Abstract

This study documents the effect of financial literacy on the portfolio diversity of family wealth in China with a two-way, fixed-effect model. The results show that most people in China do not have sufficient financial literacy to understand financial assets, which implies a lack of financial knowledge in China. It also looks into the determinants of holding each financial asset, no matter how high- or low-risk, which has not been fully explored in the existing literature. The empirical results found that the knowledge of portfolio diversity increases according to their levels of education and financial literacy. In addition, people living in urban areas diversify their portfolios more than in rural areas. People with high financial literacy understand the value of time (interest); therefore, they prefer to have portfolios that evaluate time and avoid options that do not (cash). We also found that people’s characteristics in risk significantly affect whether they hold stock, mutual funds, or other financial assets.

Similar content being viewed by others

Introduction

In recent decades, a number of studies have fiercely discussed the issue of financial literacy in China. The topic has captured the attention of academia, the market, as well as the government. The Chinese Regulatory Securities Commission (CSRC) announced plans for primary and secondary schools nationwide to offer financial literacy courses.Footnote 1 It is interesting to note that Chinese families have been investing their savings solely in real estate. This phenomenon is mainly caused by the traditional idiom: along with real estate comes wealth (有土斯有財). Property prices in China have soared in the past two decades, and 90% of Chinese families own their own houses/property.Footnote 2 The continuing increase in housing prices has also encouraged families to invest in property. However, is it really a good way for Chinese families to distribute their wealth?

As mentioned in and verified by many studies, a healthy economic system should be established by comprehensive industries, capital, and financial markets. Businesses can obtain sufficient funds from the primary market, and families can trade stock shares in the secondary market (liquid stock market). More trading in the stock market leads to higher funding for businesses. It stimulates and helps improve technological innovation. When a new technology is created, the business shares increase in value, and stockholders receive a reasonable return. This is a typical mechanism of how investment helps economic development in the financial market. However, in China, too large a proportion of resources and capital have been invested in the house market. This leads to limited financial diversity and could harm the financial well-being of families. It could also impair long-term national policy. In particular, Peng (2018) expresses concern over a possible bubble in China’s property market.

We measured financial diversity by the number of different types of financial assets for a family. The Chinese Household Financial Survey includes 11 types of financial assets: (1) Cash, (2) Lend, (3) Current deposit, (4) Time deposit, (5) Non-RMB currency, (6) Gold, (7) Stock, (8) Bond, (9) Mutual Fund, (10) Derivative, and (11) Bank Product. We combined (5) Non-RMB currency, (6) Gold, (8) Bond, and (10) Derivative into category (11) Bank Product as other financial products because the proportion of assets in these four categories (5, 6, 8, 10) is relatively small, less than 1%. After this combination, there remains seven types of financial assets discussed in this paper. If a family has each financial asset, then its diversity is equal to 7. If a family only has cash assets out of the seven financial assets, its diversity is equal to 1. In other words, the higher the score, the more diverse is the family’s portfolio. Figure 1 presents the following proportions of portfolio diversity: 40.28% of Chinese people have two financial assets; 30.02% have one asset; and 19.88% have three. Figure 2 shows the proportion of each financial asset: 40.20% of Chinese have cash in hand, 35.28% have current deposits, and 13.06% have time deposits. Figures 1 and 2 show that 90.6% of Chinese people prefer cash or deposits as their financial assets. This implies that most Chinese people either do not understand or choose to invest in other financial assets, including stocks and mutual funds. It may also illustrate a lack of financial knowledge in China.

Key features of China’s household financial portfolios are high property ownership rates and a high savings rate. The asset composition of Chinese households in 2015 was as follows: 75% in housing investment, 13.72% in bank deposits, and the rest in other financial assets (1.26% in stock, 0.18% in bonds, 0.79% in mutual funds, 0.01% in financial derivatives, 0.49% in wealth management, 0.02% in foreign exchange, 9.30% in other categories, and 0.79% in debt).

This paper will address the insufficiency of portfolio diversity in China. Chinese households consider their home as their priority asset: In 2015, 75% of Chinese household investment was in housing. This paper does not discuss why Chinese families prefer housing to other financial assets. The existing literature provides many explanations, such as the bequest motive and gender composition (this has been added in the paper). Instead, we adopt the value of the home and personal income as independent variables because they are indicators of a household’s financial condition. The empirical results also show that those in better financial conditions (homeowners) have more capability to diversify their portfolios.

Financial literacy becomes a popular issue in recent years as the Chinese economic system is getting complicate. Lack of financial knowledge hampers the effective use of various financial assets. If families do not understand the mechanisms and essence of financial markets, they do not have enough willingness and capabilities to diversify their investment strategies. However, it is very important to distribute investment risk and obtain a stable return for financial diversity.

