Abstract

Despite the extensive literature on the relationship between entrepreneurship and institutions, there is limited knowledge of the relationship between institutions and engagement after failure. This study compares the entrepreneurial engagement of entrepreneurs who have recently experienced failure and individuals without entrepreneurial experience, emphasizing the interaction of government policies and programmes (formal institutions) and individualistic/collectivist cultures (informal institutions) with business failure and its impact on entrepreneurial engagement. We test our hypotheses using multilevel analysis on a large cross-sectional sample that combines individual-level data from the Global Entrepreneurship Monitor (GEM) database with country-level data from 49 economies. We provide evidence of selection bias for the entrepreneurial engagement of entrepreneurs after failures and of the role of culture as a significant aspect of re-entry into entrepreneurship. Therefore, our evidence helps reinforce the view that postfailure entrepreneurs are a special group of entrepreneurs and validates the contribution of institutional economic theory in explaining this phenomenon, especially the key role of informal institutions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The extant literature suggests that entrepreneurship contributes to economic growth (Acs et al., 2012; Kusa et al., 2021; Van Stel et al., 2005). Empirical evidence further confirms that a significant part of entrepreneurial activity is conducted by entrepreneurs who exit one business and begin another (Nielsen & Sarasvathy, 2016; Westhead et al., 2005). Such entrepreneur exit and re-entry has attracted the attention of several researchers (Amankwah-Amoah et al., 2022; Cefis et al., 2022; De Hoe & Janssen, 2022; Gottschalk & Müller, 2022; Simmons et al., 2014). Entrepreneurs who experienced a business exit due to poor performance – usually labelled in the literature as a business failure or involuntary exit (Fuentelsaz et al., 2021; Justo et al., 2015) – may have better opportunity recognition and exploitation skills for the next venture (Mueller & Shepherd, 2016; Ucbasaran et al., 2013). However, they may also suffer financial, emotional, and social costs that prevent new entrepreneurial engagement (Jenkins, 2022; Ucbasaran et al., 2013).

Entrepreneurship is concerned with the discovery, evaluation and exploitation of profitable opportunities (Shane & Venkataraman, 2000), and individual engagement in the process is a joint function of both individual and contextual factors (Lim et al., 2016; Shepherd et al., 2019). Previous research has tended to concentrate on individual characteristics in explaining re-entry after failure (Baù et al., 2017; Espinoza-Benavides & Díaz, 2019; Stam et al., 2009); however, surprisingly, comparisons of entrepreneurial engagement across those with and without entrepreneurial experience have received limited attention (Gottschalk & Müller, 2022; Hessels et al., 2011; Nielsen & Sarasvathy, 2016). Furthermore, while a few recent studies have included environmental factors (Amankwah-Amoah et al., 2019; Espinoza-Benavides et al., 2021; Simmons et al., 2019), they have failed to acknowledge context variations that may (dis)encourage re-engagement in entrepreneurship after a business failure, in particular, the role of a country's formal and informal institutions (North, 1990). On the one hand, it is still unclear whether informal institutions can play a fundamental role in fostering entrepreneurial activity after a failure, as they have already been shown to engage in initial/novice entrepreneurial activity (Urbano et al., 2018). Along this line, we only know about the disincentive produced by social stigma due to entrepreneurial failure (Lee et al., 2021; Simmons et al., 2014, 2019). Recently, it has been found for emerging economies that social media has a positive effect on re-entry after entrepreneurial failure (Espinoza-Benavides & Díaz, 2019). On the other hand, regarding formal institutions, although it is expected that governmental support for entrepreneurship favours re-entry after failure (Guerrero & Espinoza-Benavides, 2021b), thus far, the evidence is weak. To address this gap in the literature, we ask the following research question: Are there differences in entrepreneurial engagement between entrepreneurs who have recently experienced failure and those who have not previously been involved in entrepreneurship? Additionally, is this engagement moderated by country-specific conditions/institutions?

On the one hand, we use entrepreneurial learning theories (Cope, 2011; Politis, 2005) to comprehend the trade-off between the learning experience and the adverse effects of business failure. We argue that failure provides different types of learning, entrepreneurial knowledge, resilience, optimism, and additional motivation that dominate the adverse effect of failure and may provide confidence in re-engaging in the entrepreneurship process. By doing so, we expect to confirm the differences and selection bias between entrepreneurs with a recent business failure and other types of entrepreneurs. For example, within the taxonomy of habitual entrepreneurs (Westhead & Wright, 1998), people who return to entrepreneurship after having closed a previous business due to failure are classified as serial entrepreneurs. These entrepreneurs can be described as individuals who close and start a business sequentially; they are distinct from portfolio entrepreneurs who run more than one business at the same time and from novice entrepreneurs who are starting their first business (Ucbasaran et al., 2008; Wiklund & Shepherd, 2008). Previous studies have corroborated differences in behaviours/motivations, stakeholder relations, and performance among these three types of entrepreneurs (Hessels et al., 2011; Ucbasaran et al., 2003b; Westhead et al., 2003, 2005). Furthermore, evidence from recent studies has shown different types of postentrepreneurial failure re-entrants (Espinoza-Benavides et al., 2021) who manage their re-entry processes and routes into entrepreneurship differently (Williams et al., 2020), affecting both the quality and speed of their new ventures (Guerrero & Espinoza-Benavides, 2021a). These differences could be explained by the deeper and more significant learning that results from critical events, such as those from a business failure (Cope, 2011).

On the other hand, we use institutional theory (North, 1990) to understand the role of formal and informal institutions in the relationship between entrepreneurs with recent business failure and their re-engagement in entrepreneurship and individuals without entrepreneurial experience. We expect that entrepreneurial engagement is strengthened in entrepreneurs who fail in countries with governmental support for entrepreneurship. Along this line, we argue that countries with pro-entrepreneurship policies recognize failure as part of the entrepreneurial process and generate direct policies – such as entrepreneur-friendly bankruptcy laws or tax benefits (Lee et al., 2022) – or indirect policies – such as venture capital financing – which assigns particular importance to investment selection on entrepreneurs with prior founding experience (Hsu, 2007). Moreover, we expect that, after failure, the entrepreneur needs – and seeks more from – government programme support.

Within the informal dimension of institutions, we focus on the degree of individualism/collectivism in the national culture. Researchers have supported the idea that individualism encourages new firm creation (McGrath et al., 1992; Shane, 1993; Thomas & Mueller, 2000). However, collectivist culture is based on cooperation and harmony and concern for the well-being of the group (Wink, 1997). We expect that entrepreneurs in collectivistic cultures are more likely to use their own support network (provided by collectivist cultures), a critical factor in re-engagement into entrepreneurship for entrepreneurs who have experienced a recent business failure.

We test our hypotheses on a large cross-sectional sample of 485,926 individuals from 49 countries. We combine individual-level data between 2013 and 2018 obtained from the Global Entrepreneurship Monitor database with country-level data from the National Expert Survey, the World Bank, and the GLOBE study. Given the structural characteristics of the available data at the individual and country levels, we rely on a multilevel random-effects logistic regression model to control for different sources of variances.

Our study makes three theoretical contributions. First, we extend the ongoing entrepreneurial business failure literature (Amankwah-Amoah et al., 2022; Cefis et al., 2022; Gottschalk & Müller, 2022; Jenkins, 2022) by providing new evidence on failed businesses and re-engagement in entrepreneurship. We corroborate the differences and the selection bias between this particular group of habitual entrepreneurs (Westhead & Wright, 1998) and those that have not experienced a recent business failure. By doing so, we contribute to the ongoing debate on whether or not to support this type of entrepreneur (e.g., Gottschalk & Müller, 2022). Second, the recent literature has made some advances in the study of the context that affects re-entry to entrepreneurship (Guerrero & Espinoza-Benavides, 2021b; Guerrero & Peña-Legazkue, 2019; Tipu, 2020). We reinforce the relevance of this line of research and validate and extend institutional theory towards re-entry after failure. We study a new formal institution – government support – and a new informal institution – collectivism – as potential moderators. We emphasize collectivist culture as a significant aspect of re-engaging in entrepreneurship and raise questions about the effectiveness of government policies and programmes in supporting entrepreneurship after a business failure. Finally, in line with the former and from a broader theoretical perspective, we extend the implication of institutions on entrepreneurial activity. Although institutional theory has been extensively studied in entrepreneurship research regarding its potential to predict entrepreneurial activity, there are still research questions to be considered (Urbano et al., 2018). We narrow the application of formal dimensions, such as government support, and informal dimensions, such as collectivist culture, as determinants of entrepreneurial activity.

