Abstract

Globally, the twenty-first century will witness rapid population ageing. Already in 2050, one out of five persons in the world, and one out of three in Europe, is expected to be 60 or over (UN 2015). Moreover, we have entered into a new stage of population ageing in terms of its causes, which have altered its consequences. In the first stage, lasting until the middle of the twentieth century in developed countries, population ageing was entirely due to the decline in fertility, with Sweden being commonly used as an example (Coale 1957; Bengtsson and Scott 2010; Lee and Zhou 2017). During this stage, the increase in life expectancy was primarily driven by declines in infant and child mortality. It worked in the opposite direction to the fertility decline, making the population younger since it added more years before, than after retirement (Coale 1957; Lee 1994). In the second stage of population ageing, which is the current situation, population ageing is primarily driven by the increase in life expectancy, which is now due to declining old-age mortality. As a result, more years are added after retirement than in working ages (Lee 1994). Could immigration or an upswing in fertility stop population ageing? The short answer is most likely not. The effect of migration on population aging is generally regarded as minor (Murphy 2017), and since population ageing is a global phenomenon, it will be of no general help anyway. A rapid increase in fertility is improbable and, in any case, an increase would take some 25 years before adding to the labor force. Instead, attention has been focused on how to adapt our social systems to the increasing number of elderly per worker – more so since the increase in the elderly-per-worker ratio came in parallel with a rise in per capita costs for the institutional care, home care, and general health care for the elderly.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1.1 The Need for Accurate Mortality Forecasts Is Greater Than Ever Before

Globally, the twenty-first century will witness rapid population ageing. Already in 2050, one out of five persons in the world, and one out of three in Europe, is expected to be 60 or over (UN 2015). Moreover, we have entered into a new stage of population ageing in terms of its causes, which have altered its consequences. In the first stage, lasting until the middle of the twentieth century in developed countries, population ageing was entirely due to the decline in fertility, with Sweden being commonly used as an example (Coale 1957; Bengtsson and Scott 2010; Lee and Zhou 2017). During this stage, the increase in life expectancy was primarily driven by declines in infant and child mortality. It worked in the opposite direction to the fertility decline, making the population younger since it added more years before, than after retirement (Coale 1957; Lee 1994). In the second stage of population ageing, which is the current situation, population ageing is primarily driven by the increase in life expectancy, which is now due to declining old-age mortality. As a result, more years are added after retirement than in working ages (Lee 1994). Could immigration or an upswing in fertility stop population ageing? The short answer is most likely not. The effect of migration on population aging is generally regarded as minor (Murphy 2017), and since population ageing is a global phenomenon, it will be of no general help anyway. A rapid increase in fertility is improbable and, in any case, an increase would take some 25 years before adding to the labor force. Instead, attention has been focused on how to adapt our social systems to the increasing number of elderly per worker – more so since the increase in the elderly-per-worker ratio came in parallel with a rise in per capita costs for the institutional care, home care, and general health care for the elderly.

The increase in per capita costs for the elderly is most clearly visible in the United States and Japan, but also in a selection of European countries, among them Sweden (Lee and Mason 2011; Qi 2016). Attempts to adapt social care, health care, and pension systems to this new reality, among other things by increasing the minimum pension age and even indexing them to life expectancy, are not sufficient. Accurate life expectancy projections for planning the supply of health care and other services to the elderly forms of care become then crucial. This said, the public pension system is still a main driver of costs in a large number of countries, which is why we need to learn how to design national pension systems that adapt to the ageing process. Specifically, the re-design of public pension systems has increasingly been directed to creating public life-cycle savings-transfer schemes that are financially sustainable.

An example of a financially stable pension scheme that by design is demographically robust is the Non-financial Defined Contribution (NDC) public pension scheme, introduced in a number of European countries since the mid-1990s (Latvia, Italy, Poland, Norway, and Sweden). What’s more, the demographic stability features of such NDC systems are being emulated by other countries, where Germany is a prime example. This is not the end of the story, however. In fact, it is more where the story of this publication begins. What has happened is that life expectancy these days is an important parameter in calculating newly granted pensions, not only in public NDC schemes, but also increasingly in occupational and or employer-based financially defined contribution schemes. Indeed, more and more countries are converting from defined benefit to defined contribution schemes (e.g. Australia, Denmark, the Netherlands, Sweden, the United Kingdom and the United States).

What all systems for public and private pension, health care, and elderly care have in common is that accurate life expectancy and mortality projections are important for both planning and managing expenditures. This is why the topic of the endeavor presented in this publication is how to project future mortality accurately. Ideally, projected values should be very close to outcomes observed later. The problems arises when there is a systematic tendency to over- or underestimate the remaining number of years a group of persons of a certain age may be expected to be alive.

In practice, during recent decades, demographers, actuaries, economists, and other social scientists have done just this. They have systematically underestimated improvements in future life expectancy for people 60 and older. This means that current pension schemes are under-financed. Similarly, to calculate future costs for social and health care systems, accurate mortality forecasts are equally important.

The demographic models used in projecting mortality are usually based on statistical modelling of historical data. The question is, is it possible to bring the results of mortality modelling closer to the ideal, and if so, what do demographers need to do to achieve this result? This reasoning provided the motivation for forming the Stockholm Committee on Mortality Forecasting in 2000, and the question is still a high priority, which is an important message of this publication. Here, we attempt to identify what we have learned since this collaboration began, and discuss what remains to be done. Doing so, we go beyond the five themes addressed in our previous publications. We discuss whether information on socioeconomic status can be used to improve mortality forecasting – in particular the fact that persons with low socio-economic status (income, education, occupation) tend to be worse off in terms of life expectancy than those with higher status.

1.2 Determinants and Dynamics of Life Expectancy – Pensions Are Upping the Ante for the Challenge Facing the Art of Projecting Mortality

In 2003, the first chapter of the first volume of the Stockholm Committee on Mortality Forecasting was titled “Life Expectancy Is Taking Center Place in Modern National Pension Schemes – A New Challenge for the Art of Projecting Mortality” (see Chap. 2 in the current volume). Now, 15 years later, we are beginning to get a clear perspective of the challenge of life expectancy dynamics, and its repercussions for public policy in general and for pensions in particular. Since 2003, we have become much more aware of the importance of understanding both the determinants and dynamics of life expectancy. Below we will argue that accurate projections of life expectancy are more necessary than before. Pension scheme design is nowadays increasingly proactive rather than reactive. Life expectancy now has the leading role in the design of pension schemes – in setting the minimum age at which benefits can be claimed and how they are calculated.

