Abstract

In recent years, environmental issues have become controversial, and policymakers are discovering new predictors of carbon emissions. Some economists/researchers have advocated for fiscal decentralization to improve the quality of the environment by offering more financial authority to provincial/local and sub-national governments. Therefore, this work aims to inspect the effect of fiscal decentralization on economic growth and environmental quality in India by taking data from 1996 to 2021. This work applies both ARDL and NARDL econometric models for empirical examination. The findings of this study suggest that expenditure decentralization has asymmetric long-term and short-term consequences on economic growth, and carbon emission in India. The result of the asymmetric ARDL model also indicates that positive and negative shock in expenditure decentralization contrarily affects economic growth and carbon emission. Moreover, the positive and negative shock in revenue decentralization helps in reducing carbon emissions both in the long run and short run in India. These outcomes are useful for policy analysis from the Indian economic policy perspective. The study also laid out potential outcomes that may benefit India’s local governments and central government in resolving the issues of economic growth and environmental degradation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Environmental degradation has become a serious concern for decades and a significant global threat. The ecological threat is attributed to the high consumption of fossil fuels, raising the earth’s temperature and contributing to global warming (Sencer Atasoy 2017). The atmospheric emissions alter the global climate, which causes floods, heat waves, drought, heavy snowfall, and cloud blasts. It directly harms human lives, health and biological systems, and its conservation has become a major global policy agenda. Therefore, several initiatives have been taken simultaneously by various countries to prevent environmental degradation in the future. The Montreal Protocol was established in 1989 to weed out ozone-depleting substances, to avoid increasing greenhouse gas emissions. Therefore, the Kyoto Protocol was introduced in 1998. Climate change is a global distress and significant issue. To cope with it, Paris hosted a “united nations world climate change conference” in 2015. It aimed to reduce global environmental growth below \(2^\circ{\rm C}\) by forcing “green energy”, and “environment-friendly technology”, and using adequate energy infrastructure. Moreover, the key component of the Paris Agreement (COP 21) was about the nationally determined contributions (NDCs) under which countries set their aim to reduce carbon emission (CO2) growth. At the Glasgow climate conference, several nations recently reached a global net-zero CO2 emission (COP 26). In line with this, country-level effort has also been made worldwide to protect against CO2. The Indian government announced “Panchamrit” at COP 26 to enhance climate quality. “Panchamrit” aims to attain long-term net-zero CO2 by 2070 and cut carbon emission intensity (concerning GDP) by 45% by 2030. Despite all the efforts, the increasing global temperature trends and reduction in environmental quality have been noted. Udeagha and Ngepah (2022) observed a 1.5% annual increase in greenhouse gas emissions worldwide over the past 10 years. The global average per capita CO2 emission has also risen from 4.28 in 1990 to 4.69 in 2021. According to Edgar (2019), the origin of this increase in carbon emissions has been the subject of numerous studies because it is a crucial component that directly affects climate change and global warming.

India is the fastest-growing economy with the fastest growth rate globally (IMF 2023). However, India is the third largest carbon emitter in the world. The per capita carbon emitted was 0.66 t in 1990, which rose to 1.93 t in 2021.Footnote 1 It indicates excessive emission of carbon or deterioration of environmental quality which is a threat to the environment. Policy makers and researchers have identified several policies and strategies to deal with the challenges from environmental degradation. Among others, fiscal decentralization is one of the effective instruments to improve environmental quality (Li et al. 2021; The Phan et al. 2021; Wang et al. 2022). Su et al. (2021) empirically found that fiscal decentralization plays a key role in determining the environmental quality. Jin and Rider (2020) viewed that India’s fiscal system is arguably ‘too centralized’ as compared to ‘too centralized’ fiscal system of China. It is well known that the Indian constitution is federal in form and unitary in spirit. Keeping note of these issues in India, it is pertinent to examine the importance of fiscal decentralization in improving environmental quality and economic growth in India.

The concept of fiscal decentralization caught the attention of various countries (Brazil, Peru, and Mexico) only after the 1990s. Over the past few decades, fiscal decentralization has been identified as a global trend and has assumed a prominent position in economic research (Wang and Lei 2016). In the public finance theory, fiscal decentralization is the key concept, which is the transfer of powers from the central government to the local government (regional, provincial, and municipal) to control significant social and “economic decisions in the service of economic goals” (Oates 1999; Hao et al. 2020). Even though the local governments have more knowledge about their communities, the delegation of governments improves the efficiency of public products, which tends to strengthen economic growth (Rodríguez-Pose and Krøijer 2009). “India is a federal republic with twenty-eight states, seven union territories, including the National Capital Territory of Delhi, and one central government (the Union)”. Fiscal decentralization in India is based on the 73rd amendment of the constitution in India’s fiscal system, which gives legislative powers to local administrations/panchayats. But, the 73rd amendment does not provide enough power to “panchayats” in spending money. Instead, India’s “decentralization” of expenditure provisions to the “panchayats” coincides with those of the States. Moreover, the concurrent expenditure assignments make it unclear about which level of government is in charge of providing a particular service. This differs from strong and exclusive expenditure assignments, which the normative literature recommends. Because of this, it is challenging for citizens to hold public authorities accountable. India is the world’s largest populated nation; thus, it is difficult to maintain a decentralized system in India. Therefore, the officials have failed to distribute funds from the Center to the local government in a transparent manner. Moreover, in the aftermath of the Covid-19 pandemic, the Indian economy is facing macroeconomic instability, a high unemployment rate, spurring inflation, and a current account deficit. Given these circumstances, well-planned fiscal decentralization is anticipated to offer a productive instrument for achieving long-term economic growth, macroeconomic stability, and enhanced environmental quality.

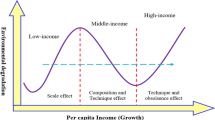

The connection between fiscal decentralization, economic growth and environmental quality has been intensely explored by researchers for a long time (Li et al. 2021; Safi et al. 2022; The Phan et al. 2021; Zhou and Lu 2019). The new avenue for research has been made possible by the “endogenous growth theory” offered by Romer (1986) and the “labour capital model” provided by Lucas (1988). Moreover, numerous researchers have expanded this approach by including environmental quality into this framework (Aghion et al. 1998; Grimaud and Rougé 2005). Through empirical study, a number of scholars have started to look at the effects of FD on economic growth and the quality of the environment with inconsistent results (Digdowiseiso 2022; Liu et al. 2022; Udeagha and Ngepah 2022; Wang and Su 2022; Zahra and Badeeb 2022). The degree of fiscal decentralisation incorporates distinct economic and political dimensions which may affect economic expansion and environmental pollution differently. A low degree of fiscal decentralization is associated with stronger central administration suggesting better control over fiscal and monetary policies. It can help in achieving higher environmental quality. In contrast, high degree of fiscal decentralization is generally difficult to attain politically and economically which may have less effect on environmental quality. Therefore, fiscal decentralization may have asymmetric effect on environmental quality.

These contradicting pieces of evidence prompt scholars to delve deeper into the topic of fiscal decentralization through different approaches. Several studies have explored the connection between fiscal decentralization and economic growth and/or fiscal decentralization and environment quality in developing and developed countries. To the best of our knowledge, there is no study which has seriously attempted to explore these issues in the context of a developing country like India. Few studies have explored the relationship between fiscal decentralization and economic growth in India without considering environmental quality (Bardhan 2002; Xavier et al. 2021; Escolano et al. 2012; Ganaie et al. 2018; Tarigan 2003). Using the “environmental Kuznets curve” (EKC), some other studies have examined the link between environmental quality and economic growth without considering fiscal decentralization (Ghosh 2010; Jayanthakumaran et al. 2012; Sajeev and Kaur 2020; Tiwari 2012). Therefore, the present study contributes to a deeper understanding of the relationship among fiscal decentralization, economic growth, and environmental quality by ensuing fresh viewpoints in the environmental economic literature. Firstly, it is the first study to inspect how fiscal decentralization affects India’s economic growth and environmental quality in a non-linear setup. The examination of nonlinear impact gives an idea to reconcile the conflicting evidence highlighted in previous works. Secondly, this is the first attempt in using the growth modelling methodology to study the nonlinear relationship. For this purpose, a nonlinear ARDL model is used as proposed by Shin et al. (2014). Lastly, the “Hatemi-J (2012) causality test” is additionally used to comprehend the symmetric and asymmetric association among fiscal decentralization, economic growth, and environmental quality. This study also employed the BDS test to know the nonlinear behavior of the selected variables.

