Abstract

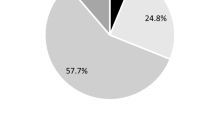

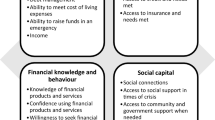

As economic downturns and social uncertainties arise domestically and globally, the capability to cope with financial emergencies and adversities, known as financial resilience, becomes increasingly crucial. It needs particular attention when those developmental risks impact individuals and families at the micro level. However, existing studies mainly explored financial resilience at a macro level, using simple indicators, and in developed countries. These prevent us from understanding and improving people’s financial well-being and its predictors both theoretically and practically. This study aims to fill these research gaps in conceptualization, measurement, and context for the first time. It builds upon relevant theories on resilience, financial well-being, intersectionality, and China’s context to develop and examine a financial resilience conceptual framework. The framework comprises four components: current asset, financial access, financial literacy, and social capital. It also includes four levels ranging from financially vulnerable to low, moderate, and high financially resilient. Using data from the China Family Panel Studies, this study provided an overview of family financial resilience in mainland China. One-fifth of the sampled 3710 families were financially vulnerable or low resilient. Fifteen demographic and socioeconomic determinants, except for region and sex, were significantly associated with financial resilience. The study further identified four combined scenarios featuring benchmarks, cumulative risk factors, and protective factors. These findings have implications for targeted policies and services on financial resilience enhancement, poverty alleviation, and sustainable development in countries with developmental risks. It inspires new perspectives for finance and family studies and suggests specific directions for financial well-being research.

Similar content being viewed by others

Data Availability

This paper uses data from the China Family Panel Studies (CFPS). This data is publicly available on the website: https://www.isss.pku.edu.cn/cfps/.

Code Availability

Not applicable.

References

Ansong, D., Okumu, M., Otchere, F., Koomson, I., & Sherraden, M. (2021). Addressing the burden of education financing in low and lower-middle-income countries: The role of savings accounts, cash transfers, and other income sources. Journal of Family and Economic Issues, 42(4), 745–756. https://doi.org/10.1007/s10834-021-09757-5

Benini, R., & Liping, H. (2013). Special issue on China: Re-thinking China’s economic transition and development in the post-crisis era Introduction: China facing new challenges, beyond the global crisis. Economic Change and Restructuring, 46(1), 1–7. https://doi.org/10.1007/s10644-013-9141-z

Bhamra, R., Dani, S., & Burnard, K. (2011). Resilience: The concept, a literature review and future directions. International Journal of Production Research, 49(18), 5375–5393. https://doi.org/10.1080/00207543.2011.563826

Boateng, G. O., Neilands, T. B., Frongillo, E. A., Melgar-Quiñonez, H. R., & Young, S. L. (2018). Best practices for developing and validating scales for health, social, and behavioral research: A primer. Frontiers in Public Health, 6, 149. https://doi.org/10.3389/fpubh.2018.00149

Bradley, R. H., & Corwyn, R. F. (2002). Socioeconomic status and child development. Annual Review of Psychology, 53, 371–399. https://doi.org/10.1146/annurev.psych.53.100901.135233

Bufe, S., Roll, S., Kondratjeva, O., Skees, S., & Grinstein-Weiss, M. (2022). Financial shocks and financial well-being: What builds resiliency in lower-income households? Social Indicators Research, 161(1), 379–407. https://doi.org/10.1007/s11205-021-02828-y

Chai, X., Wang, Z., Wang, J., & Liu, Z. (2023). Development and implementation of financial literacy intervention manual for adolescents: Based on the financial resilience framework. Social Work and Management, 23(1), 26–34.

