Abstract

We study cheap-talk pre-play communication in static all-pay auctions. For the complete information case of two bidders, all correlated equilibria are payoff equivalent to the Nash equilibrium if there is no reserve price, or if it is commonly known that one bidder has a strictly higher value. Similarly, for the independent private values case of two bidders with no reserve price, all communication equilibria are payoff equivalent to the Bayesian Nash equilibrium. Hence, in such environments the Nash equilibrium and the Bayesian Nash equilibrium predictions are robust to pre-play communication between the bidders. On the other hand, if there are three or more symmetric bidders, or two symmetric bidders and a positive reserve price, then with complete information there may exist correlated equilibria such that the bidders’ payoffs are higher than in any Nash equilibrium, and with independent private values there may exist communication equilibria such that the bidders’ payoffs are higher than in any Bayesian Nash equilibrium. In these cases, pre-play cheap talk may affect the outcomes of the game, since the bidders have an incentive to coordinate on such equilibria.

Similar content being viewed by others

Notes

There are also other reasons to use correlated equilibrium as a solution concept. Correlated equilibrium has arguably more compelling epistemic foundations than Nash equilibrium (Aumann 1987); it is easier for boundedly rational players to learn to play correlated equilibrium than Nash equilibrium (Hart and Mas-Colell 2013). Communication equilibrium is one of the most popular ways of extending the concept of correlated equilibrium to games with incomplete information but not the only one (Forges 1993; Bergemann and Morris 2016).

For example, Aoyagi (2003) studies self-enforcing collusion with pre-play communication in repeated auctions.

See also Azacis and Vida (2015) for related results for the first-price auction with a continuum of bids.

For a survey of other experimental research on contests see Dechenaux et al. (2015).

Alternatively one can keep the action set \(A_{i}=\left[ 0,\infty \right) \), but this will result in an unnecessary multiplicity of equilibria because there will be multiple possible “inactive” bids.

All considered sets and functions are Borel measurable; all considered probability measures are Borel, with topology of weak convergence.

The principal-agent literature often uses a first-order approach for describing an agent’s best response. This approach is not going to work here because a bidder’s expected payoff is typically discontinuous in own bid.

For example, in the second-price auction without the reserve price there are many Nash equilibria: the truthful equilibrium, and infinitely many equilibria involving weakly dominated strategies (Blume and Heidhues 2004). If the bidders correlate their play, then it is possible to sustain the following collusive scheme. Before the auction a designated winner is randomly chosen; during the auction the bidders coordinate on the equilibrium where the designated winner obtains the good for free by submitting a very high bid while the other bidders submit zero bids. See Section V. A in the working paper version of Marshall and Marx (2009).

The result in Proposition 2 for the case \(r=0\) follows from a more general result, Proposition 6 in Sect. 4.1, that allows for incomplete information. However, the proof here is different and more intuitive.

An alternative way to finish the proof is to use Theorem 3 from Moulin and Vial (1978), which shows that for any game that is strategically equilvalent to a zero-sum game there exist no “correlation scheme” that improves upon all Nash equilibrium payoffs for both players. The class of “correlation schemes” in Moulin and Vial (1978) includes correlated equilibria, as well as some other joint action plans that require certain commitment on the part of the players.

See example on p. 204 in Moulin and Vial (1978).

Specifically, they formulate the collusive problem as a linear programming problem, and, by discretizing the bid spaces, manage to derive some properties of the dual problem which imply the result.

We conjecture that at least for some parameters no other payoffs can be achieved by correlated equilibria, but we have not managed to prove this because of the technical difficulties outlined in the beginning of this section.

The actual correlated equilibrium in Example 2 is slightly more involved: the active bidders are in addition recommended whether to bid high or low, and the probabilities of the mediator’s profiles of recommendations are adjusted to ensure incentive compatibility.

It is possible to construct correlated equilibria with asymmetric payoffs, but we do not present them here. We do not claim that the upper bound on the payoff in the presented symmetric correlated equilibria is the highest one could achieve.

For example, the results of Siegel (2014) imply that the Bayesian Nash equilibrium exists and is unique when there are finitely many strictly positive values for every bidder.

If bidder i is uncertain about his valuation \(v_{i}\), then a transformation of his payoff according to formula (1) is likely to change his best response, because in general \(E\left[ 1/v_{i}\right] \ne 1/E \left[ v_{i}\right] \). For the case of correlated values it is unclear how part (i) of the deviational strategy described in the previous paragraph has to be adjusted in order to guarantee a bidder his Bayesian Nash equilibrium payoff.

Lopomo et al. (2011) check the robustness of the result by studying numerically other environments with two bidders.

Azacis and Vida (2015) also present several results on the optimal collusive schemes in the first-price auction with omniscient mediator who is assumed to know the bidders values. In such a model the bidders can generally do better than in the Bayesian Nash equilibrium without communication: the mediator selectively reveals information on the bidders’ values to induce asymmetric beliefs which lead to less aggressive bidding. Bergemann et al. (2017) also study related constructions.

Here is a sketch of the argument. If following every message the posterior probability that bidder 1 is of type 0 is not higher than r, then after every message either type of bidder 1 gets zero payoff in the continuation Bayesian Nash equilibrium. Then the prior belief \(p_{1}\) must also be not higher than r, and hence the Bayesian Nash equilibrium payoffs of the game without communication are the same. If the posterior beliefs following some messages are above r, then it is optimal for bidder 1 of type 1 to send messages that induce the highest possible belief that bidder 1’s type is 0. However, since the equilibrium posterior beliefs must reflect the strategy of bidder 1, the highest posterior belief cannot be greater than the prior \(p_{1}\). Hence, the posterior beliefs after every message must be equal to the prior, which implies payoff equivalence with the Bayesian Nash equilibrium of the game without communication.

