Abstract

This paper presents a simple model of firm and consumer behavior. We formulate a sub-market entry game, where boundedly rational firms decide on investing in R&D for inventing new products that will appeal to targeted groups of consumers. The success depends on the amount of resources available for the project as well as on the firm’s familiarity with market characteristics. Successful innovation feeds back into the firm size and (potentially into) market knowledge and increases the future R&D productivity. A new product decreases the market-shares of incumbents. However, this business stealing effect is asymmetric across incumbent population. We identify the section of parameter space where firms have an incentive to diversify horizontally. In this section, the model results in rich industrial dynamics. Firm size heterogeneity emerges endogenously in the model. Equilibrium firm size distributions are heavy tailed and skewed to the right. The heaviness of the tail depends on submarket specificity of firm’s market knowledge. This relationship is non-monotonic, emphasizing two different effects of innovation on industrial dynamics (positive feedback and asymmetric business stealing).

Similar content being viewed by others

Notes

Except that Page and Tassier (2007) study the linear structure, while we study the circular structure in order to avoid boundary problems.

Although empirical findings point to the fact that firms spend a constant share of their revenues (not profits) on R&D, our assumption of scale neutrality implies that the constant share of revenues is constant share of profits.

This might be, for example, due to the fact on a global anonymous market, it is impossible to identify who produces which product.

Alternatively, we could make firms homogenous in this respect and introduce a parameter that would control their beliefs. For example, they would always anticipate that δ % of their market share will get stolen. This enters the profit maximization problem (later Eq. 2) in a trivial way and does not modify the incentive structure, but rather only the size of expected profits. Our approach of modeling optimistic firms is equivalent to setting δ = 0.

For the review of the approach and references, see Ladley (2012).

This is required in order to ensure that the probability of innovating is close to zero unless there is some money spent on R&D. Recall that we want to concentrate on purposeful innovation.

Although the part of the model can be analytically tractable when linear functional forms are used. See Appendix.

Except in marginal cases where asymmetric product placement in initial stages of industry development might create incentives for certain firms to enter unknown submarkets.

Figure 2 demonstrates the effects for fairly small parameter changes. This choice was made in order to keep scales across panels comparable. In general, the regime borders shift in response to parameter changes in a non-linear way. Larger changes to parameters (compared to those presented in the figure) result in more pronounced boundary shifts that “squeezes” one of the three regimes (eventually out of the graph in present scaling). However, simple scale adjustment for the axis brings us to a picture which is indistinguishable to the one presented in Fig. 1.

A pseudo code of the simulation is provided in the Appendix.

Which is over a million runs for various parameter constellations.

For a good summary of these approaches see Beirlant et al. (1999).

On top of this, Hill estimator has been recently shown to be the most suitable candidate to estimate tail thickness in samples that are not particularly large (Bottazzi et al. 2013).

Changing the initial conditions (for example, doubling the number of consumers) changes average values of the Hill index (without changing the qualitative picture). Thus the model can be calibrated. However, this will require careful consideration and detailed data not only about the parameters, but also about the initial conditions of the actual industry.

The Model’s behavior is similar for values of c higher than the ones reported on Fig. 3.

References

Anderson TW, Darling DA (1952) Asymptotic theory of certain “goodness of fit” criteria based on stochastic processes. Ann Math Stat 23(2):193–212

Arrow K (1962) Economic welfare and the allocation of resources for inventions. In: Nelson R R (ed) The rate and direction of inventive activity. Princeton University Press, Princeton, pp 609–626

Babutsidze Z, Cowan R (2014) Showing or telling? local interaction and organization of behavior. J Econ Interac Coord 9(2):151–181

Balkema A, de Haan L (1974) Residual life at target age. Ann Probab 2:792–804

Beirlant J, Dierckx G, Goegebeur Y, Matthuys G (1999) Tail index estimation and an exponential regression model. Extremes 2(2):177–200

Beirlant J, Vynckier P, Teugels J L (1996) Tail index estimation, pareto quantile plots, and regression diagnostics. J Am Stat Assoc 91(436):1659–1667

Bottazzi G, Pirino D, Tamagni F (2013) Zipf law and the firm size distribution: a critical discussion of popular estimators. J Evol Econ 25(3):585–610

