Abstract

The deterioration of Consumer Confidence has been considered an important driver of the recent financial crisis. However, empirical evidence on the relationship between confidence and household consumption is often inconclusive; in many cases, available analysis does not seem to confirm that confidence is able to predict expenditures once the role of economic fundamentals has been accounted for. Nevertheless, generally speaking, most of the literature refers to the most advanced economies of Europe and the USA, while evidence for emerging economies remains scarce. The main aim of this paper is to fill this gap for Brazil, looking at Consumer Survey data published by the Fundação Getulio Vargas since 2005, and studying its relationship with Brazilian consumption expenditures. According to the results, the overall Consumer Confidence Index and the Present Situation Index are good predictors of consumption, helping to improve the goodness of fit of consumer spending forecasting models. We also show that in Brazil a positive shock to confidence has a positive and significant impact on consumption for at least three quarters, a finding similar to those for more industrialized countries.

Source: FGV/IBRE for the confidence indicator; IBGE for consumption expenditures

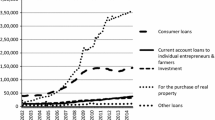

Source: FGV/IBRE

Source: FGV/IBRE

Similar content being viewed by others

Notes

Early investigations include those of Fair (1971), who links the University of Michigan index with both durable and nondurable consumer expenditures, and Mishkin (1978), who argues that the Michigan index may be a good proxy for the consumer’s subjective assessment on the probability of future financial distress. More recent studies analyzing the relationship between confidence and consumption are those of Carroll and Dunn (1997), Carroll et al. (1994), Fuhrer (1993), Leeper (1992), Matsusaka and Sbordone (1995), and Golinelli and Parigi (2004).

The web-based responses were compared to those obtained with telephone questionnaires, finding no significant differences. The share of web-based questionnaires is however always below 5% of the total.

Data for Europe and the US are available upon request.

Constant-price values measured as of February 2016 [deflated by the Extended National Consumers Price Index (IPCA) calculated by the Brazilian Institute of Geography and Statistics (Institute Brasileiro de Geografia e Estatistica—IBGE)]. https://www.ibge.gov.br/en/statistics/economic/prices-and-costs/17129-extended-national-consumer-price-index.html?=&t=o-que-e

As established by the Brazilian Business Cycle Dating Committee, see https://portalibre.fgv.br/estudos-e-pesquisas/codace/.

If we consider the whole sample (1996–2015), we do accept the homoscedasticity hypothesis.

For the role of commodities prices for Latin American economies, see Gallagher and Porzecanski 2010.

According to the Brazilian Dating Committee the recession started in 2014.Q2 and ended in 2016.Q4. During these 11 quarters, seasonally adjusted GDP fell by 8.6%, one of the worst recessions in the history of Brazil.

References

Acemoglu, D., & Scott, A. (1994). Consumer confidence and rational expectations: Are agents’ beliefs consistent with the theory? The Economic Journal,104(422), 1–19.

Beaudry, P., & Portier, F. (2014). News-driven business cycles: insights and challenges. Journal of Economic Literature,52(4), 993–1074.

Bentes, F. G. M. (2006). O Poder Preditivo do Índice de Confiança do Consumidor no Brasil: Uma Análise através de Vetores Autorregressivos. Dissertação-Mestrado em Economia—IBMEC, Rio de Janeiro.

Carroll, C.-D., & Dunn, W. E. (1997). Unemployment expectations, jumping (S, s) triggers, and household balance sheets. In B. S. Bernanke & J. J. Rotemberg (Eds.), NBER macroeconomics annual (pp. 165–229). Cambridge, MA: MIT Press.

Carroll, C. D., Fuhrer, J., & Wilcox, D. (1994). Does consumer sentiment forecast household spending? If so, Why? American Economic Review,84, 1397–1408.

Dees, S., & Brinca, P. S. (2013). Consumer confidence as a predictor of consumption spending: Evidence for the United States and the Euro area. International Economics,134, 1–14. https://doi.org/10.1016/j.inteco.2013.05.001.

Fair, R. C. (1971). Consumer sentiment, the stock market and consumption functions. Princeton University Econometric Research Program Research Memorandum (Vol. 119).

Fei, S. (2011). The confidence channel for the transmission of shocks. Banque de France Working Paper (No. 42).

Fuhrer, J. C. (1993). What role does consumer sentiment play in the US economy? Federal Reserve Bank of Boston, New England Economic Review (pp. 32–44).

Gallagher, K. P., & Porzecanski, R. (2010). The Dragon in the Room: China and the Future of Latin American Industrialization. Stanford: Stanford University Press.

Garner, C. A. (1991). Forecasting consumer spending: Should economists pay attention to consumer confidence surveys? Federal Reserve Bank of Kansas City Economic Review,76, 57–71.

Gayer, C. (2010). Report: the economic climate tracer—a tool to visualise the cyclical stance of the economy using survey data. Brussels: European Commission.

Golinelli, R., & Parigi, G. (2004). Consumer sentiment and economic activity: a cross-country comparison. Journal of Business Cycle Measurement and Analysis,1(2), 147–170.

Graminho, F. M. (2015). Sentimento e Macroeconomia: uma análise dos índices de confiança no Brasil. Brazilian Central Bank, trabalhos para discussão (No. 408).

Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica,37(3), 424–438. https://doi.org/10.2307/1912791

Katona, G. (1975). Psychological economics. New York: Elsevier.

Leeper, E. M. (1992). Consumer attitudes: King for a day. Federal Reserve Bank of Atlanta Economic Review,77(3), 1–16.

Malgarini, M., & Margani, P. (2007). Psychology, consumer sentiment and household expenditures. Applied Economics,39, 13.

Matsusaka, J. G., & Sbordone, A. M. (1995). Consumer confidence and economic fluctuations. Economic Inquiry,33(2), 296–318.

Mishkin, F. S. (1978). Consumer sentiment and spending on durable goods. Brookings papers on economic activity,1, 217–232.

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica,57(6), 1361–1401.

Pesaran, M. H., & Shin, Y. (1998). Generalized Impulse response analysis in linear multivariate models. Economics Letters,58, 17–29.

Picchetti, P. (2016). Expectativas de recuperação em uma recessão profunda. Boletim Macro IBRE.

Throop, A. W. (1992). Consumer sentiment: Its causes and effects. Federal Reserve of San Francisco Review,1, 35–39.

Toda, H. Y., & Yamamoto, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics,66(1–2), 225–250.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Campelo, A., Bittencourt, V.S. & Malgarini, M. Consumers Confidence and Households Consumption in Brazil: Evidence from the FGV Survey. J Bus Cycle Res 16, 19–34 (2020). https://doi.org/10.1007/s41549-020-00042-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-020-00042-2