Abstract

We study all-pay auctions where each player observes her private value as well as a noisy private signal about the opponent’s value, following Fang and Morris’s (J Econ Theory 126(1):1–30, 2006) analysis of winner-pay auctions with multidimensional private signals. A unique symmetric monotonic equilibrium exists if the signal is not informative enough. When the signal is sufficiently informative, there exists a symmetric non-monotonic equilibrium in which all types of players randomize in overlapping supports. The revenue is lower than that in the standard independent private value setting. Fixing the signal’s informativeness, the all-pay auction raises lower revenue than the second-price auction, whereas the revenue ranking between the all-pay and the first-price auction is ambiguous.

Similar content being viewed by others

Notes

Such as rent-seeking and lobbying (Ellingsen 1991; Baye et al. 1993; Che and Gale 1998), research and development (Che and Gale 2003), job promotion (Clark and Riis 1998), R&D procurement contests (Dasgupta 1986; Kaplan 2012; Fu et al. 2014; Kovenock et al. 2015), and crowdsourcing (Liu et al. 2014; Chawla et al. 2019). As an auction format, all-pay auctions also play a critical role in fund-raising and charity auctions (Goeree et al. 2005; Engers and McManus 2007; Schram and Onderstal 2009).

A similar pattern of behavior is observed in the study by Chen (2019), who focuses on incentives to spy on other players before a contest.

See also discussions in Fang and Morris (2006) for a comparison of the private signals environment and the APV setting.

We show that players with the low value randomize in an interval strictly below the low value in the APA. Fang and Morris (2006) show that low-value players bid their value in the FPA.

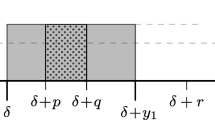

In proving Proposition 2 we show that type \((v_h,h)\) is indifferent across all bids in \([\underline{b}, \widehat{b}]\) and \((v_l,h)\) is indifferent across all bids in \([0,\overline{b}]\), for all \(q \in [q^{*}, 1]\).

According to Fang and Morris (2006), there exists a unique SME in the SPA and the FPA in the independent private binary value setting. Furthermore, the revenue in the two auction formats is given by \(p^2_h v_h + (1-p^2_h) v_l\). It is straightforward to show that the same is true for the APA when \(q=\frac{1}{2}\) based on our proof of Proposition 3.

References

Amann E, Leininger W (1995) Expected revenue of all-pay and first-price sealed-bid auctions with affiliated signals. J Econ 61(3):273–279

Amann E, Leininger W (1996) Asymmetric all-pay auctions with incomplete information: the two-player case. Games Econ Behav 14(1):1–18

Azacis H, Vida P (2015) Collusive communication schemes in a first-price auction. Econ Theor 58:125–160

Baik KH (1994) Effort levels in contests with two asymmetric players. South Econ J 61:367–378

Baye MR, Kovenock D, De Vries CG (1993) Rigging the lobbying process: an application of the all-pay auction. Am Econ Rev 83:289–294

Baye MR, Kovenock D, De Vries CG (1996) The all-pay auction with complete information. Econ Theory 8:291–305

Bergemann D, Brooks B, Morris S (2017) First-price auctions with general information structures: implications for bidding and revenue. Econometrica 85(1):107–143

Chawla S, Hartline JD, Sivan B (2019) Optimal crowdsourcing contests. Games Econ Behav 113:80–96

Che YK, Gale I (1996) Expected revenue of all-pay auctions and first-price sealed-bid auctions with budget constraints. Econ Lett 50(3):373–379

Che YK, Gale I (2003) Optimal design of research contests. Am Econ Rev 93:646–671

Che YK, Gale IL (1998) Caps on political lobbying. Am Econ Rev 88:643–651

Chen B, Jiang X, Knyazev D (2017) On disclosure policies in all-pay auctions with stochastic entry. J Math Econ 70:66–73

Chen ZC (2019) Spying in contests. Working paper

Chen ZC (2020) Optimal information exchange in contests. Working paper

Chi CK, Murto P, Välimäki J (2019) All-pay auctions with affiliated binary signals. J Econ Theory 179:99–130

