Abstract

Sintered neodymium-iron-boron (NdFeB) magnets and lithium-ion (Li-ion) batteries are essential in a number of clean energy technologies such as electric vehicles and wind turbines. The United States (US) has some manufacturing capacity for Li-ion batteries and almost no capacity for producing sintered NdFeB magnets. As a result, the US imports significant quantities of these batteries and magnets. Trade statistics on imported batteries and magnets, however, include only those materials imported in the form of batteries and magnets (referred to here as reported imports) and exclude materials embedded in intermediate and final products such as hard disk drives, electric motors, electric vehicles, and wind turbines (referred to here as embedded imports). This paper develops original estimates of embedded imports of NdFeB magnets and Li-ion batteries, leading to a more complete picture of US imports than looking at reported imports alone. It estimates that more than 90% of NdFeB magnet imports were embedded in intermediate and final products in 2021. In contrast, more than 90% of Li-ion battery imports were in the form of the batteries themselves rather than embedded in intermediate and final products.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Clean energy technologies are undergoing rapid changes as governments attempt to reduce greenhouse-gas emissions and dependence on fossil fuels—leading, in turn, to increased demand for these technologies, such as wind turbine generators and electric vehicles, and the underlying components and raw materials on which they are based (Hund et al. 2020). Two such components are sintered neodymium-iron-boron (NdFeB) magnets and lithium-ion (Li-ion) batteries; not only are these essential in clean energy technologies, such as efficient motors for turbines and energy storage, respectively, but they contain critical materials. NdFeB magnets contain rare earths, while Li-ion batteries contain lithium and often cobalt (the focus of this paper), as well as graphite, nickel, and manganese—all of which are considered critical by both the United States (US) and the European Union (Blengini et al. 2020; “U.S. Geological Survey Releases 2022 List of Critical Materials” 2022). Despite this designation, the US currently has little to no domestic capacity for these important precursors, and underdeveloped supply chains for sintered NdFeB magnets in Li-ion batteries.

Instead, the supply chains for sintered NdFeB magnets and Li-ion batteries are global, and the US depends on imports for significant quantities of these products. As of 2022, there is no commercial-scale US production of sintered NdFeB magnets; in 2021, US customers imported approximately 12,100 thousand tonnes of NdFeB magnets that were reported in trade statistics as magnet imports (“USA Trade Online” 2022). For Li-ion batteries in that same year, it is difficult to estimate actual output quantities due to the complex nature of the supply chain; however, in 2020, the US accounted for 9% of total global Li-ion battery production capacity—about 42 GWh (Yu and Sumangil 2021; “Electric Vehicle Batteries” 2021).Footnote 1 This, in comparison with the fact that global demand for Li-ion batteries was estimated to be 230 GWh (Saiyid 2021), and the fact that the US imported about 7.4 million tonnes of Li-ion batteries in 2021 (“USA Trade Online” 2022), it is likely that the US is unable to meet current domestic demand for Li-ion batteries and is thus reliant on foreign sources for these clean energy technologies.

However, less clear are the quantities of imported magnets and batteries not reflected directly in international-trade statistics—that is, those that are embedded in imported intermediate products (such as motors) and final goods (such as electric vehicles). Current literature regarding embedded trade is sparse (Al-rawahi and Rieber 1991; Tercero Espinoza and Soulier 2016), even though embedded trade is important to the overall assessment of an economy’s import reliance, which, in turn, informs trade and manufacturing policy. Indeed, the lack of inclusion of embedded trade flows can often lead to distortions in finding a country’s import reliance, and, on the flip side, the inclusion of embedded trade can aid in identifying exposure to supply disruptions farther down the supply chain, as well as identify a different source for embedded imports, in comparison to sources for raw materials (Nassar, Alonso, and Brainard 2020). What is clear, is that the US lacks capacity along the supply chain for sintered NdFeB magnets and Li-ion batteries (“MP Materials to Build U.S. Magnet Factory, Enters Long-Term Supply Agreement with General Motors” 2021; “National Blueprint for Lithium Batteries: 2021-2030” 2021). In the upstream, the US and Canada account for 3% and 3.5% of global lithium and cobalt processing, respectively (“What Does the US Inflation Reduction Act Mean for the EV Battery Supply Chain?” 2022); in direct contrast, China represents 59% and 75% of global processing, respectively (“What Does the US Inflation Reduction Act Mean for the EV Battery Supply Chain?” 2022). Along the Li-ion battery supply chain, the US is responsible for 0.16% of global cathode capacity and 0.27% of global anode capacity (“What Does the US Inflation Reduction Act Mean for the EV Battery Supply Chain?” 2022). There is also currently to US policy regarding the recycling of end-of-life Li-ion batteries (“FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals” 2022). NdFeB magnet production, the US is responsible for 16% of mining and < 1% of magnet alloy manufacturing (Smith et al. 2022). Thus, the expected future demand for magnets and batteries coupled with the lack of a resilient domestic supply chain for both these technologies makes it necessary to better characterize the current state of US imports of these items. Understanding how much, and from who, the US imports magnets and batteries can highlight the flexibility of the current supply chain. This is important for policymakers regarding energy security, future policy mechanisms, and potential interventions, as demand and trade relationships continue to shift.

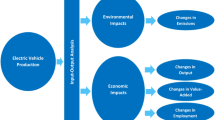

The purpose of this paper is to estimate the quantities of such embedded US imports for the period 2000–2021 and to compare embedded with reported quantities—to provide a clearer picture of US imports. How important are embedded imports relative to reported imports? Related questions that this analysis helps answer are as follows: what is the current state of domestic US manufacturing for magnets and batteries? How much, if any, of this domestic production is consumed in the US? Further, of the magnets and batteries imported from outside the US, what percentage are imported in the form of magnets and batteries (that is, reported imports of magnets and batteries)? Alternatively, what percentage is embedded in intermediate and final products further downstream, such as motors and electric vehicles (EVs)? And finally, who are the countries and companies that constitute the major suppliers of these items? In answering these questions, results show that the concept of embedded trade is ever-more significant throughout the time period studied, especially as worldwide trade continues to become more prevalent. By estimating the number of magnets and batteries embedded in imports, it is possible to better understand the overall trade of these items and better characterize the supply chain for the US and world.

Our work builds on previous work. A 1991 paper by Al-Rawahi and Rieber (Al-rawahi and Rieber 1991) examines the flow of copper contained in net imports to assess how embedded trade flows affect estimates of domestic consumption and intensity of use, and the same broad framework is followed in this paper, in terms of classifying imported goods by manufacturing stage (i.e., semi manufactured and final goods). A more recent paper by authors Tercero-Espinoza and Soulier (Tercero Espinoza and Soulier 2016) examine the international trade flows of copper contained in goods, studying the flow of copper contained in trade flows between major regions-EU-28, North America, Latin America, China, Japan, and the rest of the world, and utilizes various publicly available data along with the harmonized system (HS), similar to this paper. This 2016 paper also estimates embedded trade flows, in turn allowing for a detailed insight into the relative advantages of the regions across the global value chain; thus, this paper serves exists within the same realm as Tercero-Espinoza and Soulier’s (2016) work, although our overall focus is constrained to a US-perspective, and again, this paper focuses on manufactured inputs, rather than raw resources. Thus, our contribution serves as initial groundwork for better understanding the supply chains for green technologies as well as providing more detailed estimates of trade flows and trade partners, for items, rather than materials.

This paper also focuses more on the quantity of trade flows in terms of tonnage, compared to other work that attempts to estimate trade flows which typically focus on value. For example, Wiedmann et al. (2013) address the use of resource productivity indicators in the context of managing natural resources; the authors examine natural resource productivity by analyzing global trade flows and trade balances of raw materials within an economic input-output model, in order to assess the use of domestic resources compared to a country’s use of non-domestic resources. This analysis is important in terms of understanding trade flows, but again, emphasis is placed on the value of flows, unlike our own.

There are also several studies which evaluate the trade, consumption, and recycling of various critical materials and related components that focus less on traditional economic methods (München and Veit 2017; Mayyas, Steward, and Mann 2019; Habib, Parajuly, and Wenzel 2015; Pavel et al. 2016a), but to our knowledge, there are very few works that examine the trade of embedded materials (Al-rawahi and Rieber 1991), and no research which focuses specifically on the embedded trade of goods.

