Abstract

Real-life risk decisions are taken in a social context. However, we still know little about how that affects risk decisions. We have experimentally investigated the effect of social comparison on risk taking. We designed an experiment that allows us to isolate social comparison from other channels whereby the social context can affect risk decisions. The design also allows us to find impacts of the social reference point both if the individual cares about the distance to the social reference point and if she cares about her rank. Thus, we compare risk-taking in isolation to risk-taking with various exogenously imposed social reference points. We find that risk-taking is affected by the desire to get ahead of others, both when the social reference point is within reach (rank can be affected) and when it is out of reach (rank cannot be affected). Our results suggest that people do not only care about rank but also care about the distance to the social reference point.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Decisions under risk are an integral part of our daily lives and span a wide range of decisions, from educational choices and financial investments to daily health related activities. Standard economic models on risk preferences assume that an individual makes her decisions involving risk in isolation from other people, that is, without any social context.Footnote 1 However, many decisions involving risk are in fact not made in isolation from other people. Hence, contextual factors such as presence of others or knowing the outcome of others can influence risk decisions. In this paper, we investigate the interaction between risk preferences and social comparison. By using an experimental approach, where we exogenously vary the outcome of others, we investigate the causal effect of other people’s outcomes on individuals’ own decisions under risk.

The importance of social comparison in our daily life decisions is well known. In this paper, we investigate if knowing the outcomes of others facing similar circumstances affect decisions under risk. For example, an individual might take more financial risk if observing the high income or expensive consumption of others, or she might risk injury or health damages by overtraining when observing others’ sports results or by undergoing unsafe beauty procedures when observing others’ looks. Do individuals take more risk if they thereby have the chance to become better off or avoid to be worse off than others? Does knowing that you are for sure worse off or for sure better off than others affect decisions involving risk? We investigate both of these questions.

There is a rich body of literature on social preferences, which extends the standard economic model where an individual is unaffected by others by allowing for social comparison (see overview in e.g., Fehr & Schmidt, 2006). In social preference models, an individual’s utility depends not only on her own outcome but also on the outcome of others, which is taken as a reference point in the social comparison. Utility is negatively affected if an individual has less than others, which we refer to as envy. Meanwhile, having more than others can either affect utility positively, that is, status concerns (e.g., Frank, 1985), or negatively, that is, guilt (e.g., Fehr & Schmidt, 1999). There is significant support in the experimental literature that social preferences affect people’s behavior, suggesting that social comparison is an important factor in decision-making.

Our paper adds to a small but growing body of experimental research on individual decisions under risk in a social context, more specifically when social comparison is possible when the risky decision is made. Broadly speaking, the experimental literature can be categorized in the following two dimensions: if the individual either can or cannot affect others’ outcome and if others either can or cannot affect their own outcome. This is summarized in Table 1.

Much of the previous literature has studied social context in a situation where an individual can affect the outcome of others, but others cannot influence their own outcome (e.g. Brennan et al., 2008; Brock et al., 2013; Rohde & Rohde, 2011).We label this the dictator case, shown in the bottom left corner of Table 1. Brennan et al. (2008) and Brock et al. (2013) investigate altruism in a risky environment, where the individual choose risk for the other at a cost for herself (either a certain or a probabilistic cost). A general lesson from these studies is that models that work well to explain preferences over the distribution of outcomes do not seem to be directly transferable to preferences over risk. For example, Brennan et al. (2008) show that people are not willing to pay to reduce other people’s risk, even though people are often found to pay to increase the payoff to others. In Rohde and Rohde (2011) individuals either choose risk for a group of others given own risk, or they choose own risk given the risk facing the others. They find no significant impact of risk facing others on own risk choices, but they do find that people prefer independent rather than correlated risk for others. Another set of studies consider an individual’s decisions under risk in a social context where other people’s outcomes depend on their own risk decisions (the competition case).Footnote 2Lahno and Serra-Garcia (2015) and Gantner and Kerschbamer (2018) use a one-shot design where the individual make risk choices after the other have done so, but without observing the outcome for the other. They find a tendency to imitate the risk choice of the other. Lahno and Serra-Garcia (2015) explain this by norms to conform, and Gantner and Kerschbamer (2018) by convex distributional preferences. Viscusi et al. (2011) compare a complex risk decision when in a group compared to in isolation. Group members make choices simultaneously (and may revise them until time is up). Subjects make riskier choices when they observe choices of other group members.Footnote 3 The authors explain this by perceived possibilities to learn, given the complexity of the risk-decision. Dijk et al. (2014) and Fafchamps et al. (2015) are interested in competitive/status concerns and use designs with repeated rounds, where the outcome of each participant is observed between rounds. They both find that participant increase risk to keep up with winners. In both the dictator and the competition cases, social comparison might influence an individual’s risk choices. However, in both cases, the social context can also affect decisions under risk through other mechanisms. In the dictator case, altruism or feeling responsible for the outcome of others, and in the competition case perceived possibilities to learn from others or norms to conform.

The focus of our paper is to investigate the interaction between social comparison and risk preferences. Hence, to isolate the impact of social comparison on an individual’s own risky choices, an exogenous social reference point is needed, that is, the outcome of others has to remain fixed.Footnote 4 This corresponds to the category labelled the social comparison case in Table 1. The few previous studies in the social comparison case have used different theoretical points of departure and therefore different experimental designs. Linde and Sonnemans (2012), Schwerter (2013) and Gamba et al. (2017) extend cumulative prospect theory to a risky context. Though the framing differs, Linde and Sonnemans (2012) and Gamba et al. (2017) have similar experimental designs.Footnote 5 In particular, subjects make risk choices knowing that they are either in a social loss context (where the individual is sure to have less than the other) or in a social gain context (where the individual is sure to have more than the other). In Schwerter (2013), individuals make risky choices that may affect their social rank. Linde and Sonnemans (2012) find evidence of risk aversion in both the social loss and the social gain context, but stronger in the social loss context. Gamba et al. (2017) instead find higher risk-taking in the social loss context than in the social gain context, but also for large social gains. Schwerter (2013) find that subjects adjust risk-taking to increase the probability of a social gain rather than a social loss. More precisely, they choose lotteries with larger gains but lower probabilities of a gain when the income of the other is higher (such that it can only be surpassed with a large gain). Müller and Rau (2019) is probably the study that is closest to ours. They investigate the intersection between risk preferences and inequity aversion and extend the social preference model by Fehr and Schmidt (1999). Müller and Rau (2019) experimentally elicit risk preference in isolation and inequity aversion and use these to predict risk-behavior in a social loss and a social gain context, respectively.