The rest of the paper is divided into the following sections: The theoretical foundation and synopsis of prior research are addressed in the “Synopsis of related work” section. Data collection and econometric modelling are covered in the “Data and methodology” section, and the empirical findings are reported in the “Discussion of findings” section. The “Conclusion” section outlines the concluding remarks, policy recommendation, and ideas for future research.

Synopsis of related work

This portion of the study highlights important earlier investigations that study the effects of fiscal decentralization (FD) on economic growth (EG) and carbon emission (CO2). This section divides existing literature broadly into two categories. First, it enumerates the impact of FD on EG, and second, it presents research that is based on FD and environmental quality nexus. Both sections first delve into the theoretical foundation, and later discuss the empirical findings from literature.

Survey of literature: Fiscal decentralization and economic growth

The theoretical foundation for understanding how FD affects EG received its inheritance from Oates (1972); Oates (19992005); Tiebout (1956); Musgrave (1983). The empirical research, however, indicates no agreement on the association between the two. The connection between FD and economic growth has been extensively discussed throughout the recent decades (Baskaran and Feld 2013; de Xavier et al. 2021; Ganaie et al. 2018; Iimi 2005; Liu et al. 2019). FD is thought to boost output by introducing “transparency and lowering corruption by closely tying elected leaders and voters” together (Abdellatif et al. 2015). Under India’s decentralized system, local governments are answerable and accountable to their local communities. Accordingly, local governments work to implement the best policies and strategies that help in taking productivity and economic growth to new heights. Because FD has a variety of effects on economic growth outcomes, including the best use of available resources, “building physical and social infrastructure”, the encouragement of innovations, and the improvement of factor productivity (Kalirajan and Otsuka 2010). In addition, local government also plays a crucial role in determining local-level development.

Fiscal decentralization gives local governments the necessary tools to address economic issues while holding them accountable to the broader population. As a result, through the efficient use of economic resources, FD significantly impacts the economic growth rate (Oates 1972). Four main hypotheses can be used to determine the relationship between “FD and economic growth”. Firstly, “the diversification hypothesis,” claims that public goods are homogeneous across all of the nation’s provinces and/or municipalities. Decentralization is ineffective because local levels do not adequately take into account differences in people’s preferences (Agarwal 2019; Thiesen 2005). Secondly, “decentralized governments hypothesis” continually searches for ways to create goods more cheaply and effectively, leading to increased productivity and economic expansion (Gemmell et al. 2013). The third argument is based on the “productivity enhancement hypothesis” which “asserts that the process of decentralization transfers responsibilities along with accountabilities” (Amagoh and Amin 2012). The final “political declaration hypothesis” highlights that democratic ideals are fostered through decentralized political power and are closely linked to the promotion of development and long-term economic prosperity (Thiesen 2005).

Many academicians have argued that excessive FD may retard regional economic growth. Thiesen (2005) assembled this argument into three groups. The first group maintains that FD leads to regional inequality because rich regions offer high-level production with comparatively high incomes, while poor regions can only produce low-level public goods (Liu et al. 2017). Thus, the regional inequality is resulting in lower economic growth of the nation. The second group suggests that FD simplifies special interests’ ability to influence local governments’ decision-making because the likelihood of doing so is higher than that of the national level. Third, the more significant levels of decentralization can hinder long-term economic growth because it makes it more problematic for the union government to carry out its stability role (Bardhan and Mookherjee 2000).

Corroborating the theoretical underpinnings, empirical studies could not single out a particular hypothesis which would hold good, and receive widespread recognition. Table 1 summarises the strand of literature revealing positive, negative, or no/mixed relationship between fiscal decentralization and economic growth.

Survey of literature: Fiscal decentralization and environmental quality

Ever since the proposition of “vote with the feet” theory (Tiebout 1956), there has been growing interest in knowing the environmental effects of FD. Therefore, numerous scholars have tried to investigate the link between FD and CO2 emissions but could not reach a consensus (Batterbury and Fernando 2006; Fell and Kaffine 2014). The first body of work claims that FD has accelerated a “race to the bottom” approach by causing environmental degradation (Liu et al. 2019). On this point of view, a large body of literature agrees that local administrations are extra prone to adopt a “race to the bottom” approach. Because of this condition, lowering environmental protection would allow for more economic growth and, as a result, would promote CO2 emissions. In order to account for the regional correlations of CO2 emissions, Zhang et al. (2017) conducted a study on FD on the operational mechanisms of Chinese pollution control. They asserted that the “green paradox” is caused by the Chinese strategy of decentralization, which creates a system that noticeably promotes CO2 emissions. Chen and Liu (2020) used geographic Durbin framework for 31 provinces of China to study the effects of FD on carbon emissions. The findings of this study recognized fiscal decentralization as a significant driver that causes environmental degradation. Similar conclusions are drawn by Xia et al. (2021) and Xiao-Sheng et al. (2022). Furthermore, using the Durbin dynamic spatial framework, Lin and Zhou (2021) present the detrimental effect of fiscal decentralization on ecological sustainability in economically industrialized and eastern regions of China. Yang et al. (2021), (2022), and Zhan et al. (2022) support the results of Lin and Zhou (2021).

The “race to the top” or higher levels of fiscal decentralization are highlighted in the second body of literature as being more efficient in lowering CO2 emissions and controlling pollution. Fiscal decentralization helps local governments prioritize resident demands, determine the extent of regional environmental damage, and assist in better allocation of resources (Millimet 2003; Mu 2018). It also encourages local governments to “race to the top” by making environmental regulations more stringent (Levinson 2003). This is because local government ought to improve the quality of the environment while fostering economic development through FD (Cheng et al. 2020). Using the weighted least squares method, Sigman (2007) conducted a study on 37 countries worldwide and found evidence in support of the “race to top” approach. Hao et al. (2020) investigate the relationship between FD and CO2 emission, and present the favourable impact of FD on CO2 emission. In a similar vein, Xu (2022) “investigated the connection between FD and effective environmental management in China”. They found that FD significantly enhances environmental governance and effectiveness, lowering the nation’s rate of ecological degradation. Cheng et al. (2020) used a dynamic panel regression model in the provinces of China. The findings of this study suggest that there is negative association between FD and environmental degradation which support the “race to top” approach. Xia et al. (2022) used the “first-order differential dynamic panel econometrics model” to analyse the FD reform’s impact on China’s CO2 emissions between 2010 and 2019. Due to the decentralization of revenue, they observed that fiscal imbalance reduced CO2 emissions, whereas expenditure asymmetry undermined CO2 emission control. The asymmetric impact of FD on environmental quality in developing countries like Pakistan was examined by Li et al. (2021), who found that FD enhances environmental quality. Moreover, advanced level of living standards, long-term economic growth, and lower CO2 emissions are all outcomes of FD, which increases the efficiency of the public sector by giving local authorities more excellent information and perfect knowledge. Apart from this, the numerous research paper reached similar conclusions (See, for instance, Bowman Cutter and DeShazo 2007; Elheddad et al. 2020; Khan et al. 2020a, b; Xia et al. 2021, 2022; Xiao-Sheng et al. 2022; Yang et al. 2021).

