Abstract

The resource-based view, signaling, and behavioral perspectives focus on different theoretical mechanisms through which human capital and the behavioral characteristics of nascent entrepreneurs, in combination with insider and outsider financing, may influence the emergence of new ventures. This work tests the relative explanatory power of these different theoretical perspectives. We estimate a mediation model to disentangle the direct effect of nascent entrepreneur personal characteristics on new firm creation from their indirect effects, mediated by the amount of insider financing committed to new ventures and access to greater outsider financing. Our empirical results are based on data from the Panel Study of Entrepreneurial Dynamics (PSED II) and improve our understanding of the drivers of new firm creation and their underlying mechanisms. Our findings support the resource-based view and the behavioral perspective in our sample of nascent entrepreneurs, but do not provide evidence of the signaling perspective.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Nascent entrepreneurs are individuals currently in the process of starting a new business (e.g. Reynolds & White, 1997). Each year, hundreds of millions of nascent entrepreneurs are involved in gestation activities aimed at starting a new firm (e.g. Bosma et al., 2021). The success of such activities is marked by the emergence of a fully operative new firm. If nascent entrepreneurs are unsuccessful, they will eventually give up and disengage from the creation of a new firm.Footnote 1 Therefore, understanding why some nascent entrepreneurs manage to start new firms while others fail is of considerable academic, practical, and political interest.

Previous studies that investigated factors driving the transition leading to the emergence of a new firm highlight the crucial role played by the human capital and behavioral characteristics of nascent entrepreneurs. Several scholars have considered the effects of nascent entrepreneurs’ educational achievements and previous work experience, in particular their entrepreneurial, managerial, and industry-specific experience (Alomani et al., 2022; Davidsson & Honig, 2003; Dimov, 2010; Hopp & Sonderegger, 2015; Rotefoss & Kolvereid, 2005; Wagner, 2004), on new firm creation. The motivation and self-efficacy of nascent entrepreneurs have also attracted considerable attention (Alomani et al., 2022; Carsrud & Brännback, 2011; Dimov, 2010; Hechavarria et al., 2012; Hopp & Stephan, 2012). In addition, scholars agree that financial capital favors successful entrepreneurial outcome in nascent entrepreneurs (Gartner et al., 2012; Reynolds, 2011).

However, the channels through which the human capital and behavioral characteristics of nascent entrepreneurs, in combination with financing, drive the emergence of new firms have remained largely unexplored (see Dimov, 2010, for an exception). This is an important gap to address, as different theoretical perspectives emphasize different underlying theoretical mechanisms resulting in different (direct or indirect) channels. In this study we aim to fill this gap in the literature on entrepreneurship to improve our understanding of why nascent entrepreneurs with certain personal characteristics succeed whilst others fail. In this way, we also facilitate the design of effective support schemes for the creation of new firms.

We consider three theoretical perspectives that are popular in the literature on nascent entrepreneurship: The resource-based view (RBV), signaling and behavioral perspectives. RBV scholars argue that nascent entrepreneurs with greater resource endowments are more likely to successfully create an operating new firm. They predict that the human capital of nascent entrepreneurs, as reflected in their educational achievements and previous work experience, has a direct positive effect on new firm creation. Entrepreneurs with greater higher human capital have better personal skills which enable them to manage gestation activities more effectively (Davidsson & Honig, 2003; Dimov, 2010; Rotefoss & Kolvereid, 2005). The personal financial resources that nascent entrepreneurs can leverage also play a crucial role (e.g. Cassar, 2004). As higher human capital entrepreneurs are also generally wealthier (Åstebro & Bernhardt, 2005; Xu, 1998), this creates an indirect link between entrepreneurs’ human capital and new firm creation, mediated by the amount of personal financial resources these individuals commit to the new firm gestation process. Signaling theory highlights that entrepreneurs with greater human capital incur higher opportunity costs when starting a new firm, in terms of lost salary and career opportunities, but they also convey quality signals to uninformed external parties, making them better placed to attract external financial resources (Higgins & Gulati, 2006; Hoenig & Henkel, 2015; Hsu, 2007; Plummer et al., 2016). According to this perspective, an indirect link exists between nascent entrepreneur human capital and the likelihood of new firm creation, mediated by the amount of outsider finance nascent entrepreneurs have access to. In addition, the amount of insider finance entrepreneurs commit to their new ventures (i.e. their “skin in the game”, Leland & Pyle, 1977) constitutes another quality signal that attracts outsider finance. The extent that higher human capital individuals commit a greater amount of insider finance to their new ventures, including the capital provided by family members and friends, creates a mediation-of-the-mediation effect between entrepreneur human capital, insider finance, outsider finance, and entrepreneurial success.

Lastly, scholars looking through the lens of behavioral theories argue that the behavioral characteristics of nascent entrepreneurs, such as entrepreneurial self-efficacy and motivation, have a direct positive impact on successful entrepreneurial outcome (Baron, 2007; Hechavarria et al., 2012; Hopp & Stephan, 2012). However, there may also be an indirect link between these behavioral characteristics in nascent entrepreneurs and the likelihood of creating a new firm, mediated by the greater amount of personal finance these entrepreneurs commit to the gestation of their new ventures, and the abovementioned link between insider and outsider finance (again, a mediation-of-the-mediation effect).

To test the predictions of these theoretical perspectives, we used data from the Panel Study of Entrepreneurial Dynamics (PSED II) managed by the University of Michigan (Reynolds & Curtin, 2008). PSED II offers longitudinal survey-based data on a large sample of nascent entrepreneurs, allowing us to distinguish those who successfully created an operational firm from those who did not. It also provides information on the human capital and behavioral characteristics of nascent entrepreneurs, the amount of insider capital that nascent entrepreneurs and their family members and friends committed to the new venture creation process, and the amount of outsider capital provided by financial intermediaries (in the form of bank loans and outsider equity capital).

Our econometric findings support the RBV perspective. They confirm the findings of previous studies by showing that the industry-specific experience of nascent entrepreneurs (but not their managerial or entrepreneurial experience) have direct positive effects on new firm emergence, pointing to the greater entrepreneurial skills of these individuals (i.e. a “capability” effect). Even though the entrepreneurs’ education and general work experience do not have any positive direct effects, they do exert a positive indirect effect mediated by insider financing (a “wealth” effect of human capital). In addition, we detect a positive mediation-of-the-mediation effect of these variables through the positive link between insider and outsider financing. Indeed, as predicted by signaling theory, “skin in the game” helps nascent entrepreneurs attract outsider financing. Conversely, the prediction, again based on signaling theory, that the generic and specific human capital of nascent entrepreneurs has positive indirect effects on new firm emergence, mediated by outsider financing, is not supported by our results. Overall, our results do not offer much support to signaling theory. Lastly, our findings provide support to the behavioral perspective in highlighting the positive direct association between the self-efficacy of entrepreneurs and new firm emergence. They also reveal a so far neglected channel through which entrepreneurs’ behavioral traits influence the emergence of a new firm. Even though entrepreneur motivation does not have any direct effect on the creation of a new firm, it has a positive indirect “wealth” effect mediated by the greater amount of insider finance that more highly motivated entrepreneurs commit to the venture creation process, and by the positive relationship between insider and outsider financing (i.e. once again, a mediation-of-the-mediation effect).

This paper contributes to the literature on nascent entrepreneurs by improving our understanding of the theoretical mechanisms underlying the relationships between entrepreneur personal characteristics, financing, and eventual success in creating a new firm. We also contribute to the literature on human capital by disentangling the wealth, capability, and signaling effects of the generic and specific human capital characteristics of nascent entrepreneurs. Finally, we contribute to the entrepreneurial finance literature by highlighting the crucial mediation and mediation-of-the-mediation effects of insider financing on new firm creation.

Factors driving new firm emergence: Conceptual model and hypotheses

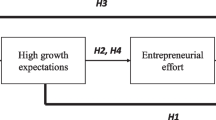

Figure 1 illustrates our conceptual model linking the human capital and behavioral characteristics of nascent entrepreneurs, the insider finance they commit to the new firm creation process, the outsider finance they obtain access to, and entrepreneurial outcome.