Our objective is to investigate social comparison, and it is therefore important to keep others’ income fixed, that is, exogenous. Thus, we have designed an experiment that is classified as the social comparison case in Table 1. As the individual cannot affect the absolute income of others, this precludes altruism or perceived responsibility over others’ income, and as others do not make their own decisions there are no learning possibilities. The advantage with an experimental approach is that we can investigate the causal effect of a reference point on decision under risk, whereas the reference point is endogenous in most real-life situations. We consider both impacts of income rank and of distance to the social reference point given rank. We test for the impact of a social reference point on individual’s own decision under risk in three cases: (i) in a social gain context where an individual’s income is higher than others’ income, that is, guilt or status concerns; (ii) in a social loss context where an individual’s income is lower than others’ income, that is, envy; and (iii) when income rank can change. As a comparison case, we also let subjects make decisions involving risk in isolation, without mentioning others’ income. Moreover, we investigate heterogeneity in individuals’ motivations, by categorizing subjects into four behavioral types: (i) only rank matters; (ii) distance matters and the respondent is status motivated; (iii) distance matters and the respondent is guilt motivated; or (iv) the social context does not matter.

Similar to Müller and Rau (2019), we extend the social preference model by Fehr and Schmidt (1999) to study the impact of social comparison when distance, that is, the difference in own income, to the social reference point matters. We predict risk behavior in a social context conditional on risk preferences in isolation, as in Müller and Rau (2019). However, we allow for both guilt and status concerns, that is, either negative or positive utility from being ahead of others, whereas Müller and Rau assume negative utility. Furthermore, we have designed our experiment such that we can detect impacts of social comparison if the individual cares about her rank, but not the distance to the social reference point. Individuals might not be affected by the difference in income but only the mere fact that they are either ahead or behind (e.g., Schwerter, 2013).Footnote 6 Experiments on competitive behavior have shown that individuals seem to be motivated by rank) (e.g., Dijk et al., 2014; Zink et al., 2008).

We find that the social reference point affects risk-taking behavior. In particular, distance to the social reference point affects risk-taking, and thus individuals are not only concerned about rank. Moreover, risk-taking behavior is affected by the pursuit of being ahead of others. Hence, status concerns appear to be more important than guilt.

The rest of the paper is organized as follows. The next section discusses our theoretical framework on social reference points and decision-making under risk. Section 3 describes our experimental design, and Sect. 4 presents our results. Finally, the last section discusses and concludes the paper.

2 Theoretical framework

In this section, we present a theoretical framework to provide predictions of how social comparison affects an individual’s decision-making in a risky context. To make exposition viable and closely linked to our experimental setting, we outline a two-person model with an individual who makes decisions under risk, later represented by lotteries with binary outcomes, and a passive other individual, whose exogenously given outcome provides the social reference point for the decision-maker. We consider two types of social preferences: (i) rank of outcome and (ii) distance between own and others’ outcome. The key implications regarding decisions under risk are summarized in behavioral conjectures below.

Let us assume an additive utility function with a private component and a social component

The private component is \(v\left({x}_{i}\right)\), and utility depends on own outcome, \({x}_{i}\). The social component is \(g\left({b}_{j}-{x}_{i}\right)\), where \({b}_{j}\) is the outcome of the other individual, that is, the social reference point. We consider two separate cases of \(g\left(\cdot\right)\), where utility depends either on rank or on the distance to the social reference point.

2.1 Rank comparison

Let us begin with the case where only rank matters. The idea that utility depends on rank dates back at least to Veblen (1899), but it has received only limited attention in experimental economics (e.g., Dijk et al., 2014; Zink et al., 2008). Preferences over rank implies a discrete shift in the utility function at the social reference point.Footnote 7

If an individual only cares about her rank, we do not expect any systematic difference in risk-taking behavior between an isolated context, a social loss context, and a social gain context, where in the latter two cases her rank cannot be affected as discussed above.

Conjecture 1a

If an individual only cares about rank, and her position relative to the social reference point cannot be affected by her decision, risk-taking is not affected.

On the other hand, if an individual cares about rank, then her risk-taking is also affected if it can affect her rank. We represent the decision under risk by a lottery, with either a safe increase in income or with some probability to increase income and some probability to get nothing. The lottery is more attractive for an individual with social preferences for rank when her rank can rise compared to the same lottery in isolation (see Eqs. (1) and (2)).

Conjecture 2a

If an individual only cares about rank, she should exhibit more risk-taking when there is a possibility to catch up to a social reference point.

Conjecture 2b

If an individual only cares about rank, she should exhibit less risk-taking when there is a risk of falling behind a social reference point.

