Abstract

This study develops a two-country differential game model of transboundary pollution control with a continuum of polluting and oligopolistic industries. Governments choose the paths of their pollution permits, the market-clearing prices of which are determined endogenously, as in a general oligopolistic equilibrium model. We consider both autarky and bilateral free trade of polluting goods and derive solutions under international cooperation, open-loop Nash equilibrium, and linear Markov-perfect Nash equilibrium in each regime. Under autarky, we obtain similar results to those in the literature; that is, international cooperation achieves the least pollution, and the linear Markov-perfect Nash equilibrium results in higher pollution than the open-loop Nash equilibrium. Under free trade, each country’s welfare depends on the emissions of both countries, and if trade is frictionless, the same solution can be achieved by international cooperation, the open-loop Nash equilibrium, and the linear Markov-perfect Nash equilibrium. Moreover, when all industries have the same number of firms and trade is frictionless, free trade is better for the environment than autarky. However, if trade costs exist, international trade may result in higher pollution than autarky.

Similar content being viewed by others

Data Availability

Data sharing is not applicable to this article as no datasets were generated or analyzed in the current study.

Notes

For example, according to the United States Environmental Protection Agency, transportation sector accounts for 29% of 2019 greenhouse gas emissions in the U.S. After transportation, electricity production (25%), industry (23%), commercial and residential (13%), and agriculture (10%) follow. See https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions.

Pollution control is one of the important issues in the United Nation’s “Sustainable Development Goals.” In particular, Goals 3, 6, 13, and 14 of “Transforming our world: the 2030 Agenda for Sustainable Development” emphasize the importance of long-term objectives for reducing pollution and international cooperation to achieve them. See https://sdgs.un.org/2030agenda.

See Colacicco [7] for a survey of the literature.

In a static framework without pollution accumulation, Colacicco [8] introduces pollution emissions from production into the GOLE model in which wages are determined in the labor-market equilibrium, and examines the properties of optimal emission taxes.

Nkuiya and Plantinga [24] develop a differential game model of environmental policy in open economies with the structure being a reciprocal market model. Their focus is on a comparison between noncooperative and cooperative solutions of emissions tax decisions, rather than comparing between outcomes under autarky and trade. Moreover, they assume a single polluting industry and thus abstract from general equilibrium effects.

We implicitly assume that there are other factors of production, which are sector-specific. These sector-specific factors include skilled labor and physical capital, and we assume that the owners of these factors are the residual claimants (i.e., a firm’s revenue net of the payment for pollution permits is distributed to the factor owners) and that they save all of their factor income (as in, e.g., [17]). Note that their savings behavior does not affect the dynamic equilibrium of the world economy because we consider a continuum of industries and each industry is negligible in size.

We do not consider pollution abatement activities; thus, \(\alpha (z)\)’s are exogenously given. Moreover, we allow for the case where some industries do not pollute (i.e., \(\alpha (z)=0\)). In light of the discussion in footnote 7, the case of \(\alpha (z)=0\) implies that good z is produced by using only specific factors, such as skilled labor. Empirical evidence (e.g., [5]) shows that pollution-intensive industries tend to be capital intensive and less skill intensive.

We eliminate the possibility of technological heterogeneity among firms within an industry by assuming that all firms have free access to the most advanced environmental technologies in each industry.

An alternative method of distributing pollution permits is called grandfathering, in which the government allocate the permits for free and the permits are traded among firms. If the permit market is competitive, there will not be differences in the equilibrium price between grandfathering and auction, although the two mechanisms have different distributive effects.

Equation (5) indicates that the levels of emissions in each country is equal to the amounts of pollution permits at each moment in time. This implies that we eliminate the possibility that pollution permits can be stored to be used in the future. This possibility, called allowance banking, can be found in the actual markets, such as the European Union Emissions Trading System. However, incorporating the possibility of banking makes the analysis quite complex and abstracts clear insights about the effects of international trade in goods markets, which is the focus of our study.

We henceforth denote Foreign variables with an asterisk.

