Abstract

This paper draws on recent developments in the theory of choice under uncertainty to model anomalies in intertemporal choice. Cognitive limitations leading to hyperbolic discounting and magnitude effects in intertemporal choice may be described in terms of bounded awareness, and represented by phenomena familiar from visualization software such as Google Earth. Cognitive limits on visualization impose constraints on both the area being viewed and the level of detail of the view, with a trade-off between the two. Increasing detail at the expense of limiting the area viewed may be described as zooming. Data from a field experiment were used to assess the theory with an incentive-compatible multiple price list approach involving magnitude levels of 5x, 10x and 20x the basic magnitude level with time horizons of one, three, six and 12 months. Without zooming adjustments in base consumption, very strong hyperbolic and magnitude effects were found, and present bias could not explain the hyperbolic effects. The zooming model provides an explanation of what appear to be significant intertemporal anomalies in the data.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Anomalies in intertemporal choice include hyperbolic discounting, quasi-hyperbolic discounting (present bias), and magnitude effects (Chung and Herrnstein 1967; Thaler 1981; Ainslie 1991; Loewenstein and Prelec 1992; Laibson 1997) and represent deviations from the well-known discounted utility model (Samuelson 1937).

Magnitude effects in intertemporal choices in the form of systematically lower discount rates associated with prospects with larger monetary amounts appear as an accepted empirical regularityFootnote 1 with few convincing explanations. It may not be explained by the functional form of the utility function and is called the “increasing proportional sensitivity property” (Prelec and Loewenstein 1991).

Hyperbolic discounting has been a popular way to model anomalies in intertemporal choice associated with intertemporally inconsistent behavior with potential negative externality effects. While hyperbolic discounting has been accepted as a widespread behavioral characteristic there is no generally accepted account of its sources or its relationship to other aspects of choice, notably including choice under uncertainty.

The aim of this paper is threefold. First, we link anomalies in intertemporal choice to the literature on unawareness that has arisen mainly in the context of choice under uncertainty. Second, we introduce a visual metaphor for bounded awareness as ‘zooming’, derived from visualization software such as Google Earth. Third, we present the results of experimental studies designed to test the zooming hypothesis.

The approach used in the present paper draws on recent developments in the theory of choice under uncertainty, in which the standard assumption that decision-makers are aware of all possible states of nature is relaxed. Models incorporating various forms of ‘unawareness’ have been developed by Grant and Quiggin (2013), Halpern and Rego (2014), and Heifetz et al. (2006) among others. Schipper (2015) provides a bibliography.

The standard assumption of full awareness may be violated in two ways. First, decision-makers may limit the set of contingencies they consider, effectively imputing zero probability to some possible states of nature. This form of unawareness may be referred to as ‘restriction’. Alternatively, decision-makers may lump together contingencies which are, in reality, distinct, as in Heifetz et al. (2006). This form of unawareness may be referred to as ‘coarsening’.Footnote 2

Given bounded cognitive resources, decision-makers must engage in both restriction and coarsening if they are to reduce even relatively simple decision problems to a manageable scale. Moreover, there is a trade-off between the two processes: the fewer possibilities that are excluded from consideration, the coarser must be the aggregation of those that remain.

Visualization software inspired by Google Earth provides a metaphor that is familiar to many. With use of such tools one chooses an area to ‘zoom in’ on as well as the degree of zooming in. As one zooms in, new details appear but the frame becomes much narrower. Zooming permits more focus on the details within a narrow frame but causes the user to lose sight of the larger landscape.

In many situations the brain works as a mental zooming device and narrows in the focus on some specific issues or aspects of prospects that are compared rather than evaluating these holistically. Narrow framing (Barberis et al. 2006) or choice bracketing (Read et al. 1999) in some contexts are more specific outcomes of the zooming behavior of the brain. This is therefore a more general theory to attempt to explain what appear to be specific patterns of systematic inconsistent intertemporal choices which have been captured with hyperbolic discount functions or as magnitude effects with higher patience for larger prospects.

In the present paper, we apply the ‘zooming’ metaphor in relation to decisions involving intertemporal choice. The main focus of the paper is the relationship between ‘zooming out’ and asset integration. We argue that higher stakes are likely to contribute to ‘zooming out’, which in turn leads to higher levels of asset integration.

Section 2 of the paper reviews the literature on hyperbolic discounting and magnitude effects in intertemporal choice including the attempts that have been made at explaining the phenomena. Section 3 outlines the interpretation of zooming in relation to hidden framing and partial asset integration. Section 4 describes field experiments used to obtain data for testing the consistency of the theory with the data. Section 6 uses the standard along with the zooming model of bounded awareness to demonstrate and discuss the predictive power of the model. The final section concludes.

