Abstract

This article considers an N-firm oligopoly with abating and non-abating firms and analyses a dynamic setting in which the environmental regulator sets the tax rate to incentivise firms to undertake emission-reduction actions according to different hypotheses (fixed rule and optimal rule). The behaviour of the public authority sharply affects the firm’s (individual) incentive to move towards the abatement activity over time. This changes the number of (non)abating firms on the market and the corresponding social welfare outcomes. The article eventually shows that the environmental policy may cause oscillations resulting in a coexistence of the two types of firms in the long term and pinpoints the welfare outcomes emerging in the model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change is a pressing worldwide phenomenon (see, e.g., The Economist, 2019, for critical issues) predominantly stemming from greenhouse gas (GHG) emissions, which result from the process of combustion of fossil fuels for manufacturing and services production. According to the latest available data, World’s GHG emissions have increased by \(53\%\) in the period 1990–2019, with \(60\%\) of GHG emissions produced by ten countries, and China and the US responsible for \(36\%\) of them (Climatewatchdata.org 2022).

The worldwide worry about climate change has induced several countries to implement environmental policies in highly polluting industries. The EU is a leading political institution in the process of “de-carbonization” focusing on cutting GHG emissions (mainly CO and CO\(_{2}\)) from industrial activities. The main environmental policy instrument the EU uses to incentivise de-carbonization is the Emission Trading System (EU ETS), which started in 2005 and is still in place. It works on the “cap and trade” principle: the European institutions fix a cap on the total amount of some GHGs that installations the system covers can emit. Over time, the cap decreases: thus, total emissions fall. Within the cap (de facto, a quota), installations trade certificates which represent emissions allowances. Given their limited number, those certificates have value. After each year, to cover entirely its emissions, an installation must concede enough allowances, otherwise, fines are imposed. If an installation cuts emissions, the unused allowances can be either saved for future needs or sold to other installations that are short of them. This system guarantees flexibility because emissions are cut where it is more efficient, and carbon price incentivises investment in “green” (abatement) technologies (European Commission, 2022).

Recently, the US has also implemented actions to reduce emissions and fight climate change. However, the US attitude towards environmental policies has been oscillating. In 2008, under President Barack Obama, the US administration started preparing the Presidential Climate Action Plan (in 2013) to reduce GHG (mainly carbon dioxide) emissions, showing concerns about global warming and moving the administration closer to European counterparts and Japan. The directives in this plan represented a sharp reversal of the Bush administration, which became more open to climate-change issues quite late (The New York Times, 2009, 2013). However, during the subsequent administration, President Trump weakened or wiped out more than 125 rules and policies aimed at protecting the environment; as a consequence of looser environmental policies and controls, firms decreased their engagement in environmental activities (The New York Times, 2017; The Washington Post, 2020). Indeed, data show that, except for the years of the COVID-19 pandemic, emissions during the Trump administration have been increasing (E.P.A., 2023). With the Biden administration, environmental regulations are likely to be re-introduced (The New York Times, 2021). Moreover, after decades of unsuccessful congressional actions, on August 7th 2022, the US Senate passed the Inflation Reduction Act. Once law, this act will provide \(\$369\)bn in terms of subsidies and tax credits over a decade on renewable energy and electric vehicles, hydrogen hubs, carbon capture and storage, and more, representing the largest package of climate spending in the US history (The Economist, 2022). Another example is the case of Australia. In fact, due to a change of government in 2014, a carbon pricing policy introduced in 2012 was repealed (Ernest and Young, 2021). As a consequence, the level of emissions has increased in the subsequent three years after a five-year decreasing trend (World Bank, 2023). Therefore, firms’ adoption of environmental actions can change/adapt over time in response to different attitudes of the society, and thus indirectly of governments, toward environmental policies.

Given the major importance of these facts, there is a growing trend to acknowledge the effects of pollution abatement in the economic literature (regardless of the existence of ad hoc laws or regulations requiring these reductions), and the study of the policy-oriented firm’s incentive to reduce emissions in the market activities dates back at least to some decades ago (e.g., Carlsson, 2000; Oates & Strassmann, 1984; Carraro & Siniscalco, 1993; Conrad & Wang, 1993; Katsoulacos & Xepapadeas, 1996; Requate, 2005a; Simpson, 1995; Ulph, 1996; van der Ploeg & de Zeeuw, 1992), though the pressure towards an ecological transition (on the supply side) can result from various external stakeholders (e.g., consumers or community groups). The environmental theoretical literature developed in strategic competitive markets has mainly focused on static models with widespread aims and objectives (e.g., Buccella et al., 2021, 2022, 2023; Lambertini et al., 2017; Lee and Park, 2021; Ouchida & Goto, 2016; Poyago-Theotoky & Yong, 2019; Xu et al., 2022).

The climate issue calls for the attention of individuals, governments and international organisations; an investigation of this subject is timely and critical, amongst other things, to address its relevant dynamic concerns affecting the lifetime of individuals worldwide (Jørgensen et al., 2010; Requate, 2005b). Unfortunately, the literature dealing with policy issues (e.g., environmental taxation and other instruments), especially those that incentivise market-based instruments for the adoption of abatement technologies, in dynamic oligopolies (or in models that study the non-linear dynamics of firms in strategic markets) is rather scant, with some exceptions, e.g., Benchekroun and Chaudhuri (2011), who consider the dynamic effects of a Markovian tax on emissions in a polluting oligopoly industry, showing that it can favour cartelization, which can negatively affect social welfare. More recently, with other aims and modelling frameworks, Elsadany and Awad (2019) studied a mixed duopoly with public and private firms and environmental taxes considering stability issues and applying methods for chaos control, whereas van der Meijden et al. (2022) and Yanase and Kamei (2022) respectively concentrate on an oligopoly-fringe model with non-renewable resources to assess the dynamic effects of imperfect competition in markets for fossil fuel on welfare, climate damages and the Green Paradox, and the effects of government permits in a two-country differential game that account for transboundary pollution control with a continuum of polluting oligopolistic industries. In addition, some works have focused (e.g., Antoci et al., 2021) on the effects of public policies to prevent offshoring phenomena by firms towards countries with less stringent environmental legislation.

The present research departs from the recent contribution by Buccella et al. (2021) framed in a static duopolistic setting, in which the authors pinpoint the existence of a trade-off on the firm side whether to abate pollution through an end-of-pipe technologyFootnote 1 when the environmental regulator sets the tax rate to maximise social welfare (with the aim of incentivising emission-reduction actions). The main economic mechanism of Buccella et al. (2021) works as follows. On one hand, installing and using an end-of-pipe technology forces firms to incur green R &D investment costs and then profits reduce through this channel. On the other hand, the abatement activity allows abating firms to save on the environmental tax burden computed on emissions, which is higher for non-abating than for abating firms. The strategic decision of each profit-maximising firm in this environment passes through simple, but non-trivial, effects that modify the individual incentive to use either dirty technology or green technology. When the benefits allowed by a reduced tax burden on emissions are lower (resp. overcome) the costs to incur R &D green investments, firms get higher profits by choosing not to abate (resp. to abate). To sum up, abating firms sustain R &D green investment costs, but save on the environmental tax burden; non-abating firms do not sustain R &D green investment costs, but the environmental tax burden is higher than under abatement. The convenience towards or against pollution abatement is studied by applying a game-theoretic approach in non-cooperative (static) quantity-setting and price-setting duopolies and depends on the extent of public awareness towards a clean environment and the efficiency of the R &D green technology. The endogenous market outcomes range from a Pareto efficient sub-game perfect Nash equilibrium (SPNE), in which firms do not abate, to a Pareto efficient SPNE, in which firms abate, passing through an anti-green prisoner’s dilemma and coordination game with an indeterminate outcome in pure strategies.

The present article extends (Buccella et al., 2021) in a twofold direction: (1) it considers an N-firm oligopoly with dirty (D) and green (G) firms, and (2) it passes to a dynamic setting in which the environmental regulator sets the tax rate to incentivise firms to undertake emission-reduction actions according to different hypotheses (fixed rule and optimal rule) by relaxing the assumption that the number of firms belonging to every group is given over time. From a dynamic point of view, this article is closer in spirit to Benchekroun and Chaudhuri (2011) and aims to fill a gap in the existing literature on the nonlinear dynamics of oligopolies by considering different ways to set the environmental tax rate dynamically and how the regulator can indeed modify the individual incentives of firms whether to abate over time. The article pinpoints several static and dynamic results emerging in an oligopoly in which the regulator acts as an additional player (other than the N oligopolistic firms) by choosing the tax rate either with a fixed rule or an optimal (welfare-maximising) rule. Choosing an optimal rule for environmental taxation generates incentives that, depending on the main parameters of the problem (the efficiency of the R &D cleaning technology and the societal awareness towards a clean environment) allow profit-maximising firms to deviate to play an environmentally friendly strategy (by installing an end-of-pipe cleaning technology) instead of maintaining dirty technology. The number of firms prevailing in the long term can also be characterised by persistent oscillations.

