Abstract

The paper focuses on the role of consumer confidence and selected well-being measures in aggregate consumption and in subsets of aggregate consumption on a broad set of 22 OECD countries. Consumer confidence played a positive and statistically significant role in the development of expenditures especially on durable and semi-durable goods and services. The increase in cognitive, affective and eudaimonic measures of well-being, measured by the Cantril ladder, positive and negative affect and freedom to make life choices variables, had negative impact on total consumption and expenditures on semi-durable goods and services. Possible explanations for these estimates are provided in the paper. Based on the purpose of expenditure, consumer confidence was a significant determinant of all expenditures except for unavoidable spending such as food, health, housing, water, energy, and fuel. The subjective well-being indicators showed a negative impact on expenditures on clothing and footwear, recreation and culture, and restaurants and hotels. Possible explanations for the positive and negative effects of subjective well-being measures on consumption, benefits of including the freedom of choice variable, and directions for future research regarding the introduction of understudied variables are discussed.

Similar content being viewed by others

1 Introduction

Psychology and economics can contribute to a better understanding of consumer behavior. While purchasing power (i.e., the ability) depends on real income and wealth, willingness stems from the consumers’ confidence, i.e., subjective perceptions and expectations about national and personal economic conditions (Katona, 1968). Studies have shown that consumers deviate from the rationality assumption proposed by neo-classical economic theory, and do not always attempt to maximize utility, nor do they behave in a predictable way (Gintis, 2000). In reality, individuals make economic decisions under the influence of various psychological, political, social, environmental, and other factors. Since confidence indexes measure perception and expectation, focusing on psychological factors can improve understanding of consumer behavior. However, the research (Dragouni et al., 2016; Gabriele et al., 2009; Kemp et al., 2014; Larson & Shin, 2018; Malgarini & Margani, 2007) suggests that psychological motives may affect some groups of households and some particular categories of expenditure more than others. One of the factors that mediate the effects of consumer confidence in spending behavior can be subjective well-being (SWB) or its subsets such as happiness. SWB is defined as the experience of positive emotions such as happiness and contentment, the development of one’s potential, having some control over one’s life, having a sense of purpose, and experiencing positive relationships (Huppert, 2009). As Jaunky et al. (2020) describe, the impact of consumption on happiness, which may be considered as one aspect of the psychological construct of SWB, has been introduced as a new and imperative domain of concern for economists, psychologists, sociologists, and diverse policy makers all over the world. Although the effect of short-term emotions has been studied, e.g., regarding their effect on less crucial buying decisions (Wood & Rettman, 2007), long-term emotions, such as SWB, have been rather ignored by consumer researchers (Lyubomirsky et al., 2005). Most of the research so far has investigated the effect of consumption behavior on SWB (Carter & Gilovich, 2010; Dunn et al., 2011; Nicolao et al., 2009; Xiao & Kim, 2009; Zhong & Mitchell, 2010). With the exception of Zhong and Mitchell (2012), who showed that SWB influences spending on hedonic products, studies did not examine the impact of well-being on consumers’ consumption.

The standard economic theory based on rational behaviour of households is unsatisfactory given the empirical results. What is needed is an extension of the factors that might affect consumption, and the present paper goes in this direction since it does not stem from the standard economic assumptions. Using psychological concepts described below, the paper looks at how the human psychology drives consumption expenditure as important aspects of economic behavior. The goal of this paper is to extend existing knowledge on consumption behavior in two ways. First, we directly evaluate the role of selected well-being measures in the dynamics of both aggregate consumption and its subsets defined by durability and purpose. Second, we assess the effects on a broad set of countries using dynamic panel techniques. The variables used in the analysis were a cognitive measure of SWB (Cantril ladder), affective measures of SWB (positive and negative emotions), and freedom of choice, which is considered a predictor of happiness, and an eudaimonic measure of SWB (see Inglehart et al., 2008; Veenhoven, 2000; Verme, 2009).

2 Consumer Confidence and its Measurement

Consumer confidence measures the perceptions of customers about their recent and future financial situation and economic climate (Ou et al., 2014). Views on the possibility of using the Consumer Confidence Index (CCI), a measure of the prevailing consumer sentiment, to analyze private consumption, vary, and the efficacy of the CCI in analyzing and forecasting economic phenomena is not universally accepted. Ludvigson (2004), Cotsomitis and Kwan (2006), or Karasoy Can and Yüncüler (2018) suggest that when the consumer confidence is combined with other variables, it makes only a small improvement for forecasting purposes. Contrary to that, Caleiro (2021) considers the CCI relevant to solving a variety of economic problems. Acuña et al. (2020) conclude that the CCI provides a more accurate prediction of consumption even after controlling for macroeconomic variables. Singal (2012), Dees and Soares Brinca (2013), Dragouni et al. (2016), Lahiri et al. (2016) or Benhabib and Spiegel (2019) show that the CCI can successfully predict consumer spending. Mourougane and Roma (2003), Chua and Tsiaplias (2009), and Utaka (2014) consider the CCI a relevant predictor of the short-term growth in gross domestic product. Lemmon and Portniaguina (2006), Chen (2011), Hsu et al. (2011), and Rojo-Suárez and Alonso-Conde (2020) indicate that changes in the consumer confidence Granger-cause stock returns. Vuchelen (2004), Kwan and Cotsomitis (2006), Mandal and McCollum (2013), Kłopocka (2017), Pan (2018), Karasoy Can and Yüncüler (2018), Claveria (2019), and Acuña et al. (2020) found a negative causality between the consumer confidence and the unemployment rate both in the short run and long run. On the other hand, Demirel and Artan (2017) found no relation between economic confidence and unemployment in 13 EU countries. Mermod and Dudzevičiūtė (2011) detected causality from the consumer confidence to consumption expenditure for developed countries, and causality from economic growth to the consumer confidence for developing countries. Klopocka and Gorska (2021) analyzed data for 14 EU countries and found that the combination of subjective and objective indicators offers a more reliable basis for predictions and policy assessments. Most studies cover one country (mostly the US or countries within the EU region) or a selected group of EU countries, while evidence for emerging economies remains scarce. Exceptions are represented, for instance, by Khumalo (2014) who found a positive effect of the consumer confidence on consumers’ behavior in South Africa. Campelo et al. (2020) and Ghosh (2021) looked at consumer spending in Brazil and found that unemployment changes, stock market fluctuations, interest rate variation, and alterations in the CCI affect consumer spending, making the CCI a good predictor of spending in Brazil. Most studies confirm that the CCI has predictive power on consumption expenditures under certain circumstances (e.g. Çelik & Özerkek, 2009; Dées & Brinca, 2013 ; Gelper, Lemmens & Croux, 2007; Van Aarle & Kappler, 2012). As suggested by Ou et al. (2014) or Hampson et al. (2020), a distinction between the national consumer confidence (i.e., an individual’s perception about the recent and future macroeconomic climate), and personal consumer confidence (an individual’s perception about changes in their recent and future personal financial situation) improves understanding of the index. Vanlaer et al. (2020) and Malovaná et al. (2021) consider the personal consumer confidence more important than the national consumer confidence in determining household savings decisions.

The predictive power of the consumer confidence is more obvious during exceptional events such as political or economic shocks, environmental crisis, etc. (Batchelor & Dua, 1998; Fuhrer, 1993; Garner, 2002; Katona, 1968; Throop, 1992). Malgarini and Margani (2007) suggest the effect of the shocks is higher for inactive people and for dependent workers who may react less rationally. The uncertain economic situation may lower the personal consumer confidence, increase perceived financial vulnerability, and affect future consumer behavior (Brüggen et al., 2017; Hampson et al., 2020; Lowe, 2018), independent of how probable the loss of a job or household income is. Vanlaer et al. (2020) looked at the relationship between the decrease in the consumer confidence after the global financial crisis and the household spending behavior in 18 EU countries and found that the impact of the consumer confidence on saving had increased after the crisis. Teresiene et al. (2021) studied the impact of COVID-19 on the consumer confidence and found a rapid and robust effect of the pandemic in a short period. In the longer period, the spread of the pandemic did not affect the CCI in the EU countries, while negatively affecting the CCI in the US or China (Teresiene et al., 2021). A negative tone of economic news and high media coverage of exceptional events have a strong mediating effect on the consumer confidence and subsequent consumption behavior (e.g. Boomgaarden et al., 2010; Garz, 2018; Hollanders & Vliegenthart, 2011; Kleijnnijenhuis et al., 2015; Sorić et al., 2019; Soroka et al., 2015; Svensson et al., 2017; Vliegenthart & Damstra, 2019). However, changes in consumer behavior can occur for other reasons than turbulent economic or political changes (El Alaoui et al., 2020; Mandal & McCollum, 2013).

