International Finance, Rethymnon, Crete the annual conference of the Royal Economic Society and Scottish Economic Society 2023, Glasgow; the 14th Real Estate Markets and Capital Markets (ReCapNet) Conference, ZEW Mannheim; the Seminar at the Center of Economics Prosperity, Católica Lisbon; and at the annual conference of the Verein fuer Socialpolitik 2022, Basel.

Funding

Open Access funding enabled and organized by Projekt DEAL. The author did not receive support from any organization for the submitted work. No funding was received to assist with the preparation of this manuscript. No funding was received for conducting this study. The author received money from the Fundação para a Ciência e a Tecnologia (FCT) grant PTDC/EGE-ECO/28596/2017 ‘Rethinking Fiscal Policy in the Global Economy’ during the revise.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no relevant financial or non-financial interests to disclose. The author has no competing interests to declare that are relevant to the content of this article. The author certifies that he has no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript. The author has no financial or proprietary interests in any material discussed in this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Robustness

See Tables 11, 12, 13, 14, 15 and Figs. 6, 7.

Long-run cross-country

See Tables 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29 and 30.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fehrle, D. Hedging against inflation: housing versus equity. Empir Econ 65, 2583–2626 (2023). https://doi.org/10.1007/s00181-023-02449-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02449-z