Abstract

This paper provides a new and complementary demand-side-oriented explanation for counter-cyclical pricing, which we define as the presence of more frequent price discounts during high-demand seasons than in low-demand seasons in seasonal product categories. Our study focuses on how an increase in marginal utility of consumption in high-demand seasons (resulting in a seasonal upward demand shift) can increase price elasticity in storable and frequently-purchased product categories, where consumers may exhibit forward-looking price expectations and engage in stockpiling and where consumption may be endogenous. We propose that during high-demand periods, a price discount is more likely to increase purchase quantities due to lower satiation of consumption and to increase total consumption which induces category expansion. This leads to higher price elasticity during high-demand periods than during low-demand periods as consumers have forward-looking price expectations and stockpile and/or consumption is endogenous. Thus, we present stockpiling and endogenous consumption as the consumer behavioral mechanisms behind counter-cyclical price elasticity. Unlike most existing studies, our proposed mechanisms capture forward-looking consumers’ dynamic trade-offs created by temporary price reductions and, therefore, shed light on the practice of counter-cyclical price promotion, as opposed to a seasonal change in mean prices. We investigate the roles of stockpiling and endogenous consumption using the framework of a dynamic inventory model with endogenous consumption by allowing consumption utility to be subject to exogenous seasonal fluctuation. Our model indicates that during high-demand periods, demand elasticity increases by 9.63% relative to low-demand periods, offering a motivation for counter-cyclical price promotion. Counterfactual experiments were done to validate the roles of the proposed mechanisms of stockpiling and endogenous consumption, both of which explain counter-cyclical patterns in price elasticity as individually, as well as collectively, when the marginal utility of consumption varies across seasons.

Similar content being viewed by others

Notes

We assign the maximum inventory of five units.

The output we report is based on the following parameter values: \((\alpha =-0.33, \theta _{h1}=1.33, \theta _{h2}=-0.47, \theta _{l1}=0.67, \theta _{l2}=0.23, \kappa =-0.1\)).

We want to emphasize the fact that our choice of product category is based on the seasonal nature of the category demand. In other words, we believe that the increase in soup demand during the winter is driven mainly by exogenous demand shocks, such as temperature, and not by lowered prices. In fact, a firm’s pricing can cause demand to increase; however, considering the robust conformity of the demand trend with the seasonal trend of temperature and anecdotal evidence for seasonal preference for soup, we believe that the demand shifts upward mainly due to an exogenous factor. Given the seasonality in demand on an a priori basis, the observed pattern of prices is a deviation from the prediction of standard economic theory, an increase in demand during high-demand periods.

A sale is defined as any price at least 10% below the mean price of a UPC in a store over the sample period.

Hendel and Nevo (2003) propose a similar framework to identify households’ stockpiling behaviors without studying consumption behavior and the evolution of consumption.

Calculating a consumption rate in this way, we assume that households are willing to maintain a certain level of inventory on hand and, thus, restock once the existing level of inventory falls below that level. The threshold level of inventory triggering a new purchase is not necessarily zero, but could be.

Note that some prices lower than the highest observed (or regular) prices are considered off-sale prices for the regressions. This definition may secure enough observations with off-sale prices during the high season, but the effects of a sale in our regressions might be underestimated.

To ensure that the patterns we report are robust, we run random-effect models for all four outcome variables. The results are similar, except that \(\phi _{1}\) for model (4) is moderately significant - i.e., \(\phi _{1}=1.83^{**}, p=0.03\). This may suggest that endogenous consumption is an ongoing behavior regardless of seasons for the canned soup category. However, the significant positive interaction term in the random-effect model (\(\phi _{3}=3.72^{***}\)) still supports the seasonality in endogenous consumption. The additional tables are available upon request.

It is worth noting that we do not postulate a causal relationship between inventory-carrying cost and consumption rate in this analysis. Households may accelerate their consumption of canned soup in order to reduce the carrying cost of canned-soup inventory. Or consumption of canned soup increases since households substitute other meal options with canned soup during sale periods. In either case, consumption rate is endogenous with respect to price or inventory.