The rest of the article proceeds as follows. Section 2 presents the static (one-shot) modelling oligopoly by considering the demand side and the production side of the economy, specifically showing the technological characteristics of the abating and non-abating firms and the behaviour of the (welfare-maximising) environmental regulator. It also studies the Nash equilibrium emerging in this setting. Section 3 moves to the dynamic analysis by considering two different hypotheses about the behaviour of the regulator and presents the main analytical results and simulation exercises. Section 4 outlines the conclusions.

2 The model

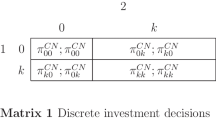

Consider an oligopolistic industry in which N firms (\(N>0\) is constant) compete on quantities. The production process leads to the emission of pollution (Ulph, 1996). To simplify the discussion, we assume that one unit of output produced by the generic firm i corresponds to one unit of pollution, i.e., the production activity takes place through a polluting technology, where \(i=\{1,\ldots ,N\}\) is the firm index. The generic firm i produces \(q_{i}\) units of polluting output. In addition, firms choose whether to abate pollution by using an end-of-pipe technology, which allows them to abate \(k_{i}<q_{i}\) units of pollutant. The number of abating firms is denoted by G (green), whereas the number of non-abating firms is denoted by D (dirty), and \(N=D+G\). The index \(d=\{1,\ldots ,D\}\) denotes the generic dirty D-firm and the index \(g=\{1,\ldots ,G\}\) denotes the generic green G-firm. Thus, if the generic firm i chooses not to abate, it emits an amount of pollutant equal to \(q_{i}\). Differently, if the generic firm i chooses to abate, it emits an amount of pollutant equal to \(e_{i}=q_{i}-k_{i}\) (Buccella et al., 2021; Ulph, 1996).

The environmental regulator (government) aims at levying an emissions tax \(\tau \in [0,1)\) per each unit of polluting output to incentivise firms undertaking emissions-reduction actions to maximise social welfare. Consequently, the tax base under no abatement is \(q_{i}\) and the corresponding tax revenue is \(\tau q_{i}\), whereas the tax base under abatement becomes \(q_{i}-k_{i}\) (i.e., the remaining pollution), and the corresponding tax revenue is \(\tau (q_{i}-k_{t})\).

The aggregate environmental damage from industrial production is captured by the expression:

where ED is a convex function of total pollution (van der Ploeg and de Zeeuw, 1992; Ulph, 1996) and \(x>0\) is the burden that the environmental regulator attaches to the environmental damage, representing the awareness of the overall society towards the environment and thus against the damage from industrial production (computed as aggregate emission squared). An increase in x implies, ceteris paribus, an increase in the extent of the relative weight of the environmental damage as measured by the overall society.

On the demand side, we assume that goods are homogeneous and the inverse market demand for the product of every firm (which is the result of the maximisation of a quadratic utility function of consumers with identical preferences) is given by:

where p is the market price.

Profits of the generic firm i are given by the following expression:

in which we have assumed zero marginal costs, \(F_{i}\ge 0\) is the fixed costFootnote 2 to install the abating technology, \(C(k_{i})=\frac{z}{2}k_{i}^{2}\) represents the cost of the effort to abate pollution, which depends only on \(k_{i}\) (end-of-pipe), and \(z>0\) is a parameter weighting abatement efficiency thus scaling up/down the abatement effort total costs. It represents an exogenous index of technological progress, measuring for example the appearance of a new technology weighting the degree at which the available abatement can be implemented. A reduction in z can be interpreted as a technological advance.

The profit equation of the generic non-abating D-type firm is:

where \(C(k_{d})=0\), \(F_{d}=0\) and \( {\displaystyle \sum \limits _{h\ne d}} q_{h}\) is the sum of the quantities produced by all dirty firms other than firm d.

Differently, the profit equation of the generic abating G-type firm is:

where \( {\displaystyle \sum \limits _{r\ne g}} q_{r}\) is the sum of the quantities produced by all green firms other than firm g.

The mechanism trading-off the benefits and costs of pollution abatement is clear from the expressions in (4) and (5 ). In fact, on one hand, the abatement activity forces a firm to incur abatement (variable and fixed) costs to install the abatement technology. This effort tends to reduce the profits of each abating firm. On the other hand, abating pollution allows each abating firm to save on the side of the environmental tax costs from taxation and then pay a smaller amount of environmental taxes than each non-abating firm. This effect tends to increase the profits of each abating firm. Studying the convenience for each selfish firm to install an abatement technology depends on the relative weight of the marginal benefits of pollution abatement compared to the corresponding marginal costs. This is the main aim of the present article, which tackles this issue in a dynamic oligopoly framework.

The optimality conditions for each profit-maximising firm allow us to compute the expressions for the output reaction functions of the generic dirty (d) firm and the generic green (g) firm. These functions are respectively given by:

and

In addition, the generic g-firm also chooses the abatement effort to satisfy the following condition:

By taking into account the expressions (6) and (7) and considering the homogeneity of both groups of green and dirty firms (i.e., the symmetric equilibrium condition, which implies that all the firms belonging to one group are identical), we obtain the quantity produced by each type of firm given the behaviour of the rivals belonging to the other type, that is:

and

From (9) and (10) it is possible to compute the equilibrium quantities at the Nash equilibrium, whose coordinates are given by:

where

The expression in (11) implies that D-firm and G-firm produce the same amount in equilibrium. This is because of the properties of the abating end-of-pipe technology, which does not directly affect the production process.

The equilibrium consumer surplus, \(CS^{*}\), is defined as follows:

whereas the corresponding equilibrium aggregate environmental damage, \(ED^{*}\), and the total tax revenue, \(TR^{*}\), are respectively given by:

where \(k^{*}=k_{g}\) and

The producer surplus corresponding to the Nash equilibrium, \(PS^{*}\), is:

where

and

where \(F:=F_{g}\) to simplify the notation. Therefore, the equilibrium social welfare function \(W^{*}\) is described by the following index:

Equation (19) represents a multi-objective function including heterogeneous components with conflicting goals and objectives. The environmental regulator maximises the expression in (19) by choosing the extent of the environmental tax rate, \(\tau \). From the first order conditions, one gets:

From simple calculations we can verify that \(\tau ^{FOC}<1\) but \(\tau ^{FOC}\) can in general be negative. For \(\tau ^{FOC}\in [0,1)\) the following expression must be verified:

The condition in (21) implies that the public awareness should be high enough to guarantee that the society is willing to collect resources to be used as a public transfer to incentivise firms to undertake emission-reduction actions through ad hoc environmental taxation.

The correct expression of the optimal tax rate is then given by:

Let us now focus on how taxation is affected by G, i.e., the number of green firms. In particular, let us consider the case of a constant value of N, i.e., the total number of firms. Therefore, a change in G leads to a change in the relative number of green and dirty firms. The results are summarised in Proposition 1 (see also Fig. 1 for a geometrical illustration of the result of the proposition).

Proposition 1

Let us consider \(x_{1},x_{2},\widetilde{x},{\widehat{x}}\) as defined in the proof. Then, the following results hold.

-

(I)

Let \(z<\sqrt{1+N}\) then \(\widetilde{x}<{\widehat{x}}<x_{1}<x_{2}\). Furthermore

-

(a)

if \(x>x_{2}\) then \(\tau ^{o}\) is a decreasing and positive function \(\forall G\in [0,N]\);

-

(b)

if \(x\in (x_{1},x_{2})\) then \(\tau ^{o}\) is positive and inverted U-shaped;

-

(c)

if \(x\in ({\widehat{x}},x_{1})\) then there exists \({\widehat{G}}\) such that \(\tau ^{o}=0\) \(\forall G\in \left[ 0,{\widehat{G}}\right] \) and \(\tau ^{o}>0\) \(\forall G\in \left( {\widehat{G}},N\right] \). When \(\tau ^{o}>0\), \(\tau ^{o}\) is inverted U-shaped;

-

(d)

if \(x\in (\widetilde{x},{\widehat{x}},)\) then \(\tau ^{o}\) is a non-decreasing function \(\forall G\in [0,N]\) and there exists \({\widehat{G}}\) such that \(\tau ^{o}=0\) \(\forall G\in \left[ 0,\widehat{G}\right] \) and \(\tau ^{o}>0\) \(\forall G\in \left( {\widehat{G}},N\right] \); e) if \(x<\widetilde{x}\) then \(\tau ^{o}=0\) \(\forall G\in [0,N]\).

