Abstract

In this paper, we consider dividend problem for an insurance company whose risk evolves as a spectrally negative Lévy process (in the absence of dividend payments) when a Parisian delay is applied. An objective function is given by the cumulative discounted dividends received until the moment of ruin, when a so-called barrier strategy is applied. Additionally, we consider two possibilities of a delay. In the first scenario, ruin happens when the surplus process stays below zero longer than a fixed amount of time. In the second case, there is a time lag between the decision of paying dividends and its implementation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In risk theory, we usually consider the classical Cramér–Lundberg risk process. Lately, a more general setting of a spectrally negative Lévy process has been analyzed. That is, it is assumed that risk process is a process with stationary and independent increments having non-positive jumps which model arriving claims. The classic research of the Scandinavian school had focused on determining the “ruin probability” of the process ever becoming negative, under the assumption that the risk process has positive profits. Since in this case, however, the surplus has the unrealistic property that it converges to infinity with probability one, de Finetti [1] introduced the dividend barrier model in which all surpluses above a given level are transferred (subject to a discount rate) to a beneficiary, and raised the question of optimizing this barrier.

For the classical risk process, an intricate “bands strategy” solution was discovered by Gerber [2, 3]; for exponential claims, this reduces to the simple barrier strategy: “pay all you can above a fixed constant barrier”.

There has been a great deal of work on de Finetti’s objective, usually concerning barrier strategies. Gerber and Shiu [4] and Jeanblanc and Shiryaev [5] considered the optimal dividend problem in a Brownian setting. Irbäck [6] and Zhou [7] studied the constant barrier under the Cramér–Lundberg model. Hallin [8] formulated the time dependent integro-differential equations describing the payoff associated to a bands policy. The optimality of the “bands strategy” was recently established by Albrecher and Thonhauser [9] in the presence of fixed interest rates as well. For related work considering both excess-of-loss reinsurance and dividend distribution policies (e.g., in a diffusion setting), see [10, 11] and the references included in this papers; and for work including also a utility function, see [12].

For the Lévy risk process considered in this paper without Parisian delay, Avram et al. [13], Loeffen [14] and Loeffen and Renaud [15] found sufficient conditions for which the barrier strategy is optimal. In fact, Avram et al. [16] proved that, in this case, the bands strategy is optimal.

In this paper, we want to analyze the dividend problem when the so-called Parisian delay either at the moments of dividends payments or at the ruin time is applied. The name for this delay comes from a Parisian option that is activated or canceled depending on the type of option if the underlying asset price stays above or below the barrier for a long enough period of time (see [17] and [18]).

For the classical risk process, Dassios and Wu [19] consider the Parisian type delay between the decision to pay the dividend and its implementation. The decision to pay is taken when the surplus reaches the fixed barrier, but it is implemented only when the surplus stays above barrier longer than a fixed amount of time. The dividend is paid at the end of this period. A similar problem for a spectrally negative Lévy process of bounded variation was analyzed in [20]. In this paper, we generalize this result for the general spectrally negative Lévy risk process. Since the ruin time is classical, we know that the band strategy is optimal and we also know the necessary conditions under which an optimal strategy is the barrier strategy. We still believe that this new Parisian strategy (although not optimal within all strategies) could be very useful for the insurance companies giving a possibility of the natural delay between decision and its implementation.

In this paper, we also consider Parisian delay at the ruin. That is, ruin occurs if the process stays below zero longer than for a fixed period of time. We first analyze the strategy for which the dividends are paid according to the classical barrier dividend strategy transferring all surpluses above given level to dividends. We also prove the verification theorem for this type of ruin. In particular, we find sufficient conditions for the barrier strategy to be optimal.

We believe that giving a possibility of Parisian delay could better describe many situations of an insurance company. For example, it can be checked if indeed a company’s reserves increase and we can pay dividends (in the first scenario) or a possibility for the insurance company to get solvency can be given (in the second scenario).

The paper is organized as follows. In Sects. 2 and 3, we introduce the basic notions, notations and model we deal in this paper. In Sect. 4, we find the discounted cumulative dividends payments until the Parisian ruin time. In Sect. 5, we prove the verification theorem and find the necessary conditions for the barrier strategy to be optimal. In Sect. 6, we analyze the case when there is a time lag between the decision to pay dividends and its implementation. Sections 7 and 8 are devoted to some examples and concluding remarks.