Cabral LMB, Mata J (2003) On the evolution of the firm size distribution: Facts and theory. Am Econ Rev 93(4):1075–1090

Carvalho V, Grassi B (2013) Firm dynamics and the granular hypothesis. mimeo, Paris School of Economics

Coad A (2009) The growth of firms: A survey of theories and empirical evidence. Edward Elgar

Cohen WM, Klepper S (1992) The anatomy of industry R&D intensity distributions. Am Econ Rev 82(4):773–799

Cohen WM, Levin RC, Mowery DC (1987) Firm size and R&D intensity: A re-examination. J Ind Econ 35(4):543–565

Cohen WM, Levinthal DA (1989) Innovation and learning: Thte two faces of R&D. Econ J 99:543– 563

Dekkers A, Einmahl J, de Haan L (1989) A momend estimator for the index of an extreme value distribution. Ann Stat 17:1833–1855

Gibrat R (1931) Les inégalités économiques. Recueil Sirey, Paris

Gil PM, Figueiredo F (2013) Firm size distribution under horizontal and vertical innovation. J Evol Econ 23:129–161

Harris C, Vickers J (1985) Perfect equilibrium in a model of a race. Rev Econ Stud 52(2):193–209

Hill BM (1975) A simple general approach to inference about the tail of a distribution. Ann Stat 3(5):1163–1174

Hopenhayn HA (1992) Entry, exit, and dirm dynamics in long run equilibrium. Econometrica 60:1127–1150

Hotelling H (1929) Stability in competition. Econ J 39:41–57

Kalecki M (1945) On the gibrat distribution. Econometrica 13(2):161–170

Klepper S, Thompson P (2006) Submarkets and the evolution of market structure. RAND J Econ 37(4):861–886

Klette TJ, Kortum S (2004) Innovating firms and aggregate innovation. J Polit Econ 112(5):986–1018

Ladley D (2012) Zero intelligence in economics and finance. Knowl Eng Rev 27:273–286

Lancaster K (1979) Variety, equity, and efficiency. Columbia University Press, New York

Luttmer EG J (2007) Selection, growth and size distribution of firms. Q J Econ 122(3):1103–1144

Luttmer EGJ (2011) On the mechanics of firm growth. Rev Econ Stud 78 (3):1042–1068

Matthuys G, Beirlant J (2000) Adaptive threshold selection in tail index estimation. In: Embrechts P (ed) Extremes and Integrated Risk Management. Risk Books, London, pp 37–49

Metzig C, Gordon MB (2013) A model for scaling in firms’ size and growth rate distribution. arXiv:1304.4311v3

Nelson RR (1982) The role of knowledge in R&D efficiency. Q J Econ 97 (3):453–470

Page S, Tassier T (2007) Why chains beget chains: An ecological model of firm entry and exit and the evolution of market similarity. J Econ Dyn Control 31:3427–3458

Salop SC (1979) Monopolistic competition with outside goods. Bell J Econ 10:141–156

Silverberg G, Verspagen B (1994) Collective learning, innovation and growth in a boundedly rational, evolutionary world. J Evol Econ 4(3):207–26

Simon HA (1955) On a class of skew distribution functions. Biometrika 52:425–440

Sraffa P (1926) The laws of return under competitive conditions. Econ J 36:535–550

Sutton J (1998) Technology and market structure. MIT Press, Cambridge Mass

Thompson P (2001) The microeconomics of an R&D-based model of endogenous growth. J Econ Growth 6(4):263–83

Author information

Authors and Affiliations

Corresponding author

Additional information

The author is grateful to Robin Cowan, Steven Klepper, Stefan Straetmans and two anonymous referees for lengthy discussions. Comments from participants of various meetings in Barcelona, Jena, Maastricht, Milan, Nice, Sophia Antipolis and Vienna, especially those from Ajay Agrawal, Alex Coad, André Lorentz, Frank Neffke, Bulat Sanditov, Paolo Saviotti, Marco Valente and Bart Verspagen are also appreciated.

Appendix

Appendix

1.1 Solution to the firm’s problem at t = 0 for linear functional forms

Here we use linear functional forms for the decay of consumer preferences and firm knowledge productivity in terms of distance. Namely, we assume that

And that

In contrast to the setup discussed in the paper, the higher the parameter controlling the preference decay \(\tilde c\), the lower the consumer taste specificity. The same applies to \(\tilde a\).

