Abstract

Recent studies have explored the role of firm dynamics and the connection to job reallocation. However, limited attention has been devoted to the role of micro and small firms in this process, particularly about the quality of the jobs generated. Therefore, this article aims to measure the impact of micro and small firm dynamics on occupation diversification in Brazil, with specific emphasis on job quality. The study used data from 558 microregions within the Brazilian industrial sector between 2003 and 2015. Panel data were applied to three econometric models: Feasible Generalized Least Squares (FGLS), Driscoll–Kraay (DK) and Instrumental Variable (IV) models for robustness analysis, including Two-Stage Least Squares (2SLS), Limited Information Maximum Likelihood (LIML), and the Generalized Method of Moments with Continuously Updating Estimators (GMM-CUE). Our main finding reveals that the dynamics of micro and small firms positively impact occupation diversity in Brazil, leading to the creation of a wider range of job types. Furthermore, the frequency of change of firms from microenterprises to small businesses increases the occupation diversity in the Brazilian industrial sector. Our findings are significant in providing policy recommendations for developing countries to achieve a more diverse labor market.

Similar content being viewed by others

Introduction

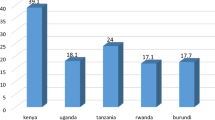

The competitive and dynamic process among firms demands rapid adaptation to market conditions and regional and national economic cycles (Cefis et al., 2022; Machado, 2016; Santarelli & Vivarelli, 2007). Numerous studies have used variables related to firm dynamics to explain economic phenomena such as productivity (Bosma & Nieuwenhuijsen, 2000), market survival (Segarra & Callejón, 2002), and job creation (Decker et al., 2014). Firm competition affects job creation, destruction, and reallocation mainly within the same sector rather than across different sectors (Caves, 1998). Small firms substantially generate total employment in developing countries face significant competition from firms of different sizes (Decker et al., 2014; Haltiwanger et al., 2013). For example, most jobs in small businesses in the United States are created and eliminated through firm entry and exit (Haltiwanger et al., 2013). In Latin America, there is evidence of a high job reallocation rate among small firms, especially those with fewer than 20 employees and this dynamic decreases as the firm size increases, in line with the international average (Haltiwanger et al., 2014).

The evidence concerning reallocation within sectors raises new questions about job creation and destruction in small firms. For example, there is a need to understand what kind of employment opportunities are generated by small firms. However, despite the encouragement of entrepreneurial behavior by international organizations (OECD, 2021; World Bank, 2023) not only the quantity but also the quality of jobs generated by small firms remains an underexplored topic (Block et al., 2018). Noteworthy, the literature on firm dynamics does not distinguish the types of occupations (Haltiwanger et al., 2014; Spletzer, 2000). Labor economics has addressed this debate, which examines the role of small and microenterprises (MSEs) (Brixy et al., 2007; Burgess et al., 2000; Osterman, 2013). Therefore, the quality of jobs generated by MSEs is an important aspect to consider, including factors such as wages (Brixy et al., 2007; Nyström & Elvung, 2014), job stability (Burgess et al., 2000) and working conditions (Osterman, 2013), especially for developing nations.

Given the abundance of small firms within the country, Brazil serves as a significant case study for examining firm dynamics. For example, 85% of all Brazilian firms have up to 10 employees, and 53% of jobs are concentrated in firms with a maximum of 50 employees (Coelho et al., 2017). According to the Organization for Economic Cooperation and Development (OECD), Brazil's industry, mainly composed of manufacturing, has a similar share of employment and value added as the average of OECD member countries, but lower than other emerging countries (OECD, 2020). This scenario demonstrates the importance of analyzing the small firm dynamics of the industrial sector and their impact on occupations in a developing country. Therefore, this article aims to measure the impact of the dynamics of micro and small industrial firms on the diversity of occupations in Brazil. Furthermore, we discuss the types of jobs opportunities created and the corresponding wage levels in micro and small industrial firms, through their wage premium and type of occupation.

In this sense, we present theoretical and practical justifications for carrying out this study. First, our study advances by presenting new insights on firm dynamics (Haltiwanger, 2009; Li & Rama, 2015; Liedholm, 2002; Rijkers et al., 2014) and economic diversification (Balland et al., 2019; Boschma, 2017; Hidalgo, 2023; Saviotti & Pyka, 2004; Saviotti et al., 2020). Second, this study addresses a gap in the literature concerning the analysis of job quality and firm dynamics within the context of economic diversification, particularly focusing on small firms. While previous studies have primarily focused on firm dynamics quantitatively, this study brings attention to the qualitative aspect of occupation diversity (Block et al., 2018). Third, it provides a methodological contribution by introducing the evaluation of small firm dynamics through the turbulence index developed by Audretsch and Fritsch (1996) and Fritsch (1996). In other terms, this study proposes a unique index considering the entry and exit of the firm size transitions, while the previous literature proposed entry and exit as new firms and closures. Fourth, this analysis integrates economic diversification and job quality within the industrial sector. This perspective is still unexplored by the literature, especially considering the occupation diversity phenomena in a developing region. Fifth, the study offers practical insights for policymakers by examining a developing country and using regional data at the micro-regional level to formulate policies for firm growth, economic efficiency improvements, and providing better occupations. This approach enables the formulation of targeted policy recommendations to support economic development effectively.

Literature review

Growth and decline of small firms in developing countries

The concept of the firm life cycle encompasses stages such as birth, growth, survival, or exit of firm from the market (Cefis et al., 2022; Coad, 2009; Geroski, 1995). The dynamics of small firms is influenced by factors such as the life cycle, age, and the entry and exit of other firms (Haltiwanger, 2009). The firm's age and the selection process resulting from entry and exit affect the wage and productivity of small firms, as they are closely related to the life cycle and market selection (Haltiwanger, 2009). Given this complex landscape, it is necessary to understand the factors that influence the growth trajectory, decline, and competitive dynamics of small firms (Cefis et al., 2022; Coad, 2009; Gupta et al., 2013; Machado, 2016; Santarelli & Vivarelli, 2007).

Machado (2016) examined how the competitive selection process affects small firms' growth. The author identified the main factors of competitive selection, such as market structure, innovation, firm age, and sectoral dynamics. Coad (2009) characterized the entry of new firms as a "chaotic process" with high entry and exit rates, and as a result, many firms do not intend to grow and choose to remain small. Moreover, firms face the limited access to credit, difficulties in finding a consumer market, and challenges in hiring human capital, which might hinder small firms' growth (Coad, 2009; Gupta et al., 2013).

Competitive selection is an important factor in determining whether firms decline or decrease in size. Cefis et al. (2022) divide the factors that influence the exit of firms from the market into micro and macrofactors. Some of the macrofactors listed are environmental regulations, regional characteristics, and financial crises. Microfactors are those related to the characteristics of the firms that affect their exit or survival, such as innovation, technical efficiency, and financial resources (the liability of smallness) (Cefis et al., 2022). Concerning this point, Headd and Kirchhoff (2009) found that slightly more firms grow than decline in size. It should be noted that some sectors exhibit more volatility (with more firms growing and shrinking), while others remain stable (with few firms changing in size) (Headd & Kirchhoff, 2009).

Some studies have analyzed the dynamics of small firms in developing countries. Tybout (2000) pointed out the exclusive benefits that large firms enjoy, such as preferential access to credit and legal regulations that favor them. For instance, Meressa (2020) identified variables such as access to credit and inputs as significant factors in her analysis of the Ethiopian context. This type of environment hampers the growth and performance of small firms in developing countries (Meressa, 2020; Tybout, 2000). For example, Hsieh and Klenow (2009) and Hsieh and Klenow (2014) show that developing countries have a higher share of small firms than developed countries. However, these firms do not grow and achieve the same productivity due to misallocation of resources (such as credit, labor regulations, and physical and human capital) (Hsieh & Klenow, 2009, 2014). Furthermore, McKenzie and Paffhausen (2019) investigated the causes of exit in small firms in developing countries. The authors found that the higher probability of closure is due to the lower profitability and productivity of small firms.