2.2 Income comparison

The second type of social preferences relates to the distance between an individual’s outcome and the social reference point. There are several possible utility functions where this distance matters. We use the social preference model by Fehr and Schmidt (1999) and extend it to a risky environment while allowing for both positive (status) and negative (guilt) utility of being ahead of the other individual.Footnote 8Footnote 9Footnote 10 The Fehr and Schmidt model is linear in own consumption as well as in deviations from the social reference point. We introduce risk preferences by adding non-linearity to the own consumption component, \(v\left(\cdot\right)\), where the curvature of \(v\left(\cdot\right)\) captures the degree of risk aversion. For simplicity, we keep the social component linear, such that utility depends linearly on deviations from the social reference point, as described in Eq. (3) below.Footnote 11 The social component of the utility function based on the Fehr and Schmidt’s framework is then

The first part of the function shows the disutility from having less than the other. The parameter \(\alpha\) is the weight to utility from having less than the other, that is, envy (\(\alpha \le 0\)). The second part shows utility when an individual has more than the other and the weight to utility from having more is measured by β. In the Fehr and Schmidt model, the emphasis has been on inequality aversion, which assumes that β is negative, that is, guilt. However, if individuals are status-seeking they derive positive utility from being ahead of others and β is positive.

Turning to risk aversion, we apply the Arrow–Pratt measure of absolute risk aversion: \(R=\frac{-U^{''}(x_i,b_j)}{U^{'}(x_i,b_j)}.\) Risk aversion depends on the ratio between the curvature and the slope of the utility function. Since the social component is linear, it does not affect the curvature, \(U^{''}({x}_{i},{b}_{j})=v^{'}({x}_{i}),\) but it does affect the slope, \({U}^{'}\left({x}_{i},{b}_{j}\right).\) In the social loss context, \({U}^{'}\left({x}_{i},{b}_{j}\right)=v\left({x}_{i}\right)-\propto .\) Since \(\propto <0\), the slope is steeper. Therefore, \(\left|R\right|=\left|\frac{-U^{''}(x_i,b_j)}{U^{'}(x_i,b_j)}\right|<\left|\frac{-v^{''}(x_i)}{v^{'}(x_i)}\right|\). Risk-averse individuals will be less risk-averse compared to in isolation, and risk-seeking individuals will take less risk. However, the risk-taking behavior of a risk-neutral individual is not affected, since \(u^{''}\left(\cdot\right)=0\) she continues to make risk-neutral choices.

Conjecture 1b

If an individual cares about distance to the social reference point, risk-averse individuals will be less risk-averse than in isolation and risk-seeking individuals will be less risk-seeking than in isolation. Risk-neutral individuals will remain risk-neutral.

Let us turn to the social gain context, where the slope is \({U}^{'}\left({x}_{i},{b}_{j}\right)=v\left({x}_{i}\right)+\beta .\) If an individual is inequality averse β is negative. The slope of the utility function will then be flatter in a social gain context, that is \(\left|R\right|=\left|\frac{-U^{''}(x_i,b_j)}{U^{'}(x_i,b_j)}\right|>\left|\frac{-v^{''}(x_i)}{v^{'}(x_i)}\right|.\) Risk-averse individuals will be more risk-averse compared to in isolation, and risk-taking individuals more risk-taking. This is the same result as in Müller and Rau (2019). If the individual is status seeking, β is positive, and the utility function is steeper in a social gain context than in isolation. This implies \(\left|R\right|=\left|\frac{-U^{''}(x_i,b_j)}{U^{'}(x_i,b_j)}\right|<\left|\frac{-v^{''}(x_i)}{v^{'}(x_i)}\right|,\) that is risk-averse individuals will be less risk-averse compared to in isolation, and risk-seeking individuals less risk-seeking.Footnote 12

Conjecture 1c

If an individual cares about distance (income) to the social reference point and has positive utility from advantageous inequality, risk-averse individuals will be less risk-averse and risk-seeking individuals less risk-seeking in the social gain context compared to in isolation. If people instead have negative utility from advantageous inequality, risk-averse individuals will be more risk-averse and risk-seeking individuals more risk-seeking in the social gain context compared to in isolation.

If an individual can affect her rank, she has to compare incomes in both the social loss and the social gain context. In general, there will be a kink in the utility function at the social reference point, implying that the utility function is not differentiable. However, with a negative β, this kink makes the utility function more concave around the social reference point, implying a tendency to be more risk-averse. With a positive β, it is not clear whether the kink will create concavity, convexity, or neither of these around the social reference point; this will depend on the relative size of β and α. In the special case where \(\beta =-\alpha\), there will be no kink, and the prospect to catch-up will have no particular influence on risk-taking. As in Conjecture 1b and the first part of Conjecture 1c, risk-averse individuals will be less risk-averse, and risk-taking individuals less risk-taking, compared to in isolation. In the specific case of risk-neutral individuals, risk behavior will be completely determined by the “curvature changes” induced by the kink. They will be more risk-averse if \(\beta <-\alpha\), remain risk-neutral if \(\beta =-\alpha\), and be more risk-taking if \(\beta >-\alpha\). In other cases, the risk behaviors conjectured in 1b and 1c will be adjusted by the concavity or convexity induced by the kink.

3 Experimental design and procedure

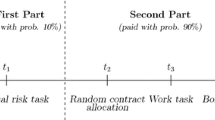

We designed a laboratory experiment to investigate the role of social comparison when an individual makes decision under risk. Subjects in our experiment were randomly paired to allow for comparison. In each pair, there are two distinct roles: a “Player” and an “Other”. The Player actively makes decisions involving risk. The Other receives a certain amount of money that exogenously creates the social reference point to the Player. Importantly, the paired subjects cannot affect each other’s outcome with their choices. Therefore, our experiment has the three key features that enable us to test the impact of social comparison on risk-taking behavior: i) an exogenously given social reference point; ii) that a subject cannot affect the outcome of the other subject; and iii) that there is no perceived possibility to learn from others.

