Abstract

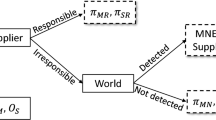

We consider the endogenous selection of strategic contracts in an asymmetric duopoly with substitutable goods. the duopoly comprises a typical managerial firm with a sales delegation and a socially responsible firm (CSR firm) with a linear combination of social welfare and quantity as its managerial delegation contract. In particular, we examine how the equilibrium market structure changes from the case wthere both firms adopt sales delegation contracts to the case wthere one of the firms becomes a CSR firm, after the owners of the firms select their strategic contracts. We show that two market structures that are asymmetric with respect to their strategic contracts can become equilibrium market structures under the pure strategic contract class. Furthermore, we consider a unique mixed strategy equilibrium to examine how the risk domination between the two asymmetric equilibrium market structures affects equilibrium selection. there, we find that the competition wthere the firm with the sales delegation and the CSR firm have a price contract and a quantity contract, respectively, risk-dominates the competition wthere the firms have a quantity contract and a price contract, respectively. Finally, by deriving the order of social welfare among the four subgames, we show that the social incentive does not coincide with the private incentive in the robust equilibrium with respect to risk domination in the endogenous selection game of the strategic contracts of the asymmetric duopoly with the firm with a sales delegation and the CSR firm.

Similar content being viewed by others

Notes

1Singh and Vives (1984) and Klemperer and Meyer (1986) provided the most fundamental model of a firm’s endogenous choice of a strategic contract in an oligopolistic market, without separation between ownership and management. they showed that when the goods are substitutes, firms will always choose a quantity contract, but when the goods are complements, they will prefer a price contract.

Furthermore, Tasnádi (2006) investigated the endogenous choice of strategic contracts in an oligopolistic market with capacity constraints.

Most recently, Nakamura (2017a) studied the endogenous choices of strategic contracts in a duopoly wthere the owner and manager of each firm bargain over the content of the managerial delegation contract. then, Nakamura (2017b) examined the endogenous choice of a strategic contract (i.e., a price or quantity contract) in a duopoly, wthere firms’ demand functions are asymmetric (see Choi and Lu 2012) when their managerial contracts are determined through bargaining between the owner and the manager.

See also the detailed survey of Kitzmueller and Shimshack (2012).

the objective functions of CSR firms are defined as “partial privatization,” which means that a social welfare-maximizing public firm gradually comes to resemble a standard profit-maximizing private firm in a mixed oligopoly. See Matsumura (1998) for a detail discussion.

A “socially concerned firm” refers to a “CSR firm” in the analytical approach of theoretical industrial organization.

8Nakamura (2015a) investigated the endogenous selection problem of a typical managerial firm with sales delegation and a managerial public firm, wthere the delegation contracts are defined as a linear combination of social welfare and the difference between consumer surplus and producer surplus in the context of a mixed duopolistic market.

9Hino and Zennyo (2017) showed that when a contract consists of profit and consumer surplus, the firm’s CSR decisions, as the delegation parameters, are strategic substitutes, even in a market with homogeneous good quantity competition. This implies that the level of CSR can serve as a commitment device for firms to produce aggressively in the market. This property is also indicated in the model proposed in this paper.

More precisely, Hino and Zennyo (2017) adopted two types of managerial delegation contracts within each firm, M i , as follows:

-

1.

M i = (1 − 𝜃 i )π i + 𝜃 i C S and

-

2.

M i = (1 − 𝜃 i )π i + 𝜃 W,

wthere π i , CS, and W denote each firm’s profit, consumer surplus, and social welfare, which is equal to the sum of the firms’ profits and consumer surplus, (i = 0, 1). In addition, the sum of firms’ profits is called the producer surplus, PS. Furthermore, Hino and Zennyo (2017) refers to 𝜃 as the CSR level. On the other hand, in this model, the managerial delegation contract within CSR firm 1, M 1, is given as follows: M 1 = W + 𝜃 1 q 1, wthere q 1 denotes the quantity of firm 1, and 𝜃 1 represents the CSR level of firm 1, which indicates the weight in the managerial delegation contract of CSR firm 1. the type of managerial delegation contract of the CSR firm, presented in Kopel and Brand (2012), Nakamura (2015a), and Hino and Zennyo (2017), is different from that in this study. However, the delegation parameter of the CSR firm has the same influence on the market outcomes, including the payoffs to the owner, as those of the delegation parameter (the CSR level) in the above works. More specifically, similarly to Kopel and Brand (2012), Nakamura (2015a), and Hino and Zennyo (2017), the levels of the delegation parameter in this study refer to the degree of the aggressive behavior in the market

-

1.

