Abstract

Although past research has firmly established the positive effects of network status for resource acquisition and success in entrepreneurial endeavors, we still have a fragmented, limited understanding of the actual drivers of network status emergence. Prior research has mainly focused on the post-founding phase, pointing to the importance of current employment–based and firm-level affiliations in new ventures for their future status formation. In this paper, we extend the attention to the pre-founding phase in a study of spinoffs. Building on imprinting and signaling theories, we theorize that coming from a highly reputable parent firm has a long-term positive impact on a spinoff’s subsequent status by signaling a young spinoff firm’s quality to external parties. We advance previous research by further theorizing that such imprinting is contingent on the level of knowledge relatedness between the parent and spinoff as well as on whether there exists a strategic alliance between them post-founding. In addition, we argue a positive three-way interaction among parent reputation, parent-spinoff knowledge relatedness, and the parent-spinoff strategic alliance. Our analysis of a comprehensive longitudinal sample of 162 Australian mining spinoffs (i.e., firms started by ex-employees of incumbent parent firms) and 3405 strategic alliances from 2001 to 2014 supports majority of our hypotheses.

Plain English Summary

Newly founded firms often face the challenge of establishing connections with resource-rich counterparts to acquire the resources that they lack. Existing research underscores the significance of founders’ affiliations, either based on their current employment or at the firm level, in facilitating such connections. Paradoxically, for new firms to forge ties with more resource-rich entities, they must possess a higher status, implying pre-existing connections to firms already linked with other resource-rich entities in the industry. This presents a dilemma as new firms lack a proven track record, resulting in an information gap between their founders and external firms attempting to assess their potential for partnerships. In light of imprinting and signaling theories, we extend the focus to the pre-founding phase, emphasizing the enduring importance of a highly reputable employment-based affiliation of founders for a nascent firm to signal its quality to external parties. Our research reveals that, in the absence of an established track record, the benefits derived from originating in a highly reputable firm are contingent on maintaining a post-founding relationship with it and operating in similar markets. We delve into two-way and three-way interactions to comprehensively examine these dynamics. Beyond the theoretical implications, our study offers practical strategies for new firms that can enable them to establish connections with high-status entities within the industry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Network status represents how centrally positioned an organization is relative to others in the industry (Podolny, 2010). Past entrepreneurship research has firmly established the particular importance of network status for resource acquisition and success in entrepreneurial endeavors (Dimov et al., 2007; Pollock et al., 2010; Shipilov et al., 2017). Achieving a higher network status has been associated with a range of beneficial outcomes, such as forming cooperative relations with prominent partners (Gulati & Gargiulo, 1999; Schillebeeckx et al., 2016; Shipilov & Li, 2008), lower recruitment costs (Bidwell et al., 2015), better market performance (Pollock et al., 2015), and higher initial public offering (IPO) evaluations (Pollock et al., 2010; Stuart et al., 1999). Accordingly, the achievement of network status in new ventures has been a key research question for scholars not only in the fields of entrepreneurship but also in adjacent fields such as strategy, over the past two decades (George et al., 2016; Hallen, 2008; Piazza & Castellucci, 2014; Pollock et al., 2019; Shipilov & Li, 2008).

Given the beneficial outcomes of developing a higher status, it is important to identify what determines the network status of new firms. To achieve a higher status, new firms should form alliances with high-status firms in the network. It is because the network status of a focal firm increases not only by the count of its alliances but also—and mainly—by the higher status of the firms with which it forges ties (Jensen, 2008). Due to liabilities of newness, the lack of a track record can lead to an information gap between the founders of new firms and external firms that try to assess their quality for potential partnerships. From a signaling theory perspective (Spence, 1974), previous studies have investigated how information asymmetry about new firms can be mitigated. To date, studies have mainly focused on how new firm’s current relations with prestigious parties can reduce information asymmetry around them and offer credible quality signals. For instance, studies show how affiliations of top managers with prominent firms (Higgins & Gulati, 2003, 2006), or reputable venture capitalists (VCs) (Pollock et al., 2010), can provide important quality signals that can affect the network status formation of existing new ventures. Such studies explain that prestigious firms are highly selective in choosing new partners since they value their reputationFootnote 1 and want to avoid putting their own reputation at stake (Fombrun & Shanley, 1990). So, a new firm acquiring relations with high-status parties would signal its quality to other potential high-status firms in the network. However, such studies typically look at the immediate effects of the relations and affiliations that are formed post-founding and do not specifically explain achievement of such initial relationships in the first place. Insights from the spinoff literature argue for the lasting effects of pre-founding affiliations of founders with the previous employer on new spinoffs’ organizational outcomes (cf. Klepper & Simons, 2000; Roberts et al., 2011; Simsek et al., 2015). Combining these insights with previous research on status formation raises an important question of whether post-founding network status can benefit from pre-founding affiliation signals. So far, such pre-founding effects have not been explicitly taken into account in models of status formation and emergence. Switching attention to pre-founding effects may shift our understanding of what drives the formation of network status.

Spinoffs—new ventures that are founded by ex-employees of an incumbent parent firm in the same industry (Klepper, 2009)Footnote 2—are particularly suitable for studying the effect of pre-founding affiliations. The spinoff literature has attributed a range of benefits to affiliation with the parent firm through the inheritance of organizational practices and entrepreneurial mindset (Basu et al., 2015; Bruneel et al., 2010; Ellis et al., 2017; Feldman et al., 2019; Juhász, 2021). In addition, spinoffs will need to develop networks beyond the parent, as the relationship between a spinoff and the parent firm may become fractious or discontinue (Bae & Lee, 2021; Buenstorf & Klepper, 2009; Walter et al., 2014). Therefore, we aim to investigate the following research question: “How do pre-founding affiliations of a spinoff’s founders with their parent firm influence the development of spinoff’s status post-founding?”.

To answer this research question, we draw upon signaling theory (Spence, 1974). Status literature on new firms has established the signaling value of the upper echelon’sFootnote 3 post-founding employment affiliations in forming ties with more prestigious investors (Higgins & Gulati, 2003). While the signaling perspective may be able to explain the mitigation of the information asymmetry around new spinoffs depending on the pre-founding affiliations of their founders with a parent, it cannot explain the persistence of such signals. Therefore, we further draw upon imprinting theory which can provide a bridge between the past and future of a firm (Simsek et al., 2015). A central notion in this theory is that the imprinting effect of the founding conditions has a lasting impact on a new firm’s subsequent development trajectory (Boeker, 1989; Ellis et al., 2017). The imprinting effects of first alliance partners’ reputation on new firms’ status formation have also been demonstrated by Milanov and Shepherd (2013).

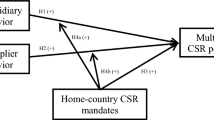

Combining signaling and imprinting theories, we theorize how the parent’s reputation affects spinoff network status. The imprinting literature suggests that the strength of imprinting depends on the relation between the imprinter (i.e., the parent firm) and the imprinted entity (i.e., the spinoff) (Simsek et al., 2015; Uzunca, 2018). In particular, the similarity and strength of the relation between the imprinter and the imprinted entity may moderate the imprinting effect (Uzunca, 2018). As such, we propose knowledge relatedness as a measure of similarity between the parent and the spinoff and maintaining a formal alliance with the parent firm post-founding as a measure of relation strength to moderate the parental imprints on spinoffs. Therefore, we investigate how parental reputation influences spinoff network status and how this relation is moderated by knowledge relatedness and formal parental alliances.

We test our hypotheses using comprehensive longitudinal data of 139 spinoffs and 3405 strategic alliances that started operations in the Australian mining industry between 2001 and 2014. Spinoffs are a common mode of entry into this industry, accounting for up to 40% of all new entrants. Due to the high capital investments required in the mining projects and their high failure rates, alliances with resource-rich firms are critical for new mining firms (Bakker, 2016; Bakker & Shepherd, 2017). The positive long-term performance effects stemming from the formation of these strategic alliances have been affirmed in recent research (cf. Zarea Fazlelahi et al., 2023). As a junior miner (i.e., the boards of start-up mining ventures, Krause et al., 2022) told us about the resource benefits of strategic alliances for their resource-constrained venturesFootnote 4: “They [partners] would bring mining technology, extraction technology, such as metallurgy and marketing, and potentially off-take for the commodity.” Such resource-rich firms would be more likely to partner with higher-status new ventures (Dimov & Milanov, 2010).

