Abstract

We develop a method for extracting “other information” from the articulation between bottom-line accounting numbers and stock prices. We posit that “other information” captures future earnings growth originating from conservative accounting recognition principles as demonstrated by Penman and Zhang (2020) and Penman and Zhu (2022), as well as nonzero net present value investment opportunities. Our findings confirm that “other information” is strongly associated with various proxies for expected future earnings growth and firm risk attributes. Furthermore, we show how a structural expected return model incorporating our “other information” estimate can predict out-of-sample future stock returns and generate sizeable long-short return spreads.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A substantial number of accounting-based valuation studies recognize that a gap exists between the stock price and the valuation implied by bottom-line accounting numbers, the so-called “other information” (henceforth, 𝜗).Footnote 1 Given evidence that the value relevance of bottom-line accounting numbers has declined and loss-making firms have become more common in recent decades, a better understanding of 𝜗 becomes increasingly important to financial statement users and standard setters.Footnote 2 The identification and measurement of 𝜗, however, pose substantial challenges due to its unobservable nature and indeterminacy of dimensionality. In this paper, we uncover 𝜗 from the articulation between the stock price and bottom-line accounting numbers and validate its valuation implications.

While the stock price capitalizes the projection of a firm’s future earnings and earnings growth, the bottom-line accounting numbers, namely earnings and (cum-dividend) book value, only record the “certainty” portion of value-added from past transactions and defers the recognition of more risky components of economic benefits until the underlying risk is largely resolved (Penman & Zhang, 2020; Penman & Zhu, 2022). An “other information” term is consequently required to bridge the gap between the stock price and the valuation implied by bottom-line accounting numbers. In this paper, we develop a method to estimate 𝜗. We start from a parsimonious linear valuation model that accommodates accounting conservatism and estimate 𝜗 as the difference between the stock price and a linear combination of bottom-line accounting numbers. By design, the 𝜗 estimate summarizes all value-relevant information beyond current earnings and (cum-dividend) book values, adjusted for risk.

The concept of 𝜗 captures the capitalized future earnings and earnings growth that are yet to be recognized in current earnings and book values. Its omission in the financial statements can be attributed to two related, but distinct, effects. First, according to conservative accounting principles, the riskier components of economic benefits associated with past transactions are deferred to the future until that risk is resolved; hence, the generation of future earnings growth is tied to risk. That is, holding the firm’s lifelong earnings stream constant, such a deferral mechanism creates 𝜗 by matching the earnings recognition to the underlying uncertainty resolution process.Footnote 3 Second, the firm may face nonzero-NPV investment opportunities that represent valuable operating options. These options, if exercised at a future date, would alter the firm’s lifelong earnings stream. Holding the accounting policy constant, any valuation changes due to changes in the firm’s future investment opportunities would be reflected in 𝜗.Footnote 4

Our empirical examination focuses on assessing the validity of 𝜗 estimates. First, we show that firms that appear to exhibit more conservative accounting and face more valuable future investment opportunities tend to have a larger proportion of their equity values that is attributable to 𝜗. These results suggest that both accrual accounting and real investment opportunities jointly explain equity valuation beyond bottom-line accounting numbers. In addition, we show that 𝜗 strongly predicts future earnings growth even after controlling for expected growth proxies, as identified by Penman and Zhu (2014, 2022) (henceforth, PZ) and other studies. We also provide evidence that 𝜗 significantly predicts one-year-ahead equity risk attributes such as stock beta, downside beta, idiosyncratic volatility, and stock returns. Collectively, these tests validate the role of 𝜗 in conveying signals for evaluating expected earnings growth and the embedded riskiness in growth.

As an empirical application, we examine the usefulness of our 𝜗 estimate in constructing out-of-sample expected return measures. We derive a characteristic expected return expression that combines the book-to-market ratio, forward earnings yield and the 𝜗-to-price ratio. It can be viewed as a concise version of PZ’s expected return model.Footnote 5 Unlike PZ, we do not use historical return data to estimate the return-characteristic relation nor carry forward the weights attached to the characteristics in implementing our expected return model. Instead, we seek a forward-looking construction by utilizing the transformation of valuation parameter estimates as obtained through the Ashton and Wang (2013) regressions at the industry level. We show that our expected return estimates predict one-year-ahead realized stock returns almost one-to-one in the cross-section, consistent with expected returns being optimal statistical forecasts of future realized returns. These results hold even after controlling for future cash flow news and discount rate news, as well as other leading return predictors. In addition, the discount rate news proxy based on our expected return estimates exhibits highly significantly negative coefficients with contemporaneous returns, consistent with notion that a rise in the discount rate depresses the stock price (Easton & Monahan, 2005; Lee et al. 2020).Footnote 6 Further portfolio analysis reveals that our expected return estimates generate an ex ante near-monotonic decile ranking of one-period-ahead realized stock returns. Specifically, an investor following a long-short portfolio strategy based on the extreme deciles earns an 10.40% hedge return per annum on average, and there is no evidence of reversal in the hedge portfolio returns up to five years ahead.

We extend the valuation literature in two important aspects. First, we characterize and quantify the missing link between stock price and bottom-line accounting numbers. Our “other information” variable naturally connects to expected future earnings and earnings growth resulting from conservative accounting principles and future nonzero-NPV investment opportunities, and conveys risk. It complements bottom-line accounting numbers in explaining risky earnings growth and expected stock returns. It is estimated from a reverse engineering procedure using the stock price, current book value, (forward) earnings, and dividends, as well as industry-wide information. We recognize implicitly the joint effect of future cash flow growth and the riskiness associated with the growth on valuation. This is in contrast to the conventional valuation approach that estimates growth in expected cash flows and riskiness as separate value attributes.

Second, by giving empirical content to “other information”, our study directs fundamental analysis to evaluate long-term expected earnings growth. By relating a hypothesized source of growth to 𝜗, one can validate how much the market is willing to pay for that growth. Given the evidence that growth stocks appear to outperform value stocks for over a decade,Footnote 7 understanding what the market is paying for beyond bottom-line accounting numbers becomes increasingly crucial for understanding the changing investment landscape. From the standard setter’s perspective, it comes down to whether detailed financial statement analyses can add to the understanding of 𝜗. Barth et al. (2019) show that while the value relevance of bottom-line accounting numbers has decreased over time, the decrease is compensated by detailed accounting line items. Our study further suggests that the incremental value relevance of an accounting line item likely depends on how the underlying accounting procedure handles risky expected growth or how it reveals future investment opportunities.

In addition, we propose a new approach for estimating firm-level expected stock returns. There are a few noticeable differences between our expected return estimates and those found in the existing literature. Unlike in applications of the implied cost of capital (ICC) models (e.g., Claus and Thomas, 2001; Gebhardt et al. 2001; Easton, 2004), implementing our expected return model does not require separate assumptions about risk and long-term growth. Instead, we rely on the 𝜗 term to capture the joint valuation implications of risky growth, to ascertain whether our 𝜗 estimate is internally consistent in the sense that it jointly reflects the co-determination of expected earnings growth and associated risk (Penman, 2016). Moreover, our forward-looking estimation procedure does not rely on historical returns for its model calibration, contrary to existing characteristic models for expected returns (e.g., Lyle et al. 2013; Penman & Zhu2014, 2022).Footnote 8 We use only time t data and allow both the characteristics and valuation weights to be updated when new information becomes available.Footnote 9 While our firm-specific expected return estimates use the industry cost of capital as a component, we provide evidence showing that deviations of firm-specific characteristics from their respective industry averages play a more important role in predicting future returns. Hence, our expected return model can be thought of as a hybrid model that combines appealing features of both ICC and characteristic models.

The rest of the paper is organized as follows. Section 2 explains the motivation and relation to prior literature. Section 3 details the theoretical foundations and estimation procedure. Section 4 describes the sample and obtains empirical estimates of the valuation multiples. Section 5 examines the usefulness of the 𝜗 estimate for explaining expected growth and firm risks. Section 6 constructs the expected return estimates and validates their out-of-sample performance. Section 7 presents additional analyses and robustness checks. Section 8 concludes the paper.

2 Motivation and relevant literature

“Other information” (𝜗) has been recognized as an important valuation construct since Ohlson (1995). The fundamental analysis literature seeks to identify observable elements of 𝜗 to inform investment strategies. Value relevance studies also invoke the concept of “other information” to articulate the relevance of certain accounting measurements. Corporate finance studies often draw links between certain managerial practices and 𝜗 to study their valuation consequences. Conceptually, 𝜗 summarizes all value-relevant information that is beyond earnings and (cum-dividend) book values, adjusted for risk.

