Abstract

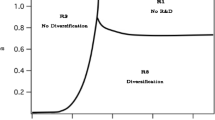

We investigate the relationship between competition and innovation using a dynamic oligopoly model that endogenizes both the long-run innovation rate and market structure. We use the model to examine how various determinants of competition, such as product substitutability, entry costs, and innovation spillovers, affect firms’ equilibrium strategies for entry, exit, and investment in product quality. We find an inverted-U relationship between product substitutability and innovation: the returns to innovation initially rise for all firms but eventually, as the market approaches a winner-take-all environment, laggards have few residual profits to fight over and give up pursuit of the leader, knowing he will defend his lead. The increasing portion of the inverted-U reflects changes in firm’s investment policy functions, whereas the decreasing portion arises from the industry transiting to states with fewer firms and wider quality gaps. Allowing market structure to be endogenous yields different results compared to extant work that fixes or exogenously varies the market structure.

Similar content being viewed by others

Notes

We define the long-run innovation rate as the average rate at which the industry’s frontier quality improves, averaged across the ergodic set of states. In Pakes and McGuire (1994), the long-run innovation rate equals the exogenous rate at which the outside good’s quality improves, as discussed in Appendix A.

To clarify our terminology, a firm is a leader if its product quality is greater than or equal to all other firms in the industry. Since multiple firms can exist at this industry frontier, there can be multiple lead firms. A laggard is any firm with a quality level strictly below the frontier product quality.

Other work considers different forms of innovation spillovers. Levin and Reiss (1998) incorporate spillovers by allowing a firm’s innovation outcome to depend on the investment levels of all firms in the industry. Similarly, Kamien et al. (1992) capture innovation spillovers in the form of research joint ventures. For our purposes, the key notion behind the innovation spillover is that a laggard firm’s R&D is more efficient.

Borkovsky (2012) studies a more realistic innovation process in a dynamic quality-ladder model where firms time the release of new innovations and can stockpile successful innovations.

Although the scale of a 0, x jt , and market size M are arbitrary, we consider levels of a 0 on the order of one which implies a leader’s innovation rate will range from .1 to .9 for x values roughly spanning one to nine. We therefore think of investment (and market size) as being measured in millions to yield investment and profit levels typically observed.

Doraszelski and Satterthwaite (2010) define an investment transition function, such as f(τ | x, ω, s), as being unique investment choice (UIC) admissible if the function leads to a unique investment choice for the firm.

We choose the bound such that the outside good’s share is less than .001, so that firms’ profits would not improve much if the outside good were even further behind.

The distribution of scrap values could be a function of ω.

Iskhakov et al. (2013) examines leapfrogging behavior in the context of a dynamic duopoly model with cost-reducing investments.

We include a complementary slackness condition due to the non-negativity constraint on investment.

The averages we report in the simulations are not necessarily from the recurrent class of states. The innovation rate we report corresponds to the steady-state innovation rate if the initial state falls in the recurrent class, otherwise the measure we report is simply the average over the first 100 years.

To relate these costs to a particular industry, consider that Intel’s 2012 4th-quarter net income was $2.5 billion. Since cost estimates of semiconductor fabrication plants are typically around $3 billion, our range of entry costs seems at least plausible. For estimates of fabrication plants costs, see http://finance.yahoo.com/news/Construction-Of-Chip-twst-2711924876.html, http://topics.nytimes.com/top/news/business/companies/taiwan-semiconductor-manufacturing-company-ltd/index.html, and http://www.optessa.com/industries_semi.htm, all accessed on 2.8.13.

Many of our model’s parameters could be reasonably chosen, via calibration or formal estimation, using industry data. The R&D efficiency and spillover parameters, a 0 and a 1, could be estimated using data on R&D expenditures and product innovation outcomes. Quality preferences, γ, could be estimated using standard demand data or calibrated based on data from similar industries. Income can be chosen based on Census information or knowledge of the relevant consumer demographics. Under log utility, the maximum amount any firm can charge is y.

