Abstract

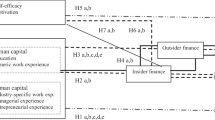

Retaining external investment is an important task for private firms. However, the entrepreneurial financing literature has primarily focused on how to attract, instead of retain, start-up funding. Integrating social embeddedness, signaling, and strategic choice theories, we propose that entrepreneurs’ resource background, philanthropic, and innovative activities affect the exit speed of external investment for Chinese private ventures. In particular, we propose that external investment exits entrepreneurs with deprived resources faster than those more resourceful entrepreneurs. Yet, external investment stays longer when less resourceful entrepreneurs commit to innovative or philanthropic activities.

Similar content being viewed by others

Notes

The Gini coefficient is a widely used indicator of economic inequality. A Gini coefficient of zero represents absolute equality, while one represents absolute inequality. It is usually believed that societies that have a Gini coefficient of more than 0.40 are at an increased risk of widespread social unrest. As a reference, Organization for Economic Cooperation and Development ranks the U.S. as having the highest Gini coefficient (at 0.39 after taxes and transfers) among the G7, followed by the U.K. at 0.34 and Italy at 0.32.

References

Acs, Z. 2006. How is entrepreneurship good for economic growth? Innovations: Technology, Governance, Globalization, 1(1): 97–107.

Acs, Z. J., & Audretsch, D. B. 1988. Innovation in large and small firms: An empirical analysis. American Economic Review, 78(4): 678–690.

Agostino, M., & Trivieri, F. 2014. Does trade credit play a signaling role? Some evidence from SMEs microdata. Small Business Economics, 42: 131–151.

Ahlers, G., Cumming, D., Gunther, C., & Schweizer, D. 2015. Signaling in equity crowdfunding. Entrepreneurship Theory & Practice, 39(4): 955–980.

Ahlstrom, D. 2010. Innovation and growth: How business contributes to society. Academy of Management Perspectives, 24(3): 11–24.

Ahlstrom, D., & Bruton, G. D. 2001. Learning from successful local private firms in China: Establishing legitimacy. Academy of Management Perspectives, 15(4): 72–83.

Ahlstrom, D., & Bruton, G. D. 2006. Venture capital in emerging economies: Networks and institutional change. Entrepreneurship Theory and Practice, 30(2): 299–320.

Ahlstrom, D., Bruton, G. D., & Yeh, K. S. 2008. Private firms in China: Building legitimacy in an emerging economy. Journal of world business, 43(4): 385–399.

Ahlstrom, D., Cumming, D. J., & Vismara, S. 2018. New methods of entrepreneurial firm financing: Fintech, crowdfunding and corporate governance implications. Corporate Governance: An International Review, 26(5): 310–313.

Arthurs, J., Hoskisson, R., Busenitz, L., & Johnson, R. 2008. Managerial agents watching other agents: Multiple agency conflicts regarding underpricing in IPO firms. Academy of Management Journal, 51(2): 277–294.

Astley, G. W., & Van de Ven, A. H. 1983. Central perspectives and debates in organization theory. Administrative Science Quarterly, 28(2): 245–274.

Balboa, M., & Marti, J. 2007. Factors that determine the reputation of private equity managers in developing markets. Journal of Business Venturing, 22: 453–480.

Barnett, M., & Salomon, R. 2006. Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strategic Management Journal, 27(11): 1101–1122.

Barrett, P., & Sexton, M. 2006. Innovation in small, project-based construction firms. British Journal of Management, 17: 331–346.

Baron, R. A., Tang, J., Tang, Z., & Zhang, Y. 2018. Bribes as entrepreneurial actions: Why underdog entrepreneurs feel compelled to use them. Journal of Business Venturing, 33(6): 679–690.

Bergh, D., Connelly, B., Ketchen, D., & Shannon, L. 2014. Signaling theory and equilibrium in strategic management research: An assessment and a research agenda. Journal of Management Studies, 51(8): 1334–1360.

