Abstract

This paper addresses the economic lot and delivery scheduling problem (ELDSP) within three-echelon supply chains, focusing on the complexities of demand uncertainty, limited shelf-life of products, and sequence-dependency of setups. We develop a novel mixed-integer non-linear programming (MINLP) model for a supply chain comprising one supplier, multiple manufacturers with flexible flow shop (FFS) production systems, and multiple retailers, all operating over a finite planning horizon. The common cycle (CC) strategy is adopted as the synchronization policy. Our model employs fuzzy set theory, particularly the “Me measure,” to effectively handle the retailers’ demand uncertainty. Our findings indicate that total supply chain costs escalate with an increase in demand, final components’ holding costs, and sequence-dependent setup costs, but decrease with increasing production rates. Furthermore, while total costs are significantly sensitive to changes in demand, they are relatively insensitive to fluctuations in sequence-dependent setup times. The models developed offer valuable managerial insights for optimizing costs in synchronized multi-stage supply chains, aiding managers in making informed decisions about production lot sizes and delivery schedules under both deterministic and fuzzy demand scenarios. Additionally, the proposed models bridge key research gaps and provide robust decision-making tools for cost optimization, enhancing supply chain synchronization in practical settings.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The integration of production and distribution is increasingly recognized as a critical area of focus within supply chain management, aimed at reducing costs and boosting competitiveness [18]. The economic lot and delivery scheduling problem (ELDSP) emerges from the need for integrated decision-making across supply chains, which arises due to the significant impact of production and delivery operations on the cost-effectiveness of the supply chain. ELDSP was first investigated by Hahm and Yano [19] as an extension of the economic lot scheduling problem (ELSP). The primary difference between ELSP and ELDSP lies in the location of production demand: in ELSP, it occurs within the same facility, whereas in ELDSP, a supplier produces multiple components at a production facility and directly delivers them to an external customer, such as an assembly facility (AF). This process incurs additional transportation and delivery costs across the entire supply chain. The objective of ELDSP is to coordinate procurement, manufacturing, and delivery activities to minimize the average costs of setup, inventory holding, and delivery [15]. It aims to determine the optimal production sequence, production and delivery intervals, quantities, and schedules. The complexity of the problem escalates in industries like food and healthcare, where products have a limited shelf life, and storage time cannot exceed a predetermined interval [38, 39].

ELDSP is investigated under various synchronization policies. These include the common cycle (CC) policy, where production and delivery intervals are equal [20]. This policy is advantageous in terms of both modeling and practical implementations [53]. Other approaches include the integer multipliers (IM) policy, which sets the production interval as an integer multiple of the delivery interval [19], and the basic period (BP) approach, where each product’s cycle time is either a power-of-two (PT) or a non-power-of-two (NPT) multiplier of a so-called basic period [22, 51].

Most ELDSP studies have considered infinite planning horizons. However, this assumption does not align with real-world applications, especially for products with finite life cycles [43]. Typically, the planning horizon is determined through a contract between the supplier and the AF over a limited period. It is also reasonable to assume a finite horizon when the demand rate remains relatively stable [51]. Additionally, setup times and costs in production systems are often sequence-dependent. For instance, in flow shop scheduling, setups depend on the job positions within the production sequence; meaning that setup times cannot be merely included in production or processing times [23, 25, 37]. Moreover, work centers or machines with a limited production capacity, such as those used for plastic production, blending, or metal forming, incur specific setup times and costs during the changeover from one component to another [29]. While sequence-dependency of setups has been explored in some ELSP models (e.g., [5, 26, 55, 58]), it has been rarely investigated in the ELDSP context.

Many authors have investigated the production planning and scheduling problem while considering uncertainty in various parameters (e.g., [7, 24, 40]). Specifically, Yao et al. [61] and Chang et al. [10] applied fuzzy set theory to study ELSP under demand uncertainty. However, previous ELDSP models have assumed deterministic demand, which is not realistic in practical situations. When prior demand data is incomplete, or a new product is introduced to the market, accurately estimating demand with 100% certainty is not possible [56]. Consequently, demand uncertainty becomes a major source of risk in supply chains, significantly affecting production planning as well as service levels and total costs [59, 62]. In lot-sizing problems without shortages, the demand rate is identified as the most influential factor on average expected costs [3, 36]. These observations underscore the critical importance of incorporating demand uncertainty into the model to manage potential fluctuations in this key parameter effectively.

In this paper, we formulate a new ELDSP model under the CC synchronization policy. This model operates over a finite planning horizon within a supply chain that consists of a single supplier, multiple manufacturers, and multiple retailers. Multiple components are processed in several production facilities, each configured as a flexible flow shop (FSS) with unrelated parallel machines. Importantly, setup times and costs are sequence-dependent. Each component has a limited shelf-life, and we address the uncertainty in retailers’ demand for each component using fuzzy set theory. Karthick and Uthayakumar [30] suggest that when it is difficult to measure demand uncertainty based on historical data, a fuzzy-based technique is the best approach to address the uncertainty.

To enhance this method, we employ the Me measure, which is a flexible and powerful approach for fuzzy decision-making. This measure builds upon Pos (i.e., possibility) and Nec (i.e., necessity) measures by incorporating a generalized optimistic-pessimistic adjusting factor, allowing for the consideration of varying attitudes of decision-makers in fuzzy events and supporting realistic uncertain decision-making processes [60]. This technique aligns with recent advancements in applying fuzzy logic across various domains to successfully navigate complexities and uncertainties inherent in system operations. Some of the notable studies include Ameri et al. [1], Birjandi et al. [8], Song et al. [46], and Sun et al. [47].

Given this context, research on ELDSP has primarily focused on deterministic scenarios, overlooking the dynamic and uncertain conditions prevalent in real-world supply chains. Our study aims to bridge these gaps by introducing a novel approach that integrates fuzzy logic to manage demand uncertainty and sequence-dependent setups, thereby providing a more comprehensive and realistic framework for tackling ELDSP in multi-stage supply chains. Our model not only addresses the complexities of sequence-dependent setups but also enhances decision-making under uncertainty, pioneering new methodologies in the field and offering key insights for optimizing supply chain operations.

Building on this foundation, we develop a practical business framework for cost optimization in multi-stage supply chains within fuzzy environments. Through a series of numerical experiments, we assess the validity of our proposed model and discuss the results, utilizing possibility and necessity measures in fuzzy settings. Furthermore, we perform a sensitivity analysis to evaluate the robustness of our model. This analysis demonstrates how variations in parameter values can impact the average total cost in the integrated multi-stage supply chain.

The rest of paper is organized as follows: Sect. "Literature review" reviews the related literature. Sect. "Problem statement and mathematical model" presents the problem statement and mathematical model. Sect. "Applying the Me measure to capture uncertainty" applies the Me measure to address fuzzy uncertainty and derive approximation models. The proposed solution approach, experimental results, and sensitivity analyses are discussed in Sect. "Numerical experiments and discussions". Sect. "Managerial implications" presents an overview of the managerial implications, and the paper concludes in Sect. "Conclusions and future directions" with final remarks and directions for future research.

Literature review

In this section, we explore two critical streams of research relevant to our study: (1) the traditional approaches to ELDSP to discuss the foundational aspects and historical evolution of ELDSP within supply chain management, (2) the innovative applications of fuzzy logic and metaheuristics in addressing complex problems and enhancing decision-making under uncertainty. Together, these bodies of work provide a solid groundwork that frames the context of our study, highlighting how our research follows established methods and introduces new approaches.

