Abstract

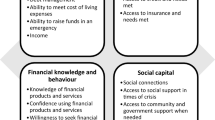

Financial inclusion is a policy priority in both developed and developing countries. Yet almost one in four people remain financially excluded around the globe, with the vast majority living in the developing world. In this paper, we argue that financial resilience: an individual’s ability to function effectively in adverse financial situations, can better help us assist people to cope with financial adversity, develop effective policy and, ultimately, improve economic development. This paper builds on an existing financial resilience measurement framework and adapts it to develop a measure appropriate to the context of developing countries. Indonesia, where one in three people are financially excluded, is used as a case country from which to draw conclusions. We use the Indonesia Family Life Survey and put forward the country’s first snapshot of financial resilience. Implications for research and policy are presented.

Similar content being viewed by others

Availability of data and material

This paper uses data from the Indonesia Family Life Survey. This data is publicly available.

Code availability

Not applicable.

Notes

Figures in US dollars per day are converted into annual values in Rupiah using the private consumption purchasing power parity-adjusted conversion factor, equal to 4,721 Rp. per USD in 2015 (source: https://data.worldbank.org/indicator/).

We use 2, instead of 1.75, as the threshold that characterizes the lower end category of severe financial vulnerability. Using 1.75, only 1.9% of the sample would fall in that vulnerability category. Using 2, 6.2% of the sample falls in that category, which is more consistent with other studies explaining that 7% of the Indonesian population are extremely poor (World Bank, 2020), although we do not pretend that there should be an exact match between extreme poverty and severe financial vulnerability.

References

Abbott-Chapman, J., Denholm, C., & Wyld, C. (2008). Social support as a factor inhibitting teenage risk-taking: Views of students, parents and professionals. Journal of Youth Studies, 11, 611–627.

Abidoye RB, Puspitasari G, Sunindijo R, et al. (2020) Young adults and homeownership in Jakarta, Indonesia. International Journal of Housing Markets and Analysis.

Adger, W. (2000). Social and ecological resilience: Are they related? Progress in Human Geography, 24, 347–364.

Afifa L. (2020) Jokowi points out Indonesia's low literacy, financial inclusion. Available at: https://en.tempo.co/read/1300743/jokowi-points-out-indonesias-low-literacy-financial-inclusion#.XjHw2_DlZws.email.

Akter, S., & Mallick, B. (2013). The poverty-vulnerability-resilience nexus: Evidence form Bangladesh. Ecological Economics, 96, 114–124.

Alkire, S., & Seth, S. (2015). Multidimensional poverty reduction in india between 1999 and 2006: Where and how? World Development, 72, 93–108.

Alatas, V., Banerjee, A., Hanna, R., et al. (2012). Targeting the poor: Evidence from a field experiment in Indonesia. American Economic Review, 102, 1206–1240.

Amidjono, D.S., Brock, J., & Junaidi, E. (2016) Financial literacy in Indonesia. In: Aprea, C., Wuttke, E., & Breuer K, et al. (eds) International Handbook of Financial Literacy. Singapore: Springer.

Bah, A., Bazzi, S., Sumarto, S., et al. (2019). Finding the poor vs. measuring their poverty: Exploring the drivers of targeting effectiveness in Indonesia. The World Bank Economic Review, 33, 573–597.

Banerjee, A., Banerjee, A. V., & Duflo, E. (2011). Poor economics: A radical rethinking of the way to fight global poverty. Public Affairs.

Bank Indonesia. (2012) Financial education in Indonesia: Experiences and evaluation.

Bonanno G. (2005) Clarifying and extending the construct of adult resilience. Amercian Psychologist: 265–267.

Boukhatem, J. (2016). Assessing the direct effect of financial development on poverty reduction in a panel of low- and middle-income countries. Research in International Business and Finance, 37, 214–230.

Buikstra, E., Ross, H., King, C. A., et al. (2010). The components of resilience - perceptions of an Australian rural community. Journal of Community Psychology, 38, 975–991.

Burkett I and Sheehan G. (2009) From the margins to the mainstream: The challenges for microfinance in Australia. Foresters Community Finance.

Cameron, L., & Shah, M. (2014). Can mistargeting destroy social capital and stimulate crime? Evidence from a cash transfer program in Indonesia. Economic Development and Cultural Change, 62, 381–415.

Cnaan, R. A., Moodithaya, M. S., & Handy, F. (2012). Financial inclusion: Lessons from rural South India. Journal of Social Policy, 41, 183–205.