In addition to the households’ purchase patterns, we also present additional descriptive evidence from a store-level data set and reduced-form-model results, both of which are consistent with the endogenous consumption in Appendix A and Appendix B, respectively. Also, we examine the households’ purchase patterns for other seasonal product categories and report in Appendix E. We find that our model may potentially be extended to the soft drinks category. Soft drinks exhibit counter-cyclical pricing and similar patterns in consumption expansion.

Package size is not modeled since the standard package size (18 oz) is dominant in this market. Non-standard package sizes are not used for model calibration.

The quadratic function allows for a flexible shape of the consumption utility including a satiation effect of consumption. Nevertheless, we do not impose any restrictions on parameter values during estimation, but instead rely on data variations to define the shape of the consumption utility.

We assume that a household’s decision to visit stores for a given time period does not depend on the inventory level of the focal category. The variation in the store-visit probability is statistically significant across households (one-way ANOVA, F(211,21836) = 11.83) but is not significant across seasons (two-sample t-test(22046) = 1.88). Thus, we obtain the empirical store-visit probability of each household from the data and assume that the store-visit probability is constant over time.

We provide the details of estimation procedures in Appendix C.

We estimate the full model using different discount factors - i.e., 0.95, 0.97 and 0.98 - but the results do not change qualitatively depending on discount factors. So, we report the results and simulations based on a discount factor of 0.95.

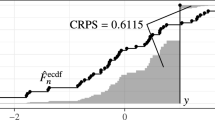

We compare the simulated price distribution based on the estimated price process with the sample price distribution in Appendix D.

We also estimate the models with more than two types of consumer segments - i.e., 3-segment and 4-segment models - but do not find a significant improvement of the model fit. Furthermore, the BIC index is not favorable to including more segments than two types.

The literature reveals that the inventory cost estimates for consumer packaged goods vary across a wide range: $0.01 for a 32oz bottle of ketchup (Erdem et al., 2003); $0.02-$0.75 for a 64oz bottle of laundry detergent (Hendel & Nevo, 2006); $0.3-$2.0 for an 11oz can of soup (Haviv, 2022). Our estimates for both types of consumers are relatively high compared to these estimates.

We report the model fit of all four models in Appendix D. The proposed full model fits the data better than the others. Accounting for endogenous consumption, among all the other model components, is critical to improve the model fit.

In order to hold the rest of the model assumptions constant, such as the seasonal difference in category preference and consumer heterogeneity, we calculate the weekly consumption rates separately for each season, and for two groups of households divided by the total soup purchase.

A baseline demand is simulated based on the choice probabilities for each brand-quantity option at mean prices from the data and zero beginning inventory. We then simulate the demand by decreasing the price for Campbell’s by 1%. Finally, we compare the new demand to the baseline demand to report the price elasticity. Prices are also simulated based on the estimates for the price process.

The price elasticity predicted by our model’s estimates roughly falls into the range found in the literature for other frequently purchased consumer goods: for example, 4.9 for ketchup (Erdem et al., 2003); 2.5-4.5 for laundry detergent (Hendel & Nevo, 2006); and 3.0-5.0 during high season and 1.8-3.3 during low season for tuna (Meza & Sudhir, 2006). Haviv (2022) finds a much lower elasticity for the same canned-soup category. That could be because he studies a sub-category of canned soup covered by a dominant monopoly firm, or because his model with search possibly under-predicts price elasticity, as a similar model with search does so for laundry detergent (Seiler, 2013).

In order to make Model A close to the full model, the constant rates of consumption are obtained from the expected consumption rates conditional on purchase, simulated using the full model. The constant rates of consumption are obtained separately by season and by consumer type. Note that for Model 1 reported in Table 7, the constant rates of consumption are obtained directly from the data. That is because the goal of Model 1 is to assess the bias that would have been produced if an alternative model ignored endogenous consumption in an estimation stage.

We also ran a counterfactual with non-seasonal price process that is otherwise the same as for the full model; both models allow for endogenous consumption. The result is similar under endogenous consumption and has essentially the same implication (9.63% for full model vs. 9.55% for counterfactual model with non-seasonal price process).