We make the following contributions to entrepreneurship literature. First, our research contributes parental reputation as a previously overlooked driver of spinoff network status. This advances network status literature that studies the importance of signals of employment-based affiliations of the founding and top management teams of new ventures on their ability to form ties with prestigious industry partners (Higgins & Gulati, 2003, 2006; Milanov & Shepherd, 2013). We show that pre-founding employment affiliations of founders matter as drivers of network status, but its effects are contingent on knowledge relatedness and alliance ties between the spinoff and parent. We thereby contribute to how the nature of the relationship influences the strength of the parent’s reputational imprint on the spinoff’s network status. We also contribute to the spinoff literature by combining the signaling and imprinting theories to conceptualize parents as a signal of quality that facilitates the building of relations with other firms rather than merely as a conduit for the transfer of knowledge (Agarwal et al., 2004; Basu et al., 2015; cf. Ellis et al., 2017; cf. Juhász, 2021; McEvily et al., 2012).

2 Theoretical framework

2.1 Signaling and network status emergence and formation

Accumulation of network status is important for organizational outcomes (Shipilov & Li, 2008). High-status firms are perceived by relevant stakeholders to have credibility and legitimacy (Podolny, 2010). Previous studies on established firms have found that a track record of past interorganizational collaborations and the performance history of partner firms drive the accumulation of a firm’s network status (Al-Laham & Souitaris, 2008; Gulati & Gargiulo, 1999; Jensen, 2008; Piazza & Castellucci, 2014), which increases the likelihood of potential high-status partners forming ties with the focal firm (Baum et al., 2005; Gulati, 1995). For instance, based on the structural homophily perspective, Jensen (2008) showed that high-status incumbent firms favor collaborations with other high-status incumbents. However, such predictions have limited explanatory power in the context of new ventures that have no pre-existing alliance networks. Theories such as signaling have been suggested to be more relevant for explaining how such new firms can form ties with prestigious companies.

Signaling theory proposes that where there is information asymmetry between two parties, one party can send signals to the other that would provide indications of its quality through characteristics that are costly and difficult to imitate (Spence, 1974). The importance of effective signals to overcome information asymmetries is well-established in various contexts such as initial public offerings (Colombo et al., 2019; Pollock et al., 2010) and venture capital (Higgins & Gulati, 2006), as well as crowdfunding and entrepreneurial finance more generally (Kleinert et al., 2020). In the context of network status formation, studies on new ventures have typically focused on how current affiliations provide important signals that subsequently drive the formation of status. Such studies suggest that third-party affiliations with prominent members of a network can alleviate information asymmetry around a new firm by signaling its quality and showing that the new firm is positively evaluated by knowledgeable third parties. For example, studies have focused on founders’ personal ties and employment affiliations as important signals about the venture. Founders’ personal ties have also been shown to positively influence the status formation of new firms in the early years (Sterling, 2015). Post-founding prominent third-party affiliations of a venture’s top management team have been shown to positively influence the likelihood of high-status firms investing in the new venture (Higgins & Gulati, 2006). However, despite mounting evidence that pre-founding employment affiliations matter for entrepreneurial outcomes—specifically for spinoff firms (cf. Andersson & Klepper, 2013; Basu et al., 2015; Bruneel et al., 2013; Dick et al., 2013)—such effects have not been taken into account in models of status formation and emergence based on signaling theory.

Connecting with high-status firms and developing a high status in the network would provide important quality signals for new spinoff firms. Similar to other new firms, newly founded spinoffs face the liabilities of newness and smallness which could lead to information asymmetry around them. Despite the importance of the parent firm for spinoff growth and survival (cf. Agarwal et al., 2004; Basu et al., 2015), the reputational capital of parents has not been considered a signaling cue driving spinoff’s status formation. This might be because spinoffs do not necessarily maintain a relationship with their parent after incorporation (Buenstorf & Klepper, 2009), which restricts their access to their parent’s complementary resources after founding. However, spinoff founders may still rely on the transferred knowledge from the parent to develop their firm’s capabilities. Even if the ties are being cut, parent firms may continue to influence the development of the spinoff in terms of knowledge creation (Basu et al., 2015) and organizational practices (Feldman et al., 2019). However, the relation between parent’s reputational capital and spinoffs is overlooked by previous research. In the following, we will review the literature on imprinting theory which can offer an explanation for how entities can influence a spinoff despite not being connected to it. This can help to explain how signaling theory may apply in such cases.

2.2 Imprinting theory

Imprinting is “a process whereby, during a brief period of susceptibility, a focal entity develops characteristics that reflect prominent features of the [then prevailing] environment, and these characteristics continue to persist despite significant environmental changes in subsequent periods” (Marquis & Tilcsik, 2013, p.199). The founding period is a susceptible period of imprinting (Marquis & Tilcsik, 2013; Simsek et al., 2015), which is assumed to be less than 10 years after incorporation by many entrepreneurship studies (Carpenter et al., 2003; Milanov & Fernhaber, 2009; Robinson, 1999). Experience, knowledge, and connections gained in the past by founders are seen as endowments that shape the imprint and subsequent outcome (De Cock et al., 2021; Ellis et al., 2017). The founders are the carriers of the imprint from the parent to the spinoff (Ellis et al., 2017), and there is some evidence that past connections carry stronger imprints than contemporaneous connections (McEvily et al., 2012; Soda et al., 2004; Zarea Fazlelahi et al., 2018, 2020, 2022). Most of the literature has focused on the founder as a conduit for transferring knowledge to their new firm (De Cock et al., 2021), but some studies suggest that the imprint consists of a shared identity between imprinter and the imprintee (Uzunca, 2018).

In the absence of a track record, the founding team’s pre-founding affiliations may indicate strong signals of the quality of a new spinoff to external firms. Such initial signals may have an imprinting influence on the external perception of the new spinoff for an extended number of years to come. The persistence and continuing influence of the initial quality signals developed during the sensitive period of a new firm’s founding can be attributed to the persistence of the schemas that form the initial opinion and judgment about a new spinoff (DiMaggio, 1997). Such schemas are “knowledge structures that represent objects or events and provide default assumptions about their characteristics, relationships, and entailments under conditions of incomplete information” (DiMaggio, 1997, p.269). The initial schemas developed about a focal entity have been argued to dominate the decisions and actions toward it (Schneider, 1991). Accordingly, external organizations may be reluctant to revise their decisions based on the initial signals of quality by engaging their cognitive resources again to assess new information (DiMaggio, 1997). In addition, previous research suggests that new judgments about the quality of new spinoffs are based on previous judgments (Von Hippel et al., 1993). Indeed, research studying schemas suggests that new information is more likely to be absorbed if it is relevant to the existing schemas (DiMaggio, 1997). We therefore draw on the imprinting perspective to hypothesize that parents’ reputation at the time of founding would have such a signaling effect on spinoffs’ status formation since external audiences may use such cues to make an initial judgment about the new spinoffs.

Additionally, the imprinting perspective suggests the circumstances under which imprints are formed may amplify their effects (Simsek et al., 2015). Specifically, the similarities between the imprinter and the imprinted entity, as well as a formal collaboration between the two, may moderate the imprinting effect (Dimov et al., 2012; Ni Sullivan et al., 2014; Uzunca, 2018). Similarities between a spinoff and parent firm have been characterized as knowledge relatedness and shown to affect spinoff outcomes (Bae & Lee, 2021; Basu et al., 2015). A relation that continues during the founding period has also been shown to lead to strong imprints (Uzunca, 2018). Semadeni and Cannella (2011) showed that the effect of parental endowments on a spinoff’s performance is influenced by the joint effect of relatedness and formal links between the spinoff and the parent firm. Accordingly, we hypothesize both a direct effect of parent reputation on a spinoff’s network status as well as also how knowledge relatedness and holding an alliance with the parent moderate the effect of the parent’s reputation.