3 Subjective Well-being, Emotions, and Consumers´ Consumption Expenditure

Economic research has confirmed the importance of studying consumers' feelings and emotions when predicting consumer behavior (Ahmad & Rangaraju, 2017; Johnson & Naka, 2014; Nyman & Ormerod, 2014). Regarding the relationship between consumption and SWB or its components, studies (Bertram-Hümmer & Baliki, 2015; Dumludag, 2015; Gokdemir, 2015; Guillen-Royo, 2008; Noll & Weick, 2015; Zhang & Xiong, 2015) focus mainly on levels of consumption. Specific findings depend on what a given study actually measures–e.g., some studies consider happiness a synonym for SWB, others draw a difference between these two. For instance, Schmutte and Ryff (1997) describe psychological well-being as a general feeling of happiness. The Organisation for Economic Cooperation and Development (2013) describes three main types of SWB measures: cognitive measures related to the evaluation of life experiences or life as a whole (e.g., life satisfaction, Cantril ladder); affective measures related to “emotional well-being” (positive and negative affects or affect balance at or during a certain point or period in time); and measures related to the concept of “eudaimonia,” which capture individual happiness or welfare (Deci & Ryan, 2008; Heintzelman, 2018; Huta & Waterman, 2014). Most studies regard life satisfaction as a cognitive self-evaluation of happiness (Diener, 1984; Veenhoven, 1994) or SWB (Andrews & Withey, 1976; Campbell, 1976; Michalos, 1980). Tsurumi et al. (2021) found that total consumption contributes primarily to cognitive and eudaimonic measures of SWB. Duesenberry’s (1949) theory of consumer behavior suggests that various types of consumption enhance happiness and therefore also SWB in at least three ways. Increased consumption of durable goods, food, or housing may enhance happiness by alleviating material hardship or making life easier, serving as a form of coping mechanism against increased stress (Cheng et al., 2016). Conspicuous consumption of visible goods such as expensive vehicles, holidays, clothes, cosmetics, or jewelry may enhance happiness by increasing social status (Chao & Shor, 1998; Dutt, 2006; Johanson-Stenman & Martinsson, 2006; Kaus, 2013; Perez-Truglia, 2013). Finally, spending on leisure or charitable activities may enhance happiness by positively affecting social relationships (Pugno, 2009).

Similar to the consumer confidence, the impact of SWB on consumer behavior may be more profound during exceptional situations that lead to more dramatic behavioral reactions and changes, as we see in cases of panic buying and other herd behavior phenomena during disease outbreaks, national disasters, wars, or terrorist attacks (Leach, 1994; Lins & Aquino, 2020). Terror management theory (Arndt et al., 2004; Kennett-Hensel et al., 2012) explains how exceptional events motivate compensatory behavior to alleviate negative emotions. The compensatory behavior can take the form of purchasing unnecessary products or products of daily need in extensive quantity to regain the sense of control, security, or comfort. The threatening situation can make these purchases look necessary for survival (Arafat et al., 2020; Chua et al., 2021; Dodgson, 2020; Fairfield et al., 2015; Hendrix & Brinkman, 2013). Studies (Bentall et al., 2021; Burroughs & Rindfleisch, 2002) show that fear, anxiety, depressive mood, or elevated stress levels can lead to an active response such as over-purchasing or impulse spending behavior. These responses serve as a self-protective mechanism to manage negative emotions and restore a positive sense of self (Sneath et al., 2009). However, Landau et al. (2011) point out that some individuals may react passively and decrease their spending.

According to cognitive behavioral theories, cognitive evaluations (i.e., appraisals) influence emotions, while, at the same time, emotions influence the cognitive evaluation, and this interaction leads to a behavioral response (Ellsworth, 2013; Moors et al., 2013). The consumer confidence may function as an appraisal tied to specific emotions. Studies (Hampson et al., 2020; Kursan Milaković, 2021; Ng & Russell-Bennett, 2015) show that psychological mechanisms through which the consumer confidence leads to changes in spending behavior have a cognitive and affective dimension, but the affective component has not been sufficiently explored, with few exceptions (e.g., Sekizawa et al., 2021; Van Giesen & Pieters, 2019). Sekizawa et al. (2021) found that the level of the CCI and its fluctuation in Japan are associated with anxiety and positive affects; therefore, when the consumer confidence is higher, people tend to be happier and less anxious. The affect-as-information model suggests that emotions provide information related to one’s current available tendencies and cognitions (Schwarz & Bohner, 1996); therefore, people use emotional information to make judgments that influence their attitudes and behavior (e.g., Gino & Shea, 2012; Gino et al., 2012; Higgins, 2006). Two types of current emotions affect our decisions. We experience integral emotions when we make decisions, but we happen to have incidental emotions, unrelated to the appraisal (Brooks & Schweitzer, 2011; Olekalns & Smith, 2009; Tsay & Bazerman, 2009). Anxiety aroused prior to a decision may lead to perceiving certain behavior as worse, while positive emotions may lead to overvaluing benefits, undervaluing losses, and being more open to risk-taking (e.g., Barry et al., 2004; Friedman et al., 2004; Steinel et al., 2008; Van Kleef et al., 2004). Our decisions are also affected by anticipated emotions that we expect to have post-decision and that influence our risk estimation, intentions, and expectations (see e.g., Bagozzi et al., 2016; Carrera et al., 2011; Kotabe et al., 2019; Riquelme & Alqallaf, 2020; Zampetakis et al., 2016). Dread (i.e., extent of perceived lack of control, feelings of dread, and perceived catastrophic potential) is one of the anticipated emotions with a significant effect on our decisions and behavior (Senik, 2008). Together with the uncertainty of the situation, they create two psychological dimensions of the “risk” (Peters & Slovic, 1996) that influence the cognitive evaluation of risk and determine behavior, as explained by the risk-as-feelings hypothesis (Loewenstein et al., 2001). Perceived risk and uncertainty can strengthen fear and anxiety (Mi et al., 2019; Zheng et al., 2019), which can result in higher pessimism, more pessimistic risk estimates, and make consumers more risk-averse (Kuhnen & Knutson, 2011; Miu et al., 2008; Patt & Weber, 2014; Peng et al., 2014; Smithson, 2008; Stanton et al., 2014). Therefore, uncertainty and perceived risk can increase saving behavior (Bande & Riveiro, 2013; Carroll et al., 2012; Ceritoglu, 2013; Chamon et al., 2013; Mastrogiacomo & Alessie, 2014; Mody et al., 2012). However, this precautionary motive to build up a financial reserve is not universally supported (Fossen & Rostam-Afschar, 2013).

Both the consumer confidence and SWB are closely related to expectations, which can be defined as the assumptions individuals uphold about their future (Augusto-Landa et al., 2011; Conversano et al., 2010; Diener et al., 2003; Eid & Diener, 2004; Mäkikangas & Kinnunen, 2003; Pleeging & Burger, 2020). Optimistic people are generally happier, more resilient to negative economic or political shocks, and have a greater SWB (Arampatzi et al., 2015, 2020; Ekici & Koydemir 2016; Frijter et al., 2012). Optimism represents a psychological capital that serves as a buffer against misfortune (Youssef & Luthans, 2007). This corresponds to the economical view of confidence related to predictability (Malovaná et al., 2021). As explained by Akerlof and Shiller (2010), high confidence can lead to increased optimism about the future, while low confidence leads to higher pessimism. Similarly, a high trait of optimism can lead to higher confidence and thus spending more/saving less, while a high trait of pessimism leads to lower confidence and thus spending less/saving more. A distinction between optimism and pessimism as stable personality traits and as states that are more changeable may be necessary. The self-regulatory model talks about “dispositional optimism “ as a global expectation that good things will be plentiful in the future and bad things sparse and is associated with less distress, more active coping, and lower engagement in avoidance or denial (Scheier et al., 2001). Buchanan and Seligman (1995) describe that pessimists explain away bad events with internal, stable, and global causes, while optimists focus on external, unstable, and specific causes. Both theories suggest that optimism and pessimism involve cognitive, emotional, and motivational components, and thus influence our judgments, decisions, and behaviors. Since optimists can be pessimistic under certain conditions and vice versa, optimism and pessimism probably have both a trait and a state component (Luthans & Youssef, 2007). Although traits are more related to overall well-being, states relate more to specific outcomes such as educational or work-related goals and success (Kluemper et al., 2009; Peterson, 2000). While the trait may be important in explaining consumers´ habits, the state may help explain changes in the consumer confidence. Katona (1968) hypothesized that spending would increase when people became optimistic, and precautionary savings would rise when they became pessimistic. Kahneman and Tversky (1982) describe the forecast error as a tendency to overestimate the likelihood of positive events, and underestimate the likelihood of negative events, which can be explained by psychological biases such as the law of small numbers (Rabin, 2002) or the hindsight bias (Shiller, 2003), which make situations seem more predictable and more probable. Shiller (2003) explains that people make forecasts in uncertain situations by looking for familiar patterns and assuming that future favorable patterns will resemble past ones. Finally, due to the illusion of control, people optimistically distort the reality, believing that their own situation will be consistently better than the general one, which makes them expect a personal success with a probability inappropriately higher than the objective probability warrants (DeBondt & Thaler, 1995). The biases affect both the subjective probability of future economic events and their retrospective interpretation and may create the illusion that we can control the external factors to create an optimistic future. Especially during critical events, people amplify the forecast error and perceive their personal and future conditions better than the aggregate and past ones (Bovi, 2009), so that they can be individual optimists and social pessimists at the same time (Rosner & Nagdy, 2014). In line with Buchanan and Seligman (1995), if we feel we are in control of our lives, we feel more optimistic about our situation (regardless of the objective factors) than about the national situation, which we cannot control directly.