It can be shown that an analogous result holds for the case when \(p\in \left[ \frac{r}{v},1\right] \) and r is sufficiently high. The proof is long, and thus not included in the paper.

The inefficiency of Bayesian Nash equilibrium is easy to observe when \( p\approx 0\) and \(r\approx v\). Efficiency requires that each bidder with value v submits an active bid, and thus the sum of the ex ante expected bids must be at least \(2\left( 1-p\right) r\approx 2v\). However, the bidders’ gross ex ante payoff is only \(v\left( 1-p^{2}\right) \approx v\), which gives an impossibilty.

Another implication is that the Nash equilibrium prediction is robust to the bidders’ having arbitrary correlated beliefs about payoff-irrelevant states of the world, as long as these beliefs are consistent with the common prior (Aumann 1974).

Such models include all-pay auctions with general cost functions (Siegel 2009) as well as models of contests where the determination of the winner stochastically depends on the amount of resources committed by the participants, i.e. rent-seeking contests and models of conflict (Tullock 1980; Hirshleifer 1989), tournaments between workers (Lazear and Rosen 1981), R &D contests (Baye and Hoppe 2003), etc.

Relatedly, Einy et al. (2022) identified classes of games with a unique correlated equilibrium which coincides with the unique Nash equilibrium.

For example, Ivanov (2010) investigates how strategic mediators can be used in sender-receiver games.

One can use the existing results on implementation of correlated and communication equilibria without a mediator for general games. See Forges (2009) for a survey. The constructions in these papers are for finite sets of actions, but they can be adapted to implement the correlated and communication equilibria constructed here.

It also seems unlikely that there may exist other interesting correlated and communication equilibria that can be implemented by direct unnmediated communication before the all-pay auction. In the environment with complete information such pre-play communication only achieves payoffs that are in the convex hull of the Nash equilibrium payoffs of the game without communication (Forges 1990). We conjecture that it is impossible to improve upon the Bayesian Nash equilibria using only such pre-play communication in the all-pay auction with incomplete information as well.

Blume and Board (2013) introduced the idea that instead of communication via a noisy communication channel it is possible to use direct communication when there is uncertainty about the ability of the players to understand some messages.

It is straightforward to verify that the entries in table: (i) sum up to one; and (ii) are nonnegative. The latter is because

$$\begin{aligned} u_{1}+u_{2}=\frac{\left( v^{2}u_{1}+r^{2}u_{2}\right) +\left( r^{2}u_{1}+v^{2}u_{2}\right) }{v^{2}+r^{2}}\le \frac{2r^{2}}{v^{2}+r^{2}}<1 \end{aligned}$$where the first inequality follows from \(v^{2}u_{i}+r^{2}u_{j}\le r^{2}\).

Bidding exactly r is dominated by bidding slightly above r if there is a positive probability that the opponent bids r.

It is straightforward to verify that the entries in table: (i) sum up to one; and (ii) are nonnegative. The latter is because

$$\begin{aligned} \frac{v-r}{4}-\frac{3v+r}{v}\frac{n}{8}U\ge \frac{v-r}{4}-\frac{3v+r}{v} \frac{n}{8}{\overline{U}}=\frac{\left( v-r\right) ^{2}\left( v+r\right) \left( \left( 3n-4\right) v+nr\right) }{2v\left( \left( 9n-14\right) v^{2}+\left( 6n-8\right) vr+\left( n+6\right) r^{2}\right) }\ge 0 \end{aligned}$$where the equality is by definition of \({\overline{U}}\).

If there are multiple Bayesian Nash equilibria, then every communication equilibrium is interim payoff equivalent to some Bayesian Nash equilibrium. We do not include this observation in Proposition 6 because we are not aware of any examples of multiple Bayesian Nash equilibria in this setting.

It is straightforward to verify that \({\widehat{\pi }}\in \left[ 0,1\right] \) and that the entries in table: (i) sum up to one; and (ii) are nonnegative (since \(r>pv\)).

Bidding exactly r is dominated by bidding slightly above r if there is a positive probability that the opponent bids r.

It is straightforward to verify that the entries in table: (i) sum up to one; and (ii) are nonnegative for p sufficiently small (since \(g=\frac{2}{n }\) when \(p=0\)).

References

Amann E, Leininger W (1996) Asymmetric all-pay auctions with incomplete information: the two-player case. Games Econom Behav 14:1–18

Antsygina A, Teteryatnikova M (2022) Optimal information disclosure in contests with stochastic prize valuations. Econ Theor. https://doi.org/10.1007/s00199-022-01422-8

Aoyagi M (2003) Bid rotation and collusion in repeated auctions. J Econ Theory 112:79–105

Aumann R (1974) Subjectivity and correlation in randomized strategies. J Math Econ 1:67–96

Aumann R (1987) Correlated equilibrium as an expression of Bayesian rationality. Econometrica 55:1–18

Azacis H, Vida P (2015) Collusive communication schemes in a first-price auction. Econ Theor 58:125–160

Baye M, Hoppe H (2003) The strategic equivalence of rent-seeking, innovation, and patent-race games. Games Econom Behav 44:217–226

Baye M, Kovenock D, de Vries C (1993) Rigging the lobbying process: an application of the all-pay auction. Am Econ Rev 83:289–294

Baye M, Kovenock D, de Vries C (1996) The all-pay auction with complete information. Econ Theor 8:291–305