2.3 Hypothesis development

2.3.1 Parent’s reputation and the new spinoff’s future status

We argue that parent’s reputation has a signaling value for potential prominent partners, making them confident about the quality of the newly founded spinoff and helping to reduce the asymmetries by screening available information. Qualities of parent firms have been argued to affect the new spinoff firms’ knowledge bases, innovation, and performance because “good parents produce good ‘kids’” (Hunt et al., 2019, p.482). One such signal of quality is a firm’s reputation (Benjamin & Podolny, 1999), which “is fundamentally an economic concept that captures differences in perceived or actual quality or merit that generate earned, performance-based rewards” (Washington & Zajac, 2005, p.283). The reputation of others has been shown to spill over to new ventures. For example, having a more reputable VC offers positive signals that increase the venture’s valuation (Lee et al., 2011) and the venture’s ability to attract resources (Vanacker & Forbes, 2016). The reputation of the first partners has similarly been shown to have a positive lasting effect on a venture’s status (Milanov & Shepherd, 2013).

Although parent firms may not have an ongoing relation with their spinoffs (Cirillo, 2019; Walter et al., 2014), they may have a lasting impact on spinoffs via the founders, carrying elements from their prior experiences in the parent firm into their new organization (Ellis et al., 2017; Johnson, 2007). A parent firm’s reputation may impact the initial status evaluations of spinoffs, as it provides legitimacy to spinoffs (Sahaym, 2013; Wang, 2021). More reputable parent firms are more likely to have access to unique and superior expertise, and spinoff founders coming from such parents in the same industry can be perceived as carriers of those industry contacts and knowledge. Thus, we expect that pre-founding affiliations to parents with high reputations can signal to outsiders the spinoff’s access to valuable resources and help with developing an initial positive awareness about the quality of the new spinoff. The status emanates from an expectation that spinoff firms live up to their parent’s reputation, as they have learned their parent’s norms, values, and cognitive frameworks (Ellis et al., 2017).

Pre-founding signals such as those from the parent may imprint more significantly than contemporaneous connections (McEvily et al., 2012; Soda et al., 2004), as the original imprint is likely to be more resistant to revisions based on new information (Marquis & Tilcsik, 2013). The persistence of the imprint can be attributed to the schemas that form the initial judgment about a spinoff (DiMaggio, 1997). The initial schemas developed about a focal entity dominate future actions toward it (Schneider, 1991). Accordingly, external organizations may be reluctant to revise their initial schemas of quality signals (DiMaggio, 1997). Thus, we predict that once initial status evaluations about a spinoff are formed, they are unlikely to change. This continuous influence can increase the status of new spinoffs by increasing the desire of outside high-status organizations to forge ties with them in the long run. Therefore, we suggest the following:

-

Hypothesis 1. The reputation of a spinoff’s parent pre-founding will positively influence the spinoff’s future status.

2.3.2 Knowledge relatedness with parent and the new spinoff’s future status

If spinoffs are established in knowledge domains related to their parent firms, they are perceived to benefit from the parent’s knowledge and resources. Studies have provided extensive evidence of parents’ knowledge increasing spinoffs’ survival and performance (Agarwal et al., 2010; Chatterji, 2009; Franco & Filson, 2006). The external audience perceives that such spinoffs start with more relevant knowledge accumulated from their parents and thus are more familiar with the industry norms and practices (Bae & Lee, 2021; Capone et al., 2019; Hunt et al., 2019; Walter et al., 2014). If there is greater knowledge relatedness between spinoffs and their parents, we expect a parent’s reputation to act as a stronger signal of the quality of a new spinoff due to more relevant knowledge carried by founders. This perceived higher-quality signal increases the attractiveness of a spinoff as a potential partner by further reducing information asymmetries around the new spinoff—a key element of its status in the industry (Hubbard et al., 2018).

Moreover, the effects of relatedness with the parent firm are imprinted at founding, thus giving those spinoffs who are related more lasting learning benefits as they are more likely to share an identity with their parent (Uzunca, 2018). Such relational identification makes it more likely that the reputation of the parent is perceived to be of relevance to the spinoff, resulting in higher perceived quality of the spinoff. Together with an increased perception of a spinoff’s quality, we suggest the following:

-

Hypothesis 2: Knowledge relatedness has a positive moderating effect on the relationship between the pre-founding reputation of a spinoff’s parent and the spinoff’s future status.

2.3.3 Having a tie with a parent and the new spinoff’s future status

In the first hypothesis, we established that a spinoff founder’s pre-founding employment affiliations with a parent with a high reputation have a positive signaling effect on the spinoff’s future status formation. We suggest that this ongoing relationship through a formal strategic alliance would strengthen the imprinting effect of pre-founding affiliations. Since reputation is an economic signal of quality, highly reputable firms are more vigilant when choosing partners (Pollock et al., 2019). Maintaining a relation with the spinoff post-founding provides a strong signal that the reputable parent categorizes the spinoff as an attractive partner (Milanov & Shepherd, 2013; Semadeni & Cannella, 2011). Because status is a function of the firm’s a spinoff affiliates with, an ongoing partnership with a high-quality parent is likely to raise the status of the venture in the industry network (Pollock et al., 2015). More importantly, as highly reputable firms are more visible (Rindova et al., 2005), it also increases the spinoff’s visibility.

In addition, highly reputable parents are more likely to have high-status partners (Dimov & Milanov, 2010). When spinoffs form a strategic alliance with their parent, they become an indirect tie to those high-status partners of their parent. Given that the probability of tie formation between two organizations increases if they have a common partner (Gulati and Gargiulo (1999), this provides an opportunity for new spinoffs to get referrals to such high-status firms through their parent (Hallen & Eisenhardt, 2012). Key stakeholders are looking for ways to minimize the uncertainty surrounding new firms without a track record to be able to choose better collaborators (Pollock & Gulati, 2007). Therefore, such referrals can further add to the attractiveness of new spinoffs in the network by decreasing the uncertainty around them. Thus, we suggest that a parent firm opting to ally with a newly founded spinoff would further strengthen the pre-founding affiliations’ effect since it signals the spinoff’s post-founding qualities and potential. Therefore, we suggest the following:

-

Hypothesis 3: Having a tie with a parent has a positive moderating effect on the relationship between the pre-founding reputation of a spinoff’s parent and the spinoff’s future status.

2.3.4 Three-way interaction of knowledge relatedness, having a tie with a parent, and the parent’s reputation

When a spinoff firm is established in closer knowledge domains to its parent firm, it is more likely that the spinoff can better benefit from its parent’s reputation, as the parent’s reputation is more likely to be seen as a relevant quality signal. We expect that having a direct tie with the parent after starting a new spinoff should magnify the effect of the interaction between knowledge relatedness and the parent’s reputation on spinoff status. The formal tie with a relevant and reputable partner such as the parent will make the spinoff a more attractive partner (Uzunca, 2018). Semadeni and Cannella (2011) found that spinouts related to their parent and who maintain a tie post-founding benefit more from parental endowments. Similarly, we argue that parental reputation, as one such endowment, will have a more positive effect for related spinoffs when having a post-founding tie than not having one. Forming an alliance with the parent firm post-founding would signal that the spinoff and parent are on good terms, thereby breeding trust and curbing opportunism (Coleman, 1988; Gulati, 1995). This is important, as research has shown that operating in related knowledge domains may sometimes cause tensions and hostile actions from the parent firm (Klepper & Thompson, 2010; Walter et al., 2014). External firms might in such situations be hesitant to form ties with the new spinoff (Bae & Lee, 2021). A tie post-founding may signal that the spinoff is on good terms with the parent, thus reducing information asymmetry and uncertainty among customers or investors. By working together with a highly reputable parent, the two firms are providing a signal that they have the knowledge and expertise to develop and deliver high-quality products or services.

Absence of post-founding ties while being active in related knowledge domains may signal that the parent and spinoff are not on good terms post-founding (Bae & Lee, 2021). This potential hostility may result from exploiting an idea that was originally conceived while the founders were still working for the parent firm (Walter et al., 2014). Such absence may also signal that the spinoff does not have access to the relevant endowments of the parent firm, reducing the attractiveness of the spinoff as a potential partner.