Our study also has practical implications. We present new evidence to continue the support of first-time entrepreneurship since even if the entrepreneur fails, the cost/benefit of engaging in entrepreneurship is better than inactivity. Our study also offers help to entrepreneurs who are evaluating re-entry after a business failure to become more aware of their national context, which may enable them to better manage the process. Additionally, thanks to the results at the macro level – government policies and programmes and collectivist cultures – we propose measures that could be applied at the local level.

The remainder of the paper is organized as follows. The next section presents the theoretical framework and the testable hypotheses. The third section describes the data, variables used in the analysis, and the methodological approach to test the hypotheses. In the fourth section, we present the obtained results, and the final section discusses our findings.

Theoretical overview and hypotheses

Entrepreneurial engagement

Entrepreneurship is an activity that involves the discovery of new venture ideas, evaluations, and exploitation of opportunities (Shane & Venkataraman, 2000). Recognition is part of the primary activities in discovering entrepreneurial opportunities (Sarason et al., 2006), one from which other phases of new venture creation often flow (Belchior & Lyons, 2021; Ozgen & Baron, 2007). Here, two alternative perspectives seek to explain the opportunity recognition process: the discovery perspective, which posits that opportunities exist in the market independent of the entrepreneur and the creation perspective, which assumes that opportunities do not exist and that the entrepreneur must create them (Mary George et al., 2016). Despite their differences, both perspectives assume that the entrepreneur’s goal is to form and exploit opportunities (Alvarez & Barney, 2007). The next stage – opportunity evaluation – determines whether investing resources to introduce something new to the market represents a personally attractive action path for “me” or “my firm” (Haynie et al., 2009). The last stage – exploitation of the opportunity – refers to those activities undertaken by an entrepreneur to exploit an opportunity by building efficient business systems for full-scale operations that lead to returns (March, 1991).

This study adopts a comprehensive vision of the entrepreneurial process, where engagement in entrepreneurship encompasses the entrepreneur’s involvement, whether in the recognition, evaluation, or exploitation of an opportunity.

Entrepreneurial learning, business failure and entrepreneurial engagement

The experiential learning perspective has emerged as the most influential theory in entrepreneurial learning research. This theory conceptualizes entrepreneurial learning as a process of updating a subjective stock of knowledge based on experience (Cope, 2011; González-Tejero & Molina, 2022; Lattacher & Wdowiak, 2020; Politis, 2005). With this, two concepts emerge to distinguish entrepreneurial experience and entrepreneurial knowledge. Entrepreneurial experience is a direct observation or participation in the entrepreneurship process, while the practical wisdom derived from this experience represents entrepreneurial knowledge (Politis, 2005). The nature of the experience significantly influences the learning process. Experiences perceived as critical can potentially cause "higher level" learning and may lead to significant changes in mind and behaviour (Lattacher & Wdowiak, 2020). Business failure is undoubtedly a critical event in the life of an entrepreneur (Espinoza-Benavides & Díaz, 2019).

To understand this critical entrepreneurial experience, it seems relevant to highlight that the closure of a business (or exit of a business by a partner/founder), called the “discontinuation of entrepreneurial activity”, should not necessarily be considered a business failure. Indeed, there is widespread awareness in the literature that "exit ≠ failure" (Cefis et al., 2022). This discontinuation can happen, for example, due to the sale of a business, the termination of the relationship between the owners of a business or the retirement of the entrepreneur, which are cases that are not associated with the concept of “business failure” (DeTienne, 2010; DeTienne & Cardon, 2012; Wennberg et al., 2010).

According to Ucbasaran et al. (2013), there are different definitions of business failure. From a broader perspective, failure could be considered as ceasing to participate in the ownership of a business. From a narrower perspective, it could be defined as declaring bankruptcy. We consider the following definition: “Business failure is the cessation of involvement in an enterprise because the minimum expectations of economic viability that had been stipulated by the entrepreneur have not been met” (Ucbasaran et al., 2013, p. 175).

For this research, we decide not to deepen the extensive body of previous literature that addresses the causes of a business failure – not because it is an irrelevant topic; in contrast, its importance explains the fact that a large number of studies in the last two decades have been conducted in this regard (Guerrero & Espinoza-Benavides, 2021b). However, we limit ourselves to commenting that empirical evidence has shown that the causes of a business failure are multifactorial and can be external to the business or internal and associated with the individual. Nevertheless, in the field of small businesses, weak management skills and little or no business experience of the manager (individual level) are main causes of the failure of this type of business.

Failed entrepreneurs have gone through the process of making business closure decisions, so it is reasonable to assume that they do not represent a random sample of all entrepreneurs in the process of engaging in entrepreneurship; i.e., failed entrepreneurs are different from novice entrepreneurs (Gottschalk & Müller, 2022). Therefore, our main interest lies in learning more about what happens to the entrepreneur(s) after they have experienced entrepreneurial failure. Previous literature has highlighted that the consequences of entrepreneurial failure on the individual are very complex and certainly paradoxical (Baù et al., 2017; Byrne & Shepherd, 2015). Much research has focused on the positive aspects of experiencing a business failure, emphasizing the process of recovery from failure and the potential learning benefits associated with this experience (Cope, 2011; Lattacher & Wdowiak, 2020). Failure can lead to a valuable learning opportunity for entrepreneurs and strengthen them for future re-engagement in running a business, although it also represents an emotional experience that can be traumatic and hinder learning (Byrne & Shepherd, 2015; Lattacher & Wdowiak, 2020; Shepherd et al., 2009). Additionally, entrepreneurs may also suffer financial, emotional, and social costs that prevent new entrepreneurial engagement (Jenkins, 2022; Shepherd et al., 2009; Ucbasaran et al., 2013). Therefore, when comparing individuals with and without a recent business failure experience, to recognize, evaluate, and exploit an opportunity (i.e., entrepreneurial engagement), the key difference is the trade-off between learning experience and adverse effects.

Several studies – that have conducted mainly in-depth interviews – have found evidence of learning outcomes, such as a consciousness of personal strengths, the awareness of increased resilience, improved insights into the nature and management of social networks inside and outside the venture, and an enhanced understanding of the strengths, weaknesses, opportunities and threats of the former venture (Lattacher & Wdowiak, 2020). Additionally, as we note above, a key positive outcome of the entrepreneurial learning process is entrepreneurial knowledge, which is reflected in the ability to recognize and exploit opportunities (Corbett, 2005; Politis, 2005; Shane & Venkataraman, 2000; Wang & Chugh, 2014).

Additionally, it has been found that entrepreneurs who fail are better equipped for success in subsequent new venture attempts (Mueller & Shepherd, 2016); they manage uncertainty by investing only if conditions are favourable (McGrath, 1999) and can facilitate the process of identifying more business opportunities (Amankwah-Amoah et al., 2018). Nonetheless, these opportunities are perhaps less innovative (Ucbasaran et al., 2009). Entrepreneurial experience may affect the decision to re-engage in entrepreneurship by influencing the perceived ability to take on an entrepreneurial role, gain legitimacy, and access resources (Del Bosco et al., 2019). Furthermore, failure in the presence of entrepreneurial resilience may makes founders more confident and better positioned to start subsequent ventures (Lee & Wang, 2017). It has also been shown that failed entrepreneurs seek to challenge stigmas (Simmons et al., 2014) and show optimism relative to novice entrepreneurs (Ucbasaran et al., 2010).

In summary, unlike people with no entrepreneurial experience, we expect that failure provides different types of learning, entrepreneurial knowledge, resilience, optimism, and additional motivation. These aspects dominate the adverse effect of failure and may provide confidence in re-engaging in the entrepreneurship process. This argument leads to the following hypothesis.

-

Hypothesis 1: Entrepreneurs with recent business failure are more likely to engage in entrepreneurship than individuals without entrepreneurial experience.