2 The Model

In this paper, we assume that the risk process X is a spectrally negative Lévy process. That is, X={X t } t≥0 is a process with stationary and independent increments having non-positive jumps. We will assume that the process X starts from X 0=x and later we will use convention ℙ(⋅|X 0=x)=ℙ x (⋅) and ℙ0=ℙ. The most known particular example of such a process is the classical Cramér–Lundberg risk process:

where x>0 denotes an initial reserve and C i (i=1,2,…) are i.i.d. distributed claims with the distribution function F. The arrival process is a homogeneous Poisson process N t with intensity λ. The premium income is modeled by a constant premium density c where we assume the net profit condition, that is, \(\lambda\mathbb{E}C_{1}/c<1\). The general Lévy process takes into account not only large claims compensated by a steady income at the rate c>0, but also small perturbations coming from the Gaussian component and additionally (when ν(−∞,0)=∞ for the Lévy measure ν of X) compensated countable infinite number of the small claims arriving over each finite time horizon. Working under this class of models, it became apparent that, despite the diversity of possible probabilistic behaviors, it allows expressing all results in a unifying manner via the so-called q-harmonic scale function W (q)(x) defined via its Laplace transform in (8). This paper further illustrates this aspect by unveiling the way the scale functions intervene in a quite complicated control problem.

Formally, we consider the risk process controlled by the dividend policy π given by

where X 0=x>0 is the initial reserve and \(L^{\pi}_{t}\) is an increasing, adapted and left-continuous process representing the cumulative dividends paid out by the company up to time t. The optimization objective function is given by the average cumulative discounted dividends received until the moment of ruin:

where σ π is a ruin time that we specify later depending on the considered scenario and q is a discounting rate.

The objective of beneficiaries of an insurance company is to maximize v π(x) over all admissible strategies π:

where Π is a set of all admissible strategies, that is, strategies \(\pi=\{L^{\pi}_{t}, t\geq0\}\) such that \(L^{\pi}_{t}-L^{\pi}_{t-}<U_{t-}^{\pi}\).

We will consider two scenarios of applying a fixed delay. In the first one, the surplus process stays above a barrier longer than a fixed time d. This strategy we will denote by π a,d . The dividends are paid till \(\sigma^{\pi_{a,d}}=\inf\{t\geq0: U^{\pi_{a,d}}_{t}<0\}\). In the second case, we consider a strategy π a,ζ where we pay dividends according to a barrier strategy with the barrier at level a till the Parisian ruin time defined formally by

That is, the ruin occurs if the process \(U^{\pi^{a,\zeta}}\) stays below zero for a longer period than a fixed time ζ>0.

3 Preliminaries

We first review some fluctuation theory of spectrally negative Lévy processes and refer the reader for more background to [21–23] and references therein.

In this paper, we consider a spectrally negative Lévy process X={X t } t≥0, that is, a Lévy process with the Lévy measure ν satisfying ν(0,∞)=0 (for simplicity we exclude the case of a compound Poisson process with negative jumps). Since all jumps of X are non-positive, the moment generating function \(\mathbb{E}[\mathrm{e}^{\theta X_{t}}]\) exists for all θ≥0 and it is given by \(\mathbb{E}[\mathrm{e}^{\theta X_{t}}] = \mathrm{e}^{t\psi(\theta)}\) for some function ψ(θ) which is strictly convex with the property that lim θ→∞ ψ(θ)=+∞. Moreover, ψ is strictly increasing on [Φ(0),∞[, where Φ(0) is the largest root of ψ(θ)=0. We shall denote the right-inverse function of ψ by Φ:[0,∞[→[Φ(0),∞[. We will consider also the dual process \(\widehat{X}_{t}=-X_{t}\) which is a spectrally positive Lévy process with the Lévy measure \(\widehat{\nu} (0,y )=\nu (-y,0 )\). The characteristics of \(\widehat{X}\) will be indicated by using a hat over the existing notation for the characteristics of X.

For any θ for which \(\psi(\theta) = \log\mathbb{E}[\exp \theta X_{1}]\) is finite, we denote by ℙθ an exponential tilting of measure ℙ with Radon–Nikodym derivative with respect to ℙ given by

where \({\mathcal{F}_{t}}\) is a right-continuous natural filtration of X. Under the measure ℙθ, the process X is still a spectrally negative Lévy process with the characteristic function ψ θ given by:

3.1 Scale Functions

For p≥0, there exists a function W (p):[0,∞[→[0,∞[, called the p-scale function, that is continuous and increasing with the Laplace transform

The domain of W (p) is extended to the entire real axis by setting W (p)(z)=0 for z<0. We denote W (0)(z)=W(z). Throughout the paper, we assume that the following (regularity) condition is satisfied:

where σ a Gaussian coefficient of X. For later use, we mention some properties of the function W (p) that have been obtained in the literature. On ]0,∞[, the function z↦W (p)(z) is right- and left-differentiable, and under condition (9), it holds that z↦W (p)(z) is continuously differentiable for z>0. Moreover, if σ>0 it holds that W (p)∈C ∞(]0,∞[) with W (p)′(0)=2/σ 2; if X has unbounded variation with σ=0, it holds that W (p)′(0)=∞ (see [24, Lemma 4]).