Feltham and Ohlson (1995) assert that there are two major avenues in which earnings and book values fail to capture all NPVs of future earnings and earnings growth. First, conservative accounting principles require that the riskier components of economic benefits originating from past transactions are deferred to the future. The deferral can be exemplified by the immediate expensing of costs associated with internally generated intangibles, aggressive asset depletion schedules, asymmetric asset impairments, deferred revenue recognition, and so forth. In this manner, earnings are shifted across reporting periods, given a lifelong earnings stream. Therefore, accounting conservatism induces predictable future earnings growth, which is priced in by the market through 𝜗.

Second, “virtually all accounting procedures do not recognize today the expected net present value of future investment projects” (Feltham & Ohlson, 1995, pp.718-719). Future positive-NPV investment opportunities represent operating options that managers exercise at their discretion. Holding the accounting policy constant, the valuation may change when investors anticipate exercising such options, thus reflecting an additional source of expected future earnings growth. In other words, 𝜗 represents the NPVs added by not only the deferred expected earnings growth originating from past transactions but also the expected long-term earnings growth associated with future investment projects, adjusted for risk. In some instances, the valuation effects of the two sources of growth may not be easily disentangled. In fact, they are often jointly in action. For example, R&D activities may bring more investment opportunities within reach of the firm’s competencies, but the underlying risk in the R&D outcome means that accounting must defer the recognition of the expected payoff as earnings and booked assets.

Risk and uncertainty are intrinsically linked to earnings growth attributable to accounting conservatism and future investment opportunities. The accounting deferral mechanism is essentially driven by the underlying risks of expected future earnings so that earnings are recognized only when the associated uncertainty is resolved (Penman & Reggiani, 2013). Therefore, conservative accounting to a certain extent creates 𝜗 by matching the earnings recognition to the underlying uncertainty resolution process (Penman & Zhang, 2020). While investment opportunities may have positive NPVs ex ante, there is often some significant risk that a firm may forgo profitable investment projects due to capacity constraints or even undertake projects that turn out to yield negative NPVs. In other words, the ex post value attributed to these investment opportunities eventually depends on the firm’s capacity to exercise the option and other factors that may change the expected profitability of the investment projects, all of which are at risk today. Hence, 𝜗 also reflects risk from the firm’s investment opportunity set. Furthermore, consistent with the modern economics of accounting, where book values of assets can be expected to generate a risk-free rate of return under conservative accounting principles, the associated future earnings/cash flows are then viewed as certainty equivalents (Christensen & Feltham, 2009; Cochrane, 2009). Consequently, the risk element measured by the covariance between risky earnings/cash flows and the stochastic discount factor must be included in 𝜗. Therefore, 𝜗 reflects not only expected earnings growth but also the associated risk that determines the discount rate in valuation.

The conceptual and practical importance of 𝜗 in valuation has been largely overlooked in the extant literature. For example, studies often directly regress stock prices on contemporaneous bottom-line accounting numbers and treat the fitted value of the regression as the intrinsic equity value, where the error from estimation is attributed to mispricing. Using this approach, Rhodes-Kropf et al. (2005) decompose the market-to-book ratio into the market-to-intrinsic value and intrinsic value-to-book components and find that the former (latter) is a positive (negative) predictor of the firm’s future mergers and acquisitions activities. We argue that 𝜗 constitutes a correlated omitted variable in this analysis. Omitting 𝜗 can lead to inconsistent estimates for the valuation weights of the accounting numbers and thus erroneous intrinsic value estimates. Indeed, it is expected that firms facing more investment opportunities and thus higher 𝜗 embedded in their stock prices are more likely to pursue growth through mergers and acquisitions (Levine, 2017). A similar critique applies to several studies of how market mispricing affects corporate policies such as earnings management, corporate governance, corporate investments, and the value-versus-growth anomaly.Footnote 10

However, estimating 𝜗 has proved to be a challenging task. Two common approaches have been used to quantify it in the literature. The first approach attempts to extract 𝜗 from the difference between the expected abnormal earnings based on the consensus analyst forecasts of earnings and the abnormal earnings predicted from an AR(1) model in the Ohlson (1995) framework (e.g., Dechow et al. 1999). The second approach attempts to identify observable variables that may contain information for incremental future cash flows as proxies for 𝜗 (e.g., Myers, 1999).Footnote 11 Unfortunately, these attempts to measure and incorporate 𝜗 in valuation models have failed to consistently deliver material improvement in applications for several reasons. First, as argued above, 𝜗 by its very nature embeds the market’s expectations on both short-term and long-term earnings growth. It possesses a multidimensional property, and its nature is likely to be context-specific.Footnote 12 Calibrating an observable accounting proxy that sufficiently aggregates such information may be impractical. Second, as 𝜗 is defined relative to bottom-line accounting numbers, its identification requires a framework that allows for accounting conservatism. Third, 𝜗 must reflect the joint effects of expected earnings growth and the risk adjustment (i.e., the discount rate). It suggests that the expected earnings growth and the associated risk need to be simultaneously co-determined (Penman, 2016).Footnote 13

In a slightly different context, PZ motivate a valuation and expected return model that effectively incorporates some elements of 𝜗. Specifically, they argue that the effects of conservative accounting principles can be partially captured by various line items from the financial statements. Therefore, accounting ratios based on these line items should bear signals about expected earnings growth and the associated risks as a result of conservative accounting practices. For instance, PZ argue that several balance-sheet growth measures, including operating accruals and change in net operating assets, imply partial realizations of growth potentials and resolution of risks originating from past transactions and thus are inversely related to future growth and risk. Based on their characteristic model, they find that, in addition to current book value and earnings, these accounting ratios can reliably predict two-year-ahead earnings growth. They further show that the same set of ratios appear to be consistently priced in ex ante expected returns, beyond current earnings and book values. Their results provide support to the notion that 𝜗 should capture expected earnings growth and the riskiness in that growth.

In this paper, we develop a new approach to measuring 𝜗 based on a reverse-engineering procedure. Our approach extends and complements PZ’s work in several aspects. First, given that 𝜗 is latent, a bottom-up identification strategy (as in PZ) is unlikely to capture all the factors that contribute to it. There may be an inexhaustible list of accounting ratios that could be constructed to capture some of the conservatism effects. Furthermore, 𝜗 also captures nonzero NPVs that are added by future investment opportunities, which are beyond the recognition scope of almost all accounting procedures and thus largely unexplored in the PZ analysis. Therefore, we pursue a top-down approach and rely on the stock price as an efficient information aggregation mechanism to reduce the high-dimensionality of 𝜗 into an observable scalar value. After all, assuming market efficiency, any information is value-relevant if and only if it is priced.

Second, while PZ’s analysis qualitatively links accounting conservatism with future growth and riskiness in that growth, we seek to quantify the net valuation effect attributable to 𝜗. By construction, the 𝜗 estimate that is derived from our approach reflects expected growth only to the extent that it adds nonzero NPV. Conceptually, it is possible that a source of earnings growth is value-neutral if the risk premium associated with such earnings growth in the discount rate completely offsets the growth.Footnote 14 This makes our measurement potentially useful for evaluating managerial practices. For example, an option to enter a new product market may add future earnings and earning growth, but it may not necessarily add value if the underlying risk is too high.

3 Estimation procedure

Our estimation procedure is outlined as follows. First, we express stock price as a linear combination of the (cum-dividend) book value, earnings, and 𝜗. We then follow Ashton and Wang (2013) and Wang (2018) to recast this general linear expression into a cross-sectional earnings forecasting model. Next, we estimate this model by industry-year to recover the industry average valuation parameters. To the extent that firms in the same industry operate in a similar business environment and apply similar accounting policies, these industry average parameter estimates serve as reasonable conditional averages for the firm-specific valuation multiples. Finally, we insert the obtained parameter estimates and firm-specific accounting numbers back into the linear valuation model. This yields an explicit estimate of 𝜗 as the difference between the observed stock price and the resultant linear combination of bottom-line accounting numbers.