2 Literature review

The ‘behavioral’ approach to economics, in which models of economic agents are based on stylized facts about observed behavior, rather than on normatively appealing postulates for rational behavior, has become increasingly popular. The standard model of discounting exhibits the properties of stationarity and dynamic consistency which together imply a constant discount rate. Under this model, if the long-run future is to be given any significant weight, the discount rate over short periods must be moderate. A large body of experimental and theoretical literature has arisen around the claim that actual decisions are not consistent with the hypothesis of constant discounting.

The best-known claim of this kind is that the short-term future is discounted at a higher rate (per unit of time) than the long-term future. Behavior of this kind may be represented by hyperbolic or quasi-hyperbolic discounting.

Magnitude effects in discounting arise when a proportional increase in the magnitude of both current and future consumption possibilities leads to reduced discounting, that is, to an increase in the likelihood of choosing higher consumption in the future, rather than a smaller increase in present consumption.

Thaler (1981), who finds strong magnitude effects, hypothesizes that these effects are explained by self-control problems. He also observes that both hyperbolic and magnitude effects can be explained by a fixed cost of waiting. Another explanation could be that there is a fixed cost or minimum amount that is needed before a delay in receiving a given amount becomes salient (Benhabib et al. 2010).

Experiments undertaken during the twentieth century were widely interpreted as providing clear evidence of these effects. Notable work on non-constant discounting includes that of Chung and Herrnstein 1967; Loewenstein and Prelec 1992; Ainslie 1991; and Laibson 1997. Strong magnitude effects were found by Thaler (1981) and Loewenstein and Prelec (1992).

More recent research, using more rigorous experimental methods, has cast doubt on these results. In their survey of the literature, Andersen et al. (2013) note that “The magnitude effect is a robust finding…., and appears in studies that rely on hypothetical payoffs as well as real monetary rewards”. However, Andersen et al. (2013) observe that most studies that identify magnitude effects use hypothetical questions and do not satisfy the quality standards of experimental economics. With few exceptions “all evidence of the magnitude effect that meets certain minimal standards of salience and design occurs in samples of college-age students”. Further, much of the apparent magnitude effect may be explained by rounding behavior with small stakes. For their sample of Danish adults, Andersen et al. conclude that “the alleged magnitude effect in discounting is not economically significant”.

Similarly, while noting that non-constant discounting represents the “received wisdom”, Andersen et al. (2014) report that a study of adult Danes yields no evidence to support either quasi-hyperbolic or “fixed cost” discounting. Reviewing the literature in the light of this finding, Andersen et al. (2014) conclude that the experimental evidence for “hyberbolicky” discounting is far weaker than is widely supposed. Furthermore, Andersen et al. (2013) observe that most studies that identify magnitude effects use hypothetical questions and do not satisfy the quality standards of experimental economics.

Experimental findings giving greater or lesser support to the hyperbolic discounting and magnitude effects continue to emerge and it seems unlikely that the issues will be resolved in the near future. It is appropriate, therefore, to consider broader theoretical frameworks within which such instances of bounded rationality may be modelled and assessed.

The nascent literature on bounded awareness, which has so far focused mainly on choice under uncertainty, provides one possible framework for examining intertemporal choices in which cognitive bounds on rationality may be relevant.

Two notions of unawareness are considered in the literature. In the first, characterized by Grant and Quiggin (2013), agents have access to a proper subset of the true state space. This form of unawareness is referred to as restriction. In the second form of unawareness, characterized by Heifetz et al. (2006), agents have access to a representation of the state space derived as a projection of the true state space. This form of unawareness is referred to as coarsening.

In terms of the Google Earth metaphor, zooming in leads to restriction, since the range of possibilities and time periods under consideration is restricted. Zooming out leads to coarsening, since distinctions between possibilities are disregarded.

Zooming may be either beneficial or harmful, depending on whether the possibilities and distinctions excluded from consideration are in fact relevant. For example, to the extent that coarsening elides irrelevant aspects of framing, it yields superior decisions.

In the present context, it will be argued that zooming out promotes asset integration and, by reducing the prevalence of hyperbolic discounting, tends to generate more dynamically consistent decisions.

3 A model with zooming

We begin with an additively time-separable intertemporal utility function with exponential discounting as the benchmark model. We assume that respondents have concave utility functions within given time periods (Andersen et al. 2008). We focus exclusively on “gains only” situations so that we can ignore “gain-loss” asymmetries. The hyperbolic and magnitude anomalies that we seek to explain are evident in experiments with gains only and therefore are not a direct effect of gain-loss asymmetries.

Respondents are given the choice between two prospects,Footnote 3 M A at time t 1 and M B at time t 2, where t 1 > t 0 = 0 and t 1 < t 2. Decision-makers must choose between U A and U B :

where δ is the continuous time discount rate and where y is background consumption.Footnote 4

The zooming theory with limited asset integration assumes that the prospects offered at two different points in time are integrated to varying degrees with decisions regarding other endowments of the decision-maker. This concept can be illustrated as follows:

where base consumption (y) is assumed to be a function of the prospect characteristics P *. Using a daily wage rate (y) as the “starting reference point” for short-term prospects makes it possible to model zoom-adjusted base consumption as followsFootnote 5:

The degree of this type of asset integration depends on the length of the time horizon and the magnitude of the prospects. A higher level of asset integration, “zooming out”, occurs over longer time horizons and for larger amounts, whereas for shorter time intervals and smaller amounts, a lower level of asset integration is needed. Thus, in the latter case, the decision is “zoomed in”, becoming more myopic and less holistic because the problem may be more trivial or of a more short-term nature. The novel contribution of this theory is therefore the notion that the decision-maker automatically adjusts the framing of the decision problem to the most relevant scale to simplify the decision-making process.

