Abstract

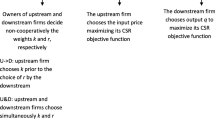

We work on a linear bilateral monopoly to analyze the effects of firms’ social concern. Both firms in the market, the up-stream manufacturer and the down-stream retailer, can be socially concerned. Firm’s social concern is modeled through a broader firm objective. In addition to their profit both firms also care about a share of consumer surplus. In our two stage game, at first the manufacturer fixes the wholesale price per quantity, which has to be paid by the retailer. Subsequently, the retailer chooses the optimal quantity. First, the game is analyzed for exogenous levels of social concern for both firms. Afterwards, both firms are able to choose endogenously their respective level of social concern. The results show that firm’s social concern increases firm profit for the manufacturer as well as the retailer’s profit. Moreover, the firms’ broader objective function softens the classical double marginalization problem, because in equilibrium all market participants, consumers included, are better off compared to a bilateral monopoly with two pure profit-maximizing firms. Therefore, firms’ social responsibility results in a Pareto improvement.

Similar content being viewed by others

Notes

An interview with Paul Pollack concerning the “Unilever” long-term strategy is printed in the Harvard Business Review (2012).

In this paper, the socially concerned firm is called “non-profit” firm, but the objective function is the same like in our model.

“Perfectly coordinated” means that the double marginalization problem is completely solved. The manufacturer is able to use a two-part tariff with a wholesale price w and a fixed fee F to absorb the whole retailer’s profit. This is not the case in an “imperfectly coordinated” marketing channel without two-part tariff which is treated in this paper.

Tirole (1988) summarizes the idea of double marginalization and also uses a linear framework.

Berman et al. (1999) show within their empirical analysis that only two stakeholder groups, customers and employees, influence firm’s financial performance. Following their study, the stakeholder groups community relations, natural environment and workplace diversity do not have any impact on firm’s financial performance.

In more detail, our main results also hold for all fixed fees \(F\) which are lower than the retailer’s profit \(\pi _{r}\), \(F < \pi _{r}\).

For all our maximization problems, the second-order conditions are fulfilled.

The superscript “\(*\)” displays equilibrium values.

All the results are proven in the Appendix.

With the superscript “\(**\)” we illustrate equilibrium values with the firms’ profit-maximizing level of social concern. In more detail, we insert \(\theta _{m}=\frac{2}{3}\) and \(\theta _{r}=\frac{1}{3}\) into the expression indicated with the superscript “\(*\)”.

References

Adams RB, Hermalin BE, Weisbach MS (2010) The role of boards of directors in corporate governance: a conceptual framework and survey. J Econ Lit 48(1):58–107

Arya A, Mittendorf B (2010) Input markets and the strategic organization of the firm. Found Trends Account 5(1):1–97

Arya A, Mittendorf B, Yoon D-H (2008) Friction in related-party trade when a rival is also a customer. Manag Sci 54(11):1850–1860

Baron DP (2001) Private politics, corporate social, responsibility, and integrated strategy. J Econ Manag Strategy 10(1):7–45

Berman SL, Wicks AC, Kotha S, Jones TM (1999) Does stakeholder orientation matter? the relationship between stakeholder management models and firm financial performance. Acad Manag J 42(5):488–506

Bose A, Gupta B (2013) Mixed markets in bilateral monopoly. J Econ 111(2):141–164

Brand B, Grothe M (2013) A note on “Corporate social responsibility and marketing channel coordination”. Res Econ 67(4):324–327

Bromberger AR (2011) A new type of hybrid. Stanford Social Innovation Review (Spring), pp 48–53

Economist Intelligence Unit (2007) Global business barometer. http://www.economist.com/media/pdf/20080116CSRResults.pdf. Accessed 17 Aug 2011

Ernst, Young (2011) The top 10 risks for business: a sector-wide view of the risks facing businesses across the globe. http://www.ey.com/Publication/vwLUAssets/Business_risk_report_2010/$FILE/EY_Business_risk_report_2010.pdf. Accessed 17th Aug 2011

Fernández-Kranz D, Santaló J (2010) When necessity becomes a virtue: the effect of product market competition on corporate social responsibility. J Econ Manag Strategy 19(2):453–487

Fisman R, Heal G, Nair VB (2005) Corporate social responsibility: doing well by doing good? (working paper)

Fisman R, Heal G, Nair VB (2006) A model of corporate philanthropy (working paper)