The function W (p) plays a key role in the solution of the two-sided exit problem as shown by the following classical identity. Letting \(\tau^{+}_{a}, \tau^{-}_{a}\) be the entrance times of X into [a,∞[ and ]−∞,−a[, respectively, that is,

it holds for z∈[0,a] that

Closely related to W (p) is function Z (p) given by

where \(\overline{W}^{(p)}(z) = \int_{0}^{z}W^{(p)}(y)\,\mathrm{d}y\) is the anti-derivative of W (p). Moreover, the scale functions appear also in the so-called two-sided downward exit problem:

and in the one-sided downward exit problem that for any β with ψ(β)<∞, p≥ψ(β)∨0 and x≥0 gives:

where \(W^{(u)}_{\beta}\) and \(Z^{(u)}_{\beta}\) are the scale functions with respect to the measure ℙβ, u=p−ψ(β) and u/Φ(u) is understood in the limiting sense if u=0. In fact, for each z∈ℝ, W (p)(z) is analytically extendable, as a function of p, to the whole complex plane; and hence the same is true for Z (p)(z). In such a case, arguing again by analytic extension, one may weaken the requirement that p≥ψ(β)∨0 to simply p≥0.

The ‘tilted’ scale functions can be linked to the non-tilted scale functions via the relation \(\mathrm{e}^{\beta z} W^{(u)}_{\beta}(z) = W^{(p)}(z)\) from [25, Remark 4]. This relation implies that

3.2 Parisian Ruin

One of most important characteristics in risk theory is a ruin probability defined by \(\mathbb{P}_{x}(\tau^{-}_{0}<\infty)\) for \(\tau^{-}_{0}=\inf\{t>0: X_{t} < 0 \}\). Czarna and Palmowski [26] extended this notion to the so-called Parisian ruin probability that occurs if the process X stays below zero for a period longer than the fixed ζ>0 (see also [27, 28] for the result concerning classical risk process). Let

then we define the Parisian ruin probability as:

The following result summarize [29, Theorem 1].

Theorem 3.1

For any x≥0, the Parisian ruin probability equals

where W=W (0) is the scale function defined via (8).

4 Parisian Delay at Ruin

In this section, we will consider the Parisian ruin time (5) and the dividends paid according to the barrier strategy that corresponds to reducing the risk process \(U^{\pi^{a,\zeta}}\) to the level a if x>a, by paying out the amount x−a, and subsequently paying out the minimal amount of dividends to keep the risk process below the level a. It is well known (see [13]) that for 0<x≤a the corresponding controlled risk process \(U^{\pi^{a,\zeta}}\) under ℙ x is equal in law to the process {a−Y t :t≥0} under ℙ x for

involving a Lévy process X reflected at its past supremum:

where we use notations y∨0=max{y,0}. In this case, for all x≥0,

and \(L_{t}^{\pi^{a,\zeta}} =a\vee\overline{X}_{t} - a\).

Note that for x≤a,

and

Assume that X→∞ a.s. Then by the Markov property and the fact that X jumps only downwards, we derive

Hence

Using the change of measure (6) with θ=Φ(q), the Optional Stopping theorem and the fact that on ℙΦ(q) the process X tends to infinity a.s. (since \(\psi_{\varPhi(q)}^{\prime}(0+)=\psi^{\prime}(\varPhi (q)+)>0\)), we have for x≤a,

where by Theorem 3.1,

It follows from Theorem 3.1 that under condition (9) the function V (q)(y) (similarly W (q)(y)) is continuously differentiable for y∈ℝ.

Moreover, for n∈ℕ, by (16),

and

since \(L_{t}^{\pi^{a,\zeta}}=\overline{X}_{t}-a\) under ℙ a can increase only by 1/n up to time \(\tau_{a+1/n}^{+}\). The last increment in the above equation is o(1/n) since X is regular on (0,∞). Hence,

and then

Thus from (15), (16) and (18) it follows that v a,ζ is continuously differentiable for all x∈ℝ and

In particular,

Hence we get the following theorem.

