Abstract

Our study pores on evaluating the impact of firm specific and macro level determinants of energy intensity of Indian firms belonging to manufacturing and power sector. We collect a panel dataset of 3316 firms for 10 years ranging from 2010 to 2020. We employ the advanced biased corrected method of moments estimator and the quantile regression estimator for panel data models for our empirical analysis. We find that poor labor efficiency is largely responsible for increasing energy intensity of the sample firms. Energy intensity can be optimized by investing in better plant and machinery. Moreover, machineries that require frequent repairs and maintenance need to be replaced with latest tools. While larger firms are found to be energy intensive, profitable firms are found to be in a better position to enhance their energy efficiency. Under macroeconomic scenario, GDP growth and trade openness lead to boosting up the energy consumption at the firm level whereas, the global energy prices act as a constraint and necessitate careful use of energy. Based on our findings we provide certain policy recommendations and suggestions in order to limit energy intensity and enhance energy efficiency of the Indian manufacturing firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Energy is crucial for the development of human civilization and is universally recognized as the basic necessity for the expansion and growth of economies and societies. However, the industrial operations based on fossil fuels have led to adverse environmental impacts across the globe [1]. In this regard, the United Nation’s SDG Report [2] underlines, “promoting renewable energy deployment and enhancing energy efficiency will be the key strategies to reduce greenhouse gas emissions”. Nevertheless, meeting the current energy demands entirely through renewable energy sources is a challenging chore for countries that undertake growth-oriented strategies and massive industrialization. Several authors expect fossil fuels will continue to dominate in the field of global energy requirements in the imminent period [1, 3].

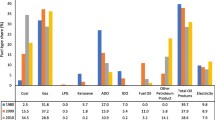

On the path of rapid economic advancement, a high dependence on fossil fuels is observed in case of India. Reportedly, the country primarily meets its energy demands through coal and crude oil, which account for 56.13% and 33.40% respectively [4]. India also stands among the top four greenhouse gas emitters in the world [5]. The figures are in contrast with the country’s commitment of reducing carbon emissions up to 45% by the year 2030.Footnote 1 Moreover, India has also joined the net zero campaign at the COP26 summit and aims to achieve the same by 2070Footnote 2 in line with the Paris agreement 2015.

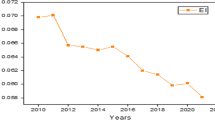

Such contrasting scenarios motivate us to look out for all possible ways to curb emissions by focusing upon current energy utilizations. The objective of the present study is to assess the determinants of energy consumption of manufacturing firms in India and discover possible ways to reduce the energy intensity (henceforth, EI). It is highly essential to gain energy efficiency by optimizing EI for ensuring environmental sustainability [6]. EI can be defined as the amount of energy consumed for producing a given unit of output [7]. EI is reciprocal to energy efficiency, i.e., lesser energy consumed to produce a unit of output indicates better energy efficiency and vice-versa [1].

The industrial sector in India is the largest consumer of energy as it accounts for 50.59% of the country’s total energy usage [4]. Thus, the industrial sector, especially, the manufacturing sector becomes a potential examinee for our research. We believe certain factors such as efficiency of labor, plant and machineries, size of operations, and profitability are directly responsible in determining the level of EI in a manufacturing firm. Furthermore, a firm’s operations and energy requirements can also be impacted by the economic growth of the country it belongs to. Likewise, the international trade practices as well as global energy prices can also influence the EI levels of firms. Specifically, we posit the following research questions (RQs), which we intend to answer in the current study.

-

RQ1: How do firm specific variables impact the EI of Indian manufacturing firms?

-

RQ2: How do the macro-economic variables impact the EI of Indian manufacturing firms?

By answering to the above RQs, the current study can contribute to the extant literature on energy in manifold dimensions. First, departing from past literature, we integrate both firm specific and macro-economic variables in a single study to evaluate their significance over firm level EI. We believe the findings of our analysis will highlight the significant factors to be taken care of for controlling EI and take appropriate decision at managerial and administrative levels by the Indian manufacturing sector. We have collected data of a large number of manufacturing units from varied sectors, which will help in diagnosing the energy use practices of the entire manufacturing industry in Indian context. Additionally, we also encompass some conventional electricity generating firms in the study because of their high amount of fossil fuel consumption.

Second, our study is based on a rapid advancing economy—India, which requires a sustainable energy policy in order to meet energy demands without posing any threat to the environment [8]. Third, the study covers the post-amendment period of the Energy Conservation Act, 2001 (or the EC Act, 2001). The amendment has brought in certain stricter provisions on energy use practices for the energy intensive firms. Thus, we can also find out the effectiveness of the policies implemented.

Additionally, we also contribute to the literature in terms of econometric methodology as we employ the advanced biased corrected method of moments estimators model [9] for the empirical analysis along with the quantile regression for panel data model [10]. While the former works in a linear framework the latter is employed in a non-linear framework. Therefore, we also perceive that the outcome of this study will be an aid in policy inputs towards rising environmental concerns and climate change.

The rest of the paper is divided into following sections. The extended first section provides a brief idea about the EC Act, 2001 and the recent amendments. The succeeding section gives an apprehension of the past literature related to EI followed by a theoretical framework section. The data and methodology section explains about data collection and model specification for empirical analysis. We further interpret the results of the analysis under results and discussion section. The final section concludes the paper by highlighting some policy suggestions.

1.1 Legal framework on energy intensity

The concentration over efficient use of energy in Indian industries compounds with the implementation of EC Act, 2001. The EC Act was enacted with the aim of reducing the EI of Indian economy.Footnote 3 Bureau of Energy Efficiency (BEE) was set up under the EC Act as a statutory body to implement the Act.

The EC Act, 2001 was further amended in the year 2010. The EC (Amendment) Act, 2010 included issuing energy saving certificates, identifying designated consumers (DCs) (industry wise), increasing the penalty for offences committed under the Act, prescribing the value of per metric ton of oil equivalent of energy to be consumed by industries etc. are among the major amendments brought into the Act. Following the EC (Amendment) Act, 2010, the BEE launched the Perform, Achieve and Trade (PAT) Scheme in July 2012. PAT is a market-based theme to improve the cost effectiveness and diminish the EI in energy intensive industries, which are identified as DCs. Under the PAT scheme, energy efficiency certificates or ESCerts are issued by the government to the industries meeting the prescribed energy efficiency levels. The ESCerts can also be traded between firms and the DCs who fail to achieve the prescribed efficiency levels can buy those ESCerts from the energy efficient firms. In this way the EC (Amendment) Act, 2010 is encouraging firms in India to cut down their EI.

