Abstract

Selection of the appropriate firms [industries] for investment or resource allocation has implications for high returns, productivity and overall economic growth. However, numerous evaluation criteria, especially financial performance criteria, that must be examined before reaching this decision sometimes present challenges for decision-makers. This research proposes a framework for firm-level performance evaluations based on two multi-criteria decision-making (MCDM) methods: fuzzy analytical hierarchical process (FAHP) and the technique of order preferences by similarity to ideal solutions (TOPSIS). The proposed framework evaluates the overall performance of individual firms by simultaneously utilizing all available financial performance criteria. Unlike previous research with Fuzzy AHP and TOPSIS methods, the proposed framework does not rely on expert judgements to create a pairwise comparison or to assign criteria weight but relies on the normalized multivariate linear correlation between performance criteria. Using the proposed framework, a sample of Japanese firms was evaluated and ranked based on their overall financial performance. The practical implication is that decision-makers can simultaneously utilize all established financial performance criteria for firm-level performance evaluation without giving priority to any criteria or requiring initial expert judgement to weight performance criteria. Moreover, the proposed framework simplifies the evaluation procedures, making it easy for benchmarking analyses.

source: author)

source: author)

source: author)

Similar content being viewed by others

Data availability

The data used for this research are downloadable from: https://nkbb.nikkei.co.jp/en/service/nikkei-needs/

Code availability

Not applicable.

Change history

01 November 2021

A Correction to this paper has been published: https://doi.org/10.1007/s41685-021-00217-4

Notes

A similar fuzzification process was adopted by Torfi et al. (2010).

A further step might be to check if the weights are appropriately applied using \(\sum_{\mathrm{j}}{\widehat{\stackrel{\sim }{w}}}_{\mathrm{j}}=1\) and the Consistency Ratio,\(\mathrm{CR}\le 0.1.\)

The initial sample size was 24 construction firms. However six construction firms were drop due to data incompleteness.

Available at https://nkbb.nikkei.co.jp/en/service/nikkei-needs/.

It is important to note that there is hardly a consensus definition of profitability and value metrics (in the strict sense) in corporate finance literature. Our definitions are, therefore, presented in agreement with cited sources and, in some cases, in a loose sense.

Only a few and most common metrics are discussed in this preliminary section.

Unlike previous FAHP studies, the pairwise comparison matrix of the performance criteria in this study were the correlation matrices of the performance criteria computed from the pooled data. Noteworthily, the sum of criteria weight was 1 in all cases. However, consistency ratios (CRs) were between -0.15 and -0.20, depending on the criteria grouping (profitability, valued added or overall criteria). The absolute values of these CRs would imply that the CR permissible limit was not violated. The literature on AHP shows that CR depends on the size of the criteria matrix and could range from the traditional value of 0.10 to 0.20. Also, since this study used a novel approach rather than the traditional approach where the pairwise comparison matrix of criteria is computed from expert judgements/opinions, this explains the negative CRs in this study. Either way, the CR permissible limits are not violated.

Table 4 is a 10-year average of the value added criteria for each firm.

Table 7 is a 10-year average of profitability metrics for each firm.

Table 10 is a 10-year average of all performance criteria for each firm.

References

Akkoç S, Vatansever K (2013) Fuzzy performance evaluation with AHP and TOPSIS methods: evidence from turkish banking sector after the global financial crisis. Eurasian J Business Econ 6(11):53–74

Aldalou E, Perçin S (2018) Financial performance evaluation of Turkish airline companies using integrated fuzzy ahp fuzzy topsis model*. Int J Econ Adm Stud 18:582–598. https://doi.org/10.18092/ulikidince.347925

Asmild M, Paradi JC, Reese DN, Tam F (2007) Measuring overall efficiency and effectiveness using DEA. Eur J Oper Res 178(1):305–321. https://doi.org/10.1016/j.ejor.2006.01.014

Athanassakos G (2007) Value-based management, EVA and stock price performance in Canada. Manag Decis 45(9):1397–1411. https://doi.org/10.1108/00251740710828663

Awasthi A, Chauhan SS, Goyal SK (2010) A fuzzy multicriteria approach for evaluating environmental performance of suppliers. Int J Prod Econ 126(2):370–378. https://doi.org/10.1016/j.ijpe.2010.04.029

Aydogan EK (2011) Performance measurement model for Turkish aviation firms using the rough-AHP and TOPSIS methods under fuzzy environment. Expert Syst Appl 38(4):3992–3998. https://doi.org/10.1016/j.eswa.2010.09.060

Buckley JJ (1985) Fuzzy hierarchical analysis. Fuzzy Sets Syst 17(3):233–247. https://doi.org/10.1016/0165-0114(85)90090-9