Theorem 4.1

The value function corresponding to the barrier strategy π a,ζ is given by (20). The optimal barrier a ∗ satisfies:

In particular, if V (q)∈C 2(ℝ) and there exists a unique solution of the equation:

then a ∗ is the optimal barrier.

Remark 4.1

Note that V (q)∈C 2(ℝ), if W (q)∈C 2(ℝ). This is the case, if, e.g., the Gaussian component is present.

5 Verification Theorem

To prove the optimality of a particular strategy π across all admissible strategies Π for the dividend problem (4), where the ruin time σ π is given by the Parisian ruin (5), we are led, by standard Markovian arguments, to consider the following variational inequalities:

for functions f:ℝ→ℝ in the domain of the extended generator Γ of the process X, which acts on C 2(]0,∞[) functions f as

where ν is the Lévy measure of X, σ 2 denotes the Gaussian coefficient, and \(p_{0}=c - \int_{-1}^{0}y\nu(\mathrm{d}y)\), if the jump-part has bounded variation; see [22, Ch. 6, Thm. 31.5]. In particular, if E|X|<∞ and X has unbounded variation (resp., bounded variation), a function f that is C 2 (resp., C 1) on [0,∞[ and that is ultimately linear lies in the domain of the extended generator.

Theorem 5.1

Let C∈]0,∞] and suppose f is continuous and piecewise C 1 on ]−∞,C[ if X has bounded variation and that f is C 1 and piecewise C 2 on ]−∞,C[ if X has unbounded variation. Suppose that f satisfies (24). Then \(f\ge\sup_{\pi\in\varPi_{\leq C}} v^{\pi}\) for v π defined in (3) with the Parisian ruin time (5), where Π ≤C is a set of all strategies bounded by C. In particular, if C=∞, then f≥v ∗.

Proof

We will follow classical arguments. Let π∈Π ≤C be any admissible policy and denote by L=L π and U=U π the corresponding cumulative dividend process and the risk process, respectively. By [22, Ch. 6, Thm. 31.5], the function g(t,x,z)=e−qt f(x)1 {z≤ζ} is in the domain of the extended generator of the three-dimensional Markov process \((t,U^{\pi}_{t}, \varsigma^{U}_{t})\), with \(\varsigma^{U}_{t} =t-\sup\{s\leq t: U_{t}\geq0\}\). Note that a finite number of discontinuities of f and hence also a single discontinuity of 1 {z≤ζ} are allowed here. Hence we are also allowed to apply Itô’s lemma (e.g., [30, Thm. 32]) if X is of unbounded variation and the change of variable formula (e.g., [30, Thm. 31]) if X is of bounded variation:

where M t is a local martingale with M 0=0, L c is the pathwise continuous part of L, and for a function g the process J g is given by

where A s =U s−+ΔX s with Δx s =X s −x s− and B s =−ΔL s denotes the jump of −L at time s. Let T n be a localizing sequence of M. Applying the Optional Stopping theorem to the stopping times \(T_{k}^{\prime}=T_{k}\wedge\sigma^{\pi}\) and using Fatou’s theorem, we derive

Invoking the variational inequalities f′(x)≥1 (hence f(A s +B s )−f(A s )≤−ΔL s if A s >0) and (Γ−q)f(x)≤0, we have

Letting n→∞ in conjunction with the monotone convergence theorem and using the fact that \(\mathbf{1}_{\{\varsigma^{U}_{\sigma ^{\pi}}\leq\zeta\}}=0\) completes the proof. □

Using the verification theorem, we find the necessary conditions under which the optimal strategy takes the form of a barrier strategy.

Theorem 5.2

Assume that σ>0 or that X has bounded variation or, otherwise, suppose that \(v^{a^{*},\zeta}\in C^{2}(]0,\infty[)\). If q>0, then a ∗<∞ and the following hold true:

-

(i)

\(\pi^{a^{*}, \zeta}\) is the optimal strategy in the set \(\varPi_{\leq a^{*}}\) of all strategies bounded by a ∗ and \(v^{a^{*},\zeta} = \sup_{\pi\in\varPi_{\leq a^{*}}} v^{\pi}\).

-

(ii)

If \((\varGamma- q)v^{a^{*},\zeta}(x)\leq0\) for x>a ∗, the value function and the optimal strategy of (4) is given by \(v_{*} = v^{a^{*},\zeta}\), where the ruin time σ π is given by the Parisian moment of ruin (5).

The proof of Theorem 5.2 is based on the verification Theorem 5.1 and the following lemma.

Lemma 5.1

(i) We have a ∗<∞.