Ohlson (1995) and Feltham and Ohlson (1995) show that the market price of equity can be expressed as a linear function of current accounting fundamentals and a variable summarizing other value-relevant information under the following three assumptions. First, required return is defined by the no-arbitrage condition: \(\mathbb {E}_{t}[P_{t+1}+d_{t+1}]=RP_{t}\), where Pt is the stock price, dt is net dividend (net of capital contribution) at time t, R equals the gross rate of required return, and \(\mathbb {E}_{t}[.]\) is the expectation operator conditional on information available at time t. Second, the clean surplus accounting relation holds: bt = bt− 1 + xt − dt, where bt is book value of equity and xt is accounting earnings. Third, the future abnormal earnings can be predicted by the current bottom-line accounting numbers and an unidentified 𝜗 in a linear fashion. Pope and Wang (2005) further extends this framework by incorporating accounting conservatism manifested in abnormal book value growth as an additional predictor of abnormal earnings. Under these assumptions, equity value can be summarized by the following simple linear pricing rule:

where 𝜗t denotes “other information” that is priced by the market but not yet captured by bottom-line accounting numbers.Footnote 15 This specific form is consistent with the Miller and Modigliani (1961) dividend irrelevance proposition, as book value and dividend compensate each other one-for-one.

Given the linear combination of accounting fundamentals, bt + α1(bt + dt) + α2xt, the term 𝜗t represents the value-relevant other information reflected in the market but not booked in accounting. Equation 1 echoes the notion that, when buying a stock, investors not only buy the value implied by current earnings and book value, but also the expected earnings growth reflected in 𝜗. For simplicity, we assume that 𝜗t follows an autoregressive AR(1) process:Footnote 16

where ϕ > 0 is restricted by the transversality condition such that it is allowed to be higher than one plus the cost of equity capital for only some finite periods. ε𝜗,t+ 1 is a zero-mean error term. We view (ϕ − 1) as the firm’s expected growth rate in 𝜗, which changes every period based on the new information that becomes available.

To estimate 𝜗, we need to estimate a set of valuation parameters, α1, α2, and ϕ, in Eqs. 1 and 2. We obtain these estimates using the method developed in Ashton and Wang (2013). Specifically, we first replace 𝜗t = Pt − (1 + α1)bt − α2xt − α1dt by invoking the linear pricing rule of Eq. 1. Under the no-arbitrage dividend condition and clean surplus accounting, Eqs. 1 and 2 then imply that the expected earnings can be written as:Footnote 17

Equation 3 establishes an intrinsic link between prices and expected earnings and reflects the notion that prices lead earnings. That is, prices forecast future earnings beyond the information reflected in current earnings and book values. Note that Eq. 3 holds without an error term, where the valuation parameters (α1, α2, ϕ, R) are the “true” firm-specific parameters conditional on time t information. While the firm-specific parameters in the model are latent, their sample averages can be estimated from a portfolio of reasonably homogeneous firms, given a measure for \(\mathbb {E}_{t}[x_{t+1}]\).Footnote 18 Hence, for each cross-section of firms at time t, Eq. 3 has the feature of a random coefficient model. The sample average estimates can then be used to approximate the firm-specific parameters.

Following a longstanding capital market practice, we estimate the valuation parameters by industry-years. Specifically, we deflate both sides of Eq. 3 by Pt and run the following regression model:

where the dependent variable FEt,t+ 1 is the analysts’ consensus one-period-ahead earnings forecast formed at t and serves as our proxy for market earnings expectations, \(\mathbb {E}_{t}[x_{t+1}]\). This implies that the imprecision in recovering the true firm-specific parameters from Eq. 4 may arise from two sources: the measurement error in FEt,t+ 1 and the random deviations of the firm-specific valuation parameters from their industry averages. We denote the estimated industry-level parameters as \(\overline {\alpha }_{1}\), \(\overline {\alpha }_{2}\), \(\overline {\phi }\), and \(\overline {R}\).

From Eq. 1, it follows that the firm-level 𝜗 can then be estimated as:

The estimated 𝜗 term, \(\hat {\vartheta }_{it}\), captures future growth as reflected in current prices and the current state of the industry, but not as manifested in the firm’s bottom-line accounting numbers. Notably, our estimation procedure uses only time t information, which ensures that the accounting numbers, stock prices, earnings forecasts, and valuation weights are based on the same information set. This is due to fact that our model is based on a partial equilibrium condition that holds at every industry-year.

Although the estimates for the valuation parameters and 𝜗 are subject to estimation error, to what extent the measurement error problem detracts from the usefulness of the model is an empirical question. If the industry-level valuation parameters (\(\overline {\alpha }_{1}\), \(\overline {\alpha }_{2}\)) are consistent estimates of the firm-specific valuation parameters (αi1, αi2), then

approaches zero, and, thus, on average, we have consistent estimates of 𝜗. The measurement error described in Eq. 6 has the following properties: the error is independent of the current price; the variance of the error increases with either the variance of α1 or α2; and the consistent estimation of individual α1 and α2 is a sufficient but not necessary condition for the consistent estimation of 𝜗.

4 Data and estimates

4.1 Data description

Our empirical analysis draws data from three sources: (1) analysts’ forecasts and stock price information from I/B/E/S; (2) accounting data from Compustat, and (3) stock return data from CRSP. We construct a base sample of all firms listed in NYSE, AMEX, and NASDAQ and identified at the intersection of the three databases from 1985 to 2015. We exclude all non-equity issues, such as ADRs, as indicated by the CRSP share code (SHRCD). Following prior studies, to mitigate the effect of extreme values, we delete observations with a book-to-price ratio (bt/Pt) lower than 0.01 or higher than 100, earnings yield (xt/Pt) lower than − 1 or higher than 1, or stock price lower than $0.5. The estimation sample consists of 88,702 firm-year observations over 11,157 firms. Table 1 summarizes our sample selection procedure. The subsamples employed in subsequent validation tests may vary depending on availability of additional variables required. All variables used in the study are defined in Appendix.

We conduct our tests using per-share data adjusted for stock splits and stock dividends. The market expectation of one-year-ahead earnings, \(\mathbb {E}_{t}[x_{t+1}]\), is measured using the median analyst forecast, FEt,t+ 1, observed four months after the fiscal year-end. We accumulate one-year-ahead buy-and-hold stock returns, Rt+ 1, from May of year t + 1 to April of year t + 2. We follow the recommendation by Shumway (1997) and apply a − 33% adjustment for delisting returns.

Table 2 provides sample descriptive statistics of the input variables used in the estimation of Eq. 4. The mean and median of book-to-market ratio (bt/Pt) are 0.61 and 0.51, comparable to those reported in prior studies. The forward earnings yield, FEt,t+ 1/Pt, is higher than the trailing earnings yield, xt/Pt, at all reported percentiles of their distributions, consistent with expected earnings being less affected by negative accruals. Accruals (Acct) have a negative mean and median, consistent with prior findings that accruals tend to have more income-decreasing items. Net operating asset growth (ΔNOAt), percentage sales growth rate (Salegt), investments in property, plant & equipment (Investt), and net external financing (Exft) all have positive means and medians, indicating that firms typically experience positive growth. The average one-period-ahead buy-and-hold return, Rt+ 1, is 12% with a large standard deviation of 48%. Overall, the distributions of input variables and key firm characteristics are within the expected ranges reported in prior studies.

4.2 Model estimates

We estimate (4) by industry and year using the equal-weighting one-step generalized method of moments (GMM). Although the regression model is non-linear in the valuation parameters, Slutsky’s theorem ensures that consistent estimation of the linear coefficients leads to consistent estimation of the re-parameterized model parameters (Hayashi, 2000). In our baseline analysis, the estimation of Eq. 4 is conducted over 12 industries for each year, using the industry classification provided by Kenneth French’s data library.Footnote 19 We test the robustness of our results to alternative industry classifications and other grouping criteria in Section 7.

Table 3 Panel A presents the average GMM estimates of the valuation parameters. Column (1) reports the time series averages of industry required returns \(\overline {R}\). The time series average expected return is 8.5%, similar to what is reported in prior studies.Footnote 20 Column (2) shows that the average growth in 𝜗, (\(\overline {\phi }-1\)), is positive and statistically significant, suggesting that investors typically anticipate that the firm’s long-term growth opportunities will expand. Table 3 columns (3) and (4) show that \(\overline {\alpha }_{1}\) is statistically insignificant and close to zero in most years, and that \(\overline {\alpha }_{2}\) is positive in all years. Furthermore, these observations suggest that the incremental role of earnings increases over time when valuation anchors on book value. Table 3 Panel B compares the average valuation multiples by industry. For instance, average growth in 𝜗, (\(\overline {\phi }-1\)), is only 1.68% in the manufacturing sector but reaches 13.19% in the healthcare sector. They suggest that industry membership is an important source of variation in valuation multiples, thus lending support to our industry-specific estimation of valuation parameters.