In zooming in on a narrower set of factors and excluding other issues, the individual faces a simplified problem that can be evaluated more quickly, which, in turn, will expedite decision-making. The adjustment involves no adjustment of the discount rate, which is assumed to be constant for an individual at that specific point in time. If this theory is correct, zoom-adjustment of the base consumption level should eliminate or reduce hyperbolic and magnitude effects in time preference experiments, and decisions should appear rational in the zoom-framing perspective, as in other theories of reference-dependent preferences (Kőszegi and Rabin 2006; Kőszegi and Rabin 2007).

Given that reference consumption levels are unobservable, we assume that for the period in question, a base consumption level and investment levels that are similar in magnitude to those upon which the decisions are based are appropriate starting points. This is similar to assumptions made by other researchers, e.g., Andersen et al. (2008, 2014). The structural model may therefore simply be reformulated as follows to capture zooming adjustment with partial asset integration:

where base consumption at each point in time represents the unobservable zooming level, which, according to the proposed model, is a function of the length of the time interval and the magnitude of the amount at the far end that is under consideration in each choice set. Larger amounts and longer time horizons imply wider framing and zooming out because these decisions are more momentous and therefore “require” a more holistic treatment that implies a higher level of asset integration.

Another aspect of Eq. (4) is that it focuses on the utilities of prospects, where utility is a function of incomes received under alternative prospects. Following Andersen et al. (2008), respondents are risk-averse and have utility functions with diminishing marginal utility. Neglect of this property could lead to the overestimation of discount rates. Diminishing marginal utility is also relevant in more narrow framing perspectives, as diminishing marginal utility also affects short-term consumption. Indeed, we argue that it is narrow framing that leads to diminishing marginal utility in short-term decision-making, which tends to be consumption-oriented. More long-term and larger decisions tend to be investment-oriented and are associated with consumption over longer periods of time. For the sake of simplicity, in testing the potential explanatory power of the zooming model, we have used utility functions with constant elasticity of marginal utility. In addition, we utilize the responses in a set of risk preference experiments for the same respondents to derive a measure of risk aversion that we utilize as a proxy for diminishing marginal utility in our time preference estimation.

In testing whether the model potentially can explain hyperbolic discounting and magnitude effects, these phenomena should as a minimum be reduced and ultimately become very small when zooming adjustment of base consumption is included in the analysis of experimental data with time horizon and magnitude effects included among the (randomized) experimental treatments. We therefore use such data to test the potential explanatory power of the model.

There are, however, three important unobservable components that require attention in relation to such a calibration test: a) the determinants of the appropriate initial base consumption; b) the determinants of the functional form of the zooming adjustment to the length of the time horizon; and c) the determinants of the functional form of the zooming adjustment to the magnitude effect. The zooming model implies that the base consumption level is an increasing function of both the length of the time horizon and the magnitude of the far end monetary payment (with less narrow framing for larger, longer-term decisions).

Andersen et al. (2008) chose the daily wage rate as the base consumption level in their time preference experiments in Denmark. With our data such a small universal base consumption yielded negative discount rates for long horizons and large amounts. We increased the universal base consumption from MK 300 (daily wage)Footnote 6 to MK 5000 to ensure positive discount rates for large amounts (>MK 10,000) and long time horizons (12 months). This increased average discount rates overall but did not reduce the strong time horizon and magnitude effects in our data. We have used the same daily wage rate as a starting point for decisions with a short time horizon (one month) in two of our zooming models.

If mental zooming is similar to visual zooming and if the observable area adjusts similarly to the mentally observed “area”, it may be relevant to test this adjustment to the mental “area” as if the brain translates the visual area using the same scale as the mental area. For example, when one visually zooms in using Google Earth, reducing the distance from the earth to half the initial distance reduces the visually observable area to one quarter if the angle of vision is constant and the radius of the observable area is reduced by half.

When base consumption is included in a non-linear utility function, the same non-linear adjustment to time and magnitude frames occurs if these frames are included in linear form. We therefore start with this type of linear adjustment in the consumption/income space to time and magnitude frames in a utility function with constant elasticity of marginal utility, assessing the effects of deviating from it. Because we do not have a theory that indicates clearly which functional form is more appropriate, we resort to testing alternative functional forms empirically. Because the unobservable base consumption level and degree of zooming may vary across individuals, we test for the general tendency in the data. Some individuals may be more prone to high levels of asset integration; thus, they may make more holistic decisions and exhibit greater “rationality”. In contrast, others may zoom in more narrowly and may thus exhibit greater myopia and “irrationality” in their decisions. If risk aversion elicited from risk preference experiments is an indicator of individual variation in degree of asset integration, we capture such variation through our inclusion of individual risk aversion parameters as variations in the elasticity of marginal utility.

