Abstract

The 2008 global financial crisis and its aftermath have shown the ability to predict bankruptcy to be a vital management skill and that the methodologies used for that purpose should be as close to reality as possible. This study aims to develop a multiple criteria system to predict bankruptcy in small- and medium-sized enterprises (SMEs). It combines cognitive mapping with the measuring attractiveness by a categorical based evaluation technique (MACBETH), resulting in a more complete and transparent process for evaluating SMEs and their risk of bankruptcy. What differentiates this framework is the fact that it is based on information obtained directly from managers and bank analysts who deal with this type of adversity on a daily basis. The results highlight the importance of financial and strategic aspects, among others, and demonstrate how cognitive mapping can improve the understanding of the decision situation at hand, while MACBETH facilitates the calculation of trade-offs among evaluation criteria.

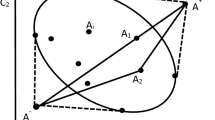

Source: Ensslin et al (2000, adap.)

Source: Eden (2004: 676)

Similar content being viewed by others

References

Altman E (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23(4):589–609.

Altman E and Sabato G (2007). Modeling credit risk for SMEs: Evidence from the US market. Abacus 43(2):332–357.

Andrés J, Lorca P, de Cos Juez J and Sánchez-Lasheras F (2011). Bankruptcy forecasting: A hybrid approach using fuzzy c-means clustering and multivariate adaptive regression splines (MARS). Expert Systems with Applications, 38(3):1866–1875.

Bălan M (2012). Stochastic methods for prediction of the bankruptcy risk of SMEs. Procedia Economics and Finance 3:125–131.

Bana e Costa C and Chagas M (2004). A career choice problem: An example of how to use MACBETH to build a quantitative value model based on qualitative value judgments. European Journal of Operational Research 153(2):323–331.

Bana e Costa C and Vansnick J (1994). MACBETH: An interactive path towards the construction of cardinal value functions. International Transactions in Operational Research 1(4):489–500.

Bana e Costa C, Corte J and Vansnick J (2012). MACBETH. International Journal of Information Technology & Decision Making 11(2):359–387.

Bana e Costa C, De Corte J and Vansnick J (2005). On the mathematical foundations of MACBETH. In: Figueira J, Greco S and Ehrgott M (eds). Multiple Criteria Decision Analysis: The State of the Art Surveys. Springer: New York, pp 409–442.

Bana e Costa C, De Corte J and Vansnick J (2016). On the mathematical foundations of MACBETH. In: Greco S, Matthias E and Figueira J (eds.). Multiple Criteria Decision Analysis: State of the Art Surveys. Springer: New York, pp 421–463.

Bana e Costa C, Lourenço J, Chagas M and Bana e Costa J (2008). Development of reusable bid evaluation models for the Portuguese electric transmission company. Decision Analysis 5(1):22–42.

Bana e Costa C, Silva F and Vansnick J (2001). Conflict dissolution in the public sector: A case-study. European Journal of Operational Research 130(2):388–401.

Beaver W (1966). Financial ratios as predictors of failure. Journal of Accounting Research 4(3):71–111.

Bell S and Morse S (2013). Groups and facilitators within problem structuring processes. Journal of the Operational Research Society 64(7):959–972.

Bellovary J, Giacomino D and Akers M (2007). A review of bankruptcy prediction studies: 1930 to present. Journal of Financial Education 33(Winter):1–42.

Belton V and Stewart T (2002). Multiple Criteria Decision Analysis: An Integrated Approach. Kluwer Academic Publishers: Dordrecht.

Ben-Ari M and Yeshno T (2006). Conceptual models of software artifacts. Interacting with Computers 18(6):1336–1350.

Canas S, Ferreira F and Meidutė-Kavaliauskienė I (2015). Setting rents in residential real estate: A methodological proposal using multiple criteria decision analysis. International Journal of Strategic Property Management 19(4):368–380.

Ciampi F and Gordini N (2013). Small enterprise default prediction modeling through artificial neural networks: An empirical analysis of Italian small enterprises. Journal of Small Business Management 51(1):23–45.