As discussed in footnotes 7 and 8, we allow for the case where production can occur without emitting pollution, and thus \(\alpha (z)=0\) holds. In this case, the equilibrium output of each firm is \(y(z)=a/[n(z)+1]\).

The assumption of symmetric countries is more appropriate when we consider a pollution control game between developed countries than when considering a game between developed and developing countries. Considering a pollution control game between developed countries can also be justified because the free-trade situation (to be discussed later) is characterized as a reciprocal market model, which explains intraindustry trade (i.e., two-way trade in similar products belonging to the same industry) and a large fraction of trade between developed countries accounts for such intraindustry trade (see, e.g., [29]).

The superscript w stands for “world welfare” maximization.

In light of (11), the price of the emission permits might be negative when the governments choose sufficiently large levels of permits along the dynamic path. Intuitively, because of the oligopolists’ market power, production in the economy is inefficiently low, which counteracts the government’s incentive to regulate pollution. If the optimal amount of emissions placed in the market could be higher than demand when the price is zero, the government would pay firms for buying permits with the aim of stimulating output. This possibility of the negative price of permits corresponds to the well-known result that the optimal tax on emissions must be negative because of the inefficiency caused by the firms’ market power, as documented by Benchekroun and Long [2] in a differential game of polluting oligopoly and by Colacicco [8] in a GOLE model with pollution.

Proofs of the propositions are provided in the “Appendix”.

The superscript ac stands for “autarky” and “cooperation.”

The superscript ao stands for “autarky” and “open-loop.”

The superscript am stands for “autarky” and “Markov perfect.”

In the “Appendix”, we demonstrate that \(S^{ac}<S^{ao}\) remains valid even when we relax the assumption that Home and Foreign share identical preferences, technologies, and production structures.

The above discussion can be verified by inspecting the values of \(\mathrm{d}TE(t)/\mathrm{d}S(t)\) shown in the “Appendix”. In the case of international cooperation, (A3) indicates that \(\mathrm{d}TE(t)/\mathrm{d}S(t)=\left[ \rho +2\delta -\sqrt{(\rho +2\delta )^2+16(A_2)^2\beta /B_2}\right] \Big /2<0\), which is smaller than \(\mathrm{d}TE(t)/\mathrm{d}S(t)=\left[ \rho +2\delta -\sqrt{(\rho +2\delta )^2+8(A_2)^2\beta /B_2}\right] \Big /2<0\) in the open-loop Nash equilibrium given by (A5). Moreover, from (A13), \(\mathrm{d}TE(t)/\mathrm{d}S(t)=2\psi _1=\left[ \rho +2\delta -\sqrt{(\rho +2\delta )^2+12(A_2)^2\beta /B_2}\right] \Big /3<0\) when the government uses linear feedback strategies, and this value is larger than \(\mathrm{d}TE(t)/\mathrm{d}S(t)\) in the open-loop Nash equilibrium.

We focus on trade in goods. In other words, we eliminate the possibility that the markets for pollution permits are integrated and, for example, when the price of permits differ between countries, firms can increase their profits by trading permits. This implies that we continue to consider (4) for the market-clearing condition for pollution permits. The segmentation of the permit markets could originate an inefficient allocation of permits, but if we focus on the symmetric solution, the prices of permits are the same in both national markets.

See the “Appendix” for derivation.

As the two countries are assumed to be symmetric, the marginal utility of income in equilibrium is also the same across countries; thus, we set \(\lambda =\lambda ^*\).

Since \((1+\phi ^2)^2-4\phi ^2=(1-\phi ^2)^2>0\) and \(\tilde{A}_2>\tilde{A}_3\), \(\Delta >0\) holds.

In other words, “carbon leakage” occurs in this economy in the sense that more stringent emission regulation in one country leads to an incentive to increase emissions in other countries. Kiyono and Ishikawa [15] present three main channels through which international carbon leakage can arise: (1) changes in a country’s industrial structure, (2) relocation of plants in response to emission regulations, and (3) changes in the price of fossil fuels. The mechanism of carbon leakage in our model is related to the first and third channels in [15].