Institutions and entrepreneurship

Considering the importance of the external environment for entrepreneurship (Welter et al., 2019), institutional theory has been recognized as a powerful perspective in the research on several phenomena, including that of cross-country variations in entrepreneurial activity (e.g., De Clercq et al., 2013; Kim & Li, 2014; Stephan et al., 2015).

The extant literature has demonstrated that an appropriate institutional context provides the conditions necessary for stimulating new business activity, reducing the risks of starting a new venture and facilitating entrepreneur efforts to acquire resources (Busenitz et al., 2000). Moreover, the quality of institutional contexts influences the allocation of different types of entrepreneurship (Urbano et al., 2018).

According to North (1990, p. 3), “institutions are the rules of the game in a society, or more formally, institutions are the constraints that shape human interaction”. Institutions refer to the aspects of social structure that facilitate and constrain behaviour (Scott, 1995). The main function of institutions in a society is to create order and reduce uncertainty to change (North, 1990). These institutions can be formal, such as laws, government regulations, and contracts, or informal, such as norms, customs, conventions, values, attitudes, and the culture of a determined society (North, 1990; Stephan et al., 2015). Formal and informal institutions are interdependent, interact, and influence each other. Additionally, institutions are characterized by their durability but evolve over time. On the other hand, informal institutions change more slowly than formal institutions (Williamson, 2000).

In this framework, researchers have studied entrepreneurial activity through different formal institutions, such as bankruptcy laws (e.g., Lee et al., 2011), country regulations (e.g., De Clercq et al., 2010), financial systems (e.g., De Clercq et al., 2013), the legal system (e.g., Kim & Li, 2014), education (e.g., Dheer, 2017), labour markets (e.g., Fu et al., 2018), entrepreneurial customer relationship management (e.g., Al-Omoush et al., 2021), coworking spaces (e.g., Bouncken et al., 2022), property rights, corruption, and government activity (e.g., Estrin et al., 2013).

Although informal institutions have been widely explored in terms of national culture – especially as concerns of individualism and collectivism (Pinillos & Reyes, 2011; Siu & Lo, 2013) – they have also been studied through internal market dynamics, openness and R&D transfer (He et al., 2020), socially supportive culture (Stephan et al., 2015), and trust and cultural values (De Clercq et al., 2013).

However, despite the extensive literature on the relationship between formal and informal institutions and entrepreneurial activity, only a few studies have analysed the context of new business creation after a business failure. For example, Simmons et al. (2019) found that high levels of either public stigma or fear of business failure heighten gender gaps of entrepreneurial re-entry after failure; Amankwah-Amoah et al. (2019) showed that corruption forced some entrepreneurs to shift to the informal sector; Guerrero and Peña-Legazkue (2019) found that the experiential capital of entrepreneurs positively influences the likelihood of rapidly re-engaging in entrepreneurship and that spatial context conditions strengthen this positive relationship; and more recently, Espinoza-Benavides et al. (2021) concluded that formal ecosystem institutions/organizations have a low incidence of re-entry activity in the context of emerging countries. Nevertheless, informal institutions/organizations, such as social media, support re-entry activity after business failure.

Institutions and re-entry after business failure

Government support

As mentioned above, the formal context arises from the different rules, policies, norms, and laws that incentivize some behaviours and stunt others (Busenitz et al., 2000; Scott, 1995). An institutional context that is expected to influence the allocation of entrepreneurial activity is to be provided by the state or government because it establishes and enforces rules, regulations, and property rights (Fogel et al., 2006).

Governments need to support and encourage entrepreneurship since new businesses create jobs and stimulate economic growth (Storey, 2005). However, some countries and regions seem better able than others to meet this challenge (Audretsch et al., 2007). For this reason, policymakers have developed different initiatives that seek to promote entrepreneurship. According to Lundström and Stevenson (2005), entrepreneurship policy is about positively influencing the environment in favour of entrepreneurship and introducing measures that enable more people to move through the entrepreneurial process. This process begins with becoming aware of entrepreneurship as an option and continues through to the early stages of a firm’s survival and growth (the first three and a half years of the entry of a business).

Entrepreneurship policy uses a wide variety of initiatives, such as changing regulations, taxes, bankruptcy laws, or social security; programmes for entrepreneurship promotion in mass media; business service centres or mentoring programmes that provide advice, counselling, and technical and management assistance; support for the development of a financial market for entrepreneurs (e.g., angel investor business, venture capitals), tax credits, direct loans, or loan guarantees; digital public services, platforms and open innovation environments; and training programmes and the integration of entrepreneurship in the educational system, among many other policies and instruments (Audretsch et al., 2007; Lundström & Stevenson, 2005; Nambisan et al., 2019; Thanh, 2022).

We expect that a government’s general prioritization for entrepreneurship establishes programmes that influence new business creation – and particularly entrepreneurial re-entry after business failure – for three main reasons. First, there may be policies or programmes that directly support re-entry; for example, countries may provide only limited protection for entrepreneurs and managers of bankrupt firms or may have more entrepreneur-friendly bankruptcy laws. In summary, such changes may reduce the time spent on and the cost associated with bankruptcy procedures and encourages new ventures (Lee et al., 2011). A case in point is that the European Commission considers bankruptcy an opportunity and states that failed entrepreneurs learn from their mistakes and may perform better the second time than might novice entrepreneurs (European Commission, 2007). Therefore, the Commission has taken the initiative to improve insolvency laws to facilitate a restart after failure (Gottschalk & Müller, 2022). Second, there may be policies or programmes that indirectly support re-entry, for example, government support for financing entrepreneurship through venture capital. Indeed, venture capital funds assign special importance to the entrepreneur (“the jockey”) – and especially to prior founding experience (Hsu, 2007) – during investment selection. Third, all potential entrepreneurs can use the resources available from government-sponsored programmes and enjoy the privileges derived from government policies (Busenitz et al., 2000); however, involuntary exits may produce a financial, emotional, and motivational cost, so we expect that entrepreneurs who are engaged in entrepreneurship need and seek more from this support. These arguments suggest the following hypothesis.

-

Hypothesis 2: The positive relationship between entrepreneurs with recent business failures and their re-engagement in entrepreneurship compared to that of individuals without entrepreneurial experience is moderated by governmental support for entrepreneurship, such that the relationship is stronger in countries with governments that provide more support for entrepreneurship.

Individualism/collectivism

As mentioned at the end of the previous section, recent studies have shown the great importance of sociocultural context variables, or informal institutions, on entrepreneurial activity after a business failure; in fact, the evidence is strong that societies with higher rates of stigmatization of failure discourage both new entrepreneurship and re-entry after a business failure (Espinoza-Benavides et al., 2021; Lee et al., 2021; Simmons et al., 2019) and that entrepreneurial ecosystems with pro-entrepreneurial social media might favour re-entry activity in emerging economies (Espinoza-Benavides et al., 2021). However, the impact of a cultural aspect of countries/societies, namely, the degree of individualism-collectivism (Hofstede, 2001), on re-entry activity after a business failure has not been studied thus far, although this cultural aspect has been analysed and provided interesting empirical and theoretical results in several studies oriented towards new ventures (Morales et al., 2019; Pinillos & Reyes, 2011; Schmutzler et al., 2019; Siu & Lo, 2013; Stephan & Uhlaner, 2010) under the theoretical framework of institutional theory.

Individualism/collectivism is one of the most extensively studied cultural dimensions in the entrepreneurial domain, constituting the “profound structure” of cultural differences. According to Hofstede (2001, p 225), “individualism stands for a society in which the ties between individuals are loose: Everyone is expected to look after him/herself and her/his immediate family only. Collectivism stands for a society in which people from birth onwards are integrated into strong, cohesive in-groups that, throughout people’s lifetime, continue to protect them in exchange for unquestioning loyalty”.

Researchers have supported the idea that individualism encourages new firm creation (McGrath et al., 1992; Shane, 1992; Thomas & Mueller, 2000) since it values characteristics such as autonomy, personal achievement, independence, and self-orientation (Pinillos & Reyes, 2011). People in individualist cultures assume that their identity is a direct consequence of their unique traits and may be encouraged to resist social pressure if it contradicts their values and preferences (Goncalo & Staw, 2006). Thus, Hofstede (1980, p. 221) defines individualism as emotional independence from “groups, organizations, or other collectivises”.