Chen, J., Rong, S., & Song, M. (2021). Poverty vulnerability and poverty causes in rural China. Social Indicators Research, 153(1), 65–91. https://doi.org/10.1007/s11205-020-02481-x

Chen, Z., & Jin, M. (2017). Financial inclusion in China: Use of credit. Journal of Family and Economic Issues, 38(4), 528–540. https://doi.org/10.1007/s10834-017-9531-x

Connor, K. M., & Davidson, J. R. T. (2003). Development of a new resilience scale: The Connor-Davidson Resilience Scale (CD-RISC). Depression and Anxiety, 18(2), 76–82. https://doi.org/10.1002/da.10113

Coppola, M., Russolillo, M., & Simone, R. (2020). On the management of retirement age indexed to life expectancy: A scenario analysis of the Italian longevity experience. Journal of Risk Finance, 21(3), 217–231. https://doi.org/10.1108/JRF-01-2020-0012

Dai, X., & Li, W. (2022). The influence of culture capital, social security, and living conditions on children’s cognitive ability: Evidence from 2018 China Family Panel Studies. Journal of Intelligence, 10(2), 19. https://doi.org/10.3390/jintelligence10020019

Demiguc-Kunt, A., Klapper, L.F., Singer, D., & van Oudheusen, P. (2015). The Global Findex Database 2014: Measuring financial inclusion around the world. World Bank Policy Research Working Paper (7255).

Dinh, H., Freyens, B., Daly, A., & Vidyattama, Y. (2017). Measuring community economic resilience in Australia: Estimates of recent levels and trends. Social Indicators Research, 132(3), 1217–1236. https://doi.org/10.1007/s11205-016-1337-y

Dutta, K. K., & Babbel, D. F. (2014). Scenario analysis in the measurement of operational risk capital: A change of measure approach. Journal Risk and Insurance, 81(2), 303–334. https://doi.org/10.1111/j.1539-6975.2012.01506.x

Estrada, G., Han, X., Park, D., & Tian, S. (2018). Asia’s middle-income challenge: An overview. Emerging Markets Finance and Trade, 54(6), 1208–1224. https://doi.org/10.1080/1540496x.2017.1421939

Fan, J. X., Wen, M., Jin, L., & Wang, G. (2013). Disparities in healthcare utilization in China: Do gender and migration status matter? Journal of Family and Economic Issues, 34(1), 52–63. https://doi.org/10.1007/s10834-012-9296-1

Fan, J. X., & Yu, Z. (2022). Prevalence and risk factors of consumer financial fraud in China. Journal of Family and Economic Issues, 43(2), 384–396. https://doi.org/10.1007/s10834-021-09793-1

Feldman, S. (1959). A critical-appraisal of the current asset concept. Accounting Review, 34(4), 574–578.

Fletcher, D., & Sarkar, M. (2013). Psychological resilience: A review and critique of definitions, concepts, and theory. European Psychologist, 18(1), 12–23. https://doi.org/10.1027/1016-9040/a000124

Fungacova, Z., & Weill, L. (2015). Understanding financial inclusion in China. China Economic Review, 34, 196–206. https://doi.org/10.1016/j.chieco.2014.12.004

Gallopin, G. C. (2006). Linkages between vulnerability, resilience, and adaptive capacity. Global Environmental Change-Human and Policy Dimensions, 16(3), 293–303. https://doi.org/10.1016/j.gloenvcha.2006.02.004

He, Y., & Ahunov, M. (2022). Financial literacy: The case of China. China & World Economy, 30(5), 75–101. https://doi.org/10.1111/cwe.12438

Heltberg, R., Hossain, N., Reva, A., & Turk, C. (2013). Coping and resilience during the food, fuel, and financial crises. Journal of Development Studies, 49(5), 705–718. https://doi.org/10.1080/00220388.2012.746668

Hussain, A., Endut, N., Das, S., Thanvir, M., Chowdhury, A., Haque, N., Sultana, S., & Ahmed, K. J. (2019). Does financial inclusion increase financial resilience? Evidence from Bangladesh. Development in Practice, 29(6), 798–807. https://doi.org/10.1080/09614524.2019.1607256

