Abstract

This paper sheds new light on the dynamic effects of inter-firm network agreements on firm performance and investigates whether the specific combination of partner profiles triggers heterogeneous causal effects. Using a staggered difference-in-differences design, we find that participation in network agreements has a persistent impact on firms’ revenues, value added, and EBITDA that is amplified at least through the third year of collaboration. Our results show that micro firms benefit more from collaboration in network agreements, especially when they enter into relationships with larger partners. In addition, companies benefit more from network ties when most of their partners belong to the same travel-to-work area.

Plain English Summary

Participating in a network agreement is a valuable solution for improving long-term revenues and operating margins. Our analysis shows that network agreements introduced into the Italian legal system in 2009 yield increasing benefits that become larger in the third year of cooperation and stabilize thereafter. Moreover, the interaction of partners’ characteristics affects the magnitude of the effects. Micro firms benefit more from formal networks, especially when they collaborate with larger partners. Moreover, network agreements are highly beneficial when most network members operate in the same area. The Italian policy on network agreements has proven to be a “best practice” under the Small Business Act. However, since it takes some time for the results of network agreements to reach their peak, institutional communication should be improved to raise the right expectations about their potential. From a management perspective, partner selection is a critical step, as a good match of partner characteristics can increase the value creation potential of formal networks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Networks of inter-firm collaborative agreements are a widely debated and studied phenomenon (Riccaboni & Pammolli, 2002; Hoang & Antoncic, 2003; Pammolli et al., 2016; Smith-Doerr & Powell, 2010; Pammolli et al., 2021). The mechanisms underlying network formation and their evolution have been extensively studied from a variety of disciplinary approaches, including organizational economics, management studies, and sociology. An important contribution to the theoretical conceptualization of interfirm network formation comes from transaction cost theory (Williamson, 1979, 1991). This framework has been a point of reference in the scholarly debate that has followed. However, it leaves the many strategic implications of cooperative networks largely unexplored (Powell, 1990; Granovetter, 1985). Network agreements can indeed serve to overcome strategic weaknesses and gain a competitive advantage (Jarillo, 1988; Gulati et al., 2000). The ability to gain timely access to key assets, know-how, capabilities, and technologies while maintaining flexibility and autonomy favors collaborative agreements. They provide strategic advantages that would otherwise be foreclosed (Powell, 1990; Gulati, 1999; Orsenigo, Pammolli, and Riccaboni, 2001; Pammolli & Riccaboni, 2002), especially in a dynamic competitive environment (Riccaboni & Moliterni, 2009; Mamédio et al., 2019). Moreover, better access to external information and capabilities (Malecki & Veldhoen, 1993) can strengthen the market position of network members or facilitate entry into new market segments (Coviello & Munro, 1995; Laurell et al., 2017).

Networks of inter-firm strategic alliances typically take time to produce substantial benefits, though (Rosenfeld, 1996; Huggins, 2001). The emergence of network outcomes is influenced by the speed at which learning occurs. Learning to leverage external know-how and resources is critical to achieving market goals and improving organizational performance (Gibb, 1997; Stuart, 2000). However, companies need time to absorb knowledge and increase their learning capabilities (Cohen & Levinthal, 1990; Latham & Le Bas, 2006). In addition, value creation in the post-formation phase of an alliance is usually hampered by the high coordination costs resulting from the complexity of ongoing activities to be performed jointly and the interdependence of tasks (Gulati & Singh, 1998). Over time, as network members learn to pool their resources and develop effective coordination routines, the alliance begins to deliver increasing value (Dyer et al., 2018; Gulati et al., 2012).

The relational nature of networks suggests that partners’ performance gains are a function of specific assets and capabilities developed within an idiosyncratic relationship (Mesquita et al., 2008). The unique way in which the partners’ attributes are combined shapes the identity of the relationship and influences its value creation potential (Dyer & Singh, 1998; Tang et al., 2016). Thus, one characteristic that makes a partnership special and is thought to determine the extent of its impact is the heterogeneity of partners in terms of size, resources, and capabilities (Burgers et al., 1993).

Sustained collaboration among firms is thought to benefit smaller firms in many ways: due to financial, technological, and professional constraints, small firms may rely on network partnerships to acquire key resources (Stuart, 2000), external knowledge (Inkpen & Tsang, 2005), and information about market and industry trends (O’donnell, 2014). However, because smaller companies gain advantages from access to the complementary resources of partners, the value of an alliance depends ostensibly on the resource profiles of the other members (Tang et al., 2016; Katila et al., 2022). On this basis, large, well-established firms are plausibly very valuable partners (Stuart, 2000): smaller firms can benefit from the consolidated market position, customer base, financial resources, and reputation of larger firms (Podolny & Page, 1998) in return for their flexibility and innovation potential, especially in a dynamic environment (Narula, 2004; Mitchell & Singh, 1996).

The value creation potential of network partnerships is also mitigated by distance (Enright, 1995; Dyer, 1996; McKelvey et al., 2003). Cooperative agreements between nearby partners can benefit from spatial spillovers and agglomeration economies (Van Oort et al., 2012). Co-location of partners facilitates knowledge and information flows (Audretsch & Feldman, 1996) through recurrent face-to-face interactions (Breschi & Lissoni, 2001) and spatially constrained labor mobility (Kesidou & Romijn, 2008). Direct communication channels between close partners and a continuous flow of information facilitate the coordination of complex tasks and accelerate convergence towards efficient coordination routines (Ring & van de Ven, 1992; Gulati et al., 2012).

Despite the many acknowledged benefits of building enduring network ties, alliances between firms may not produce the hoped-for results (Kale et al., 2002; Miles & Snow, 1992). Network members may behave opportunistically and not fully commit to shared strategic goals (Williamson, 1993) or seek to increase their bargaining power to gain a greater share of the partnership’s value creation (Panico, 2017; Hoffmann et al., 2018). Inaccurate relationship design can lead to an unfair division of labor and poor outcomes (Miles & Snow, 1992) and increases the risk of aggressive misappropriation tactics (Katila et al., 2008). Effective control mechanisms are needed to prevent harmful behaviors and promote strategic alignment among partners (Das & Teng, 1998a). Contractual control becomes important in this context because it provides stability to the relationship by formalizing the partners’ rights, obligations, and mutual expectations (Bentivogli et al., 2013).

In this spirit, and with the aim of stimulating the competitiveness of small businesses and promoting durable network relationships (Capuano et al., 2012), the Italian government introduced in 2009 a legal instrument, the “network agreement” (in its original definition “network contract” or “contratto di rete”), which aims to regulate and secure strategic inter-firm cooperation (Massari et al., 2015). Early empirical evidence shows that participation in network agreements is positively associated with firm performance (Burlina, 2020; Dickson et al., 2021; Cisi et al., 2020). Smaller firms benefit more from networks in terms of value added per unit of sales (Cisi et al., 2020; Aiello et al., 2023) and sales growth (Costa et al., 2017). However, because the legislation was introduced only recently, there is still limited evidence on the persistence of network effects over the medium to long term. Companies usually have high expectations regarding the benefits they can derive from formal collaboration in the short term (Rosenfeld, 1996). Then, when the value creation potential of networks matures only over time (Gulati et al., 2012), companies may show disappointment and reduce their commitment (Huggins, 2001). Deepening our understanding of network agreements can help us better understand their potential from a dynamic perspective. In addition, further evidence is needed to determine whether and how the interaction of partner characteristics, in particular, firm size (Cantele & Vernizzi, 2015) and geographic distance (Cisi et al., 2020; Rubino & Vitolla, 2018), conditions the value creation potential of network agreements and leads to heterogeneity in causal effects.