For some parameterizations, we can find equilibria with absorbing states where no firms invest. These equilibria typically either have a single leader at the frontier with multiple laggards below the entry threshold or all firms at the frontier. The laggards serve to deter potential entrants, and the leader prefers not to invest because it could induce the laggards to exit, prompting entry by new firms at a higher quality level. These parameterizations seem unrealistic and so we avoid them, in part by having scrap values that induce distant laggards to exit.

See Song (2011) for a dynamic oligopoly model of research joint ventures.

PMC = 0.78 corresponds to \(\frac {1}{\pi /\sqrt {6}}\), the inverse of the standard deviation of a logit error term. A PMC of 1.56 is therefore equivalent to doubling the coefficients on all terms in the utility function while maintaining the standard variance of the logit error.

In some markets, PMC evolves over time. When idiosyncratic shocks are perception errors about unknown product quality, PMC intensifies as consumers learn firms’ qualities. Consider the search engine market, born in the 1990’s with the sequential entry of Excite, Yahoo!, WebCrawler, Lycos, Infoseek, Altavista, Inktomi, AskJeeves, Google, MSN, Overture, and Alltheweb. Consumer uncertainty was initially high regarding search engine quality because most people lacked experience in the domain and evaluating the quality of a given query was difficult. Over time, the search engines refined their algorithms and consumers gained general experience with web-based search technologies. Four years after entering, Google led the U.S. search query market with a 29.2 % market share and now maintains its market dominance with a 65.6 % share, according to comScore. Google’s profits have soared as its competitors struggle (PCWorld 2010, Forbes 2011).

For values of 1 / σ ε < 0.3, the industry continues to fill up with an increasing number of firms (as illustrated on the left-hand side of Fig. 3d) and industry innovation continues to drop for reasons explained in this section. For values of 1 / σ ε > 1. 9, entry continues to fall (as illustrated on the right-hand side of Fig. 3d) and the industry moves closer to a persistent monopoly with industry innovation continuing to decline.

The bottom row of Fig. 5 plots the policy functions to show the absorbing states when the laggard is sufficiently far behind the leader (who is always at 30 for these plots). Figure 5d and e depicts policy functions for duopolies with high and low PMC, respectively. Figure 5f considers a triopoly to show that the presence of the third firm (at ω = 14) only has a small effect on the other two firms’ innovation policies, by comparing panel (e) to (f). Note that the leader’s higher innovation for ω 2 < 14 results from the third firm being at ω 3 = 14. When both laggards in Fig. 5f are tied at ω 2 = ω 3 = 14 or lower, neither invests. Even with low PMC, the residual profits are insufficient motivation to invest when they are far behind the leader.

To draw a comparison with the results in Aghion et al. (2005) and Goettler and Gordon (2011) conduct a comparative static in PMC in a nondurable version of their model where the laggard is at most one step behind the leader. Figure 11 of Goettler and Gordon (2011) shows that industry innovation increases in PMC and they claim the same result would hold even if the maximum quality gap between the firms is widened. That claim is correct, but only for moderate increases in the maximum quality gap. If the maximum gap is sufficiently wide that a laggard eventually gives up (as in the current paper), then innovation is decreasing in PMC because the point of giving up is reached more quickly the higher is PMC.

The industry innovation rate at an arbitrary state s equals one minus the probability that all frontier firms fail to innovate: \(1 - (1 - f\left (\tau = 1 \right |\bar {x}(s)))^{\sum _{j=1}^{J(s)} I(\omega _{j} = \bar {\omega })}\) where \(\bar {x}(s)\) is the investment by each firm at the frontier and the exponent gives the number of firms at the frontier.

(2010) does, however, find that process R&D (to lower costs) increases as import tariffs fall.

PM set λ = − 4, γ = 3, and report ω∗ = 12. However, the GAUSS code for their model (http://www.economics.harvard.edu/faculty/pakes/program), uses a value of 12 for the point of concavity after scaling by 3 and shifting by − 4. The corresponding value for ω∗ on the ω grid (0, 1, 2, … ) is 16 / 3.