The superscript fc stands for “free trade” and “cooperation.”

The superscript fo stands for “free trade” and “open-loop.”

The superscript fm stands for “free trade” and “Markov perfect.”

Note, however, that, in this case of frictionless trade, the solution is defined in terms of total emissions, and thus the allocation of permits between countries is indeterminate.

Yanase [30] considers a two-country dynamic model with global pollution in which there is one polluting sector characterized by a reciprocal-markets model and countries use a tax to control emissions and shows that, when countries cooperatively determine their environmental policies, autarky and free trade in the absence of trade costs generate the same optimal solution. Thus, the claim in Proposition 9 (i) corresponds to Proposition 1 in [30].

The basic idea is that each country has comparative advantage in goods with relatively lower \(\alpha (z)\). In addition, when opening trade, prices of such goods increase compared to the autarkic levels. The opposite occurs for goods with relatively higher \(\alpha (z)\). Thus, trade reduces the variance in prices across sectors.

Focusing on the outcomes under international cooperation, we can show in the “Appendix” that free trade achieves not only a higher steady-state welfare but also a higher discounted present value of instantaneous utility than autarky. For the comparison between noncooperative equilibria under autarky and the free trade, however, examining the discounted present value of instantaneous utility entails complexity. Thus, we consider the steady-state welfare as a second admissible approximation.

Among the various types of possible asymmetries between countries, a difference in the damage from global pollution has been of great interest in the literature. Zagonari [32] extends the Dockner–Long model to the case where two countries have different parameters of the damage function and showed that, compared to the cooperative outcome, less pollution stock can be achieved through appropriate unilateral initiatives by an “environmental-concerned” country. Manoussi and Xepapadeas [20] consider a dynamic game of climate policy design in which two heterogeneous countries determine emissions and solar radiation management (SRM) activities. The authors study the effects of asymmetries between countries in several aspects and show that a tradeoff between emissions and SRM emerges at the noncooperative solution if the asymmetry is in damages of global warming between countries.

Colacicco [6] incorporates firm heterogeneity into a GOLE model, keeping the assumption that entry or exit of firms does not exist in each industry.

References

Benchekroun H, Ray Chaudhuri A (2014) Transboundary pollution and clean technologies. Resource Energy Econ 36(2):601–619. https://doi.org/10.1016/j.reseneeco.2013.09.004

Benchekroun H, Long NV (1998) Efficiency inducing taxation for polluting oligopolists. J Public Econ 70(2):325–342. https://doi.org/10.1016/S0047-2727(98)00038-3

Brander J, Krugman P (1983) A ‘reciprocal dumping’ model of international trade. J Int Econ 15(3):313–321. https://doi.org/10.1016/S0022-1996(83)80008-7

Brander JA (1981) Intra-industry trade in identical commodities. J Int Econ 11(1):1–14. https://doi.org/10.1016/0022-1996(81)90041-6

Broner F, Bustos P, Carvalho V (2011) Sources of comparative advantage in polluting industries. Economics Working Papers 1331, Department of Economics and Business, Universitat Pompeu Fabra

Colacicco R (2012) The “average” within-sector firm heterogeneity in general oligopolistic equilibrium. MPRA Paper 40212, University Library of Munich, Germany

Colacicco R (2015) Ten years of general oligopolistic equilibrium: a survey. J Econ Surv 29(5):965–992

Colacicco R (2021) Environment, imperfect competition, and trade: insights for optimal policy in general equilibrium. Res Econ 75(2):144–151. https://doi.org/10.1016/j.rie.2021.04.001

Copeland BR, Shapiro JS, Taylor MS (2021) Globalization and the environment. NBER Working Papers 28797, National Bureau of Economic Research, Inc

Dockner EJ, Jorgensen S, Long NV, Sorger G (2000) Differential games in economics and management science. Number 9780521637329 in Cambridge Books. Cambridge University Press