While scholars generally agree that the personal characteristics of entrepreneurs and finance are the key drivers of the creation of a fully operative new firm, they diverge as regards the underlying theoretical mechanisms explaining why. Different theoretical perspectives emphasize different direct and/or indirect links between these variables. These perspectives are considered below.

The RBV perspective

The capability effect of entrepreneur human capital

Scholars adhering to the RBV perspective have long recognized that the generic and specific human capital of entrepreneurs (Barney, 1991, 2001; Barney & Arikan, 2005; Becker, 1964), as reflected in their education and generic work experience, on the one hand, and in their industry-specific, managerial, and entrepreneurial experience, on the other hand, is a key resource they can leverage to achieve better performance (Unger et al., 2011).

The greater the education and work experience of nascent entrepreneurs, the greater their cognitive abilities, which will help entrepreneurs identify promising business opportunities. Arguments from the “knowledge corridor thesis” (Ronstadt, 1988; Venkataraman, 1997) suggest that education and work experience of nascent entrepreneurs create a set of knowledge (the so-called “knowledge corridor”) that shapes the information they can see, interpret, and respond to. Indeed, individuals notice information related to what they already know, and discard other information (Shane, 2000; Von Hippel, 1994). More educated and experienced nascent entrepreneurs, having larger knowledge corridors, are better positioned to obtain information on potential business opportunities from heterogeneous sources, process and interpret this information in a more accurate way, and make a better judgment about the merits of these opportunities (Dimov, 2010).

Moreover, nascent entrepreneurs with greater specific human capital are more likely to be equipped with the task-related personal skills required to exploit the business opportunities they have discovered. In particular, they can leverage their industry-specific, entrepreneurial and/or managerial experience to manage effectively the gestation activities leading to the emergence of a fully operative new firm (Davidsson & Honig, 2003). Nascent entrepreneurs with greater industry-specific work experience have more profound knowledge of the sector of operations of their new firms, related to, for example, market trends, customers willingness to pay, product and process technologies, and cost structure, and greater knowledge of the actors involved in the startup process (e.g. customers and suppliers; see, for example, Cooper et al., 1994; Bruderl et al., 1992; Colombo & Grilli, 2005; Kor et al., 2007). Hence, they will progress more rapidly in the development of their firms’ technology and the creation of a functioning prototype, identify more quickly and accurately the first customers that may act as a market testbed for their firms’ products, and manage more effectively marketing and sales activities. The experience serial nascent entrepreneurs have accumulated in starting previous new firms (Ucbasaran et al., 2008, 2009; Westhead et al., 2005) and their previous managerial experience (Kim et al., 2006) will provide them with similarly valuable context-specific expertise, which will help them in organizing and coordinating gestation activities.

Based on the above arguments, one expects to observe a positive direct association between nascent entrepreneur (generic and above all specific) human capital and their success in starting a new firm, as predicted by Hypothesis H1:

-

H1a: A direct positive association exists between the educational achievements of nascent entrepreneurs and new firm emergence.

-

H1b: A direct positive association exists between the generic work experience of nascent entrepreneurs and new firm emergence.

-

H1c: A direct positive association exists between the industry-specific work experience of nascent entrepreneurs and new firm emergence.

-

H1d: A direct positive association exists between the managerial experience of nascent entrepreneurs and new firm emergence.

-

H1e: A direct positive association exists between the entrepreneurial experience of nascent entrepreneurs and new firm emergence.

Several previous studies have considered the impact of nascent entrepreneur human capital on entrepreneurial outcome. The findings are not unanimous, and generally depend on the specific component of human capital under consideration. For example, most previous studies show a positive association between nascent entrepreneurs’ industry-specific experience and successful transition from a nascent to a new firm (e.g. Dimov, 2010; Wagner, 2004), even if some exceptions exist (Davidsson & Gordon, 2012). Rotefoss and Kolvereid (2005) found entrepreneurial experience to be the single most important factor for predicting a positive outcome of the business startup process. Dimov (2010) and Hopp and Sonderegger (2015) again found a positive effect, mediated by the nascent entrepreneur’s opportunity confidence and number of gestation activities, respectively. Davidsson and Honig (2003) also confirm that nascent entrepreneurs with previous entrepreneurial experience are involved in more gestation activities, but they are not more likely to report any sales or profit. Results relating to the generic human capital of nascent entrepreneurs are generally weaker (Davidsson & Gordon, 2012). One possible reason is that the effects of human capital variables are indirect, being mediated by other (e.g. financial) variables, as we argue below.

The wealth effect of entrepreneur human capital

Scholars and practitioners agree finance to be a key resource facilitating the creation of a fully operating new firm. However, the entrepreneurial finance literature has long recognized that there are information asymmetries between entrepreneurs and financial intermediaries that generate adverse-selection and moral-hazard problems and make access to outsider financing highly problematic (Hall & Lerner, 2010). These problems are magnified when firms are still in a nascent stage. Indeed, it is extremely difficult for financial intermediaries to assess both the entrepreneurial abilities of nascent entrepreneurs and the business opportunities they face. Thus, financial intermediaries are likely to ask for a “lemon premium” (Akerlof, 1970), which makes outsider financing very costly for high-quality entrepreneurs (Cassar, 2004), and may even discourage them from seeking such financing (Kon & Storey, 2003). In turn, financial constraints of nascent entrepreneurs hinder the new firm creation process due to lack of adequate financing.

In summary, in accordance with the pecking-order hypothesis (Myers & Majluf, 1984; see also Fazzari et al., 1988), one would expect nascent entrepreneurs to resort to insider financing first, namely, their own savings and funds provided by family members, friends, and other insiders.Only when insider financing is exhausted will they then resort to outside financial channels.Footnote 2 Hence, insider finance is a key resource for nascent entrepreneurs. In accordance with this view, previous studies show that unexpected exogenous positive shocks to the personal wealth of an individual, such as winning a lottery or receiving an unexpected inheritance or gift, are positively associated with the likelihood of starting a new firm (Blanchflower & Oswald, 1998; Holtz-Eakin et al., 1994; Lindh & Ohlsson, 1996). Scholars have also shown that financial endowment by nascent entrepreneurs is an important condition both for preserving their involvement within the startup process and for the transition from business idea to new firm (Gartner et al., 2012).

While studies of nascent entrepreneurs have tended to associate their greater educational achievements and generic work experience with superior entrepreneurial abilities, the “wealth effect” of their generic human capital has not received adequate attention. Indeed, there is a positive relationship between the generic human capital and the wealth of individuals. For example, Åstebro and Bernhardt (2005) found that the household income in a given year of entrepreneurs who started a business in that year and who have a PhD or Master degree is almost 80 percent higher than the household income of entrepreneurs who do not have a high level of education. Similarly, the income of entrepreneurs with at least 6 years of work experience was 20–30 percent higher than their less experienced peers (see also Xu, 1998). This consideration also applies to nascent entrepreneurs. More educated nascent entrepreneurs and those with more work experience are likely to have more savings and so can invest more of their own money in their nascent ventures. They are also likely to mobilize greater financial resources from their relatives, friends, and other insiders. In turn, the greater insider financing committed to the new firm creation process positively influences entrepreneurial outcome. Hypothesis 2 is as follows:

-

H2a: An indirect positive association exists between the educational achievements of nascent entrepreneurs and new firm emergence directly mediated by the amount of insider financing.

-

H2b: An indirect positive association exists between the generic work experience of nascent entrepreneurs and new firm emergence directly mediated by the amount of insider financing.

Signaling theory

As we mentioned above, there are considerable information asymmetries between nascent entrepreneurs and financial intermediaries which make it difficult for nascent entrepreneurs to obtain outsider finance. Those who successfully get outsider finance are more likely to create a fully operative new firm, and they do so more rapidly than those we do not receive outsider finance (Hechavarría et al., 2016; Warhuus et al., 2021). Signaling theory (Spence, 1973, 2002) suggests that to overcome the difficulties associated with information asymmetries and obtain outsider finance, nascent entrepreneurs can convey quality signals to investors. Signals are costly and observable actions that distinguish high-quality from low-quality entrepreneurs as bearing signaling costs tends to be unprofitable for the latter.

