Abstract

Spinoff firms are a common phenomenon in entrepreneurship where employees leave incumbent parent firms to found their own. Like other types of new firms, such new spinoffs face liabilities of newness and smallness. Previous research has emphasised the role of the initial endowments from their parent firm to overcome such liabilities. In this study, we argue and are the first to show, that, in addition to such endowments, growing an alliance network with firms other than their parents’ is also critical for spinoff performance. Specifically, we investigate the performance effect of alliance network growth in newly founded spinoffs using a longitudinal sample of 248 spinoffs and 3370 strategic alliances in the mining industry. Drawing on theory based on the resource adjustment costs of forming alliances, we posit and find a U-shaped relationship between the alliance network growth and spinoff performance, above and beyond the parent firm’s influence. We further hypothesise and find that performance effects become stronger with increased time lags between alliance network growth and spinoff performance, and when spinoffs delay growing their alliance networks. Implications for theory and practice are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Spinoffs are new firms founded by ex-employees of incumbent firms (Klepper, 2009), and have been the focus of substantial research, making for a considerable proportion of new entrants in various industries (Fackler et al., 2016). New firms face various challenges, such as the liabilities of newness and smallness (Aldrich & Auster, 1986; Stinchcombe, 1965). To overcome these liabilities, spinoffs rely on endowments from their parents (Bruneel et al., 2013; Klepper & Sleeper, 2005). These endowments are mainly in the form of intangible resources (e.g., reputation, specialised knowledge, experiential learning, etc.), that the spinoff entrepreneurs bring with them to their new firms and have acquired prior to their firm incorporation (cf. Chatterji, 2009; Dick et al., 2013). It is not clearly investigated in the spinoff literature how new spinoffs compensate for their lack of tangible and intangible resources after incorporation. Paying attention to this is important since spinoffs often do not have access to their parent’s complementary resources after incorporation since the spinoff entrepreneurs often lose their relationship with their parents (Buenstorf & Klepper, 2009). For instance, conflicts may arise between parent firms and employees who leave to start their own company, impeding resource sharing (McKendrick et al., 2009; Walter et al., 2014), or the parent firm may simply not be capable of offering the required resources (Chesbrough, 2002). Therefore, growing strategic alliance networks with firms other than their parents’ might be very important for spinoff performance as a compensation for losing their access to parent’s complementary resources. This study is thus devoted to this so far unexplored research question focusing on the performance effects of growing alliance networks, which go beyond the parental tie, for new spinoffs.

To benefit from alliances, the development of dedicated resources that might have limited utilisation outside of the alliance network is required (Madhok et al., 2015). This creates a challenge, where the performance benefits may be influenced by the number of alliances in the firm’s alliance network; from which the resources can be leveraged as well as the time and investment it takes to develop those resources (Gulati & Singh, 1998; Madhok et al., 2015). We draw on resource adjustment cost theory (Madhok et al., 2015) to investigate this complex nature of the effect of alliance network growth on spinoff performance, as this theory takes into account both the benefits and the costs associated with growing a network of alliances. Based on this theory we posit a U-shaped relationship between alliance network growth and spinoff performance. To further investigate the potential temporal dynamics of the posited relationship, we connect resource adjustment theory with recent advances on hypothesising the effect of time (Aguinis & Bakker, 2021; Wood et al., 2021) in terms of increased time lags between the dependent and independent variables, and the timing of when spinoffs grow their alliance networks.

We utilise a longitudinal sample of 3370 strategic alliances and 248 newly founded spinoffs in the mining industry to test our hypotheses. The mining industry makes a particularly suitable context to investigate the effect of alliance network growth on spinoff performance and the temporal dynamics between them. It is an industry with a large number of spinoffs and alliances, and the alliances are relatively homogenous, which allow us to better observe the performance effects of network growth (Bakker, 2016). It takes several years for new mining projects to develop through a somewhat standard process of exploration, development, and exploitation (Bakker & Shepherd, 2017), which allow for a better investigation of temporal dynamics and alliance growth, by keeping other sources of variance constant.

Our study makes several contributions. Firstly, it extends the literature on spinoffs by introducing alliance network growth as a novel driver of performance. Previous studies have shown the parent firm as the main driver of spinoff performance (Agarwal et al., 2004; Au et al., 2013; Basu et al., 2015; Chatterji, 2009; Fackler et al., 2016); however, we investigate whether the performance effects of alliance network growth hold over and above the parent firm effect. Secondly, we hypothesise and confirm a U-shaped relationship between the alliance network growth and spinoff performance. Our implications go beyond the spinoff context and contribute to the broader literature that studies the performance effects of alliance network growth for newly founded firms (cf. Baum et al., 2000; Moghaddam et al., 2016; Pangarkar & Wu, 2013; Rothaermel & Deeds, 2006; Shin et al., 2016; Zhou et al., 2019). We introduce adjustment cost arguments in a literature that has overwhelmingly focused on resource complementarity to be automatic in alliances in terms of accessing resources and creating competitive advantage (Baum et al., 2000; Chang, 2004), and learning and knowledge sharing (Powell et al., 1996) to provide a more precise theory on the alliance network performance effects. Lastly, we examine the temporal dynamics of the alliance network growth-spinoff relationship. Combining resource adjustment cost arguments with distinct time constructs from the entrepreneurship and strategy field (Aguinis & Bakker, 2021; Wood et al., 2021) provides a more precise theory on the temporal dynamics of the performance effects of alliance network growth in terms of increased time lags and timing.

This paper is structured as follows: firstly, we review the literature and develop our hypotheses. Next, we explain the sample and the methodology, and present the results. Finally, we discussed the scholarly and managerial implications of the key findings.

Theoretical background

Spinoffs have received substantial attention in the academic literature due to their higher performance and better survival rates when compared to other types of new firms (e.g., Agarwal et al., 2016; Bruneel et al., 2013; Dick et al., 2013; Thorburn, 2000). In previous studies, the main determinants of spinoff performance are identified as: their parent firm’s performance and characteristics; the founders’ prior employment experiences while working in the parent firm; and the human capital of the founding spinoff team (see Table 1). Franco and Filson (2006) demonstrate that spinoffs originated from parents with higher know-how have higher survival rates; concurrently, the performance of the parent firm is positively associated with the success of spinoffs (Dick et al. (2013). Spinoffs that stem from promising opportunities in the market are shown to have higher survival rates than spinoffs pushed out from struggling parent firms that have had poor performance (Fackler et al., 2016). The revenue of such opportunity-based new spinoffs is also demonstrated to grow faster than spinouts (i.e., new firms started and backed by incumbents) and spinoffs coming from parents with poor performance (Bruneel et al., 2013). Moreover, Fackler et al. (2016) show that the survival rate of spinoffs is negatively related to the number of employees in the parent firm (i.e., parent firm size).