Traditional approaches to ELDSP

Compared to studies on ELSP (e.g., [4, 9, 31, 45, 48, 65]), ELDSP has been much less investigated. Torabi et al. [50] formulated ELDSP over a finite planning horizon and under the CC approach, for a two-level supply chain, featuring a supplier operating a flexible flow line (FFL) production system and a single AF. Jenabi et al. [27] investigated the common-cycle ELDSP over a finite planning horizon for a supply chain with an FFL manufacturing system and unrelated parallel machines, incorporating sequence-dependent setup costs and times. Further, Torabi and Jenabi [51] explored ELDSP with a finite planning horizon under the BP approach, where a supplier produces multiple components on an FFL system. Torabi and Jenabi [52] then considered the PT variant of the BP approach to formulate the same ELDSP as in Torabi and Jenabi [51] and proposed an efficient hybrid genetic algorithm (HGA) to solve it. Dousthaghi et al. [12] presented a mixed-integer non-linear model for the finite planning horizon ELDSP for one supplier, operating a flexible job shop with unrelated parallel machines, and one AF. The problem was formulated under the BP approach, where each component has a deterministic shelf-life without spoilage. An efficient hybrid particle swarm optimization (HPSO) algorithm was developed to solve the problem. As’ad and Bahroun [2] formulated the synchronization problem in a multi-level supply chain as a mixed-integer non-linear model under the common rotation cycle policy, using a greedy search algorithm to find the optimal cycle time.

Some studies have explored ELDSP within three-echelon supply chains. Kim et al. [35] investigated a three-stage supply chain consisting of one supplier, one manufacturer with a single-stage production facility, and multiple retailers, applying the common cycle rotation policy, and proposed a heuristic solution. Nikandish et al. [41] developed both an analytical solution procedure and an efficient heuristic for solving ELDSP with an infinite planning horizon, focusing on a three-level supply chain with one supplier, multiple single-machine manufacturers, and multiple retailers under the common rotation cycle policy. Osman and Demirli [42] addressed ELDSP for a three-stage supply chain with multiple first-tier suppliers, multiple second-tier suppliers, and one manufacturer, exploring two synchronization policies, i.e., CC and IM. They proposed an efficient hybrid solution methodology that combines linearization, outer approximation, and Benders decomposition. Goli and Davoodi [16] formulated ELDSP for a three-level closed-loop supply chain, which includes multiple suppliers, one manufacturer with a sub-open-shop manufacturing/remanufacturing system, and one AF, under both the CC and IM policies. They utilized biography-based optimization and a simulated annealing (SA) algorithm for solving the problem. Similarly, Goli and Alinaghian [15] considered a comparable three-stage supply chain as Goli and Davoodi [16], but with a single supplier at the second stage operating an open-shop system with two manufacturing machines. They developed two SA algorithms to tackle the problem.

Regarding more complex supply chains, Kia et al. [34] examined ELDSP within a four-level supply chain, which includes suppliers, producers, assemblers, and retailers. Their objective was to minimize inventory, transportation, and setup costs. They utilized the CC and IM synchronization approaches and proposed an efficient, modified imperialist competitive algorithm (ICA) to solve the model.

To summarize, within the traditional realm of ELDSP research, the focus has predominantly been on optimizing production and delivery schedules across various supply chain configurations, often under the assumptions of certainty and finite planning horizons. Table 1 provides a comprehensive overview of the related literature, summarizing key findings and methodologies used in previous studies relevant to our research topic. Each entry highlights the contributions and limitations of past work, setting the stage for our study’s objective and approach.

Innovative applications of fuzzy logic and metaheuristics

ELDSP is recognized as an NP-hard problem [15]. This complexity has led researchers to apply a variety of metaheuristic algorithms to find effective solutions (e.g., [13, 15, 16, 27, 34, 51, 52]). However, while metaheuristics have been extensively explored, the integration of fuzzy logic into ELDSP represents a pioneering approach by our research. This novel incorporation is designed to tackle uncertainties associated with the demand rates; a factor unaddressed by the current ELDSP studies.

Research continues to push the boundaries by integrating metaheuristics, like genetic algorithms, and innovative optimization methods, like the teaching–learning-based optimization (TLBO), to enhance efficiency and quality in solving various optimization problems, including scheduling problems (see, e.g., [6, 14, 23]). The efficacy of fuzzy logic in managing uncertainties is showcased in various domains. For instance, Ameri et al. [1] and Birjandi et al. [8] demonstrate the adaptability of fuzzy logic in operational and financial contexts respectively, handling uncertainty in system performance and financial assessments. Additionally, Song et al. [46], Sun et al. [47], and Zhang et al. [63] apply fuzzy logic in control systems under cyber threats and dynamic environments, underscoring its robustness in high-uncertainty scenarios.

The above studies collectively indicate the growing importance of fuzzy logic and metaheuristics in tackling operational and environmental uncertainties within complex systems. This validates the relevance of these advanced computational techniques in enhancing strategic decision-making and operational efficiency in supply chain management.

Bridging the gap in ELDSP

Reviewing the literature reveals that existing research on ELDSP has mainly centered on deterministic environments, with less consideration for the sequence-dependency of setups and the complexities arising from uncertain conditions in supply chain environments. While various synchronization policies and optimization techniques have been explored, the sequence-dependent nature of setups and their cost implications in a real-world context have not been thoroughly examined. This oversight leaves a notable gap, particularly in environments where demand uncertainty is prevalent and significantly impacts supply chain efficiency.

Our study addresses this gap by integrating both sequence-dependent setups and fuzzy logic into ELDSP, marking a novel approach in this research domain. By emphasizing the sequence-dependency of setups, we underscore the importance of considering the order of operations and its direct effects on production scheduling and operational costs. This approach is complemented by the application of fuzzy logic, which enables handling the inherent uncertainty in demand forecasting to enhance the resilience and strategic decision-making within the supply chain.

In terms of methodology, while metaheuristic algorithms are commonly applied to tackle the NP-Hard nature of ELDSP, our research extends their applicability by incorporating fuzzy logic, particularly the Me measure, to better manage uncertainty. This methodological innovation not only addresses the deterministic limitations of previous studies but also enhances the algorithms’ effectiveness under uncertain conditions.

Our model, building on foundational work by Nikandish et al. [41] and Torabi et al. [50], employs the Me measure to model demand uncertainty in a three-stage supply chain, which includes a captive supplier, multiple manufacturers with FFS manufacturing systems, and multiple retailers over a finite planning horizon. The problem is formulated as a mixed-integer non-linear programming model, assuming sequence-dependent setup times and costs and addressing products with limited shelf-lives, with the CC strategy as the synchronization policy. To the best of our knowledge, this comprehensive model is the first in ELDSP which integrates such realistic assumptions for multi-stage supply chains, establishing new benchmarks for the field and providing a robust framework for practical managerial guidelines.

Problem statement and mathematical model

Consider a three-echelon supply chain that consists of a single supplier, multiple manufacturers, and multiple retailers. The supplier operates a single-machine type, while the manufacturers use the FFS manufacturing systems with unrelated parallel machines. Each manufacturer produces multiple components and delivers them in batches to its retailers. The CC policy is employed as the synchronization approach, and the planning horizon is finite. The predetermined shelf-life of each component is also considered. The problem is formulated under fuzzy uncertainty with the objective of minimizing the sum of average setup, inventory holding, and delivery costs per unit of time across the entire supply chain. Decision outputs include the production sequence of components at each manufacturer, production and delivery intervals for the whole supply chain, and delivery batch sizes for the retailers. The following assumptions are made in formulating the problem:

-

Each component is processed on no more than one machine in each work center.

-

Each machine can process only one component at a time.

-

All machines at work centers are available continuously without interruptions.

-

Setup times and costs are sequence-independent at the supplier but sequence-dependent at the manufacturers.

-

Setup times and costs at the retailers are considered negligible.

-

Inventory holding costs are assumed to be linear.

-

Buffers between consecutive work centers have unlimited capacity, allowing for work-in-process (WIP) inventory.

-

The production capacity of manufacturers is sufficient to meet all retailers’ demand, preventing shortages.

-

The lot size for each component is consistent across all work centers.

-

A production lot must be completely processed at one work center before moving to the next work center, i.e., lot-splitting is not permitted.

-

The processing of a production lot is continuous and cannot be interrupted (no preemption).

-

Delivery lead time is considered negligible.

-

Production for each component in a production cycle is initiated when its inventory level reaches zero (applying the “zero-switch rule”).

-

The retailers’ demand for each component is characterized by fuzzy metrics.

-

Each component produced by each manufacturer is assigned for a specific retailer only.

-

The production sequence of components on each machine at each work center is unique and determined by the solution procedure.