Literature Review

Previous research has explored the determinants of household participation in financial markets and portfolio allocation choices, which include age, gender, marital status, and the environment. It shows that young and old people make more mistakes in financial investment decisions than middle-aged people. In addition, as compared with men, women are relatively conservative and are less willing to invest in risky assets. The results also show that marital status and number of children fundamentally influence investment decisions (Almenberg & Dreber, 2015; Calvet et al., 2009; Campbell, 2006; Haliassos & Bertaut, 1995; Massa & Simonov, 2006; Nicolosi et al., 2009; Poterba & Samwick, 2001). From a market information aspect, it shows that investors’ perception of social capital resources and trust in the stock market all affect the degree of participation in the financial market (Balloch et al., 2015; Brown et al., 2008; Georgarakos & Pasini, 2011; Grinblatt et al., 2011; Guiso et al., 1996). Housing is also an important impact factor on in the selection of household investment portfolios (Chetty et al., 2017; Cocco, 2005; Flavin & Yamashita, 2002).

In their portfolios, households can choose between risk-free assets, such as bank deposits, and risky assets, such as stocks, corporate bonds, and futures. The classic portfolio theory believes that risky assets are an indispensable part of a family investment portfolio, but many families do not follow this financial theory (Markowitz, 1952). Therefore, in addition to the factors we discussed above, financial literacy has also been studied as a factor that influences family participation in the financial market and family portfolio selection.

As the scale of household financial asset investment continues to grow, knowledge of how to manage and allocate assets has become more and more important. American households with less wealth accumulation prefer to spend their assets on transportation rather than on high-risk investments such as stocks (Campbell, 2006). Based on data from 10 European countries, the risk asset component is reduced in the selection of portfolios in countries with inadequate healthcare systems (Atella et al., 2012). Household income and debt repayment risk also limit household investment in risky assets (Cardak & Wilkins, 2009; Guiso et al., 1996; Heaton & Lucas, 2000; Yao & Zhang, 2005).

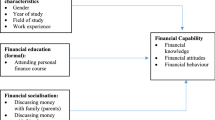

Existing empirical studies show that financial literacy has a significant impact on household investment decisions. The definition of financial literacy varies from study to study. Lusardi and Mitchell (2014) define financial literacy as "the ability to process economic information and make informed decisions about financial planning, wealth accumulation, debt, and pensions. To measure people's level of financial literacy, the International Financial Education Network (INFE) breaks down financial literacy into financial knowledge, financial attitude, and financial behavior. Large-scale surveys were conducted in three parts, each of which asked different questions, in 14 countries. The results showed that families with higher levels of financial literacy tended to make sound financial decisions (Atkinson & Messy, 2012).

Abreu and Mendes (2010), using Portuguese data, supported the idea that an investor’s financial knowledge positively affects investment diversification. They examined the effect of financial literacy on portfolio diversification and its effect on the number of stocks in a portfolio. However, more and varied stocks in a portfolio can only indicate diversification of investment in the stock market, but it does not show the importance of the stock market to an investor’s overall financial assets.

According to the 2005 De Nederlandsche Bank Household Survey (DHS) data, the financial literacy of households improves participation in the stock market (van Rooij et al., 2011). Lack of knowledge of the stock market will reduce the stock holding rate (Yoong, 2011). Jappelli and Padula (2015) created an intertemporal portfolio model with regard to financial literacy and stock market participation, indicating that investors with financial literacy can reduce market entry costs and transaction costs. Data from this model and from several European countries have confirmed that financial literacy and cognitive ability are closely related to stock investment decisions (Christelis et al., 2010). For Chinese household consumers, those with higher levels of financial literacy are more likely to hold risky financial assets in their portfolios than those with lower levels of financial literacy (Liao et al., 2017). Financial literacy can influence the choices in investors’ portfolios by improving their understanding of, and comparative ability to manage, financial assets. Families with high financial literacy significantly increase their investment in risky financial assets (Li et al., 2020a; Li et al., 2020).

Chu et al. (2017) and Liao et al. (2017) both investigated the relationship between financial literacy and risky investment (stock market and mutual funds) in China with the China Survey of Consumer Finance. They found that people with higher financial literacy were more likely to participate in the stock market and invest in mutual funds. Chu et al. (2017) used the participation of risky investments and the return of risky investment as dependent variables to examine the effect of financial literacy on the participation of risky investment and its effect on investment return. Meanwhile, Liao et al. (2017) adopted shares of risky assets as the dependent variable and examined the effect of financial literacy on the risky aggregate investment, which avoided the bias caused by the extreme value. This study used the holding proportion of each portfolio to identify whether households with higher financial literacy preferred riskier investments. This methodology could help avoid the bias estimation caused by extreme samples. For example, an individual who holds a large number of stock shares could increase the average participation.