The positive relationship between δ and profits in PM would extend to values lower than 0.4 if we were to increase the maximum number of firms, which becomes binding at δ = 0.4 in these simulations.

For our model, we can calculate an alternative measure of consumer surplus without imposing \(\bar {\omega }_{max}\). To compute this alternative measure, we simulate the model using policy functions obtained from the model that imposes \(\bar {\omega }_{max}\) but track and use the absolute quality grid when computing consumer surplus in each period. When equilibrium in our model never yields a monopoly, the equilibrium policies are good approximations to the policies when \(\bar {\omega }_{max}\) is relaxed. When the constraint is relaxed, the difference is much greater, particularly when δ is low.

References

Aaker, D. (1991). Managing brand equity. New York: Free Press.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., Howitt, P. (2005). Competition and innovation: an inverted-U relationship. The Quarterly Journal of Economics, 120(2), 701–728.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. Review of Economics and Statistics, 91(1), 20–32.

Arrow, K. (1962). Economic welfare and the allocation of resources for invention. In R. Nelson (Ed.), The rate and direction of inventive activity. Princeton: Princeton University Press.

Berry, S., Levinsohn, J., Pakes, A. (1995). Automobile prices in market equilibrium. Econometrica, 63(4), 841–890.

Besanko, D., Doraszelski, U., Kryukov, Y., Satterthwaite, M. (2010). Learning-by-doing, organizational forgetting, and industry dynamics. Econometrica, 78, 453–508.

Bloom, N., Schankerman, M., Van Reenen, J. (2013). Identifying technology spillovers and product market rivalry. Econometrica, 81(4), 1347–1393.

Borkovsky, R. (2012). The timing of version releases: A dynamic duopoly model. Working paper, University of Toronto.

Borkovsky, R., Doraszelski, U., Kryukov, Y. (2012). A dynamic quality ladder model with entry and exit: exploring the equilibrium correspondence using the homotopy method. Quantitative Marketing and Economics, 10(2), 197–229.

Bronnenberg, B., Dubé, J.P., Mela, C., Albuquerque, P., Erdem, T., Gordon, B.R., Hanssens, D., Hitsch, G., Hong, H., Sun, B. (2008). Measuring long-run marketing effects and their implications for long-run marketing decisions. Marketing Letters, 19, 367–382.

Caplin, A., & Nalebuff, B. (1991). Aggregation and imperfect competition: on the existence of equilibrium. Econometrica, 59, 25–59.

Chen, Y., & Schwartz, M. (2010). Product innovation incentives: Monopoly vs. Competition. Working paper, Georgetown University.

Cohen, W.M. (1995). Empirical studies of innovative activity. In P. Stoneman (Ed.), Handbook of the economics of innovation and technological change. Oxford: Blackwell Publishers.

Cohen, W.M., & Levin, R. (1989). Empirical studies of innovation and market structure. In R. Schmalensee & R. Willig (Eds.), Handbook of industrial organization (vol. 2, pp. 1059–1107). Amsterdam: North-Holland.

Cohen, W.M., & Levinthal, D.A. (1989). The implications of Spillovers for R&D investment and welfare: a new perspective. In A. Link & K. Smith (Eds.), Advances in applied micro-economics, Vol. 5: The factors affecting technological change. Greenwich: JAI Press.

Dasgupta, P., & Stiglitz, J. (1980). Industrial structure and the nature of innovative activity. Economic Journal, 90(358), 266–293.

Day, G. (1994). The capabilities of market-driven organizations. Journal of Marketing, 58, 37–52.

Department of Justice and Federal Trade Commission (2010). Horizontal merger guidelines. http://ftc.gov/os/2010/08/100819hmg.pdf Accessed 24 Oct 2013.

Doraszelski, U. (2003). An R&D race with knowledge accumulation. RAND Journal of Economics, 34(1), 19–41.

Doraszelski, U., & Satterthwaite, M. (2010). Computable Markov-perfect industry dynamics. RAND Journal of Economics, 41(2), 215–243.

