Abstract

This paper considers a dual-channel supply chain with one vendor and multiple buyers in which (1) one channel is an offline channel where standard products are produced and shipped to the buyers and (2) the second channel is an online channel with the flow of customized products between the vendor and the online buyers/consumers. The first channel follows a vendor managed inventory with consignment stock (VMI-CS) agreement between the vendor and buyers. The supply lead time between the vendor and the buyer is considered controllable, at a cost. Two models are analyzed: (1) in the first model, the standard and customized product’s demand rate is assumed to be price and lead time-sensitive, and (2) in the second model, the demands are uncertain or ambiguous and are treated as a trapezoidal fuzzy number. It is reasonably complex to obtain analytical solutions. Hence, two algorithms are proposed to obtain the numerical solution with the objective of maximizing total profit. Numerical examples, sensitivity analysis, and managerial insights are given to test the model. Finally, conclusions and directions for future research are provided.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Inventory management is a part of supply chain management that monitors the movement of goods from the initial production stage to the final stage of reaching their consumers. The key feature of inventory management is to maintain a clear record of each new or returned product entering or leaving a warehouse. Also, its purpose is to keep the right products in the right place at the right time, and this requires inventory visibility: knowing when to reorder, how much to order, and where to store stocks. In addition, the basic steps of inventory management include purchasing inventory, storing inventory, and making a profit from inventory. With so many different types of businesses operating today, attracting and retaining customers are a challenging task, so manufacturers need to handle certain strategies. Vendor managed inventory (VMI) is not a new concept, but many retailers have not adopted it as part of their business strategy. However, when properly implemented, a salesperson’s VMI strategy can bring significant benefits to the business. A VMI policy is where the buyer shares information with a vendor. The vendor maintains an agreed inventory level of a specific product, i.e., once stock levels reach a specific reorder level, the vendor replenish the stock on behalf of the buyer. Consignment Stock (CS) policy is an agreement signed between the vendor and the buyer, under which the stock is in the hands of the buyer, while the vendor retains ownership of the goods/products until they are sold.

The rapid growth of the Internet has led to a massive increase in online business opportunities. Consumers who once had to go to a supermarket or business place to buy goods or services can now make purchases from the comfort of their homes or workplaces. Online business reduces or eliminates many of the overhead costs associated with a brick-and-mortar business. Doing business online offers many benefits and can easily attract many customers through this online business. Nowadays, online business is in great use; for example, more and more customers use Flipkart and Amazon. Therefore, some researchers (see, for instance, [6, 7]) have proven with their models that a manufacturer can achieve dominant profits by pursuing their business both online and offline. However, here are some questions to determine why a large number of merchants are not interested in online and offline businesses:

-

Before the buyer/consumer receives an item, it flows through numerous stages and many players; hence, the price increases when the product arrives at the buyer rather than from the vendor. When the vendor trades the same product online with the intention of helping the consumer by reducing the unnecessary price, the buyer’s business is affected.

-

The market demand for a product cannot be constant. Whereas, when supplying the product offline only, the manufacturer can modestly estimate the demand. However, predicting product demand in both online and offline businesses is extremely challenging.

-

In retail stores, consumers have the opportunity to buy the product they want immediately. On the other hand, if consumers want to order/purchase a product online, they may have to wait a few days to receive their order. Some will accept this lead time, and some will not wait. Therefore, excessive lead time can affect online business.

-

Some consumers will go to the retailer store and acquire the items they want with satisfaction. However, while purchasing products online, that 100% satisfaction is unlikely because the ordered item may sometimes arrive late or damaged.

This research has been done to answer the above questions. This article describes offline and online business strategies under two different demand patterns. The vendor produces a standard product from a core item by adding some basic features and then selling it through an offline channel. Moreover, in this channel, the VMI-CS agreement is signed between the vendor and buyer, and the lead time between the two supply chain players (vendor and buyer) is considered to be controllable. The vendor builds the goods from the core item in the online channel and customizes them based on the online consumer’s order. Two models are considered in this paper depending on the product’s demand. In the first model, the demands for the standard and customized (personalized) items are assumed to be related to the selling price and lead time, while in the second model, the demand rates of standard and customized items among multiple buyers and online consumers are considered unpredictable (ambiguous or uncertain); therefore, the demand rate is considered to be a trapezoidal fuzzy number. The defuzzification method is performed with the signed distance method. The remainder of the paper is organized as follows: second section includes a review of the literature. Preliminary definitions are provided in the third section. The fourth section provides a problem statement, notations, and assumptions for developing the model. The fifth section discusses two VMI-CS policy-based mathematical formulations with controllable lead time. In the sixth section, the solution procedure was developed to find the optimal solutions with the necessary and sufficient conditions. Section seven considers two numerical experiments and comparative studies to validate the proposed concept. The sensitivity analysis of the parametric values is covered in the eighth section. Section nine provides management insights. Finally, section ten concludes with a summary of the findings and recommendations for further research.

Literature review

The literature review section covers topics such as dual-channel supply chain, controllable lead time, price-sensitive demand, CS policy in a fuzzy environment (ambiguous or vague sense), VMI & CS policy, and, finally, the literature gap analysis.

Dual-channel supply chain

Today, most industries continue to trade online as well as offline. The following are the articles that came out to solve the problems that arise in such an environment. Liu et al. [22] illustrated a dual-channel production inventory model with pricing resolutions. Batarfi et al. [6] developed a modern strategy for profit maximization with two channels in the supply chain. Zhou et al. [47] investigated the dual-channel supply chain with pricing decisions under free-riding services. Batarfi et al. [7] proposed a two channel supply chain model with pricing and inventory decisions under the learning and forgetting concept. Li et al. [23] examined the supply chain model with the pricing and service effort tactics in online and offline business. Pi et al. [28] introduced service strategies with competition and collaboration in the dual-channel supply chain under uninterrupted demand. Chen and Su [10] illustrated a coordinated supply chain model with CS agreement under online and offline business practices. Zhu et al. [49] developed a two-channel coordinating inventory model with demand uncertainty. Yang et al. [44] examined the effects of the reviews received from online customers under the dual-channel supply chain. From this, we gathered the benefits and strategies of doing business online and offline.

Controllable lead time

A lead time is a delay between the origin and completion of a process. Lead time plays a vital role in supply chains, so we will look at the consequences of reducing it from the perspective of researchers. Jha and Shanker [16] have developed a two-echelon supply chain model between a single vendor and multi-buyer with variable lead time and service-level constraints. Yi and Sarker [42] are the first researchers who analyzed the CS policy model under controllable lead time. Mandal and Giri [24] have illustrated an integrated supply chain model between a single-vendor multi-buyer with varying lead time and quality improvement. Yang et al. [43] describe inventory competition problems with lead time effects in a dual-channel distribution chain. Modak and Kelle [25] analyzed the dual-channel supply chain model with delivery-time-dependent stochastic demand. Castellano et al. [11] have studied single vendor-multiple buyers supply chain model with the distribution-free approach under controllable lead time. From the review above, we learned the importance of controllable lead time and the benefits of reducing it in the supply chain.

Price-dependent demand

Pricing is the crucial factor in maximizing profits in the supply chain by ensuring that supply and demand are in sync. Therefore, the literature on the benefits that can occur if the demand for a commodity depends on its price is given below. Taleizadeh et al. [38] have developed an imperfect supply chain model with pricing decisions under buyback of defective products. Taleizadeh et al. [37] have analyzed pricing and ordering decisions on two competing supply chain under the Stackelberg game-theoretic approach. Alfares and Ghaithan [1] have developed a pricing supply chain model with price-dependent demand. Zhao et al. [46] have examined a two-echelon supply chain model with pricing decisions of complementary items. Gupta et al. [14] have developed a three-echelon supply chain with pricing decision-making under uncertain demand. Bieniek [8] has addressed a vendor and retailer managed consignment inventory model with additive price-dependent demand. Dey et al. [12] have presented an integrated inventory model to implement selling price-dependent demand and investment. Sarkar et al. [33] developed a retail strategy for improved sustainability services for consumers. We explored how we can increase demand for a product based on price and make better decisions in the supply chain.