According to Heritage Theory “spinoffs inherit knowledge from their parents that shape their nature at birth” (Klepper & Sleeper, 2005, p.1291). Prior research shows that spinoffs build their capabilities based on the knowledge transferred from their parent firms (Agarwal et al., 2004; Basu et al., 2015). The transferred knowledge can be explicit in the form of codified routines, or implicit in the form of tacit knowledge (Agarwal et al., 2004). Studies have also shown that employee-entrepreneurs can acquire expert marketing knowledge (Agarwal et al., 2004), technology (Agarwal et al., 2004; Chatterji, 2009; Klepper & Sleeper, 2005), entrepreneurial processes (Ellis et al., 2017), and organisational routines (Phillips, 2002), and ultimately gain financial resources and develop social networks (Agarwal & Shah, 2014; Agarwal et al., 2016; Elfring & Hulsink, 2007) during their employment in the parent firm. These so-called initial endowments of spinoffs can shape the dynamic capabilities and strategic decisions that lead to higher performance (Basu et al., 2015). Founders’ individual expertise and capabilities, developed in the parent firm, can contribute positively to the spinoff’s impactful knowledge creation (Basu et al., 2015).

Yet, spinoffs often do not maintain a direct relationship with their parent firm after being established (cf. Buenstorf & Klepper, 2009), and therefore reduce the access to their parents’ complementary resources after founding. In addition, the parent firm’s knowledge and resources may lose relevance due to spinoff’s differentiation from its parent (Chesbrough, 2002; Chesbrough & Rosenbloom, 2002). So, what is an alternative source that new spinoffs can recognise to compensate for their lack of resources after founding? Studies on new ventures propose developing strategic alliances as a strategy to obtain the required resources during the founding period (e.g., Baum et al., 2000; Moghaddam et al., 2016; Rothaermel & Deeds, 2006). Strategic alliances are generally formed for the ‘joint pursuit of agreed-on goal(s) in a manner corresponding to a shared understanding about contributions and payoffs’ (Gulati et al., 2012, p.533). They cover a wide range of interorganisational links, such as licensing, equity joint ventures, outsourcing, and venture capital investment (Contractor & Lorange, 2002). The various types of alliances help firms to pool their resources and capabilities together, and create unique learning opportunities for partner firms (Inkpen, 2000). The access to the skills and knowledge of their partners allows firms to incorporate this knowledge into their learning systems and structures, which would not have been possible without an alliance agreement (Hemmert, 2019; Inkpen, 2000). Das and He (2006, p.121) go so far and mention for new firms alliances are “a matter of survival” due to the uncertainty about the quality, legitimacy and attractiveness of new firms, and an elevated need to learn from outside partners (Dai et al., 2017; Hubbard et al., 2018; Pangarkar & Wu, 2013).

Studies of new firms investigating the relationship between the growing alliance networks and the performance have so far found different results. Studies based on the resource-based view (RBV) have mostly predicted and found support for a positive relationship. Prior studies have shown that new firms that form alliance networks to access resources achieve better performance (Baum et al., 2000; Eisenhardt & Schoonhoven, 1996; Yu et al., 2014), while others have not been able to replicate this positive effect (cf. Deeds et al., 2000). There are also studies that find support for a negative effect of alliance network growth on new firm performance. For instance, Alvarez and Barney (2001) argue that while new firms acquire access to their partner’s resources through alliances, their partners, that are often larger firms, can also access the new firm’s new technology. This may lead to larger partners’ opportunistic behaviour, and appropriation of the new firm’s resources (Alvarez & Barney, 2001).

Moghaddam et al. (2016) argued that, when extending the argument about how firms achieve and sustain competitive advantage through forming alliances to dynamic capabilities perspective, the relation might become non-linear, given that the development of capabilities happens through repeated practice and building effective routines and processes (Eisenhardt & Martin, 2000, p.1114). Such studies have typically focused on the number of alliances added to the network as an indicator of alliance capability development, which subsequently allows firms to reap benefits (Rothaermel & Deeds, 2006). The performance of new firms is lower for those firms that form a small alliance network, as they have not yet developed their alliance management capability. Therefore, when new firms add too many alliances to their networks, performance would decline due to exhaustion of managerial attention. However, this view does not consider the opportunities available outside of alliances nor that the capability developed for managing alliances can be used across alliances, hence, reducing the cost of growing an alliance network (Madhok et al., 2015). Madhok et al. (2015) propose a resource adjustment costs perspective for involvement in alliances. This perspective suggests that, in order to realise value from an alliance, firms face adjustments costs when deploying and transforming their existing resources to adapt to their alliance needs. Within the context of an alliance, direct costs include those of modifying existing resources of a firm to better align with those of the partner(s). Capabilities to manage an alliance have a degree of fungibility or specificity that limits their use outside the alliance network (Madhok et al., 2015). In addition, there are indirect adjustment costs in terms of the value of opportunities foregone by a firm, which limit the use of its transformed resources (Madhok et al., 2015). Such indirect costs are defined as “the costs of resource deployment that result in foregone revenue and can be defined as the (unexploited) value of the best opportunity for deploying the resources outside of the alliance.” (Madhok et al., 2015, p.97). Additionally, Madhok et al. (2015) suggest that involvement in alliances and evaluation of its costs and benefits happens over time. However, the time effect cannot be conceptualised by merely focusing on the relationship between spinoff alliance network growth and its performance. Not considering time “explicitly both conceptually and operationally” prevents understanding the processes by which the main effect of alliance growth unfolds for spinoff performance (Aguinis & Bakker, 2021, p.2). Therefore, we further investigate the temporal dynamics in terms of increased time lags and timing entering alliances (also see Aguinis & Bakker, 2021).

Spinoff Alliance Network Growth and Performance

Spinoffs with low levels of alliance network growth will face low direct adjustment costs associated with developing capabilities for working with their alliances (Madhok et al., 2015). Engaging in a few alliances will tie only a limited amount of resources to the network (Madhok et al., 2015). Moving to moderate levels of alliance network growth will increase the direct adjustment costs and those of developing management capabilities to manage a larger network increase. Each additional alliance will require adjustments to the spinoffs resource base, further increasing costs (Madhok et al., 2015). With low levels of network growth, the opportunity costs are also low for the spinoff, which means that while the alliance network itself may offer little performance benefits, the spinoff can generate higher performance by using its resources in more profitable opportunities. While strategic alliances are unstable and are characterised by high failure rates and premature termination, in particular in the mining industry (Bakker, 2016; Kale & Singh, 2009), these spinoffs also bear low costs associated with being engaged in alliances.

When moving to moderate levels of alliance growth, the amount of resources dedicated to the alliance network leaves little chance to seek profitable opportunities elsewhere. Yet, the spinoff alliance network has not become large enough to either fully benefit from opportunities in the network, or to effectively leverage its alliance management capabilities across its network. The spinoffs with moderate levels of alliance network growth will not see much of the benefits associated with the alliancing activities, when compared to those having high levels of alliance network growth. This happens because their grown alliance network is still small to reap substantial benefits from it. Indeed, new spinoffs that are ‘stuck in the middle’ may bear all the adjustment costs with only slightly better chances of success, when compared to having those having a lower level of alliance network growth, which proves insufficient to compensate for all the associated costs. Taken together with the increasing direct costs, this suggests that the performance of spinoffs will decrease from low to moderate levels of alliance network growth.