Using a large sample of Italian manufacturing and service firms, we contribute to filling this gap by drawing a causal inference about the impact of participation in network agreements on firms’ revenues, value added and EBITDA. Our work adds novelty as we conduct a dynamic assessment of the causal impact of network agreements over time up to the seventh year of networking. Our empirical approach allows us to overcome the pitfalls of two-way fixed effects Diff-in-Diff estimations in settings with multiple time periods and different treatment times across units (Goodman-Bacon, 2021). Firms are considered treated from the time they sign an agreement, and because they enter into the agreement at different times, a staggered design was most appropriate for modeling our data. We conducted an event study using the estimation method proposed by Sun & Abraham (2020), which provides robust estimates under the hypothesis of heterogeneous effects across treatment cohorts. We formally accounted for the self selection of firms into the treatment by selecting an appropriate counterfactual group through propensity score matching (Rosenbaum & Rubin, 1983).

By comparing subsamples of treated firms, we advance the discussion by providing insights into the heterogeneity of causal effects induced by idiosyncratic combinations of partner profiles. Rather than limiting our analysis to determining whether firms derive stronger or weaker benefits from formal networks based on their own characteristics, we explored how the fit between partner profiles can generate a synergistic effect that moderates the value creation potential of formal networks (Dyer & Singh, 1998; Stuart, 2000; Luo, 1997). Our results show that network agreements have a positive and significant impact on revenues, value added, and EBITDA. Formal strategic networks were found to produce increasing benefits that rise by the third year of treatment and tend to stabilize thereafter. The network effects persist over time until the sixth year of the agreement and then lose statistical significance, likely due to the limited number of remaining observations. As expected, micro firms with fewer than ten employees benefit most from network participation. However, we find that micro firms reap greater benefits when they enter into a contractual relationship with at least one medium/large partner.

Regarding the spatial concentration of networks, a comparison of the treatment effects of firms in networks with at least \(60\%\) of members from the same area with those of firms in networks with less than \(60\%\) of participants from the same area shows similar dynamic effects in both subgroups (especially for revenues and EBITDA). However, when we isolate the \(25\%\) of network firms involved in the most and least spatially concentrated agreements, the benefits of creating formal ties within highly connected geographic areas become clear.

Implications for policy and management can be derived from our findings. Inter-firm alliances formalized through a network agreement yield persistent benefits over time, confirming the strategic and long-term nature of the collaboration. However, the economic impact of network agreements takes time to grow and stabilize. Therefore, proper communication is needed to help potential network participants develop the right expectations about the effectiveness of networks. When forming networks, partners must be carefully selected based on the expected synergies among potential partners’ resources and competencies.

The remainder of this article is organized as follows. Section 2 provides the theoretical background, describes the main features of the Italian policy on network agreements, and develops the main hypotheses. Section 3 describes the sample, section 4 outlines the econometric approach, while our results are discussed in section 5. Finally, in section 6 we draw the main conclusions, discuss policy and managerial implications, and provide suggestions for future studies.

2 Theoretical background

2.1 Inter-firm network policies

Since the late 1980s, several countries have launched programs to promote the development of inter-firm linkages to foster sustained collaboration and learning (e.g., Huggins, 2001; Porras et al., 2004; Rosenfeld, 1996). Following the Danish program launched in 1989 (Chaston, 1995), similar initiatives were implemented in other countries, from Norway and Australia (Porras et al., 2004) to the United States (Rosenfeld, 1996). These policies allowed the first evidence to be gathered on the effectiveness of network policies. On the one hand, participants claimed that networking increased their competitivenessFootnote 1 (Gelsing & Knop, 1991), increased sales and market share (Gelsing & Knop, 1991; Rosenfeld, 1996). Conversely, the initiatives brought to light several issues that could threaten the success of network collaboration. As mentioned earlier, participants were very disappointed because they could not realize the results expected from the networks in the short term (Rosenfeld, 1996; Huggins, 2001).

More recently, authorities have renewed their commitment by officially recognizing inter-firm networks as a possible response to the challenges of economic globalization, as stated in “the Bologna Charter on SMEFootnote 2 policies”, adopted by OECD member countries in 2000.Footnote 3 Later, in 2008, the European Commission summarized a set of guidelines in the “Small Business Act” to advance the implementation of public policy for small and medium-sized enterprises (MISE, 2011). Again, networks were recognized as a crucial solution to promote business development and competitiveness (MISE, 2016).

Following the guidelines of the Small Business Act, the Italian legislator created a specific framework to promote the formation of inter-company strategic alliances and to meet the needs of entrepreneurs, especially small and medium-sized enterprises (Bugamelli et al., 2009; Calligaris, Del Gatto, Hassan, Ottaviano, and Schivardi, 2016). The policymaker introduced a legal instrument, “the network agreement”, to ensure long-term network-type partnerships (Capuano et al., 2012).

As established by law,Footnote 4 Italian entrepreneurs may enter into cooperation agreements to increase their innovative capacity and competitiveness in national and international markets. In this context, the participants of the network must commit and agree on a long-term oriented plan.Footnote 5 Network agreements must always specify the strategic objectives pursued and the rights and obligations that govern the relationship between the companies (Angelone, 2013).Footnote 6 Flexibility is an important feature that characterizes the discipline of network agreements: it leaves great autonomy to network participants, who can define individual responsibilities, assign decision rights, and set the rules that each of them must follow to achieve the goals (Massari et al., 2015; Mellewigt et al., 2007). This makes it possible to give legal stability to strategic cooperation. Since opportunism constantly threatens inter-firm relations (Parkhe, 1993), the implementation of organizational structures backed by contractual protection and enforcement mechanisms is a valuable option for limiting adversarial tactics and aligning the strategic vision (Parkhe, 1993).

2.2 The impact of network agreements on firm performance

The emergence of inter-firm networks has led to a rich academic debate (Smith-Doerr & Powell, 2010; Anderson et al., 1994; Podolny & Page, 1998; Gulati, 1998). Organizational studies have addressed the phenomenon and conceptualized the network as a hybrid solution to deal with transactions and governance costs (Williamson, 1975, 1991). In this theoretical perspective, networks’ performance is subject to a precise evaluation based on their characteristics and associated costs compared to alternative governance structures. Yet, the transaction-cost theory does not properly address the social (Granovetter, 1985) and the strategic (Powell, 1990) implications of inter-firm relationships.

Theoretical arguments grounded on the resource-based view (Wernerfelt, 1984; Barney, 1991) suggest that the exchange of focal assets (e.g., physical equipment, capabilities or knowledge) enabled by long-lasting connections can be a source of sustained competitive advantage (Grandori, 1997). As firm performance is strongly affected by partners’ tangible and intangible assets, resource accessibility through external channels becomes critical to achieve a competitive advantage (Lavie, 2006; Eisenhardt & Schoonhoven, 1996).

Firms can find great support in interoganizational networks, especially when operating in emergent and growth-stage markets (Hambrick, MacMillan, and Day, 1982; Eisenhardt & Schoonhoven, 1996). Thus, when embedded in a strong network of relationships, networking firms have the opportunity to strengthen their market position (Hagedoorn, 1993), which should have a positive impact on sales. Networking firms can also benefit from production synergies and adopt cost-containment practices. By pooling resources (Grandori, 1997), firms share risks and can achieve economies of scale typical of joint production arrangements, as well as economies of scale made possible by sharing equipment and knowledge (Shan, 1990; Jarillo, 1988). Enduring connections can ensure the supply of inputs and services under favorable conditions (Powell, 1990). Given the opportunity to achieve cost savings while collaborating on inputs (Oughton & Whittam, 1997), firms are expected to experience an improvement in gross operating income.

