Abstract

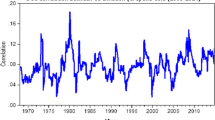

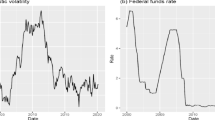

This study purposes of investigating the roles of gold as a hedge or a safe haven against inflation in Canada. We utilize the standard and quantile techniques in the volatility models, with the time-varying conditional variance of the regression residuals based on the TGARCH descriptions. We found that gold only plays a minor role as a hedge and safe haven against inflation since their returns do not evolve with the same rhythm as inflation. The rolling regression analysis, on the other hand, demonstrates that the incidents of refuge against purchasing power loss only occasionally occur at different times and not consistently across holding periods. These findings indicate that gold does not have the ability to secure Canadian investment during high inflationary periods and at all the time. Thus, Canadian investors should hold a well-diversified portfolio to earn sustainable return and protection from purchasing power loss.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Source: Natural Resources Canada.

- 2.

- 3.

The universal agreement believes that the sheer size of gold holdings is vital for gold investors to keep track of the gold reserves of the central banks because they influence gold purchases and sales worldwide.

References

Adrangi, B., Chatrath, A., Raffiee, K.: Economic activity, inflation, and hedging: The case of gold and silver investments. J. Wealth Manage. 6(2), 60–77 (2003)

Arnold, S., Auer, B.R.: What do scientists know about inflation hedging? North Am. J. Econ. Finance 34, 187–214 (2015)

Artigas, J. C.: Linking global money supply to gold and to future inflation. World Gold Council, Gold: Report (2010)

Bae, K.-H., Karolyi, G.A., Stulz, R.M.: A new approach to measuring financial contagion. Rev. Financial Stud. 16(3), 717–763 (2003)

Baillie, R.T.: Commodity prices and aggregate inflation: Would a commodity price rule be worthwhile? Carnegie-Rochester Conf. Ser. Public Policy 31(1), 185–240 (1989)

Bampinas, G., Panagiotidis, T.: Are gold and silver a hedge against inflation? A two century perspective. Int. Rev. Financial Anal. 41(C), 267–276 (2015)

Barisheff, N.: Portfolio diversification with gold, silver and platinum bullion. AIMA J. (71) (2006).

Baur, D.G., McDermott, T.K.: Is gold a safe haven? International evidence. J. Bank. Finance 34(8), 1886–1898 (2010)

Baur, D.G., Smales, L.A.: Gold and Geopolitical Risk (2018). SSRN 3109136

Beckmann, J., Czudaj, R.: Gold as an inflation hedge in a time-varying coefficient framework. North Am. J. Econ. Finance 24(C), 208–222 (2013)

Bekaert, G., Wang, X.: Inflation risk and the inflation risk premium. Econ. Policy 25(64), 755–806 (2010)

Boudoukh, J., Richardson, M.: Stock returns and inflation: A long-horizon perspective. Am. Econ. Rev. 83(5), 1346–1355 (1993)

Brooks, C.: Introductory Econometrics for Finance, 2nd edn. Cambridge University Press, New Yok (2008)

Brown, K.C., Howe, J.S.: On the use of gold as a fixed income security. Financial Anal. J. 43(4), 73–76 (1987)

Caballero, R.J., Krishnamurthy, A.: Collective risk management in a flight to quality episode. J. Finance 63(5), 2195–2230 (2008)

Cai, J., Cheung, S.Y.L., Wong, M.C.S.: What moves the gold market? J. Futures Mark. 21(3), 257–278 (2001)

Chen, J.: Can gold hedge stock market and inflation simultaneously? Int. J. Econ. Finance 12(4), 1–0 (2020)

Conover, C.M., Jensen, G.R., Johnson, R.R., Mercer, J.M.: Can precious metals make your portfolio shine? J. Invest. 18(1), 75–86 (2009)

Crowder, D.: 8 inflation-proof investments for Canadian investors. https://inflationcalculator.ca/8-inflation-proof-investments-for-canadian-investors/. Accessed 13 Oct 2019

Dempster, N., Artigas, J.C.: Gold: inflation hedge and long-term strategic asset. J. Wealth Manage. 13(2), 69–75 (2010)

Epstein, L.G., Schneider, M.: Ambiguity, information quality, and asset pricing. J. Finance 63(1), 197–228 (2008)

Fama, E.F., Schwert, G.W.: Asset returns and inflation. J. Financ. Econ. 5(2), 115–146 (1977)

Ghazali, M.F., Lean, H.H., Bahari, Z.: Is gold a good hedge against inflation? Empirical evidence in Malaysia. Kajian Malaysia 31(Supp. 1), 69–84 (2015)

Ghazali, M.F., Lean, H.H., Bahari, Z.: Gold investment in malaysia: Refuge from stock market turmoil or inflation-protector? J. Soc. Sci. Res. Special Issue 2, 214–224 (2018)

Ghazali, M.F., Lean, H.H., Bahari, Z.: Does gold investment offer protection against stock market losses? Evidence from five countries. Singap. Econ. Rev. 62(2), 275–301 (2020)

Ghazali, M.F., Lean, H.H., Bahari, Z., Tuyon, J.: Gold investment and financial crisis: Some theoretical considerations. Labuan Bull. Int. Bus. Finance 16(1), 53–63 (2018)