Previous studies have shown the human capital characteristics of entrepreneurs to act as effective signals (Higgins & Gulati, 2006; Hsu, 2007; Hoenig & Henkel, 2015; Plummer et al., 2016). Better educated and more experienced nascent entrepreneurs are likely to experience higher opportunity costs when starting a new firm in terms of lost salary and future career opportunities as, for example, managers or senior technicians (e.g. Van Der Sluis et al., 2008). The money they leave on the table is a quality signal that likely facilitates access to outsider financing.

Moreover, previous studies have highlighted that entrepreneurs with greater specific human capital (i.e. industry specific, managerial, and/or entrepreneurial experience) generally create firms that exhibit better survival rates and faster growth (Colombo & Grilli, 2005, 2010; Delmar & Shane, 2006; Kotha & George, 2012). This evidence confirms that the (specific) human capital of nascent entrepreneurs generates a separating equilibrium, distinguishing high-quality start-ups from lower quality ones. Accordingly, the entrepreneurial finance literature has long recognized the importance of the specific human capital of the “jockey” in attracting funding from professional investors (Bernstein et al., 2017; Gompers et al., 2020).Footnote 3

In summary, we expect nascent entrepreneurs with greater specific and (although to a lesser extent) generic human capital to be better positioned than other entrepreneurs to overcome the information asymmetry problems that otherwise make access to outsider financing difficult. This creates an indirect association between these human capital characteristics and successful entrepreneurial outcome, mediated by outsider financing. Hypothesis H3 is structured as follows:

-

H3a: An indirect positive association exists between the educational achievements of nascent entrepreneurs and new firm emergence directly mediated by the amount of outsider financing.

-

H3b: An indirect positive association exists between the generic work experience of nascent entrepreneurs and new firm emergence directly mediated by the amount of outsider financing.

-

H3c: An indirect positive association exists between the industry-specific work experience of nascent entrepreneurs and new firm emergence directly mediated by the amount of outsider financing.

-

H3d: An indirect positive association exists between the managerial work experience of nascent entrepreneurs and new firm emergence directly mediated by the amount of outsider financing.

-

H3e: An indirect positive association exists between the entrepreneurial experience of nascent entrepreneurs and new firm emergence directly mediated by the amount of outsider financing.

Another effective signal nascent entrepreneurs can convey to investors is the amount of insider finance (especially personal capital) they invest in the new venture creation process. Nascent entrepreneurs’ “skin in the game” (Leland & Pyle, 1977) shows to prospective investors their commitment to the entrepreneurial project and their confidence in their own entrepreneurial abilities. While alleviating information asymmetries with financial intermediaries, it also facilitates access to outsider financing. In other words, by putting their own “skin in the game” resource providers are reassured “that the entrepreneurs are able to endure adversity and not ‘jump ship’ and abandon their projects when faced with difficulties” (Zott & Huy, 2007: page 89). Previous studies of nascent entrepreneurs also confirm this prediction (Hechavarría et al., 2016; Warhuus et al., 2021). Indeed, according to Gartner et al. (2012), less than 2% of nascent entrepreneurs use outsider financing (including funds provided by family members, friends, and other insiders) without putting up any personal money.

We have mentioned above that nascent entrepreneurs with greater generic human capital, being wealthier, can commit greater personal finance to the new firm development process. Therefore, the positive association between insider and outsider finance creates an indirect link between nascent entrepreneur education level and generic work experience and entrepreneurial outcome, mediated by both insider and outside finance (i.e. a mediation-of-the-mediation effect). Hypothesis H4 follows as such:

-

H4a: An indirect positive association exists between the educational achievements of nascent entrepreneurs and new firm emergence indirectly mediated by the amount of outsider financing, which increases with the amount of insider financing.

-

H4b: An indirect positive association exists between the generic work experience of nascent entrepreneurs and new firm emergence indirectly mediated by the amount of outsider financing, which increases with the amount of insider financing.

The behavioral perspective

Previous studies have examined the influence of nascent entrepreneur behavioral traits on new firm creation, with special attention to their motivation and self-efficacy. As suggested by socio-cognitive theories (Bandura & Locke, 2003; Bandura, 1991; Latham & Locke, 1991), the personal motivation of nascent entrepreneurs, i.e. their willingness to exert effort in the new venture creation process to make the venture succeed (Carsrud & Brännback, 2011; Laukkanen, 2023), is fundamental for the development of a fully operative new firm since the implementation phase requires intense effort and hard work (Reynolds & Miller, 1992; Reynolds & Curti, 2011; Dimov, 2010; Hopp & Sonderegger, 2015). Nascent entrepreneurs believe in the potential of their business ideas, but only few actually take action to implement these ideas (Collewaert et al., 2016; Linder & Nippa, 2019). Moreover, to succeed in launching a new venture, nascent entrepreneurs must be adequately confident about their own capabilities (Busenitz & Barney, 1997). Previous studies show that self-efficacy, defined as one’s belief in the ability to perform tasks and fulfill roles (Bandura, 1991; McCann & Vroom, 2015), is a distinct characteristic of entrepreneurs (Chen et al., 1998; Krueger & Dickson, 1994; Markman et al., 2002; Zhao et al., 2005). They also show that entrepreneurial self-efficacy, reflecting individuals’ belief in their ability to successfully launch an entrepreneurial venture (McGee et al., 2009), is an important driver of new firm creation. Nascent entrepreneurs who have greater confidence in their own abilities are more motivated and perseverant in conducting the gestation activities that lead to setting up a new firm, make more aggressive entrepreneurial decisions, and are ultimately more likely to get a new firm running (Cassar & Friedman, 2009; Dimov, 2010; Hopp & Sonderegger, 2015; Townsend et al., 2010).Footnote 4 On this basis, hypothesis H5 is as follows:

-

H5a: A direct positive association exists between the self-efficacy of nascent entrepreneurs and new firm emergence.

-

H5b: A direct positive association exists between the motivation of nascent entrepreneurs and new firm emergence.

An aspect that has gone unexplored is the indirect association between the behavioral traits of nascent entrepreneurs and the establishment of a new firm mediated by the greater amount of insider and outsider financing available to nascent entrepreneurs who exhibit higher levels of self-motivation and self-efficacy.

Nascent entrepreneurs who are strongly motivated to start a new firm and have greater confidence in their entrepreneurial abilities will be more inclined to invest more of their own savings in their entrepreneurial projects. On the one hand, these nascent entrepreneurs tend to have more ambitious goals for their firms. The greater complexity and size of their entrepreneurial projects require greater financial resources. On the other hand, because of their greater confidence in their entrepreneurial abilities, they expect the finances invested in their new firms to yield greater marginal returns, which encourages them to invest more of their personal savings in their entrepreneurial projects.Footnote 5 In addition, more committed and confident nascent entrepreneurs are likely to exert more effort and to have more convincing arguments to solicit funds from relatives, friends, and other insiders (Shane & Cable, 2002). In turn, as the insider financing they invest in their new ventures increases, so does the probability of a successful entrepreneurial outcome. Hypothesis H6 is thus as follows:

-

H6a: An indirect positive association exists between the self-efficacy of nascent entrepreneurs and new firm emergence directly mediated by the amount of insider financing.

-

H6b: An indirect positive association exists between the motivation of nascent entrepreneurs and new firm emergence directly mediated by the amount of insider financing.

Lastly, as we highlighted earlier, nascent a greater degree of “skin in the game” facilitates the access of entrepreneurs to outsider financing. In this way, the self-motivation and -efficacy of nascent entrepreneurs exert an additional indirect positive effect on entrepreneurial outcome (i.e. a mediation-of-the-mediation effect). Hypothesis H7 is thus as follows:

-

H7a: An indirect positive association exists between the self-efficacy of nascent entrepreneurs and new firm emergence indirectly mediated by the amount of outsider financing, which increases with the amount of insider financing.

-

H7b: An indirect positive association exists between the motivation of nascent entrepreneurs and new firm emergence indirectly mediated by the amount of outsider financing, which increases with the amount of insider financing.