Financial literacy has been discussed within the context of economic decisions (Disney & Gathergood, 2013; Hilgert et al., 2003; Lusardi & Mitchell, 2007; Mottola, 2013). People’s lack of financial knowledge limits their capability to engage in desirable financial practices, including budgeting, maintaining an emergency fund, diversifying investments, and setting financial goals. On the other hand, the lack of financial literacy leads to poor financial decisions and limits the diversity of financial portfolios (Cocco et al., 2005; Van Rooij et al., 2011). Investors are only able to invest in products of which they are aware and with which they are familiar (Coval & Moskowitz, 1999; Grinblatt & Keloharju, 2001; Hau, 2001). Additionally, lower financial literacy leads people to make suboptimal decisions, then to choose loans, and to eventually suffer from debt accumulation (Gerardi, 2010).

Effective portfolio diversity requires a family to have financial knowledge and sufficient information to ensure that the portfolio is reasonable. Despite different cultures, whether Eastern or Western, the head of household is the major decision-maker in the family. Their knowledge significantly affects a family’s investment strategy. This study documents the effect of financial literacy on family wealth portfolio diversity in China with a two-way fixed-effect model. It also look into the determinants of holding each financial asset, which has not yet been fully explored in the existing literature.

Data

The China Household Finance Survey (CHFS) is a unique source of Chinese households’ financial information. It includes information on Chinese families’ housing and financial assets as well as their liabilities, credit restraints, income, and expenditures. The CHFS is widely applied in many areas, such as the social sciences, economics, and finance. The sample size includes around 130,000 individuals and 35,000 households. Based on the design and sample size, the CHFS is an appropriate dataset for analyzing financial diversity and choices in Chinese families’ financial diversity and choices. This paper uses CHFS samples from 2011 through 2015 to investigate family portfolio diversity in China and focuses on whether financial literacy increases a family’s portfolio diversity. Our sample size is much larger than those in the existing literature. The sample includes 12,000 households compared to around 3000 in existing studies. The households are from various provinces. The results confirm that Chinese households lack financial literacy.

Although there are 35,000 households in the raw dataset, the survey has missing data on some households. For example, some participants refused to provide information on their portfolios and other relevant variables. Therefore, we only included households that provided complete information.

Table 1 shows the descriptive statistics. The portfolio diversity in China is 2.168 out of 7, which is low. It shows that Chinese families do not diversify their financial assets. Only 33% of heads of households were female. Most heads of households were male, which implies that males still dominate the Chinese family. Most of our sample participants were married.

Financial literacy in China is limited, with a score of 1.155 out of 4. This shows that Chinese people correctly answer only one of four basic financial questions, which implies a lack of financial knowledge in China. People in China are seldom concerned with economic or financial information. This study uses the answer to the question, “What is your degree of concern for economic and financial information?” to measure financial carefulness. It computed a value from 1 to 5, for the answer “Not at all,” a value of 2 for “Seldom concerned,”3 for “Generally concerned,” 4 for “Very concerned,” and 5 for “Extremely concerned.” The mean of financial carefulness is 2.268 out of 5. Not surprisingly, only 9.47% of participants had attended economic or financial courses. Additionally, Chinese people are risk-averse because they prefer investments with slight risk and small returns if they have adequate money.

This study aims to investigate the Chinese family’s portfolio diversity with a two-way, fixed-effect model. The dependent variable is the measure of diversity, indicating how many different types of financial assets a family has. As mentioned earlier, the CHFS provides 11 types of financial assets, but we reduced this to seven categories. If a family has each financial asset, then its diversity is equal to 7. If a family has only one asset, its diversity is equal to 1 (i.e., the higher the score, the more diversified is the portfolio of the family). We used the type of asset to separate our sample portfolios into two groups: low-risk and high-risk. Assets in the low-risk portfolio group included cash, current deposits, and time deposits. Assets in the high-risk group included stocks, mutual funds, lending, and other financial products. Because our data was collected at the household level, we used the head of household as the family representative. We assumed that the head of household is the main decision-maker in a family. The head of household’s status could affect a family’s financial strategy. Therefore, this study applied the head of household’s characteristics as independent variables because this method could better represent a family’s profile and exclude data noise. This approach also made it possible to examine the determinants of proportion of each financial asset. In so doing, we could evaluate how the allocation of different financial assets was affected by the determinants. Consequently, the approach provided an interesting comparison of financial assets.

Table 2 shows the average portfolio diversity by province. The country’s average portfolio had a diversity score of 2.168 out of 7, which is relatively low. The top three provinces or municipalities with the most diverse portfolios are Shanghai (2.750), Beijing (2.709), and Guangdong (2.419). These are all municipalities. The provinces with the least diverse portfolios are Shanxi (1.73), Heilongjiang (1.786), and Anhui (1.80). While Shanghai has the highest diversity, its score is still less than half of full diversity. This implies that the diversity of Chinese household portfolios is very limited.