As δ → 1, the relation between q 0 and q 1 becomes homogeneous.

In the two asymmetric market structures with respect to the strategic contracts, the owners of firms 0 and 1 face the asymmetric functions q 0(p 0,q 1) (p 0(q 0,p 1)) and q 1(p 0,q 1) (p 1(q 0,p 1)) in the p-q game (the q-p game).

Superscript pp represents the functions and (equilibrium) market outcomes in the p-p game.

the superscript pq represents the functions and (equilibrium) market outcomes in the p-q game.

the superscript qp represents the functions and (equilibrium) market outcomes in the q-p game.

the superscript qq represents the functions and (equilibrium) market outcomes in the q-q game.

From straightforward calculations, we have

In this paper, we suppose that the linear combination of the profit and the quantity is adopted within typical sales delegation firm 0, while the linear combination of social welfare and the quantity within CSR firm 1 as their managerial delegation contracts. Thus, in each subgame, each firm’s owner wisthes the less aggressive of his manager in the market, the sets the negative level of his delegation parameter. In particular, in the p-p game, the negative level of the delegation parameter is set by the owner of sales delegation firm 0 in order to make his manager less aggressive in the market, wthereas the negative level of the delegation parameter is set by the owner of CSR firm 1 in the three types of subgames, i.e., the p-q game, the q-p game, and the q-q game.

In addition, we assume that a 0 = α − c 0 and a 1 = α − c 1 is sufficiently large, and the difference between a 0 and a 1 is sufficiently small, implying that the difference of each firm’s marginal cost, c i is sufficiently small, (i = 0, 1). In all four games, we use these expressions to represent the market outcomes.

When a ≡ a 0 = a 1, from straightforward calculations, we have \(\theta ^{pp}_{1} \gtreqless 0 \iff \delta \gtreqless 0.853635\). When δ is sufficiently high, the owner of firm 1 refrains from setting his delegation parameter higther by decreasing his delegation parameter, becasue the market competition becomes sufficiently intense.

the market outcomes other than the payoffs of firms 0 and 1, which are equal to their respective profits in the p-p game, are relegated to the Appendix :.

From straightforward calculations, we have \(\partial \theta ^{pq}_{1} \left (\theta _{0} \right ) / \partial \theta _{0} = - \delta \left (1 - \delta ^{2}\right ) / 2 \left (2 - \delta ^{2}\right ) < 0\).

the market outcomes other than the payoffs of firms 0 and 1, which are equal to their respective profits in the p-q game, are relegated to the Appendix :.

25Matsumura and Ogawa (2012) showed that the owner of the public firm, whose objective function is social welfare, sets a price that is equal to his marginal cost in the q-p game, in the context of a mixed duopoly without managerial delegation. In the setting in this study with managerial delegation, \(p^{qp}_{1} \left (q_{1}\right )\) becomes the difference between the marginal cost of frim 1, c 1, and the delegation parameter of firm 1, 𝜃 1, at the third stage, which is similar to that in Matsumura and Ogawa (2012).

the market outcomes except for the payoffs of firms 0 and 1, which are equal to their respective profits in the q-p game, are relegated to the Appendix :.

More precisely, Hino and Zennyo (2017) considered the situation in which both firms adopt symmetric delegation contracts, which are the weighted average of the firm’s profit and social welfare/consumer surplus with respect to the firm’s respective delegation parameters in the homogeneous good quantity competition only.

the market outcomes except for the payoffs of firms 0 and 1, which are equal to their respective profits in the q-q game, are relegated to the Appendix :.

In the case wthere the sales delegation contracts à la Fershtman and Judd (1987), Sklivas (1987), and Vickers (1985) are adopted within both firms, when the strategic contract of the owner of the rival firm is fixed, the relevant firm’s owner follows the strategic contract of his rival firm’s owner, implying that the two symmetric market structures (i.e., both the p-p game and the q-q game) can become the equilibrium market structures under the pure strategic contract class. From straightforward calculations, we obtain the result that the p-p game risk-dominates the q-q game for any a 0,a 1 > 0 and δ ∈ (0, 1), when the sales delegation contracts are adopted within both firms.