Notwithstanding, other authors have offered empirical evidence to suggest that collectivism is positively related to entrepreneurial activity (Baum et al., 1993; Hunt & Levie, 2002). The main argument is that collectivistic societies may not necessarily discourage entrepreneurship but perhaps lead to different motivations for and forms of entrepreneurship. For example, Baum et al. (1993) found that in both individualist and collectivist cultures, entrepreneurs are motivated by the need for autonomy and achievement, but – exclusively in collectivist cultures, such as Israel – there is also a strong need for affiliation.

Some previous studies that relate entrepreneurial activity to the more individualistic or collectivist culture have found that in more developed countries, individualism positively affects entrepreneurship, but its effect is negative for less developed countries (Pinillos & Reyes, 2011); also in more collectivist countries, such as China, the social norms of interdependence with others (collectivism) are good predictors of entrepreneurial activity (Siu & Lo, 2013). A more global study has confirmed that the influence of the social context interacts with the cognitive processes of the individual, influencing entrepreneurial activity in each country/culture in a differentiated way (Schmutzler et al., 2019).

Despite the apparent contradictory evidence on the role of an individualistic or collectivistic culture in entrepreneurial activity, we argue that a collectivistic culture reinforces entrepreneurial re-entry after failure. Given the economic, emotional, and social costs facing entrepreneurs with a recent entrepreneurial failure (Jenkins, 2022; Shepherd et al., 2009; Ucbasaran et al., 2013), the support of friends, family and society at large is crucial to achieving a process of critical reflection, sensemaking and identification of the reasons for failure and, thus, enabling learning from this experience (Cope, 2011; Ucbasaran et al., 2013). Recently, Amankwah-Amoah et al. (2022) found that experience with business failure influences serial entrepreneurs to seek collaborative arrangements in the formation and running of successive ventures. Additionally, friends, family, and society are important to supporting them economically and to helping them overcome grief and shame. In a collectivist culture, the person’s primary goal is not to maintain independence from others but to promote the interests of the group (Davidson et al., 1976) – a goal based on cooperation and harmony and on the well-being of the group (Wink, 1997). People feel that they are an indispensable part of the group and are unconcerned about their own benefit and the possibility that others may exploit their efforts (Triandis et al., 1986). In collectivistic cultures, strong ties with friends and family play a significant role in obtaining financial resources (e.g., personal loans) and social networks (Baum et al., 1993). Supporting entrepreneurs who fail provoke a positive response in a society with a strong social preference for group cohesion and acceptance by others. These arguments suggest the following hypothesis.

-

Hypothesis 3: The positive relationship between entrepreneurs with a recent business failure and their re-engagement in entrepreneurship compared to that of individuals without entrepreneurial experience is moderated by the country’s individualism/collectivism culture, such that the relationship is stronger in more collectivistic cultures.

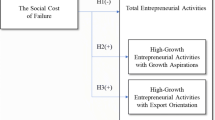

Figure 1 presents our model and the main hypotheses.

Methodology

Data and sample

This study utilizes a unique combination of data from the Global Entrepreneurship Monitor (GEM), the World Bank database (WBDB), and the cultural levels from the GLOBE study. The individual observations are obtained from the publicly available Global Entrepreneurship Monitor (GEM) adult population survey (APS, 18–64 years old) for a cross-country pool of individual interviews. To increase the stability of the measures, we pool the GEM data across the six-year period from 2013 to 2018 and include all countries that participated at least once during these years (Autio et al., 2013; Lim et al., 2016). The GEM respondents in each country are randomly selected from the general population and interviewed about their entrepreneurial attitudes, intentions, and activities. The GEM database has become the most widely used database for measuring entrepreneurship, especially for our research topic, due to its breadth of countries and variables (Autio et al., 2013; Guerrero & Peña-Legazkue, 2019; Lim et al., 2016; Simmons et al., 2014, 2019). All research members apply the same data-collecting and sampling methods to achieve comparable results in each country (Reynolds et al., 2005). Since the objective of our study is to compare people who have no experience in entrepreneurship with those who had a recent involuntary exit, we use a sample of all of the people who answered the survey, excluding voluntary exit entrepreneurs and individuals who own a business and paid wages for more than one year prior to their GEM interview. Thus, we include in the sample the individuals who started businesses shortly before or shortly after a failure, accounting for the anticipation that entrepreneurs can have about an imminent business failure (Simmons et al., 2019). This approach also permits us to exclude portfolio entrepreneurs.

Country-level variables are collected from the entrepreneurship regulatory institutions data from the GEM National Expert Survey (NES); economic measures from the World Bank database; and culture levels from data on national cultural practices from the GLOBE study.

The cumulative number of GEM respondents participating in all countries is 1.0752.74, of which 943,326 (88%) did not have an established business or make a voluntary exit. Merging GEM data with the GLOBE culture study yielded 49 matching countries. After omitting observations for missing values and nonvalid answers, we are left with a final cross-sectional sample of 485,926 (45%) observations.Footnote 1

Variables and measures

Dependent variable

Similar to other research (e.g., De Clercq et al., 2013; Hessels et al., 2011; Lee et al., 2021; Lim et al., 2016), we use GEM APS data to measure entrepreneurial engagement in new business creation. In our study, entrepreneurial engagement is a binary variable that shows whether the entrepreneur is engaged in any of the three stages of the entrepreneurial process.

The first stage, engagement in discovering opportunities, is measured with the item: In the next six months, there will be good opportunities for starting a business in the area where you live. This item indicates the general perception of opportunities and has been used in previous studies on opportunity recognition (e.g., Arenius & Clercq, 2005). This question has also been used to identify potential entrepreneurs (e.g., Hessels et al., 2011).

The second stage, engagement in evaluating opportunities, is measured with the items: you are – by yourself, or with others – currently trying to start a new business, including any self-employment, or selling any goods or services to others, or you are – by yourself, or with others – expecting to start a new business, including any type of self-employment, within the next three years. These items indicate first-person involvement and have been used in other studies to construct the variable for engagement in entrepreneurial opportunity evaluation (e.g., Lim et al., 2016) and as a proxy for intentional and nascent entrepreneurs (e.g., Hessels et al., 2011).

The final stage, engagement in exploiting opportunities, is measured with the respondent who is actively involved in start-up efforts as owner, or if s/he manages and owns a business that is up to 42 months old and does so to take advantage of a business opportunity, rather than because there are no better work choices. These items indicate an early-stage entrepreneurial activity (De Clercq et al., 2013; Reynolds et al., 2005) and that this activity is an opportunity-driven rather than necessity-driven business (Boudreaux et al., 2019).

In summary, entrepreneurial engagement takes the value 1 if the respondent is engaged in the discovery, evaluation, or exploitation of an opportunity and 0 otherwise.

Individual-level predictor

We use the GEM APS to identify individuals who have experienced a recent business failure. The GEM survey asks if the respondents shut down, discontinued, or quit a venture in the past 12 months. For those who have exited, they ask What was the most important reason for quitting this business? with the possibility of choosing between nine answers: 1) an opportunity to sell the business; 2) the business was not profitable; 3) problems getting financing; 4) another job or business opportunity; 5) exit planned in advance; 6) retirement; 7) personal reasons; 8) an incident; or 9) other. As we note above, we exclude from the sample respondents who exited voluntarily (answers 1, 4, 5, 6, or 7). Following previous studies (Justo et al., 2015; Simmons et al., 2014, 2019), we create the binary variable Business Failure, which takes the value of 1 if the respondent indicated that his or her exit was due to failure (answers 2, 3, 8, or 9) and 0 otherwise.

Cross-level interactions

Based on institutional theory, we suggest that formal and informal institutions affect entrepreneurial engagement for those who have experienced recent a business failure compared to those without entrepreneurial experience.