CS policy in fuzzy environment

It is essential to understand the uncertainty in managing inventory strategies in supply chain management. In inventory models, there are uncertainties in demand for goods. Some stochastic techniques have been used to deal with these issues under the inventory policies of some supply chain management. In such cases, uncertainties are shaped by probability distributions based on past analysis. However, past data may not always be accurate. Moreover, uncertainty in integrated inventory models is difficult to determine and implement. Therefore, fuzzy-based techniques for treating these uncertainties may be the best way to apply inventory concepts in the supply chain. Yao and Chiang [41] have analyzed a fuzzy inventory with two different defuzzification methods and finally stated that the signed distance method is better for the defuzzification process. Björk [3] has developed an economic order quantity model by considering the inventory associated cost as a triangular fuzzy number and defuzzification using the signed distance method. Kazemi et al. [17] have developed an inventory model with variable back-ordering under a trapezoidal fuzzy number. Sadeghi and Niaki [30] have examined a bi-objective vendor managed inventory model with trapezoidal fuzzy demand. Zhong et al. [48] analyzed the inventory model with variable pricing under fuzzy environment. Maity et al. [26] studied the economic order quantity model by assuming the demand rate as fuzzy/uncertain. Sarkar et al. [31] have developed a three-level supply chain model with fuzzy inventory cost under the signed distance defuzzification method. Karthick and Uthayakumar [18] examined the two-level supply chain model with triangular fuzzy demand under the signed distance defuzzification approach. Karthick and Uthayakumar [19] analyzed the effects of constant and trapezoidal fuzzy demand under VMI-CS policy. Samanta et al. [34] introduced the concept of the influence of an individual on a focal network under a fuzzy environment. Saha et al. [35] examined the best dynamic investment for promotion under trapezoidal-type demand rate. Karthick and Uthayakumar [20] established the sustainable supply chain model using the signed distance approach in two distinct situations with triangular fuzzy demand. Bhuniya et al. [9] studied various business strategies based on deterministic and triangular fuzzy demand using the centroid approach. Gupta et al. [15] analyzed two types of decision-makers’ functioning in two distinct groups of supply chain networks in an intuitionistic fuzzy environment. Karthick and Uthayakumar [21] investigated the consignment stock policy model with payment and shipment delays under trapezoidal fuzzy number. From the above literature works, we have found ways of dealing with the fuzzy concept in the inventory model.

Vendor managed inventory and consignment stock policy

In the supply chain, some strategies are essential to attract customers and make more profit, based on which both VMI and CS policy appear to be the best strategies. Valentini and Zavanella [39] have developed a CS policy model with the analysis of industrial purpose. Zavanella and Zanoni [45] studied the integrated inventory model with CS agreement between a single manufacturer and multiple buyers. Battini et al. [4] also established a two-level integrated supply chain model with CS agreement policy. Srinivas and Rao [29] have analyzed the supply chain model with genetic algorithm under CS policy between a single manufacturer and multiple buyers. Both VMI and CS policy have different natures. However, researchers have proven that they can increase profits by incorporating it into their model. Ben-Daya et al. [5] developed a VMI-CS policy supply chain model between a single manufacturer and multiple buyers. Gharaei et al. [13] explored VMI-CS contract between the single vendor and multi-buyer with the consideration of penalty, green, and quality control policies. Wu et al. [40] studied the CS policy integrated supply chain model with delayed effect and advertising strategies. Mokhtari and Rezvan [27] have examined a VMI production model with partial back-ordering between the single supplier and multiple buyers. Ahmed et al. [2] created a synergic inventory model with imperfect manufacturing in the context of a global supply chain. Sardar et al. [36] considered a machine learning technique for on-demand forecasting under consignment stock policy. Sen et al. [32] analyzed the effectiveness of CS policy with storage space constraints. With these, it seems that when VMI and CS agreements are put together, it will reduce unnecessary costs and help to add products among customers on time.

The literature gap in previous research

The literature review study reveals that only a few inventory models have been established in the context of business practices through online and offline. However, the models considering the VMI-CS agreement on the offline channel are very limited in the literature. No one can always accurately predict the demand for a particular item, which is subject to change in the environment. Therefore, in this article, two models are developed depending on the demand for the item. Assuming that the demand rate depends on the selling price and the lead time, Batarfi et al. [7] have developed a dual-channel inventory model. Several related models are in the literature, for example, Batarfi et al. [6] and Chen and Su [10] . Although these models can predict or fulfil the existing demands of the industry, it is challenging (bit difficult) to predict them in the future. However, most researchers consider the distribution of products or goods on the offline channel between a single vendor and a single buyer, and assumed the lead time between them to be zero. Therefore, to fill such gaps or drawbacks, in this article, we assume that the demand rate of the standard and the customized item is ambiguous, as the supply of goods takes place between one vendor and multiple buyers in the offline channel. In addition, we have considered the lead time between them as a variable. The demand rate is treated as a trapezoidal fuzzy number, whereas some literature dealt the CS policy model with constant or price-dependent demand (see Battini et al. [4], Alfares and Ghaithan [1], Bieniek [8], and Dey et al. [12]). As far as we know, no supply chain model under the VMI-CS agreement in two different aspects concerning the demand pattern has been reported in the literature on the dual-channel inventory model with multiple buyers and variable lead time. Contributions of various study articles from the existing literature are given in Table 1, through which the key factors of this model can be easily identified.

Preliminaries

We need the following definitions to treat the fuzzy inventory model with the VMI-CS agreement under the signed distance defuzzification process.

Definition 3.1

(Fuzzy number) The fuzzy number is expressed as a fuzzy set \({\tilde{D}}\) on \({\mathbb {R}}\) defining a fuzzy interval in \({\mathbb {R}},\) satisfies the following conditions:

-

1.

\({\tilde{D}}\) must be a normal fuzzy set.

-

2.

\({\tilde{D}}_{\lambda }\) must be a closed interval \(\forall \lambda \in (0,1]\) (convex).

-

3.

The support of the fuzzy set \({\tilde{D}}\) must be bounded.

-

4.

Its membership function (see, for instance [18]) is piece-wise continuous.

Definition 3.2

(Trapezoidal fuzzy number) The fuzzy number \({\tilde{t}}\) is said to be a non-negative trapezoidal fuzzy number (see, Fig. 1) \((t_{1},t_{2},t_{3},t_{4})\), such that \(t_{1}< t_{2}< t_{3} < t_{4}\).

The membership function of trapezoidal fuzzy number is given by

where \(t_{1}=\) lower limit, \(t_{2}=\) lower mode, \(t_{3}=\) upper mode, and \( t_{4}=\) upper limit of the fuzzy number \({\tilde{t}}.\) We represent the trapezoidal fuzzy number as \({\tilde{t}}=(t-\varphi _1, t-\varphi _2, t+\varphi _3, t+\varphi _4)\), where \(\varphi _i\), \(i=1, 2, 3, 4\) are arbitrary positive numbers with the restriction \(d_i>\varphi _1>\varphi _2,\) \(\varphi _3<\varphi _4.\) For the trapezoidal fuzzy number \({\tilde{F}}=(t_1,t_2,t_3,t_4),\) the left and right \(\lambda \) cuts of \({\tilde{F}}\) are, respectively, given by \({\tilde{F}}_L(\lambda )=t_1+(t_2-t_1)\lambda \) and \({\tilde{F}}_U(\lambda )=t_4-(t_4-t_3)\lambda .\)

Definition 3.3

(Signed distance method) For any \(t\in R,\) \(d(t,0)=t\) is named as the signed distance from t to 0. If \(t>0,\) then the distance from t to 0 is \(t=d(t,0);\) if \(t<0, \) the distance from t to 0 is \(-t=-d(t,0).\) Therefore, \(d(t,0)=t\) is known as the signed distance from t to 0. For the fuzzy set \({\tilde{F}}\in R^+, 0\le \lambda \le 1,\) the following expression can be obtained as \({\tilde{F}}=\bigcup \nolimits _{0\le \lambda \le 1}{\tilde{F}}_{\lambda }=\bigcup \nolimits _{0\le \lambda \le 1}[L_\lambda , R_{\lambda }].\) The signed distance of the interval \([L_\lambda , R_\lambda ]\) measured from the origin 0 is given by \( d([L_\lambda , R_\lambda ],{\tilde{0}})=\frac{({\tilde{F}}_L(\lambda )+{\tilde{F}}_U(\lambda ))}{2}. \) For the fuzzy number \({\tilde{F}}\in R^-,\) the proposed defuzzification methods \(d({\tilde{F}}, 0)\) (the distance from \({\tilde{F}}\) to 0) are written as

Problem definition, notations, and assumptions

Problem definition

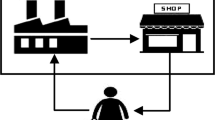

Some companies/manufacturers trade the same product through offline and online. Thus, buyer’s sales may be affected if the same product is sold via offline and online. Therefore, this paper considers standard items for offline sales and customizable items for online sales. Assuming this, there will be no loss in sales for both the vendor and the buyer, and thus, the number of sales and profit will increase. Figure 2 illustrates a simple and efficient way to understand this model. The vendor manufactures two products from a single core item and refers to them as the standard and customizable item. In producing this way, the only question that arises is how much quantity of the core substance is required for the production of each item, so we consider it as a variable. Furthermore, a VMI-CS agreement between the vendor and the buyer is considered to market the products manufactured as standard items through offline. This agreement will increase the interest among the buyers to purchase the standard items. In this paper, two models are considered; in the first model, the demand rate is dependent on the selling price and the lead time, and in the second model, the demand rate is considered a fuzzy number (ambiguous). The following are the reasons for dividing a single model into two models based on demand rate: While promoting/marketing a product, it is a bit difficult to predict the demand rate. Therefore, before making such a prediction, it is essential to think from the person who wants to buy a product. Nowadays, most consumers order an item based on the selling price and the delivery time (lead time), which is why the demand rate on the first model is calculated based on the selling price and lead time. Nonetheless, the product’s selling price and lead time can only be predicted for a short period. However, it is impossible to predict the selling price or lead time of an item in the future, all of which may vary according to the respective context. Based on this, we consider the demand rates in the second model as trapezoidal fuzzy numbers. These models can be compared to two scenarios, the first model for the present context and the second model for the future context. The purpose of this study is to examine which of these two models is more profitable.