In this dataset more than 80% of the participants were from urban areas in China; we found that the financial literacy rate is very low. One reason for this may be that the willingness to save among Chinese is relatively high because within Chinese culture saving is believed to be critical and important. However, most Chinese consider “saving” in the form of cash and deposit only. Stock and mutual funds are not considered as ways of saving within Chinese culture due to the high-risk nature. Formerly in China, investing in the stock market was widely viewed as “gambling.” Therefore, people may think that putting money in a bank is the most secure way to save. Given this traditional attitude, people in China have no incentive to seek out further financial knowledge. Furthermore, there basic financial literacy is not taught at the elementary level, which increases the difficulty of learning financial concepts as continuing education. This situation impedes their ability to absorb financial knowledge and boost their financial literacy.Footnote 3

All of this implies that, in general, in China, people do not have a sufficient level of financial literacy to understand economic mechanisms and the financial market. The three provinces with the highest financial literacy were Beijing (1.46), Gansu (1.39), and Qinghai (1.34). Table 2 also shows a potential positive correlation between portfolio diversity and financial literacy: the province with the highest portfolio diversity also has relatively higher financial literacy. The correlation coefficient between portfolio diversity and financial literacy is 0.469, but further analysis is needed to examine the relationship between portfolio diversity and financial literacy.

Figure 3 demonstrates the financial portfolio diversity of each province and municipality in China geographically. Figure 4 shows the financial literacy of each province and municipality. From Fig. 3, it shows that the coastal provinces have higher portfolio diversity. However, it is not obvious that the coastal provinces have higher financial literacy whereas the municipalities, such as Beijing, Shanghai, and Guangdong do.

Methodology

This study uses a two-way fixed-effects model to investigate the effect of financial literacy on portfolio diversity.

It further divided the share of risky aggregate investment into shares of stock, mutual funds, lending, and other products. Furthermore, it also looked at the share of low-risk financial assets, including cash, current deposits, and time deposits, to capture the effect of financial literacy on them. This will contribute to the existing literature on how financial literacy affects each financial asset. Using the share of each portfolio can improve the measurement of financial assets, for example, if an investor increases each portfolio by 1000 dollars but increases the investment to 10,000 dollars in the stock market. The methodology of using share measurement can identify if the share of the investment in other portfolios, except the stock market, has actually decreased. Furthermore, it includes the variable of rural area, which is important but has not yet been included in the literature.

In Eq. 1, which the existing literature has usually adopted for examining the effects of financial literacy:

PDi,t,s indicates the portfolio diversity for individual i in province s and at time period t. The individual characters, ϕ, include the individual’s gender, educational level, year of birth, marital status, risk aversion level, the value of house, personal income, and community status (urban or rural). Participants were asked how much the house was worth, and the study adopted this answer as the value of the house (unit: 10,000 RMB) if they were the owner of the house. Additionally, a value of zero was given if the household did not own any houses.

In fact, Chinese households typically have very high savings rates. There are many factors have been considered as possible drivers of this custom: rational expectations of future demand Chen & Wen (2017), competitive saving motive (Wei & Zhang, 2011), demographic changes (Curtis et al., 2015), the interaction between the decline in fertility rate and the senior insurance programs (İmrohoroğlu & Zhao, 2020), the one-child policy (Choukhmane et al., 2013), and the voluntary bequest motive (Yang & Gan, 2020). In Chinese culture, investments in housing are considered “saving”; therefore, this study uses homeownership as a proxy for a household’s wealth.

Housing is considered as one of the major components of assets for Chinese households. There are four main reasons for this. First, housing assets can be transferred from one generation to another. Second, although there are many reasons to buy a house (such as to get married, to upgrade one’s quality of living, to be close to educational institutions, to be close to the workplace, and to invest), Chinese households are more likely to be willing to upgrade living quality, and they have strong marriage-induced housing demand. In the Chinese tradition, the husband has an obligation to provide a house in which the couple will stay after marriage. Li, Li, et al. (2020), Li, Song, et al. (2020) showed that high gender ratio (more sons than daughters) had a significant effect on the portfolio of a household. Third, Chinese households showed strong motivation for precautionary savings and voluntary bequests (Yang & Gan, 2020).

FL denotes the level of financial literacy. It consists of four financial questions. If participants provided the correct answer, they earned one point. Therefore, the highest financial literacy score is 4, and the lowest score is 0. FCare is the variable showing individual pays attention to financial, economic information or news. FCourse is a dummy indicating whether the individual attends courses related to finance.

This paper further used each of the seven financial portfolios that it provided in the survey and calculated their total value. Then the proportion of each portfolio was calculated according to their values. For example, Cash denotes the proportion of cash in all portfolios or the value of cash divided by the total value of all seven portfolios. Lend denotes the proportion of lending in all portfolios or the value of lending divided by the total value of all seven portfolios. Cdeposit denotes the proportion of current deposits, Tdeposit is the proportion of time deposits. Stock indicates the proportion of stock, and MFund indicates the proportion of mutual funds. Other indicates the proportion of other bank products. The categories of financial investment had been modified and re-arranged as low- and high-risk investments. Lending has moved to the high-risk category. The definition of low-risk investment is that the return can be reasonably or precisely expected without any default. The amount of adding up the proportions of these seven categories mentioned above, and the number or total value is equal to 1.