Clark DJ, Riis C (1998) Competition over more than one prize. Am Econ Rev 88(1):276–289

Dasgupta P (1986) The theory of technological competition. In: New developments in the analysis of market structure. Palgrave, Macmillan, London, pp 519–549

Ellingsen T (1991) Strategic buyers and the social cost of monopoly. Am Econ Rev 81:648–657

Engers M, McManus B (2007) Charity auctions. Int Econ Rev 48(3):953–994

Fang H, Morris S (2006) Multidimensional private value auctions. J Econ Theory 126(1):1–30

Fu Q, Jiao Q, Lu J (2014) Disclosure policy in a multi-prize all-pay auction with stochastic abilities. Econ Lett 125(3):376–380

Goeree JK, Maasland E, Onderstal S, Turner JL (2005) How (not) to raise money. J Polit Econ 113(4):897–918

Hillman AL, Riley JG (1989) Politically contestable rents and transfers. Econ Polit 1(1):17–39

Kaplan TR (2012) Communication of preferences in contests for contracts. Econ Theory 51:487–503

Konrad KA (2004) Altruism and envy in contests: an evolutionarily stable symbiosis. Soc Choice Welfare 22:479–490

Kovenock D, Morath F, Munster J (2015) Information sharing in contests. J Econ Manag Strat 24:570–596. https://doi.org/10.1111/jems.12105

Krishna V, Morgan J (1997) An analysis of the war of attrition and the all-pay auction. J Econ Theory 72:343–362

Kuang Z, Zhao H, Zheng J (2019) Information design in simultaneous all-pay auction contests. Working Paper

Lazear EP, Rosen S (1981) Rank-order tournaments as optimum labor contracts. J Polit Econ 89(5):841–864

Liu TX, Yang J, Adamic LA, Chen Y (2014) Crowdsourcing with all-pay auctions: a field experiment on taskcn. Manag Sci 60(8):2020–2037

Liu Z, Chen B (2016) A symmetric two-player all-pay contest with correlated information. Econ Lett 145:6–10

Lizzeri A, Persico N (2000) Uniqueness and existence of equilibrium in auctions with a reserve price. Games Econ Behav 30(1):83–114

Lu J, Parreiras SO (2017) Monotone equilibrium of two-bidder all-pay auctions redux. Games Econ Behav 104:78–91

Lu J, Wang Z (2020) Optimal disclosure of value distribution information in all pay auction. Working Paper

Lu J, Ma H, Wang Z (2018) Ranking disclosure policies in all-pay auctions with incomplete information. Econ Inq 56:1464–1485

Morath F, Münster J (2008) Private versus complete information in auctions. Econ Lett 101:214–216

Myerson RB (1981) Optimal auction design. Math Oper Res 6(1):58–73

Rentschler L, Turocy TL (2016) Two-bidder all-pay auctions with interdependent valuations, including the highly competitive case. J Econ Theory 163:435–466

Riley JG, Samuelson WF (1981) Optimal auctions. Am Econ Rev 71(3):381–392

Schram AJ, Onderstal S (2009) Bidding to give: an experimental comparison of auctions for charity. Int Econ Rev 50(2):431–457

Siegel R (2014) Asymmetric all-pay auctions with interdependent valuations. J Econ Theory 153:684–702

Tian G, Xiao M (2007) Endogenous information acquisition on opponents’ valuations in multidimensional first price auctions

Weber R (1985) Auctions and competitive bidding. Proc Symp Appl Math 33:143–170

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The author declares that he has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work was supported by the National Natural Science Foundation of China No. 71903046 and the “Shenzhen Peacock Plan” start-up research grant.

Rights and permissions

About this article

Cite this article

Chen, Z. All-pay auctions with private signals about opponents’ values. Rev Econ Design 25, 33–64 (2021). https://doi.org/10.1007/s10058-020-00242-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-020-00242-3

Keywords

- All-pay auction

- First-price auction

- Second-price auction

- Revenue ranking

- Multidimensional signals

- Private signals