We use the following notations to develop the mathematical model:

Indices:

\(s\): Index denoting the single supplier. The subscript \(s\) is applied to related parameters to clearly indicate their association with the supplier.

\(i\): Index representing manufacturers. Each manufacturer and its corresponding parameters and variables in the model are uniquely identified by this index.

\(j\): Index representing work centers. Each work center and its corresponding parameters and variables in the model are uniquely identified by this index.

\(k\): Index representing machines. Each machine and its corresponding parameters and variables in the model are uniquely identified by this index.

\(u,w\): Indices representing components. These indices are used to model the sequence of components as they proceed, enabling the characterization of sequence-dependent transitions from one component to the next on a machine.

\(l\): Index representing the position of components in the production sequence. This index is critical for modeling the order in which components are processed, particularly for calculating sequence-dependent variables in the model.

Parameters:

\({A}_{s}\): Total delivery cost of input raw materials for the supplier. This parameter includes all expenses associated with the transportation and handling of raw materials to the supplier’s facility.

\({h}_{{s}_{0}}\): Holding cost per unit of input raw materials per time unit at the supplier. This parameter quantifies the cost incurred for storing each unit of raw materials at the supplier’s facility over a given period.

\({h}_{s}^{\prime}\): Holding cost of one unit of processed material per time unit at the supplier. This parameter quantifies the cost incurred for storing each unit of material that has undergone processing at the supplier’s facility over a specified period.

\(s{c}_{s}\): Production setup cost at the supplier. This parameter represents the cost associated with preparing the supplier’s facility to produce a new batch of goods.

\({f}_{s}\): Conversion factor of input raw materials to processed materials at the supplier. This parameter quantifies the yield of raw materials being transformed into finished goods during production at the supplier’s facility.

\(I\): Number of manufacturers in the second stage of the supply chain.

\(n{c}_{i}\): Number of components produced by manufacturer \(i\). This parameter indicates the manufacturer’s production capacity, impacting inventory management and production planning.

\(nw{c}_{i}\): Number of work centers at manufacturer \(i\). This parameter is essential for modeling and optimizing workflow at each manufacturing site.

\(n{m}_{ij}\): Number of unrelated parallel machines at work center \(j\) of manufacturer \(i\). This parameter indicates the number of machines that can operate independently at a given work center within the manufacturing facility.

\({m}_{ikj}\): The \(k\)th machine at work center \(j\) of manufacturer \(i\). This parameter is essential for modeling machine-specific operations and sequencing.

\({\widetilde{d}}_{iu}\): Fuzzy demand for component \(u\) produced by manufacturer \(i\). This parameter captures demand uncertainty, allowing for a more flexible and realistic modeling of demand.

\({P}_{ijku}\): Production rate of component \(u\) on machine \(k\) at work center \(j\) of manufacturer \(i\). This parameter specifies the quantity of component \(u\) that machine \(k\) can produce per unit time.

\(p{t}_{ijku}\): Processing time for each lot of component \(u\) on machine \(k\) at work center \(j\) of manufacturer \(i\) (\(pt_{ijku} = {\raise0.7ex\hbox{${\tilde{d}_{iu} .T}$} \!\mathord{\left/ {\vphantom {{\tilde{d}_{iu} .T} {P_{ijku} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${P_{ijku} }$}}\)). This parameter measures the time required to process a batch of component \(u\), from the start of production to completion on the specified machine.

\(s{t}_{ijkuw}\): Sequence-dependent setup time required to switch from producing component \(u\) to component \(w\) on machine \(k\) at work center \(j\) of manufacturer \(i\). This parameter accounts for the time taken to reconfigure or adjust the machine when transitioning between different components in the production sequence, impacting the production flow.

\(s{c}_{ijkuw}\): Sequence-dependent setup cost incurred when transitioning from the production of component \(u\) to component \(w\) on machine \(k\) at work center \(j\) of manufacturer \(i\). This parameter reflects the expenses associated with the setup changes required for different production sequences, inclduing labor, lost production time, and any other costs related to the reconfiguration of machinery for different components.

\({h}_{iju}\): Holding cost for one unit of component \(u\) per time unit incurred between work centers \(j\) and \(j+1\) of manufacturer \(i\). This parameter represents the cost of maintaining inventory as it waits to be processed by the next work center in the manufacturing sequence.

\({h}_{iu}\): Holding cost for one unit of the final component \(u\) per time unit at manufacturer \(i\) and its associated retailers. This parameter captures the cost of storing the completed component before it is moved downstream in the supply chain.

\({A}_{i}\): Delivery cost associated with transporting input materials to manufacturer \(i\). This parameter quatifies expenses related to the transportation and handling of raw materials from their source to the manufacturing facility.

\({h}_{i}^{\prime}\): Holding cost per unit of input materials per time unit at manufacturer \(i\). This parameter reflects the cost incurred for storing and maintaining inventory of raw materials at the manufacturing facility.

\({f}_{iu}\): Conversion rate of input materials to component \(u\) at the initial work center of manufacturer \(i\). This parameter quantifies the efficiency of the manufacturing process in transforming raw materials into specific components at the beginning of the production workflow.

\({L}_{iu}\): Shelf-life of component \(u\) at manufacturer \(i\). This parameter reflects the maximum allowable duration for which a component can be stored at the manufacturer.

\({A}_{iu}\): Delivery cost associated with transporting final component \(u\) from manufacturer \(i\) to its designated retailers. This parameter encompasses various costs such as transportation fees, handling charges, and any other expenditures incurred during the delivery process.

\(PH\): Planning Horizon. The parameter is a predetermined period over which the supply chain operations and scheduling decisions are made, i.e., the timeframe within which production, inventory management, and delivery activities are optimized.

\(M\): A large positive number. It is a sufficiently large positive constant utilized in the linearization process of the mixed-integer non-linear programming model.

Decision Variables:

\({\sigma }_{ij}\): A vector indicating the production sequence of components at work center \(j\) of manufacturer \(i\). Each element of the vector corresponds to a specific component and is equal to 1 if that componenet is processed at the work center before any subsequent components in the sequence; otherwise, it is equal to 0.

\({\sigma }_{ikj}\): A vector indicating the production sequence of components on machine \(k\) at work center \(j\) of manufacturer \(i\). Each element of the vector corresponds to a specific component and is equal to 1 if that componenet is processed on the machine at the work center before any subsequqnet compoenets in the sequence; otherwise, it is equal to 0.

\(T\): Length of the common cycle of production and delivery. This variable represents the duration of a complete production and delivery cycle and is essential for coordinating production, inventory management, and delivery activities across the supply chain.

\(IM\): Number of production cycles occurring over the planning horizon \(PH\). This variable determines how many production cycles are scheduled within the specified planning horizon to fulfill the demand and production requirements of the supply chain.

\({Q}_{iu}\): Production lot size of component \(u\) at all work centers of manufacturer \(i\) (\({Q}_{iu}={\widetilde{d}}_{iu}.T\)). This variable determines the quantity of a specific component produced at the manufacturer in each production cycle.

\({b}_{iju}\): Starting time of processing component \(u\) at work center \(j\) of manufacturer \(i\) after the required setup is fulfilled. This variable ensures that components are processed in accordance with the predetermined sequence and setup requirements.

\({x}_{ijklu}\): 1, if component \(u\) is assigned to position \(l\) in \({\sigma }_{ikj}\); 0, otherwise. This is a binary variable that indicates whether a specific component is assigned to a specific position in the production sequence. This variable ensure that components are processed in the correct order to meet production requirements.

Total cost function at the supplier (TCS)

The supplier receives the input raw materials and converts them to the output materials based on \({f}_{s}\), which then will be delivered to the manufacturers. Figure 1 illustrates the inventory levels of input and output materials at the supplier throughout a typical production cycle, highlighting the points at which inventory levels are highest and lowest. The cost components at the supplier are formulated as follows:

Average delivery cost:

Average production setup cost:

Average holding cost of the input raw materials:

Average holding cost of the output materials:

Hence, the supplier’s total cost function is as follows:

Total cost function at the manufacturers (TCM)

Each manufacturer receives the processed materials from the supplier and uses an FFS production facility to convert them into final components. The following costs are incurred at each manufacturer:

Average delivery cost:

Average production setup cost:

The first part of Eq. (7) represents the setup cost for the first component processed on the \(k\)th machine at work center \(j\) of manufacturer \(i\) (i.e., \({m}_{ikj}\)), following the last assigned component. The second part accounts for the dependent setup costs of the components that follow in the sequence.