For the analytical tractability of the results, we introduce another simplification of a functional form. We assume that

Without loss of generality, to simplify calculations we also assume that N÷4=0.

Then, we know that

which for d = 0 collapses to

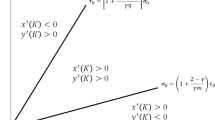

Producers can take three types of decisions: (i) do not try to innovate / no R&D, so in this case they expect to earn π ø; (ii) innovate on the submarket where you operate, so they expect profits π o; (iii) enter other submarkets / diversify, so they expect π d.

Given the initial conditions (the same as used in the paper), we know that

The new product will split the demand equally with the incumbent product on that submarket where it is located.Initially all submarkets are symmetric and therefore the demand for the new product (D n e w ) will not depend in the submarket in which it is located, and thus on d. Therefore,

We can also express the expected profits from diversification by investing in the R&D project at the distance d from the currently operational submarket. This is

The demand for the new product coming from consumer s is

where \(d^{s}_{new}\) is the distance from consumer s’s preferred submarket to the submarket where the new product is located.

Using this expression we can calculate

Note that the demands from consumers on the submarket where the new product is placed and on the one the most distant from it are counted twice in the first summand. Hence, the second summand.

Using the same principles we can write down the demand from consumer s for the old product of the innovator after the new product has been placed

where \(d^{s}_{old}\) is the distance from consumer s’s preferred submarket to the submarket where the innovator’s old product is traded.

Now we can calculate the total demand for the old product that is traded at distance d from the new product.

Substituting definitions of D n e w and \(D^{d}_{old}\) back in Eqs. 19 and 20, results into the Eqs. 18–20 fully characterizing the producers problem in only one choice variable - d.

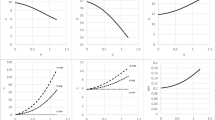

We can numerically analyze the consumer’s problem. For that we fix Y = 200, p = 1 and β = 0.15. It turns out that, in this setup, for any values of \(\tilde a\) and \(\tilde c\) there are always innovation incentives (π ø is always dominated). However, if R&D becomes really expensive, β→1 and research incentives disappear gradually. For example, if β = 0.888 we have all three possible regimes in the space \(\tilde a\in [0;1] \times \tilde c\in [0;1]\). These regimes are plotted in Figs. 6 and 7.

1.2 Pseudo-code of a single simulation run

-

1.

Initialization

-

(a)

Choose parameter a

-

(b)

Choose parameter c

-

(c)

Create submarkets

-

(d)

Create consumers

-

(e)

Match consumers with submarkets (e.g. assign each consumer a unique submarket as her ideal variety)

Create firms

-

(f)

Match firms with submarkets (e.g. assign each firm a unique submarket where it sells its first product)

-

(g)

For each firm, set last period’s sales to Y

-

(a)

-

2.

For each t

-

(a)

For each submarket

-

i.

Calculate demand on a new product on the submarket (\(D_{\iota }^{i}\))

-

i.

-

(b)

For each firm

-

i.

For each submarket

-

A.

Calculate the total demand on the products in case the new product is placed in given submarket (\(\sum {{D^{i}_{j}}}\))

-

B.

Calculate profits from potential innovation by adding \(D_{\iota }^{i}\) to \(\sum {{D^{i}_{j}}}\)

-

C.

Calculate expected profits from innovation by taking into account r

-

D.

Factor in the costs of innovation R

-

A.

-

ii.

Choose the most profitable submarket to innovate

-

iii.

Compare the expected profits from innovating there to profits in t − 1

-

iv.

If former is greater, start R&D project in that submarket

-

v.

Else – do not invest in R&D

-

vi.

Draw a random number from the uniform distribution to determine whether R&D project was successful.

-

vii.

Depending from the outcome, calculate new total demand and revenues

-

i.

-

(c)

If none of the firms conducted R&D this period – end simulation

-

(d)

Else go to t + 1

-

(a)

Rights and permissions

About this article

Cite this article

Babutsidze, Z. Innovation, competition and firm size distribution on fragmented markets. J Evol Econ 26, 143–169 (2016). https://doi.org/10.1007/s00191-015-0425-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-015-0425-5