In this paper, we develop a mathematical model using the notations and assumptions listed below.

Notations

The following notations will be used to develop the model.

Parameters | |

|---|---|

\(d_{\mathrm{r}j}\) | Demand rate of \(j\mathrm{th}\) buyer on offline channel, \(j=1,2,\ldots y\) (units/year) |

\(d_\mathrm{c}\) | Online channel demand rate (units/year) |

\(a_\mathrm{d}\) | Primary demand, \(a_\mathrm{d}>0\) (units/year) |

\(\theta _\mathrm{s},(1-\theta _\mathrm{s})\) | Percentage share of the demand going to the online and offline channel respectively \((\%)\) |

\(\alpha _{\mathrm{r}j}\) | Coefficient of price elasticity of the standard item for \(j\mathrm{th}\) buyer \((\mathrm{unit}^2/\$/\mathrm{year})\) |

\(\alpha _{\mathrm{c}i}\) | Coefficient of price elasticity of the customized \(i\mathrm{th}\) item, \(i=1,2,\ldots z\) \((\mathrm{unit}^2/\$/\mathrm{year})\) |

\(\rho \) | Cross-price sensitivity |

\(\beta _{\mathrm{r}j}\) | Sensitivity of delivery lead time of demand \(d_{\mathrm{r}j}\) \((\mathrm{customer}/\mathrm{day})\) |

\(\beta _\mathrm{c}\) | Sensitivity of delivery lead time of demand \(d_\mathrm{c}\) \((\mathrm{customer}/\mathrm{day})\) |

\(\psi _{\mathrm{c}i}\) | Percentage of core item stock used for customized item \(i=1,2,3,\ldots z\) \((\%)\) |

\(p_\mathrm{r}, p_\mathrm{c}\) | Production rate for the standard and core item for eventual customization, \(p_\mathrm{r}>a_{d}, p_\mathrm{c}>a_{d} (\mathrm{units}/\mathrm{year})\) |

\(p_{\mathrm{cr}}, p_{\mathrm{cc}i}\) | Production cost for the standard and the customized \(i\mathrm{th}\) item \((\$/\mathrm{year})\) |

\(w_{\mathrm{r}j}\) | Wholesale price of the standard item to the \(j\mathrm{th}\) buyer \((\$/\mathrm{unit})\) |

\(S_\mathrm{mr},S_\mathrm{mc}\) | Setup cost for the standard and core item respectively \((\$/setup)\) |

\(O_{\mathrm{r}j}\) | Ordering cost for the standard item of \(j\mathrm{th}\) buyer \((\$/\mathrm{order})\) |

\(h^\mathrm{pf}_\mathrm{m}\) | Physical and financial holding cost for the vendor \((\$/unit/year)\) |

\(h^f_{\mathrm{m}j}\) | Financial holding cost for a unit of the standard item at the \(j\mathrm{th}\) buyer’s side paid by the vendor \((\$/\mathrm{unit}/\mathrm{year})\) |

\(h^p_{\mathrm{r}j}\) | Physical holding cost for \(j\mathrm{th}\) buyer \((\$/\mathrm{unit}/\mathrm{year})\) |

\(h^p_{\mathrm{d}j}\) | Physical holding cost of \(j\mathrm{th}\) buyer in transit \((\$/\mathrm{unit}/\mathrm{year})\) |

\(t_j\) | Fixed transportation cost for \(j\mathrm{th}\) buyer \((\$/\mathrm{shipment})\) |

\(v_j\) | Variable transportation cost for \(j\mathrm{th}\) buyer \((\$/\mathrm{unit})\) |

\(T_\mathrm{r}\) | Cycle time (year) |

\(\textit{B}(\textit{l}_j)\) | Lead time crashing cost for \(j\mathrm{th}\) buyer \((\$/\mathrm{year})\) |

Decision variables | |

|---|---|

\(n_j\) | Number of shipments for \(j\mathrm{th}\) buyer (integer) |

\(s_{\mathrm{r}j}\) | Selling price of a standard item for \(j\mathrm{th}\) buyer \((\$/\mathrm{unit})\) |

\(s_{\mathrm{c}i}\) | Selling price of \(i\mathrm{th}\) customized item \((\$/\mathrm{unit})\) |

\(q_{\mathrm{r}j}\) | Shipment size of \(j\mathrm{th}\) buyer for the standard item \((\mathrm{units}/\mathrm{shipment})\) |

\(q_\mathrm{c}\) | Production quantity of the core item for eventual customization (units) |

\(\textit{l}_j\) | Lead time length of \(j\mathrm{th}\) buyer (year) |

Assumptions

The following assumptions are considered while developing the model.

-

1.

In the offline channel, the model is described between a single vendor and multiple buyers with standard products. In the online channel, the consumer will place a direct order with the vendor for their personalized products.

-

2.

An infinite planning horizon is considered and the inventory level of the buyer is continuously reviewed (see, for instance, Yi and Sarker [42]).

-

3.

The production rate of the standard and customized products considered as finite and each product’s production rate should be strictly greater than its demand rate (i.e., \(p_\mathrm{r}>d_{\mathrm{r}j},\) \(p_\mathrm{c}>d_\mathrm{c}\)) to avoid any shortages (see, for instance, Yi and Sarker [42]).

-

4.

The vendor’s setup cost and buyer’s ordering cost are constant/fixed and independent of the order/production quantity (see Batarfi et al. [7]). The financial holding cost of the products in the vendor’s inventory is omitted from the total cost. In addition, the financial holding cost of the products stored in the buyer’s warehouse will be added until the buyer pays the vendor for the products purchased.

-

5.

The holding cost of vendor is divided into two parts, namely financial and physical. Therefore, vendor’s holding cost is \(h^\mathrm{pf}_{\mathrm{m}}\) and unit holding cost for \(j\mathrm{th}\) buyer in transit is \(h_{\mathrm{d}j}=h_{\mathrm{d}j}^\mathrm{p}+h_{\mathrm{m}j}^\mathrm{f}.\)

-

6.

For the \(j\mathrm{th}\) buyer, the lead time \(\textit{l}_j\) consists of \(n_j\) components which are mutually independent. The \(k\mathrm{th}\) component has a minimum duration \(m_{j,k}\), normal duration \(n_{j,k}\), and a crashing cost per unit time \(e_{j,k}\), and assume that \(e_{j,1} \le e_{j,2} \le \cdots \le e_{j,n_{ij}}\). The lead time components are to be crashed one at a time beginning from the least component of \(e_i\) and so on.

-

7.

Let \( l _{j,0}= \sum _{k=1}^{n_{ij}}n_{j,k}\) and \( l _{j,f}\) is the length of the lead time components \(1, 2, 3,\ldots ,f\) crashed to their minimum duration, then expression of \( l _{j,f}\) is given by \( l _{j,f}= l _{j,0}-\sum _{j=1}^{f}(n_{j,k}-m_{j,k})\), where \(f=1, 2,\ldots ,n_{ij}\) and crashing cost for the lead time per cycle is given by

$$\begin{aligned} B(\textit{l}_j)= & {} e_{j,f}\left( \textit{l}_{j,f-1}-\textit{l}_j \right) \\&\quad + \sum _{k=1}^{f-1} e_{j,k}(n_{j,k}-m_{j,k}),~\textit{l}_j\in \left[ \textit{l}_{j,f}, \textit{l}_{j,f-1}\right] . \end{aligned}$$

Mathematical model

This section discusses two mathematical models that include inventory calculations for supply chain players.

The average inventory of the system is calculated as (refer, Yi and Sarker [42])

The average inventory of buyer is derived by dividing \(\sum _{j=1}^{y}q_{\mathrm{r}j}^2\left( \frac{n_{j}}{2p_\mathrm{r}}-\frac{n_{j}^2}{2p_\mathrm{r}}+\frac{n_{j}^2}{2d_{\mathrm{r}j}}\right) \) by the cycle time \(T_\mathrm{r}=\sum _{j=1}^{y}\frac{n_{j}q_{\mathrm{r}j}}{d_{\mathrm{r}j}}\), the calculation is on the following:

The average inventory in transit is calculated as

The average inventory of the vendor in the offline channel \(I^\mathrm{c1}_\mathrm{vendor}\) is calculated by subtracting \(I_\mathrm{buyer}\) and \(I_\mathrm{transit}\) from the average system inventory \(I_\mathrm{cs}\)

The average inventory of core products/items needed to be customized on an online channel \(I^{c2}_\mathrm{vendor}\) is calculated as

Vendor’s function

The vendor has two channels, so the inventory costs associated with each channel are described as follows:

Channel 1 (offline channel)

The inventory costs which the vendor incurs through the offline channel are listed below.