The EC Act has freshly been amended in the year 2022, which added a ‘carbon credit trading’ scheme similar to the PAT scheme. As per the amendment, upon complying with the emission norms set by the government firms will be issued a ‘carbon credit certificate’ which can be traded. Firms holding the certificate will be allowed to produce CO2 and other greenhouse gases up to a permissible limit. Furthermore, the identified DCs may be asked to meet a specific share of energy needs from non-fossil sources as per the amendment.

2 Review of literature

The global attention is currently shifting towards sustainability. Holistically, sustainable development goals demand reducing EI and improving energy efficiency [6]. Thus, effective utilization of energy, developing energy efficient technologies, generating more output with less energy input and reducing energy wastage are the key to reduce EI.

The extant literature discusses a number of factors which help in reducing the level of EI. At industry level; earnings of the firms, labor, use of raw material and plant and machinery etc. hold a significant impact on EI [7, 11, 12]. The effectiveness of labor productivity, for instance, significantly determines the level of EI. The EI tends to reduce with an increase in labor productivity; but if the labor is unproductive, then the production process will consume more energy thereby increasing the EI. Similarly, if employees will be less productive the management keep substituting labor for capital to increase productivity also with a view to reduce per unit costs. In connection with this rationale, Soni et al. [7] find a positive impact of labor intensity while, Sahu and Narayanan [13] and Jain and Kaur [12] find a negative impact of the labor intensity on EI. Subrahmanya [11] also exhibits a negative correlation between labor productivity and EI. As similar to labor, machine and equipment that require more maintenance may lead to higher intensity in energy [7, 14]. Thus, repairs and maintenance costs of machinery hold a significant impact on EI. Soni et al. [7] also find a direct impact of installation costs of plant and machinery on EI.

In addition to this, costs of raw material, stores and spares also hold a negative relation with EI because investment on better quality raw material results in minimizing efforts on the creation of finished goods and thereby reducing the per unit energy consumption [7]. In contrast to this, earnings of the firm denotes firms’ efficiency, and thus holds a negative association with EI; noting that EI and energy efficiency are reciprocal to each other [7]. In the same way, technological development intensity is found to be inversely associated with EI, because technological innovation amplifies efficiency in energy use and thereby reduces EI [15].

Studies have also found the size of firm as an important determinant of EI. Larger firms can invest more towards technological advancement and thereby can reduce their EI [12, 15]. While enquiring about Indian steel and iron industries [16], prove that profit margin and size of firm negatively influence EI. Interestingly, the authors find insignificant impact of labor intensity and technological import intensity on EI.

Under firm specific variables, Soni et al. [7] finds that software intensity and outsourced intensity are significant drivers of EI. The impact of such factors on EI can however be both positive and negative—depending upon firm structure. The extant literature also explains about the significant association of certain macro level variables on EI. In a study conducted on OPEC countries, Samargandi [6] probes the roles of some macro level factors namely, technological innovation, trade openness, and energy price in determining EI. Yan [17] shows that urbanization in China significantly magnifies EI. Adom and Kwakwa [18] also present a significant and direct impact of urbanization and technological diffusion on EI of manufacturing sector in Ghana. Contrastingly, Sadorsky [19], while enquiring upon 76 developing countries, finds a mixed result of urbanization affecting EI. Using the data from 1980 to 2010, the author also finds statistically negative and positive impact of income and industrialization respectively on EI.

Ma and Stern [20] assert that technological change is a major contributor in declining EI. By employing logarithmic mean divisia index, the author also finds the evidence of structural change causing an increase in EI and show that inter-fuel substitution has marginal contribution to the changes in EI. Voigt et al. [21] also applies logarithmic mean divisia index, along with factor index decomposition approach, to examine trends of EI and its determinants in 40 major economies. The study period commences from 1995 through 2007, and the result reveals that the variation in EI at country level is attributed to technological change whereas structural changes is less important in most countries for determining the level of EI. Focusing on the problem of EI in Nigeria, Adom [22] exhibits significant and negative impacts of FDI, trade openness and crude oil price on EI. The author also finds a significant and positive effect of industry value-added over EI.

Barkhordari and Fattahi [23] use the autoregressive distributed lag approach, and finds a long-run relationship between energy price and EI for the period 1986–2015 in Iranian industry. Vanden et al. [24] also show energy prices as a principal driver of EI in China. The study is carried out using a panel data for 2500 most energy intensive enterprises and reveals that R&D expenditure, ownership reform in enterprises, and changes in industrial structure as prime contributors in declining EI. A similar study by Cornillie and Fankhauser [25] also empirically discloses that energy prices and enterprise restructuring as most significant drivers of EI.

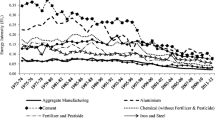

In a study conducted on Chinese manufacturing industries, Li et al. [26] shows a declining trend in EI from 1980 to 2014 by using WSR and VAR models. The author suggests that encouraging technological advancements and improving energy consumption practices can help in further reducing EI in manufacturing sector. Similarly, Oak and Bansal (2017) mentions about cement industries in India, that with the use of energy saving techniques, the EI in these industries is declining. Using data envelopment analysis approach, Wang and He [27] examine the region wise EI trend in China (eastern, central, and western) for the period 2000–2011 and find out that the western region has witnessed a better reduction in EI than other regions.

In another study conducted on China’s Shanxi province for the period 2000–2015, Zhang et al. [28] underline that, by focusing on sector specific EI and industry framework, the overall EI can be controlled in the long run. Lin and Wang [29] also bring out that the factors like sectoral development along with industrial modification and increased managerial efficiency have contributed towards a declining EI. In a further study, Zhang et al. [30] probe the firm-specific factors affecting EI of industries in China. The authors, with the use of decomposition and attribution models, explain that R&D has led to a 49% decline in EI from 2000 to 2017. Espindola et al. [31] observed a correlation between potential energy saving and energy consumption and find a linear association between the variables. The authors also underline that evaluating energy use practices helps in enhancing performances of smaller industries.