One of the important variables explaining differences in dealing with uncertain situations, making decisions, and coping with emotions is therefore the perceived control we have over our life. The locus of control (Rotter, 1954) reflects individual differences in beliefs about the degree to which we can control the outcomes of events in our life (Galvin et al., 2018). It moderates the effects of external stressors on affective and behavioral responses (Debus et al., 2014; Jiang et al., 2020; Reknes et al., 2019). Similar to optimism, it can serve as a buffer against economic, psychological, political, and other shocks by giving the individual a sense of control and freedom to decide what to do. Individuals with an internal locus of control believe that they have control over the outcomes in their life (Twenge et al., 2004). They have a greater appreciation of freedom of choice, represented by the size of an opportunity set with mutually exclusive alternatives (Verme, 2009). People with an external locus of control believe that things happening in their lives are beyond their control and have no power in affecting them, since they happen due to chance, fate, luck, or are the result of the control by powerful others (Fong et al., 2017). They have a lower appreciation of freedom of choice, since it is regulated by the degree of perceived control, which shapes the expectations we have about the outcome of our choices (Verme, 2009). The external locus of control leads to more problems in dealing with stress and uncertainty (Debus et al., 2014; Reknes et al., 2019). Externals often blame others for their problems and adopt the victim mentality to protect their self against shame, guilt, or regret we may feel when we accept that things went wrong because of our actions (Ng et al., 2006; Twenge et al., 2004). This mentality may lead the externals to be more passive because they do not believe they can actively cope with the situation (Ng et al., 2006). Veenhoven (2000), Inglehart et al. (2008), and Verme (2009) in their analyses of relationship between happiness and other psychological variables used a “perceived fate control” variable represented by a question: “Please use this scale where 1 means ‘none at all’ and 10 means ‘a great deal’ to indicate how much freedom of choice and control you feel you have over the way your life turns out.” The question combines information on both the freedom of choice and the locus of control. Based on their studies, we may consider these variables interrelated. Since the locus of control is not measured internationally, but data on the freedom of choice are available, it may improve our understanding of the psychological variables behind consumer behavior. Hampson et al. (2020) show that the effects of the consumer confidence depend on the locus of control, with the influence of national consumer confidence significantly stronger for consumers with an external locus of control, who are more susceptible to lowered well-being in response to external stressors (Debus et al., 2014). As suggested by Sekizawa et al. (2021), cognitive evaluations of the national economy lead to behavioral changes based on whether an individual feels personally financially affected by the situation and whether the level of affectedness is strong enough to evoke emotional feelings of financial vulnerability. In Hampson et al. (2020), the locus of control served as a moderator of the relationship between the national consumer confidence and perceived financial vulnerability, defined as the probability that an individual will experience financial hardship, i.e., will not be able to maintain the current standard of living (O’Connor et al., 2019). When individuals experience higher perceived financial vulnerability, they become more price-conscious when making new purchases, as this helps to conserve financial resources (Hampson & McGoldrick, 2017). As the financial vulnerability is psychologically very taxing, it can lead to reduced well-being, physical and mental problems, or material deprivation (O’Loughlin et al., 2017). Understanding its role in consumers’ behavior and its relation to the national and personal consumer confidence and psychological variables of overall well-being, locus of control, negative or positive affect is of both theoretical and practical interest (O’Loughlin et al., 2017; Treanor, 2016).

Studies (Demirel & Artan, 2017; Kłopocka, 2017; Matošec & Obuljen Zoričić, 2019; Taylor & McNabb, 2007) agree that macroeconomic variables alone explain only a small proportion of consumer behavior. Therefore, we expect that other factors play an important role, though they may affect different consumers differently, and probably influence especially discretionary, infrequent, and planned purchases, not strictly necessary for life. Their effect may be more visible during exceptional circumstances (Desroches & Gosselin, 2002), as these result in a strong emotional reaction and affect the perception of uncertainty. The psychological concepts described above can be understood through the lenses of the cognitive appraisal theory, which shows how the cognitive evaluation of stressors (for instance, economic recession) interacts with emotions, potentially resulting in a behavioral change (Moschis, 2007). The reaction to a stressor follows an appraisal-emotion-behavior sequence (Folkman & Lazarus, 1984), where individuals evaluate to what extent a stressor potentially affects them. The cognitive appraisal leads to a positive or negative emotional response that affects our expectations about behavioral outcomes, while the locus of control or freedom of choice gives the individual a sense of how the stressor is controllable. This results in a behavioral response, which may include active or passive coping strategies and behavioral adaptations to deal with the stressor and accompanying emotions, such as hedonic shopping, over-purchasing, or saving (Hampson et al., 2020; O’Loughlin et al., 2017; Sekizawa et al., 2021; Treanor, 2016).

4 Data and Statistical Approach

We used yearly data for a panel of 22 OECD countries. The sample starts in 2008 and ends in 2020. The countries were chosen so that the final number of observations was maximized. The reason for limiting the number of countries was missing data on the confidence indicators. The estimates are therefore based on a total of 286 observations. The selected countries are Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Mexico, Netherlands, Poland, Portugal, South Korea, Spain, Sweden, United Kingdom, and the United States.

To capture the development of consumption, we make use of the real total consumption of households. We also employ consumption in two disaggregated ways. The first approach disaggregates total consumption (CONSUMPTION) into four types of expenditures according to durability: expenditures on durable goods (DURABLE), semi-durable goods (SEMIDURABLE), non-durable goods (NONDURABLE), and expenditures on services (SERVICES). The second approach differentiates total consumption according to purpose, which is embodied in the COICOP methodology (The Classification of Individual Consumption according to Purpose), into 12 divisions: food and non-alcoholic beverages (COICOP1), alcoholic beverages, tobacco (COICOP2), Clothing, and footwear (COICOP3), Housing, water, energy, fuel (COICOP4), Furnishings, household equipment and maintenance (COICOP5), Health (COICOP6), Transport (COICOP7), Post and telecommunication (COICOP8), Recreation and culture (COICOP9), Education (COICOP10), Restaurants and hotels (COICOP11) and Miscellaneous goods and services (COICOP12). For the purposes explained below, we also employ the gross domestic product (GDP) in the analysis. The notation in brackets is the designation of the series, which will be used further below, especially in the tables.

The sentiments of consumers are captured by four indicators: consumer confidence indicator published by the OECD (CONFIDENCE), and Life ladder (LADDER), Freedom to make life choices (FREEDOM), positive affect (POSITIVE), and negative affect (NEGATIVE) indicators derived from the World Happiness Report (Helliwell et al., 2021). The Life ladder score, which represents the cognitive measure of SWB, is measured by answering a question: “Please imagine a ladder, with steps numbered from 0 at the bottom to 10 at the top. The top of the ladder represents the best possible life for you and the bottom of the ladder represents the worst possible life for you. On which step of the ladder would you say you personally feel you stand at this time?” Freedom to make life choices, as a eudaimonic measure of SWB, is the national average of responses to the question “Are you satisfied or dissatisfied with your freedom to choose what you do with your life?” Affective measures of SWB are measured by positive and negative affect. The positive affect represents the average of three positive affects (happiness, laughter, and enjoyment) measured through a question: “Did you experience the following feelings during A LOT OF THE DAY yesterday? The negative affect is defined as the average of three negative affects (worry, sadness, and anger) measured by responses to the question: “Did you experience the following feelings during A LOT OF THE DAY yesterday?” Although the last two variables are called “affects”, they correspond to what we generally consider “emotions”. For a full explanation of the methodology of the specific measurements, see the Statistical Appendix 1 of the World Happiness Report (Helliwell et al., 2021).

All consumption variables and the gross domestic product series are measured using constant prices of the national base year. The national base year differs slightly among the countries; usually, it is 2015. The CCI published by the OECD is expressed as an index with a long-term average set to 100. The published series are first transformed by natural logarithm and then detrended. The SWB of consumers captured by the variables of freedom to make life choices, positive affect, and negative affect are measured as the average response for each person, with values ranging from 0 to 1, while the life ladder is measured on a scale from 0 to 10.