Bettignies, J., & Brander, J. 2007. Financing entrepreneurship: Bank finance versus venture capital. Journal of Business Venturing, 22: 808–832.

Bian, Y. 2002. Chinese social stratification and social mobility. Annual Review of Sociology, 28: 91–116.

Bian, Y., Breiger, R., Davis, D., & Galaskiewicz, J. 2005. Occupation, class, and social networks in urban China. Social Forces, 83(4): 1443–1468.

Bourgeois III, L. J. 1981. On the measurement of organizational slack. Academy of Management Review, 6: 29–39.

Boyne, G. A., Meier, K. J., O’Toole, L. J., & Walker, R. M. 2006. Public service performance: Perspectives on measurement and management. Cambridge:Cambridge University Press.

Bruno, A., & Tyebjee, T. 1985. The entrepreneur’s search for capital. Journal of Business Venturing, 1(1): 61–74.

Bruton, G., & Ahlstrom, D. 2003. An institutional view of China’s venture capital industry: Explaining the differences between China and the west. Journal of Business Venturing, 18(1): 233–259.

Bruton, G. D., Ahlstrom, D., & Si, S. 2015. Entrepreneurship, poverty, and Asia: Moving beyond subsistence entrepreneurship. Asia Pacific Journal of Management, 32(1): 1–22.

Bruton, G., Chahine, S., & Filatotchev, I. 2009. Founders, private equity investors, and underpricing in entrepreneurial IPOs. Entrepreneurship Theory & Practice, 33(4): 909–928.

Busenitz, L. W., Fiet, J. O., & Moesel, D. D. 2005. Signaling in venture capitalist-new venture team funding decisions: Does it indicate long-term venture outcomes? Entrepreneurship Theory and Practice, 29(1): 1–12.

Cao, Y. 2010. The investigation of the operational situation of immigrant farmers and getihu in Beijing. Labor Security World, 12: 41–43.

Carter, R., & van Auken, H. 1990. Personal equity investment and small business financial difficulties. Entrepreneurship Theory & Practice, 15(2): 51–60.

Chauvet, L., & Collier, P. 2008. Elections and economic policy in developing countries. Available at: http://basepub.dauphine.fr/bitstream/handle/123456789/4315/2008-11.pdf?sequence=1. [Accessed on May 29, 2019].

Chen, F., & Zhang, X. 2009. There will be no limitation on the number of employees in getihu. Hunan Daily, July 23rd.

Child, J. 1972. Organizational structure, environment and performance: The role of strategic choice. Sociology, 6(1): 1–22.

China Family Panel Studies 2014. The Institute of Social Science Survey. China:ISSS) of Peking University.

Chow, C., & Fung, M. 2000. Small businesses and liquidity constraints in financing business investment: Evidence from Shanghai’s manufacturing sector. Journal of Business Venturing, 15: 363–383.

Christensen, L., MacKey, A., & Whetten, D. 2014. Taking responsibility for corporate social responsibility: The role of leaders on creating, implementing, sustaining, or avoiding socially responsible firm behaviors. Academy of Management Perspectives, 28(2): 164–178.

Chung, C., & Luo, X. 2013. Leadership succession and firm performance in an emerging economy: Successor origin, relational embeddedness, and legitimacy. Strategic Management Journal, 34: 338–357.

Churchill, N. C., & Lewis, V. L. 1983. The five stages of small business growth. Harvard Business Review, (May/June): 30–50.

Cohen, G. 1989. On the currency of egalitarian justice. Ethics, 99: 906–944.

Connelly, B., Certo, S., Ireland, R., & Eeutzel, C. 2011. Signaling theory: A review and assessment. Journal of Management, 37(1): 39–67.

Covin, J. G., & Slevin, D. P. 1989. Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10(1): 75–87.

Damanpour, F. 1991. Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3): 555–590.