Coady, D., Grosh, M., & Hoddinott, J. (2004). Targeting of transfers in developing countries: Review of lessons and experience. World Bank.

Cole S, Sampson T and Zia B. (2011) Prices or knowledge? What drives demand for financial services in emerging markets? The journal of Finance LXVI: 1933–1967.

Conger, R. D., & Conger, K. J. (2002). Resilience in midwestern families: Selected finding from the first decade of a prospective, longitudinal study. Journal of Marriage and Family, 64, 361–373.

Connolly, C., Georgouras, M., & Hems, L., et al. (2011) Measuring financial exclusion in Australia. Centre for social impact (CSI) - University of New South Wales, for National Australia Bank.

Consumer Financial Protection Bureau. (2018) Pathways to Financial well-being: The role of financial capability. United States Government

Cull, R., Ehrbeck, T., & Holle, N. (2014) Financial inclusion and development: Recent impact evidence. Focus note no. 92. Consultative Group to Assist the Poor.

Cummins, R. A. (2010). Subjective wellbeing, homeostatically protected mood and depression: A synthesis. Journal of Happiness Studies, 11, 1–17.

Dawood, T. C., Pratama, H., Masbar, R., et al. (2019). Does financial inclusion alleviate household poverty? Empirical evidence from Indonesia. Economics and Sociology, 12, 235–252.

Daud, S. N. M., Marzuki, A., Ahmad, N., et al. (2019). Financial vulnerability and its determinants: Survey evidence from Malaysian households. Emerging Markets Finance and Trade, 55, 1991–2003.

Deb, P., Okten, C., & Osili, U. O. (2010). Giving to family versus giving to the community within and across generations. Journal of Population Economics, 23, 1091–1115.

DeLoach, S. B., & Smith-Lin, M. (2018). The role of savings and credit in coping with idiosyncratic household shocks. The Journal of Development Studies, 54, 1513–1533.

Demiguc-Kunt, A., Klapper, L.F., & Singer, D., et al. (2015) The global findex database 2014: Measuring financial inclusion around the world. World Bank Policy Research Working Paper (7255).

Demirgüç-Kunt, A., Klapper, L., Singer, D., et al. (2018). The global findex database 2017: Measuring financial inclusion and the fintech revolution. World Bank.

Donnellan, B., Conger, K. J., McAdams, K. K., et al. (2009). Personal characteristics and resilience to economic hardship and its consequences: Conceptual issues and empirical illustrations. Journal of Personality, 77, 1645–1676.

Dwiputri, I. N. (2017). The impact of the unconditional cash transfer program (Blt) on cigarette consumption in Indonesian society. Journal of Indonesian Economy and Business, 32, 138–150.

Elbers, C., Fujii, T., Lanjouw, P., et al. (2007). Poverty alleviation through geographic targeting: How much does disaggregation help? Journal of Development Economics, 83, 198–213.

Ensel, W. M., & Lin, N. (1991). The life stress paradigm and psychological distress. Journal of Health and Social Behaviour, 32, 321–341.

ESCAP. (2019). Closing the gap: Empowerment and inclusion in Asia and the Pacific. UN ESCAP.

Filmer, D., & Pritchett, L. H. (2001). Estimating wealth effects without expenditure data—or tears: An application to educational enrollments in States of India. Demography, 38, 115–132.

Freudenberg, B., Chardon, T., Brimble, M., et al. (2017). Tax literacy of Australian small businesses. J. Austl. Tax’n, 19, 21.

Gertler, P., Levine, D. I., & Moretti, E. (2009). Do microfinance programs help families insure consumption against illness? Health Economics, 18, 257–273.

Gignoux, J., & Menéndez, M. (2016). Benefit in the wake of disaster: long-run effects of earthquakes on welfare in rural Indonesia. Journal of Development Economics, 118, 26–44.

Gitaharie, B.Y., Soelistianingsih, L., & Djutaharta, T. (2018). Financial inclusion: Household access to credit in Indonesia. In Gani, L., Gitaharie, B.Y., & Husodo, Z.A., et al. (eds) Competition and cooperation in economics and business. London: Taylor & Francis Group.

Gnangnon, S. K. (2019). Does multilateral trade liberalization help reduce poverty in developing countries? Oxford Development Studies, 47, 435–451.

Gomez-Barroso, J. L., & Marban-Flores, R. (2013). Basic financial services: A new service of general economic interest? Journal of European Social Policy, 23, 332–339.