Data and methodology

Data setting

The present work examines the asymmetric impact of fiscal decentralisation on environmental quality in India using data from 1996 to 2021 based on data availability. The carbon emission (CO2) data is retrieved to account for environmental pollution as followed by Hafeez et al. (2019), Li et al. (2021), and Mahmood et al. (2020). Variables on fiscal decentralization are used based on Li et al. (2021) and The Phan et al. (2021). The government size and index of institutional quality are also used as a control variable by following Li et al. (2021) and The Phan et al. (2021). The “principal component analysis” (PCA) is used to determine the “institutional quality index” (IQI).Footnote 2 The major sources of data on variables in interest include “Reserve bank of India”, “the world development indicator”, and “the World Bank”. Details of the variables are reported in Table 2, and descriptive statistics of the variables is listed in Table 3.

Research methodology

The present work employed Shin et al. (2014)’s “nonlinear autoregressive model” (NARDL) to capture the asymmetric effect of FD on economic growth and environmental quality. The NARDL method includes a “dynamic error correction model” that captures the short-term and long-term asymmetries effects. It can also produce better results at smaller sample sizes and allow for asymmetric nonlinearity and cointegration within a single equation (Ahmad et al. 2017; Romilly et al. 2001). Thus, this model is more suited to give precise and accurate results in the case where the variables are of the order of \(I (0), I (1),\) or both. In addition, it also provides unbiased long-term estimates and test statistics on some endogenous explanatory variables. It also takes many gaps and archives data creation processes from a general to a specific framework. Due to these parameters, the NARDL model enables to integrate short-run correction to long-run equilibrium without losing the long-run data. The following two specifications of NARDL model are used which is closely related to the models of Li et al. (2021) and Liu and Li (2019).

where in Eqs. 1 and 2, \(t=\) time periods. \({\alpha }_{0}\), \({\alpha }_{1}\), \({\alpha }_{2}\), \({\alpha }_{3}\), \({\alpha }_{4}=\) parameters for the estimation. \({\mathrm{EG}}_{\mathrm{t}}=\) economic growth. \({\mathrm{CO}}_{2}=\) carbon emission. \({EDR}_{t}=\) expenditure decentralization.\({RDR}_{t}=\) revenue decentralization. \({GOVS}_{t}=\) government size \({IQI}_{t}=\) institutional quality index.Footnote 3

The “error correction model” \((ECM)\) in the next step is written to estimate the short-run effects of FD in Eqs. (3) and (4), respectively. The econometric technique used in the next phase, provides estimates of both short-term and long-term impact in a one-step as follows:

Here, economic growth model is presented in Eq. (3), and the carbon emission model is presented in Eq. (4). The short-run dynamics are judged by the coefficients devoted to the difference operator. Likewise, estimates of \({\omega }_{2}-{\omega }_{5}\) are normalized on \({\omega }_{1}\) in Eqs. (3) and (4). Equations (3) and (4) measure the short-term and long-term approximations of the linear ARDL model. Nevertheless, Pesaran et al. (2001) proposed \(F\)-test, and \(ECM\) or \(t\)-test to establish the cointegration. \(F\)-test and ECM estimates used non-standard distributions by using newly calculated critical values to assess the level of integration of variables.

The linear specification discussed above supposed that the behaviour of FD on economic growth and carbon emission are symmetric. If these specifications are invalid, two possible specifications could be attributed, one of which states that asymmetric effects are possible only when the decentralization structure in an economy behaves differently from the centralization structure in the economy. Second, asymmetric effects can occur when centralization allocates to a larger government size than to a smaller government size from decentralization (Liu and Li 2019). Plentiful empirical studies inspect the asymmetric effect of FD on macroeconomic variables (See, for instance, Cahyaningsih and Fitrady 2019; Chen et al. 2020; Lao-Araya 2002; Tan and Avshalom-Uster 2021). Therefore, the current work also aims to explore the asymmetric relationship among fiscal decentralisation, environmental quality, and economic growth.

Now, we decompose FD variables into two partial sums, a “positive partial sum and negative partial sum” as follows:

Equations (5a, b), to (6a, b) represent positive and negative partial sums, respectively. The positive partial sum \({\mathrm{EDR}}_{\mathrm{t}}^{+}( {\mathrm{RDR}}_{\mathrm{t}}^{+})\) is supposed to measure the changes due to an increase in expenditure and revenue decentralization. In contrast, the negative partial sum \({\mathrm{EDR}}_{\mathrm{t}}^{-}( {\mathrm{RDR}}_{\mathrm{t}}^{-})\) is supposed to measure the changes due to the decrease in expenditure and revenue decentralization. We re-formalized Eqs. (3) and (4), and include partial sum variables \({\mathrm{EDR}}_{\mathrm{t}}^{+}( {\mathrm{RDR}}_{\mathrm{t}}^{+})\) and \({\mathrm{EDR}}_{\mathrm{t}}^{-}( {\mathrm{RDR}}_{\mathrm{t}}^{-})\), in the modified equations as follows:

The nonlinear models are used here to construct partial sum variables in Eqs. (7) and (8). Shin et al. (2014) state that “both symmetric and asymmetric models are subjected to the same OLS method with the same diagnostic tests”.

Now, this study is carried out using more relevant asymmetry assumptions. Firstly, if the lag value of \(k\) is associated with \({\mathrm{\Delta EDR}}_{t-k}^{+}\) (\({\mathrm{\Delta RDR}}_{t-k}^{+}\)) is different than associated with the \({\mathrm{\Delta EDR}}_{t-k}^{-}\)(\({\mathrm{\Delta RDR}}_{t-k}^{-}\)), then the short-term asymmetric effects on economic growth and carbon emissions will be proved. Additionally, another technique satisfies the effect of short-run asymmetric when the “Wald test rejects the null hypothesis of \(\sum {\beta }_{1k}\) = \(\sum {\delta }_{1k}\) and \(\sum {\eta }_{1k}\) = \(\sum {\lambda }_{1k}\)” in Eq. (7) and (8). On the other hand, long-term “asymmetric effects” will be reported if the “Wald test” negated the nulls of \(\frac{{\upomega }_{2}^{+}}{{\upomega }_{1}}=\frac{{\upomega }_{3}^{-}}{{\upbeta }_{1}}\) and \(\frac{{\upomega }_{4}^{+}}{{\upomega }_{1}}=\frac{{\upomega }_{5}^{-}}{{\upbeta }_{1}}\). Furthermore, Toda and Yamamoto (1995) inspected the path of symmetric causality among the variables. But, the ways of the fundamental connection between the variables have traditionally been controlled by using a symmetric technique. Hatemi-J (2012) recently proposed a new method for testing an asymmetric causality between positive and negative change with other variables. Therefore, this work employed Hatemi-J (2012) approach to estimate the “symmetric and asymmetric” behaviour for economic growth in models 3 and 4, and carbon emissions in models 7 and 8.

Discussion of findings

Pre-estimation analysis

This work investigates the asymmetric impressions of fiscal decentralization (FD) on India’s economic growth and environmental quality (CO2). It explains the empirical result in four steps. The first step explores the stationarity behaviour of variables of interest. The empirical outcomes of the “autoregressive distributed lag” (ARDL) model of economic growth and CO2 are estimated in step two. Step three presents the empirical findings of the nonlinear (NARDL) model. The last step shows diagnostic check results. Before implementing the ARDL and NARDL models, the “unit root test” is necessary to understand the stationary behaviour of the selected dataset. This work first employed batteries of traditional stationarity tests, namely Dickey and Fuller (1979) hereafter (ADF) and Phillips and Perron (1988) hereafter (PP). Results from traditional unit root tests presented in Table 4, show stationary behaviour of all variables at first difference. But, EG is also found to be stationary at level. During the study period (1996 to 2021), the Indian economy faced several economic shocks, slowdowns, and crises due to internal and international issues. Therefore, this work has employed Zivot and Andrews (1992) modern “unit root test” to capture the possible structural breaks. In the presence of a structural break, traditional unit root tests produce biased results (Perron 1989). Table 5 presents the outcome of the modern unit root test. The result shows that all selected variables are stationary at the first difference except GOVS. A few variables, RDR, EG and IQI, are found to be integrated at order one. The findings suggest the non-stationary behaviour of the variables in the presence of structural breaks and capture possible break dates between 2003 and 2017. Identified break dates are linked with the Indian internal and international economic shocks viz. the Asian financial crisis, global financial crisis, the twin shock of demonetization, and the internal level crash due to the implementation of “Goods and Service Tax” (GST), etc. Furthermore, before using any econometric strategy, it is crucial to determine the nonlinearity of the dataset. To do so, the BDS method suggested by Broock et al. (1996) is applied. The findings of the BDS method demonstrate that all the variables are found to be nonlinear in nature. The outcomes of the BDS method are reported in Table 6. Therefore, the application of the nonlinear ARDL model in further analysis is appropriate.