As we moved into the twenty-first century, the “philosophy” for projecting life expectancy employed by many official statistical agencies, embraced a general belief that improvements in mortality could not continue into the twenty-first century at the same rate as they did in the preceding half century. This belief is exemplified in the approach adopted in the three country-practice contributions in the first volume of Perspectives on Mortality Forecasting – Finland (Chap. 3 by Alho), Norway (Chap. 4 by Brunborg), and Sweden (Chap. 5 by Lundström).

In projecting life expectancy in the 1990s, Statistics Finland adjusted future age-specific mortality rates so that the implied increase in life expectancy gradually slowed down until the line reached a certain target value. Norway employed a similar procedure, i.e. a trend extrapolation of past rate(s) of change in mortality with a gradual decrease in the rate of change towards an “end target”. In Sweden, the extrapolation included a downward adjustment of the historical rate of change, for the period 2000–2050 as time passed, first by 25 percent and then by 50 percent.

For many, the eye-opening event of the time was Oeppen and Vaupel’s article “Broken Limits to Life Expectancy”, published in Science. In this article, they concluded that there is no evidence that the upward linear trend in best-performance life expectancy is coming to an end:

Continuing belief in imminent limits (to improvements in mortality) is distorting public and private decision-making.[…] If life expectancy were close to a maximum, then the increase in the record expectation of life should be slowing. It is not. For 160 years, best-performance life expectancy has steadily increased by a quarter of a year per year, an extraordinary constancy of human achievement (Oeppen and Vaupel 2002).

In Chap. 13 of the present volume, Oeppen and Vaupel write: “If the trend of the past 160 years continues for the next half century, (best performance) life expectancy in 2050 will reach a record of 97.5.” At the time, the message of these two papers conflicted with the cautious note “Overly optimistic forecasts of life expectancy have already influenced important areas of public policy” (Olshansky et al. 2001).

Waldron (2005), commissioned by the USA Office of the Government Actuary, examined the life expectancy projections underlying the US’s official projections for Social Security, and even projection models employed in several European countries. She concluded that, regardless of the choice of procedure, including use of the “state of the art” Lee-Carter model, ex-post evaluations show that the models systematically underestimate expected lifespans, frequently owing to the widespread use of “expert opinion”. Keilman and Pham (2004) evaluated official mortality projections in 14 European countries, published after World War II, against actual outcomes. They showed slow increases in projected life expectancies. On average, the under-prediction of life expectancy amounted to 1.0–1.3 years of life for projections 10 years ahead, and 3.2–3.4 years of life 20 years ahead (see Chap. 9 by Keilman).

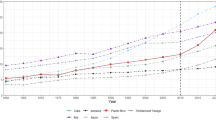

Mortality rates of the older population have declined faster and faster since at least the 1960s. At a joint World Bank – Swedish conference held in Stockholm in December 2009 on NDC pension schemes, a paper examined patterns of mortality decline in the Scandinavian countries – Denmark, Finland, Norway and Sweden, and four other countries – Japan, Portugal, the United Kingdom and the United States (Alho et al. 2013). At that time, Japan (# 3) and Sweden (# 10) were in the top 10 group of performers and Portugal (# 51) and the US (# 47) at the bounds of the top quartile, with the remaining countries in-between these four. The examination covered birth cohorts in these eight countries beginning earliest in 1908 and ending in 2007.

The clearest pictures are those for Japan and Sweden. In war-free Sweden, age groups 65–74 and 75–84 show an unmistakable acceleration in the rate of decline in mortality around 1945–1950, when death rates started to decline faster than before 1945. This new trend is still visible in 2014. The same process is observable for Japan, but it is much stronger and shorter in duration. It begins in the mid-1950s and continues up to 1990, but even as it decreases in strength, the rate of acceleration in these age groups is still on a par with all the other countries but the US. The latter country goes between phases of accelerating and decelerating increases in the rate of change in mortality. Most noteworthy is that in Japan, from around 1990, acceleration in the decline in mortality also came to the age group 85–99 and is still going on.

The success of procedures or lack of it, for projecting life expectancy is reflected directly in the fairness and financial sustainability of national pension schemes. To begin with, more and more life expectancy is entering directly into determination of individual benefits in national pension schemes. This means that non-biased cohort life expectancy projections over a succession of birth cohorts are essential for fulfilling the social criterion of fairness of individual outcomes within and between generations, and the fiscal criterion of maintaining financial balance. Both require that the procedure employed to project life expectancy does not lead to systematically biased estimates of life expectancy – i.e. systematic under or overestimation of the life expectancy of the pension insurance pool’s birth cohorts. The other side of the same coin is that systematic underestimation of life expectancy creates financial deficits that have to be financed by younger generations, which goes against the notion of intergenerational fairness.

The challenge is to design statistical models that capture the dynamics of the rate of decline in mortality. It has been demonstrated that, with data for 2400 individual birth cohorts for the period 1907–2014 for eight countries,Footnote 1 both classical period models and the Lee-Carter model systematically underestimate life expectancy, and that the scale of the errors is increasing (Palmer et al. 2018). As an alternative, a new model for projecting cohort life expectancy from the changing relationship between period and cohort mortalities has been used (Palmer et al. 2018). Applying the new model to the entire sample, the most important finding is that it delivers systematically unbiased projections for the individual cohort observations for the eight countries separately, and in the aggregate. Other promising alternative models are also being developed that are not systematically biased and that have improved accuracy (Bergeron-Boucher et al. 2017; Pascariu et al. 2018).

1.3 Cause of Death Forecasts

Is it useful to include causes of death (CoD) in mortality forecasting models? Willett (Chap. 20) lists some of the problems. First, interactions between different causes are difficult to model. Second, CoD reporting is unreliable at older ages where most deaths occur. Third, there is the danger of misclassification of deaths by cause (e.g., primary or secondary cause) particularly for the very oldest. Fourth, there are important major causes that change over time with medical advances. Finally, cause classification methods change over time and may distort observed trends (Tuljapurkar and Boe 1998; Booth 2006). Wilmoth (2005) showed that when trends are extrapolated linearly, cause-specific mortality forecasts result in lower future values for life expectancy than do all-cause forecasts, because the CoD that declines most slowly is the one that dominates in the end. Caselli, Vallin, and Marsili (Chap. 18) illustrate this point empirically for England and Wales. Alho (1991) found that using CoD did not improve the accuracy of his mortality forecasts for the US. A major review of mortality forecasting methods for the UK population concluded that such forecasts should not be carried out by cause of death (GAD 2001). However, cause-elimination projections may be useful as reference scenarios; see Rosén (Chap. 19) for an application to Swedish data.