Carton RB, Hofer CW (2010) Organizational financial performance: identifying and testing multiple dimensions. Acad Entrepreneurship J 16(1):1–22

Chen SY, Lu CC (2015) Assessing the competitiveness of insurance corporations using fuzzy correlation analysis and improved fuzzy modified TOPSIS. Expert Syst 32(3):392–404. https://doi.org/10.1111/exsy.12099

Cho HJ, Pucik V (2005) Relationship between innovativeness, quality, growth, profitability, and market value. Strateg Manag J 26(6):555–575. https://doi.org/10.1002/smj.461

de Wet JH, Hall JH (2004) The relationship between EVA MVA and Leverage. Meditari Accountancy Res 12(1):39–59. https://doi.org/10.1108/10222529200400003

Ertuǧrul I, Karakaşoǧlu N (2009) Performance evaluation of Turkish cement firms with fuzzy analytic hierarchy process and TOPSIS methods. Expert Syst Appl 36(1):702–715. https://doi.org/10.1016/j.eswa.2007.10.014

Eyüboğlu K, Celik P (2016) Financial performance evaluation of turkish energy companies with fuzzy AHP and fuzzy TOPSIS Methods. Business Econ Res J 7(3):21–21. https://doi.org/10.20409/berj.2016321806

Ganea M (2015) Determinant factors of the economic value added in the case of Romanian companies listed on the Bucharest Stock Exchange. Audit Financiar, XII I(1):100–107

Ghazanfari M, Rouhani S, Jafari M (2014) A fuzzy TOPSIS model to evaluate the business intelligence competencies of port community systems. Polish Maritime Res 21(2):86–96. https://doi.org/10.2478/pomr-2014-0023

Ghosh I, Biswas S (2017) A novel framework of ERP implementation in Indian SMEs: Kernel principal component analysis and intuitionistic Fuzzy TOPSIS driven approach. Accounting 3(2):107–118. https://doi.org/10.5267/j.ac.2016.7.004

Ioan Ban A, Iuliana Ban O, Bogdan V, Sabau Popa DC, Tuse D (2020) Performance evaluation model of romanian manufacturing listed companies by fuzzy ahp and topsis. Technol Econ Dev Econ 26(4):808–836. https://doi.org/10.3846/tede.2020.12367

Jovčić S, Pruša P, Dobrodolac M, Švadlenka L (2019) A proposal for a decision-making tool in third-party logistics (3PL) provider selection based on multi-criteria analysis and the fuzzy approach. Sustainability (Switzerland), 11(15). https://doi.org/10.3390/su11154236

Kabir G, Hasin MAA (2012) Framework for benchmarking online retailing performance using fuzzy AHP and TOPSIS method. Int J Ind Eng Comput 3(4):561–576. https://doi.org/10.5267/j.ijiec.2012.03.003

Kahraman C, Cebeci U, Ruan D (2004) Multi-attribute comparison of catering service companies using fuzzy AHP: the case of Turkey. Int J Prod Econ 87(2):171–184. https://doi.org/10.1016/S0925-5273(03)00099-9

Knauer T, Silge L, Sommer F (2018) The shareholder value effects of using value-based performance measures: Evidence from acquisitions and divestments. Manag Account Res 41(February):43–61. https://doi.org/10.1016/j.mar.2018.02.001

Ksenija M, Boris D, Snežana K, Sladjana B (2017) Analysis of the efficiency of insurance companies in Serbia using the fuzzy AHP and TOPSIS methods. Econ Res-Ekonomska Istrazivanja 30(1):550–565. https://doi.org/10.1080/1331677X.2017.1305786

Mandic K, Delibasic B, Knezevic S, Benkovic S (2014) Analysis of the financial parameters of Serbian banks through the application of the fuzzy AHP and TOPSIS methods. Econ Model 43:30–37. https://doi.org/10.1016/j.econmod.2014.07.036

Mcnamara C, Mong S (2005) Performance management and management: some insights from practice. Aust Account Rev 15(1):14–28

Metaxas IN, Koulouriotis DE, Spartalis SH (2016) A multicriteria model on calculating the Sustainable Business Excellence Index of a firm with fuzzy AHP and TOPSIS. Benchmarking 23(6):1522–1557. https://doi.org/10.1108/BIJ-07-2015-0072

Myšková R, Hájek P (2017) Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. J Int Stud 10(4):96–108. https://doi.org/10.14254/2071-8330.2017/10-4/7

O’Byrne SF (1996) Eva and market value. J Appl Corp Financ 9(1):116–126. https://doi.org/10.1111/j.1745-6622.1996.tb00109.x

Petravičius T, Tamošiuniene R (2008) Corporate performance and the measures of value added. Transport 23(3):194–201. https://doi.org/10.3846/1648-4142.2008.23.194-201