To simulate permanent price cuts, we lower the Campbell’s prices by 10% every week and re-calculate a new price process using the new price history. To rule out possibilities that existing seasonal difference in prices affect the demand, we use the same price history for both seasons. We simulate the demand for 100,000 households, and, to impute the initial beginning inventory, we drop the initial one year of the simulated demand. In simulating demand for counterfactual models, the intercepts are scaled up such that the average demand is comparable with that of the full model.

For this analysis, we use the Nielsen Retail Scanner Data to investigate the variation in sales across store formats, the variety of which is absent in the IRI Marketing Data Set.

Although we cannot discern the identity of individual retail chains in the data set, we find a couple of retail chains that exhibit stable price trends over time.

The high-demand periods are defined based on the observed sales trend in the data as follows: June through August and November for soft drinks, June through August for ice cream, and May through September for beer. Data for ice cream are from Nielsen Consumer Panel Data. We focus on bulk ice creams, a typical category sold by retailers.

References

Ailawadi, K. L, & Neslin, S. A. (1998). The effect of promotion on consumption: Buying more and consuming it faster. Journal of Marketing Research, 35(3), 390–398.

Bayot, D., & Caminade, J. (2015). Popping the cork: Why the price of champagne falls during the holidays? (pp. 1–006). Paper No: Kilts Booth Marketing Series.

Bell, D., Chiang, J., & Padmanabhan, V. (1999). The decomposition of promotional response: An empirical generalization. Marketing Science, 18(14), 504–526.

Bell, D. R., Iyer, G., & Padmanabhan, V. (2002). Price competition under stockpiling and flexible consumption. Journal of Marketing Research, 39(3), 292–303.

Bils, M. (1989). Pricing in a customer market. The Quarterly Journal of Economics, 104(4), 699–718.

Bronnenberg, B., Kruger, M., & Mela, C. (2008). Database paper - the IRI marketing data set. Marketing Science, 27, 745–748.

Butters, R. A., Sacks, D. W., & Seo, B. (2020). Why do retail prices fall during seasonal demand peaks? Working Paper

Chen, J., & Rao, V. R. (2020). A dynamic model of rational addiction with stockpiling and learning: An empirical examination of e-cigarettes. Management Science, 66(12), 5485–6064.

Chevalier, J., Kashyap, A., & Rossi, P. (2003). Why don’t prices rise during periods of peak demand? evidence from scanner data. American Economic Review, 93(1), 15–37.

Chiang, J. (1991). A simultaneous approach to the whether, what and how much to buy questions. Marketing Science, 10(4), 297–315.

Ching, A., Erdem, T., & Keane, M. P. (2009). The price consideration model of brand choice. Journal of Applied Economics, 24(3), 393–420.

Ching, A., & Erdem, T., & Keane, M. P. (2020). How much do consumers know about the quality of products? Evidence from the diaper market. The Japanese Economic Review, 71, 541–569.

Chintagunta, P. (1993). Investigating purchase incidence, brand choice and purchase quantity decisions of households. Marketing Science, 12(2), 184–208.

Erdem, T., Imai, S., & Keane, M. (2003). Brand and quantity choice dynamics under price uncertainty. Quantitative Marketing and Economics, 1, 5–64.

Erdem, T., Keane, M. P., & Sun, B. (2008). The impact of advertising on consumer price sensitivity in experience goods markets. Quantitative Marketing and Economics, 6, 139–176.

Erdem, T., Katz, M., & Sun, B. (2010). A simple test for distinguishing between internal reference price theories. Quantitative Marketing and Economics, 8, 303–332.

Gangwar, M., Kumar, N., & Rao, R. C. (2013). Consumer stockpiling and competitive promotional strategies. Marketing Science, 33(1), 94–113.

Gordon, B., & Sun, B. (2015). A dynamic model of rational addiction: Evaluating cigarette taxes. Marketing Science, 34(3), 452–470.

Guadagni, P., & Little, J. (1983). A Logit model of brand choice calibrated on scanner data. Marketing Science, 2(3), 203–317.

Guler, A., Misra, K., & Vilcassim, N. (2014). Countercyclical pricing: A consumer heterogeneity explanation. Economics Letters, 122, 343–347.