When moving from moderate to higher levels of alliance network growth, adjustment costs are expected to flatten. After growing the alliance networks to a certain level, it is expected that spinoffs face fewer additional costs by adding more alliances (Madhok et al., 2015). This fungibility of alliance management capabilities allows spinoffs to leverage them across their network and take advantage of new collaboration opportunities without having to redevelop those capabilities (Vassolo et al., 2004). Alliance capabilities are also improved through experience with multiple alliances, which leads to the creation of codified routines, policies, and procedures, as well as tacit knowledge to realise the benefits presented by alliances (Rothaermel & Deeds, 2006). This would lower both the direct adjustment costs for new spinoffs and the opportunity costs through fewer foregone opportunities. The growth of the alliance network presents opportunities that can be realised with existing alliance capabilities (Pangarkar & Wu, 2013), and therefore reduce the need to seek opportunities outside networks. With a larger network, spinoffs also reduce the impact of potential alliance failure by having a larger number of partners. Having higher levels of alliance network growth increases the chances of selecting an alliance with above-average financial benefits for new spinoffs. In short, growing a larger alliance network will likely result in benefits growing more in relation to costs. Therefore, we suggest:

-

Hypothesis 1: The relationship between spinoff network growth and spinoff performance is U-shaped.

Temporal dynamics between the alliance network growth and new spinoff performance

In order to understand the temporal dynamics between the alliance network growth and new spinoff performance, we use the time lag between the two variables to test the boundary conditions of the hypothesised U-shaped relationship between them (Aguinis & Bakker, 2021). The time lag between the spinoff alliance network growth and performance is likely to affect the U-shaped relationship between the two. Since the alliancing capabilities are built over time through repeated engagements in strategic alliances (Rothaermel & Deeds, 2006), a longer time elapses since the formation of an alliance network, which ultimately allows for the new spinoff to accumulate more experiences as a result of alliancing activities, and therefore, reap more benefits from their existing alliance networks. Research from Baum et al. (2000) on a sample of new ventures confirmed that performance benefits of alliance networks increase exponentially with a longer time lag. Moreover, once resources are transformed for the alliance network, they both limit opportunities to use them outside alliance networks and offer opportunities for further redeployment inside the alliance network; therefore, the performance improves over time (Madhok et al., 2015; Sakhartov & Folta, 2014). This is sometimes referred to as time compression diseconomies (Dierickx & Cool, 1989), which suggests that such resources and capabilities take time to develop and adjust (Argyres et al., 2019). The opportunity costs associated with redeploying resources and capabilities are larger for more unrelated applications, such as trying to deploy alliance-specific capabilities outside of an alliance network (Helfat & Eisenhardt, 2004; Sakhartov & Folta, 2014). Moreover, capabilities are typically more scale free, allowing them to be redeployed in similar settings for relatively low adjustment costs (Sakhartov & Folta, 2014); this suggests that for larger alliance network growth, the performance benefits will increase over time. While this may suggest that for shorter timeframes, spinoffs would prefer alternative choices to investing in resources in their alliance network, the adjustment costs typically appear after resource allocation choices have been made (Madhok et al., 2015). As such, we expect the performance effect for alliance network growth to increase with larger time lags. This increased positive performance is expected to be more pronounced for spinoffs with high levels of alliance network growth, since there are more opportunities to redeploy the alliance capabilities within the existing networks. Similarly, increased time lags will give spinoffs with low level of alliance network growth slightly better performance outcomes when compared to those with lower time lags. This happens because such spinoffs face low opportunity costs due to their deploying of resources outside of alliances; they have only invested a smaller portion of their resources in alliancing activities, and over time, have acquired more experiences to explore their options and reap more benefits. However, firms with moderate levels of alliance network growth still cannot experience substantial performance outcomes over time, as the opportunity cost of redeploying their resources is higher for them, when compared to having lower or higher levels of alliance network growth. Therefore, the slopes of the U-shaped relationship between spinoff alliance network growth and spinoff performance become steeper with increased time lag between the two.

-

Hypothesis 2: The U-shaped relationship between spinoff network growth and spinoff performance is stronger when there has been a longer time since the formation of alliances than less time.

Timing is also another dimension of time that can help recognise the temporal dynamics between the alliance network growth of spinoffs and their performance (Aguinis & Bakker, 2021). Timing refers to how the specific placement of an event on a timeline affects the outcome variable. Therefore, it is important to know whether the effect of alliance network growth on spinoff performance is different for spinoffs that have just been founded compared to those a couple of years after the founding. Research shows that the timing of strategic actions is likely to affect their influence on the firm performance (cf. Katila & Chen, 2008). Despite inheriting knowledge and practices from their parents, new spinoffs need to make crucial decisions about the extent to which they will use the transferred knowledge, and how they will build up on it in their new firm (Basu et al., 2015). Therefore, to benefit effectively from the new knowledge and resources from their strategic alliances and to combine them within their existing systems, newly founded spinoffs firstly need to have a good understating of their own resources and knowledge bases to build on. Moreover, the high levels of uncertainty associated with the period immediately preceding incorporation will increase the opportunity costs associated with resources; consequently, they will prompt managers to be more flexible and less committed to investing in adjusting resources (Sakhartov & Folta, 2014). This will likely reduce the benefits of alliance networks. In time, the uncertainty and therefore the opportunity costs of investing in alliance networks will decrease, allowing spinoffs to increase benefits from investing in their alliance networks. Accordingly, we assume that recently founded spinoffs will benefit less from the growth of alliance networks when compared to those a couple of years after the founding. Thus, we suggest:

-

Hypothesis 3:Strategic alliances added to the network shortly after founding will offer fewer performance-enhancing benefits to the spinoffs than alliances added later.

Research Methods

We tested the hypotheses using comprehensive longitudinal data on alliances, organisational characteristics, and performance growth in spinoffs that began operations in Australia between 2002 and 2011. Spinoffs are a major entry mode into the mining industry. In Australian mining, spinoffs are accounted for up to 40% of all new entrants between 2002 and 2012. Mining spinoffs enter multiple alliances, but not all of them might succeed as one of the interviewed spinoff founders mentioned:

“The lesson there is choose your partners wisely. In Spinoff X,Footnote 1 we have had several joint ventures and one of them was very successful and we had a joint venture with Mitsubishi and they spent more than 1 to 2 million dollars on one of our projects and we had another joint venture which was less than successful but we went into it … and we were not surprised that the end result was not a good result. A third joint venture we had also, not a very good result because that was the company ran out of money.”

The mining industry is selected because strategic alliances are commonplace in this industry as a means of sharing risks and resources (Bakker, 2016). New firms and larger companies both enter alliances to pursue their strategic goals (Knoben & Bakker, 2019). The alliances are relatively homogenous in terms of the nature of the contracts and the collaborations. This allows an enhanced observation of the performance effects of network growth. Further, mining projects take several years to develop through the exploration, development, and exploitation stages (Bakker & Shepherd, 2017), which allows for a better investigation of temporal dynamics and alliance growth by keeping other sources of variance constant. Therefore, focusing on this industry provides an ample variance to test the veracity of our key propositions.