Guérin, I., Roesch, M., Venkatasubramanian, G., et al. (2014). The social meaning of over-indebtedness and creditworthiness in the context of poor rural South Indian Households (Tamil Nadu). In I. Guérin, S. Morvant-Roux, & M. Villarreal (Eds.), Microfinance, debt and over-indebtedness: juggling with money (pp. 125–150). Routledge.

Hallegatte, S. (2014), Economic resilience: definition and measurement. In The World Bank CCG, Office of the Chief Economist (ed).

Hastuti, T. N., & Usman, S., et al. (2006) A rapid appraisal of the implementation of the 2005 direct cash transfer program in Indonesia: A case study of five kabupaten/Kota. Jakarta: SMERU Research Report.

Jacobs, D., Perera, D., & Williams, T. (2014) Inflation and the cost of living. Bulletin. Reserve Bank of Australia.

Johnston, D., & Morduch, J. (2008). The unbanked: Evidence from Indonesia. World Bank Economic Review, 22, 517–537.

Kamaluddin, A., & Madi, N. (2005). Tax literacy and tax awareness of salaried individuals in Sabah and Sarawak. National Accounting Research Journal, 3, 71–89.

Karlan, D., & Thuysbaert, B. (2019). Targeting Ultra-Poor Households in Honduras and Peru. The World Bank Economic Review, 33, 63–94.

Karsidi, R., Trinugroho, I., Nugroho, L. I., et al. (2015). Why households borrow from informal predatory lenders: Evidence from Indonesia. Journal of Economics and Economic Education Research, 16, 173–181.

Kempson, E., & Poppe, C. (2018). Understanding financial well-being and capability - a revised model and comprehensive analysis. Oslo Metropolitan University.

H-j, K., & Kim, W.-r. (2015). The evolution of cash transfers in Indonesia: Policy transfer and national adaptation. Asia and the Pacific Policy Studies, 2, 425–440.

Leyshon, A., & Thrift, N. (1995). Geographies of financial exclusion: Financial abandonment in Britain and the Untied States. Transactions of the Institute of British Geographers, 20, 312–341.

Lusardi, A., & Mitchell, O. S. (2007). Financial literacy and retirement preparedness: Evidence and implications for financial education. Business Economics, 42, 35–44.

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52, 5–44.

Lusardi, A., Mitchell, O. S., & Curto, V. (2010). Financial literacy among the young. The Journal of Consumer Affairs, 44, 358–380.

Majid, M. S. A., Dewi, S., Aliasuddin, , et al. (2017). Does financial development reduce poverty? Empirical evidence from Indonesia. Journal of the Knowledge Economy, 10, 1019–1036.

Mani, S., Mitra, S., & Sambamoorthi, U. (2018). Dynamics in health and employment: Evidence from Indonesia. World Development, 104, 297–309.

Marron, D. (2013). Governing poverty in a neoliberal age: New labour and the case of financial exclusion. New Political Economy, 18, 785.

Masten, A. S. (2001). Ordinary magic: Resilience processes in development. Amercian Psychologist, 56, 227–238.

Miguel, E., Gertler, P., & Levine, D. I. (2005). Does social capital promote industrialization? Evidence from a rapid industrializer. Review of Economics and Statistics, 87, 754–762.

Morrow, B.H. (2008) Community resilience: A social justice perspective. In Initiative CarR (ed) CARRI Research Report 4.

Nichita, A., Batrancea, L., Marcel Pop, C., et al. (2019). We learn not for school but for life: Empirical evidence of the impact of tax literacy on tax compliance. Eastern European Economics, 57, 397–429.

Norris, F.H. (2010) Behavioral Science perspectives on resilience. CARRI Research Report 10. Community and Regional Resilience Institute.

Okten, C., & Osili, U. O. (2004). Social networks and credit access in Indonesia. World Development, 32, 1225–1246.

Orthner, D. K., Jones-Sanpei, H., & Williamson, S. (2004). The resilience and strengths of low-income families. Family Relations, 53, 129–167.

Park, C. (2003). Interhousehold transfers between relatives in Indonesia: Determinants and motives. Economic Development and Cultural Change, 51, 929–944.

Priebe, J. (2017). Old-age poverty in Indonesia: Measurement issues and living arrangements. Development and Change, 48, 1362–1385.

Putnam, R. (2000). Bowling alone: The collapse and revival of American community. Simon and Schuster.