The result of the ARDL model

This section separately discusses the short-run and long-run outcomes using economic growth (EG) and carbon emission (CO2) as focused variables. Table 7 presents the outcomes of the linear ARDL model. Section \(\mathrm{I}\) gives the outcome of short-run estimates of the economic growth model. The calculated expenditure decentralization (\(EDR\)) coefficient is found to be positive and significant, which indicates that a 1% increase in \(\mathrm{EDR}\) raises economic growth by 1.38%. It means that \(\mathrm{FD}\) positively influences economic growth in the short run. Therefore, this result supports three hypotheses that are based on fiscal decentralization analysis, namely “decentralization theorem” of Oates (1972), the “Leviathan hypothesis” (Brennan and Buchanan 1980), and the “Productivity enhancement hypothesis” (Martinez-Vazquez and McNab 2003). The result of this work is also in line with the previous work (Arif and Ahmad 2020; de Xavier et al. 2021; Hanif et al. 2020; Hung and Thanh 2022). Apart from EDR, revenue decentralization (RDR) also boost-up the EG in various manners (Nguyen and Anwar 2011). The greater amount of government revenue reduces the government’s dependence on foreign aid and decreases the tax burden. The calculated RDR coefficient is also positive and significant. The coefficient signifies that a 1% increase in RDR will result in a 2.73% increase in economic progress. Though the 1-year lagged value of RDR has a negative and insignificant value, which is indirectly connected with the EG, the result indicates that a 1% increase in the lagged year of RDR results in a 2.7% decrease in the EG. Thus, we observed a difference in magnitude in the current and lagged value of RDR over the short-run period.

Furthermore, the calculated coefficient of government size (GOVS) was positively and significantly connected with economic growth. Nevertheless, it is discovered that the GOVS 1-year lagged value is negative and insignificant. Economic theory has shown that the effectiveness of institutions is crucial in determining economic growth. Moreover, coefficient of institutional quality (IQI) turns out to be positive but insignificant.

According to the long-run findings of the “linear specification” in the EG model, indicators of FD are found to be positive but insignificant. In contrast, GOVS and IQI are found to be negative even though government size is found to be significant. It infers that a 1% upsurge in government size will result in a 0.81% reduction in India’s economic growth. However, this outcome is beyond our expectations and inconsistent with the previous literature (Bhattacharya et al. 2017; Carraro and Karfakis 2018; Salman et al. 2019).

The subsequent analysis presents the empirical findings of environmental quality (CO2). The estimated EDR coefficient is found to be positive, and it is significantly associated with India’s quality of the environment. It infers that a 1% surge in the EDR tends to a 0.90% rise in environmental quality. This outcome is consistent with the study by Cheng et al. (2020) and Li et al. (2021). They have drawn higher degrees of FD that positively impact CO2 emission for China and Pakistan, respectively. Moreover, the same conclusion has also been noted by Farzanegan and Markwardt (2018) and Liu and Li (2019). They defined the positive link between FD and environmental status, proving the presence of the “race to bottom” theory. Moreover, the coefficients of RDR and GOVS are found to be positive but insignificant with respect to CO2 emission. However, IQI in such cases is found to be negative even though it has an insignificant relationship with the emission level in the short run. On the other side, the long-run outcome of the environmental quality model presents an interesting case, where the coefficient of EDR is negative but significant and negatively associated with India’s emission level. Thus, this result is not in favour of our expectations and is inconsistent with the study by Li et al. (2021) and You et al. (2019). This is because FD in the state or local level government has less access to resources that they can utilize as per their requirement.

Moreover, a growth-led approach attracts many countries to invest in high-profit-led industries, which results in higher pollution levels. Therefore, the FD played an essential role in mitigating the high degree of environmental pollution by allocating resources to local or state-level governments. Thus, it supports the “pollution haven hypothesis” and “race to bottom” approach. This result also recommends to revise FD policy in India because, in the past 10 years, the Indian government has invested vast amounts of GDP in industrial sectors (Economic Survey 2022). It is interesting to note that the coefficient of RDR is also discovered to be negative and insignificant in the long run. The coefficient of GOVS is positively and significantly associated with environmental quality. It indicates that a 1% rise in the size of the government leads to a 1.5% increase in the quality of the environment. It could be because India is a leading country globally and has invested heavily in new projects, infrastructure and industries in the last two decades. Moreover, in the long run, IQI also does not play an essential role towards India’s level of CO2 emission.

Stability diagnostic test

The diagnostic tests are reported in section \(\mathrm{III}\) in Table 7 For both the economic growth and CO2 models, the calculated coefficient of F statistics is statistically significant at 5% level. It confirms the cointegration relationship in both models. The error correction term is found to be negative and significant in both models. It suggests a long-run adjustment rate towards the equilibrium for the estimated models. The RESET test examines the “correct specifications for the estimated models”. The result of RESET suggests insignificant outcomes for EG and CO2 models. Furthermore, serial correlation estimation is also tested to understand the correlation resistance among the models. The “Lagrange multiplier” (LM) test presents insignificant outcomes for EG and CO2 models. Lastly, this work tests the structure stability using “CUSUM” and “CUSUM-square” tests. Figures 1a, b and 2a, b display the structural stability of the EG and CO2 models, respectively.

The findings of NARDL model

This section outlines the asymmetric effect of FD on economic growth and environmental quality. The short-run analysis is presented in Section I of Table 8. The outcome of negative shock in EDR yields a favourable but insignificant (negligible) impact on EG. At the same time, the result of positive shock in EDR exerts a positive and significant effect on EG in the short run. It implies that a 1% surge in EDR increases the level of economic growth by 1.082%.

The findings from the perspective of revenue are in contrast to expenditure decentralization. The positive and negative changes in RDR have positive and negative impact on economic growth. These calculated effects are significant from an economic perspective, suggesting that RDR and EDR have a nonlinear effect on economic growth. In the context of government size, results revealed that GOVS has a favourable impact on EG. This outcome is in line with work that detected a favourable impact of GOVS on economic growth for different nations (See, for instance, Al-Fawwaz 2015; Alshahrani and Al-Sadiq 2014; Jiranyakul 2013).

Similarly, this work finds that the IQI has a substantial unfavourable impact on EG. But, the 1-year lagged value of the GOVS coefficient presents a positive and significant effect on EG. This is due to the weakness in institutional quality that has hindered in accelerating economic growth. This outcome is consistent with the findings of Iqbal and Daly (2014). The long-run perspective effects are reported in Section II in Table 8. The positive and negative shifts in EDR harm EG, while the positive (negative) change in RDR has a negative (positive) impact on EG. Moreover, the coefficients of GOVS and IQI have a positive but insignificant effect on EG in the long run.