Ghosh, D., Levin, E.J., Macmillan, P., Wright, R.E.: Gold as an inflation hedge? Stud. Econ. Finance 22(1), 1–25 (2004)

Hoang, T.H.V.: Has gold been a good hedge against inflation in France from 1949 to 2011? Empirical evidence of the French specificity. In: 29th International Conference of the French Finance Association, French (2012)

Hoang, T.H.V., Lahiani, A., Heller, D.: Is gold a hedge against inflation? New evidence from a nonlinear ARDL approach. Econ. Model. 54, 54–66 (2016)

Iqbal, J.: Does gold hedge stock market, inflation and exchange rate risks? An econometric investigation. Int. Rev. Econ. Finance 48, 1–7 (2017)

Jaffe, J.F.: Gold and gold stocks as investments for institutional portfolios. Financial Anal. J. 45(2), 53–59 (1989)

Jaffe, J.F., Mandelker, G.: The “Fisher effect” for risky assets: An empirical investigation. J. Finance 31(2), 447–458 (1976)

Jastram, R.W.Z.: The Golden Constant: The English and American Experience 1570–1976. Ronald Press Publication, New York (1977)

Jastram, R.W., Leyland, J.: The Golden Constant: The English and American Experience 1560–2007. Edward Elgar Publishing , London (2009)

Koutsoyiannis, A.: A short-run pricing model for a speculative asset, tested with data from the gold bullion market. Appl. Econ. 15(5), 563–581 (1983)

Kutan, A.M., Aksoy, T.: Public information arrival and gold market returns in emerging markets: Evidence from the Istanbul Gold Exchange. Sci. J. Adm. Dev. 2, 13–26 (2004)

Laurent, R.D.: Is there a role for gold in monetary policy? Econ. Perspect. 18(2), 2–14 (1994)

Lê Cook, B., Manning, W.G.: Thinking beyond the mean: A practical guide for using quantile regression methods for health services research. Shanghai Arch. Psychiat. 25(1), 55 (2013)

Levin, E.J., Wright, R.E.: Short-run and long-run determinants of the price of gold. Working Paper: World Gold Council (2006)

Lipschitz, L., Otani, I.: A simple model of the private gold market, 1968–74: An exploratory econometric exercise. Staff Papers 24(1), 36–63 (1977)

Michaud, R.O., Michaud, R., Pulvermacher, K.: Gold as a strategic asset. World Gold Council, 10 (2006)

Miyazaki, T., Hamori, S.: Testing for causality between the gold return and stock market performance: Evidence for ‘gold investment in case of emergency.’ Appl. Financial Econ. 23(1), 27–40 (2013)

Narayan, P.K., Narayan, S., Zheng, X.: Gold and oil futures markets: Are markets efficient. Appl. Energy 87(10), 3299–3303 (2010)

Ranson, D., Wainwright, H.C.: Inflation Protection: Why Gold Works Better Than “Linkers.” World Gold Council, London (2005)

Ranson, D., Wainright, H. C.: Why gold, not oil, is the superior predictor of inflation. Gold Report, World Gold Council, 6–7 November (2005b)

Salisu, A.A., Raheem, I.D., Ndako, U.B.: The inflation hedging properties of gold, stocks and real estate: A comparative analysis. Resour. Policy 66, 101605 (2020)

Singh, N.P., Joshi, N.: Investigating gold investment as an inflationary hedge. Bus. Perspect. Res. 7(1), 30–41 (2019)

Taylor, N.J.: Precious metals and inflation. Appl. Financial Econ. 8(2), 201–210 (1998)

Tkacz, G.: Gold prices and inflation (No. 2007, 35). Bank of Canada Working Paper (2007)

Tully, E., Lucey, B.M.: A power GARCH examination of the gold market. Res. Int. Bus. Finance 21(2), 316–325 (2007)

Wang, K.M., Lee, Y.M., Thi, T.B.N.: Time and place where gold acts as an inflation hedge: An application of long-run and short-run threshold model. Econ. Model. 28(3), 806–819 (2011)

Worthington, A.C., Pahlavani, M.: Gold investment as an inflationary hedge: Cointegration evidence with allowance for endogenous structural breaks. Appl. Financial Econ. Lett. 3(4), 259–262 (2007)

Acknowledgment

This research work is funded by the Fundamental Research Grant Scheme (FRG0459-2017), supported by the Ministry of Higher Education and Universiti Malaysia Sabah. The authors also would like to thank Universiti Malaysia Kelantan for financial support for attending the International Conference on Business and Technology (ICBT 2020).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Ghazali, M.F., Mohd Ussdek, N.F., Amin, H., Muhammad, M.Z. (2021). Gold and Inflation in Canada: A Time-Varying Perspective. In: Alareeni, B., Hamdan, A., Elgedawy, I. (eds) The Importance of New Technologies and Entrepreneurship in Business Development: In The Context of Economic Diversity in Developing Countries. ICBT 2020. Lecture Notes in Networks and Systems, vol 194. Springer, Cham. https://doi.org/10.1007/978-3-030-69221-6_84

Download citation

DOI: https://doi.org/10.1007/978-3-030-69221-6_84

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-69220-9

Online ISBN: 978-3-030-69221-6

eBook Packages: EngineeringEngineering (R0)