Benoit J-P, Dubra J (2006) Information revelation in auctions. Games Econom Behav 57:181–205

Bergemann D, Brooks B, Morris S (2017) First-price auctions with general information structures: implications for bidding and revenue. Econometrica 85:107–143

Bergemann D, Morris S (2016) Bayes correlated equilibrium and the comparison of information structures in games. Theor Econ 11:487–522

Bergemann D, Morris S (2019) Information design: a unified perspective. J Econ Lit 57:44–95

Bertoletti P (2016) Reserve prices in all-pay auctions with complete information. Res Econ 70:446–453

Blume A, Board O (2013) Language barriers. Econometrica 81:781–812

Blume A, Heidhues P (2004) All equilibria of the Vickrey auction. J Econ Theory 114:170–177

Camerer C (2003) Behavioral game theory: experiments in strategic interaction. Princeton University Press, Princeton

Chen Z (2019) Information disclosure in contests: private versus public signals, Working paper (available at SSRN 3326462)

Cotter K (1991) Communication equilibria with large state spaces. In: Khan MA, Yannelis NC (eds) Equilibrium theory in infinite dimensional spaces. Studies in economic theory, vol 1. Springer, Berlin, pp 288–299

Dechenaux E, Kovenock D, Sheremeta R (2015) A survey on experimental research on contests, all-pay auctions, and tournaments. Exp Econ 18:609–669

Einy E, Haimanko O, Lagziel D (2022) Strong robustness to incomplete information and the uniqueness of a correlated equilibrium. Econ Theor 73:91–119

Forges F (1990) Universal mechanisms. Econometrica 58:1341–1364

Forges F (1993) Five legitimate definitions of correlated equilibrium in games with incomplete information. Theor Decis 35:277–310

Forges F (2009) Correlated equilibria and communication in games. In: Myers R (ed) Encyclopedia of complexity and systems science. Springer, Berlin, pp 1587–1596

Garratt R, Tröger T, Zheng C (2009) Collusion via resale. Econometrica 77:1095–1136

Graham D, Marshall R (1987) Collusive bidder behavior at single-object second-price and English auctions. J Polit Econ 95:1217–1239

Haimanko O (2022) Equilibrium existence in two-player contests without absolute continuity of information. Econ Theory Bull 10:27–39

Harbring C (2006) The effect of communication in incentive systems—an experimental study. Manag Decis Econ 27:333–353

Hart S, Mas-Colell A (2013) Simple adaptive strategies: from regret-matching to uncoupled dynamics. World Scientific Series in Economic Theory, vol 4, World Scientific

Hernando-Veciana A, Tröge M (2011) The insider’s curse. Games Econom Behav 71:339–350

Hillman A, Riley J (1989) Politically contestable rents and transfers. Econ Polit 1:17–39

Hillman A, Samet D (1987) Dissipation of contestable rents by small numbers of contenders. Public Choice 54:63–82

Hirshleifer J (1989) Conflict and rent-seeking success functions: ratio vs. difference models of relative success. Public Choice 63:101–112

Hwang S-H, Rey-Bellet L (2020) Strategic decompositions of normal form games: zero-sum games and potential games. Games Econ Behav 122:370–390

Ivanov M (2010) Communication via a strategic mediator. J Econ Theory 145:869–884

Kovenock D, Morath F, Münster J (2015) Information sharing in contests. J Econ Manag Strateg 24:570–596

Krishna V, Morgan J (1997) An analysis of the war of attrition and the all-pay auction. J Econ Theory 72:343–362

Lazear E, Rosen S (1981) Rank-order tournaments as optimum labor contracts. J Polit Econ 89:841–864

Lehrer E, Sorin S (1997) One-shot public mediated talk. Games Econom Behav 20:131–148

Lizzeri A, Persico N (2000) Uniqueness and existence of equilibrium in auctions with a reserve price. Games Econom Behav 30:83–114

Lopomo G, Marshall R, Marx L (2005) Inefficiency of collusion at English auctions, B.E. Journals of Theoretical Economics. Contrib Theor Econ 5(1):1–26

Lopomo G, Marx L, Sun P (2011) Bidder collusion at first-price auctions. Rev Econ Des 15:177–211

Marshall R, Marx L (2007) Bidder collusion. J Econ Theory 133:374–402

Marshall R, Marx L (2009) The vulnerability of auctions to bidder collusion. Quart J Econ 124:883–910

McAfee P, McMillan J (1992) Bidding rings. Am Econ Rev 82:579–599

Milgrom P, Stokey N (1982) Information, trade and common knowledge. J Econ Theory 26:17–27

Moulin H, Vial J-P (1978) Strategically zero-sum games: the class of games whose completely mixed equilibria cannot be improved upon. Intern J Game Theory 7:201–221

Myerson R (1982) Optimal coordination mechanisms in generalized principal-agent problems. J Math Econ 10:67–81

Rosenthal RW (1974) Correlated equilibria in some classes of two-person games. Intern J Game Theory 3:119–128

Siegel R (2009) All-pay contests. Econometrica 77:71–92

Siegel R (2014) Asymmetric all-pay auctions with interdependent valuations. J Econ Theory 153:684–702

Szech N (2011) Asymmetric all-pay auctions with two types. University of Bonn, Discussion paper

Tan X (2016) Information revelation in competitions with common and private values. Games Econom Behav 97:147–165

Tullock G (1980) Efficient rent-seeking. In: Buchanan J, Tollison R, Tullock G (eds) Towards a theory of the rent-seeking society. Texas A &M University Press, College Station, pp 97–112