Now, we report the findings of the asymmetric impact of FD on emission levels. In the short run, the coefficient of positive change in EDR draws a positive and significant effect on emission level. This means that a 1% increase in EDR will lead to a rise of 0.722% in the carbon emission level. This case advocates that mostly local governments frequently recruit high-profit businesses without enforcing stringent environmental regulations (You et al. 2019). Thus, in this situation, “race to the bottom” approach is validated. Conversely, the coefficient of negative shock in EDR gives a harmful impact on environmental quality. Moreover, positive shock in the coefficient of RDR exerts favourable and significant effect on environmental quality. In contrast, the coefficient of negative shock determines unfavourable and considerable evidence for environmental quality in India. It suggests that a 1% increase in RDR reduces the level of environmental quality in India by 0.064%, thus being in line with the research findings of Li et al. (2021).

The coefficient of GOVS in the short run suggests a positive but insignificant impact on emission levels. At the same time, the coefficient of the 1-year lagged value of GOVS suggests a negative and significant impact on environmental quality. This means that a 1% present rise in the coefficient of GOVS will reduce the level of carbon emissions by 0.141%. This result is consistent with the outcome of Li et al. (2021) for Pakistan and Farzanegan and Markwardt (2018), who draw the same evidence for the North African region and the Middle East.

The coefficient of IQI also negatively and significantly affects environmental quality in India. This means that a 1% increase in the IQI results in a 0.023% reduction in carbon emissions from India in the short run. Thus, this result is consistent with the outcome of Solarin et al. (2017), who found a negative relationship between institutional and environmental quality in Ghana.

The long-run result suggests that a positive shock to EDR exerts a positive and negligible impact on environmental quality. At the same time, the coefficient of negative shock has a negative and insignificant impact on environmental quality. This means that a 1% increase in positive and negative shocks to expenditure decentralization determines a 1.275% increase and a 2.047% decrease in environmental quality. Conversely, the negative and positive shock in RDR is adversely linked with environmental quality. In this case, a 1% increase in RDR negatively influences ecological quality. This outcome is consistent with the study of He (2015), who identified an insignificant relationship between the two for China. Similar to the short run, the derived coefficient of GOVS suggests a negative but insignificant result for environmental quality in the long run. It implies that a 1% increase in GOVS results in a 1.151% decrease in the level of environmental quality. This outcome is consistent with the findings of Li et al. (2021), who derived a negative influence of government expenditure in Pakistan. It implies that the coefficient of government expenditure helps reduce carbon emissions in Pakistan. Moreover, the derived coefficient of IQI suggests a negative and significant impact in controlling environmental quality. This means that if there is a 1% increase in IQI, India’s carbon emission gets reduced by 0.025%. It is important to note here that short-run and long-run findings of institutional quality have no difference in controlling environmental degradation in India.

Stability diagnostic test

Next, this study reports test the validity of the nonlinear ARDL model in Section III of Table 8. The result of the F-statistics confirms the legitimacy of long-run effects and the presence of a cointegration relationship in both economic growth and CO2 models. Apart from this, a test for serial correlation is done in both models with first order. The results of the LM test coefficient reveal an absence of first-order serial correlation. Moreover, the \(Adj- R\) square estimate suggests that both models are well fit. In order to investigate correct specification and parameter stability, three tests are employed: RESET, CUSUM, and CUSUM-square. Lastly, we applied the Wald test to capture both models’ nonlinear/asymmetric behaviour. The Wald test findings indicate that in both the models, short-run and long-run asymmetries are present. We further also present the result of FD dynamic multipliers on economic growth and environmental quality.

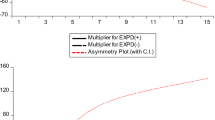

Multiplier dynamics adjustments result

Figure 3a and b shows the evidence of the dynamic multiplier of FD on EG, and Fig. 4a and b displays the evidence of the dynamic multiplier of FD on CO2, indicating the dynamic adjustment of periods between the two. The red-dotted lines indicate that favourable and unfavourable fluctuations are statistically meaningful based on the difference and strength of asymmetric changes between favourable and unfavourable shifts. Moreover, the plain black and dotted black line represents favourable and unfavourable changes, respectively. The cumulative multiplier for revenue decentralization of the economic growth model is displayed in Fig. 3a, which portrays the favourable and unfavourable adjustments. Likewise, Fig. 3b noted favourable and unfavourable expenditure decentralization outcomes over the period. In addition, Fig. 4a displays over time favourable and unfavourable adjustments to the CO2 model for revenue decentralization, while Fig. 4b presents the expenditure decentralization outcome for favourable and unfavourable changes.

Symmetric and asymmetric Granger causality analysis

For robustness check, this study applied Hatemi-J (2012) approach to detect asymmetric behaviour among the variables. This test is superior in cases where the series are integrated differently. The result of the Hatemi-j causality test is presented in Table 9, which suggests asymmetric bidirectional causality between the negative shift in RDR and EG. Also, asymmetric unidirectional causality is found for a positive change in RDR and EG components. Moreover, unidirectional asymmetric causality is also found for the positive component of EDR and EG, and the negative component of RDR to EG. Also, the asymmetric unidirectional causality was discovered from the component of EG to the positive and negative components of RDR. The empirical result also reveals asymmetric bidirectional causality between EG and EDR, and positive causality from RDR to EG. In the case of carbon emission, the empirical result also discloses asymmetric unidirectional causality among positive and negatives shock in RDR. But, in the case of RDR, the bidirectional causality is found from a component of EG to a negative component of RDR, and a positive component of RDR to EG. Whereas asymmetric unidirectional causality is detected from the negative change in RDR to EG and the components of EG to the positive component of RDR.

Conclusion

This study explores the effect of fiscal decentralization on environmental quality and economic growth in India from 1996 to 2022. The present work applied nonlinear ARDL models and derive important conclusions pertaining to the relationship among fiscal decentralization, economic growth, and environmental quality. This work approves the asymmetric or nonlinear relationship between fiscal decentralization and economic growth, and between environmental quality and economic growth. The later part is ignored by the existing literature in the context of India. The primary findings of this paper are as follows.

-

1.

The short-run findings of the ARDL model suggest a negative relationship between revenue decentralization and economic growth. In contrast, a positive association between expenditure decentralization and economic growth has been detected. In the long run, expenditure decentralization is positively related, and government expenditure is negatively associated with economic growth.

-

2.

The expenditure decentralization in the short run is positively associated with carbon emission. But in the long run, expenditure and revenue decentralization are negatively linked with carbon emission.

-

3.

The empirical evidence of the nonlinear ARDL model suggests a positive shift in expenditure decentralization that affects economic growth in the short run. In contrast, it has a negative impact in the long run. The negative change in expenditure decentralization harms economic growth both in the short and long run.

-

4.

The empirical findings of the revenue decentralization case show that the components of positive shift and 1-year lag are negatively and significantly associated with short-term economic growth. Moreover, a negative shock to revenue decentralization is positively and significantly connected with economic growth in the long run.

-

5.

Moreover, this work revealed a positive shock in the components of expenditure decentralization that upsurge environmental quality throughout the short-run and long-run periods. As a result, local governments are encouraged to compete for economic growth because the central government has significant control over rewarding and penalizing local administrations.

-

6.

The empirical evidence of the positive and negative shifts in revenue decentralization also positively influences environmental quality in the short run. But, an adverse change in revenue decentralization outcome has a negative impact on environmental quality in India both in the short and long run.

-

7.

The component of government expenditure reports negative effect on environmental quality in both short run and long run. The same conclusion is drawn by the components of institutional quality in both short and long run.

Based on the empirical findings, this study has made some policy recommendations which are as follows:

-

i.

Decentralization has played an important role in enhancing economic growth and reducing carbon emission levels (Hao et al. 2020; Liu et al. 2019; Fell and Kaffine 2014). Although the degree of fiscal decentralization in India is low (Jin and Rider 2020), it has several advantages in raising the growth rate and reducing the level of carbon emission. Therefore, from a policy perspective, this study suggests that policymakers should focus on new reforms to increase the extent of decentralization by considering the environmental quality. In order to increase the influence of state/regional/ sub-national government on the environment quality, the central government should focus on new fiscal reforms and implement appropriate policies.

-

ii.