Our main results show that, in comparing raw trade data to estimated embedded NdFeB magnets, the US sources the majority of these magnets from imports of manufactured goods. Further, the sources of these imports come from an array of producing countries— the majority in Asia, although the import of some manufactured goods come from North American trading partners and Europe. Thus, despite a lack of domestic resources and manufacturing of sintered NdFeB magnets, the US can procure these critical products, which is reflected in our estimates of the trade data. Regarding the embedded trade of Li-ion batteries, the story is a little different: in comparing raw trade data to the estimated embedded Li-ion batteries, between 2000 and 2014, the US sourced the bulk of these batteries from imports of manufactured goods. However, after 2014, the import of Li-ion batteries in their reported form eclipsed those embedded in imported goods. The sources of these batteries remain varied among different countries, as is the sources of manufactured goods that contain said items. Thus, having a diverse supply chain for both magnets and batteries, the US can ensure that it can obtain these goods in the event of a supply disruption, and better protect consumers and manufacturers from price volatility.

Methodology and data

General approach

Our approach starts with the conceptual distinction between reported and embedded imports. Reported imports are, unsurprisingly, those imports of NdFeB magnets and Li-ion batteries that are imported as magnets and batteries and reported as such in the international-trade statistics. Embedded imports are those magnets and batteries embedded in imported intermediate and final products. An example of an intermediate product is a motor and of a final product is an automobile.

This study uses import data from the US Census Bureau’s USATrade database (“USA Trade Online” 2022). Trade data is classified using the harmonized system (HS), and is administered by the World Customs Organization, and serves as the foundation for trade classification systems used by the US and other countries(“Understanding HS Codes and the Schedule B” 2022). The HS assigns 6-digit codes to items; countries may then add additional digits to the 6-digit codes for further classification. The US uses a 10-digit code, known as a Schedule B, and as such, this study uses the 10-digit Schedule B code whenever possible; otherwise, the 6-digit HS code is used.

Our general approach for estimating embedded US imports of NdFeB magnets and Li-ion batteries is a two-step process, following the identification of appropriate 10-digit Schedule B (or 6-digit HS) codes that include intermediate and final products containing either NdFeB magnets or Li-ion Batteries. See Appendix for a complete list of codes used and methodology.

-

1.

Collect import data for the years 2000–2021 for the appropriate items, and

-

2.

Estimate the tonnage of NdFeB magnet or Li-ion battery contained in each relevant trade category, as shown in Eq. (1):

The technology intensity is the estimated percentage of imported goods (motors, vehicles, etc.) that contain NdFeB magnets or Li-ion batteries. Technology weight is the estimated weight of magnet or battery per imported good. For brevity, we refer to the intensity and weights as “technology factors.”

The assumptions and estimates are discussed in greater detail below, as well as the Appendix (Tables 11–17).

Limitations

Given that this methodology relies on public trade statistics and assumed technology factors (weight and intensity), there are some inherent limitations that should be noted. First, estimates are drawn from publicly available data, and the trade of these technologies in terms of country of origin is likely obscured. For example, data may show that the US imports a vehicle from India, so that we must assume India is the country of origin in the sense that India has manufactured that vehicle (and all its components). Realistically, this may not be the case: international trade can be characterized by complex, global value chains where services, materials, parts, and components often crossing borders (Luck 2017). This limitation is an issue mainly in the interpretation of major suppliers of suppliers to the US and may be improved in future research should more granular data become available. Second, uncertainty exists surrounding the data used, such that we are unable to quantify with a reliable statistical method, given the overall lack of data points. As the assumed technology factors are gathered from available literature, we recognize that the assumptions used are likely incomplete in terms of representing the respective technology markets to the highest degree.

Third, the technology factors drive these embedded trade estimates, and, apart from wind turbines, are time constant. This is due to the lack of technology-specific data that would allow us to infer any kind of technological innovation that occurs across time that would directly impact the weight and use of a magnet or battery in a product. Should more detailed, historical data become available, this should be included in future use.

Measuring reported and embedded NdFeB magnet imports

There are two different types of rare earth magnets— samarium-cobalt (SmCo) and NdFeB. NdFeB magnets account for 98% of rare earth magnet demand, while SmCo magnets up the remaining 2% (Ohno et al. 2016). NdFeB magnets are the strongest commercially available permanent magnets and are key in terms of miniaturizing magnets and thus motors used in consumer electronics, household products, vehicles, and offshore wind turbines. There are two types of NdFeB magnets: sintered and bonded, where the former accounted for 90% of NdFeB magnet production in 2018 (Ohno et al. 2016). The choice of sintered or bonded depends on the magnet’s application: sintered magnets are higher performance, but are limited in shape and size, and are generally used in electric motors and wind turbine generators (Ohno et al. 2016). Bonded magnets are more cost-effective in terms of manufacturing, and can be cut or drilled into different shapes, so that they are widely used in consumer electronics (Ohno et al. 2016). This paper focuses only on the import of sintered NdFeB magnets, for two reasons; first, sintered NdFeB magnets make up the bulk of demand for rare earth magnets, and are sold more on a dollar-basis compared to bonded NdFeB magnets (Constantinides 2006). Second, current trade data only specifies the import of sintered NdFeB magnets, so that we do not have access to publicly-available data regarding the import of bonded NdFeB magnets.

Imports of sintered NdFeB magnets are classified into three categories: reported, and two types of embedded imports—those in intermediate goods and final products. The reported category represents sintered NdFeB magnet imported as magnets, which fall under the HS code 8505110070.Footnote 2 Intermediate goods are items that contain a sintered NdFeB magnet but are not considered a final good. Final goods are items that contain an intermediate good, are considered a finished product. Table 11 in the Appendix provides a detailed list of relevant HS codes used and their classification for items considered.

After import data are collected and classified, the number of items imported in each category are multiplied by their assumed technology intensity (appendix Table 12). Here, “technology intensity” refers to the percentage of goods currently sold that are estimated to contain NdFeB magnets. The product of this is then multiplied by the estimated weights of sintered NdFeB magnets contained in imported items (Appendix Table 13).

In certain cases, accurate estimates could not be found for the weight of sintered NdFeB magnets for specific items. In these cases, the average weight of a sintered NdFeB magnet is based on estimated neodymium content as well as average weights of items (Appendix Table 14). For magnets in motors and generators, a separate literature estimate that specifies the quantity of NdFeB magnets per KW is used.

Measuring reported and embedded Li-ion battery imports

There are two main types of batteries: primary and secondary. Primary batteries are not rechargeable and are typically used in applications where a system needs a low amount of power (Schmidt, Buchert, and Schebek 2016). Secondary batteries are rechargeable, which is accomplished through a chemical reaction that takes place in an electrochemical cell, which is then reversed during charging (Tsiropoulos, Tarvydas, and Lebedeva 2018). In recent years, secondary batteries have come to the forefront of the battery market—powering consumer electronics such as smart watches, cell phones, laptops and other portable electronics, as well as EVs. There are two main types of secondary batteries in consumer electronics and EVs: nickel-based and lithium-ion. Ni-based batteries are a mature technology and are well understood; specifically, nickel-cadmium (NiCd) batteries, which have been in use for decades. NiCd batteries slowly lost market share to nickel-metal-hydride (NiMH) batteries in the 1990s. NiMH batteries avoid the use of toxic cadmium and have a higher energy density than NiCd batteries. Li-ion batteries, in turn, are replacing NiMH batteries in many applications due to their lighter weight, non-toxic materials, and the lack of memory effect (Sick, Bröring, and Figgemeier 2018). Thus, this study focuses on secondary Li-ion batteries.

The calculation of Li-ion batteries imported to the US mirrors the methodology for NdFeB magnets, although there are a few important differences in classification and identification. First, the “intermediate” classification is excluded. This is because, in examining publicly available trade data, it is not clear what could be considered an intermediate product in which a battery is imported import. Therefore, imports of Li-ion batteries are classified into two categories: reported and embedded in final goods. Second, reported import data does not distinguish Li-ion batteries in terms of components, so that it is difficult to accurately estimate the share of anodes, cathodes, or separators intended for Li-ion battery production. Third, according to the US Census and World Customs Organization, items that fall under HS codes 8506 and 8507 include singles cells as well as cells grouped into batteries or battery packsFootnote 3; thus, the estimates presented in this paper are assumed to concern battery packs, not cells.Footnote 4 Fourth, in terms of categorizing electric vehicles, “BEV” is defined as a battery electric vehicle, while “HEV” refers to hybrid electric vehicles, and “PHEV” refers to plug-in hybrid electric vehicles, unless otherwise noted. The term electric vehicle (EV) is used to refer to BEV’s, HEV’s, and PHEV’s, unless otherwise noted. Finally, estimates do not include heavy or commercial vehicles, due to a lack of data.

