Abstract

Trade promotions are the most important promotional tool available to a manufacturer. However trade promotions can achieve their objective of increasing short-term sales only if the retailer passes through these promotions. Empirical research has documented that there is a wide variation in retail pass-through across products. However little is known about the variations in pass-through over time. This is particularly important for products with distinct seasonal patterns. We argue that extant methods of measuring pass-through are inadequate for seasonal products. We therefore introduce a measurement approach and illustrate it using two product categories. We find interesting differences in pass-through for loss-leader products versus regular products during high demand and regular demand periods. We find that retailers use a deep and narrow pass-through strategy (high pass-through on loss-leader products, but small pass-through on regular products) during periods of regular demand and broad and shallow pass-through strategy (smaller, but similar pass-through on both loss-leader and regular products) during periods of high demand. Loss leader products continue to obtain higher pass-through in high demand periods, if the category's high demand period is also a high demand period for other product categories as well.

Similar content being viewed by others

Notes

In our empirical analysis, we found that the variance of the wholesale prices was an order of magnitude smaller than the variance in retail prices and the error term.

In previous versions of the paper, we used the joint GMM estimation for the supply and demand equations. To address reviewer concerns about the effects of instruments on demand estimates and assess the validity of the endogeneity correction on demand estimates, we estimated the demand and supply models separately. Since the joint estimation results are not substantively different from the two step estimation results, we report only the two-step estimation results in this version of the paper.

For tuna we used the price per oz for 12 oz cans, for beer we used the price of bottled beer etc.

A manager of Starkist confirmed that retailers typically use “Chunky Light” as a loss leader because of its appeal to the price sensitive segment as the cheapest source of protein. Consistent with this, we also found Safeway and Kroger only used “Chunky Light” in their feature inserts.

We estimated the model with Feature*(1-Lent) and Feature*Lent and find the Feature*Lent is not significantly different from zero.

The model with only wholesale prices as instruments did not converge for the beer category.

The manufacturer effects include manufacturer dummies and manufacturer-lent interaction effects. Note that potential cross pass-through effects are already accounted for in the category profit maximizing margin. Based on a reviewer's suggestion, we checked if our results are robust to including wholesale prices of other brands (i.e., cross-pass-through effects). The inclusion of the cross-wholesale price increases the number of estimated coefficients and therefore the zone effects became insignificant in this specification. However the substantive insights about pass-through effects continue to be similar. Since we did not find store traffic effects to be significant in the tuna category, we have not included these in the reported regressions; we however report the effects for beer.

References

Armstrong, M. K. S. (1991). Retail response to trade promotion, an incremental analysis of forward buying and retail promotion, Unpublished Doctoral Dissertation, University of Texas at Dallas.

Besanko, D., Dubé, J.-P., & Gupta, S. (2005). Own brand and cross-brand pass-through. Marketing Science, 24(1), 123–137.

Blattberg, R., & Levin, A. (1987). Modeling the effectiveness and profitability of trade promotions. Marketing Science, 6(Spring), 124–146.

Blattberg, R., & Neslin, S. A. (1990). Sales promotions: Concepts, methods and strategies. Englewood Cliff, NJ: Prentice Hall.

Bulow, J. I., & Pfleiderer, P. (1983). A note on the effect of cost changes on prices. Journal of Political Economy, 91(1), 182–185.

Cannondale Associates (2002). Trade promotion spending and merchanding survey, Wilton, CT.

Chevalier, M., & Curhan, R. C. (1976). Retail promotions as a function of trade promotions: A descriptive analysis. Sloan Management Review, 18(3), 19–32.

Chevalier, J. A., Kashyap, A., & Rossi, P. (2003). Why don't prices rise during periods of peak demand: Evidence from scanner data. American Economic Review, March.

Chintagunta, P. K. (2002). Investigating category pricing maximization at a retail chain. Journal of Marketing Research, 39(2), 141–154.