Jamison, T. B., Ganong, L., & Proulx, C. M. (2017). Unmarried coparenting in the context of poverty: Understanding the relationship between stress, family resource management, and resilience. Journal of Family and Economic Issues, 38(3), 439–452. https://doi.org/10.1007/s10834-016-9518-z

Jayasinghe, M., Selvanathan, E. A., & Selvanathan, S. (2020). The financial resilience and life satisfaction nexus of Indigenous Australians. Economic Papers, 39(4), 336–352. https://doi.org/10.1111/1759-3441.12296

Joseph, R. (2021). The Great Recession and economic resilience: A longitudinal analysis of low-income households in the United States. Journal of Social Service Research, 47(6), 886–897. https://doi.org/10.1080/01488376.2021.1942394

Kass-Hanna, J., Lyons, A. C., & Liu, F. (2022). Building financial resilience through financial and digital literacy in South Asia and Sub-Saharan Africa. Emerging Markets Review, 51, 100846. https://doi.org/10.1016/j.ememar.2021.100846

Kessler, R. C., Green, J. G., Gruber, M. G., Sampson, N. A., Bromet, E., Cuitan, M., et al. (2010). Screening for serious mental illness in the general population with the K6 screening scale: Results from the WHO World Mental Health (WMH) survey initiative. International Journal of Methods in Psychiatric Research, 19, 4–22.

Kirchler, E., & Maciejovsky, B. (2001). Tax compliance within the context of gain and loss situations, expected and current asset position, and profession. Journal of Economic Psychology, 22(2), 173–194. https://doi.org/10.1016/s0167-4870(01)00028-9

Kober, R., & Thambar, P. J. (2021). Coping with COVID-19: The role of accounting in shaping charities’ financial resilience. Accounting Auditing & Accountability Journal, 34(6), 1416–1429. https://doi.org/10.1108/aaaj-09-2020-4919

Lee, S., & Chen, G. (2022). Understanding financial resilience from a resource-based view: Evidence from US state governments. Public Management Review, 24(12), 1980–2003. https://doi.org/10.1080/14719037.2021.1955951

Liang, Z., & Huang, Y.-T. (2023). Intersecting self-stigma among young Chinese men who have sex with men living with HIV/AIDS: A grounded theory study. American Journal of Orthopsychiatry, 93(1), 75–85. https://doi.org/10.1037/ort0000657

Liao, L., Huang, N., & Yao, R. (2010). Family finances in urban China: Evidence from a national survey. Journal of Family and Economic Issues, 31(3), 259–279. https://doi.org/10.1007/s10834-010-9218-z

Løvschal, M. (2022). Retranslating resilience theory in Archaeology. Annual Review of Anthropology, 51(1), 195–211. https://doi.org/10.1146/annurev-anthro-041320-011705

Min, J., Li, Y., Xu, L., & Chi, I. (2018). Psychological vulnerability of widowhood: Financial strain, social engagement and worry about having no care-giver as mediators and moderators. Ageing & Society, 38(11), 2356–2375. https://doi.org/10.1017/S0144686X17000654

Muir, K., Reeve, R., Connolly, C., Marjolin, A., Salignac, F. and Ho, K. (2016). Financial resilience in Australia 2015. Centre for Social Impact, University of New South Wales, & National Australia Bank.

Newman, S., Saul, D., Dearien, C., & Hernandez, N. (2023). Self-employment or selfless employment? Exploration of factors that motivate, facilitate, and constrain Latina entrepreneurship from a family embeddedness perspective. Journal of Family and Economic Issues, 44(1), 206–219. https://doi.org/10.1007/s10834-021-09813-0

Norris, F. H. (2010). Behavioral science perspectives on resilience. CARRI Research Report 10: Community and Regional Resilience Institute.