There is some empirical evidence on firm dynamics in developing countries. Liedholm (2002) studied the life cycle of firms in Africa and Latin America. The author found that approximately 30% of firms start with self-employed owners. Moreover, micro and small firms act as shock absorbers because large firms lay off workers during economic downturns, which leads to the emergence of new firms by former employees of large firms (Liedholm, 2002). Davies and Kerr (2018) estimated an exit rate of approximately 25% for small firms in Ghana and large firms had an exit rate equal to 20%. Shiferaw (2009) found similar results for Ethiopia, since the probability of survival was lower for small firms.

Coelho et al. (2017) confirmed that the distribution of firms in Brazil is similar to that described by Hsieh and Klenow (2014) for developing countries. The distribution of firms is asymmetric, with a large share of small firms and a low share of medium-sized firms. The OECD (2020) pointed out that the creation of small firms is common in Brazil. However, the rate of small firms with self-employed owners is twice as high as the OECD average (OECD, 2020). The OECD report showed a high rate of firm creation and exit, although no association was observed with job creation. The report points out that it is because small firms do not have growth prospects relative to large, market-savvy firms.

Job reallocation and small firms

The international literature has been engaged to debate on job reallocation, correlated with the dynamic of small firms’ approach. Theoretical models, such as those proposed by Ericson and Pakes (1995) and Jovanovic (1982), propose learning from firms and explain the dynamics through firm learning. Santarelli and Vivarelli (2007) analyze that either passive or active learning, founders in these theoretical models exhibit heterogeneity in terms of their capabilities and beliefs. The authors argue that firms are committed to making recursive decisions, where early exit remains an available and rational option. Whether due to entry mistakes, learning failures, or incorrect differentiation strategies, newborn firms may cease to exist during the early phases of their life cycles (Santarelli & Vivarelli, 2007). These theoretical findings are corroborated by certain stylized facts. For example, small and young firms exhibit low survival rates; however, those that do survive tend to experience high growth rates (Gil, 2010).

Davis and Haltiwanger (1992) conducted an analysis of job reallocation within North American industries spanning from 1972 to 1986. The authors found that that smaller firms exhibit higher rates of job reallocation in contrast to larger counterparts. This dynamic is closely linked to cycles of expansion, contraction, and potential firm exits (Davis & Haltiwanger, 1992). Broersma and Gautier (1997) found similar results within the Netherlands' industrial sector spanning from 1971 to 1991. They noted that despite the high rates of job creation and destruction observed in small firms, these entities still make a substantial contribution to overall job creation in the Netherlands. Additionally, Hijzen et al. (2010) demonstrated that from 1997 to 2008 in the United Kingdom, small firms were responsible for approximately two-thirds or 65 percent of all job creations and 45 percent of job destructions through reallocations. In contrast, Rijkers et al. (2014) argued that small firms had a constrained influence on job creation dynamics in Tunisia. They suggested that this limited dynamism and creative destruction bolstered the contribution of incoming firms while diminishing overall firm output, thereby compromising economic efficiency. Brummund and Connolly (2019) analyzed the Brazilian economy and found evidence that small firms, both young and mature, contribute to approximately 45% of jobs. However, these firms have high volatility, with large rates of market exit and job destruction.

Studies (Caves, 1998; Cefis et al., 2022; Fritsch, 2008) have shown that job reallocations due to competition and changes in firm size can predict whether a firm will grow or exit the competitive market. For example, Fritsch (2008) argued that this dynamic tends to present a net positive effect on job creation by increasing competitiveness in the regional economy. Job creation is driven by supply-side factors such as increased efficiency, faster structural change, innovation, and greater product variety (Saviotti et al., 2020). Also, Van Praag and Versloot (2007) pointed out that small firms generate positive externalities through entrepreneurship by creating jobs. They found that small firms tend to grow faster than larger firms. However, concerns have been raised about compensation and the stability of jobs in small firms. This dynamic is related to firm reallocation, specifically the entry and exit of small firms in the market (Haltiwanger et al., 2014). Given this dichotomy between positive and negative effects, Van Praag and Versloot (2007) raised questions about the quality of jobs generated by small firms.

Quality of occupations in small firms

Most articles discuss firm dynamics but do not consider the quality of jobs (Bartelsman et al., 2005; Haltiwanger et al., 2014). Block et al. (2018) identified several dimensions that can represent job quality, including (i) wages, (ii) bonuses and share-based remuneration, (iii) non-monetary benefits, (iv) job security, and (v) job content and types. Oi and Idson (1999) underscore the significance of wage levels as a pivotal component of job quality. They assert a direct correlation between wages and the size of the employing firm. Brixy et al. (2007) argued that German firms employing fewer than 50 workers provided lower wages during the period from 1997 to 2001. Additionally, the authors discovered that entrepreneurial firms, characterized as younger and smaller enterprises, offered salaries approximately 8% lower than the overall average. Nyström and Elvung (2014) identified that wages in entrepreneurial firms were 2.9% lower compared to larger, well-established firms in the market between 1998 and 2008 in Sweden. Nevertheless, the literature continues to engage in ongoing debate regarding the correlation between wages and firm size. For example, Kim (2018) diverges from earlier research conducted by (Brixy et al., 2007) and Nyström and Elvung (2014) by shedding light on instances where smaller firms with substantial human capital emerge victorious. The author scrutinized data from Massachusetts Institute of Technology (MIT) graduates spanning from 2006 to 2014, revealing that young firms tend to offer wages approximately 10% higher than those provided by established firms in the market.

Another aspect linked to job quality involves the dynamics of entry and exit in small firms, which tend to offer lower-quality employment compared to larger firms (Block et al., 2018; Kuhn et al., 2016). In essence, employment in smaller firms often exhibits higher volatility (Burgess et al., 2000; Kuhn et al., 2016). Burgess et al. (2000) demonstrated that job reallocation rates are elevated in firms with fewer than 50 employees. Kuhn et al. (2016) focused on Denmark between 2002 and 2007, controlling for the impact of human capital. Their findings revealed that groups of workers with elementary education contribute significantly to job creation, yet they also account for high rates of job destruction among those seeking highly qualified workers. Similar findings pertaining to the high volatility of employment in small firms have been observed in the context of Brazil (Brummund & Connolly, 2019).

Analyzing the type of employment generated is essential in assessing job quality. For instance, entrepreneurial firms tend to create more low-skilled jobs compared to established firms (Kuhn et al., 2016). Similarly, Coad et al. (2017) discovered that individuals with lower qualifications, prior unemployment experience, or lower previous income are inclined to work in entrepreneurial ventures. In Tanzania and Ghana, Teal (2011) observed that workers with similar levels of human capital received lower wages in small firms. Moreover, data from Denmark between 1995 and 2002 revealed that jobs in entrepreneurial firms did not exhibit short-term wage growth (Malchow-Møller et al., 2011). Micro and small firms often serve as employers for low-skilled or marginalized workforce (Åstebro & Tåg, 2017; Block et al., 2018).