The initial inspections of the data showed that consumption data was all nonstationary, which is to be expected, while the sentiment indicators were all stationary, which in the case of the CCI is by definition since it is published as detrended.

To express all the variables in a common measure, the consumption series were transformed into growth rates expressed as decimal numbers. The CCI was divided by 100 and the life ladder indicator was divided by 10. This means that all the SWB indicators assume values from the interval 0 to 1. Table 1 summarizes some statistical properties of the adjusted data.

Normality is tested by the Jarque–Bera test under the null hypothesis of normal distribution, the unit root is tested by Levin-Lin-Chu, and Fisher-ADF tests under the null hypothesis of unit root *, **, *** signifies rejection of the null hypothesis at 10%, 5%, 1% level of significance, respectively.

We test for the presence of unit roots by utilizing two tests: the Levin-Lin-Chu unit root test and the Fisher-ADF test. Suppose the following representation of the panel:

where y represents the endogenous variable, x stands for exogenous variables, ε represents errors, i denotes cross-sections, j = 1 … ni signifies possible different lag orders for the cross-sections. The null hypothesis is related to the coefficient α. More specifically, the null hypothesis is that α is equal to zero. If the null hypothesis is rejected, then the series is considered stationary. The Levin-Lin-Chu test assumes a common unit root process across the cross-sections. On the other hand, the Fisher-ADF unit root test allows for individual unit root processes across cross-sections. The number of lags in Eq. (1) was selected by the Schwarz information criterion, which in most cases meant one lag. The vector x includes only the intercept, no trends were assumed. Since the property of stationarity is crucial for the subsequent analysis, we employ these two different tests to check for the presence of unit roots. As the results in Table 1 show, all the series may be considered stationary after the adjustments mentioned above.

The variables that capture the SWB of consumers should be suspected to exhibit significant correlations among them. Table 2 presents the correlation matrix between the five variables.

The correlation matrix in Table 2 shows that the correlations between the CCI (CONFIDENCE) and the SWB indicators are statistically significant, but they are relatively small with respect to their magnitude. Therefore, the CCI should be considered as a separate variable. On the other hand, the correlations between the variables of life ladder (LADDER), freedom to make life choices (FREEDOM), and positive affect (POSITIVE) are quite considerable. The correlations between any of these three variables and the negative affect variable (NEGATIVE) are then again significantly smaller. Therefore, we consider the CCI and the variable of negative effect separately and use principal components analysis for the other three variables to extract a principal component that would capture most of their original variability.

The principal components analysis starts with the variance matrix of the original variables, here life ladder, freedom to make life choices, and positive affect. The principal components are obtained by eigenvalue decomposition of the original variance matrix. The principal components analysis was performed using the Pearson correlation matrix. Table 3 shows the eigenvalues associated with the decomposition of the original correlation matrix.

Since there are three variables, there are three eigenvalues. The sum of the three eigenvalues must be three because the analysis is based on a correlation matrix. The last column shows that the first principal component accounts for 83% of the total variance. There are no strict rules as to what the threshold should be. In practice, threshold of 80% or 85% are common. We conclude that it is sufficient to use the first component only to capture the vast majority of the variance produced by the three variables. This variable is named COMPONENT and its properties are shown in Table 1.

The objective of the empirical analysis is to verify the impacts of the three SWB indicators on consumption. The empirical analysis faces the wide-spread problem of endogeneity. Endogeneity arises from dependence of the variable assumed as independent on the variable designated as dependent, omitted variables and measurement errors. In a vast majority of economic modelling all these problems should be expected to be present. The problem of omitted variables stems from the fact that the true economic model is never known in practice. Mutual relationships between the confidence and SWB indicators on one hand and consumption on the other hand cannot be ruled. The frequent approach employed to tackle this issue is to make use of instrumental variables, which means variables correlated with independent variables but uncorrelated with the error term. We apply the estimation based on instrumental variables in the form of the generalized method of moments.

The general structure of the empirical model we estimate is:

where c represents constants, y contains a measure of consumption, x contains the three SWB measures. In Table 1, we showed that the variables are already stationary; therefore, we do not apply the typical transformation in the form of differencing Eq. (2) as it would lead to over-differencing.

The possible cross-section fixed effects are accounted for by using orthogonal deviations. Arellano-Bond 2-step estimation is used. To compute coefficient covariances, White period method is used to account for within cross-section heteroskedasticity and serial correlation. This means that the computed coefficient covariances are robust to within cross-section heteroskedasticity and serial correlation.

Since three coefficients are estimated, it is necessary to employ at least three instruments. Lagged regressors by one period are used as instruments, and contemporary real GDP growth is used as the fourth instrument. Real GDP growths are correlated with the regressors while the correlation with the error of (2) is small. The validity of instruments is tested by Sargan-Hansen J-test, which tests the null hypothesis that the over-identifying restrictions are valid.

5 Results and Discussion

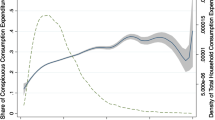

The results presented in Table 4 indicate that the CCI always plays a positive and statistically significant role in the development of consumption. This means that an increase in the CCI increases the growth of total consumption and expenditures on durable and semidurable goods and services, which is similar to findings by Gelper et al. (2007) and Adrangi and Macri (2011) for durable goods or Malgarini and Margani (2007) for services. However, both Garner (2002) and Malgarini and Margani (2007) show that the CCI is not statistically significant in the case of durable goods. The positive estimated coefficient associated with CCI is the lowest in the case of expenditures on nondurable goods, which can be explained by the fact that a relatively high proportion of these expenditures is directed on goods whose consumption is necessary. Nondurable goods mainly consist of food and non-alcoholic beverages and alcoholic beverages and tobacco. We may expect that the consumer confidence influences spending on nondurable goods especially during exceptional events, when consumer priorities are centered on basic needs (Di Crosta et al., 2021). The uncertainty of the external situation may lead to panic buying and over purchasing of nondurables to restore the sense of security by creating a supply of food and beverages to be prepared for the possible bad times. The effect of CCI on consumption spending is estimated to be the strongest in the case of consumption of durable goods. We plot this relationship in Fig. 1.

The SWB indicators have statistically significant effects in the case of total consumption and expenditures on semidurable goods and services. The component variable represents the joint impact of the variables of the life ladder, the freedom to make life choices, and the positive affect. The impacts of the component variable as well as that of negative affect are negative. While the positive impact of the CCI on the total consumption was expected, the previous theoretical discussion showed that the impacts of the other variables might be positive or negative. Our results show that within the total consumption they tend to have an impact on those expenditures, which are more easily postponed. Expenditures on semidurable goods include especially expenditures on clothing and footwear.

It is difficult to compare the magnitudes of the impact in our study with other studies since there are no comparable studies. When interpreting the results only from the point of view of this study it should be noted that the median values of consumer confidence, component, and negative affect are 0.998, 0.483, and 0.229, respectively. Given the values of the estimated coefficients it may be, therefore, concluded that given these three variables the impact of consumer confidence is on average the highest. Although the estimated coefficients of the component and negative affect are lower than that of consumer confidence, given the median values mentioned above, the effects of both the component and the negative affect on consumption dynamics are non-negligible.

We may interpret the results in line with Larson and Shin (2018) or Zwanka and Buff (2020) who suggest that buying non-necessities may also include pursuing freedom or with Kemp et al. (2014) who suggest that buying non-necessities serves as a coping mechanism to deal with negative emotions. Therefore, in the case of the component variable, a higher sense of freedom, higher cognitive well-being, and positive affect (therefore, higher overall SWB) may prevent consumers from spending. As stated by Guven (2009), happy people tend to save more and spend less with respect to their future decisions and expectations. Ozari (2007) and Zhong and Mitchell (2012) suggest that high well-being consumers prefer lower-cost, everyday pleasures, such as going swimming or engaging in their favorite hobby, to expensive indulgences. Other studies (Carter & Gilovich, 2010; Dunn et al., 2011; Nicolao et al., 2009; Xiao & Kim, 2009; Zhong & Mitchell, 2010) also suggest the opposite direction, i.e., that consumption of certain goods leads to increased happiness or SWB. We may expect that respondents who evaluate their SWB positively (in this case, all three aspects of the SWB) do not feel the need to use consumption as a mechanism to enhance their happiness through any of the described channels such as coping with distress, improving social status, or social relationships. In case of the negative emotions, they can make consumers more passive, negatively affect the decision-making and lead to more pessimistic estimates of the outcomes of their choices, which may be important in purchasing semidurable goods or services, as suggested by Miu et al. (2008) or Peng et al. (2014). Landau et al. (2011) and Degli Esposti et al. (2021) point out that individuals may react passively and decrease spending on non-necessities such as nonbasic clothes when feeling negative emotions.