Gupta, S. (1989). Impact of sales promotions on when, what, and how much to buy. Journal of Marketing Research, 25, 342–355.

Hartmann, W. R., & Nair, H. S. (2010). Retail competition and the dynamics of demand for tied goods. Marketing Science, 29(2), 366–386.

Haviv, A. (2022). Consumer search, price promotions, and counter-cyclic pricing. Marketing Science, 41(2), 294–314.

Heckman, J. (1981). Heterogeneity and State Dependence, Studies in Labor Markets, Sherwin Rosen, ed., University of Chicago Press, 91–140.

Heckman, J., & Singer, B. (1984). A method for minimizing the impact of distributional assumptions in econometric models for duration data. Econometrica, 52(2), 271–320.

Hendel, I., & Nevo, A. (2003). The post-promotion dip puzzle: What do the data have to say? Quantitative Marketing and Economics, 1(4), 409–424.

Hendel, I., & Nevo, A. (2006). Measuring the implications of sales and consumer inventory behavior. Econometrica, 74(6), 1637–1673.

Ho, T.-H., Tang, C. S., & Bell, D. R. (1998). Rational shopping behavior and the option value of variable pricing. Management Science, 44(12), 145–160.

Kamakura W. A., & Russell G. J. (1989). A probabilistic choice model for market segmentation and elasticity structure. Journal of Marketing Research, 26, 379–390.

Kim, J. Y., & Ishihara, M. (2021). Evaluating the effect of soda taxes using a dynamic model of rational addiction. SSRN, 3892506

Krishnamurthi, L., & Raj, S. P. (1991). An empirical analysis of the relationship between brand loyalty and consumer price elasticity. Marketing Science, 10(2), 172–183.

Lal, R., & Matutes, C. (1994). Retail pricing and advertising strategies. Journal of Business, 67(3), 345–370.

MacDonald, J. (2000). Demand, information and competition: Why do food prices fall at seasonal demand peaks? The Journal of Industrial Economics, 48(1), 27–45.

Meza, S., & Sudhir, K. (2006). Pass-through timing. Quantitative Marketing and Economics, 4, 351–382.

Nevo, A., & Hatzitaskos, K. (2006). Why does the average price paid fall during high demand periods? The Center for the Study of Industrial Organization at Northwestern University Working Paper, 0086,

Nijs, V., Dekimpe, M., & Steenkamps, J. (2001). The category-demand effects of price promotions. Marketing Science, 20(1), 1–22.

Osborne, M. (2018). Approximating the cost-of-living index for a storable good. American Economic Journal: Microeconomics, 10(2), 286–314.

Rotemberg, J., & Saloner, G. (1986). A supergame-theoretic model of price wars during booms. The American Economic Review, 76(3), 390–407.

Rust, J. (1987). Optimal replacement of GMC bus engines: An empirical model of Harold Zurcher. Econometrica, 55(5), 999–1033.

Seiler, S. (2013). The impact of search cost on consumer behavior: A dynamic approach. Quantitative Marketing and Economics, 11, 155–203.

Sudhir, K., Chintagunta, P. K., & Kadiyali, V. (2005). Time-varying competition. Marketing Science, 24, 96–109.

Sun, B. (2005). Promotion effect on endogenous consumption. Marketing Science, 24(3), 430–443.

Sun, B., Neslin, S., & Srinavasan, K. (2003). Measuring the impact of promotions on brand switching when consumers are forward looking. Journal of Marketing Research, 40, 389–405.

Warner, E., & Barsky, R. (1995). The timing and magnitude of retail store markdowns: Evidence from weekends and holiday. Quarterly Journal of Economics, 110, 321–352.