Spinoffs that are unrelated to the parent firm benefit less from a parent’s reputation, as the reputation of a parent loses relevance to the venture’s status if there is little knowledge relatedness. An ongoing tie in those situations may constrain the venture in charting its own course away from the parent resulting in reduced performance (Parhankangas & Arenius, 2003; Semadeni & Cannella, 2011). Once those initial categorizations of a venture’s quality are determined, outsiders are unlikely to change those, suggesting that the tie offers a lasting signal of irrelevant quality (DiMaggio, 1997). If an unrelated spinoff has no tie with the parent, it is unlikely to benefit much from the parent’s reputation, but will be less constrained by the “apron ties” (Semadeni & Cannella, 2011), which should elevate the attractiveness of the venture as a potential partner and investment target. As such, we would expect for unrelated ventures that the presence of a tie has the reverse effect of a related venture, in that for unrelated spinoffs, an ongoing tie has a more negative effect compared to no tie on the parent reputation–spinoff status relationship. Uzunca (2018) showed that establishing a tie post-founding did not overcome a venture’s initial disadvantage of not being related to the parent firm, so we would expect the effect of knowledge relatedness to be more positive than that of having a tie. Therefore, we suggest the following:

-

Hypothesis 4: The moderating effect of knowledge relatedness on the parent reputation and spinoff’s status relationship is more positive when the spinoff holds a post-founding tie with its parent.

3 Methods

3.1 Data

To investigate the hypothesized effects, we compiled a sample of newly founded mining firms using the Register of Australian Mining (henceforth “the Register”) database. The Register contains longitudinal data about (1) all mining companies that are active or were active (back to 2001) in Australian mining, including their profit, loss, asset and liability history, their Australian mineral interests, and a summary of their corporate and operational achievements; (2) all projects and mines recorded in Australia, including their location, ownership, mining resources/reserves, and comments on their history of activities and programs; and (3) all company directors and their organizational affiliations. The Register is updated yearly. We had access to the online archive for the period 2001–2012. We then updated the dataset for two more years from the last two available printed archives published in 2013 and 2014.

Orbis and Osiris were used to gather data about IPOs and firm information for private and public firms in our sample. We used Zephyr to obtain data about mergers and acquisitions in the industry.

Our setting is suitable for testing our hypotheses because spinoffs are a major entry mode into the Australian mining industry. Additionally, strategic alliances are common in this industry to share risks and resources (Bakker, 2016; Zarea Fazlelahi, 2019). This industry is centralized around a number of large, resource-rich mining firms. Partnering up with such large firms is highly competitive among newer and smaller firms. While distinct in some regards, mining shares many similarities with other industries regarding how relationships between constructs work (Bakker, 2016; Bakker & Shepherd, 2017; Zarea Fazlelahi & Burgers, 2018, 2020). Alliance networks are essential in mining, in particular for new firms such as spinoffs. This is for a number of reasons. First, to develop and exploit a mine, resource needs increase exponentially from the exploration stage. Such capital and capabilities cannot be obtained from banks, stock markets, or venture capitalists. As such, alliances are essential for mining spinoffs to grow and succeed (Bakker, 2016; Zarea Fazlelahi et al., 2023) and status is an important variable to attract such alliance partners (Pollock et al., 2010). Another is that specialised skills and assets are typically needed, so alliances and therefore status in the network are essential. It is a situation similar to one in biotechnology, where small ventures often need to ally with large pharmaceuticals. Therefore, developing a high status to access resources is highly relevant for new firms in the Australian mining industry.

3.2 Sample

New firms were identified based on their first appearance in the Register. There is no left-censoring as all firms were tracked from birth. We cross-checked the incorporation date of each firm with the Dun & Bradstreet Hoovers Business Browser. We used the Australian Securities Exchange (ASX) to remove first appearances that were a result of name changes rather than an incorporation of a new firm. Our observation period ranges from 2001 to 2014. We closed the selection window of adding new spinoffs in 2007 to ensure at least 7 years of operation for all spinoffs included in our sample. The average time for a mining project to reach the exploitation stage is almost 5 years (Bakker & Shepherd, 2017); thus, our sampling window covers the whole development period. We excluded new mining firms that are not independent, such as subsidiaries, to avoid confounding effects of alternative imprinting sources. Our sample only includes publicly listed firms, but we included alliances with private and public mining firms for developing network-related measures and observing status dynamics. To be identified as a spinoff firm, firms had to be incorporated during or after 2001, where at least 25% of the founding team was coming from the same mining firm—that is, the parent firm—immediately 1 year before the corporation (Muendler et al., 2012). The focus on intra-industry spinoffs is consistent with the seminal work of Klepper (2009) and what has been frequently applied as the definition of spinoffs in the literature (cf. Basu et al., 2015; Franco & Filson, 2006; Klepper & Thompson, 2010). Using this cut-off rate is consistent with previous spinoff studies using similar datasets where an explicit note of firm type is not available (cf. Andersson & Klepper, 2013; Eriksson & Kuhn, 2006).

The Register contains information about the board members, from which we identified the founding members for each sampled firm. We cross-checked the list of founding members with the Morningstar Premium dataset by going through firm annual reports and biographies of the founding members to identify prior affiliations while checking (but not finding any) occurrences of multiple parents, which was not the case. The distribution of percentages across spinoffs is minimum = 0.25, maximum = 1, mean = 0.46, and median = 0.60. Another consideration is firm ownership in choosing spinoffs. Our sample consists of spinoffs, defined as ones in which the parent firm has no ownership over 50% in the spinoff, as it would legally be required to announce that. Firms in which mining firms do own a significant stake are considered spinouts, which occur in the mining industry, but outside the scope of our study, as the influence of the parent firm will be quite different in those cases. This process resulted in 162 spinoff firms.

3.3 Measures

The Register annually documents all mining projects with details of their ownership stake and parties involved. We created unique identifiers for every company, project, and director. To operationalize our network variables, we constructed matrices of alliance networks for each year that linked companies to companies. We recorded a network relationship between two firms when they were jointly involved in the same mining project in the same year. We used UCINET version 6.681 to construct all the network-related measures (Borgatti et al., 2002).

3.3.1 Dependent variables

Spinoff firm status (t + 1)

We operationalized a spinoff firm’s status using Bonacich’s (1987) eigenvector centrality measure, which is a commonly accepted status measure in a variety of industries and contexts by previous research studies (Hallen, 2008; Jiang et al., 2021; Lin et al., 2009). Eigenvector centrality is a measure of a node’s influence within a network, which takes into account both the number of connections a node has and the importance of those connections. Accordingly, this measurement assumes a spinoff’s standing in a social order from the number of its strategic alliances as well as the status of those alliance firms, which is, in turn, contingent on the status of their alliance partners and so on (Pollock et al., 2019).

An alternative measure of status is Bonacich (1987)’s beta centrality (Chang & Matsumoto, 2022; Milanov & Shepherd, 2013; Pollock et al., 2015). Using this measurement requires the definition of two parameters α and β. Milanov and Shepherd (2013) suggest that relevance of α depends on the use of “raw scores” in the analyses. Several studies have set β as the reciprocal (inverse) of the largest eigenvalue of the correlational matrix (cf. Borgatti et al., 2002; Milanov & Shepherd, 2013; Podolny, 2001; Pollock et al., 2015).Footnote 5 Given that the values of α and β are somewhat arbitrary choices, we prefer to use eigenvector centrality.