-

(II)

Let \(z>\sqrt{1+N}\) then \(\widetilde{x}<x_{1}<{\widehat{x}}<x_{2}\). Furthermore

-

(a)

if \(x>x_{2}\) then \(\tau ^{o}\) is a decreasing and positive function \(\forall G\in [0,N]\);

-

(b)

if \(x\in ({\widehat{x}},x_{2})\) then \(\tau ^{o}\) is positive and inverted U-shaped;

-

(c)

if \(x\in (x_{1},{\widehat{x}})\) then \(\tau ^{o}\) is positive and strictly increasing;

-

(d)

if \(x\in (\widetilde{x},x_{1})\) then \(\tau ^{o}\) is a non-decreasing function \(\forall G\in [0,N]\) and there exists \({\widehat{G}}\) such that \(\tau ^{o}=0\) \(\forall G\in \left[ 0,{\widehat{G}}\right] \) and \(\tau ^{o}>0\) \(\forall G\in \left( {\widehat{G}},N\right] \);

-

(e)

if \(x<\widetilde{x}\) then \(\tau ^{o}=0\) \(\forall G\in [0,N]\).

Proof

To understand the behaviour of the optimal tax rate, we consider the function \(\tau (G)=\tau ^{FOC}\). We have that

Therefore, \(\tau (0)>0\) if and only if \(x>x_{1}\equiv 1/N\) where \(x_{1} <1\).

In addition,

so that \(\tau (N)>0\) if and only if \(x>\widetilde{x}\equiv \frac{z}{N(1+z+N)}\) where \(\widetilde{x}\in [0,\frac{1}{N})\).

From the derivative of (20) we have that

where \(A\!\!=\!\!-\left[ x(N+1)\right] ^{2}\!\!<\!\!0\), \(B=\left[ 2(1+N)(1-Nx)xz\right] \) and \(C=z^{2}[1+N(1+x)-x^{2}\) \(N^{2}]\). We note that \(B>0\Leftrightarrow x<x_{1}\) and \(C>0\Leftrightarrow x<x_{2}\equiv \frac{1+\sqrt{5+4N}}{2N}\).

Let M(G) be the second-degree polynomial that appears inside the brackets on the right-hand side of (23). Then, its discriminant is equal to

Then, \(\tau \) is a monotonic decreasing function of G if \(x>x_{3}\equiv 1+2/N\).

We also note that \(\widetilde{x}<x_{1}<x_{2}<x_{3}\).

Instead, if \(x<x_{3}\) the polynomial M(G) shows (a) two negative roots if \(B<0\) and \(C<0\) (that is, if \(x>x_{2}\)); (b) two roots of opposite sign if \(B<0\) and \(C>0\) (that is, if \(x\in (x_{1},x_{2})\)) or if \(B>0\) and \(C<0\) (that is, if \(x<x_{1}\)). Other combinations of the signs of B and C are not possible.

In case (a), the expression in (20) is a monotonic decreasing function in the interval [0, G]. In case (b), the graph of the function in (20) shows an inverted U-shaped behaviour in the interval \([0,+\infty )\) with a maximum point at

We note that \(G^{M}<N\) if and only if \(x<{\widehat{x}}\), where

A direct comparison shows that\(\ \widetilde{x}<{\widehat{x}}\), and \(\widehat{x}<x_{1}\Leftrightarrow z<\sqrt{N+1}\). The proof follows by the comparison of the different results obtained. \(\square \)

Proposition 1 shows, amongst other things, that the optimal tax rate can be a decreasing function of the number of green firms (G). In fact, although the environmental damage is an increasing function of the number of dirty and green firms (and this implies a greater need for taxation), the output of the individual firm decreases with G (and this implies a lower need for taxation). Therefore, the environmental impact of the production of each firm and the aggregate environmental damage decrease with G. Consequently, there is less need to levy an ad-hoc tax to incentivise firms to abate pollution. Finally, we note that regardless of its trend over time, taxation remains positive for any G if x is sufficiently large (\(x>1/N\)).

Panel A: \(N=10\), \(z=0.2\). Panel B: \(N=10\), \(z=5.2\). Outline of the results of Proposition 1

3 The dynamic setting

In the static analysis made so far we assumed that the number of the firms belonging to the two groups (D and G) is given and constant over time. This assumption, however, is too strong in a dynamic setting, as firms may want to change their strategy and play the one that guarantees the highest profit over time, in turn, moving from D to G (or viceversa). In this regard, an innovation of the present article compared to the existing related literature, especially (Buccella et al., 2021), which has mostly been developed in a static setting, is to move towards a dynamic framework considering various assumptions about the behaviour of the environmental regulator, which can significantly affect the profits of the firms belonging to both the D-group and G-group, and then it can modify the individual incentive whether to abate over time.

More formally, we assume – irrespective of the strategy adopted in the past – that a given percentage (\(0<\delta <1\)) of firms can, in every period, change the status and switch towards producing, at time \(t+1\), by means of the technology allowed to get the highest profits in the current period (time t), where \(t\in \mathcal {N}\) is the time index. Indeed, we are assuming that a given percentage of equipment used for the production process loses its functionality (natural obsolescence, breakdown, etc.) and therefore needs to be changed. When firms must do new investments, they can decide whether to install green or dirty technology.

If both technologies (D and G) yield the same profits, firms that are allowed to change their status will half (\(\delta N/2\)) choose to be green and half (\(\delta N/2\)) choose to be dirty. Once they have decided on their strategies, firms coordinate themselves on the Nash equilibrium defined in (11). We note that regardless of the choices of the firms to be dirty or green they continue to produce the same level of output in accordance with the end-of-pipe technology leading the G-firm to abate non-strategically, as is clear from the expression in (8).

We now introduce the index describing the incentive to change the status time by time, i.e. the profit differential between G and D. This index is given by the following expression:

The dynamic analysis that will be studied in the subsequent sections will consider two hypotheses about the behaviour of the environmental regulator to set the tax rate \(\tau \) over time: 1) fixed environmental tax rate, and 2) optimal environmental tax rate.

3.1 Fixed environmental tax rate

This section deals with a first, simple, exercise, and considers that the level of taxation decided by the public authority is constant over time, i.e., \(\tau _{t}=\tau \) for any t. By using this assumption together with the expression in (25) the dynamics of the system will be monotonic and convergent towards the equilibrium in which all firms choose to abate (resp. not to abate) if:

where \(\tau _{TH}:=\sqrt{2zF}\).

The dynamic system in this case is given by:

Figure 2 shows the time evolution of the number of green firms existing in the market depending on the value of the tax rate above or below the threshold \(\tau _{TH}\). Regarding the threshold, we note that it depends positively on the fixed cost. Thus, when the fixed costs to install a cleaning technology are relatively high a firm is incentivised to become green in the long term only whether the tax rate is high enough (see Antoci et al., 2021 on the problem of the possibility of offshoring in the presence of overly burdensome regulation of firms in a context of perfect competition).

If the environmental tax rate is fixed over time, results are quite simple: in the long term, only one type of firm remains in the market. There exists a boundary—represented by \(\tau _{TH}\)— that separates the possible evolution of the adopted technologies (green or dirty). This result seems to contrast with the observation of actual markets in which firms that adopt different technologies coexist (Konar and Cohen, 2000). In the next section, we will see how considering a more articulated action of the public authority can sharply change the dynamic results of the model.

3.2 Optimal environmental tax rate

Like the static analysis, in this section we will assume that government acts to maximise social welfare. In a dynamic context in which the relative number of firms (i.e., the percentage of firms of type G and of type D) is not constant, this objective is not straightforward. Indeed, from the expression in (20) the optimal tax rate depends on the existing number of firms. As it would be difficult to consider an environment in which the regulator has this type of information updated time by time, we will assume that at time t it will choose an optimal tax rate based on the number of G-firm and D-firm that existed in the past (i.e., at time \(t-1\)), which is therefore assumed to be known (i.e., there is an information lag of one period). In other words, in this section we will study the dynamics of a game with \(N+1\) players in which \(D+G\) (profit maximising) firms coordinate themselves on the Nash equilibrium given the level of the environmental taxation, whereas the regulator (the additional player) pursues the goal of social welfare maximisation.

This type of strategic interaction, in which players have different objectives or they are heterogeneous, has not been much explored in the literature on the dynamics of oligopolies. Over the course of the years, this literature has mainly focused on the study of the heterogeneity in the strategies adopted by firms, which were all basically profit-oriented (Lamantia and Radi, 2018; Zeppini, 2015), in contexts of bounded rationality and/or limited knowledge of the market (e.g., Bischi et al., 2015).