Setup cost

Setup costs include the cost of arranging the equipment needed to make the items before production starts and configuring a machine for a production run. In this case, the cost of preparing the machine prior to each production of standard products obtained from the core item is

Physical and financial holding cost

The vendor manufactures standard products, stocks a specific amount of goods, and provides the required quantity to the buyer. Therefore, the cost of holding the stored inventory for y buyers is

Financial holding cost

According to the VMI-CS policy, the vendor will continue to ship the products to the buyer, and the goods received will be stored in the buyer’s warehouse. The vendor’s cost for holding those items in the buyers’ warehouse is

Production cost

The vendor will produce standard products from the core components to be delivered to the buyer, so the cost of producing such products will be

Transportation cost

Standard products will be sent to the buyers’ in \(\sum _{j=1}^{y}n_j\) shipments by the vendor. The buyers’ fixed transportation cost is \(\sum _{j=1}^{y}t_j\frac{n_jd_{\mathrm{r}j}}{q_{\mathrm{r}j}}\), while the variable transportation cost is \(\sum _{j=1}^{y}v_jd_{\mathrm{r}j}\). As a result, the buyer’s total transportation cost is

Lead time crashing cost

By reducing the lead time duration, the customer may obtain the goods in a timely way, thus incurring the crashing cost to shorten the lead time, which is

Transit lead time cost

During the period of lead time, the cost incurred for holding the inventory at the time of transport is

By adding all the above costs, then we get the total inventory cost function corresponding to the offline channel as

Therefore, to calculate the profit \(P^\mathrm{off}_\mathrm{m}(n_j,s_{\mathrm{r}j}, q_{\mathrm{r}j}, l_j)\) to be received from the offline channel (through y buyers), the inventory cost to the vendor has to be subtracted from the wholesale price of \(j\mathrm{th}\) buyer, which is calculated as

Channel 2 (online channel)

The inventory costs connected with the vendor’s online channel are given in the following:

Setup cost for customized items

The cost of constructing and preparing machinery for the production of customized products for online consumer is

Holding cost for core items

The cost of holding the core item required for the customization process is

Production cost

After receiving an order from an online consumer, the vendor will create customized products according to their preferences and the cost required for this procedure is

The cost function related to online channel is obtained as

The vendor’s profit through the online channel \(P^\mathrm{on}_m(s_{\mathrm{c}i}, q_\mathrm{c})\) is calculated by subtracting the cost function (3) from online consumers’ selling price of customized items

Buyers function

The inventory costs associated with y buyers are given in the following.

Ordering cost

The cost incurred at the time of placing an order to the vendor via the offline channel is

Purchasing cost

The cost incurs for purchasing the standard item from the vendor is

Physical holding cost

The vendor will send the needed amount of products to the buyer and incur the financial cost of holding those products, which is

The inventory costs associated with y buyers are calculated by adding the ordering cost, the standard item’s purchasing cost, and the physical holding cost

The profit of y buyers \(P^\mathrm{off}_{\mathrm{r}}(s_{\mathrm{r}j}, q_{\mathrm{r}j} )\) is calculated by subtracting the inventory cost of y buyers (5) from the selling price of the standard item to the consumer, which is

By combining Eqs. (2), (4), and (6), the integrated profit function of the dual-channel supply chain can be obtained. Two model formulations have been developed considering two different demand modes in the integrated profit function, which are found in the sections “Model formulation-I” and “Model formulation-II”.

Model formulation-I

The vendor ships the standard item to each buyer in equal shipments of size \(q_{\mathrm{r} j}\) and sells at the wholesale price \(w_{\mathrm{r}j}\). The buyer sells the standard item to the customer/consumer at a retail price \(s_{\mathrm{r}j}\) and pays the vendor only when the items are withdrawn from inventory/warehouse. The vendor continues producing and shipping the standard item until the buyer’s inventory reaches a maximum level.

However, in this model formulation, the demand rate of the two-channel is assumed to be a linear function dependent on selling price and lead time, that is, \(d_{\mathrm{r}j}=(1-\theta _\mathrm{s})a_\mathrm{d}-\alpha _{\mathrm{r}j} s_{\mathrm{r}j}+\rho \sum _{i=1}^{z}s_{\mathrm{c}i}-\beta _{\mathrm{r}j}{} \textit{l}_j\) and \(d_\mathrm{c}=\theta _\mathrm{s} a_\mathrm{d}-\sum _{i=1}^{z}\alpha _{\mathrm{c}i}s_{\mathrm{c}i}+\rho s_{\mathrm{r}j}+\beta _\mathrm{c}{} \textit{l}_j.\) The integrated profit function of the supply chain with the consideration of \(j\mathrm{th}\) buyer is obtained as

Therefore, the total integrated profit function for a single vendor and y buyers can be written as

Model formulation-II

In this formulation, a fuzzy optimization model has been developed due to the lack of knowledge in market demand. The trapezoidal fuzzy number is used to alleviate the lack of information or uncertainty of demand. Therefore, the fuzzification and defuzzification process is implemented in the following:

Fuzzification

The demand rate between y buyers on offline channel is written as

and the demand rate in the online channel as

where \(\varphi _{d_{\mathrm{r}j1}}, \varphi _{d_{\mathrm{r}j2}}, \varphi _{d_{\mathrm{r}j3}}, \varphi _{d_{\mathrm{r}j4}}, \varphi _{d_\mathrm{c1}},\) \( \varphi _{d_\mathrm{c2}}, \varphi _{d_\mathrm{c3}}\) and \( \varphi _{d_\mathrm{c4}},\) \(j=1,2,3;\) are arbitrary positive numbers under the following conditions: \(d_{\mathrm{r}j}>\varphi _{d_{\mathrm{r}j1}}>\varphi _{d_{\mathrm{r}j2}},\) \(\varphi _{d_{\mathrm{r}j3}}<\varphi _{d_{\mathrm{r}j4}};\) \(d_\mathrm{c}>\varphi _{d_\mathrm{c1}}>\varphi _{d_\mathrm{c2}},\) \(\varphi _{d_\mathrm{c3}}<\varphi _{d_\mathrm{c4}}.\) Therefore, the fuzzified integrated profit function for a single vendor and \(j\mathrm{th}\) buyer is established as

Hence, the total fuzzified integrated profit for a single vendor and y buyers is written as

Defuzzification

Defuzzification is the method of generating a quantifiable result in crisp logic from fuzzy sets and corresponding membership functions (i.e., the process of reducing the fuzzy set to a crisp set or converting the fuzzy quantity to a crisp quantity). There are several methods to convert a fuzzy objective non-linear programming problem model into a crisp objective non-linear programming problem model in the defuzzification process. The signed distance method is one of the effective approaches for the defuzzification process (see Sarkar et al. [31]).

The left and right \(\lambda \) cuts of \(d_{\mathrm{r}j}\) and \(d_{\mathrm{c}}\) are given below

and

respectively.

Therefore, left and right \(\lambda \) cuts of the integrated profit function \({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (9) are obtained as

and

respectively. Therefore, using the signed distance method (see, Definition 3.3), the fuzzified profit function described with trapezoidal fuzzy number can be converted into the crisp function as follows:

Hence, the defuzzified profit function of the supply chain is established as

where

For simplification, the defuzzified profit function for single vendor and \(j\mathrm{th}\) buyer is identified as

Solution procedure

Throughout this section, all derivatives and equations are obtained for the \(i\mathrm{th}\) customized item and \(j\mathrm{th}\) buyer. The necessary and sufficient conditions can be used for proving unique optimum solutions (i.e., \(s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j},\) and \(q_\mathrm{c}\)).

Necessary conditions for optimum solutions

Model formulation - I

Theorem 6.1

When the number of shipments \(n_j,\) selling price of \(i\mathrm{th}\) customized item \(s_{\mathrm{c}i},\) shipment size of the standard item for the \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j},\) production quantity of the core item for customization \(q_\mathrm{c}\), and the lead time of \(j\mathrm{th}\) buyer \(\textit{l}_j\) is constant, then the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to the selling price of standard item for \(j\mathrm{th}\) buyer \(s_{\mathrm{r}j}.\)

Proof

The first- and second-order partial derivatives of the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) with respect to the selling price of standard item for \(j\mathrm{th}\) buyer \(s_{\mathrm{r}j}\) are

and

respectively. Therefore, the unique optimum solution \(s_{\mathrm{r}j}\) is obtained by equating (14) to zero, that is, \(\frac{\partial P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)}{\partial s_{\mathrm{r}j}}=0.\) Then, the obtained optimum solution of \(s_{\mathrm{r}j}\) is

From Eq. (15), it is clear that the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to \(s_{\mathrm{r}j}.\) Hence, this completes the proof of Theorem 6.1. \(\square \)

Theorem 6.2

When the number of shipments \(n_j,\) selling price of standard item for \(j\mathrm{th}\) buyer \(s_{\mathrm{r}j},\) shipment size of the standard item for the \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j},\) production quantity of the core item for customization \(q_\mathrm{c}\), and the lead time of \(j\mathrm{th}\) buyer \(\textit{l}_j\) is constant, then the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to the selling price of \(i\mathrm{th}\) customized item \(s_{\mathrm{c}i}.\)