Fiscal decentralization is found to have a positive effect on economic growth. Therefore, the government should allocate adequate funding for environmental projects to maintain good ecological quality. Moreover, good governance plays a vital role in a better decentralization system, given that India is one of the most populous countries in the world. Thus, improving India’s governance quality is important to maintain an effective decentralisation system. The central government needs to decentralize the national task of environmental pollution reduction to each state and city to inform the local governments about the importance of reduction in carbon emission.

-

iii.

Since there is a huge problem with pollution in India’s major cities, the central and state governments have to focus on “smart transportation” and “green infrastructure” to minimize the pollution level.

-

iv.

Under the poor level of environmental quality, achieving a high growth rate is difficult. Therefore, it is essential to sustain economic growth. So, policymakers should design a new growth model focusing on the environment as an indicator.

-

v.

Lastly, the central government must authorize more funds to maintain environmental quality and establish a new consumption and production structure based on “green” and “clean energy”.

Data availability

The datasets generated and/or analysed in the current study are available in the World Bank data (https://data.worldbank.org/) and Reserve bank of India (https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications#!2) repository.

Notes

The PCA analysis result is not listed to save space.

This index is prepared by PCA analysis using six governance indicators based on Kauffman et al. 2010.

References

Abdellatif L, Atlam B, Aly H (2015) Revisiting the relation between decentralization and growth in the context of marketization. East Eur Econ 53(4):255–276

Agarwal A (2019) Non-uniform impact of fiscal decentralization on economic growth: a state level analysis in India (SSRN Scholarly Paper No. 3472373). https://doi.org/10.2139/ssrn.3472373

Aghion P, Ljungqvist L, Howitt P, Howitt P, Brant-Collett M, García P (1998) Endogenous growth theory. MIT press

Ahmad N, Du L, Lu J, Wang J, Li H-Z, Hashmi MZ (2017) Modelling the CO2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123(C):164–172

Al-Fawwaz T (2015) The impact of government expenditures on economic growth in Jordan (1980–2013). Int Bus Res 9(1):Articel 1. https://doi.org/10.5539/ibr.v9n1p99

Alshahrani S, Al-Sadiq A (2014) Economic growth and government spending in Saudi Arabia: an empirical investigation. IMF WORKING PAPERS 2014/003. https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Economic-Growth-and-Government-Spending-in-Saudi-Arabia-an-Empirical-Investigation-41203

Amagoh F, Amin AA (2012) An examination of the impacts of fiscal decentralization on economic growth. Int J Bus Adm 3(6):72–81

Arif U, Ahmad E (2020) A framework for analyzing the impact of fiscal decentralization on macroeconomic performance, governance and economic growth. Singap Econ Rev 65(01):3–39. https://doi.org/10.1142/S0217590818500194

Bardhan P (2002) Decentralization of governance and development. J Econ Perspect 16(4):185–205. https://doi.org/10.1257/089533002320951037

Bardhan PK, Mookherjee D (2000) Capture and governance at local and national levels. Am Econ Rev 90(2):135–139. https://doi.org/10.1257/aer.90.2.135

Baskaran T, Feld LP (2013) Fiscal decentralization and economic growth in OECD countries: is there a relationship? Public Financ Rev 41(4):421–445. https://doi.org/10.1177/1091142112463726

Batterbury SPJ, Fernando JL (2006) Rescaling governance and the impacts of political and environmental decentralization: an introduction. World Dev 34(11):1851–1863

Bhatt A, Scaramozzino P (2013) Federal transfers and fiscal discipline in India: An empirical evaluation (SSRN Scholarly Paper No. 2252559). https://doi.org/10.2139/ssrn.2252559

Bhattacharya M, Awaworyi Churchill S, Paramati SR (2017) The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew Energy 111:157–167. https://doi.org/10.1016/j.renene.2017.03.102

Bowman Cutter W, DeShazo JR (2007) The environmental consequences of decentralizing the decision to decentralize. J Environ Econ Manag 53(1):32–53. https://doi.org/10.1016/j.jeem.2006.02.007

Brennan G, Buchanan JM (1980) The power to tax analytic foundations of a fiscal constitution. Cambridge University Press

Broock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Economet Rev 15(3):197–235. https://doi.org/10.1080/07474939608800353

Cahyaningsih A, Fitrady A (2019) The impact of asymmetric fiscal decentralization on education and health outcomes: evidence from Papua Province, Indonesia. 12(2). https://www.economics-sociology.eu/?663,en_the-impact-of-asymmetric-fiscal-decentralization-on-education-and-health-outcomes-evidence-from-papua-province-indonesia

Carraro A, Karfakis P (2018) Institutions, economic freedom and structural transformation in 11 sub-Saharan African countries. ESA Working Papers, Article 288957. https://ideas.repec.org//p/ags/faoaes/288957.html

Chen X, Liu J (2020) Fiscal decentralization and environmental pollution: a spatial analysis. Discrete Dyn Nat Soc 2020:e9254150. https://doi.org/10.1155/2020/9254150

Chen H, Hongo DO, Ssali MW, Nyaranga MS, Nderitu CW (2020) The asymmetric influence of financial development on economic growth in Kenya: evidence from NARDL. SAGE Open 10(1):2158244019894071. https://doi.org/10.1177/2158244019894071

Cheng S, Fan W, Chen J, Meng F, Liu G, Song M, Yang Z (2020) The impact of fiscal decentralization on CO2 emissions in China. Energy 192:116685. https://doi.org/10.1016/j.energy.2019.116685

Davoodi H, Zou H (1998) Fiscal decentralization and economic growth: A cross-country study. J Urban Econ 43(2):244–257. https://doi.org/10.1006/juec.1997.2042

de Xavier FA, Lolayekar AP, Mukhopadhyay P (2021) Decentralization and its impact on growth in India. J South Asian Dev 16(1):130–151. https://doi.org/10.1177/09731741211013210

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366):427–431. https://doi.org/10.2307/2286348

Digdowiseiso K (2022) Are fiscal decentralization and institutional quality poverty abating? Empirical evidence from developing countries. Cogent Econ Financ 10(1):2095769. https://doi.org/10.1080/23322039.2022.2095769

Economic Survey (2022) Industry: steady recovery. https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap09.pdf. Accessed 1 Feb 2023

EDGAR (2019) Fossil CO2 and GHG emissions of all world countries. https://edgar.jrc.ec.europa.eu/report_2019. Accessed 7 Nov 2022

Elheddad M, Djellouli N, Tiwari AK, Hammoudeh S (2020) The relationship between energy consumption and fiscal decentralization and the importance of urbanization: evidence from Chinese provinces. J Environ Manag 264:110474. https://doi.org/10.1016/j.jenvman.2020.110474

Escolano J, Eyraud L, Moreno Badia M, Sarnes J, Tuladhar A (2012) Fiscal performance, institutional design and decentralization in European Union countries. IMF Working Paper No. 45. IMF, Washington, DC

Farzanegan MR, Markwardt G (2018) Development and pollution in the Middle East and North Africa: democracy matters. J Policy Model 40(2):350–374. https://doi.org/10.1016/j.jpolmod.2018.01.010

Fell H, Kaffine DT (2014) Can decentralized planning really achieve first-best in the presence of environmental spillovers? J Environ Econ Manag 68(1):46–53. https://doi.org/10.1016/j.jeem.2014.04.001

Ganaie AA, Bhat SA, Kamaiah B, Khan NA (2018) Fiscal decentralization and economic growth: evidence from Indian states. South Asian J Macroecon Public Financ 7(1):83–108. https://doi.org/10.1177/2277978718760071

Gemmell N, Kneller R, Sanz I (2013) Fiscal decentralization and economic growth: spending versus revenue decentralization. Econ Inq 51(4):1915–1931. https://doi.org/10.1111/j.1465-7295.2012.00508.x

Ghosh S (2010) Examining carbon emissions economic growth nexus for India: a multivariate cointegration approach. Energy Policy 38(6):3008–3014. https://doi.org/10.1016/j.enpol.2010.01.040