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank anonymous referees and especially the Guest Editor, Dan Kovenock, for very helpful suggestions. I also thank Maria Goltsman, Sandeep Baliga, Andreas Blume, Roberto Burguet, Ying Chen, Matthew Jackson, Rene Kirkegaard, Val Lambson, Bart Lipman, Stephen Morris, Philip Reny, Roberto Serrano, Itai Sher, Andrzej Skrzypacz, Leeat Yariv and the seminar participants at McMaster University, Simon Fraser University, Université de Montré al, University of Rochester, CETC (Toronto, 2009), IIOC (Vancouver, 2010), and International Game Theory Festival (Stony Brook, 2011) for helpful comments and conversations. In addition I thank Linjie Hao and Dillon Huddleston for research assistance. Financial support from Social Sciences and Humanities Research Council of Canada is gratefully acknowledged (Grant #410-2010-0333). All remaining errors are mine.

Appendix

Appendix

1.1 Proofs of Section 3

Proof of Proposition 3

Denote \(u_{i}=\frac{1}{v-r}U_{i}\) for \(i=1,2\), and fix \(\left( u_{1},u_{2}\right) \in {\mathbb {R}} _{+}^{2}\) such that \(v^{2}u_{i}+r^{2}u_{j}\le r^{2}\). The bidders are given recommendations according to the following probability distribution, where “bid above r” means “bid uniformly on \(\left( r,v\right] \)”.Footnote 36

Suppose bidder 1 is suggested to bid 0 and bids \(b\in \left( r,v\right] \) instead.Footnote 37 Then his payoff is

where the inequality follows from \(r^{2}u_{1}+v^{2}u_{2}\le r^{2}\). If bidder 1 is suggested to bid r, then it is clearly optimal to comply, since the opponent bids 0 in such case. If bidder 1 is suggested to bid above r, then he is indifferent between all bids since the payoff from bidding \(b\in \left[ r,v\right] \) is

To summarize, bidder 1 gets a payoff of \(v-r\) when he is suggested to bid r, and zero payoff otherwise. Hence, his ex ante payoff is \( u_{1}\left( v-r\right) =U_{1}\). Using a similar argument for bidder 2, we conclude that the considered correlation rule is a correlated equilibrium, and it achieves the desired payoffs. \(\square \)

Proof of Proposition 4

Fix \(U\in \left[ 0,{\overline{U}}\right] \), where \({\overline{U}}=\frac{2\left( v-r\right) }{n}\frac{\left( n-2\right) v^{2}+\left( n-2\right) vr+2nr^{2}}{ \left( 9n-14\right) v^{2}+\left( 6n-8\right) vr+\left( n+6\right) r^{2}}\). Consider the following symmetric correlation rule. First, a pair of bidders is randomly chosen, with each pair being equally likely to be chosen. Next, the bidders receive private bid recommendations without being told whether they have been chosen. The bidders who are not chosen are recommended to bid 0, and the chosen bidders are given recommendations according to the following probability distribution, where “bid low” means “bid uniformly on \(\left( r, \frac{1}{2}\left( v+r\right) \right] \)”, and “bid high” means “bid uniformly on \(\left( \frac{1}{2}\left( v+r\right) ,v\right] \) ”, and where \(x=\frac{1}{v+r}\left( \frac{v-r}{4}-\frac{ 3v+r}{v}\frac{n}{8}U\right) \).Footnote 38

If a bidder is suggested to bid 0, then he knows that either he was not chosen (which happens with probability \(\frac{n-2}{n}\)), or that he was chosen but only his opponent was suggested to bid above 0 (which happens with probability \(\frac{2}{n}\left( \pi _{l}+\pi _{h}\right) \)).

If this bidder bids \(b\in \left( r,\frac{1}{2}\left( v+r\right) \right] \) instead, then he has a chance to win only if none of his opponents bid high. In particular, bidder i could win if (i) he was not chosen, and one chosen bidder bids low (which happens with probability \(\frac{n-2}{n}\left( 2\pi _{l}\right) \)); (ii) he was not chosen, and two chosen bidders bid low (which happens with probability \(\frac{n-2}{n}\pi _{ll}\)); (iii) he was chosen, and his opponent bids low (which happens with probability \(\frac{2}{n }\pi _{l}\)). The expected payoff this bidder is then

Note that (2) is equal to \(-r\) if \(b=r\). If \(b=\frac{1}{2}\left( v+r\right) \), then (2) becomes

where the inequality holds since \(U\le {\overline{U}}\). Since (2) is convex in b, this implies that it is nonpositive for every \(b\in \left[ r,\frac{1}{2}\left( v+r\right) \right] \).

If this bidder bids \(b\in \left( \frac{1}{2}\left( v+r\right) ,v\right] \) instead, then he wins for sure if none of his opponents bid high, and has a chance to win otherwise. In particular, bidder i wins for sure if (i) he was not chosen, and none of the chosen bidders bid high (which happens with probability \(\frac{n-2}{n}\left( 2\pi _{l}+\pi _{ll}\right) \)); (ii) he was chosen, and his opponent does not bid high (which happens with probability \( \frac{2}{n}\pi _{l}\)). Also bidder i could win if (i) he was not chosen, and one chosen bidder bids high (which happens with probability \(\frac{n-2}{n }\left( 2\pi _{h}+2\pi _{hl}\right) \)); (ii) he was not chosen, and two chosen bidders bid high (which happens with probability \(\frac{n-2}{n}\pi _{hh}\)); (iii) he was chosen, and his opponent bids high (which happens with probability \(\frac{2}{n}\pi _{h}\)). The expected payoff of this bidder is then

Note that (4) is equal to (3) if \(b=\frac{1}{2} \left( v+r\right) \), and (4) is equal to zero if \(b=v\). Since (4) is convex in b, this implies that it is nonpositive for every \(b\in \left( \frac{1}{2}\left( v+r\right) ,v\right] \).