Eigenvector centrality is calculated using the following equation (e.g., see Bonacich, 2007). Given an adjacency matrix \(A\) where \({a}_{ij}=1\) if i and j vertices (i.e., nodes) in the network are connected and \({a}_{ij}=0\) if they are not, the following equation describes eigenvector centrality of vertex i (denoted as \({x}_{i})\):

The centrality of each vertex is therefore determined by the centrality of the vertices it is connected to. \(\lambda\) is the largest eigenvalue of \(A\) and n is the number of vertices. We used a normalized eigenvector centrality measure which takes into account the size of the network and the number of nodes in it. Normalization is a way of standardizing eigenvector centrality scores across networks of different sizes, so that comparisons can be made between nodes in different networks. There are several ways of normalization of the eigenvector values. UCINET uses the Euclidean norm for normalizing eigenvector values which is demonstrated to provide a more balanced view of the eigenvectors as centrality measures compared to other normalization approaches. The Euclidean norm of a vector is computed as the square root of the sum of the squares of its elements. Then, each value is divided by the Euclidean norm (see Ruhnau, 2000 for a mathematical demonstration.).Footnote 6

3.3.2 Independent variables

Parent firm’s reputation

Prior studies have mainly measured reputation in VC contexts by prior studies (cf. Milanov & Shepherd, 2013; Pollock et al., 2015). A VC firm’s quality is determined by the successful investment decisions that it makes, which can be observed and evaluated by the external audience as its track record. Therefore, the reputation of VCs has typically been operationalized as their ability to develop the firms in their portfolio to an IPO (Lee et al., 2011; Pollock et al., 2015). In the mining industry, the quality of a firm is determined by its ability to make superior decisions regarding evaluations of mining opportunities (Bakker & Shepherd, 2017): “Mining companies usually pursue multiple potential opportunities simultaneously, building a portfolio of mining ventures and moving them through a stage-gate development process, with the successful management of this process being one of their primary tasks” (Bakker & Shepherd, 2017, p.132). Specifically, due to the large scope and resource requirements of mining projects, progressing them to the next stage can represent billions of dollars. Therefore, presenting a project’s successful progress to the next stage can potentially increase the reputation capital of a mining firm. Bakker and Shepherd (2017) suggest three clearly identifiable stages of opportunity evaluation in mining projects: prospecting, developing, and exploiting.

Accordingly, we operationalized the parent firm’s reputation by dividing the number of projects that had moved to the next stage in its portfolio of projects in year t by the number of all projects that were added to its project portfolio over the t − 5 period (5 years preceding time t). This variable was calculated at the time of the spinoff’s entry into the industry network and is thus treated as time-invariant (see Milanov & Shepherd, 2013).

3.3.3 Moderators

Knowledge relatedness

We measured knowledge relatedness as the extent to which the alliance portfolio of a spinoff was similar to that of its parent firm in terms of the target minerals (e.g., gold, aluminum, coal), following the procedure outlined by Bae and Lee (2021). Specifically, we compared the alliance portfolio of the spinoff until the end of the sample period with the alliance portfolio of its parent firm before the spinoff’s establishment. Considering the availability of the data and the sample selection period, this is no longer than the past 7 years for the parent firm. Using this information and inspired by Jaffe’s (1986) relatedness measurement, we calculated the knowledge relatedness between a spinoff j and its parent firm k as follows:

where \({M}_{j}\) and \({M}_{k}\) represent vectors of the alliance portfolio consisting of the number of alliances that were invested in each commodity class for spinoff j and its parent k, respectively. It is worth noting that our measure not only compares the type of commodities that spinoffs and parents pursued in their alliance portfolios but also considers the proportion of the overall alliance portfolio of a spinoff and its parent dedicated to similar commodities.

Tie with parent

We included this variable as a binary value that is 1 if the spinoff was involved in a strategic alliance with its parent post-founding and 0 otherwise (Uzunca, 2018).

3.3.4 Control variables

We included a comprehensive set of control variables following previous research on status to ensure the robustness of our claims. We included a list of the operationalization of control variables together with the dependent and independent variables in Table 1.

3.4 Analysis approach

Considering the self-reproducing nature of status (Pollock et al., 2015), our model controls for a lagged dependent variable, which conceptualizes the change in status as dynamic and path-dependent (cf. Milanov & Shepherd, 2013; Pollock et al., 2015). As this could lead to autocorrelation concerns and the consequent endogeneity problem, we employed system generalized method of moments (GMM) to test our hypotheses with Stata v.17 using the xtabond2 package (Roodman, 2009). The system GMM estimator addresses various types of endogeneity by instrumenting endogenous variables with pre-determined as well as exogenous variables. The lagged terms of regressors can be used as valid instruments given that they are pre-determined and hence cannot be associated with the current error term, as long as error terms are not serially correlated (Agarwal et al., 2016). This estimator also addresses unobserved heterogeneity by using the first differencing method (Roodman, 2009). Therefore, this estimator is an efficient tool for addressing endogeneity problems. Additionally, system GMM allows for time-invariant variables and specifies additional moment conditions in which lagged differences of the dependent variable are instruments in the level equation, thus improving performance with highly persistent autoregressive processes (Arellano & Bover, 1995; Blundell & Bond, 1998).

To test our hypotheses, we estimated changes in the spinoff’s status using the following dynamic panel data model:

where \({S}_{it}\) represents the status of firm i at time t, \({X}_{it}\) represents a vector of independent and control variables for firm i at time t, \({\mu }_{i}\) represents unobserved heterogeneity for firm i, and \(\varepsilon\) represents the error terms.

We followed Roodman’s (2009) recommendations to select the instruments for our model. Any regressor can be theoretically used as an instrument, but to correctly specify the lag structure, it is important to consider whether a focal variable is strictly exogenous, pre-determined, or endogenous (Arellano, 2003). Since our model includes both lagged dependent variables and fixed effects, the standard treatment is to use lags of one and longer for pre-determined variables and lags of two and longer for endogenous variables (Roodman, 2009). Accordingly, we used at least three periods of lagged dependent variable (Angrist & Pischke, 2009, p.243) in addition to lags of one and longer for pre-determined variables. For these methodological choices to work, there are two main assumptions: (1) The residuals in the first differences should be autocorrelated in the AR(1) test, and (2) there should be no autocorrelation in residuals in second differences as shown by the AR(2) test (see Sect. 5.3 in Angrist & Pischke, 2009). We report the results for both tests in Table 4. Accordingly, AR(1) should be significantly correlated by model construction, which is supported by a p-value of p = 0.001 in all models in Table 4. The results of AR(2) suggest that there is no serial correlation between second differences in residuals (p-values range from p = 0.058 to p = 0.063). This suggests no lags of the dependent variable that are used as instruments are endogenous in our models.

We also report Hansen overidentification and difference tests. These are additional specification tests to indicate the validity of the lags and instruments and the consistency of the GMM estimator (Roodman, 2009). The results of those specification tests are reported in Table 4. The p-values for the Hansen overidentification test range from p = 0.837 to p = 0.952 for all our models, indicating there is no support for the null hypothesis that the overidentification restrictions are valid, suggesting our instruments and lag structures are valid. The p-values of the Hansen difference test for dependent variable lags indicate that our instruments are not correlated with the error terms and hence exogenous, and our models are correctly specified (p-values range from p = 0.841 to p = 0.939). Additionally, significant Wald chi-squared results suggest that the instruments are jointly relevant and contribute to the identification of the parameters (Roodman, 2009). In short, these specification tests all show the GMM estimator to be consistent and the model, instruments, and lags to be appropriately specified.

4 Results

Tables 2 and 3 present the summary correlations among variables and descriptive statistics of the sample. To test our hypotheses, our hypothesized variables and controls were regressed on spinoff status formation (see Table 4). Model 1 is the baseline model where we entered all the control variables. In Model 2, we entered the parent’s reputation for testing our direct effect in Hypothesis 1. Models 3 and 4 include the two-way interaction terms pertaining to knowledge relatedness and tie with a parent, respectively (Hypotheses 2 and 3). In Model 5, we entered our three-way interaction term (Hypothesis 4). This model also includes all other two-way interactions of the moderators and the independent variable, which are included in any generic form of the three-way interaction regression equation (Dawson & Richter, 2006). The independent variables and moderators were mean-centered prior to creating the interaction terms. The common tests for multicollinearity are not necessary when utilizing instrumental analysis that isolates the own effect of independent variables from the group effect and other-variable effect (Roodman, 2009). We used Stata 17’s Margins command to conduct simple slope tests to probe the two-way interactions (see Jaccard et al., 2003) and the slope difference tests to probe the three-way interaction (see Dawson & Richter, 2006). Test values were set at one standard deviation below and above the mean for parent’s reputation and knowledge relatedness and at 0 and 1 for a tie with the parent.

Hypothesis 1 suggests that the reputation of a parent has a positive effect on the spinoff’s future status. Model 2 in Table 4 does not present a significant coefficient for the parent’s reputation. Therefore, we do not find support for Hypothesis 1.