This study controlled for the province-fixed effect and also for the variable indicating whether families live in rural areas. In order to avoid having the fixed effect alleviate the regional disparity, this study further found that families in rural areas have lower portfolio diversity. Additionally, families in rural areas preferred to hold a higher proportion of cash in their financial portfolios. In other words, families in rural areas needed cash to manage most transactions in their daily life. It is worth noting that the survey was administered in the period when online mobile banking had not widely penetrated rural areas. Thus, the results showed that the specifications of the above model appropriately mitigated the bias of unequal access across different regions of China.

Results

Table 3 shows the results for portfolio diversity. It shows that the level of financial literacy has a significantly positive effect on portfolio diversity through different settings, which confirms robustness. Column 1 controls the basic chrematistics and financial literacy, and Column 2 further controls the participant’s financial attitudes, the value of house, personal income, and living area. Moreover, Column 3 top up the control of the province fixed effects, and column 4 top up the control of province and time-fixed effects. It found that all specifications have a heteroskedasticity problem based on the χ 2 statistics of the Breusch-Pagan test. As a result, we used the cluster corrected covariance matrix to fix this issue. The F-statistics in all models rejected the null hypothesis that the coefficients were all zero. Furthermore, none of the pairwise correlation coefficients were greater than 0.7; thus, there is no multicollinearity in the empirical models. Therefore, the diagnostic tests discussed above indicate that the estimation results are reliable.

Table 3 shows that portfolio diversity increases with the level of education and financial literacy. People who pay more attention to economic and financial information have more diverse portfolios. Attending economic and financial classes also helps to diversify a portfolio. Risk averters prefer to concentrate their money on investments with which they are familiar. People living in cities have more diverse portfolios than those in rural areas. The value of house and personal income directly indicates a household’s economic condition. How much a house is worth is an important measurement of household’s financial status. A more expensive house and high personal income diversify a household’s portfolio. Interestingly, the empirical results show that a female’s portfolio diversity is not significantly different from a male’s. Finally, it also found that prime-age people have higher portfolio diversity because the results show people’s age has a non-linear concave effect on diversification.

This paper presents several interesting results on financial assets. Firstly, it finds that financial assets are more diverse with the head of household’s education. This indicates that well-educated heads of households are more capable and willing to accept different financial assets. In addition, married couples have wider financial diversity than single persons. Third, higher scores of financial literacy significantly increase financial diversity. If the head of household pays more attention to financial and economic information, the spread of the family’s financial diversity is significantly wider. Further, attending economic or financial courses increases diversity as well. Fifth, risk-lovers have substantially wider financial diversity than risk-averse people. Finally, wealthier households are more able to diversify their portfolio. It is well-established in the literature that portfolio choices are shaped by a household’s income and wealth (Paravisini et al., 2017). This study finds consistent results that a household’s portfolio diversification is associated with the value of house and personal income. Families in rural areas have significantly less diversification than those in less rural areas.

The value of time and the risk of financial assets are the essential components to measure the value of a financial asset. The proportion of cash, a risk-free financial asset without increasing its value over time, is applied to test whether families understand the value of time. Holding a higher proportion of cash implies that a family does not realize its financial assets are actually depreciating over time, given that inflation is generally positive in most cases. Therefore, the estimation of holding cash proportion is a robustness test to examine what we obtain in financial diversity. This study finds consistent results, and the signs of the determinants are in line with our expectations.

Table 4 shows that higher financial literacy reduces the proportion of holding cash because people know the value of time. People with higher literacy increase the proportion of holding deposits and lending because the value of time is evaluated. Table 4 presents the results for the proportion of cash (Column 1), current deposits (Column 2), and time deposits (column 3). It shows that financial literacy significantly increases the proportion of holding current and time deposits but decreases the proportion of holding cash. This is an interesting finding because people with high financial literacy understand the value of time (interest), and they prefer to have portfolios that evaluate time (deposit and lending), and avoid options that do not evaluate time (cash). People with higher interest in economic information are willing to increase the proportion of time deposits, but reduce holding cash and current deposits.

On the other hands, risk averters are willing to keep risk-free financial assets, such as cash and deposits. The valuable house and high personal income reduce the proportion of holding cash while the value of house and income do not affect the proportion of current and time deposit. It also shows that people living in rural areas have a higher proportion of cash held in their portfolio, and a lower proportion of holding deposits.