Doignon J (1984). Matching relations and the dimensional structure of social choices. Mathematical Social Sciences 7(3):211–229.

du Jardin P (2015). Bankruptcy prediction using terminal failure processes. European Journal of Operational Research 242(1):286–303.

Eden C (2004). Analyzing cognitive maps to help structure issues or problems, European Journal of Operational Research 159(3):673–686.

Eden C and Ackermann F (2001a). SODA—The principles. In: Rosenhead J and Mingers J (eds). Rational Analysis for a Problematic World Revisited: Problem Structuring Methods for Complexity, Uncertainty and Conflict. Wiley: Chichester, pp 21–41.

Eden C and Ackermann F (2001b). Group decision and negotiation in strategy making. Group Decision and Negotiation 10(2):119–140.

Ensslin L, Dutra A and Ensslin S (2000). MCDA: A constructivist approach to the management of human resources at a governmental agency. International Transactions in Operational Research 7(1):79–100.

Ferreira F and Santos S (2016). Comparing trade-off adjustments in credit risk analysis of mortgage loans using AHP, Delphi and MACBETH. International Journal of Strategic Property Management 20(1):44–63.

Ferreira F, Jalali M, Meidutė-Kavaliauskienė I and Viana B (2015). A metacognitive decision making based-framework for bank customer loyalty measurement and management. Technological and Economic Development of Economy 21(2), 280–300.

Ferreira F, Santos S and Rodrigues P (2011). Adding value to branch performance evaluation using cognitive maps and MCDA: A case study. Journal of the Operational Research Society 62(7):1320–1333.

Ferreira F, Santos S, Marques C and Ferreira J (2014a). Assessing credit risk of mortgage lending using MACBETH: A methodological framework. Management Decision 52(2):182–206.

Ferreira F, Santos S, Rodrigues P and Spahr R (2014b). Evaluating retail banking service quality and convenience with MCDA techniques: A case study at the bank branch level. Journal of Business Economics and Management 15(1):1–21.

Ferreira F, Santos S, Rodrigues P and Spahr R (2014c). How to create indices for bank branch financial performance measurement using MCDA techniques: An illustrative example. Journal of Business Economics and Management 15(4):708–728.

Ferreira F, Spahr R and Sunderman M (2016). Using multiple criteria decision analysis (MCDA) to assist in estimating residential housing value. International Journal of Strategic Property Management 20(4):354–370.

Ferreira F, Spahr R, Gavancha I and Çipi A (2013). Readjusting trade-offs among criteria in internal ratings of credit-scoring: An empirical essay of risk analysis in mortgage loans. Journal of Business Economics and Management 14(4):715–740.

Fiedler F (1967). A Theory of Leadership Effectiveness. New York: McGraw-Hill.

Filipe M, Ferreira F and Santos S (2015). A multiple criteria information system for pedagogical evaluation and professional development of teachers. Journal of the Operational Research Society 66(11):1769–1782.

Frydman H, Altman E and Kao D (1985). Introducing recursive partitioning for financial classification: The case of financial distress. The Journal of Finance 40(1):269–291.

Gonçalves T, Ferreira F, Jalali M and Meidutė-Kavaliauskienė I (2016). An idiosyncratic decision support system for credit risk analysis of small and medium-sized enterprises. Technological and Economic Development of Economy 22(4):598–616.

Gordini N (2014). A genetic algorithm approach for SMEs bankruptcy prediction: Empirical evidence from Italy. Expert Systems with Aplications 41(14):6433–6445.

Gumparthi S, Manickavasagam V and Ramesh M (2010). Credit scoring model for auto ancillary sector. International Journal of Innovation, Management and Technology 1(4):362–373.

Han C, Kang H, Kim G and Yi J (2012). Logit regression based bankruptcy prediction of Korean firms. Asia-Pacific Journal of Risk and Insurance 7(1):1–30.

Howick S and Ackermann F (2011). Mixing OR methods in practice: Past, present and future directions. European Journal of Operational Research 215(3):503–511.

Hu Y and Chen C (2011). A PROMETHEE-based classification method using concordance and discordance relations and its application to bankruptcy prediction. Information Sciences 181(22):4959–4968.

Iturriaga F and Sanz I (2015). Bankruptcy visualization and prediction using neural networks: A study of US commercial banks. Expert Systems with Applications, 42(6):2857–2869.