Before moving on through the details of the dynamic analysis, we note that the green technology used in the paper (end-of-pipe) is standard in the static industrial organisation (IO) literature, at least since Ulph (1996) and Asproudis and Gil-Moltó (2015). This implies that there is no multiplicative relationship between production and abatement in the expression of profits (because the effectiveness of green technology in reducing the environmental damage from industrial production occurs at the end of the production process). Consequently, in the static model, there is no relationship between q and k in the optimum and the equilibrium values of production and abatement depend only on the environmental tax rate. Unlike this scenario, considering an environmental technology that follows the R &D models à la d’Aspremont and Jacquemin (1988, 1990) would lead to a more articulated relationship, in which the optimal choices of one firm on quantity would also depend on the abatement choices of other firms, and abatement decisions would be defined strategically.

In a dynamic setting, the expression defining the profit differential in (25), by assuming a strictly positive value of the tax rate, modifies to become

where

and

Given the positivity of the denominator in (28) we can concentrate on the sign of the expression

We note that when the optimal tax rate is zero the difference between G- and D-firms is irrelevant as no firm is incentivised to invest in cleaning technologies and all the firms become dirty (this is clearly shown by the expression in (8)).

Then, we have that

where \(H:[0,N]\rightarrow [0,N]\).Footnote 3

We observe that no fixed point \(G\in (0,N)\) can exist (unless when \(P(G)=0\) for \(G=N/2\) and \(\tau ^{FOC}(N/2)>0\ \)that happens with zero probability), whereas if the fixed point \(G=0\) exists it is locally asymptotically stable, and the same applies to fixed point \(G=N\). In fact, we have \(H^{\prime }(0)=H^{\prime }(N)=1-\delta \). In this regard, the following results hold.

Proposition 2

Let us consider the map defined in (35). If a) \(x<\frac{1}{N}\) or if b) \(x>\frac{1}{N}\) and \(z>\frac{1}{2F}\) then the fixed point \(G=0\) exists and it is locally asymptotically stable. If \(x>\frac{1}{N}\) and \(z<\frac{1}{2F}\) the fixed point \(G=0\) does not exist.

Proof

We have that

and

Let us consider the case \(x<1/N\). From (37) if follows from the definition of map (35) that the fixed point 0 exists. Let us consider the case \(x>1/N\). By evaluating the elements of the polynomial \(\Psi _{1}\) and knowing that discriminant of \(\Psi _{1}\) is positive, the polynomial always admits two real roots \({\overline{x}}_{1}=\frac{1+2zFN-(N+1)\sqrt{2Fz}}{N(1-2Fz)}\) and \({\overline{x}}_{2}=\frac{1+2zFN+(N+1)\sqrt{2Fz}}{N(1-2Fz)}\). For \(z>\frac{1}{2F}\), \({\overline{x}}_{1}\) and \({\overline{x}}_{2}\) are negative and P(0) takes a negative value for any \(x>1/N\). If \(z<\frac{1}{2F}\) we have that \({\overline{x}}_{1}<0<{\overline{x}} _{2}\) and it is easily verified that \({\overline{x}}_{2}<1/N\). So again \(P(0)>0\) \(\forall x>1/N\). Combining the results, the thesis follows. \(\square \)

Proposition 3

Let us consider the map defined in (35). If a) \(\frac{x}{z}<\frac{1}{N^{2}+Nz+N}\) or if b) \(\frac{x}{z}>\frac{1}{N^{2}+Nz+N}\) and \(F>\frac{z}{2}\left( \frac{N^{2}x+x(z+1)N-z}{X}\right) ^{2}\) then the fixed point \(G=N\) does not exist. If \(\frac{x}{z}>\frac{1}{N^{2}+Nz+N}\) and \(F<\frac{z}{2}\left( \frac{N^{2}x+x(z+1)N-z}{X}\right) ^{2}\) then the fixed point \(G=N\) exists and it is locally asymptotically stable.

Proof

Let \(X=xN^{3}+((2x+1)z+2x)N^{2}+((x+1)z^{2}+(2x+2)z+x)N+z\). We have that

and

By evaluating the sign of \(\tau ^{opt}(N)\) and \(\Psi _{2}(F)\) we get the result. \(\square \)

There are three parameters useful to disentangle the results, F, x and z: F is the fixed cost to install the cleaning technology for each G-firm, x is the awareness of the overall society towards a clean environment, in turn, measuring the weight the society attaches to against the damage from industrial production, and z measures the efficiency of the cleaning technology.

Intuitively, \(G=0\) is a possible outcome of the model when the weight given by society to having a clean environment is too low, or society has a high relative focus on environmental quality but either the efficiency of the available technology is low or the fixed cost to activate it is too high \(\left( z>\frac{1}{2F}\right) \). Conversely, \(G=N\) is a possible outcome of the model when the ratio x/z is sufficiently large and simultaneously the fixed cost to install the cleaning technology is sufficiently low.

In the present model, as the solutions of a fourth-degree polynomial are involved in the definition of the switching points, their analytical expression, although feasible, is rather cumbersome. However, a result on the occurrence of switches is given by the following proposition that greatly simplifies the subsequent analysis:

Proposition 4

Map (35) has at most two switches. All switches are induced by changes in the sign of (34).

Proof

We first note that the profit differential is described by a fourth degree polynomial. From the signs of the coefficients \(A_{i},i=0..4\) it follows that this polynomial has at most three positive roots. For \(F=0\) the polynomial reduces to a second degree polynomial defining a non-negative convex function that becomes zero at \(G=\widetilde{G}:=\frac{z(1-Nx)}{x(N+1)}\). For this value, we also have that \(\tau ^{FOC}=0\). We recall that for \(\tau <0\) the map is \(G_{t+1}=(1-\delta )G_{t}\).

Let us denote by P(G, F) the polynomial (34) in which we explicit the dependence of this polynomial on F. We note that \(\frac{\partial P(G,F)}{\partial F}<0\) so that in the intervals where P is negative an increase in the value of F maintains P negative. In addition, \(\frac{\partial ^{2}P(G,F)}{\partial G\partial F}<0\), \(\frac{\partial ^{3}P(G,F)}{\partial ^{2}G\partial F}<0\) so that in the intervals where P is decreasing (resp. concave) with respect to G an increase in the value of F maintains P decreasing (resp. concave) with respect to G. For any value of \(F>0\) we have that \(\underset{G\rightarrow \infty }{\lim }P(G,F)=-\infty \). From the fact that P(G, F) is \(C^{\infty }\), we have the existence of a threshold value \(\widetilde{F}\) such that for \(\forall F\in (0,\widetilde{F})\) the polynomial admits two relative maxima \(G_{M}^{1}\) and \(G_{M}^{2}\) with \(G_{M}^{1}<G_{M}^{2}\) and one relative minimum \(G_{m}\). Since for \(F>0\) it turns out that a) \(P(\widetilde{G},F)<0\) and b) there exists an interval \(\left( \widetilde{G}-\varepsilon ,\widetilde{G}\right) \) with \(\varepsilon >0\) for which \(\frac{\partial P(G,F)}{\partial G}<0\) \(\forall G\in \left( \widetilde{G}-\varepsilon ,\widetilde{G}\right) \), an interval \((0,\widetilde{\widetilde{F}})\subset (0,\widetilde{F})\) exists such that \(\forall F\in (0,\widetilde{\widetilde{F}})\) the polynomial has four roots \(G_{i}\), \(i=0\ldots 3\), ordered, without loss of generality, in ascending order with \(G_{0}<G_{1}<\widetilde{G}\). Let us consider two cases depending on the value of Nx.

Case 1. If \(Nx<1\), \(\forall F\in (0,\widetilde{\widetilde{F}})\) we have that \(G_{0}<0\) and \(G_{0}<G_{1}<\widetilde{G}<G_{2}<G_{3}\), with P negative in the interval \((\widetilde{G},G_{2})\). Thus, in the interval \([0,\min (G_{2},N))\) the map is given by \(G_{t+1} =(1-\delta )G_{t}\) from which it follows that \(\forall F\in (0,\widetilde{\widetilde{F}})\) at most two switches for the map can exist. Given the properties of P described so far, the maximum number of switches is still two even considering F varying in the interval \((0,+\infty )\). In fact, starting from \(F\in (0,\widetilde{\widetilde{F}})\) as F increases the roots \(G_{2}\) and \(G_{3}\) can go outside the interval [0, N] or they can disappear whereas the roots \(G_{0}\) and \(G_{1}\) as long as they exist will be always smaller than \(\widetilde{G}\) and therefore not relevant for the definition of the dynamics.