Our first indicator for measuring formal institutions uses the National Expert Survey (NES) of the Global Entrepreneurship Monitor (GEM). The NES component of GEM aims to determine whether conditions encourage or hinder an economy’s entrepreneurial climate. To do this, a panel of at least 36 experts for each country participates in the survey. Each of the factors is assessed using a series of items for which the experts must identify the veracity or lack thereof based on a 5-point Likert scale ranging from “totally false” to “totally true”. On this basis, a score of 1 to 2 indicates that, according to the expert, the conditions are negative for entrepreneurship, while a value between 4 and 5 indicates that the conditions are positive. We use the continuous variable Governmental policies and programmes to measure one of the country’s institutional formal conditions from the GEM NES Governmental policies and programmes index. This variable indicates the extent to which public policies support entrepreneurship as a relevant economic issue; that taxes or regulations are either size-neutral or encourage new business and SMEs; and the presence and quality of programmes directly assisting SMEs at all levels of government (national, regional, municipal).

Next, we measure the informal institutions – consisting of the social values, norms, and beliefs associated with human behaviour – using the cultural dimensions obtained from the GLOBE project. Prominent and plentiful entrepreneurship research, recently and over the last 20 years, has used data developed by the GLOBE project (Autio et al., 2013; Bullough et al., 2022; Schmutzler et al., 2019). The GLOBE measures of national cultural attributes are based on a survey of more than 17,000 managers from 951 organizations operating in 63 countries around the world. The GLOBE method of measuring cultural dimensions with a seven-point Likert scale, with cultural dimensions presented as regression-predicted scores, allows the correction for response bias. In particular, we use Institutional Collectivism as a continuous variable relying on GLOBE, which indicates “the degree to which organizational and institutional practices encourage and reward collective distribution of resources and collective action” (House et al., 2004, p. 12). We choose to use cultural practices (“as is”) – instead of cultural value (“should be”) – since our theory development emphasizes cultural influences as experienced by individuals in their cultural contexts.

Individual and country-level controls

Consistent with extant studies on entrepreneurial engagement, business failure, institutions, and multilevel analysis, we include both individual- and country-level control variables.

For the individual level, we use the GEM APS database to control for gender measured as a dichotomous variable (values of 1 and 0, respectively), indicating whether the individual is male or female (Armuña et al., 2020; Simmons et al., 2019), and age and squared age as a continuous variable indicating the age and the squared age of the entrepreneur at the time of the survey (Baù et al., 2017). We also control for Household income as an ordered category variable that takes the value of 1 if the individual has an income ranked in the lowest 1/3 of the national household income distribution, 2 in the middle 1/3, and 3 in the upper 1/3 within the top one-third of each; Education as an ordered category variable that takes the value 1 if the respondent has no education, 2 some secondary education, 3 secondary education, 4 tertiary education, and 5 if he or she had post-tertiary education; Social Capital as a dichotomous variable that takes the value of 1 if the entrepreneur personally knows someone who started a new business in the last two years and 0 otherwise; Perceived entrepreneurial skills as a dichotomous variable that takes the value of 1 if the respondent self-reported having the knowledge, skill, and experience to start a new business and 0 otherwise (Belchior & Lyons, 2021; Schmutzler et al., 2019; Škare et al., 2022); and Fear of fail as a dichotomous variable that takes the value of 1 if the respondent answers that fear of failure prevents you from starting a business and 0 otherwise (Kusa et al., 2021).

For country-level controls, we use the World Bank database to include the log_GDP_PC_PPP(t-1) continuous variable that measures the gross domestic product (GDP) each year per capita using purchasing power parity; GDP Growth(t-1) as a continuous variable that measures the growth/reduction in the GDP by country each year; and Unemployment(t-1) that measures the share of the labour force without work but available for and seeking employment. We also include Bankruptcy Laws, which determines the formal costs of failure from the resolving insolvency data of the WBDB database (Lee et al., 2011). This index reflects the time, cost, and outcome of insolvency proceedings as well as the strength of the legal framework for the liquidation and reorganization process. We lag these country-level variables by one year to reduce potential endogeneity.

Additionally, we include the remaining cultural dimensions (Autio et al., 2013; Schmutzler et al., 2019) – Performance Orientation, Assertiveness, Future Orientation, Humane Orientation, In-Group Collectivism, Gender Egalitarianism, Power Distance, Uncertainty Avoidance – as defined by the GLOBE project (House et al., 2004). Finally, we include the year as a dummy variable that captures year fixed effects using 2013 as a reference in the model.

Methodological approach

Since we combine individual-level observations with country-level measures and the recommendations of the utility of a multilevel approach in studies of institutions and entrepreneurship (Amorós et al., 2019; Pathak & Muralidharan, 2016), we analyse our data using hierarchical linear modelling methods (multilevel modelling). Several research studies on entrepreneurship have applied this method approach (e.g., Fu et al., 2018; Simmons et al., 2019). These methods have several advantages over single-level designs, as they reduce the risk of Type I errors when they do not acknowledge the existence of a higher level – in our case, countries – and treat all variables as if they were observed at the individual level (Stephan et al., 2015). The use of conventional single-level analysis could increase the possibility of “false positives” due to an underestimation of standard errors and leads to biased results (Estrin et al., 2022). Consequently, to estimate the effect of a business failure on entrepreneurial engagement, as well as the moderating effect of the country-level formal and informal institutional context, we use random-effect logistic regression. Random effects analysis allows the regression coefficient, in our case business failure, and intercepts to vary across countries. Taken together, this can be formalized at the individual level (level 1) as

where at the country level (level 2)

In this model, Entrepreneurial_engagementij denotes the probability of individual i engaging in entrepreneurship in country j; \({\gamma }_{00}\) is the mean of the intercepts across countries; \({\gamma }_{10}\) is the mean of the slope of Business Failure across countries; \({\gamma }_{0q}\) are country-level regression coefficients; \({\gamma }_{11}\) is the regression coefficient of the interaction of Business Failure (level 1) with government programmes (level 2) and \({\gamma }_{12}\) with Institutional Collectivism (level 2); and \({\beta }_{1j}\) and \({\beta }_{cj}\) are individual-level regression coefficients. The random part of the equation is represented by the combination of the individual-level residuals \({R}_{ij}\) and the country-level residuals \({U}_{0j}\) and \({U}_{1j}\). In other words, country characteristics might affect the individual-level regression by varying individual-level intercepts across countries and by varying the individual-level Business Failure slopes across countries.

Consistent with prior work on multilevel modelling (e.g., Autio et al., 2013; Estrin et al., 2022; Pathak & Muralidharan, 2016), we proceed with a stepwise testing strategy to examine the predictors of entrepreneurial engagement. First, we estimate the between-country variance that exists in the dependent variable by excluding all predictors or controls in our random-effect logistic regression model. We observe significant country-level variance (p < 0.01) in our dependent variable and an interclass correlation (ICC) of 0.16, which provides support for the choice of a multilevel model over a simple logistic regression model. This regression model is called the “null model” (Model 0 in Table 3). Second, we add individual- and country-level controls to the models to estimate the proportion of variance explained by these predictors (model 1 in Table 3). Finally, we include the individual and country predictors (model 2 in Table 3). Finally, we include the interaction term between business failure and country-level variables (models 3–4 in Table 3).

Results

Descriptive results

Table 1 presents variable definitions and descriptive statistics, and Table 2 shows correlations for all of the variables included in this study. Of the people who answered the survey – excluding entrepreneurs who own a business and paid wages for more than one year and entrepreneurs who experienced a voluntary exit – 46% displayed entrepreneurial engagement, and 2% had a recent business failure. The respondents’ average age was 40 years, with 51% being male; 45% self-reported having the entrepreneurial skills to start a business; and 44% acknowledged that fear of failure prevented them from starting a business.

Turning to country-level interaction variables, the average score of the NES component governmental programme in the GEM survey was 2.55 based on a 5-point Likert scale. Institutional collectivism had an average value of 4.15, indicating that most countries were rated as collectivist.

Country control variables included gross domestic product using purchasing power parity per capita of all countries between 2013 and 2018 with an average of US$30,737 – we present it in log form – GDP growth of 1.86% and unemployment of 9.78%. All of these variables were lagged by one year.

Additionally, the estimated variance inflation factor (VIF) in the model was calculated at 5.89. Although this value seems high, we noted that the inclusion of the controls age and age squared are essentially collinear. When controlling only by age, the VIF was calculated to be 2.38. Taking this into account, and following the previous literature, the VIF scores suggested no evidence of multicollinearity. Therefore, the presented regression models were not distorted by this problem.