Dockner EJ, Long NV (1993) International pollution control: cooperative versus noncooperative strategies. J Environ Econ Manag 25(1):13–29. https://doi.org/10.1006/jeem.1993.1023

Fujiwara K (2009) Why environmentalists resist trade liberalization. Environ Resource Econ 44(1):71–84. https://doi.org/10.1007/s10640-009-9262-z

Gallagher KP (2009) Economic globalization and the environment. Annu Rev Environ Resour 34(1):279–304. https://doi.org/10.1146/annurev.environ.33.021407.092325

Grafton RQ, Kompas T, Long NV (2017) A brave new world? Kantian-Nashian interaction and the dynamics of global climate change mitigation. Eur Econ Rev 99:31–42. https://doi.org/10.1016/j.euroecorev.2017.04.002

Kiyono K, Ishikawa J (2013) Environmental management policy under international carbon leakage. Int Econ Rev 54(3):1057–1083. https://doi.org/10.1111/iere.12028

Kossioris G, Plexousakis M, Xepapadeas A, de Zeeuw A, Mäler KG (2008) Feedback nash equilibria for non-linear differential games in pollution control. J Econ Dyn Control 32(4):1312–1331. https://doi.org/10.1016/j.jedc.2007.05.008

Krugman P (1981) Trade, accumulation, and uneven development. J Dev Econ 8(2):149–161. https://doi.org/10.1016/0304-3878(81)90026-2

Lambertini L (2018) Differential games in industrial economics. Number 9781107164680 in Cambridge Books. Cambridge University Press

Long NV (2010) A survey of dynamic games in economics. Number 7577 in World Scientific Books. World Scientific Publishing Co. Pte. Ltd

Manoussi V, Xepapadeas A (2017) Cooperation and competition in climate change policies: mitigation and climate engineering when countries are asymmetric. Environ Resource Econ 66(4):605–627. https://doi.org/10.1007/s10640-015-9956-3

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725. https://doi.org/10.1111/1468-0262.00467

Neary JP (2003) Globalization and market structure. J Eur Econ Assoc 1(2–3):245–271. https://doi.org/10.1162/154247603322390928

Neary JP (2016) International trade in general oligopolistic equilibrium. Rev Int Econ 24(4):669–698. https://doi.org/10.1111/roie.12233

Nkuiya B, Plantinga AJ (2021) Strategic pollution control under free trade. Resource Energy Econ 64:101218. https://doi.org/10.1016/j.reseneeco.2021.101218

Rubio SJ, Casino B (2002) A note on cooperative versus non-cooperative strategies in international pollution control. Resource Energy Econ 24(3):251–261. https://doi.org/10.1016/S0928-7655(02)00002-7

Van der Ploeg F, Zeeuw A (1992) International aspects of pollution control. Environ Resource Econ 2(2):117–139. https://doi.org/10.1007/BF00338239

Van der Ploeg F, Zeeuw A (2016) Non-cooperative and cooperative responses to climate catastrophes in the global economy: a North-South perspective. Environ Resource Econ 65(3):519–540. https://doi.org/10.1007/s10640-016-0037-z

Wirl F (2011) Global warming with green and brown consumers. Scand J Econ 113(4):866–884. https://doi.org/10.1111/j.1467-9442.2011.01677.x

World Development Report 2009: Reshaping Economic Geography. The World Bank

Yanase A (2010) Trade, strategic environmental policy, and global pollution. Rev Int Econ 18(3):493–512. https://doi.org/10.1111/j.1467-9396.2010.00883.x

Yanase A (2012) Trade and global pollution in dynamic oligopoly with corporate environmentalism. Rev Int Econ 20(5):924–943. https://doi.org/10.1111/roie.12004

Zagonari F (1998) International pollution problems: unilateral initiatives by environmental groups in one country. J Environ Econ Manag 36(1):46–69. https://doi.org/10.1006/jeem.1998.1037

Acknowledgements

The authors would like to thank seminar audiences at the 2021 Workshop on Dynamic Games in Environmental Economics and Management and two anonymous referees for their helpful comments. This work has been financially supported by the Japan Society for the Promotion of Science (JSPS) Grant-in-Aid for Scientific Research (B) No. 20H01492, (C) No. 20K01605, Grant-in-Aid for Young Scientists (B) No. 18K12761, and the Joint Research Program of KIER.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no potential conflict of interest regarding the publication of this work.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the topical collection “Dynamic Games in Environmental Economics and Management” edited by Florian Wagener and Ngo Van Long.