We construct the other information estimate \(\widehat {\vartheta }_{t}\) according to Eq. 5. To capture the relative importance of 𝜗 in the stock price, we scale the estimate by stock price, \(\widehat {\vartheta }_{t}/P_{t}\). Figure 1 plots the annual averages of this ratio over time separately for the five industry sectors, also from French’s data library. On average, 𝜗 accounts for approximately 50% of the stock price, indicating that 𝜗 is indeed an important valuation component. This ratio varies considerably over time and across industry sectors. For example, \(\widehat {\vartheta }_{t}/P_{t}\) reached almost 100% in the healthcare industry in 1997, but dipped into the negative region in the finance industry (included in the “Others” sector) during the 2008 financial crisis.

5 “Other information” and risky earnings growth

In this section, we present evidence that delineates the drivers of 𝜗 and the implications for a firm’s future earnings growth and associated risk attributes.

5.1 Accounting conservatism effect

While the stock price capitalizes the projection of a firm’s lifelong earnings stream, accounting earnings and book value growth are credited only by the “certainty” portion of value-added from past transactions, and the recognition of more risky components of value creation is deferred until the underlying risk is largely resolved. Such deferrals under conservative accounting principles give rise to 𝜗. We empirically examine whether 𝜗 manifests the accounting conservatism effect by regressing the estimate \(\widehat {\vartheta }_{t}/P_{t}\) on several firm-specific proxies for accounting conservatism.

We apply three commonly used conservatism measurements in our analysis.Footnote 21 We first use ΔNOAt to (inversely) measure conservatism. PZ argue that the accounting recognition of balance sheet growth implies the resolution of uncertainty, reducing the deferral of earnings and book value growth. Therefore, we expect ΔNOAt to be negatively associated with the 𝜗 estimate.Footnote 22 We then use the difference between realized stock return and the ratio of current earnings over lagged stock price as the second measure of conservatism. This measure is essentially the difference between economic earnings and accounting earnings scaled by beginning-of-the-period stock price, and it captures the conservatism in earnings recognition (Zhang, 2000). Finally, we consider the Cscoret developed by Penman and Zhang (2002). It estimates the “reserves” created by conservative accounting through aggressive expensing of R&D and advertising expenditures. Table 4 Panel A shows that \(\widehat {\vartheta }_{t}/P_{t}\) is indeed negatively associated with the first measure and positively related to the other two, supporting the notion that accounting conservatism can induce 𝜗.

5.2 Investment opportunity effect

Our 𝜗 construct not only reflects the conservatism effect but also captures the value attributable to the firm’s future investment opportunities. Intuitively, the equity value of the firm depends not only on the “recursion value” of its assets-in-place but also, at least in part, on exercising future investment opportunities by the firm. While the former is partly proxied by the linear combination of (cum-dividend) book value and earnings (adjusted for accounting conservatism as discussed above), the latter is factored into stock prices without affecting the accounting numbers; thus, it must manifest in the 𝜗 term.Footnote 23 To validate this interpretation, we examine whether our 𝜗 estimate is associated with reasonable proxies for the firm’s investment opportunities.

We consider several proxies for investment opportunities used in prior studies.Footnote 24 Specifically, we alternately estimate the association of 𝜗 with the firm’s patent stock, R&D intensity, and asset redeployability (Cao et al. 2008; Trigeorgis & Reuer, 2017; Grullon et al. 2012; Kim & Kung, 2017). Table 4 Panel B reports the regression estimates. In these regressions, we control for the PZ growth proxies to partial out the effects of accounting conservatism on 𝜗. The estimates show that the firm’s equity value attributable to 𝜗 is higher when the firm accumulates more innovation outputs, reinvests more in inventive activities, or has the ability to redeploy assets to alternative production technologies.

5.3 “Other information” and expected earnings growth

A key implication of 𝜗 is that it can forecast expected earnings growth. From the accounting conservatism perspective, accounting deferrals shift current earnings and book value growth to future periods, inducing expected earnings growth without affecting the firm’s total lifelong earnings. From the perspective of investment opportunities, the firm can expand the scope and scale of its operations, charging incremental future earnings growth beyond the earnings stream implied by the status quo production technology. Both mechanisms suggest that 𝜗 should be positively related to expected future earnings growth.

Figure 2 shows the empirical distribution of \(\hat {\vartheta }_{t}/P_{t}\) by the quintile of analysts’ consensus long-term growth estimates (LTGt), a proxy for analysts’ expectation of the firm’s earnings growth over the next three to five years. Strikingly, as LTGt increases, all quintiles of the distribution uniformly move rightwards, demonstrating a strong positive association between expected earnings growth and 𝜗.

Empirical distribution of \(\hat {\vartheta _{t}}/P_{t}\) by long-term growth quartiles. Note: This figure plots the kernel density distributions of \(\hat {\vartheta }_{t}/P_{t}\) by quartile of analysts’ consensus long-term growth estimates (Ltgt). LTG Qi denotes the ith quartile of Ltgt for i = 1,2,3,4

To examine the incremental predictive power of \(\hat {\vartheta }_{t}/P_{t}\) relative to other growth proxies, we estimate the following cross-sectional regression model:

where EGrowtht,t+h is a measure of the firm’s forward earnings growth from year t to year t + h, Yt denotes a vector of control variables, and Γ is a vector of corresponding coefficients. Following PZ, Eq. 7 controls for other determinants of earnings growth identified by PZ, including earnings yield (xt/Pt), book-to-market ratio (bt/Pt), change in net operating assets (ΔNOAt), accruals (Acct), investments in PP&E and inventories (Invt), external financing (Extft), firm size (Mcapt), and leverage (Levt). Admittedly, we can only observe future growth up to a finite horizon h in our empirical tests, so we cannot quantify all implications of \(\hat {\vartheta }_{t}/P_{t}\) for growth in the far distant future.

We estimate Eq. 7 by year and report the Fama and MacBeth (1973) estimates in Table 5. If \(\widehat {\vartheta }_{t}/P_{t}\) has incremental information content in explaining the expected earnings growth, then we expect β > 0. In Panel A, we use \(\widehat {\vartheta }_{t}/P_{t}\) to forecast future realized growth. In Table 5 columns (1) to (3), the dependent variables EGRt,t+h (h = 2,3,4) are h-year-ahead earnings growth defined as follows:Footnote 25

In Column (4), we consider the 4-year compound annual growth rate in sales,

as an additional growth proxy, because the growth embedded in 𝜗 may realize into sales before earnings in the finite horizon. The estimates in Panel A show that, for all four growth proxies, the β coefficients are positive and statistically significant at the 1% level. The coefficients are also economically significant. For example, the estimates in Table 5 column (1) imply that a one-standard-deviation increase in \(\widehat {\vartheta }_{t}/P_{t}\) is associated with an incremental increase in EGRt,t+ 2 equivalent to 30.1% of its standard deviation.

In Panel B, we replicate the regressions with four alternative growth metrics implied by analysts’ forecasts to test whether the market’s current growth expectation is associated with 𝜗. Through columns (1) to (4), we consider analysts’ long-term growth estimates (LTGt) and implied earnings growth (IEGRt,t+h, with h = 2,3,4). IEGRt,t+h is defined the same way as EGRt,t+h, except that realized future earnings (xt+h) are replaced with analysts’ h-year-ahead earnings forecasts observed at year t. The results based on these measures remain similar to those in Panel A. Overall, the results in Table 5 indicate that other information, as implied by our model, captures sizeable cross-sectional variation in expected future earnings growth.

5.4 “Other information” and firm risk

Both the accounting conservatism effect and investment opportunity effect suggest that 𝜗 should also indicate firm risk. On the one hand, conservatism is an accounting response to the risk in the economic benefits associated with past transactions. This implies that the larger the portion of value that is attributable to 𝜗, the greater the risk that is associated with future earnings and earnings growth. On the other hand, the NPVs of future investment opportunities are uncertain and at the risk of not being realized. Therefore, 𝜗 indicates not only expected growth but also risk to the firm.

We extend our analysis to examine the ability of 𝜗 to capture future firm risk attributes. We estimate the following regression model:

where Riskt+ is a proxy for the firm’s forward risk and where the set of control variables Yt are the same as those specified in Eq. 7. Again, we conduct the Fama-MacBeth estimation of Eq. 10 and report the results in Table 6.