Hypothesis testing and results

Table 3 reports the results from the multilevel random intercept models predicting entrepreneurial engagement. Model 0 (null) estimates an intercept-only model to study whether a significant between-country variance exists in the dependent variable. This model, without any predictors or controls, returns an intraclass correlation (ICC) of 0.16, implying that 16% of the total variance in the dependent variable entrepreneurial engagement can be explained by variation between countries. This result supports the application of multilevel analysis techniques.

Model 1 (Table 3) includes all individual- and country-level controls. This step reports the proportion of variance in entrepreneurial engagement considered by only the individual- and country-level controls. We observe that controls are significant and behave according to those in the previous literature (Autio & Acs, 2010; Baù et al., 2017; Simmons et al., 2019; Tipu, 2020). The variance component of the random intercept decreases from 1.938 in the null model to 1.234 in Model 1, indicating that our controls explain up to 36.3% of the country-level variance.

Model 2 shows the influence of business failure on entrepreneurial engagement. As the results show, the entrepreneur with a business failure variable has a positive and significant effect on the dependent variable, supporting hypothesis 1. A one-standard-deviation increase in the variable “entrepreneur with a business failure” nearly duplicates the likelihood of average entrepreneurial engagement (odds ratio = 1.753; p < 0.001). We refer to “average” because the multilevel models, in effect, algorithmically fit models on the “average” of the individual-level dependent variable across countries (Autio et al., 2013).

Model 3 tests hypothesis 2, which states that governmental programmes moderate the relationship of the entrepreneurs with a business failure and their entrepreneurial engagement. Even though we find a positive and significant effect of governmental policies and programmes on entrepreneurial engagement (odds ratio: 1.040; p < 0.001), the positive effect of governmental policies and programmes on entrepreneurs with a business failure and entrepreneurial engagement (odds ratio: 1.021) is not statistically significant.

Model 4 tests hypothesis 4, which states that institutional collectivist cultures moderate the relationship of entrepreneurs with a business failure and their entrepreneurial engagement. In line with the previous literature (Autio et al., 2013; Pinillos & Reyes, 2011), the finding suggests that collectivism has a negative effect on entrepreneurial engagement, i.e., individualism has a positive and significant effect (odds ratio: 0.860; p < 0.01). However, the interaction of business failure and entrepreneurial engagement (odds ratio: 1.744; p < 0.0001) has a positive and statistically significant effect, which provides support for hypothesis 3. Another important result in this model is that the relationship of the entrepreneur with a business failure and their entrepreneurial engagement reverses to a negative and significant value (odds ratio: 0.178; p < 0.0001).

To briefly explain the fulfilment of the hypotheses set out in the theoretical framework and our research question, our analysis presents evidence suggesting that entrepreneurs, after a recent failure, are more likely to engage in entrepreneurship. Additionally, we can highlight that government policies and programmes have no effect and that the collectivist culture improves entrepreneurial engagement.

Discussion

As we discussed earlier, entrepreneurship is concerned with the discovery, evaluation and exploitation of profitable opportunities (Shane & Venkataraman, 2000). Entrepreneurs who experience a business failure may have better opportunity recognition, and it is commonly assumed that they have more evaluation and exploitation skills and, therefore, a higher chance of coping with the liabilities of newness than do novices when starting a new business (Mueller & Shepherd, 2016; Politis, 2005; Ucbasaran et al., 2013). However, this assumption is not so obvious since there are different costs of failure that have not necessarily been overcome when failed entrepreneurs decide to re-engage in entrepreneurship. Additionally, individual engagement in the process is a joint function of both individual and contextual factors (Lim et al., 2016; Shepherd et al., 2019). The extent to which entrepreneurs bear the burden of failure depends on institutional conditions, which vary across countries and regions (Lee et al., 2021). Therefore, we propose that entrepreneurs after a recent failure are more likely to engage in entrepreneurship than those without recent entrepreneurial experience. We also propose that this positive relationship is stronger in countries with governments that provide more support for entrepreneurship and in more collectivist cultures. However, our analysis does not support all our hypotheses.

Our analysis suggests that after a recent failure, entrepreneurs are more likely to engage in the process of discovery, evaluation, and exploitation of opportunities than are those without recent entrepreneurial experience. Stam et al. (2009) commented that conventional economic logic/rationality should predict that one should not restart a new business after an entrepreneurial failure; this empirical evidence proves otherwise. On the one hand, entrepreneurs are generally an overconfident and optimistic group of individuals who, despite failure, do not adjust their levels of optimism and confidence (Ucbasaran et al., 2013). Thus, they remain convinced that they are as good entrepreneurs as they were before the failure. As the popular quote from Jose Narosky states, "In war, there are no unwounded soldiers", and the entrepreneur validates failure as part of the entrepreneurial process. In addition, learning outcomes of a business failure (i.e., entrepreneurial knowledge), such as a consciousness of personal strengths, improved management skills, and an enhanced understanding of the former venture's strengths, weaknesses, opportunities, and threats, may provide even more confidence and optimism in re-engaging in the entrepreneurship process. On the other hand, the benefits of entrepreneurship dominate the adverse effect of failure. As discussed, failure may create financial, emotional, and motivational costs to the entrepreneur. However, potential benefits, such as new income (financial), autonomy (emotional), or the challenge of the stigma of failure (motivational), have a stronger force in the decision to re-engage in entrepreneurship. Recently, Gottschalk and Muller (2022) proposed that failed entrepreneurs go through a process of business closure decisions, so it is reasonable to assume that, in the process of entrepreneurship, they are not a random sample of all entrepreneurs. Even though their results on the survival of entrepreneurs with a previous failure compared to that of novices are higher in novices, our results support the proposed selection process. We may say that entrepreneurs are always entrepreneurs, even when they fail.

The results also indicate that the interaction effects among entrepreneurs and institutional conditions are more complex than our theoretical argument suggests. As noted, individual engagement is also affected by formal institutional conditions. Although government policies and programmes for entrepreneurship are significant for entrepreneurial engagement, we find that they are neutral for failed entrepreneurs. We interpret this finding as there are fewer government policies and programmes for entrepreneurship focused on entrepreneurs who fail, that there is support, but it does not produce the desired effect, or that government policies and programmes do not discriminate between individuals. Our evidence is in line with what Guerrero and Espinoza-Benavides (2021a, b) theoretically argued – that entrepreneurial support ecosystems should have special considerations for re-entry entrepreneurs who come from previous failure processes and that public policies and programmes are not oriented towards this type of entrepreneur. However, this finding can be seen as positive, as we can interpret that although policies and programmes do not target entrepreneurs who fail, they do not penalize failure.

Another important finding is the moderating role within the informal dimension of institutions, such as the degree of individualism-collectivism in the culture. As noted, we present evidence that failed entrepreneurs are more likely to engage in entrepreneurship than are those without experience. However, our results also show that this effect is stronger in the particular context of collectivist societies. The results also show that when moderated by collectivist societies, the relationship between entrepreneurs who fail and those with no experience in entrepreneurship is reversed, i.e., in more individualistic societies, failed entrepreneurs are less likely to engage in entrepreneurship than are those without experience. One explanation is that in a collectivist culture, the individual's main objective is to promote the group's interests based on cooperation and harmony. The support of friends, family, and society is crucial for critical reflection, identification of reasons for failure, and allocation of financial resources and social networks. This finding is in line with Amankwah-Amoah et al. (2022), who found that the experience of a business failure influences serial entrepreneurs to seek collaborative arrangements in the formation and management of successive ventures. Instead, individualistic societies value characteristics such as autonomy, independence, and self-orientation. The “I” is more important than “we”, and success is a personal achievement (Pinillos & Reyes, 2011). Therefore, we can infer that failure is a personal defeat. Another explanation is that more socially supportive cultures, such as of collectivist societies, are more inclusive and thus more accepting of minority groups (Stephan & Uhlaner, 2010). Although entrepreneurs are not typically seen as a minority, they represent only a minor part of the economic activity of a country. Moreover, as we show in our descriptive results, entrepreneurs with recent failures are, indeed, a minority of entrepreneurial activity.