Rosengard, J. K., & Prasetyantoko, A. (2011). If the banks are doing so well, why can’t i get a loan? Regulatory constraints to financial inclusion in Indonesia. Asian Economic Policy Review, 6, 273–296.

Salignac, F., Muir, K., & Wong, J. (2016). Are you really financially excluded if you choose not to be included? Insights from social exclusion resilience and ecological systems. Journal of Social Policy, 45(2), 269–286. https://doi.org/10.1017/S0047279415000677

Salignac, F., Marjolin, A., Reeve, R., & Muir, K. (2019). Conceptualizing and measuring financial resilience: A multidimensional framework. Social Indicators Research, 145(1), 17–38. https://doi.org/10.1007/s11205-019-02100-4

Seccombe, K. (2002). ‘Beating the Odds’ Versus ‘Changing the Odds’: Poverty, resilience, and family policy. Journal of Marriage and Family, 64, 384–394.

Serido, J., Shim, S., & Tang, C. (2013). A developmental model of financial capability: A framework for promoting a successful transition to adulthood. International Journal of Behavioural Development, 37, 287–297.

Stango, V., & Zinman, J. (2009). Exponential growth bias and household finance. Journal of Finance, 64, 2807–2849.

Strauss, J., Witoelar, F., & Sikoki, B. (2016). Household survey questionnaire for the Indonesia family life survey wave 5. RAND Corporation.

Sujarwoto, S., Tampubolon, G., & Pierewan, A. C. (2019). A tool to help or harm? Online social media use and adult mental health in Indonesia. International Journal of Mental Health and Addiction, 17, 1076–1093.

Tadele, F., & Manyena, S. B. (2009). Building disaster resilience through capacity building in Ethiopia. Disaster Prevention and Management: An International Journal, 18, 317–326.

Tadjoeddin, M. Z. (2019). Inequality and exclusion in Indonesia. Journal of Southeast Asian Economies, 36, 284–303.

Tambunan, T. (2012) Indonesia: Building an inclusive development model. In Yunling, Z., Kimura, F., & Oum, S. (eds) Moving toward a new development model for East Asia: The role of domestic policy and regional cooperation. Jakarta: Economic Research Institute for ASEAN and East Asia (ERIA).

Tambunan, T. (2015) Financial inclusion, Financial education, and financial regulation: A story from Indonesia. ADBI Working Paper 535. Tokyo: Asian Development Bank Institute.

Taylor, M. (2011). Measuring financial capability and its determinants using survey data. Social Indicators Research, 102, 297–314.

Tsukada, K., Higashikata, T., & Takahashi, K. (2010). Microfinance penetration and its influence on credit choice in Indonesia: Evidence from a household panel survey. The Developing Economies, 48, 102–127.

Uddin, G. S., Shahbaz, M., Arouri, M., et al. (2014). Financial development and poverty reduction nexus: A cointegration and causality analysis in Bangladesh. Economic Modelling, 36, 405–412.

Vial, V., & Hanoteau, J. (2015). Returns to micro-entrepreneurship in an emerging economy: A quantile study of entrepreneurial Indonesian households’ welfare. World Development, 74, 142–157. https://doi.org/10.1016/j.worlddev.2015.04.008

Von Stumm, S., O’Creevy, M. F., & Furnham, A. (2013). Financial capability, money attitudes and socioeconomic status: Risks for experiencing adverse financial events. Personality and Individual Differences, 54, 344–349.

Wibowo, P.P. (2013) Financial education for financial inclusion: Indonesia perspective. Jakarta: Department of Banking Research and Regulation, Bank Indonesia.

World Bank. (2019) The World Bank in Indonesia: Overview. Available at: https://www.worldbank.org/en/country/indonesia/overview.

World Bank. (2020) Aspiring Indonesia—Expanding the Middle Class. Available at: https://www.worldbank.org/en/news/infographic/2020/01/30/aspiring-indonesia-expanding-the-middle-class.

Funding

No funding to declare.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics approval

This paper uses data that is publicly available. The analysis has been undertaken in full compliance with our institution’s ethics protocols.

Consent to participate

Consent to participate is integrated in the methods used by the Indonesia Family Life Survey.

Consent for publication

This paper uses data from the Indonesia Family Life Survey. This data is publicly available and can be used for publications.

Conflict of interest

No conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Salignac, F., Hanoteau, J. & Ramia, I. Financial Resilience: A Way Forward Towards Economic Development in Developing Countries. Soc Indic Res 160, 1–33 (2022). https://doi.org/10.1007/s11205-021-02793-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-021-02793-6