Occupation diversity considers the variety of occupations present within a workforce, offering resilience to economic shocks (Hausmann & Hidalgo, 2011; Hausmann & Klinger, 2006; Hausmann et al., 2008). A diverse range of occupations can mitigate the impact of economic downturns or sector-specific crises by providing alternative opportunities for individuals with various skills (Freitas et al., 2024; Hausmann & Hidalgo, 2011; Saviotti et al., 2020). Moreover, occupation diversity fosters innovation by bringing together different skill sets and knowledge backgrounds (Freitas et al., 2024; Saviotti et al., 2020). This diversity of perspectives can lead to a more innovative and dynamic environment within firms (Saviotti & Pyka, 2004). Furthermore, occupation diversity contributes to economic growth and development by promoting innovation, entrepreneurship, and investment across multiple sectors, thereby stimulating Gross Domestic Product (GDP) growth (Balland et al., 2019; Boschma et al., 2018; Saviotti & Pyka, 2004; Zhu & Li, 2017). In the subsequent section, we outline the method employed to assess firm dynamics and occupation diversity within the Brazilian industrial sector.

Data and methods

Sample and sources of data

To empirically assess the impact of firm dynamics on occupation diversity, we used econometric panel data models. Therefore, this is a retrospective study, without the intervention of the researchers, which utilizes secondary data. We compiled databases from various research and statistical institutions spanning the period from 2003 to 2015 for 558 Brazilian microregions. Table 1 summarizes the variables we used for the econometric model. To discuss job opportunities and the corresponding wage levels in small industrial firms, we created two tables (Appendix). These tables outline the main occupations within the industrial sector by firm size, their share in the total job market, and the wage premium relative to the minimum wage.

We collect data on GDP per capita, trade openness, and urbanization from research and national statistical institutions, such as the Brazilian Institute of Geography and Statistics (IBGE) and the Institute of Applied Economic Research (IPEA). We also use the database provided by DataViva, which has official data about exports, industries, locations, and occupations available for the entirety of Brazil. Finally, we analyzed data from the Brazilian Ministry of Labor, called the Annual Social Information Report (RAIS), to construct firm statistics.

This study follows the Brazilian Micro and Small Business Support Service (SEBRAE, 2013) criteria to categorize firms by size, which is divided into three categories. The industrial microenterprises (ME) have a maximum of 19 employees. The industrial small enterprises (EPP) present from 20 to 99 employees. Furthermore, according to (Veloso et al., 2019), the industry sector includes the following subsectors: extractive industries, manufacturing, electricity and gas, water, sewage, waste management, and civil construction.

Description of variables

To examine the relationship between small firm reallocation and occupation diversity, we constructed a variable that measures the dynamics through the expansion and contraction of firm size. This variable is adapted from the turbulence index (mainly linked to the entry and exit of firms) (Baptista & Karaöz, 2011). First, the variable freq_ind counts the number of firms that changed their size category each year. The variable freq_ind 1_2, counts the number of firms that grew from ME to EPP. Second, the variable Firm_dynamics measures the rate of firm size transitions. Firm dynamics is an adaptation of the turbulence indices that capture the rate of entry and exit of firms, as proposed by Baptista and Karaöz (2011), Bosma and Nieuwenhuijsen (2000), and Segarra and Callejón (2002). According to the original models, the turbulence indices are calculated as either \(entry+exit\) or \(entry+exit/incumbents\) (Audretsch & Fritsch, 1996; Bosma & Nieuwenhuijsen, 2000). Our model measures the entry, representing the means of transition from ME to EPP. The exit is equivalent to the transition from EPP to ME. The incumbents are the firms that remained EPP or ME in the period analyzed. We build the variables according to the following equations:

The comma indicates the firm's size transition in the year t for microregion i.

The dependent variable is Occupation Diversity, which refers to the variety of occupations and job roles within an economy. Economies with a more diverse range of occupations and skills are better positioned to engage in sophisticated production (Gala et al., 2018). This diversity allows for the accumulation of a broad spectrum of capabilities and knowledge, facilitating innovation, adaptation, and specialization in various industries. The evolution of various occupations into more intricate sectors or regions is facilitated by their ability to attract a diverse array of relatively distinct productive activities, thereby enhancing their capacity to effectively integrate and innovate in the advancement of complex economic endeavors (Hausmann et al., 2017).

In this sense, Occupation Diversity is a proxy for the number of occupations generated, as defined by DATAVIVA (2023). This variable uses the 4-digit occupation classifications from the Brazilian Classification of Occupations (CBO – Classificação Brasileira de Ocupações) that are present for a given variable. In this article, the variable for occupation diversity is calculated for each microregion in Brazil. Low occupation diversity means that employment is concentrated in only a few occupation groups, while high occupation diversity implies that employment is distributed across many occupation groups.

Additionally, this article also analyzed the impact of some control variables, such as macroeconomic variables, human capital, and urbanization. These variables are expressed as a percentage (%). Urbanization was chosen to control agglomeration economies such as knowledge spillovers and job growth (Glaeser et al., 1992). Human Capital measures the accumulation of knowledge in the region and indicates the tendency of individuals to conduct business (Chowdhury et al., 2019). Furthermore, human capital is important with the accumulation of new capabilities and for unrelated diversification (Pinheiro et al., 2021). We also include two macroeconomic variables (i.e., GDP per capita and Trade Openness). GDP per capita is a proxy for growth and business cycles and is related to entrepreneurship (Acs et al., 2012; Ajide, 2022). Trade openness controls the efficiency of firms since they are exposed to international competition (Daumal & Selin, 2010; Frankel & Romer, 1999).

Empirical strategy

We define two econometric models according to the following specifications:

Equation (3) introduces the primary explanatory variable, freq_ind_1_2, which is the variation in firms' growth. Equation (4), on the other hand, highlights the main variable, the firm dynamics. This equation demonstrates how the rate of growth and decline of firms affects the occupation diversity. Additionally, \({\alpha }_{it}\) represents the intercept of each equation, \({\beta }_{k}Control{s}_{it}\) are the control variables used in both models, \({\theta }_{i}\) represents the fixed effects and \({u}_{it}\) represents the error term. We used the natural logarithm value for all variables, which allowed us to interpret the coefficients as percentage rates.

We performed several statistical tests to guarantee an adequate econometric model. Initially, this study examined the Variance Inflation Factor (VIF) to assess the presence of multicollinearity in the econometric model. We did not find multicollinearity because the mean VIF remained below 10 (Alin, 2010; Gujarati & Porter, 2009). To assess the presence of heteroskedasticity, we performed the Wald test (Prob > chi2 = 0.0000) (Greene, 2017), which revealed its existence. Consequently, we employed robust standard errors in estimating the model. Baseline control models include ordinary least squares (OLS), fixed effects (FE), and random effects (RE). Models utilizing the Feasible Generalized Least Squares (FGLS) and Driscoll–Kraay (DK) techniques were chosen as robust baseline models due to their ability to estimate robust standard errors, thereby accounting for spatial correlation, heteroscedasticity, and autocorrelation (Driscoll & Kraay, 1998; Vogelsang, 2012).

Some robustness checks were employed with instrumental variable models, specifically two-stage least squares (2SLS), limited information maximum likelihood (LIML), and generalized method of moments (GMM). These models are necessary to control endogeneity between the occupation diversity (\({Y}_{it}\)), firm dynamics and the frequency of changes in firm size (\({X}_{it}\)). This occurs because changes in explanatory variables can influence the dependent variable and vice versa. To address this issue, we applied the technique proposed by Tchamyou (2017). This technique involves regressing the explanatory variable with its first-time lag and utilizing the values adjusted for heteroscedasticity and spatial autocorrelation using the Driscoll–Kraay method as an instrument in the second stage (Ajide, 2022; Asongu & Nwachukwu, 2018; Driscoll & Kraay, 1998).