In Panel A, we examine how 𝜗 is associated with future stock market risk attributes. The first risk attribute is the firms’ capital asset pricing model (CAPM) beta, Betat+ 1, a conventional measure of the stock’s systematic risk exposure. The second measure is the downside CAPM beta, \(Beta^{Down}_{t+1}\), which focuses on the firm’s exposure to negative aggregate market news. The third measure is the idiosyncratic volatility, IV olt+ 1, which has been shown to bear asset pricing consequences after controlling for systematic risk. Lastly, we also consider one-year-ahead return, Rt+ 1, as a dependent variable, because its predictable component is a comprehensive measure of priced risk in asset pricing theory. For all measures of equity risk, we find highly significant positive coefficients of \(\widehat {\vartheta }_{t}/P_{t}\), suggesting that 𝜗 is indeed associated with elevated levels of riskiness. We note that a one-standard-deviation rise in \(\widehat {\vartheta }_{t}/P_{t}\) implies an incremental 11.2% increase in a typical firm’s downside beta (see Table 6 column 2).

In Panel B, we examine how 𝜗 relates to forward volatility in various fundamental performance measures. The results show that \(\widehat {\vartheta }_{t}/P_{t}\) positively forecasts the volatility of quarterly return on equity, cash flow from operations, sales growth, and profit margin over the three-year period. This suggests that the stock market risk implications of 𝜗 are congruent with implications of 𝜗 for fundamental performance risks. Collectively, the results in Tables 5 and 6 support the role of our 𝜗 estimate in capturing expected earnings growth as well as the riskiness in that growth.

6 Application: estimating expected returns

To validate the usefulness of the estimates of 𝜗, we construct a characteristic expected return model that incorporates 𝜗 and examine its out-of-sample predictive ability for stock returns. The no-arbitrage condition, clean surplus relation, and Eqs. 1 and 2 together imply the following total required return expression (with added firm subscript i for precision):

where \(\boldsymbol \upbeta = \left [ (1 + \alpha _{1}), (1+ \alpha _{1} + \alpha _{2}) , \phi \right ]\) and \(\mathbf {Z}_{it} = \left [\frac {b_{it}}{P_{it}}, \frac {\mathbb {E}_{t}[x_{it+1}]}{P_{it}}, \frac {\vartheta _{it}}{P_{it}}\right ]\).

Equation 11 describes the expected one-period-ahead return as a linear function of book-to-market ratio, forward earnings yield, and the price-deflated 𝜗. Consistent with Eq. 1, we expect that the last term in Eq. 11, \(\mathbb {E}_{t}[\vartheta _{t+1}] = \phi \vartheta _{t}\), summarizes the implications of long-term earnings growth for risk and expected returns beyond book value and earnings. Penman and Zhang (2020) show theoretically that earnings growth and earnings yield convey information about expected stock returns under conservative accounting. The return expression also closely resembles the return-characteristic relation employed in PZ, except that we do not require explicit proxies for long-term growth and we base our earnings yield on forward earnings rather than realized earnings.Footnote 26

We use three industry-level estimates, (\(\overline {\alpha }_{1}\), \(\overline {\alpha }_{2}\), \(\overline {\phi }\)), in place of the firm-specific parameters in Eq. 11 to construct expected firm-specific return estimates. In other words, we construct the firm-level expected return from Eq. 11 by combining cross-sectional industry average parameter estimates and the firm-level book-to-price ratio, forward earnings yield, and the estimated 𝜗-to-price, as follows:

where \(\overline {\boldsymbol \upbeta } \equiv \left [ (1 + \overline {\alpha }_{1}), (1+ \overline {\alpha }_{1} + \overline {\alpha }_{2}), \overline {\phi } \right ]\) and \(\widehat {\mathbf {Z}}_{it} \equiv \left [\frac {b_{it}}{P_{it}} , \frac {FE_{it,t+1}}{P_{it}}, \frac {\widehat {\vartheta }_{it}}{P_{it}} \right ].\)

The above estimation procedure bears the notable feature that we use only time-t information to construct time-t expected future returns. Hence, this is a forward-looking approach and can be used to describe ex ante market perceptions.Footnote 27 If the industry-based parameters (\(\overline {\alpha }_{1}\), \(\overline {\alpha }_{2}\), \(\overline {\phi }\)) are all consistent estimates of the firm-specific valuation parameters (α1, α2, ϕ), then the expected difference between the true firm expected return of Eq. 11 and our expected return estimate of Eq. 12, \(R_{it} - \widehat {R}_{it} = \boldsymbol \upbeta \mathbf {Z}_{it}^{\prime } -\overline {\boldsymbol \upbeta }\widehat {\mathbf {Z}}_{it}^{\prime } \), would be zero. Hence, consistent estimation of all the valuation parameters yields consistent estimation of the firm’s true expected returns.

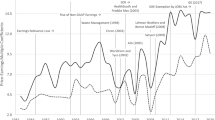

Figure 3 visualizes the time-series evolution of the average expected return estimates and the implied risk premiums. The risk premium appears to rise after major market shocks such as the 2001-2002 dot-com bubble burst, the 2007-2008 financial crisis, and the 2010-2011 European sovereign debt crisis. This is consistent with the notion that risk premiums are higher in adverse market and economic environments. Importantly, the parameter \(\bar {\phi }-1\), which captures the expected expansion of 𝜗, appears to contribute some sensitivity of the expected return estimates to temporal macroeconomic conditions. Specifically, all estimates of \(\bar {\phi }-1\) are positive and around 2.5% except for the years 2008-2009, when \(\bar {\phi }-1\) drops sharply to -3% due to the extremely depressed prospects in business activities. These observations seem to echo the Ashton and Wang (2013) interpretation of \(\bar {\phi }-1\) as a proxy for expected macroeconomic growth prospects.

Time series plot of expected return estimates. This figure plots the expected return estimates (ER), expected risk premiums (RP), and the growth rates in “other information”, (\(\overline {\phi }-1\)), over the sample period 1985 to 2015. The solid line and the dashed line plot the average expected return estimates and the risk-free rates for each year. The dotted line plots the yearly averages of the estimated long-term growth rate of 𝜗, \(\overline {\phi }-1\). The shaded bars between the solid and dashed lines indicate the annual averaged expected risk premiums

6.1 Return forecast regressions

We examine the usefulness of incorporating the 𝜗 estimate in the context of predicting stock returns out-of-sample. Following the prior literature, our validation methodology is based on a tautological decomposition of realized stock returns (Vuolteenaho, 2002; Easton & Monahan, 2005). Specifically, the log-transformed realized return (rt+ 1 = log(1 + Rett+ 1)) is approximately the sum of the log-transformed expected return (ert), cash flow news (cfnt+ 1), and discount rate news (drnt+ 1):

While the expected return is known at time t, the two news components are contemporaneous and not predictable ex ante. We specify the following regression model:

where \(er_{t} = log(1+\widehat {R}_{it})\). If the empirical proxies on the right-hand side are perfect, Eq. 14 should coincide with Eq. 13, implying δ1 = δ2 = δ3 = 1. Since empirical measures of these three return components involve measurement errors, the construct validity of the expected return estimates can be jointly assessed by how closely their regression coefficients in Eq. 14 are from their theoretical values of one.

The cash flow news proxy is defined as follows:

where roet+ 1 = log(1 + xt+ 1/bt), froet,t+ 1 = log(1 + FEt,t+ 1/bt), and κc is the expected persistence of roet+ 1 estimated from a two-year cross-sectional hold-out sample for each industry.Footnote 28 The number 0.96 is approximately equal to one minus the historical average of dividend yield.

The discount rate news is calculated as

where \(\bar {r}\) and κr are the constant and persistence parameters of an assumed first-order auto-regressive process for log-transformed expected returns, \({er}_{t+1} = \bar {r} + \kappa _{r} \times er_{t}+ \varepsilon ^{\mu }_{t+1}\). Because our measure of expected return admits time variation, our proxy for drnt+ 1 slightly differs from that used in Easton and Monahan (2005), which applies to models assuming constancy in expected returns.