Table 5 presents the estimated impacts of the SWB indicators on consumption classified according to purpose. The CCI is not a statistically significant determinant of consumption in the case of expenditures on housing, water, energy and fuel, which is an expected result since these expenditures are practically unavoidable. Its impact on expenditures on health is also rather limited for the very same reason.

The statistically significant and negative estimated coefficients associated with SWB indicators are found in the cases of expenditures on clothing and footwear, recreation and culture, and restaurants and hotels. These results confirm the estimates presented in Table 4 where it was shown that these indicators have a negative impact on expenditures on semidurable goods and services. Furthermore, the variables of life ladder, the freedom to make life choices, and the positive affect (COMPONENT) jointly negatively influence the expenditures on transport, which may be just a reflection of their negative impact on the previously mentioned expenditures since the use of various means of transport often accompanies the consumption of services in the divisions of restaurants and hotels, and recreation and culture. These three variables also have a slight negative impact on the growth of expenditures on education. Individuals who are currently feeling high level of well-being, experiencing happiness and control over their life may not be feeling the pressure to invest in their education to improve their future. In line with the forecasting error (Bovi, 2009; Kahneman & Tversky, 1982), but also due to the current satisfactory state, they may expect their future to be similarly satisfying as their current life.

6 Conclusions

As Veenhoven et al. (2021) state, there is a growing demand for information about how our choices will affect our happiness. However, equally important is understanding how our level of happiness or overall well-being affects our choices in various aspects of our life, consumers´ behavior included. Our study contributes to the area of research on the relationship between various aspects of well-being and consumption by adding the variable of consumer confidence, which is considered an important psychological factor affecting consumers´ spending. Indeed, our results suggest that the consumer confidence is a useful concept in predicting the consumer behavior for durable and semidurable goods and services in selected OECD countries, i.e., not only for countries within the EU or for the US. Since the consumer confidence is based on our expectations about the national and personal future economic situation, it plays a more important role in deciding whether to buy durable goods or spend money on clothes or services, i.e., on goods that require more planning or that may be associated with hedonic shopping, than on other types of goods. Individuals may purchase them more when evaluating their economic situation as good and expecting it will stay the same (or get better), so that they can either afford or deserve the purchase. On the other hand, the nondurables are bought frequently and spending on them may be a result of a habit more than of the level of the consumer confidence. The effect of the consumer confidence on purchasing nondurables may increase during exceptional events such as political, economical, or environmental crisis, when individuals may prepare for worse times by making stocks of food, and may be affected by the negative picture created by media resulting in panic buying and overpurchasing. The results in several countries suggest that the consumer confidence correlates positively with happiness and negatively with worry or anxiety (Barazzetta, 2015; Ekici & Koydemir, 2016; Frijters et al., 2012).

To analyze the effect of SWB on consumption, we looked at three aspects of SWB as suggested by the OECD (2013). The cognitive measure represented by the Cantril ladder, the affective measure represented by the positive and negative affect, and the eudaiomonic measure represented by the freedom of choice show a negative effect on total consumption and expenditures on clothing and footwear, recreation and culture, and restaurants and hotels. Our results suggest that the freedom of choice may have a moderating effect on spending behavior similarly to the locus of control concept, helping consumers cope with positive or negative affect in ways that do not result in an increase in spending behavior. Since the locus of control is not measured repeatedly and on an international basis, the use of freedom of choice as an alternative eudaimonic measure of SWB, as suggested also by Verme (2009), may be a helpful addition for studies on consumer behavior. Finally, our study can contribute to the understanding of how SWB influences consumption, contrary to most of research that studied the opposite direction of relationship, i.e. how consumption affects SWB.

In Sekizawa et al.´s (2021) study, the variables we analyzed, except for the freedom of choice that was not included, were associated with higher levels of the consumer confidence. These results were not replicated in our study. One possible explanation, for instance, may be that the negative affect variable retrieved from the World Happiness Report includes both inhibiting and disinhibiting negative emotions, which may have opposing effects on consumer behavior. Also, we combined two data sets, one from the World Happiness Report and one from the OECD, however, the combination allowed us to compare larger data sets and variables that would be difficult to measure to such an extent for one specific study. For future research, including more types of emotions and dividing them based on their impact on behavior may provide additional information, as well as adding understudied variables such as hope or a combination of the optimism and pessimism trait and state measurement.

Our study used data from countries based on the availability of complete data sets. As research in countries outside the EU region or the US is sparse, future research should also focus more on developing countries and countries outside the mentioned geographical areas. In our study, we did not focus on the effect of possible exceptional events on changes in consumer confidence, although, as explained in the theoretical part of the paper, consumer confidence may serve as an important predictor of consumer behavior especially during exceptional and turbulent situations. Therefore, another possible direction of future research, together with the focus on the understudied variables, may include a more extensive analysis of the impact of national and international exceptional events.

References

Acuña, G., Echeverría, C., & Pinto-Gutiérrez, C. (2020). Consumer confidence and consumption: Empirical evidence from Chile. International Review of Applied Economics, 34, 75–93.

Adrangi, B., & Macri, J. (2011). Consumer Confidence and Aggregate Consumption Expenditures in the United States, Review of Economics & Finance, Better Advances Press, Canada, 1, 1–18.

Ahmad, N., & Rangaraju, S. K. (2017). Impact of consumer confidence during good times and bad times. Social Science Electronic Publishing.

Akerlof, G. A., & Shiller, R. J. (2010). Animal spirits: How human psychology drives the economy, and why it matters for global capitalism. Princeton University Press.

Andrews, F. M., & Withey, S. B. (1976). Social indicators of well-being: America’s perception of life quality. Plenum Press.

Arafat, S. M. Y., Kar, S. K., Marthoenis, M., Sharma, P., Hoque Apu, E., & Kabir, R. (2020). Psychological underpinning of panic buying during pandemic (COVID-19). Psychiatry Research, 289, e113061.

Arampatzi, E., Burger, M., Stavropoulos, S., & Tay, L. (2020). The role of positive expectations for resilience to adverse events: Subjective well-being before, during and after the Greek bailout referendum. Journal of Happiness Studies, 21, 965–995. https://doi.org/10.1007/s10902-019-00115-9

Arampatzi, E., Burger, M. J., & Veenhoven, R. (2015). Financial distress and happiness of employees in times of economic crisis. Applied Economic Letters, 22(3), 173–179.

Arndt, J., Solomon, S., Kasser, T., & Sheldon, K. M. (2004). The urge to splurge: A terror management account of materialism and consumer behavior. Journal of Consumer Psychology, 14, 198–212.

Augusto-Landa, J. M., Pulido-Martos, M., & Lopez-Zafra, E. (2011). Does perceived emotional intelligence and optimism/pessimism predict psychological well-being? Journal of Happiness Studies, 12, 463–474.

Bagozzi, R. P., Belanche, D., Casaló, L. V., & Flavián, C. (2016). The role of anticipated emotions in purchase intentions. Psychology of Marketing, 33, 629–645.

Bande, R., & Riveiro, D. (2013). Private saving rates and macroeconomic uncertainty: Evidence from Spanish regional data. Economic and Social Review, 44(3), 323–349.

Barazzetta, M. (2015). The asymmetric effect of expectations on subjective well-being. Working Papers 374, ECINEQ, Society for the Study of Economic Inequality. Available at http://www.ecineq.org/milano/WP/ECINEQ2015-374.pdf

Barry, B., Fulmer, I. S., & Van Kleef, G. A. (2004). I laughed, I cried, I settled: The role of emotion in negotiation. In M. J. Gelfand & J. M. Brett (Eds.), The handbook of negotiation and culture (pp. 71–94). Stanford University Press.

Batchelor, R., & Dua, P. (1998). Improving macro-economic forecasts: The role of consumer confidence. International Journal of Forecasting, 14(1), 71–81.

Benhabib, J., & Spiegel, M. M. (2019). Sentiments and economic activity: Evidence from US states. The Economic Journal, 129(618), 715–733.

Bentall, R. P., Lloyd, A., Bennett, K., McKay, R., Mason, L., Murphy, J., McBride, O., Hartman, T. K., Gibson-Miller, J., Levita, L., Martinez, A. P., Stocks, T., Butter, S., Vallières, F., Hyland, P., Karatzias, T., & Shevlin, M. (2021). Pandemic buying: Testing a psychological model of over-purchasing and panic buying using data from the United Kingdom and the Republic of Ireland during the early phase of the COVID-19 pandemic. PLoS ONE, 16(1), e0246339.

Bertram-Hümmer, V., & Baliki, G. (2015). The role of visible wealth for deprivation. Social Indicators Research, 124, 765–783.

