Abstract

We analyse a model of environmental regulation where two firms can optimally decide to invest in an emission abatement technology and the regulator taxes firms’ emissions in a time-consistent manner. Depending on the values of the parameters measuring the extent of emission abatement that firms may achieve and the degree of product differentiation, we characterize the subgame perfect equilibria, developing all admissible scenarios where either both firms invest in abatement technologies, none of them do, or just one does, and show the conditions under which a win-win solution emerges, validating a strong form of Porter hypothesis. We also extend the main result to the oligopoly game with a generic number of firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is well appreciated that the ability of an environmental regulator to commit to the stringency of a policy instrument in a credible manner has various implications. Suppose the regulator can tax firms’ emissions. Then, the regulator understands that if firms anticipate that future emission policies will be strict, they would increase the current level of abatement. The regulator might want to commit to a future tax policy, as a means of affecting current investment in abatement. This incentive is the source of the well-known time-consistency problem.

In the absence of a pre-commitment ability related to the emission tax rate, firms have lower incentives to invest in abatement technologies because the regulator has an ex-post possibility to step up taxation and expropriate profits from greener technologies. On the other hand, if the regulator is not able to commit, firms might also abate more to ratchet down regulation and increase profits. In an oligopolistic industry further strategic considerations may add up, because a firm, while deciding to increase abatement to reduce the impact of taxes, will have to take into account that such tax reduction might lead to a negative effect on its profit because its rival will raise its output to adjust to a lower tax. In the absence of pre-commitment, each firm may have a strategic incentive to increase abatement to induce the regulator to lower emission taxes, but at the same time firms may decide strategically to let the rival move first.

So, the question arises: under which circumstances is it profitable for an oligopolistic firm to invest in emissions abatement when a regulator sets emission taxes optimally to incentivize firms to abate carbon emissions and thus reduce social damage arising from emissions? Put in another way, under which circumstances will a win-win solution emerge, validating a strong form of Porter hypothesis (Porter 1991; Porter and van der Linde 1995a, b)? While the weak form states that firms may have an incentive to invest in green technologies upon receiving a policy stimulus, in order to soften the impact of regulation, the strong form holds that firms should actually find themselves better off, i.e., their profits should increase by doing so. Should this go along with an increase in welfare, then one would observe the arising of the win-win solution. This has been the subject of a quite large literature which has delivered theoretical validations of the strong version of the Porter hypothesis under several assumptions, in a variety of dinamic and static models featuring price vs quantity competition and including the existence of asymmetric marginal production costs of green and brown technologies (either way). And indeed, one of the earliest models delivering a validation of its strong form is due to Xepapadeas and de Zeeuw (1999), in a differential game in which firms are price takers and, reacting to emission taxation, update and downsize their capital endowment over time. In so doing, they reduce the tax burden and become both more efficient and greener, thereby delivering the win-win solution.Footnote 1

Here, we shall adhere to the static approach adopted in most of the related literature, to examine the matter under the assumption of invariant marginal cost, and to find confirmation of the strong version whenever investments in emission abatement are viable in a framework aligned with (Petrakis and Xepapadeas 1999, 2003).

These strategic issues are present in many industrial sectors, such as the automobile sector. Public policies to promote usage of electric vehicles feature national recovery programs from the Covid crisis (IEA 2021), and electric vehicles are often seen as an important element to reducing global greenhouse gas emissions. From a policy perspective, understanding the strategic incentives of such policies and their environmental benefits is therefore critical.

The purpose of this paper is to answer these questions in a simple setting with two firms selling a differentiated product which generates carbon emissions, which can however be reduced upon investing in an abatement technology. We model a multiple stage game, where at stage one the two firms choose whether to abate or not, at stage two they determine the level of investment to maximize profits, at stage three the regulator chooses the optimal emission tax rate such that social welfare is maximized,Footnote 2 then at stage four firms set their optimal outputs in a Cournot setting.

Our main result is that depending on the values of the parameters measuring the extent of emission abatement that firms may achieve and the degree of product differentiation, a time-consistent win-win equilibrium solution may emerge, where both firms maximize their profits, invest optimally in emission abatement and, at the same time, environmental damage is reduced and social welfare is maximized.