Appendices

Appendix A Proofs

1.1 A.1 Proof of Proposition 1

In the matrix form, the linear dynamic system consisting of (5) and (19) is

In the steady state, \(\dot{TE}=\dot{S}=0\). By solving (A1) for the steady-state solutions for the pollution stock and sum of emissions, we obtain

The eigenvalues of the coefficient matrix in (A1) are \(\frac{\rho +\sqrt{(\rho +2\delta )^2+16(A_2)^2 \beta /B_2}}{2}\) and \(\frac{\rho -\sqrt{(\rho +2\delta )^2+16(A_2)^2 \beta /B_2}}{2}\), which are positive and negative, respectively. As the dynamic system has one predetermined variable, S, and one jump variable, TE, the steady state is a saddle point.

For future reference, we derive the explicit solutions of (A1) with the initial condition \(S(0)=S_0\) and the terminal condition \(\lim _{t\rightarrow \infty } S(t)=S^{ac}\). The solutions are

where \(\eta ^-\) is the negative eigenvalue of the coefficient matrix in (A1). By substituting (A2a) into (A2b), the total emissions along the optimal path can be represented in the feedback form:

Along the saddle path toward the steady state, the total emissions are decreasing in the stock of pollution. \(\square \)

1.2 A.2 Proof of Proposition 2

From (5), (24) and its Foreign counterpart, the matrix form of the dynamic system of the open-loop Nash equilibrium is given by

In the steady state, \(\dot{E}=\dot{E}^*=\dot{S}=0\). By solving (A4) for the steady-state solutions for the pollution stock and emissions in each country, we obtain

The eigenvalues of the coefficient matrix in (A4) are \(\rho +\delta >0\), \(\frac{\rho +\sqrt{(\rho +2\delta )^2+8(A_2)^2 \beta /B_2}}{2}>0\), and \(\frac{\rho -\sqrt{(\rho +2\delta )^2+8(A_2)^2 \beta /B_2}}{2}<0\). As the dynamic system has one predetermined variable, S, and two jump variables, E and \(E^*\), the steady state is a saddle point.

Deriving the explicit solutions of (A4) and rearranging the terms to obtain the total emissions along the open-loop Nash equilibrium path in the feedback form,

is obtained. \(\square \)

1.3 A.3 Proof of Proposition 3

From the first-order condition for maximizing the right-hand side of (26), it follows that

For the moment, let us focus on the case where \(a(A_1 B_2+A_2 B_1)+(A_2)^2V'(S) \ge 0\), that is,

By substituting (A7) into (26), differentiating by S, and rearranging the terms, we obtain

Letting \(E(S)=E^*(S)=E^a(S)\), (A8) can be rewritten as (27) in the text.

By substituting \(E^a(S)=\psi _0 +\psi _1 S\) into (27), we obtain

The above equation holds for any \(S\ge 0\) that satisfies \(E^a(S)\ge 0\) if and only if the following two equations are satisfied:

By solving (A11) for \(\psi _1\), we obtain

However, the positive root for \(\psi _1\) violates the stability of the steady state because

in this case. Thus, we must have

By solving (A10) for \(\psi _0\) and using (A13), we obtain

Recall that the strategy \(E^a(S)=\psi _0 +\psi _1 S\) is valid only if \(E^a(S)\ge 0\), or equivalently, \(S\le -\psi _0/\psi _1\equiv \hat{S}\). If \(S>\hat{S}\), the optimal emissions are zero for both countries. Substituting \(E=E^*=0\) into (26) yields \(\rho V(S)=K-(\beta /2)S^2-\delta V'(S)S\). Solving this differential equation of S, we can obtain the value function V(S) for \(S>\hat{S}\).