Average holding cost of the processed materials:

where \([u]\) denotes the component placed in the \(u\)th position of \({\sigma}_{ikj}\). Equation (8) calculates the holding costs for the processed materials during both production and setup intervals.

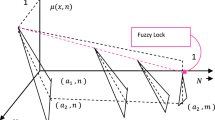

The holding cost of the output (i.e., processed) materials is incurred only at the first work center (i.e., \(j=1\)) and depends on the sequence of components at this work center for each manufacturer. Figure 2 depicts the inventory levels of processed materials at the first work center of each manufacturer, showcasing the fluctuations during a specified period. It indicates periods of inventory depletion which reflects the impact of production scheduling and demand response.

Average holding cost of the WIP inventory:

Figure 3 tracks the WIP inventory levels at each manufacturer, illustrating how inventory fluctuates in response to production adjustments and demand changes.

Average holding cost of the final components:

Figure 4 displays the inventory levels of final component \(u\) at each manufacture, highlighting how inventory adapts to changes in production rates and market demand.

Therefore, the total cost function at a manufacturer is determined as follows:

Total cost function at the retailers (TCR)

Following the economic order quantity (EOQ) model, each retailer orders batches of the required components from its respective manufacturer. Figure 5 illustrates the inventory level of various components at retailers, showcasing trends of inventory accumulation and depletion. The cost components at this level are calculated as follows:

Average delivery cost for the retailers served by each manufacturer:

Average holding cost for the retailers served by each manufacturer:

Hence, the total cost function at the retailers is formulated as follows:

Mixed-integer non-linear model

In the previous subsections, we discussed how the total cost functions are determined at the supplier, manufacturers, and retailers. Building on this foundation, we introduce our mixed-integer non-linear model, which integrates these elements to optimize overall supply chain performance. This subsection outlines the entire model, followed by a detailed explanation of its components.

Objective function (15) minimizes the total supply chain costs. Constraint (16) ensures that no component can be processed before its required processing at the previous work center is completed. Constraint (17) ensures that no component can be processed before its predecessor in the respective production sequence (i.e., \({\sigma}_{ikj}\)). Constraint (18) implies that each component must occupy a unique position in the sequence of each machine at every work center of each manufacturer (i.e., \({\sigma}_{ikj}\)). Constraint (19) stipulates that there can be at most one component at each position of every machine across all work centers of the manufacturers. Constraint (20) guarantees that a component can only be placed in a position if another component is placed in the previous position of the sequence. Constraint (21) requires that the processing of component \(u\) (i.e., the first component in the machine sequence at the \(j\)th work center) cannot begin until the corresponding machine is properly set up. Constraint (22) specifies that the processing completion time of each component at the final work center must not exceed the common cycle time (i.e., T). Constraint (23) ensures that the total production and storage time of component \(u\) does not exceed its shelf-life at each manufacturer. Constraint (24) states that the planning horizon must be an integer multiple (i.e., \(IM\)) of the common cycle time (i.e., \(T\)). Finally, constraints (26) and (27) define the types of decision variables used in the model.

Since the proposed ELDSP is formulated as a non-linear model, we use additional variables and the linearized cost functions to convert it into a linear model as below. Table 2 details these additional variables and specific cost functions used in the linearization of the non-linear model, showing how each variable and cost function is derived.

Next, we use the Me measure to address demand uncertainty in the model described above.

Applying the Me measure to capture uncertainty

In this section, we incorporate demand uncertainty into our model and employ the Me measure to quantify and manage it, thus enhancing the model’s robustness to market fluctuations.

Me measure

To address uncertainty in the proposed model, we apply the Me measure, as presented by Xu and Zhou [60]. This measure is one of the most general fuzzy measures that extends the credibility measure by unifying the basic possibility and necessity measures. Thus, it is particularly useful in practical situations where a flexible measure is needed to adapt to changes in the attitudes of decision-makers [64]. By using the Me measure, the varying judgments of the decision-maker are modeled by adjusting the optimistic-pessimistic parameter. Hence, this approach avoids reliance solely on extreme optimistic or pessimistic judgments, providing a more effective way to handle fuzziness [17, 44, 49, 54].

The Me measure for set A is defined as below:

where Pos denotes the possibility measure, Nec refers to the necessity measure, and \(0\le \lambda \le 1\) represents the optimistic-pessimistic parameter, which determines the combined attitude of the decision-maker [60]. The Me measure then converts the possibilistic model into two distinct, crisp models: the lower approximation model (LAM) and the upper approximation model (UAM). Next, we present the crisp counterparts of the linearized model introduced in Sect. "Mixed-integer non-linear model".

The crisp counterparts

Assuming that demand is a triangular fuzzy number, it is represented by \({\widetilde{d}}_{iu}=\left(d{l}_{iu},{d}_{iu},d{u}_{iu}\right)\), where \({d}_{iu}\) is the most likely demand value and \(d{l}_{iu}\) and \(d{u}_{iu}\) are defined as follows:

where \(disn>0\) and \(disp>0\) denote the distance from the most likely demand to the left and right extremes, respectively, capturing the lower and upper bounds of demand uncertainty. This triangular distribution is selected due to its ability to provide a reasonable approximation for uncertain quantities when minimal data is available. Then, using the Me measure, which accommodates varying levels of optimism/pessimism among decision-makers, the expected value of \({\widetilde{d}}_{iu}\) in the objective function is calculated using the following formula:

Hence, the cost functions are reformulated as follows:

The LAM is then obtained as follows:

The UAM is formulated similarly to the LAM, except that \(disp\) is replaced by \(disn\).

Numerical experiments and discussions

In this section, we conduct a set of numerical experiments to validate and explore the proposed model and illustrate its efficiency and practicality. Additionally, we discuss the performance and complexity of our solution algorithm to demonstrate its effectiveness in addressing the computational demands of the model.

Design of the numerical experiments

Table 3 presents the parameter values used in the numerical experiments, detailing the assumptions and inputs of our model. We adopted numerical values for some parameters from Nikandish et al. [41]. For parameters not included in previous models, we randomly generated the required values using a uniform distribution.

To meet the demand requirements, \({d}_{iu}\) and \({P}_{ijku}\) must satisfy \(\mathop \sum \nolimits_{u = 1}^{{nc_{i} }} {\raise0.7ex\hbox{${d_{iu} }$} \!\mathord{\left/ {\vphantom {{d_{iu} } {P_{ijku} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${P_{ijku} }$}} \le 1,\forall i,j,k\). Additionally, since a component’s value increases as it moves through the supply chain, the unit holding costs are defined such that \({h}_{iu}\ge {h}_{iju}\ge {h}_{i}^{\prime}={h}_{s}^{\prime}\ge {h}_{{s}_{0}}\), ensuring that the costs are proportional to the stage of the supply chain and the component’s added value. To guarantee feasibility of the solutions, the value of \({L}_{iu}\) is set to be sufficiently large, not less than \({T}_{min}\), according to the following formulation:

where,

Hence,

Discussion on the Me measure

Six sample problems of varying sizes were randomly generated using the parameter values from Table 3. Each problem was solved five times to compare performance under both deterministic and fuzzy conditions. The small- and medium-sized problems were solved using GAMS, while the larger ones were tackled using the well-known genetic algorithm. Table 4 presents the numerical results for these six problem instances, providing average objective function values for both deterministic and fuzzy models, namely, UAM and LAM, across multiple iterations.

The following observation summarizes the main result derived from Table 4.

Observation 1: Among the crisp counterparts of the fuzzy model, the Upper Approximation Model (UAM) outperforms the Lower Approximation Model (LAM) in the ELDSP under consideration, i.e., UAM achieving lower objective function values than LAM.