The problem of timing and pre-commitment ability in environmental policy has been explored widely in the literature (Laffont and Tirole 1996a, b; Requate, 2005; Montero 2002a, b, among others), but most work has been devoted to monopolistic industries or imperfect competition with the purpose of comparing different environmental policies, i.e. taxes vs permits, or standards, assuming that the level of the policy instrument or the environmental target are exogenous (e.g., Lee 1975; Montero 2002a, b), or, for example, under asymmetric information (Karp and Zhang 2005, 2012; Tarui and Polasky 2005).

A pioneering work, examining the issue of credibility when a regulator can tax emissions in an oligopolistic market is offered by Petrakis and Xepapadeas (1999, 2003). They show that there are cases where a policy lacking commitment may lead firms to reduce emissions and hence increase social welfare. They consider a homogeneous Cournot oligopoly and study the effect of the size of the industry as a proxy of the degree of competition on environmental policies, but do not characterize the equilibrium outcomes of the abatement game.

Our paper is mostly related to Poyago-Theotoky and k. Teerasuwannajak, (2002); Moner-Colonques and Rubio (2015) and Buccella et al. (2021), which consider strategic firm settings in a multi-stage game.

Poyago-Theotoky and k. Teerasuwannajak, (2002) analyze the role of product differentiation under full commitment and no commitment and compare the tax rates in the two scenarios. They find that the optimal tax rate is always lower in the latter (time-consistent) case, when products are highly differentiated. The same ranking applies to social welfare as well. Moner-Colonques and Rubio (2015) compare two policy instruments, i.e. taxes and standards, to reduce emissions and distinguish whether the regulator has the ability to commit or not. They show that the strategic behaviour of two firms competing in a homogeneous Cournot duopoly has a detrimental effect on welfare when environmental damages are sufficiently large.

Our paper is close in spirit to Buccella et al. (2021), analysing the equilibrium outcomes in the abatement game. They find a set of different pure strategy Nash equilibria for both quantity and price setting duopolies, depending on the parameters indicating the societal awareness toward a green environment and the relative cost of abatement. In particular, they find that if such awareness is low (high) and the cost of abatement is relatively high (low), then firms do not abate (do abate) as the Pareto efficient outcome of the game.

Our paper expands on their work, developing all admissible scenarios where either both firms invest in abatement technologies, or none of them do, or just one does, in a more general framework with product differentiation and characterize all emerging (subgame-perfect) equilibria depending on the relevant parameters, and, in particular, the parameter measuring the extent of emission abatement that a firm may achieve. In the appendix, we also extend the analysis to the oligopoly case, to assess individual incentives at the first stage. By doing so, we show that the general case replicates the same predictions emerging from the analysis of the duopoly game.

The paper is structured as follows. Section 2 introduces the model setup. Sections 3 and 4 contain the analyses of the subgames and the first stage and derive the equilibrium outcomes. Concluding remarks are in Sect. 5. The appendix illustrates the extension to the oligopoly case.

2 The Model

The setup has its essential elements in common with Buccella et al. (2021). The utility function of the representative consumer is the same as in Singh and Vives (1984):

in which \(q_{1}\) and \(q_{2}\) are the output levels of two differentiated varieties of the same good, and parameter \(s\in \left( 0,1\right]\) is a direct measure of product substitutability (and an inverse measure of product differentiation), whereby if \(s=1\) the good is homogeneous. The two quantities are supplied, respectively, by firms 1 and 2, which compete à la Cournot under imperfect, symmetric and complete information, along the demand functions solving the consumer’s optimization problem:

Firms share the same constant marginal production cost \(c\in \left[ 0,a\right) ,\) and since production or consumption (or both) entail GHG emissions, are also subject to a tax t, which entails a per-firm burden amounting to \(T_{i}=t\left( eq_{i}-f\left( k_{i}\right) \right) .\) Here, \(eq_{i}\) is the volume of emissions, whose unit level is \(e>0,\) and \(f\left( k_{i}\right) =zk_{i}\), with \(z>0\), is the extent of emission abatement that firm i may achieve, provided it decides to invest in a green technology. This, in turn, entails a cost \(\Gamma _{i}=bk_{i}^{2}/2,\) with \(b>0\), as in Buccella et al. (2021) and many others.Footnote 3 The convexity of the abatement investment cost function is meant to allow for the concavity of profits and the existence of an inner equilibrium at the R &D stage. Accordingly, the total cost function borne by firm i is \(C_{i}\left( k_{i},q_{i},t\right) =cq_{i}+T_{i}+\Gamma _{i},\) and its profit function is

insofar as \(k_{i}\) is positive.