Case 2. If \(Nx>1\), \(\forall F\in (0,\widetilde{\widetilde{F}})\) we have that \(G_{0}<G_{1}<\widetilde{G}<0\) and \(\widetilde{G}<G_{2}<G_{3}\), with (a) P negative in the interval \([0,G_{2})\) if \(G_{2}>0\) or (b) P positive in the interval \([0,G_{3})\) if \(G_{2}<0\). Then, also in this case, \(\forall F\in (0,\widetilde{\widetilde{F}})\) at most two switches for the map can exist. Starting from \(F\in (0,\widetilde{\widetilde{F}}),\) as F increases, \(G_{0}\) and \(G_{1}\) continue to be negative, as long as they exist, and thus they are not relevant for the definition of the dynamics. Therefore, the maximum number of switches is still two. Concerning which inequality induces the switch between the pieces of the map, taking into account the non-negativity constraint on \(\tau \), we can conclude that for \(x>1/N\) the inequality \(\tau ^{FOC}(G)>0\) is always verified and therefore any switches of the map are only determined by changes of signs of P(G) in the interval [0, N]. When \(x<1/N\) we have that at the point \(\widetilde{G}\), where \(\tau ^{FOC}\) changes sign from negative to positive \(P(\widetilde{G})<0\) and therefore no change at \(\widetilde{G}\) occurs. \(\square \)

Despite the switches induced by changes in the sign of (34), the non-negativity of \(\tau ^{FOC}\) cannot be excluded from the definition of the map. This is because if \(x<1/N\) there are cases in which there exists an interval in the set \(0<G<\widetilde{G}\) in which \(P(G)>0\) and \(\tau ^{FOC}<0\). Indeed, without the positivity condition of \(\tau ^{FOC}\), in that interval there would be the incentive to pollute (with no economic sense) this would let “green” firms (i.e., the firms that instal the cleaning technology) be super-polluting (as the amount of abatement becomes negative when \(\tau ^{FOC}<0\)) while increasing at the same time their profits.

We remark that even if the sign changes of \(\tau ^{FOC}\) are not part of the definition of the switches, the values of G at which these switches occur (determined by the roots of P) involve all the parameters of the model except for \(\delta \). In fact, \(\delta \) only contributes to defining the slope of the map, which is given by \(1-\delta \) for both I and Z. In this regard, we note that much of the contributions in the literature focus on models in which the switches are usually set exogenously and the properties of the map are studied as the parameters defining the pieces of the map. See for example the works generated by the pioneering contributions of Sushko et al. (2003) and Tramontana et al. (2010) on business cycles and inflationary dynamics, respectively. An exception is given by the work of Sushko et al. (2005), which elaborates on some properties of an economic growth model in which parameters enter simultaneously into the definition of the pieces of the map and the definition of the switching point.

Considering the results of Proposition 3 we can infer that (1) when the two fixed points are attractive (see Propositions 2 and 3), the dynamics are defined by a two-branch map and trajectories converge to 0 or N if the initial condition respectively lies to the left or right of the switching point (see, for instance, Fig. 8, Panel A), (2) if there are two switches then 0 is an attractor, and the map is described by Z, first and third branches, and by I, second branch (see, for instance, Fig. 9, Panel A), (3) if at least one of the fixed points is not attractive, regardless of whether the map consists of two or three branches, there is still a set of initial conditions for which the dynamics are (at least temporarily) oscillatory, (4) when there are persistent oscillations only two branches of the map are involved to describe the oscillatory dynamics of the model, I before and Z after the discontinuity point (see, for instance, Fig. 7, Panel A and Fig. 9, Panel A). We note however that the existence of a third branch is also possible.

Despite the possibility of persistent oscillations, from a mathematical point of view the model is characterised by regular dynamics as the slope of both branches, given by \(1-\delta \), is positive and smaller than 1. When a cycle of period k exists its stability is determined by the eigenvalue

Then, all the existing cycles are locally stable. When a stable cycle does not exist the dynamics are quasi-periodic with trajectories dense on an interval. We pinpoint that in our model we cannot observe chaotic regimes as there is no sensitivity to initial conditions, i.e., trajectories generated by two different neighbouring initial conditions will remain close to each other at every iterate. Also, it is not possible to have an attractive Cantor set. This is because it needs the existence of infinitely many coexisting unstable cycles, which cannot occur in this regime of stable dynamics.

We will now consider the various scenarios, given N, by letting the other parameters vary and then study the properties of the map. To simplify the exposition of the results we will define the map to be of type I (resp. Z) if the dynamics are characterised only by branch I (resp. Z) on the domain [0, N]. Instead, we define the map to be of type I-Z (resp. Z-I) if there is only one switching point on the interval [0, N] such that the dynamics are characterised by I (resp. Z) before the switching point, and by Z (resp. I) after the switching point. On similar ground, we will define the map to be of type Z-I-Z if there are two switching points \(\hat{G}_{1}\) and \(\hat{G}_{2}\) on the interval [0, N] and the dynamics are characterised by I on the intervals \([0,\hat{G}_{1})\) and \((\hat{G}_{2},N]\) and by Z on the interval \((\hat{G}_{1},\hat{G}_{2})\).

Figure 3 classifies the possible configurations of the map in the parameter space (x, z) for different values of the fixed cost F. The meaning of the colours in the various panels is detailed in the caption. Starting from the (polar) condition \(F=0\) (Panel A), so that firms incur no additional cost to switch from dirty to green technology, we note that depending on the value of x and z the convergence of the industry to a state in which all firms are green is not guaranteed. In particular, given any level of z, if the society’s awareness towards a clean environment is relatively low (i.e., very low values of x) then all firms in the long term may remain dirty (white region). The result is reversed if x is sufficiently high (green region). It is interesting to note that it is also possible to observe (for an intermediate range of values of x) a situation in which the initial conditions (i.e., the relative number of G- and D-firms) may lead to opposite results (blue region), i.e., a low (resp. high) initial number of green firms lead the oligopolistic industry to coordinate on an equilibrium in which all firms do not invest (resp. invest) in abatement. If the fixed costs to install a cleaning technology are low but positive (Panel B) two possible new scenarios for low values of z (very efficient abatement technology) appear depending on the value of x: the grey area when x is relatively low and the red area when x is relatively high. In these cases, the configuration of the oligopolistic industry can generate a situation in which both types of firms coexist in the long term. In addition, as discussed so far, the evolutionary mechanism considered does not allow for the emergence of a stationary equilibrium within the interval [0, N]. This coexistence of strategies in this scenario allows us to observe the emergence of persistent switching from one technology to another accompanied by changes in the taxation policies. A higher value of fixed costs (Panel C) changes the relative size of the parameter regions observed in Panel B favouring the emergence of scenarios in which firms choosing dirty technology survive in the long term. A further increase in fixed costs (Panel D) makes the emergence of firms adopting a cleaning technology more difficult in the long term.

Different configurations of the map in the 2D parameter space (x, z) for different values of the fixed cost F (\(N=10\)). Panel A: \(F=0\). Panel B: \(F=0.000036\). Panel C: \(F=0.0009\). Panel D: \(F=0.09\). In the white region the map is of type Z. In the green region the map is of type I. In the blue region the map is of type \(I-Z\). In the red region the map is of type \(Z-I\). In the grey region the map is of type \(Z-I-Z\). (Color figure online)

To analyze the dynamics generated by the map in more detail (especially when the dynamics are not converging to any fixed point) we consider the following parameter set \(N=20\), \(F=0.0009\) and \(\delta =0.4\). Figure 4, Panel A shows a two-dimensional bifurcation diagram in the (x, z) parameter plane. The coloured bar next to the figure identifies which periodicity the colours in the diagram are associated with. We recall that x is the burden that the environmental regulator attaches to the environmental damage, or the awareness of the overall society towards the environment and thus against the damage from industrial production, whereas z weights abatement efficiency. The yellow-coloured regions denote a parameter space in which there exists a locally stable fixed point (\(G=0\) in the region with small values of x, and \(G=N\) in the region with large values of x). An interesting feature of the analysis of piecewise linear maps is that several elements of the two-dimensional bifurcation diagram can be determined analytically. To this purpose, several papers (e.g., Tramontana et al., 2010, 2014) describe the border collision bifurcation (BCB) curves related to the cycles of the first degree of complexity. We recall that these curves define the birth/death of a k-cycle (for any integer \(k>1\)) formed by 1 point defined by one regime and \(k-1\) points defined by the other regime (see Avrutin et al., 2019 for a survey on the results for this kind of maps). This procedure can be only partially adapted to the present paper as it needs the explicit expression of the switching points to characterise the BCB curves. As this route is not feasible, in this paper we consider the expressions of the points defining a cycle of a given periodicity kFootnote 4 with 1 point defined by one regime and \(k-1\) points defined by the other regime. Then, we impose that such a cycle has an element at the switching point, i.e., it is a root of the polynomial (34). This expression allows the BCB curves to be determined in the plane (x, z), at least in implicit form. To clarify this procedure, we consider a four-period cycle consisting of one point defined by regime Z and three points defined by regime I (see the red region in Fig. 4, Panel A). For such a cycle to exist its coordinates must be as follows:

To define a BCB curve, one of its elements (either the maximum element or its pre-image) must solve the equation \(P(G)=0\). Proceeding similarly, we obtain the BCB curves shown in Fig. 4, Panel B. The “dense” black part in the upper right corner of the picture in Fig. 4, Panel B is due to BCB curves that are very close to each other.