Data collection and sample

We compiled data on 248 mining spinoffs that were founded during this period. Within the entrepreneurship literature, a firm has been considered as a new firm if it is 10 years or younger (cf. Baum et al., 2000; Carpenter et al., 2003; Certo et al., 2001; Milanov & Fernhaber, 2009). The data we employ come from several sources. We used the Register of Australian Mining as the main source, which is the most comprehensive dataset in the existence of mining firms, their directors, and their strategic alliances. The Register includes all strategic alliances, the companies involved, and their respective stakes in the project. It also provides a summary of the project’s annual progress. Because the disappearance and appearance of a company in the dataset are sometimes due to name changes, we crossed-checked information about founding time for each firm with the Dun & Bradstreet Hoovers Business Browser dataset and checked for name changes of firms on the Australian Exchange website. Financial data (e.g., revenue, ROA, etc.) was gathered from the MorningStar Premium dataset for each spinoff according to annual reports.

The sample consists of new spinoff firms that were 10 years old or less in 2011. To be identified as spinoffs, firms had to be new companies where at least 25% of their employees originated from the same mining company one year before initiation (Muendler et al., 2012). We initially used The Register dataset to identify the founding teams of new firms and their previous experience within the mining industry. This information was crossed-checked with the MorningStar Premium. In quantitative research, spinoffs are typically operationalised by a percentage of the employees in the new firm originating from the same parent firm. We focus on spinoffs, employing a 25% cut-off use by Muendler et al. (2012). The 25% cut-off ensures that at least two people originate from the same prior employer. Choosing a 25% cut-off allowed us to include smaller size new firms, where at least one founder was from a prior employer. Accordingly, the criteria aligns with that of Muendler et al. (2012) for larger founding teams of more than five founders. Additionally, among the sampled new firms as spinoffs, the percentage of employees coming from the same parent firm was about 45%, which is higher than the 25% cut-off rate, and suggests the strength of the spinoff phenomenon studied in the sample.

The mining firm that originated the majority of the founding team was identified as the parent firm for that spinoff firm. Overall, we found 248 new firms with such characteristics. By incorporating information on all newly founded spinoffs during the observation period, the research design avoids the common sample selection problem of overrepresentation of currently successful firms that can cause a survival bias and influence the inferences about factors producing organisational behaviour and success (Baum & Silverman, 2004).

Measures

Dependent variables:

Spinoff Performance

Spinoff performance has been measured by both revenue (Bruneel et al., 2013) and return on assets (i.e., ROA) (Dick et al., 2013). Revenue data is often a preferred measure of firm growth and financial performance of new ventures (Baum et al., 2000), because it is relatively accessible and applies to all sorts of firms and it is relatively insensitive to capital intensity (Delmar et al., 2003). ROA is a key measure of company's profitability, equal to a fiscal year's earnings divided by its total assets. Return on assets essentially shows how much profit a company is making on the assets used in its business.

Another widely used indicator of spinoff performance in the literature is “survival rates” (cf. Agarwal et al., 2004; Fackler et al., 2016; Franco & Filson, 2006). However, this was not an appropriate choice for this study, considering the length of the observation period. Out of 248 spinoffs founded in different time points during the ten years, only 14 firms were terminated before 2011. This suggests failure is highly unlikely, and therefore it is not a proper measure for performance in this analysis.

We obtained spinoffs’ revenue and ROA from annual reports of mining firms that are available from the Morningstar Premium dataset. To get a less skewed distribution of the variable, we took a natural logarithm from revenue. We use the revenue/ROA (t + 1) when controlling for revenue/ROA (t). The resulting effect is, in essence, for the difference of revenue/ROA between (t) and (t + 1) (i.e., one-year performance change). We used absolute growth rather than percentage growth. Certo et al. (2020) discuss the unequivocal limitations of the use of percentages. In a series of simulations, they demonstrate that, in management studies, the use of percentages can result in inconsistent empirical findings. They argue that transforming data into ratios may lead to spurious relationships between numerators, denominators, or both, and do not reveal the main effect in multiple regressions.

We entered an observation for each spinoff’s revenue for every year that we had data of. For instance, a spinoff that has 5 years of data would contribute 5 observations to the analysis. The length of each spinoff’s observations differs due to its founding time or failure during the observation period. The dependent variable is measured at time t + 1 to let the effect of independent variables at time t unfold. In this paper, our focus is on the founding period, rather than subsequent performance after the founding. The founding period is assumed to be less than 10 years by many entrepreneurship studies (cf. Carpenter et al., 2003; Milanov & Fernhaber, 2009; Robinson, 1999).

Independent variables:

Spinoff network growth

For each spinoff, network growth is measured as a count of the total accumulated number of alliance partners (Ahuja, 2000). We computed all network measures with the Social Network Analysis software package Ucinet 6 (Borgatti et al., 2002). We then calculated the dependent variable using the five-year moving window for network matrices. This variable would count all of the new alliance partners that the spinoff formed ties, in the five-year period preceding year t. As Gulati (2007) explains, this is because past alliances are likely to influence the current organisational outcomes. We used a moving window of five years of prior alliances, based on research that suggests the normal lifespan for most alliances is usually no more than five years (Kogut, 1988).

Control variables:

In addition to controlling for lagged dependent variables, we considered many other factors that, according to spinoff literature, influence the performance of a spinoff. We controlled for a variety of additional spinoff and parent firm characteristics in four main categories: organisational controls, human capital, parent firm performance, and post-spinoff links with the parent.

Organisational controls

We controlled for time since establishment, also known as spinoff age, and defined as the number of years since its founding, to ensure that any significant effects of our theoretical variables were not a spurious result of company aging. We also controlled for the size of the new spinoff firm, which may affect its performance (Fackler et al., 2016). We control for the spinoff size by obtaining the financial assets and liabilities of the spinoffs in Australian dollars, and then taking the natural log of company size in each year. Financial assets as a proxy for firm size have been used by previous studies as a control variable (cf. Ahuja et al., 2009; Bakker, 2016). We also added a binary variable that controlled for the fixed effects of each year by assigning a dummy for each observation year, from 2002 to 2011 (i.e., Year dummy or Time effects). We also controlled for the R&D investment by measuring the mining firms’ exploration and development expenditure that is documented in their annual financial reports as statements of cash flow. Because mining projects are capital intensive, the investments that firms make in exploration and development may allow them to identify the potential opportunities quicker, and to increase financial benefit (Bakker & Shepherd, 2017).

Human capital

The education of the founding team has also been considered to be influential on the new spinoffs outcomes (Yeganegi et al., 2016). We controlled for PhD experience, defined as whether or not there is a PhD holder in the founding team (Taheri & van Geenhuizen, 2011).

Parental firm performance

The parent firm’s financial situation has been found to affect the success of the spinoff (Dick et al., 2013; Fackler et al., 2016; Franco & Filson, 2006). Spinoffs coming from successful parent firms and not out of necessity are shown to achieve higher growth rates when compared to spinoffs stemming from the ones in crisis (Amankwah-Amoah, 2014; Fackler et al., 2016). Therefore, we controlled for parent’s profitability at the time of spinoff founding by obtaining ROA measure (i.e., rerun on assets) for each parent firm (Dick et al., 2013). We obtained parent’s ROA from annual reports of mining firms that are available from the Morningstar Premium dataset. This was a time-invariant variable.