While enquiring about the EI of metallic industries in India, Jain and Kaur [12] with the use of MLM and pooled RE panel regression, purport to show labor intensity as the most dominating and R&D as the least affecting determinant in minimizing EI. In another study, Sahu and Narayanan [13] while conducting an enquiry on manufacturing industries in India for the period 2000–2008, note that capital intensity, repair intensity, labor intensity, and R&D positively drive EI whereas, technological import intensity negatively affect EI. The authors show a non-linear relationship between firm size and EI. However, Sahu and Mehta [32], while examining the determinants of EI and CO2 emission intensity for the period 2000–2014, show that medium sized firms are more energy intensive than smaller or larger firms. The authors also support that firms spending on R&D activities are energy efficient. Therefore, manufacturing firms should try to adapt new energy efficient technologies through R&D and import energy saving technology.

Based on the extant literature, we find that most of the studies individually use either firm specific or macro level factors to determine their impact on EI. Therefore, our study stands out as a novel attempt to include both types of factors and evaluates their impacts on EI. In this regards, we believe our study will be a value addition to the existing body of literature on energy in a distinct fashion.

3 Theoretical framework

With an attempt to study the energy use practices of manufacturing firms in India, a list of firm specific as well as macroeconomic variables are considered in the current study, which are provided in Table 1. The selected variables are crucial in the context of a developing country like India. The expected signs of the variables are also highlighted along with to show their theoretical relevance upon EI.

India is a hub of abundantly available man-power [33]. However, the energy use practices in an industry largely depends on the skills of the man-power. An efficient labor force will consume lesser energy whereas, an unskilled labor force may lead to more energy wastage and ineffective use of energy thereby enhancing EI. Thus, the association of LI can be positive [7] or negative [12] depending upon the efficiency of labor.

Plant and machinery in an industry require power and fuel for production processing and in turn, the intensity of power and fuel depend upon the efficiency of plant and machinery. Soni et al. [7] quote that better plant and machinery lead to better energy efficiency. Thus, investment in acquiring efficient and energy saving plant and machinery could cut down the EI and hence, we expect a negative association of PMI with EI.

Plant and machinery also depreciate due to wear and tear. They require repairs and maintenance in order to keep up the workability. Therefore, regular expenditure on repairs and maintenance are expected to help in reducing EI. Nevertheless, Sahu and Mehta [32] state that firms incurring higher expenses on repairs are energy intensive. Thus, the impact of RMPMI on EI can be either positive or negative.

Larger firms generally avail the benefit of economies of scale [34]. In case of larger firms, per unit energy requirements can be minimized with bulk productions and heavy industrial processing. Therefore, firm size is expected to be negatively associated with EI.

Introduction of new software and information technology are expected to bring in innovative, smart and professional ideas in the production process which will further help in optimizing the EI. Thus, we expect the SI to have an inverse relation with EI.

A profitable firm can invest in new and efficient machineries [16] and can also invest in R&D to find innovative ways to reduce EI [34]. Induction of energy saving technologies, increasing the size of production and gaining economies of scale can be possible further with abundance of profit. In this sense, we expect an increase in PATI can reduce EI.

The royalties paid for acquiring copyrights, patents, industrial design, etc. along with technical know-how helps in gaining technological advancement and innovative ideas in the production and distribution process. It can result in technology spill-over to the energy intensive firms and will further lead to optimizing the EI. Thus, TDI is expected to be negatively associated with EI.

While looking at the macroeconomic variables, the GDP growth can be directly attributed to an increase in EI because the manufacturing sector consumes 57% of the total commercial energy in India and contributes 26% to the nation’s GDP [8]. Additionally, being a developing country, India is not in a position to slow down its industrial operations in order to cut down its energy usage. In such a case, we assume GDPGR to positively affect the EI of sample firms.

Changes in the global energy prices can affect the industrial productions and EI at the firm level. As per the Ministry of petroleum and natural gas, Govt. of India, India is the 3rd largest crude oil importer in the world. Accordingly, it is obvious that a hike in the energy prices will significantly impact the energy use practices in India. In case of energy price hikes, it is expected that firms will either cut down the energy usage or use better technology to improve their energy efficiency [22]. Thus, we expect a negative effect of CHGPEI on EI.

Trade openness is the sum of exports and imports of a country proportionate to its GDP. Trade openness increases competition among local firms to sustain the global business competition. In such scenario, firms will be more concerned with boosting up industrial output, which will further demand higher energy use. Therefore, we expect a positive impact of TRADEOPEN on EI.

In essence, in the quest for finding all possible ways to reduce EI, we expect to strike out the crucial determinants that lead to increase or decrease the firm level EI of Indian manufacturing firms. Variables that lead to surging EI, need to be addressed with adequate measures in order to make the firms’ operation sustainable.

4 Data collection and description

We have collected a dataset of 3316 manufacturing firms and power sector companies operating in India. The data is extracted from the Centre for Monitoring Indian Economy (CMIE) ProwessIQ.Footnote 4 We have collected a few variables namely GDP growth, global price of energy index, and trade openness from the World Bank open database. The period of the study is taken from 2010 to 2020. The amendment of the EC Act in the year 2010 stimulates us to commence the study from 2010 through 2020 subject to the availability of latest data for the selected companies.