We estimate Eq. 14 alternately using panel regressions controlling for year fixed effects and Fama-MacBeth regressions. Table 7 reports the results. Column (1) shows that, after controlling for year fixed effects, ert positively predicts one-year-ahead stock returns on a univariate basis. The predictive coefficient is 0.87, which is statistically significant at the 1% level. In column (2), after controlling for contemporaneous news proxies, the coefficient of ert is raised to 1.03 and remains highly significantly different from zero but statistically indistinguishable from the theoretical value of one. Column (3) further shows that adding additional return predictors does not impair the loading on our expected return estimates. Columns (4) to (6) present qualitatively similar results and support similar inferences using Fama-MacBeth regressions. Importantly, 27 (23) out of the 30 annual cross-sectional regressions produce positive (and statistically significant) coefficient estimates for ert across the specifications in Columns (4) to (6), demonstrating the stability of its return predictability. Turning to our news proxies, we find that cfnt+ 1 (drnt+ 1) receives large and highly significant positive (negative) coefficients across all specifications. Notably, the negative coefficients on drnt+ 1 imply that discount rate changes based on our expected return estimates induce large negative revisions in contemporaneous stock prices, further supporting the validity of ert as an expected return proxy. In Table 7 Columns (5) and (6) cfnt+ 1 (drnt+ 1) receives positive (negative) coefficients in all of the 30 annual cross-sectional regressions. In comparison, Easton and Monahan (2005) find that most existing implied cost of capital estimates do not load sufficiently large return predictive coefficients, and their derived discount rate news proxies exhibit weak explanatory power for contemporaneous returns.

6.2 Portfolio analysis

An important question in evaluating the usefulness of an expected return measure is whether investors can expect to earn economically meaningful gains if they form portfolios based on this measure. Therefore, we conduct portfolio analysis to test whether a long-short strategy based on the expected return estimates, ert, is associated with sizable out-of-sample gains. This approach is also useful in mitigating the measurement error problems in firm-level expected return estimates (which confound inferences in Table 7), as firm-level measurement errors are smoothed out at the portfolio level. Specifically, we form 10 portfolios of stocks based on decile rankings of firms’ expected return estimates and observe the subsequent annual buy-and-hold returns for each of the years t + 1 to t + 5. Table 8 reports time series averages of these portfolio returns. At the one-year horizon, our expected return estimate, ert, generates a near-monotonic ranking of realized returns. An investor following a zero-cost investment strategy going long on the tenth decile portfolio and short on the first decile portfolio is expected to generate a hedge return of 10.40% (t-statistic 2.64), which is both statistically significant and economically large.

Furthermore, extending the buy-and-hold horizon to the fifth year, we find no sign of reversal in the gains earned in the first year. This suggests that the one-year-ahead return spread is unlikely to be caused by mispricing, corroborating the risk-based interpretation. Moreover, the apparent demise of return predictability beyond the first year after portfolio formation is mostly driven by the rebounce of the low extreme decile portfolios. If the investor buys the tenth decile and shorts on the second decile portfolios, she can still expect approximately 5% annual hedge returns from the second year onward, and these return spreads are marginally statistically significant. Therefore, our expected return estimate maintains a modest level of return predictability over the long term for most of the stocks. Collectively, the results in Tables 7 and 8 demonstrate the usefulness of the new expected return measure developed by incorporating our 𝜗 estimate.

6.3 Return predictability of industry costs of capital and firm-specific adjustments

One of the valuation parameters we uncover from estimating (4) by industry-year is the industry cost of capital \(\overline {R}\). We can further show that our firm-specific expected return estimates are equal to \(\overline {R}\) adjusted by deviations in the firm fundamentals from their respective industry averages. Specifically, the expected return estimate for firm i in industry j can be re-expressed as:

where \((\frac {{FE}_{t, t+1}}{P_{t}})_{j}\), \((\frac {x_{t}}{P_{t}})_{j}\), \((\frac {b_{t}}{P_{t}})_{j}\), and \((\frac {b_{t-1}}{P_{t}})_{j}\) denote the industry averages of \(\frac {{FE}_{t, t+1}}{P_{t}}\), \(\frac {x_{t}}{P_{t}}\), \(\frac {b_{t}}{P_{t}}\), and \(\frac {b_{t-1}}{P_{t}}\), respectively.Footnote 29 This is intuitive since the firm-level expected return should be able to be expressed as industry cost of capital adjusted for deviations of the firm’s characteristics from those of industry counterparts. Given that industry cost of capital is widely used in practice, the above explicit relation raises an interesting question: What is the incremental return predictability of firm-specific characteristics relative to the firm’s industry cost of capital?

To investigate the explanatory power of the industry average cost of capital (\(\overline {R}_{jt}\)) and the firm-specific characteristic adjustments (i.e., the last four terms in Eq. 17 or, equivalently, \(\widehat {R}_{it} - \overline {R}_{jt}\)), we re-estimate the regressions in Table 7 after replacing ert with \(er^{ind}_{t} = log(1+\overline {R}_{jt})\) and \(er^{firm}_{t} = log(1+\widehat {R}_{it} - \overline {R}_{jt})\). Table 9 Panel A reports the return forecast regression estimates. The results show that, while both components have positive predictability for future stock returns across most specifications, the predictive coefficients on the firm-specific components are notably larger and more significant. These estimates suggest that the firm-specific adjustments to average industry required returns yield important forward-looking risk-relevant information.

Furthermore, we conduct a 5×5 double-sorted portfolio analysis to dissect the relative importance of the two expected return components. We first sort stocks in each annual cross-section into quintiles by industry cost of capital, \(\overline {R_{j}}\), then further sort stocks within each quintile portfolio into sub-quintiles by the firm-specific component \(\widehat {R}_{it} - \overline {R}_{jt}\). Table 9 Panel B reports the average one-year-ahead stock returns for the resulting 25 portfolios. While returns appear to be increasing in both dimensions of sorting, the relation is considerably stronger by the firm-specific dimension. This conditional double-sorting strategy allows us to focus on the incremental return predictability of the firm-specific component when holding the industry component constant. Across all quintiles sorted by \(\overline {R_{j}}\), a conditional quintile sorting on \(\widehat {R}_{it} - \overline {R}_{jt}\) yields sizeable hedge returns ranging from 4.6% to 13.1%, all statistically significant at the 1% level. In comparison, the hedge return spreads generated by \(\overline {R_{j}}\) range from 0.28% to 6.18% and are only statistically significant within three quintile portfolios sorted by \(\widehat {R}_{it} - \overline {R}_{jt}\).Footnote 30

Overall, these results suggest that while industry- and firm-specific components complement each other in predicting stock returns, the return predictive ability of \(\widehat {R}_{it}\) is largely attributable to its firm-specific characteristic adjustments.

7 Robustness tests

In this section, we discuss a number of robustness tests that we perform to examine the sensitivity of our results to alternative empirical design choices.

7.1 Ignoring “other information”

One may argue that the return predictive ability of our expected return estimates may be driven entirely by the information conveyed by forward earnings yield and book-to-market ratios. To check for this possibility, we estimate expected returns by restricting 𝜗 to zero. Untabulated results show that the cross-sectional return predictive regression coefficients are considerably lower, ranging from 0.21 to 0.39, and the average one-year-ahead extreme decile portfolio hedge return is about half as large as that reported in Table 8. These findings indicate that 𝜗 is an important contributor to the construction of meaningful expected return estimates.

7.2 The importance of industry grouping

One innovation in our estimation procedure is the use of industry average valuation multiples to approximate the firm-level counterparts. This method assumes that firms in the same industry have common exposure to similar input and product market conditions, and thus their accounting numbers and value drivers have more comparable implications for valuation. To examine the importance of this approach, we estimate (4) again in the cross-section without any industry grouping and repeat all subsequent analyses. In this case, the ability of 𝜗 to explain growth and firm risk and the return predictive ability of the resulting expected return estimates become considerably weaker. For example, we note a return predictive coefficient of 0.34 (t-stat 2.12) for the univariate specification and of 0.46 (t-stat 2.66) after controlling for cash flow news and discount rate news in the Fama-MacBeth return forecast regressions. This analysis elucidates the importance of industry grouping in improving model performance.

7.3 Alternative industry classifications

We also check whether our results hold for alternative industry classifications. In the main tests, we apply a 12-industry classification scheme. Intuitively, using the valuation parameters estimated from a portfolio of firms with greater homogeneity should generate more accurate estimates of firm-specific parameters. Clearly, there is a trade-off between more granular industry classifications and statistical reliability in estimations. We assess the sensitivity of our results to alternative industry classifications by repeating the analyses presented in Tables 5, 6 and 7 using the Fama-French 5-industry classification. Table 10 columns (1) to (3) report the regression estimates using the Fama and MacBeth (1973) regressions. Notably, we find that our 𝜗 estimate is strongly associated with expected earnings growth and future risk attributes. Moreover, the resulting expected return measures significantly predict the cross-section of future returns out-of-sample.