Peterson PI, Peterson DR, Conroy RM, Wanis RS, Park YS, Dorsey RE, Edmister R, Johnson JD (1996) Company performance and measures of value added. In: Company performance and measures of value added. The Institute of Chartered Financial Analysts. https://doi.org/10.2470/rf.v1996.n2.4456

Rezaie K, Ramiyani SS, Nazari-Shirkouhi S, Badizadeh A (2014) Evaluating performance of Iranian cement firms using an integrated fuzzy AHP-VIKOR method. Appl Math Model 38(21–22):5033–5046. https://doi.org/10.1016/j.apm.2014.04.003

Richard PJ, Devinney TM, Yip GS, Johnson G (2009) Measuring organizational performance: towards methodological best practice. J Manag 35(3):718–804. https://doi.org/10.1177/0149206308330560

Seçme NY, Bayrakdaroǧlu A, Kahraman C (2009) Fuzzy performance evaluation in Turkish Banking Sector using Analytic Hierarchy Process and TOPSIS. Expert Syst Appl 36(9):11699–11709. https://doi.org/10.1016/j.eswa.2009.03.013

Shafii M, Hosseini SM, Arab M, Asgharizadeh E, Farzianpour F (2016) Performance analysis of hospital managers using fuzzy AHP and fuzzy TOPSIS: Iranian experience. Global J Health Sci 8(2):137–155. https://doi.org/10.5539/gjhs.v8n2p137

Sharma AK, Kumar S (2010) Economic value added (EVA)—literature review and relevant issues. Int J Econ Financ. https://doi.org/10.5539/ijef.v2n2p200

Shaverdi M, Ramezani I, Tahmasebi R, Rostamy AAA (2016) Combining fuzzy AHP and fuzzy TOPSIS with financial ratios to design a novel performance evaluation model. Int J Fuzzy Syst 18(2):248–262. https://doi.org/10.1007/s40815-016-0142-8

Shayan, M. (2013). Exploring the relationship between financial ratios and created shareholders value: A life cycle perspective. European Online Journal of Natural and Social Sciences, 2(3), 195–206. www.european-science.com

Singh H, Kumar R (2013) Hybrid methodology for measuring the utilization of advanced manufacturing technologies using AHP and TOPSIS. Benchmarking 20(2):169–185. https://doi.org/10.1108/14635771311307669

Sun CC (2010) A performance evaluation model by integrating fuzzy AHP and fuzzy TOPSIS methods. Expert Syst Appl 37(12):7745–7754. https://doi.org/10.1016/j.eswa.2010.04.066

Tansel Y, Yurdakul M (2020) Development of a new trapezoidal fuzzy AHP-TOPSIS hybrid approach for manufacturing firm performance measurement. Granular Computing 0123456789(2002). https://doi.org/10.1007/s41066-020-00238-y

Torfi F, Farahani RZ, Rezapour S (2010) Fuzzy AHP to determine the relative weights of evaluation criteria and Fuzzy TOPSIS to rank the alternatives. Appl Soft Comput J 10(2):520–528. https://doi.org/10.1016/j.asoc.2009.08.021

Uyemura DG, Kantor CC, Pettit JM (1996) EVAR for banks: value creation, risk management, and profitability measurement. J Appl Corp Financ. https://doi.org/10.1111/j.1745-6622.1996.tb00118.x

Valcic SB, Bagaric L (2015) Value creation and value capture in the hotel industry. Tourism in Southern and Eastern Europe 3: 35–48. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2637244

Valčić SB, Bagarić L (2017) Return on strategic effectiveness—the need for synchronising growth and development strategies in the hotel industry using revenue management. Econ Res-Ekonomska Istrazivanja 30(1):1631–1654. https://doi.org/10.1080/1331677X.2017.1383173

Varaiya N, Kerin RA, Weeks D (1987) The relationship between growth, profitability, and firm value. Strateg Manag J 8(5):487–497. https://doi.org/10.1002/smj.4250080507

Venanzi, D. (2012). Financial performance measures and value creation: a review. SSRN Electronic Journal, 1–36. https://doi.org/10.2139/ssrn.1716209

Viswanadham N, Luthra P (2005) Models for measuring and predicting shareholder value: a study of third party software service providers. Sadhana—Acad Proc Eng Sci 30(2–3):475–498. https://doi.org/10.1007/BF02706257

Wang YJ (2008) Applying FMCDM to evaluate the financial performance of domestic airlines in Taiwan. Expert Syst Appl 34(3):1837–1845. https://doi.org/10.1016/j.eswa.2007.02.029

Wu HY, Tzeng GH, Chen YH (2009) A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard. Expert Syst Appl 36(6):10135–10147. https://doi.org/10.1016/j.eswa.2009.01.005