The model may explain quasi-hyperbolic discounting or present bias as an instance of extremely narrow framing of base consumption that, in the limit, reduces to a purely static decision that ignores future outcomes. This may occur as a break or a switch from the more continuous framing adjustment that is implied by the mental zooming hypothesis to a purely static/myopic corner solution.

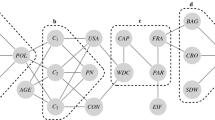

4 Experimental design and implementation

Using a multiple price list (MPL) design, field experimental data from representatives gathered from a random sample of rural households in Malawi were used to examine anomalies in intertemporal choice and to test whether the hidden zooming hypothesis has the potential to explain these phenomena. The treatments used included three front end timing treatments, four endpoint timing treatments and four magnitude level treatments. The front end timing treatment included present timing, a one-week delay and a one-month delay, specifications that allowed for separate testing of quasi-hyperbolic versus hyperbolic discounting. The endpoint timing treatments included one-month, three-month, six-month and 12-month delays. The magnitude levels, which were fixed for the endpoints, were MK 1000, MK 5000, MK 10,000 and MK 20,000. Although other researchers have used MPLs where the near future amounts are fixed and have varied the more distant amounts (Pender 1996; Andersen et al. 2014), such a design can lead to substantial censoring in developing country settings (Pender 1996; Yesuf and Bluffstone 2009). We therefore chose to fix the more distant future amount and identified a switching point through offering alternative near future or current amounts.

A possible limitation of the Andersen et al. (2014) study is that they use only two magnitude levels, DKr 1500 and DKr 3000, which implies only a doubling of the magnitude. Our experiment includes magnitudes that are 5, 10 and 20 times the smallest magnitude, with varying delays in the initial point in time and with real payments. We can therefore test whether fixed transaction costs related to delayed payments can eliminate the magnitude effect, as suggested by the findings of Andersen et al. (2014), and can test the model in the magnitude dimension.

This strategy varying the front end amount while fixing the endpoint amount allows for much higher discount rates without any censoring problems due to high future monetary payouts. Even given this design, however, we encountered individuals with extremely high discount rates that were outside the range of our standardized lists. For these individuals, we extended the lists on an individual basis until a switch point was identified. Fixing the future amount of each prospect is also a convenient way to test the model. The simple design of the intertemporal choice prospects in the MPLs is presented (example of the prospects) in the Appendix. The basic treatment variations are presented in Table 1.

There are 44 unique possible combinations, as the 1 month–1 month combination is irrelevant. We further reduced the number of treatments to 27 but retained the “middle ground” treatments that were considered most relevant to the analysis of farm input demand decisions, which the experiments were designed to illuminate, and which are typically made 3–6 months before a crop is harvested. The amounts that smallholder farm households typically spend on farm inputs are also in the range of MK 5000 to 20,000. We preferred to compare two future points in time in most treatments (20) but included a sufficient number of treatments (7) involving the comparison of the present time with a future point in time to test for present bias. The numbers in parentheses in Table 1 indicate how many of the treatments contained each treatment level.

The treatments were randomized across households. Each household was confronted with 9 of the 27 series, so that all 27 series were distributed across three household representatives in each village.

The time preference experiments were run jointly with risk preference and input demand experiments. The order of these experiments was randomized, which enabled us to test for the order effects of the experiments.

In each series, using ten cards from a card deck, the starting point was randomized by the experimental enumerator to minimize starting point bias. After receiving an answer for this random task, the enumerator was told to go to the endpoint of the series in the direction in which a switch point was expected, where the direction depended on whether the respondent chose the near future (current) amount or the far future amount. If the respondent chose the near future amount, the bottom task in the series would be chosen. If the respondent then switched to the far future amount, the enumerator would move to the series in the middle between the two previously tested series and then continue to quickly narrow in on the switch point.

There were cases in which a switch point was not identified before the bottom of the series was reached. The enumerator then added rows by offering even smaller near future (current) amounts until a switch point was detected. In analyzing the data, we tested for starting point bias by creating a variable that interacted the starting point dummy with the row number that had been randomly chosen as the starting point in that series.

Four well-trained Malawian MSc-graduates in economics were recruited as experimental enumerators. They were first trained by the first author in the classroom for one day and then tested the experimental formats on one another after being introduced to the designs. Next, they were involved in the field testing of the designs in an out of the sample location, also with close follow-up by the first author.

After some modifications to the design and refinements of the method of conducting the interviews, an implementation plan was established. Within each district, several villages (typically four per district) were sampled. The experiments required one day in each village, and one district was completed in one week.