As we would like to investigate the role of a social reference point, we have a baseline condition with no social reference point (Isolation) as well as three conditions with a social reference point. To elicit risk preferences, we use a choice list. Subjects made 20 independent decisions between a lottery and a certain amount in each condition. We fixed the probability of winning in the lotteries while we varied the payoffs from the certain option. The certain amount increases from five to 100 in steps of five. The lottery always has a 50–50 chance of winning either 100 or nothing. Thus, we expect a risk-neutral subject to choose the lottery for any safe amount below 50, which is the expected value of the lottery. A risk-seeking subject would also choose a lottery for certain amounts above 50, and a risk-averse subject would also choose certain amounts below above 50. In addition to the income from the lottery, the Player has an endowment of 50. Thus, the total income is at least 50, which means only income from the endowment, and at most 150, which is the sum of the endowment of 50 and the gain from lottery of 100. When certain amount are chosen over the lottery, the total income could be in between 50 and 150, for example 80 if 30 for sure was chosen.

To investigate if distance to the social reference point matters, we have one condition where the subject is for sure above the social reference point (Above) and one where she is for sure below the social reference point (Below). In both of these conditions the rank is given. To be able to find impacts of rank on social comparison, we have one condition where rank is not given (Catch-up). If choosing the lottery, the individual has a 50% probability of being above the social reference point and a 50% probability of being below it. The main difference between conditions is the endowment of the “Other”, which is either “25” (Above), “125” (Catch-up), “175” (Below) or not specified (Isolation). Thus, any decision made only has monetary consequences for the “Player”. A summary of the conditions in our experiment is presented in Table 2. We set the endowment of the “Other” to 125 in the Catch-up condition since pilot studies indicated risk preferences close to risk-neutrality in the study population. To investigate if individuals are willing to take more risks to catch-up, we calibrated the experiment such that endowment of the “Other” in this condition was expected to be higher than the switching-point for most people, which the pilot studies had indicated to be centered on 100.Footnote 13 Though our design allows us to test both for an impact of distance to the social reference point and for an impact of rank when distance to the social reference point does not matter, we are not able to test for an additional impact of rank when distance to the social reference point does matter.

A total of 293 students from Addis Ababa University (Ethiopia) participated in the experiment. Subjects were recruited by poster advertisements placed at the university. The experiment was conducted using paper and pen in English, which is the teaching language of the university. It was presented orally in the local language (Amharic). Subjects also had the possibility to ask questions in Amharic. In the experiment, subjects made the decisions on separate sheets (see Appendix I). The beginning of each part states that “you are given X birr and the other participant is given Y birr”, where Birr is the Ethiopian currency (X and Y are the amounts stated in Table 2). Then, for each of the 20 decisions, they were asked to indicate whether they prefer either the lottery or the certain amount. In the instruction, we emphasized that there were no right or wrong answers. Table A1 in Appendix II shows descriptive statistics of the subjects.Footnote 14

We used a within-subject design where the order of the conditions was randomized, and all subjects decided on all conditions of the experiment as if their role was the Player. At the end of the experiment, pairs were called to one out of four payment stations where a coin toss determined who would be the Player. Then, one of the conditions and one of the choices from the choice list was randomly selected for real play. If the Player had chosen a lottery in that decision, this was represented by the drawing of a ball from a bag containing five yellow and five white ping pong balls. The composition of the balls was physically shown to subjects before the balls were put into the bag. The subject selected a color and then drew a ball. If the color of the drawn ball matched the selected color, they won 100, otherwise nothing. Thereafter, both members of the pair group received their payment in cash. This procedure was explained clearly to subjects at the beginning of the experiment. Considering that the participants were students the money at stake was significant.Footnote 15 It is important to note that, when subjects make their decisions, they do not know the identity of the other person in the pair, and they do not know whether their role will be the Player or the Other. However, they do know that the pair will be called to a payment station together. Thus, we have departed from the convention of anonymous interaction. The reason is to make the social reference point more focal.

4 Results

We first analyzed the impact of a social reference point when rank cannot be affected and, hence, focused on a possible impact of the distance to the social reference point on risk-taking. More specifically, we investigated Conjectures 1a, 1b, and 1c by comparing risk-taking in the social loss (Below) and social gain (Above) conditions with risk-taking in the isolated condition. Next, we turned to the impact of a social reference point when rank can be either improved or lost in the catch-up (Catch-Up) condition. Conjectures 2a and 2b describe the behavior if people are only concerned about rank. Last, we investigated the heterogeneity of individual behavior and categorized subjects into the following behavioral types based on the experimental results: (i) only rank matters; (ii) only distance matters and the respondent is status motivated; (iii) only distance matters and the subject is guilt motivated; and (iv) the social context does not matter.

4.1 Risk-taking when rank is given

As risk-aversion in isolation matters for behavioral conjectures, we separated subjects into three categories: risk-averse, risk-neutral, and risk-seeking. Subjects were classified as risk-neutral if their lowest preferred certain amount was either 50 or 55 (implying a total amount of 100 or 105 with the endowment). A risk-neutral subject should be indifferent between a certain pay of 50 or the lottery; however, as they do not have the option of being indifferent, the lowest preferred certain amount would have to be either 50 or 55. Thus, risk-averse subjects have switching points below 50 and risk-seeking subjects have switching points above 55. As can be seen in Table 3 below, 26.5% are categorized as risk-averse, 38.1% risk-neutral and 35.4% risk-seeking, while a certainty equivalent of 55.292 shows that individuals on average are risk-neutral. In Table 3, we also show the descriptive statistics from the same categorization of individuals for the other three conditions. To analyze our research questions, we need to investigate within individual changes between conditions.Footnote 16

We began to investigate the impact of a social reference point when the distance between own outcome and the reference point can be affected but rank is given. Remember that risk-taking should not be affected if only rank matters to the subject. If distance to the outcome of the other also matters, risk-averse individuals should be less risk-averse and risk-seeking individuals less risk-seeking in the social loss (Below) condition compared to in Isolation. In the social gain (Above) condition, guilt-motivated risk-averse individuals should be more risk-averse and guilt-motivated risk-seeking individuals more risk-seeking than in Isolation. Status-motivated risk-averse individuals should be less risk-averse, and status motivated risk-seeking individuals less risk-seeking than in Isolation. Hence, to investigate the impact of the social reference point on risk-taking we need to condition on risk-taking in isolation, that is without a social reference point. Figure 1 and Table 4 compare risk-taking in the social gain (Above) and the social loss (Below) conditions, respectively, with risk-taking in Isolation, while formal testing by using regressions are shown in Table 5.