Data and methods

The sample

In this paper we rely on data provided by the Panel Study of Entrepreneurial Dynamics (PSED) managed by the University of Michigan (Reynolds & Curtin, 2008). The PSED database provides data describing the very early phase of the entrepreneurial process up to the emergence of an operating new firm or the nascent entrepreneur’s disengagement from the process. In particular, the PSED II version of the database contains longitudinal data on the creation of new firms as provided by nascent entrepreneurs who were surveyed yearly over a six-year period starting in 2005/2006. The PSED II database also provides detailed information on individual nascent entrepreneurs related to their human capital, as reflected in their educational attainments and previous work experience, as well as behavioral characteristics.

The PSED II database has been used in previous studies to assess the characteristics of nascent entrepreneurs and the relationship between these characteristics and the outcome of the entrepreneurial process, that is, the creation of an operating new firm or abandonment of the process (see, for example: Reynolds & Curtin, 2008; Reynolds, 2011; Gartner & Shaver, 2012; Gartner et al., 2012; Hopp & Stephan, 2012; Hopp & Sonderegger, 2015; Reynolds, 2017). In this paper, we focus on individual nascent entrepreneurs who are owners (either solo or in teams) of their firms, and we investigate how the outcome of their entrepreneurial effort was influenced by their human capital and behavioral characteristics, both directly and through access to greater amounts of insider and outsider financing.

The dependent variable of the econometric models and the econometric methodology

The dependent variable of the econometric models captures the successful creation by nascent entrepreneurs of a fully operative new firm and confronts it with the abandonment of the start-up process. According to Reynolds (2017: page 41), “There is no consensus on either the conceptual (theoretical) or the operational (measurement) definitions of (….) the birth of a new firm.” However, scholars generally agree that one needs to rely on objective evidence of the activities nascent entrepreneurs are engaged in and their achievements, over and beyond their subjective judgment. Some previous studies identify the emergence of a fully operating new firm as when the start-up achieves a period of positive cash flow (Reynolds, 2011; Hechavarria et al., 2012; Hopp & Stephan, 2012; Hopp & Sonderegger, 2015), but other scholars disagree with this definition. Nascent entrepreneurs are often not sophisticated enough to predict cash flow precisely enough (Katz & Cabezuelo, 2004). More importantly, their objectives may diverge from the creation of a firm that is immediately profitable. Indeed, many fully operative new firms may need to spend available cash for a long initial period – one that practitioners call the “valley of death”- as firms’ salary expenses and investments in the tangible and intangible assets needed to fuel growth exceed the value of their sales. Indeed, “researchers who focus solely on studying profitable exchanges may unduly restrict the identification and selection of newly created organizations in their early stages” (Katz & Gartner, 1988: page 432). Coherently, some previous studies focused attention on sales to discriminate the nascent entrepreneurs who managed to create a fully operative new firm from those who did not (see, among others: Gatewood et al., 1995; Carter et al., 1996; Newbert, 2005; Delmar & Shane, 2006). Coherent with this approach, we consider a firm as “emerged” when it has received payment from customers resulting in a period of positive sales.

More precisely, we took the following steps to define the dependent variable of our econometric models. First, we identified the nascent entrepreneurs who had “disengaged” from the entrepreneurial process by considering the responses to questions A15 and A42 of the PSED II questionnaire (asked every time the questionnaire was conducted). Question A15: “Would you consider yourself to be disengaged from the original business effort that we discussed a year ago?”; and question A42: “Do you consider yourself to be actively involved with the new business start-up or disengaged from it?”. Disengaged entrepreneurs were included in the Quit category (see, for example, Hechavarria et al., 2012, in which a similar approach was applied). Second, to identify those who successfully proceeded to create an operative new firm from the remaining entrepreneurs, we considered the responses to the following PSED II question (question E13): “Has this new business receive(d) any money, income, or fees from the sale of goods or services for more than six months?”. New firm emergence was used as a dummy variable with a value equal to 1 in the case of occurrence of this condition in any one of the six PSED’s waves. For entrepreneurs in the Quit category, New firm emergence was taken as equal to 0.

The sample comprised 917 nascent entrepreneurs after eliminating those for whom there were missing values in either the independent variables or the controls. A total of 505 entrepreneurs managed to create a new firm, and 412 entrepreneurs abandoned the new firm creation process. Similar to Hopp and Stephan (2012), we excluded from this analysis 37 respondents who, at the end of our observation period, were “still trying” to launch a new firm.

Our main estimates are based on a logit model that distinguishes entrepreneurs who created a new firm (i.e. New firm emergence equals 1) from those that gave up on the start-up development process (i.e. New firm emergence equals 0). As a robustness check, we ran a multinomial logit model that also considers the Start-up development category (37 respondents as reported above). In addition, we re-ran the logit model after combining the Quit and Start-up development categories. Finally, to exploit the longitudinal dimension of the data better, we ran a survival data analysis and competing risk models with a specification similar to those of the logit and multinomial logit models described above. The estimates obtained from these additional models are reported in the Appendix and are discussed in "Robustness checks" section.

The independent and control variables

Following Becker (1964) and other studies using the PSED database (e.g. Davidsson & Honig, 2003; Dimov, 2010), we consider both the generic human capital of nascent entrepreneurs, as reflected in their level of education and general work experience, and their specific human capital related to their industry-specific work experience, managerial, and entrepreneurial experience. The PSED distinguishes eight educational levels, and our Education variable was re-coded from the dummy variables reported in the original PSED screening survey to the following ordinal scheme, in line with Townsend et al. (2010): 10 = less than high-school; 12 = high-school graduate; 14 = some college experience; 16 = college graduate; 18 = graduate degree. Work experience considers the number of years of full-time paid work. Industry experience measures the number of years of work of the focal entrepreneur in the industry in which the new firm operates. Managerial experience is the ratio of the number of years the respondents had managerial, supervisory, or administrative responsibilities to the total number of years of full-time, paid work experience. Lastly, Serial entrepreneur equals 1 if the focal nascent entrepreneur had previously founded one or more firms.

As for the behavioral traits of nascent entrepreneurs, we again follow the approach of previous studies (see, for example: Cassar & Friedman, 2009; Dimov, 2010; Hechavarria et al., 2012; Hopp & Stephan, 2012; Acharya & Berry, 2023) by considering their motivation and self-efficacy, and we replicated the measures used by Hopp and Stephan (2012). Motivation is the average of the responses given to the following items, expressed on a 5-point Likert scale (from 1 = completely disagree, to 5 = completely agree): Y9, “There is no limit as to how long I would give maximum effort to establish this new business”; Y10, “My personal philosophy is to ‘do whatever it takes’ to establish my own business.” Self-efficacy is the average of the responses given to the following items, again expressed on a 5-point Likert scale: Y4, “Starting this new business is much more desirable than other career opportunities I have”; Y5, “If I start this new business, it will help me achieve other important goals in my life”; Y6, “Overall, my skills and abilities will help me start this new business”; Y7, “My past experience will be very valuable in starting this new business”; and Y8, “I am confident I can put in the effort needed to start this new business.” The two variables have satisfactory Cronbach’s alphas of 0.70 and 0.68.Footnote 6

Moreover, we aim to investigate the extent to which the impact of nascent entrepreneurs’ personal characteristics on new firm emergence is mediated by the availability of greater financial resources. As is common in the entrepreneurial finance literature (e.g. Robb & Robinson, 2014), we distinguish between outsider financing, obtained through market transactions with financial intermediaries, and insider non-intermediated financing, including that provided by relatives and friends.Footnote 7Outsider financing is the (log of the) sum of the money provided by financial intermediaries as reflected in the following PSED II items: AQ8, “personal bank loans”; AQ9, “asset backed loans”; and AQ10, “funds: other sources.” Insider financing is the (log of the) sum of the money considered by the following PSED II items: AQ4, “personal savings”; AQ5, “personal loans received by the respondent from family members and relatives”; AQ6, “personal loan received by the respondent from friends, employers or work colleagues”; and AQ7, “credit card loans to the respondent.” All independent variables are winsorized at 1% to mitigate the effects of outliers on the estimates.