We incorporate time lag into the model estimation process to improve the accuracy of the estimation and prevent the loss of observations. Acemoglu et al. (2003) suggested that just one instrument is a conservative approach. This approach assumes that only the variable of interest is endogenous, which may lead to an underestimation of the result of the variable and an increase in the coefficients of the variables considered exogenous. We employed as follows:

\({X}_{it}\) in both equations are the control variables used in the base model and \({\theta }_{i}\) represents the fixed effects and \({\mu }_{it}\) represents the error term. The adjusted values of \(Firm Dynamic{s}_{it}\) and \(Freq In{d}_{it}\) estimated through \(Firm Dynamic{s}_{it-1}\) and \(Freq In{d}_{it-1}\) are placed in the second stage:

\({X}_{it}\) in both equations are the control variables used in the baseline model, \({\theta }_{i}\) represents the fixed effects and \({\upsilon }_{it}\) the error term.

Results

Regional distribution of occupation diversity

The descriptive statistics of the variables under analysis are presented in Table 2. It elucidates the heterogeneous and unequal nature of the Brazilian economy. Notably, the diversity in occupations exhibits a wide range of values (ranging from 5 to 595) across microregions, resulting in a considerable standard deviation of 122. This disparity underscores the regional inequality prevalent in Brazil, with certain regions such as São Paulo and Rio de Janeiro boasting several diverse occupations, while underdeveloped areas like the Amazonia and Northeast regions exhibit fewer occupation varieties.

Moreover, the frequency of transitions in firm sizes mirrors the disparities observed in occupation diversity across regions. Furthermore, discrepancies exist concerning the presence of qualified workers, with some microregions reporting fewer formal workers with higher education levels. Conversely, there are regions where over 60% of the workforce possesses formal education. On average, approximately 12.2% of workers have formal education, with a standard deviation of 5.4%.

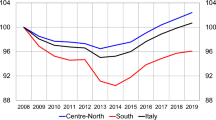

Figure 1 illustrates the distribution maps with the evolution of occupation diversity in Brazil from 2003 to 2015. Occupation diversity presents an unequal distribution through the Brazilian microregions. A higher level of occupation diversity is observed in the South and Southeast regions of the country. Central-West, Northeast, and North regions exhibit elevated rates of occupation diversity, mainly within microregions that feature urban agglomerations, such as state capitals and coastal regions. For example, in 2015, the state of Amazonas demonstrated a substantial occupation diversity index in Manaus (562), the state capital. Conversely, the countryside presents lower occupation diversity, as exemplified by Japurá City (48).

Frequency of firm size changes

In this section, we discuss the econometric results regarding the influence of the firm size transition on occupation diversity. According to the FGLS model presented in Table 3, a rise in the frequency of size changes among ten industrial firms corresponds to a 0.25% increase in occupation diversity. In other words, this phenomenon reveals the positive and statistically significant effect on occupation diversity when firms transition from the classification of microenterprises to that of small businesses. The Driscoll–Kraay (DK) model confirms this phenomenon, although with the distinction that the influence of firm frequency on occupation diversity (0.13%) is somewhat lower compared to the impact identified by the FGLS model. This finding is relevant because it reveals the influence of the frequency of size changes between ten industrial firms on occupation diversity in Brazil.

The control variables on the FGLS model indicated that GDP (12.2%), urbanization (1.2%), and trade openness (1.6%) had a positive impact on occupation diversity. These coefficients exhibited statistical significance at the 1% significance level. We found that the human capital variable achieved statistical significance at the 1% level in the DK model. In other terms, increasing 1% of the rate of people with higher education will increase 113% the occupation diversity in Brazil.

Firm dynamics

In this section, we discuss the econometric results regarding the influence of the firm dynamics variables (Firm_Dynamics_1 and Firm_Dynamics_2) on occupation diversity. These findings are summarized in Table 4. According to the DK model, a 1% increase in firm dynamics within the industry sector results in a 23% increase in occupation diversity across Brazilian microregions, statistically significant at 1% level. This finding implies that an increase in firm dynamics improves occupation diversity in Brazil.

Noteworthy, our control variables also presented statistical significance at 1% level. The DK model indicated that 1% increase in GDP per capita implies in 15.4% increase in occupation diversity in Brazilian microregions. The same applies to the other variables, as human capital (1.16%), and trade openness (1%).

We present the econometric results on the impact of the variable Firm_Dynamics_2 on occupation diversity in Brazil. These findings are summarized in Table 5. The DK model reveals that Firm Dynamics increases the occupation diversity in Brazil (26%). Once again, the control variables exhibited a statistically significant and positive influence, except for urbanization. The variable GDP per capita 1% increase improves occupation diversity in 15.4%, the same goes to human capital which improves the occupation diversity in 1.16% and trade openness increase would imply in 0.1% increase. However, the urbanization variable shows a negative effect of 0.1% on occupation diversity as presented in the table below.

In summary, Tables 4 and 5 confirm a positive and statistically significant impact of small industrial firms' dynamics on occupation diversity within Brazilian microregions. This article contributes by unveiling the importance of industrial firms' reallocation on occupation diversity in Brazil.

Estimates with instrumental variables (IV)

Robustness analysis will be conducted using 2SLS, LIML, and GMM models to control for endogeneity. All instrumental models include tests for endogeneity. The Kleibergen–Paap F test exceeds the recommended threshold of 10, indicating a low probability of a weak correlation between the instrument and the endogenous regressor (Olea & Pflueger, 2013). The Anderson–Rubin interval demonstrates greater efficiency in the just identified model and remains robust in the presence of weak instruments (Andrews et al., 2019). This interval is recommended because it can yield valid measures of effect estimate uncertainty, even when dealing with weak instruments (Huntington-Klein, 2021).

To enhance robustness, we estimate the LIML model, which exhibits reduced bias in finite samples when the reduced form is weak despite producing the same estimated values as the 2SLS model in the just identified model (Hansen, 2022). In the case of the GMM model, we utilized the continuously updated estimator (CUE) in the version proposed by Hansen et al. (1996). This choice is attributed to the improved efficiency of this estimator in conducting tests for weak instruments, especially in the presence of heteroscedasticity (Keane & Neal, 2023). Regarding the LIML model, the same tests as those in the 2SLS model are also reported.

We present the robustness tests of firm size transitions derived from the preceding econometric models. These findings are summarized in Table 6. These models illustrate that firm growth, specifically the transition from microenterprise (ME) to small enterprises (EPP), remained statistically significant at the 1% level. Across all econometric models, we observed that a ten-firm increase in size within microregions corresponded to a 0.3% rise on occupation diversity. It is worth noting that the control variables (such as GDP per capita, human capital, and trade openness) also retained statistical significance and exhibited positive impacts on occupation diversity, with the exception of the urbanization variable.

We present the robustness tests of Firm_Dynamics_1 derived from the preceding econometric models. These findings are summarized in Table 7. Notably, Firm_Dynamics_1 demonstrates statistical significance at the 5% level. This observation underscores the relevance of considering both firm growth and degrowth as variables in determining occupation diversity within Brazilian microregions. In essence, our findings indicate that the phenomenon of firm dynamics increases 0.794% in occupation diversity. Furthermore, it is pertinent to highlight that the control variables (including GDP per capita, human capital, and trade openness) also maintain statistical significance and yield positive effects, except for the urbanization variable.

We present the robustness tests of Firm_Dynamics_2 derived from the preceding econometric models. These findings are summarized in Table 8. Once more, Firm_Dynamics_2 demonstrates a positive effect on occupation diversity, underscoring the significance of this phenomenon in forecasting occupation diversity within Brazilian microregions. Put differently, a 1% increase in firm dynamics corresponds to a 0.914% increase in occupation diversity. Moreover, it is noteworthy to emphasize that the control variables (comprising GDP per capita, human capital, and trade openness) retain statistical significance and contribute positively, with the exception of the urbanization variable.