Chintagunta, P. K., Dube, J. P., & Goh, K. Y. (2005). Beyond the endogeneity bias: The effect of unmeasured brand characteristics on household-level brand choice models. Management Science, 51(5), 832–849.

Curhan, R. C., & Kopp, R. (1986). Factors influencing grocery retailer's support of Trade Promotions, Report No. 86-104, Cambridge, MA: Marketing Science Institute.

Goldberg, P. K. (1995). Product differentiation and oligopoly in international markets: The case of the US automobile industry. Econometrica, 63, 891–951.

Grier (2001). Grocery trade promotions: How important is pass-through? Grocery Trade Review, www.georgemorris.org, January.

Kumar, N., Rajiv, S., & Jeuland, A. (2001). Effectiveness of trade promotions: Analyzing the determinants of retail rass-through. Marketing Science, 20(4), 382–404.

MacDonald, J. M. (2000). Demand, information and competition: Why do food prices fall at seasonal demand Peaks? The Journal of Industrial Economics, 48(1), 27–45.

Sudhir, K. (2001). Competitive pricing behavior in the auto market: A structural analysis. Marketing Science, 20(1), 42–60.

Sudhir, K., Chintagunta, P., & Kadiyali, V. (2005). Time varying competition. Marketing Science, 24(1), 96–109.

Sun, B., Neslin, S. A., & Srinivasan, K. (2003). Measuring the impact of promotions on brand switching when consumers are forward looking. Journal of Marketing Research, 40(4), 389–405.

Tyagi, R. K. (1999). A characterization of retailer response to manufacturer trade deals. Journal of Marketing Research, 36, 510–516.

Walters, R. G. (1989). An empirical investigation into retailer response to manufacturer trade promotions. Journal of Retailing, 65(2), 253–272.

Warner, E. J., & barsky, R. B. (1995). The timing and magnitude of retail store markdowns: Evidence from Weekends and Holiday. Quarterly Journal of Economics, 110, 321–352.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL classifications L11 · L81 · M30

The paper is based on the second essay of the first author's dissertation at New York University. The authors thank Joel Steckel, Yuxin Chen, Peter Golder and Pinelopi Goldberg for their comments. We also thank participants at the 2003 Marketing Science Conference at the University of Rotterdam for their comments. We thank the editor Peter Rossi and an anonymous reviewer for their constructive comments and suggestions for improving the paper.

Appendices

Appendix A: Inference of trade deals

One limitation of the DFF's data set is that it does not include trade deal information. Trade deals or trade promotions can take different forms: off-invoice allowances, bill-back allowances, flat allowances, free goods, display allowances, free goods, display allowances, and inventory financing (Kumar et al., 2001). However given that we have information on wholesale price; a great part of these promotions can be inferred from the data by detecting temporary significant reductions in the wholesale price. This method of inference implies that we restrict our study of trade promotions to only wholesale price discounts. Fortunately, according to some researchers (Blattberg and Neslin, 1990; Hess et al., 1995) more than 90% of trade promotions involve off-invoice allowances.

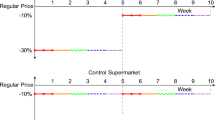

The idea behind the inference of trade deals is simple: We compare the wholesale price in a week against a “regular price”, which is also inferred based on some average price over a longer period of time. When the measured price decreases a substantial amount below the regular price we infer that there was a trade promotion.

First how does one infer “the regular price”? We used two alternatives: (1) the average price over one calendar year and (2) a moving average of past prices. For tuna, we obtained similar inferences of trade promotion periods using both measures. For the beer category, it was not possible to compute a moving average since the holiday periods are very short (2 weeks), that the trade promotion discount substantially affected the moving average and thus was unable to serve as a reasonable proxy for regular prices. We now discuss how we infer whether there is a trade promotion during a particular period using the two alternative definitions of “regular price.”

-

(1)

Regular price is the average price of the year: As discussed, we compute the regular price as the average price during the year. We also compute the standard deviation of prices for each year. Assuming a normal distribution for prices, we then classify a period as having a trade promotion if the deviation from the regular price was 1.645 times the standard deviation. This implied that there exists more than a 90% probability that there is indeed a substantially different deviation from the regular price. We also tested other levels of probability in determining trade promotions (95%; 85%) and our reported results are robust.