In Table 4, the lower and upper bounds of the objective function are represented by LAM and UAM, respectively. Consistent with the expectations of the Me method, the numerical results confirm that the optimal values for deterministic models fall within these bounds. Furthermore, the proposed model, aimed at minimizing the objective function, demonstrates that UAM < LAM. This outcome is due to the distinct sizes of the feasible solution spaces for UAM and LAM; UAM, which is based on the possibility measure, has a larger feasible solution space compared to LAM, which relies on the necessity measure. This broader solution space under the possibility measure enables UAM to achieve more favorable outcomes than LAM. The numerical results validate these findings and underscore their practical implications for decision-making in economic lot sizing and delivery scheduling in multi-stage supply chains with fuzzy demands.

Figure 6 presents a comparison of the objective function values from the deterministic model and the fuzzy models, i.e., UAM and LAM. This figure clearly illustrates the relationship between the LAM and UAM measures and their deterministic counterpart, as previously discussed. Additionally, it highlights how the gap between these values varies with the problem size.

Sensitivity analysis

To investigate the robustness of our results, we conduct a systematic sensitivity analysis to examine the impact of changes in parameter values on the average total supply chain cost. We adjust each parameter value by − 10% and + 10%, while maintaining all other parameter values fixed. Table 5 illustrates how the objective function value changes with increases or decreases in model parameters for six randomly generated problem instances across small, medium, and large sizes. Each problem is solved five times, and the average objective function value is reported in the table. Each column in the table corresponds to the percentage change applied to a specific parameter, and the values within the table indicate how changes in each parameter affect the objective function value across problem instances of various sizes. Positive values signify an increase in the objective function value, whereas negative values indicate a decrease.

The following observation summarizes the main insights that we obtain from Table 5.

Observation 2: In the three-stage supply chain under consideration,

-

(a)

The average total supply chain cost increases with the demand, the holding cost of the final component, and the sequence-dependent setup cost. Conversely, it decreases with an increase in the production rate.

-

(b)

The average total supply chain cost is relatively insensitive to changes in sequence-dependent setup time, yet it is significantly sensitive to changes in demand.

Intuitively, the relationship between the final components’ holding cost and the total cost in the system is expected to be positive, as this cost term directly impacts the total costs at manufacturers and retailers. Similarly, an increase in sequence-dependent setup costs elevates the total costs at manufacturers, thereby increasing the overall supply chain cost. Regarding demand, higher demand rates lead to increased inventories of raw materials, WIP, and final products, thus escalating inventory holding costs throughout the system. Due to the uncertainty in demand, supply chain players are often compelled to maintain higher stock levels to accommodate potential increases in demand.

Surprisingly, the relationship between the total supply chain cost and the production rate might appear counterintuitive. While one might expect higher production rates to increase the number of final components and thus raise inventory holding costs at manufacturers and retailers, a detailed analysis reveals otherwise. An enhanced production rate may alleviate bottlenecks in the manufacturing process, allowing components to move more quickly through work centers and effectively reducing inventory levels of processed and WIP components.

These sensitivity analysis results validate our proposed model and are consistent with the findings by Lai et al. [36]. Observation 2-(a) underscores the need for supply chain managers to remain vigilant about fluctuations in demand rates, as well as holding costs and setup costs, to adjust their cost management strategies appropriately. On the other hand, the first part of Observation 2-(b) suggests that managers need not be overly concerned about moderate changes in setup times. This is a crucial insight, especially since setup times can be affected by unexpected system incidents, such as component or machine breakdowns.

Computational performance and complexity

In this subsection, we conduct numerical experiments to assess the effectiveness and efficiency of our proposed method and provide a thorough examination of the computational aspects involved in our study. We discuss the specific hardware and software configurations used, the experimental setup, the algorithmic efficiency and complexity, and provide an analysis of the results obtained from these experiments.

Evaluating algorithm performance

The numerical experiments were executed on a personal computer equipped with an Intel Core i5 processor running at 1.7 GHz. We used the General Algebraic Modeling System (GAMS) for obtaining exact solutions and MATLAB 2020 for implementing and running the genetic algorithm (GA).

To rigorously test the scalability and efficiency of our solution methodology, we generated nine problem instances that ranged from small to medium sizes and processed them by both GAMS and GA. Particularly, we solved each problem instance five times by using GA and calculated the average results in order to mitigate random performance variations. Then, for each problem instance, we recorded the objective function value provided by both GAMS and GA. Also, we carefully documented the computational time requirements for both methods to highlight their practical limitations and advantages.

To assess the GA’s performance, we compare its solutions against those obtained from GAMS. The comparison is quantified using the gap percentage formula as follows:

where \({F}_{GAMS}\) and \({F}_{GA}\) represent the objective function value obtained by GAMS and GA, respectively.

The results of these experiments are summarized in Table 6, which includes data on problem sizes, objective function values from GAMS and GA, run times, and the percentage gaps between the solutions obtained from GAMS and those derived from GA. It should be noted that, for the largest two problem instances (i.e., problem instances 8 and 9 in Table 6), GAMS was unable to find a solution even after running for over 12 h. This underscores the computational challenges associated with the NP-Hard nature of the problem and highlights the limitations of using exact solution methods for large-scale instances in practical scenarios.

As demonstrated in Table 6, GAMS provided exact solutions for smaller instances efficiently, with running times as low as a few seconds. However, as problem sizes increased, GAMS’s running times escalated substantially, reaching several hours for medium-sized instances and becoming infeasible for the largest sizes tested. In contrast, GA maintained not only acceptable performance deviation, with gap percentages consistently below 6.6%, but also demonstrated significantly faster execution times across all problem sizes. For instance, even for the largest problems, where GAMS could not produce a solution within a reasonable timeframe, GA’s running times remained under 10 min. These results validate the efficacy of GA in providing near-optimal solutions efficiently, especially as the problem size increases and GAMS becomes impracticable due to extensive computational demands.

This comparison highlights the GA’s advantages in terms of speed and scalability, making it a more viable option for larger or more complex problem instances that are typical in real-world applications. The ability of GA to deliver timely results without compromising heavily on solution quality makes it particularly valuable in dynamic operational environments where decision-making speed is critical.

Algorithmic complexity

As discussed, while GAMS is used to establish baseline solutions for smaller problem instances, its application becomes computationally prohibitive as the problem size increases due to the NP-hard nature of ELDSP. This limitation underscores the necessity of employing a heuristic approach for larger instances.

To ensure a comprehensive understanding of the computational demands of our genetic algorithm, a detailed analysis of its complexity is essential. The algorithm’s complexity is influenced by multiple factors, including population size, problem dimensions, and the number of iterations. For our problem, the complexity scales primarily with the product of the maximum number of iterations (\(MaxIt\)) and the population size (\(nPop\)), further magnified by the problem dimensions (\(i\), \(j\), \(k\), \(l\)) representing the structural complexity of the scheduling problem. Given the extensive use of matrix operations and the iterative nature of genetic algorithms, these factors contribute significantly to computational load, particularly in larger problem instances.

An overview of our GA, along with a complete derivation and detailed complexity analysis, is provided in Appendix A. This examination highlights our method’s scalability and efficiency, particularly in contrast to traditional exact methods, which may struggle with the NP-hard nature of the problem at scale. We also analyze the theoretical computational complexity of our approach, expressed in Big O notation, to discuss how computational demands scale with problem size. This analysis helps delineate the practical deployment of our methods in real-world scenarios.

Managerial implications

In this research, we explore the economic lot and delivery scheduling problem within three-echelon supply chains under conditions of demand uncertainty and sequence-dependent setups. Our novel fuzzy finite-horizon model provides essential insights that guide supply chain managers in refining their operational strategies and decision-making processes. Our findings demonstrate how variations in demand, along with holding and sequence-dependent setup costs, significantly influence supply chain expenses. Managers can leverage these insights to strategically minimize total costs by optimizing production lot sizes and delivery schedules, thereby enhancing the economic efficiency of the entire supply chain. Additionally, by incorporating fuzzy set theory, particularly the Me measure, our model tackles the complexities of demand uncertainty. This integration offers a realistic and adaptable framework that improves decision-making and enables managers to develop robust strategies that anticipate and mitigate the risks associated with demand variability, leading to more resilient supply chain operations.