Damanpour, F., Walker, R., & Avellaneda, C. 2009. Combinative effects of innovation types and organizational performance: A longitudinal study of service organizations. Journal of Management Studies, 46(4): 650–675.

Davidsson, P. 1991. Continued entrepreneurship: Ability, need, and opportunity as determinants of small firm growth. Journal of Business Venturing, 6(6): 405–429.

Davis, D. 1999. Self-employment in Shanghai: A research note. China Quarterly, 157: 22–43.

Dineen, B., & Allen, D. 2016. Third party employment branding: Human capital inflows and outflows following “best places to work” certifications. Academy of Management Journal, 59(1): 90–112.

Davila, A., Foster, G., & Gupta, M. 2003. Venture capital financing and the growth of start-up firms. Journal of Business Venturing, 18(6): 689–708.

Domínguez, G. 2014. “Corruption and elitism” fueling inequality in China. Available at: http://www.dw.de/corruption-and-elitism-fueling-inequality-in-china/a-17813952. [Accessed on May 29, 2019].

Filatotchev, I., & Bishop, K. 2002. Board composition, share ownership, and underpricing of UK IPO firms. Strategic Management Journal, 23(10): 941–955.

Friedman, M. 1970. The social responsibility of business is to increase its profits. The New York Times Magazine, 13(September 9): 32–33.

Garnaut, R., Song, L., Yao, Y., & Wang, X. 2012. Private enterprise in China. ANU Press.

Gassmann, O., & Keupp, M. M. 2007. The competitive advantage of early and rapidly internationalizing in the biotechnology industry: A knowledge-based view. Journal of World Business, 42: 350–366.

Gibbert, M., Hoegl, M., & Valikangas, L. 2007. In praise of resource constraints. MIT Sloan Management Review, 48(3): 14–17.

Guo, H., Tang, J., & Su, Z. 2014. To be different or to be the same? The interactive effect of organizational regulatory legitimacy and entrepreneurial orientation on new venture performance. Asia Pacific Journal of Management, 31(3): 665–685.

Guo, B., Lou, Y., & Perez-Castrillo, D. 2015. Investment, duration, and exit strategies for corporate and independent venture capital backed startups. Journal of Economics and Management Strategy, 24(2): 415–455.

Granovetter, M. 1985. Economic action and social structure: The problem of embeddedness. The American Journal of Sociology, 91(3): 481–510.

Green, S. 1988. Is equality of opportunity a false ideal for society? The British Journal of Sociology, XXXIX, (1): 1–27.

Grimes, M. 2010. Strategic sensemaking within funding relationships: The effects of performance measurement on organizational identity in the social sector. In Entrepreneurship Theory & Practice, July: 763–783.

Gulati, R., & Gargiulo, M. 1999. Where do interorganizational networks come from? American Journal of Sociology, 104(5): 1439–1293.

Hansen, G. S., & Wenerfelt, B. 1989. Determinants of firm performance: The relative importance of economic and organizational factors. Strategic Management Journal, 10(5): 399–411.

Harrison, R., Dibben, M., & Mason, C. 1997. The role of trust in the informal investor’s investment decision: An exploratory analysis: 63–81. Summer:Entrepreneurship Theory & Practice.

He, A. 2013. U.S. business asks easing of market barriers. China Daily, October 31st.

Henry, P. 2005. Social class, market situation, and consumer’s metaphors of (dis)emplowerment. Journal of Consumer Research, 31(4): 766–778.

Hite, J. 2005. Evolutionary processes and paths of relationally embedded network ties in emerging entrepreneurial firms: 113–144. January:Entrepreneurship Theory & Practice.

Hite, J. M., & Hesterly, W. S. 2001. The evolution of firm networks: From emergence to early growth of the firm. Strategic Management Journal, 22(3): 275–286.

Hoehn-Weiss, M., & Karim, S. 2014. Unpacking functional alliance portfolios: How signals of viability affect young firms’ outcomes. Strategic Management Journal, 35: 1364–1385.