-

(2)

Regular price is moving average price: In this case, we computed the regular prices as a moving average of the wholesale price for each period. The moving average is defined as:

$$w_{rt} = \alpha w_t + (1 - \alpha )w_{rt} - 1$$

The notion is that the retailer updates the reference (or regular price) for each period. We tested the robustness of the results for different values of α. We then classified each period as a trade promotion period if the price deviates from the regular price by more than a threshold value (which is a certain percentage of the regular price). We tested the robustness of the threshold by varying the percentage from 5% to 12.5% of regular price.

Appendix B: Measuring pass-through in the presence of residual retailer inventory and forward buying

In measuring pass-through, the literature typically assumes that all the products sold by the retailer in a given period are purchased entirely at the wholesale price negotiated for that period. However this seldom happens in the real world. Retailers may have in stock, products purchased in earlier periods at different prices—residual inventory, or retailers may also take advantage of a trade promotion today to sell in future periods—forward buying. To capture the actual pass through of trade deals, one should correct for the effects introduced by both the residual inventory and the forward buying. This requires information on what share of stock was acquired at each price. This information is rarely available to researchers and typically not readily available even to retailers, who maintain the accounting values of their inventory using rules such as LIFO or FIFO.

Dominick's measurement of wholesale prices follows such a smoothing procedure. The Average acquisition cost (AAC) is measured as:

\(n_t^p\): purchase at time t; w t : wholesale price at time t; \(I_t^f\): inventory at the final of time t.

The AAC represents a weighted average of the present wholesale price and the previous period's AAC. The consensus in the extant literature is that the absence of actual wholesale price information biases the estimates of pass-through. We show that using AAC (rather than the actual wholesale price) for pass-through measurement can help reduce the potential bias in estimating pass-through due to residual inventory and forward buying effects, when inventories are unobserved using two special cases.

-

1.

Residual inventory. Assume that in period t there is a residual inventory of \(I_{t - 1}^f\). If during this period, a trade deal is offered at a discount (Δw) from the regular wholesale price and the retailer purchases \(n_1^p\) units. Suppose the retailer sell all units \(( {I_{t - 1}^f + n_i^p } )\) to the end consumers at a reduced retail discount of price Δp. The actual measure of pass through for period t that we are interested in is the one measuring the proportion of the trade deal to the retailer that is passed through to the end consumers or:

$$ \beta _t = \frac{{{\rm total}\,{\rm deal}\,{\rm to}\,{\rm consumers}}}{{{\rm total}\,{\rm deal}\,{\rm to}\,{\rm retailer}}} = \frac{{\Delta p_t \big( {n_t^p + I_{t - 1}^f } \big)}}{{\Delta w_t n_t^p }} $$(A.2)Suppose we don't have information on inventory or purchased quantities, but we observe the actual trade deal discount (\(\Delta w_t = w_{{\rm Reg}} - w_t\)). A measure of pass-through in period t that is commonly used is the ratio of change in retail price to change in wholesale prices:

$$ \beta _t = \frac{{\Delta p_t }}{{\Delta w_t }} $$(A.3)Comparing (A.3) with (A.2), we see that (A.3) consistently underestimates the actual value of the pass through. Therefore even if wholesale prices were available but not inventories, this measurement is not adequate for measuring the pass through.

We show that using AAC's, available in our data, we can get a more accurate measure of pass through.