A suitable school within the village (in most cases) or in close proximity was identified as the field laboratory. A classroom was typically chosen, and tables and chairs were organized in each corner of the room so that each enumerator could interview a respondent without being disturbed by the others. The respondents sat with their backs to the center of the classroom. Those who had not yet participated in the experiments waited at sufficient distances outside the classroom and were unable to observe the activities taking place inside. Those who had completed all experiments received their payments (in cash and in kind) and were asked to return to their homes and avoid speaking with anyone outside the classroom who had not yet participated in the experiment. The enumerators conducted all three types of experiments while randomizing their order and rotating the respondents among themselves.

Due to the limited literacy and numeracy of the respondents, the enumerators had to spend time explaining the details to the respondents and teaching them the concepts of probability and random choice that were required for them to participate in the more cognitively challenging risk preference experiments. We decided not to provide the respondents with information about the implied annual discount rates in the intertemporal choice tasks, as most of the respondents were unfamiliar with the concept of an annual discount rate.

All of the respondents received payouts in the risk preference and input demand experiments, whereas each respondent had a 10% probability of receiving a payout in the time preference experiments based on a random draw of a card from ten cards. For a winner, a new card would be drawn to identify one of the nine series he or she had completed, and another card would be drawn to determine the task in that series. Their choice during that task determined whether they would receive the near future payment or the far future payment.

The organizers of the survey, who were from the University of Malawi, took responsibility for ensuring that proper payments were made on the appropriate dates. The fact that the households belonged to a panel that had been visited and interviewed many times during the preceding six years gave the respondents reason to trust that they would in fact receive the future payments.

5 Data

Data for this study come from a longitudinal farm household survey with an original sample of 450 households located in six districts in central and southern Malawi. Household interviews took place in 2006, 2007, 2009 and 2012. In 2006, households were randomly sampled within each Enumeration Area (EA) following the Integrated Household Survey of 2004, conducted by Malawi’s National Statistical Office. In the 2012 survey, we found and re-interviewed 350 of the original households.

Time and risk preference experiments were implemented in relation to the 2012 round survey that combined our time preference module with the MPL approach of Holt and Laury (2002) for risk preferences. The Holt and Laury approach contained four hypothetical series with high stakes followed by four incentivized lower stake monetary series. We used only the four monetary series in the estimation of risk preferences explained below.

Some descriptive statistics for the respondents are included in the Appendix. We see that about 41% of the sample were females, 15% had formal employment, 45% had some form of nonagricultural business, 69% had been exposed to drought during the last year, and 30% had applied for a loan. Land and livestock are important wealth indicators. Average farm size is very small (1.2 ha) and many had no livestock, also showing that the sample consisted of poor smallholder farmers.

6 Methods and data analysis

The utility differential from Eq. (4) is specified as

capturing the probability that prospect A is chosen. A further extension of the estimation of the above models includes stochastic errors. More specifically, we applied the Luce specification, which was also used by Holt and Laury (2002) in estimates of risk preferences and by Laury et al. (2012) in estimates of time preferences:

where μ is the stochastic (Luce) error.

We use a constant elasticity of marginal utility utility function, U = C 1-r with relative risk aversion (r) serving as a proxy to adjust for individual variation in elasticity of marginal utility in the time preference tasks. This leads to lower estimates of discount rates than when risk aversion/diminishing marginal utility is ignored (Andersen et al. 2008). Experimental data with Multiple Price Lists (MPLs) were used to estimate individual risk aversion. We had a series of 11 MPLs per respondent where the first four were hypothetical with real world framing (choice among more or less risky maize varieties—maize being the respondents’ main staple food crop). The next four were monetary series with real payout, and the last three were for Prospect Theory parameter elicitation. We have here used four monetary lists which were designed very similarly to that of Holt and Laury (2002) to estimate the individual risk preferences.Footnote 7 An expo-power utility function with Luce error was used for the estimation of relative risk aversion, following Holt and Laury (2002).

Our approach is similar to that of Andersen et al. (2008) who jointly estimated risk and time preferences with data from Denmark except that we make the estimation recursively. We think this is appropriate as the experiments were also run recursively in the field. Although some findings indicate that poor people tend to be more risk averse than others—such that they exhibit decreasing relative risk aversion (DRRA) relative to wealth and increasing partial risk aversion (IPRA) relative to game levels (Wik et al. 2004; Yesuf 2004)—Binswanger (1980) and Mosley and Verschoor (2005) find no significant association between risk aversion and wealth. We therefore think we do not make a big mistake by assuming a constant elasticity of marginal utility/CRRA utility function in the time preference estimation.

Based on the prospects presented and the utility function, a log-likelihood function is constructed for the maximum likelihood estimation of relevant parameters and variables such as the discount rate (δ), the noise parameter (μ), treatment (prospect) characteristics (Z i ) and the predicted individual risk aversion (R j ):

The choice of exponential discounting enables us to test for deviations from this specification with our randomized treatments and makes it possible to assess whether the zooming hypothesis potentially can explain hyperbolic discounting and magnitude effects. Significant time horizon and magnitude treatment effects in the baseline estimates—without zooming adjustments in base consumption—serve as a starting point for the test of the zooming hypothesis.