Reported imports are simply Li-ion battery packs, which falls under HS codes 8507600000, 8607600020, and 85067808010.Footnote 5 After import data is collected and classified (Appendix Table 15), the number of items for each category are multiplied by the assumed Li-ion battery intensity (Appendix Table 16). This follows the same logic regarding intensity for NdFeB magnets, as some manufacturers may choose different cathode chemistries that are not considered Li-ion. Footnote 6 After this step, the product is then multiplied by the assumed Li-ion weights (Appendix Table 17).

US domestic capabilities: the broader context of imports

Domestic manufacturing of sintered NdFeB magnets

The US does not currently produce sintered NdFeB magnets on a commercial scale. Footnote 7 However, there is some domestic capacity for production of important precursors, such as rare earths, with one operating rare earth mine, Mountain Pass, located in California. In 2021, Mountain Pass produced 43,000 tons of rare earths; however, it appears that 100% of this production was exported earths (“Mineral Commodities Summary 2022” 2022). There are no commercial recycling projects to recover rare earths from used sintered NdFeB magnets; it is not currently economical to engage in reprocessing scrap material, and further, as electronics and appliances are shredded, their magnetic content ends up too diluted in the waste stream to be used (Yang et al. 2017).

There has been some recent movement in terms of expanding US sintered NdFeB magnet product, although it is unclear how rapidly this could change current capabilities. In early 2020, USA Rare Earths partnered with Round Top Heavy Rare Earth and Critical Materials in Texas, in order to begin production of rare earth powders (“USA Rare Earth Acquires U.S. Rare Earth Permanent Magnet Manufacturing Capability” 2020). At the same time, UCore announced plans to begin mining rare earths in Alaska, with the expectation of operations coming online in 2023 (“Ucore Chairman Provides Strategic Update to Shareholders: Taking Action Today to Secure Tomorrow” 2020; “Ucore Ships Bokan REE Sample for Testing” 2020). In April 2020, USA Rare Earth purchased NdFeB magnet production equipment from a now-shuttered operation in North Carolina; this equipment is expected to produce about 2000 tonnes of rare earth magnets per year, which would meet 17% of current US demand (“USA Rare Earth Acquires U.S. Rare Earth Permanent Magnet Manufacturing Capability” 2020). For recycling, the National Science Foundation recently awarded money to the University of Pennsylvania with the intent of developing methods for recovering and recycling metals include rare earths (“Rare Earths 18th Edition Update 3” 2019). And, in 2020, the Pentagon awarded a Texas-based company called Urban Mining $29 million (Kramer 2021); Urban Mining recycles rare earths in order to produce sintered NdFeB magnets, and were expected to begin production in the first quarter of 2020 (“Urban Mining Progresses in Pioneering Effort to Scale Up Rare-Earth Magnet Production from Recycled Magnets” 2019) but it is unclear if that has come to fruition. In 2022, the Department of Defense awarded Mountain Pass $35 million to separate and process heavy rare earths and ultimately establish end-to-end permanent magnet supply chain (“DoD Awards $35 Million to MP Materials to Build U.S. Heavy Rare Earth Separation Capacity” 2022); Mountain Pass has also announced it will invest $700 million in the magnet supply chain by 2024 (“FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals” 2022).

Given that the US currently does not have manufacturing capacity for sintered NdFeB magnets, being able to distinguish between reported vs. embedded import allows us to have a more detailed insight into both demand for, and use of, NdFeB magnets, as well where the US sources these magnets from. In turn, we can then have a better understanding of the supply chain for sintered NdFeB magnets.

Domestic manufacturing of Li-ion batteries

The US does have manufacturing capacity for Li-ion batteries; however, China is the world’s largest Li-ion battery producer. In 2020, China accounted for 77% of global Li-ion battery manufacturing capacity; in contrast, the US accounted for about 9% of global capacity (Yu and Sumangil 2021), most of which is due to the recently-opened Tesla Gigafactory in Nevada (Stevens 2019).Footnote 8 The Nevada Gigafactory currently produces Tesla Model 3 electric motors and battery packs, as well as large-scale battery packs(“Tesla Gigafactory,” 2023)Footnote 9. Much like the production of NdFeB magnets, the supply chain features many steps, and the US is absent from most of those (Ladislaw, Carey, and Bright 2019). The US does not take part in the mining or chemical processing, which is believed to be due to both import reliance for materials, as well as a lack of strategic push to grow the li-ion industry domestically (Ladislaw, Carey, and Bright 2019). Some analysts believe that if the US can invest in certain stages of the value chain—mainly, cell manufacturing and pack assembly—the US might become more competitive (Mayyas, Steward, and Mann 2019).

Compared to NdFeB magnet manufacturing, the US possesses some market share in terms of production along the supply chain. First, in 2019, domestic sources of cobalt (an important material in battery cathode production) came primarily from steel recycling, mine tailings, and a mine located in Michigan (“Mineral Commodity Summaries 2020" 2020); however, most of US cobalt supply is made up from scrap and imports (“Mineral Commodity Summaries 2020” 2020). There are some current projects expected to begin production in the near future, although it is not clear how specific these timelines are. Australia-based Jervois Mining’s Idaho Cobalt Operations project in Idaho is expected to contain 25,000 tons of cobalt, (“Jervois Ups Idaho Cobalt Estimate by 22%, Stock Advances” 2020) while First Cobalt is currently developing a copper/cobalt mine, also located in Idaho (Bohlsen 2020). It is important to note, however, that both companies intend to refine the cobalt ores outside of the US, so that it is not certain that the development of these resources can support a further building of the US’s Li-ion manufacturing capabilities. As mentioned above, the domestic supply of cobalt is mainly from recycling, and there is another recycling project in the works: an Ireland-based company recently announced it has invested in a US recycling project, with the goal of producing and recycling battery materials (MacDonald 2020), although it is unclear where the production from that plant will go.

As the US does not currently maintain a competitive seat both in terms of global Li-ion battery manufacturing capacity as well as along the production supply chain, the analysis of embedded trade can have an impact on understanding patterns in terms of what technologies demand Li-ion batteries, as well as consumer consumption patterns. Further, by quantifying the import of Li-ion batteries in terms of items they are embedded in, we can examine where the US sources this technology from.

Recent US policy changes impacting magnets and batteries

In 2022, the Inflation Reduction Act (IRA) was signed into law (O’Brien 2022). Considered a landmark bill, one of the major components is that it encourages the buildout of US domestic capacity for clean energy manufacturing, which includes the Li-ion battery sector. The IRA provides $60 billion for domestic manufacturing for clean energy, including tax credits for battery module and cell capacity, and critical mineral costs (Kennedy and Fischer 2022). On the demand-side, the bill introduces a tax credit of up to $7500 for new EV and hybrid plug-ins through 2032, and $4000 for used versions(O’Brien 2022). The requirement for this tax credit is that the electric vehicles must have must have final assembly in North America (“Frequently Asked Questions on the Inflation Reduction Act’s Initial Changes to the Electric Vehicle Tax Credit” 2022); further, critical minerals (including include Li, Co, Gr, Ni, and Mn) contained in the vehicles may not be sourced from “foreign entities of concern” which includes China and Russia (“What Does the US Inflation Reduction Act Mean for the EV Battery Supply Chain?” 2022, Blakemore and Ryan 2022).

The IRA will also have an impact on domestic manufacturing of sintered NdFeB magnets, with an Advanced Manufacturing production tax credit which includes critical minerals. This in turn may encourage further domestic buildout of magnet manufacturing (“New Federal Legislation Could Deliver Powerful New Benefits to NioCorp for Its Critical Minerals” 2022). This policy will both encourage consumer demand for clean energy technologies, while potentially supporting US domestic capacity to manufacture these items. As such, the IRA will likely change the current energy landscape, with regards to sintered NdFeB batteries and Li-ion batteries.

Results—sintered NdFeB magnets

US imports of sintered NdFeB magnets, reported and embedded, 2000–2021

Our main findings can be seen in Fig. 1, which compares the import of reported goods with our estimates of sintered NdFeB magnets contained in intermediate and final goods. In 2021, the US imported 12,097 tonnes of sintered NdFeB magnets in their reported form, a 1% increase from the previous year, although comparing their import in 2000 to 2021, these imports increased by over 400%. This shows how consumption of sintered NdFeB magnets in their reported form has increased sharply for the time period, demonstrating increased demand. When comparing this to our estimates regarding the amount of NdFeB magnets embedded in imported goods, US demand for these magnets is perhaps even more significant. Between 2000 and 2021, the majority of sintered NdFeB magnets imported to the US were embedded in motors and other intermediate goods, followed by vehicles and other final goods.