We also consider other criteria to achieve homogeneous groupings of firms. First, we consider tercile partitions based on firm size or book-to-market within each of the Fama-French five industries. Furthermore, in a smaller sample using panel regressions controlling for year fixed effects, we replicate the analyses using the Hoberg and Phillips (2016) text-based industry networks when estimating (4). All attempts return similar results to those in our main analyses.

7.4 Excluding loss firms

We examine the sensitivity of our results to a sample that excludes loss-making firms. One potential concern is that loss-making firms may have significant impact on the estimation results, as the connection between their accounting numbers and stock prices may differ from profitable firms. To address this concern, we repeat our analyses by excluding firms with negative earnings before estimating the industry-level valuation parameters. Table 10 columns (4)-(6) report the Fama and MacBeth (1973) regression results. Again, the results suggest that the exclusion of loss firms does not alter our main inferences as reported in Tables 5, 6, and 7.

8 Conclusion

Established valuation theories have long celebrated the existence of an “other information” (𝜗) variable that bridges the gap between stock prices and the value embedded in bottom-line accounting numbers. We show how this other information captures the net present value-added by anticipated yet uncertain future investment opportunities, as well as risky earnings growth originating from conservative recognition principles. We also posit that although expected future earnings growth may add to stock valuation, the risk associated with that growth countervails its value implications. Therefore, 𝜗 manifests the net effect of future earnings growth and the riskiness in that growth.

We characterize and quantify 𝜗 from the articulation between bottom-line accounting numbers and stock price. 𝜗 is estimated from a reverse engineering procedure using stock price, current book value, and forward earnings and dividends, as well as industry-wide information. A battery of empirical validation tests show that the 𝜗 estimate is highly associated with the firm’s accounting conservatism and future investment opportunities, and that it yields significant predictive power for future earnings growth and risk attributes.

Finally, we demonstrate the economic significance of 𝜗 in an application of constructing out-of-sample expected return estimates. We derive a structural expected return expression that explicitly incorporates the 𝜗 term and examine its ability to predict stock returns out-of-sample. We find that our expected return estimates can significantly predict future realized stock returns (even after controlling for future cash flow news and discount rate news) and generate sizeable long-short return spreads. Furthermore, while both industry average required return and deviations in firm characteristics from the respective industry averages complement each other in predicting firm-specific returns, the return predictive ability is largely attributable to the latter component.

Notes

Ohlson (1995) is the first to introduce the term to summarize factors not captured by current abnormal earnings that contribute to the prediction of future abnormal earnings and thus equity value.

For example, Barth et al. (2019) find that bottom-line accounting numbers explain smaller fractions of stock price variations over time. Joos and Plesko (2005) show that as short-term losses become more frequent, an increasingly important component of valuation is attributable to the terminal value.

In a mark-to-market accounting, all nonzero-NPV investments are captured in the book value, and 𝜗 becomes redundant. In that sense, 𝜗 is a natural consequence of accrual accounting.

The investment opportunity effect is distinct from the accounting conservatism effect in the sense that it is attributed to anticipated future transactions, while virtually all accounting recognition rules apply to past transactions.

Our one-period-ahead expected return is conceptually different from the implied cost of equity capital in prior accounting-based valuation literature. The so-called implied cost of equity capital is the constant long-run average discount rate that equates the capitalized future cash flows to price, while our expected return is specifically designed to predict one-year-ahead stock returns.

As per the Vuolteenaho (2002) firm-level return decomposition framework, discount rate news is associated with a one-for-one decrease in realized returns. While prior studies often regard a positive return predictive ability of expected return estimates as evidence of their construct validity, it is often neglected that innovations in valid expected return proxies must be negatively associated with contemporaneous stock returns.

See, for example, Otani (2020).

Note that prior literature uses t + 1 period returns to estimate t period coefficients attached to the characteristics, while we use all time t information to estimate the coefficients. Prices are also arguably less noisy than returns. This is because future dividends are uncertain even if ex-dividend prices do not change.

The valuation weights that are calibrated using historical data may not be consistent with real-time investor expectations. We independently estimate the valuation weights for each year from a partial equilibrium condition that must hold at every t, so the estimated valuation weights, earnings expectations, accounting numbers, and stock prices are based on the same information set by design.

Myers (1999) uses the firm’s order backlog and capital expenditure as proxies for 𝜗. A large body of value-relevance literature also relates certain observable variables to 𝜗. These papers regress stock prices or returns on variables of interest after controlling for bottom-line accounting numbers (e.g., Lev and Zarowin, 1999; Barth et al. 2001, 2005). If the estimated coefficient is statistically significant or the adjusted R-squared increases, then the variable is regarded as value-relevant. However, this strand of literature does not help measure or quantify 𝜗 in the implementation of valuation models.

For instance, the customer acquisition and retention rates may be the key signals for a SaaS (software as a service) startup’s long-term earnings growth, as its future profitability depends crucially on the economies of scale. In contrast, for a pharmaceutical company, long-term growth or survival may depend on the company’s ability to win patent races to secure a sustained monopoly in its addressable market.

When using a stand-alone asset pricing model and historical stock returns to estimate the discount rate, some temporal variations of earnings and the business cycle may be “priced out” in current stock prices (Christensen & Feltham, 2009).

In the words of Penman (2016, p.114): “If expected earnings growth is discounted because it is risky, that growth does not add to price.”

Throughout the paper, we suppress the firm subscripts when there is no chance of confusion. The linear pricing rule is more general than it may appear. Pope and Wang (2000) extend the linear pricing rule in a setting incorporating stochastic discount factors. Ang and Liu (2001) show that this linear form is preserved for a class of affine processes with any specification of the set of value-relevant firm fundamentals and any latent dynamics of the expected risk premiums under certain conditions.

We could explicitly include other variables in the dynamic, such as a conservatism adjustment term as per Ashton and Wang (2013). Note, also, that 𝜗t itself can be expressed as a nonlinear function of accounting and non-accounting variables.

The implied dynamic of earnings in Eq. 3 is in sharp contrast to linear information dynamics introduced in Ohlson (1995) and others. Note that dt is replaced by bt− 1 via the clean surplus relation. Since dividends are represented by the net dividend, it is more convenient to use bt− 1 in empirical estimation.

Note that in Hansen (1982) terms, the model is exactly identified since there are four “instruments” (Pt, xt, bt, and bt− 1) and four “parameters” (α1, α2, ϕ, and R). In fact, Ashton and Wang (2013) run annual cross-sectional estimations of this model to obtain average cost of capital estimates for the market and industries.

Note that there is no commonly accepted firm-specific measure of accounting conservatism. The book-to-market ratio has been used as a measure of conservatism, but it is not applicable here due to our research design.

Using other PZ variables such as accruals and investments will produce similar results, as these measures are similar to ΔNOAt by construction.

Importantly, conservative accounting recognition rejects transactions that are yet to take place.

This definition is used to accommodate small and negative denominators. If current earnings xt is positive and not too small, this definition produces growth measures close to the standard measure \(\sqrt [\leftroot {-2}\uproot {2}h]{1+(x_{t+h} - x_{t})/x_{t}}-1\).

Forward earnings are consistent with valuation theory and embed important information not captured by realized earnings, though the proxy is potentially biased. In an unreported test, we find that replacing forward earnings yield with realized earnings lowers the return predictive power, especially after controlling for cash flow news and discount rate news.

This is in contrast to the recursive estimation approach, which may use up to 10 years of lagged period observations. The corresponding expected return estimates using distant past information are, therefore, unlikely to indicate real time market expectations. Since our estimation requires only one-year-ahead forecasts of earnings, it also reduces the data availability requirement, compared to existing implied cost of capital models.

All estimates of κc are significantly below 1, thus rejecting the unit root null.