Table 5 shows the results of the proportion of holding stock, mutual funds, lending, and other financial assets. People’s characteristics on risk have significant effects on holding stock, mutual funds, lending, and other financial assets. Females are more willing to hold stock, mutual funds, and other financial assets, but not lending. People with higher education are more willing to have stock, mutual funds, and other financial assets. However, age has a non-linear concave effect on holding shares of stock and other bank products. In addition, marriage increases the proportion of holding stock, mutual funds, and other financial products. People who are interested in financial information increases the proportion of holding stock, while financial literacy does not play an important role. In mutual funds, financial literacy, interested in financial information, and have been taken financial courses all have a significant positive effect on the proportion of mutual funds. The proportion of other financial assets is positively affected by financial literacy and the concerns of financial information, but it is not affected by financial courses. Financial literacy and carefulness are positive factors for increased lending. Risk aversion reduces the proportion of stock, mutual funds, and other financial services. High housing value significantly increases the proportion of stock, mutual fund, and other financial assets. Wealthier households have lower proportion of lending. High personal income increases the proportion of stock and mutual fund. These findings are consistent with the literature that poorer families tend to hold more cash while wealthier households possess more financial assets (OECD, 2018). Living in rural areas reduces the proportion of stock, and other financial assets. To sum up these results, financial carefulness could increase the chance of holding a risky portfolio, but being risk-averse reduces the chances of holding one.

Discussion and Implication

This study investigates the effect of financial literacy on risk-free financial choice, and confirms that Chinese households with higher financial literacy prefer to hold a smaller proportion of cash while they hold a higher proportion of bank deposits. This is because the bank deposit generates interest, rather than nothing.

This study includes a dummy that indicates whether participants are living in a rural area or not, and examines this effect on the financial portfolio. It found that people in rural areas have higher shares of holding cash, while they reduce holding other financial portfolios, even bank deposits. This finding indicates that: (1) People living in rural areas have more motivation for holding cash to deal with their daily life; (2) People in rural areas have less access to financial knowledge, which results in holding cash for them. Policymakers could promote financial knowledge via the education system to build up a healthier financial environment for Chinese households.

Many Chinese families put the majority of their income into the property market, and this limits the family’s financial diversity in China. Families should have appropriate financial diversity to distribute the risk and obtain a stable return. The Chinese government introduced some programs for primary and secondary schools to strengthen students’ financial literacy, including price-to-earnings ratios and the essence of the Capital Asset Pricing Model (CAPM). However, how these financial programs work on helping students’ financial literacy needs further study. This research does not include the effect from the head of household’s spouse, parent, or other member living at the same property, but it would be interesting to investigate and weigh their contribution. Researchers might examine the effect of financial literacy on the diversity return as an important extension in the future. Furthermore, do private or public employees behave differently in regard to financial diversity? Those are topics for future research.

References

Abreu, M., & Mendes, V. (2010). Financial literacy and portfolio diversification. Quantitative Finance, 10(5), 515–528. https://doi.org/10.1080/14697680902878105

Almenberg, J., & Dreber, A. (2015). Gender, stock market participation and financial literacy. Economics Letters, 137, 140–142. https://doi.org/10.1016/j.econlet.2015.10.009

Atella, V., Brunetti, M., & Maestas, N. (2012). Household portfolio choices, health status and health care systems: A cross-country analysis based on SHARE. Journal of Banking & Finance, 36(5), 1320–1335. https://doi.org/10.2139/ssrn.1744882

Atkinson, A., & Messy, F.-A. (2012). Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study. OECD Financial Education. https://doi.org/10.1787/20797117

Balloch, A., Nicolae, A., & Philip, D. (2015). Stock market literacy, trust, and participation. Review of Finance, 19(5), 1925–1963. https://doi.org/10.2139/ssrn.2392747

Brown, J. R., Ivković, Z., Smith, P. A., & Weisbenner, S. (2008). Neighbors matter: Causal community effects and stock market participation. The Journal of Finance, 63(3), 1509–1531. https://doi.org/10.1111/j.1540-6261.2008.01364.x

Calvet, L. E., Campbell, J. Y., & Sodini, P. (2009). Fight or flight? Portfolio rebalancing by individual investors. The Quarterly Journal of Economics, 124(1), 301–348. https://doi.org/10.1162/qjec.2009.124.1.301

Campbell, J. Y. (2006). Household finance. The Journal of Finance, 61(4), 1553–1604. https://doi.org/10.1111/j.1540-6261.2006.00883.x

Cardak, B. A., & Wilkins, R. (2009). The determinants of household risky asset holdings: Australian evidence on background risk and other factors. Journal of Banking & Finance, 33(5), 850–860. https://doi.org/10.1016/j.jbankfin.2008.09.021

Chen, K., & Wen, Y. (2017). The great housing boom of China. American Economic Journal: Macroeconomics, 9(2), 73–114. https://doi.org/10.1257/mac.20140234

Chetty, R., Sándor, L., & Szeidl, A. (2017). The effect of housing on portfolio choice. The Journal of Finance, 72(3), 1171–1212. https://doi.org/10.1111/jofi.12500

Choukhmane, T., Coeurdacier, N., & Jin, K. (2013). The one-child policy and household savings.