Constant base consumption in the baseline models is set high enough, i.e., MK 5000, to ensure positive discount rates for all time horizons and future amount magnitude levels. This may, however, be too large for decisions over small amounts and short time horizons and we adjust this in the zooming models.

The sensitivity analyses of zooming calibration adjustment in this study included varying the functional form of time horizon adjustment and the magnitude adjustment.

A stepwise approach to testing the base consumption zooming theory is used with no zooming as the base scenario. Zooming model 1 tests for linear zooming in time horizon. Zooming model 2 tests for linear zooming in time horizon and magnitude. Based on the outcome in these two models, stronger adjustment in time horizon and weaker zooming adjustment in future amount are used in Zooming model 3.

Table 2 givens an overview of the base consumption adjustment in the alternative zooming models.

7 Results

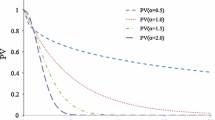

We start by examining the estimation results using a standard continuous time exponential discounting utility function with constant base consumption set at MK 5000 (close to a monthly wage) (the baseline model). The results for this structural model are presented in Table 3, and the predicted discount rate distributions by time horizon for MK 10,000 future amounts and one week delayed initial point in time are shown in Fig. 1a. The magnitude effects for the same model are predicted in Fig. 1b.

The model demonstrates very strong time horizon and magnitude effects. The discount rate varies from a 180–220% range for a one-month time horizon to a 0–40% range for a 12-month time horizon. The discount rates vary in the range 290–330% for small amounts (MK 1000) and go down to 80–120% for large amounts (MK 20,000) when the time horizon is 3 months. Such conscious discount rate adjustments seem very implausible and seem to lend support for an alternative explanation where varying the degree of asset integration systematically with prospect characteristics may be a reasonable alternative route.

As a first step towards testing the zooming hypothesis, to adjust base consumption to the time frame of the prospects, we have made base consumption a linear function of the number of months of the time horizon in the second model in Table 3. The predicted discount rate distributions by length of time horizon are presented in Fig. 2a while the predicted magnitude effects are presented in Fig. 2b.

We observe that the variation in discount rates for alternative time horizons have been substantially reduced. The distributions are close to each other for three, six and 12 month horizons and are in the range of 60–130% for each of these time horizons while the range is higher, 120–160% for the one month horizon (for MK 10,000 and one week delay in initial point in time). Comparing this to the base model also shows that the magnitude effects were reduced by the zooming in time horizon, as can be seen by comparing Figs. 1b and 2b. However, the magnitude effects are still highly significant (Table 3) for smaller amounts with a distribution in the range 170–220% for MK 1000 versus a range of 60–120 for MK 20,000.

Zooming model 2 adjusts base consumption linearly both in time horizon and magnitude (model 3 in Table 3) and the time horizon and magnitude variations are predicted in Fig. 3a and b.

Figure 3a and model 3 in Table 3 show that there still is a significant inverse relationship between time horizon and the average discount rate. This linear zooming therefore under-adjusts for time horizon. On the other hand, the model appears to have over-adjusted for magnitude as the signs have switched in model 3 in Table 3 and are significant and this change is also observed when comparing Fig. 2b and 3b. However, the magnitude effects have become much smaller. These results therefore point in the direction of a zooming model that adjusts more strongly for time horizon and less strongly for magnitude. Our Zooming model 3 is such a model. This model uses quadratic adjustment in time horizon and square-root adjustment in magnitude. This is model 4 in Table 3 and with predicted time horizon and magnitude effects in Fig. 4a and b respectively.

The model appears to perform well in both dimensions with respect to eliminating time horizon and magnitude effects, except for the smallest magnitudes and shortest time horizons, which may be associated with a discontinuous shift towards very narrow framing. We should remember that all models were adjusted for individual variation in estimated levels of relative risk aversion. Fig. 5 shows the distribution of relative risk aversion in the sample as estimated from the four monetary Holt and Laury type of MPLs.Footnote 8 With CRRAs in the range 0.65–0.95 discount rates have been adjusted downward but we see from Fig. 4a and b that the rates remain much higher than that found in Denmark by Andersen et al. (2008). One reason for this could be that our respondents are much poorer and poverty may be associated with liquidity constraints and high discount rates (Holden et al. 1998).

The experiments included treatments with the initial point either delayed or current to test for present bias (quasi-hyperbolic discounting). Table 3 reveals significant present bias in the form of higher discount rates when the near point in time is the present. The zooming adjustment somewhat reduced the coefficient for present bias in the zooming models but it remained significant and positive. To examine its size we have predicted the discount rates from the base model and compared it with Zooming model 3 for larger amounts (MK 10,000) and 12 month horizon and for small amounts (MK 1000) and short time horizon (3 months).