Xin’e Z, Ting W, Yuan Z (2012) Economic value added for performance evaluation: a financial engineering. Systems Engineering Procedia. https://doi.org/10.1016/j.sepro.2012.04.059

Yang CC, Chen BS (2004) Key quality performance evaluation using fuzzy AHP. J Chin Institute Industrial Eng 21(6):543–550. https://doi.org/10.1080/10170660409509433

Zadeh L (1965) Fuzzy set. Inf Control 8:338–353. https://doi.org/10.1016/S0019-9958(65)90241-X

Zolfani SH, Sedaghat M, Zavadskas EK (2012) Performance evaluation of rural ICT centres (telecenters), applying fuzzy AHP, SAW-G and TOPSIS Grey, a case study in Iran. Technol Econ Dev Econ 18(2):364–387. https://doi.org/10.3846/20294913.2012.685110

Funding

This research was supported by Productivity Research Grant of Japan Productivity Centre (JPC). Grant No. 2019PRG.

Author information

Authors and Affiliations

Contributions

This research was entirely designed and implemented by Joseph Junior ADUBA.

Corresponding author

Ethics declarations

Conflict of interest

This is to declare that I have no relevant material or financial interests that relate to the research described in this paper.

Research involving human participants and/or animals

Not applicable.

Informed consent

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised due to the equation 1 and the equation of "Total Factor Productivity" was published incorrectly and corrected in this version.

Appendices

Appendix A

Arithmetic properties of triangular fuzzy numbers

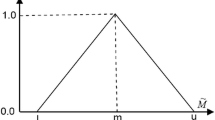

Two triangular fuzzy numbers \(\tilde{A }({\mathrm{a}}_{1},{\mathrm{a}}_{2},{\mathrm{a}}_{3})\) and \(\tilde{B }({\mathrm{b}}_{1},{b}_{2},{\mathrm{b}}_{3})\) represented in Fig. 6 have the following properties:

-

1.

Addition of two TFNs

$$\tilde{A }\oplus \tilde{B }=\left({\mathrm{a}}_{1}+{b}_{1},{\mathrm{a}}_{2}+{\mathrm{b}}_{2},{\mathrm{a}}_{3}+{\mathrm{b}}_{3}\right), {\mathrm{a}}_{1}\ge 0, {\mathrm{b}}_{1}\ge 0.$$ -

2.

Multiplication of two TFNs

$$\tilde{A }\otimes \tilde{B }=\left({\mathrm{a}}_{1}\times {b}_{1},{\mathrm{a}}_{2}\times {\mathrm{b}}_{2},{\mathrm{a}}_{3}\times {\mathrm{b}}_{3}\right), {\mathrm{a}}_{1}\ge 0, {\mathrm{b}}_{1}\ge 0.$$ -

3.

Subtraction of two TFNs

$$\tilde{A }\ominus \tilde{B }=\left({\mathrm{a}}_{1}-{b}_{1},{\mathrm{a}}_{2}-{\mathrm{b}}_{2},{\mathrm{a}}_{3}-{\mathrm{b}}_{3}\right), {\mathrm{a}}_{1}\ge 0, {\mathrm{b}}_{1}\ge 0.$$ -

4.

Division of two TFNs

$$\tilde{A }\oslash \tilde{B }=\left({\mathrm{a}}_{1}/{b}_{1},{\mathrm{a}}_{2}/{\mathrm{b}}_{2},{\mathrm{a}}_{3}/{\mathrm{b}}_{3}\right), {\mathrm{a}}_{1}\ge 0, {\mathrm{b}}_{1}\ge 0.$$ -

5.

Inverse and symmetry of a TFN

$${\tilde{A }}^{-1}=\left(1/{\mathrm{a}}_{1},1/{\mathrm{a}}_{2},1/{\mathrm{a}}_{3}\right), {\mathrm{a}}_{1}\ge 0$$$$-\tilde{A }=\left({-\mathrm{a}}_{1.}-{a}_{2},-{\mathrm{a}}_{3}\right).$$ -

6.

Distance between two TFNs

$$d\left(\tilde{A },\tilde{B }\right)=\sqrt{\frac{1}{3}\left[{({\mathrm{a}}_{1}-{b}_{1})}^{2}+{({\mathrm{a}}_{2}-{b}_{2})}^{2}+{({\mathrm{a}}_{3}-{b}_{3})}^{2}\right].}$$

About this article

Cite this article

Aduba, J.J. Framework for firm-level performance evaluations using multivariate linear correlation with MCDM methods: application to Japanese firms. Asia-Pac J Reg Sci 6, 1–44 (2022). https://doi.org/10.1007/s41685-021-00213-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-021-00213-8