Christelis, D., Jappelli, T., & Padula, M. (2010). Cognitive abilities and portfolio choice. European Economic Review, 54(1), 18–38. https://doi.org/10.1016/j.euroecorev.2009.04.001

Chu, Z., Wang, Z., Xiao, J. J., & Zhang, W. (2017). Financial literacy, portfolio choice and financial well-being. Social Indicators Research, 132(2), 799–820. https://doi.org/10.1007/s11205-016-1309-2

Cocco, J. F. (2005). Portfolio choice in the presence of housing. The Review of Financial Studies, 18(2), 535–567. https://doi.org/10.1093/rfs/hhi006

Cocco, J. F., Gomes, F. J., & Maenhout, P. J. (2005). Consumption and portfolio choice over the life cycle. The Review of Financial Studies, 18(2), 491–533. https://doi.org/10.1093/rfs/hhi017

Coval, J. D., & Moskowitz, T. J. (1999). Home bias at home: Local equity preference in domestic portfolios. The Journal of Finance, 54(6), 2045–2073. https://doi.org/10.1111/0022-1082.00181.

Curtis, C. C., Lugauer, S., & Mark, N. C. (2015). Demographic patterns and household saving in China. American Economic Journal: Macroeconomics, 7(2), 58–94. https://doi.org/10.1257/mac.20130105

Disney, R., & Gathergood, J. (2013). Financial literacy and consumer credit portfolios. Journal of Banking & Finance, 37(7), 2246–2254. https://doi.org/10.1016/j.jbankfin.2013.01.013

Flavin, M., & Yamashita, T. (2002). Owner-occupied housing and the composition of the household portfolio. American Economic Review, 92(1), 345–362. https://doi.org/10.1257/000282802760015775

Georgarakos, D., & Pasini, G. (2011). Trust, sociability, and stock market participation. Review of Finance, 15(4), 693–725. https://doi.org/10.1093/rof/rfr028

Gerardi, K. (2010). Financial Literacy and Subprime Mortgage Delinquency: Evidence from a Survey Matched to Administrative Data. DIANE Publishing. https://doi.org/10.2139/ssrn.1600905

Grinblatt, M., & Keloharju, M. (2001), What makes investors trade? The Journal of Finance, 56(2), 589–616. https://doi.org/10.1111/0022-1082.00338

Grinblatt, M., Keloharju, M., & Linnainmaa, J. (2011). IQ and stock market participation. The Journal of Finance, 66(6), 2121–2164. https://doi.org/10.1111/j.1540-6261.2011.01701.x

Guiso, L., Jappelli, T., & Terlizzese, D. (1996). Income risk, borrowing constraints, and portfolio choice. The American Economic Review, 86, 158–172.

Haliassos, M., & Bertaut, C. C. (1995). Why do so few hold stocks? The Economic Journal, 105(432), 1110–1129. https://doi.org/10.2307/2235407

Hau, H. (2001). Location matters: An examination of trading profits. The Journal of Finance, 56(5), 1959–1983. https://doi.org/10.1111/0022-1082.00396.

Heaton, J., & Lucas, D. (2000). Portfolio choice and asset prices: The importance of entrepreneurial risk. The Journal of Finance, 55(3), 1163–1198. https://doi.org/10.1111/0022-1082.00244

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behavior. The Federal Reserve Bulletin, 89, 309.

İmrohoroğlu, A., & Zhao, K. (2020). Household saving, financial constraints, and the current account in China. International Economic Review, 61(1), 71–103. https://doi.org/10.1111/iere.12417

Jappelli, T., & Padula, M. (2015). Investment in financial literacy, social security, and portfolio choice*. Journal of Pension Economics & Finance, 14(4), 369–411. https://doi.org/10.1017/S1474747214000377

Li, J., Li, Q., & Wei, X. (2020a). Financial literacy, household portfolio choice and investment return. Pacific-Basin Finance Journal, 62, 101370. https://doi.org/10.1016/j.pacfin.2020.101370

Li, W., Song, C., Xu, S., & Yi, J. (2020). High sex ratios and household portfolio choice in China. Journal of Human Resources. https://doi.org/10.3368/jhr.57.2.1217-9245R2

Liao, L., Xiao, J. J., Zhang, W., & Zhou, C. (2017). Financial literacy and risky asset holdings: Evidence from China. Accounting & Finance, 57(5), 1383–1415. https://doi.org/10.1111/acfi.12329

Lusardi, A., & Mitchell, O. S. (2007). Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics, 54(1), 205–224. https://doi.org/10.1257/jel.52.1.5

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52(1), 5–44. https://doi.org/10.1257/jel.52.1.5