Figures 6 and 7 show the model’s prediction of discount rates when the initial point is the present and when the initial point is delayed for larger amounts (10,000 MK) and 12 month horizons (Fig. 6) as well as for smaller amounts (1000 MK) and three month horizons (Fig. 7). The extent of the present bias appears to exist for larger and smaller amounts and for alternative time horizons and remains significant after the zooming adjustment in base consumption.

As a robustness check we included other socio-economic variables in both the discount rate and the Luce error component of the jointly estimated model. The results are presented in Appendix Table A2 for the base model without zooming adjustment and for Zooming model 3. The basic results do not change significantly although some of the socio-economic variables were significantly correlated with the discount rate as well as the Luce error.

8 Discussion

As we have shown, when zooming adjustments are applied to base consumption, hyperbolic discounting and magnitude effects are removed from the estimated preference representation. The estimated preferences after zooming adjustment take the standard form of expected utility with constant relative risk aversion and exponential discounting.

These preferences may be regarded, in the terminology of Hausman (2016) as the “purified” preferences that would actually maximize the welfare of the agent. In this interpretation, the higher the level of zooming out, the closer actual choices are to purified preferences. Zooming in, by contrast, produces a focus on normatively irrelevant features of the problem, resulting in behavioral effects such as hyperbolic discounting.

However, as Infante et al. (2016) argue, there are serious psychological and philosophical problems associated with the idea of preference purification, implying as it does the existence of an inner rational agent trapped in an outer psychological shell. Hence, it may be more appropriate to take observed choices as representative of preferences, regardless of the level of zooming.

On either interpretation, zooming adjustments in base consumption may explain both hyperbolic discounting and magnitude effects. Adjusting base consumption may therefore be theoretically more appropriate than adjusting the discounting function to the time horizon or the magnitudes of decision prospects if we want a model that is closer to how people actually behave and handle the alternative prospects in these experiments. However, this supposition should be further tested with alternative data sets.

9 Conclusion

As stated by Loewenstein and Prelec (1992), no simple theory can hope to account for all motives that influence a particular decision. In this paper, we have proposed a zooming model based on the idea of bounded awareness and reference dependent utility. We hope that the model will contribute to a deeper understanding of certain anomalies in intertemporal choice: hyperbolic discounting and magnitude effects.

Doubt about the existence of these phenomena has arisen because they have been mostly identified in hypothetical experiments that do not meet the quality standards of experimental economics (Andersen et al. 2014). Based on an incentive-compatible field experiment with prospects characterized by alternative time horizons and magnitudes, we demonstrate that these phenomena are highly significant and cannot be explained by present bias/quasi-hyperbolic discounting. They are, however, consistent with the zooming model proposed here. On the other hand, our findings indicate that small amounts and short horizons are associated with additional mark-ups of discount rates and that our zooming theory cannot explain present bias (quasi-hyperbolic discounting).

Future research should aim to further test the model by examining more explicit questions about how respondents integrate their decisions with their background consumption and/or by more explicitly framing the background consumption that respondents should consider when making their decisions. Furthermore, it will be important to test the model in different environments to assess the conditions for its dominance versus more holistic modes of framing intertemporal prospects to which respondents may switch.

Notes

See Frederick et al. (2002) for a review of early studies and Andersen et al. (2010) for a more recent review.

Quiggin (2015) uses the terms ‘reduction’ and ‘coalescence’ respectively.

A prospect is a good or amount of money received at a specific point in time. The individual is assumed to integrate this good or additional budget item into its utility function. However, this integration is partial and more partial the smaller or less significant the amount or good is.

The finding of limited asset integration in studies of risk preferences implies risk aversion in small stakes gambles (Binswanger 1981; Rabin 2000). Base consumption is therefore in risk preference models typically modelled as a small amount and to be different from total wealth of respondents (Andersen et al. 2008). We make the same assumption of limited asset integration in time preference models and formulate base consumption levels accordingly.

The functional form for zooming adjustment may be explored empirically through calibration. We cannot rule out that respondents consciously also adjust their discount rate if alternative borrowing and lending opportunities are there for alternative prospects. Our experimental data come from an area where such opportunities are very poorly developed, possibly explaining high shadow discount rates. There is evidence of high discount rates in such settings (Holden et al. 1998).

MK = Malawi Kwacha, US$1 = MK 284 at the time of the experiments (August 2012).

The field protocols for these experiments are included in the Appendix.

More details on this estimation are available from the authors upon request.

References

Ainslie, G. (1991). Derivation of rational economic behavior from hyperbolic discount curves. American Economic Review, 81(2), 334–340.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2008). Eliciting risk and time preferences. Econometrica, 76(3), 583–618.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2013). Discounting behaviour and the magnitude effect: Evidence from a field experiment in Denmark. Economica, 80, 670–697.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2014). Discounting behavior: A reconsideration. European Economic Review, 71, 15–33.