Pan, X., Wu, W., & Zhang, X. (2020). Is financial advice a cure-all or the icing on the cake for financial literacy? Evidence from financial market participation in China. International Review of Financial Analysis, 69, 101473. https://doi.org/10.1016/j.irfa.2020.101473

Peng, C., She, P., & Lin, M. (2022). Financial literacy and portfolio diversity in China. Journal of Family and Economic Issues, 43(3), 452–465. https://doi.org/10.1007/s10834-021-09810-3

Peng, P., & Mao, H. (2022). The effect of digital financial inclusion on relative poverty among urban households: A case study on China. Social Indicators Research. https://doi.org/10.1007/s11205-022-03019-z

Qi, X., Ye, S., Xu, Y., & Chen, J. (2022). Uneven dynamics and regional disparity of multidimensional poverty in China. Social Indicators Research, 159(1), 169–189. https://doi.org/10.1007/s11205-021-02744-1

Ren, Q., & Ye, M. (2017). Donations make people happier: Evidence from the Wenchuan earthquake. Social Indicators Research, 132(1), 517–536. https://doi.org/10.1007/s11205-016-1233-5

Rothwell, D. W., Giordono, L., & Stawski, R. S. (2022). How much does state context matter in emergency savings? Disentangling the individual and contextual contributions of the financial capability constructs. Journal of Family and Economic Issues, 43(4), 703–715. https://doi.org/10.1007/s10834-022-09823-6

Salignac, F., Hanoteau, J., & Ramia, I. (2022). Financial resilience: A way forward towards economic development in developing countries. Social Indicators Research, 160(1), 1–33. https://doi.org/10.1007/s11205-021-02793-6

Salignac, F., Marjolin, A., Reeve, R., & Muir, K. (2019). Conceptualizing and measuring financial resilience: A multidimensional framework. Social Indicators Research, 145(1), 17–38. https://doi.org/10.1007/s11205-019-02100-4

Serido, J. (2020). Weathering economic shocks and financial uncertainty: Here we go again. Journal of Family and Economic Issues, 41(3), 389–390. https://doi.org/10.1007/s10834-020-09702-y

Serido, J., Shim, S., & Tang, C. (2013). A developmental model of financial capability: A framework for promoting a successful transition to adulthood. International Journal of Behavioral Development, 37(4), 287–297. https://doi.org/10.1177/0165025413479476

Sharpe, D. L., Yao, R., & Liao, L. (2012). Correlates of credit card adoption in urban China. Journal of Family and Economic Issues, 33(2), 156–166. https://doi.org/10.1007/s10834-012-9309-0

Sherraden, M. S. (2013). Building blocks of financial capability. In J. Birkenmaier, M. S. Sherraden, & J. Curley (Eds.), Financial capability and asset development: Research, education, policy, and practice (pp. 3–43). Oxford University Press.

Shi, W., Chongsuvivatwong, V., Geater, A., Zhang, J., Zhang, H., & Brombal, D. (2011). Effect of household and village characteristics on financial catastrophe and impoverishment due to health care spending in Western and Central Rural China: A multilevel analysis. Health Research Policy and Systems, 9(1), 16. https://doi.org/10.1186/1478-4505-9-16

Siller, H., & Aydin, N. (2022). Using an intersectional lens on vulnerability and resilience in minority and/or marginalized groups during the Covid-19 pandemic: A narrative review. Frontiers in Psychology, 13, 894103. https://doi.org/10.3389/fpsyg.2022.894103

Stevenson, C., Wakefield, J. R. H., Bowe, M., Kellezi, B., Jones, B., & McNamara, N. (2022). Weathering the economic storm together: Family identification predicts future well-being during covid-19 via enhanced financial resilience. Journal of Family Psychology, 36(3), 337–345. https://doi.org/10.1037/fam0000951

Sun, M. (2021). The potential causal effect of hukou on health among rural-to-urban migrants in China. Journal of Family and Economic Issues, 42(3), 508–517. https://doi.org/10.1007/s10834-020-09698-5