Dubé, J.P., Hitsch, G., Manchanda, P. (2005). An empirical model of advertising dynamics. Quantitative Marketing and Economics, 3, 107–144.

Dutta, S., Narasimhan, O., Rajiv, S. (1999). Success in high-technology markets: is marketing capability critical. Marketing Science, 18(4), 547–568.

Ericson, S., & Pakes, A. (1995). Markov-perfect industry dynamics: a framework for empirical work. Review of Economic Studies, 62(1), 53–82.

Fershtman, C., & Pakes, A. (2000). A dynamic oligopoly with collusion and price wars. RAND Journal of Economics, 31(2), 207–236.

Gilbert, R. (2006). Looking for Mr. Schumpeter: where are we in the competition-innovation debate? In A. Jaffe, J. Lerner, S. Stern (Eds.), Innovation policy and the economy (vol. 6).

Gilbert, R., & Newbery, D.M. (1982). Preemptive patenting and the persistence of monopoly. American Economic Review, 72, 514–526.

Goettler, R.L., & Gordon, B.R. (2011). Does AMD Spur intel to innovate more? Journal of Political Economy, 119(6), 1141–1200.

Gowrisankaran, G., & Town, R.J. (1997). Dynamic equilibrium in the hospital industry. Journal of Economics and Management Strategy, 6(1), 45–74.

Greenstein, S., & Ramey, G. (1998). Market structure, innovation, and vertical product differentiation. International Journal of Industrial Organization, 16, 285–311.

Griliches, Z. (1998). The search for R&D Spillovers. In R&D and productivity: The econometric evidence. University of Chicago Press.

Grossman, G.M., & Helpman, E. (1991). Quality ladders in the theory of growth. Review of Economic Studies, 58, 43–61.

Han, J., & Kim, N. (2001). Entry barriers: A Dull-, One-, or two-edged sword for incumbents? Unraveling the paradox from a contingency perspective. Journal of Marketing, 65(1), 1–14.

Harris, C., & Vickers, J. (1987). Racing with uncertainty. Review of Economic Studies, 54(1), 1–21.

Hof, R.D. (2011). Lessons from Sematech. Technology Review. Published by MIT, 25 July.

Iskhakov, F., Rust, J., Schjerning, B. (2013). The dynamics of Bertrand price competition with cost-reducing investments. Working paper, Georgetown University.

Kamien, M.I., Muller, E., Zang, I. (1992). Research joint ventures and R&D cartels. American Economic Review, 82(5), 1293–1306.

Karakaya, F., & Stahl, M.J. (1989). Barriers to entry and market entry decisions in consumer and industrial goods markets. Journal of Marketing, 53(2), 80–91.

Khanna, T. (1995). Racing behavior technological evolution in the high-end computer industry. Research Policy, 24, 933–958.

Klemperer, P. (1995). Competition when consumers have switching costs: An overview with applications to industrial organization, macroeconomics, and international trade. Review of Economic Studies, 62(4), 515–539.

Lee, T., & Wilde, L. (1980). Market structure and innovation: A reformulation. Quarterly Journal of Economics, 94, 429–436.

Lerner, J. (1997). An empirical exploration of a technology race. RAND Journal of Economics, 28, 228–247.

Levin, R.C., & Reiss, P.C. (1998). Cost-reducing and demand-creating R&D with Spillovers. RAND Journal of Economics, 19(4), 538–556.

Levin, R.C., Cohen, W.M., Mowery, D.C. (1985). R&D appropriability, opportunity, and market structure: New evidence on some schumpeterian hypotheses. American Economic Review, 75(2), 20–24.

Levin, R.C., Klevorick, A.K., Nelson, R.R., Winter, S.G. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity, 3, 783–831.

Loury, G. (1979). Market structure and innovation. Quarterly Journal of Economics, 93, 395–410.

Nickell, S. (1996). Competition and corporate performance. Journal of Political Economy, 104, 724–746.