In the Appendix :, we give the ranking orders of the delegation parameters of firms 0 and 1.

More precisely, from straightforward calculations, we get \(p^{pq}_{0} > p^{pp}_{0} > p^{qq}_{0} > p^{qp}_{0}\) and \(p^{pq}_{1} > p^{pp}_{1} > p^{qq}_{1} > p^{qp}_{1}\) as the ranking orders of the prices of firms 0 and 1, respectively, among the four games. We realize that the ranking order of the price of firm 0 is the same as that of the price of firm 1 among the four games. the calculations of the ranking orders of the prices of firms 0 and 1 are presented in the Appendix :.

Since the manager of firm 1 takes social welfare into account, we pay attention to the fact that the positive relation between p 0 and p 1 is not that strong in the p-p game. Thus, the level of \(p^{pp}_{0}\) is not sufficiently high. there, the quantity of firm 1, \(q^{pp}_{0}\), is the lowest of the four games. Thus, because the market share of firm 1 is sufficiently large, the price of firm 0 does not become very high. Moreover, from straightforward calculations, we have \(q^{qq}_{0} > q^{qp}_{0} > q^{pq}_{0} > q^{pp}_{0}\). the calculations of the ranking order for the quantity of firm 0, q 0, are presented in the Appendix :.

More specifically, we can derive r 0 and \(r^{*}_{1}\) as follows:

We can judge \(r^{*}_{0} > r^{*}_{1}\) under the assumption that the difference between a 0 and a 1 is sufficiently small. Thus, under a more strict symmetric assumption, such that a ≡ a 0 = a 1, \(r^{*}_{1} > r^{*}_{0}\) holds. From straightforward calculations, we have \(r^{*}_{1} \left (a \right ) - r^{*}_{0} \left (a \right ) = \delta ^{3} \left (8 - 8 \delta ^{2} + \delta ^{4} \right ) / \left (64 - 128 \delta ^{2} + 80 \delta ^{4} - 15 \delta ^{6}\right ) > 0\).

More precisely, as stated in Harsanyi and Selten (1988) and Matsumura and Ogawa (2017), we recognize that for any a 0, a 1, and δ, \(r^{*}_{1} > r^{*}_{0} \Rightarrow \gamma ^{pq} > \lambda ^{qp}\), wthere \(\gamma ^{pq} = \left (U^{pq}_{0} - U^{qq}_{0} \right ) \times \left (U^{pq}_{1} - U^{pp}_{1} \right )\) and \( \lambda ^{qp} = \left (U^{qp}_{0} - U^{pp}_{0} \right ) \times \left (U^{qp}_{1} - U^{qq}_{1} \right )\). Thus, if the threshold value of the probability such that the owner of firm 0 always chooses a price contract, \(r^{*}_{1}\), is higther than the threshold value of the probability that the owner of firm 1 always chooses his price contract, \(r^{*}_{0}\), since the motivation for the owner of firm 0 to always choose a price contract is stronger than the corresponding motivation of the owner of firm 1. Thus, the p-q game risk-dominates the q-p game for any a 0, a 1, and δ.

the specific calculations for the ranking orders of the consumer surplus and producer surplus in the four games are given in the Appendix :.

References

Brand B, Grothe M (2015) Social responsibility in a bilateral monopoly. J Econ 115:275–289

Chirco A, Scrimitore M (2013) Choosing price or quantity? the role of delegation and network externalities. Econ Lett 121:482–486

Choi K, Lu Y (2012) A note on endogenous timing with strategic delegation: unilateral externality case. Bullet Econ Res 64:253–264

Din H-R, Sun C-H (2016) Combining the endogenous choice of timing and competition version in a mixed duopoly. J Econ 118:141–166

Dixit A (1979) A model of duopoly suggesting a theory of entry barriers bell. J Econ 10:20–32

Fershtman C, Judd K (1987) Equilibrium incentives in oligopoly. Amer Econ Rev 77:927–940

Ghosh A, Mitra M (2014) Reversal of bertrand? cournot rankings in the presence of welfare concerns. J Inst Theor Econ 170:499–519