Acknowledgements

All estimates and analyses in this paper, based on data provided by IRI, are the authors’ and not IRI’s. The same disclaimer applies to the analyses calculated (or derived) based on data from The Nielsen Company (US), LLC, and marketing databases provided by the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

Appendix A. Lack of a post-promotional dip

In this section, we present additional descriptive evidence suggesting endogenous consumption in the canned-soup category from a store-level data set.Footnote 26 If a promotion leads to stockpiling without changing the consumption rate, the sales volume for the category decreases in the period immediately following the promotion, producing a post-promotion dip in sales. By contrast, if the consumption rate increases as an outcome of an increase in purchase quantity due to a promotion, the post-promotion dip is less likely to occur. We verify this prediction using the Nielsen Retail Scanner Data that include an extensive number of retailers and a variation in pricing formats. In particular, we compare the category-wide sales volume following a promotion at a retailer with a high-low pricing policy (HILO) against a retailer with an everyday-low-price policy (EDLP). We choose an EDLP with a sales volume comparable to that of HILO during the periods of regular prices and assess the impact of promotions by measuring the difference in sales volume across two formats.

In the data set, we find a pair of retail chains that exhibit different pricing formats, representing EDLP and HILO, respectively.Footnote 27 The two retail chains are comparable in terms of geographic concentration, the number of stores, and the aggregate sales volume during the periods of regular prices at HILO. The left panel of Fig. 7 shows the weekly trend in the sales volume for canned soup aggregated over all stores in each retail chain. The sales volume in HILO tends to fluctuate week to week as a result of promotions, while the sales volume in EDLP is rather stable week to week. An observation related to our interests is that the sales volume in HILO does not decrease below that of EDLP in the weeks following the promotions. Due to the lack of a post-promotion dip in sales volume, the aggregate sales are higher in HILO relative to sales in EDLP, suggesting a category expansion by the promotion. In the right panel of Fig. 7, we compare the store-level sales of a pair of stores from the same zip code with different pricing formats, which reveals a similar pattern. In addition, we check the robustness of this finding from another pair of retail chains with different pricing formats from another regional market. In sum, a price promotion generates an immediate peak in canned-soup sales that is not followed by a post-promotion dip in the subsequent weeks. This pattern is consistent with our prediction for the store-wide sales when a promotion accelerates the consumption rate.

We note that the lack of a post-promotion dip can be caused by reasons other than endogenous consumption. Thus, in the following analyses, we discuss three other possible explanations for the observed pattern.

First, the lower average price at HILO relative to that at EDLP could drive the higher aggregate sales. Table 11 reports the average unit price for major products at the two stores. The prices at EDLP are actually lower even during high season, when there are more frequent price promotions at HILO. Figure 8 shows the weekly price trend for a best-seller UPC across stores, confirming the lower price level at EDLP.

Second, we consider the possibility that the sales peak at HILO is caused mainly by the households that switch stores from EDLP to buy canned soup during price promotions, rather than by the existing customers at HILO. To investigate the store-switching behavior, using the panel data sets, we find 149 households that ever bought canned soup in the EDLP retail chain in the Northeastern market that we use for the main analysis. One fifth of them, or 29 out of 149 households, do not switch stores for a canned-soup purchase, always buying at the same store. Then, the remaining 120 households purchase canned soup at both types of pricing formats. If they strategically switch stores to HILO to benefit from price promotions on canned soup, the purchase price at HILO stores should be lower than that at EDLP stores. Thus, we compare the unit price averaged over shopping trips at each type of pricing format by households. A paired-sample t-test result indicates that there is not a significant difference in the unit price paid at HILO \((M=.098, SD=.026)\) and EDLP \((M=.100, SD=.028)\) stores; \(t_{119}=-0.6180\), \(p=0.7311\). Households’ store-switches do not seem to be driven mainly by price promotions on canned soup at HILO stores.

Lastly, a particular product assortment in HILO could possibly lead to a favorable outcome for its stores. To compare the product assortments of the two stores, we examine the market shares by brand, can size and UPC. Figure 9 shows that the market shares by brand and can size are very similar across the two stores. Also, the two stores offer similar UPC assortment. Almost all the major UPCs that take up more than 1% of market share at one store are also offered at the other store. There is no major change in UPC assortment across seasons in either store. In sum, we do not find any particular product assortment, in terms of brand, can size or specific UPC, that is exclusively offered at HILO and drives higher sales.