Theoretical contribution

Our findings allow us to make three key theoretical contributions to the entrepreneurship literature. First, we extend the ongoing entrepreneurial business failure literature (Amankwah-Amoah et al., 2022; Cefis et al., 2022; Gottschalk & Müller, 2022; Jenkins, 2022) by providing evidence related to business failure and their re-engagement in entrepreneurship. Within the well-known taxonomy of habitual entrepreneurs (Westhead & Wright, 1998), individuals who re-enter entrepreneurship after a business has failed are classified as serial entrepreneurs. Previous studies have corroborated the differences in behaviours/motivations, especially outcomes, between these entrepreneurs and novices (Gottschalk & Müller, 2022; Ucbasaran et al., 2003a; Westhead et al., 2005). Our research presents empirical evidence that there is indeed a selection bias regarding engaging in entrepreneurship, which could be explained by the deeper and more meaningful learning that stems from critical events, such as a business failure (Cope, 2011; Gottschalk & Müller, 2022). This evidence reinforces that future research should control previous experiences of failure to explain entrepreneurial activity.

Second, despite the extensive literature on entrepreneurial failure, some contexts that affect re-entry to entrepreneurship have only recently been investigated (Guerrero & Espinoza-Benavides, 2021b; Guerrero & Peña-Legazkue, 2019; Tipu, 2020). Similarly, although institutional theory (North, 1990) has been widely used in terms of its potential to predict entrepreneurial activity, there are still research questions to be considered (Lee et al., 2021; Urbano et al., 2018). In this research, we reinforce the relevance of the study of contexts and validate and extend institutional theory towards re-entry after failure. To this end, we test the role of formal and informal institutions. On the one hand, our finding reveals that the formal institutions tested – government policies and programmes – have a neutral effect when we compare failure and novice entrepreneurs. This is a theoretically significant result because several studies have highlighted the contribution of formal institutions to re-engagement in entrepreneurship, such as more pro-entrepreneurship bankruptcy laws (Lee et al., 2011). In this cross-country study, we find evidence that, in general, these policies are innocuous among previously failed entrepreneurs and novices. On the other hand, we found that informal institutions tested – such as those in a collectivist culture – have a stronger effect on entrepreneurial re-engagement. This finding may be contradictory since individualism may encourage the creation of new businesses, as it values autonomy, personal achievement, independence, and self-orientation (Pinillos & Reyes, 2011). However, in line with Stephan and Uhlaner (2010), we argue that "optimal" entrepreneurial activity is embedded in a social context, i.e., not in an individualistic culture but one rich in social capital, such as collectivism.

Third, these exciting results extend the implications of institutions for entrepreneurial activity. Our results are consistent with recent evidence found in other studies on the importance of formal and informal institutional factors on entrepreneurial activity research (e.g., Lee et al., 2021; Morales et al., 2019; Schmutzler et al., 2019). We add other formal dimensions, such as government support, and informal dimensions, such as a collectivist culture, as determinants of entrepreneurial activity, which undoubtedly encourages further research in this area.

Practical contribution

Our results have several practical implications. First, our results support the concept that the entrepreneurial learning that results from entrepreneurial failure is likely to provide extra confidence and optimism to overcome the adverse effects of the failure. Additionally, potential financial, emotional, or social factors dominate the costs of failure. This phenomenon is especially relevant to fostering first-time entrepreneurship since even if the entrepreneur fails, the gain in entrepreneurial learning is probably more significant than the costs of failure. In other words, in terms of cost/benefit, engaging in entrepreneurship is better than inactivity. Second, for entrepreneurs who are evaluating re-entry after a business failure, our study helps them become more aware of their national context – formal and informal – which may enable them to better manage the process. Third, we believe that efforts should be made between educational institutions and public organizations to promote a more collectivist or collaborative culture to support entrepreneurs who have experienced failure. In addition, collaboration is needed to systematize and disseminate the lessons learned from experiencing the process of closing a failed business. Finally, for policymakers, the new evidence we have provided on the interactions that entrepreneurs have with the institutions surrounding them should encourage more supportive entrepreneurial policies. For countries with individualistic cultures, public policies should be developed to show business failure as part of the entrepreneurship process and not with a negative connotation. Additionally, we provide evidence for the further creation of, for example, mentor networks or support groups in individualistic cultures to supplement the need already met by family and friends to overcome emotional and motivational damage in collectivist cultures.

Limitations and future research

This study is not free of limitations, which provide future research opportunities. First, as our analysis was based on self-reported statements, we relied on the subjective judgement of the entrepreneurs interviewed. Self-reporting biases can be minimized by the inclusion of objective measures, such as analysing entrepreneurs who are in a formal bankruptcy process. Second, our research is limited to the scope of failed entrepreneurship experiences. The data only identified entrepreneurs who had exited and failed in business during the year of the survey, so entrepreneurs who exited a business in previous years were not considered. A longitudinal design to study failed entrepreneurs would better track their entrepreneurial experience. Third, the questionnaire used in the GEM survey did not identify the industry of the business in which the entrepreneur failed. Therefore, whether entrepreneurial engagement differs among industries could also be studied.

Future research could also consider additional country-specific variables, such as economic and political freedom; the level of corruption; financial access (e.g., venture capital, crowdfunding, microfinance); taxes; other cultural dimensions (e.g., uncertainty avoidance, long-term orientation); digitalization, digital platforms and open innovation environments; and entrepreneurial ecosystems. Several studies have suggested that these variables influence entrepreneurial engagement (Autio et al., 2013; Boudreaux et al., 2019; Bruton et al., 2015; Estrin et al., 2013; Nambisan et al., 2019) and that they might also have a direct, moderating, or mediating effect in the context of entrepreneurs after failure.

Data availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Change history

01 February 2023

A Correction to this paper has been published: https://doi.org/10.1007/s11365-023-00842-9

Notes

The countries considered in the analysis are the following: Argentina, Australia, Austria, Bolivia, Brazil, Canada, China, Colombia, Czech Republic, Denmark, Ecuador, Egypt, El Salvador, Finland, France, Georgia, Germany, Greece, Hong Kong, Hungary, India, Indonesia, Iran, Ireland, Israel, Italy, Japan, Jordan, Kazakhstan, Korea, Malaysia, Mexico, The Netherlands, Philippines, Poland, Portugal, Qatar, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, United Kingdom, United States, and Zambia. We consider all countries that participated at least once in the GEM APS survey between 2013 and 2018.

References

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2012). Growth and entrepreneurship. Small Business Economics, 39, 289–300. Springer.

Al-Omoush, K. S., Simón-Moya, V., Atwah Al-ma’aitah, M., & Sendra-García, J. (2021). The determinants of social CRM entrepreneurship: An institutional perspective. Journal of Business Research, 132, 21–31.

Alvarez, S. A., & Barney, J. B. (2007). Discovery and creation: Alternative theories of entrepreneurial action. Strategic Entrepreneurship Journal, 1, 11–26.

Amankwah-Amoah, J., Boso, N., & Antwi-Agyei, I. (2018). The effects of business failure experience on successive entrepreneurial engagements: an evolutionary phase model. Group and Organization Management, 43, 648–682.

Amankwah-Amoah, J., Hinson, R. E., Honyenuga, B., & Lu, Y. (2019). Accounting for the transitions after entrepreneurial business failure: An emerging market perspective. Structural Change and Economic Dynamics, 50, 148–158. Elsevier B.V.

Amankwah-Amoah, J., Adomako, S., & Berko, D. O. (2022). Once bitten, twice shy? The relationship between business failure experience and entrepreneurial collaboration. Journal of Business Research, 139, 983–992. Univ Kent, Kent Business Sch, Canterbury, Kent, England.

Amorós, J. E., Poblete, C., & Mandakovic, V. (2019). R&D transfer, policy and innovative ambitious entrepreneurship: evidence from Latin American countries. Journal of Technology Transfer, 44, 1396–1415. Springer US.

Arenius, P., & Clercq, D. D. (2005). A network-based approach on opportunity recognition. Small Business Economics, 24, 249–265.