Some causes of death are related to life style factors, such as smoking, obesity, exercise etc. Examples are lung cancer, cardiovascular diseases, and problems with the respiratory system. Chetty et al. (2016) analyzed the correlates in local variation in life expectancy in the United States. They showed that life expectancy was negatively correlated with rates of smoking and obesity and positively correlated with exercise rates among individuals in the bottom income quartile. Janssen, De Beer, and their colleagues have done innovative work and developed mortality projection models that explicitly account for smoking-related mortality (Janssen et al. 2013; Stoeldraijer et al. 2013; Janssen and de Beer 2016). They separated smoking-related mortality from non-smoking-related mortality, estimated age- and sex-specific mortality rates for both types of mortality, parameterized the age schedules, and extrapolated the parameters of these schedules. The model contains separate parameters for the delay of mortality and for the compression of the age at death distribution; hence the name CoDE-model. To include smoking-related mortality of men and women may potentially result in more accurate mortality projections, because the onset and the level of the smoking epidemics (and subsequent fall in prevalence) differ between the sexes. Smoking behavior explains a large part of the divergence in life expectancies between the sexes after World War II, and their convergence in recent decades.Footnote 2

1.4 Period and Cohort Perspectives

Virtually all life expectancies discussed in this volume are computed from period life tables. A period life expectancy may be interpreted as the expected life length of a newborn child if all age-specific period mortality rates would remain constant over time. It relates to the behavior of many different birth cohorts during just one calendar year. However, this is a hypothetical situation, and real people do not live in this way. They are members of only one birth cohort, and they live their lives during many years.

Survival in real birth cohorts is different from survival in the hypothetical situation of constant period mortality rates, for various reasons (Borgan and Keilman 2016). First, in times of falling mortality, the life expectancy of a certain birth cohort is comparable to that based on age-specific mortality rates for a particular year many decades later. This is what demographers call a “tempo effect”. Second, there are cohort effects. Mortality decreased regularly for subsequent cohorts, but some cohorts may display a typical pattern. An example is the case of Denmark, discussed earlier, where women born in the interwar period adopted unhealthy life styles.

Because of their high mortality, Danish female period life expectancy stagnated in the 1970s and 1980s (Lindahl-Jacobsen et al. 2016). Then, Danish female period life expectancy started to rise again as this cohort died out. Third, there is mortality selection. The frail members of a birth cohort tend to die earlier than members that are more robust. That leaves a selected population at the higher ages. When longevity improves, more of the frail cohort members will live longer. Thus for a country where the living conditions improved early (examples are Norway and Sweden) the elderly population in our days may contain more frail persons than it does in countries where the living conditions improved later (for example, in Italy). On the other hand, factors that enabled more members of a cohort to survive may have also led to improved health for the members of the cohort that were not at high risk of death.

Because of these complications, cohort life expectancy may increase faster than what period life tables suggest. For instance, “best practice” cohort life expectancies for women born between 1870 and 1920 increased by 0.43 years of age per calendar year (Shkolnikov et al. 2011) – almost twice as fast as the improvement in best practice period life expectancy for women since 1840 (0.24 years of age per calendar year). Here, best practice life expectancy may refer to the maximum life expectancy observed among national populations in a given year or for a given birth cohort (see also Oeppen and Vaupel in Chap. 13). Wilmoth (2005) shows empirical evidence for Sweden for the period 1751–2002 and birth cohorts 1751–1911. Goldstein and Wachter (2006) use official estimates and projections of female life expectancy from Sweden and the United States. In addition, they derive analytical expressions for gaps and lags between the two types of life expectancies. The life expectancy lag is the number of years it takes for a period life expectancy to reach the current level of the cohort life expectancy. The gap is the difference between the life expectancy for a cohort born in a particular year, and the period life expectancy for that year. Goldstein and Wachter (2006) find that period life expectancies are approximately equal to cohort life expectancies for cohorts born about 40–50 years earlier. They note also that the lag lengthens as mortality improves. The life expectancy gap has risen and then fallen over time. Canudas-Romo and Schoen (2005) analyze the Siler model of age-specific mortality combined with constant rates of mortality decline, and find qualitatively similar effects for the lag. Gaps were about one-ninth to one-tenth of the lags. Missov and Lenart (2011) assume a Gompertz model for age-specific mortality and the same yearly improvement in mortality at all ages. Under these conditions, the temporal change in period life expectancy is approximately proportional to but less than the change in cohort life expectancy. If period life expectancy improves by 2 years of age per decade, cohort life expectancy would improve by 2.5 years per decade, or by 25 per cent more. Wilmoth (2005) assumes that distributions of deaths by age change over time in accordance with a linear shift model. Under this model, he also finds that cohort life expectancies increase faster than period life expectancies. Like Missov and Lennart, he establishes a simple linear relationship between period and cohort life expectancies.

Another consequence of the distorted view that period life tables give in times of changing mortality is the compression around the mean or the modal age of the age-at-death distribution. Ouellette and Bourbeau (2011) show an on-going process of mortality compression in Canada, France, Japan, and the United States. Keilman et al. (2018) find the same for Norway. Deaths tend to be progressively concentrated near the mean or the modal age at death. The findings for these five countries are based on period data. Observed and projected cohort patterns for the age at death distribution (AADD) for Norway suggest that compression in cohorts born 1900–1950, measured as a decrease in the standard deviation of the AADD beyond 30 years, is twice as fast compared to compression in period AADDs during the years 1900–2060. Canudas-Romo (2008) studies the period standard deviation from the modal age at death, assuming the Siler mortality change model as in Canudas-Romo and Schoen (2005) and a Gompertz mortality change model. The period standard deviation is constant under the Gompertz model, but falls regularly under the Siler model. Ediev (2013) discusses the theoretical link between period and cohort compression measures. He concludes that compression in periods may very well go together with decompression in cohorts. Tuljapurkar and Edwards (2011) show that the variance in the age at death is inversely related to the Gompertz slope of log mortality.

Given the problems inherent to a period approach, it will not come as a surprise that methods that project cohort life expectancies perform rather well. Zhao de Gosson de Varennes et al. (2016) demonstrate that compared to the classical Lee-Carter method for extrapolating age-specific mortality rates period-wise, projecting cohort life expectancy based on its rate of change in mortality works well in eight countries with long data series. See also Sect. 1.2 on determinants and dynamics of life expectancy in this chapter.

1.5 Joint Forecasting of Mortality in Similar Populations

Since the early days of cohort-component forecasting, official forecasters have been keen to assure forecast users of the external validity of their results. For example, the forecast of a given country should not markedly deviate from the developments in countries with similar culture, economics, or social life. Secondly, male and female mortalities should not diverge in an unreasonable manner.