The strategic decision about whether or not to invest in the abatement technology is the essential feature of the game, whose structure includes four stages. In the first, which takes place in discrete strategies, firms face the binary choice between investing or not to abate emissions. In the second, any firm that has previously decided to go for it must determine the amount of investment to maximise its profits.Footnote 4 In the third stage, the policy maker sets the emission tax so as to maximise social welfare, and the fourth stage hosts market competition in the output space. In every stage in which they are involved, firms choose their respective strategies simultaneously and noncooperatively, and information across stages is perfect. The solution concept is the subgame perfect equilibrium by backward induction. In this respect, it is also worth stressing that, since the level of the emission tax is chosen once firms have invested (if they do so at all), environmental policy is time consistent, as in Petrakis and Xepapadeas (2003). This is indeed a relevant aspect, which has often emerged in the related literature (for a recent account, see Fukuda and Ouchida (2020); and Lambertini and Tampieri (2023). The matter can be summarised as follows. Should the policy maker set the tax before firms’ investment decisions, there would exists a temptation to modify it after the incorporation of any green technology in firms’ production plants. Hence, an emission tax ideally supposed to stimulate innovation would only affect output, on the basis of the tradeoff between profits and consumer surplus on one side and the environmental damage on the other. All of this can be avoided if the authority can credibly commit. However, the existence of an effective commitment device is questionable, as norms can be modified faster than physical capital and technology.

The overall industry net emissions are \(E_{I}=e\left( q_{1}+q_{2}\right) -z\left( k_{1}+k_{2}\right)\), and the resulting environmental damage is

due to the fact that a linear function would underestimate the effective damage.Footnote 5 Hence, the public authority chooses t to maximise social welfare, i.e., solves

where \(CS=U-\sum _{i=1}^{2}p_{i}q_{i}\) is consumer surplus (i.e., indirect utility) and \(T=t\sum _{i=1}^{2}\left( eq_{i}-zk_{i}\right)\) is the tax income (remember that \(k_{i}\) might be nil). The presence of the tax income balancing its impact on industry profits (and the impact of the tax on market price) reflects the partial equilibrium perspective adopted to analyse the sector in isolation. That is, T is redistributed to consumers, adding itself up to consumer surplus in various forms, such as health care, schooling, or infrastructures.

In the next section, we will review the three admissible scenarios in which (i) neither firm invests in abatement projects; (ii) both do; and (iii) one does while the other abstains. Each scenario is the characterization of a specific two- or three-stage subgame generated by firms’ discrete choices at the first stage.

3 The Subgames

Here we delve into the three possible subgames arising when, respectively, (i) both firms choose not to invest and react to the tax by adjusting output levels only; (ii) both of the invest; and finally (iii) just one does, while the other confines itself to adjusting production.

3.1 Neither Firm Invests

In this case, \(k_{1}=k_{2}=0.\) Therefore, the relevant profit function of firm i at the market stage is

which obviously engenders the following symmetric Cournot-Nash equilibrium:

with profits \(\pi _{00}^{CN}=\left( q^{CN}\right) ^{2}\). Subscript 00 indicates that abatement activity is nought at the industry level.

The level of the welfare-maximising tax is

for all \(e>1/2\), which in turn reveals that the optimal policy is indeed a tax provided that the coefficient determining the steepness of D, namely, \(e^{2}/2>1/8\) (i.e., one quarter of the coefficient appearing in the consumer surplus function).

The relevant equilibrium magnitudes simplify as follows:

3.2 Both Firms Invest

Here, the profit function is defined as in (3) for both firms. Obviously, the expression of the Cournot-Nash quantity at the market stage, for a generic tax level, coincides with (7). The optimal tax is now equal to

while the symmetric effort at the Nash equilibrium of the first stage is

if and only if \(4e^{4}+2e^{2}\left( 1+s\right) -s-1>0.\) The latter condition is satisfied by all \(e>\sqrt{2\left( \sqrt{(1+s)(5+s)}-1-s\right) }/4\), while the second order condition is always satisfied. Moreover, it can be verified that \(eq_{kk}^{CN}>zk_{kk}^{N}\) in the whole parameter space, which entails that, at equilibrium, the productive technology in use cannot become totally green, or

Lemma 1

Provided \(k_{kk}^{N}>0\), firms’ abatement efforts always leave a positive volume of emissions unabated.