Ofek, E., & Sarvary, M. (2003). R&D, marketing, and the success of next-generation products. Marketing Science, 22(3), 355–370.

Pakes, A., & McGuire, P. (1994). Computing Markov-perfect Nash equilibria: Numerical implications of a dynamic differentiated product model. RAND Journal of Economics, 25(4), 555–589.

Reinganum, J. (1983). Uncertain innovation and the persistence of monopoly. American Economic Review, 73(4), 741–748.

Reuters (2011). Goldman cuts intel to sell as supply glut looms, shares fall, May 19, accessed on 10/24/2013 at www.reuters.com/article/2011/05/19/us-intel-research-goldman-idUSTRE74I4 T120110519.

Scherer, F. (1967). Market structure and the employment of scientists and engineers. American Economic Review, 57, 524–531.

Schumpeter, J. (1942). Capitalism, socialism, and democracy. New York: Harper.

Spence, M. (1984). Cost reduction, competition, and industry performance. Econometrica, 52(1), 101–122.

Soberman, D., & Gatignon, H. (2005). Research issues at the boundary of competitive dynamics and marketing evolution. Marketing Science, 24(1), 165–174.

Song, M. (2011). A dynamic analysis of cooperative research in the semiconductor industry. International Economic Review, 52(4), 1157–1177.

Sutton, J. (1991). Sunk cost and market structure: Price competition, advertising, and the evolution of concentration. Cambridge: MIT Press.

Teshima, K. (2010). Import competition and innovation at the plant level: Evidence from Mexico. Working paper, Instituto Tecnologico Autonomo de Mexico.

The New Yorker (2006). Deal sweeteners by James Surowiecki, 27 November.

The New Yorker (2007). Running on fumes by Elizabeth Kolbert, 5 November.

Vives, X. (2008). Innovation and competitive pressure. Journal of Industrial Economics, 56(3), 419–469.

Weintraub, G.Y., Benkard, C.L., Van Roy, B. (2008). Markov perfect industry dynamics with many firms. Econometrica, 76(6), 1375–1411.

Wernerfelt, B. (1984). A resource based view of the firm. Strategic Management Journal, 5(2), 171–180.

Author information

Authors and Affiliations

Corresponding author

Additional information

Both authors contributed equally to this research and are listed alphabetically. We appreciate helpful comments from Ron Borkovsky, Wes Hartmann, Peter Reiss (Co-Editor), and two anonymous referees. We also thank Ariel Pakes for making available Gauss code that implements Pakes and McGuire (1994), from which our code evolved. Following suit, Matlab code may be downloaded from our web sites for solving and simulating the dynamic oligopoly models in this paper. All remaining errors are our own.

Appendix A: comparison to Pakes and McGuire (1994)

Appendix A: comparison to Pakes and McGuire (1994)

The key difference between our model and PM is the way product quality enters a consumer’s utility function. PM sets utility for consumer i from good j ∈ (1, … , J) as

where g( · ) is an increasing and concave function of relative quality. We set σ ε to its standard value of \(\sqrt {6}/\pi \). PM specifies that

where λ is a shift parameter that determines the competitiveness of the outside good and γ > 0 rescales the quality ladder. Hence, g( · ) is linear for low values of relative quality and concave for high ones, and utility is a weakly concave function of relative quality.

To facilitate direct comparison with PM, we modify our model to have constant marginal utility for money such that income drops out, yielding the utility function:

The outside good’s utility in both PM and our model is u i0 = ε i0.

The PM discrete-choice model uses a non-standard normalization: rather than subtracting the mean utility of the outside good from the utility of each choice, PM subtracts the quality of the outside good from the quality of each choice and converts relative quality to utils using a concave function. Accordingly, the dynamic game in PM cannot be derived from a model where consumers have preferences directly over absolute quality. In our model, g( · ) is linear (and hence omitted), and we use the standard normalization to convert from absolute qualities to relative qualities (see Section 3.1).

The linearity of our quality index in utility does allow for concave preferences over quality itself. For example, the absolute index ν could be in units of log-quality, in which case innovations represent proportional, not additive, increments in quality.