If a bidder is suggested to bid low, then he knows that he is chosen, and faces exactly one chosen opponent. This opponent bids 0, low, or high with probabilities \(\frac{\pi _{l}}{\pi _{l}+\pi _{ll}+\pi _{hl}}\), \(\frac{\pi _{ll}}{\pi _{l}+\pi _{ll}+\pi _{hl}}\), and \(\frac{\pi _{hl}}{\pi _{l}+\pi _{ll}+\pi _{hl}}\), respectively. The expected payoff of this bidder from bidding any \(b\in \left( r,\frac{1}{2}\left( v+r\right) \right] \) is

If he bids \(b\in \left( \frac{1}{2}\left( v+r\right) ,v\right] \) instead, then his payoff is

If a bidder is suggested to bid high, then he knows that he is chosen, and faces exactly one chosen opponent. This opponent bids 0, low, or high with probabilities \(\frac{\pi _{h}}{\pi _{h}+\pi _{hl}+\pi _{hh}}\), \(\frac{\pi _{hl}}{\pi _{h}+\pi _{hl}+\pi _{hh}}\), and \(\frac{\pi _{hh}}{\pi _{h}+\pi _{hl}+\pi _{hh}}\), respectively. The expected payoff of this bidder from bidding any \(b\in \left( \frac{1}{2}\left( v+r\right) ,\frac{1}{2}v\right] \) is

If he bids \(b\in \left( r,\frac{1}{2}\left( v+r\right) \right] \) instead, then his payoff is

Each bidder gets a payoff of \(\frac{U}{\frac{2}{n}\left( \pi _{l}+\pi _{ll}+\pi _{hl}\right) }\) when he is suggested to bid low, and zero payoff otherwise. Hence, his ex ante payoff is U. Thus the considered correlation rule is a correlated equilibrium, and it achieves the desired payoffs. \(\square \)

1.2 Proofs of Section 4

Proof of Proposition 5

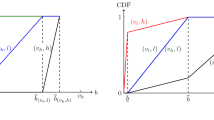

(ii) In every Bayesian Nash equilibrium, type 0 of each bidder bids 0 and gets a zero payoff. Let us represent the equilibrium strategy of bidder i of type v as a distribution function \(G_{i}:\left\{ 0\right\} \cup \left[ r,\infty \right) \rightarrow \left[ 0,1\right] \), let \({\underline{b}} _{i}\) and \({\overline{b}}_{i}\) be the infimum and the supremum of the support of his equilibrium bids, and let \(U_{i}\ge 0\) be his equilibrium payoff.

Note that \(U_{i}\le v-{\overline{b}}_{i}\). Also note that bidder j of type v can secure a payoff arbitrarily close to \(v-{\overline{b}}_{i}\) by bidding slightly above \({\overline{b}}_{i}\). Thus \(U_{j}\ge v-{\overline{b}}_{i}\). Reversing the roles of i and j, and rearranging, we get \(U_{i}=U_{j}=U\).

Next, note that bidder i of type v can secure a payoff arbitrarily close to \(p_{j}v-r\) by bidding slightly above r, and thus winning when the opponent is of type 0. Hence, \(U\ge \max \left\{ p_{1}v-r,p_{2}v-r,0\right\} \). If this inequality is strict, then neither bidder of type v bids 0 with positive probability, and thus \(\underline{b }_{i},{\underline{b}}_{j}\ge r\). Moreover, \(U>\max \left\{ p_{1}v-r,p_{2}v-r,0\right\} \) implies that each bidder of type v must be winning with positive probability against the opponent of type v. Then \( {\underline{b}}_{i}<{\underline{b}}_{j}\) is impossible, since bidder i who bids below \({\underline{b}}_{j}\) always loses against the opponent of type v. But \({\underline{b}}_{i}={\underline{b}}_{j}={\underline{b}}\) is impossible either: the requirement of winning with positive probability against the opponent of type v implies that both bidders bid \({\underline{b}}\) with positive probability, which cannot happen in equilibrium since each bidder could profitably deviate to a slightly higher bid. Thus \(U=\max \left\{ p_{1}v-r,p_{2}v-r,0\right\} \).

Let \(p_{1}\le p_{2}\). It is straightforward to check that the following is a Bayesian Nash equilibrium. Types 0 of both bidders bid 0. Type v of bidder 1 bids 0 and r with probabilities \(\frac{\min \left\{ r-p_{2}v,0\right\} }{\left( 1-p_{1}\right) v}\) and \(\frac{p_{2}-p_{1}}{ 1-p_{1}}\), respectively, and bids uniformly on \(\left( r,\min \left\{ \left( 1-p_{2}\right) v+r,v\right\} \right] \) otherwise; type v of bidder 2 bids 0 with probability \(\frac{\min \left\{ r-p_{2}v,0\right\} }{ \left( 1-p_{2}\right) v}\), and bids uniformly on \(\left( r,\min \left\{ \left( 1-p_{2}\right) v+r,v\right\} \right] \) otherwise. \(\square \)

Proof of Proposition 6

Denote by \(U_{i}^{*}\left( v_{i}\right) \) the interim expected payoff of player i of type \(v_{i}\) in the Bayesian Nash equilibrium \(\left( \mu _{1}^{*},\mu _{2}^{*}\right) \), and by \(U_{i}\left( v_{i}\right) \) the interim expected payoff of player i of type \(v_{i}\) in the communication equilibrium \(\mu \). Let \(\mu _{i}\left( \cdot |v_{i}\right) \) be the marginal probability measure of \(\mu \) on \(A_{i}\) conditional on \( v_{i}\) (defined in Sect. 2).