Homans, G. 1961. Social behavior: Its elementary forms. New York:Harcourt, Brace & World.

Hrebiniak, L., & Joyce, W. 1985. Organizational adaptation: Strategic choice and environmental determinism. Administrative Science Quarterly, 30: 336–349.

Hull, C., Tang, Z., Tang, J., & Yang, J. 2019. Information diversity and innovation for born-globals. Asia Pacific Journal of Management, forthcoming.

Janney, J., & Folta, T. 2006. Moderating effects of investor experience on the signaling value of private equity placements. Journal of Business Venturing, 21: 27–44.

Jia, M., & Zhang, Z. 2015. News visibility and corporate philanthropic response: Evidence from privately owned Chinese firms following the Wenchuan earthquake. Journal of Business Ethics, 129(1): 93–114.

Johnson, R. A., & Greening, D. W. 1999. The effects of corporate governance and institutional ownership types on corporate social performance. Academy of Management Journal, 42: 563–576.

Jonsson, S., & Lindbergh, J. 2011. The development of social capital and financing of entrepreneurial firms: From financial bootstrapping to bank funding. Entrepreneurship Theory & Practice, (July): 661–686.

Katila, R., & Shane, S. 2005. When does lack of resources make new firms innovative? Academy of Management Journal, 48(5): 814–829.

Lanzolia, G., & Frankort, H. 2016. The online shadow of offline signals: Which sellers get contracted in online B2B marketplaces? Academy of Management Journal, 59(1): 207–231.

Lechner, C., Dowling, M., & Welpe, I. 2006. Firm networks and firm development: The role of the relational mix. Journal of Business Venturing, 21: 514–540.

Leng, Z. 2013. The discussion on the major difference in “the state’s advancement and the retreat of the private ownership”. Hongqi Wengao, 1: 17–20.

Lester, R., & Cannella, A. 2006. Interorganizational familiness: How family firms use interlocking directorates to build community-level social capital. Entrepreneurship Theory & Practice, Nov.: 755–774.

Lester, R. H., Certo, S. T., Dalton, C. M., Dalton, D. R., & Cannella, A. A. 2006. Initial public offering investor valuations: An examination of top management team prestige and environmental uncertainty. Journal of Small Business Management, 44: 1–2.

Li, Z. 2012. The state council’s new policy: Micro-businesses are gaining RMB 15 billion for financial report. Xinhuanet, April 28th.

Li, H., Meng, L., Wang, Q., & Zhou, L. 2008. Political connections, financing and firm performance: Evidence from Chinese private firms. Journal of Business Venturing, 87(2): 283–299.

Li, Y., Yao, F. K., & Ahlstrom, D. 2015. The social dilemma of bribery in emerging economies: A dynamic model of emotion, social value, and institutional uncertainty. Asia Pacific Journal of Management, 32(2): 311–334.

Lin, N. 1999. Social networks and status attainment. Annual Review of Sociology, 25: 467–487.

London, T. 2008. The base-of-the-pyramid perspective: A new approach to poverty alleviation. Academy of Management Proceedings, 1: 1–6.

Lou, B. 2006. The investigation and survey of accounting management in private ventures in Zhejiang province. Economic Theory and Economic Management, 3: 66–70.

Lu, X. 2001. Social structural change in rural China. Unpublished manuscript in Beijing Chinese academy of social science.

Luo, X., & Chung, C. 2005. Keeping it all in the family: The role of particularistic relationships in business group performance during institutional transition. Administrative Science Quarterly, 50: 404–439.

Luo, X., Chung, C., & Sobczak, M. 2009. How do corporate governance model differences affect foreign direct investment in emerging economies? Journal of International Business Studies, 40: 444–467.

Luo, X., Zhou, L., & Liu, S. 2005. Entrepreneurial firms in the context of China’s transition economy: An integrative framework and empirical examination. Journal of Business Research, 58: 277–284.