(ii) It holds that \((\varGamma-q)v^{a^{*},\zeta}(x)= 0\) for x≤a ∗.

(iii) For x≤a ∗,

Proof

Part (i) follows from the fact that V (q)′(y) is continuous and increasing from some point onward. Indeed, note that by [33] we have \(V^{(q)}(y)=\mathrm{e}^{\varPhi(q)y}\mathbb{P}_{y}(\tau^{\zeta}=\infty )\geq \mathrm{e}^{\varPhi(q)y}\mathbb{P}_{y}(\tau_{0}^{-}=\infty)=\frac{1}{\psi^{\prime}(0+)}W^{(q)}(y)\) and W (q)′(y) tends to ∞ as y→∞. The proof of (ii) follows from (15) and the martingale property of

where x≤a ∗. Part (iii) is a consequence of (21) and the definition of a ∗ given in (22). □

Moreover, we can give other necessary condition for the barrier strategy to be optimal.

Corollary 5.1

Suppose that

Then the barrier strategy at a ∗ is an optimal strategy.

Proof

Using Theorems 4.1 and 5.2, the proof is the same as the proof of [14, Theorem 2]. □

Corollary 5.2

Suppose that, for x>0, \(\widehat{\nu}\,'(x)\) is monotone decreasing, then \(\pi^{a^{*}, \zeta}\) is the optimal strategy of (4).

Proof

By (19), the proof is similar like the proof of [14, Theorem 3]. In fact, it suffices to prove that V Φ(q) has a completely monotone derivative. This fact follows from Theorem 3.1 since \(\frac{\partial}{\partial x}\mathbb{P}^{\varPhi(q)}_{x}(\tau_{0}^{-}=\infty )\) and \(\frac{\partial}{\partial x} \mathbb{P}^{\varPhi(q)}_{x}(\tau^{-}_{0}<\infty, -X_{\tau^{-}_{0}}\in \mathrm{d}z)\) are completely monotone. Indeed, it is known that

where \(\widehat{U}_{\varPhi(q)}\) is the renewal function of the descending ladder height process \(\widehat{H}_{t}\) under ℙΦ(q) and \(\widehat{\kappa}_{\varPhi(q)}(\alpha,\beta)\) is the Laplace exponent of the bivariate descending ladder height process \((\widehat{L}_{t}^{-1}, \widehat {H}_{t})\) under ℙΦ(q) with \(\widehat{\kappa}_{\varPhi(q)}(0,0)=\psi^{\prime}(\varPhi(q))>0\). From the proof of [14, Theorem 3] it follows that \(\widehat{U}_{\varPhi(q)}^{\prime}(0,x)\), hence also \(\frac{\partial }{\partial x}\mathbb{P}^{\varPhi(q)}_{x}(\tau_{0}^{-}=\infty)\), is completely monotone. Moreover, by [21, (7.15), p. 195], we have

and hence \(\frac{\partial}{\partial x} \mathbb{P}^{\varPhi(q)}_{x}(\tau^{-}_{0}<\infty, -X_{\tau^{-}_{0}}\in \mathrm{d}z)\) is also completely monotone. □

6 Parisian Delay at the Moment of Dividend Payments

In this section, we analyze the case when we pay dividends only when the surplus process stays above the barrier a longer than a time lag d>0. The dividends are paid at the end of that period and they are paid until the regular ruin time \(\sigma^{\pi_{a,d}}=\inf\{t\geq0: U_{t}^{\pi_{a,d}}<0\}\). Then by (10) for x∈[0,a],

and by the Markov property for x≥a,

where \(\mathbb{E}_{x} [ \mathrm{e}^{-q\tau_{a}^{+}}, \tau_{a}^{+}<\tau_{0}^{-} ]\) is given in (10).

By (13) for z≥0, the double Laplace transform of \(\mathbb{E}_{z} [\mathrm{e}^{-q \tau^{-}_{0}}, -X_{\tau_{0}^{-}}\in\mathrm {d}y, \tau_{0}^{-}\leq s ]\) equals

where u q =α+q−ψ(β). Moreover,

Further, the value v a,d (a) is determined by (30) if X has no Gaussian component (σ=0), or by the smooth paste condition

otherwise.

Lemma 6.1

If σ>0 then (33) holds.