Despite being a potential source of advantages for participating firms, networks may fail to yield positive returns (Kale et al., 2002; Hoffmann et al., 2018). According to the so-called relational risk (Das & Teng, 1996), network members may not fully commit to a common strategic goal and pursue their own interests by adopting opportunistic behaviors (Williamson, 1993). Network members might exploit dependence asymmetries to increase their bargaining power and unfairly misappropriate their partners’ assets (Katila et al., 2008; Hagedoorn, 1993; Panico, 2017). Fear of opportunistic behavior itself can lead companies to act aggressively to maintain their control over strategic resources and claim most of the value created by the partnership (Panico, 2017). Therefore, effective control mechanisms are needed to prevent opportunism and to align the behavior of partners in accordance with mutual expectations and common goals in the long term (Das & Teng, 1998b; Miles & Snow, 1992).

Contractual control is suited for the purpose. The Italian policy on network agreements has provided a legal solution to formalizing long-lasting inter-firm connections while granting autonomy to the members in regulating internal relationships (Massari et al., 2015). The agreement can be shaped to fit the specific competitive needs of participating firms while acting as a control mechanism through the definition of individual responsibilities, decision rights and mutual expectations (Parkhe, 1993). As such, it is expected to provide the benefits of strategic collaboration while protecting against the pitfalls of opportunistic behavior. In early studies, participation in network agreements was found to have a positive impact on firm sales growth (Burlina, 2020) and employment growth (Dickson et al., 2021; Cisi et al., 2020). Membership in a network agreement was found to be positively associated with firms’ gross margin ratio (value added per unit of sales) and export propensity (Cisi et al., 2020). Moreover, early descriptive studies suggested a potentially positive association between participation in network agreement and EBITDA (Foresti et al., 2014). However, the persistence of the effects of network agreements remains largely unexplored, in part because the policy was introduced only recently, which did not allow for observation of treatment effects over the long term.

Inter-firm alliances that serve strategic purposes are inherently time-bound phenomena: relationships take time to consolidate as companies’ confidence in working with their partners gradually matures through the interplay of formal control mechanisms and trust (Das & Teng, 1998b). The gradual emergence of network outcomes over time is strongly influenced by the speed at which learning occurs. Mutual learning enabled by the acquisition of partners’ know-how is one of the drivers of firms’ alliances (Stuart, 2000; Gibb, 1997). Acquiring external technological know-how creates opportunities to enter new market segments (Mitchell & Singh, 1996), expand in international markets with lower risks (Zhou et al., 2007), and introduce incremental organizational advances with subsequent efficiency gains (Haned et al., 2014). The act of learning itself favors a more efficient accumulation of external knowledge by subsequent periods (Cohen & Levinthal, 1990). This implies an incremental improvement in firms’ capabilities to deal with performance-enhancing technologies and innovation over time (Dyer & Singh, 1998).

In the post-formation phase of an alliance, network members must generally face high coordination costs, due to the complexity of the tasks and strong interdependencies implied by the strategic nature of cooperation (Gulati & Singh, 1998). Partners’ experience, gained as the result of a continuous learning process, can be exploited to improve inter-firm coordination (Reuer & Ariño, 2007). Network members only gradually converge to the optimal coordination of the activities they are committed to (Gulati et al., 2012). The more partners’ complementary resources are interdependent, the higher the degree of organizational complexity permeating the relationship (Thompson, 1967), and the greater the subsequent costs. As partners develop a more accurate understanding of each other’s resources, capabilities, structural idiosyncrasies, and interdependencies, they make organizational adjustments to improve the efficiency and effectiveness of coordination mechanisms, leading to performance gains(Zollo et al., 2002).Footnote 7 To the extent that partners invest in relationship-specific assets and coordination routines to improve compatibility, strategic collaboration begins to deliver increasing value (Dyer et al., 2018).

Empirical evidence on network initiatives supported by public programs supports the hypothesis that strategic networks yield delayed returns. From an early evaluation of two network initiatives funded in the United StatesFootnote 8 time constraints and the fact that benefits could not be realized in a short period of time proved to be the greatest obstacle to collaboration among network participants (Rosenfeld, 1996). The United Kingdom’s experienceFootnote 9 confirms the fact that networking firms show strong disappointment when the expected benefits of collaboration are not achieved in the short term (Huggins, 2001), which increases the risk of low engagement of network members. Little is currently known about the long-term effects of Italian policy. Early descriptive comparisons across firms in a network agreement and stand-alone firms claimed no significant difference in revenue growth within two years from the establishment of the agreement (Foresti et al., 2014). Most studies examining the performance gap between firms that entered into a network agreement and firms that never joined an agreement rely on observational data going no further than 2015 (Cisi et al., 2020; Rubino et al., 2019; Costa et al., 2017; Foresti et al., 2014; Dickson et al., 2021). Since few firms signed an agreement prior to 2012, this means that the vast majority of enterprises in a network agreement are not observed in treatment for more than three full years. Moreover, and most importantly, we have limited evidence on the evolution of the impact of network agreements over time. Initial evidence comes from Costa et al. (2017), who claim that network effects on revenue and employment growth tend to increase the longer the treatment lasts. However, the analysis covers only a limited time period (firms first treated in 2011 are followed for a maximum of four years after treatment), and further evidence is needed to show the impact of networks over time.

Based on the aforementioned arguments, we posit the following hypotheses:

-

Hypothesis 1a: participation in network agreements has a positive effect on the revenue and gross operating income of companies.

-

Hypothesis 1b: the benefits of network agreements emerge and grow over time.

2.3 Network composition as a driver of heterogeneous effects

The impact of networks can be expected to exhibit a degree of heterogeneity due to the unique combination of specific firm profiles and the ability of partners to leverage the diversity of their resource endowments (Goerzen & Beamish, 2005; Wen et al., 2021).

A typical characteristic that shapes relationships between firms and potentially affects the value creation potential of networks is the size of the firm (Burgers et al., 1993). Smaller firms, constrained by resource scarcity, may exploit collaboration with external partners to face increasing competition within and across borders (Narula, 2004). Despite their critical role in driving European economiesFootnote 10 (European Commission et al., 2020; Muller et al., 2019), SMEs suffer from the pitfalls commonly associated with their small size, among which is the limited availability of human and financial resources (Kelliher & Reinl, 2009). Smaller firms may struggle to access new or broader markets due to the lack of capabilities, resources, or reputation (Kim & Vonortas, 2014). Moreover, in a competitive environment where scale and scope are critical to success and cost containment practices are a primary source of advantage, SMEs struggle to compete with larger and more efficient enterprises (Gomes-Casseres, 1997; Barney, 1991).

When size constraints become too great to be competitive, connecting with external partners in a network-type organizational structure can offer SMEs several advantages (Street & Cameron, 2007). Through long-term relationships, smaller companies can fill resource gaps (Stuart, 2000; Pyke, 1992) by gaining access to focal assets that they could not develop internally or purchase from external suppliers (Parida et al., 2010; Sarkar et al., 2001). Moreover, formal collaboration allows smaller firms to pursue innovation or undertake capital-intensive projects while sharing the associated costs and risks (Teng, 2007).

Consequently, network ties are found to be positively associated with SME survival and growth (Watson, 2007). In the case of Italy, SMEs with fewer than 50 employees were found to have a greater increase in value added per unit of sales compared to larger firms (Cisi et al., 2020). Another study found that family businesses exhibit higher value added per unit of sales when they participate in a network agreement, with the magnitude of the effect decreasing as the size of the firm increases (Aiello et al., 2023). Participation in network agreements has also been shown to have stronger effects on the sales growth of microenterprises compared to medium-sized enterprises (Costa et al., 2017).Footnote 11

On this basis, we formulate the following hypothesis:

-

Hypothesis 2a: smaller firms experience stronger positive effects on revenues and gross operating income from participating in network agreements than larger firms.