Post-spinoff links with parent

We considered three ways in which spinoffs and parent firms would be connected after the spinoff event: a) being involved in a strategic alliance with the parent or having a tie with parent (Uzunca, 2018); b) parent firm holding an ownership stake in the spinoff or parent ownership (Semadeni & Cannella, 2011); and c) working in the parent firm as spinoff founders or the number of employees still in the parent (Chesbrough, 2003). We defined a dummy variable for the first two variables that were 1 when at time t, and zero otherwise. We counted the number of founders who still stay employed in the parent firm after the spinoff event for measuring the number still in the parent variable. We measured these variables only at the founding, so they are time-invariant.

Analysis and Results

We employed a longitudinal panel data design to test the hypotheses using a dataset spanning from 2002 to 2011. Since we have included a lagged dependent variable in the models, this might raise concerns about potential inconsistency in estimates, due to the probability of the lagged dependent variable being correlated with the error term. We used the Generalised Two-stage Least Square (G2sls) random-effects model to test our hypotheses with Stata v.15 using xtivreg package. The lagged terms of regressors can be used as valid instruments given that they are predetermined, and hence cannot be associated with the current error term, as long as error terms are not serially correlated (Agarwal et al., 2016). Unobserved heterogeneity can also be addressed by using first differencing (Roodman, 2009). We used Sargan-Hansen (or Hansen’s J) test to indicate the validity of the choice of our instruments and the consistency of our estimator. The results are reported at the bottom of Tables 3 and 4. The p-values for the Sargan-Hansen overidentification test indicate that our instruments and models are valid.

Table 2 provides the bivariate correlations and descriptive statistics for the variables we used to test the hypotheses. The average age of spinoffs (i.e., the time since establishment) is 3.6 and ranges from 1 to 10 years. There are not very high correlations between variables, which means that there is not a multicollinearity concern. The existence of multicollinearity could lead to less precise parameter estimates for correlated variables.

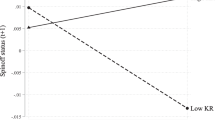

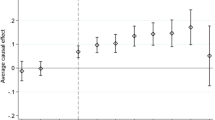

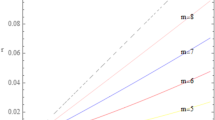

Tables 3 and 4 show the analysis of random-effects regression of spinoff performance as measured by spinoff revenue, and by ROA, respectively. In Hypothesis 1, we employed a generalised two-stage hierarchical regression to test for the hypothesised U-shaped effect of spinoff alliance network growth on performance in. Model 1 would reveal the linear effects (if any) of spinoff network growth on spinoff revenue (Table 3) and on ROA (Table 4). Although we did not hypothesise any such effects, it was important to determine whether simple linear effects were present (Haans et al., 2016). Model 1 in both Tables 3 and 4 shows that there were no significant linear effects of spinoff alliance network growth on spinoff revenue and ROA, respectively. Additionally, the coefficients are negative. In the second step (shown in Model 2, Tables 3 and 4) the squared form of the measure of spinoff alliance network growth was entered. For interpretation purposes, a positive quadratic term would indicate a U-shaped upward curve, while a negative would indicate an inverted U-shaped downward relationship (Haans et al., 2016). A significant positive sign for these variables would thus support Hypothesis 1. Model 1, in both Tables 3 and 4, shows that spinoff network growth squared was positively related to revenue (β = 0.003, p < 0.05) and ROA (β = 0.157, p < 0.05), supporting Hypothesis 1. The performance declines at first as the number of spinoff alliances increase, reaching a minimum of 12 in both models for revenue and ROA, but then increasing continuously until it reaches the maximum alliance number of 27. We note that at the maximum, performance slightly passes the levels achieved by those spinoff firms with one alliance. Figures 1 and 2 depict this relationship.

In Tables 3 and 4, we also report the Wald Chi-square that represents the fit of the model. As can be seen, the fit of the model improves from Model 1 to Model 2, in both tables. Additionally, we report the R-squared statistics, which represents the proportion of the variance for a dependent variable, as explained by an independent variable or variables, in a regression model. Considering Models 1 and 2, model 2 has the highest overall R-squared, as shown in Tables 3 and 4, which confirms the better fit of the model for a convex U-shaped function.

To test Hypothesis 2, we used a two-year, a three-year, and then a four-year time lag between the independent and dependent variables, to test how the effect of adding more alliances on the spinoff performance unfolds over a longer time period. We could not consider longer lags since the number of observations would become too small. The results are reported in Tables 3 and 4 of Models 3 to 8. The U-shaped relationship between spinoff network growth and performance is evident in all models. While in a quadratic function, the coefficient of the squared term predicts the steepness of the function, a more positive coefficient of the squared spinoff network growth would suggest a stronger relationship between the independent and dependent variable (Haans et al., 2016). As seen in Tables 3 and 4, the coefficient has increased in the models containing the squared term from the one-year to a four-year lag between independent and dependent variables, which supports Hypothesis 2. The results are also shown in Figs. 1 and 2.

In Hypothesis 3, we tested if the effect of alliance network growth on spinoff performance is different for spinoffs that have just been founded and compared them to those tested after a couple of years of being founded. To test this, we split the sample in two by running the analysis once for time since establishment before Year 5, and once after Year 5. In this way, we could capture the effect of adding alliances in the years before Year 5 versus the effect of adding them after Year 5 within the founding period. The results for performance measured by revenue are reported in Table 5. We could not run this analysis for performance based on ROA due to the lack of enough data when splitting the sample.Footnote 2 Models 1 and 2 summarise the results for years with time since establishment in the first 5 years, and Models 3 and 4 report the results for time since establishment over the second 5 years. Model 1 shows that the linear effect of the spinoff alliance network growth is negative and significant (β = -0.0462, p < 0.05) for years before Year 5. Although Model 3 does not report significant results, it shows that the coefficient for spinoff alliance network growth is positive for adding alliances after Year 5. The results are shown in Fig. 3.

Discussion

The aim of this article was to examine the effect of alliance network growth on newly founded spinoff performance. Consistent with heritage theory, previous studies mostly associate the influence of parents’ performance, the spinoffs founders’ prior employment experiences in the parent firm, and their human capital (cf. Basu et al., 2015; Chatterji, 2009; Dick et al., 2013; Fackler et al., 2016; Phillips, 2002). Furthermore, research that draws upon RBV and dynamic capabilities found inconclusive results when testing the relationship between the alliance network growth and performance of new firms (Moghaddam et al., 2016). Infusing cost with benefit arguments based on Madhok et al.’s (2015) notion of adjustment costs, we hypothesised a nonlinear relationship between alliance network growth and spinoff performance. We further examined the boundary condition of our proposed U-shaped relationship by considering a longer time gap between the independent and dependent variables. We additionally posited that the timing of growing alliance networks would affect the performance benefits that new spinoffs can earn from entering alliances. Our results were based on a longitudinal sample of spinoffs in the mining industry, and provided support for our arguments.