US imports of sintered NdFeB magnets, reported and embedded (thousands of tonnes). There were no data from the US Census Bureau for years 2000–2002, and so these values were taken from UN Comtrade. However, UN Comtrade data does not provide data at the same granular level (data are collected at the 6-digit HS code level, rather than10-digit HS code). Thus, imports were multiplied by the estimated percent share of imports of NdFeB magnets imported at the port level starting in 2014. This estimate is based on author calculations. In terms of data from 2003 to 2014 taken from port level data (rather than district-level), and were multiplied by the 2014 estimated share of NdFeB. For the intermediate and final categories, there were no data available for years 2000 and 2001, so that these years were supplemented with USATrade data measured in “quantity 1 (general)” which we acknowledge could lead to discrepancies. Source: US Census Bureau; UN Comtrade; author calculations

In fact, for this time period, on average, 96% of sintered NdFeB magnets imported were contained in intermediate goods, and on average, 3% of NdFeB magnets imported were contained in vehicles and other final goods. Ultimately, these results show that, when comparing reported imports of sintered NdFeB magnets to those contained in imports, the US sources most of these magnets in the form of manufactured goods rather than as reported imports. Further, the trends displayed in the data show increasing demand for sintered NdFeB magnets in their reported form, as well as for finished technologies that utilize rare earth magnets.

Embedded NdFeB magnet imports—intermediate and final goods

In 2000, motors intended for electronics or appliances were responsible for 99% of NdFeB magnets imported in intermediate goods (Table 1), and their share of total intermediate imports does not change across time. Indeed, the import of magnets embedded in motors increases between 2015 and 2021. However, it is also important to note that, for this study, data collected for the hard disk drive category was supplemented with port-level data which is not as granular as import data at the HS district-level.

Aside from the possible data discrepancy in years 2000 and 2001 (see Table 1 notes), the overall increase in imports for sintered NdFeB magnets in motors leads us to the conclusion that demand for electrified transport as well as goods with self-contained electric motors is increasing. Again, this highlights overall increased demand for NdFeB magnets, so that understanding where the US sources them will become increasingly important.

Estimates for magnets embedded in vehicles and other final goods are found in Table 2. As with the import of intermediate goods, the import of sintered NdFeB magnets contained in vehicles and other final goods increased between 2000 and 2015, but decreased by 2019. In a closer look at the data, these imports increased throughout 2019, but dropped sharply in 2020, which is likely due to manufacturing issues and decreased demand stemming from the COVID-19 pandemic. Thus, we assume the decrease in imports in 2021 is likely due to both a slow recovery in demand as well as delays in shipping due to supply chain constraints (Newton 2022). However, excluding the pandemic, the results indicate an overall increase in demand for these magnets and associated technologies. Regarding BEVs, HEVs, and PHEVs, import data for these items was not recorded until 2017 (see Table 2 notes), and we acknowledge that electric transport was being sold in the US prior to 2017. The Toyota Prius—one of the most popular HEVs that has been in production since the late 1990s—had mainly utilized induction motors (that do not contain permanent magnets). It is unclear when Toyota began transitioning toward permanent magnet motors; however, it appears that certain Toyota hybrid vehicles used permanent magnet motors as early as 2010 (“Prius Specifications” 2009). Thus, it could be assumed that the US was importing electric vehicles which contained permanent magnets prior to 2017. Conventional vehicles are responsible for the majority of imported sintered NdFeB magnets, followed by appliances and electronics. While there are no rare earth magnets contained in the motors of conventional vehicles, they are employed in various other automotive applications, including electric air-conditioning, electric superchargers/turbochargers, generators, electric oil pumps, electric power steering, and electric brake systems (“Rare Earths: Global Industry, Markets and Outlook, 2018” 2018).

Following conventional vehicles, commercial goods—MRI machines and generators intended for wind turbines—are also responsible for a large amount of sintered NdFeB magnets imported in final goods, although their overall share decreases over time.

Ultimately, most sintered NdFeB magnets imported to the US are embedded in motors and intermediate goods. This is prevalent when it comes to the future of clean energy technologies, which is clearly demonstrated through figure above in terms of the consumption of wind energy turbines. As governments continue to support the deployment of clean energy, the import of EV’s and wind turbine generators will increase.

Embedded NdFeB magnet imports by trade partner

Table 3 outlines major sources of reported imports of sintered NdFeB magnets, while Table 4 shows the major sources of sintered NdFeB magnets embedded in intermediate and final goods. In looking at the suppliers the list becomes much more diverse from both a country and regional perspective. However, one can see the same exporters in the majority of suppliers—China, Japan, Germany, and Canada. Using this data, a Herfindahl-Hirschman Index (HHI)Footnote 10 was calculated, in order to discern how concentrated the sintered NdFeB market is by country. The HHI for US import partners for sintered NdFeB magnets in 2021 is estimated to be approximately 6960, which shows a highly concentrated market, with China dwarfing other suppliers. This is likely due to China’s dominance of both rare earths and rare earth magnet production. It is important to highlight that these suppliers did not change drastically between 2019 and 2020, which in turn suggests that, despite the COVID-19 pandemic, the US was able to maintain trade relations with producing countries.

Results—lithium-ion batteries

US imports of Li-ion batteries, reported and embedded, 2000–2021

In 2021, the US imported over 7,370,370 tonnes of Li-ion batteries in their reported form, of which 99% was made up of batteries intended for electric vehicles (Fig. 2). Although the time period examined begins in the year 2000, data on reported Li-ion battery imports were not reported until 2009, so that the reported trade statistics for between 2000 and 2009 do not accurately reflect these US imports. In 2009, the trade statistics reported that the US imported 461 tonnes of Li-ion batteries, which quadrupled to 2321 tonnes by 2014. Between 2015 and 2020, these imports grew 700%, which illustrates sharp, growing demand for Li-ion batteries in their reported form. When supplementing the reported trade data with our estimates of embedded imports across the time period, 48% of Li-ion batteries imported to the US were contained in final goods, and the remaining 52% were imported in their reported form, on average.

US imports of Li-ion batteries (thousands of tonnes), reported and embedded. 1. Panel 1 illustrates the import of Li-ion batteries- due to insufficient data between 2000 and 2005, USA Trade data only accounts for the import of consumer electronics and appliances. 2. Panel 2 illustrates the changing dynamic of US imports of Li-ion batteries. First, data regarding reported Li-ion imports was not recorded until 2009, which accounts for the increase in the share of imports attributed to reported Li-ion batteries by 2010. 3. Panel 3 shows that by 2015, imports of Li-ion batteries in their reported form have quickly dwarfed the import of Li-ion batteries embedded in electronics and appliances. Data regarding EV’s, HEV’s, and PHEV’s was not recorded until 2017. 4. We define EV’s as fully battery electric; HEV as hybrid electric motor; and PHEV as plug-in hybrid electric vehicle. Source: US Census Bureau; author calculations

When taking into account our estimates of Li-ion batteries embedded in final products, in 2021 the US imported about 7,623,747 tonnes of Li-ion batteries, the majority of which are EV Li-ion batteries in their reported form. This trend is fairly new since the data did not start reflecting the import of EV batteries until 2015. In fact, between 2000 and 2014, consumer electronics were responsible for, on average, 89% of Li-ion imports overall, after which this category was eclipsed by the import of Li-ion batteries intended for EV’s. That being said, the overall trend displayed in the data demonstrates increasing demand for Li-ion batteries, both reported and embedded. Further, the general results illustrate that the bulk of demand for Li-ion battery imports is for electrified transport. This ultimately allows for a more complete picture regarding US sources and supply of Li-ion batteries.

Table 5 below allows for a detailed view regarding the types of primary Li-ion batteries imported to the US. Data regarding the import of EV Li-ion batteries were not recorded until 2015, but they clearly dwarf the import of non-EV batteries imported. This can be attributed to both the growing demand for electrified transport, as well as the fact that EV batteries are larger in size compared to non-EV LIBs so that their overall tonnage would be larger.

Embedded Li-ion battery imports—final goods

Table 6 provides a more comprehensive breakdown of the items considered in imported final goods that contain Li-ion batteries. As mentioned above, imported consumer electronics were responsible for the bulk of Li-ion batteries imported to the US between 2000 and 2015; yet, by 2020, the majority of the batteries imported to the US were intended for, contained in, EVs. The data did not start reflecting the import of Li-ion EV (BEV, HEV, and PHEV) batteries until 2015, and the import of EVs until 2017; however, historical data shows sales of EVs in the US as early as 2012 (“Summary Report on EVs at Scale and the U.S. Electric Power System” 2019), so we acknowledge our estimates are potentially skewed without further historical trade data.

In examining the import of Li-ion batteries embedded in non-EV items (Table 6), consumer electronics are by far the largest source of imported Li-ion batteries. Laptops, combined with mobile phones making up the majority of batteries imported to the US in an embedded form, which reflects overall increasing demand for portable electronics.