Grimaud A, Rougé L (2005) Polluting non-renewable resources, innovation and growth: welfare and environmental policy. Resour Energy Econ 27(2):109–129. https://doi.org/10.1016/j.reseneeco.2004.06.004

Hafeez M, Yuan C, Yuan Q, Zhuo Z, Stromaier D, Sultan Musaad OA (2019) A global prospective of environmental degradations: economy and finance. Environ Sci Pollut Res Int 26(25):25898–25915. https://doi.org/10.1007/s11356-019-05853-0

Hanif I, Wallace S, Gago-de-Santos P (2020) Economic growth by means of fiscal decentralization: an empirical study for federal developing countries. SAGE Open 10(4):2158244020968088. https://doi.org/10.1177/2158244020968088

Hao Y, Chen Y-F, Liao H, Wei Y-M (2020) China’s fiscal decentralization and environmental quality: theory and an empirical study. Environ Dev Econ 25(2):159–181. https://doi.org/10.1017/S1355770X19000263

Hatemi-J A (2012) Asymmetric causality tests with an application. Empir Econ 43(1):447–456. https://doi.org/10.1007/s00181-011-0484-x

He Q (2015) Fiscal decentralization and environmental pollution: evidence from Chinese panel data. China Econ Rev 36:86–100. https://doi.org/10.1016/j.chieco.2015.08.010

Hung NT, Thanh SD (2022) Fiscal decentralization, economic growth, and human development: empirical evidence. Cogent Econ Financ 10(1):2109279. https://doi.org/10.1080/23322039.2022.2109279

Iimi A (2005) Decentralization and economic growth revisited: an empirical note. J Urban Econ 57(3):449–461. https://doi.org/10.1016/j.jue.2004.12.007

IMF (2023) Inflation peaking amid low growth, world economic outlook update. https://www.imf.org/en/Publications/WEO/Issues/2023/01/31/world-economic-outlook-update-january-2023. Accessed 16 Jan 2023

Iqbal N, Daly V (2014) Rent seeking opportunities and economic growth in transitional economies. Econ Model 37:16–22. https://doi.org/10.1016/j.econmod.2013.10.025

Jayanthakumaran K, Verma R, Liu Y (2012) CO2 emissions, energy consumption, trade and income: a comparative analysis of China and India. Energy Policy 42:450–460. https://doi.org/10.1016/j.enpol.2011.12.010

Jin J, Zou H (2005) Fiscal decentralization, revenue and expenditure assignments, and growth in China. J Asian Econ 16(6):1047–1064. https://doi.org/10.1016/j.asieco.2005.10.006

Jin Y, Rider M (2020) Does fiscal decentralization promote economic growth? An empirical approach to the study of China and India. J Public Budg Account Financ Manag 34(6):146–167. https://doi.org/10.1108/JPBAFM-11-2019-0174

Jiranyakul K (2013) The relation between government expenditures and economic growth in Thailand (SSRN Scholarly Paper No. 2260035). https://doi.org/10.2139/ssrn.2260035

Kalirajan K, Otsuka K (2010) Decentralization in India: outcomes and opportunities. Australian National University. (ASARC Working Paper 2010/14)

Khan A, Muhammad F, Chenggang Y, Hussain J, Bano S, Khan MA (2020a) The impression of technological innovations and natural resources in energy-growth-environment nexus: a new look into BRICS economies. Sci Total Environ 727:138265. https://doi.org/10.1016/j.scitotenv.2020.138265

Khan MI, Teng JZ, Khan MK (2020b) The impact of macroeconomic and financial development on carbon dioxide emissions in Pakistan: evidence with a novel dynamic simulated ARDL approach. Environ Sci Pollut Res Int 27(31):39560–39571. https://doi.org/10.1007/s11356-020-09304-z

Lao-Araya K (2002) Effect of decentralization strategy on macroeconomic stability in Thailand. ERD WORKING PAPER SERIES no.17. https://www.adb.org/sites/default/files/publication/28312/wp017.pdf

Levinson A (2003) Environmental regulatory competition: a status report and some new evidence. Natl Tax J 56(1):91–106

Li X, Younas MZ, Andlib Z, Ullah S, Sohail S, Hafeez M (2021) Examining the asymmetric effects of Pakistan’s fiscal decentralization on economic growth and environmental quality. Environ Sci Pollut Res 28(5):5666–5681. https://doi.org/10.1007/s11356-020-10876-z

Lin B, Zhou Y (2021) Does fiscal decentralization improve energy and environmental performance? New perspective on vertical fiscal imbalance. Appl Energy 302:117495. https://doi.org/10.1016/j.apenergy.2021.117495

Liu L, Li L (2019) Effects of fiscal decentralisation on the environment: new evidence from China. Environ Sci Pollut Res 26(36):36878–36886. https://doi.org/10.1007/s11356-019-06818-z

Liu Y, Martinez-Vazquez J, Wu AM (2017) Fiscal decentralization, equalization, and intra-provincial inequality in China. Int Tax Public Financ 24(2):248–281. https://doi.org/10.1007/s10797-016-9416-1

Liu L, Ding D, He J (2019) Fiscal decentralization, economic growth, and haze pollution decoupling effects: a simple model and evidence from China. Comput Econ 54(4):1423–1441

Liu R, Zhang X, Wang P (2022) A study on the impact of fiscal decentralization on green development from the perspective of government environmental preferences. Int J Environ Res Public Health 19(16):9964. https://doi.org/10.3390/ijerph19169964

Lucas RE (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42. https://doi.org/10.1016/0304-3932(88)90168-7

Mahmood MT, Shahab S, Hafeez M (2020) Energy capacity, industrial production, and the environment: an empirical analysis from Pakistan. Environ Sci Pollut Res 27(5):4830–4839. https://doi.org/10.1007/s11356-019-07161-z

Martinez-Vazquez J, McNab RM (2003) Fiscal decentralization and economic growth. World Dev 31(9):1597–1616. https://doi.org/10.1016/S0305-750X(03)00109-8

Millimet DL (2003) Assessing the empirical impact of environmental federalism. J Reg Sci 43(4):711–733. https://doi.org/10.1111/j.0022-4146.2003.00317.x

Mu R (2018) Bounded rationality in the developmental trajectory of environmental target policy in China, 1972–2016. Sustainability 10(1):Article 1. https://doi.org/10.3390/su10010199

Musgrave WF (1983) Rural communities: some social issues. Aust J Agric Econ 27(2):145–151. https://doi.org/10.1111/j.1467-8489.1983.tb00635.x

Nguyen LP, Anwar S (2011) Fiscal decentralisation and economic growth in Vietnam. J Asia Pac Econ 16(1):3–14. https://doi.org/10.1080/13547860.2011.539397

Oates WE (1999) An essay on fiscal federalism. J Econ Lit 37(3):1120–1149. https://doi.org/10.1257/jel.37.3.1120

Oates W (1972) Fiscal Federalism. Harcourt Brace Jovanovich, New York

Oates WE (2005) Toward a second-generation theory of fiscal federalism. Int Tax Public Financ 12(4):349–373. https://doi.org/10.1007/s10797-005-1619-9

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57(6):1361–1401. https://doi.org/10.2307/1913712

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326. https://doi.org/10.1002/jae.616

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346. https://doi.org/10.2307/2336182

Rodríguez-Pose A, Krøijer A (2009) Fiscal decentralization and economic growth in Central and Eastern Europe. Growth Chang 40(3):387–417. https://doi.org/10.1111/j.1468-2257.2009.00488.x

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Romilly P, Song H, Liu X (2001) Car ownership and use in Britain: a comparison of the empirical results of alternative cointegration estimation methods and forecasts. Appl Econ 33(14):1803–1818. https://doi.org/10.1080/00036840011021708