We downloaded a total of 18,463 companies belonging to manufacturing and power sectors knowing the fact that these firms are the high energy consumers. The power sector firms include the conventional electricity generating firms, where the electricity generation is based on fossil fuels. Further, firms with missing values for the variables of interest were eliminated. Afterwards, we looked for firms with their net sales figures at least for 5 years and eventually, we finalized a set of 3316 companies. Notably, there is no sub-classification of the firms made further as we intend to assess the energy use practices of the manufacturing and power sector firms as a whole. Moreover, the number of observations vary over the years due to missing values of the variables in different time periods, which makes the dataset unbalanced. The details regarding data sorting and the year-wise number of observations can be found in Table 7 in Appendix. The final sample includes an unbalanced panel dataset of 3316 number of cross-sectional units for 10 years. The figures of the financials taken from the ProwessIQ are in INR (in million). The empirical analysis is executed using STATA 17.0 software and is based on the following regression equation:

where EI is the regressand, denotes energy intensity, which is calculated by taking the percentage of the expenditure on power and fuel to net sales. We evaluate EI in terms of economic value of the energy consumed as it may not be appropriate to measure energy consumption in physical units for an analysis made over the years [35]. The term φit symbolizes the overall random disturbance term. The description of the regressors can be found in Table 1. The variables are chosen based on their theoretical relevance over the industrial energy usage. Labour productivity, efficiency of plant and machinery use of technologies etc. can have a direct impact at the production level. These variables also get affected over the years due to change in technology and method of productions. For instance, the rising implications of artificial intelligence (AI) posits a question mark on the need for labour and old machineries in the current manufacturing process. At macro level, the growth and the international trade prospects of India demand for incessant energy consumption to keep the pace of economy as well as to stand firm in the international business competition. Given such circumstances, we believe the findings of the study will be more practical in nature.

5 Empirical modelling and analysis

In this section, we proceed with the application of empirical model and analysis of the data and elaborate the practical implications. We start with the descriptive statistics including mean, standard deviation (SD), skewness and kurtosis which are presented in Table 2.

5.1 Descriptive statistics and correlation

The SD of EI shows that the series is highly deviating from the mean value. As mentioned earlier, the dataset contains heterogeneity as we include manufacturing firms from various sectors viz., power, construction, cement, textiles, chemical, metals, and paper and pulp industries. Practically, the energy requirements of different sectors are different. It also depends upon the scale of operation of the manufacturing unit. Thus, EI seems to be highly dispersed. In the similar fashion, LI, PMI and PATI also seem to be highly deviating. Notably, the volume of sales, values of plant and machinery, salaries and wages and profit after tax etc. differ to a large extent across firms, which bring high dispersions in all these variables. Similarly, high deviation of the variable CHGPEI indicate the volatile behavior of the energy prices at global level.

The negative skewness values of GDPGR and CHGPEI denote that the distributions are skewed to the left as compared to the normal distribution. Oppositely, the positive skewness values of rest of the variables show that the distributions are skewed to the right than the normal distribution. As per the results of kurtosis, TRADEOPEN is the only variable that follow a platykurtic distribution (as the value is less than 3) and rest of the variables have leptokurtic distribution (as the values are more than 3). The measure of kurtosis facilitates understanding the multivariate normality of the variables [36]. It is a measure of deviation from normality. The high kurtosis values of the firm level variables explain that the variables are more dispersed from normality and are also susceptible to extreme events.

Under Table 3 we present the correlation matrices to confirm that there is no perfect linear relationship between the independent variables of our interest. The lower degrees of correlations between the variables depict that there is no multicolinearity among the variables. The absence of multicolinearity is also confirmed by the low value of the mean variance inflation factor (VIF) test.

5.2 Stationarity check

We present the results of panel unit root test in Table 4. As we are dealing with an unbalanced panel dataset with time gaps, we employ the Fisher-type [37] panel unit root test to check for stationarity of the variables. We present the modified inverted chi-squared values of Dickey-Fuller and Phillips-Perron unit root tests in Table 4. As per the results, we assert that all the variables, except TDI, are stationary in their level form {i.e., I (0)}. Furthermore, the variable TDI also becomes stationary at the first difference {i.e., I (1)}.

5.3 Model implication

As mentioned earlier, the panel dataset consists of 3316 cross-sectional units for a time period of 10 years, signifying N > T. Thus, we opt for employing linear dynamic panel data models for the analysis. Evidently, the generalized method of moments (GMM) is the most popularly used tool in the dynamic framework. Specifically, the difference GMM and the system GMM approaches, given by Arellano and Bond [38] and Blundell and Bond [39] respectively, have been in use over the years and are efficient in dealing with several econometric issues viz., auto-correlation and endogeneity [40].

Nevertheless, Bun and Windmeijer [41] exclaim that the problem of weak instrument persists with the GMM models. The weak instruments can lead to biasness and poor precision. Later on Breitung et al. [9] introduce the bias-corrected method of moment (BCMM) estimator wherein the biasness can be solved using standard numerical optimization process. The author also state that in terms of appropriateness and correctness, the BCMM estimator can outperform the GMM approach. Both fixed and random-effect assumptions can be accommodated by the BCMM estimator. In case of large-N and small-T, which prevails in our study, the model allows for individual heteroskedasticity. Furthermore, with the use of panel corrected standard errors, cross-sectional dependence is also addressed [9].

The dynamic panel data models takes the lagged term of dependent variable as a regressor. While adding the lagged term of the regressand EI, we redraft Eq. 1 as follows:

Despite the application of BCMM model, we further seek to examine the results in a non-linear framework. In this regard, we choose to employ the quantile regression estimator for panel data (QRPD) with non-additive fixed effects given by Powell [10]. The model is appropriate for panel data analysis and accounts for unobserved heterogeneity in the dataset. The QRPD model permits the parameters to vary on the basis of an observation specific disturbance term and an unspecified fixed effect function [10]. The individual-specific heterogeneity is allowed as per the model without splitting the sample and thus, the model can address heterogeneity even in the presence of any outliers in the dataset [42]. The results are exhibited in different quantiles, which helps in diagnosing richer estimation [43]. The QRPD estimator is also suitable when T is small [10]. Thus, in the presence of a large number of cross-sectional units and diversified sectors of sample firms, the model is expected to accommodate the heterogeneity of our dataset and provide robust estimates. The results of the QRPD model are presented in Table 6 for low, moderate, and high quantiles (i.e., 10th, 50th, and 90th quantiles). It shows the distinct scenarios of firms with different levels of EI.

5.4 Discussion of results

Both the empirical models provided in Tables 5 and 6 depict consisting results for the variables. In Table 5, we provide the results of the (BCMM) estimators. The lagged term of EI shows a positive association with EI depicting that the previous year energy consumption has a direct impact on current year energy usage. Any manufacturing unit will definitely look to keep an upward trend of its productions and thus, the year-wise energy requirement is also supposed to be increasing. Among other regressors, the variable LI holds a positive impact on EI and is similar to the results drawn by Sahu and Narayanan [44], Soni et al. [7] and Kumar et al. [35]. The result entails that a one unit increase in labor intensity will lead to an increase in EI by 0.485782 units, ceteris paribus. In simple terms, firms paying higher salaries and wages are consuming higher energy. The statement is also supported by the QRPD model in all quantiles. However, this is in contrast to the results reported by Subrahmanya [11] and Sahu and Narayanan [13] whilst the latter assume that higher labor intensive firms use more energy saving techniques and that helps in reducing EI.