Sun, S., & Chen, Y.-C. (2022). Is financial capability a determinant of health? Theory and evidence. Journal of Family and Economic Issues, 43(4), 744–755. https://doi.org/10.1007/s10834-022-09869-6

Sun, S., Chen, Y.-C., Ansong, D., Huang, J., & Sherraden, M. S. (2022). Household financial capability and economic hardship: An empirical examination of the financial capability framework. Journal of Family and Economic Issues, 43(4), 716–729. https://doi.org/10.1007/s10834-022-09816-5

Tahir, M. S., Shahid, A. U., & Richards, D. W. (2022). The role of impulsivity and financial satisfaction in a moderated mediation model of consumer financial resilience and life satisfaction. International Journal of Bank Marketing, 40(4), 773–790. https://doi.org/10.1108/ijbm-09-2021-0407

Tinta, A. A., Ouedraogo, I. M., & Al-Hassan, R. M. (2022). The micro determinants of financial inclusion and financial resilience in Africa. African Development Review, 34(2), 293–306. https://doi.org/10.1111/1467-8268.12636

Wang, L., Lu, W., & Malhotra, N. K. (2011). Demographics, attitude, personality and credit card features correlate with credit card debt: A view from China. Journal of Economic Psychology, 32(1), 179–193. https://doi.org/10.1016/j.joep.2010.11.006

Wann, C. R., & Burke-Smalley, L. A. (2023). Attributes of households that engage in higher levels of family financial planning. Journal of Family and Economic Issues, 44(1), 98–113. https://doi.org/10.1007/s10834-021-09805-0

Wen, Y., & Hanley, J. (2015). Rural-to-urban migration, family resilience, and policy framework for social support in China. Asian Social Work and Policy Review, 9(1), 18–28. https://doi.org/10.1111/aswp.12042

World Bank. (2022a). World development indicators: The world by income and region. https://datatopics.worldbank.org/world-development-indicators/the-world-by-income-and-region.html

World Bank. (2022b). Population total in China. https://data.worldbank.org/indicator/SP.POP.TOTL?locations=CN

World Bank. (2022c). Poverty ratio in China. https://data.worldbank.org/indicator/SI.POV.DDAY?locations=CN

Wu, B., Bian, W., Xue, Y., & Zhang, H. (2021). Confucian culture and homeownership: Evidence from Chinese families. Journal of Family and Economic Issues, 42(1), 182–202. https://doi.org/10.1007/s10834-020-09685-w

Xiao, J. J., Yan, C., Bialowolski, P., & Porto, N. (2021). Consumer debt holding, income and happiness: Evidence from China. International Journal of Bank Marketing, 39(5), 789–809. https://doi.org/10.1108/ijbm-08-2020-0422

Xie, Y., & Hu, J. (2014). An introduction to the China Family Panel Studies (CFPS). Chinese Sociological Review, 47(1), 3–29. https://doi.org/10.2753/CSA2162-0555470101.2014.11082908

Xu, Y. (2018). Generalized trust and financial risk-taking in China: A contextual and individual analysis. Frontiers in Psychology. https://doi.org/10.3389/fpsyg.2018.01308

Yang, B., Feldman, M. W., & Li, S. (2021). The status of family resilience: Effects of sustainable livelihoods in rural China. Social Indicators Research, 153(3), 1041–1064. https://doi.org/10.1007/s11205-020-02518-1

Yao, R., Xiao, J. J., & Liao, L. (2015). Effects of age on saving motives of Chinese urban consumers. Journal of Family and Economic Issues, 36(2), 224–238. https://doi.org/10.1007/s10834-014-9395-2

Yao, R., & Xu, Y. (2015). Chinese urban households’ security market participation: Does investment knowledge and having a long-term plan help? Journal of Family and Economic Issues, 36(3), 328–339. https://doi.org/10.1007/s10834-015-9455-2