Finally, the model specification includes a set of controls related to other entrepreneur personal characteristics, including gender (Male), ethnicity (White), and the entrepreneurial experience of relatives (Carter et al., 2003; Cassar & Friedman, 2009; Rotefoss & Kolvereid, 2005). We also include region dummies (from census region) and industry dummies (from question AB1: “type of business”).Footnote 8

The descriptive statistics for the variables used in the econometric analysis and correlations are shown in Table 1. The correlations between the human capital variables and behavioral trait variables are generally low, with the exception of the correlations between Education and Motivation (− 0.22) and between Industry experience and Self-efficacy (0.19).

As expected, the human capital variables, especially Education, are positively correlated with Insider finance, whereas their positive correlations with Outsider finance are small or non-existent. Outsider finance is positively correlated with Insider finance (0.247).

Results

Main results

In Table 2, column 1, we report the estimates of a logit model of the probability of new firm creation that includes as explanatory variables the human capital variables, the variables reflecting entrepreneur behavioral traits, the finance variables, and controls. All independent and control variables are defined as reported in "The independent and control variables" section. The variables Work experience, Industry experience, and Managerial experience are winsorized at the 1% level. The dependent variable of model 1 is New Firm Emergence that is a dummy equal to 1 if the new business received money from the sale of goods or services for more than six months, and 0 if the nascent entrepreneur quitted. Robust standard errors are reported in parentheses.

The results of the estimates, expressed in a log-odds metric, are largely in accordance with those of previous studies. Self-efficacy and Industry experience exhibit a positive and significant association with new firm creation (p = 0.078 and 0.016, respectively). These associations also have great economic significance. With all remaining variables at their mean value, when Self-efficacy, and Industry experience move from a value equal to one standard deviation below the mean to a value equal to one standard deviation above the mean, the probability of new firm creation increases by 6.95 and 9.73 percentage points, respectively. As regards the finance variables, Insider finance and Outsider finance are both positively and significantly associated with New firm creation (p = 0.000 and 0.004, respectively). The magnitude of the effect of these variables again is quite large. When Insider finance moves from a value equal to one standard deviation below the mean to a value equal to one standard deviation above the mean, the probability of creating a new firm increases by 19.88 percentage points. The effect of a similar variation in Outsider finance is large as well (+11.56 percentage points).

In columns 2 and 3 of Table 2, we report the estimates of OLS models where the dependent variables are the logarithm of Insider finance and Outsider finance, respectively, and the explanatory variables are entrepreneurs’ personal characteristics and controls.

Our estimates indicate that entrepreneurs with stronger motivations and those with greater generic human capital, as reflected in their education achievements and work experience, use a significantly greater amount of insider financing (p = 0.000, 0.006, and 0.019, respectively). Moreover, the magnitude of the effects of these three variables is quite large. When they move from a value equal to one standard deviation below the mean to a value equal to one standard deviation above the mean, the Insider finance committed to the creation of the new firm increases by approximately $23,000 (Motivation), $15,000 (Education), and $12,000 (Work experience).

Conversely, we fail to find any positive significant association between nascent entrepreneurs’ personal characteristics and the amount of outsider financing. The only variable that significantly influences the amount of financing that nascent entrepreneurs receive from banks and other financial intermediaries is Insider finance (p = 0.000). The association between this variable and Outsider finance is also economically significant. A 1 percent increase in Insider finance leads to a 0.14 percent increase in the amount of outsider financing that nascent entrepreneurs have access to.

The results of the estimates of the mediation model are reported in Table 3. This table reports the estimate of direct and indirect effects of the mediation model. The dependent variable is New Firm Emergence, that is a dummy equal to 1 if the new business received money from the sale of goods or services for more than six months and 0 if the nascent entrepreneur quitted. Definition of all independent variables is in "The independent and control variables" section. Consistently with previous models, variables Work experience, Industry experience, and Managerial experience are winsorized at 1% level, whilst Insider finance and Outsider finance are expressed in logarithm. To test for mediation, similarly to other research (Linder & Nippa, 2019), we used the PROCESS procedure developed by Hayes (2012). This involves using bootstrapping to draw 5,000 replacement samples from the focal sample and constructing bias-correcting confidence intervals around the indirect effects. For each variable capturing nascent entrepreneurs’ human capital characteristics (Education, Work experience, Industry experience, Managerial experience and Serial Entrepreneur) and behavioral traits (Motivation and Self-efficacy), we report the estimated direct effect and its standard error (column 1) and (total) indirect effects (column 2). We also distinguish indirect effects mediated by insider financing, those mediated by outsider financing, and those arising from the positive association between insider financing and outsider financing (i.e. the mediation-of-mediation effect). For all indirect effects, we report confidence intervals. Confidence intervals that do not contain zero indicate a significant indirect effect.

The RBV perspective predicts a positive direct association between the human capital of nascent entrepreneurs and the probability of a positive entrepreneurial outcome, because of the greater entrepreneurial skills of nascent entrepreneurs with greater human capital. Our findings support this contention but only as regards the specific human capital of entrepreneurs related to their industry-specific experience.

In accordance with H1c, Industry experience has a positive and significant direct association with the odds of new firm creation, as indicated earlier. Both Managerial experience and Serial entrepreneur exhibit positive, though non-significant (p-value = 0.169 and p-value = 0.217), direct links, contrary to H1d and H1e. Contrary to H1a and H1b, the generic human capital of nascent entrepreneurs, as reflected in their educational achievements and general work experience, does not have any significant direct association with the odds of new firm creation. However, Education and Work Experience have positive indirect effects on the emergence of an operative new firm, mediated by the greater insider capital that entrepreneurs with greater generic human capital commit to the entrepreneurial process. As is predicted by H2a and H2b, Education and Work experience have positive and significant indirect effects on New firm emergence mediated by Insider finance (b = 0.0202, SE = 0.0087, 95% confidence interval (CI) [0.0055, 0.0393] for Education; and b = 0.0029, SE = 0.0014, 95% confidence interval (CI) [0.0005, 0.0061] for Work experience). These results support the view that insider finance is a fundamental resource of nascent entrepreneurs and that their generic human capital has an important “wealth effect” favoring the creation of a new firm.

The results of our estimates provide only limited support to signaling theory. Contrary to H3, we do not find any significant indirect effect on New firm emergence of (both generic and specific) human capital variables, mediated by access to outsider finance. The only signal that attracts outsider finance is the insider finance nascent entrepreneurs commit to the new firm creation process (i.e. their “skin in the game”). Indeed, as shown earlier, Outsider finance is positively and significantly related to Insider finance. This link generates positive mediation-of-the-mediation effects of Education and Work experience on New firm emergence (b = 0.0019, SE = 0.0011, 95% confidence interval (CI) [0.0003, 0.0044] for Education, and b = 0.0003, SE = 0.0002, 95% confidence interval (CI) [0.0000, 0.0007] for Work experience), as predicted by H4. These effects account for 7.5 percent and 9.7 percent of the total indirect effects of these variables, respectively.

Finally, let us consider the effects on New firm creation of nascent entrepreneurs’ behavioral traits. As is predicted by H5a, Self-efficacy does have a significant (and sizable, as previously shown) direct effect on New firm emergence, while Motivation does not have any significant direct effect, contrary to H5b. Moreover, contrary again to H6a and H7a, we failed to identify any indirect effects of Self-efficacy on New firm emergence, mediated by the finance variables. Conversely, our results support H6b and H7b in showing an indirect positive link between Motivation and New firm emergence, mediated by Insider finance (b = 0.0644, SE = 0.0222, 95% confidence interval (CI) [0.0286, 0.1161]) and a positive and significant mediation-of-mediation effect (b = 0.0060, SE = 0.0032, 95% confidence interval (CI) [0.0013, 0.0137]) through the positive association between insider and outsider financing. The latter effect accounts for approximately 11% of the total indirect effect of Motivation on New firm emergence. In sum, the influence of Motivation on the creation of an operating new firm is fully mediated by greater insider capital.

A summary of our hypothesis test results is provided in Table 4.