In Fig. 1 the x-axis measures risk attitudes in terms of the sum of certainty equivalent and the fixed endowment of 50 without a social reference point (Isolation) and the y-axis measures risk attitudes in terms of the sum of certainty equivalent and the fixed endowment of 50 with a social reference point. The dots are frequency weighted. The 45-degree line indicates the same choices in both conditions. Dots above the 45-degree line indicate riskier decisions with a social reference point, and dots below the line indicate less risky choices with a social reference point. The vertical dotted lines divide people into risk-averse (to the left), risk-neutral (in the middle), and risk-seeking (to the right) in isolation. Table 4 shows the shares of each risk type in isolation (risk-averse, risk-neutral, or risk-seeking) who either increase risk-taking, do not change risk-taking, or decrease risk-taking in the social contexts. There is substantial individual heterogeneity. Still, it is clear from both Fig. 1 and Table 4 that people who are risk-averse in Isolation more often increase than decrease risk-taking in the social conditions. The risk-neutral people change their risk-taking decisions less often than do others. Though the difference in risk-taking decisions for risk-seeking people is less clear from the figure than is the difference for risk-averse people, they more often decrease than increase risk-taking, especially when being behind others. This pattern of behavior in the social context is in line with Conjectures 1b and 1c, but not with Conjecture 1a, according to which there should be no systematic impact of the social context when rank is given. Thus, our results favor a model where distance to the social reference point affects utility. Moreover, risk-averse individuals are less risk-averse and risk-seeking individuals less risk-seeking in the social gain context compared to in the case without social comparison. This suggests that people like to be ahead of others, or, in other words, that β is positive.

Table 5 presents results from regressions comparing risk-taking in the social gain (Above) and social loss contexts (Below) with the comparison condition without a social reference point (Isolation) for risk-averse, risk-neutral, and risk-seeking individuals. All regressions use individual fixed effects.

Regression results support the patterns found in Fig. 1 and Table 4. Individuals who are risk-averse in isolation increase risk-taking in both the social loss and the social gain context, whereas individuals who are risk-seeking in isolation decrease risk-taking in both social contexts. There is no systematic impact of the social reference point on risk-neutral individuals. These results are in line with utility from deviations between own income and a social reference point, where people get positive utility (status) from being ahead of others and disutility (envy) from being behind of others. The results are not in line with a model either where the social reference point matters only through rank or where social preferences do not matter.

Result 1

When rank cannot be affected, risk-averse individuals make riskier choices and risk-seeking individuals less risky choices than in isolation in both the social loss context and the social gain context. This is in line with a model where people get negative utility from negative deviations from the social reference point (envy) (Conjecture 1b) and positive utility from positive deviations (status) (Conjecture 1c). It is not in line with a model where people get utility of rank only (Conjecture 1a).

4.2 Risk-taking when rank can change

Next, we investigate the Catch-up condition where rank is not given. There is a 0.5 probability of improving rank in a lottery choice, while the individual know if rank is improved or not for certain outcomes. We first investigate Conjectures 2a and 2b, that is, if risk choices are in accordance with the rank-utility model. Individuals who are motivated by rank and who chose at least some certain outcome below the social reference point in Isolation should increase risk-taking and thereby increase the possibility to catch up. However, the most risk-seeking individuals, who only choose certain outcomes above the social reference point in Isolation should decrease risk-taking and thereby be certain of catching up for more choices. Figure 2 and Table 6 compare risk-taking in the Catch-up condition both with risk-taking in the Isolation and in the Below condition.

The dashed vertical line in Fig. 2 is the social reference point of 125. Both Fig. 2 and Table 6 show the same results. It is clear that the most risk-taking subjects, who can increase the possibility of improving rank by reducing risk-taking, often do so. For the less risk-taking subjects, who can increase the possibility of improving rank by increasing risk-taking, the pattern is less clear. In Fig. 2 we see that many of them choose the approximately risk-neutral choice throughout. Table 7 shows the regression results of the same comparison as in Fig. 2 and Table 6, where separate regressions are run on those who can increase the possibility of catching up by increased risk-taking and those who can do so by decreased risk-taking.

In line with Conjecture 2a and 2b, we find that individuals who can catch up by taking more risks do so, whereas individuals who increase the possibility to catch up if they take less risk do this. In the latter case, the effect is large and statistically significant. In the former case, the effect is smaller and only statistically significant when the comparison condition is Isolation.

Even if results are in line with our conjectures where only rank matters, they are also in line with models where deviations from the social reference point matters. In Table 8, we divide the group of individuals who can increase their possibility to get ahead by increasing risk-taking into subgroups of risk-averse, risk-neutral, and weakly risk-seeking in Isolation. We refer to subjects who can increase their possibility to get ahead by decreasing risk-taking as strongly risk-seeking. This allows us to investigate how well the utility from deviations model can explain results in the Catch-up condition. The weakly risk-seeking individuals decrease risk-taking, even though this should decrease their possibility of catching up with the social reference point. The risk-neutral individuals remain risk-neutral, even if they can increase their possibilities to catch up by taking more risk. This result is more in line with the utility from deviations model than with the utility from rank model. In particular, it is in line with the utility from deviations model with \(\beta \approx -\propto\).