In addition to the regions characterised by cycles of complexity equal to 1, there exist other (an infinite number, indeed) regions in which there are cycles of higher complexity, that is, cycles in which more elements are defined by both pieces of the map. Specifically, a number, the rotation number, can be associated with each region to classify all the periods and cycles with the same period. In this notation, a periodic orbit of period k is characterised by the period and the number of points in the two branches (denoted by I and Z respectively) separated by the discontinuity point. A cycle has a rotation number \(\frac{p}{k}\) if a k-cycle has p points on the I side and the others \(k-p\) on the Z side. Then, between any pair of periodicity regions associated with the rotation numbers \(\frac{p_{1}}{k_{1}}\) and \(\frac{p_{2}}{k_{2}}\) there exists a periodicity region associated with the rotation number \(\frac{p_{1}}{k_{1}}\oplus \frac{p_{2}}{k_{2}}=\frac{p_{1}+p_{2}}{k_{1}+k_{2}}\) (where \(\oplus \) stands for the so-called Farey composition rule, or summation rule, see for example in Avrutin et al., 2019). For example, Fig. 4, Panel C depicts a bifurcation diagram for x (with \(z=0.5\)) showing how an increase in x causes an increase in the periodicity of the cycles of the first degree of complexity. An enlargement view of such a bifurcation diagram (Fig. 4, Panel D) shows that a region with rotation number \(\frac{2}{13}\) exists between two regions characterised by cycles of the first-degree of complexity of period 6 and a cycle of the first-degree complexity of period 7. We remark that these regions are very thin and then they cannot easily be identified by the two-dimensional bifurcation diagram reported in Fig. 4, Panel A.

Bifurcation diagram in the (x, z)-parameter plane for \(N=10\), \(F=0.0009\) and \(\delta =0.4\) (Panel A). Bifurcation curves of first-degree of complexity for some cycles, which are obtained following the procedure described in the main text (Panel B). Bifurcation diagram for x showing the Farey composition rule. Parameter set: \(N=10\), \(F=0.0009\), \(\delta =0.4\) and \(z=0.5\). (Panel C). Enlargement view of Panel C (Panel D)

The dynamic events in the scenarios analysed in Figs. 3 and 4 are exemplified in Figs. 5, 6, 7, 8, and 9 to pinpoint some additional economic features of the model. In particular, Fig. 5 shows (Panel A) a typical trajectory corresponding to the dynamic outcomes about the times series of the number of firms prevailing in the long term in the white scenario (in which all firms have the incentive to become dirty). The corresponding Panel B and Panel C refer to the time series of the environmental tax rate and social welfare. After an initial increase, the tax rate marks the start of a reduction approaching zero in the long term. The shape of the time series of social welfare shows – despite the disappearance of green technology in the long run –, that the trajectory is “rational” at the societal level, due to the low awareness towards a clean environment and the corresponding importance of economic goals coming from the industrial production of the oligopolistic market, social welfare increases. Figure 6 details the green scenario, in which the parameters describe outcomes at all different than those observed in the white scenario. The corresponding Panels A–C show, respectively, a typical trajectory of the time series of the number of G-firms prevailing in the long term, and the corresponding environmental tax rate and social welfare outcomes. In this case, all the firms have the incentive to become green over time and the initial high tax rate chosen by the regulator is gradually lowered as far as there are improvements in the environmental quality, i.e., a cleaner society, by the societal goal. The red scenario is described in Fig. 7 (Panels A–C) and is characterised by an interesting coexistence of D- and G-firms whose number oscillates between these two different technologies with regular oscillations, after an initial reduction (resp. increase) in the tax rate (resp. social welfare). In the blue scenario (Fig. 8, Panels A–C) history matters and there exist two long-term equilibria depending on initial conditions. If the number of G-firms is initially small (resp. large) then the firms using green technology disappear (resp. prevail) in the long term. From a societal perspective, it would be better to lie in a trajectory in which all the firms become green, but this is not guaranteed and depends on the level of taxation used (a higher level of taxation leads to higher social welfare). If the tax rate is lower, there are no incentives to invest in clean R &D and firms will be back to using dirty technology and the society will be worse off. Society will then be better off by keeping the level of taxation high even in the long term allowing firms to become green. Finally, the grey scenario is more articulated (Fig. 9, Panels A–C): there exists a multiplicity of attracting steady states but the state in which all the firms become of the G type leads to a higher social welfare although with oscillations. We also note that even in the presence of a unique (internal) attractor, the related trajectories may not necessarily be associated with higher welfare than when all firms are green.

Time series of the number of G-firms (Panel A: initial condition \(G=8\)), the optimal environmental tax rate (Panel B) and the corresponding social welfare (Panel C). The white scenario (all firms become dirty in the long term). Parameters: \(N=10\), \(\delta =0.4\), \(x=0.02\), \(z=0.279297\) and \(F=0.0009\). (Color figure online)

Time series of the number of G-firms (Panel A: initial condition \(G=1\)), the optimal environmental tax rate (Panel B) and the corresponding social welfare (Panel C). The green scenario (all firms become green in the long term). Parameters: \(N=10\), \(\delta =0.4\), \(x=0.35\), \(z=0.9\) and \(F=0.0009\). (Color figure online)

Time series of the number of G-firms (Panel A: initial condition \(G=1\)), the optimal environmental tax rate (Panel B) and the corresponding social welfare (Panel C). The red scenario (coexistence of dirty and green firms in the long term; there are oscillations). Parameters: \(N=10\), \(\delta =0.4\), \(x=0.25\), \(z=0.1\) and \(F=0.0009\). (Color figure online)

Time series of the number of G-firms (Panel A: initial condition \(G=3\)), the optimal environmental tax rate (Panel B) and the corresponding social welfare (Panel C). The blue scenario (history matters). Parameters: \(N=10\), \(\delta =0.4\), \(x=0.13\), \(z=0.998\) and \(F=0.0009\). (Color figure online)

Time series of the number of G-firms (Panel A), the optimal environmental tax rate (Panel B) and the corresponding social welfare (Panel C). The grey scenario (coexistence of dirty and green firms and oscillations). Parameters: \(N=10\), \(\delta =0.4\), \(x=0.1\), \(z=0.9\) and \(F=0.0009\). (Color figure online)

Going further into the analysis of social welfare, Fig. 10, Panels A–C show, in the (x, z) plane, the change in welfare associated with the state where no firms are green (Panel A), all firms are green (Panel B) and the number of green firms is defined by a trajectory with an initial value of G close to but less than N (Panel C). In this last case, a trajectory will converge to (1) N if N is attractive, (2) an internal attractor if this exists, and (3) 0 if 0 is the only attractor of the system. To evaluate social welfare in this case we considered the average social welfare after a sufficiently long transient, which coincides with the welfare associated with 0 or N if these states are attractive or with the average welfare defined over the k points forming the (attractive)\(\ k\)-period cycle. In addition, Fig. 10, Panel D compares the levels of welfare in 0 and N and those corresponding to the internal attractor when it exists, highlighting the existence/attractiveness of states 0 and N. The dark green region (resp. light green) illustrates the set of parameters (x, z) in which steady-state N welfare dominates steady-state 0 when N is attractive and 0 does not exist (resp. exists). The red region illustrates the parameter area where trajectories generated by a sufficiently large initial condition are captured by the internal attractor. However, society would be better off in state N (which is not a fixed point of the system in this case). Again for this parameter configuration, 0 is a fixed point that attracts sufficiently low initial conditions of G and the related social welfare is less than the welfare associated with the internal attractor. Differently, in the light pink (resp. light blue) region, the system has only one (the internal) attractor, and the related social welfare is less (resp. greater) than the welfare associated with state N (resp. with states 0 and N). The orange region identifies the set of parameters such that the welfare corresponding to the internal attractor is greater than the welfare corresponding to N, which does not exist in this case, and the welfare corresponding to 0, which is an attractor of the system in this case. The grey region is such that 0 is the only attractor of the system, but society would be better off in N. Finally, the magenta region represents the area where 0 is the only attractor of the system and social welfare associated with it is greater than that associated with N.

Interestingly, the red and light pink regions represent a “dynamic trap”. This is because evolutionary dynamics make dirty firms persist in the economy and society even though from a welfare perspective society would be better off if firms were all green.