During the past two decades, extrapolation methods have regained prominence in mortality forecasting, primarily because assessments of earlier judgmental forecasts have been shown to grossly underestimate future life expectancy. However, separate extrapolations of the mortality of genders, or of countries, will eventually lead to divergence. Happily, the time series tools used in extrapolation offer multiple ways of constraining forecasts to behave in a coherent manner. A rather large literature has evolved that links varying forms of substantive reasoning regarding trends in smoking, obesity etc. (Staetsky 2009; King and Soneji 2011) to extrapolation. Notable statistical contributions include Li (2013), Kleinow (2015), and Raftery et al. (2014).

However, the empirical evidence regarding the convergence of male and female mortality, or across countries, is equivocal. Thorslund et al. (2013) provide evidence of convergence between male and female life expectancy at 65, since the 1990s, in, for instance, several Northern European countries. However, an analysis of 23 European countries in Alho (2016) shows that both the creation of the male-female difference occurred differently in different countries and considerable differences in trends continue to exist to this date. Notably, European countries that have suffered large war casualties, and the former socialist States, have histories that differ from those observed in northern Europe, and show little evidence of convergence.

1.6 From Scenarios to Stochastic Modelling

The scenario-based approach as a way to express forecast uncertainty has been criticized from a statistical point of view (Alho and Spencer 1985; Lee 1998). Obviously, uncertainty is not quantified as no probability is attached to the high-low interval. A second drawback is that one assumes perfect correlation over time: when mortality is low one year, it is also low in all other years. In reality, mortality shows random fluctuations. Third, the scenario-based approach is inconsistent when variant assumptions for mortality are combined with variant assumptions for fertility (or migration). With three variants for each of the two components, nine different combinations for population results can be made. However, a variant pair that is extreme for one variable is not necessarily extreme for another variable.

Since the future is inherently uncertain, one should compute a forecast by stochastic methods. However, official forecasters of mortality have been slow to adopt such methods. A notable exception is the implementation of a stochastic approach by the U.N. (Raftery et al. 2012). This work builds on ideas similar to those of Girosi and King (2008). In both works, data from similar countries is used in joint forecasting, a feature that is particularly important for countries with poor data.

Raftery et al. (2012) adopted a Bayesian approach to population forecasting. This view is particularly useful when one combines expert opinions with empirical data. The application of the Bayesian approach in demography, “Bayesian demography”, started to gain popularity about 10 years ago.Footnote 3 The Bayesian approach to demographic forecasting is a welcome development in addition to frequentist methods that have been used more widely. For instance, see Alho and Spencer (2005, p. 235) for stochastic modelling of future mortality for 18 European countries in the framework of the Uncertain Population of Europe (UPE) Project.

In contrast to population forecasting by statistical agencies, in actuarial science stochastic modelling has become, during the past decade, the standard. The difficulty in using safety margins and other scenarios in the pricing of annuities and other mortality related insurance products has proven to be difficult, to the point that liquid markets for such products are few. Notable examples of stochastic modelling are the formulations by Hahn and Christiansen (2016) and van Berkum et al. (2017), who both develop full probability models for age-specific mortality of one or more populations, and compute the posterior distributions of the relevant risk measures using Markov Chain Monte Carlo techniques.

Macroeconomics is another field where the inadequacy of the scenario-based assessment of forecast uncertainty is becoming evident. Generational accounting and the sustainability of pension systems can now be analyzed in stochastic demographic settings (Alho et al. 2008). Recent analyses (Lassila et al. 2014) allow for adaptive responses to stochastic shocks. Extensions of stochastic demographic modelling to migration (Bijak 2011) and household composition (Keilman 2017) are now available.

1.7 How Conditions in Early Life Affect Mortality in Later Life

The idea that childhood conditions are important for health in later life, which can be traced far back in time, came into focus in the 1920–1930s, when demographers and epidemiologists became aware of a long-term decline in mortality (Derrick 1927; Kermack et al. 1934; Bengtsson and Mineau 2009). They found that as each birth cohort got healthier, and infant mortality declined, health improved in the remaining part of their lives as well. The focus was on infant mortality, regardless of the determinants of infant mortality, as a predictor of mortality throughout the life course. The role of fetal development, which also can be traced far back in time, came into focus much later, in the 1970s (Forsdahl 1977; Barker and Osmond 1986). It has since then dominated the research, in both medical and social sciences.

Adverse conditions in early life influence cardiovascular diseases, respiratory and allergic diseases, diabetes, hypertension and obesity, breast and testicular cancers, neuropsychiatric and some other disorders later in life (Kuh and Ben-Shlomo 2004). Three specific diseases, respiratory tuberculosis, hemorrhagic stroke, and bronchitis, which have accounted for two thirds of the total decline in mortality in ages 15–64 years from the mid-nineteenth century to the first decade of the twentieth century, reflect demonstrable responses from conditions in infancy and childhood (see Chap. 21 by Lindström and Davey Smith). The question is then, if children early in life, during fetal stage or in first years of life are “programmed” for a certain health status, can this information be used to improve mortality forecasting?

Birth weight has become a common indicator of fetal development, both in medical and economic research. Low birth weight is associated with high blood pressure later in life. Despite the effects not being large (Huxley et al. 2002),Footnote 4 this measure is still correlated with increased risks of heart disease (Barker 1994) and diabetes (Hales et al. 1991). Many diseases have since then been added to the list of outcomes associated with low birth weight, including schizophrenia (Brown and Derkits 2010). Recently, high birth weight, somewhat counterintuitively, has been associated with increased incidences of breast and prostate cancer (Risnes et al. 2011). Thus, the relationship between birth weight and diseases later in life appears to be U-shaped.

Low birth weight has also been shown to be linked to educational and labor market outcomes (Currie and Moretti 2007; Johnson and Schoeni 2011; Royer 2009). Children with low birth weight perform worse in school, and earn less, than children with normal birth weight do (Currie and Hyson 1999; Case et al. 2005). However, some studies have only found small effects of birth weight. A study of Norway using register data, for example, found that a 10% lower birth weight, a sizable difference from the norm is associated with only 1.2% lower IQ for males, 0.3% shorter height, and 0.9% less earnings (Black et al. 2007).

Birth weight does not change much in the long term, only during extreme situations, such as during wars and famines, if at all (Abolins 1962). For example, since 1860 in Norway, adult height, weight and lifespan have increased substantially, and still the average birth weight has only varied within a range of 200 g (Rosenberg 1988). Since the overall effects on both health and earnings are small, the birth-weight measure is unlikely to be an important indicator predicting mortality trends.