Zhang, B. (2015). China’s economic transition syndrome. China & World Economy, 23(3), 59–78. https://doi.org/10.1111/cwe.12114

Zhang, W., Li, H., Ishida, S., & Park, E. (2010). China’s non-governmental microcredit practice: History and challenges. Journal of Family and Economic Issues, 31(3), 280–296. https://doi.org/10.1007/s10834-010-9215-2

Zhao, X., Yu, Y.-H., Peng, M.-M., Luo, W., Hu, S.-H., Yang, X., Liu, B., Zhang, T., Gao, R., Chan, C. L.-W., & Ran, M.-S. (2021). Change of poverty and outcome of persons with severe mental illness in rural China, 1994–2015. International Journal of Social Psychiatry, 67(4), 315–323. https://doi.org/10.1177/0020764020951234

Zheng, L., & Peng, L. (2021). Effect of major illness insurance on vulnerability to poverty: Evidence from China. Frontiers in Public Health, 9, 791817. https://doi.org/10.3389/fpubh.2021.791817

Funding

No funding to declare.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflict of interest.

Ethical Approval

This paper uses publicly available data from the China Family Panel Studies (CFPS). Its ethics code is IRB00001052-14010.

Consent to Participate

Consent to participate is integrated in the methods used by the China Family Panel Studies (CFPS).

Consent for Publication

This paper uses data from the China Family Panel Studies (CFPS). This data is publicly available and can be used for publications.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Survey Questions and Justifications of the Financial Resilience Framework

Survey questions | Justifications | |

|---|---|---|

Current asset | ||

Savings | “What is the total family savings including cash and deposit?” “What is the total family income in the last 12 months?” | There are two pre-processed variables in the database, “savings” and “finc”. We obtained the income per month to see the ratio between savings and income (Salignac et al., 2019). Categories of the ratio were divided based on the study by Salignac et al. (2022) |

Debt management | “Excluding mortgage loan, what is the total amount of your family’s unpaid off bank loan?” | We computed the debt-to-income ratio based on the study by Salignac et al. (2022). Categories of the ratio were divided based on the sample distribution, i.e., 0 codes 4, (0,1) codes 3, [1, 3) codes 2, 3 and above codes 1 |

Raise emergency funds | “If your family has to raise a total amount of 20,000 yuan in case of some emergency. How difficult will it be to raise the money?” | |

Met living expenses | “Expense” is a pre-processed variable in the database, we computed the expense-to-income ratio based on the implications by Salignac et al. (2022). Categories of the ratio were divided based on the sample distribution, i.e. [0, 0.5) codes 4, [0.5,1) codes 3, [1, 2) codes 2, 2 and above codes 1 | |

Income quartile | “fincome1_per_p” is a pre-processed variable in the database, which has 4 ascending categories | |

Financial access | ||

Access to bank accounts | “What is the total amount of the certificate of deposits currently held by your family?” | Based on the answer to this question and the amount of household total deposit, we can define whether this household has a bank account or not and how active use of their account |

Access to credits | “When your family needs to borrow a large amount of money (e.g. purchasing a house, operation turnover), from whom you can borrow money first? | These two questions provide multiple choices covering relatives, friends, bank credit or loans, formal credit institutions other than banks, stranger lenders, fringe lending, etc., which match with the credit item in Salignac et al.’s framework mostly. This situation also reflects the emerging credit card market and special emphasis on credit debt in China and is similar to those in Indonesia (Fungacova & Weill, 2015; Wang et al., 2011; Xiao et al., 2021). For the unmet demand, if respondents were rejected by more lenders, their unmet situation may be severer |

Unmet credit demand | “Has your family been rejected to borrow a relatively large amount of money by the following lenders?” | |

Access to insurances | “In the past 12 months, how much was the total expenditure on commercial insurance?” “In the past 12 months, what was the total amount of retirement insurance that all of your family members have received?” | From the direct answers to these two questions, we can infer whether respondents have access to various forms of insurance and the degree of active use of this financial product and service. Based on the sample distribution, we consider 50,000 as a cutoff point for basic insurance users and significant insurance users |