Jalali M, Ferreira F, Ferreira J and Meidutė-Kavaliauskienė I (2016). Integrating metacognitive and psychometric decision making approaches for bank customer loyalty measurement. International Journal of Information Technology and Decision Making 15(4):815–837.

Junior H (2008). Multicriteria approach to data envelopment analysis. Pesquisa Operacional 28(2):231–242.

Keeney R (1992). Value-Focused Thinking: A Path to Creative Decisionmaking. University Press Harvard: Harvard.

Lopez J and Saidenberg M (2000). Evaluating credit risk models. Journal of Banking and Finance 24(1):151–165.

Martins V, Filipe M, Ferreira F, Jalali M and António N (2015). For sale… but for how long? A methodological proposal for estimating time-on-the-market. International Journal of Strategic Property Management 19(4):309–324.

Mingers J and Rosenhead J (2004). Problem structuring methods in action. European Journal of Operational Research 152(3):530–554.

Morrison A, Breen J and Ali S (2003). Small business growth: Intention, ability, and opportunity. Journal of Small Business Management 41(4):417–425.

Ohlson J (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 18(1):109–131.

Porcaro D (2010). Applying constructivism in instructivist learning cultures. Multicultural Education & Technology Journal 5(1):39–54.

Ronald W, Rumelhart E and Hinton E (1986). Learning internal representations by error propagation. In: Rumelhart E and McClelland J (eds). “Parallel Distributed Processing: Explorations in the Microstructure of Cognition” (Vol. 1), Cambridge: MIT Press/Bradford Books.

Roy B (1985). Méthodologie Multicritére d’Aide à la Décision, Paris: Economica.

Santos S, Belton V and Howick S (2002). Adding value to performance measurement by using systems dynamics and multicriteria analysis. International Journal of Operations & Production Management 22(11):1246–1272.

Santos S, Belton V and Howick S (2008). Enhanced performance measuring using OR: A case study. Journal of the Operational Research Society 59(6):762–775.

Shin K, Lee T and Kim H (2005). An application of support vector machines in bankruptcy prediction model. Expert Systems with Applications 28(1):127–135.

Smith P and Goddard M (2002). Performance management and operational research: A marriage made in heaven? Journal of the Operational Research Society 53(3):247–255.

Tegarden D and Sheetz S (2003). Group cognitive mapping: A methodology and system for capturing and evaluating managerial and organizational cognition. Omega: The International Journal of Management Sciences 31(2):113–125.

Watson J and Everett J (1998). Small business failure and external risk factors. Small Business Economics 11(4):371–390.

Zavadskas E and Turskis Z (2011). Multiple criteria decision making (MCDM) methods in economics: An overview. Technological and Economic Development of Economy 17(2):397–427.

Zmijewski M (1984). Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research 22(Suppl.):59–82.

Zopounidis C and Dimitras A (1998). Multicriteria Decision Aid Methods for the Prediction of Business Failure. Dordrecht: Kluwer Academic Publishers.

Zopounidis C and Doumpos M (2002). Multicriteria classification and sorting methods: A literature review. European Journal of Operational Research 138(2):229–248.

Zopounidis C, Galariotis E, Doumpos M, Sarri S and Andriosopoulos K (2015). Multiple criteria decision aiding for finance: An updated bibliographic survey. European Journal of Operational Research 241(2):339–348.

Acknowledgements

Records of the expert panel meetings, including pictures, software outputs and non-confidential information of the study, can be obtained from the corresponding author upon request. The authors gratefully acknowledge the outstanding collaboration of the panel members: Filipe Nunes, João Nunes, João Oliveira, José Damião, Paula Cabrera and Rui Pedro Oliveira. Institutional and facility support from the ISCTE Business School, University Institute of Lisbon, Portugal, is also recognized.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Oliveira, M.D.N.T., Ferreira, F.A.F., Pérez-Bustamante Ilander, G.O. et al. Integrating cognitive mapping and MCDA for bankruptcy prediction in small- and medium-sized enterprises. J Oper Res Soc 68, 985–997 (2017). https://doi.org/10.1057/s41274-016-0166-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41274-016-0166-3