Armuña, C., Ramos, S., Juan, J., Feijóo, C., & Arenal, A. (2020). From stand-up to start-up: exploring entrepreneurship competences and STEM women’s intention. International Entrepreneurship and Management Journal, 16, 69–92. Springer.

Audretsch, D. B., Grilo, I., & Thurik, A. R. (2007). Handbook of research on entrepreneurship policy. Edward Elgar Publishing.

Autio, E., & Acs, Z. (2010). Intellectual property protection and the formation of entrepreneurial growth aspirations. Strategic Entrepreneurship Journal, 4, 234–251.

Autio, E., Pathak, S., & Wennberg, K. (2013). Consequences of cultural practices for entrepreneurial behaviors. Journal of International Business Studies, 44(4), 334–362.

Baù, M., Sieger, P., Eddleston, K. A., & Chirico, F. (2017). Fail but try again? The effects of age, gender, and multiple-owner experience on failed entrepreneurs’ reentry. Entrepreneurship: Theory and Practice, 41, 909–941.

Baum, J. R., Olian, J. D., Erez, M., Schnell, E. R., Smith, K. G. A., Sims, H. P., Scully, J. S., & Smith, K. G. A. (1993). Nationality and work role interactions: A cultural contrast of Israeli and U.S. entrepreneurs’ versus managers’ needs. Journal of Business Venturing, 8, 499–512.

Belchior, R. F., & Lyons, R. (2021). Explaining entrepreneurial intentions, nascent entrepreneurial behavior and new business creation with social cognitive career theory–a 5-year longitudinal analysis. International Entrepreneurship and Management Journal, 17, 1945–1972. Springer.

Boudreaux, C. J., Nikolaev, B. N., & Klein, P. (2019). Socio-cognitive traits and entrepreneurship: The moderating role of economic institutions. Journal of Business Venturing, 34, 178–196. Elsevier.

Bouncken, R. B., Lapidus, A., & Qui, Y. (2022). Organizational sustainability identity:‘New Work’of home offices and coworking spaces as facilitators. Sustainable Technology and Entrepreneurship, 1(2), 100011.

Bruton, G., Khavul, S., Siegel, D., & Wright, M. (2015). New financial alternatives in seeding entrepreneurship: Microfinance, crowdfunding, and peer-to-peer innovations. Entrepreneurship: Theory and Practice, 39, 9–26.

Bullough, A., Guelich, U., Manolova, T. S., & Schjoedt, L. (2022). Women’s entrepreneurship and culture: Gender role expectations and identities, societal culture, and the entrepreneurial environment. Small Business Economics, 58(2), 985–996.

Busenitz, L. W., Gomez, C., & Spencer, J. W. (2000). Country institutional profiles: Unlocking entrepreneurial phenomena. Academy of Management Journal, 43(5), 994–1003.

Byrne, O., & Shepherd, D. A. (2015). Different strokes for different folks: Entrepreneurial narratives of emotion, cognition, and making sense of business failure. Entrepreneurship Theory and Practice, 39(2), 375–405.

Cefis, E., Bettinelli, C., Coad, A., & Marsili, O. (2022). Understanding firm exit: a systematic literature review. Small Business Economics, 59, 423–446. Springer.

Cope, J. (2011). Entrepreneurial learning from failure: An interpretative phenomenological analysis. Journal of Business Venturing, 26, 604–623.

Corbett, A. C. (2005). Experiential learning within the process of opportunity identification and exploitation. Entrepreneurship Theory and Practice, 29, 473–491.

Davidson, A. R., Jaccard, J. J., Triandis, H. C., Morales, M. L., & Diaz-Guerrero, R. (1976). Cross-cultural model testing: toward a solution of the etic-emic dilemma. International Journal of Psychology, 11, 1–13.

De Hoe, R., & Janssen, F. (2022). Re-creation After Business Failure: A Conceptual Model of the Mediating Role of Psychological Capital. Frontiers in Psychology, 13, 842590–842590.

De Clercq, D., Danis, W. M., & Dakhli, M. (2010). The moderating effect of institutional context on the relationship between associational activity and new business activity in emerging economies. International Business Review, 19, 85–101.

De Clercq, D., Lim, D. S. K., & Oh, C. H. (2013). Individual-level Resources and New Business Activity: The Contingent Role of Institutional Context. Entrepreneurship Theory and Practice, 37, 303–330.

Del Bosco, B., Chierici, R., & Mazzucchelli, A. (2019). Fostering entrepreneurship: an innovative business model to link innovation and new venture creation. Review of Managerial Science, 13, 561–574. Springer.

DeTienne, D. R. (2010). Entrepreneurial exit as a critical component of the entrepreneurial process: Theoretical development. Journal of Business Venturing, 25, 203–215.

DeTienne, D. R., & Cardon, M. S. (2012). Impact of founder experience on exit intentions. Small Business Economics, 38, 351–374.

Dheer, R. J. S. (2017). Cross-national differences in entrepreneurial activity: role of culture and institutional factors. Small Business Economics, 48, 813–842. Small Business Economics.

Espinoza-Benavides, J., & Díaz, D. (2019). The entrepreneurial profile after failure. International Journal of Entrepreneurial Behaviour and Research, 25, 1634–1651.

Espinoza-Benavides, J., Guerrero, M., & Díaz, D. (2021). Dissecting the ecosystems’ determinants of entrepreneurial re-entry after a business failure. European Business Review, 33(6), 975–998.

Estrin, S., Korosteleva, J., & Mickiewicz, T. (2013). Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing, 28, 564–580. Elsevier Inc.

Estrin, S., Korosteleva, J., & Mickiewicz, T. (2022). Schumpeterian Entry: Innovation, Exporting, and Growth Aspirations of Entrepreneurs. Entrepreneurship Theory and Practice, 46(2), 269–296.

European Commission. (2007). Overcoming the stigma of business failure: For a second chance policy. European Commission Brussels.

Fogel, K., Hawk, A., Morck, R., & Yeung, B. (2006). Institutional obstacles to entrepreneurship. Oxford University Press London.

Fu, K., Larsson, A. S., & Wennberg, K. (2018). Habitual entrepreneurs in the making: how labour market rigidity and employment affects entrepreneurial re-entry. Small Business Economics, 51, 465–482. Small Business Economics.

Fuentelsaz, L., González, C., & Maícas, J. P. (2021). High-growth aspiration entrepreneurship and exit: The contingent role of market-supporting institutions. Small Business Economics, 57(1), 473–492.

Goncalo, J. A., & Staw, B. M. (2006). Individualism-collectivism and group creativity. Organizational Behavior and Human Decision Processes, 100, 96–109.

González-Tejero, C. B., & Molina, C. M. (2022). Training, corporate culture and organizational work models for the development of corporate entrepreneurship in SMEs. Journal of Enterprising Communities, 16, 168–188. Emerald Publishing Limited.

Gottschalk, S., & Müller, B. (2022). A second chance for failed entrepreneurs: a good idea? Small Business Economics, 59(2), 745–767.

Guerrero, M., & Espinoza-Benavides, J. (2021a). Do emerging ecosystems and individual capitals matter in entrepreneurial re-entry’quality and speed? The International Entrepreneurship and Management Journal, 17(3), 1131–1158.

Guerrero, M., & Espinoza-Benavides, J. (2021b). Does entrepreneurship ecosystem influence business re-entries after failure? International Entrepreneurship and Management Journal, 17, 211–227.

Guerrero, M., & Peña-Legazkue, I. (2019). Renascence after post-mortem: the choice of accelerated repeat entrepreneurship. Small Business Economics, 52, 47–65.

Haynie, J. M., Shepherd, D. A., & McMullen, J. S. (2009). An opportunity for me? The role of resources in opportunity evaluation decisions. Journal of Management Studies, 46(3), 337–361.

He, J., Nazari, M., Zhang, Y., & Cai, N. (2020). Opportunity-based entrepreneurship and environmental quality of sustainable development: A resource and institutional perspective. Journal of Cleaner Production, 256, 120390. Elsevier Ltd.

Hessels, J., Grilo, I., Thurik, R., & Van Der Zwan, P. (2011). Entrepreneurial exit and entrepreneurial engagement. Journal of Evolutionary Economics, 21, 447–471.