Hybrid electric vehicles (HEV’s) are responsible for the bulk of overall Li-ion batteries embedded in electrified transport. From our estimates (Fig. 3), US imports of all four types of electrified transport considered increases between 2017 and 2021.Footnote 11 Further, the majority of LIB’s imported are contained within HEV, followed by fully battery electric vehicles, which perhaps highlights consumer preferences. This is especially interesting when considering the historical trend in electric vehicle manufacturers’ battery preferences. The Toyota Prius is one of the most popular hybrid electric vehicles, and has utilized NiMH batteries despite other manufacturer’s move to Li-ion batteries in the early 2000s (Tajitsu and Shirouzu 2016). The manufacturer held back from incorporating Li-ion batteries was mainly due to cost, size, and safety; however, since at least 2015 Toyota has started utilizing Li-ion batteries in some Prius models (Greimel 2015) which likely points to cost- and safety-related issues being overcome.

Embedded Li-ion battery imports by trade partner

In terms of supply diversity for Li-ion batteries in their reported form, Table 7 outlines the fact that the US sources both EV and non-EV Li-ion batteries mainly from Asia—South Korea, Japan, and China being present in the top 5 suppliers for both categories. In parallel to the sintered NdFeB magnets section, an HHIFootnote 12 for US non-EV and EV import partners is 5226 and 7814, respectively. So, although the US does source batteries from a diverse set of countries, there is still a relatively high degree of market concentration for these imports.

The same can be said about the import of batteries embedded in vehicles and other final goods, with perhaps a higher degree of regional diversity (Table 8). In the table below, while there are several main producers for all three technologies—Japan, South Korea, Germany, Mexico, and China. This regional diversity supports US trade in that in ensures better insulation from shocks such as a supply disruption. However, please note that the trade data only portrays the most recent point of origin regarding imports to the US, so that our results regarding the source of imports may not accurately reflect the supply chain in its entirety.

Finally, when looking at import sources for electronics and household appliances in the table below, results do not necessarily reflect the trends seen for reported Li-ion batteries and those contained in vehicles (Table 8). China is responsible for by far the most Li-ion batteries contained in non-EV final products. However, the remaining major suppliers of these items are diverse in terms of producing country and region.

Discussion and trends

With regards to our results, there are a few important takeaways. First, the US relies wholly on sintered NdFeB magnet imports, the bulk of which are embedded in motors and other intermediate goods which signals the importance of these magnets in US manufacturing; further, results show that the bulk of these imports are mainly vehicles intended for EV’s (fully battery electric, hybrid, and plug-in). This is important when considering the role of US policy and current federal initiatives; the current administration’s goal for a net-zero emissions economy by 2050 (“FACT SHEET: President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S. Leadership on Clean Energy Technologies” 2021) demands a rapid technology transition from many domestic sectors, including transportation (“Biden-Harris Administration Releases First-Ever Blueprint to Decarbonize America’s Transportation Sector” 2023). Further, domestic demand for electrified transport has been growing since 2011; in 2021 alone, domestic purchases of electrified vehicles doubled (“Hybrid-Electric, Plug-in Hybrid-Electric and Electric Vehicle Sales” 2022). Coupling this with the likely continued increase in demand for EV’s with federal policy support, it is clear sintered NdFeB magnets will continue to be an important part of the overall supply chain for electrified transport in the US. Thus, a stronger, more resilient domestic manufacturing supply chain for sintered NdFeB magnets will be intrinsic to increased deployment of these technologies.

Another important takeaway is the decrease in imports of specific items that contained sintered NdFeB magnets during the COVID-19 pandemic; between 2019 and 2020, there was a noticeable drop in categories such as hard disk drives, generators, and smaller decreases for categories such as consumer electronics, due to reduced consumer spending, closure of factories, and shipping delays stemming from the pandemic (“Electronic Products” 2021). These imports quickly regained momentum in 2021 as markets recovered; but what this illustrates is the importance of maintaining a robust supply chain in the event of an unanticipated disruption, especially as there is no current domestic capabilities. In fact, the mix of countries who supplied the US did not change drastically between 2019 and 2020, which shows that the US was able to maintain these important trade relations during the pandemic. However, China remains the largest source of sintered NdFeB magnets; if trade relations with China and other non-FTA partners do change in the near future, policymakers must be aware that there’s a potential risk in cutting off these imports from manufacturers.

Regarding US sources of Li-ion battery imports, results show that the import of batteries in their reported form quickly outpaces the import of batteries embedded in final goods starting in 2015; as mentioned above, this could be due to data collection for reported Li-ion batteries starting later in the time period studied. Excluding this category from our estimates, there is still an increase in imports of Li-ion batteries embedded in final goods between 2000 and 2021, which highlights an increasing demand for this technology across time, so that it is clear that maintaining a strong and diverse supply chain should continue to be a priority. In comparing imports between 2019 and 2020, no decrease is demonstrated in imports across any categories, nor a shift in suppliers, despite the COVID-19 pandemic. This signifies that the US is, indeed, maintaining a robust and diverse supply chain for Li-ion batteries. While it is still too soon to accurately estimate the impact of the pandemic on manufacturing and demand, this difference might be due to the supply chain for Li-ion batteries to be more mature, and thus more resilient, as Li-ion batteries have been in some form of development since the late 1990’s (Patil 2008). As such, it is assumed that the supply chain remains secure the farther downstream. Of course, the drop in imports of magnets compared to batteries between 2019 and 2020 could also be due to several other reasons, ranging from policy decisions, changes in consumption, or data collection error, which will only become more apparent as more time passes and economies recover.

Li-ion batteries can be further broken down into different types based on variations in their cathode chemistries. Nickel manganese cobalt oxide (NMC) is, to date, considered the most successful of the Li-ion systems with high growth potential. Nickel cobalt aluminum (NCA) batteries, while characterized by several positive characteristics, are more costly and have safety concerns. Currently, NCA batteries are utilized by Panasonic and Tesla. Lithium manganese oxide (LMO) batteries are typically blended with NMC batteries to enhance their specific energy and lifespan. Lithium cobalt oxide (LCO) batteries are costly due to their Co content, and are currently losing market share to LMO, NCA, and NMC batteries. Lithium iron phosphate (LFP) batteries are considered to be one of the safer options of Li-ion batteries. They are used mainly in specialty markets, although recent advancements have reduced costs and manufacturers such as Ford and Volkswagen are considering utilizing them in North American cars (Blois 2023). Table 9 provides an overview of the five main cathode chemistries.

The choice of cathode materials depends on intended end-use, and specific formulas are often well-kept secrets in the manufacturing industry (Miao et al. 2019). However, there are some generally accepted assumptions regarding the application of Li-ion batteries. First, in terms of batteries meant for consumer electronics, LCO batteries are preferred (Pagliaro and Meneguzzo 2019), due to high energy density, long life cycle, and ease of manufacturing; yet, as of 2019, analysts assert that LCO will quickly be replaced in the future with NMC, as manufacturers move away from chemistries that utilize higher amounts of Cobalt (Miao et al. 2019). Second, Li-ion batteries—primarily NMC—will likely dominate the EV battery sector in the near future (M. M. Wang, Zhang, and Zhang 2016a; Raugei and Winfield 2019; Miao et al. 2019), and are the most widely-adopted chemistry for Li-ion batteries contained in current-production EV’s (Raugei and Winfield 2019).Footnote 13

As cathode chemistries are important in terms of both applications to burgeoning clean energy technology, as well as their cost and use of critical materials, we extended our methodology to also estimate the amount of different cathode chemistries imported to the US, in terms of the Li-ion batteries embedded in electrified transport (HEV, PHEV, and BEV). While there is only 5 years of data available regarding US imports of electrified transport to with which to apply this methodology, we feel that these estimates reveal current trends, allowing for a better picture regarding consumption of differing EV chemistries, and thus, consumption of critical materials.

Table 10 below shows that the NMC chemistry is the dominant type of chemistry imported in EV’s followed by the LCO chemistry, which follows the logic that NMC Li-ion batteries are quickly becoming the preferred choice for electric cars. In 2021, 29% of EV Li-ion batteries imported to the US were NMC, followed by LCO with a market share of 26%, and LFP with a share of 23%. These estimates are in line with the current thought that NMC chemistries will quickly overtake other Li-ion cathode chemistries in their use in electric transport. Should the electrified transport industry continue to follow this trend, this sector would likely benefit from further policy support to reduce costs and increase efficiency to encourage further market penetration.