Our findings provide several implications for the entrepreneurship and management literature. We primarily contribute to the spinoff literature by clarifying the performance effects of alliance network growth. Previous studies consistent with the heritage theory have suggested the parent firm as a source of advantage for the spinoffs (cf. Agarwal et al., 2004; Basu et al., 2015; Bruneel et al., 2013; Dick et al., 2013). However, parental endowments are mainly earned prior to founding, and spinoffs’ access to their parent firms’ complementary resources after the founding is often limited due to potential conflicts (Bae & Lee, 2020; Walter et al., 2014). We show that growing alliance networks is a potential strategy to deal with the liabilities of newness and smallness at founding over and above the endowments from the parent firm.

Secondly, we contribute to the ongoing discussion about the performance effects and mechanisms of growing alliance networks (Baum et al., 2000; Moghaddam et al., 2016; Pangarkar & Wu, 2013). The results support our hypothesised U-shaped relationship between alliance network growth and new spinoff performance. Whereas prior studies consist of RBV and dynamic capabilities finding positive (Baum et al., 2000; Pangarkar & Wu, 2013), negative (Alvarez & Barney, 2001), and non-existent effects (Su et al., 2009), the present model introduces adjustment and opportunity costs arguments (Madhok et al., 2015) to this literature. Therefore, our proposed model provides a more precise theory that could be applied to different types of new firms with different initial endowments.

Lastly, our contingency analysis indicated the important role of time in the alliance network-spinoff performance relationship. Specifically, the results show that a longer timeframe between adding alliances to the network, and the observed performance outcomes provide more positive results in larger networks. Moreover, we show that the timing of network growth matters in that strategic alliances added shortly after founding will offer fewer benefits for the new spinoff, than those added later. These results are consistent with those of Deeds and Rothaermel (2003), who found that the relationship between individual alliance age and performance is a curvilinear U-shaped one; this shows that, after hitting a low point, the performance of alliances improves over time. Together, the results suggest that performance outcomes of strategic alliances take time to unfold, and that alliances contribute to new firms’ performance. These findings align with an emerging literature on time in entrepreneurial action in that the timing of the action and the time gap between action and outcome impacts on outcomes of entrepreneurial action (Aguinis & Bakker, 2021; Wood et al., 2021). Accordingly, we tested three elements of time in exploring the temporal dynamics between alliance network growth and performance outcomes. These elements are: the frequency in which something occurs within a timeframe or number of alliances the network grew within a 5-year moving window; the duration of the effect of network growth and performance outcomes over time as indicated by varying time lags; and the timing of when spinoffs grow their alliance networks in relation to their moment of founding (Aguinis & Bakker, 2021). Developing a more time-calibrated theory of alliance networks would have exciting opportunities for future research (Aguinis & Bakker, 2021). For example, Wood et al. (2021) define sequencing as the fourth dimension of time, which opens up opportunities to study the sequence of alliance network growth. Does it matter if alliances with certain types of firms are added earlier or later? Does the pattern in terms of the amount of growth matter? Should spinoffs grow their network at a consistent pace, or take it more slowly early on and then accelerate later?

Our study also has implications for practice. Since employees leaving a firm to pursue opportunities they came across with in the parent firm might not be of interest to the parent firm, our paper suggests those spinoff founders could instead forge alliances with other firms in the industry to access complementary resources. However, founders should be aware of the costs and adjustments required to successfully benefit from those alliances. Therefore, our results suggest that spinoffs may firstly need to seek significant growth of their networks to benefit from alliances, as smaller networks costs tend to outweigh benefits. Secondly, spinoff founders may be better off waiting a couple of years after founding to pursue the growth of their network, as network growth straight after founding reduces spinoff performance. Lastly, spinoff founders need to focus on the longer term, as adding alliances to the spinoff’s network takes time to realise the benefits. Our results suggest that after at least 4 years, the benefits of engaging in alliances start to have more significant effects on performance.

Limitations and Implications for Future Research

Entrepreneurship and strategy literature have considered performance as a multi-faceted phenomenon (Davidsson, 2016; Miller et al., 2013; Venkatraman & Ramanujam, 1986) that involves various perspectives, such as shareholder vs employee (Semadeni & Cannella, 2011), and different criteria, such as new product vs profit (George et al., 2001). We measured two aspects of spinoff performance, namely revenue and ROA growth. We suggest that future research should use different measures for operationalising spinoff performance, that consider return on sales, return on equity (ROE), and return on capital employed (ROCE).

Another limitation of our study is that we focus on the single industry of Australian mining. This addresses recent calls for more studies on drivers of competitive dynamics and firm-level performance implications in the natural resource industries (Casarin et al., 2020, p.378), and complements spinoff studies in high-tech industries such as disk drive production (Agarwal et al., 2004), laser technology (Klepper & Sleeper, 2005), medical services (Chatterji, 2009), and information and communication technology (Ellis et al., 2017). However, in doing so, we cannot rule out that the effects of alliance network growth are different on spinoff performance, or, in other contexts are different in magnitude or function. Depending on different activities carried out in alliances (Gulati & Singh, 1998), the cooperation requirements in them might differ greatly, which could ultimately affect the costs and benefits that firms will reap from them. While this may have some change in magnitude, Knoben and Bakker (2019) argued that the underlying processes regarding alliance formation in mining are generalisable to other industries. Nonetheless, we encourage future work to re-examine our findings for other types of industry settings. Finally, due to data limitations we could not test Hypothesis 3 for the ROA outcome. However, we acknowledge that future research should test this hypothesis with longer time lags. Despite these limitations, we believe our study provides valuable insights into how establishing an alliance network in the founding may benefit new spinoff firms in an industry.

Conclusion

Our study is the first one to show that there are important, complex performance effects of alliance network growth for new spinoffs. Such effects go beyond the ties to the parent firm that have been emphasised in prior theorising and empirical research on spinoff performance. Growing those alliance networks seems to firstly dimmish performance, when moving from low to moderate levels of alliance network growth, and then enhance it when moving from moderate to high levels. We also show that the time lag between growing alliance networks and realising performance benefits intensifies the U-shaped relationship, which means spinoffs realise value from growing alliance networks over more extended periods of time. Furthermore, new spinoffs can see higher performance benefits from alliances added a few years after founding when compared to those added earlier. Together, our empirically backed theoretical arguments suggest that new spinoffs should chart their strategy for growing their alliance networks carefully to achieve performance benefits.

Notes

Name changed due to anonymity.

We tried different points in time for splitting the sample but could not run the whole analysis due to lack of enough data. This has been acknowledged as a limitation in the discussion section.

References

Agarwal, R., Campbell, B. A., Franco, A. M., & Ganco, M. (2016). What do I take with me? The mediating effect of spin-out team size and tenure on the founder–firm performance relationship. Academy of Management Journal, 59(3), 1060–1087.

Agarwal, R., Echambadi, R., Franco, A. M., & Sarkar, M. B. (2004). Knowledge transfer through inheritance: Spin-out generation, development, and survival. Academy of Management Journal, 47(4), 501–522.

Agarwal, R., & Shah, S. K. (2014). Knowledge sources of entrepreneurship: Firm formation by academic, user and employee innovators. Research Policy, 43(7), 1109–1133.

Aguinis, H., & Bakker, R. M. 2021. Time is of the essence: Improving the conceptualization and measurement of time. Human Resource Management Review, 31(2): 100763.

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Ahuja, G., Polidoro, F., & Mitchell, W. (2009). Structural homophily or social asymmetry? The formation of alliances by poorly embedded firms. Strategic Management Journal, 30(9), 941–958.