Proof

The first- and second-order partial derivatives of the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) with respect to the selling price of \(i\mathrm{th}\) customized item \(s_{\mathrm{c}i}\) are

and

respectively. Therefore, the unique optimum solution \(s_{\mathrm{c}i}\) is obtained by equating (17) to zero, that is, \(\frac{\partial P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)}{\partial s_{\mathrm{c}i}}=0.\) Then, the obtained optimum solution of \(s_{\mathrm{c}i}\) is

From Eq. (18), it is clear that the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to \(s_{\mathrm{c}i}.\) Hence, this completes the proof of Theorem 6.2. \(\square \)

Theorem 6.3

When number of shipments \(n_j,\) selling price of standard item for \(j\mathrm{th}\) buyer \(s_{\mathrm{r}j},\) selling price of \(i\mathrm{th}\) customized item \(s_{\mathrm{c}i},\) production quantity of the core item for customization \(q_\mathrm{c}\), and the lead time of \(j\mathrm{th}\) buyer \(\textit{l}_j\) is constant, then the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to the shipment size of the standard item for \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j}.\)

Proof

The first- and second-order partial derivatives of the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) with respect to the shipment size of the standard item for the \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j}\) are

and

respectively. Therefore, the unique optimum solution \(q_{\mathrm{r}j}\) is obtained by equating (20) to zero, that is, \(\frac{\partial P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)}{\partial q_{\mathrm{r}j}}=0.\) Then, the obtained optimum solution of \(q_{\mathrm{r}j}\) is

where \(\Gamma _1=(((1-\theta _s)a_d-\alpha _{\mathrm{r}j} s_{\mathrm{r}j}+\rho \sum _{i=1}^{z}s_{\mathrm{c}i}-\beta _{\mathrm{r}j}{} \textit{l}_j)(h^p_{\mathrm{r}j}+h^{pf}_\mathrm{m}+h_{\mathrm{m}j}^f-n_jh^p_{\mathrm{r}j}-n_jh_{\mathrm{m}j}^f)+n_jp_\mathrm{r}h^p_{\mathrm{r}j}+n_jp_\mathrm{r}h^f_{\mathrm{m}j}).\) From Eq. (21), it is clear that the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to \(q_{\mathrm{r}j}.\) Hence, this completes the proof of Theorem 6.3. \(\square \)

Theorem 6.4

When the number of shipments \(n_j,\) selling price of standard item for \(j\mathrm{th}\) buyer \(s_{\mathrm{r}j},\) selling price of \(i\mathrm{th}\) customized item \(s_{\mathrm{c}i},\) shipment size of the standard item for the \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j}\), and the lead time of \(j\mathrm{th}\) buyer \(\textit{l}_j\) is constant, then the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to the production quantity of the core item for customization \(q_\mathrm{c}.\)

Proof

The first- and second-order partial derivatives of the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) with respect to the production quantity of the core item for customization \(q_\mathrm{c}\) are

and

respectively. Therefore, the unique optimum solution \(q_\mathrm{c}\) is obtained by equating (23) to zero, that is, \(\frac{\partial P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)}{\partial q_{\mathrm{c}}}=0.\) Then, the obtained optimum solution of \(q_\mathrm{c}\) is

From Eq. (24), it is clear that the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave with respect to \(q_\mathrm{c}.\) Hence, this completes the proof of Theorem 6.4. \(\square \)

Theorem 6.5

For fixed values of \(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j},\) and \(q_\mathrm{c},\) then the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is convex in \(\textit{l}_j\in [\textit{l}_{j,f}, \textit{l}_{j,f-1}]\).

Proof

If we take the first- and second-order partial derivative of \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) with respect to \( l _j\), we get

and

respectively. Therefore, the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) occurs maximum only at the end points of the interval \( l _j\in [ l _{j,f}, l _{j,f-1}]\). Hence, this completes the proof of Theorem 6.5. \(\square \)

Theorem 6.6

For fixed values of \(\textit{l}_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}\) and \(q_\mathrm{c},\) then the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave in \(n_j\).

Proof

If we take the first- and second-order partial derivative of \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) with respect to \(n_j\), we get

and

respectively. Therefore, the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is concave in \(n_j\). Hence, this completes the proof of Theorem 6.6. \(\square \)

Model formulation-II

Theorem 6.7

When the number of shipments \(n_j,\) production quantity of the core item for customization \(q_\mathrm{c}\), and the lead time of \(j\mathrm{th}\) buyer \(\textit{l}_j\) is constant, then the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is concave with respect to the shipment size of the standard item for the \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j}.\)

Proof

The first- and second-order partial derivatives of the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) with respect to the shipment size of the standard item for the \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j}\) are

and

respectively. Therefore, the unique optimum solution \(q_{\mathrm{r}j}\) is obtained by equating (26) to zero, that is, \(\frac{\partial d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})}{\partial q_{\mathrm{r}j}}=0.\) Then, the obtained optimum solution of \(q_{\mathrm{r}j}\) is

where \(\Gamma _2=((d_{\mathrm{r}j}+\frac{1}{4}(\varphi _{d_{\mathrm{r}j4}}+\varphi _{d_{\mathrm{r}j3}}-\varphi _{d_{\mathrm{r}j2}}-\varphi _{d_{\mathrm{r}j1}}))(h^p_{\mathrm{r}j}+h^{pf}_\mathrm{m}+h_{\mathrm{m}j}^f-n_jh^p_{\mathrm{r}j}-n_jh_{\mathrm{m}j}^f)+n_jp_\mathrm{r}h^p_{\mathrm{r}j}+n_jp_\mathrm{r}h^f_{\mathrm{m}j}).\) From Eq. (27), it is clear that the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is concave with respect to \(q_{\mathrm{r}j}.\) Hence, this completes the proof of Theorem 6.7. \(\square \)

Theorem 6.8

When the number of shipments \(n_j,\) shipment size of the standard item for the \(j\mathrm{th}\) buyer \(q_{\mathrm{r}j}\), and the lead time of \(j\mathrm{th}\) buyer \(\textit{l}_j\) is constant, then the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is concave with respect to the production quantity of the core item for customization \(q_\mathrm{c}.\)

Proof

The first- and second-order partial derivatives of the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) with respect to the production quantity of the core item for customization \(q_\mathrm{c}\) are

and

respectively. Therefore, the unique optimum solution \(q_\mathrm{c}\) is obtained by equating (29) to zero, that is, \(\frac{\partial d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})}{\partial q_{\mathrm{c}}}=0.\) Then, the obtained optimum solution of \(q_\mathrm{c}\) is

From Eq. (30), it is clear that the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is concave with respect to \(q_\mathrm{c}.\) Hence, this completes the proof of Theorem 6.8. \(\square \)

Theorem 6.9

For fixed values of \(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}\) and \(q_\mathrm{c}\), then the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is linear on \(\textit{l}_j.\)

Proof

On taking the first-order derivative of the profit functions \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) will lead to

Equation (32) results as a constant. If \(\frac{e_{j,f}}{q_{ij}}>\left[ {h}^p_{dj}+{h}^f_{\mathrm{m}j}\right] ,\) then \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is linear increase on \(\textit{l}_j.\) If \(\frac{e_{j,f}}{q_{ij}}<\left[ {h}^p_{dj}+{h}^f_{\mathrm{m}j}\right] ,\) then \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is linear decrease on \(\textit{l}_j.\) If \(\frac{e_{j,f}}{q_{ij}}=\left[ {h}^p_{dj}+{h}^f_{\mathrm{m}j}\right] ,\) then \(d_0({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is flat on \(\textit{l}_j.\) Therefore, the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is linear on \(\textit{l}_j.\) Hence, this completes the proof of Theorem 6.9. \(\square \)

For the fixed values of \(n_j, q_{\mathrm{r}j}\) and \(q_\mathrm{c},\) the maximum profit \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) occurs always only at the end points of \([\textit{l}_{j,f}, \textit{l}_{j,f-1}].\)

Theorem 6.10

For fixed values of \(\textit{l}_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}\) and \(q_\mathrm{c},\) then the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is concave in \(n_j\).

Proof

If we take the first- and second-order partial derivative of \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) with respect to \(n_j\), we get

and

respectively. Therefore, the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is concave in \(n_j\). Hence, this completes the proof of Theorem 6.10. \(\square \)

Sufficient conditions for optimum solutions

Model formulation-I

Theorem 6.11

For fixed \(n_j\), \(\textit{l}_j\in [\textit{l}_{j,f}, \textit{l}_{j,f-1}]\), then the optimal solutions of \(s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j},\) and \(q_\mathrm{c}\) will maximize the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j),\) exist, and are unique.