Glaeser EL, Scheinkman JA (1996) The transition to free markets: where to begin privatization. J Comp Econ 22(1):23–42

Goering GE (2007) The strategic use of managerial incentives in a non-profit firm mixed duopoly. Manag Decis Econ 28(2):83–91

Goering GE (2008) Welfare impacts of a non-profit firm in mixed commercial markets. Econ Syst 32(4):326–334

Goering GE (2012) Corporate social responsibility and marketing channel coordination. Res Econ 66(2):142–148

Harvard Business Review (2012) Captain planet. Harv Bus Rev 90(6):112–118

Hermalin BE, Weisbach MS (1998) Endogenously chosen boards of directors and their monitoring of the CEO. Am Econ Rev 88(1):96–118

Hermalin BE, Weisbach MS (2003) Boards of directors as an endogenously determined institution: A survey of the economic literature. Federal Reserve Bank of New York Economic Policy Review vol 9, no 1, pp 7–26

Hillman AJ, Keim DG (2001) Shareholder value, stakeholder management, and social issues: what’s the bottom line? Strateg Manag J 22(2):125–139

Husted BW, Allen DB (2011) Corporate social strategy: stakeholder engagement and competitive advantage. Cambridge University Press, New York

Jensen MC (2001) Value maximization, stakeholder theory, and the corporate objective function. J Appl Corp Financ 14(3):8–21

Jensen MC (2002) Value maximization, stakeholder theory, and the corporate objective function. Bus Ethics Q 12(2):235–256

Jeuland AP, Shugan SM (1983) Managing channel profits. Market Sci 2(3):239–272

Kopel M, Brand B (2012) Socially responsible firms and endogenous choice of strategic incentives. Econ Model 29(3):982–989

Kopel M, Brand B, (2013) Why do socially concerned firms provide low-powered incentives to their managers? (working paper)

KPMG (2011) Kpmg international survey of corporate responsibility reporting 2011. http://www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/corporate-responsibility/Documents/2011-survey.pdf. Accessed 27th Feb 2013

Lambertini L, Tampieri A (2010) Corporate social responsibility in a mixed oligopoly (working paper)

Manasakis C, Mitrokostas E, Petrakis E (2007) Corporate social responsibility in oligopoly (working paper)

McKinsey and Company (2007) Shaping the new rules of competition: UN global compact participant mirror. http://www.unglobalcompact.org/docs/summit2007/mckinsey_embargoed_until020707.pdf. Accessed 17th Aug 2011

McWilliams A, Siegel D (2001) Corporate social responsibility: a theory of the firm perspective. Acad Manag Rev 26(1):117–127

McWilliams A, Siegel D (2011) Creating and capturing value : strategic corporate social responsibility, resource-based theory, and sustainable competitive advantage. J Manag 37(5):1480–1495

Porter ME, Kramer MR (2011) Creating shared value. Harv Bus Rev 89(1–2):62–77

Siegel DS, Vitaliano DF (2007) An empirical analysis of the strategic use of corporate social responsibility. J Econ Manag Strategy 16(3):773–792

Spengler JJ (1950) Vertical integration and antitrust policy. J Polit Economy 58(4):347–352

The Economist (2012) Taking the long view

Tirole J (1988) The theory of industrial organization. MIT Press, Cambridge

UN Global Compact and Accenture (2010) The new era of sustainability. http://www.unglobalcompact.org/docs/news_events/8.1/UNGC_Accenture_CEO_Study_2010.pdf. Accessed 17th Aug 2011

Acknowledgments

We want to thank Herbert Dawid, Florian Englmaier, Michael Kopel an anonymous referee and the editor for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Result 1

\(\square \)

1.2 Proof of Result 2

1.2.1 Proof of (i)

whereas the second result can be explained in the following. First, we look at the first-order condition of the first stage given by

Differentiate \(\frac{\partial v_{m}}{\partial w}\) w.r.t. \(\theta _{r}\) yields

By rearranging this we get the following expression

The denominator is the SOC and is therefore negative for a maximum. \(\frac{\partial w}{\partial \theta _r}<0\) is true if the numerator is negative as well. Differentiate the first-order condition w.r.t. \(\theta _r\):

From Result 1 we know that \(w \ge c\). Therefore, \(\frac{\partial v_{m}}{\partial q}>0\) and consequently the first product is negative for \(\theta _{m}>0\). The first and third derivative in the second term are positive while the second one is negative. As a result, also the second product is negative. In summary, \(\frac{d^2 v_{m}}{d w \, d \theta _r}<0 \implies \frac{\partial w^{*}}{\partial \theta _{r}}<0\). \(\square \)