Additionally, we see that \(\partial k_{kk}^{N}/\partial s<0\), which implies the following:

Remark 2

Provided \(k_{kk}^{N}>0\), then it is monotonically increasing (resp., decreasing) in the degree of product differentiation (resp., substitutability).

The intuitive explanation of this result is that since product differentiation boosts gross profits, this offers firms higher internal funds to invest in emission abatement. Therefore, as product differentiation increases, the incentive to invest in emission reduction increases. On the contrary, as competition becomes more intense (that is, \(s\rightarrow 1\)), such incentive is reduced by the usual free-riding behaviour. This result is consistent with Poyago-Theotoky and k. Teerasuwannajak, (2002).

Also in this case, the optimal policy instrument, whose simplified expression is

may change sign (and therefore also nature). The remaining equilibrium expressions for profits, environmental damage and social welfare are omitted for the sake of brevity, and we will do the same in the next case as well. Yet, even skipping altogether the explicit illustration of the details of the proof (which is trivial), it can be shown that the above Remark has a direct and relatively straightforward implication:

Corollary 3

Provided \(k_{kk}^{N}>0\), then \(\partial D_{kk}^{CN}/\partial s>0.\) That is, any increase in product differentiation (or, the representative consumer’s preference for variety) leads to a reduction of the environmental damage (and conversely).

3.3 The Asymmetric Case

Here, \(k_{i}\) is endogenously determined, while \(k_{j}=0.\) Once again, equilibrium outputs are as in (7). The optimal tax is

and the equilibrium abatement investment of firm i at the previous stage is

provided that \(4e^{2}\left( 4e^{2}+1+s\right) -s-1>0\), which is the same condition appearing in the previous case, this being due to the fact that the additive separability characterising the profit function makes the best replies in the investment space orthogonal to each other. However, it can be shown that the following holds:

Lemma 4

Provided \(k_{k0}^{N},k_{kk}^{N}>0,\) then \(k_{k0}^{N}>k_{kk}^{N}\) over the whole admissible parameter range.

This amounts to saying that, once a firm is aware that the rival does not carry out any green R &D at all, it has a higher incentive to do so, the reason being that the tax in practice raises marginal production cost and therefore reducing its impact is equivalent to becoming more efficient.

This fact, however, may not be conducive to higher profits, in view of the presence of the quadratic cost of investing. Indeed,

provided the critical threshold of b is positive; otherwise, \(\pi _{0k}^{CN}>\pi _{k0}^{CN}\) for all \(b\ge \max \left\{ 0,\overline{b} \right\}\). We are now ready to look at the first stage of the game.

4 The First Stage

This takes place in discrete strategies, with firms facing Matrix 1, which captures their strategic incentives as to whether to invest or not in R &D projects for abatement technologies.

If the other firm does not invest, we have

which is positive, if equilibrium investments are positive, so \(\pi _{k0}^{CN}>\pi _{00}^{CN}\) everywhere. This suffices to exclude the arising of a symmetric equilibrium with both firms deciding not to invest at all. Unfortunately, the other two conditions, \(\pi _{kk}^{CN}-\pi _{0k}^{CN}\gtrless 0\) and \(\pi _{kk}^{CN}-\pi _{00}^{CN}\gtrless 0\) are not so easily readable. However,

where \(\Phi\) is a positive polynomial. Therefore, if indeed \(\pi _{kk}^{CN}-\pi _{0k}^{CN}>0\), this opens the way to the win-win solution, i.e., the validation of the Porter hypothesis in its strong form.