Consequences of concave g(·)

The concave g(ω) in PM, as well as alternative concave specifications (e.g., log as used in Weintraub et al. 2008), has two important implications for the industry’s equilibrium behavior: an exogenous long-run innovation rate and distorted utility rankings of inside products. We discuss each of these implications and then compare industry outcomes in the two models using a comparative static in the outside good’s rate of innovation.

Any numerical solution to the dynamic quality-ladder game requires relative qualities be bounded. Both PM and our model ensure a lower bound by providing a scrappage value such that firms exit when their relative quality gets sufficiently low. We provide an upper bound by assuming the outside good improves when a firm with relative quality \(\bar {\omega }_{max}\) improves its absolute quality. By choosing \(\bar {\omega }_{max}\) sufficiently high, this assumption has no effect on firms’ equilibrium policies.

PM creates an upper bound by specifying consumer preferences such that the benefit of higher relative quality ω j quickly goes to zero once ω j exceeds some threshold ω∗, regardless of competitors’ qualities. The most significant consequence of this bounding approach is that δ, the exogenous innovation rate of the outside good, solely determines the industry’s long-run innovation rate. The upper panel of Fig. 10 plots g(ω) as specified in PM. Consumer utility is linear for ω ≤ ω∗ and nearly flat for ω > ω∗. This kink in utility implies that consumers effectively place no value on product quality improvements above ω∗.Footnote 25 In principle, one could choose ω∗high enough that firms never reach it over some finite horizon of interest. When interested in innovation over any medium or long run, however, any such ω∗would be too high for computational feasibility.

To assess the implications of a concave g(ω), first consider the case with an outside good of fixed quality (δ = 0). A monopolist would stop investing shortly after surpassing ω∗ as consumers barely value the improvements and investment is costly. Competing firms, even if neck-and-neck, would also stop investing shortly after surpassing ω∗since the concave g(ω) compresses utility differences between firms above ω∗. Innovation in the long run would be zero since all firms would stop investing shortly after reaching ω∗.

When δ > 0, improvements in the outside good bring firms back below ω∗, thereby restoring the profit incentive to innovate. Long-run innovation in PM is therefore determined solely by the rate of improvement in the outside good.

As δ increases, firms invest at higher values of ω because the concave investment technology function, f(τ | x, ω, s), implies a given long-run innovation rate is attained at lower cost when investments are spread out across periods. For ω > ω∗, the incentive to innovate is driven by the desire to smooth investments across periods, rather than by the desire to reap higher current profits. That is, rather than a sudden increase in investment when ω falls below ω∗, firms will invest at ω slightly higher than ω∗despite the absence of immediate profit gains.

These consequences of concave g(ω) may have little impact on the equilibrium if firms rarely reach ω > ω∗. The lower panel of Fig. 10, however, shows that firms tend to be above ω∗, unless δ is very high. For δ ranging from 0 to 0.9, we plot the percentage of simulated firms whose ω exceeds ω∗. This percentage exceeds 0.9 for δ < 0.45 and only falls below 0.5 for δ > 0.85. Simulated industry outcomes, such as innovation, profits, consumer surplus, and social surplus, are therefore heavily influenced by the concave g(ω). Conceptually, a model in which the outside good is the primary driver of industry behavior fails to endogenously determine the main outcomes of interest.

Plot of g(ω) and share of firms above ω∗ in Pakes and McGuire (1994)

The second implication of the concave g( · ) is consumers’ utility rankings of inside goods depend on the outside good’s quality. For example, a consumer indifferent between two products that differ in quality will strictly prefer the higher quality product if the outside alternative improves. Consequently, the relative market shares depend on the outside good’s absolute quality: as the outside good improves, holding fixed the inside goods’ qualities, the relative market share of the higher-quality product increases. Standard discrete choice models do not have this property.