Robustness checks

To further elucidate the above evidence and check the robustness of our results, we conducted four additional analyses. Results corresponding to the estimates of Model 1 in Table 2 are reported in Table 5 of Appendix A, and the estimates of the mediation model are reported in Table 6 of Appendix A. First, we winsorized at 2% (instead of 1%) the variables Work experience, Industry experience, Managerial Experience, Insider finance, and Outsider Finance. The results are reported in column 1 of Table 5, and under Model 1 in Table 6. They are in line with those reported above.Footnote 9

Second, we re-estimated our models after adding the 37 nascent entrepreneurs, who were still developing their firms at the end of wave f, to the counterfactual represented by the entrepreneurs who disengaged from the entrepreneurial process. The results (reported in column 2 of Table 5 and under Model 2 in Table 6 of Appendix A) are very close to those reported earlier.

Third, we used a more granular version of insider financing by splitting it into two components: Owner finance and Family and friends finance, which measure the amount of financing committed by the main owner and the amount received from family members, friends, and other insiders, respectively. As is apparent from the estimates in column 3 of Table 5 (Appendix A), both variables are positively and significantly associated with New firm creation, and their effects have similar economic significance. Moreover, Model 3 of Table 6 (Appendix A) indicates that Motivation, Education, and Work experience are positively associated with the amount of insider financing committed to new firm creation by the main owner. In turn, the amount of financing committed by the main owner positively affects the amount of financing received by family members, friends, and other insiders. Conversely, Motivation, Education, and Work experience do not have any direct influence on Family and friends finance, and the latter variable does not significantly influence financing received from outsiders.

Model 4 (see Table 5 of Appendix A, column 4) adds the variable Solo to identify entrepreneurs who started the new business alone as well as the interaction terms between Solo and our explanatory variables. We do not detect a significant difference between solo entrepreneurs and entrepreneurial teams, with the exception of Self-efficacy, which has a positive significant effect on new firm creation only when nascent entrepreneurs start a business alone.Footnote 10

In column 5 of Table 5 (Appendix A), we report the results of the estimates of a multinomial logit model that distinguishes three categorical entrepreneurial outcomes: New firm emergence, Quit (the baseline category), and Start-up development. Notably, Self-efficacy, Industry experience, Insider finance, and Outsider finance are all positively associated with the likelihood of new firm emergence, in line with the findings illustrated earlier.

Last, in column 6 of Table 5 (Appendix A), we report the results of a Cox semi-parametric competing risk model to examine the drivers of the hazard rates of creating a new firm (NF) and disengaging from the entrepreneurial process (QUIT). We report the subhazard ratios. The results of the estimates show that the same variables that are positively associated with the likelihood of creating a new firm (Self-efficacy, Industry experience, and the finance variables) also accelerate this transition. These same variables also significantly reduce the hazard rate of abandoning the entrepreneurial process.

Discussion

This paper contributes to the entrepreneurship literature in several ways. First of all, we contribute to the stream of previous studies that focus on the ability of nascent entrepreneurs to successfully create a fully operating new firm. These studies investigated the effects of the human capital of nascent entrepreneurs on the entrepreneurial outcome (Davidsson & Honig, 2003; Dimov, 2010; Hopp & Sonderegger, 2015; Kessler & Frank, 2009; Kim et al., 2006; Rotefoss & Kolvereid, 2005; Wagner, 2004), and show that these effects vary depending on the different dimensions of human capital. In particular, the specific human capital of nascent entrepreneurs related especially to their managerial and industry-specific experiences is more consistently associated with a successful outcome than generic human capital related to education and general work experience (Davidsson & Gordon, 2012). Previous studies have also highlighted the positive effects of the behavioral characteristics of nascent entrepreneurs, notably their motivation (Dimov, 2010; Hopp & Sonderegger, 2015; Reynolds & Curtin, 2008; Reynolds & Miller, 1992) and self-efficacy (Cassar & Friedman, 2009; Dimov, 2010; Hopp & Sonderegger, 2015). Moreover, a positive entrepreneurial outcome is closely related to the amount of insider and outsider financing committed to the new firm creation process (Frid, 2014; Hechavarría et al., 2016; Warhuus et al., 2021). However, the literature has devoted less attention to identifying the theoretical mechanisms explaining why the human capital and behavioral characteristics of nascent entrepreneurs, in combination with financial resources, drive new firm emergence. Indeed, the positive associations detected by previous studies are compatible with different theoretical perspectives. For example, nascent entrepreneurs with high human capital may be more successful either because they have superior entrepreneurial skills, or because, being wealthier, they commit greater internal financial resources to the new firm creation process (or both). The human capital of entrepreneurs also is as a quality signal, reducing information asymmetries and attracting outsider financing. In this work we developed and tested a comprehensive mediation model that allows the (allegedly positive) direct effects of the human capital and behavioral traits of nascent entrepreneurs on entrepreneurial outcome to be disentangled from the indirect effects mediated by insider and outsider financing. In this way, we were able to test the relative explanatory power of the different theoretical perspectives popular in the entrepreneurship literature, namely: the RBV, signaling and behavioral perspectives.

As the RBV suggests, our results indicate that the human capital of nascent entrepreneurs has positive “capability” and “wealth” effects on new firm creation, but these two effects are related to different human capital dimensions. The positive effect of the generic human capital of nascent entrepreneurs is fully mediated by the greater insider financing (in particular, their personal savings) that more educated and experienced entrepreneurs commit to the new firm creation process (i.e. a “wealth” effect”; Blanchflower & Oswald, 1998; Holtz-Eakin et al., 1994; Kim et al., 2006; Frid et al., 2016). Conversely, the specific human capital of nascent entrepreneurs, as reflected notably in their industry-specific experience (but not in their entrepreneurial and managerial experience), has a direct positive effect on entrepreneurial outcome, which suggests that these individuals have superior entrepreneurial skills (i.e. a “capability” effect; Colombo & Grilli, 2005; Unger et al., 2011).

Conversely, our work provides only limited support to the predictions of the signaling perspective. In accordance with signaling theory, previous studies have shown that firms funded and managed by higher human capital individuals are more likely to attract venture capital (Hsu, 2007; Colombo & Grilli, 2010; Hoenig & Henkel, 2015; Plummer et al., 2016) and collect larger proceeds from IPOs (Higgins & Gulati, 2006). This study failed to replicate these results for nascent entrepreneurs. Neither their generic nor specific human capital characteristics were associated with greater outsider financing. A possible explanation is that in the very early development stage of an entrepreneurial project, when firms do not have any sales, the information environment is so noisy that it is difficult for financial intermediaries to attend to and correctly interpret the signals conveyed by nascent entrepreneurs’ human capital. The small amount of outsider financing that most nascent entrepreneurs are looking for at this stage (Warhuus et al., 2021) is also likely to reduce the effort financial intermediaries commit to process the information these signals convey. In this way, our results confirm the claim raised recently by scholars in the fields of management and entrepreneurship (e.g. Plummer et al., 2016; Drover et al., 2018; Vanacker et al., 2020) that in a noisy information environment, boundedly rational signal receivers may be overwhelmed by the information conveyed by multiple (and mostly weak) signals. Accordingly, we find that the only signal that attracts outsider finance is the amount of personal capital nascent entrepreneurs commit to the new firm creation process (i.e. their “skin in the game”, Leland & Pyle, 1977), a strong signal that is easy to interpret. This result confirms the crucial role of insider finance highlighted by previous studies (Gartner et al., 2012). Because of the positive association between the education and general work experience of nascent entrepreneurs and insider finance, the link between insider and outsider finance also creates an important positive mediation-of-the-mediation effect between nascent entrepreneur generic human capital and new firm creation. This link was overlooked by previous studies.Footnote 11

Lastly, our findings support the view advanced by the behavioral perspective that the motivation and self-efficacy of nascent entrepreneurs are fundamental drivers of the new firm creation process (Alomani et al., 2022; Cassar & Friedman, 2009; Dimov, 2010; Hopp & Sonderegger, 2015). We add to the literature by highlighting the different channels through which these behavioral traits of nascent entrepreneurs influence entrepreneurial outcome. We show that while self-efficacy has a positive direct effect,Footnote 12 it does not influence the amount of insider and outsider financing. Conversely, motivation has no direct effect on entrepreneurial outcome. Its positive effect is fully mediated by the insider capital that more committed entrepreneurs invest in the new venture creation process (i.e. a “wealth” effect) and by the positive link between insider and outsider financing mentioned above (i.e. a mediation-of-the-mediation effect).