On the contrary, we infer that the increasing EI can be due to poor labor productivity and lack of efficiency in laborers. In point of fact, despite the number of laborers employed or the labor-hours devoted, the energy requirement largely depends on the skills and efficiency of the laborers. In such a case, if the labor is not effective at par to optimize the EI, the production process can be shifted to automated processes with advanced technologies. Howsoever, there is a further need to assess the opportunity cost between the manual and automated processes in order to arrive at the optimal option. Nevertheless, from a diametric point of view, in a country with high population and abundant labor force it is not prudent to automate the production process. Therefore, labor force ought to be made efficient in terms of handling the production processes and minimizing energy wastage. Proper training and skill development programs need to be exercised [35] and the labor expenditure needs to be optimized in order to minimize the EI [7]. Sahu and Narayanan [44] also suggest that increment in labour efficiency can be an alternative to improve energy efficiency in India.

We find a negative impact of PMI on EI through both the models. As per the BCMM approach, a one unit increase in investment on plant and machinery leads to a decrease in EI by 0.000402 units. The result is however, conflicting with the findings of Kumar et al. [35]. Our results depict that higher expenses incurred on plant and machinery leads to a reduction in EI. Under PMI we consider net plant and machinery, computer and other electrical assets. Plant and machinery constitute an essential part of the production process. Machineries consume power and fuel in the manufacturing process. It is therefore, the productivity and energy requirements both will be depending upon the efficiency of the machineries. It is possible that better plant and machinery will lead to efficient energy use with lesser energy wastage and will eventually reduce the EI. Same result is derived by the QRPD model in all quantiles, which validates that the notations are applicable to all sectors of manufacturing firms. Nonetheless, the magnitudes of the coefficient seem to be the lowest as compared to all other variables, which denotes that PMI is least impacting EI in the sample firms. It can be because of the difference between the cost of plant and machineries and the energy expenses. The monetary value of the latter may be meagre in comparison with the former; but undoubtedly the requirement of power and fuel to run the huge machineries is indispensable. Thus, the efficiency of plant and machinery plays a crucial role in determining EI.

Remarkably, Soni et al. [7] find a positive impact of PMI on EI. However, the authors infer that high spending on plant and machinery does not contribute towards enhancing energy efficiency for their sample industries. Accordingly, the authors advise to invest wisely on machineries with smart technology. Hence, as per our results, we infer that the industries spending on better and efficient plant and machinery will genuinely witness a reduction in EI.

The variables RMPMI, LNTA, SI, PATI, and TDI seem to be insignificant as per the BCMM model. However, they are significant in the non-linear framework. The coefficient of RMPMI is positive in all quantiles, establishing a direct relationship of this variable on EI. The result coincides with the outcomes of previous studies namely, Kumar [34]; Sahu and Narayanan [13]; Soni et al. [7] and Kumar et al. [35]. RMPMI denotes the proportion of overall expenses incurred for repairs and maintenance of plant and machinery. Notably, the variable seems to be one of the dominating factors in determining EI while comparing the magnitude of coefficients. A one unit increase in the repairs and maintenance expenses is leading to more than 0.76 units increase in EI. Thus, incurring high expenditure on repairs seems to be a major concern for manufacturing firms. Kumar [34] opines if plant and machinery require more repairs and maintenance it indicates that they have become obsolete and will consume more energy. As per Kumar et al. [35] outdated plants ought to be replaced with modern technology so that the production methods can be upgraded to save more energy.

Firm size denoted by LNTA appears to have a positive association with EI in all quantiles. It should be noted that LNTA is taken in natural logarithmic form. It represents that a relative change in LNTA will lead to an absolute change in EI, ceteris paribus. Thus, as per the results, larger firms seem to be energy intensive, which contrasts with our prior assumption. The results however, aligns with Sahu and Narayanan [13], as the authors exclaim that EI is higher in larger firms. Contrastingly, Sahu and Mehta [32] find that medium sized firms are energy intensive while small and large firms are not. However, our findings suggest that firms with all scales of productions are energy intensive. Evidently, firms expanding in terms of fixed assets possessions become more energy intensive as the installed machinery also demand incessant energy inputs [45]. Thus, increase in firm size will seemingly lead to enhancing EI. In such cases efforts and planning are required to optimize the per unit energy consumption.

The significant and positive associations of SI with EI in all quantiles contrast with our previous assumption that SI would bring in innovative, smart and professional ideas into the production process. Instead, firms spending on software and IT-enabled services are seemed to be more energy intensive. Moreover, SI also seems to be the most dominating variable in determining EI as per its coefficient value. Identical finding was derived by Sahu et al. [46] and the authors state that high spending on software and information technology cannot control EI as the software run by the computers also require energy to operate. The modern day productions are also assisted by IT-enabled processes and thus, its increasing application will apparently demand more energy usage.

Profitability seems to have an inverse relationship with EI. Though the impact is insignificant in the first model, it is significant and negative in all quantiles of the second model. It indicates that profit making firms are able to reduce their EI. This is in accordance with the findings derived by Kumar et al. [35], Sahu and Narayanan [44], Sharma et al. [16], Sahu and Narayanan [13], and Kumar [34]. Profitability is the primary measure of a firm’s performance and future perspectives. Net profit of a firm accumulates additional funds for future investments as an option of ploughing back of profits. Sharma et al. [16] exhibit that increase in profit will enable firms to invest more towards improving energy efficiency. Evidently, with the funds available in the form of profit, industries can to adopt energy saving technology [13] and install energy efficient machineries and can also undertake R&D activities [34]. Given such arguments, we infer that profitable firms are less energy intensive. Therefore, firms should intend to plough back their profit in energy efficient technologies with the aim to reduce EI. Moreover, the magnitude of coefficient for PATI is also among the lowest. It should be noted that merely earning profit cannot help in reducing EI. Rather, EI can be minimized if the available profit is utilized in making appropriate investments aimed at ensuring sustainability.