Safi A, Wang Q-S, Wahab S (2022) Revisiting the nexus between fiscal decentralization and environment: evidence from fiscally decentralized economies. Environ Sci Pollut Res 29(38):58053–58064. https://doi.org/10.1007/s11356-022-19860-1

Sajeev A, Kaur S (2020) Environmental sustainability, trade and economic growth in India: implications for public policy. Int Trade Polit Dev 4(2):141–160. https://doi.org/10.1108/ITPD-09-2020-0079

Salman M, Long X, Dauda L, Mensah CN (2019) Impact of institutional quality on economic growth and carbon emissions: evidence from Indonesia, South Korea and Thailand. J Clean Prod. https://doi.org/10.1016/j.jclepro.2019.118331

Sencer Atasoy B (2017) Testing the environmental Kuznets curve hypothesis across the U.S.: evidence from panel mean group estimators. Renew Sustain Energy Rev 77(C):731–747

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Sickles RC, Horrace WC (eds) Festschrift in honor of Peter Schmidt econometric methods and applications. Springer, pp 281–314. https://doi.org/10.1007/978-1-4899-8008-3_9

Sigman H (2007) Decentralization and environmental quality: an international analysis of water pollution (Working paper No. 13098). National Bureau of Economic Research. https://doi.org/10.3386/w13098

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719. https://doi.org/10.1016/j.energy.2017.02.089

Su C-W, Umar M, Khan Z (2021) Does fiscal decentralization and eco-innovation promote renewable energy consumption? Analyzing the role of political risk. Sci Total Environ 751:142220. https://doi.org/10.1016/j.scitotenv.2020.142220

Tahiri A, Osmani R (2022) Fiscal decentralization and economic growth: Empirical evidence from western balkans. X(11). https://ijecm.co.uk/wpcontent/uploads/2022/11/10111.pdf

Tan E, Avshalom-Uster A (2021) How does asymmetric decentralization affect local fiscal performance? Reg Stud 55(6):1071–1083. https://doi.org/10.1080/00343404.2020.1861241

Tarigan MS (2003) Fiscal decentralization and economic development: a cross-country empirical study. Forum Int Dev Stud 24(8):245–271

The Phan C, Jain V, Purnomo EP, Islam MdM, Mughal N, Guerrero JWG, Ullah S (2021) Controlling environmental pollution: dynamic role of fiscal decentralization in CO2 emission in Asian economies. Environ Sci Pollut Res 28(46):65150–65159. https://doi.org/10.1007/s11356-021-15256-9

Thiesen U (2005) Fiscal decentralization and economic growth in rich OECD countries: is there an optimum? Econ Bull 41(5):175–182

Tiebout CM (1956) A pure theory of local expenditures. J Polit Econ 64. https://econpapers.repec.org/article/ucpjpolec/v_3a64_3ay_3a1956_3ap_3a416.htm

Tiwari AK (2012) Debt sustainability in India: empirical evidence estimating time-varying parameters. Econ Bull 32(2):1133–1141

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econom 66(1):225–250. https://doi.org/10.1016/0304-4076(94)01616-8

Udeagha MC, Ngepah N (2022) Disaggregating the environmental effects of renewable and non-renewable energy consumption in South Africa: fresh evidence from the novel dynamic ARDL simulations approach. Econ Chang Restruct 55(3):1767–1814. https://doi.org/10.1007/s10644-021-09368-y

Wang L, Lei P (2016) Fiscal decentralization and high-polluting industry development: city-level evidence from Chinese panel data. Int J Smart Home 10:297–308. https://doi.org/10.14257/ijsh.2016.10.9.28

Wang Q-S, Su C-W (2022) Fiscal decentralisation in China: is the guarantee of improving energy efficiency? Energy Strateg Rev 43:100938. https://doi.org/10.1016/j.esr.2022.100938

Wang et al (2022) Environmental impact of fiscal decentralization, green technology innovation and institution’s efficiency in developed countries usingadvance panel modelling. Energy Environ. https://doi.org/10.1177/0958305X221074727

Wu AM, Wang W (2013) Determinants of expenditure decentralization: Evidence from China. World Dev 46:176–184. https://doi.org/10.1016/j.worlddev.2013.02.004

Xia S, You D, Tang Z, Yang B (2021) Analysis of the spatial effect of fiscal decentralization and environmental decentralization on carbon emissions under the pressure of officials’ promotion. Energies 14(7):Article 7. https://doi.org/10.3390/en14071878

Xia J, Li RYM, Zhan X, Song L, Bai W (2022) A study on the impact of fiscal decentralization on carbon emissions with U-shape and regulatory effect. Front Environ Sci 10. https://www.frontiersin.org/articles/10.3389/fenvs.2022.964327

Xiao-Sheng L, Yu-Ling L, Rafique MZ, Asl MG (2022) The effect of fiscal decentralization, environmental regulation, and economic development on haze pollution: empirical evidence for 270 Chinese cities during 2007–2016. Environ Sci Pollut Res 29(14):20318–20332. https://doi.org/10.1007/s11356-021-17175-1

Xu M (2022) Research on the relationship between fiscal decentralization and environmental management efficiency under competitive pressure: evidence from China. Environ Sci Pollut Res Int 29(16):23392–23406. https://doi.org/10.1007/s11356-021-17426-1

Yang B, Jahanger A, Ali M (2021) Remittance inflows affect the ecological footprint in BICS countries: do technological innovation and financial development matter? Environ Sci Pollut Res Int 28(18):23482–23500. https://doi.org/10.1007/s11356-021-12400-3

Yang X, Wang J, Cao J, Ren S, Ran Q, Wu H (2022) The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: evidence from 269 cities in China. Empir Econ 63(2):847–875. https://doi.org/10.1007/s00181-021-02151-y

You D, Zhang Y, Yuan B (2019) Environmental regulation and firm eco-innovation: evidence of moderating effects of fiscal decentralization and political competition from listed Chinese industrial companies. J Clean Prod 207:1072–1083. https://doi.org/10.1016/j.jclepro.2018.10.106

Zahra S, Badeeb RA (2022) The impact of fiscal decentralization, green energy, and economic policy uncertainty on sustainable environment: a new perspective from ecological footprint in five OECD countries. Environ Sci Pollut Res 29(36):54698–54717. https://doi.org/10.1007/s11356-022-19669-y

Zhan X, Li RYM, Liu X, He F, Wang M, Qin Y, Xia J, Liao W (2022) Fiscal decentralisation and green total factor productivity in China: SBM-GML and IV model approaches. Front Environ Sci 10. https://www.frontiersin.org/articles/10.3389/fenvs.2022.989194

Zhang K, Zhang Z-Y, Liang Q-M (2017) An empirical analysis of the green paradox in China: from the perspective of fiscal decentralization. Energy Policy 103(C):203–211

Zhou L, Lu Y (2019) Environmental quality optimization and fiscal decentralization: an expanded endogenous growth model. IOP Conf Ser Mater Sci Eng 677(2):022036. https://doi.org/10.1088/1757-899X/677/2/022036

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):251–270. https://doi.org/10.2307/1391541

Acknowledgements

The authors wish to acknowledge the role of Visvesvaraya National Institute of Technology Nagpur, Maharashtra, India, in supporting the study. We also thank the anonymous reviewers for their valuable comments and suggestions.

Author information

Authors and Affiliations

Contributions

Bibhuti Ranjan Mishra: conceptualization; model selection; writing original manuscript; supervision; corrections. Arjun: conceptualization; model selection; empirical analysis; writing original manuscript; data collection; revision. Aviral Kumar Tiwari: reviewing and editing.

Corresponding author

Ethics declarations

Consent for publication

The authors have provided consent to publish this work if accepted in ESPR.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mishra, B.R., Arjun & Tiwari, A.K. Exploring the asymmetric effect of fiscal decentralization on economic growth and environmental quality: evidence from India. Environ Sci Pollut Res 30, 80192–80209 (2023). https://doi.org/10.1007/s11356-023-28009-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28009-7