Hypothesis 2 proposed that having a higher knowledge relatedness with a parent has a positive moderating effect on the relationship between the reputation of a spinoff’s parent and the spinoff’s future status. The results of Model 3 provide support for Hypothesis 2 (β = 0.0677, p = 0.014). To understand the nature of this relationship, we plotted the results in Fig. 1. It shows that having a higher knowledge relatedness with a parent enhances the positive effect of having a reputable parent on the subsequent status of spinoffs. Conversely, the parent’s reputation seems to have a negative effect on the spinoff’s status when there the spinoff operates in domains unrelated to the parent firm.

Hypothesis 3 proposed that having a tie with a parent has a positive moderating effect on the relationship between the reputation of a spinoff’s parent and the spinoff’s future status. Model 4 of Table 4 shows that the coefficient for the interaction term was positive and significant at (β = 0.0784, p = 0.072). Figure 2 shows that having a tie with a parent enhances the positive effect of having a reputable parent on the subsequent status of spinoffs. When there is no ongoing tie, the parent’s reputation has a nonsignificant effect on the spinoff’s status. This provides support for Hypothesis 3.

Hypothesis 4 stated that the moderating effect of knowledge relatedness on the parent reputation and spinoff’s status relationship is more positive when the spinoff holds a post-founding tie with its parent. The coefficient for the three-way interaction was significant and positive (β = 0.8330, p = 0.022) (see model 5 in Table 4). Figure 3 plots this relationship. The single slope tests and slope difference tests are provided in Table 5 and 6, respectively. The results for the simple slope tests in Table 5 indicate that parent reputation tends to have a positive effect when the spinoff and the venture share related knowledge bases (line 1, slope = 0.281, p = 0.003) and negative when there is no relatedness (line 3, slope = − 0.058, p = 0.001, and line 4, slope = − 0.387, p = 0.053) aligned with our Hypotheses 3 and 4. An investigation of the slope difference tests in Table 6 shows that the combination of an ongoing tie and high knowledge relatedness has the most positive effect of parent reputation with line 1 being significantly more positive than line 2 (slope difference = − 328, p = 0.002), line 3 (slope difference = − 270, p = 0.009), and line 4 (slope difference = 0.668, p = 0.013). It also confirms our argument that the combination of a tie with unrelated knowledge bases is worse than not having a tie, with line 4 being more negative than 2 (slope difference = 0.996, p = 0.000). In the case of no tie, high knowledge relatedness is more positive than low knowledge relatedness with line 2 being more positive than line 3 (slope difference = 0.058, p = 0.004). Taken together, this provides strong support for Hypothesis 4.

5 Discussion

The antecedents and outcomes of status continue to be an important topic for management scholars and a central theme in strategy and entrepreneurship (George et al., 2016; Pollock et al., 2019). Previous studies have shown the importance of quality signals from current affiliations of founders and firm-level partnerships on the status formation of new ventures (cf. Higgins & Gulati, 2006; Milanov & Shepherd, 2013; Sterling, 2015). Building on signaling and imprinting theories and using a sample of newly founded spinoffs from 2001 to 2014, we found that external firms look beyond the post-founding career-based and firm-level affiliations of new ventures as signals of quality and also consider pre-founding affiliations of founders. Our research indicates that the impact of the previous employer’s reputation, as an important quality signal, on a new spinoff’s status is contingent upon specific conditions. We found evidence that the effect of the signal is stronger on status when working in similar knowledge domains as the parent firm, as well as holding a strategic alliance tie with a parent post-founding. Additionally, the positive moderating impact of knowledge relatedness with the parent firm on the compositional benefits of coming from highly reputable parents on the spinoff’s subsequent status is enhanced for spinoffs that hold a strategic alliance with their parent post-founding. Our combined perspective based on signaling and imprinting proposes that a parent’s reputation signals a new spinoff’s quality and influences other firms’ initial evaluations and perceptions of the new spinoffs, and these perceptions persist despite changes in the network conditions.

Together, these results have important implications for theory and practice. First, our study adds to the literature on status emergence and formation by identifying the reputation of pre-founding career-based affiliations of founders as a new driver of status formation in ventures. Our results suggest that such historical ties can be relevant signals under the right conditions, as opposed to the reputation of post-founding affiliations, which has been shown to be a direct driver of status (Higgins & Gulati, 2003, 2006; Milanov & Shepherd, 2013). An implication of our findings is that addressing the reputation of pre-founding career-based affiliations as well as contingencies may resolve the theoretical “chicken and the egg” puzzle of the reciprocal relationship between reputation driving status and status driving reputation when investigating post-founding drivers of status (Hubbard et al., 2018; Pollock et al., 2015).

Second, our research makes a significant contribution by uncovering the dual moderating impacts of knowledge relatedness and parent-spinoff alliances on the relationship between a parent company’s reputation and the spinoff’s status. Unlike previous studies primarily focusing on historical effects as passive influences, such as the contingent effect of a partner’s reputation on the partner’s past network cohesion (e.g., Milanov & Shepherd, 2013), our findings reveal strategic alternatives over and above the previous findings. We show that new spinoffs can either hold a post-founding relationship with their parent or work in similar market with them or pursue a combination of both these strategies. These alternatives enable spinoffs to actively leverage their parent’s reputation, adding a dynamic dimension to the understanding of status transfer in spinoffs and their parental heritage.

Third, the result for the three-way interaction provides additional insights on what shapes the perception of the initial signal based on prior affiliations of a newly founded spinoff. Specifically, our findings having high knowledge relatedness with parents could signal a greater potential for transfer of parent’ tacit knowledge by spinoff founders (Agarwal et al., 2016). Having a tie with parent strengthens the signal of the quality due to ongoing access to the parent firm’s knowledge. Our results also suggest that in the case of low knowledge relatedness, holding a tie might not be as relevant for benefiting from a parent’s reputation. This may provide a fruitful starting point for further theorizing on how spinoffs with lower reputation affiliations may use compensating strategies regarding status formation.

An additional signal receiving increased attention for spinouts and employee spinoffs is the potential hostility of the parent towards the spinoff (Kim, 2022; Vaznyte et al., 2021; Walter et al., 2014). Such hostility has been shown to be higher when the parent and spinoff are related (Bae & Lee, 2021) and when there is no ongoing tie between the parent and the spinoff (Walter et al., 2014). Our results show that in case of high knowledge relatedness if there is no tie between spinoff and parent, the relationship between high parent reputation and spinoff status is not significantly negative (line 2 in Fig. 3). This suggests that parental hostility signals might be a weaker signal than the benefits of knowledge relatedness. One explanation may be that the knowledge relatedness and the founder coming from the parent make a spinoff better equipped to deal with potential hostile actions from the parent, as it may have developed capabilities and strategies to deal with hostile actions (Bahoo-Torodi & Torrisi, 2022; Vaznyte et al., 2021). While our study aligns with this notion, it also shows that in such situations, spinoffs are evaluated much more positively when they have an ongoing relation with the parent firm. An implication of our study is that the presence or absence of a tie post-founding plays a key role in understanding this dynamic in relation to knowledge relatedness between parent and spinoffs.

Fourth, we contribute to the spinoff literature by conceptualizing founders as a legitimacy spillover rather than merely a conduit for knowledge spillover. Previous studies show the active role of spinoff founders in transferring knowledge from the parent and combining it with the spinoff’s to generate superior organizational outcomes (e.g., Basu et al., 2015; Feldman et al., 2019). We add the role of founders in the process of reputation spillover by taking active measures post-founding, such as building their firm on similar knowledge domains of parents and forming an alliance with a parent, to benefit more from such spillover effects. This provides more evidence of the active role of founders in carrying imprints from imprinting sources (Simsek et al., 2015), by showing reputational spillover effects in addition to the established knowledge spillovers (Juhász, 2021; McEvily et al., 2012). This furthers our understanding of the benefits and limits of inheritances from parent to spinoff firms (cf. Ellis et al., 2017).