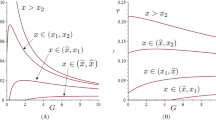

To this aim, we have performed numerical simulations systematically yielding a picture analogous to what appears in Fig. 1, where we have fixed \(a-c=1,\) \(b=1\) and \(s=z=1/2\). As we already know, \(\pi _{k0}^{CN}\ge \pi _{00}^{CN}\) always, and therefore the green curve is tangent to the horizontal axis from above. Conversely, \(\pi _{kk}^{CN}-\pi _{00}^{CN}\) and \(\pi _{kk}^{CN}-\pi _{0k}^{CN}\) cross it twice, and one of these intersection points coincides with the tangency of the green curve with the horizontal axis, which takes place at

which coincides with the threshold level beyond which R &D efforts are positive. Given the above parameter values, here and in the remaining graphs \(\overline{e}\left( s\right) \simeq 0.4142.\)

We may thus conclude that when \(\pi _{kk}^{CN}-\pi _{0k}^{CN}<0,\) Matrix 1 yields two asymmetric equilibria, \(\left( 0,k\right)\) and \(\left( k,0\right) ,\) and the mixed strategy one becomes also relevant. Otherwise, when \(\pi _{kk}^{CN}-\pi _{0k}^{CN}>0,\) there exists a unique equilibrium at the intersection of dominant strategies in \(\left( k,k\right) ,\) which is also Pareto-efficient for firms. This materialises the first component of the win-win solution.

The last step consists in assessing \(SW_{kk}^{CN},\) \(SW_{k0}^{CN}\) and \(SW_{00}^{CN},\) by finding out that

at \(e=\overline{e}(s),\) and evaluating the pattern of the welfare levels, portrayed in Fig. 2.

There clearly emerges that \(SW_{00}^{CN}<SW_{0k}^{CN}<SW_{kk}^{CN}\) for all \(e>\overline{e}(s),\) which, together with the aforementioned findings about profits, implies the following

Proposition 5

For all \(e>\overline{e}(s)\), the unique equilibrium \(\left( k,k\right)\) delivers a validation of the strong form of the Porter hypothesis.

Notice that since \(\partial \overline{e}(s)/\partial s>0\), as product differentiation increases, the range of values of e for which the unique equilibrium \(\left( k,k\right)\) exists widens, implying that the strong form of the Porter Hypothesis can be confirmed for lower values of the parameter measuring the extent of emission abatement that the technology may achieve. The interest of this result lies also in the fact that the win-win solution emerges in presence of abatement technologies, while it has been frequently validated in connection with replacement technologies sometimes associated with exogenous investment costs (see, e.g., André et al. 2009; Lambertini and Tampieri 2012).

To complement the above claim, it is worth noting that \(D_{kk}^{CN}=D_{k0}^{CN}=D_{00}^{CN}\) at \(e=\overline{e}(s),\) and the graph in Fig. 3 reveals that the industry-wide investment associated with \(\left( k,k\right)\) minimises the environmental damage, as \(D_{kk}^{CN}<D_{k0}^{CN}<D_{00}^{CN}\) for all \(e>\overline{e}(s)\).

5 Concluding Remarks

We have illustrated the equilibrium analysis of a differentiated Cournot duopoly with GHG emissions being taxed in a time-consistent way and possibly abated by firms through costly investments. To do so, we have explicitly parametrized some exogenous elements of the model, such as the intensity of per-unit emissions.

This is a relevant aspect since, under the regulator’s inability to precommit to an emission tax, the possibility that strategic behaviour may be welfare improving depends on various parameters, affecting the incentives to alter firms’ investments in a strategic fashion in order to induce favourable shifts in future environmental policy. At the same time, the regulator should anticipate how environmental taxes affect not only current emissions levels, but also the effect of policy on incentives to innovate in a carbon-reducing technology.

We have identified the critical intensity of emissions at which firms’ abatement efforts are systematically positive, irrespective of whether both choose to invest or not. And, on the basis of the same threshold, we have shown that a time-consistent win-win equilibrium solution may emerge, validating a strong form of the so-called Porter hypothesis. Thus, in our model the strategic behaviour of firms can be welfare improving and may induce more investment in abatement technology if a tax is used to control pollution in a time-consistent manner.

Although these theoretical insights are valuable, the implications for empirical work are probably even more noteworthy. An empirical challenge is to use existing data to validate the Porter Hypothesis in our context. This has to be left for further research.

Notes

The relation between competition and innovation has been studied extensively in Lambertini (2017); Lambertini et al. (2017). More specifically, for the so-called Porter hypothesis, see Greaker (2003a, 2003b); André et al. (2009); Constantatos and Herrmann (2011); Lambertini and Tampieri (2012); Ranocchia and Lambertini (2021). In particular, Constantatos and Herrmann (2011) use a model in which the green technology is indeed cost-efficient. Exhaustive surveys of the early years of the debate on the Porter hypothesis are in Lanoie et al. (2011) and Ambec et al. (2013). A recent dynamic approach to the Porter hypothesis and encompassing the preservation of biological species is in Feichtinger et al. (2022).