Proof

For n∈ℕ,

where the last term is bounded above by \(\frac{1}{n}\mathbb{P}(\tau^{+}_{1/n}>d)\). Moreover, by (10),

and by (12),

Multiplying both sides of (34) by two, subtracting v a,d (a−1/n)+v a,d (a) and dividing by 1/n produces:

where we use (11). Now, since W (q)(0)=0 and \(W^{(q)\prime}(0)=\frac{2}{\sigma^{2}}\), we have

Hence the increment (37) converges to \(v_{a,d}(a)2q(W^{(q)}(0)-\frac{1}{4}W^{(q)}(0))=0\) as n→∞. Moreover,

and lim n→∞(v a,d (a+1/n)−v a,d (a−1/n))=0 by the continuity of the value function. Thus the increment (36) also tends to 0 as n→∞. Taking the limit as n→∞ in (35)–(37) completes the proof of (33). □

All results of this section could be summarized in the next theorem.

Theorem 6.1

The value function v a,d (x) corresponding to the strategy π a,d is given in (29)–(33).

7 Examples

7.1 Classical Risk Process with Phase-Type Claims Perturbed by a Brownian Motion

Let

where σ,c>0, B t is a standard Brownian motion, N t is a Poisson process with intensity λ, and a generic C has a phase-type distribution with the minimal representation (m,T,α). Hence the pdf of C equals F(x)=1−αeTx 1 and T is a subintensity matrix of a killed Markov process, where 1 denotes a column vector of ones. In this case,

where t=−T1. Recall that a strictly positive Φ(q) solves the equation ψ(Φ(q))=q. Under ℙΦ(q), the process X is again a risk process (38) with its counterparts c (q)=c+Φ(q)σ 2, σ (q)=σ, λ (q)=λEe−Φ(q)C, and the claim distribution F (q) of phase-type with parameters: m (q)=m and α (q)=α Δ, T (q)=Δ −1 TΔ+Φ(q)I for the diagonal matrix Δ with (−Φ(q)I−T)−1 t (see [31, Appendix A]). We denote t (q)=−T (q) 1 and we use the convention that superscript (0) denotes the original measure ℙ.

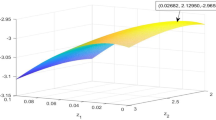

7.1.1 Dividend Strategy π a,ζ

We start from deriving the scale function W (q)(x). Let ρ j be a root with a negative real part of the equation

For simplicity we will assume that ρ j are distinct (see [31, Remark 4] and [32] for a general set-up). Then from [33] and [31, Lemma 1] (see also [32, Cor. 2.1]) we have

for \(A_{j} =\frac{1}{\rho_{j}}\lim_{s\to\rho_{j}}(s-\rho_{j})(\varphi (s)-\varphi(\infty))\) and

for the eigenvalues η j of T with negative real parts.

Moreover,

where ϕ is a density of a standard normal random variable and the kth convolution F (q)∗k is again of phase-type as it is described in [34].

Quantities (40) and (41) allow calculating numerically the value function v a,ζ(x) given in (20) for the dividend strategy π a,ζ, where the V (q)(x) is defined by (19). Note also that for a general claim size phase-type distribution the barrier strategy is not always optimal. For example, the Erlang distribution does not always satisfy assumptions of Corollary 5.2 (see, e.g., [14]).

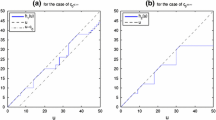

7.1.2 Dividend Strategy π a,d

To find the value function for the second scenario, note that for x≥a we have

Further,

Thus, by (29) and (30), to calculate v a,d it is sufficient to find the scale function W (q)(x) and a few other quantities that we identify right now.

We will consider the dual process \(\widehat{X}\) and its so-called fluid embedding. In this procedure, the phase-type jumps are substituted by linear stretches of unit slope and by adding a supplementary background process J describing the ‘travel’ through the phases of the jump. To be more precise, let J t be a Markov process on the finite state space {1,2,…,m+1} with an intensity matrix \(\mathbf{Q}^{(q)}_{ij}\) defined by the equalities \(\mathbf {Q}^{(q)}_{11}=-\lambda_{q}\), \(\mathbf{Q}^{(q)}_{ij}=T^{(q)}_{ij}\) for i,j>1 and \(\mathbf {Q}^{(q)}_{1(k+1)}=\lambda\boldsymbol{\alpha}^{(q)}_{k}\), \(\mathbf {Q}^{(q)}_{(k+1)1}=\mathbf{t}_{k}^{(q)}\) for k=1,…,m. We construct the Markov Additive process \((\tilde{X}_{t}, J_{t})\) in such a way that \(\tilde{X}_{t}=-ct-\sigma B_{t}\) if J t =1 and \(\tilde{X}_{t}=t\) if J t ≠1. Define \(\tilde{\tau}_{x}^{+}=\inf\{t\geq0: \tilde{X}_{t} \geq x\}\). For x≥a, using the change of measure (6) and the Optional Stopping theorem, we have

where ℙ(θ) means that we have applied the intensity matrix Q (θ). Moreover, for y>0 and k>1,

where e k is the unit vector with 1 at the kth position.