The variable TDI, which considers the amount paid for Royalties, technical know-how etc. seems to be insignificant in most of the cases. Nevertheless, the variable is significant and positive for higher energy intensive firms i.e., firms falling in 90th quantiles. The outcome contrasts with Kumar et al. [35] but aligns with Sahu and Narayanan [13]. The positive impact of TDI over EI intimates that the technology brought into the highly energy intensive firms are meant for boosting up production and not for optimising the energy usage. However, it contrasts with our prior assumption of technology spill-over. Thus, the high energy intensive firms should bring in latest technologies to deal with the energy related challenges instead of focusing on raising their productions only.

We find that the macro-level variables also show significant associations on EI as per both the models. Seemingly, GDPGR holds a significant and positive relation with EI. As per the BCMM model, one unit rise in GDP growth leads to 0.003848 unit of increase in firm level EI. It means that GDP growth is positively influencing the firm level energy consumption. GDP growth depicts the pace of economic advancement of a nation. As per Pradhan et al. [47] energy runs the engine of economic growth of a nation. In a country like India where the industrial sector contributes 26% to the nation’s GDP [8], the energy use can hardly be compromised. Thus, it is obvious that the GDP growth and energy consumption will rise in parallel to each other. The results are also validated by the QRPD model especially, in 50th and 90th quantiles. It denotes that moderate and high energy intensive firms are more responsive to GDP growth of the nation. However, it posits a threat to the environmental concerns in the country.

While validating the GDP-CO2 nexus, Haldar and Sethi [48] argue that the developing countries are boosting up industrial production at the cost of environment. Hence, the authors suggest to shift the productions to renewable energy options. This suggestion is further supported by many authors working in the field of energy and environment [6, 30]. However, Haldar and Sethi [48] have also agreed to the fact that the developing nations are still at the nascent stage with regards to renewable energy consumption. In such a scenario, minimizing the EI appears to be the instant solution to the current situation. As per Pradhan et al. [49], shifting towards clean energy technology is required in order to support economic advancement while simultaneously keeping up with the environmental norms. Additionally, the government intervention in the way of identifying DCs, imposing penalties and implementing the PAT scheme appears to be of greater importance.

The variable CHGPEI derives a negative relationship with EI. CHGPEI is taken as the proxy for global energy prices. Hence, the result of BCMM approach entails that one unit change in the global price of energy will lead to a decrease in EI of Indian manufacturing firms by 0.000396 units. The result is in line with the findings of Adom [22]. Song and Zheng [50] also find similar result, but relatively limited impact of energy prices on EI in China. Contrastingly, Samargandi [6] finds positive impact of energy price on the EI in OPEC countries. The author justifies that the energy price is considerably lower in OPEC countries. Thus, a slight hike in the energy prices does not significantly influence the intensity level. Whilst in case of Nigeria, Adom [22] explicates that in case of increment in energy prices larger firms adopt energy efficient technology whereas, smaller firms try to cut down the energy usage. In terms of using energy efficient technology, the effect is seen in Iranian industries that the energy pricing policy has failed to minimize EI as they use energy intensive technology [23]. As per Zarepour and Wagner [51], industries absorb the increased energy prices by accepting lower profits. Further firms pass through the cost to customers by raising the price of the commodity.

In Indian context, our result confirms that there is a negative impact of energy price changes on Indian industries energy usage. The reason being India is among the top importers of energy and hence, any fluctuation in the global energy price will bring more caution towards energy use practices in the country. If the level of EI remains the same even in case of an upsurge in energy prices, it results in an increase in the production costs [23]. Hence, along with using energy saving technology, the firms also need to focus on minimizing energy wastages and optimizing cost of production which can further reduce the EI. Rentschler and Kornejew [52] also exhibit that in response to energy price hikes firms attempt to enhance their energy efficiency. Nonetheless, as per the QRPD model, the results are insignificant in the lower and moderate level quantiles while, the impact is significant and positive in the highest quantile. It denotes that the aforesaid arguments may not be applicable for highly energy intensive firms. Such firms will continue their operations regardless of the fluctuations in global energy prices and thus, their EI can be seen surging.

Another important macro level variable i.e., TRADEOPEN holds a significant and positive impact on EI. It is also validated by the QRPD model in all quantiles. The result however, contrasts with the outcomes of Adom [22] and Samargandi [6] but is in parallel to the findings of Yan [17]. TRADEOPEN accounts for the sum of imports and exports of a country. For countries viz., Nigeria, South Korea and OPEC countries, the authors [22]; Samargandi [6] respectively) have mentioned that trade openness has led to a reduction in EI. The authors argue that global competition promotes industries to be energy efficient. Nevertheless, for country like China, Yan [17] deduces that export has led to a growth in provincial EI. Eventually, increase in import–export practices opens up the domestic market and simultaneously, creates challenges for the domestic producers. In this sense, firms will be more concerned towards increasing production and productivity which will demand more energy use. Especially, in Indian context, the rapid growth of industries is seen with the opening up of the economy and it still continues with the emergence of new dimensions in international trade. In addition to this, with regards to import–export mechanism, India imports more than its exports and energy (especially crude oil) constitutes the highest proportion of imports (Ministry of Commerce and industry, Govt. of India). India also stands 3rd in the list of oil importers in the world (Ministry of petroleum and natural gas, Govt. of India). Hence, we can interpret that trade openness is positively magnifying the EI in Indian context. In this regard, there is a need to shift concentration towards fetching more energy efficient technologies so that the technology spill-over into the country can be comprehended. In terms of sustaining global competition, firms also need to optimize their production costs by controlling the energy expenditure.

Evidently, the magnitudes of the coefficients for macroeconomic determinants are comparatively lesser than other variables, which connotes that the impacts of these factors on firm level energy consumption can be of lower intensity. However, it can be interpreted that the industrial energy consumption is a modest part of the economic activities taking place in the country. The monetary value of energy expenses incurred at the firm level is way less than the value of GDP and international trade of the country. Nonetheless, the hardheaded fact is that the energy consumption is the base of all such economic activities. Thus, the magnitudes of intensities demonstrated by both the models hold true in a pragmatic sense. Moreover, irrespective of saturations of the coefficients, the statistical significance apparently predicates the importance of these factors in determining firm level EI.