To summarize, we obtain the linear Markov-perfect Nash equilibrium under autarky as follows:

where \(\psi _0\) and \(\psi _1\) are given by (A14) and (A13), respectively. From (A15) and the fact that \(\dot{S}=0\) means a positive relationship between emissions and the pollution stock in the steady state, we conclude that there exists a unique steady state that satisfies \(\dot{S}=2E^a(S)-\delta S=2(\psi _0+\psi _1 S)-\delta S=0\). From this condition, we obtain the steady-state pollution stock (28). \(\square \)

1.4 A.4 Proof of Proposition 4

It is straightforward from (20) and (25) that \(S^{ac}<S^{ao}\). Note that we can generalize this result in the case in which the two countries do not necessarily share the same preferences, production structures, or technologies. In this case, the steady-state pollution stock in each regime can be calculated as

Thus, we obtain

where

which are both positive.

From (25), (28), and (A14), the difference in the steady-state levels of the pollution stock between the open-loop and linear Markov-perfect Nash equilibria is calculated as

In light of (A13), it follows that

Thus, the sign of (A17) is positive; the linear Markov-perfect Nash equilibrium results in a larger steady-state pollution stock than the open-loop Nash equilibrium. \(\square \)

1.5 A.5 Proof of Proposition 5

From (5) and (40), the matrix form of the dynamics of TE and S is given by

The steady-state solutions for TE and S are derived as

Further, the coefficient matrix in (A18) has one positive and one negative eigenvalue, indicating that the steady state is a saddle point.

Deriving the explicit solutions of (A18) and rearranging the terms to obtain the total emissions in the feedback form, we have

If \(\phi =1\), the coefficient of S(t) in the above equation can be rewritten as

where \(S^f\) is given by (50). \(\square \)

1.6 A.6 Proof of Proposition 6

The dynamic system consisting of (5), (43), and (44) can be rewritten in a matrix form as follows:

The steady-state solutions are

We can also verify that the coefficient matrix in (A21) has two positive and one negative eigenvalues, indicating that the steady state is a saddle point.

Deriving the explicit solutions of (A21) and rearranging the terms to obtain the total emissions along the open-loop Nash equilibrium in the feedback form, we have

If \(\phi =1\), (A22) can be rewritten as

which is the same as the cooperative solution. \(\Box \)

1.7 A.7 Proof of Proposition 7

From the first-order condition for maximizing the right-hand side of (26), it follows that

In the case where \(\gamma _1 -\gamma _3 E^*(S) +V'(S) \ge 0\), we have

By substituting (A25) into (46), differentiating by S, and rearranging the terms, we obtain

Analogously for the foreign government, we obtain:

Letting \(E(S)=E^*(S)=E^f(S)\) in (A26) and (A27) and rearranging, we obtain (47).

Substituting \(E^f(S)=\tilde{\psi }_0+\tilde{\psi }_1 S\) into (47) yields

Similar to Proposition 3, we can obtain the values of \(\tilde{\psi }_0\) and \(\tilde{\psi }_1\) as follows:

where

Given the nonnegativity constraint on \(E^f(S)\), the linear Markov-perfect Nash equilibrium is represented as follows:

where \(\tilde{\psi }_0\) and \(\tilde{\psi }_1\) are given by (A30) and (A29), respectively. As the steady-state condition is \(\dot{S}=2E^f(S)-\delta S=2\left( \tilde{\psi }_0+\tilde{\psi }_1 S\right) -\delta S=0\), the statement of the proposition can be obtained.