However, mere participation in a network may not be enough for smaller companies to realize the full potential of the alliance. Indeed, the uniqueness of network alliances and their value creation potential depend on the particular interplay of the partners’ resources (Stuart, 2000). How dyadic interactions evolve within a network through the combination of firm profiles determines the chance of achieving relational rents (Dyer & Singh, 1998). The internal fit between partners affects the risk that firms face when they connect with their peers and the outcome of the relationship (Tang et al., 2016). Thus, the value of network participation depends on the specific characteristics of the partners, the availability of resources (Aggarwal, 2020) and the opportunity of the companies to exploit the interdependencies of assets (Katila et al., 2022). For this reason, well-endowed firms, like larger companies, can be seen as extremely valuable partners for smaller enterprises (Stuart, 2000). Partners with a consolidated market position and a significant revenue stream can facilitate entry into market niches or share their customer base, providing greater benefits to smaller firms (Mitchell & Singh, 1996). Established firms with excess resources can help smaller firms translate technical expertise into marketable products or make organizational improvements (Katila et al., 2022). Smaller firms can leverage the financial resources of larger partners in return for their recognized flexibility and innovative potential (Narula, 2004). In addition, association with larger partners that have significant legitimacy could enhance the status and reputation of smaller members in the marketplace (Parida et al., 2010; Podolny & Page, 1998; Baum & Oliver, 1991).

When connected to larger firms, smaller firms may take on more of the risk associated with collaboration, though (Street & Cameron, 2007). Larger firms typically hold a central position in the network and may unfairly benefit from a power imbalance (Hu et al., 2021). Uneven dynamics can arise from the different speeds at which smaller and larger companies can imitate or learn from their partners (Alvarez & Barney, 2001). Proprietary technologies provided by smaller companies could be used in ways not agreed upon in advance (Gomes-Casseres, 1997), increasing the risk that much of the value derived from the collaboration will be captured by larger firms (Sulej et al., 2001). In addition, informal control mechanisms and poor management of relationships can lead to an uneven distribution of the gains made by networks (Gomes-Casseres, 1997). Strong heterogeneity in the size of partners may also involve organizational and operational differences that increase the complexity of coordination (Goerzen & Beamish, 2005), undermining the relationship or even preventing the formation of an alliance (Lavie, 2007). Enforceable formal networks that can flexibly discipline collaboration provide a solution to mitigate the disadvantages of network partnerships between larger and smaller enterprises (Alvarez & Barney, 2001) favoring the harmonization of partners’ goals and the activation of effective control and coordination mechanisms (Mellewigt et al., 2007).

To the best of our knowledge, there is still a lack of evidence on the impact of firm size heterogeneity on the performance of networks (Cantele & Vernizzi, 2015). Further evidence is needed in this regard.

Based on the above arguments, we develop the following hypothesis:

-

Hypothesis 2b: smaller firms in a network agreement with at least one larger partner have stronger positive effects on revenues and gross operating income than similar firms in networks without a larger partner.

The unique identity of each relationship and its potential contribution to firms’ performance are also influenced by the geographic concentration of the network and the resulting proximity of network partners (Dyer & Singh, 1998; Dyer, 1996; Enright, 1995; McKelvey et al., 2003). Regional scholars have widely discussed the importance of spatial proximity in shaping firms’ activity and competitiveness (Lychagin, Pinkse, Slade, and Reenen, 2016; Morgan, 2004; Grieser et al., 2022). Partners’ location in the same geographical area eases the exchange of information and knowledge (Enright, 1995; Giroud, 2013). Proximate companies can easily share information on products and markets to better serve the customers and improve revenue flows (Parr, 2002b). Moreover, the intentional and unintentional knowledge flows facilitated by face-to-face recurrent interactions (Breschi & Lissoni, 2001; Harabi, 1997) and human-intensive communication processes (Dyer, 1996), foster the diffusion of new ideas and affect co-located firms’ performance (Van Oort et al., 2012; Audretsch & Belitski, 2023).

Localized labor mobility is regarded as one of the main channels through which knowledge diffuses across enterprises (Kesidou & Romijn, 2008). Workers’ mobility reinforces social cohesion between firms and consolidates social ties (Eriksson, 2011; Dahl & Pedersen, 2004). Cooperation is enabled by proximate partners’ positive attitude animated by prior knowledge of one another, mutual esteem (Mellewigt et al., 2007), shared values and vision (Rinaldi & Cavicchi, 2016; Huggins, 2000) and a common culture (Asheim, 1996). Networking firms’ co-location in highly and well-connected regions contributes to reducing the travel time between firms. Lower travel time allows firms to reach their partners more frequently and facilitates monitoring activities (Giroud, 2013; Bai et al., 2021). Frequent on-site visits may, in turn, induce higher commitment by partners and support managers to evaluate the activities carried out to fulfill the agreement (Giroud, 2013) lowering the uncertainty that surrounds strategic partnerships. Besides, repeated contacts among nearby partners allow for better managing the organizational and coordination complexities permeating the alliances (Ring & van de Ven, 1992; Enright, 1995). Direct communication channels activated within geographically-bounded communities (Asheim, 1996) favor a clear understanding of organizational requirements, and faster convergence toward efficient coordination routines mitigating coordination costs (Gulati et al., 2012).

Previous empirical research on network agreements has shown that the geographic openness or dispersion of network agreements is negatively related to firm performance (Cisi et al., 2020; Rubino & Vitolla, 2018). Increasing geographic distance between partners is associated with lower export propensity (Cisi et al., 2020) and efficiency (Rubino & Vitolla, 2018).

Most empirical studies to date examine how the performance of networks changes as a function of the geographic dispersion of partners (Rubino & Vitolla, 2018; Cisi et al., 2020; Cantele & Vernizzi, 2015), but further evaluation is needed to provide a causal interpretation of the results. Co-location in the same area reasonably implies that firms can reach the partners’ headquarters in a short time. As shorter travel time between firms favors recurrent face-to-face interactions and allows for effective management of the transactions (Giroud, 2013; Coval & Moskowitz, 2001; Lerner, 1995), we expect that having most network partners in the same area can enhance the benefits of formal cooperation.

To conclude, we posit the following hypothesis:

-

Hypothesis 3: higher geographic concentration of network agreements in spatially bounded communities yields stronger positive effects on revenues and gross operating income.

3 Data

For our analysis, we relied on two main data sources. Data on network contracts are provided by Unioncamere (Italian Federation of Chambers of Commerce, Industry, Crafts and Agriculture), the public institution representing all Italian Chambers of Commerce.Footnote 12 The dataset includes all contracts signed through March 2015, including agreements with and without legal status. We focused on the latter group because it contains most of the contracts signed at that time (about 89%). For each contract, we recorded the date the contract began, the year of each subsequent amendment to the original act, and a description of the main strategic goals of the parties involved. Then we have the list of all member companies together with further information about their main location (province - NUTS 3 region - and municipality), economic activity (industry according to the ATECO 2007 classificationFootnote 13) and identity number (tax number). Descriptive statistics on the network agreement can be found in the Appendix, Table A1.

The firm-level data come from the AIDA - Bureau Van DijkFootnote 14 database, a source that provides information on Italian private companies that are required by law to disclose their financial statements. For this study, we collected data for about one million Italian manufacturing and service firms. We obtained an unbalanced panel with observations for the period 2010-2018.

We applied some data cleaning procedures and, in particular, excluded the observations that fell in the top and bottom one percent of the distribution of company revenues, EBITDA (earnings before interest, taxes, depreciation, and amortization), and value added, i.e., the main outcome variables used in the analysis.Footnote 15 We focused our analysis on agreements signed between 2011 and 2014, so for each agreement we have accounting data for at least one year before and four years after it was signed. A shorter follow-up period would not have allowed us to examine the dynamic evolution of the network’s impact over time and its persistence (Rosenfeld, 1996; Foresti et al., 2014).

Because the Unioncamere dataset contains statistics on network contracts updated through March 2015, we matched these with the Infocamere datasets (updated through June 2019Footnote 16) to ensure that the sample included only those entities that signed a contract in 2011-2014 and were still in a network at the end of 2018. This allowed us to have a setting with an absorbing treatment (Sun & Abraham, 2020). Consistently, we removed the entities that withdrew from a contract before the end of 2018.