Luo, Y. 1999. Environment–strategy–performance relations in small businesses in China: A case of township and village enterprises in southern China. Journal of Small Business Management, 1: 37–52.

MacKay, R., & Chia, R. 2013. Choice, chance, and unintended consequences in strategic change: A process understanding of the rise and fall of NorthCo automotive. Academy of Management Journal, 56(1): 208–230.

Matten, D., & Moon, J. 2008. “Implicit” and “explicit” CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Academy of Management Review, 33(2): 404–424.

Mavlanova, T., Benbunan-Fich, R., & Koufaris, M. 2012. Signaling theory and information asymmetry in online commerce. Information & Management, 49: 240–247.

Milakovich, M., & Gordon, G. 2012. Public administration in America. Cengage Learning.

Muller, A., & Kraussl, R. 2011. Doing good deeds in times of need: A strategic perspective on corporate disaster donations. Strategic Management Journal, 32: 911–929.

Myers, S. 1984. The capital structure puzzle. Journal of Finance, 39: 575–592.

Nanda, R., & Rhodes-Kropf, M. 2013. Investment cycles and startup innovation. Journal of Financial Economics, 110(2): 403–418.

Nohria, N., & Gulati, R. 1996. Is slack good or bad for innovation? Academy Journal of Management, 39(5): 1245–1264.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. 2003. Corporate social and financial performance: A meta-analysis. Organization Studies, 24: 403–441.

Park, S., & Lou, Y. 2001. Guanxi and organizational dynamics: Organizational networking in Chinese firms. Strategic Management Journal, 22: 455–477.

Park, H., & Patel, P. 2015. How does ambiguity influence IPO underpricing? The role of the signaling environment. Journal of Management Studies, 52(6): 797–818.

Payne, D., & Joyner, B. 2006. Successful U.S entrepreneurs: Identifying ethical decision-making and social responsibility behaviors. Journal of Business Ethics, 65: 203–217.

Perotti, E. C. 1993. Bank lending in transition economies. Journal of Banking and Finance, 17(5): 1021–1032.

Perrini, F., Russo, A., & Tencati, A. 2007. CSR strategies of SMEs and large firms: Evidence from Italy. Journal of Business Ethics, 74(3): 285–300.

Piff, P., Kraus, M., Cote, S., Cheng, B., & Keltner, D. 2010. Having less, giving more: The influence of social class on prosocial behavior. Journal of Personality and Social Psychology, 99(5): 771–784.

Pignataro, G. 2012. Equality of opportunity: Policy and measurement paradigms. Journal of Economic Surveys, 26(5): 800–834.

Randoy, T., & Goel, S. 2003. Ownership structure, founder leadership, and performance in Norwegian SMEs: Implications for financing entrepreneurial opportunities. Journal of Business Venturing, 18: 619–637.

Rawls, J. 1971. A theory of justice. Cambridge, MA:Harvard University Press.

Ring, P., & Van de Ven, A. 1994. Developmental processes of cooperative interorganizatoinal relationships. Academy of Management Review, 19(1): 93–118.

Rosenbusch, N., Brinckmann, J., & Bausch, A. 2011. Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26: 441–457.

Rumelt, R. P. 1991. How much does industry matter? Strategic Management Journal, 12(3): 167–185.

Rumelt, R. P. 2011. Good strategy bad strategy: The difference and why it matters. New York:Crown Business.

Schradie, J. 2012. The trend of class, race, and ethnicity in social media inequality: Who still cannot afford to blog? Information, Communication & Society, 15(4): 555–571.

Shane, S. A. 2000. Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11: 448–469.

Shang, Y. 2014. Private businesses welcome the “lukewarm” and how to deal with “the last kilometer” in implementing policies. Xinhuanet, April 17th.

Spence, M. 1973. Job market signaling. Quarterly Journal of Economics, 87: 355–374.

Spence, M. 1974. Market signaling: Information transfer in hiring and related processes. Cambridge, MA:Harvard University Press.