As we know since Levin (1985); Simpson (1995) and Katsoulacos and Xepapadeas (1995), in oligopoly the welfare maximising tax on emissions cannot induce firms to fully internalise the marginal environmental damage, except in the limit as the industry becomes perfectly competitive. The source of this drawback is the tradeoff between the environmental externality and consumer surplus, namely, the same that jeopardises the functioning of the Coase Theorem (Buchanan 1969; Barnett 1980).

The presence of a stage at which firms play in discrete strategies in order to decide whether to invest at all before finely tuning the investment level is crucial as each firm must know the exact structure of the ensuing R &D stage, in particular whether the rival is about to invest or not. A structure like this is labelled as extended game with observable delay after Hamilton and Slutsky (1990) but has been used even before, e.g. by Singh and Vives (1984). An setup largely analogous to the present one is in Bacchiega et al. (2010), where the issue is whether to invest or not in the model of d’Aspremont and Jacquemin (1988) with process innovation followed by Cournot competition.

The shape of the damage function has to be convex in the volume of emissions in order to reflect the scientific evidence on the matter (see, among many others, Solomon et al. 2009). This requirement, in models in which relevant magnitudes are parabolic, is met by defining the damage as a quadratic function of emissions. This assumption has been adopted in many other contributions to the literature on green innovation, including those appearing in footnote 3, and is also incorporated in integrated assessment models (Nordhaus and Boyer 2000).

References

Ambec S, Cohen M, Elgie S, Lanoie P (2013) The Porter Hypothesis at 20: Can Environmental Regulation Enhance Innovation and Competitiveness? Rev Environ Econ Policy 7:2–22

André FJ, González P, Porteiro N (2009) Strategic quality competition and the porter hypothesis. J Environ Econ Manag 57:182–94

Bacchiega E, Lambertini L, Mantovani A (2010) R &D-Hindering Collusion. B.E. J Econ Anal Policy 10(Topics), article 66

Barnett A (1980) The Pigouvian tax rule under monopoly. Am Econ Rev 70:1037–41

Buccella D, Fanti L, Gori L (2021) To Abate, or Not to Abate? A strategic approach on green production in Cournot and Bertrand duopolies. Energy Econ 96, art. 105165, 1–15

Buchanan JM (1969) External diseconomies, corrective taxes, and market structure. Am Econ Rev 59:174–77

Chiou J-R, Hu J-L (2001) Environmental research joint ventures under emission taxes. Environ Resour Econ 20:129–46

Constantatos C, Herrmann M (2011) Market inertia and the introduction of green products: Can strategic effects justify the porter hypothesis? Environ Resour Econ 50:267–84

d’Aspremont C, Jacquemin A (1988) Cooperative and noncooperative R &D in duopoly with spillovers. Am Econ Rev 78:1133–37

Feichtinger G, Lambertini L, Leitmann G, Wrzaczek S (2022) Managing the tragedy of commons and polluting emissions: a unified view. Eur J Oper Res 303:487–99

Fukuda K, Ouchida Y (2020) Corporate social responsibility (CSR) and the environment: Does CSR increase emissions? Energy Econ 92, article 104933, 1–10

Greaker M (2003) Strategic environmental policy: Eco-dumping or a green strategy? J Environ Econ Manag 45:692–707

Greaker M (2003) Strategic environmental policy when the governments are threatened by relocation. Resour Energy Econ 25:141–54

Hamilton J, Slutsky S (1990) Endogenous timing in duopoly games: Stackelberg or Cournot equilibria. Games Econ Behav 2:29–46

IEA (2021) How global electric car sales defied Covid-19 in 2020. Paris, France https://www.iea.org/commentaries/how-global-electric-car-sales-defied-covid-19-in-2020

Karp L, Zhang J (2005) Regulation of stock externalities with correlated abatement costs. Environ Resour Econ 32:273–99

Karp L, Zhang J (2012) Taxes versus quantities for a stock pollutant with endogenous abatement costs and asymmetric information. Econ Theory 49:371–409