Second, our study contributes to the literature examining the performance effects of the human capital of entrepreneurs (Unger et al., 2011). This literature has shown that the different dimensions of human capital (e.g. generic vs specific) have different effects on the performance of start-ups, influencing them through different channels (e.g. Colombo & Grilli, 2005, 2010). We highlight that these effects also depend on the stage in the firm development process. For example, the signaling value of entrepreneur human capital, well documented in the entrepreneurship literature as mentioned above, does not seem to materialize before firms receive initial income from the sales of their products or services.

Lastly, our study contributes to the entrepreneurial finance literature by highlighting the crucial mediation and mediation-of-the-mediation effects of insider financing on new firm creation. Studies have long recognized the importance of insider financing for new firms (Reynolds, 2011; Robb & Robinson, 2014). We contribute to this literature by showing that in a very early stage of the entrepreneurial process, committing a greater amount of insider financing, an action that occurs more frequently for more motivated, better educated, and more experienced entrepreneurs, is the only way to attract outsider investors. In this way, we provide a fresh perspective on the pecking-order hypothesis (Fazzari et al., 1988; Myers & Majluf, 1984) by highlighting the link between the amount of insider finance and the amount of outsider finance that entrepreneurs can mobilize.

Limitations

Like any study, our work has its limitations, which open up new avenues for future research. First, in this study, we focused on the personal characteristics of the main entrepreneur. The fact that the robustness checks did not detect any substantial difference between ‘solo’ entrepreneurs and entrepreneurs working within teams regarding the (direct and indirect) links between the variables under consideration in this study and entrepreneurial outcome (with the exception of self-efficacy and entrepreneurial experience) reassures us about the validity of our approach. Nevertheless, investigating the personal characteristics of all entrepreneurial team members more comprehensively would be an interesting addition to our work. Second, in this work we tested three important theoretical perspectives used by scholars of the new firm creation process, the RBV, signaling and behavioral perspectives. Accordingly, we focused on the direct effects of the human capital and behavioral characteristics of nascent entrepreneurs on new firm creation and their indirect effects mediated by insider and outsider financing. Our analysis could be extended to other perspectives that focus on other personal characteristics of nascent entrepreneurs (e.g. social capital). Incorporating these factors in our mediation model would make our analysis even more comprehensive. Third, the measure of entrepreneurial success considered in this study is the creation of a fully operative new firm. We do not have information on the post-entry performance of these newly created firms. If this information were available, one could refine the analysis, distinguishing the creation of successful and unsuccessful firms (i.e. those that do not grow and possibly do not survive). Indeed, one might argue that early termination of an entrepreneurial project that ultimately has very small chances of post-entry success can be regarded as a better outcome of the entrepreneurial development process than the creation of an unsuccessful firm.

Fourth, with regards to serial entrepreneurs, we did not consider the number of entrepreneurial projects in which they were involved. Most entrepreneurs had created just one previous firm, while a small number had created a considerable number of ventures, which is why we preferred to use a dummy variable differentiating (more or less experienced) serial entrepreneurs from other entrepreneurs. In addition, we did not have information on the characteristics of the ventures serial entrepreneurs had created (e.g. the industry of operations) and their performance. Using this more fine-grained information, we could improve our understanding of the conditions under which entrepreneurial experience positively influences new firm creation.

Finally, nascent entrepreneurs may obtain initial equity financing from different channels, including, for example, business angels (Capizzi et al., 2022), corporate venture capital investors (Dushnitsky, 2012), governmental venture capital institutions (Colombo et al., 2016), and domestic and international (more or less reputable) independent VC investors (Gompers & Lerner, 2001). Unfortunately, the information provided by PSED did not allow us to differentiate between these different channels and to assess their allegedly different effects on new firm emergence.

Conclusions

Despite the limitations highlighted in the previous section, our study has important implications for nascent entrepreneurs. First, it highlights the key role of insider financing for a successful entrepreneurial outcome. In particular, nascent entrepreneurs need to be aware that without committing their personal savings to their entrepreneurial projects, there is no way to attract outsider investors or to convince relatives, friends, and other insiders to finance the entrepreneurial process. In fact, other quality signals relating to their human capital characteristics are ineffective. Second, our results show that successful new firm creation also depends on selected human capital and behavioral characteristics of nascent entrepreneurs, independent of the financial resources they may be able to collect. From this perspective, it is reassuring that individuals with greater industry-specific experience and those who are more confident in their own entrepreneurial abilities have better chances to succeed in creating a fully operative new firm.

Data availability

The data used in this paper are available at this link: https://www.psed.isr.umich.edu.

Notes

Scholars agree that the creation of a new firm is not an instant phenomenon but proceeds through a series of steps (Bhidé, 2000; Gartner, 1985). According to Bergmann and Stephan (2013, p. 946), “a key transition in the entrepreneurial process is that from nascent to new business ownership, i.e. the transition from taking steps to starting a business to actually creating an operational firm.” This transition is characterized by great uncertainty, and only about 30 to 55 percent of nascent entrepreneurs manage to create a fully operative new firm (e.g. Parker & Belghitar, 2006; van Gelderen et al., 2005).

Robb and Robinson (2014) investigate the capital structures of a sample of 3,536 U.S. nascent firms. They find that only 40% get access to outsider debt and that an even smaller share (less than 6%) get access to outsider equity. Gartner et al. (2012) show that most (83.8%) nascent entrepreneurs contribute personal funds to their start-ups. About one-third (31.8%) use other sources, but this latter figure includes family members, friends, and other insiders.

Serial entrepreneurs have likely had the opportunity to develop previous collaborative relationships with banks, business angels, and venture capitalists, especially if their ventures were successful (Hsu, 2007; Wright et al., 1997; Zhang, 2011). Thus, they can leverage these relations to obtain the outsider financing required to start their new firms, which reinforces the signaling effect of this human capital component.

This latter finding was not sustained by Hechavarria et al. (2012), who instead found that nascent entrepreneurs exhibiting greater self-efficacy were less likely to disengage from the start-up effort.

According to the estimates of Cassar and Friedman (2009), nascent entrepreneurs with a level of self-efficacy at the 75th percentile invest 10% more personal wealth in their new firms compared with those with a level of self-efficacy at the 25th percentile level.

In contrast to Dimov (2010), our measure of start-up motivation comprises answers to only two questions, as the third

question that was part of Dimov’s analysis based on the PSED I, was not included in the PSED II. For the same reason we do not include in our measure of self-efficacy the answer to one question that was considered by Cassar and Friedman (2009) and Hechavarria et al. (2012).

Differently from Gartner et al. (2012), we include funds from family members and friends in the insider finance category as they are not obtained through market transactions. In a robustness check, we distinguish between funds from the entrepreneurs’ family members and friends and their personal funds.

We also have information on the age of the nascent entrepreneur. However, we dropped the variable Age because it is highly correlated with the variable Work experience. When Age is added to the model specification, its coefficient is not significant (the results are available from the authors on request).

When winsorizing at 5%, the results remain very similar to those presented here and are available on request.

Conversely, serial entrepreneurs are significantly more likely to create a new firm only when they join forces with other entrepreneurs.

For example, Gartner et al. (2012) found a positive association between the education and net worth of nascent entrepreneurs, and the amount of outsider finance (including finance provided by family members and friends) they manage to attract. Our findings suggest that the link between education and outsider finance is likely to be traced to the positive association between education and personal wealth and that between personal wealth and outside finance, and it is not driven by the information value of nascent entrepreneurs’ educational achievements.

This result is not straightforward. For example, the experimental results of Stevenson et al. (2019) show that in the context of crowdfunding, the relationship between self-efficacy and firm performance is ambiguous.