Aldrich, H., & Auster, E. R. 1986. Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in organizational behavior.

Alvarez, S. A., & Barney, J. B. (2001). How entrepreneurial firms can benefit from alliances with large partners. Academy of Management Perspectives, 15(1), 139–148.

Amankwah-Amoah, J. (2014). Old habits die hard: A tale of two failed companies and unwanted inheritance. Journal of Business Research, 67(9), 1894–1903.

Argyres, N., Mahoney, J. T., & Nickerson, J. (2019). Strategic responses to shocks: Comparative adjustment costs, transaction costs, and opportunity costs. Strategic Management Journal, 40(3), 357–376.

Au, K., Chiang, F. F., Birtch, T. A., & Ding, Z. (2013). Incubating the next generation to venture: The case of a family business in Hong Kong. Asia Pacific Journal of Management, 30(3), 749–767.

Bae, J., & Lee, J. M. 2020. How technological overlap between spinouts and parent firms affects corporate venture capital investments in spinouts: the role of competitive tension. Academy of Management Journal.

Bakker, R. M. (2016). Stepping in and stepping out: Strategic alliance partner reconfiguration and the unplanned termination of complex projects. Strategic Management Journal, 37(9), 1919–1941.

Bakker, R. M., & Shepherd, D. A. (2017). Pull the plug or take the plunge: Multiple opportunities and the speed of venturing decisions in the Australian mining industry. Academy of Management Journal, 60(1), 130–155.

Basu, S., Sahaym, A., Howard, M. D., & Boeker, W. (2015). Parent inheritance, founder expertise, and venture strategy: Determinants of new venture knowledge impact. Journal of Business Venturing, 30(2), 322–337.

Baum, J. A., Calabrese, T., & Silverman, B. S. (2000). Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strategic Management Journal, 21(3), 267–294.

Baum, J. A., & Silverman, B. S. (2004). Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing, 19(3), 411–436.

Borgatti, S. P., Everett, M. G., & Freeman, L. C. 2002. Ucinet for Windows: Software for Social Network Analysis. Needham, MA: Analytic Technologies.

Bruneel, J., Van de Velde, E., & Clarysse, B. (2013). Impact of the Type of Corporate Spin-Off on Growth. Entrepreneurship Theory & Practice, 37(4), 943–959.

Buenstorf, G., & Klepper, S. (2009). Heritage and agglomeration: The Akron tyre cluster revisited. The Economic Journal, 119(537), 705–733.

Carpenter, M. A., Pollock, T. G., & Leary, M. M. (2003). Testing a model of reasoned risk-taking: Governance, the experience of principals and agents, and global strategy in high-technology IPO firms. Strategic Management Journal, 24(9), 803–820.

Casarin, A. A., Lazzarini, S. G., & Vassolo, R. S. (2020). The forgotten competitive arena: Strategy in natural resource industries. Academy of Management Perspectives, 34(3), 378–399.

Certo, S. T., Busenbark, J. R., Kalm, M., & LePine, J. A. (2020). Divided we fall: How ratios undermine research in strategic management. Organizational Research Methods, 23(2), 211–237.

Certo, S. T., Covin, J. G., Daily, C. M., & Dalton, D. R. (2001). Wealth and the effects of founder management among IPO-stage new ventures. Strategic Management Journal, 22(6–7), 641–658.

Chang, S. J. (2004). Venture capital financing, strategic alliances, and the initial public offerings of Internet startups. Journal of Business Venturing, 19(5), 721–741.

Chatterji, A. K. (2009). Spawned with a silver spoon? Entrepreneurial performance and innovation in the medical device industry. Strategic Management Journal, 30(2), 185–206.

Chesbrough, H. 2002. Graceful exits and missed opportunities: Xerox's management of its technology spin-off organizations. The Business History Review: 803–837.

Chesbrough, H. (2003). The governance and performance of Xerox’s technology spin-off companies. Research Policy, 32(3), 403–421.

Chesbrough, H., & Rosenbloom, R. S. (2002). The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spin-off companies. Industrial and Corporate Change, 11(3), 529–555.

Contractor, F. J., & Lorange, P. (2002). The growth of alliances in the knowledge-based economy. International Business Review, 11(4), 485–502.

Dai, Y., Du, K., Byun, G., & Zhu, X. (2017). Ambidexterity in new ventures: The impact of new product development alliances and transactive memory systems. Journal of Business Research, 75, 77–85.

Das, T., & He, I. Y. 2006. Entrepreneurial firms in search of established partners: review and recommendations. International Journal of Entrepreneurial Behavior & Research.

Davidsson, P. 2016. Researching entrepreneurship (2 ed., Vol. 33). Springer.

Deeds, D. L., DeCarolis, D., & Coombs, J. (2000). Dynamic capabilities and new product development in high technology ventures: An empirical analysis of new biotechnology firms. Journal of Business Venturing, 15(3), 211–229.

Deeds, D. L., & Rothaermel, F. T. (2003). Honeymoons and liabilities: The relationship between age and performance in research and development alliances. Journal of Product Innovation Management, 20(6), 468–484.

Delmar, F., Davidsson, P., & Gartner, W. B. (2003). Arriving at the high-growth firm. Journal of Business Venturing, 18(2), 189–216.

Dick, J. M., Hussinger, K., Blumberg, B., & Hagedoorn, J. (2013). Is success hereditary? Evidence on the performance of spawned ventures. Small Business Economics, 40(4), 911–931.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35(12), 1504–1511.

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10–11), 1105–1121.

Eisenhardt, K. M., & Schoonhoven, C. B. (1996). Resource-based view of strategic alliance formation: Strategic and social effects in entrepreneurial firms. Organization Science, 7(2), 136–150.

Elfring, T., & Hulsink, W. (2007). Networking by entrepreneurs: Patterns of tie—formation in emerging organizations. Organization Studies, 28(12), 1849–1872.

Ellis, S., Aharonson, B. S., Drori, I., & Shapira, Z. (2017). Imprinting through inheritance: A multi-genealogical study of entrepreneurial proclivity. Academy of Management Journal, 60(2), 500–522.

Fackler, D., Schnabel, C., & Schmucker, A. (2016). Spinoffs in Germany: Characteristics, survival, and the role of their parents. Small Business Economics, 46(1), 93–114.

Franco, A. M., & Filson, D. (2006). Spin-outs: Knowledge diffusion through employee mobility. The Rand Journal of Economics, 37(4), 841–860.

George, G., Zahra, S., Wheatley, K., & Khan, R. (2001). The effects of alliance portfolio characteristics and absorptive capacity on performance: A study of biotechnology firms. The Journal of High Technology Management Research, 12(2), 205–226.

Gulati, R. 2007. Managing network resources: Alliances, affiliations, and other relational assets. Oxford University Press on Demand.

Gulati, R., & Singh, H. 1998. The architecture of cooperation: Managing coordination costs and appropriation concerns in strategic alliances. Administrative Science Quarterly: 781–814.

Gulati, R., Wohlgezogen, F., & Zhelyazkov, P. (2012). The two facets of collaboration: Cooperation and coordination in strategic alliances. Academy of Management Annals, 6(1), 531–583.