Comparing outcomes

To compare the equilibrium implications of the PM model and the linear model, we perform a comparative static that varies the exogenous rate of innovation in the outside good δ from 0 to 0.9. For each δ, we simulate the industry for 100 periods and average the results over 10,000 simulations. We parameterize the models to be similar to the baseline specification in PM, as summarized in Table 2. We bound the outside good’s quality to be within 14 steps of the frontier. This lower bound on the outside good is large enough to ensure the outside good’s market share is tiny when a firm is at \(\bar {\omega }_{max}\). We do not allow for innovation spillovers when comparing our model to PM (a 0 = 0). In each simulation, the maximum number of firms is seven, and the simulation starts with one firm at the entry point and another firm two steps ahead.

Figure 11 plots the results for both models. In panel (a), industry innovation (i.e., the average rate of improvement in the frontier product) is exactly δ in PM, as expected. The innovation rate in the linear model exceeds δ and is relatively insensitive to its value because equilibrium innovation is primarily determined by competition between firms, not competition with the outside good. The difference between the two models declines as δ rises: when δ = 0, innovation is zero for PM and about 0.9 in the linear model, and when δ = 0.9, both models have innovation rates around 0.9. Similarly, the gaps across models in markups and the leader’s share shrink as δ increases, but do not entirely disappear.

Comparison to Pakes and McGuire (1994) while varying δ: our demand model is labeled “linear” because its utility function is linear in some function of absolute product quality (e.g., quality itself or log quality). Pakes-McGuire uses a utility function that is concave in product quality measured relative to the outside good. The y-axis of each panel corresponds to its title. Industry innovation is measured as the share of periods where the industry’s frontier quality improves. The x-axis in each panel is δ, the rate the outside good improves, as labeled on the bottom row

Panel (b) shows the average number of firms active in the industry. In PM, the industry reaches the maximum number of allowed firms when δ < 0.4. Increasing the number of firms allowed indeed increases the number of firms active, but has little effect on other outcomes. The number of firms in PM is sensitive to δ, decreasing to about 2.5 when δ = 0.8. In contrast, varying δ has essentially no effect on the number of firms in the linear model.

Panels (c) and (d) show that as δ increases, markups and the leader’s share increase in PM and decline in the linear model. In both models, firms face greater competition from the outside good as it innovates faster. But in PM, a sharp reduction in the number of firms offsets the increase in competition from the outside good, and the net change is less competition resulting in higher markups. This reduction in the number of firms is also responsible for the increase in industry profits in PM, reported in panel (e), as δ increases beyond 0.4.Footnote 26 Panel (f) plots consumer surplus, which in our model is consistently more than twice as large as that found in PM because of the higher innovation rates in our model and despite the higher markups.Footnote 27

In summary, by relaxing restrictions on the innovation incentives of lead firms, our model produces strikingly different outcomes from those in PM.

1.1 Appendix B: Robustness checks

We compute a large number of comparative statics to explore the robustness of our findings. Specifically, we vary the innovation efficiency (a 0), the innovation spillover (a 1), the probability distribution over entrant’s quality (\(G_{\omega _{e}}\)), and the degree of product-market competition (PMC). For \(G_{\omega _{e}}\), we consider a distribution with two mass points, such that the entrant enters at the frontier \(\omega _{e} = \bar {\omega }\) with probability κ e and enters at quality \(\omega _{e} < \bar {\omega }\) with probability (1 − κ e ). We refer to κ e as the probability that the entrant “leaps” to the frontier. In unreported results, we found that varying ω e ∈ 3, 4, 5 has little effect on all of the outcomes.

We also consider the effect of changing certain parametric assumptions in our model. First, we implement a different form for innovation spillovers. The baseline form, which appears in Eq. (4), increases laggard’s investment efficiency by a 1 independent of the degree to which the laggard is behind the lead firm. We modify this equation such that a laggard’s investment efficiency is a linear function of the quality gap: \(\tilde {a}(\omega _{j},s) = a_{0}(1+a_{1}(\bar {\omega } - \omega _{j}))\). Second, we alter the form of the consumer’s utility function. Instead of the quasi-linear form in Eq. (2), we use a linear version defined as \(\tilde {u}_{ij} = \gamma \omega _{j} - p_{j} + \sigma _{\epsilon } \varepsilon _{ij}\).