Overall, the robustness check, which controls for endogeneity in the econometric models through instrumental variables, indicates that our primary variables (namely, firm size transition and firm dynamics) maintain statistical significance, exhibit a positive impact, and continue to be pertinent in predicting occupation diversity in Brazil.

Quality of occupations

The dynamics of industrial firms exert a positive impact on occupation diversity in Brazil. This section provides a qualitative discussion of occupations within the industrial sector, considering occupation types and workers' remuneration. These dimensions are important in the discourse on the quality of occupations within small firms (Block et al., 2018). The main occupations under analysis are presented in Appendix.

Two distinct periods, 2003 and 2015, were analyzed to explore potential changes over this period (see Tables 9 and 10). Statistics were compiled from the top 20 occupations within the industry, with a primary focus on assessing occupations predominantly generated by MEs and EPPs. In addition, the average remuneration value for each occupation was determined at prices in 2022. Furthermore, an additional comparative benchmark was introduced, emphasizing how much the average occupation's remuneration relates to the minimum wage for 2003 and 2015, adjusted to 2022 prices. Note that the Brazilian Minimum Wage in 2003, corrected to 2022 prices, is R$762. Additionally, the Brazilian Minimum Wage in 2015, corrected to 2022 prices, is R$1,257.

We found significant heterogeneity between 2003 and 2015, analyzing the occupations generated by the industry through small firms. Table 9 presents information concerning garment and construction workers, highlighting the lower wage premiums in microenterprises (MEs) compared to their small-sized enterprises (EPPs) counterparts. For garment workers, the wage disparity amounted to 48% in 2003. By 2015, the scenario for this occupation revealed a negative wage premium (-9%) with respect to the minimum wage, coupled with a 27% differential for small enterprises (EPP). These findings align with existing literature that indicates that smaller firms offer lower wages (Brixy et al., 2007; Nyström & Elvung, 2014).

Occupations that demand higher levels of human capital tend to offer higher salary premiums. For instance, microenterprise (ME) managerial occupations featured premiums exceeding 100% of the minimum wage in 2003 and 2015. This occupation classification encompasses roles such as Information Technology Managers, Marketing and Communication Managers, Supply Managers, and similar positions. This finding aligns with Kim's (2018) study, which examined the correlation between salary premiums and higher levels of human capital. Conversely, the low-wage industrial sector in microenterprises (MEs) generates numerous low-skilled occupations. Occupations like Construction Assistants, Salesmen and Demonstrators, and Building Conservation Workers exhibited less than 10% wage premiums in 2003. In 2015, this category experienced negligible changes, even resulting in a negative salary premium. This phenomenon finds an explanation in the analyzed literature, where entrepreneurial firms tend to create jobs with lower qualifications and exhibit limited wage growth in the short term (Kuhn et al., 2016; Malchow-Møller et al., 2011).

Discussion and policy implications

Our econometric findings provide important insights that advance the literature on firm dynamics and occupation diversity, as well as offer policy implications. Our results support previous studies that highlight the contribution of firm growth to a more diversified labor market (Caves, 1998; Coad, 2009). Our paper aligns with the literature advocating that employment growth is correlated with firm size (Haltiwanger et al., 2013), noting that small firms tend to grow more than larger, older firms, even in developing countries (Hsieh & Klenow, 2014). Additionally, our findings corroborate Merotto et al. (2018), which highlights the high concentration of small firms in developing countries. We extend this understanding by demonstrating that the dynamics of micro and small firms are crucial for providing occupation diversity in developing regions.

The firm dynamics are similar to a life cycle process within the sector. The existing literature has underscored the importance of firm reallocation measures, such as the turbulence index, in bolstering economic efficiency by influencing productivity (Bosma & Nieuwenhuijsen, 2000; Foster et al., 2001). Surprisingly, however, our investigation reveals that, in addition to the notable selection phenomena explored by Fritsch (2008), firm dynamics foster structural changes that engender occupation diversity at a regional level. This result finds resonance in the work of Saviotti et al. (2020), who posit that the surge in efficiency and variety supports the emergence of new sectors and a broader diversification, consequently leading to job creation and the advent of new occupations. Furthermore, our focus on small industrial firms reveals the positive impact on the occupation diversity in a developing country. This finding is aligned with previous studies that indicate that most jobs are concentrated in firms with fewer than 50 employees in Brazil (Brummund & Connolly, 2019; Coelho et al., 2017). Additionally, firm dynamics positively impact employment (Broersma & Gautier, 1997; Hijzen et al., 2010). Therefore, a higher degree of dynamics among small firms through reallocation corresponds to increased diversity in Brazilian industries.

In summary, we found that (i) Firm dynamics positively affect occupation diversity, stimulating job creation through regional competitiveness channels, such as enhanced efficiency (Fritsch, 2008). (ii) The effects on the quality of industry-generated occupations are diverse during this period, characterized by varying wage premiums between occupations with differing levels of human capital, particularly within microenterprises (MEs). (iii) The findings are consistent with the literature indicating a lower remuneration in small firms, but the Brazilian context reveals distinct wage premium disparities for the same occupation type and firm size.

Through the findings presented above, some policy recommendations can be developed by policymakers in developing countries. First, authorities can support Small and Medium Enterprises (SMEs) in developing regions. This is important because this firm group present a significant impact on occupation diversity. In this sense, policies should be implemented to support the growth and development of SMEs, which might affect the economic development of regions. Noteworthy, these programs might primarily focus on firm’s growth and productivity since these firms tend to offer higher wages and create better occupations. Second, authorities can include financial incentives, access to capital, and business support services tailored to the needs of small and medium-sized enterprises. These activities might increase the entrance of new small and medium enterprises in developing regions and reduce the exit of these firms. Third, authorities can promote entrepreneurship and innovation by encouraging entrepreneurs in fostering innovation, which contributes to the dynamism of firms, leading to increased occupation diversity. In this sense, government initiatives such as startup incubators, entrepreneurship training programs, and research and development grants can help promote a culture of innovation and entrepreneurship in developing areas. Fourth, the econometric findings also revealed the relevance of human capital, which requires policy strategies to enhance the skills and qualifications of the workforce. This is also necessary for supporting occupation diversity. Policies aimed at improving access to education, vocational training, and lifelong learning opportunities can help develop a more skilled and adaptable workforce, capable of meeting the changing demands of the labor market. Fifth, considering the social and economic disparities in Brazil, the public authorities can address regional disparities in occupation diversity targeting regional development strategies. This could involve infrastructure investment, industry clusters development, and incentives to attract businesses to underdeveloped regions. By promoting economic diversification and job creation in these areas, policymakers can help reduce regional inequalities. These policy recommendations might create a dynamic environment for small and medium enterprises, providing occupation diversity, and ultimately contributing to sustainable economic growth and development in developing regions.

Conclusion

This article measured the impact of the dynamics of micro and small industrial firms on the diversity of occupations in Brazil. Our primary finding reveals that the dynamics of micro and small firms have a positive influence on occupation diversity in Brazil, resulting in the creation of a broader array of job types. Furthermore, our results indicate that industrial microenterprises (MEs) tend to generate lower-quality jobs and offer a lower wage premium compared to other industrial small enterprises (EPPs). In this sense, we provided insights to address the research question regarding the impact of SMEs' firm dynamics on occupation diversity in a developing region.

Our theoretical contribution highlights the connection between the literature on firm dynamics and economic diversification. This insight holds significance for future research endeavors in various economic sectors, regions, and countries. Moreover, it delves into a relatively underexplored topic in the literature, exploring the link between job quality and firm dynamics in a developing country. Additionally, the article offers a methodological contribution by adapting the turbulence index proposed by Audretsch and Fritsch (1996) to specifically examine transitions in small firm sizes. Lastly, we offer clear policy recommendations aimed at enhancing occupation diversity in developing regions.