Appendix B. Reduced-form analysis for endogenous consumption

This section reports a reduced-form analysis that suggests endogenous consumption. We estimate an extended version of the price-consideration model proposed by Ching et al. (2009). More specifically, we incorporate the idea of endogenous consumption in their model in a reduced-form way. The price-consideration model is a variation of a logit demand model that allows for the notion that consumers may not know the prices when they are not in need of the category, whereas a typical demand model assumes that consumers are always aware of the prices.Footnote 28 We choose the framework of the price-consideration model for the following reasons. First, because the price-consideration model captures the impact of inventory on category consideration, it allows us to examine the data pattern consistent with stockpiling behavior. Second, the model requires us to construct a measure of inventory given an assumption regarding consumption behavior, and incorporating alternative assumptions is relatively simple. We take into account the endogenous-consumption behavior in the model by modifying the function for the inventory measure.

We describe the model that we estimate. At each time period t, a household makes decisions in two sequential stages: category consideration and purchase. The probability that a household i considers the category with J brands at time t is specified as:

where \(I_{it}\) is inventory;

is an indicator for high-demand periods; and \(\gamma _{0i}\) is the intercept. The inventory variable is a function of purchase and consumption as follows:

is an indicator for high-demand periods; and \(\gamma _{0i}\) is the intercept. The inventory variable is a function of purchase and consumption as follows:

where \(d_{ijt}\) is an indicator equal to 1 if brand j is bought at t; \(q_{j}\) is the purchase volume; and \(R_{it}\) is the consumption rate of household i at time t. To incorporate the notion of endogenous consumption, we allow the consumption rate to change over time as a function of available inventory. In particular, we adopt a functional form defined in Ailawadi and Neslin (1998), as follows.

where \(A_{it}\) denotes available inventory, or the sum of beginning inventory and the quantity purchased at time t, and \(\bar{C_{i}}\) is the average consumption rate for household i. Flexibility parameter f governs the impact of inventory on the consumption rate. The estimated value for f being smaller than one indicates that the consumption rate is flexible and increases with available inventory. The functional form implies that with f being greater than one, the impact of available inventory on the consumption rate exponentially decreases as the inventory amount increases. At the value of f being equal to one, the consumption rate does not increase above the average consumption rate \(\bar{C_{i}}\) despite the increase in the available inventory.

If the household decides to consider the category, then it looks at prices and makes a purchase decision from among available brands. The utility that household i receives from brand j is specified as

where \(P_{jt}\) is price, and \(\beta _{ij}\) is brand fixed effects. The term \(GL_{ijt}\) is the brand-loyalty variable that depends on the household’s purchase history for brand j (Guadagni & Little, 1983), and we specify this variable in an exponential smoothing function, \(GL_{ijt}=\delta GL_{ij,t-1} +(1-\delta ) d_{ij,t-1}\), where \(d_{ij,t-1}\) is an indicator equal to one if brand j is bought at \(t-1\). We normalize the utility of no-purchase to zero; that is, \(U_{i0t}=\epsilon _{i0t}\). We assume that the error term \(\epsilon _{ijt}\) follows an extreme value distribution. Thus, the conditional probability that household i buys brand j at time t given the category consideration is

where \(\tilde{U}_{ijt}\) is the deterministic component of the utility. Finally, the unconditional probabilities are given by

We allow \(\gamma _{0i}\) and \(\beta _{ij}\) to be random coefficients - i.e., \(\gamma _{0i}\sim \mathcal {N}(\gamma _{0},\sigma _{\gamma })\) and \(\beta _{ij}\sim \mathcal {N}(\beta _{j},\Sigma _{\beta })\). We use simulated maximum likelihood to estimate the model. The set of parameters we estimate is \(\{ \gamma _{0}, \gamma _{1}, \gamma _{2}, \beta _{j}, \alpha , \lambda , \delta , \sigma _{\gamma }, \Sigma _{\beta } \}\).