Goering GE (2012) Corporate Social Responsibility and Marketing Channel Coordination. Res Econ 66:142–148

Goering GE (2014) The Profit-maximizing case for corporate social responsibility in a bilateral monopoly. Manag Decis Econ 35:493–499

Hamilton JH, Slutsky SM (1990) Endogenous timing in duopoly games: stackelberg or cournot equilibria. Games Econ Behav 2:29–46

Harsanyi JC, Selten R (1988) A general theory of equilibrium selection in games. MIT Press, Cambridge

Hino Y, Zennyo Y (2017) Corporate social responsibility and strategic relationships forthcoming, in International Review of Economics

Hoernig S (2012) Strategic delegation under price competition and network effects. Econ Lett 117:487– 489

Katz ML, Shapiro C (1985) Network externalities, competition, and compatibility. Amer Econ Rev 75:424–440

Kitzmueller M, Shimshack J (2012) Economic perspectives on corporate social responsibility. J Econ Lit 50:51–84

Klemperer P, Meyer M (1986) Price competition vs quantity competition: the role of uncertainty. RAND J Econ 17:618–638

Kopel T, Brand B (2012) Socially responsible firms and endogenous choice of strategic incentives. Econ Modell 29:982–989

Lambertini L (2000a) Extended games played by managerial firms. Jpn Econ Rev 51:274–283

Lambertini L (2000b) Strategic delegation and the shape of market competition. Scott J Polit Econ 47:550–570

Lambertini L, Schultz C (2003) Price or quantity in tacit collusion? Econ Lett 78:131–137

Matsumura T (1998) Partial privatization in mixed duopoly. J Public Econ 70:473–483

Matsumura T, Ogawa A (2012) Price versus quantity in a mixed duopoly. Econx Lett 116:174–177

Matsumura T, Ogawa A (2014) Corporate social responsibility or payoff asymmetry? Stud Endogenous Timing Game South Econ J 81:457–473

Matsumura T, Ogawa A (2017) Inefficient but Robust Public Leadership forthcoming in Journal of Industry, Competition and Trade

Nakamura Y (2015a) Endogenous choice of strategic variables in an asymmetric duopoly with respect to the demand functions that firms face. Mancthester Sch 83:546–657

Nakamura Y (2015b) Endogenous choice of strategic incentives in a mixed duopoly with a new managerial delegation contract for the public firm. Int Rev Econ Financ 35:262–277

Nakamura Y (2017a) Price versus quantity in a duopolistic market with bargaining over managerial delegation contracts. Manag Decis Econ 83:326–343

Nakamura Y (2017b) Price versus quantity in a duopoly with a unilateral effect and with bargaining over managerial contracts. J Ind Compet Trade 17:83–119

Reisinger M, Ressner L (2009) The choice of prices versus quantities under uncertainty. J Econ Manag Strat 18:1155–1177

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15:546–554

Sklivas SD (1987) The strategic choice of management incentives. RAND J Econ 18:452–458

Sun CH (2013) Combining the endogenous choice of price/quantity and timing. Econ Lett 120:364– 368

Tanaka Y (2001a) Profitability of price and quantity strategies in an oligopoly. J Math Econ 35:409– 418

Tanaka Y (2001b) Profitability of price and quantity strategies in a duopoly with vertical product differentiation. Econ Theory 17:639–700

Tasnádi A (2006) Price vs. quantity in oligopoly games. Int J Ind Organ 24:541–554

Vickers J (1985) Delegation and the theory of the Firm. Econ J 95:138–147

Acknowledgments

We are grateful for the financial support of the Inamori Foundation, the Seimeikai Foundation (16-002), and KAKENHI (16K03665).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Market Outcomes Except for the Delegation Parameters and Payoffs of the owners of Firms 0 and 1 for in the Four Games

1.1.1 p-p game

There, we present the equilibrium market outcomes, except for the delegation parameters and the payoffs of firms 0 and 1 in the p-p game.

1.1.2 p-q game

There, we present the equilibrium market outcomes, except for the delegation parameters and the payoffs of firms 0 and 1 in the p-q game.

1.1.3 q-p game

There, we present the equilibrium market outcomes, except for the delegation parameters and the payoffs of firms 0 and 1 in the q-p game.