Furthermore, our research underscores the importance of synchronizing production and delivery activities. Effective synchronization boosts coordination across the supply chain, which streamlines operations and reduces lead times to more efficiently meet market demands. Our study also highlights the necessity for strategic resource allocation, particularly in terms of scheduling and machine usage. Understanding the impact of sequence-dependent setup times and costs is crucial for making informed decisions that directly affect overall supply chain performance. These insights should inform policymakers in developing guidelines that promote synchronization and cost-efficient production and delivery practices, which likely improve the competitiveness and sustainability of supply chains. Overall, by integrating these managerial insights into their operational strategies, supply chain managers are better equipped to handle the complexities associated with economic lot and delivery scheduling, ultimately enhancing both supply chain performance and competitive advantage.

Conclusions and future directions

In this paper, we developed a novel mixed-integer non-linear mathematical model for ELDSP in a three-echelon supply chain implementing the common cycle policy across a finite planning horizon. The model outlines a supply chain structure comprising a captive supplier, multiple manufacturers, and multiple retailers, where each manufacturer operates as a flexible flow shop with unrelated parallel machines and produces multiple components with sequence-dependent setup times and costs. We employed the Me measure approach to tackle demand uncertainty and enhance the model’s adaptability in practice. Despite the complexity of the baseline model, its linearization and conversion into two crisp models allowed for solving small to medium-sized problem instances efficiently in reasonable times.

Our comprehensive analysis, supported by numerical experiments, provides managerial insights into cost optimization and synchronization in multi-stage supply chains. We addressed ELDSP under both deterministic and fuzzy demand scenarios and evaluated the robustness of the proposed model against key system parameters. Our research systematically identifies the system parameters with the most significant impact on total supply chain costs, notably demand rates, holding costs, and sequence-dependent setup costs. These parameters directly influence cost optimization strategies within supply chain management and are critically addressed in our model, underlining its potential to enhance strategic decision-making. Additionally, by integrating demand uncertainty and sequence-dependent setups, our approach provides practitioners with a valuable practical tool for refining operational efficiency and cost-effectiveness in their supply chain, demonstrating the practicality and strategic relevance of our model.

In concluding our study on the fuzzy finite-horizon ELDSP with sequence-dependent setups, it is crucial to acknowledge our research limitations. While our model provides a comprehensive framework for optimizing supply chain operations and addressing demand uncertainty, it operates within a finite planning horizon and assumes a certain level of uniformity in production and delivery schedules across the supply chain. Additionally, the model presumes that manufacturers have sufficient production capacity to meet demand without shortages, and that the processing of production lots occurs without interruption. While these assumptions facilitate the model’s tractability and application, they may limit its transferability to the contexts where supply chain dynamics are more volatile. Also, our model’s application of the fuzzy set theory and the Me measure for handling demand uncertainty offers a robust mechanism for dealing with information ambiguity. However, it could benefit from incorporating other uncertainty modeling techniques, such as stochastic programming or robust optimization, to provide a more diversified methodological approach to supply chain planning.

To extend the applicability of our research, future studies could explore the integration of real-time data analytics and machine learning algorithms to dynamically adjust the supply chain parameters in response to emerging trends and disruptions. This could improve the model’s responsiveness to real-world complexities and refine the decision-making process in supply chain management. Considering cases where setup and holding costs are uncertain could also provide valuable insights for supply chain risk management. Additionally, incorporating more realistic assumptions into the model, such as components’ quality inspections and scheduling of maintenance plans for machinery, would enhance its practical applicability. Future research could also consider the impact of environmental compliance and greenhouse gas costs. This would extend the ELDSP framework to include economic and environmental factors, particularly in scenarios involving imperfect products and their reworking, to provide a broader perspective on sustainability in supply chain management. Furthermore, investigating the interplay between different supply chain stages and expanding the model to include reverse logistics would offer a more holistic view of supply chain operations and their broader economic and environmental impacts. Finally, formulating the problem with alternative scheduling policies or considering more complex production facilities, such as flexible job shop or open shop environments, and comparing these results would open new avenues for research.

References

Ameri Z, Sana SS, Sheikh R (2019) Self-assessment of parallel network systems with intuitionistic fuzzy data: a case study. Soft Comput 23:12821–12832. https://doi.org/10.1007/s00500-019-03835-5

As' ad RA, Bahroun Z (2015) Synchronization of replenishment decisions for the multi stage economic lot delivery and scheduling problem. In: 2015 6th international conference on modeling, simulation, and applied optimization (ICMSAO). IEEE, pp 1–6. https://doi.org/10.1109/ICMSAO.2015.7152202

Asadkhani J, Mokhtari H, Tahmasebpoor S (2021) Optimal lot-sizing under learning effect in inspection errors with different types of imperfect quality items. Oper Res. https://doi.org/10.1007/s12351-021-00624-7

Beck FG, Biel K, Glock CH (2019) Integration of energy aspects into the economic lot scheduling problem. Int J Prod Econ 209:399–410. https://doi.org/10.1016/j.ijpe.2018.02.012

Beck FG, Glock CH (2020) The economic lot scheduling problem: a content analysis. Int J Prod Res 58(11):3437–3454. https://doi.org/10.1080/00207543.2019.1668071

Behroozi F, Hosseini SMH, Sana SS (2021) Teaching–learning-based genetic algorithm (TLBGA): an improved solution method for continuous optimization problems. Int J Syst Assur Eng Manag 12(6):1362–1384. https://doi.org/10.1007/s13198-021-01319-0

Beykal B, Avraamidou S, Pistikopoulos EN (2022) Data-driven optimization of mixed-integer bi-level multi-follower integrated planning and scheduling problems under demand uncertainty. Comput Chem Eng 156:107551. https://doi.org/10.1016/j.compchemeng.2021.107551

Birjandi AK, Dehmolaee S, Sheikh R, Sana SS (2021) Analysis and classification of companies on Tehran stock exchange with incomplete information. RAIRO-Oper Res 55:S2709–S2726. https://doi.org/10.1051/ro/2020114

Camussi NB, Cerda J, Cafaro DC (2021) Mathematical formulations for the optimal sequencing and lot sizing in multiproduct synchronous assembly lines. Comput Ind Eng 152:107006. https://doi.org/10.1016/j.cie.2020.107006

Chang PT, Yao MJ, Huang SF, Chen CT (2006) A genetic algorithm for solving a fuzzy economic lot-size scheduling problem. Int J Prod Econ 102(2):265–288. https://doi.org/10.1016/j.ijpe.2005.03.008

Clausen J, Ju S (2006) A hybrid algorithm for solving the economic lot and delivery scheduling problem in the common cycle case. Eur J Oper Res 175(2):1141–1150. https://doi.org/10.1016/j.ejor.2005.06.037

Dousthaghi S, Tavakkoli-Moghaddam R (2012) An economic lot and delivery scheduling problem with the fuzzy shelf life in a flexible job shop with unrelated parallel machines. Int J Ind Eng Comput 3(4):663–680. https://doi.org/10.5267/j.ijiec.2012.04.001

Dousthaghi S, Tavakkoli-Moghaddam R, Makui A (2013) Solving the economic lot and delivery scheduling problem in a flexible job shop with unrelated parallel machines and a shelf life by a proposed hybrid PSO. Int J Adv Manuf Technol 68:1401–1416. https://doi.org/10.1007/s00170-013-4930-0

Ghasemiyeh R, Moghdani R, Sana SS (2017) A hybrid artificial neural network with metaheuristic algorithms for predicting stock price. Cybern Syst 48(4):365–392. https://doi.org/10.1080/01969722.2017.1285162

Goli A, Alinaghian M (2020) A new mathematical model for production and delivery scheduling problem with common cycle in a supply chain with open-shop system. Int J Manuf Technol Manag 34(2):174–187. https://doi.org/10.1504/IJMTM.2020.106206