This analysis is important on several levels: first, by characterizing the sources of these items for the US, we can better understand the dynamics of supply, especially with regards to producing countries and companies; and second, our methodology distinguishes itself in that it estimates the flow of goods or components, rather than raw materials. This is significant in that it can help guide future work attempting to untangle trade statistics, and aid in producing more accurate estimates of trade flows. This is significant within the context of understanding the flow of items related to clean energy technologies, even more so as NdFeB magnets and Li-ion batteries contain critical materials. The need for more detailed trade flows becomes more urgent in the passing of the 2022 IRA, whose purpose is to incentivize the growth of domestic manufacturing capacity for clean energy technologies. Aimed at fostering more domestic capabilities and overall supply chain resilience for sintered NdFeB magnets and Li-ion batteries, its implications could be far-reaching. Trade partnerships can change due to the IRA’s mandates, and consumer demand for these technologies may increase. Because of this, it is necessary to understand these supply chains in detail, to determine their flexibility in accommodating this potential market shift. This analysis aids in providing a more granular examination of these supply chains, and informs future policy decisions within this context.

The goal of this particular section is to highlight the fact that, while the US has very little domestic manufacturing capacity of Li-ion batteries, and, as is clear from the data and results, domestic demand for Li-ion batteries- especially those in finished products—is high and will likely continue as demand for portable electronics and electric transport increases. This is especially relevant considering the potential impact of the IRA on domestic manufacturing. Our results also show that the sources of these products vary, across stages of item and within items, which demonstrates a diverse supply chain, which ultimately ensures a higher degree of energy security. Like our results for sintered NdFeB magnets, however, China remains the dominant supplier, dwarfing other US sources of Li-ion batteries. As the IRA mandates that Li-ion precursors must be sourced either domestically or from sources other than China, it is unclear where the US will procure batteries in the future, should domestic capacity fail to gain a foothold. But, by illuminating current sources of embedded Li-ion batteries, this may allow guidance for policymakers in maintaining or strengthening relations with other trade partners in order to continue to support a resilient supply chain.

Conclusion

This work seeks to provide a methodology that can aid researchers in interpreting publicly available trade statistics for products whose components are yet to be accurately reflected in public data. Given that the method is currently limited by the opacity of trade data, and driven by time-constant technology factor assumptions, there are several ways in which this method could be improved so that it can be applied to other sectors and goods. First, the inclusion of time-varying technology factors (weight and intensity) would be a significant contribution to the current method; this was a difficult task for permanent magnets and Li-ion batteries, as their use and adoption are still nascent. This may not be the case for more mature technologies whose technology factor efficiencies have been more well-documented in ecological and related literature. By including time-varying technology factors, estimates would provide a much more detailed picture of supply chains, and thus a more nuanced discussion of disruptions and implications. Second, the method is limited in terms of researchers’ ability to quantify uncertainty, so that it would be greatly improved by more historical data points, as literature allows. This may even be currently feasible for a technology where more data exists: some kind of statistical method may be applied to better cement results and provide a more detailed discussion.

Despite these limitations, we believe this method can be extended in ways that would benefit further research and policy decisions. End-of-life (EoL) is not addressed in this method, and the addition of this final portion of the supply chain would serve as both an improvement for the current method, as well an avenue for future research. Measuring the quantity of embedded materials in end-use technologies that are domestically recycled would allow for a more in-depth examination of the current state of a domestic supply chain, and likely improve the analysis of import reliance and supply chain resiliency. In terms of future research, the addition of EoL data and estimates could provide a much more systems-wide analysis that can highlight current and potential capabilities for recycling or identify areas along a domestic supply chain that would further benefit from policy support to improve resiliency. This could be valuable for other clean energy technology research, such as wind turbines, solar panels, and rare earths, where the recycling potential has yet to be commercialized at an industry-wide scale (Heffernan 2022; “Carbon Rivers Makes Wind Turbine Blade Recycling and Upcycling a Reality With Support From DOE” 2022; “DOE Announces $18 Million to Streamline Commercialization of Clean Energy Technologies” 2022). The inclusion of estimated embedded trade in exports would also extend this research for a more global perspective. This paper focuses on US imports; however, the method could be applied to export trade statistics. In doing so, estimates of embedded trade contained in imports and exports can better characterize the complexity of a global supply chain for a technology, and shed light on production capabilities and trade decisions that would otherwise not be obvious from reported data. This would be important in contributing to a more exhaustive discussion of global market trends, identifying trade partners, linchpin suppliers, and anticipating potential supply chain disruptions. While more complex, this may be especially useful in estimating trade flows materials or technologies whose markets are currently difficult to disentangle from public data due to the complexity of their manufacturing supply chains. Ultimately, we hope this methodology serves as a foundation for future trade data analysis and related policy.

Data availability

Data available upon request from Hannah Gagarin at hrgagar@sandia.gov.

Notes

This is based off of 2019 data

This specifies sintered NdFeB magnets only. The trade data currently does not have any information regarding the import of bonded NdFeB magnets.

Confirmed via communication with the US Census on August 24th, 2021.

The rationale behind this assumption is due to the fact that literature estimates of Li-ion battery weights are for packs, not cells.

According to USITC, the Schedule B code can be defined as follows: 8507 is defined as “Electric storage batteries, including separators therefor, whether or not rectangular (including square); parts thereof”; 8507600000 is defined as “Lithium-ion batteries”; 8607600020 is defined as “Lithium-ion batteries: Of a kind used as the primary source of electrical power for electrically powered vehicles of subheadings 8703.40, 8703.50, 8703.60, 8703.70 or 8703.80”; and 8507808010 is defined as “Lithium-ion storage batteries”. See https://uscensus.prod.3ceonline.com/ for further definition. Regarding the subheadings 8703, these are defined electric vehicles- either fully battery electric, hybrid, or plug-in hybrid. See https://hts.usitc.gov/current for full definitions.

We also break out the types of EV’s imported to the US by cathode chemistry, based on literature estimates. The estimates used as well as the results can be found in the appendix (App. Table 2b).

Magnet Applications and Arnold Magnetic Technology have capacity to produce bonded NdFeB magnets, although the latter is not currently in operation (“Magnet Applications, Inc. Recognized for Its R&D Advancements in 3D Printed NdFeB Magnets” 2017; “Rare Earths: Global Industry, Markets and Outlook, 2018” 2018) Urban Mining does have capacity to produce sintered NdFeB magnets, but it is unclear if they are currently in production. As of April 2020, A US DOE report has stated that there are no commercial-scale manufacturers currently online (“Critical Materials Rare Earths Supply Chain: A Situational White Paper” 2020; “Urban Mining Progresses in Pioneering Effort to Scale Up Rare-Earth Magnet Production from Recycled Magnets” 2019)

It is unclear if manufacturing capacity encompasses cell or pack production; however, according to Yu and Sumangil (2021), it is more cost effective for companies to produce cells and packs in-house, or produce cells as geographically close to pack assembly as possible, in order to minimize supply chain issues.

These include powerwalls, intended to power residential homes, and powerpacks, which are intended for commercial use.

A Herfindahl-Hirschman Index measures the level of market concentration by accounting for the relative size distribution of firms in a market. A score that approaches zero demonstrates a large number of firms in a market; 1500-2500 signals moderate concentration; over 2500 is highly concentrated (“HERFINDAHL-HIRSCHMAN INDEX” 2018).

Please note, data did not start reflecting their import until 2017, which explains the lack of historical data

A Herfindahl-Hirschman Index measures the level of market concentration by accounting for the relative size distribution of firms in a market. A score that approaches zero demonstrates a large number of firms in a market; 1500-2500 signals moderate concentration; over 2500 is highly concentrated (“HERFINDAHL-HIRSCHMAN INDEX” 2018).