By the definition of Bayesian Nash equilibrium, for every i and \(P_{i}\) -a.e. \(v_{i}\), it is unprofitable to deviate to any strategy \(\widetilde{\mu }_{i}(\cdot |v_{i})\):

By the definition of communication equilibrium, for every i and \(P_{i}\) -a.e. \(v_{i}\), it is unprofitable to deviate to the following strategy: first, randomize over the type reports according to \(P_{i}\), and then, regardless of the mediator’s recommendation, choose bids according to some bidding strategy \({\widetilde{\mu }}_{i}(\cdot |v_{i})\):

For every i and \(v_{i}\ne 0\), such that both (5) and (6) hold, perform the following operations. Take (5) with \( {\widetilde{\mu }}_{i}=\mu _{i}\) and (6) with \({\widetilde{\mu }} _{i}=\mu _{i}^{*}\), add the two resulting inequalities, and divide by \( v_{i}\). Then for every i and \(P_{i}\)-a.e. \(v_{i}\) we get

Next, integrate (7) with respect to \(P_{i}\) over the set of types of bidder i for which inequality (7) holds. Note that the resulting inequality continues to hold even if we integrate over \(T_{i}\) because (7) is satisfied for \(P_{i}\)-a.e. \( v_{i}\), and because we have assumed that \(P_{i}\left( \left\{ 0\right\} \right) =0\). Sum up the resulting inequalities over i:

Since \(\sum \nolimits _{k=1,2}\rho _{k}\left( b\right) =1\) for every b, inequality (8) holds as an equality. This implies that the following inequalities hold as equalities as well for \(P_{i}\)-a.e. \( v_{i} \): inequality (5) when \({\widetilde{\mu }}_{i}=\mu _{i}\), and inequality (6) when \({\widetilde{\mu }}_{i}=\mu _{i}^{*}\).

Hence, for every i, \(P_{i}\)-a.e. \(v_{i}\), the following is true for any \( {\widetilde{\mu }}_{i}(\cdot |v_{i})\):

and

This implies that \(\left( \mu _{i}^{*},\mu _{j}\right) \) is a Bayesian Nash equilibrium. In this equilibrium bidder i of type \(v_{i}\) gets payoff \(U_{i}\left( v_{i}\right) \), and bidder j of type \(v_{j}\) gets payoff \( U_{j}^{*}\left( v_{j}\right) \). Since by assumption the Bayesian Nash equilibrium is unique, for every i we have \(\mu _{i}=\mu _{i}^{*}\), and thus \(U_{i}^{*}\left( v_{i}\right) =U_{i}\left( v_{i}\right) \) for every \(P_{i}\)-a.e. \(v_{i}\).Footnote 39\(\square \)

Proof of Proposition 7

We show that for \(p\in \left[ 0,\frac{r}{v}\right) \) there exists a communication equilibrium such that each bidder of type v gets a payoff of \(\frac{\left( r^{2}-p^{2}v^{2}\right) \left( v-r\right) }{v^{2}+r^{2}-2pv^{2} }\). Consider the following symmetric communication rule. If a bidder reports type\(\ 0\), then he is suggested to bid 0. If a bidder reports type v and his opponent reports type 0, then this bidder is suggested to bid r or “bid above r” (which means “bid uniformly on \(\left( r,v\right] \)”), with probabilities \({\widehat{\pi }}=\frac{\left( r-pv\right) \left( v+r\right) }{v^{2}+r^{2}-2pv^{2}}\) and \(1-{\widehat{\pi }}\), respectively. If both bidders report type v, then they are given recommendations according to the following probability distribution.Footnote 40

We need to check the incentives to tell the truth and to comply with the recommendations only for the bidders of type v, since the bidders of type 0 have no incentive to lie or to disobey.

If a bidder of type v has reported v and is suggested to bid 0, then he knows that his opponent must be of type v and bids r or above r, with probabilities \(\frac{\pi _{r}}{\pi _{r}+\pi _{h}}\) and \(\frac{\pi _{h} }{\pi _{r}+\pi _{h}}\), respectively. If this bidder bids \(b\in \left( r,v \right] \) instead, then his payoff isFootnote 41

If a bidder of type v has reported v and is suggested to bid r, then it is clearly optimal to comply, since the opponent bids 0, regardless of the type, in such case.

If a bidder of type v has reported v and is suggested to bid above r, then he knows that either his opponent is of type 0 and thus bids 0, or his opponent is of type v and bids 0 or high, with probabilities \(\frac{ p\left( 1-{\widehat{\pi }}\right) }{p\left( 1-{\widehat{\pi }}\right) +\left( 1-p\right) \left( \pi _{h}+\pi _{hh}\right) }\), \(\frac{\left( 1-p\right) \pi _{h}}{p\left( 1-{\widehat{\pi }}\right) +\left( 1-p\right) \left( \pi _{h}+\pi _{hh}\right) }\), and \(\frac{\left( 1-p\right) \pi _{hh}}{p\left( 1-\widehat{ \pi }\right) +\left( 1-p\right) \left( \pi _{h}+\pi _{hh}\right) }\), respectively. The expected payoff of this bidder from bidding any \(b\in \left[ r,v\right] \) is

To summarize, if a bidder of type v truthfully reports his type and follows the recommendations, then he gets a payoff of \(v-r\) when he is suggested to bid r, and zero payoff otherwise. Hence, his ex ante payoff is \(\left( p{\widehat{\pi }}+\left( 1-p\right) \pi _{r}\right) \left( v-r\right) =\frac{\left( r^{2}-p^{2}v^{2}\right) \left( v-r\right) }{ v^{2}+r^{2}-2pv^{2}}\).