Boomgaarden, H. G., Vliegenthart, R., De Vreese, C. H., & Schuck, A. R. T. (2010). News on the move: Exogenous events and news coverage of the European Union. Journal of European Public Policy, 17(4), 506–526.

Bovi, M. (2009). Economic versus psychological forecasting. Evidence from consumer confidence surveys. Journal of Economic Psychology, 30(4), 563–574.

Brooks, A. W., & Schweitzer, M. (2011). Can nervous nelly negotiate? How anxiety causes negotiators to make low first offers, exit early, and earn less profit. Organizational Behavior and Human Decision Processes, 115(1), 43–54.

Brüggen, E., Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228–237.

Buchanan, G., & Seligman, M. E. P. (1995). Explanatory style. Lawrence Erlbaum Associates.

Burroughs, J. E., & Rindfleisch, A. (2002). Materialism and well-being: A conflicting values perspective. Journal of Consumer Research, 29, 348–370.

Caleiro, A. B. (2021). Learning to classify the consumer confidence indicator (in Portugal). Economies, 9(3), 125.

Campbell, A. C. (1976). Subjective measures of well-being. American Psychologist, 31, 117–124.

Campelo, A., Seda Bittencourt, V., & Malgarini, M. (2020). Consumers confidence and households consumption in Brazil: Evidence from the FGV survey. Journal of Business Cycle Research, 16(1), 19–34.

Carrera, P., Caballero, A., Muñoz, D., & Oceja, L. (2011). Anticipated emotions and personal experience for predicting behavioral intentions and behavioral expectations. The Spanish Journal of Psychology, 14(2), 535–547.

Carroll, C. D., Slacalek, J., & Sommer, M. (2012). Dissecting saving dynamics: measuring wealth, precautionary and credit effects. ECB working paper series, 1474, 1–50.

Carter, T. J., & Gilovich, T. (2010). The relative relativity of material and experiential purchases. Journal of personality and social psychology, 98(1), 146–159. https://doi.org/10.1037/a0017145

Carter, T. J., & Gilovich, T. (2012). I am what I do, not what I have: The differential centrality of experiential and material purchases to the self. Journal of Personality and Social Psychology, 102(6), 1304–1317.

Çelik, S., & Özerkek, Y. (2009). Panel cointegration analysis of consumer confidence and personal consumption in the European Union. Journal of Business Economics and Management, 10(2), 161–168.

Ceritoglu, E. (2013). The impact of labour income risk on household saving decisions in Turkey. Review of Economics of the Household, 11(1), 109–129.

Chamon, M., Liu, K., & Prasad, E. (2013). Income uncertainty and household savings in China. Journal of Development Economics, 105(C), 164–177.

Chao, A., & Schor, J. B. (1998). Empirical tests of status consumption: Evidence from women’s cosmetics. Journal of Economic Psychology, 19, 107–131.

Chen, S.-S. (2011). Lack of consumer confidence and stock returns. Journal of Empirical Finance, 18(2), 225–236.

Cheng, Z., King, S., Smyth, R., & Wang, H. (2016). Housing property rights and subjective wellbeing in Urban China. European Journal of Political Economy, 45(Suppl), 160–174.

Chua, C. L., & Tsiaplias, S. (2009). Can consumer sentiment and its components forecast Australian GDP and consumption? Journal of Forecasting, 28, 698–711.

Chua, G., Yuen, K. F., Wang, X., & Wong, Y. D. (2021). The determinants of panic buying during COVID-19. International Journal of Environmental Research and Public Health, 18, 3247.

Claveria, O. (2019). Forecasting the unemployment rate using the degree of agreement in consumer unemployment expectations. Journal for Labour Market Research, 53, 1–10.

Conversano, C., Rotondo, A., Lensi, E., Della Vista, O., Arpone, F., & Reda, M. A. (2010). Optimism and its impact on mental and physical well-being. Clinical Practice and Epidemiology in Mental Health : CP & EMH, 6, 25–29.

Cotsomitis, J. A., & Kwan, A. C. C. (2006). Can consumer confidence forecast household spending? Evidence from the European commission business and consumer surveys. Southern Economic Journal, 72(3), 597–610.

De Grauwe, P. (2012). Booms and busts in economic activity: A behavioral explanation. Journal of Economic Behavior & Organization, 83(3), 481–501.

DeBondt, W. F. M., & Thaler, R. H. (1995). Financial decision making in markets and firms: A behavioral perspective. In R. Jarrow, V. Maksimovic, & W. T. Ziemba (Eds.), Finance (pp. 385–410). Handbooks in operations research and management science.

Debus, M. E., Konig, C. J., & Kleinmann, M. (2014). The building blocks of job insecurity: The impact of environmental and person-related variables on job insecurity perceptions. Journal of Occupational and Organizational Psychology, 87(2), 329–351.

Deci, E. L., & Ryan, R. M. (2008). Hedonia, eudaimonia, and well-being: An introduction. Journal of Happiness Studies, 9(1), 1–11.

Dees, S., & Brinca, P. (2013). Consumer confidence as a predictor of consumption spending: Evidence for the United States and the Euro area. International Economics, 134, 1–14.

Degli Esposti, P., Mortara, A., & Roberti, G. (2021). Sharing and sustainable consumption in the era of COVID-19. Sustainability, 13, 1903.

Demirel, S. K., & Seyfettin, A. (2017). The causality relationships between economic confidence and fundamental macroeconomic indicators: Empirical evidence from selected European Union countries. International Journal of Economics and Financial Issues, 7, 417–424.

Desroches, B., & Gosselin, M.-A. (2002). The Usefulness of Consumer Confidence Indexes in the United States. Staff Working Papers, Bank of Canada.

Di Crosta, A., Ceccato, I., Marchetti, D., La Malva, P., Maiella, R., Cannito, L., et al. (2021). Psychological factors and consumer behavior during the COVID-19 pandemic. PLoS ONE, 16(8), 0256095.

Di Domenico, A., Palumbo, R., Fairfield, B., & Mammarella, N. (2016). Fighting apathy in Alzheimer’s dementia: A brief emotional-based intervention. Psychiatry Research, 242, 331–335.

Diener, E. (1984). Subjective well-being. Psychological Bulletin, 75, 542–575.

Diener, E., Oishi, S., & Lucas, R. E. (2003). Personality, culture, and subjective well-being: Emotional and cognitive evaluations of life. Annual Review of Psychology, 54, 403–425.

Dodgson, L. (2020). A human behavior expert explains 4 psychological reasons why people are panic buying items in bulk during the coronavirus pandemic. Retrieved from: https://www.insider.com/why-people-are-panic-bulk-buying-during-the-coronavirus-pandemic-2020-3. Accessed on 14/12/2021.

Dragouni, M., Filis, G., Gavriilidis, K., & Santamaria, D. (2016). Sentiment, mood and outbound tourism demand. Annals of Tourism Research, 60, 80–96.

Duesenberry, J. (1949). Income, savings, and the theory of human behavior. Harvard University Press.

Dumludag, D. (2015). Consumption and life satisfaction at different levels of economic development. International Economic Review, 62, 163–182.

Dunn, E. W., Gilbert, D. T., & Wilson, T. D. (2011). If money doesn’t make you happy, then you probably aren’t spending it right. Journal of Consumer Psychology, 21(2), 115–125.

Dutt, A. K. (2006). Consumption and happiness: Alternative approaches, rough draft prepared for the conference on new directions in the study of happiness. Notre Dame: University of Notre Dame.

Eid, M., & Diener, E. (2004). Global judgments of subjective well-being: Situational variability and long-term stability. Social Indicators Research, 65(3), 245–277.

Ekici, T., & Koydemir, S. (2016). Income expectations and happiness: Evidence from British panel data. Applied Research in Quality of Life, 11(2), 539–552.

El Alaoui, M., Bouri, E., & Azoury, N. (2020). The determinants of the US consumer sentiment: Linear and nonlinear models. International Journal of Financial Studies, 8, 38.

Ellsworth, P. C. (2013). Appraisal theory: Old and new questions. Emotion Review, 5(2), 125–131.

Fairfield, B., Mammarella, N., Palumbo, R., & Di Domenico, A. (2015). Emotional meta-memories: A review. Brain Sciences, 5, 509–520.

Folkman, S., & Lazarus, R. S. (1984). Stress, appraisal, and coping. Springer.

Fong, L. H. N., Lam, L. W., & Law, R. (2017). How locus of control shapes intention to reuse mobile apps for making hotel reservations: Evidence from Chinese consumers. Tourism Management, 61, 331–342.

Fossen, F. M., & Rostam-Afschar, D. (2013). Precautionary and entrepreneurial savings: New evidence from German households. Oxford Bulletin of Economics and Statistics, 75(4), 528–555.

Friedman, R., Anderson, C., Brett, J., Olekalns, M., Goates, N., & Lisco, C. C. (2004). The positive and negative effects of anger on dispute resolution: Evidence from electronically mediated disputes. Journal of Applied Psychology, 89(2), 369–376.