Instead, recent research has shown that infections due to certain bacteria, viruses, and parasites during pregnancy lead to health problems later in life (Adams Waldorf and McAdams 2013). Children exposed to the 1918 pandemic during the fetal stage, for example, show elevated risks for cancers and coronary heart disease at older ages (Mazumder et al. 2010; Myrskylä et al. 2013). Furthermore, children are vulnerable to maternal and environmental factors not only during the fetal stage but also in the first years of life. In fact, the development of cells and organs are gradually slowing down and completed only when the individual is about 20 years of age. Taking the lungs as an example, they not only keep growing in size after birth, but new alveolar sacs develop for several years, with this structures being also very sensitive to infections (Broman 1923).

Streptococcal infections in early childhood are associated with rheumatic heart disease in later life (Cunningham 2012), whereas respiratory infections have been suggested to impair lung function (Bengtsson and Lindström 2003).Footnote 5 Recent research, studying effects of exposure to specific diseases, like whooping cough, in first years of life on mortality over the full life course shows that scarring overpowers selection at ages around 25 years, where after the net negative health effects increase with age (Quaranta 2014). Moreover, infections in early life are associated with cancer and diabetes at older ages (Finch and Crimmins 2004). They may also cause inflammation in atherosclerosis, which is a risk factor for a variety of diseases including cardiovascular diseases, diabetes and some forms of cancer later in life (Libby et al. 2002; Finch 2010).

Getting back to the question of whether information on conditions early in life can be used to improve mortality forecasting, we conclude that information on birth weights cannot be relied upon to predict life spans. Instead, infections in the first year of life, manifested in infant mortality, seems far more promising, as emphasized by the development of research in the last decade. However, since infant mortality has declined to very low levels during the twentieth century, this predictor is likely to lose importance over time, at least for developed countries. The same is likely the case for information on season of birth, which is another predictor of life expectancy.Footnote 6 Instead, early life factors at the family level, which in the past were not associated with mortality, are likely to become more and more important (Bengtsson and Van Poppel 2011). Whether they can be used for mortality forecasting, is, however doubtful, since the effect is not strong enough to have any practical importance for the projections themselves. Alternatively, it seems more promising to use information on life-style factors such as obesity or smoking, which have become increasingly relevant predictors for health and mortality (Janssen et al. 2013; Neovius et al. 2010).

1.8 The Increasing Gap in Life Expectancy with Respect to Position in the Income Distribution

In this section, we discuss some issues that were not addressed in any of the five booklets. Recently, socioeconomic differences in length of life have received a lot of attention, in particular the fact that persons with low socio-economic status (income, education, occupation) tend to be worse off in terms of adult mortality than those with higher status. The gradient is stronger among men than among women, and has grown stronger in the recent past (Elo 2009; Mackenbach et al. 1997; Marmot et al. 1991; Torssander and Erikson 2010; Cutler et al. 2012; de Gelder et al. 2017; Chetty et al. 2016). While some argue that the socioeconomic differences in adult mortality have always existed, others are skeptical. Most of this research is based on cross-sectional data for cities. Studies based on longitudinal data for Sweden, the Netherlands, and Canada find barely any social differences in adult mortality in the past (Bengtsson and Dribe 2011; Bengtsson and Van Poppel 2011).

What characterizes individuals in the lower income deciles is that their relative income status remains largely unchanged throughout their working lives and follows them into retirement. Consequently, and not surprisingly, the result is a low pension in retirement, since all pensions are related one way or another to individual working life incomes. In addition, many studies for Western European and Anglo-Saxon countries show population differences in life expectancy with respect to other socioeconomic characteristics than income, such as education and occupation (National Academies of Sciences 2015; Chetty et al. 2016). This research has also shown that income gaps we see at retirement, originate already at younger ages, sometimes even earlier than age 40. What’s more, it is likely that differences in life expectancy by income group are partially at least indirectly related to level of education and choice of occupation, as the empirical evidence reveals that persons with low education and low-skilled occupations have lower life expectancy than highly educated persons with occupations requiring high intellectual skills.

What these studies make clear is that the gap in life expectancy by income has several important characteristics. The first is that seen over a longer period of time, life expectancy in some populations is largely stagnant in the low deciles. Persons with higher income and those who live in more economically dynamic local cultures are experiencing growth in life expectancy. Geography, i.e., the social environment of peoples’ home communities, also turns out to be important. For example, in New York City, Chetty et al. (2016) find that the life expectancy of low-income individuals is 5 years more than in Detroit, which is attributed to differences in “social” infrastructure. They also find that the strongest determinant of life expectancy differentials across income deciles is the prevalence of unhealthy life-style factors (smoking, drinking, exercise, dietary, etc.) among persons in the lowest deciles.Footnote 7 One has to bear in mind, however, that causality runs both ways: not only from low income (through bad health) to low life expectancy, but also the other way around.

What are the ramifications in the present context? The average total working-life income of women is generally less than that of men, which means that women are likely to be overrepresented as low-income individuals in all income deciles. The reasons are well-known: this is in part due to an uneven division of child care and care of elderly relatives, in part due to lower earnings for equal work and lower wages in female dominated occupations (such as the care sector and sales personnel), partly due to individual decisions to work part time even as children become older. It comes as no surprise then that the gender difference in the scale of pensions at retirement is generally a reflection of women’s working careers.

Despite their lower income, however, the life expectancy of women exceeds that of men. This gender gap in life expectancy leaves its imprint on the redistribution of income within a pension insurance pool. As a group, since women live several years longer than men, money is ultimately transferred from men to women. This has generally been viewed as an acceptable transfer of resources, partially compensating within the insurance pool for women’s lower share of the income of male-female partners prior to retirement.

The general picture emerging from the empirical literature is nevertheless that the poor are increasingly transferring income to the rich in the universal unisex old-age insurance pool, if we focus singularly on how annuities are created. And, as a consequence, the literature is beginning to produce proposals of how to even out the distributional outcomes within the insurance pool, in the context of a public pension scheme.

There are two proposals – in addition to maintaining the status quo in insurance pool distribution. One is a technical tax-transfer solution that can be designed to redistribute money within the annuity pension pool (Holzmann et al. in preparation). Alternatively, information on the socio-economic determinants of life expectancy can be used to create separate insurance pools. For instance, a simple procedure is to stratify new retirees into separate, say, birth-cohort decile-based insurance pools by income, as measured by Defined Contributions (DC) account balances at the commencement of retirement.

However, stratifying by income is already what is happening as the default in the overall DC format in countries that have NDC and/or FDC public pension schemes. In addition, status quo is that persons with the lowest working-life income in all countries already receive some form of guarantee or social pension, often means-tested – financed by general tax revenues. This may nevertheless be a first-best solution, provided the amount transferred through the guarantee contributes sufficient income for the least well-off 20–30 percent of the pensioners’ population.