Katsoulacos Y, Xepapadeas A (1995) Environmental policy under oligopoly with endogenous market structure. Scand J Econ 97:411–20

Laffont JJ, Tirole J (1996) Pollution Permits and Compliance Strategies. J Public Econ 42:85–25

Laffont JJ, Tirole J (1996) Pollution permits and environmental innovation. J Public Econ 42:127–40

Lambertini L (2017) Green innovation and market power. Annu Rev Resour Econ 9:231–52

Lambertini L, Tampieri A (2012) Vertical differentiation in a Cournot industry: the Porter hypothesis and beyond. Resour Energy Econ 34:374–80

Lambertini L, Tampieri A (2023) On the private and social incentives to adopt environmentally and socially responsible practices in a monopoly industry. J Clean Prod 426, article 139036, 1–11

Lambertini L, Poyago-Theotoky J, Tampieri A (2017) Cournot competition and “Green" innovation: an inverted-U relationship. Energy Econ 68:116–23

Lanoie P, Laurent-Lucchetti J, Johnstone N, Ambec S (2011) Environmental policy, innovation and performance: new insights on the Porter hypothesis. J Econ Manag Strategy 20:803–42

Lee DR (1975) Efficiency of pollution taxation and market structure. J Environ Econ Manag 2:69–72

Levin D (1985) Taxation within Cournot Oligopoly. J Public Econ 27:281–90

Moner-Colonques R, Rubio SJ (2015) The timing of environmental policy in a duopolistic market. Economia Agraria y Recursos Naturales 15:11–40

Montero J-P (2002) Permits, standards, and technology innovation. J Environ Econ Manag 44:23–44

Montero J-P (2002) Market structure and environmental innovation. J Appl Econ 5:293–325

Nordhaus WD, Boyer J (2000) Warming the World. Economic models of global warming, Cambridge, Mass., MIT Press

Petrakis EA, Xepapadeas (1999) Does government precommitment promote environmental innovation?. In: Petrakis E, Sartzetakis E, Xepapadeas A (eds) Environmental Regulation and Market Power, Edward Elgar, Chelthenham, pp 145–161

Petrakis E, Xepapadeas A (2003) Location decisions of a polluting firm and the time consistency of environmental policy. Resour Energy Econ 25:197–214

Porter ME (1991) America’s green strategy. Sci Am 264:168

Porter ME, van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9:97–118

Porter ME, van der Linde C (1995b) Green and competitive: ending the stalemate. Harvard Business Review (September–October), 120–34

Poyago-Theotoky J (2007) The organization of R &D and environmental policy. J Econ Behav Organ 62:63–75

Poyago-Theotoky J, Teerasuwannajak K (2002) The timing of environmental policy: a note on the role of product differentiation. J Regul Econ 21:305–16

Ranocchia C, Lambertini L (2021) Porter hypothesis vs pollution haven hypothesis: Can there be environmental policies getting two eggs in one basket? Environ Resour Econ 78:177–99

Requate (2005) Timing and commitment of environmental policy, adoption of new technology, and repercussion on R &D. Environ Resour Econ 31:175–99

Simpson RD (1995) Optimal pollution taxation in a Cournot duopoly. Environ Resour Econ 6:359–69

Solomon S, Plattner G-K, Knuttic R, Friedlingstein P (2009) Irreversible climate change due to carbon dioxide emissions. Proc Natl Acad Sci 106:1704–09

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15:546–54

Tarui N, Polasky S (2005) Environmental regulation with technology adoption, learning and strategic behaviour. J Environ Econ Manag 50:447–67

Xepapadeas A, de Zeeuw A (1999) Environmental policy and competitiveness: the Porter hypothesis and the composition of capital. J Environ Econ Manag 37:165–82

Funding

Open access funding provided by Alma Mater Studiorum - Università di Bologna within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Ethical Approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank the Lead Guest Editor, Phoebe Koundouri, an anonymous referee, as well as Anna Alberini and the audience at EAERE 2022 (Rimini, June 28–July 1, 2022) for fruitful comments and discussion. We gratefully acknowledge the financial support received from the PRIN2017 Grant No. 201782J9R9 “Experimental assessment of climate change economics” led by Marco Casari. The usual disclaimer applies.

Appendix

Appendix

If \(n\ge 2\) single-product firms are present, the representative consumer’s utility function takes the following form:

Therefore, the individual demand function of firm i is

and its profit function is

for any \(k_{i}\ge 0\).