Frijters, P., Liu, A. Y. C., & Meng, X. (2012). Are optimistic expectations keeping the Chinese happy? Journal of Economic Behavior and Organization, 81, 159–171.

Fuhrer, J. (1993). What role does consumer sentiment play in the U.S. macroeconomy? New England Economic Review, 32–44. Available at: http://www.bostonfed.org/economic/neer/neer1993/neer193b.pdf

Gabriele, S., Martelli, B. M., & Raitano, M. (2009). The consumers’ mood coping with the crisis. Evidences from isae consumer survey. Journal of Applied Economic Sciences, 4, 372–386.

Galvin, B. M., Randel, A. E., Collins, B. J., & Johnson, R. E. (2018). Changing the focus of locus (of control): A targeted review of the locus of control literature and agenda for future research. Journal of Organizational Behavior, 39(7), 820–833.

Garner, C. A. (2002). Consumer confidence after September 11. Federal Reserve Bank of Kansas City Economic Review, 87, 5–26.

Garz, M. (2018). Effects of unemployment news on economic perceptions—evidence from German Federal States. Regional Science and Urban Economics, 68, 172–190.

Gelper, S., Lemmens, A., & Croux, C. (2007). Consumer sentiment and consumer spending: Decomposing the Granger causal relationship in the time domain. Applied Economics, 39(1), 1–11.

Ghosh, S. (2021). Consumer confidence and consumer spending in Brazil: A Nonlinear autoregressive distributed lag model analysis. Arthaniti Journal of Economic Theory and Practice, 20(1), 53–85.

Gino, F., Brooks, A., & Schweitzer, M. (2012). Anxiety, advice, and the ability to discern: Feeling anxious motivates individuals to seek and use advice. Journal of Personality and Social Psychology, 102(3), 497–512.

Gino, F., & Shea, C. (2012). Deception in negotiations: The role of emotions. Oxford University Press.

Gintis, H. (2000). Strong reciprocity and human sociality. Journal of Theoretical Biology, 206(2), 169–179.

Gokdemir, O. (2015). Consumption, savings and life satisfaction: The Turkish case. International Review of Economics, 62(2), 183–196.

Guillen-Royo, M. (2008). Consumption and subjective wellbeing: Exploring basic needs, social comparison, social integration and hedonism in Peru. Social Indicators Research, 89(3), 535–555.

Guven, C. (2009). Weather and financial risk-taking: Is happiness the channel? Available here: https://ideas.repec.org/p/diw/diwsop/diw_sp218.html. Accessed on 20/12/2021.

Hampson, D. P., Gong, S., & Xie, Y. (2020). How consumer confidence affects price conscious behavior: The roles of financial vulnerability and locus of control. Journal of Business Research. https://doi.org/10.1016/j.jbusres.2020.10.032.Advanceonlinepublication

Hampson, D. P., & McGoldrick, P. J. (2017). Antecedents of consumer price consciousness in a turbulent economy. International Journal of Consumer Studies, 41(4), 404–414.

Heintzelman, S. J. (2018). Eudaimonia in the contemporary science of subjective well-being Psychological well-being, self-determination, and meaning in life. In E. Diener, S. Oishi, & L. Tay (Eds.), Handbook of well-being. DEF Publishers.

Helliwell, J. F., Layard, R., Sachs, J., & De Neve, J.-E. (Eds.) (2021). World Happiness Report 2021. New York: Sustainable Development Solutions Network. Available here: https://worldhappiness.report/ed/2021/. Accessed on 16/12/2021.

Hendrix, C., & Brinkman, H.-J. (2013). Food insecurity and conflict dynamics: Causal linkages and complex feedbacks. Stability International Journal of Security and Development, 2, 26.

Higgins, E. T. (2006). Value from hedonic experience and engagement. Psychological Review, 113, 439–460.

Hollanders, D., & Vliegenthart, R. (2011). The influence of negative newspaper coverage on consumer confidence: The Dutch case. Journal of Economic Psychology, 32(3), 367–373.

Hsu, C.-C., Lin, H.-Y., & Wu, J.-Y. (2011). Consumer confidence and stock markets: The panel causality evidence. International Journal of Economics and Finance, 3(6), 91.

Huppert, F. A. (2009). Psychological well-being: Evidence regarding its causes and consequences. Applied Psychology: Health and Well Being, 1(2), 137–164.

Huta, V., & Waterman, A. S. (2014). Eudaimonia and its distinction from hedonia: Developing a classification and terminology for understanding conceptual and operational definitions. Journal of Happiness Studies, 15(6), 1425–1456.

Inglehart, R., Foa, R., Peterson, C., & Welzel, C. (2008). Development, freedom, and rising happiness: A global perspective (1981–2007). Perspectives on Psychological Science, 3, 264–285.

Jaunky, V. C., Jeetoo, J., & Rampersad, S. (2020). Happiness and consumption in Mauritius: An exploratory study of socio-economic dimensions, basic needs, luxuries and personality traits. Journal of Happiness Studies, 21, 2377–2403.

Jiang, X., Hu, X., Liu, Z., Sun, X., & Xue, G. (2020). Greed as an adaptation to anomie: The mediating role of belief in a zero-sum game and the buffering effect of internal locus of control. Personality and Individual Differences, 152, 109566.

Johansson-Stenman, O., & Martinsson, P. (2006). Honestly, why are you driving a BMW? Journal of Economic Behavior & Organization, 60, 129–146.

Johnson, M. A., & Naka, A. (2014). Downside risk: What the consumer sentiment index reveals. Financial Services Review, 23(1), 45.

Kahneman, D., & Tversky, A. (1982). The psychology of preferences. Scientific American, 246(1), 160–173.

Karasoy Can, H. G., & Yüncüler, Ç. (2018). The explanatory power and the forecast performance of consumer confidence indices for private consumption growth in Turkey. Emerging Markets Finance and Trade, 54, 2136–2152.

Katona, G. (1968). On the function of behavioral theory and behavioral research in economics. American Economic Review, 58, 146–149.

Kaus, W. (2013). Conspicuous consumption and “race”: Evidence from South Africa. Journal of Development Economics, 100, 63–73.

Kemp, E., Kennett-Hensel, P. A., & Williams, K. H. (2014). The calm before the storm: Examining emotion regulation consumption in the face of an impending disaster. Psychology & Marketing, 31, 933–945.

Kennett-Hensel, P. A., Sneath, J. Z., & Lacey, R. (2012). Liminality and consumption in the aftermath of a natural disaster. Journal of Consumer Marketing, 29, 52–63.

Khumalo, J. (2014). Consumer spending and consumer confidence in South Africa: Cointegration analysis. Journal of Economics and Behavioral Studies, 6(2), 95–104.

Kleijnnijenhuis, J., Schultz, F., & Oegema, D. (2015). Frame complexity and the financial crisis: A comparison of the United States, the United Kingdom and Germany in the period 2007–2012. Journal of Communication, 65, 1–23.

Kłopocka, A. M. (2017). Does consumer confidence forecast household saving and borrowing behavior? Evidence for Poland. Social Indicators Research, 133, 693–717.

Klopocka, A.M., & Gorska, R. (2021). Forecasting household saving rate with consumer confidence indicator and its components: Panel data analysis of 14 European countries. European Research Studies Journal, 24(3), 874–898.

Kluemper, D. H., Little, L. M., & Degroot, T. (2009). State or trait: Effects of state optimism on job-related outcomes. Journal of Organizational Behavior, 30(2), 209–231.

Kotabe, H. P., Righetti, F., & Hofmann, W. (2019). How anticipated emotions guide self-control judgments. Frontiers in Psychology, 10, 1614.

Kuhnen, C. M., & Knutson, B. (2011). The influence of affect on beliefs, preferences, and financial decisions. Journal of Financial and Quantitative Analysis, 46(3), 605–626.

Kursan Milaković, I. (2021). Purchase experience during the COVID-19 pandemic and social cognitive theory: The relevance of consumer vulnerability, resilience, and adaptability for purchase satisfaction and repurchase. International Journal of Consumer Studies. https://doi.org/10.1111/ijcs.12672.Advanceonlinepublication

Kwan, A. C. C., & Cotsomitis, J. A. (2006). The usefulness of consumer confidence in forecasting household spending in Canada: A national and regional analysis. Economic Inquiry, 44, 185–197.

Lahiri, K., Monokroussos, G., & Zhao, Y. (2016). Forecasting consumption: The role of consumer confidence in real time with many predictors. Journal of Applied Econometrics, 31(7), 1254–1275.

Landau, D., Iervolino, A. C., Pertusa, A., Santo, S., Singh, S., & Mataix-Cols, D. (2011). Stressful life events and material deprivation in hoarding disorder. Journal of Anxiety Disorders, 25, 192–202.