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91. https://doi.org/10.2307/2975974

Massa, M., & Simonov, A. (2006). Hedging, familiarity and portfolio choice. The Review of Financial Studies, 19(2), 633–685. https://doi.org/10.1093/rfs/hhj013

Mottola, G. R. (2013). In our best interest: Women, financial literacy, and credit card behavior. Numeracy, 6(2), 4. https://doi.org/10.5038/1936-4660.6.2.4

Nicolosi, G., Peng, L., & Zhu, N. (2009). Do individual investors learn from their trading experience? Journal of Financial Markets, 12(2), 317–336. https://doi.org/10.1016/j.finmar.2008.07.001

OECD. (2018). The Role and Design of Net Wealth Taxes in the OECD. OECD Tax Policy Studies No. 26. https://www.oecd-ilibrary.org/content/publication/9789264290303-en. https://doi.org/10.1787/9789264290303-en

Paravisini, D., Rappoport, V., & Ravina, E. (2017). Risk aversion and wealth: Evidence from person-to-person lending portfolios. Management Science, 63(2), 279–297. https://doi.org/10.1287/mnsc.2015.2317

Peng, C. (2018). Identifying bubbles in China’s property market for consumer financial well-being. Journal of Financial Counseling and Planning, 29(2), 182–197. https://doi.org/10.1891/1052-3073.29.2.182

Poterba, J. M., & Samwick, A. (2001). Household Portfolio Allocation over the Life Cycle. In NBER Chapters (pp. 65–104). National Bureau of Economic Research, Inc. https://ideas.repec.org/h/nbr/nberch/10285.htmlhttps://doi.org/10.7208/chicago/9780226620831.003.0003

Van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449–472. https://doi.org/10.1016/j.jfineco.2011.03.006

Wei, S.-J., & Zhang, X. (2011). The competitive saving motive: Evidence from rising sex ratios and savings rates in China. Journal of Political Economy, 119(3), 511–564. https://doi.org/10.1086/660887

Yang, X., & Gan, L. (2020). Bequest motive, household portfolio choice, and wealth inequality in urban China. China Economic Review, 60, 101399. https://doi.org/10.1016/j.chieco.2019.101399

Yao, R., & Zhang, H. H. (2005). Optimal consumption and portfolio choices with risky housing and borrowing constraints. The Review of Financial Studies, 18(1), 197–239. https://doi.org/10.1016/j.chieco.2019.101399

Yoong, J. (2011). Financial Illiteracy and Stock Market Participation: Evidence from the RAND American Life Panel. Oxford: Oxford University Press.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare that are relevant to the content of this article.

Informed Consent

The data are properly anonymised and informed consent was obtained at the time of original data collection by China Household Finance Survey.

Research Involving Human Participants and/or Animals

The Department of Land Economy requires all research that involves the collection of primary data to obtain ethics approval—and in some other special circumstances. This research did not contain the collection of primary data, and ethics approval was deemed unnecessary.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This is one of several papers published together in Journal of Family and Economic Issues on the “Special Issue on Consumer and Family Economic and Financial Issues"

Appendices

Appendix

See Appendix Table 6.

Respondent’s Attitude and Financial Knowledge

Financial Course.

What is your degree of concern for economic and financial information?

-

1.

Extremely concerned

-

2.

Very concerned

-

3.

Generally concerned

-

4.

Seldomly concerned

-

5.

Not at all

Financial Course.

Have you ever taken economic and financial classes?

-

1.

Yes

-

2.

No

Risk Aversion.

Which of the choice below do you want to invest most if you have adequate money?

-

1.

Project with high-risk and high-return

-

2.

Project with slightly high-risk and slightly high-return

-

3.

Project with average risk and return

-

4.

Project with slight risk and return

-

5.

Unwilling to carry any risk

-

6.

No idea

Financial Literacy.

Given a 4% interest rate, how much would you have in total after 1 year if you have 100 yuan deposited?

-

1.

Under 104

-

2.

104

-

3.

Over 104

-

4.

Cannot figure out

With an interest rate of 5% and an inflation rate of 3%, the staff you buy with the money you have saved in the bank for 1 year is

-

1.

More than last year

-

2.

The same as last year

-

3.

Less than last year

-

4.

Cannot figure out

What would you choose between a lottery with 100% shot at 4,000 yuan and another with 50% shot at 10,000 yuan and 50% chance for nothing?

-

1.

The former

-

2.

The latter

Which one do you think is more risky, stock or fund?

-

1.

Stock

-

2.

Fund

-

3.

Haven’t heard about stock

-

4.

Haven’t heard about fund

-

5.

Neither of them have been heard about

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Peng, C., She, PW. & Lin, MK. Financial Literacy and Portfolio Diversity in China. J Fam Econ Iss 43, 452–465 (2022). https://doi.org/10.1007/s10834-021-09810-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-021-09810-3