Table 12 reports the estimation results for two models. The full model allows the flexible consumption rate to vary, depending on the available inventory amount, and estimates the flexibility parameter f , whereas the nested model restricts the flexibility parameter to be one \({({\textbf {f}} =1)}\). We first look at the full model with the focus on the category-consideration component. The negative sign for the inventory coefficient \((\gamma _{1}=-10.180)\) indicates that households restock the canned soup when the inventory is low, consistent with households’ inventory behaviors. The flexibility parameter is smaller than one \({({\textbf {f}} =-1.452)}\), suggesting that the consumption rate increases with the available inventory amount, rather than being constant over time. A t-test rejects the null hypothesis that the estimated flexibility parameter is greater than one \((t=-37.657\), \(p<0.001)\). The estimated coefficients suggest that the inventory affects the purchase incidence and consumption rate for the canned-soup market. Then, we compare the goodness of fit of two models. The nested model constrains the consumption rate to be the average consumption rate despite the increase in available inventory. A log-likelihood ratio test rejects the nested model in favor of the full model \((LLR=9.333\), \(p<0.01)\). In sum, the reduced-model results are consistent with the endogenous-consumption hypothesis.

Appendix C. Estimation procedure

This section provides each step for the estimation of our model. We first estimate the price process separately from the structural parameters for consumer preferences. Then, we estimate the dynamic discrete choice model, where the estimated price process is used to form households’ expectation about future prices. The structural estimation essentially follows the nested fixed-point algorithm (Rust, 1987).

The households’ optimal decision in terms of purchase and consumption is described as a solution to a dynamic programming problem. The consumption decision is nested in the purchase decision; that is, the solution for the consumption-optimization problem is obtained conditional on the optimal brand-quantity decision for each value function. Thus, the alternative-specific value functions for a purchase choice option jq is a max function with respect to consumption amount \(c_{it}\) given state variables. We discretize the consumption amount into ten grid points, allowing the maximum weekly consumption of up to ten cans of soup.

Note that the state variables in our dynamic programming problem include continuous variables, \({{\textbf {P}} _{t}}\) and \(I_{it}\). It is not possible to solve for value function at every point in a continuous state space. Thus, within the estimation routine, we approximate the household-specific value functions using the interpolation method (Keane and Wolpin 1994). We approximate the value function at a set of discrete grid points using a polynomial function and interpolate the value function at points of state space not in the given grids. We specify the polynomial as a function of price, inventory, and interaction of price and inventory, as below:

where \(A_{j,k,l}^{V}\) are parameters to be estimated separately for each season and each type of household. The polynomial for the value function without a store visit \(W({\textbf {P}} _{t}, I_{it})\) is similarly defined, resulting in another set of parameters \(A_{j,k,l}^{W}\). We fit the polynomial function by least squares based on 500 grid points of price and inventory. The sample grid points for brand-specific prices are randomly drawn from the empirical distribution of the data. The grid points for inventory are set to be the Chebyshev quadrature nodes in the interval (0, 160).

Given the solution to the dynamic programming problem, the estimation algorithm searches for values of parameters that maximize the likelihood of the observed sample. The likelihood of household i’s observed choice is formed by integrating over k latent taste types. In order to construct the likelihood, there is an initial-conditions problem because we do not observe each household’s inventory at the start of the observed data (Heckman, 1981). We hold out n initial histories of store-visit and purchase for each household from the calibration sample and use them to impute the initial inventory by setting the inventory at the first period of observed data to be zero and solving the dynamic programming problems over n periods until the initial point of the calibration sample. Following a routine for the estimation of maximum likelihood estimators, standard errors are calculated using the inverse of the Information Matrix. For empirical application, we use the household samples with more than three purchases during the sample period in order to investigate the effect of inventory. There are 212 such households from the Eau Claire market. In addition, we set \(n=10\) (hold-out initial history) and \(K=2\) (latent taste types).

Appendix D. Model fit

Our proposed model accounts for the consumer’s strategic decisions on when, what, and how much to buy under endogenous consumption. To assess the validity of our hypothesis of endogenous consumption, we compare our full model with a baseline model in which consumption amounts are exogenously given. In addition, we also consider two more baseline models that ignore other crucial components of the full model: the seasonal nature of category preference and consumer heterogeneity that creates the seasonal fluctuation in consumer composition. Goodness-of-fit statistics for models are reported in Table 13. The main result is that accounting for endogenous consumption substantially improves fit over accounting for other components. To see this, compare Model 1 with Models 2-4, which show an overall upward shift in model fit. This indicates the importance of recognizing consumption as an endogenous decision variable instead of an exogenously given constant.