Define now the matrix Λ which solves the following matrix equation:

Then by, e.g., [35, Remark 2.1], we have

Inverting the above Laplace transforms in θ allows deriving \(\mathbb{E}_{x-a} [\mathrm{e}^{-q \tau^{-}_{0}}, \tau_{0}^{-}\leq d,\allowbreak X_{\tau _{0}^{-}}=0 ]\), \(\mathbb{E}_{x-a} [\mathrm{e}^{-q \tau^{-}_{0}}, \tau_{0}^{-}\leq d, -X_{\tau _{0}^{-}}\in\mathrm{d}y ]\) and hence also (by taking q=0) the probability \(\mathbb{P}_{x-a}(\tau_{0}^{-}>d)\).

When X t is the Cramér–Lundberg risk process (1) with exponential claims, the dividend problem under the strategy π a,d (where there is a time lag d between the decision of dividend payment and its implementation) was already studied in [19]. Similar considerations for the Brownian motion with drift are included in [36].

8 Concluding Remarks

In this paper, we solved the dividend problem for a spectrally negative Lévy risk process when a Parisian delay is applied either at the ruin or at the moments of payments. In the next step, it would be reasonable to analyze a more general Gerber–Shiu function taking into account the penalty at the moment of Parisian ruin. One can also include positive phase jumps as it is, for example, in the case of a research based firm. The positive jump of the risk process is then interpreted as the net present value of future income stemming from an invention (see [37]). In our model, the barrier is fixed. In fact, one can consider nonlinear barriers (see [38]) or even an absorbing barrier that moves as the risk process attains new maxima. The latter case is motivated by the bank’s profit maximization with the constrain that it maintains a certain level of leverage ratio or, in other words, the regulated risk process evolves till the moment of severe asset deterioration. The dividend problem is closely related to the valuation of a firm using the discounted cash flow approach (see [39]). It would be good to investigate this relationship in the context of a Parisian delay. Nevertheless, we leave these points for future research.

References

de Finetti, B.: Su un’impostazione alternativa dell teoria colletiva del rischio. In: Trans. XV Intern. Congress Act, vol. 2, pp. 433–443 (1957)

Gerber, H.U.: Entscheidungskriterien für den Zusammengesetzten Poisson Prozess. Mitt. Ver. Schweiz. Versicher.math. 69, 185–228 (1969)

Gerber, H.U.: Games of economic survival with discrete- and continuous-income processes. Oper. Res. 20, 37–45 (1972)

Gerber, H.U., Shiu, E.S.W.: Optimal dividends: analysis with Brownian motion. N. Am. Actuar. J. 8, 1–20 (2004)

Jeanblanc, M., Shiryaev, A.N.: Optimization of the flow of dividends. Russ. Math. Surv. 50, 257–277 (1995)

Irbäck, J.: Asymptotic theory for a risk process with a high dividend barrier. Scand. Actuar. J. 2, 97–118 (2003)

Zhou, X.: On a classical risk model with a constant dividend barrier. N. Am. Actuar. J. 9, 1–14 (2005)

Hallin, M.: Band strategies: the random walk of reserves. Blätter DGVFM 14, 231–236 (1979)

Albrecher, H., Thonhauser, S.: Optimal dividend strategies for a risk process under force of interest. Insur. Math. Econ. 43, 134–149 (2008)

Asmussen, S., Højgaard, B., Taksar, M.: Optimal risk control and dividend distribution policies. Example of excess-of loss reinsurance for an insurance corporation. Finance Stoch. 4, 299–324 (2000)

Paulsen, J.: Optimal dividend payments until ruin of diffusion processes when payments are subject to both fixed and proportional costs. Adv. Appl. Probab. 39(3), 669–689 (2007)

Grandits, P., Hubalek, F., Schachermayer, W., Zigo, M.: Optimal expected exponential utility of dividend payments in Brownian risk model. Scand. Actuar. J. 2, 73–107 (2007)

Avram, F., Palmowski, Z., Pistorius, M.R.: On the optimal dividend problem for a spectrally negative Lévy process. Ann. Appl. Probab. 17, 156–180 (2007)

Loeffen, R.: On optimality of the barrier strategy in de Finetti’s dividend problem for spectrally negative Lévy processes. Ann. Appl. Probab. 18(5), 1669–1680 (2008)