If a bidder of type v has reported 0, then he is suggested to bid 0. He knows that either his opponent is of type 0 and thus bids 0, or his opponent is of type v and bids r or above r, with probabilities p, \( \left( 1-p\right) {\widehat{\pi }}\), and \(\left( 1-p\right) \left( 1-\widehat{ \pi }\right) \), respectively. If this bidder bids \(b\in \left( r,v\right] \), then his payoff is

where the inequality follows from the fact that payoff is a linear function of b and is thus maximized either at \(b=r\) or at \(b=v\).

Thus the considered communication rule is a communication equilibrium, and it achieves the desired payoffs.

\(\square \)

Proof of Proposition 8

The proof is similar to the proof of part (ii) of Proposition 5. In every Bayesian Nash equilibrium, type 0 of each bidder bids 0 and gets a zero payoff. Let the equilibrium strategy of bidder i of type v be represented by distribution function \(G_{i}:\left\{ 0\right\} \cup \left[ r,\infty \right) \rightarrow \left[ 0,1\right] \), \( {\underline{b}}_{i}\) and \({\overline{b}}_{i}\) be the infimum and the supremum of the support of his equilibrium bids, and \(U_{i}\ge 0\) be his equilibrium payoff.

Note that \(U_{i}\le \prod \nolimits _{k\ne i}\left( p+\left( 1-p\right) G_{k}\left( {\overline{b}}_{i}\right) \right) v-{\overline{b}}_{i}\). Also note that bidder j of type v can secure a payoff arbitrarily close to \(\prod \nolimits _{k\ne i,j}\left( p+\left( 1-p\right) G_{k}\left( {\overline{b}} _{i}\right) \right) v-{\overline{b}}_{i}\) by bidding slightly above \(\overline{ b}_{i}\). Thus \(U_{j}\ge U_{i}\). Since this is true for every pair of i and j, we have \(U_{i}=U\) for every i.

Next, note that bidder i of type v can secure a payoff arbitrarily close to \(p^{n-1}v-r\) by bidding slightly above r, and thus winning when the opponent is of type 0. Hence, \(U\ge \max \left\{ p^{n-1}v-r,0\right\} \). If this inequality is strict, then neither bidder bids 0 with positive probability, and thus \({\underline{b}}_{i}\ge r\) for every i. Moreover, \( U>\max \left\{ p^{n-1}v-r,0\right\} \) implies that each bidder of type v must be winning with positive probability against some opponent of type v. Then it is impossible to have \({\underline{b}}_{i}<{\underline{b}}=\min _{j\ne i} {\underline{b}}_{j}\), since bidder i who bids below \({\underline{b}}\) always loses against the opponents of type v. But \({\underline{b}}_{i}={\underline{b}} \) is impossible either: the requirement of winning with positive probability against some opponent of type v implies that the bidders who bid \( {\underline{b}}\) must do so with positive probability, which cannot happen in equilibrium since each bidder could profitably deviate to a slightly higher bid. Thus \(U=\max \left\{ p^{n-1}v-r,0\right\} \).

It is straightforward to check that the following is a Bayesian Nash equilibrium. Type 0 of each bidder bids 0. Type v of each bidder bids 0 with probability \(x=\frac{1}{1-p}\left( \max \left\{ \left( \frac{r}{v} \right) ^{\frac{1}{n-1}}-p,0\right\} \right) \), and bids according to \( G\left( b\right) =\frac{1}{1-p}\left( \left( \max \left\{ p^{n-1}-\frac{r}{v },0\right\} +\frac{b}{v}\right) ^{\frac{1}{n-1}}-p\right) \) on \(\left( r,\min \left\{ \left( 1-p^{n-1}\right) v+r,v\right\} \right] \). \(\square \)

Proof of Proposition 9

We show for sufficiently small \(p>0\) there exists a communication equilibrium such that each bidder of type v gets a payoff of \(2p^{n-1}v\). Consider the following symmetric communication rule. If a bidder reports type \(\ 0\), then he is suggested to bid 0. If exactly one bidder reports v, then this bidder is suggested to“bid low” (which means “bid uniformly on \(\left( 0,\frac{1}{2}v \right] \)”). If \(m>1\) bidders report v, then a pair of bidders out of these m bidders is randomly chosen, with each pair being equally likely to be chosen. The bidders receive private bid recommendations without being told whether they have been chosen. The bidders who are not chosen are recommended to bid 0, and the chosen bidders are given recommendations according to the following probability distribution where “bid high” means “bid uniformly on \(\left( \frac{1}{2}v,v\right] \)”, and where

is the probability that a bidder who submitted report v was chosen and that he is not the only one who submitted v.Footnote 42

We need to check the incentives to tell the truth and to comply with the recommendations only for the bidders of type v, since the bidders of type 0 have no incentive to lie or to disobey.

If a bidder of type v has reported v and is suggested to bid 0, then he knows that either he was not chosen (which happens with probability \( 1-p^{n-1}-g\)), or that he was chosen but only his opponent is suggested to bid above 0 (which happens with probability \(g\pi _{l}\)).