Proof

For the fixed values of \(n_j\) and \(\textit{l}_j\), the Hessian matrix \({\mathbf {H}}^{I}\) is as follows:

The solution will be optimal if the corresponding Hessian matrix \({\mathbf {H}}^{I}\) of the profit function \(P^1_{\mathrm{mr}j}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (7) is negative definite. It is enough to show all the principal minors of \({\mathbf {H}}^{I}\) as \((-1)^kH_{kk}^I>0\) where \(k=1,2,3,4.\)

The first principal minor of \({\mathbf {H}}^I\) is

These are proved in section “Model formulation- I” [see Eqs. (15), (18), (21), and (24)]

The second principal minor of \({\mathbf {H}}^I\) is

The third and fourth principal minors are given in the Appendix. Therefore, the determinant of Hessian matrix \({\mathbf {H}}^I\) is negative definite, for any positive values of \(s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}\) and \(q_\mathrm{c}.\) Hence, this completes the proof of Theorem 6.11\(\square \)

Model formulation-II

Theorem 6.12

For fixed \(n_j\), \(\textit{l}_j\in [\textit{l}_{j,f}, \textit{l}_{j,f-1}]\), then the optimal solutions of \(q_{\mathrm{r}j}\) and \(q_\mathrm{c}\) will maximize the profit function \(d_0({\tilde{P}}^2_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13), exist, and are unique.

Proof

For the fixed value of \(n_j\) and \(\textit{l}_j\), the Hessian matrix \({\mathbf {H}}^{II}\) is as follows:

The solution will be optimal if the corresponding Hessian matrix \({\mathbf {H}}^{II}\) of the profit function \(d_0({\tilde{P}}^{2}_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) is negative definite. It is enough to show that all the eigen values of the Hessian matrix \({\mathbf {H}}^{II}\) are negative, where

are proved in the “Model formulation-II” section [see Eqs. (27) and (30)]

Therefore, the profit function \(d_0({\tilde{P}}^2_{\mathrm{mr}j}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (13) attains the maximum at the optimal solutions. Hence, this completes the proof of Theorem 6.12. \(\square \)

Algorithms

This subsection contains two algorithms for numerically evaluating the proposed models.

Algorithm-I (for model formulation-I)

-

Step 1 Set \([n_1,n_2,n_3,..,n_y]=[1,1,1,\ldots ,1].\)

-

Step 2 For every \([\textit{l}_1,\textit{l}_2,\textit{l}_3,\ldots ,\textit{l}_y]\) (see Table 3) and continue the following steps from 2.1 to 2.4.

-

Step 2.1 Initialize the values of \([s_{\mathrm{c}1}, s_{\mathrm{c}2}, s_{\mathrm{c}3},\ldots ,s_{\mathrm{c}z}], [q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) and \(q_\mathrm{c},\) compute \([s_{\mathrm{r}1},s_{\mathrm{r}2},s_{\mathrm{r}3},\ldots ,s_{\mathrm{r}y}]\) using Eq. (16).

-

Step 2.2 Using the values of \([s_{\mathrm{r}1},s_{\mathrm{r}2},s_{\mathrm{r}3},\ldots ,s_{\mathrm{r}y}], [q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) and \(q_\mathrm{c},\) compute \([s_{\mathrm{c}1}, s_{\mathrm{c}2}, s_{\mathrm{c}3},\ldots ,s_{\mathrm{c}z}]\) using Eq. (19).

-

Step 2.3 Similarly, compute the value of \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3}, \ldots ,q_{\mathrm{r}y}]\) and \(q_\mathrm{c},\) using the values of \([s_{\mathrm{r}1},s_{\mathrm{r}2},s_{\mathrm{r}3},\ldots ,s_{\mathrm{r}y}],\) \([s_{\mathrm{c}1}, s_{\mathrm{c}2}, s_{\mathrm{c}3},\ldots ,s_{\mathrm{c}z}], q_\mathrm{c},\) and \([s_{\mathrm{r}1},s_{\mathrm{r}2},s_{\mathrm{r}3},\ldots , s_{\mathrm{r}y}],[s_{\mathrm{c}1}, s_{\mathrm{c}2}, s_{\mathrm{c}3},\ldots ,s_{\mathrm{c}z}],\) \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\), respectively, from Eqs. (22) and (25).

-

Step 2.4 Repeat steps 2.1 to 2.3 until the values of \([s_{\mathrm{r}1},s_{\mathrm{r}2},s_{\mathrm{r}3},\ldots ,s_{\mathrm{r}y}], [s_{\mathrm{c}1}, s_{\mathrm{c}2}, s_{\mathrm{c}3},\ldots ,s_{\mathrm{c}z}],\) \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) and \(q_\mathrm{c},\) occurs no change.

-

-

Step 3 Using the values of \([s_{\mathrm{r}1},s_{\mathrm{r}2},s_{\mathrm{r}3},\ldots ,s_{\mathrm{r}y}], [s_{\mathrm{c}1}, s_{\mathrm{c}2}, s_{\mathrm{c}3},\ldots ,s_{\mathrm{c}z}],[q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) and \(q_\mathrm{c},\) calculate the total profit \(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) (8) of the supply chain.

-

Step 4 Set \(n_j=n_j+1\), repeat Steps from 2 to 3.

-

Step 5 If \(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\ge P^1_\mathrm{mr}(n_j+1,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) and \(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\ge P^1_\mathrm{mr}(n_j-1,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j),\) where \(j= 1, 2, 3, \ldots , y.\)

-

Step 6 \(P^1_\mathrm{mr}(n_j^*,s_{\mathrm{r}j}^*, s_{\mathrm{c}i}^*, q_{\mathrm{r}j}^*, q_\mathrm{c}^*, l_j^*)\)=\(\max \) \(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) and we obtain \([n_1,n_2,n_3,..,n_y],\) \([s_{\mathrm{r}1},s_{\mathrm{r}2},s_{\mathrm{r}3},\ldots ,s_{\mathrm{r}y}],\) \( [s_{\mathrm{c}1}, s_{\mathrm{c}2}, s_{\mathrm{c}3},\ldots ,s_{\mathrm{c}z}],[q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}],\) \(q_\mathrm{c}\) and \([\textit{l}_1,\textit{l}_2,\textit{l}_3,\ldots ,\textit{l}_y]\) as the optimal solution.

Algorithm-II (for model formulation-II)

-

Step 1 Set \([n_1,n_2,n_3,..,n_y]=[1,1,1,\ldots ,1].\)

-

Step 2 For every \([\textit{l}_1,\textit{l}_2,\textit{l}_3,\ldots ,\textit{l}_y]\) (see, Table 3) and continue the following steps from 2.1 to 2.3.

-

Step 2.1 Initialize the value of \(q_\mathrm{c},\) compute \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) using Eq. (28).

-

Step 2.2 Using the values of \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) and compute \(q_\mathrm{c},\) using Eq. (31).

-

Step 2.3 Repeat steps 2.1 to 2.2 until the values of \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) and \(q_\mathrm{c},\) occurs no change.

-

-

Step 3 Using the values of \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}]\) and \(q_\mathrm{c},\) calculate the total profit \(d_0({\tilde{P}}^2_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) (10) of the supply chain.

-

Step 4 Set \(n_j=n_j+1\), repeat Steps from 2 to 3.

-

Step 5 If \(d_0({\tilde{P}}^2_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\ge d_0({\tilde{P}}^2_\mathrm{mr}(n_j+1, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) and

\(d_0({\tilde{P}}^2_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\ge d_0({\tilde{P}}^2_\mathrm{mr}(n_j-1, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}}),\) where \(j= 1, 2, 3, \ldots , y.\)

-

Step 6 \(d_0({\tilde{P}}^2_\mathrm{mr}(n_j^*, q_{\mathrm{r}j}^*, q_\mathrm{c}^*, l_j^*), {\tilde{0}})\)=\(\max \) \(d_0({\tilde{P}}^2_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) and we obtain \([n_1,n_2,n_3,..,n_y],\) \([q_{\mathrm{r}1},q_{\mathrm{r}2}, q_{\mathrm{r}3},\ldots ,q_{\mathrm{r}y}],\) \(q_\mathrm{c}\) and \([\textit{l}_1,\textit{l}_2,\textit{l}_3,\ldots ,\textit{l}_y]\) as the optimal solution.

Numerical analysis

Numerical examples

This subsection consists of two numerical examples, which provide numerical data considering three buyers for our convenience. For simplicity, the parameters for three buyers are arranged in the row matrix, i.e., the demand rate through offline channel \(=[d_{\mathrm{r}1} , d_{\mathrm{r}2} , d_{\mathrm{r}3}]\) where \(d_{\mathrm{r}j}\) is the demand rate of \(j\mathrm{th}\) buyer. Numerical data are taken from Ben-Daya [5] and Batarfi et al. [7].