What’s more, in a broader perspective, the amount of money on pension account balances is by far not the only component of overall personal resources, which include capital income (also with a high-income profile) and other sources that one would normally take into account in granting a means-tested income transfer for retired persons. Therefore, in practice the status quo approach might not be so bad after all. In addition to this, the economists will remind us to bring into the discussion individuals’ supply of labor, and its determinants, which explains individual lifetime earnings – and ultimately the magnitude of pensions granted – through individual preferences for work and leisure.

Let us return now to the discussion from a previous section – that of the development of mortality and forecasting life expectancy. The point of departure was the ongoing increase in life expectancy of the older population and developing projection models that produce unbiased cohort-based forecasts over time. Of course, the emerging empirical evidence regarding socio-economic heterogeneity in life expectancy has implications for projections, even only if implicitly.

To begin with, we are gaining a better understanding of the underlying mechanisms. The knowledge emanating from the empirical research (Chetty et al. 2016), together with the many “bits and pieces” from other studies, suggests that there remains considerable potential for further dramatic improvements in life expectancy. This would occur through improved community social-infrastructure and public health policy directed towards creating awareness of individuals’ “self-destructive” life styles. If this is the direction in which we are moving, the result will be that a larger share of birth cohorts will reach the pension age and beyond, a share that will enjoy healthier years in old age. This would create then even more decades of considerable improvements in life expectancy, adding to the effect of continued advancements in medical technology.

Notes

- 1.

Denmark, France, Italy, the Netherlands, Norway, Sweden, the United Kingdom and the United States.

- 2.

- 3.

- 4.

See also Chap. 22 by Christiansen.

- 5.

See also Chap. 24 by Bengtsson and Alter.

- 6.

See Chap. 23 by Doblhammer.

- 7.

On the other hand, they found that access to health care services was not a significant factor, indicating that provision is generally sufficient on a regional level in the United States. They also report that, as a group, first generation immigrants have a longer life expectancy than persons born in the United States.

References

Abolins, J. (1962). Weight and length of the newborn during the Years 1918–1922 and 1938–1942. Acta Paediatrica, 51(S135), 8–13.

Adams Waldorf, K., & McAdams, R. (2013). Influence of infection during pregnancy on fetal development. Reproduction, 146(5), R151–R162.

Alho, J. M. (1991). Effect of aggregation on the estimation of trend in mortality. Mathematical Population Studies, 3(1), 53–67.

Alho, J. (2016). Descriptive findings on the convergence of female and male mortality in Europe (Technical report, ETLA Working Papers 40).

Alho, J. M., & Spencer, B. D. (1985). Uncertain population forecasting. Journal of the American Statistical Association, 80(390), 306–314.

Alho, J., & Spencer, B. (2005). Statistical demography and forecasting (Springer Series in Statistics). New York: Springer.

Alho, J. M., Jensen, S. E. H., & Lassila, J. (2008). Uncertain demographics and fiscal sustainability. Cambridge: Cambridge University Press.

Alho, J., Bravo, J., & Palmer, E. (2013). Annuities and life expectancy in NDC. In R. Holzmann, E. Palmer, & D. Robalinio (Eds.), Nonfinancial defined contribution pension schemes in a changing pension world (Vol. 2, pp. 395–436). Washington, DC: World Bank.

Barker, D. J. P. (1994). Mothers, babies and disease in later life. London: BMJ Publishing Group.

Barker, D. J. P., & Osmond, C. (1986). Infant mortality, childhood nutrition, and ischaemic heart disease in England and Wales. The Lancet, 327(8489), 1077–1081.

Bengtsson, T., & Dribe, M. (2011). The late emergence of socioeconomic mortality differentials: A micro-level study of adult mortality in southern Sweden 1815-1968. Explorations in Economic History, 48, 389–400.

Bengtsson, T., & Lindström, M. (2003). Airborne infectious diseases during infancy and mortality in later life in southern Sweden, 1766–1894. International Journal of Epidemiology, 32(2), 286–294.

Bengtsson, T., & Mineau, G. P. (2009). Early-life effects on socio-economic performance and mortality in later life: A full life-course approach using contemporary and historical sources. Social Science & Medicine, 68(9), 1561–1564.

Bengtsson, T., & Scott, K. (2010). The ageing population. In Population ageing – a threat to the welfare state? The case of Sweden (pp. 7–22). Heidelberg: Springer.

Bengtsson, T., & Van Poppel, F. (2011). Socioeconomic inequalities in death from past to present: An introduction. Explorations in Economic History, 48(3), 343–356.

Bergeron-Boucher, M. P., Canudas-Romo, V., Oeppen, J., & Vaupel, J. W. (2017). Coherent forecasts of mortality with compositional data analysis. Demographic Research, 37, 527–566.

Bijak, J. (2011). Forecasting international migration in Europe: A Bayesian view (Vol. 24). Dordrecht: Springer Science & Business Media.

Bijak, J., & Bryant, J. (2016). Bayesian demography 250 years after Bayes. Population Studies, 70(1), 1–19.

Black, S. E., Devereux, P. J., & Salvanes, K. G. (2007). From the cradle to the labor market? The effect of birth weight on adult outcomes. The Quarterly Journal of Economics, 122(1), 409–439.

Booth, H. (2006). Demographic forecasting: 1980 to 2005 in review. International Journal of Forecasting, 22(3), 547–581.

Borgan, O., & Keilman, N. (2016). Do Japanese and Italian women live longer than women in Scandinavia? European Journal of Population, 1–13.

Broman, I. (1923). Zur Kenntnis der Lungenentwicklung. Anatomischer Anzeiger, 57, 83.

Brown, A. S., & Derkits, E. J. (2010). Prenatal infection and schizophrenia: A review of epidemiologic and translational studies. American Journal of Psychiatry, 167(3), 261–280.

Canudas-Romo, V. (2008). The modal age at death and the shifting mortality hypothesis. Demographic Research, 19, 1179–1204.

Canudas-Romo, V., & Schoen, R. (2005). Age-specific contributions to changes in the period and cohort life expectancy. Demographic Research, 13(3), 63–82.

Case, A., Fertig, A., & Paxson, C. (2005). The lasting impact of childhood health and circumstance. Journal of Health Economics, 24(2), 365–389.

Chetty, R., Stepner, M., Abraham, S., Lin, S., Scuderi, B., Turner, N., Bergeron, A., & Cutler, D. (2016). The association between income and life expectancy in the United States, 2001–2014. Journal of the American Medical Association, 315(16), 1750–1766.

Coale, A. J. (1957). How the age distribution of a human population is determined. In Cold spring harbor symposia on quantitative biology (Vol. 22, pp. 83–89). New York: Cold Spring Harbor Laboratory Press.