Although this article opens multiple avenues regarding firm dynamics and occupation diversity, we describe some limitations and recommendations for future studies. Firstly, this article employed aggregated data for industry categories, which fail to uncover the heterogeneity within the subsectors of the Brazilian industry. Subsequent studies might analyze disaggregated data within these subsectors. Secondly, future studies must incorporate a wider range of regional control variables, including proxies for institutional characteristics. Thirdly, our analysis is confined to the formal sector in Brazil, neglecting the substantial presence of small firms operating in the informal economy. In this regard, future studies could advance by exploring alternative proxies for firm dynamics, such as examining firm entry and exit patterns. Fourth, future studies might consider other proxies for economic sophistications (i.e., Economic Complexity Index).

In conclusion, this study highlights the intricate relationship between firm dynamics, firm size transitions, and occupation diversity, particularly emphasizing the important role of small firms in driving these dynamics. Our analysis reveals the significant impact of SMEs on the economic landscape, offering several practical implications for policymakers. First, increasing financial services to micro and small enterprises in developing regions is essential to boost firm entry. Second, public authorities can enhance productivity and competitiveness by providing business support services. Third, implementing qualification and training programs for entrepreneurs can increase labor productivity and international business practices among micro and small firms. These policies will help small firms grow, improve productivity, and diversify occupational opportunities. Recognizing the importance of fostering a dynamic ecosystem that supports firm growth and diversity, policymakers can promote targeted strategies to enhance entrepreneurship, thereby fostering a more resilient and inclusive economy.

Availability of data and materials

We cited all the used databases, which are public and online available.

References

Acemoglu, D., Johnson, S., Robinson, J., & Thaicharoen, Y. (2003). Institutional causes, macroeconomic symptoms: Volatility, crises and growth. Journal of Monetary Economics, 50(1), 49–123. https://doi.org/10.1016/S0304-3932(02)00208-8

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2012). Growth and entrepreneurship. Small Business Economics, 39(2), 289–300. https://doi.org/10.1007/s11187-010-9307-2

Ajide, F. M. (2022). Economic complexity and entrepreneurship: Insights from Africa. International Journal of Development Issues. https://doi.org/10.1108/IJDI-03-2022-0047

Alin, A. (2010). Multicollinearity: Multicollinearity. Wiley Interdisciplinary Reviews: Computational Statistics, 2(3), 370–374. https://doi.org/10.1002/wics.84

Andrews, I., Stock, J. H., & Sun, L. (2019). Weak instruments in instrumental variables regression: Theory and practice. Annual Review of Economics, 11(1), 727–753. https://doi.org/10.1146/annurev-economics-080218-025643

Asongu, S. A., & Nwachukwu, J. C. (2018). Educational quality thresholds in the diffusion of knowledge with mobile phones for inclusive human development in sub-Saharan Africa. Technological Forecasting and Social Change, 129, 164–172. https://doi.org/10.1016/j.techfore.2018.01.004

Åstebro, T., & Tåg, J. (2017). Gross, net, and new job creation by entrepreneurs. Journal of Business Venturing Insights, 8, 64–70. https://doi.org/10.1016/j.jbvi.2017.06.001

Audretsch, D. B., & Fritsch, M. (1996). Creative destruction: Turbulence and economic growth in Germany. In Behavioral norms, technological progress, and economic dynamics. University of Michigan Press.

Balland, P.-A., Boschma, R., Crespo, J., & Rigby, D. L. (2019). Smart specialization policy in the European Union: Relatedness, knowledge complexity and regional diversification. Regional Studies, 53(9), 1252–1268. https://doi.org/10.1080/00343404.2018.1437900

Baptista, R., & Karaöz, M. (2011). Turbulence in growing and declining industries. Small Business Economics, 36(3), 249–270. https://doi.org/10.1007/s11187-009-9226-2

Bartelsman, E., Scarpetta, S., & Schivardi, F. (2005). Comparative analysis of firm demographics and survival: Evidence from micro-level sources in OECD countries. Industrial and Corporate Change, 14(3), 365–391. https://doi.org/10.1093/icc/dth057

Baum, C., Schaffer, M., & Stillman, S. (2022). IVREG2: Stata module for extended instrumental variables/2SLS and GMM estimation [Computer software]. Publisher: Boston College Department of Economics. Retrieved from https://ideas.repec.org/c/boc/bocode/s425401.html

Block, J. H., Fisch, C. O., & van Praag, M. (2018). Quantity and quality of jobs by entrepreneurial firms. Oxford Review of Economic Policy, 34(4), 565–583. https://doi.org/10.1093/oxrep/gry016

Boschma, R., Coenen, L., Frenken, K., & Truffer, B. (2018). Towards a theory of regional diversification: Combining insights from Evolutionary Economic Geography and Transition Studies. In Transitions in Regional Economic Development. Routledge.

Boschma, R. (2017). Relatedness as driver of regional diversification: A research agenda. Regional Studies, 51(3), 351–364. https://doi.org/10.1080/00343404.2016.1254767

Bosma, N., & Nieuwenhuijsen, H. R. (2000). Turbulence and productivity in the Netherlands. EIM Small Business Research and Consultancy.

Brixy, U., Kohaut, S., & Schnabel, C. (2007). Do newly founded firms pay lower wages? First evidence from Germany. Small Business Economics, 29(1/2), 161–171. https://doi.org/10.1007/s11187-006-0015-x

Broersma, L., & Gautier, P. (1997). Job creation and job destruction by small firms: An empirical investigation for the Dutch manufacturing sector. Small Business Economics, 9(3), 211–224. https://doi.org/10.1023/A:1017982719207

Brummund, P., & Connolly, L. (2019). Who creates stable jobs? Evidence from Brazil. Oxford Bulletin of Economics and Statistics, 81(3), 540–563. https://doi.org/10.1111/obes.12273

Burgess, S., Lane, J., & Stevens, D. (2000). Job flows, worker flows, and churning. Journal of Labor Economics, 18(3), 473–502. https://doi.org/10.1086/209967

Caves, R. E. (1998). Industrial organization and new findings on the turnover and mobility of firms. Journal of Economic Literature, 36(4), 1947–1982.

Cefis, E., Bettinelli, C., Coad, A., & Marsili, O. (2022). Understanding firm exit: A systematic literature review. Small Business Economics, 59(2), 423–446. https://doi.org/10.1007/s11187-021-00480-x

Chowdhury, F., Audretsch, D. B., & Belitski, M. (2019). Institutions and entrepreneurship quality. Entrepreneurship Theory and Practice, 43(1), 51–81. https://doi.org/10.1177/1042258718780431

Coad, A. (2009). The growth of firms: A survey of theories and empirical evidence. Edward Elgar Publishing.