A question now arises: considering a parameter set belonging to these regions, does a value of \(\tau \) exist (in the model with a fixed environmental tax rate) allowing the economy to converge to \(G=N\) and society to be better off? An answer to that question is provided by Fig. 10, Panel E, which shows that a tax rate slightly higher than \(\tau _{TH}=\sqrt{2zF}\) (this is given by the blue region in the figure, which is a subset of the union of the red and light pink regions in Panel D) can make the system converge to the N state.

The analysis made so far allows us to have some policy considerations. For instance, increasing the level of commitment of the regulator/government to approach an environmental policy goal with a fixed tax rate may let society be better off than under a (bounded rational) regulator/government whose decisions are driven by short-term economic/environmental outcomes.

Social welfare. Social welfare corresponding to the states 0 and N (Panels A and B, respectively). Long-term average social welfare related to a generic trajectory generated by a sufficiently large initial condition of G (Panel C). Social welfare comparison (Panel D). Social welfare under optimizing policies versus fixed rule (Panel E)

4 Conclusions

This article tackles the issue of pollution abatement by considering a game-theoretic approach framed in a standard static context in which firms choose whether to be environment-oriented ((Buccella et al., 2021)) through an ad-hoc cleaning effort. In the former case, firms use an end-of-pipe technology for pollution abatement coming from the industrial production of goods and services. In the latter case, the pollution from industrial production is not abated.

The recent article by Buccella et al. (2021) belongs to the static IO literature. The strategic competition is based on Cournot rivalry in which two firms (duopoly) non-cooperatively choose whether to abate (through an end-of-pipe technology) in the first decision-making stage, knowing that the regulator (government) levies an ad-hoc tax rate to incentivise emission-reduction actions by maximising social welfare. In this setting, a wide spectrum of SPNE of the abatement decision game can emerge—ranging from dirty to green production—depending on the relative size of the societal awareness towards a clean environment (i.e., against the damage generated by industrial production) and the index measuring the relative cost of abatement (i.e., the exogenous index of technological progress weighting the efficiency of the cleaning technology).

Compared to Buccella et al. (2021), the present article presents two main differences: (1) it considers an N-firm oligopoly instead of a two-firm duopoly, and (2) it moves from a static context to a dynamic scenario pinpointing the different long-term market configurations emerging depending on the behaviour of the regulator. The regulator, which is welfare-oriented, can set the environmental tax rate according to a fixed rule over time or an optimal rule by maximising social welfare dynamically. The article focuses on the role of the public authority in shaping the individual (firm’s) incentive to be green or dirty. Of course, this choice sharply affects the social welfare outcomes prevailing in equilibrium compared to the basic static framework studied by Buccella et al. (2021). The policy implications are deep and depend on the main parameters of the problem. The article highlights the active role of the regulator as a player choosing alongside firms with a social welfare goal instead of being profit-maximising. If the tax rate is chosen by the government/regulator according to a fixed rule over time, the number of G-firms (or D-firms) does not change in the long term. This means that the economy will end up with all firms being dirty or green. Unlike this, the government/regulator can sharply affect the kind of firms and the level of emissions from industrial production if the tax rate is determined by maximising the social welfare dynamically. In the former case (fixed tax rate), the dynamics defined by public intervention are simple as the behaviour of the regulator establishes a path within the industry that leads to the disappearance of one of the two types of firms, depending on the extent of taxation. In the latter case (optimal tax rate), government intervention can make industrial dynamics more complex with possible greater volatility of the type of firms even in the long term (persistence of the two types of firms in the market).

Turning on the example of the US history and its policy approach towards environmental protection, our model is capable of capturing the long-term oscillations in the number of firms adopting green or dirty technologies. These oscillations are determined, given the fixed cost of abatement, by the size of the optimal environmental tax rate, which, in turn, depends on public awareness towards a clean environment. The parameter measuring this awareness, therefore, allows us to capture in a broad sense the political nature of the different approaches and recipes adopted by the US government over time (through differences in the size of the tax rate). In this sense, therefore, changing the way society evaluates environmental quality is responsible for (and then can explain) the oscillations in the number of green and dirty firms that can be observed in the market, implying the coexistence of both types of firms in the long term. This result cannot be obtained in the benchmark static duopoly of Buccella et al. (2021).

The model analysed in the present article is based on a set of simplifying and precise assumptions that call for significant extensions.

First, given their relevance in contemporary economics, it would be extremely worth considering the case of managerial firms in which ownership and control are separated, and then analysing, in the presence of government intervention (1) how and who would take abatement decisions; and (2) which incentive scheme should be proposed to managers, in the light of the increasing appearance of retribution contracts linked to “green” performances (see, inter alias, Buccella et al., 2022, 2023; Park & Lee, 2023; Poyago-Theotoky & Yong, 2019; Xu & Lee, 2023).

Second, this paper examines just the emission taxes as a tool to incentivise abatement activities. However, “green” subsidies to reduce the cost of cleaning technology investments and policy mixes are alternative tools that can be used to nudge firms into cutting emissions.

Third, this work simply assumes that society indirectly shows its level of awareness around a clean environment, represented by the weight the regulator/government uses to internalise the evaluation of the environmental damage. However, as widely observed, consumers can directly show their environmental concern by being willing to pay higher prices (a premium) for “green labelled” products (“green consumerism”, see e.g. Giallonardo and Mulino, 2023). Moreover, in the last decades, firms worldwide have voluntarily adopted environmental actions, as several consulting firms report (see e.g. KPMG, 2020, 2022), mainly in response to increasing environmental sensitivity. It would be interesting to analyse how the environmental concerns of the different social groups (consumers, firms) can affect the government/regulator’s attitude towards the environmental policy. All these subjects are left to future research.

Notes

End-of-pipe technologies (implemented as a last stage of a process before a stream is disposed of/delivered) are a common assumption in the environmental economics literature and represent an example of cleaning technology not directly linked to output like “the number of the filters in a refinery’s pipe for CO\(_{2}\) reduction or ‘scrubbers’ to remove SO\(_{2}\) from a fuel gas coal-fired electric plant” (Asproudis and Gil-Moltó, 2015, p. 169). Moreover, Frondel et al. (2007) have empirically shown that, in OECD countries, regulatory measures and the stringency of environmental policies (on which this work focuses) are more important for end-of-pipe technologies, while clean production processes tend to be favoured by cost savings, general management systems and specific environmental management tools motives.

This assumption follows the pioneering article by Katz and Shapiro (1985), who consider fixed cost of compatibility in network industries. We extend their assumption to a market with abating firms.

In what follows we will focus on I and Z not playing L any relevant role. On this point, see Avrutin et al. (2019).

The expression of such points does not depend on x nor z.

References

Antoci, A., Borghesi, S., Iannucci, G., & Sodini, M. (2021). Should I stay or should I go? Carbon leakage and ETS in an evolutionary model. Energy Economics, 103, 105561.

Asproudis, E., & Gil-Moltó, M. J. (2015). Green trade unions: Structure, wages and environmental technology. Environmental and Resource Economics, 60, 165–189.

Avrutin, V., Gardini, L., Sushko, I., & Tramontana, F. (2019). Continuous and discontinuous piecewise-smooth one-dimensional maps: Invariant sets and bifurcation structures. World scientific series on nonlinear science series A. (Vol. 95). Singapore: World Scientific.

Benchekroun, H., & Chaudhuri, A. R. (2011). Environmental policy and stable collusion: the case of adynamic polluting oligopoly. Journal of Economic Dynamics & Control, 35, 479–490.

Bischi, G. I., Lamantia, F., & Radi, D. (2015). An evolutionary Cournot model with limited market knowledge. Journal Economic Behavior & Organization, 116, 219–238.

Buccella, D., Fanti, L., & Gori, L. (2021). To abate, or not to abate? A strategic approach on green production in Cournot and Bertrand duopolies. Energy Economics, 96, 105164.

Buccella, D., Fanti, L., & Gori, L. (2022). “Green’’ managerial delegation theory. Environment and Development Economics, 27, 223–249.

Buccella, D., Fanti, L., & Gori, L. (2023). Environmental delegation versus sales delegation: A game-theoretic analysis. Environment and Development Economics, 28, 469–485.

Carlsson, F. (2000). Environmental taxation and strategic commitment in duopoly models. Environmental and Resource Economics 15, 243-256.

Carraro, C., & Siniscalco, D. (1993). Strategies for the international protection of the environment. Journal of Public Economics, 52, 309–328.