The last two columns in Table 7 compare the Catch-up condition with the social loss condition (Below). The fact that there are effects of the Catch-up condition in this comparison could be taken to suggest that the possibility to change rank matters. However, without more precise knowledge of \(\propto\) and \(\beta\), we do not know how risk-taking differs between the Catch-up and the two social loss conditions (Above and Below) in the utility from deviations model. Hence, the utility from deviations model could potentially explain these results even without a jump at the social reference point. Hence, while we can infer that the risk-taking decisions of subjects are in line with a model where they care about distance to the social reference point and are status motivated, we do not know if there is also a jump at the social reference point.

Result 2

When rank can be affected, risk behavior is affected in the same way as when rank cannot be affected. This is in line with a model where people get negative utility from negative deviations from the social reference point and positive utility from positive deviations.

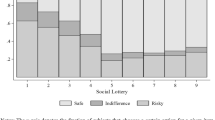

4.3 Behavioral types

Figures 1 and 2 show substantial heterogeneity in behavior. We here investigate individual behavior in detail. More specifically, we divide subjects into behavioral types. We categorized respondents whose responses were completely in line with either (i) only rank matters; (ii) distance matters and the respondent is status motivated; (iii) distance matters and the respondent is guilt motivated; or (iv) the social context does not matter.Footnote 17 In total, 34.3% of the respondents had responses completely in line with at least one of these types. Among risk-neutral respondents, we cannot distinguish between types (ii) to (iv), as these types will choose the risk-neutral choice throughout. Among the risk-neutral subjects who can be categorized, 16% care only about rank, whereas 84% either care about distance to the social reference point or do not care about the social context. For the risk-averse and risk-seeking individuals we can categorize into each of the four types: 41.1% care about distance and are status motivated, 39.3% are not affected by the social context at all, 10.7% care only about rank, and 8.9% care about distance to the social reference point and are guilt-motivated. Among respondents who did not answer in accordance with any of these four types, two patterns stood out as being common. In all, 21.7% of the remaining risk-neutral or risk-seeking individuals always chose more risk in a social context, and 12.3% of the remaining risk-averse or risk-neutral individuals always chose less risk in a social context. To sum up, there is large heterogeneity in behavior, but distance seems to be more important than rank in our sample.

5 Discussion and conclusion

An element of risk is present both in many of our daily life decisions and in long-term investments such as educational choices and pension savings. Moreover, most of these decisions under risk are made in a social context, where we know other people’s social position or income. There is now a large body of both empirical and theoretical literature showing that utility is affected by the outcome of others as shown theoretically by social preference models (e.g., see overview Fehr & Schmidt, 2006). If the utility we derive from a decision is related to others’ outcome, we should expect that decisions involving risk in social contexts might differ from similar decisions made in isolation. To investigate the impact of a social context on decisions under risk using naturally occurring data is challenging. Hence, we use an experimental approach where we exogenously vary others’ income, which represents a social reference point. We investigate the impact of social comparison on risk-taking. To exogenously vary others’ income allows us to rule out other factors that might matter for decision-making in a social context, such as altruism, responsibility or learning.

We use two different social preference models to evaluate the effect of social context on individuals’ decisions under risk: (i) utility from rank of outcome and (ii) difference between own and others’ outcome matters for utility. As risk preferences in isolation matter for implied risk behavior in the social context, we use a within-subject design to allow for analyses at individual level with randomized order of the different risky decisions. Decisions under risk in isolation are compared with those in three different social contexts; (i) individuals for sure have an income below others’ income, (ii) individuals for sure have an income above others’ income, and (iii) individuals can have an income that is either below or above the social reference point, that is, rank is not given.

We find that the social reference point influences subjects’ decisions under risk. We further find that people want to be ahead of others and that the distance to the social reference point matters. In particular, we find that people adjust their risk-taking both upwards and downwards when this either increases their possibility of rising above the social reference point or decreases their risk of falling behind the social reference point. We also find that people who are risk-averse when making decisions in isolation become less risk-averse in a social context, whereas risk-seeking people become less risk-seeking. On the other hand, risk-neutral people in an isolated setting also remain risk-neutral also in a social context. This is in line with a model where people care about the distance to the social reference point and want to be ahead of others. This is not in line with a model where only rank matters. With our experimental design, we are not able to tell whether rank matters in addition to distance to the social reference point.

Are there other models that could explain our results? First, as the outcome of others is given, all intention-based models become irrelevant. In addition, models where individuals believe that they can learn something by observing the choices or outcomes of others become irrelevant. Our results are in line with positive utility from being ahead of others (status); they are not in line with negative utility from advantageous inequality (guilt). Hence, the results are not inline with inequality aversion.

Our design also allow for behavior consistent with cumulative prospect theory extended to a social reference point as previously investigated by Linde and Sonnemans (2012) and Gamba et al. (2017). In standard cumulative prospect theory, the utility function is convex in the loss domain and concave in the gain domain. If this property is transferable to a social reference point, we should expect subjects to be more risk-taking in the social loss context than in the social gain context.Footnote 18 These predictions do not hold in our data. Risk-taking is affected in the same way in the social gain as in the social loss context.

A key feature of our study is that we investigate the role of social comparisons on risk-taking in a context where there is no connection between the decision-maker and the outcome of others. This enables us to identify the effect of social comparison on risk-taking in a social context and to distinguish it from other mechanisms. For example, in experiments where subjects allocate payoffs between themselves and others, they frequently appear to be inequality-averse rather than rather than being status-seeking. However, a situation where subjects can be held responsible for the outcome of others is fundamentally different from one where they cannot be held responsible.