Coad, A., Nielsen, K., & Timmermans, B. (2017). My first employee: An empirical investigation. Small Business Economics, 48(1), 25–45. https://doi.org/10.1007/s11187-016-9748-3

Coelho, D. S. C., Corseuil, C. H., & Foguel, M. N. (2017). Crescimento Do Emprego Nas Firmas Da Economia Brasileira: Resultados Por Grupos De Idade E Tamanho. econstor. Retrieved from https://www.econstor.eu/bitstream/10419/177560/1/td_2344.pdf

Correia, S. (2023). IVREGHDFE: Reghdfe + ivreg2 (adds instrumental variable and additional robust SE estimators to reghdfe) [Stata]. Retrieved from https://github.com/sergiocorreia/ivreghdfe (Original work published 2017)

DataViva. (2023). DataViva. Retrieved from https://www.dataviva.info/pt/

Daumal, M., & Selin, Ö. (2010). The impact of international trade flows on economic growth in Brazilian states. Review of Economics and Institutions, 2(1), 1. https://doi.org/10.5202/rei.v2i1.27

Davies, E., & Kerr, A. (2018). Firm survival and change in Ghana, 2003–2013. Journal of African Economies, 27(2), 149–171. https://doi.org/10.1093/jae/ejx023

Davis, S. J., & Haltiwanger, J. (1992). Gross job creation, gross job destruction, and employment reallocation. The Quarterly Journal of Economics, 107(3), 819–863. https://doi.org/10.2307/2118365

Decker, R., Haltiwanger, J., Jarmin, R., & Miranda, J. (2014). The role of entrepreneurship in US job creation and economic dynamism. Journal of Economic Perspectives, 28(3), 3–24. https://doi.org/10.1257/jep.28.3.3

Driscoll, J. C., & Kraay, A. C. (1998). Consistent covariance matrix estimation with spatially dependent panel data. The Review of Economics and Statistics, 80(4), 549–560. https://doi.org/10.1162/003465398557825

Ericson, R., & Pakes, A. (1995). Markov-perfect industry dynamics: A framework for empirical work. The Review of Economic Studies, 62(1), 53. https://doi.org/10.2307/2297841

Foster, L., Haltiwanger, J. C., & Krizan, C. J. (2001). aggregate productivity growth: Lessons from microeconomic evidence. In New Developments in Productivity Analysis (pp. 303–372). University of Chicago Press. Retrieved from https://www.nber.org/books-and-chapters/new-developments-productivity-analysis/aggregate-productivity-growth-lessons-microeconomic-evidence

Frankel, J. A., & Romer, D. H. (1999). Does trade cause growth? American Economic Review, 89(3), 379–399. https://doi.org/10.1257/aer.89.3.379

Freitas, E., Britto, G., & Amaral, P. (2024). Related industries, economic complexity, and regional diversification: An application for Brazilian microregions. Papers in Regional Science, 100011. https://doi.org/10.1016/j.pirs.2024.100011

Fritsch, M. (1996). Turbulence and growth in West Germany: A comparison of evidence by regions and industries. Review of Industrial Organization, 11(2), 231–251. https://doi.org/10.1007/BF00157669

Fritsch, M. (2008). How does new business formation affect regional development? Introduction to the special issue. Small Business Economics, 30(1), 1–14. https://doi.org/10.1007/s11187-007-9057-y

Gala, P., Camargo, J., Magacho, G., & Rocha, I. (2018). Sophisticated jobs matter for economic complexity: An empirical analysis based on input-output matrices and employment data. Structural Change and Economic Dynamics, 45, 1–8. https://doi.org/10.1016/j.strueco.2017.11.005

Geroski, P. A. (1995). What do we know about entry? International Journal of Industrial Organization, 13(4), 421–440. https://doi.org/10.1016/0167-7187(95)00498-X

Gil, P. M. (2010). Stylised facts and other empirical evidence on firm dynamics, business cycle and growth. Research in Economics, 64(2), 73–80. https://doi.org/10.1016/j.rie.2009.11.001

Glaeser, E. L., Kallal, H. D., Scheinkman, J. A., & Shleifer, A. (1992). Growth in Cities. Journal of Political Economy, 100(6), 1126–1152. https://doi.org/10.1086/261856

Greene, W. (2017). Econometric analysis (8th ed.). Pearson.

Gujarati, D. N., & Porter, D. C. (2009). Basic econometrics (5th ed.). McGraw-Hill.

Gupta, P., Guha, S., & Krishnaswami, S. (2013). Firm growth and its determinants. Journal of Innovation and Entrepreneurship, 2(1), 15. https://doi.org/10.1186/2192-5372-2-15

Haltiwanger, J. (2009). Entrepreneurship and job growth. In Entrepreneurship, economic growth, and public policy (pp. 119–145). Cambridge University Press.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who Creates Jobs? Small versus Large versus Young. The Review of Economics and Statistics, 95(2), 347–361. https://doi.org/10.1162/REST_a_00288

Haltiwanger, J., Scarpetta, S., & Schweiger, H. (2014). Cross country differences in job reallocation: The role of industry, firm size and regulations. Labour Economics, 26, 11–25. https://doi.org/10.1016/j.labeco.2013.10.001

Hansen, B. (2022). Econometrics. Princeton University Press.

Hansen, L. P., Heaton, J., & Yaron, A. (1996). Finite-sample properties of some alternative GMM estimators. Journal of Business & Economic Statistics, 14(3), 262–280. https://doi.org/10.1080/07350015.1996.10524656

Hausmann, R., & Klinger, B. (2006). Structural Transformation and Patterns of Comparative Advantage in the Product Space (SSRN Scholarly Paper 939646). https://doi.org/10.2139/ssrn.939646

Hausmann, R., Rodríguez, F., & Wagner, R. (2008). Growth Collapses. In Money, Crises, and Transition: Essays in Honor of Guillermo A. Calvo. Retreived from https://direct.mit.edu/books/edited-volume/2739/chapter/74134/Growth-Collapses

Hausmann, R., Morales-Arilla, J., & Santos, M. (2017). Panama beyond the Canal: Using Technological Proximities to Identify Opportunities for Productive Diversification (SSRN Scholarly Paper 2880643). https://doi.org/10.2139/ssrn.2880643

Hausmann, R., & Hidalgo, C. A. (2011). The network structure of economic output. Journal of Economic Growth, 16(4), 309–342. https://doi.org/10.1007/s10887-011-9071-4

Headd, B., & Kirchhoff, B. (2009). The growth, decline and survival of small businesses: An exploratory study of life cycles. Journal of Small Business Management, 47(4), 531–550. https://doi.org/10.1111/j.1540-627X.2009.00282.x

Hidalgo, C. A. (2023). The policy implications of economic complexity. Research Policy, 52(9), 104863. https://doi.org/10.1016/j.respol.2023.104863

Hijzen, A., Upward, R., & Wright, P. W. (2010). Job creation, job destruction and the role of small firms: Firm-level evidence for the UK*: Job creation and destruction. Oxford Bulletin of Economics and Statistics, 72(5), 621–647. https://doi.org/10.1111/j.1468-0084.2010.00584.x

Hsieh, C.-T., & Klenow, P. J. (2009). Misallocation and manufacturing TFP in China and India. The Quarterly Journal of Economics, 124(4), 1403–1448. https://doi.org/10.1162/qjec.2009.124.4.1403

Hsieh, C.-T., & Klenow, P. J. (2014). The life cycle of plants in India and Mexico. The Quarterly Journal of Economics, 129(3), 1035–1084. https://doi.org/10.1093/qje/qju014

Huntington-Klein, N. (2021). Instrumental variables. Chapman and Hall/CRC.