Goli A, Davoodi SMR (2018) Coordination policy for production and delivery scheduling in the closed loop supply chain. Prod Eng 12(5):621–631. https://doi.org/10.1007/s11740-018-0841-0

Goodarzian F, Hosseini-Nasab H (2021) Applying a fuzzy multi-objective model for a production–distribution network design problem by using a novel self-adoptive evolutionary algorithm. Int J Syst Sci Oper Logist 8(1):1–22. https://doi.org/10.1080/23302674.2019.1607621

Guo J, Liu W, Peng Z, Du B (2023) Integrated scheduling of distributed production and distribution in group manufacturing with uncertain travel time. Complex Intell Syst 9(2):1871–1889. https://doi.org/10.1007/s40747-022-00875-7

Hahm J, Yano CA (1992) The economic lot and delivery scheduling problem: the single item case. Int J Prod Econ 28(2):235–252. https://doi.org/10.1016/0925-5273(92)90036-7

Hahm J, Yano CA (1995) The economic lot and delivery scheduling problem: the common cycle case. IIE Trans 27(2):113–125. https://doi.org/10.1080/07408179508936724

Hahm J, Yano CA (1995) The economic lot and delivery scheduling problem: models for nested schedules. IIE Trans 27(2):126–139. https://doi.org/10.1080/07408179508936725

Hahm J, Yano CA (1995) The economic lot and delivery scheduling problem: powers of two policies. Transp Sci 29(3):222–241. https://doi.org/10.1287/trsc.29.3.222

Hasani A, Hosseini SMH, Sana SS (2022) Scheduling in a flexible flow shop with unrelated parallel machines and machine-dependent process stages: trade-off between Makespan and production costs. Sustain Anal Model 2:100010. https://doi.org/10.1016/j.samod.2022.100010

Helber S, Inderfurth K, Sahling F, Schimmelpfeng K (2018) Flexible versus robust lot-scheduling subject to random production yield and deterministic dynamic demand. IISE Trans 50(3):217–229. https://doi.org/10.1080/24725854.2017.1357089

Hosseini SMH, Sana SS, Rostami M (2022) Assembly flow shop scheduling problem considering machine eligibility restrictions and auxiliary resource constraints. Int J Syst Sci Oper Logist 9(4):512–528. https://doi.org/10.1080/23302674.2021.1942586

Hwang HC, Van Den Heuvel W, Wagelmans AP (2013) The economic lot-sizing problem with lost sales and bounded inventory. IIE Trans 45(8):912–924. https://doi.org/10.1080/0740817X.2012.724187

Jenabi M, Fatemi GS, Torabi SA (2008) Finite horizon economic lot and delivery scheduling problem: flexible flow lines with unrelated parallel machines and sequence dependent setups. Int J Eng 21:143–158

Jensen MT, Khouja M (2004) An optimal polynomial time algorithm for the common cycle economic lot and delivery scheduling problem. Eur J Oper Res 156(2):305–311. https://doi.org/10.1016/S0377-2217(03)00024-9

Kamath BN, Bhattacharya S (2006) Integrated inventory model for similar products under a two-echelon supply chain environment: an empirical Study. Opsearch 43:331–357. https://doi.org/10.1007/BF03398782

Karthick B, Uthayakumar R (2022) Optimization on dual-channel supply chain model with pricing decision and trapezoidal fuzzy demand under a controllable lead time. Complex Intell Syst 8(3):2557–2591. https://doi.org/10.1007/s40747-022-00642-8

Kayvanfar V, Zandieh M, Arashpour M (2022) Hybrid bi-objective economic lot scheduling problem with feasible production plan equipped with an efficient adjunct search technique. Int J Syst Sci Oper Logist. https://doi.org/10.1080/23302674.2022.2059721

Khouja M (2000) The economic lot and delivery scheduling problem: common cycle, rework, and variable production rate. IIE Trans 32(8):715–725. https://doi.org/10.1023/A:1007656727418

Khouja M (2003) Synchronization in supply chains: implications for design and management. J Oper Res Soc 54:984–994. https://doi.org/10.1057/palgrave.jors.2601606

Kia H, Ghodsypour SH, Davoudpour H (2017) A hybrid imperialist competitive algorithm for solving economic lot and delivery scheduling problem in a four-stage supply chain. Adv Mech Eng 9(2):1687814016686893. https://doi.org/10.1177/1687814016686893

Kim T, Hong Y, Chang SY (2006) Joint economic procurement—production–delivery policy for multiple items in a single-manufacturer, multiple-retailer system. Int J Prod Econ 103(1):199–208. https://doi.org/10.1016/j.ijpe.2005.06.005

Lai X, Chen Z, Sarker BR (2020) Optimal production lot sizing for an imperfect manufacturing system with machine breakdown and emergency maintenance policy. Kybernetes 49(5):1533–1560. https://doi.org/10.1108/K-12-2018-0687

Li X, Ma S (2017) Multiobjective discrete artificial bee colony algorithm for multiobjective permutation flow shop scheduling problem with sequence dependent setup times. IEEE Trans Eng Manag 64(2):149–165. https://doi.org/10.1109/TEM.2016.2645790

Liu J, Wu L, Zhou Z (2008) A time-varying lot size method for the economic lot scheduling problem with shelf life considerations. Eur J Ind Eng 2(3):337–355. https://doi.org/10.1504/EJIE.2008.017689

Liu P, Hendalianpour A, Razmi J, Sangari MS (2021) A solution algorithm for integrated production-inventory-routing of perishable goods with transshipment and uncertain demand. Complex Intell Syst 7:1349–1365. https://doi.org/10.1007/s40747-021-00311-2

Lohmer J, Lasch R (2021) Production planning and scheduling in multi-factory production networks: a systematic literature review. Int J Prod Res 59(7):2028–2054. https://doi.org/10.1080/00207543.2020.1797207

Nikandish N, Eshghi K, Torabi S (2009) Integrated procurement, production and delivery scheduling in a generalized three stage supply chain. J Ind Syst Eng 3(3):189–212

Osman H, Demirli K (2012) Economic lot and delivery scheduling problem for multi-stage supply chains. Int J Prod Econ 136(2):275–286. https://doi.org/10.1016/j.ijpe.2011.12.001

Pratama YNA, Darmawan M, Astanti RD, Ai TJ, Gong DC (2019) Inventory policy for dependent demand where parent demand has decreasing pattern. Int J Ind Eng Eng Manag 1(1):17–30. https://doi.org/10.24002/ijieem.v1i1.2293

Ren A, Wang Y (2018) A new approach based on possibilistic programming technique and fractile optimization for bilevel programming in a hybrid uncertain circumstance. Appl Intell 48:3782–3796. https://doi.org/10.1007/s10489-018-1177-3

Song W, Mi N, Li Q, Zhuang J, Cao Z (2023) Stochastic economic lot scheduling via self-attention based deep reinforcement learning. IEEE Trans Autom Sci Eng. https://doi.org/10.1109/TASE.2023.3248229

Song X, Song Y, Stojanovic V, Song S (2023) Improved dynamic event-triggered security control for T–S fuzzy LPV-PDE systems via pointwise measurements and point control. Int J Fuzzy Syst 25(8):3177–3192. https://doi.org/10.1007/s40815-023-01563-5

Sun P, Song X, Song S, Stojanovic V (2023) Composite adaptive finite-time fuzzy control for switched nonlinear systems with preassigned performance. Int J Adapt Control Signal Process 37(3):771–789. https://doi.org/10.1002/acs.3546

Tan M, Duan B, Su Y (2018) Economic batch sizing and scheduling on parallel machines under time-of-use electricity pricing. Oper Res Int J 18(1):105–122. https://doi.org/10.1007/s12351-016-0256-7

Torabi SA, Baghersad M, Mansouri SA (2015) Resilient supplier selection and order allocation under operational and disruption risks. Transport Res Part E Logist Transport Rev 79:22–48. https://doi.org/10.1016/j.tre.2015.03.005

Torabi SA, Ghomi SF, Karimi B (2006) A hybrid genetic algorithm for the finite horizon economic lot and delivery scheduling in supply chains. Eur J Oper Res 173(1):173–189. https://doi.org/10.1016/j.ejor.2004.11.012