Loeffen, R., Renaud, J.F.: De Finetti’s optimal dividends problem with an affine penalty function at ruin. Insur. Math. Econ. 46(1), 98–108 (2010)

Avram, F., Palmowski, Z., Pistorius, M.R.: Optimal dividend distribution for a Lévy risk-process in the presence of a Gerber–Shiu penalty function. Manuscript (2004)

Albrecher, H., Kortschak, D., Zhou, X.: Pricing of Parisian options for a jump-diffusion model with two-sided jumps. Appl. Math. Finance 19, 97–129 (2012)

Dassios, A., Wu, S.: Perturbed Brownian motion and its application to Parisian option pricing. Finance Stoch. 14(3), 473–494 (2010). http://www.springerlink.com/content/c10155vh5121180x/

Dassios, A., Wu, S.: On barrier startegy dividends with Parisian implementation delay for classical surplus processes. Insur. Math. Econ. 45, 195–202 (2009)

Landriault, D., Renaud, J., Zhou, X.: Insurance risk model with Parisian implementation delays. Methodol. Comput. Appl. Probab. (2013). doi:10.1007/s11009-012-9317-4

Kyprianou, A.E.: Introductory Lectures on Fluctuations of Lévy Processes with Applications. Springer, Berlin (2006)

Sato, K.: Lévy Processes and Infinitely Divisible Distributions. Cambridge University Press, Cambridge (1999)

Bertoin, J.: Lévy Processes. Cambridge University Press, Cambridge (1996)

Pistorius, M.R.: On exit, ergodicity of the completely asymmetric Lévy process reflected at its infimum. J. Theor. Probab. 17, 183–220 (2004)

Avram, F., Kyprianou, A.E., Pistorius, M.R.: Exit problems for spectrally negative Lévy processes and applications to (Canadized) Russian options. Ann. Appl. Probab. 14, 215–238 (2004)

Czarna, I., Palmowski, Z.: Ruin probability with Parisian delay for a spectrally negative Lévy risk process. J. Appl. Probab. 48(4), 984–1002 (2011)

Dassios, A., Wu, S.: Parisian ruin with exponential claims (2009). Submitted for publication, see http://stats.lse.ac.uk/angelos/

Dassios, A., Wu, S.: Ruin probabilities of the Parisian type for small claims (2009). Submitted for publication, see http://stats.lse.ac.uk/angelos/

Loeffen, R., Czarna, I., Palmowski, Z.: Parisian ruin probability for spectrally negative Lévy processes (2012). To appear in Bernoulli

Protter, P.: Stochastic Integration and Differential Equations. Springer, Berlin (1995)

Asmussen, S., Avram, F., Pistorius, M.: Russian and American put options under exponential phase-type Lévy models. Stoch. Process. Appl. 109, 79–111 (2004)

Egami, M., Kazutoshi, Y.: On the scale functions of spectrally negative Lévy processes with phase-type jumps (2011). Submitted for publication, see arXiv:1005.0064v4

Kyprianou, A., Palmowski, Z.: A martingale review of some fluctuation theory for spectrally negative Lévy processes. Sémin. Probab. XXXVIII, 16–29 (2005)

Assmusen, S.: Applied Probability and Queues, 2nd edn. Springer, New York (2003)

Ivanovs, J., Palmowski, Z.: Occupation densities in solving exit problems for Markov additive processes and their reflections. Stoch. Process. Appl. 122(9), 3342–3360 (2012)

Dassios, A., Wu, S.: Barrier strategy dividends with Parisian implementation delay for classical surplus processes. Insur. Math. Econ. 45(2), 195–202 (2009). http://stats.lse.ac.uk/angelos/

Jiang, Z., Pistorius, M.: Optimal dividend distribution under Markov regime switching. Finance Stoch. 16, 449–476 (2012)

Albrecher, H., Kainhofer, R.: Risk theory with a non-linear dividend barrier. Computing 68(4), 289–311 (2002)

Gajek, L., Kuciński, L.: To value a firm using DCF you must know its value: how to cope with this paradox. Manuscript (2012)

Acknowledgements

This work is partially supported by the Ministry of Science and Higher Education of Poland under the grants N N201 394137 (2009–2011) and N N201 525638 (2010–2011).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Czarna, I., Palmowski, Z. Dividend Problem with Parisian Delay for a Spectrally Negative Lévy Risk Process. J Optim Theory Appl 161, 239–256 (2014). https://doi.org/10.1007/s10957-013-0283-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-013-0283-y