Our final sample includes \(579\,464\) Italian manufacturing and service firms. The dataset includes \(3\,187\) firms participating in a contract networkFootnote 17 signed between 2011 and 2014.

Table A2, Appendix A, shows the frequency distribution of treated and control units by industry.

4 Methodology

4.1 Dynamic treatment effects estimation

To test our hypotheses, we estimated dynamic treatment effects in a setting where the timing of treatment varied across units (i.e., units join the agreement at different times) and multiple time periods. A staggered difference-in-differences (Diff-in-Diff) design was best suited to model our data and draw causal inferences (Athey & Imbens, 2021). The network agreement policy was a novelty because it introduced a new legal tool to regulate inter-firm strategic cooperation. The legal intervention promoted by the Italian policy is not expected to affect firms’ competitiveness just because it is in place. Companies must adopt the instrument to experience its effects. Companies are free to decide if and when they want to enter into an agreement, and they are considered to be treated from the moment they sign the contract. What we want to capture are the dynamic effects of participating in a formal strategic network governed by a network agreement.

To conduct Diff-in-Diff analyses in a more general setting with panel data and a staggered introduction of treatment, the typical approach is to regress the outcome variable on a time-varying treatment dummy while controlling for unit- and time-specific fixed effects: in this generalized setup, the treatment effect is measured by the so-called two-way fixed effects Diff-in-Diff estimator (TWFEDD) (Goodman-Bacon, 2021). Recently, however, several studies have raised concerns about the causal interpretation of the TWFEDD estimator, especially in the presence of heterogeneous treatment effects (Sun & Abraham, 2020; Goodman-Bacon, 2021; Callaway & Sant’Anna, 2021; De Chaisemartin & d’Haultfoeuille, 2020). To identify the source of bias, Goodman-Bacon (2021) decomposes the TWFEDD estimator into a weighted average of all possible \(2\times 2\) (two periods-two groups) Diff-in-Diff estimators comparing timing groups to each other.Footnote 18 The author points out that the change in average treatment effects over time calls into question the interpretation of the TWFEDD estimator because early treated units appear as controls in some \(2\times 2\) comparisons, even when the assumption of a common trend is met.Footnote 19

In our Diff-in-Diff application, we assume that the effects of network agreement vary over time. To determine the time evolution of treatment effects over the years, we conducted an event study analysis. Two-way fixed effects linear regressions could take a dynamic specification to obtain some dynamic effect estimates. The model takes the following form:

where \(Y_{i,t}\) is the outcome variable, \(D^{\ell }_{i,t}\) are relative time indicators, \(\mu _{\ell }\) denote relative time coefficients, \(\alpha _i\) and \(\lambda _t\) represent unit and time fixed effects respectively, while \(\varepsilon _{i,t}\) is the error term. A set of relative periods is generally excluded from the modelFootnote 20 to avoid the usual multicollinearity problems that affect the dynamic specification in eq. (1).

Although the event study specification may be appropriate to address the issues highlighted by Goodman-Bacon (2021), Sun & Abraham (2020) argue that even dynamic estimates of treatment effects derived from two-way fixed-effects regressions may be biased if one assumes heterogeneity of effects across treatment cohorts. The authors provide a decomposition of the coefficient \(\mu _{\ell }\) (eq. (1)) and show that it can be expressed as a linear combination of cohort-specific average treatment effects (CATT) from both relative period \(\ell \) and other relative periods. This means that the regression coefficient associated with the relative period \(\ell \) indicator is contaminated by treatment effects from other periods (either included in eq. (1) or excluded) unless stringent assumptions about the homogeneity of treatment effects apply. This is true even under the parallel trend assumption and the so-called “no anticipation” assumption.Footnote 21

Since we cannot plausibly support the hypothesis that firms entering a network in different years experience the same effects over time, we must adopt a heterogeneity robust solution. The inherent heterogeneity of network agreements and subsequent regulatory updates are likely to lead to heterogeneous responses from entities that are party to a contractual agreement at different points in time. While we still assume similar dynamics across cohorts (hypothesis 1b), we cannot rule out the possibility that cohort-specific effects change at different rates and have different magnitudes.

To overcome the problems associated with two-way fixed effects estimates in event studies, Sun & Abraham (2020) propose a new estimation method that is robust to heterogeneity in treatment effects. They introduce an interaction-weighted estimator (IW) derived as a weighted average of cohort-specific average treatment effects (\(CATT_{e,\ell }\)), where the weights are given by the sample fraction of each cohort in the relative period \(\ell \). Formally, it is:

where g is a set of relative time periods \(\ell \), \(E_{i}\) denotes the time at which unit i first receives the binary absorbing treatment, and e identifies the group (cohort) of units first treated at the same time. The coefficient \(\widehat{\delta }_{e,\ell }\) results from a two-way fixed effects linear regression in which the relative time indicators interact with the cohort indicators (excluding a control cohort C) and it is a Diff-in-Diff estimator for \(CATT_{e,\ell }\). Then each coefficient \(\widehat{\delta }_{e,\ell }\) is weighted by \(\widehat{Pr}\{E_{i} e \vert E_{i} \in [-\ell , T-\ell ]\}\), namely the sample fraction of cohort e at relative time \(\ell \in g\). The weights are normalized by the size of g.

To empirically evaluate the dynamic causal effects of network contracts, we relied on the Sun & Abraham (2020) estimator in eq. (2).

We identified four distinct cohorts defined by the period in which units were first treated, i.e., the year in which a company first signed a contract (i.e., 2011, 2012, 2013, 2014), as well as a cohort of units never treated. The never treated group serves as the control cohort. Then we excluded the relative periods \(-4\) and \(-1\) from the econometric specification.

Controlling for firm-specific fixed effects in the first step of the estimation procedure (i.e., TWFE regression to obtain \(\delta _{e,\ell }\)) allowed us to deal with unobservable factors that potentially influence the decision to participate in a network agreement (Cisi et al., 2020).

4.2 Selection of the counterfactual group

Under the assumptions of parallel trend and lack of anticipation, \(\widehat{\delta }_{e,\ell }\) from eq. (2) is a consistent estimator for \(CATT_{e,\ell }\) and the IW estimator is consistent for the weighted average of cohort-specific average treatment effects, with the proportion of treatment cohorts at relative time \(\ell \) acting as weights. The first assumption implies that the average outcome variable of treated and untreated units would have evolved in parallel in the absence of treatment. However, since firms are not randomly assigned to treatment but make a conscious decision to participate in a network agreement, selection bias is likely. Firms tend to self-select into the treatment, and network participants have been shown to exhibit certain observable characteristics compared to firms that never participate in an agreement (Romano et al., 2016; Bentivogli et al., 2013). Therefore, we cannot assume that treated and non-treated firms would have had the same output trend if they had not been treated, and a direct comparison between treated and control firms would be misleading (Rosenbaum & Rubin, 1983).

To address this problem, we selected an appropriate counterfactual group by performing propensity score matching (PSM). Treated and untreated firms were paired based on their probability of participating in a network agreement P(X) estimated using a set of observable firm-level characteristics (Rosenbaum & Rubin, 1983). The core assumption of the matching method is that the response variable is independent of treatment status under the condition of a vector of covariates X (Angrist & Pischke, 2009). If this is the case, then the outcome variable is independent of treatment under the condition of propensity score P(X), provided that \(0 \le P(X) \le 1\) for \(X \in \chi _{c}\) (Rosenbaum & Rubin, 1983). The observable characteristics selected to calculate P(X) should simultaneously influence the probability of joining a network agreement and be related to the response variables.