Larson, L. R. L., & Shin, H. (2018). Fear during natural disaster: Its impact on perceptions of shopping convenience and shopping behavior. Services Marketing Quarterly, 39, 293–309.

Leach, J. (1994). Survival psychology. New York University Press.

Lemmon, M., & Portniaguina, E. (2006). Consumer confidence and asset prices: Some empirical evidence. The Review of Financial Studies, 19(4), 1499–1529.

Lins, S., & Aquino, S. (2020). Development and initial psychometric properties of a panic buying scale during COVID-19 pandemic. Heliyon, 6, 04746.

Loewenstein, G. F., Weber, E. U., Hsee, C. K., & Welch, N. (2001). Risk as feelings. Psychological Bulletin, 127(2), 267–286.

Lowe, T. S. (2018). Perceived job and labor market insecurity in the United States: An assessment of workers’ attitudes from 2002 to 2014. Work and Occupations, 45(3), 313–345.

Ludvigson, S. C. (2004). Consumer confidence and consumer spending. Journal of Economic Perspectives, 18(2), 29–50.

Luthans, F., & Youssef, C. M. (2007). Emerging positive organizational behavior. Journal of Management, 33, 321–349.

Lyubomirsky, S., King, L., & Diener, E. (2005). The benefits of frequent positive affect: Does happiness lead to success? Psychological Bulletin, 131(6), 803–855.

Mäkikangas, A., & Kinnunen, U. (2003). Psychosocial work stressors and well-being: Self-esteem and optimism as moderators in a one-year longitudinal sample. Personality and Individual Differences, 35(3), 537–557.

Malgarini, M., & Margani, P. (2007). Psychology, consumer sentiment and household expenditures. Applied Economics, 39(13), 1719–1729.

Malovaná, S., Hodula, M., & Frait, J. (2021). What does really drive consumer confidence? Social Indicators Research, 155, 885–913.

Mandal, A., & McCollum, J. (2013). Consumer confidence and the unemployment rate in New York State: A panel study. New York Economic Review, 44, 3–19.

Mastrogiacomo, M., & Alessie, R. (2014). The precautionary savings motive and household savings. Oxford Economic Papers-New Series, 66(1), 164–187.

Matošec, M., & Obuljen Zoričić, Z. (2019). Identifying the interdependence between consumer confidence and macroeconomic developments in Croatia. Interdisciplinary Description of Complex Systems, 17(2-B), 345–354.

Mermod, A. Y., & Dudzevičiūtė, G. (2011). Frequency domain analysis of consumer confidence, industrial production and retail sales for selected European countries. Journal of Business Economics and Management, 12(4), 589–602.

Mi, L. H., Ryong, K. J., & Han, J. S. (2019). The effect of perceived risk on negative emotions, trust, and investment intentions: Focused on investors and potential investors. International Journal of Tourism and Hospitality Research, 33, 19–31.

Michalos, A. C. (1980). Satisfaction and happiness. Social Indicators Research, 8, 385–422.

Miu, A. C., Heilman, R. M., & Houser, D. (2008). Anxiety impairs decision-making: Psychophysiological evidence from an Iowa gambling task. Biological Psychology, 77(3), 353–358.

Mody, A., Ohnsorge, F., & Sandri, D. (2012). Precautionary savings in the great recession. IMF Economic Review, 60(1), 114–138.

Moors, A., Ellsworth, P. C., Scherer, K. R., & Frijda, N. H. (2013). Appraisal theories of emotion: State of the art and future development. Emotion Review, 5(2), 119–124.

Moschis, G. P. (2007). Stress and consumer behavior. Journal of the Academy of Marketing Science, 35(3), 430–444.

Mourougane, A., & Roma, M. (2003). Can confidence indicators be useful to predict short term real GDP growth? Applied Economics Letters, 10, 519–522.

Ng, S., & Russell-Bennett, R. (2015). The role of affect in consumer evaluation of health care services. Health Marketing Quarterly, 32(1), 31–47.

Ng, T. W. H., Sorensen, K. L., & Eby, L. T. (2006). Locus of control at work: A meta-analysis. Journal of Organizational Behavior, 27(8), 1057–1087.

Nicolao, L., Irwin, J. R., & Goodman, J. K. (2009). Happiness for sale: Do experiential purchases make consumers happier than material purchases? Journal of Consumer Research, 36(2), 188–198.

Noll, H.-H., & Weick, S. (2015). Consumption expenditures and subjective well-being: Empirical evidence from Germany. International Review of Economics, 62(2), 101–119.

Nyman, R., & Ormerod, P. (2014). Big data, socio-psychological theory, algorithmic text analysis and predicting the Michigan consumer sentiment index. Quantitative Finance Publishing.

O’Loughlin, D. M., Szmigin, I., McEachern, M. G., Barbosa, B., Karantinou, K., & Fernández-Moya, M. E. (2017). Man thou art dust: Rites of passage in austere times. Sociology, 51(5), 1050–1066.

O’Connor, G. E., Newmeyer, C. E., Wong, N. Y. C., Bayuk, J. B., Cook, L. A., Komarova, Y., Loibl, C., Lin, O., & Warmath, D. (2019). Conceptualizing the multiple dimensions of consumer financial vulnerability. Journal of Business Research, 100(C), 421–430.

OECD. (2013). OECD guidelines on measuring subjective well-being. OECD Publishing.

Olekalns, M., & Smith, P. L. (2009). Mutually dependent: Power, trust, affect and the use of deception in negotiation. Journal of Business Ethics, 85(3), 347–365.

Ou, Y. C., de Vries, L., Wiesel, T., & Verhoef, P. C. (2014). The role of consumer confidence in creating customer loyalty. Journal of Service Research, 17(3), 339–354.

Ozari, G. (2007). Cheap thrills. Retrieved from: http://www.demodirt.com/happiness_simple_pleasures.html. Accessed on 25/01/2022

Pan, W.-F. (2018). Unemployment and confidence in Canada: Evidence from national and regional level data. Economics Bulletin, 38, 1111–1123.

Patt, A., & Weber, E. U. (2013). Perceiving and communicating climate change uncertainty. Wires Climate Change, 5, 219–232.

Patt, A., & Weber, E.U. (2014). Perceptions and communication strategies for the many uncertainties relevant for climate policy. Wiley Interdisciplinary Reviews: Climate Change, 5.

Peng, J., Xiao, W., Yang, Y., Wu, S., & Miao, D. (2014). The impact of trait anxiety on self-frame and decision making. Journal of Behavioral Decision Making, 27(1), 11–19.

Perez-Truglia, R. (2013). A test of the conspicuous-consumption model using subjective well-being data. The Journal of Socio-Economics, 45, 146–154.

Peters, E., & Slovic, P. (1996). The role of affect and worldviews as orienting dispositions in the perception and acceptance of nuclear power. Journal of Applied Social Psychology, 26, 1427–1453.

Peterson, C. (2000). The future of optimism. American Psychologist, 55(1), 44–55.

Pleeging, E., & Burger, M. (2020). Hope in economics. In S. C. van den Heuvel (Ed.), Historical and multidisciplinary perspectives on hope (pp. 165–178). Springer.

Pugno, M. (2009). The Easterlin paradox and the decline of social capital: An integrated explanation. The Journal of Socio-Economics, 38, 590–600.

Rabin, M. (2002). Inference by believers in the law of small numbers. Quarterly Journal of Economics, 117, 775–816.

Reknes, I., Visockaite, G., Liefooghe, A., Lovakov, A., & Einarsen, S. V. (2019). Locus of control moderates the relationship between exposure to bullying behaviors and psychological strain. Frontiers in Psychology, 10, 1323.

Riquelme, H., & AlQallaf, A. (2020). Anticipated emotions and their effects on risk and opportunity evaluations. Journal of International Entrepreneurship, 18(3), 312–335. https://doi.org/10.1007/s10843-019-00262-3

Rojo-Suárez, J., & Alonso-Conde, A. B. (2020). Impact of consumer confidence on the expected returns of the Tokyo stock exchange: A comparative analysis of consumption and production-based asset pricing models. PLoS ONE, 15(11), 0241318.

Roser, M., & Nagdy, M. (2014). Optimism and Pessimism. Retrieved from: https://ourworldindata.org/optimism-pessimism. Accessed on 16/12/2021.

Rotter, J. B. (1954). Social learning and clinical psychology. Prentice Hall.

Sangnier, M. (2013). Does trust favor macroeconomic stability? Journal of Comparative Economics, 41(3), 653–668.

Scheier, M. F., Carver, C. S., & Bridges, M. W. (2001). Optimism, pessimism, and psychological well-being. In E. C. Chang (Ed.), Optimism & pessimism: Implications for theory, research, and practice (pp. 189–216). American Psychological Association.