As long as the average of forecast errors for all firms in industry j is zero, Eq. 4 implies:

$$ \begin{array}{@{}rcl@{}} (\frac{{FE}_{t, t+1}}{P_{t}})_{j} = \frac{\overline{R_{j}} - {\overline{\phi_{j}}}}{1+{\overline{\alpha}_{1,j}} + {\overline{\alpha}_{2,j}}} + \frac{{\overline{\phi_{j}}} ({\overline{\alpha}_{1,j}} + {\overline{\alpha}_{2,j}})}{1+{\overline{\alpha}_{1,j}} + {\overline{\alpha}_{2,j}}} (\frac{x_{t}}{P_{t}})_{j} + \frac{{\overline{\phi_{j}}} - {\overline{\alpha}_{1,j}}-1 }{1+{\overline{\alpha}_{1,j}} + {\overline{\alpha}_{2,j}}} (\frac{b_{t}}{P_{t}})_{j} + \frac{{\overline{\phi_{j}}} {\overline{\alpha}_{1,j}} }{1+{\overline{\alpha}_{1,j}} + {\overline{\alpha}_{2,j}}} (\frac{b_{t-1}}{P_{t}})_{j} \end{array} $$Rearranging terms, one can express the industry required return as a linear combination of \((\frac {{FE}_{t, t+1}}{P_{t}})_{j}\), \((\frac {x_{t}}{P_{t}})_{j}\), \((\frac {b_{t}}{P_{t}})_{j}\), and \((\frac {b_{t-1}}{P_{t}})_{j}\). Then, combining this expression with Eq. 12, Eq. 17 follows immediately.

We also performed an alternative portfolio strategy that is based on within-industry decile rankings of \(\widehat {R}_{it}\). Such a strategy earns an average hedge return of 9.36%, accounting for most of the univariate hedge return reported in Table 8.

References

Ang, A., & Liu, J. (2001). A general affine earnings valuation model. Review of Accounting Studies, 6(4), 397–425.

Ashton, D., & Wang, P. (2013). Terminal valuations, growth rates and the implied cost of capital. Review of Accounting Studies, 18(1), 261–290.

Baker, M., Foley, C.F., & Wurgler, J. (2008). Multinationals as arbitrageurs: The effect of stock market valuations on foreign direct investment. The Review of Financial Studies, 22(1), 337–369.

Barth, M.E., Beaver, W.H., Hand, J.R., & Landsman, W.R. (2005). Accruals, accounting-based valuation models, and the prediction of equity values. Journal of Accounting. Auditing & Finance, 20(4), 311–345.

Barth, M.E., Beaver, W.H., & Landsman, W.R. (2001). The relevance of the value relevance literature for financial accounting standard setting: another view. Journal of Accounting and Economics, 31(1–3), 77–104.

Barth, M.E., Li, K., & McClure, C. (2019). Evolution in value relevance of accounting information. Stanford University Graduate School of Business Research Paper.

Brown, G., & Kapadia, N. (2007). Firm-specific risk and equity market development. Journal of Financial Economics, 84(2), 358–388.

Cao, C., Simin, T., & Zhao, J. (2008). Can growth options explain the trend in idiosyncratic risk? The Review of Financial Studies, 21(6), 2599–2633.

Chi, J.D., & Gupta, M. (2009). Overvaluation and earnings management. Journal of Banking & Finance, 33(9), 1652–1663.

Christensen, P.O., & Feltham, G.A. (2009). Equity valuation. Now Publishers Inc.

Claus, J., & Thomas, J. (2001). Equity premia as low as three percent? Evidence from analysts’ earnings forecasts for domestic and international stock markets. The Journal of Finance, 56(5), 1629–1666.

Cochrane, J.H. (2009). Asset pricing. Revised edition. Princeton University Press.

Dechow, P.M., Hutton, A.P., & Sloan, R.G. (1999). An empirical assessment of the residual income valuation model. Journal of Accounting and Economics, 26(1), 1–34.

Easton, P.D. (2004). Pe ratios, peg ratios, and estimating the implied expected rate of return on equity capital. The Accounting Review, 79(1), 73–95.

Easton, P.D., & Monahan, S.J. (2005). An evaluation of accounting-based measures of expected returns. The Accounting Review, 80(2), 501–538.

Fama, E.F., & MacBeth, J.D. (1973). Risk, return, and equilibrium: empirical tests. Journal of Political Economy, 81(3), 607–636.

Feltham, G.A., & Ohlson, J.A. (1995). Valuation and clean surplus accounting for operating and financial activities. Contemporary Accounting Research, 11(2), 689–731.

Gebhardt, W.R., Lee, C., & Swaminathan, B. (2001). Toward an implied cost of capital. Journal of Accounting Research, 39(1), 135–176.

Golubov, A., & Konstantinidi, T. (2019). Where is the risk in value? Evidence from a market-to-book decomposition. The Journal of Finance, 74(6), 3135–3186.

Grullon, G., Lyandres, E., & Zhdanov, A. (2012). Real options, volatility, and stock returns. The Journal of Finance, 67(4), 1499–1537.

Hansen, L.P. (1982). Large sample properties of generalized method of moments estimators. Econometrica: Journal of the Econometric Society, 1029–1054.

Hayashi, F. (2000). Econometrics. Princeton: Princeton University Press.

Hoberg, G., & Phillips, G. (2016). Text-based network industries and endogenous product differentiation. Journal of Political Economy, 124 (5), 1423–1465.

Joos, P., & Plesko, G.A. (2005). Valuing loss firms. The Accounting Review, 80(3), 847–870.

Kadyrzhanova, D., & Rhodes-Kropf, M. (2014). Governing misvalued firms. Working paper, National Bureau of Economic Research.

Kim, H., & Kung, H. (2017). The asset redeployability channel: how uncertainty affects corporate investment. The Review of Financial Studies, 30(1), 245–280.

Lee, C.M.C., So, E.C., & Wang, C.C.Y. (2020). Evaluating firm-level expected-return proxies: implications for estimating treatment effects. The Review of Financial Studies. hhaa066.

Lev, B., & Zarowin, P. (1999). The boundaries of financial reporting and how to extend them. Journal of Accounting research, 37(2), 353–385.

Levine, O. (2017). Acquiring growth. Journal of Financial Economics, 126(2), 300–319.

Lyle, M.R., Callen, J.L., & Elliott, R.J. (2013). Dynamic risk, accounting-based valuation and firm fundamentals. Review of Accounting Studies, 18(4), 899–929.

Miller, M.H., & Modigliani, F. (1961). Dividend policy, growth, and the valuation of shares. The Journal of Business, 34(4), 411–433.

Myers, J.N. (1999). Implementing residual income valuation with linear information dynamics. The Accounting Review, 74(1), 1–28.

Nekrasov, A., & Ogneva, M. (2011). Using earnings forecasts to simultaneously estimate firm-specific cost of equity and long-term growth. Review of Accounting Studies, 16(3), 414–457.

Ohlson, J.A. (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research, 11(2), 661–687.

Otani, A. (2020). Growth stocks outperforming value by widest margin in decades. News article. The Wall Street Journal.

Penman, S. (2016). Valuation: accounting for risk and the expected return. Abacus, 52(1), 106–130.

Penman, S., & Reggiani, F. (2013). Returns to buying earnings and book value: accounting for growth and risk. Review of Accounting Studies, 18(4), 1021–1049.

Penman, S., & Zhang, X.-J. (2020). A theoretical analysis connecting conservative accounting to the cost of capital. Journal of Accounting and Economics, 69(1), 101236.

Penman, S., & Zhu, J. (2022). An accounting-based asset pricing model and a fundamental factor. Journal of Accounting and Economics, 101476.

Penman, S.H., & Zhang, X.-J. (2002). Accounting conservatism, the quality of earnings, and stock returns. The Accounting Review, 77(2), 237–264.

Penman, S.H., & Zhu, J.L. (2014). Accounting anomalies, risk, and return. The Accounting Review, 89(5), 1835–1866.

Pope, P.F., & Wang, P. (2000). Risk adjusted equity valuation and accounting betas. Lancaster University Working Paper.

Pope, P.F., & Wang, P. (2005). Earnings components, accounting bias and equity valuation. Review of Accounting Studies, 10(4), 387–407.

Rhodes-Kropf, M., Robinson, D.T., & Viswanathan, S. (2005). Valuation waves and merger activity: the empirical evidence. Journal of Financial Economics, 77(3), 561–603.

Shumway, T. (1997). The delisting bias in crsp data. The Journal of Finance, 52(1), 327–340.

Trigeorgis, L., & Reuer, J.J. (2017). Real options theory in strategic management. Strategic Management Journal, 38(1), 42–63.

Vuolteenaho, T. (2002). What drives firm-level stock returns? The Journal of Finance, 57(1), 233–264.

Wang, P. (2018). Future realized return, firm-specific risk and the implied expected return. Abacus, 54(1), 105–132.

Zhang, X. -J. (2000). Conservative accounting and equity valuation. Journal of Accounting and Economics, 29(1), 125–149.

Acknowledgements