Matching techniques combined with Diff-in-Diff estimation can eliminate the bias due to self-selection of units into the treatment, especially when contamination by unobserved time-invariant components is a concern (Heckman et al., 1997, 1998). The approach has been used previously to assess the causal impact of policies on firm performance (Biancalani et al.,, 2022). The conditional Diff-in-Diff approach is based on the less stringent assumption that the selection bias conditional on the probability of receiving the treatment is the same, on average, in the different periods before and after the treatment is assigned (Heckman et al., 1998). It disappears when the results are differenced.

Consistent with Callaway & Sant’Anna (2021), we assumed that the average outcomes of treated and nontreated units in our staggered treatment setting would have evolved in parallel as a function of the balancing score P(X) in the absence of treatment. We estimated P(X) using a probit model and then performed nearest neighbor matching to find pairs that were closest in terms of the propensity score. We chose to use matching without replacement, which means that an untreated firm can be paired with at most one treated firm. To perform matching between treated and control firms, we estimated a cross-sectional probit regression for each treatment cohort.Footnote 22

We selected our matching covariates based on previous studies that described the profile of firms in a network agreement right before the agreement was signed. We chose observable firm-level characteristics that are associated with both the likelihood of signing an agreement and firm performance (i.e., revenues, value added, and EBITDA). Several studies consistently report that larger firms are more likely to sign a network agreement (Bentivogli et al., 2013; Romano et al., 2016; Costa et al., 2017; Foresti et al., 2014). In particular, firm size, alternatively measured with sales, total assets, and employees, is found to be positively correlated with the likelihood of joining an agreement (Bentivogli et al., 2013). Previous empirical research on the effects of network agreements on participants’ performance has considered firm size when selecting a counterfactual group (Dickson et al., 2021; Burlina, 2020; Rubino & Vitolla, 2016). Therefore, we matched on the value of revenues before treatment.Footnote 23 Firm revenues in our probit specification serves as a proxy for firm size.Footnote 24. Members of network agreements have been shown to be older, on average, than firms that have never joined an agreement (Costa et al., 2017). However, the relationship between firm age and the likelihood of joining a network is not always statistically significant (Bentivogli et al., 2013). Nevertheless, we chose to include age (measured as the number of years since a firm was founded) as a regressor in the probit specification. We then added the squared value of firm age to control for nonlinearities (Bentivogli et al., 2013). Previous studies of network agreements indicate a significant relationship between the likelihood of signing an agreement and the ownership structure of the firm. In particular, being part of a business group seems to increase the likelihood of signing a contract (Foresti et al., 2014; Costa et al., 2017). On this basis, we included the size of the group of firms to which the firm potentially belongs (as measured by the number of firms involved) and the dummy Independent in the observable matching covariates.Footnote 25 The Independent dummy is defined according to the Bureau van Dijk independence indicator. It takes value one if the company is held by known recorded shareholders none of which with more than \(25\%\) of ownership or if the firm falls into the category of units that are “independent by nature”. Group membership is expected to affect firms’ performance in several regards, as ownership ties are channels through which key resources can be exchanged (Riccaboni et al., 2021; Blomström & Sjöholm, 1999). Hence, balancing the treated and control samples on the share of firms under the direct control of an ultimate owner allows for narrowing the chance that the estimated effects are affected by ownership ties and control rights. Then, in line with previous empirical research (e.g., Burlina, 2020; Cisi et al., 2020; Dickson et al., 2021), we matched treated and control units on a set of industry (2-digit ATECO codes) and regional (NUTS1 level) dummies to account for firms’ economic activities and geographical location.

Table A3, in the appendix, displays VIF values and correlation coefficients for the explanatory variables employed in the binary outcome model. The statistics do not raise any concerns about multicollinearity issues.Footnote 26

5 Results

5.1 Dynamic impacts of networks on firm performance

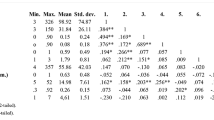

As a preliminary step in our empirical approach, we preprocessed the data by performing PSM to form a comparable counterfactual group. Tables 1 and 2 show descriptive statistics before and after matching for the full sample of treatment cohorts and untreated units. We can see that the selection procedure led to changes in the means of the main outcome variables and in the means of the matching covariates. Table 3 shows t-test statistics before and after matching to assess the extent of balancing achieved in the matched samples. The diagnostics cover the set of observable characteristics for which the treated and control units were matched, namely revenues, age, ownership structure, economic activity, and location. Results in Table 3 indicate that PSM attenuated all statistically significant differences in means between treated units and unmatched controls.

Once we had a matched control sample, we obtained dynamic treatment effects based on the Sun & Abraham (2020) heterogeneity robust estimator. To justify our approach, we estimated the weightsFootnote 27 stemming from the decomposition of TWFE estimates for relative time coefficients \(\mu _{-2}\) and \(\mu _{-3}\). When a bias affects TWFE pre-treatment coefficients, checking if \(\mu _{\ell }=0\) for some leads \(\ell \) may not be a reliable test for common pre-trends and the employment of the TWFE estimator gets questionable. We found that cohort-specific weights entering the computation of \(\mu _{-2}\) and \(\mu _{-3}\) are different from zero, raising concerns about possible contamination of TWFE estimates under treatment effects heterogeneity across cohorts.Footnote 28 The Sun & Abraham (2020) heterogeneity robust estimator allows us to properly address this issue.

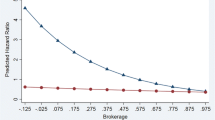

Figure 1 shows the dynamic treatment effect estimates obtained for the final sample of treated and control units after matching: it includes about 2 800 network participants and an equal number of controls.Footnote 29 Results are available in tabular form in Appendix A (Table A7). The pre-treatment coefficients for relative periods -2 and -3 are not statistically significant and are close to zero; therefore, we can rule out the presence of non-parallel pre-trends before treatment.

We find that participation in contractual networks has a clear positive causal effect on firm revenues: the effect tends to increase as we move away from period 0 (when the firm sign the contractual agreement) until we reach the third year since treatment assignment, at which point they stabilize. Revenues are estimated to be on average 12.1%, 16.6%, and 16.8% higher after the first, third, and fifth years in a network than they would have been if the firms had never signed an agreement.Footnote 30

Value added and EBITDA are also positively affected by participation in network agreements. The value added of the companies increases on average by 10.2% after one year of networking and by 15.7% after five years, while the estimated growth of EBITDA vis-à-vis stand-alone controls is 7% and 14.9% after the first and fifth years, respectively. This result shows that formalized partnerships between companies, as promoted by the Italian framework for network contracts, not only allow companies to increase sales but also facilitate rational management of shared resources, leading to cost containment practices that in turn increase intermediate economic margins (Grandori, 1997; Cisi et al., 2020). Compared to the TWFE estimates obtained from the same matched sample (see Table A13 in the Appendix), the estimates obtained using the Sun & Abraham (2020) approach are of smaller magnitude. Potential bias is likely to affect the TWFE results and lead to a potential overestimation of network effects. With heterogeneity in treatment effects, even testing for parallel pre-trends using treatment biases is not reliable.

Our results, therefore, confirm and reinforce previous evidence on the benefits derived from formal inter-firm relationships and support hypothesis 1a. In addition, we contribute to deepening existing knowledge about formal networks by providing insights into how the effects of networks evolve and persist over time. We find that causal effects become larger within three or four years of the agreement. The effects on sales and gross operating income tend to stabilize between the fourth and fifth years of exposure, with a slight increase in the sixth year. All in all, our results suggest that formal partnerships indeed take time to consolidate and deliver tangible benefits (Rosenfeld, 1996). Hypothesis 1b is thus confirmed.