NiMH batteries were historically the preferred energy source for EV’s, and may still be deployed in PHEV’s, although Li-ion are quickly expected to overtake the deployment of NiMH in EV’s(Song et al. 2019)

References

“A Note on US Trade Statistics.” 2014. USITC. https://www.usitc.gov/publications/research/tradestatsnote.pdf. Accessed 22 Apr 2021

Al-rawahi K, Rieber M (1991) Embodied copper consumption forecasts. Resour Policy 11(3):2–12

Arcus C (2018) Tesla model 3 & Chevy bolt battery packs examined. Clean Technica. https://cleantechnica.com/2018/07/08/tesla-model-3-chevy-bolt-battery-packs-examined/. Accessed 2 Jul 2021

Asari M, Sakai SI (2013) Li-Ion Battery Recycling and Cobalt Flow Analysis in Japan. Resour Conserv Recycl 81:52–59. https://doi.org/10.1016/j.resconrec.2013.09.011

Bandara HM, Dhammika JW, Darcy DA, Emmert MH (2014) Value analysis of neodymium content in shredder feed: toward enabling the feasibility of rare earth magnet recycling. Environ Sci Technol 48(12):6553–6560. https://doi.org/10.1021/es405104k

Bian Y, Guo S, Jiang L, Liu J, Tang K, Ding W (2016) Recovery of Rare Earth Elements from NdFeB Magnet by VIM-HMS Method. ACS Sustain Chem Eng 4(3):810–818. https://doi.org/10.1021/acssuschemeng.5b00852

“Biden-Harris Administration Releases First-Ever Blueprint to Decarbonize America’s Transportation Sector.” 2023. US DOE 2023. https://www.energy.gov/articles/biden-harris-administration-releases-first-ever-blueprint-decarbonize-americas. Accessed 2 Feb 2023

Bigum M, Petersen C, Christensen TH, Scheutz C (2013) WEEE and portable batteries in residual household waste: quantification and characterisation of misplaced waste. Waste Manag 33

Blakemore R, Ryan P (2022) The inflation reduction act places a big bet on alternative mineral supply chains. https://www.atlanticcouncil.org/blogs/energysource/the-inflation-reduction-act-places-a-big-bet-on-alternative-mineral-supply-chains/. Accessed 2 Feb 2023

Blengini GA, El Latunussa C, Eynard U, Torres C, de Matos D, Wittmer KG, Pavel C et al (2020) Critical Raw Materials for Strategic Technologies and Sectors in the EU - a Foresight Study. European Commission. European Commission. https://doi.org/10.2873/58081

Blois M (2023) Lithium iron phosphate comes to America. CEN 2023. https://cen.acs.org/energy/energy-storage-/Lithium-iron-phosphate-comes-to-America/101/i4. Accessed 2 Feb 2023

Bohlsen M (2020) Tesla’s potential North American battery metals supply chain contenders. Seeking Alpha. https://seekingalpha.com/article/4383766-teslas-potential-north-american-battery-metals-supply-chain-contenders. Accessed 5 Jul 2021

“BU-205: Types of Lithium-Ion” 2019. Battery University. https://batteryuniversity.com/learn/article/types_of_lithium_ion. Accessed 2 Jul 2021

“Carbon Rivers Makes Wind Turbine Blade Recycling and Upcycling a Reality With Support From DOE” 2022 US DOE 2022. https://www.energy.gov/eere/wind/articles/carbon-rivers-makes-wind-turbine-blade-recycling-and-upcycling-reality-support

Ciacci L, Vassura I, Cao Z, Liu G, Passarini F (2019) Recovering the ‘new twin’: analysis of secondary neodymium sources and recycling potentials in Europe. Resour Conserv Recycl 142:143–152. https://doi.org/10.1016/j.resconrec.2018.11.024

Constantinides S (2006) A manufacturing and performance comparison between bonded and sintered permanent magnets. Arnold Magnetic Technologies corp chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.arnoldmagnetics.com/wp-content/uploads/2017/10/Manufacturing-and-performance-comparison-between-bonded-and-sintered-permanent-magnets-Constantinides-APEEM-2006-psn-hi-res.pdf

“Critical Materials Rare Earths Supply Chain: A Situational White Paper” (2020) US Department of Energy. https://www.energy.gov/sites/prod/files/2020/04/f73/Critical%20Materials%20Supply%20Chain%20White%20Paper%20April%202020.pdf. Accessed 13 Sept 2021

“DoD Awards $35 Million to MP Materials to Build U.S. Heavy Rare Earth Separation Capacity” (2022) US Department of Defense. https://www.defense.gov/News/Releases/Release/Article/2941793/dod-awards-35-million-to-mp-materials-to-build-us-heavy-rare-earth-separation-c/. Accessed 27 June 2022

“DOE Announces $18 Million to Streamline Commercialization of Clean Energy Technologies” 2022. US DOE 2022. https://www.energy.gov/articles/doe-announces-18-million-streamline-commercialization-clean-energy-technologies. Accessed 2 Feb 2023

“Electric Vehicle Batteries” 2021. Union of Concerned Scientists. https://www.ucsusa.org/resources/ev-battery-recycling#read-online-content. Accessed 2 Feb 2023

“Electronic Products” 2021. USITC. 2021. https://www.usitc.gov/research_and_analysis/tradeshifts/2020/electronic.htm. Accessed 23 Mar 2023

“FACT SHEET: President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S. Leadership on Clean Energy Technologies” (2021) The White House. https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/22/fact-sheet-president-biden-sets-2030-greenhouse-gas-pollution-reduction-target-aimed-at-creating-good-paying-union-jobs-and-securing-u-s-leadership-on-clean-energy-technologies/. Accessed 1 Sep 2022

“FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals.” 2022. The White House. https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/22/fact-sheet-securing-a-made-in-america-supply-chain-for-critical-minerals/. Accessed 2 Feb 2023

Fischbacher J, Kovacs A, Gusenbauer M, Oezelt H, Exl L, Bance S, Schrefl T (2018) Micromagnetics of rare-earth efficient permanent magnets. J Phys D Appl Phys 51(19). https://doi.org/10.1088/1361-6463/aab7d1

Franco, Natalia Lebedeva, Di Persio, and Lois Boon-Brett. 2014. Lithium ion battery value chain and related opportunities for Europe title: lithium ion battery value chain and related opportunities for Europe. https://ec.europa.eu/jrc/sites/jrcsh/files/jrc105010_161214_li-ion_battery_value_chain_jrc105010.pdf

“Frequently Asked Questions on the Inflation Reduction Act’s Initial Changes to the Electric Vehicle Tax Credit” (2022) US Department of Treasury. https://www.irs.gov/businesses/plug-in-electric-vehicle-credit-irc-30-and-irc-30d. Accessed 4 Nov 2022

Greimel H (2015) Why Toyota offers 2 battery choices in next prius. Automotive News Europe. https://europe.autonews.com/article/20151128/COPY/311289998/why-toyota-offers-2-battery-choices-in-next-prius. Accessed 22 Apr 2021

Guyonnet D, Planchon M, Rollat A, Escalon V, Tuduri J, Charles N, Vaxelaire S, Dubois D, Fargier H (2015) Material flow analysis applied to rare earth elements in Europe. J Clean Prod 107:215–228. https://doi.org/10.1016/j.jclepro.2015.04.123

Habib K, Parajuly K, Wenzel H (2015) Tracking the flow of resources in electronic waste—the case of end-of-life computer hard disk drives. Environ Sci Technol 49(20):12441–12449. https://doi.org/10.1021/acs.est.5b02264

Habib K, Schibye PK, Vestbø AP, Dall O, Wenzel H (2014) Material flow analysis of ndfeb magnets for denmark: a comprehensive waste flow sampling and analysis approach. Environ Sci Technol 48(20):12229–12237. https://doi.org/10.1021/es501975y

Habib K, Wenzel H (2016) Reviewing resource criticality assessment from a dynamic and technology specific perspective—using the case of direct-drive wind turbines. J Clean Prod 112:3852–3863. https://doi.org/10.1016/j.jclepro.2015.07.064

Heffernan M (2022) Acid-free tech will make rare earth recycling more feasible. E-Scrap News. 2022. https://resource-recycling.com/e-scrap/2022/07/21/acid-free-tech-will-make-rare-earth-recycling-more-feasible/. Accessed 23 Mar 2023

“Herfindahl-Hirschman Index” 2018. US DOJ 2018. https://www.justice.gov/atr/herfindahl-hirschman-index

Hund K, La Porta D, Fabregas TP, Laing T, Drexhage J (2020) “Minerals for climate action: the mineral intensity of the clean energy transition”. The World Bank. https://pubdocs.worldbank.org/en/961711588875536384/Minerals-for-Climate-Action-The-Mineral-Intensity-of-the-Clean-Energy-Transition.pdf. Accessed 23 June 2021

“Hybrid-Electric, Plug-in Hybrid-Electric and Electric Vehicle Sales.” 2022. Bureau of Transportation Statistics 2022. https://www.bts.gov/content/gasoline-hybrid-and-electric-vehicle-sales. Accessed 17 Jan 2023

Işıldar A, Rene ER, van Hullebusch ED, Lens PNL (2018) Electronic waste as a secondary source of critical metals: management and recovery technologies. Resour Conserv Recycl 135:296–312. https://doi.org/10.1016/j.resconrec.2017.07.031

“Jervois Ups Idaho Cobalt Estimate by 22%, Stock Advances.” 2020. Resource World Magazine. https://resourceworld.com/jervois-ups-idaho-cobalt-estimate-by-22-stock-advances/. Accessed 14 May 2022