Stacy, R. 1995. The science of complexity: An alternative perspective for strategic change processes. Strategic Management Journal, 16(6): 477–495.

Tang, Z., & Tang, J. 2012. Stakeholder-firm power difference, stakeholders’ CSR orientation, and SMEs’ environmental performance in China. Journal of Business Venturing, 27(4): 436–455.

Tang, J., Tang, Z., & Cowden, B. J. 2017. Exploring the relationship between entrepreneurial orientation, CEO dual values, and SME performance in state-owned vs. non-state-owned enterprises in China. Entrepreneurship Theory and Practice, 41(6): 883–908.

The Beijing News, 2005. It is concerned that peasant workers contribute more than what they gain (September 2).

Tomizawa, A., Zhao, L., Bassellier, G., & Ahlstrom, D. 2019. Economic growth, innovation, institutions, and the Great Enrichment. Asia Pacific Journal of Management, 36, forthcoming.

Villanueva, J., Van de Ven, A., & Sapienza, H. 2012. Resource mobilization in entrepreneurial firms. Journal of Business Venturing, 27: 19–30.

Wang, M., Qiu, C., & Kong, D. 2011. Corporate social responsibility, investor behaviors, and stock market returns: Evidence from a natural experiment in China. Journal of Business Ethics, 101: 127–141.

Westphal, J., Boivie, S., & Chng, D. 2006. The strategic impetus for social network ties: Reconstituting broken CEO friendship ties. Strategic Management Journal, 27: 425–445.

Wu, Z., Chua, J., & Chrisman, J. 2007. Effects of family ownership and management on small business equity financing. Journal of Business Venturing, 22: 875–895.

Yan, S. 2009. The study of the new venture financing of returned-home farmers. Science & Technology Information, 33: 409–410.

Yi, Z., Li, Y., & Gao, W. 2010. The management effect of heterogeneous institutional investors: Based on the perspective of top management team’s compensation. Statistics and Decisions, 5: 122–125.

Yu, B., Hao, S., & Ahlstrom, D. 2014. Entrepreneurial firms’ network competence, technological capability, and new product development performance. Asia Pacific Journal of Management, 31(3): 687–704.

Zajac, E. J., Kraatz, M. S., & Bresser, R. F. 2000. Modeling the dynamics of strategic fit: A normative approach to strategic change. Strategic Management Journal, 21: 429–453.

Zarutskie, R. 2010. The role of top management team human capital in venture capital markets: Evidence from first-time funds. Journal of Business Venturing, 25: 155–172.

Zhang, H. 2009. New stages, new situations, and new problems in the growth of Chinese private venture owners. http://e sociology.cass.cn/pub/shxw/shgz/shgz53/P020090120329435159025.pdf. [Accessed on May 29, 2019].

Zhang, J., Souitaris, V., Soh, P., & Wong, P. 2008. A contingent model of network utilization in early financing of technology ventures. Entrepreneurship Theory & Practice, (July): 593–613.

Zhang, X. 2018. A deep report on the current state of Chinese private ventures. https://wallstreetcn.com/articles/3427437 [Accessed on May 10, 2019]

Zhang, Y., & Wisersema, M. 2009. Stock market reaction to CEO certification: The signaling role of CEO background. Strategic Management Journal, 30: 693–710.

Zhou, X. 2001. Political dynamics and bureaucratic career patterns in the People’s republic of China 1949-1994. Comparative Political Studies, 34: 1036–1062.

Acknowledgements

This research is supported by Saint Louis University’s Faculty Research Leave Award, and National Natural Science Foundation of China (NSFC grants # 71628204 and 71810107002).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tang, J., Tang, Z., Zhu, R. et al. Entrepreneurs’ resource background, innovation, philanthropy and the exit of external Investment in Private Ventures in China. Asia Pac J Manag 38, 467–489 (2021). https://doi.org/10.1007/s10490-019-09674-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-019-09674-0