1.1.4 q-q game

There, we present the equilibrium market outcomes, except for the delegation parameters and the payoffs of firms 0 and 1 in the q-q game.

1.2 The Ranking Order of Market Outcomes of Firms 0 And 1 in the Four Games

1.2.1 The Ranking Order of the Delegation Parameter of Firm 0 in the Four Games

There, we present the specific calculations for the ranking order of the delegation parameter of firm 0, as follows:

Thus, we have \(\theta ^{qq}_{0} > \theta ^{qp}_{0} = \theta ^{pq}_{0} > \theta ^{pp}_{0}\) for any δ ∈ (0, 1).

1.2.2 The Ranking Order of the Delegation Parameter of Firm 1 in the Four Games

There, we present the specific calculations for the ranking order of the delegation parameter of firm 1, as follows:

We obtain the result that \(\theta ^{qq}_{1} > \theta ^{pp}_{1} > \theta ^{pq}_{1} > \theta ^{qp}_{1}\) for any δ ∈ (0, 1).

1.2.3 The Ranking Order of Quantity of Firm 0 in the Four Games

There, we present the specific calculations for the ranking order of the quantity of firm 0, as follows:

Thus, we have \(q^{qq}_{0} > q^{qp}_{0} > q^{pq}_{0} > q^{pp}_{0}\) for any δ ∈ (0, 1).

1.2.4 The Ranking Order of Quantity of Firm 1 in the Four Games

There, we present the specific calculations for the ranking order of the quantity of firm 1, as follows:

Thus, we have \(q^{pp}_{1} > q^{pq}_{1} > q^{qp}_{1} > q^{qq}_{1}\) for any δ ∈ (0, 1)

1.2.5 The Ranking Order of Price of Firm 0 in the Four Games

There, we present the specific calculations for the ranking order of the price of firm 1, as follows:

Thus, we have \(p^{pq}_{0} > p^{pp}_{0} > p^{qq}_{0} > p^{qp}_{0}\) for any δ ∈ (0, 1)

1.2.6 The Ranking Order of Price of Firm 1 in the Four Games

There, we present the specific calculations for the ranking order of the price of firm 1, as follows:

Thus, we have \(p^{pq}_{1} > p^{pp}_{1} > p^{qq}_{1} > p^{qp}_{1}\) for any δ ∈ (0, 1)

1.2.7 The Ranking Order of Consumer Surplus in the Four Games

We give the following ranking order of the equilibrium consumer surplus in the four games:

Consequently, we obtain C S qp > C S qq > C S pp > C S pq for any δ ∈ (0, 1)

1.2.8 The Ranking Order of Producer Surplus in the Four Games

We give the following ranking order of the equilibrium producer surplus in the four games:

Consequently, we obtain P S pq > P S pp > P S qq > P S qp for any δ ∈ (0, 1)

1.2.9 The Ranking Order of Social Welfare in the Four Games

We give the following ranking order of the equilibrium social welfare in the four games:

Consequently, we obtain W qp > W qq > W pp > W pq for any δ ∈ (0, 1)

1.3 Direct Proof that the p-q Game Risk-dominates the q-p Game

First, we define \(\gamma ^{pq} = \gamma ^{pq}_{0} \times \gamma ^{pq}_{1}\), wthere \(\gamma ^{pq}_{0} = U^{qp}_{0} - U^{pp}_{0}\) and \(\gamma ^{pq}_{1} = U^{qp}_{1} - U^{qq}_{1}\). More specifically, we have

wthere

Second, we define \(\lambda ^{qp} = \lambda ^{qp}_{0} \times \lambda ^{qp}_{1}\), wthere \(\lambda ^{qp}_{0} = U^{qp}_{0} - U^{pp}_{0}\) and \(\lambda ^{qp}_{1} = U^{qp}_{1} - U^{qq}_{1}\). More specifically, we have

wthere

Comparing γ pq with λ pq, we obtain

Thus, we find that the p-q game risk-dominates the q-p game.

Rights and permissions

About this article

Cite this article

Nakamura, Y. Endogenous Market Structures in the Presence of a Socially Responsible Firm. J Ind Compet Trade 18, 319–348 (2018). https://doi.org/10.1007/s10842-017-0262-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-017-0262-3