Cunningham, M. W. (2012). Streptococcus and rheumatic fever. Current Opinion in Rheumatology, 24(4), 408.

Currie, J., & Hyson, R. (1999). Is the impact of health shocks cushioned by socioeconomic status? The case of low birthweight. American Economic Review, 89(2), 245–250.

Currie, J., & Moretti, E. (2007). Biology as destiny? Short-and long-run determinants of intergenerational transmission of birth weight. Journal of Labor Economics, 25(2), 231–264.

Cutler, D. M., Lleras-Muney, A., & Vogl, T. (2012). Socioeconomic Status and health: Dimensions and mechanisms. In M. Gleid & P. Smith (Eds.), The Oxford handbook of health economics (pp. 124–163). Oxford: Oxford University Press.

de Gelder, R., Menvielle, G., Costa, G., Kovács, K., Martikainen, P., Strand, B. H., & Mackenbach, J. P. (2017). Long-term trends of inequalities in mortality in 6 European countries. International Journal of Public Health, 62(1), 127–141.

Derrick, V. (1927). Observations on (1) errors of age in the population statistics of England and Wales, and (2) the changes in mortality indicated by the national records. Journal of the Institute of Actuaries, 58(2), 117–159.

Ediev, D. M. (2013). Mortality compression in period life tables hides decompression in birth cohorts in low-mortality countries. Genus, 69(2), 53–84.

Elo, I. T. (2009). Social class differentials in health and mortality: Patterns and explanations in comparative perspective. Annual Review of Sociology, 35, 553–572.

Finch, C. E. (2010). Evolution of the human lifespan and diseases of aging: Roles of infection, inflammation, and nutrition. Proceedings of the National Academy of Sciences, 107(suppl 1), 1718–1724.

Finch, C. E., & Crimmins, E. M. (2004). Inflammatory exposure and historical changes in human life spans. Science, 305(5691), 1736–1739.

Forsdahl, A. (1977). Are poor living conditions in childhood and adolescence an important risk factor for arteriosclerotic heart disease? Journal of Epidemiology & Community Health, 31(2), 91–95.

GAD. (2001). National population projections: Review of the methodology for projecting mortality (Technical report). London: Government Actuary’s Department.

Girosi, F., & King, G. (2008). Demographic forecasting. Princeton: Princeton University Press.

Goldstein, J. R., & Wachter, K. W. (2006). Relationships between period and cohort life expectancy: Gaps and lags. Population Studies, 60(3), 257–269.

Hahn, L. J., & Christiansen, M. C. (2016). Mortality projections for non-converging groups of populations. SSRN Papers.

Hales, C. N., Barker, D. J. P., Clark, P. M., Cox, L. J., Fall, C., Osmond, C., & Winter, P. (1991). Fetal and infant growth and impaired glucose tolerance at age 64. BMJ, 303(6809), 1019–1022.

Holzmann, R., Palmer, E., Palacios, R., & Sacchi, S. (in preparation). Non-financial defined contribution pension schemes: Facing the challenges of marginalization and polarization in the economy and society.

Huxley, R., Neil, A., & Collins, R. (2002). Unravelling the fetal origins hypothesis: Is there really an inverse association between birthweight and subsequent blood pressure? The Lancet, 360(9334), 659–665.

Janssen, F., & de Beer, J. (2016). Projecting future mortality in the Netherlands taking into account mortality delay and smoking. Joint Eurostat/UNECE Work Session on Demographic Projections, Working Paper #18.

Janssen, F., & van Poppel, F. (2015). The adoption of smoking and its effect on the mortality gender gap in Netherlands: A historical perspective. BioMed Research International, 2015. Article ID 370274.

Janssen, F., van Wissen, L. J., & Kunst, A. E. (2013). Including the smoking epidemic in internationally coherent mortality projections. Demography, 50(4), 1341–1362.

Johnson, R. C., & Schoeni, R. F. (2011). The influence of early-life events on human capital, health status, and labor market outcomes over the life course. The BE Journal of Economic Analysis & Policy, 11(3).

Keilman, N. (2017). A combined Brass-random walk approach to probabilistic household forecasting: Denmark, Finland, and the Netherlands, 2011–2041. Journal of Population Research, 34(1), 17–43.

Keilman, N., & Pham, D. (2004). Empirical errors and predicted errors in fertility, mortality and migration forecasts in the European Economic Area (Discussion Paper No. 386). Oslo: Statistics Norway.

Keilman, N., Syse, A., & Pham, D. (2018). Mortality shifts and mortality compression: The case of Norway, 1900–2060. Submitted.

Kermack, W. O., McKendrick, A. G., & McKinlay, P. L. (1934). Death rates in Great Britain and Sweden some general regularities and their significance. The Lancet, 223(5770), 698–703.

King, G., & Soneji, S. (2011). The future of death in America. Demographic Research, 25, 1.

Kleinow, T. (2015). A common age effect model for the mortality of multiple populations. Insurance: Mathematics and Economics, 63, 147–152.

Kuh, D., & Ben-Shlomo, Y. (2004). A life course approach to chronic disease epidemiology (Number 2). Oxford: Oxford University Press.

Lassila, J., Valkonen, T., & Alho, J. M. (2014). Demographic forecasts and fiscal policy rules. International Journal of Forecasting, 30(4), 1098–1109.

Lee, R. D. (1994). The formal demography of population aging, transfers, and the economic life cycle. In L. Martin & S. Preston (Eds.), Demography of aging (pp. 8–49). Washington, DC: National Academy Press.

Lee, R. D. (1998). Probabilistic approaches to population forecasting. Population and Development Review, 24, 156–190.

Lee, R. D., & Mason, A. (Eds.). (2011). Population aging and the generational economy: A global perspective. Cheltingham: Edward Elgar Publishing.

Lee, R. D., & Zhou, Y. (2017). Does fertility or mortality drive contemporary population aging? The revisionist view revisited. Population and Development Review, 43(2), 285–301.

Li, J. (2013). A Poisson common factor model for projecting mortality and life expectancy jointly for females and males. Population Studies, 67(1), 111–126.

Libby, P., Ridker, P. M., & Maseri, A. (2002). Inflammation and atherosclerosis. Circulation, 105(9), 1135–1143.

Lindahl-Jacobsen, R., Rau, R., Jeune, B., Canudas-Romo, V., Lenart, A., Christensen, K., & Vaupel, J. W. (2016). Rise, stagnation, and rise of Danish women’s life expectancy. Proceedings of the National Academy of Sciences, 113(15), 4015–4020.