Financial literacy | ||

Financial knowledge | There are 13 questions in the CFPS database to evaluate family heads’ financial knowledge. (An example question is listed below: If the annual interest rate of your savings account is 3%, and the inflation rate is 5%, how many goods you can buy using your savings in this account after 1 year? 1. More than today 2. The same as today 3. Less than today 9. Don’t know.) If respondents clicked the right choice, 2 points would be counted, 1 point for the wrong choice, and 0 for the unknown choice. By adding up the total points, a scale variable ranging from 0 to 26 was generated and then recoded into four categories, i.e. [0, 4] codes 1, [5, 14] codes 2, [15, 20] codes 3, [20, 26] codes 4. This processing is to match the study by Salignac et al. (2019) as more as practicable. In the study by Salignac et al. (2022), the Indonesian database lacks the examination of financial knowledge and behavior | |

Financial confidence | “How can you evaluate your financial knowledge level, compared to the people of your age?” | After respondents finished questions relevant to objective financial knowledge, they need to report the subjective level of their knowledge in a five-point Likert form, which can be viewed as their confidence degree to match with the study by Salignac et al. (2019). We combined “way above the average” and “above the average” as a whole and coded it into 4 to represent “Strong confidence in financial knowledge”, others were not processed |

Financial advice seeking | “I will collect product information, and compare various products as the consulting suggestion when I choose a financial investment.” | This is a five-point Likert question. Respondents need to report their behavior compared with the description. We combined “Somewhat applicable” and “Totally applicable” as a whole and coded them into 4 to represent “Often consult advice before investment choice”, others were not processed |

Proactive actions | There are 6 questions in the CFPS database to evaluate family heads’ positive financial behaviors except for the question focusing on respondents’ “advice” behavior. (An example question is listed below: I manage my own financial revenues and expenditures, as well as those of my family. 1. Totally inapplicable 2. Somewhat inapplicable 3. Generally applicable 4. Somewhat applicable 5. Totally applicable.) If respondents have more applicable positive behaviors, their added-up points would be higher. Based on the sample distribution, we calculated the mean score of their total points, which was distributed in four categories, thus constituting the range of proactive actions | |

Social capital | ||

Social networks | “In the past 12 months, how frequent was the contact between your family and non-resident relatives?” “In the past 12 months, how was the relationship between your family and neighbors?” | The social network is an important component of social capital in previous studies; existing research has also employed questions on family relationships and neighborhood relationships to measure social capital (Yang et al., 2021). We combined the values of two questions and transformed them into four categories based on the distribution |

Social networks support | “In the past 12 months, in terms of the gift and money support, did your family have interactions with your relatives or friends’ family for these life events?” | In the CFPS database, this question matches with the meaning of support from social networks most. Although village trust is used to describe the support from social networks in the study by Salignac et al. (2022), we did not adopt this way because it is more like a subjective evaluation rather than objective support |

Community & government support | “In the past 12 months, did your family receive any cash or non-cash donations from the community?” “In the past 12 months, did your family receive any of the following government subsidies?” | Following Salignac et al. (2022), we consider cash transfer/subsidy as an indicator; Also, charity donation and support are particularly asked in the CFPS database. Combining these two questions, we got a range of values that could be categorized into four types to differentiate whether and how much families receive subsidies |

Appendix 2: Robustness Check Results of Scenario Analysis Using Different Financial Resilience Indexesa

Scenario | Characteristics | Predicted financial resilience score (1–4) | 95% confidence interval | Predicted financial resilience result |

|---|---|---|---|---|

Benchmark | Male family head | 2.87 | 2.83–2.92 | Moderate financially resilient |