Example 7.1

(For Model-I) Parameters associated with vendor: \(S_\mathrm{mr}=1000 ~(\$/setup),\) \(S_\mathrm{mc}=800~(\$/setup),\) \(p_\mathrm{r}=18{,}000~(\$/\mathrm{year}),\) \(p_\mathrm{c}=18{,}000~(\$/\mathrm{year}),\) \(p_{\mathrm{c}r}=500{,}000~(\$/\mathrm{year}),\) \(p_{\mathrm{c}ci}=750{,}000~(\$/\mathrm{year}),\) \(\psi _{\mathrm{c}i}=1~(\%),\) \(h_\mathrm{m}^\mathrm{pf}=30~(\$/\mathrm{unit}/\mathrm{year}).\) Parameters associated with buyers: \([w_{\mathrm{r}1},w_{\mathrm{r}2},w_{\mathrm{r}3}]=[200,200,200]\) \((\$/\mathrm{unit}),\) \([O_{\mathrm{r}1},O_{\mathrm{r}2}, O_{\mathrm{r}3}]=[300, 200, 250]~(\$/\mathrm{order}),\) \([h^p_{\mathrm{r}2},h^p_{\mathrm{r}2},h^p_{\mathrm{r}3}]=[10,6,8]~(\$/\mathrm{unit}/\mathrm{year}),\) \([h_{\mathrm{m}1}^f,h_{\mathrm{m}2}^f,h_{\mathrm{m}3}^f]\) \(=[20,10,15]~(\$/\mathrm{unit}/year),\) \([h_{\mathrm{d}1}^p,h_{\mathrm{d}2}^p,h_{\mathrm{d}3}^p]=[10,5,7]~(\$/\mathrm{unit}/year),\) \([t_1,t_2,t_3]=[20, 10, 15]~ (\$/\mathrm{shipment}),\) \([v_1, v_2,v_3]=[5, 4, 3]~ (\$/\mathrm{unit}).\) General parameters: \(a_\mathrm{d}=15{,}000 ~(\mathrm{units}/\mathrm{year}),\) \(\theta _s=0.3 ~(\%),\) \(\rho =1.8,\) \(\alpha _{\mathrm{c}i}=2 ~(\mathrm{unit}^2/\$/\mathrm{year}),\) \(\beta _\mathrm{c}=50 ~(\mathrm{customer}/\mathrm{day}),\) \([\alpha _{\mathrm{r}1},\alpha _{\mathrm{r}2},\alpha _{\mathrm{r}3}]=[20, 10, 15] ~(\mathrm{unit}^2/\$/\mathrm{year}),\) \([\beta _{\mathrm{r}1},\beta _{\mathrm{r}2},\beta _{\mathrm{r}3}]=[40, 20, 30] ~(\mathrm{customer}/\mathrm{day}).\) In addition, Table 2 describes the lead time components for the three buyers with normal and minimum duration, and the crashing cost for each component is calculated accordingly. And, the controllable lead time for each buyer and the associated crashing cost are summarized in Table 3.

Example 7.2

(For Model-II) Fuzzy parametric values: \([d_{\mathrm{r}1},d_{\mathrm{r}2},d_{\mathrm{r}3}]=[5000, 4000, 4500]~(\mathrm{unit}/\mathrm{year}),\) \([\varphi _{d_{\mathrm{r}11}},\varphi _{d_{\mathrm{r}21}},\varphi _{d_{\mathrm{r}31}}]=[2500, 2000, 2250],\) \([\varphi _{d_{\mathrm{r}12}},\varphi _{d_{\mathrm{r}22}},\varphi _{d_{\mathrm{r}32}}]=[1250, 1000, 1125],\) \([\varphi _{d_{\mathrm{r}13}},\varphi _{d_{\mathrm{r}23}},\varphi _{d_{\mathrm{r}33}}]=[1250, 1000, 1125],\) \([\varphi _{d_{\mathrm{r}14}},\varphi _{d_{\mathrm{r}24}},\varphi _{d_{\mathrm{r}34}}]=[2500, 2000, 2250],\) \(d_\mathrm{c}=3500~(\mathrm{unit}/\mathrm{year}),\) \(\varphi _{d_{\mathrm{c}1}}=1750,\) \(\varphi _{d_{\mathrm{c}2}}=875,\) \(\varphi _{d_{\mathrm{c}3}}=875,\) \(\varphi _{d_{\mathrm{c}4}}=1750.\) Apart from the general parameters, the remaining parameter values are taken from Example 7.1.

Numerical discussion

The following can be deduced from the analysis of the two numerical experiments given in Table 4. The shipment volumes of each buyer in Model-I and Model-II are [382.71, 809.26, 495.59] and [385.83, 419.34, 401.57], respectively. Therefore, the shipment size of three buyers (i.e., \(q_{\mathrm{r}1}, q_{\mathrm{r}2}, q_{\mathrm{r}3}\)) will vary depending on the number of shipments \(n_j\), so the changes in these two models can be seen in Fig. 3. In the first model, the production quantity of the core item for customization \((q_\mathrm{c})\) depends on the number of shipments \((n_j)\), so the value of \(q_\mathrm{c}\) varies with the values of \(n_j.\) However, in the second model, the \(q_\mathrm{c}\) does not depend on the number of shipments \((n_j)\); therefore, \(q_\mathrm{c}\) remains constant (linear) with respect to the values of \(n_j\). Then, the production quantity of core material for customization in Models I and II is 369.35 and 481.37, respectively, as shown in Fig. 4. The profit of each buyer in Model-I and Model-II are [5112042.9, 6699577.0, 5912205.7] and [6896865.0, 8147246.4, 7177263.5], respectively. Figure 5 illustrates that the profitability of each buyer seems to be higher in the second model compared to the first model. The total profits/gains made by the supply chain players through Model-I and Model-II were \(\$ 17723826\) and \(\$ 22221375\), respectively. Therefore, the difference in profit percentage between the two models seems to be \(22.5185 \%\). At last, we have obtained that the second model shows the maximum profit compared to the first model, as shown in Fig. 6.

Comparative study

This subsection compares the proposed model with other existing research works in the literature. Moreover, they are compared in the following:

-

1.

If we equate \(p_{\mathrm{c}r},t_j,v_j\) and \(w_{\mathrm{r}j}\) to 0, excluding the cost components of Channel 2 and treating the demand rate as constant. The resultant cost function will be similar to that of the Yi and Sarker [42] model.

-

2.

Similarly, suppose the cost components associated with Channel 2 is entirely removed and \(\theta _s, \rho \) and \(\textit{l}_j\) are all equal to 0. In that case, the obtained profit function is equivalent to the addition of Eqs. (11) and (12) in the Batarfi et al. [7] model.

-

3.

If \(t_j, v_j\) and \(B(\textit{l}_j)\) are all equal to zero and the transit lead time cost is excluded, the total profitability of Model-I will be consistent with the Batarfi et al.’s [7] model. In the proposed model, multiple buyers are considered, so we assume \(y=1\) for a single buyer and set the transportation cost, crashing cost, and transit lead time cost as zero. The resulting profit margin resembles Eq. (32) of Batarfi et al.’s [7] model

$$\begin{aligned}&\mathrm{Percentage} ~\mathrm{increase} \\&=\frac{(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)-4808104.99)}{|4808104.99|}\times 100\\&=\frac{(5112042.9-4808104.99)}{|4808104.99|}\times 100\\&\quad = \frac{303938}{|4808104.99|}\times 100\\&\quad = 6.32137 \%. \end{aligned}$$By comparing the Model-I numerically with Batarfi et al.’s [7] model, the profitability of the Model-I is found to be 6.32137 % higher than that of the Batarfi et al.’s [7] model.

-

4.

Model-II is obtained by treating the demand rate as a trapezoidal fuzzy number and making the same assumptions as of the previous point (3). The numerical results are obtained by comparing Model-II with Batarfi et al. [7] model, assuming that the demand rates for the offline and online channels are [2500, 3750, 6250, 7500] and [1750, 2625, 4375, 5250], respectively

$$\begin{aligned}&\mathrm{Percentage} ~\mathrm{increase}\\&=\frac{(d_0({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})-4808104.99)}{|4808104.99|}\times 100\\&= \frac{(6896865-4808104.99)}{|4808104.99|}\times 100\\&= \frac{2088760}{|4808104.99|}\times 100\\&= 43.4425 \%. \end{aligned}$$As a result, the Model-II generates 43.4425 % more profit than the Batarfi et al. [7] model. Table 5 illustrates the result of comparing the proposed model with the existing [7] model.

Sensitivity analysis

For the numerical Examples 7.1 and 7.2 solved in section“Numerical analysis”, a sensitivity analysis is performed to examine the impact of changes in parameters such as \(h_\mathrm{m}^\mathrm{pf}\), \(O_{\mathrm{r}j}\), \(p_\mathrm{c}\), \(p_\mathrm{r}\), \(S_\mathrm{mc}\), and \(S_\mathrm{mr}\). This analysis was done numerically by varying the parameters from \(-50\%\) to \(+50\%\) considering one parameter at a time and maintaining the other parameters with their original values. Moreover, the effects on the model’s profitability may be clearly detected only when these parameter values are modified. The results of this sensitivity analysis are given in Tables 6 and 7, from which the following observations are made:

-

1.

As the physical and financial holding cost \(h_\mathrm{m}^\mathrm{pf}\) increases/decreases, the total profit \(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j},\) \(s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) and \(d_0({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) decreases/increases. This can be observed through Fig. 7.

-

2.

Figure 8 illustrates that the ordering cost \((O_{\mathrm{r}j})\) is inversely proportional to the total profit (\(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) and \(d_0({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\)).

-

3.

The setup cost for online channel \((S_\mathrm{mc})\) and the setup cost for offline channel \((S_\mathrm{mr})\) are inversely proportional to the total profit (\(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) and \(d_0({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\)), which is shown in Figs. 11 and 12.