If this bidder bids \(b\in \left( 0,\frac{1}{2}v\right] \) instead, then he has a chance to win only if none of his opponents bid high. In particular, bidder i could win if (i) he was not chosen, and one chosen bidder bids low (which happens with probability \(\left( 1-p^{n-1}-g\right) 2\pi _{l}\)); (ii) he was not chosen, and two chosen bidders bid low (which happens with probability \(\left( 1-p^{n-1}-g\right) \pi _{ll}\)); (iii) he was chosen, and his opponent bids low (which happens with probability \(g\pi _{l}\)). The expected payoff of this bidder is then

Note that (9) is equal to 0 if \(b=0\). If \(b=\frac{1}{2}v\), then (9) becomes

Note that (10) is equal to \(-\frac{1}{4}v\) if \(p=0\), and that ( 10) is continuous in p. Thus for p small enough (9) is nonpositive at \(b=0\) and at \(b=\frac{1}{2}v\), and it is convex in b on \(\left( 0,\frac{1}{2}v\right] \), which implies that (9) is nonpositive for every \(b\in \left( 0,\frac{1}{2}v\right] \).

If this bidder bids \(b\in \left( \frac{1}{2}v,v\right] \) instead, then he wins for sure if none of his opponents bids high, and has a chance to win otherwise. In particular, bidder i wins for sure if (i) he was not chosen, and none of the chosen bidders bid high (which happens with probability \( \left( 1-p^{n-1}-g\right) \left( 2\pi _{l}+\pi _{ll}\right) \)); (ii) he was chosen, and his opponent does not bid high (which happens with probability \( g\pi _{l}\)). Also bidder i could win if (i) he was not chosen, and one chosen bidder bids high (which happens with probability \(\left( 1-p^{n-1}-g\right) 2\pi _{hl}\)); (ii) he was not chosen, and two chosen bidders bid high (which happens with probability \(\left( 1-p^{n-1}-g\right) \pi _{hh}\)). The expected payoff of this bidder is then

Note that (11) is equal to (10) if \(b=\frac{1}{2}v\), and (11) is equal to zero if \(b=v\). Thus for p small enough ( 11) is nonpositive at \(b=\frac{1}{2}v\) and at \(b=v\), and it is convex in b on \(\left( \frac{1}{2}v,v\right] \), which implies that (11) is nonpositive for every \(b\in \left( \frac{1}{2}v,v\right] \).

If a bidder of type v has reported v and is suggested to bid low, then he knows that either he faces no opponents (with probability \(p^{n-1}\)), or that he was chosen and faces one chosen opponent who bids 0, low, or high with probabilities \(g\pi _{l}\), \(g\pi _{ll}\), and \(g\pi _{hl}\), respectively. The expected payoff of this bidder from bidding any \(b\in \left( 0,\frac{1}{2}v\right] \) is

If he bids \(b\in \left( \frac{1}{2}v,v\right] \) instead, then his payoff is

If a bidder of type v has reported v and is suggested to bid high, then he knows that he was chosen and faces one chosen opponent who bids low or high, with equal probabilities. Thus the expected payoff of this bidder from bidding any \(b\in \left( 0,v\right] \) is equal to zero.

To summarize, if a bidder of type v truthfully reports his type and follows the recommendations, then he gets a payoff of \(\frac{2p^{n-1}v}{ 2p^{n-1}+\frac{1}{2}g}\) when he is suggested to bid low, and zero payoff otherwise. Hence, his ex ante payoff is \(2p^{n-1}v\).

If a bidder of type v has reported 0, then he is suggested to bid 0. He knows that he faces no active opponents with probability \(p^{n-1}\); one active opponent who bids low with probability \(\left( n-1\right) \left( 1-p\right) p^{n-2}+2d\pi _{l}\), where \(d=\left( 1-p^{n-1}-\left( n-1\right) \left( 1-p\right) p^{n-2}\right) \); two active opponents who both bid low, both bid high, or one bids low and another high with probabilities \(d\pi _{ll}\), \(d\pi _{hh}\), and \(2d\pi _{hl}\), respectively.

If this bidder bids \(b\in \left( 0,\frac{1}{2}v\right] \), then his payoff is

Note that if \(b=0\), then (12) is equal to \(p^{n-1}v\) which is smaller than the payoff from truthtelling \(2p^{n-1}v\). If \(b=\frac{1}{2}v\) then (12) becomes

Note that (13) is equal to \(-\frac{1}{4}v\) if \(p=0\), and that ( 13) is continuous in p. Thus for p small enough (12) is smaller than \(2p^{n-1}v\) at \(b=0\) and at \(b=\frac{1}{2}v\), and it is convex in b on \(\left( 0,\frac{1}{2}v\right] \), which implies that (13) is smaller than the payoff from truthtelling \( 2p^{n-1}v \) for every \(b\in \left( 0,\frac{1}{2}v\right] \).

If this bidder bids \(b\in \left( \frac{1}{2}v,v\right] \), then his payoff is

Note that (14) is equal to (13) if \(b=\frac{1}{2}v\), and (14) is equal to zero if \(b=v\). Thus for p small enough ( 14) is smaller than \(2p^{n-1}v\) at \(b=\frac{1}{2}v\) and at \(b=v\), and it is convex in b on \(\left( \frac{1}{2}v,v\right] \), which implies that (14) is smaller than the payoff from truthtelling \( 2p^{n-1}v \) for every \(b\in \left( \frac{1}{2}v,v\right] \).

Thus the considered communication rule is a communication equilibrium, and it achieves the desired payoffs. \(\square \)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Pavlov, G. Correlated equilibria and communication equilibria in all-pay auctions. Rev Econ Design (2023). https://doi.org/10.1007/s10058-023-00333-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10058-023-00333-x