In total, we calculated the equilibrium in 32,832 dynamic oligopoly models. We did not investigate the robustness of our results on entry costs because of the relatively little variation we found between entry costs and industry innovation. For the results in Section 4, we ensured the simulated industry outcomes never reached the maximum number of allowed firms by increasing the allowed maximum as needed. In this set of extended comparative statics, due to the number of equilibria, we restrict the number of firms to not exceed nine. When the industry reaches this maximum, relaxing this constraint tends to increase industry innovation by 0.01 to 0.03. We indicate such points in these results with dots.

Product-market competition

Figure 12 presents a collection of comparative statics between PMC and innovation. The solid line plots the industry innovation rate and the dotted line plots the share of periods where monopoly arises. In the baseline model PMC = 0.78 and the comparative static in Section 4.1 varies PMC from 0.3 to 1.9. In all of these robustness checks we vary PMC from 0.3 to 3.1.

Extended comparative statics in PMC: see Appendix B for details

Columns one to three vary the base innovation efficiency (a 0), the innovation spillover (a 1), and the probability an entrant enters at the frontier quality (κ e ). In the baseline specification in Section 4.1, we set a 0 = 0.5, a 1 = 0.2, 0.6 , and κ e = 0. The top three rows set a 0 = 0.5, whereas the bottom three rows set a 0 = 0.25. Moving horizontally from column one to three varies the spillover a 1 = 0, 1, 2 . Moving vertically from row one to three varies the leap probability from κ e = 0, 0.1, 0.2 , with the same pattern present in rows four to six. The fourth and fifth columns in Fig. 12 consider a linear spillover \(\tilde {a}(\omega _{j},s)\) and linear utility \(\tilde {u}_{ij}\), respectively. Both of these columns fix the spillover at a 1 = 1 and vary a 0 and κ e as in the first three columns.

Looking across rows one and four reveals an inverted-U relationship between PMC and the industry’s innovation rate, consistent with the earlier results in Section 4.1. Although the relationship with a linear utility function more closely resembles a spike, the intuition underlying this relationship is the same. Moving down from rows one and four increases the leap probability κ e to 0.1 and 0.2. A positive leap probability enables entrants to immediately challenge the leader, resulting in higher industry innovation as PMC rises. Thus, the probability of leaping moderates the decline in innovation with high PMC because lead firms still innovate due to stronger threat of entrants.

Innovation Spillovers

Figure 13 presents extended comparative statics illustrating the relationship between innovation spillovers and innovation. In the baseline model the spillover parameter is set to a 1 = 0.2, 0.6 and the comparative static in Section 4.2 varies a 1 over 0, 6 . In this robustness check we vary a 1 over 0, 3 since the trends in Fig. 7 are steady after a 1 = 3 and the smaller range reduces the number of equilibria to compute.

Extended comparative statics in Spillover: see Appendix B for details

Conditional on a particular level of PMC, our results in Section 4.2 are broadly consistent with those in this expanded comparative static. The first column of Fig. 12 fixes PMC at 0.47 and displays the same “giving up” behavior we observe for the low PMC value in Fig. 7. The second column, which fixes PMC at 1.09, displays a relatively flat industry innovation rate, a result which lies between the low PMC of the moderate PMC of 0.78 and the high PMC of 1.56 in Fig. 7. In the third column, which fixed PMC at 2.03, innovation increases over the full spillover range. Similar to the findings earlier for PMC, a positive leap probability raises industry innovation at low spillover values and induces the leader to give up at lower spillover levels in the alternative specification columns four and five.

Rights and permissions

About this article

Cite this article

Goettler, R.L., Gordon, B.R. Competition and product innovation in dynamic oligopoly. Quant Mark Econ 12, 1–42 (2014). https://doi.org/10.1007/s11129-013-9142-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-013-9142-2