1.2.2 Proof of (ii)

\(\square \)

1.2.3 Proof of (iii)

\(\square \)

1.3 Proof of Result 3

1.3.1 Proof of (i)

\(\square \)

1.3.2 Proof of (ii)

Using backward induction, the manufacturer chooses its level of social concern to maximize its profit by

By inserting \(\theta _{m}(\theta _{r})=0\) into the value of the retailer we get the following expression, optimization problem and equilibrium levels of social concern:

\(\square \)

1.3.3 Proof of (iii)

Again, by using backward induction, at first, the retailer chooses the profit-maximizing level of social concern.

Inserting \(\theta _{r}(\theta _{m})=\frac{\theta _{m}}{2}\) into the manufacturer’s profit function results in the following expression:

After the retailer has chosen the firm’s optimal level of social concern, the manufacturer chooses its profit-maximizing level of social concern:

The sequential choice of firms’ profit-maximizing level of social concern, whereas the manufacturer determines before the retailer does, yields the following equilibrium values of \(\theta _{i}\):

The firms’ commitment effect through its objective function in the case of sequential choice is explainable by a strategic effects analysis. First, we take a look at the retailer. Its strategic effects are given by

Rewriting the equation above results in the following expression

whereas \(\frac{\partial w}{\partial \theta _{r}}<0\) for \(\theta _{m}>0\). By inserting \(q^{*}\) and \(w^{*}\) into \(\frac{-(a-w)(4-3\theta _{r})+2b \, q (2-\theta _{r})}{b(2-\theta _{r})^2}\) we get \(\frac{-(a-c)(2-3\theta _{r})}{b(2-\theta _{r})(4- \theta _{m} -2 \theta _{r})}\). We know from the previous result that \(\theta _{r}^{*}=\frac{1}{3}\). Therefore, \((\frac{\partial \pi _{r}}{\partial w}+\frac{\partial \pi _{r}}{\partial q} \, \frac{\partial q}{\partial w})\) becomes negative. The overview of the retailer’s strategic effects which explains the retailer’s incentive to choose \(\theta _{r}>0\) is summarized below

In the next step, we care about the manufacturer’s strategic effects which are given by

By rewriting we get

We know that \(\theta _{r}(\theta _{m})=\frac{\theta _{m}}{2}\). By replacing \(\theta _{r}\) with \(\frac{\theta _{m}}{2}\) in \(\frac{(a-c)(4-3\theta _{m}-2\theta _{r})}{b(4-\theta _{m}-2\theta _{r})^3}\) we get \(\frac{(a-c)^2(1-\theta _{m})}{2b(2-\theta _{m})}>0\) for \(\theta _{m}<1\). Moreover, \(-\frac{(a-c)\theta _{m}}{(4-\theta _{m}-2\theta _{r})^2}<0\) for \(\theta _{m}<1\). Additionally, \(\frac{(a+2c-3w)}{b(2-\theta _{r})}<0\) in equilibrium for \(w=w^{**}\), \(\theta _{m}^{*}=\frac{2}{3}\) and \(\theta _{r}^{*}=\frac{1}{3}\). The summary of the manufacturer’s strategic effect analysis is given by the following expression

Furthermore, the strategic effect analysis explains one finding made in Result 2. There, we have shown that the impact of the manufacturer’s social concern is only half of the retailer’s one. In detail, \(\frac{\partial q^{*}}{\partial \theta _{m}}=\frac{1}{2} \, \frac{\partial q^{*}}{\partial \theta _{r}} , \frac{\partial p^{*}}{\partial \theta _{m}}=\frac{1}{2} \, \frac{\partial p^{*}}{\partial \theta _{r}} , \frac{\partial CS^{*}}{\partial \theta _{m}}=\frac{1}{2} \, \frac{\partial CS^{*}}{\partial \theta _{r}} \,\,\, \text {and} \,\,\, \frac{\partial WF^{*}}{\partial \theta _{m}}=\frac{1}{2} \, \frac{\partial WF^{*}}{\partial \theta _{r}}\). The consideration of the strategic effects yields the following further insights:

\(\square \)

1.4 Proof of Result 4

\(\square \)

Rights and permissions

About this article

Cite this article

Brand, B., Grothe, M. Social responsibility in a bilateral monopoly. J Econ 115, 275–289 (2015). https://doi.org/10.1007/s00712-014-0412-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-014-0412-6