Fifth, our findings also have implications for industry-level competitiveness, economic growth, and overall market development. Proliferation of spinoffs and their ability to form alliances is critical for economic growth and market competitiveness of industries such as combinatorial chemistry, biopharmaceutical, and laser (Hagedoorn et al., 2018; Thompson & Klepper, 2005). While status has been shown to help form those alliances, success of spinoffs in those industries is based on maintaining a delicate balance between being related to their parent and being different to avoid hostile behaviors and market saturation affecting performance (Klepper & Sleeper, 2005; Walter et al., 2014). Interestingly, our findings indicate that in the mining industry, such status signals are most positive when spinoffs are both maintaining an ongoing tie with their parent firm and operating in the same markets. This is noteworthy, given that the commodity nature of mining industry is more prone to hostile behaviors (Klepper & Sleeper, 2005; Vaznyte et al., 2021). In that sense, aligned with findings from Walter et al. (2014), a collaborative approach towards networking is key to industry competitiveness and growth. This contributes to an emerging understanding of entrepreneurship in the natural resource industries by providing further evidence of the importance of connections (cf. Bakker & Shepherd, 2017; Henisz et al., 2014; Knoben & Bakker, 2019) in that the previous employment affiliations of founders cast a long shadow on the venture’s ability to succeed in building status in their network.

Our study has some limitations that imply future research opportunities. First, our study is limited to employee spinoffs, raising questions as to the extent to which our findings apply to other types of spinoffs, such as spinouts and divestitures. Spinouts and divestitures are typically originated by the parent firm in a knowledge domain closer to the parent (Clarysse et al., 2011), and the parent typically holds a higher and more formal involvement in spinouts as opposed to spinoffs (Semadeni & Cannella, 2011). Given our findings on the moderating role of knowledge relatedness and a formal tie between parent and spinoff, we would expect the imprinting effect of a parent’s reputation on spinout/divestiture status to be larger than what we found in a sample of employee spinoffs. Given the important role that spinoffs play in many industries (Fackler et al., 2016), it would be important for future research to investigate to what extent our findings generalize to other types of spinoffs.

In line with previous studies on status, our study is limited to within-industry reputational effects. Reputation partly concerns being known for something, which makes the quality signal very context-specific (Pollock et al., 2019), but it also refers to more generally being known in the industry networks (Lange et al., 2011), which might potentially influence status across industries or national boundaries. For example, Alvarez‐Garrido and Guler (2018) started to explore how status can transfer across international markets. Combining our longitudinal study with the work of Adams et al. (2016) on focal and downstream spinoffs may provide a fruitful first advance into the boundary conditions of parents’ reputation effects on new firms’ status that could subsequently expand into exploring how reputation of an affiliation in one industry affects new firm status in another industry or country.

Another idea to explore further would be to investigate the imprinting effect from multiple parents. The idea of “multiple parents” has been explored in the joint ventures (e.g., Anderson, 1990; Shenkar & Zeira, 1987) or spinouts contexts (Hervas-Oliver et al., 2017), but has received limited attention in employee spinoffs. Exploring the imprinting effects from multiple parents can have implications for both spinoff and imprinting literatures. Little is known about how multiple sources simultaneously imprint and interact in terms of amplifying or decaying each other’s imprinting effect (cf. Marquis & Tilcsik, 2013). While we followed extant literature in defining a parent and employee spinoff from the same industry (Klepper & Sleeper, 2005; Klepper & Thompson, 2010), it would be interesting to compare and contrast the relative imprinting effect of multiple parents from the same and different industries. Specifically as Simsek et al. (2015) point out, “we know little about how, why, and when entities differ in their receptivity and/or response to imprinting influences under the same temporal and spatial conditions” (p.306). Investigating imprinting effects from more than one parent and comparing the strength and extent of their imprinting forces in the employee spinoff context could provide some clarification on why different imprinting sources could leave weaker or stronger imprinting effects under similar conditions on the same entity.

An avenue for future research could be investigating the reciprocal relationship between spinoff status and reputation. Given that status is socially constructed and thus perceived, while reputation is a performance measure (Pollock et al., 2019), we would expect the effect of a parent’s reputation as a signal for the spinoffs quality to be weaker for spinoff reputation than for status. Specifically, Pollock et al. (2015) suggest: “While it is important to form relationships with high status others (Benjamin & Podolny, 1999), it is even more critical to develop a record of performance that builds a solid reputation early in the firm’s life (Hallen, 2008; Rindova et al., 2007). A good, early reputation enhances status, and the two continue to evolve in a dynamic, mutually beneficial way that allows the firm to later reap the rewards of both status and reputation” (p.506). It might be worthwhile retesting their hypotheses in the context of spinoffs and compare results to see if parental reputation as a predictor of spinoff status could make a significant difference in the prioritization of building such intangible assets in early stages of development of new firms.

Further, a fertile avenue for future studies is to extend our line of research by considering the effects of social responsibility-related aspects of parents’ and partners’ reputations on the future status of spinoffs. Social reputation is a competitive area for mining firms (Rodrigues & Mendes, 2018). Collaboration with stakeholders on social and environmental issues has been shown to significantly increase a mining company’s valuation (Frederiksen, 2018). In line with prior studies, we focused on the performance- and network-related elements of reputation (cf. Milanov & Shepherd, 2013; Pollock et al., 2015), but with a growing focus on sustainability, it is also important to know how a parent’s reputation for sustainable and responsible management would impact spinoffs’ status.

Notes

While status refers to sociometric characteristics of a firm, reputation is rooted in organizations’ past achievements and performance. Lange et al. (2011) identify three dominant conceptualizations for reputation, namely, that “reputation consists of familiarity with the organization, beliefs about what to expect from the organization in the future, and impressions about the organization’s favorability” (p.153).

Spinoffs (also called spin-offs or spin-outs) are distinguished from de novo startups (i.e., new ventures started by founders coming from outside of the industry or with no previous employment) and spinouts (i.e., new ventures started and backed by incumbents) (Agarwal and Shah, 2014; Fryges and Wright, 2014).

Studies suggest that top management teams and founders are essentially the same in new ventures (Preller et al., 2020).

We interviewed a number of senior executives and consultants active in the mining industry while we visited some mine sites in Australia. Although data gathered in this way were not formally used to test the hypotheses, what we learned from Australian mining executives and industry consultants gave us a more thorough understanding of the Australian mining industry.

We reran our analysis using Bonacich’s beta centrality and found similar results as to the ones reported in our study below. We thank an anonymous reviewer for guidance on this matter.

Our measure of spinoff’s status includes the tie with parent as a network link, as excluding this tie would lead to an incorrect measurement of the dependent variable. We do not expect this to affect the results, as there is a low and insignificant correlation between tie with parent and spinoff status of 0.04 (see Table 2). More importantly, eigenvector centrality as a global measure of networks is less sensitive to individual ties (Bonacich, 1987).

References

Adams, P., Fontana, R., & Malerba, F. (2016). User-industry spinouts: Downstream industry knowledge as a source of new firm entry and survival. Organization Science, 27(1), 18–35. https://doi.org/10.1287/orsc.2015.1029

Agarwal, R., Audretsch, D., & Sarkar, M. (2010). Knowledge spillovers and strategic entrepreneurship. Strategic Entrepreneurship Journal, 4(4), 271–283. https://doi.org/10.1002/sej.96

Agarwal, R., Campbell, B. A., Franco, A. M., & Ganco, M. (2016). What do I take with me? The mediating effect of spin-out team size and tenure on the founder–firm performance relationship. Academy of Management Journal, 59(3), 1060–1087. https://doi.org/10.5465/amj.2012.0853

Agarwal, R., Echambadi, R., Franco, A. M., & Sarkar, M. B. (2004). Knowledge transfer through inheritance: Spin-out generation, development, and survival. Academy of Management Journal, 47(4), 501–522. https://doi.org/10.5465/20159599

Agarwal, R., & Shah, S. K. (2014). Knowledge sources of entrepreneurship: Firm formation by academic, user and employee innovators. Research Policy, 43(7), 1109–1133. https://doi.org/10.1016/j.respol.2014.04.012

Al-Laham, A., & Souitaris, V. (2008). Network embeddedness and new-venture internationalization: Analyzing international linkages in the German biotech industry. Journal of Business Venturing, 23(5), 567–586. https://doi.org/10.1016/j.jbusvent.2007.09.001

Alvarez-Garrido, E., & Guler, I. (2018). Status in a strange land? Context-dependent value of status in cross-border venture capital. Strategic Management Journal, 39(7), 1887–1911. https://doi.org/10.1002/smj.2777

Anderson, E. (1990). Two firms, one frontier: On assessing joint venture performance. MIT Sloan Management Review, 31(2), 19.