Mackenbach, J. P., Kunst, A. E., Cavelaars, A. E., Groenhof, F., Geurts, J. J., Health, E. W. G., & o. S.I. i., and others. (1997). Socioeconomic inequalities in morbidity and mortality in Western Europe. The Lancet, 349(9066), 1655–1659.

Marmot, M. G., Stansfeld, S., Patel, C., North, F., Head, J., White, I., Brunner, E., Feeney, A., & Smith, G. D. (1991). Health inequalities among British civil servants: The Whitehall II study. The Lancet, 337(8754), 1387–1393.

Mazumder, B., Almond, D., Park, K., Crimmins, E. M., & Finch, C. E. (2010). Lingering prenatal effects of the 1918 influenza pandemic on cardiovascular disease. Journal of Developmental Origins of Health and Disease, 1(1), 26–34.

Missov, T. I., & Lenart, A. (2011). Linking period and cohort life-expectancy linear increases in Gompertz proportional hazards models. Demographic Research, 24, 455–468.

Murphy, M. (2017). Demographic determinants of population aging in Europe since 1850. Population and Development Review, 43(2), 257–283.

Myrskylä, M., Mehta, N. K., & Chang, V. W. (2013). Early life exposure to the 1918 influenza pandemic and old age mortality by cause of death. American Journal of Public Health, 103(7), e83–e90.

National Academies of Sciences, Engineering, a. M. (2015). The growing gap in life expectancy by income: Implications for federal programs and policy responses. Washington, DC: The National Academies Press.

Neovius, K., Rasmussen, F., Sundström, J., & Neovius, M. (2010). Forecast of future premature mortality as a result of trends in obesity and smoking: Nationwide cohort simulation study. European Journal of Epidemiology, 25(10), 703–709.

Oeppen, J., & Vaupel, J. W. (2002). Broken limits to life expectancy. Science, 296(5570), 1029–1031.

Olshansky, S. J., Carnes, B. A., & Désesquelles, A. (2001). Prospects for human longevity. Science, 291(5508), 1491–1492.

Ouellette, N., & Bourbeau, R. (2011). Changes in the age-at-death distribution in four low mortality countries: A nonparametric approach. Demographic Research, 25, 595–628.

Palmer, E., Alho, J. M., & Zhao de Gosson de Varennes, Y. (2018). Projecting cohort life expectancy from the changing relationship between period and cohort mortalities. Submitted.

Pascariu, M. D., Canudas-Romo, V., & Vaupel, J. W. (2018). The double-gap life expectancy forecasting model. Insurance: Mathematics and Economics, 78, 339–350.

Qi, H. (2016). Live longer, work longer? Evidence from Sweden’s ageing population. In Lund studies in economic history (Vol. 75). Lund: Lund University.

Quaranta, L. (2014). Early life effects across the life course: The impact of individually defined exogenous measures of disease exposure on mortality by sex in 19th- and 20th-century Southern Sweden. Social Science and Medicine, 119(Online May 15, 2014), 266–273.

Raftery, A. E., Li, N., Ševčíková, H., Gerland, P., & Heilig, G. K. (2012). Bayesian probabilistic population projections for all countries. Proceedings of the National Academy of Sciences, 109(35), 13915–13921.

Raftery, A. E., Lalic, N., & Gerland, P. (2014). Joint probabilistic projection of female and male life expectancy. Demographic Research, 30, 795.

Risnes, K. R., Vatten, L. J., Baker, J. L., Jameson, K., Sovio, U., Kajantie, E., Osler, M., Morley, R., Jokela, M., & Painter, R. C. (2011). Birthweight and mortality in adulthood: A systematic review and meta-analysis. International Journal of Epidemiology, 40(3), 647–661.

Rosenberg, M. (1988). Birth weights in three Norwegian cities, 1860–1984. Secular trends and influencing factors. Annals of Human Biology, 15(4), 275–288.

Royer, H. (2009). Separated at birth: US twin estimates of the effects of birth weight. American Economic Journal: Applied Economics, 1(1), 49–85.

Shkolnikov, V. M., Jdanov, D. A., Andreev, E. M., & Vaupel, J. W. (2011). Steep increase in Best-practice Cohort life expectancy. Population and Development Review, 37(3), 419–434.

Staetsky, L. (2009). Diverging trends in female old-age mortality: A reappraisal. Demographic Research, 21, 885.

Stoeldraijer, L., van Duin, C., van Wissen, L., & Janssen, F. (2013). Impact of different mortality forecasting methods and explicit assumptions on projected future life expectancy: The case of the Netherlands. Demographic Research, 29, 323.

Thorslund, M., Wastesson, J. W., Agahi, N., Lagergren, M. a., & Parker, M. G. (2013). The rise and fall of women’s advantage: A comparison of national trends in life expectancy at age 65 years. European Journal of Ageing, 10(4), 271–277.

Torssander, J., & Erikson, R. (2010). Stratification and mortality–A comparison of education, class, status, and income. European Sociological Review, 26(4), 465–474.

Tuljapurkar, S., & Boe, C. (1998). Mortality change and forecasting: How much and how little do we know? North American Actuarial Journal, 2(4), 13–47.

Tuljapurkar, S., & Edwards, R. D. (2011). Variance in death and its implications for modeling and forecasting mortality. Demographic Research, 24, 497.

UN. (2015). World population ageing, 1950–2050. New York: United Nations Publications.

van Berkum, F., Antonio, K., & Vellekoop, M. (2017). A Bayesian joint model for population and portfolio-specific mortality. ASTIN Bulletin: The Journal of the IAA, 47(3), 681–713.

Waldron, H. (2005). Literature review of long-term mortality projections. Social Security Bulletin, 66(1), 16.

Wilmoth, J. R. (2005). On the relationship between period and cohort mortality. Demographic Research, 13, 231–280.

Zhao de Gosson de Varennes, Y., Palmer, E., & Alho, J. M. (2016). Projecting cohort life expectancy based on its rate of change in mortality. In Benefit design, retirement decisions and welfare within and across generations in defined contribution pension schemes (Economic studies, Vol. 157). Uppsala: Uppsala University.

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2019 The Author(s)

About this chapter

Cite this chapter

Bengtsson, T., Keilman, N., Alho, J.M., Christensen, K., Palmer, E., Vaupel, J.W. (2019). Introduction. In: Bengtsson, T., Keilman, N. (eds) Old and New Perspectives on Mortality Forecasting . Demographic Research Monographs. Springer, Cham. https://doi.org/10.1007/978-3-030-05075-7_1

Download citation

DOI: https://doi.org/10.1007/978-3-030-05075-7_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-05074-0

Online ISBN: 978-3-030-05075-7

eBook Packages: Social SciencesSocial Sciences (R0)