An important insight from our experiment is that risk-taking decisions are influenced by the outcome of passive others, whose outcome is used a social reference point. In our experiment, each subject is paired with one other subject whose outcome serves as the social reference point. In reality, of course, the setting of social reference points is bound to be a much more complex process related to the society to which an individual belongs. Therefore, one way to think about our experiment is as a weak test of the link between social comparison and risk-taking: even a social reference point created by the outcome of an anonymous pair can affect risk-taking behavior.

How do our results compare with other studies on risk-taking where the income of a peer is exogenously varied? Linde and Sonnemans (2012) and Gamba et al. (2017) depart from cumulative prospect theory and study risk-taking in a social loss and a social gain context, with inconclusive results. Our results suggest that a possible reason might be that risk-taking in the social loss and social gain contexts depend on risk attitudes in isolation, implying that they are not well-explained by an S-shaped utility function around the social reference point. Müller and Rau (2019) also study risk-taking in a social loss and a social gain context, and build the same social preference model as we do, i.e. the Fehr-Schmidt model, where the distance between own income and the social reference point matters for utility. In their analysis, they focus on risk-averse and inequity averse individual, where the restriction to risk-averse individual is due to few risk-seeking individual in their sample. Their results are in line with model predictions for risk-averse and inequity averse individuals. Since we investigate risk-taking in the social context for risk-averse, risk-neutral and risk-seeking individuals, who are potentially status motivated rather than inequity averse, our analysis in the social loss and the social gain context can be seen as a generalization of their analysis. Schwerter (2013) study risk taking in a social context where rank is not given, i.e. similar to our Catch-up condition. Theoretically, he departs from cumulative prospect theory. However, the hypotheses in the social context, where rank is not given, are essentially the same as from the rank-utility model that we use. In practice, a strong desire to avoid a social loss is similar to a concern about social rank. Similar to us, he finds that subjects adjust risk-taking to increase the probability of a social gain rather than a social loss. However, our results when we disaggregate subjects who can increase the possibility of a social gain by increased risk into differently risk-averse subjects (Table 8), and our results when social rank is given, show that neither cumulative prospect theory with a social reference point nor a rank-utility model can fully explain risk-taking with social reference points.

In summary, our results together with results in other studies are in line with a model where not only rank but also distance to a social reference point affect risk-taking. Further, our results suggest that risk-taking is influenced by status-concerns. However, it should be noted that our analysis of behavioral types show differences in motives; some individuals appear to be unaffected by social comparison, some to care only about rank, and most to be affected by distance (the latter also shown in Müller and Rau (2019)).

Both the theoretical and experimental literature on risk preferences typically assumes that individuals make risk choices without considering the social context, that is in isolation. However, many real-world decisions, such as pension investments, adaptation of new technology, and purchase of insurance, are carried out in contexts where social comparison is possible. Our results highlight that the social context, specifically social comparison, is indeed important for decisions under risk. For welfare evaluation and policy design, this implies that it is important to consider likely social reference points and social preferences when risky decisions are made in a social context. We leave the investigation of implications in specific contexts, such as technology adaption, to future research.

Notes

For a discussion on different methods to elicit risk preferences, especially incentivized experiments and self-reported surveys, and on external and internal validity of different methods see for example Schildberg-Hörisch (2018).

Chao et al. (2017) study risk-taking after wealth changes originating from a real effort task, where the outcome of the other is affected by her performance in the task. They use cumulative prospect theory to model the response of risk-taking on both absolute and relative wealth changes. Subjects who lost more wealth than others did made riskier choices afterwards.

They also consider joint decision-making in the group under different decision rules.

There are a few studies where risk rather than outcomes are exogenously allocated to others (Friedl et al., 2014; Lahno & Serra-Garcia, 2015; Rohde & Rohde, 2011). One objective of these studies is to study the impact of and preference for systematic versus idiosyncratic risk. While social comparison is a key element in these studies too, a concern over the distribution of opportunities may matter in addition to a concern over the distribution of outcomes.

We have added positive utility from being above the social reference point, instead we could also have either negative utility from being below it, or a combination of both.

As has been discussed by, for example, Trautmann (2009), Saito (2013), Fudenberg and Levine (2012), and Brock et al. (2013), extensions of social preference models to risky environments can be done from either an ex-ante or an ex-post perspective. Since we are investigating the impact of a fixed social reference point, our analysis speaks primarily to the concern for ex-post distributions.

For example, Bolton and Ockenfels (2000) only allows for inequality aversion and not for deriving utility from being ahead of others.

Müller and Rau (2019) also extended the Fehr and Schmidt model to a risky environment to study the interaction of risk preferences and social preferences. However, as in the original model, they assume negative utility from being ahead of others, whereas we also allow positive utility.

Müller and Rau (2019) also investigate the implications of a non-linear social component.

With a non-linear g(.), a social reference point might also affect the curvature of the utility function. Müller and Rau (2019) derive conditions under which the results from the simpler model with a linear social component extend to a more general model that allows for curvature changes. In particular, results hold in the case where private and social risk preferences are of the same nature, that is if individuals who are risk-averse in isolation are also risk-averse in the social domain and individuals who are risk-seeking in isolation are also risk-seeking in the social domain.

The experiment consisted of eight conditions, four of which are in the “gain domain” (Isolation, Above, Below, and Catch-up, described above) and four of which are in the “loss domain”). In the analyses, we restrict our attention to the four treatments in the gain domain.

The descriptive statistics shows low level of education of parents and a low share of female students. The low share of female subjects is probably due to the timing of the experiment, which was after the end of the spring semester. This meant that most of our participants were students who waited for their diploma. Female students appear to stay on the campus while waiting for their diploma less often than do male students. As results are clearly driven by men, we also conducted the analysis using men only resulting in very similar results.

A daily laborer in Addis Ababa during the time of the experiment was paid approximately 100 Birr.

In the experiment, we randomized the order of the experimental conditions. In Appendix III (Tables A4–A12) we show that results are unaffected if we control for order effects.