Andersson, M., & Klepper, S. (2013). Characteristics and performance of new firms and spinoffs in Sweden. Industrial and Corporate Change, 22(1), 245–280. https://doi.org/10.1093/icc/dts046

Angrist, J. D., & Pischke, J.-S. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton University Press.

Arellano, M. (2003). Panel data econometrics. Oxford University Press. https://doi.org/10.1093/0199245282.001.0001

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Bae, J., & Lee, J. M. (2021). How technological overlap between spinouts and parent firms affects corporate venture capital investments in spinouts: The role of competitive tension. Academy of Management Journal, 64(2), 643–678. https://doi.org/10.5465/amj.2018.0223

Bahoo-Torodi, A., & Torrisi, S. (2022). When do spinouts benefit from market overlap with parent firms? Journal of Business Venturing, 37(6), 106249. https://doi.org/10.1016/j.jbusvent.2022.106249

Bakker, R. M. (2016). Stepping in and stepping out: Strategic alliance partner reconfiguration and the unplanned termination of complex projects. Strategic Management Journal, 37(9), 1919–1941. https://doi.org/10.1002/smj.2429

Bakker, R. M., & Shepherd, D. A. (2017). Pull the plug or take the plunge: Multiple opportunities and the speed of venturing decisions in the Australian mining industry. Academy of Management Journal, 60(1), 130–155. https://doi.org/10.5465/amj.2013.1165

Basu, S., Sahaym, A., Howard, M. D., & Boeker, W. (2015). Parent inheritance, founder expertise, and venture strategy: Determinants of new venture knowledge impact. Journal of Business Venturing, 30(2), 322–337. https://doi.org/10.1016/j.jbusvent.2014.06.002

Baum, J. A., Calabrese, T., & Silverman, B. S. (2000). Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strategic Management Journal, 21(3), 267–294. https://doi.org/10.1002/(SICI)1097-0266(200003)21:3/3C267::AID-SMJ89/3E3.0.CO;2-8

Baum, J. A., Rowley, T. J., Shipilov, A. V., & Chuang, Y.-T. (2005). Dancing with strangers: Aspiration performance and the search for underwriting syndicate partners. Administrative Science Quarterly, 50(4), 536–575. https://doi.org/10.2189/asqu.50.4.536

Benjamin, B. A., & Podolny, J. M. (1999). Status, quality, and social order in the California wine industry. Administrative Science Quarterly, 44(3), 563–589. https://doi.org/10.2307/2666962

Bidwell, M., Won, S., Barbulescu, R., & Mollick, E. (2015). I used to work at Goldman Sachs! How firms benefit from organizational status in the market for human capital. Strategic Management Journal, 36(8), 1164–1173. https://doi.org/10.1002/smj.2272

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Boeker, W. (1989). Strategic change: The effects of founding and history. Academy of Management Journal, 32(3), 489–515. https://doi.org/10.5465/256432

Bonacich, P. (1987). Power and centrality: A family of measures. American Journal of Sociology, 92(5), 1170–1182. https://doi.org/10.1086/228631

Bonacich, P. (2007). Some unique properties of eigenvector centrality. Social Networks, 29(4), 555–564. https://doi.org/10.1016/j.socnet.2007.04.002

Borgatti, S. P., Everett, M. G., & Freeman, L. C. (2002). Ucinet for Windows: Software for social network analysis. Harvard, MA: Analytic Technologies, 6, 12–15.

Bruneel, J., Van de Velde, E., & Clarysse, B. (2013). Impact of the type of corporate spin–off on growth. Entrepreneurship Theory and Practice, 37(4), 943–959. https://doi.org/10.1111/j.1540-6520.2012.00517.x

Bruneel, J., Yli-Renko, H., & Clarysse, B. (2010). Learning from experience and learning from others: How congenital and interorganizational learning substitute for experiential learning in young firm internationalization. Strategic Entrepreneurship Journal, 4(2), 164–182. https://doi.org/10.1002/sej.89

Buenstorf, G., & Klepper, S. (2009). Heritage and agglomeration: The Akron tyre cluster revisited. The Economic Journal, 119(537), 705–733. https://doi.org/10.1111/j.1468-0297.2009.02216.x

Capone, G., Malerba, F., & Orsenigo, L. (2019). Spinoffs in context: Entry and performance across different industries. Industrial and Corporate Change, 28(2), 259–282. https://doi.org/10.1093/icc/dty071

Carpenter, M. A., Pollock, T. G., & Leary, M. M. (2003). Testing a model of reasoned risk-taking: Governance, the experience of principals and agents, and global strategy in high-technology IPO firms. Strategic Management Journal, 24(9), 803–820. https://doi.org/10.1002/smj.338

Chang, S. J., & Matsumoto, Y. (2022). Dynamic resource redeployment in global semiconductor firms. Strategic Management Journal, 43(2), 237–265. https://doi.org/10.1002/smj.3332

Chatterji, A. K. (2009). Spawned with a silver spoon? Entrepreneurial performance and innovation in the medical device industry. Strategic Management Journal, 30(2), 185–206. https://doi.org/10.1002/smj.729

Chung, S., Singh, H., & Lee, K. (2000). Complementarity, status similarity and social capital as drivers of alliance formation. Strategic Management Journal, 21(1), 1–22. https://doi.org/10.1002/(SICI)1097-0266(200001)21:1%3c1::AID-SMJ63%3e3.0.CO;2-P

Cirillo, B. (2019). External learning strategies and technological search output: Spinout strategy and corporate invention quality. Organization Science, 30(2), 361–382. https://doi.org/10.1287/orsc.2018.1233

Clarysse, B., Wright, M., & Van de Velde, E. (2011). Entrepreneurial origin, technological knowledge, and the growth of spin-off companies. Journal of Management Studies, 48(6), 1420–1442. https://doi.org/10.1111/j.1467-6486.2010.00991.x

Coleman, J. S. (1988). Social capital in the creation of human capital. American Journal of Sociology, 94, S95–S120. https://doi.org/10.1086/228943

Colombo, M. G., Meoli, M., & Vismara, S. (2019). Signaling in science-based IPOs: The combined effect of affiliation with prestigious universities, underwriters, and venture capitalists. Journal of Business Venturing, 34(1), 141–177. https://doi.org/10.1016/j.jbusvent.2018.04.009

Dawson, J. F., & Richter, A. W. (2006). Probing three-way interactions in moderated multiple regression: Development and application of a slope difference test. Journal of Applied Psychology, 91(4), 917. https://doi.org/10.1037/0021-9010.91.4.917

De Cock, R., Andries, P., & Clarysse, B. (2021). How founder characteristics imprint ventures’ internationalization processes: The role of international experience and cognitive beliefs. Journal of World Business, 56(3), 101163. https://doi.org/10.1016/j.jwb.2020.101163

Dick, J. M., Hussinger, K., Blumberg, B., & Hagedoorn, J. (2013). Is success hereditary? Evidence on the performance of spawned ventures. Small Business Economics, 40(4), 911–931. https://doi.org/10.1007/s11187-011-9394-8

DiMaggio, P. (1997). Culture and cognition. Annual Review of Sociology, 23(1), 263–287. https://doi.org/10.1146/annurev.soc.23.1.263

Dimov, D., de Holan, P. M., & Milanov, H. (2012). Learning patterns in venture capital investing in new industries. Industrial and Corporate Change, 21(6), 1389–1426. https://doi.org/10.1093/icc/dts010

Dimov, D., & Milanov, H. (2010). The interplay of need and opportunity in venture capital investment syndication. Journal of Business Venturing, 25(4), 331–348. https://doi.org/10.1016/j.jbusvent.2009.01.002

Dimov, D., Shepherd, D. A., & Sutcliffe, K. M. (2007). Requisite expertise, firm reputation, and status in venture capital investment allocation decisions. Journal of Business Venturing, 22(4), 481–502. https://doi.org/10.1016/j.jbusvent.2006.05.001