Consumer surplus is

while the tax income is \(T=t\sum _{i=1}^{n}\left( eq_{i}-zk_{i}\right)\) and the environmental damage is \(D=E_{I}^{2}=\left[ \sum _{i=1}^{n}\left( eq_{i}-zk_{i}\right) \right] ^{2}\). Consequently, social welfare is \(SW=\sum _{i=1}^{n}\pi _{i}+CS+T-D\).

In the subgame in which firms react to the tax by adjusting outputs only (hence, \(k_{i}=0\) for all \(i=1,2,...n\)) the Cournot-Nash per-firm output for any given t is

and the welfare-maximising tax is

which entails that the critical threshold of e above which the optimal policy is indeed a tax monotonically decreases as the industry becomes more competitive (and total output and emissions increase). The resulting equilibrium magnitudes are

Once again, the additive separability of quantity and the abatement effort in the individual profit function entails that \(q_{00}^{CN}\left( n\right)\) carries over to the remaining subgames. The welfare maximising policy if all firms invest is

with \(e>1/\sqrt{2n}\) being a necessary but not sufficient condition for \(t_{kk}^{*}\left( n\right) >0\). The equilibrium symmetric abatement effort is

Here, as well as in the remainder, the equilibrium magnitudes of profits, welfare, consumer surplus and environmental damage will be omitted for the sake of brevity, being available upon request.

Now we may turn to the asymmetric cases in which a firm deviates unilaterally from either symmetric outcome. We shall examine first the case of a single firm investing in emission abatement while the others do not. Accordingly, we pose \(k_{j}=0\) for all \(j\ne i\). If so, the optimal tax \(t_{kk}^{*}\left( n\right)\) becomes

and firm i’s profit-maxising abatement is

In the opposite case, \(k_{i}=0\) while the remaining \(n-1\) abatement efforts \(k_{j},\) \(j\ne i\) appear in the expression of

and this policy triggers the vector of \(n-1\) symmetric efforts corresponding to

Using the resulting expressions of \(\pi _{kk}^{CN}\left( n\right)\), \(\pi _{00}^{CN}\left( n\right)\), \(\pi _{kk}^{CN}\left( n\right)\) and \(\pi _{0k}^{CN}\left( n\right)\), we may reconstruct the \(2\times 2\) matrix in the oligopoly case, in which firm i is the row player and any other firm identified by \(j\ne i\) is a column player:

The relevant inequalities are the same as in the main text, and give rise to Fig. 4, which is qualitatively amalogous to Fig. 1, except for the presence of n firms. The parameter values are \(a-c=1,\) \(b=1,\) \(n=5\) and \(s=z=1/2\).

All curves intercept each other in correspondence of

with

for all \(s\in \left( 0,1\right]\), and \(\overline{e}(s,n)=\overline{e}(s)\) at \(n=2\). Moreover, the numerical values listed above yield \(\overline{e} (s,n)\simeq 0.3012.\) Moreover, the single real root (not identically equal to zero) of \(\partial \overline{e}(s,n)/\partial n=0\) is negative for any \(s\in \left( 0,1\right]\), and

along the same interval. This suffices to establish that \(\partial \overline{ e}(s,n)/\partial n<0\) for all \(n\ge 2.\)

The following graphs replicate Figs. 2 and 3 for \(n=5\), with the additional distinction between \(SW_{k0}^{CN}\left( n\right)\) and \(SW_{0k}^{CN}\left( n\right)\) as well as \(D_{k0}^{CN}\left( n\right)\) and \(D_{0k}^{CN}\left( n\right) .\) (Figs. 5 and 6).

As for profits, also the sequence of welfare and damage levels beyond the threshold \(\overline{e}(s,n)\) above which investments are positive reveals that the equilibrium in which the whole industry does invest in abatement technologies is the most efficient one, delivering the highest level of welfare and the lowest environmental damage. And, as in the duopoly game, it is also selected by firms at the intersection of dominant strategies.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Agliardi, E., Lambertini, L. To Abate, or Not to Abate? The Arising of the Win–Win Solution Under Time Consistent Emission Taxation. Environ Resource Econ 87, 1389–1405 (2024). https://doi.org/10.1007/s10640-024-00879-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-024-00879-6