Torabi SA, Jenabi M (2009) Multiple cycle economic lot and delivery-scheduling problem in a two-echelon supply chain. Int J Adv Manuf Technol 43(7–8):785–798. https://doi.org/10.1007/s00170-008-1752-6

Torabi SA, Jenabi M (2009) A meta-heuristic approach for the ELDSP in flexible flow lines: the power-of-two policy. J Ind Eng Univ Tehran 43(1):1–13

Torabi SA, Karimi B, Ghomi SF (2005) The common cycle economic lot scheduling in flexible job shops: the finite horizon case. Int J Prod Econ 97(1):52–65. https://doi.org/10.1016/j.ijpe.2004.05.005

Torabi SA, Namdar J, Hatefi SM, Jolai F (2016) An enhanced possibilistic programming approach for reliable closed-loop supply chain network design. Int J Prod Res 54(5):1358–1387. https://doi.org/10.1080/00207543.2015.1070215

Torkaman S, Ghomi SF, Karimi B (2017) Multi-stage multi-product multi-period production planning with sequence-dependent setups in closed-loop supply chain. Comput Ind Eng 113:602–613. https://doi.org/10.1016/j.cie.2017.09.040

Uthayakumar R, Karthick B (2023) Analysis of several reduction strategies on a two-echelon sustainable supply chain model with triangular fuzzy demand. Opsearch 60(1):393–419. https://doi.org/10.1007/s12597-022-00610-3

Vergara FE, Khouja M, Michalewicz Z (2002) An evolutionary algorithm for optimizing material flow in supply chains. Comput Ind Eng 43(3):407–421. https://doi.org/10.1016/S0360-8352(02)00055-4

Wagner BJ, Davis DJ (2002) A search heuristic for the sequence-dependent economic lot scheduling problem. Eur J Oper Res 141(1):133–146. https://doi.org/10.1016/S0377-2217(01)00265-X

Xu W, Song DP (2022) Integrated optimisation for production capacity, raw material ordering and production planning under time and quantity uncertainties based on two case studies. Oper Res Int J 22(3):2343–2371. https://doi.org/10.1007/s12351-020-00609-y

Xu J, Zhou X (2013) Approximation based fuzzy multi-objective models with expected objectives and chance constraints: application to earth-rock work allocation. Inf Sci 238:75–95. https://doi.org/10.1016/j.ins.2013.02.011

Yao MJ, Chang PT, Huang SF (2005) On the economic lot scheduling problem with fuzzy demands. Int J Oper Res 2(2):58–71

Yildiz H, DuHadway S, Narasimhan R, Narayanan S (2016) Production planning using evolving demand forecasts in the automotive industry. IEEE Trans Eng Manag 63(3):296–304. https://doi.org/10.1109/TEM.2016.2560162

Zhang Z, Song X, Sun X, Stojanovic V (2023) Hybrid-driven-based fuzzy secure filtering for nonlinear parabolic partial differential equation systems with cyber attacks. Int J Adapt Control Signal Process 37(2):380–398. https://doi.org/10.1002/acs.3529

Zhou X, Wang J, Yang X, Lev B, Tu Y, Wang S (2018) Portfolio selection under different attitudes in fuzzy environment. Inf Sci 462:278–289. https://doi.org/10.1016/j.ins.2018.06.013

Zohali H, Naderi B, Mohammadi M, Roshanaei V (2019) Reformulation, linearization, and a hybrid iterated local search algorithm for economic lot-sizing and sequencing in hybrid flow shop problems. Comput Oper Res 104:127–138. https://doi.org/10.1016/j.cor.2018.12.008

Funding

All authors declare that there are no financial or non-financial relationships with any organizations that might have an interest in the submitted work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that there are no financial or non-financial relationships with any organizations that might have an interest in the submitted work.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: computational complexity analysis

Appendix A: computational complexity analysis

In this appendix, we provide an overview of the genetic algorithm we designed to solve our proposed model for ELDSP and analyze its computational complexity.

A.1. Genetic algorithm design overview

The genetic algorithm is structured around a population of solutions (i.e., chromosomes), each represented as a matrix of dimensions (\(i\times j\)), with each element of the matrix (i.e., sub-chromosome) containing a sub-matrix (\(k\times l\)). These dimensions correspond to the indices of manufacturers, work centers, machines, and component positions, respectively, which dictate the structural complexity of the chromosome. The genetic algorithm progresses through several phases:

-

1.

Initialization: We begin by generating a diverse initial population of chromosomes.

-

2.

Fitness evaluation: Each chromosome is evaluated based on its ability to minimize total cost.

-

3.

Selection: We employ tournament selection to pick high-quality solutions for reproduction.

-

4.

Crossover and mutation: These genetic operators introduce new chromosomes (i.e., offspring chromosomes) into the population, aiming to explore new solution areas while maintaining strong traits from previous generations.

-

5.

Population update: The algorithm continuously updates its population by selecting the best-performing chromosomes for the next generation.

-

6.

Termination: The algorithm concludes after a predetermined number of iterations and delivers a near-optimal solution.

The genetic algorithm is parameterized to balance exploration and exploitation effectively and ensure robust performance across different problem scales.

A.2. Computational complexity analysis

To provide an in-depth analysis of the computational complexity of the genetic algorithm used in our study, we focus on each stage of the algorithm’s execution. This analysis explores the computational burden associated with initializing the population, evaluating fitness, executing genetic operations, and maintaining population dynamics.

-

1.

Initialization: The initial population setup involves creating \(nPop\) chromosomes, each requiring the instantiation of \(i\times j\) sub-matrices of size \(k\times l\). Thus, the complexity of this phase is \(O(nPop\times i\times j\times k\times l)\).

-

2.

Fitness evaluation: Each chromosome’s effectiveness is measured by calculating its total cost, which involves examining every part of the chromosome’s structure. This step has a complexity of \(O(nPop\times i\times j)\).

-

3.

Selection (tournament selection): Tournament selection involves selecting the best solution from subsets of the population. Considering each tournament involves a constant number of comparisons \(t\), the complexity is \(O(nPool\times t)\), where \(nPool\) represents the number of tournaments conducted, and \(t\) is typically a small number.

-

4.

Crossover: Crossover is performed on \(nCross\) pairs, with the complexity for each crossover depending on the number of sub-chromosomes involved. Given a randomized exchange of sub-chromosomes, this step’s complexity is \(O(nCross\times i\times j)\).

-

5.

Mutation: Mutation affects \(nMut\) chromosomes in each generation. Considering a constant number of mutations per chromosome, the mutation complexity per generation is \(O(nMut\times m\times k\times l)\), where \(m\) is the number of sub-chromosomes mutated.

-

6.

Combination and selection: Combining parent and offspring chromosomes and selecting the best ones for the next generation involves sorting operations. Hence, the complexity of this phase is \(O(nPop\times \text{log}\left(nPop\right))\).

-

7.

Overall complexity per generation: Combining the complexities in all phases gives us \(O(nPop\times i\times j\times k\times l+nPop\times i\times j+nPool\times t+nCross\times i\times j+nMut\times m\times k\times l+nPop\times \text{log}\left(nPop\right))\). Simplifying this under the assumption that the matrix operations dominate, the overall per-generation complexity is approximated as \(O(nPop\times i\times j\times k\times l)\).

-

8.

Total complexity: Over \(MaxIt\) generations, the total complexity becomes \(O\left(MaxIt\times nPop\times i\times j\times k\times l\right)\), reflecting the algorithm’s significant reliance on the population size and the dimensions of the scheduling problem.

The above breakdown clarifies the computational investment required by our genetic algorithm and confirms its suitability for solving complex economic lot and delivery scheduling problems, particularly where traditional methods fail under the extensive computational demands of large-scale scenarios.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sangari, E., Jolai, F. & Sangari, M.S. A novel fuzzy finite-horizon economic lot and delivery scheduling model with sequence-dependent setups. Complex Intell. Syst. (2024). https://doi.org/10.1007/s40747-024-01517-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40747-024-01517-w