If \(\phi =1\), (A29) and (A30) can be simplified as

Then, we can verify that \(2E^f(S)=2\tilde{\psi }_0+2\tilde{\psi }_1 S\) coincides with the feedback solutions \(E(t)+E^*(t)\) in both the cooperative solution and open-loop Nash equilibrium. \(\square \)

1.8 A.8 Proof of Proposition 10

If \(n(z)=n\) for all \(z\in [0,1]\) and \(\phi =1\), the parameters of the model can be simplified to

Substituting these parameters into (13) and (36), the instantaneous utility under autarky is given by

and the instantaneous utility under free trade is

where \(\sigma ^2\equiv \mu _2^{\alpha }-(\mu _1^{\alpha })^2 \ge 0\) is the variance of technology distribution.

Given the symmetry of countries, \(E+E^*=2E\). Substituting this into (A33), we can verify that the coefficients of E and \(E^2\) in (A33) are the same as those in (A32). Comparing the constant terms, it is easily verified that the constant term in (A33) is greater than the constant term in (A32).

Substituting the above parameters under the assumption of \(n(z)=n\) for all \(z\in [0,1]\) and \(\phi =1\) into (A3), we obtain the optimal path of total emissions under autarky and international cooperation as follows:

Under free trade, (A20) and (A23) can be rewritten as

which is also identical to \(2E^f(S)=2\tilde{\psi }_0+2\tilde{\psi }_1 S\) in the Markov-perfect Nash equilibrium. From Proposition 9, we have \(S^{ac}=S^f\). Then, (A34) and (A35) coincide. This means that the discounted present value of (A32) and that of (A33) are identical except for the constant terms, which have higher value under free trade than autarky. Thus, we conclude that free trade achieves higher welfare than autarky when countries cooperate in their pollution control policies.

To consider the comparison between noncooperative equilibria under autarky and the free trade outcome, we focus on the steady-state welfare. Let us denote the steady-state welfare, as a function of the pollution stock, under autarky and free trade by \(u_A(S)\) and \(u_F(S)\), respectively. Substituting \(E=\delta S/2\) into (A32) and \(E+E^*=\delta S\) into (A33), respectively, we obtain

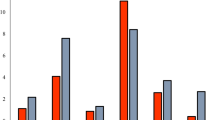

From (A36) and (A37), we can verify \(u_A(S)<u_F(S)\) for all \(S>0\) and that both \(u_A(S)\) and \(u_F(S)\) attain their maximum at \(S=2a\delta \mu _1^{\alpha }/\left( \delta ^2+4\beta \mu _2^{\alpha }\right) \equiv \bar{S}\). It is easily verified that \(\bar{S}<S^f=S^{ac}<S^{ao}<S^{am}\), as shown in Fig. 2. Since \(u^f=u_F(S^f)\), \(u^{ac}=u_A(S^{ac})\), \(u^{ao}=u_A(S^{ao})\), and \(u^{am}=u_A(S^{am})\), with (52) and (53) we have \(u^f>u^{ac}>u^{ao}>u^{am}\). \(\square \)

Appendix B Cournot–Nash Equilibrium in Product Markets Under Free Trade

From (29), each Home firm’s first-order conditions for profit maximization are

where the inequality in the second condition arises from the possibility that the trade cost is too high to serve the overseas market. With symmetry, the above profit maximization conditions are simplified to

Analogously for Foreign firms, the first-order conditions for profit maximization, with symmetry, are given by

The Cournot–Nash equilibrium in the Home market is characterized by (B1) and (B4), which derive each Home firm’s output x(z) and each Foreign firm’s output (export) m(z) as in (30). Analogously, the Cournot–Nash equilibrium in the Foreign market is characterized by (B2) and (B3), which derive each Foreign firm’s output \(x^*(z)\) and each Home firm’s output (export) \(m^*(z)\) as in (31).

Rights and permissions

About this article

Cite this article

Yanase, A., Kamei, K. Dynamic Game of International Pollution Control with General Oligopolistic Equilibrium: Neary Meets Dockner and Long. Dyn Games Appl 12, 751–783 (2022). https://doi.org/10.1007/s13235-022-00434-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13235-022-00434-2