Despite the possibility of estimating causal effects up to 7 years after the start of the agreement, treatment effects in relative period 7 must be treated with caution. Estimates for period 7 are generally not statistically significant. This may be due in part to the limited number of available observations, as the 2011 cohort members are the only units in our sample that were observed for a maximum of 7 years after treatment.Footnote 31

Dynamic treatment effects on the full sample. The graphs plot average dynamic effect estimates and 95% confidence intervals. Treatment effect estimates are obtained controlling for firm-specific and calendar year fixed effects on 47913 (panel a), 46108 (panel b) and 42891 (panel c) firm-year observations respectively. In parentheses is the number of treated units with available data at each relative period

To provide additional evidence for the strategic nature of network agreements, we examined the list of strategic goals declared by network participants. The strategic goals articulated by network members form the pillars of the agreement and are likely to shape the activities to which each partner commits, potentially affecting network outcomes. To this end, we manually classified a subset of the agreements according to the main objectives declared by the participantsFootnote 32 and identified a reliable collection of keywords to label the remaining portion of the agreements using a simple text detection algorithm. We then isolated all treated firms that participate in networks that clearly aim to increase sales by expanding market shares or entering new markets. We compared the treatment effects of the aforementioned subgroup with those of networks that pursued other goals. We find that the average causal effects on firm revenues tend to be higher when firms’ efforts are directed toward strengthening their market position. This is true for each relative period except at time 0 when exposure to the treatment is still limited. Conversely, compared to networks pursuing alternative objectives, market-based agreements have a lower impact on firms’ value added, at least within three years of treatment allocation. Similarly, we find that market-related objectives do not have a statistically significant impact on EBITDA until period 2, after which firms have a stronger impact compared to non-market-oriented network members. The treatment estimates are presented in tabular form in Appendix A (Table A8). Thus, formally defining a common strategic direction appears to enhance the positive effects of contractual agreements, at least in terms of metrics that are expected to better match stated goals, suggesting a long-term commitment to common goals among participants. Nevertheless, further research should be conducted to support this evidence.

5.2 Size and spatial concentration of partners as drivers of heterogeneous network effects

To explore the contribution of network contracts to firms’ economic performance, we extended the analysis by examining the heterogeneity of treatment effects conditional on participants’ characteristics and their interaction.

To test hypothesis 2a, we investigated whether companies with fewer than ten employees one year before the signing of the agreement can derive more benefits from participating in the network than companies with ten or more employees.Footnote 33

Figure 2 (panels a, c, and e) compares the dynamic treatment effects obtained for a subsample of micro firms with the causal effects for a group of small/medium/large firms exposed to the treatment. While both subgroups experience positive and statistically significant dynamic effects, except for a few non-significant coefficients (see also Table A9, Appendix A), micro firms benefit from higher effects.

The causal effects on revenues observed within four years of network establishment are the same for micro and small/medium/large firms and follow similar dynamics. However, from the fifth year onward, the dynamic effects continue to increase for micro firms, while they decrease for larger firms. After five years in a network agreement, micro firms increase their revenues by 18.6% compared to stand-alone controls, while larger enterprises’ revenues are 11% higher when treated.

We observe a similar pattern for the effects on firm EBITDA (panel e), while the difference between groups becomes more pronounced when treatment effects on value added are estimated (panel c). Participation in network agreements leads to a 28.3% increase in value added for micro firms and 7.3% for larger firms after the fifth year of networking.

These results support hypothesis 2a, as they show that smaller firms (in this case, micro firms) can benefit more from participating in formalized networks, especially in terms of their sales potential and value added.

We went further by testing whether the particular combination of partners’ specific characteristics could lead to further heterogeneity in treatment effects. To test hypothesis 2b, we examined whether entering into a network relationship with larger partners has stronger (or weaker) effects on microenterprise performance. To address this point, we identified the group of micro firms that have signed a contract with at least one medium-sized or large partner, as well as the group of microenterprises that participate in a network that does not involve a medium-sized or large enterprise.Footnote 34

Dynamic treatment effects by participants’ size and partners’ size. The graphs compare average causal effects estimated on different subsamples identified by network participants’ size and participation in networks involving at least one medium-sized or large partner. Treatment effect estimates are obtained by controlling for firm-specific and calendar-year fixed effects. Results are obtained on 20048 (panel a), 19163 (panel c), 17749 (panel e) firm-year observations for the group including firms with less than ten employees one year before signing an agreement while treatment effects on firms with ten or more employees are estimated on 26077 (panel a), 25057 (panel c) and 23575 (panel e) firm-year observations. Dynamic effects for the group of micro firms signing an agreement with at least one medium-sized or large partner are obtained on 4872 (panel b), 4654 (panel d) and 4285 (panel f) firm-year observations while the impact on micro firms with no medium-sized or large partner is obtained on 11572 (panel b), 11052 (panel d) and 10208 (panel f) firm-year observations

Figure 2 (panel b, d, and f) shows the impact estimates on both subsamples. Micro firms that establish a formal relationship with at least one medium/large partner appear to benefit more from participating in a contractual agreement. The treatment-induced increase in revenues is 27.4% after one year and 26% after five years in a formal partnership with larger firms. The association with larger partners leads to an increase in value added of 28.4% after the first year and 33.8% after the fifth year, and an increase in EBITDA of 29.4% and 28.4%, respectively. The causal effects follow similar dynamics over time based on the duration of treatment in both subgroups (i.e., micro firms with or without a medium/large partner), although we observe a visible difference with stronger effects on revenues, value added and EBITDA for micro firms with a larger partner. The difference tends to decrease after the fifth year when firm value added is the target variable. This suggests that even without a medium/large partner, smaller firms can leverage their complementarities to increase the long-term benefits of network agreements. Through network partnerships, small and micro firms can overcome their structural limitations and reap the long-term benefits of efficiently managing pooled production resources, even in the absence of a larger firm. However, the impact of networks on EBITDA is statistically less significant when firms do not partner with larger firms (see also Table A10, Appendix A). Thus, the advantages experienced by microenterprises appear to be primarily due to the presence of linkages with larger, well-resourced partners. Hypothesis 2b is therefore supported.

The spatial proximity of partners is expected to increase the impact of formal collaborative agreements on firm performance by promoting the activation of spatial externalities and frequent face-to-face interactions. Specifically, we hypothesize that spatial concentration in the same travel-to-work area (TTWA) facilitates inter-firm collaboration (e.g., through knowledge flows and information sharing) and enhances the benefits of a formalized network. While the literature to date has used administrative NUTS regions, we rely on the functional geography of TTWAs to better reflect the system of informal socioeconomic relationships that are intertwined within and between local communities (Eurostat, 1992; Franconi et al., 2016).Footnote 35 Each area is designed to internalize worker commuting flows, so co-location in the same TTWA should benefit from the knowledge and information exchange mediated by worker mobility. Businesses in a TTWA are part of the same interconnected regional community and are expected to engage in recurring interactions that benefit from the dissemination of knowledge mediated by localized commuting flows (Eriksson, 2011; Kesidou & Romijn, 2008).

Dynamic treatment effects based on network members’ location. Graphs compare average causal effects estimated on different subsamples identified by network participants’ spatial concentration in one travel-to-work area. Treatment effect estimates are obtained by controlling for firm-specific and calendar-year fixed effects. Results for the subgroup of firms in network agreements with at least \(60\%\) of members in the same TTWA are obtained on 24720 (panel a), 23773 (panel c) and 22291 (panel e) firm-year observations while results for firms in networks with less than \(60\%\) of participants from the same TTWA are estimated on 22474 (panel a), 21707 (panel c) and 20139 (panel e) firm-year observations. Treatment effects from networks with more than \(80\%\) of participants in the same TTWA are obtained on 12173 (panel b), 11687 (panel d) and 10919 (panel f) firm-year observations while estimates for the subsample of firms in networks with less than \(40\%\) of members in the same TTWA are obtained on 11123 (panel b), 10748 (panel d) and 9909 (panel f) firm-year observations

To test our hypothesis 3, we calculated the percentage of partnering firms located in the same TTWA for each network agreement. We then split the sample of treated firms based on their participation in a contract network with a degree of spatial concentration in a TTWA above or below a certain threshold.