The post diagnostic checks reveal that the BCMM model has nullified the problems of endogeneity and autocorrelation. The insignificant p-values of Hansen test and Arellano-Bond test (especially in second order) confirm the absence of endogeneity and serial correlation.

In point of fact, the sector specific dynamics are well captured and better defined by the QRPD model with regards to the firm-specific determinants. However, while comparing with BCMM, QRPD seems to be depicting mixed results for macro-level variables.

6 Conclusion

As among the fastest growing economies with limited resources of energy, there is a necessity of a sustainable policy for India that accommodates both energy demands and environmental laws of the nation [8]. Neither can the economic advancements be slowed down, nor can the energy requirements be compromised with. Thus, a focus on optimizing EI at the industrial level ought to be the primary goal of the government, industrialists, policy makers and researchers. In this line, our study centers around assessing the impacts of certain firm specific and macro level determinants on EI of Indian manufacturing and power sector firms.

As per our findings, we proclaim that there is a need to improve labor efficiency in order to achieve better EI. With regards to plants and machinery, investments should be made to procure better plant and machinery that can facilitate efficient use of energy. In addition, machineries that require frequent repairs and maintenance are needed to be replaced with latest and energy saving tools. Profitable firms can avail this opportunity by ploughing back their profits and can also undertake R&D activities in order to find new ways to cut down EI. Larger firms should also employ their resources to minimize EI as they are found to be energy intensive. Technological advancements should be intended to optimize EI and not to boost up productions.

Sustainable approaches and policies are required when the country is in the path of GDP growth. Along with meliorating productivity, appropriate management of energy resources is crucial at the industry level. In this regard, the government’s dictation to identify DCs and implementing the PAT scheme plays a crucial role. Being a top energy importer, the energy prices also play a significant role in India’s energy requirements. The Indian industries ought to concentrate on reducing energy wastage and use energy saving technology in order to optimize EI. In the global competitive market, along with competing over productions and exports, firms also need to contend in terms of advancement in production processes and attaining better energy efficiency.

With regards to government intervention, frequent amendments should be made to the EC Act, 2001 and fresh plan of actions should also be brought in that fit the current business scenario. Novel strategies such as the PAT scheme, should be fairly and transparently implemented. Stricter provisions should also be introduced that will push industrialists to further limit their EI and attain their prescribed energy efficiency levels.

Howsoever, the current research work is an overall study of the manufacturing sector in India. It does not incorporate industry specific classifications. A sub-sample analysis of different sectors can bring distinctive results. Thus, the study can be further extended by making a sector specific or disaggregated analysis. Furthermore, fresh variables of both micro and macro nature can be incorporated to see their impacts on EI.

Data availability

Data will be made available on demand.

Code availability

Software codes will be made available on demand.

Notes

ProwessIQ is a comprehensive database of the financials of Indian companies and is managed by ‘CMIE Pvt. Ltd.’ More information at: https://prowessiq.cmie.com/.

References

Paramati SR, Shahzad U, Doğan B. The role of environmental technology for energy demand and energy efficiency: evidence from OECD countries. Renew Sustain Energy Rev. 2022;153: 111735.

Sustainable development goals report; 2021. https://unstats.un.org/sdgs/report/2021/#sdg-goals

Doğan B, Ferraz D, Gupta M, Huynh TLD, Shahzadi I. Exploring the effects of import diversification on energy efficiency: evidence from the OECD economies. Renew Energy. 2022;189:639–50.

Energy statistics India|ministry of statistics and program implementation|government of India; 2023. https://mospi.gov.in/publication/energy-statistics-india-2023

Environment, U. N. Emissions gap report 2021. UNEP—UN Environment Programme; 2021. http://www.unep.org/resources/emissions-gap-report-2021

Samargandi N. Energy intensity and its determinants in OPEC countries. Energy. 2019;186: 115803.

Soni A, Mittal A, Kapshe M. Energy intensity analysis of Indian manufacturing industries. Resour Eff Technol. 2017;3(3):353–7.

Sahu SK, Bagchi P, Kumar A, Tan KH. Technology, price instruments and energy intensity: a study of firms in the manufacturing sector of the Indian economy. Ann Oper Res. 2022;313:319–39.

Breitung J, Kripfganz S, Hayakawa K. Bias-corrected method of moments estimators for dynamic panel data models. Econometr Stat. 2022;24:116–32.

Powell D. Quantile regression with nonadditive fixed effects. Empir Econ. 2022;63(5):2675–91.

Subrahmanya MB. Labour productivity, energy intensity and economic performance in small enterprises: a study of brick enterprises cluster in India. Energy Convers Manage. 2006;47(6):763–77.

Jain M, Kaur S. Determinants of energy intensity trends in indian metallic industry: a firm-level analysis. Vision. 2021;27:360–75.

Sahu S, Narayanan K. Determinants of energy intensity: A preliminary investigation of indian manufacturing [MPRA Paper]. 2009. https://mpra.ub.uni-muenchen.de/16606/

Sahu SK, Narayanan K. Total factor productivity and energy intensity in Indian manufacturing: a cross-sectional study. Int J Energy Econ Policy. 2011;1(2):47–58.

Oak H, Bansal S. Perform-achieve-trade policy: a case study of cement industry for energy efficiency (No. 17–05). Centre for International Trade and Development, Jawaharlal Nehru University, New Delhi, India; 2017.

Sharma A, Roy H, Dalei NN. Estimation of energy intensity in indian iron and steel sector: a panel data analysis. Statistics. 2019;20:107–21.

Yan H. Provincial energy intensity in China: the role of urbanization. Energy Policy. 2015;86:635–50.

Adom PK, Kwakwa PA. Effects of changing trade structure and technical characteristics of the manufacturing sector on energy intensity in Ghana. Renew Sustain Energy Rev. 2014;35:475–83.

Sadorsky P. Do urbanization and industrialization affect energy intensity in developing countries? Energy Econ. 2013;37:52–9.

Ma C, Stern DI. China’s changing energy intensity trend: a decomposition analysis. Energy Econ. 2008;30(3):1037–53.