Haans, R. F., Pieters, C., & He, Z. L. (2016). Thinking about U: Theorizing and testing U-and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37(7), 1177–1195.

Helfat, C. E., & Eisenhardt, K. M. (2004). Inter-temporal economies of scope, organizational modularity, and the dynamics of diversification. Strategic Management Journal, 25(13), 1217–1232.

Hemmert, M. (2019). The relevance of inter-personal ties and inter-organizational tie strength for outcomes of research collaborations in South Korea. Asia Pacific Journal of Management, 36(2), 373–393.

Hubbard, T. D., Pollock, T. G., Pfarrer, M. D., & Rindova, V. P. (2018). Safe bets or hot hands? How status and celebrity influence strategic alliance formations by newly public firms. Academy of Management Journal, 61(5), 1976–1999.

Inkpen, A. C. (2000). Learning through joint ventures: A framework of knowledge acquisition. Journal of Management Studies, 37(7), 1019–1044.

Kale, P., & Singh, H. (2009). Managing strategic alliances: What do we know now, and where do we go from here? Academy of Management Perspectives, 23(3), 45–62.

Katila, R., & Chen, E. L. (2008). Effects of search timing on innovation: The value of not being in sync with rivals. Administrative Science Quarterly, 53(4), 593–625.

Klepper, S. (2009). Spinoffs: A review and synthesis. European Management Review, 6(3), 159–171.

Klepper, S., & Sleeper, S. (2005). Entry by spinoffs. Management Science, 51(8), 1291–1306.

Knoben, J., & Bakker, R. M. (2019). The guppy and the whale: Relational pluralism and start-ups’ expropriation dilemma in partnership formation. Journal of Business Venturing, 34(1), 103–121.

Kogut, B. (1988). Joint ventures: Theoretical and empirical perspectives. Strategic Management Journal, 9(4), 319–332.

Madhok, A., Keyhani, M., & Bossink, B. (2015). Understanding alliance evolution and termination: Adjustment costs and the economics of resource value. Strategic Organization, 13(2), 91–116.

McKendrick, D. G., Wade, J. B., & Jaffee, J. (2009). A good riddance? Spin-offs and the technological performance of parent firms. Organization Science, 20(6), 979–992.

Milanov, H., & Fernhaber, S. A. (2009). The impact of early imprinting on the evolution of new venture networks. Journal of Business Venturing, 24(1), 46–61.

Miller, C. C., Washburn, N. T., & Glick, W. H. (2013). Perspective—The myth of firm performance. Organization Science, 24(3), 948–964.

Moghaddam, K., Bosse, D. A., & Provance, M. (2016). Strategic alliances of entrepreneurial firms: Value enhancing then value destroying. Strategic Entrepreneurship Journal, 10(2), 153–168.

Muendler, M.-A., Rauch, J. E., & Tocoian, O. (2012). Employee spinoffs and other entrants: Stylized facts from Brazil. International Journal of Industrial Organization, 30(5), 447–458.

Pangarkar, N., & Wu, J. (2013). Alliance formation, partner diversity, and performance of Singapore startups. Asia Pacific Journal of Management, 30(3), 791–807.

Phillips, D. J. (2002). A genealogical approach to organizational life chances: The parent-progeny transfer among Silicon Valley law firms, 1946–1996. Administrative Science Quarterly, 47(3), 474–506.

Powell, W. W., Koput, K. W., & Smith-Doerr, L. 1996. Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Administrative Science Quarterly: 116–145.

Robinson, K. C. (1999). An examination of the influence of industry structure on eight alternative measures of new venture performance for high potential independent new ventures. Journal of Business Venturing, 14(2), 165–187.

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal, 9(1), 86–136.

Rothaermel, F. T., & Deeds, D. L. (2006). Alliance type, alliance experience and alliance management capability in high-technology ventures. Journal of Business Venturing, 21(4), 429–460.

Sakhartov, A. V., & Folta, T. B. (2014). Resource relatedness, redeployability, and firm value. Strategic Management Journal, 35(12), 1781–1797.

Semadeni, M., & Cannella, A. A. (2011). Examining the performance effects of post spin-off links to parent firms: Should the apron strings be cut? Strategic Management Journal, 32(10), 1083–1098.

Shin, K., Kim, S. J., & Park, G. (2016). How does the partner type in R&D alliances impact technological innovation performance? A study on the Korean biotechnology industry. Asia Pacific Journal of Management, 33(1), 141–164.

Stinchcombe, A. L. 1965. Social structure and organizations. Emerald Group Publishing Limited.

Su, Y.-S., Tsang, E. W., & Peng, M. W. (2009). How do internal capabilities and external partnerships affect innovativeness? Asia Pacific Journal of Management, 26(2), 309–331.

Taheri, M., & van Geenhuizen, M. (2011). How human capital and social networks may influence the patterns of international learning among academic spin-off firms. Papers in Regional Science, 90(2), 287–311.

Thorburn, L. (2000). Knowledge management, research spinoffs and commercialization of R&D in Australia. Asia Pacific Journal of Management, 17(2), 257–275.

Uzunca, B. (2018). Biological children versus stepchildren: Interorganizational learning processes of spinoff and nonspinoff suppliers. Journal of Management, 44(8), 3258–3287.

Vassolo, R. S., Anand, J., & Folta, T. B. (2004). Non-additivity in portfolios of exploration activities: A real options-based analysis of equity alliances in biotechnology. Strategic Management Journal, 25(11), 1045–1061.

Venkatraman, N., & Ramanujam, V. (1986). Measurement of business performance in strategy research: A comparison of approaches. Academy of Management Review, 11(4), 801–814.

Walter, S. G., Heinrichs, S., & Walter, A. (2014). Parent hostility and spin-out performance. Strategic Management Journal, 35(13), 2031–2042.

Wood, M. S., Bakker, R. M., & Fisher, G. (2021). Back to the future: A time-calibrated theory of entrepreneurial action. Academy of Management Review, 46(1), 147–171.

Yeganegi, S., Laplume, A. O., Dass, P., & Huynh, C.-L. (2016). Where do spinouts come from? The role of technology relatedness and institutional context. Research Policy, 45(5), 1103–1112.

Yu, B., Hao, S., Ahlstrom, D., Si, S., & Liang, D. (2014). Entrepreneurial firms’ network competence, technological capability, and new product development performance. Asia Pacific Journal of Management, 31(3), 687–704.

Zhou, J., Wu, R., & Li, J. (2019). More ties the merrier? Different social ties and firm innovation performance. Asia Pacific Journal of Management, 36(2), 445–471.

Acknowledgements

The authors gratefully acknowledge the comments from reviewers at the Australian Centre for Entrepreneurship Research Exchange (ACERE) conference. The authors appreciate the financial support received from the Queensland Research Council and the Australian Research Council to undertake this research (grant number LP130100415).

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zarea Fazlelahi, F., Burgers, J.H., Obschonka, M. et al. Spinoffs’ alliance network growth beyond parental ties: performance diminishing, then performance enhancing. Asia Pac J Manag 40, 743–773 (2023). https://doi.org/10.1007/s10490-022-09804-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-022-09804-1