Panels a, c, and e of Fig. 3 compare the dynamic effects experienced by firms joining an agreement with at least 60% of participants in the same TTWA with those experienced by firms participating in a network with less than 60% of participants in the same TTWA. We chose the threshold to obtain two subsets of similar size: the threshold of 60% allowed us to split the sample of treated firms into two halves.

In panel a, we find that the impact of the network on revenues is the same in both subsamples and follows the same time trend, with firms participating in more concentrated networks having slightly larger benefits in the short run (up to period 2). Similarly, the positive effects on EBITDA (panel e) are comparable in both groups, at least until period 5. We then find that the difference in treatment effects on value added is not pronounced and increases from period 4 onward (panel c).

However, when we compare the firms in the most and least geographically concentrated networks, a different picture emerges. We have isolated the entities in networks with 80% of the members in the same TTWA and the entities in networks with less than 40% of the members in the same TTWA: they represent the top and bottom 25% of the sample, i.e., the firms participating in the most and least concentrated network agreements, respectively.

Graph b in Fig. 3 shows that the difference in treatment effects on revenues is more pronounced than in graph a, and we clearly observe that units in highly concentrated agreements can derive greater benefits from formalized inter-firm relationships. After one year in a network with more than 80% of members in the same TTWA, firms’ revenues are 14.9% higher than those of stand-alone controls, while firms in geographically dispersed networks (less than 40% in the same TTWA) experience a 5.2% increase in revenues. After the third year in a network, firms in dispersed agreements do not experience a significant benefit in revenues.

Networks with more than 80% of participants in the same TTWA also yield more benefits in value added (panel d) and EBITDA (panel f). The dynamic impact of network agreements with a small share of participants belonging to the same TTWA (less than 40%) is hardly or not statistically significant.Footnote 36

These results suggest that when we isolate the networks with the highest and lowest proportion of members in the same TTWA, the benefits of establishing formal ties with partners in the same spatial agglomeration become more apparent.Footnote 37 Therefore, our results support the hypothesis that a higher concentration of network agreements in spatially limited and highly connected areas (i.e., TTWAs) leads to stronger positive effects.

6 Conclusions

6.1 Discussion

This study offers new insights into the impact of inter-firm cooperation, formalized by the legal instrument of network agreements, on the economic outcomes of firms. It is novel in that it sheds light on the temporal evolution and persistence of the effects of network arrangements on medium-long-term firm performance and examines whether and how the heterogeneity of causal effects depends on the interaction of network participants of different sizes and locations.

Our empirical contribution supports previous evidence on the superior market performance of network firms (e.g., Burlina, 2020; Costa et al., 2017) and gross operating income (Foresti et al., 2014). Indeed, we find that participation in formal networks has a positive and statistically significant causal effect on participants’ revenues, value added, and EBITDA. Formal collaborations can provide firms with the assets and capabilities they need to increase market share or enter new market niches (Coviello & Munro, 1995; Zhou et al., 2007).

On the methodological side, we take a step forward by avoiding the pitfalls of Diff-in-Diff regressions with two-way fixed effects in staggered settings (Goodman-Bacon, 2021) while addressing potential self-selection bias (Angrist & Pischke, 2009).Footnote 38 To our knowledge, the existing empirical literature on network agreements does not explicitly address the issues that affect Diff-in-Diff estimates in settings with staggered treatment adoption when multiple cohorts of network entities are included in the analysis. Given the existence of variation in treatment timing across units, observational data on network agreements have a clearly staggered structure, and a staggered Diff-in-Diff design is most appropriate for drawing causal inferences.Footnote 39 Based on the contribution of Sun & Abraham (2020), we cope with the expected heterogeneity in network effects across treatment cohorts, possibly driven by subsequent regulatory updates, other time-varying calendar effects, or the specific characteristics of the firms grouped in each cohort. Our heterogeneity-robust event study approach not only provides unbiased estimates in a staggered framework but also allows us to fill a gap in the empirical literature providing evidence on the dynamic effects of network agreements.Footnote 40

We implemented Sun & Abraham (2020) regression-based methodology to provide a dynamic perspective on the medium- and long-term value of network agreements. We find that, on average, the dynamic impact of treatment increases in magnitude by the third year after treatment. The value created by the agreements stabilizes between the fourth and fifth years of collaboration, with a further slight increase after six years of exposure. The dynamic treatment effects show that the positive effects of network arrangements on firm performance take several years to grow and stabilize, supporting the hypothesis that network initiatives generally take time to bear fruit and create value.

Network outcomes can mature depending on how quickly learning occurs and knowledge is absorbed (Latham & Le Bas, 2006). Firms take time to improve their technological or organizational capabilities as a consequence of the increased ability to assimilate external knowledge (Cohen & Levinthal, 1990). In the post-formation phase of a strategic alliance, high coordination costs typically slow down the relationship, as network partners still need time to understand how to regulate interdependencies and manage the organizational complexity of joint tasks (Gulati & Singh, 1998; Gulati et al., 2012). As network members figure out how to combine their complementary resources and invest in resource-specific assets and coordination routines, the network begins to deliver increasing value (Zollo et al., 2002). However, if partners’ resources become too aligned through incremental adjustments and joint investments, the growth of network outcomes may slow (Dyer et al., 2018). This may explain why the dynamic effects of network agreements tend to stabilize in the medium-long term.

To further explore the implications of formal strategic inter-firm networks and whether the value creation potential of the alliance depends on relationship-specific characteristics, we examined how the interplay between the partners’ characteristics shapes the identity of the relationship and produces heterogeneous effects. Based on the estimate of average treatment effects on smaller firms (i.e., micro firms), we have corroborated previous evidence on the benefits that small firms can derive from formal networks (e.g., Aiello et al., 2023; Costa et al., 2017; Watson, 2007). Indeed, our results show that firms with fewer than ten employees derive higher benefits from network participation than larger firms, especially after the fifth year of joining. After the fifth year, the increase in sales caused by participation in formal networks is 18.6% for micro firms, while sales of larger firms increase by 11%. As inter-firm recurrent connections become a source of critical resources, knowledge, and information for smaller companies, the combination of partners’ characteristics determines the uniqueness of the interaction and the opportunity to achieve relational rents (Dyer & Singh, 1998; Stuart, 2000). Although the composition of networks is considered to be at the core of their potential benefits, we still lack evidence on the degree of heterogeneity in the causal effects produced by the interaction of members’ characteristics. In particular, little attention has been paid to the question of the effects of being linked to partners with different sizes (Cantele & Vernizzi, 2015). We addressed this gap and found that micro firms that partner with at least one medium or large firm have a stronger impact than micro firms without such a partner. This result is consistent with previous findings (Stuart, 2000). Well-equipped larger partners can add greater value to the partnership as smaller firms have the opportunity to leverage partners’ consolidated market position and customer base (Mitchell & Singh, 1996), superior assets, and reputation (Parida et al., 2010).

It is assumed that the value creation potential of formal networks is also influenced by the spatial distribution of their members. If geography still plays a role in shaping firms’ activities and competitiveness (Morgan, 2004), it is argued that the proximity of partners moderates the outcomes of formal collaborative arrangements by activating spatial spillover effects and external economies (Van Oort et al., 2012). When we isolate the agreements with the highest and lowest percentage of partners in the same TTWA, the benefits of formalizing relationships become clear, especially within a highly interconnected spatial agglomeration. Networks with more than 80% of members from the same TTWA achieve a 14.9% increase in revenues after one year of the agreement and 17.5% after five years. The estimated increase in value added corresponds to 10.6% after the first year and 13.9% after the fifth year. The EBITDA of companies involved in a highly concentrated agreement shows a statistically significant improvement from the second year onwards compared to non-networked companies.