Kennedy R, Fischer A (2022) US congress passes landmark inflation reduction act. PV Magazine. https://pv-magazine-usa.com/2022/08/12/us-congress-expected-to-pass-landmark-inflation-reduction-act/. Accessed 4 Jan 2023

Kramer D (2021) US government acts to reduce dependence on china for rare-earth magnets. Physics Today. American Institute of Physics Inc. https://doi.org/10.1063/PT.3.4675

Ladislaw S, Carey L, Bright H (2019) Critical minerals and the role of U.S. mining in a low-carbon future. Center for Strategic and International Studies. https://www.csis.org/analysis/critical-minerals-and-role-us-mining-low-carbon-future. Accessed 30 Apr 2021

Lixandru A, Venkatesan P, Jönsson C, Poenaru I, Hall B, Yang Y, Walton A, Güth K, Gauß R, Gutfleisch O (2017) Identification and recovery of rare-earth permanent magnets from waste electrical and electronic equipment. Waste Manag 68(2017):482–489. https://doi.org/10.1016/j.wasman.2017.07.028

Luck P (2016) Global supply chains, firm scope and vertical integration: evidence from China. OECD. https://www.oecd.org/trade/topics/global-value-chains-and-trade/. Accessed 11 Dec 2022

MacDonald A (2020) U.S. steps up efforts to counter China’s dominance of minerals key to electric cars, phones. Wall Street J. https://www.wsj.com/articles/u-s-steps-up-efforts-to-counter-chinas-dominance-of-minerals-key-to-electric-cars-phones-11601884801. Accessed 23 Mar 2023

“Magnet Applications, Inc. Recognized for Its R&D Advancements in 3D Printed NdFeB Magnets” 2017. Magnetics Magazine https://magneticsmag.com/magnet-applications-inc-recognized-for-its-rd-advancements-in-3d-printed-ndfeb-magnets/

Mayyas A, Steward D, Mann M (2019) The case for recycling: overview and challenges in the material supply chain for automotive Li-Ion batteries. Sustain Mater Technol 19:e00087. https://doi.org/10.1016/j.susmat.2018.e00087

Menad N, Seron A (2016) Characterisation of permanent magnets from WEEE. In: 6th International Conference on Engineering for Waste and Biomass Valorisation

Miao Y, Hynan P, Von Jouanne A, Yokochi A (2019) Current li-ion battery technologies in electric vehicles and opportunities for advancements. Energies 12(6):1–20. https://doi.org/10.3390/en12061074

“Mineral Commodities Summary 2022” (2022) US Geological Survey. https://pubs.er.usgs.gov/publication/mcs2022. Accessed 12 Jan 2023

“MP Materials to Build U.S. Magnet Factory, Enters Long-Term Supply Agreement with General Motors” 2021. BuisnessWire. 2021. https://www.businesswire.com/news/home/20211209005637/en/MP-Materials-to-Build-U.S.-Magnet-Factory-Enters-Long-Term-Supply-Agreement-with-General-Motors#:~:text=Although%20development%20of%20permanent%20magnets,%20produce%20sintered%20NdFeB%20magnets%20today. Accessed 17 Jan 2023

München DD, Veit HM (2017) Neodymium as the main feature of permanent magnets from hard disk drives (HDDs). Waste Manag 61:372–376. https://doi.org/10.1016/j.wasman.2017.01.032

Nassar NT, Alonso E, Brainard JL (2020) Investigation of U.S. Foreign Reliance on Critical Minerals—U.S. Geological Survey Technical Input Document in Response to Executive Order No. 13953 Signed September 30, 2020. https://pubs.usgs.gov/of/2020/1127/ofr20201127.pdf. Accessed 24 Mar 2021

“National Blueprint for Lithium Batteries: 2021-2030” (2021) US Department of Energy. https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf. Accessed 16 Sept 2022

“New Federal Legislation Could Deliver Powerful New Benefits to NioCorp for Its Critical Minerals.” 2022. Cision. https://www.newswire.ca/news-releases/new-federal-legislation-could-deliver-powerful-new-benefits-to-niocorp-for-its-critical-minerals-863527676.html. Accessed 17 Jan 2023

Newton E (2022) 5 industries feeling the strain of supply chain delays. GlobalTrade. https://www.globaltrademag.com/5-industries-feeling-the-strain-of-supply-chain-delays/. Accessed 4 Jan 2023

Nguyen RT, Devin Imholte D, Matthews AC, David W, Swank. (2019) NdFeB content in ancillary motors of U.S. conventional passenger cars and light trucks: results from the field. Waste Manag 83:209–217. https://doi.org/10.1016/j.wasman.2018.11.017

O’Brien S (2022) Inflation Reduction Act extends 7,500 tax credit for electric cars. CNBC. https://www.cnbc.com/2022/08/10/inflation-reduction-act-extends-7500-tax-credit-for-electric-cars.html. Accessed 4 Jan 2023

Ohno H, Matsubae K, Nakajima K, Kondo Y, Nakamura S, Nagasaka T (2016) Erratum: toward the efficient recycling of alloying elements from end of life vehicle steel scrap. Resour Conserv Recycl 2015(100):11–20. https://doi.org/10.1016/j.Resconrec.2015.04.001 Resources, Conservation and Recycling 109: 202. 10.1016/j.resconrec.2016.03.024

Pagliaro M, Meneguzzo F (2019) Lithium battery reusing and recycling: a circular economy insight. Heliyon 5(6):e01866. https://doi.org/10.1016/j.heliyon.2019.e01866

Patil, Pandit G. 2008. Developments in lithium-ion battery technology in the Peoples Republic of China. www.anl.gov

Pavel CC, Marmier A, Alves P, Schüler D, Schleicher T, Degreif S, Buchert M (2016a) Substitution of critical raw materials in low-carbon technologies: lighting, wind turbines and electric vehicles. https://doi.org/10.2790/64863

Pavel CC, Marmier A, Alves P, Schüler D, Schleicher T, Degreif S, Buchert M (2016b) Substitution of Critical Raw Materials in Low-Carbon Technologies: Lighting. Wind Turbines Electr Vehicles. https://doi.org/10.2790/64863

Pavel CC, Thiel C, Degreif S, Blagoeva D, Buchert M, Schüler D, Tzimas E (2017) Role of substitution in mitigating the supply pressure of rare earths in electric road transport applications. Sustain Mater Technol 12:62–72. https://doi.org/10.1016/j.susmat.2017.01.003

“Prius Specifications” 2009. Priups. http://www.priups.com/misc/prius-specs.htm. Accessed 16 July 2020

“Rare Earths: Global Industry, Markets and Outlook, 2018” (2018) Roskill. https://www.roskillinteractive.com/reportaction/REY18/Toc. Accessed 3 Apr 2020

“Rare Earths: Siemens Permanent Magnet Motors Take to the Skies.” 2019. Roskill Information Services, Ltd. https://roskill.com/news/rare-earths-siemens-permanent-magnet-motors-take-to-the-skies/. Accessed 15 July 2020

“Rare Earths 18th Edition Update 3” (2019) Roskill

Raugei M, Winfield P (2019) Prospective LCA of the production and EoL recycling of a novel type of li-ion battery for electric vehicles. J Clean Prod 213:926–932. https://doi.org/10.1016/j.jclepro.2018.12.237

Saiyid A (2021) Threefold increase in recycling needed to help meet 2030 demand for lithium-ion EV batteries. IHS Markit. https://ihsmarkit.com/research-analysis/threefold-increase-in-recycling-needed-to-help-meet-2030-deman.html?utm_campaign=pc018204&utm_medium=organic-social&utm_source=twitter&hsid=18f6a6d7-8407-45c6-aa7c-f2f9121946c1. Accessed 14 May 2022

Schmidt T, Buchert M, Schebek L (2016) Investigation of the primary production routes of nickel and cobalt products used for li-ion batteries. Resour Conserv Recycl 112:107–122. https://doi.org/10.1016/j.resconrec.2016.04.017

Schuler D, Buchert M, Liu R, Dittrich S, Merz C (2011) Study on rare earths and their recycling. Oko-Institut. http://www.ressourcenfieber.eu/publications/reports/Rare%20earths%20study_Oeko-Institut_Jan%202011.pdf. Accessed 8 May 2022

Sick N, Bröring S, Figgemeier E (2018) Start-ups as technology life cycle indicator for the early stage of application: an analysis of the battery value chain. J Clean Prod 201:325–333. https://doi.org/10.1016/j.jclepro.2018.08.036

Smith, Braeton J, Matthew E Riddle, Matthew R Earlam, Chukwunwike Iloeje, and David Diamond. 2022. Rare earth permanent magnets: supply chain deep dive assessment. www.energy.gov/policy/supplychains