With AAC, rather than actual wholesale price, the pass-through in period t is:

$$ \beta _t = \frac{{\Delta p_t }}{{\Delta {\it AAC}_t }} $$(A.4)Let AAC t be the average acquisition cost in period t. From (A.1), the deviation in average acquisition cost of period t from the regular acquisition price (AAC Reg) is given by:

$$ \Delta {\it AAC}_t = {\it AAC}_{{\rm Reg}} - {\it AAC}_t = \frac{{n_t^p ({\it AAC}_{{\rm Reg}} - w_t )}}{{n_t^p + I_{t - 1}^f }} $$(A.5)Substituting (A.5) in (A.4) we get:

$$ \beta = \frac{{\Delta p \cdot \big( {n_t^p + I_{t - 1}^f } \big)}}{{n_t^p ({\it AAC}_{{\rm Reg}} - w_t )}}. $$(A.6)Since AAC Reg ≅ w Reg, i.e., the average regular acquisition cost of inventory should roughly equal the regular wholesale price in the long run, Eq. (A).6 (and therefore A.4) gives a measure of pass-through which is roughly equal to the true pass-through in (A.2). It is especially important to note that (A.4) will be a less biased measurement of the pass through, compared to (A.3) which consistently underestimates pass-through (even though it is based on the actual wholesale price in a given period).

-

2.

Forward buying. Consider the case in which the retailer forward buys products to be sold one period ahead. In this case we need to relax in Eq. (A.2) the assumption that the entire inventory is sold at time t. Instead consider the case when only \(n_t^s {\rm }\) where \(\smash{( {n_t^s < n_t^p + I_{t - 1}^f }) }\) units will be sold in that period.

To focus purely on forward buying in a period assume: (1) that there is no inventory from the previous period or \(I_{t - 1}^f = 0\), (this also implies \( n_t^s < n_t^p\)); (2) that the wholesale price in period t + 1 is not discounted, i.e., w t +1 is the regular price; (3) that the retailer sells the remaining inventory \(n_t^p - n_t^s\) in period t + 1, and makes no new purchases in period t + 1. The true average measure of pass through for period t should consider sales over both periods and is given by:

$$ \beta _t = \frac{{\Delta p_t n_t^s + \Delta p_{t + 1} \left( {n_t^p - n_t^s } \right)}}{{\Delta w_t \cdot n_t^p }} $$(A.7)Suppose we don't have information on inventory or purchased quantities, but we observe the actual trade deal discount (Δw), then we would use a similar pass-through measure as in (A.3). The average pass-through over the two periods would be:

$$ \beta _t = \frac{1}{2}\left( {\frac{{\Delta p_t }}{{\Delta w_t }} + \frac{{\Delta p_{t + 1} }}{{\Delta w_{t + 1} }}} \right) $$(A.8)Since \(n_t^s < n_t^p\) and Δw t +1 ≤ Δw t (i.e., a trade promotion tends to be followed by a higher wholesale price), this measure would systematically overestimate the pass through.

If instead, we use Average Acquisition Cost (AAC) to estimate pass-through, then since \(I_{t - 1}^f = 0\), \(I_t^f = n_t^p - n_t^s\), and \(n_{t + 1}^p = 0\), we can show that \(\Delta {\it AAC}_t = {\it AAC}_{{\rm Reg}} - {\it AAC}_t = {\it AAC}_{{\rm Reg}} - w_t\) and \(\Delta {\it AAC}_{t + 1} = {\it AAC}_{{\rm Reg}} - {\it AAC}_{t + 1} = {\it AAC}_{{\rm Reg}} - w_t\). Thus

$$ \beta _t = \frac{1}{2}\left( {\frac{{\Delta p_t + \Delta p_{t + 1} }}{{{\it AAC}_{{\rm Reg}} - w_t }}} \right) $$(A.9)

While (A.9) using average acquisition cost is not identical to the true pass-through of (A.7), it is a better approximation to (A.7) than (A.8) which is based on observing the actual wholesale prices, but not accounting for forward buying. The intuition is that the carryover of the lower wholesale price de-biases the pass-through estimates in the presence of forward buying. Note that when sales in periods t and t + 1 are identical, (A.9) becomes equal to (A.7).

Rights and permissions

About this article

Cite this article

Meza, S., Sudhir, K. Pass-through timing. Quant Market Econ 4, 351–382 (2006). https://doi.org/10.1007/s11129-006-9008-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-006-9008-y