We discuss how well the model approximates the data with the focus on the full model. Table 14 compares the sample choice frequencies and simulated choice frequencies across the choice options - by brand, by quantity, and by interpurchase time. Our model generates a distribution of choices very close to the data. For example, the purchase probability in the data is 8.9%, and our model generates a probability of 8.1%. The predicted shares by brands and quantity options fit the sample distributions well. The model generates a fairly reasonable distribution of interpurchase time as well.

Finally, we compare the simulated price distribution based on the estimated price process with the sample price distribution. The first two rows of Table 15 report the probability of price decrease by brands across seasons. The frequency of price decrease generated by our price-process model is very close to the sample distribution in terms of seasonality and brand heterogeneity. The bottom two rows report the average price change conditional on price decrease, showing that our model underestimates the depth of price decrease compared to the sample distribution. Our model, however, captures major stylized features of counter-cyclical pricing - deeper sale during high season and the difference between brands.

Appendix E. Other seasonal product categories

Although we apply the model to canned-soup data, the proposed explanation for counter-cyclical pricing can be applied to other consumer packaged goods with seasonal demand for which consumption is plausibly flexible. In this section, we examine whether other seasonal products are subject to counter-cyclical pricing, stockpiling and endogenous consumption. In addition to canned soup, we examine multiple seasonal product categories: soft drinks, beer, and ice cream.Footnote 29 In Table 16, we report the regression results for three different categories, replicating the analysis we have shown for canned soup. In Table 17, we report the sales volume and price by season for each category. In the “Sales volume in ounces” rows, we report the weekly sales volume averaged across all stores separately by season to verify the seasonality in demand. In the “Unit price in cents” rows, we report the average unit prices by season in order to check whther the prices exhibit the counter-cyclical pricing pattern.

We find that soft drinks show similar patterns in households’ purchases. A sale induces the increase in purchase volume and accelerates purchase timing, but delays the subsequent purchase timing, and, finally, increases consumption rates. These patterns indicate that this category is subject to stockpiling and endogenous consumption. The impact of a sale is heightened during the high season even after controlling for exogenous seasonal shifts, in particular for purchase volume and consumption rate. These purchase patterns are consistent with the seasonality in stockpiling, endogenous consumption, and price elasticity. The impacts on the shopping cycle are not clearly consistent with the patterns shown in canned soup. Subsequent to a purchase of a product on sale, consumers delay the next purchase. We also find moderate patterns of counter-cyclical pricing for soft drinks. Soft drinks may be a good sample category to which our model can be extended.

Ice cream also shows a similar pattern in pricing - a drop in high season. However, the consumption rate does not increase during a sale. The counter-cyclical pricing for ice cream does not seem to be associated with endogenous-consumption behavior. For beer, we do not find an increase in consumption rate during a sale. Also, the purchase volume and interpurchase time do not appear consistent with stockpiling behavior. We conjecture that most people might have a natural threshold in beer consumption or that beer might incur high storage or shopping costs so that stockpiling is not convenient. Furthermore, the beer prices do not drop during the periods of high demand, which we define as May through September based on the sales trend of the data. This observation is different from the findings in Meza and Sudhir (2006), who define peaks of demand as the weeks of annual holidays, typically lasting from one to two weeks, and find that prices fall during the demand peaks.

Appendix F. Fixed-effects for brand-quantity options

Table 18 reports the fixed effects for brand-quantity options, the common parameters for both consumer types.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kwon, M., Erdem, T. & Ishihara, M. Counter-cyclical price promotion: Capturing seasonal changes in stockpiling and endogenous consumption. Quant Mark Econ 21, 437–492 (2023). https://doi.org/10.1007/s11129-023-09269-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-023-09269-6

Keywords

- Counter-cyclical pricing

- Stockpiling

- Endogenous consumption

- Category expansion

- Promotion effects

- Seasonal demand

- Price expectation