Respondents are classified as”Only rank” if they modify behaviour in the Catch-up condition but not in other social conditions. They are classified as “Status motivated” if they make choices fully in line with Conjecture 1c with positive utility from advantageous utility, They are classified as “Guilt motivated” if they make choices fully in line with Conjecture 1c with negative utility from advantageous utility. They are classified as “Not affected” if they always make the same choice as in Isolation. See Tables A2–A3 in Appendix II for a more detailed presentation of the categorization).

As explained by Gamba et al. (2017), this is the case at least for individuals who are either risk-averse or risk-neutral in isolation, whereas predictions are unclear for individuals who are risk-seeking in isolation.

References

Bolton, G. E., & Ockenfels, A. (2000). ERC: A Theory of Equity, Reciprocity, and Competition. American Economic Review, 90, 166–193.

Brennan, G., Gonzàlez, L. G., Güth, W., & Levati, M. V. (2008). Attitudes towards private and collective risk in individual and strategic choice situations. Journal of Economic Behavior and Organization, 67, 253–262.

Brock, J. M., Lange, A., & Ozbay, E. Y. (2013). Dictating the risk: Experimental evidence on giving in risky environments. The American Economic Review, 103, 415–437.

Chao, H., Ho, C. Y., & Qin, X. (2017). Risk taking after absolute and relative wealth changes: The role of reference point adaptation. Journal of Risk and Uncertainty, 54(2), 157–186.

Dijk, O., Holmen, M., & Kirchler, M. (2014). Rank matters—The impact of social competition on portfolio choice. European Economic Review, 66, 97–110.

Fafchamps, M., Kebede, B., & Zizzo, D. J. (2015). Keep up with the winners: Experimental evidence on risk taking, asset integration, and peer effects. European Economic Review, 79, 59–79.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. Quarterly Journal of Economics., 114, 817–868.

Fehr, E., & Schmidt, K. M. (2006). The economics of fairness, reciprocity and altruism – Experimemental evidence and new theories. In S.-C. Kolm & J. M. Ythier (Eds.), Handbook of the Economics of Giving, Altruism and Reciprocity (Vol. 1, pp. 615–691). Elsevier Science.

Frank, R. H. (1985). Choosing the right pond: Human behavior and the quest for status. Oxford University Press.

Friedl, A., De Miranda, K. L., & Schmidt, U. (2014). Insurance demand and social comparison: An experimental analysis. Journal of Risk and Uncertainty, 48(2), 97–109.

Fudenberg, D., & Levine, D. K. (2012). Fairness, risk preferences and independence: Impossibility theorems. Journal of Economic Behavior & Organization, 81(2), 606–612.

Gamba, A., Manzoni, E., & Stanca, L. (2017). Social comparison and risk taking behavior. Theory and Decision, 82, 221–248.

Gantner, A., & Kerschbamer, R. (2018). Social interaction effects: The impact of distributional preferences on risky choices. Journal of Risk and Uncertainty, 56(2), 141–164.

Haisley, E., Mostafa, R., & Loewenstein, G. (2008). Myopic risk-seeking: The impact of narrow decision bracketing on lottery play. Journal of Risk and Uncertainty, 37(1), 57–75.

Lahno, A. M., & Serra-Garcia, M. (2015). Peer effects in risk taking: Envy or conformity? Journal of Risk and Uncertainty, 50(1), 73–95.

Linde, J., & Sonnemans, J. (2012). Social Comparison and Risky Choices. Journal of Risk and Uncertainty, 44, 45–72.

Mo, C. H. (2018). Perceived relative deprivation and risk: An aspiration-based model of human trafficking vulnerability. Political Behavior, 40(1), 247–277.

Müller, S., & Rau, H. A. (2019). Decisions under uncertainty in social contexts. Games and Economic Behavior, 116, 73–95.

Rohde, I. M. T., & Rohde, K. I. M. (2011). Risk attitudes in a social context. Journal of Risk and Uncertainty, 43, 205–225.

Saito, K. (2013). Social preferences under risk: Equality of opportunity versus equality of outcome. The American Economic Review, 103(7), 3084–3101.

Schildberg-Hörisch, H. (2018). Are risk preferences stable? Journal of Economic Perspectives, 32, 135–154.

Schwerter, F. (2013). Social reference points and risk taking (No. 11/2013). Bonn Econ Discussion Papers.

Trautmann, S. T. (2009). A tractable model of process fairness under risk. Journal of Economic Psychology, 30, 803–813.

Trautmann, S. T., & Vieider, F. M. (2012). Social influences on risk attitudes: Applications in economics. In Roeser, S. (Ed.), Handbook of Risk Theory. Springer Verlag.

Veblen, T. (1899). The Theory of the Leisure Class: An Economic Study of Institutions. Macmillan.

Viscusi, W. K., Phillips, O. R., & Kroll, S. (2011). Risky investment decisions: How are individuals influenced by their groups? Journal of Risk and Uncertainty, 43(2), 81–106.

Zink, C. F., Tong, Y., Chen, Q., Bassett, D. S., Stein, J. L., & Meyer-Lindenberg, A. (2008). Know your place: Neural processing of social hierarchy in humans. Neuron, 58(2), 273–283.

Acknowledgements

We would like to thank Martin Kocher and Joseph Vecci for helpful suggestions and comments and Haleluya Gebru for research assistance.

Funding

Financial support from the Wallbenberg Foundation and The Swedish Research Council (ref 2018-04793) are gratefully acknowledged. Open access funding provided by University of Gothenburg.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

We have no competing interests to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lindskog, A., Martinsson, P. & Medhin, H. Risk-taking and others . J Risk Uncertain 64, 287–307 (2022). https://doi.org/10.1007/s11166-022-09376-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-022-09376-x