IBGE. (2023). Sistema IBGE de Recuperação Automática—SIDRA . SIDRA - IBGE. Retreived from www.ibge.gov.br

Ipeadata. (2023). Ipeadata . Instituto de Pesquisa Econômica Aplicada. Retreived from http://ipeadata.gov.br/Default.aspx

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica, 50(3), 649. https://doi.org/10.2307/1912606

Keane, M., & Neal, T. (2023). Instrument strength in IV estimation and inference: A guide to theory and practice. Journal of Econometrics, 235(2), 1625–1653. https://doi.org/10.1016/j.jeconom.2022.12.009

Kim, J. D. (2018). Is there a startup wage premium? Evidence from MIT Graduates. Research Policy, 47(3), 637–649. https://doi.org/10.1016/j.respol.2018.01.010

Kuhn, J. M., Malchow-Møller, N., & Sørensen, A. (2016). Job creation and job types—New evidence from Danish entrepreneurs. European Economic Review, 86, 161–187. https://doi.org/10.1016/j.euroecorev.2015.12.002

Li, Y., & Rama, M. (2015). Firm dynamics, productivity growth, and job creation in developing countries: The role of micro- and small enterprises. The World Bank Research Observer, 30(1), 3–38. https://doi.org/10.1093/wbro/lkv002

Liedholm, C. (2002). Small firm dynamics: Evidence from Africa and Latin America. Small Business Economics, 18(1), 225–240. https://doi.org/10.1023/A:1015147826035

Machado, H. P. V. (2016). Growth of small businesses: A literature review and perspectives of studies. Gestão & Produção, 23, 419–432. https://doi.org/10.1590/0104-530X1759-14

Malchow-Møller, N., Schjerning, B., & Sørensen, A. (2011). Entrepreneurship, job creation and wage growth. Small Business Economics, 36(1), 15–32. https://doi.org/10.1007/s11187-009-9173-y

McKenzie, D., & Paffhausen, A. L. (2019). Small Firm death in developing countries. The Review of Economics and Statistics, 101(4), 645–657. https://doi.org/10.1162/rest_a_00798

Meressa, H. A. (2020). Growth of micro and small scale enterprises and its driving factors: Empirical evidence from entrepreneurs in emerging region of Ethiopia. Journal of Innovation and Entrepreneurship, 9(1), 11. https://doi.org/10.1186/s13731-020-00121-9

Merotto, D., Weber, M., & Aterido, R. (2018). Pathways to better jobs in IDA countries. World Bank. 10.1596/30594.

Nyström, K., & Elvung, G. Z. (2014). New firms and labor market entrants: Is there a wage penalty for employment in new firms? Small Business Economics, 43(2), 399–410.

OECD. (2020). SME and entrepreneurship policy in Brazil 2020. OECD. https://doi.org/10.1787/cc5feb81-en

OECD. (2021). Understanding Firm Growth: Helping SMEs Scale Up. Organisation for Economic Co-operation and Development. Retrieved from https://www.oecd-ilibrary.org/industry-and-services/understanding-firm-growth_fc60b04c-en

Oi, W. Y., & Idson, T. L. (1999). Chapter 33 Firm size and wages. In Handbook of Labor Economics (Vol. 3, pp. 2165–2214). Elsevier. https://doi.org/10.1016/S1573-4463(99)30019-5

Olea, J. L. M., & Pflueger, C. (2013). A robust test for weak instruments. Journal of Business & Economic Statistics, 31(3), 358–369. https://doi.org/10.1080/00401706.2013.806694

Osterman, P. (2013). Introduction to the Special Issue on Job Quality: What Does it Mean and How Might We Think about It? ILR Review, 66(4), 739–752. https://doi.org/10.1177/001979391306600401

Pinheiro, F. L., Hartmann, D., Boschma, R., & Hidalgo, C. A. (2021). The time and frequency of unrelated diversification. Research Policy. https://doi.org/10.1016/j.respol.2021.104323

RAIS. (2023). Relatório Anual de Informações Sociais . Ministério do Trabalho e Emprego. Retrieved from https://bi.mte.gov.br/bgcaged/

Rijkers, B., Arouri, H., Freund, C., & Nucifora, A. (2014). Which firms create the most jobs in developing countries? Evidence from Tunisia. Labour Economics, 31, 84–102. https://doi.org/10.1016/j.labeco.2014.10.003

Santarelli, E., & Vivarelli, M. (2007). Entrepreneurship and the process of firms’ entry, survival and growth. Industrial and Corporate Change, 16(3), 455–488. https://doi.org/10.1093/icc/dtm010

Saviotti, P. P., & Pyka, A. (2004). Economic development by the creation of new sectors. Journal of Evolutionary Economics, 14(1), 1–35. https://doi.org/10.1007/s00191-003-0179-3

Saviotti, P. P., Pyka, A., & Jun, B. (2020). Diversification, structural change, and economic development. Journal of Evolutionary Economics, 30(5), 1301–1335. https://doi.org/10.1007/s00191-020-00672-w

Schaffer, M. (2020). xtivreg2: Stata module to perform extended IV/2SLS, GMM and AC/HAC, LIML and k-class regression for panel data models [Computer software]. Publisher: Boston College Department of Economics. Retrieved from https://ideas.repec.org/c/boc/bocode/s456501.html

SEBRAE. (2013). Anuário de Trabalho na Micro e Pequena Empresa (pp. 160–178). Retrieved from https://sebrae.com.br/Sebrae/Portal%20Sebrae/Anexos/Anuario%20do%20Trabalho%20Na%20Micro%20e%20Pequena%20Empresa_2013.pdf#page=1.00

Segarra, A., & Callejón, M. (2002). New firms’ survival and market turbulence: New evidence from Spain. Review of Industrial Organization. https://doi.org/10.1023/A:1013309928700

Shiferaw, A. (2009). Survival of private sector manufacturing establishments in Africa: The role of productivity and ownership. World Development, 37(3), 572–584. https://doi.org/10.1016/j.worlddev.2008.08.004

Spletzer, J. R. (2000). The contribution of establishment births and deaths to employment growth. Journal of Business & Economic Statistics, 18(1), 113–126. https://doi.org/10.1080/07350015.2000.10524852

Tchamyou, V. S. (2017). The role of knowledge economy in African business. Journal of the Knowledge Economy, 8(4), 1189–1228. https://doi.org/10.1007/s13132-016-0417-1

Teal, F. (2011). Higher education and economic development in Africa: A review of channels and interactions†. Journal of African Economies, 20(suppl_3), iii50–iii79. https://doi.org/10.1093/jae/ejr019

Tybout, J. R. (2000). Manufacturing firms in developing countries: How well do they do, and why? Journal of Economic Literature, 38(1), 11–44. https://doi.org/10.1257/jel.38.1.11

van Praag, C. M., & Versloot, P. H. (2007). What is the value of entrepreneurship? A review of recent research. Small Business Economics, 29(4), 351–382. https://doi.org/10.1007/s11187-007-9074-x

Veloso, F., Matos, S., & Peruchetti, P. (2019). Indicadores Regionais de Produtividade no Brasil. FGV IBRE. Retrieved from https://ibre.fgv.br/sites/ibre.fgv.br/files/arquivos/u65/nota_de_construcao_dos_indicadores_regionais_-_anual.pdf

Vogelsang, T. J. (2012). Heteroskedasticity, autocorrelation, and spatial correlation robust inference in linear panel models with fixed-effects. Journal of Econometrics, 166(2), 303–319. https://doi.org/10.1016/j.jeconom.2011.10.001

World Bank. (2023). Innovation & Entrepreneurship [Text/HTML]. World Bank. Retrieved from https://www.worldbank.org/en/topic/innovation-entrepreneurship

Zhu, S., & Li, R. (2017). Economic complexity, human capital and economic growth: Empirical research based on cross-country panel data. Applied Economics, 49(38), 3815–3828. https://doi.org/10.1080/00036846.2016.1270413

Funding

This work was supported by National Council for Scientific and Technological Development (CNPQ) n°311036/2022-8, and Federal University of Ouro Preto (UFOP) n° 23109.014957/2022-44. This study is also funded by CAPES n° 001 and Federal University of Ouro Preto—master’s degree scholarship.

Author information

Authors and Affiliations

Contributions

AB: writing—original draft, writing—review and editing, visualization, conceptualization, methodology, results. BHC: data curation, software. DH: data curation, writing—review, resources. DF: writing—original draft, writing—review and editing, methodology, results, supervision. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

Authors declare that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bueno, A., Cardoso, B.H.F., Hartmann, D. et al. Does small firm dynamics matter for occupation diversity and job quality? Evidence from Brazil. J Innov Entrep 13, 44 (2024). https://doi.org/10.1186/s13731-024-00401-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13731-024-00401-8