-

4.

The production rate for online and offline channel (i.e., \(p_\mathrm{c}\) and \(p_\mathrm{r}\)) is directly proportional to the total profit (\(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) and \(d_0({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\)) (in other words, as \(p_\mathrm{c}\) and \(p_\mathrm{r}\) increases/decreases, the total profit of the supply chain \(P^1_\mathrm{mr}(n_j,s_{\mathrm{r}j}, s_{\mathrm{c}i}, q_{\mathrm{r}j}, q_\mathrm{c}, l_j)\) and \(d_0({\tilde{P}}^{2}_\mathrm{mr}(n_j, q_{\mathrm{r}j}, q_\mathrm{c}, l_j), {\tilde{0}})\) increases/decreases), which can be observed through Figs. 9 and 10.

-

5.

When the value of \(p_\mathrm{r}\) increased to \(+50\%\), the total profit of the supply chain is \(\$ 17866146.0 \) for Model-I and \(\$22348582.0 \) for Model-II, which is approximately

$$\begin{aligned} 1.00802 \times 17723826.0 ~(\mathrm{i.e.}, ~\mathrm{total} ~\mathrm{profit} ~\mathrm{of} ~\mathrm{Example}~7.1) \end{aligned}$$and

$$\begin{aligned} 1.00572 \times 22221375.0 ~(\mathrm{i.e.}, ~\mathrm{total} ~\mathrm{profit} ~\mathrm{of} ~\mathrm{Example} ~7.2), \end{aligned}$$respectively. Thus, it is observed that \(p_\mathrm{r}\) is more sensitive than all other parameters for Model-I.

-

6.

When the \(p_\mathrm{c}\) value rises to \(+50\%\), the total profit of the supply chain is \(\$17816756.0\) for Model-I and \(\$22365832.0\) for Model-II, which is approximately

$$\begin{aligned} 1.00524 \times 17723826.0 ~(\mathrm{i.e.}, ~\mathrm{Total} ~\mathrm{profit} ~\mathrm{of} ~\mathrm{Example} ~7.1) \end{aligned}$$and

$$\begin{aligned} 1.00650 \times 22221375.0 ~(\mathrm{i.e.}, ~\mathrm{Total} ~\mathrm{profit} ~\mathrm{of} ~\mathrm{Example} ~7.2), \end{aligned}$$respectively. Therefore, \(p_\mathrm{c}\) is highly sensitive than all other parameters for Model-II.

Managerial insights

This study deals with the dual-channel integrated supply chain model, which is designed to address the challenges that managers encounter when running a business both offline and online. Furthermore, the management insight of the proposed model is given in the following:

-

1.

Consumer attitudes, purchasing habits, customer preferences, and their data are all valuable tools in any business. Businesses that do not have product customization can only collect data on the products they have in stock. Simultaneously, if the vendor allows their customers to customize the products, they can get to know their customers in ways that their competitors cannot approach.

-

2.

Personalized products are becoming more popular in the online business; however, there will be less competition due to customization, and this will lead to higher profit and recognition.

-

3.

Selling personalized products online does not necessitate the production and storage of an item. It is enough to prepare only when the consumer requires it. Furthermore, it will reduce other costs such as production and labour costs, etc.

-

4.

In the online channel, customer access is global, whereas customer access is limited to the offline channel. The reason is that the vendor can receive the order 24 h a day through the online channel and does not have to look at it full time. On the other hand, the buyer/retailer can only sell products when they are in the offline store. As a result, it is possible to increase vendor’s profits by conducting business both offline and online and attracting more consumers.

-

5.

Online business has a wider range of advertising and marketing features and is more dependent on an online platform/site than an offline business.

-

6.

According to the numerical analysis of the proposed model, if the demand for the product is ambiguous rather than price and lead time-dependent, a dual-channel operation is more effective/beneficial for the company/industry.

-

7.

Retaining a customer on an online channel is relatively difficult. At the same time, it is easy to retain loyal customers on the offline channel. Moreover, scaling a business through an offline channel takes more time and work than scaling a firm through an online channel.

-

8.

By adhering to the VMI-CS policy, the vendor can save on inventory holding costs by sending the goods to the buyers in the offline channel and making it easier for buyers to store their products.

-

9.

By crashing the lead time period, the vendor can provide streamlined functions/operations, which in turn improves customer satisfaction. In addition, it builds transparency, trust, and cooperation among buyers.

-

10.

Therefore, the solution of the proposed model can be used to estimate the performance of a two-stage dual-channel supply chain and compare the total profit in two scenarios and evaluate the controllable lead time effects. Moreover, the results reveal that the proposed model is appropriate for businesses using a dual-channel supply chain.

Conclusion

This article investigates the challenges associated with online and offline trade in two distinct scenarios (models) based on the structure/pattern of the demand rate. The demand for offline and online channels in the first model is defined by the selling price and the lead time. In contrast, in the second model, the demand rate for both channels is deemed uncertain, and the uncertainty is handled using the trapezoidal fuzzy number. The ultimate purpose of this study is to optimize total supply chain profit between the two models. Therefore, this article will pave the best path for supply chain players (vendor and buyer) to maximize profit in the supply chain. Compared to the first model, the second model exhibits the greatest benefit from numerical results, i.e., the higher profit is obtained when the product’s demand is a trapezoidal fuzzy number. This model has some limitations, and it can be extended in many ways. This study believes that the manufacturing process is faultless, although the production machinery may shift from an in-control to an out-of-control state in some circumstances. As a result, it is preferable to extend this paper to account for faulty production. Furthermore, products delivered through both offline and online channels may contain flaws. As a result, this study can be extended by integrating new strategies for recovering and repairing damaged products (see, for instance, Taleizadeh et al. [37], Mandal and Giri [24]). The second model discusses the trapezoidal fuzzy number; however, this model can be examined using any fuzzy number, such as a type-2 fuzzy interval or a Gaussian fuzzy number (see Zhong et al. [48] and Zhu et al. [49]). This study does not account for the effects of carbon emissions and energy consumption during manufacturing and transportation; hence, it can be an extension of this model (see, Sarkar et al. [33], Karthick and Uthayakumar [19]). Considering the payment and transmitting delays would be a useful development of this model (see, for instance, Karthick and Uthayakumar [21]). Setup costs are considered a non-value-added cost in the offline channel. It is preferable to reduce it; hence, introducing a discrete investment function to do so is considered an extension of this model (see, for instance, Dey et al. [12]). Inventory costs are not always consistent and can fluctuate based on the circumstances. Taking into account all costs in a fuzzy environment is a good extension of this model (see, for instance, Bjork et al. [3], Gupta et al. [14], Karthick et al. [21], Sarkar et al. [31], and Samanta et al. [34]).

References

Alfares HK, Ghaithan AM (2016) Inventory and pricing model with price-dependent demand, time-varying holding cost, and quantity discounts. Comput Ind Eng 94:170–177

Ahmed W, Moazzam M, Sarkar B, Rehman SU (2021) Synergic effect of reworking for imperfect quality items with the integration of multi-period delay-in-payment and partial backordering in global supply chains. Engineering 7(2):260–271

Björk KM (2009) An analytical solution to a fuzzy economic order quantity problem. Int J Approx Reason 50(3):485–493

Battini D, Gunasekaran A, Faccio M, Persona A, Sgarbossa F (2010) Consignment stock inventory model in an integrated supply chain. Int J Prod Res 48(2):477–500

Ben-Daya M, Hassini E, Hariga M, AlDurgam MM (2013) Consignment and vendor managed inventory in single-vendor multiple buyers supply chains. Int J Prod Res 51(5):1347–1365

Batarfi R, Jaber MY, Zanoni S (2016) Dual-channel supply chain: a strategy to maximize profit. Appl Math Model 40(21–22):9454–9473

Batarfi R, Jaber MY, Glock CH (2019) Pricing and inventory decisions in a dual-channel supply chain with learning and forgetting. Comput Ind Eng 136:397–420

Bieniek M (2019) Vendor and retailer managed consignment inventory with additive price-dependent demand. Optim Lett 13(8):1757–1771

Bhuniya S, Pareek S, Sarkar B (2021) A supply chain model with service level constraints and strategies under uncertainty. Alex Eng J 60(6):6035–6052

Chen Z, Su SII (2020) Consignment supply chain cooperation for complementary products under online to offline business mode. Flexible Serv Manuf J 2020:1–47

Castellano D, Gallo M, Santillo LC (2020) A periodic review policy for a coordinated single vendor-multiple buyers supply chain with controllable lead time and distribution-free approach. 4OR 19:1–42

Dey BK, Sarkar B, Sarkar M, Pareek S (2019) An integrated inventory model involving discrete setup cost reduction, variable safety factor, selling price dependent demand, and investment. RAIRO-Oper Res 53(1):39–57

Gharaei A, Karimi M, Shekarabi SAH (2019) An integrated multi-product, multi-buyer supply chain under penalty, green, and quality control polices and a vendor managed inventory with consignment stock agreement: The outer approximation with equality relaxation and augmented penalty algorithm. Appl Math Model 69:223–254