Barberis, N., Huang, M., & Thaler, R. H. (2006). Individual preferences, monetary gambles, and stock market participation: A case for narrow framing. American Economic Review, 96(4), 1069–1090.

Benhabib, J., Bisin, A., & Schotter, A. (2010). Present-bias, quasi-hyperbolic discounting, and fixed costs. Games and Economic Behavior, 69(2), 205–223.

Binswanger, H. P. (1980). Attitudes toward risk: Experimental measurement in rural India. American Journal of Agricultural Economics, 62(3), 395–407.

Binswanger, H.P., (1981). Attitudes toward risk: Theoretical implications of an experiment in rural India. The Economic Journal, 91(364),867–890.

Chung, S. H., & Herrnstein, R. J. (1967). Choice and delay of reinforcement. Journal of the Experimental Analysis of Behavior, 10(1), 67–74.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351–401.

Grant, S., & Quiggin, J. (2013). Inductive reasoning about unawareness. Economic Theory, 54(3), 717–755.

Halpern, J., & Rego, L. (2014). Extensive games with possibly unaware players. Mathematical Social Sciences, 70, 42–58.

Hausman, D. M. (2016). On the econ within. Journal of Economic Methodology, 23(1), 26–32.

Heifetz, A., Meier, M., & Schipper, B. (2006). Interactive unawareness. Journal of Economic Theory, 130(1), 78–94.

Holden, S. T., Shiferaw, B., & Wik, M. (1998). Poverty, market imperfections, and time preferences: Of relevance for environmental policy? Environment and Development Economics, 3, 105–130.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1655.

Infante, G., Lecouteux, G., & Sugden, R. (2016). Preference purification and the inner rational agent: A critique of the conventional wisdom of behavioural welfare economics. Journal of Economic Methodology, 23(1), 1–25.

Kőszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics, 121(4), 1133–1165.

Kőszegi, B., & Rabin, M. (2007). Reference-dependent risk attitudes. American Economic Review, 97(4), 1047–1073.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. Quarterly Journal of Economics, 112(2), 443–478.

Laury, S. K., McInnes, M. M., & Swarthout, J. T. (2012). Avoiding the curves: Direct elicitation of time preferences. Journal of Risk and Uncertainty, 44(3), 181–217.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. Quarterly Journal of Economics, 107(2), 573–597.

Mosley, P., & Verschoor, A. (2005). Risk attitudes and the ‘vicious circle of poverty’. The European Journal of Development Research, 17(1), 59–88.

Pender, J. L. (1996). Discount rates and credit markets: Theory and evidence from rural India. Journal of Development Economics, 50(2), 257–296.

Prelec, D., & Loewenstein, G. (1991). Decision making over time and under uncertainty: A common approach. Management Science, 37(7), 770–786.

Quiggin, J. (2015). The value of information and the value of awareness. Theory and Decision, 80(2), 167–185.

Rabin, M., (2000). Risk aversion and expected‐utility theory: A calibration theorem. Econometrica, 68(5), 1281–1292.

Read, D., Loewenstein, G., Rabin, M., Keren, G., & Laibson, D. (1999). Choice bracketing. In Fischhoff, Baruch and Manski, Charles F. (Eds.), Elicitation of Preferences (pp. 171–197). Dordrecht: Springer Netherlands

Samuelson, P. A. (1937). A note on measurement of utility. The Review of Economic Studies, 4(2), 155–161.

Schipper, B. (2015). The unawareness bibliography. http://www.econ.ucdavis.edu/faculty/schipper/unaw.htm.

Thaler, R. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8(3), 201–207.

Wik, M., Kebede, T. A., Bergland, O., & Holden, S. T. (2004). On the measurement of risk aversion from experimental data. Applied Economics, 36(21), 2443–2451.

Yesuf, M. (2004). Risk, time and land management under market imperfections: Applications to Ethiopia. Unpublished PhD dissertation, Gotenburg: Gotenburg University.

Yesuf, M., & Bluffstone, R. A. (2009). Poverty, risk aversion, and path dependence in low-income countries: Experimental evidence from Ethiopia. American Journal of Agricultural Economics, 91(4), 1022–1037.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

Funding for fieldwork for this research comes from Norwegian University of Life Sciences and the International Maize and Wheat Center (CIMMYT). Valuable comments have been received from Olvar Bergland, Glenn Harrison and Ferdinand Vieider.

Electronic supplementary material

ESM 1

(PDF 565 kb)

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Holden, S.T., Quiggin, J. Bounded awareness and anomalies in intertemporal choice: Zooming in Google Earth as both metaphor and model. J Risk Uncertain 54, 15–35 (2017). https://doi.org/10.1007/s11166-017-9254-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-017-9254-2

Keywords

- Intertemporal choice

- Hyperbolic discounting

- Magnitude effects

- Google Earth

- Zooming

- Limited asset integration

- Field experiment

- Calibration test