Married/cohabited | *2.87 | *2.82–2.92 | ||

35–49 years old | #2.80 | #2.75–2.86 | ||

Urban hukou | ^2.37 | ^2.34–2.41 | ||

Live in Eastern China | ||||

Full-time employed | ||||

High school education | ||||

Income yearly ¥ 40,000–¥ 59,999 | ||||

No risky financial investment | ||||

No probable serious mental illness | ||||

Cumulative mid-level risk factors | Female family head | 2.48 | 2.38–2.58 | Low financially resilient |

Not in the labor force | */ | */ | ||

Primary school education and below | #/ | #/ | ||

Income yearly ¥ 20,000–¥ 39,999 | ^/ | ^/ | ||

Social rental house | ||||

or | Male family head | 2.33 | 2.26–2.39 | |

Part-time/casual/odd jobs | *2.27 | *2.21–2.33 | ||

No education; Income yearly under ¥ 20,000 | #2.32 ^2.19 | #2.25–2.40 ^2.14–2.24 | ||

or | Male family head | 2.28 | 2.02–2.55 | |

65+ years old | */ | */ | ||

Live in Western China | #/ | #/ | ||

Rural hukou | ^/ | ^/ | ||

Probable serious mental illness | ||||

or | Female family head | 2.27 *2.24 #2.23 ^2.06 | 2.18–2.36 *2.15–2.33 #2.14–2.32 ^2.00–2.12 | |

Divorced/widowed | ||||

Rural hukou; No education; Income yearly under ¥ 20,000 | ||||

Cumulative high-level risk factors | Rural hukou | 2.13 | 1.74–2.51 | Financially vulnerable |

Unemployment | *2.14 | *1.85–2.42 | ||

Income yearly under ¥ 20,000 | #2.14 ^2.09 | #1.90–2.38 ^1.84–2.33 | ||

or | Poor health | 2.03 | 1.09–2.96 | |

No education | *1.96 | *0.72–3.21 | ||

Unemployment, part-time/casual/odd jobs | #2.00 | #0.85–3.16 | ||

Rural hukou; Income yearly under ¥ 20,000 | ^/ | ^/ | ||

or | Market rental house | 1.95 | / | |

Divorced/widowed | *1.87 | */ | ||

No internet access | #1.91 | #/ | ||

Poor health, no education, rural hukou, unemployment, income yearly under ¥ 20,000 | ^1.87 | ^/ | ||

Cumulative protective factors | College education | 3.35 | / | High financially resilient |

Income yearly ¥ 100,000+ | *3.31 | */ | ||

Self-owned house; Has internet access; Has private car; Large book collection; Large amount donation; Has risky financial investment; Prefer moderate risk & yield | #3.21 | #/ | ||

Good health; No probable serious mental illness | ^2.85 | ^2.85–2.85 | ||

Family head is a male; 35–49 years old; Married/cohabited; Live in Eastern China; Urban hukou; Full-time employed | ||||

or | Self-employed enterprise or full-time employed | 3.25 | 3.23–3.26 | |

High school education and above | *3.22 | *3.20–3.24 | ||

Income yearly ¥ 60,000+ | #3.13 | #3.12–3.15 | ||

Free-occupied or self-owned house | ^/ | ^/ | ||

Has private car, risky investment | ||||

or | 50+ years old; Married/cohabited; | 3.39 | 3.17–3.60 | |

Not in the labor force; Income yearly ¥ 100,000+; Good health | *3.38 | *3.16–3.61 | ||

Self-owned house; Has private car; Has risky financial investment; Prefer moderate risk | #3.28 ^2.94 | #3.05–3.51 ^/ |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Liu, Z., Chen, JK. Financial Resilience in China: Conceptual Framework, Risk and Protective Factors, and Empirical Evidence. J Fam Econ Iss (2023). https://doi.org/10.1007/s10834-023-09943-7

Accepted:

Published:

DOI: https://doi.org/10.1007/s10834-023-09943-7