References

Acharya, K., & Berry, G. R. (2023). Characteristics, traits, and attitudes in entrepreneurial decision-making: Current research and future directions. International Entrepreneurship and Management Journal, 19, 1965–2012. https://doi.org/10.1007/s11365-023-00912-y

Akerlof, G. (1970). The market of ‘lemons’: Quality, uncertainty and the market mechanism. Quarterly Journal of Economics, 84(3), 488–500. https://doi.org/10.2307/1879431

Alomani, A., Baptista, R., & Athreye, S. S. (2022). The interplay between human, social and cognitive resources of nascent entrepreneurs. Small Business Economics, 59, 1301–1326. https://doi.org/10.1007/s11187-021-00580-8

Åstebro, T., & Bernhardt, I. (2005). The winner’s curse of human capital. Small Business Economics, 24(1), 63–78.

Bandura, A. (1991). Social cognitive theory of self-regulation. Organizational Behavior and Human Decision Processes, 50(2), 248–287. https://doi.org/10.1016/0749-5978(91)90022-L

Bandura, A., & Locke, E. A. (2003). Negative self-efficacy and goal effects revisited. Journal of Applied Psychology, 88(1), 87–99. https://doi.org/10.1037/0021-9010.88.1.87

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barney, J. B. (2001). Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. Journal of Management, 27(6), 643–650.

Barney, J. B., & Arikan, A. M. (2005). The resource-based view: Origins and implications. In M. A. Hitt, R. E. Freeman, & J. S. Harrison (Eds.), The Blackwell handbook of strategic management (pp. 123–182). Blackwell Publishers Ltd. https://doi.org/10.1111/b.9780631218616.2006.00006.x

Baron, R. A. (2007). Behavioral and cognitive factors in entrepreneurship: Entrepreneurs as the active element in new venture creation. Strategic Entrepreneurship Journal, 1(1–2), 167–182. https://doi.org/10.1002/sej.12

Becker, G. S. (1964). Human capital. The University of Chicago Press.

Bergmann, H., & Stephan, U. (2013). Moving on from nascent entrepreneurship: Measuring cross-national differences in the transition to new business ownership. Small Business Economics, 41(4), 945–959. https://doi.org/10.1007/s11187-012-9458-4

Bernstein, S., Korteweg, A., & Laws, K. (2017). Attracting early-stage investors: Evidence from a randomized field experiment. The Journal of Finance, 72(2), 509–538. https://doi.org/10.1111/jofi.12470

Bhidé, A. V. (2000). The Origin and Evolution of New Businesses. Oxford University Press.

Blanchflower, D. G., & Oswald, A. J. (1998). What Makes an Entrepreneur? Journal of Labor Economics, 16(1), 26–60. https://doi.org/10.1086/209881

Bosma, N., Hill, S., Ionescu-Somers, A., Kelley, D., Guerrero, M., & Schott, T. (2021). Global Entrepreneurship Monitor 2020–2021 Global Report. Global Entrepreneurship Research Association London Business School.

Bruderl, J., Preisendorfer, P., & Ziegler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 57(2), 227–242. https://doi.org/10.2307/2096207

Busenitz, L. W., & Barney, J. B. (1997). Differences between entrepreneurs and managers in large organizations: Biases and heuristics in strategic decision-making. Journal of Business Venturing, 12(1), 9–30. https://doi.org/10.1016/S0883-9026(96)00003-1

Capizzi, V., Croce, A., & Tenca, F. (2022). Do Business Angels’ Investments Make It Easier to Raise Follow-on Venture Capital Financing? An Analysis of the Relevance of Business Angels’ Investment Practices. British Journal of Management, 33(1), 306–326.

Carsrud, A., & Brännback, M. (2011). Entrepreneurial Motivations: What Do We Still Need to Know? Journal of Small Business Management, 49(1), 9–26. https://doi.org/10.1111/j.1540-627X.2010.00312.x

Carter, N. M., Gartner, W. B., & Reynolds, P. D. (1996). Exploring start-up event sequences. Journal of Business Venturing, 11(3), 151–166. https://doi.org/10.1016/0883-9026(95)00129-8

Carter, N. M., Gartner, W. B., Shaver, K. G., & Gatewood, E. J. (2003). The career reasons of nascent entrepreneurs. Journal of Business Venturing, 18(1), 13–39. https://doi.org/10.1016/S0883-9026(02)00078-2

Cassar, G. (2004). The financing of business start-ups. Journal of Business Venturing, 19(2), 261–283. https://doi.org/10.1016/S0883-9026(03)00029-6

Cassar, G., & Friedman, H. (2009). Does self-efficacy affect entrepreneurial investment? Strategic Entrepreneurship Journal, 3(3), 241–260. https://doi.org/10.1002/sej.73

Chen, C., Greene, P., & Crick, A. (1998). Does Entrepreneurial Self-Efficacy Distinguish Entrepreneurs from Managers? Journal of Business Venturing, 13(4), 295–316. https://doi.org/10.1016/S0883-9026(97)00029-3

Collewaert, V., Anseel, F., Crommelinck, F., De Beuckelaer, A., & Vermeire, J. (2016). When passion fades: Disentangling the temporal dynamics of entrepreneurial passion for founding. Journal of Management Studies, 53(6), 966–995.

Colombo, M. G., & Grilli, L. (2005). Founders’ human capital and the growth of new technology-based firms: A competence-based view. Research Policy, 34(6), 795–816. https://doi.org/10.1016/j.respol.2005.03.010

Colombo, M. G., & Grilli, L. (2010). On growth drivers of high-tech start-ups: The role of founders’ human capital and venture capital. Journal of Business Venturing, 25(6), 610–626. https://doi.org/10.1016/j.jbusvent.2009.01.005

Colombo, M. G., Cumming, D. J., & Vismara, S. (2016). Governmental venture capital for innovative young firms. The Journal of Technology Transfer, 41, 10–24.

Cooper, A., Gimeno-Gascon, F., & Woo, C. (1994). Initial human capital and financial capital as predictors of new venture performance. Journal of Business Venturing, 9(5), 371–395. https://doi.org/10.1016/0883-9026(94)90013-2

Davidsson, P., & Gordon, S. R. (2012). Panel studies of new venture creation: A methods-focused review and suggestions for future research. Small Business Economics, 39(4), 853–876. https://doi.org/10.1007/s11187-011-9325-8

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301–331. https://doi.org/10.1016/S0883-9026(02)00097-6

Delmar, F., & Shane, S. (2006). Does Experience Matter? The Effect of Founding Team Experience on the Survival and Sales of Newly Founded Ventures. Strategic Organization, 4(3), 215–247.

Dimov, D. (2010). Nascent entrepreneurs and venture emergence: Opportunity confidence, human capital, and early planning. Journal of Management Studies, 47(6), 1123–1153. https://doi.org/10.1111/j.1467-6486.2009.00874.x

Drover, W., Wood, M. S., & Corbett, A. C. (2018). Toward a cognitive view of signalling theory: Individual attention and signal set interpretation. Journal of Management Studies, 55, 209–231. https://doi.org/10.1111/joms.12282

Dushnitsky, G. (2012). Corporate Venture Capital, in Cumming (eds.). Oxford Handbook of Venture Capital, Oxford University Press.

Fazzari, S. M., Hubbard, R. G., & Petersen, B. C. (1988). Financing Constraints and Corporate Investment. Brookings Papers on Economic Activity, 1, 141–206. https://doi.org/10.2307/2534426

Frid, C. J. (2014). Acquiring financial resources to form new ventures: The impact of personal characteristics on organizational emergence. Journal of Small Business & Entrepreneurship, 27(3), 323–341.

Frid, C. J., Wyman, D. M., & Coffey, B. (2016). Effects of wealth inequality on entrepreneurship. Small Business Economics, 47(4), 895–920. https://doi.org/10.1007/s11187-016-9742-9

Gartner, W. B. (1985). A Conceptual Framework for Describing the Phenomenon of New Venture Creation. Academy of Management Review, 10(4), 696–706. https://doi.org/10.2307/258039

Gartner, W. B., & Shaver, K. G. (2012). Nascent entrepreneurship panel studies: Progress and challenges. Small Business Economics, 39(3), 659–665. https://doi.org/10.1007/s11187-011-9353-4