Voigt S, De Cian E, Schymura M, Verdolini E. Energy intensity developments in 40 major economies: structural change or technology improvement? Energy Econ. 2014;41:47–62.

Adom PK. Asymmetric impacts of the determinants of energy intensity in Nigeria. Energy Econ. 2015;49:570–80.

Barkhordari S, Fattahi M. Reform of energy prices, energy intensity and technology: a case study of Iran (ARDL approach). Energ Strat Rev. 2017;18:18–23.

Fisher-Vanden K, Jefferson GH, Liu H, Tao Q. What is driving China’s decline in energy intensity? Resou Energy Econ. 2004;26(1):77–97.

Cornillie J, Fankhauser S. The energy intensity of transition countries. Energy Econ. 2004;26(3):283–95.

Li G, Liu JG, Wang XM, Liu RF. Analysis of influencing factors of change of manufacturing energy intensity in China based on WSR system methodology and VAR model. Eur J Math Sci Technol Educ. 2017;13(12):8039–50.

Wang Z, He W. Regional energy intensity reduction potential in China: a non-parametric analysis approach. J Clean Prod. 2017;149:426–35.

Zhang X, Su B, Yang J, Cong J. Index decomposition and attribution analysis of aggregate energy intensity in Shanxi Province (2000–2015). J Clean Prod. 2019;238: 117897.

Lin B, Wang M. What drives energy intensity fall in China? Evidence from a meta-frontier approach. Appl Energy. 2021;281: 116034.

Zhang C, Su B, Zhou K, Sun Y. A multi-dimensional analysis on microeconomic factors of China’s industrial energy intensity (2000–2017). Energy Policy. 2020;147: 111836.

Espindola J, Nourin FN, Qandil MD, Abdelhadi AI, Amano RS. Energy saving analysis using energy intensity usage and specific energy consumption methods. Int J Energy Clean Environ. 2021. https://doi.org/10.1615/InterJEnerCleanEnv.2020034685.

Sahu SK, Mehta D. Determinants of energy and Co2 emission intensities: a study of manufacturing firms in India. Singapore Econ Rev. 2018;63(02):389–407.

Mohan NC. Why India is grappling with labor issues? Redif. com; 2011. https://www.redif.com/business/slide-show/slide-show-1-column-why-india-is-grappling-with-labor-issues/20111025.htm#1

Kumar A. Energy intensity: A quantitative exploration for indian manufacturing. SSRN Elect J. 2003. https://doi.org/10.2139/ssrn.468440

Kumar A, Mittal A, Pradhan AK. Magnitude and determinants of energy intensity: evidence from Indian firms. Environ Sci Pollut Res. 2022;30:3270–81.

Kim N. Tests based on skewness and kurtosis for multivariate normality. Commun Stat Appl Methods. 2015;22(4):361–75.

Choi I. Unit root tests for panel data. J Int Money Financ. 2001;20(2):249–72.

Arellano M, Bond S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud. 1991;58(2):277–97.

Blundell R, Bond S. Initial conditions and moment restrictions in dynamic panel data models. J Econometr. 1998;87(1):115–43.

Pradhan AK, Hiremath GS. Effects of foreign currency debt on investment of the firms in emerging economy. Int J Financ Econ. 2021;26(4):4993–5004.

Bun MJ, Windmeijer F. The weak instrument problem of the system GMM estimator in dynamic panel data models. Economet J. 2010;13(1):95–126.

Payne JE, Truong HHD, Chu LK, Doğan B, Ghosh S. The effect of economic complexity and energy security on measures of energy efficiency: evidence from panel quantile analysis. Energy Policy. 2023;177: 113547.

Sachan A, Sahu UK, Pradhan AK, Thomas R. Examining the drivers of renewable energy consumption: evidence from BRICS nations. Renew Energy. 2023;202:1402–11.

Sahu SK, Narayanan K. Labour and energy intensity: a study of the pulp and paper industries in India. In: Human capital and development. Springer; 2013. p. 55–76.

Sahu UK, Pradhan AK. Hitting the nail on the head instead of beating the bush: Does corporate social responsibility actually address corporate environmental sustainability? Environ Dev Sustain. 2024. https://doi.org/10.1007/s10668-024-04506-8.

Sahu UK, Kumar A, Pradhan AK. Analyzing energy intensity of indian chemical industry: a panel data approach. Energy Nexus. 2024;13: 100279.

Pradhan AK, Rout S, Khan IA. Does market concentration affect wholesale electricity prices? An analysis of the Indian electricity sector in the COVID-19 pandemic context. Utilities Policy. 2021;73: 101305.

Haldar A, Sethi N. Effect of institutional quality and renewable energy consumption on CO2 emissions—an empirical investigation for developing countries. Environ Sci Pollut Res. 2021;28(12):15485–503.

Pradhan AK, Sachan A, Sahu UK, Mohindra V. Do foreign direct investment inflows affect environmental degradation in BRICS nations? Environ Sci Pollut Res. 2022;29(1):690–701.

Song F, Zheng X. What drives the change in China’s energy intensity: combining decomposition analysis and econometric analysis at the provincial level. Energy Policy. 2012;51:445–53.

Zarepour Z, Wagner N. How manufacturing firms respond to energy subsidy reforms? An impact assessment of the Iranian Energy Subsidy Reform. Energy Economics. 2023;124: 106762.

Rentschler J, Kornejew M. Energy price variation and competitiveness: firm level evidence from Indonesia. In: Fossil fuel subsidy reforms. Routledge; 2018. p. 75–106.

Acknowledgements

We are grateful to the anonymous reviewers for investing their valuable time in reading and reviewing our research work.

Funding

There is no funding information available.

Author information

Authors and Affiliations

Contributions

Udit Kumar Sahu: writing—review and editing, software, analysis and interpretation. Ashis Kumar Pradhan: initial review and editing, methodology, supervision.

Corresponding author

Ethics declarations

Competing interests

The authors have no competing interest to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sahu, U.K., Pradhan, A.K. Discovering the determinants of energy intensity of Indian manufacturing firms: a panel data approach. Discov Sustain 5, 139 (2024). https://doi.org/10.1007/s43621-024-00327-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43621-024-00327-x