Climatewatchdata.org (2022). Historical GHG emissions. retrieved Aug 23, 2022, from https://www.climatewatchdata.org/ghg-emissions?chartType=percentage &end_year=2019 &start_year=1990

Conrad, K., & Wang, J. (1993). The effect of emission taxes and abatement subsidies on market structure. International Journal of Industrial Organization, 11, 499–518.

d’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R &D in duopoly with spillovers. American Economic Review, 78, 1133–1137.

d’Aspremont, C., & Jacquemin, A. (1990). Cooperative and noncooperative R &D in duopoly with spillovers: Erratum. American Economic Review, 80, 641–642.

Elsadany, A. A., & Awad, A. M. (2019). Dynamics and chaos control of a duopolistic Bertrand competitions under environmental taxes. Annals of Operations Research, 274, 211–240.

E.P.A. (United Stated Environmental Protection Agency), (2023). Inventory of US Greenhouse gas emissions and sinks. Retrieved from, https://www.epa.gov/ghgemissions/inventory-us-greenhouse-gas-emissions-and-sinks

Ernest & Young, (2021). How businesses need to navigate environmental incentives and penalties. Retrieved from, https://www.ey.com/en_gl/tax/how-businesses-need-to-navigate-environmental-incentives-and-penalties

European Commission, (2022). EU Emission trading system (EU ETS). Retrieved Aug 23, 2022, from https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en#a-cap-and-trade-system

Frondel, M., Horbach, J., & Rennings, K. (2007). End-of-pipe or cleaner production? An empirical comparison of environmental innovation decisions across OECD countries. Business Strategy and the Environment, 16, 571–584.

Giallonardo, L., & Mulino, M. (2023). Green consumerism and firms’ environmental behaviour under monopolistic competition: A two-sector model. Italian Economic Journal. https://doi.org/10.1007/s40797-023-00223-9

Jørgensen, S., Martín-Herrán, G., & Zaccour, G. (2010). Dynamic games in the economics and management of pollution. Environmental Modeling & Assessment, 15, 433–467.

Katsoulacos, Y., & Xepapadeas, A. (1996). Emission taxes and market structure. In C. Carraro, Y. Katsoulacos & A. Xepapadeas (Eds.), Environmental policy and market structure. Economics, energy and environment, (Vol 4, pp. 3-22). Dordrecht: Springer.

Katz, M. L., & Shapiro, C. (1985). Network externalities, competition, and compatibility. American Economic Review, 75, 424–440.

Konar, S., & Cohen, M. A. (2000). Why do firms pollute (and reduce) toxic emissions? Retrieved from, SSRN: https://ssrn.com/abstract=922491

KPMG (2020). The time has come. KPMG survey of sustainability reporting 2020. Retrieved from, https://assets.kpmg/content/dam/kpmg/xx/pdf/2020/11/the-time-has-come.pdf

KPMG (2022). Big shift, small steps. The KPMG survey of sustainability reporting 2022. Retrieved from, https://assets.kpmg.com/content/dam/kpmg/se/pdf/komm/2022/Global-Survey-of-Sustainability-Reporting-2022.pdf

Lamantia, F., & Radi, D. (2018). Evolutionary technology adoption in an oligopoly market with forward-looking firms. Chaos, 28, 055904.

Lambertini, L., Poyago-Theotoky, J., & Tampieri, A. (2017). Cournot competition and “green’’ innovation: An inverted-U relationship. Energy Economics, 68, 116–123.

Lee, S.-H., & Park, C.-H. (2021). Environmental regulations in private and mixed duopolies: Taxes on emissions versus green R &D subsidies. Economic Systems, 45, 100852.

Oates, W. E., & Strassmann, D. L. (1984). Effluent fees and market structure. Journal of Public Economics, 24, 29–46.

Ouchida, Y., & Goto, D. (2016). Cournot duopoly and environmental R &D under regulator’s precommitment to an emissions tax. Applied Economics Letters, 23, 324–331.

Park, C. H., & Lee, S. H. (2023). Emission taxation, green R &D, and managerial delegation contracts with environmental and sales incentives. Managerial and Decision Economics, 44, 2366–2377.

Poyago-Theotoky, J., & Yong, S. K. (2019). Managerial delegation contracts, “green’’ R &D and emissions taxation. B.E. Journal of Theoretical Economics, 19, 20170128.

Requate, T. (2005a). Environmental policy under imperfect competition: A survey. Christian-Albrechts-Universität Kiel, Economics Working Paper No. 2005-12.

Requate, T. (2005b). Dynamic incentives by environmental policy instruments: A survey. Ecological Economics, 54, 175–195.

Simpson, R. D. (1995). Optimal pollution taxation in a Cournot duopoly. Environmental and Resource Economics 6, 359–369.

Sushko, I., Agliari, A., & Gardini, L. (2005). Bistability and border-collision bifurcations for a family of unimodal piecewise smooth maps. Discrete and Continuous Dynamical Systems B, 5, 881–897.

Sushko, I., Puu, T., & Gardini, L. (2003). The Hicksian floor-roof model for two regions linked by interregional trade. Chaos, Solitons & Fractals, 18, 593–612.

The Economist. (2019). The climate issue. September 21st – 27th, 2019.

The Economist, (2022). Joe Biden’s signature legislation passes the Senate, at last. Aug 9, 2022.

Tramontana, F., Gardini, L., & Ferri, P. (2010). The dynamics of the NAIRU model with two switching regimes. Journal of Economic Dynamics and Control, 34, 681–695.

Tramontana, F., Westerhoff, F., & Gardini, L. (2014). One-dimensional maps with two discontinuity points and three linear branches: Mathematical lessons for understanding the dynamics of financial markets. Decisions in Economics and Finance, 37, 27–51.

The New York Times, (2009). Obama putting quick stamp on environmental policy. Retrieved from, https://www.nytimes.com/2009/01/26/world/americas/26iht-calif.4.19691318.html

The New York Times, (2013). Obama outlines ambitious plan to cut greenhouse gases. Retrieved from, https://www.nytimes.com/2013/06/26/us/politics/obama-plan-to-cut-greenhouse-gases.html

The New York Times, (2017). Under Trump, the E.P.A has slowed actions against polluters, and put limits on enforcement officers. Retrieved from, https://www.nytimes.com/2017/12/10/us/politics/pollution-epa-regulations.html

The New York Times, (2021). Restoring environmental rules rolled back by Trump could take years. Retrieved from, https://www.nytimes.com/2021/01/22/climate/biden-environment.html

The Washington Post, (2020). Trump rolled back more than 125 environmental safeguards. Here’s how. Retrieved from, https://www.washingtonpost.com/graphics/2020/climate-environment/trump-climate-environment-protections/

Ulph, A. (1996). Environmental policy and international trade when governments and producers act strategically. Journal of Environmental Economics and Management, 30, 265–281.

van der Meijden, G., Withagen, C., & Benchekroun, H. (2022). An oligopoly-fringe model with HARA preferences. Dynamic Games and Applications, 12, 954–976.

van der Ploeg, F., & de Zeeuw, A. J. (1992). International aspects of pollution control. Environmental and Resource Economics, 2, 117–139.

World Bank, (2023). CO2 emissions (kt): Australia. Retrieved from, https://data.worldbank.org/indicator/EN.ATM.CO2E.KT?locations=AU

Xu, L., Chen, Y., & Lee, S.-H. (2022). Emission tax and strategic environmental corporate social responsibility in a Cournot–Bertrand comparison. Energy Economics, 107, 105846.

Xu, L., & Lee, S. H. (2023). Cournot–Bertrand comparisons under double managerial delegation contracts with sales and environmental incentives. Managerial and Decision Economics, 44, 3409–3421.

Yanase, A., & Kamei, K. (2022). Dynamic game of international pollution control with general oligopolistic equilibrium: Neary meets Dockner and Long. Dynamic Games and Applications, 12, 751–783.

Zeppini, P. (2015). A discrete choice model of transitions to sustainable technologies. Journal of Economic Behavior & Organization, 112, 187–203.

Acknowledgements

The authors acknowledge two anonymous reviewers of the journal for valuable comments on an earlier draft of the manuscript. The authors are also indebted to participants of the (1) 13th PODE conference held at the Catholic University of the Sacred Heart, Milan, Italy (May 2023), (2) 13th NED conference held at the University of Agder, Kristiansand, Norway (June 2023), and (3) 2nd DISEI-Workshop on Heterogeneity, Evolution and Networks in Economics held at the University of Florence, Italy (September 2023). Luca Gori acknowledges financial support from the University of Pisa under the “PRA – Progetti di Ricerca di Ateneo” (Institutional Research Grants) – Project No. PRA_2020_64 “Infectious diseases, health and development: economic and legal effects”. Mauro Sodini acknowledges financial support from the Czech Science Foundation (GACR) under project 23-06282S, and an SGS research project 729 of VŠBTUO (SP2023/19). The usual disclaimer applies.

Funding

Open access funding provided by Università di Pisa within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions