Abstract

The purpose of the study is to contrast the impact of ‘clean’ and ‘dirty’ electricity production on economic growth for South Africa and determine whether a faster transition from fossil fuels to renewables is beneficial for growth. To this end, we use wavelet coherence analysis to examine the time–frequency relationship between electricity and economic growth for aggregated and disaggregated measures of clean and dirty sources over the period 1985–2021 At an aggregated level, the low frequency (long-run) correlations are eventually substituted with high frequency (short-run) co-movements. At disaggregated level, the results are mixed, with dirty energy components (coal, oil, gas) having a weakening effect on economic growth over time whilst clean energy sources (solar and wind, biomass, hydro) show the greatest potential for growth over both low and high frequency relationships. Moreover, the various structural breaks identified in the frequency bands for different electricity sources allow us to evaluate the impact of energy policies and load shedding on the electricity-growth relationship and offer further insights to which clean sources of electricity production have more potential to be growth enhancing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Electricity is vital for economic activity as well as everyday living and is thus considered a crucial component of an economy’s development process. It is well known that economies with high (low) levels of electricity production and consumption tend to have higher (lower) levels of economic growth and development (Akinbami et al 2021). Therefore, access to electricity is one of the most crucial services governments can provide for improving the standard of living for poor people (Mahfouh and Amar 2014). The global urgency to increase peoples access and use of electricity is re-iterated in the sustainable development goal (SDG) 7 which seeks to “…ensure access to affordable, reliable, sustainable and modern energy for all…”.

Over the last few decades there have been growing concerns over the worlds dependency on coal for generating most of the world’s electricity. The green-house gas emissions (GHG) and the non-renewability associated with the use of ‘dirty energy’ have prompted a global movement towards a ‘cleaner and greener’ world. Renewable energies are considered the ideal energy source for addressing the ‘twin global energy’ problems of poorer countries lacking access to electricity and richer countries with electricity access using dirty sources (International Energy Agency 2022). For instance, renewables have been argued to be more energy resilient compared to dirty energy sources and present technological advantages which can overcome problems of power outages (Anderson et al. 2018). Moreover, renewable energies have been advocated to have less harmful health effects on populations compared to non-renewable sources which are often associated with respiratory infections such as tuberculosis, low birthweight, cardiovascular problems, eye infections—all which lead to increased health expenses and reduced labour productivity (Rahut et al. 2017; Sahoo et al. 2022). However, renewables are also notorious for being high-priced and high-maintenance (Li et al. 2019). Furthermore, the slow response of developing economies towards adopting renewables and the current low usage of renewables may not be sufficient to impact long-run economic growth. Ultimately, the importance of developing countries transitioning into cleaner electricity production cannot be ignored and an important policy question is whether renewable electricity production can support socio-economic development in these countries.

Amongst SSA countries, South Africa has attracted the most empirical attention on the (non)renewables-growth relationship and researchers consider the country an ideal case study for a variety of reasons. For instance, Ziramba (2008, 2009, 2015), Odhiambo (2009, 2010) and Akinbami et al. (2021) all find interest in South Africa as the largest producer, consumer and exporter of electricity in Africa which implies that any developments in the country’s domestic energy sector are most likely to spillover to many countries in the continent. Other authors highlight the country’s status as the largest emitter of carbon emissions in the Sub-Saharan African (SSA) and being amongst the top emitters in the world (Bah and Azam 2017, Akadiri et al. 2019; Bekun et al. 2019; Magazzino et al., 2021) whereas a few others highlight the country’s potential for creating clean energy such as boasting the only nuclear plant in Africa (Phiri and Nyoni 2016), being the only African country with coastal regions on both the Indian and Atlantic sides of the Oceans which gives the country a greater advantage in creating wind power (Akinbami et al. 2021) and also having abundant agricultural residual and sunshine levels for solar and biomass power generation, respectively (Ziramba 2009, 2013; Ayamolowo and Kusakana 2022).

Nonetheless, the current empirical evidence on the impacts of renewable and non-renewable energy usage on economic growth for South Africa is inconclusive with some studies finding a positive impact of (non)renewables on growth (Akinboade et al. 2008; Ziramba 2013; Phiri and Nyoni 2016; Khobai and Le Roux 2018; Nyoni and Phiri (2020);;;;) whilst other studies find insignificant (Bhattacharya et al. 2016; Destek and Aslan 2017) or negative relationships (Shakouri and Yazdi 2017). Most notable these previous studies tend to use conventional cointegration models such as the FMOLS, DOLS, ARDL, VECM and granger causality tests, all which assume a linear relationship between the variables and are sensitivity to the choice of time period used for the analysis. Only a few studies employ nonlinear techniques such as the N-ARDL model and nonlinear granger causality tests which permit the researcher to evaluate certain forms of asymmetric whilst ignoring others. Our study proposes the use of more rigorous analytical tools which can capture various forms of asymmetries and whose results are not sensitivity to the choice of time period.

Our study makes use of the continuous wavelet coherence methods to investigate the time–frequency relationship between renewable/non-renewable electricity production and economic growth in South Africa. Wavelets are mathematical tools which decompose a time series into different scales and thus localizes the signal in time–frequency space. This differs from econometric techniques which can only localize a series across a time (i.e. time series analysis) or a frequency plane (i.e. Fourier transforms) but not across both. The wavelet transforms of a time series can be envisioned in a three-dimensional plane consisting of time, real part and the imaginary/complex part from which the extracted amplitude and phase dynamics allows one to model the synchronization between a pair of variables in time–frequency space. The time–frequency synchronization of the series allows one to examine the co-movement between a pair of time series across 5 dimensions, namely; (i) a time-varying dimension (ii) frequency-varying dimension (iii) strength-varying dimension (iv) in-phase (positive co-movement) or anti-phase (negative co-movement) dimension (v) led-lag (causality) dimension. And whilst we acknowledge a growing number of empirical papers in the literature which use wavelet coherence analysis in energy studies (i.e. Mutascu (2018) for CO2 emissions and trade; Mata (2020) for electricity consumption and financial development; Magazzino et al. (2021) for energy and growth; Adebayo et al. (2022) for carbon emissions on economic growth, renewable energy, technological innovation and trade openness), our study is the first to make an application to the (non)renewable electricity – growth relationship.

Our study uses wavelet coherence analysis to simultaneously address four empirical issues on the electricity-growth nexus, the first concerning the sign of the relationship, the second pertaining to the direction of causality between the variables, the third to whether the observed relationships are short-run or long-run, and the fourth to whether there exist time-varying and cyclical-varying asymmetries in the observed relationships. We further disaggregate electricity generation into dirty and clean sources for comparative purposes and use the findings to inform policymakers and other stakeholders if there are any economic benefits of phasing out coal in the electricity generation sector and including/increasing green energy sources on ESKOMs electricity grid.

Altogether, our study presents new stylized facts on the relationship between ‘clean’ versus ‘dirty’ electricity production debate in South Africa and our findings have direct implications for the country’s electricity provider, ESKOM, who have been facing worsening ‘electricity outages’ caused by ‘breakdowns’ in local coal-based power stations. In this context, an important policy question which our study addresses is whether a shift from non-renewables to renewables electricity usage can simultaneously circumvent the load shedding problem and support long-run economic growth in an environmentally friendly manner. Moreover, our disaggregated analysis allows us to determine which source of clean electricity production is most sustainable for long-run growth and which sources need to be further developed to a level required to support such growth.

The rest of the study is structured as follows. The next section of the paper presents the literature review. Section 3 presents the data and methods whilst Sect. 4 presents the empirical analysis. Section 5 presents further discussions of the results by comparing the results with previous literature providing policy implications whilst the study is concluded in Sect. 6.

2 Literature review

Within the electricity-growth nexus, there are three empirical aspects of the relationship which researchers are most interested in. Firstly, researchers are concerned with the sign of the relationship, that is whether, the relationship is positive, negative or insignificant. Secondly, researchers are intereseted in the causal direction between electricity and growth, from which four hypothesis emerge (i) growth hypothesis, that is, electricity usage granger-causes economic growth implying that policymakers can use energy policies to boast economic growth (ii) conservation hypothesis, that is, economic growth granger-causes electricity production implying that growth of the energy sector is dependent on economic development (iii) feedback hypothesis, that is, bi-directional causality between electricity consumption and growth. implying that energy and economic development policies should be designed cojointly (iv) neutrality hypothesis, that is, no causlity between electricty consumption and growth implying that the policies aimed at growing the energy sector should be designed seperately from those aimed at fostering economic development. Thirdly, researchers are interested in whether the observed relationship exists in the short-run and/or long-run. This distinction is of interest to policymakers as they seek for ways to ensure that electricity usage produces long-run effects on economic growth and some observed short-run relations may not translate into long-term effects.

It is interesting to note that developments in the literature have been facilitated by advancements in econometric modelling techniques. For instance, earlier studies such as that of Romer (1994) relied on linear OLS regressions which could only inform on the sign of the relationship. Other studies such as Cheng (1999) which strictly employed Engle-Granger/Johansen cointegration and causality tests could only inform on the direction of causality. Some studies use vector error correction models (VECM) and autoregrsesive distributive lag (ARDL) models which can determine the sign of the relationship in both the short-run and long-run (Bildirici and Kayicki 2012; Jian et al. 2019).

There is more recent consensus that the electricty-growth relationship is asymmetric and there are concerns over the suitability of linear econometric techniques to account for nonlinear dynamics caused by (i) frequency-varying changes in economic cycles, and (ii) time-varying changes reflected as structural breaks points i.e. changes in energy policy, periods of energy crisis etc. Currently, there are three methods which have been used to examine nonlinear relationships in the electricty-growth nexus. Firstly, some studies used threshold autoregressive (TAR) and smooth transition regression (STR) models which assume that electricity-growth relationship can be modelled in two states, in which the sign and magnitude of the relationship can change after crossing some exogenously or endogenously determined threshold point (Wang and Wang 2020). Secondly, some studies use nonlinear granger causality tests to examine the nonlinear causality dynamics in the electricty-growth relationship. Thirdly, other studies examine the electricty using nonlinear cointegration models like the MTAR model (Nyoni and Phiri 2018) and the nonlinear autoregressive distributive lag (N-ARDL) model (Awodumi and Adewuyi 2020; Nyoni and Phiri 2020) and these frameworks can model asymmetric short-run and long-run dynamics in the electricty-growth relationship. Fourthly, some recent studies use the quantile regression model which assumes that both the strength and sign of the relationship can change across distribution quantiles of electricity consumption (Chen and Lei 2018).

It is important to note that the econometric tools currently used by researchers to capture nonlinearities in the energy-growth nexus only manage to capture some certain asymmetries yet ignore others. In particular, the TAR, STR and quantile regressions models present features which can only capture changing dynamics in strength and sign of the relationship; the nonlinear granger causality tests can only capture asymmetries in causal direction; whilst nonlinear contegration methods manage to capture asymmetries in over the short-run and long-run. Colletively, these techniques fail to simultaneously capture the different types of asymmetries relating to (i) strength variation (ii) time variation (iii) frequency variation (iv) causality dynamics.

Our study proposes the use of wavelet coherence framework as a means of circumventing the methodological shortcomings of both linear and nonlinear econometric tools used in previous studies. In particular, the method alllows us to investigate time-varying and frequency-varying asymmetries in the renewables/non-renewables-growth relationship pertaining to (i) the sign and strength of the relationship (ii) the direction of causality (iii) short-run and long-run dynamics. Moreover, in differing from econometric methods, the results from the wavelet coherence analysis is not distorted by changes in sample periods. In this regard, econometric analysis is sensitive to the sample period under investigation such that an increase or decrease in the sample period could alter the regression results. This is contrary to wavelet coherence analysis whose output is not distorted by a lengthening or shortening of the time period window.

We make an application wavelet of coherence analysis to investigate (non)renewables electricity-growth relationship for the South African economy and our study directly relates to three strands of South African related literature. Firstly, our study relates to previous research on the electricity consumption—growth nexus (Wolde-Rufael, 2005; Ziramba 2008; Odhimabo, 2009; Phiri and Nyoni 2016; Bah and Aza, 2017; Nyoni and Phiri 2020). Secondly, our study relates to previous (non)renewable – growth studies (Bhattacharya et al. 2016; Destek and Aslan 2017; Shakouri and Yazdi 2017; Adams et al. 2018; Khobai and Le Roux 2018; Nyoni and Phiri 2020). Thirdly, our study relates to researh on the energy consumption – growth relationship (Wolde-Rufael 2005, 2009; Esso 2010; Odhiambo 2010; Menyah and Wolde-Rufael 2010; Menyah et al., 2010; Lin and Wesseh 2014; Bildirici 2013; Kumar et al. 2015; Ranjbar et al. 2017; Bekun et al. 2019; Akadiri et al. 2019). Lastly, our study relates to previous works focusing on the impact of disaggregated measures of energy consumption on economic growth (Ziramba 2009; Bildirici and Bakirtas, 2014; Ziramba 2015; Akinboade et al. 2008; Magazzino et al., 2021).

A summary of the previous literature is presented in Table 1 and as can be observed the different studies have applied different econometric methods to data collected over different time periods and present conflicting empirical findings. Conceptually, our study can be considred as a hybrid/fusion of these four strands of literature in which we distinguish between renewable and non-renewable energy sources for electricity usage and examine their disaggregated impact on economic growth. It shoud be noted that very few studies have performed a contrast between the effect of renewable and non renewable energy on economic growth for South Africa (Bhattacharya et al. 2016; Destek and Aslan 2017; Shakouri and Yazdi 2017; Adams et al. 2018). Moreover, very few studies control for asymmetries, with the existing studies either accounting nonlinearities in the coefficient estimates (Esso 2010; Nyoni and Phiri 2018, 2020) or in causality effect (Ranjbar et al. 2017). Our study covers these identified gaps in the South African literature and further contributes to the international literature by being the first study, to the best of our knowledge, to apply wavelet coherence in the electricity-growth nexus.

3 Data and methods

3.1 Data description and summary statistics

Our study makes use of electricity generation and economic growth time series data spanning over the period 1985—2021. On one hand, the electricity data (i.e. coal, oil, gas, nuclear, hydro, solar and wind, biomass) is sourced from the BP online database. We further group this data into three classifications corresponding to i) ‘dirty’ electricity production’ (coal, oil and gas) ii) ‘clean’ electricity production (nuclear, hydro, solar and wind, biomass) iii) total electricity production (‘dirty’ and ‘clean’). On the other hand, GDP growth rates are sourced from the world Bank development indicators. The time series plots of the series are presented in Fig. 1.

The summary statistics of the time series reported in Table 2 provide some stylized facts on electricity sources and economic growth. For instance, judging from the statistics, dirty energy averages more than tenfold of clean energy sources with 99% of dirty energy attributed to coal production whilst nuclear energy accounts for 65% of clean electricity production. It is also interesting to note that some time series (gdp, total, gas, oil and solar&wind) have ‘flat tails’ implying that their distribution is non-normal and asymmetric thus implying that mean-based evaluations of the data may produce misleading inferences.

The correlation matrix presented in Table 3 provides a preliminary outlook at the electricity-growth relationship for different electricity sources. From Table 3, we observe positive (negative) correlations between gdp and total, dirty, coal, nuclear, hydro (clean, gas, oil, biomass, solar&wind) electricity sources. However, these preliminaries are based on linear analysis and do not consider asymmetric dynamics underling the data. We therefore proceed to outline the wavelet coherence methodology which will evaluate the electricity-growth correlations in a time–frequency plane.

3.2 Methods

We define a continuous wavelet transform (CWT) for a wavelet \(\psi\) through the following function:

where * denotes a complex conjugation, τ is the translation parameter which dictates where the wavelet is centred, and s is the scaling parameter controlling the length of the wavelet which is compressed if |s|< 1 and stretched if |s|> 1. The window size adjust itself optimally to longer basis functions (wider windows) at low frequencies, by stretching, and to shorter basis functions (narrower windows) at high frequency, by compressing. hence allowing for sharp frequency resolutions at low frequency movements and sharp time resolution for high frequency movements (Raihan et al. 2005). Since the wavelet coefficients contain combined information on both x(t) and ψ(t), propose the use of a complex-valued wavelet function since its corresponding transform will also be complex and can be separated into an amplitude and a phase. There are a number of ‘families’ of complex wavelet. In this study we focus on complex Morlet wavelets which has advantages over other wavelets (see Torrence and Combo (1998) for detailed discussions) and consists of a complex sinusoid (sine wave) modulate by a gaussian envelope:

To ensure that the parameterization of the Morlet wavelet depicts an inverse relation between wavelet scales and the frequencies, f \(\approx s^{ - 1}\), the Morlet be set to approximately 6 (i.e. ω0 = 2π) in order for the wavelet scale, s, to be almost equal to the Fourier period. Within the continuous complex Morlet wavelet, the wavelet power spectrum (WPS) can be extracted, which measures the variance of a time series across a two-dimension plane i.e. time and scale. Formally, the WPS for a discrete time series, xn, can be expressed as:

where δt is a uniformed time step. The Cross-Wavelet Power Spectrum (CWPS) is then introduced to measure the covariance between two time series variables, x(t) and y(t). By defining the WPS of x(t) and y(t) as Wxx =|Wx|2 and Wyy =|Wy|2, respectively, the CWPS between x(t) and y(t) is computed as (WPS)xy = Wxy =|Wxy|. We finally compute the wavelet coherence, which measures the correlation between x(t) and y(t) across time and frequency, as the ratio of the cross spectrum to the product of the product of the spectrum of the individual series i.e.

where S is a smoothing operator in both time and scale. The cross wavelet transform allows us to derive information about the phase difference between two signals and thus obtain information about the led-lag synchronizations of the two series over a time and frequency plane (Aguiar-Conraria et al. 2012). The phase-difference can be defined as:

where ϕx,y is parametrized in radians, bound between π and − π. A phase-difference of zero implies that the series are in phase with x leading y. If ϕx,y ∈ (0, π/2) and ϕx,y ∈ (0, − π/2), then the series are said to be in-phase (positive correlation) with y leading x in the former and x leading y in the latter. Conversely, if ϕx,y ∈ (π/2, π) and ϕx,y ∈ (− π/2, π), then the series are said to be in an anti-phase (negative correlation) with x leading y in the former and y leading x in the latter.

4 Empirical results

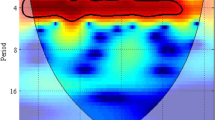

4.1 Interpreting the wavelet coherence plots

The wavelet plots present a three-dimensional visual representation of our empirical resuls. Firstly, the vertical axis (y-axis) measures the frequency bands of synchronizations with larger (smaller) periods denoting lower (higher) frequency oscillations which are anologous to long-run (short-run) relationships. Secondly, the horizontal axis (x-axis) is the time component which captures time-variation in the cyclical synchroninzation of a pair of series. Lastly, within the bands of synchronization are colour contours which represent the strength of the co-movement with hotter (cooler) colours denoting stronger (weaker) correlations. The faint white lines surrounding the regions of observed correlation indicate the 5% significance level whereas curved ‘inverted U-shaped’ line represents the cone of influence and indicates the edge-effects.

The phase difference dynamics provide additional information on the delay or synchronization between the two series and the phase information is represented by the arrow orientation in the coherence spectrum plot. The right pointed arrow ( →) indicates ‘phase-in’ dynamics between the series which is analogous to a positive co-relationship. The left pointed arrow ( ←) indicates ‘phase-out’ synchronization between the series which is analogous to a negative co-movement. The arrows point north (↑) imply that economic growth leads electricity consumption by π/2 (i.e. growth hypothesis) whilst arrows pointing down (↓) implies that electricity consumption leads economic growth by π/2 (i.e. conservation hypothesis). Moreover, the arrows facing north-east (\(\nearrow\)) and south-west (\(\swarrow\)) indicate that economic growth leads electricity production, whilst the arrows facing northwest (\(\nwarrow\)) and southeast (\(\searrow\)) imply that electricity consumption leads economic growth.

4.2 Empirical findings

We estimate wavelet coherence dynaimcs for three sets of wavelet plots between electricity production and economic growth corresponding to agggregate electricity components (total, dirty and clean), disagregated dirty electricity components (coal, oil and gas) and disagregated clean electricity components (nuclear, hydro, biomass and wind&gas). We document the results in the wavelet plots present in Figs. 2, 3, 4, 5, 6, 7, 8, 9, 10, 11 and further summarize our key findings in Table 4.

All wavelet coherence plots present two frequency bands whilst a third frequency band is observed for nuclear and hydro sources. The first frequency bands are found at low frequencies of 6–10 years for total, dirty, clean, nuclear and 8–12 year cycles for coal, oil, hydro and solar&wind. These bands extend from the beginning of the sample periods and differ in time span with some bands ranging from 1985–2010 (total, dirty, coal, biomass) whilst others range from 1985 to early 2000’s (clean, nuclear, hydro) and only those for oil, gas and solar&wind extend throughout the entire time period. The second, and more irregular, frequency bands are at higher frequencies of 0–4 years for total, dirty, coal, geothermal) and 4–8 years for oil, gas, nuclear, hydro and solar&wind. Most of these bands occur at periods of 2009–2021 (total, coal, oil, gas, nuclear) whereas others are found at older time periods of 1998–2012 (nuclear, hydro) or at shorter periods of 2018–2021 (dirty, biomass, solar&wind). The third frequency band for nuclear is also found during the 2018–2021 periods.

Within the frequency bands, the phase dynamics provide us with information on the strength of the correlation, the sign on the relationship and lead-lag dynamics. From the first or lower frequency bands we find in-phase or positive co-movements for in all electricity sources except for biomass where anti-phase or negative correlations are observed. We further note that economic growth leads electricity production (i.e. growth hypothesis) for all electricity sources with the exception of oil and gas where reverse causality is observed (i.e. conservation hypothesis). From the second and third frequency cycles, the findings are more mixed, with in-phase (anti-phase) co-movements found for total, dirty, coal, hydro, biomass and solar an dwind (oil, gas and nuclear) whereas the growth hypothesis (conservation hypothesis) is supported for coal, dirty, coal, nuclear, hydro and biomass (oil, gas and solar and wind).

It is also interesting to note periods of ‘neutral effects’ for dirty (2010–2018), clean (2005–2021), nuclear (2012–2018), hydro (2014–2021) and biomass (2010–2015) where no co-movement is observed. The discontunity of the lower and higher frequency bands at these neutral periods implies the existence of a sharp structural breaks in the relationship corresponding to four break point periods i.e. 2005, 2010, 2013/2014 and 2018.

All-in-all, we demonstrate that the co-movement between electricity production and economic growth is characterized by various asymmetries. Firstly, there are frequency asymmetries obsereved for all electricity sourced in which lower frequency components (long-run relationships) are replaced by higher frequency components (short-run relationships) over time. Secondly, there are sign asymmetries observed for oil, gas and nuclear, in which the co-movement turns from in-phase (positive) to anti-phase (negative) over time whilst the reverse is only observed for biomass. Lastly, there are lead-lag asymmetries for solar&wind in which growth hypothesis is supported at low-frequencies (long-run relationship) whilst the conversation hypothesis is supported at higher frequencies (long-run relationship).

5 Further discussion of results

5.1 Comparison to previous literature

In this section, we compare our empirical findings with those of previous South African related studies summarized in the literature review (see Table 1). We further highlight new contributions which our findings make to the current empirical knowledge.

We firstly note that our findings of a positive comovements at low-frequencies (long-term) observed for all electricity sources (except for biomass) correlates with a bulk majority of previous studies which similar establish positive long-run relationships for the energy-growth relationship (Wolde-Rufael 2009; Odhiambo 2010; Menyah et al., 2010; Shakouri and Yazdi 2017), total electrcity-growth relationship (Ziramba 2008; Odhimabo, 2009; Phiri and Nyoni 2016; Nyoni and Phiri 2018), total renewables–growth relationship (Adams et al. 2018; Khobai and Le Roux 2018), total non-renewables–growth relationship (Adams et al. 2018), oil–growth relationship (Ziramba 2009; 2015; Bildirici and Bakirtas, 2014), coal-growth relationship (Magazzino et al., 2021), gas-growth relationship (Akinboade et al. (2008) and hydro-growth relationship (Ziramba 2013). Also in alignment with previous studies, there are long-run causality effcts from electricity/energy production to growth thus offering suport for the growth hypothesis (Odhimabo, 2009; Wolde-Rufael 2009; Odhiambo 2010; Menyah and Wolde-Rufael 2010; Menyah et al., 2010; Bildirici, 2013; Ziramba 2013; 2015; Lin and Wesseh, 2014; Dlamini et al. 2015, 2016; Shakouri and Yazdi 2017; Akadiri et al. 2019; Bekun et al. 2019; Nyoni and Phiri 2020).

However, previous studies fail to account for time and frequency variation in the data, hence ignoring asymmetric dynamics in the relationship. Our findings show that allowing for time variation is necessary to capture important structural breaks which tend to alter the phase dynamics of the co-movements. For instance, we observe that these structural breaks have changed the relationship from i) positive to insignificant for total, dirty, total clean, nuclear, hydro and biomass ii) positive to negative for oil, gas and solar&wind iii) electricity leading growth to growth leading electricity for biomass. Moreover these structural breaks have altered the frequency relationships in which low-frequency co-movements are eventaully replaced with higher-frequency ones.

The ability for wavelet coherence to capture different forms of asymmetries also synthesizes some conflicting evidences found in the previous literature. For instance, the studies of Bhattacharya et al. (2016), Destek and Aslan (2017) and Nyoni and Phiri (2020) refute the existence of renewables – growth relationship as advocated by Adams et al. (2018) and Khobai and Le Roux (2018). Moreover, for dirty energy usage, Ziramba (2008) and Bildirici and Bakirtas (2014) present similar conflicting evidences of positive and insignificant relationship, respectively. Our findings amend these contradictions by showing that for most sources a positive (non)renewables-growth relationship only existed up to a certain preiod and turned insignificant or negative subsequently.

In also considering that no previous studies, to the best of our knowledge, have examined the growth effects of other disaagregated components of renewables energies such as–growth, nuclear, hydro, solar&wind, our study fills in this gap in the literature. This, in turn, allows us to have a more complete outlook on the ‘clean’ energy sector and provide a more robust analysis on the potential for clean electrcity production to boast economic growth.

5.2 Policy implications of results

Altogether, our findings present a more detailed depiction of the electricity–growth relationship which allows to further interpret our results in context of the impacts of different implemeted policies and load shedding on the electricity-growth relationship. Our results also shed light on which clean energy sources ESKOM should consider investing in as a means of diversifying the national electicity grid and supporting long-run economic growth.

Firstly, we note that the timing of implementation of certain energy policies by the department of Energy and Minerals correspond to certain structural shifts in the co-movements between different components of electricity production and economic growth. For instance, the adoption of the Renewable Energy Independent Power Provider Procurement Programme (REIPPPP) in 2010 as a medium-term energy roadmaps (Akinbami et al. 2021), weakened the long-run positive effect of dirty energy (particularly coal production) on economic growth as government intensified their efforts to shift from dirty to clean energy generation. Likewise, the introduction of the White policy paper on renewable energy policy in 2004 and the failure of government to secure Independent Power Producers (IPP) in 2005 (Ting and Byrne 2020), corresponds to a structural break which weakened the long-term effect of total clean electricity production on economic growth despite rejuvenated efforts made by the Deaprtments of Energy and Mineral Resources to increase their renewable energy output following the electricity crisis in 2008. Collectively, these findings imply that since the release of the White Paper on Renewable Energy, the government’s efforts to simultaneously reduce dirty and increase clean electricity production has not been successful in ensuring that aggreagted electricity production is growth enhancing.

Secondly, we observe that the two major periods of load shedding 2014–2015 and 2018–2021 also correspond to structural breaks found in the electricity-growth relationship. For the case of gas, oil and hydro electricity production, these structural breaks has resulted in short-term negative relationship emerging between electricity and growth with reversed causal direction in support of the the conservation hypothesis. In other words, the low economic growth experienced during these blackout periods is responsible for the higher use of gas, oil and hydro as replacements of traditional coal generation. Also note that for coal electricity production, the relationship with growth remains positive but becomes increasingly short-term particularly around the 2018–2021 period hence implying that load shedding has reduced the ability of coal generated electricity to support long-run growth.

Lastly, the disaggreagted analysis offers us insight into which sources of renewable energy are most promising to suport long-term economic growth and which sources need more development. Our findings indicate that solar&wind and biomass have the best potentails for supporting long-term growth. On one hand, solar&wind show to have long-term (positive) and short-term (negative) effects on growth particularly after the launch of the REIPPPP bidding window (BW) auction programmes in the post-2013 period. On the other hand, biomass, which was negatively correlated with growth before the adoption of the White policy paper in 2004, has had a positive impact on economic growth in the post-2013. These findings imply that the REIPPPP bidding window (BW) auction programmes were sucessful in enhancing the long-run growth effects of solar&wind and biomass at disaggregated levels but not for clean electricity production at aggregate levels. Our results further imply that the nuclear and hydro sources need to be further develpoed to support growth, with the former having a negative correlationship with growth after the adoption of the White policy paper in 2004 whilst the later has had an insignificant impact on growth in the more recent loadhsedding period of 2018–2021.

6 Conclusions

Whilst the transition from dirty to clean energy usuage is eminent for South Africa, there is also a widespread belief that non-renewable as opposed to renewable energy use is more compatible with long-term economic growth. This has caused policymakers to treat the transition as a ‘benevolent gesture’ towards mankind as a opposed to one which can sustain long-term economic growth in the country. At the same time, South African’s power utility, ESKOM, has failed to continously provide electricity supply as mandated by legislature and this has created the urgent need for the utility to update the national grid to include diverse sources of electricity generation.

Our study makes a comparative analysis on the effects of different sources of dirty and clean electricity production on economic growth with the aim of determinig whether a shift from dirty to clean electricity production can support economic growth. In differing from previous studies, we use wavelet coherence analysis to examinie the study the time–frequency relationship between electricity and economic growth at aggregated (total, dirty, clean) and disaggregated (coal, oil, gas, nuclear, hydro biomass, solar&wind) levels between 1985 and 2021. The wavelets present advantages over other econometric techniques by capturing various forms of asymmetries in the electricity-growth co-movement which allows for a more-indepth analysis of the relationship at a dissagregated level.

Overall, our analysis shows that the electricity growth—relationship has been impacted by the implementation of different government policies and periods of load shedding. At an aggregated level, the relationship for clean (dirty) sources has weakened over time particlarly after the adoption of the White policy paper in 2005 (REIPPPP policy in 2010). However, at a disaggregated level, the REIPPPP bidding window auctions launched in 2013 have created growth enhancing effects for solar&wind and biomass although some short-run negative effects are observed. We also show that whilst coal and nuclear have increasing become less supportive toward economic growth, oil and gas have supported growth during periods of load shedding although the effects are negative over the short-run.

Based on our findings, we conclude that there are potential growth benefits of South Africa shifting from dirty to clean electricity production. However, for these growth benefits to materialize, ESKOM need to upscale its renewable energy sources and in particular solar and wind and biomass. Further considering that nuclear power is not by strict definition renewable energy its advantages of producing clean energy also need to be prioritized. Ultimately, our study suggests an amendment of the IRP and REIPPP policies to capitalize on opportunities existing in clean energy sector by (i) attracting and approving more independent power producers (IPP) for solar&wind and biomass electricity production (ii) providing investments into the nuclear energy sector to support electricity production (iii) harnessing the potential of small-scale hydropower electricity.

Altogether, the present investigation evidences the utility of wavelet coherence techniques as a comprehensive framework that can be employed to scrutinize various aspects of the intricate relationship between electricity consumption and economic growth. Nevertheless, notwithstanding the advantages of the wavelet coherence method, which permits a more precise and sophisticated analysis of the data, one of the limitations of our research lies in its exclusive concentration on the South African economy. As such, we encourage subsequent scholars to employ this method on other samples, especially those economies for which previous empirical findings are inconclusive.

References

Adams S, Klobodu EKM, Apio A (2018) Renewable and non-renewable energy, regime type and economic growth. Renew Energy 125:755–767

Adebayo T, Oladipupo S, Adeshola I, Rjoub H (2022) Wavelet analysis of impact of renewable energy consumption and technological innovation on emissions: evidence from Portugal. Environ Sci Pollut Res 29:23887–23904

Aguiar-Conraria L, Magalhaes PC, Soares MJ (2012) Cycles in politics: wavelet analysis of political time series. Am J Polit Sci 56(2):500–518

Akadiri SS, Alola AA, Akadiri AC, Alola UV (2019) Contemporaneous interaction between energy consumption, economic growth and environmental sustainability in South Africa: what drives what? Sci Total Environ 686:468–475

Akinbami OM, Oke SR, Bodunrin MO (2021) The state of renewable energy development in South Africa: An overview. Alex Eng J 60:5077–5093

Akinboade OA, Ziramba E, Kumo WL (2008) The Demand for gasoline in South Africa: an empirical analysis using Co-integration techniques. Energy Economics 30:3222–3229

Anderson K, Laws N, Marr S, Lisell L, Jimenez T, Case T, Li X, Lohman D, Cutler D (2018) Quantifying and monetizing renewable energy resiliency. Sustainability 10(4):933–946

Awodumi OB, Adewuyi AO (2020) The role of non-renewable energy consumption in economic growth and carbon emission: Evidence from oil producing economies in Africa. Energ Strat Rev 27:1–19

Ayamolowo OJ, Kusakana MK (2022) South Africa power reforms: The path to dominant renewable energy-sourced grid. Energy Rep 8(1):1208–1215

Bah MM, Azam M (2017) Investigating the relationship between electricity consumption and economic growth: Evidence from South Africa. Renew Sustain Energy Rev 80:531–537

Bekun FV, Emir F, Sarkodie SA (2019) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Scientific Total Environment 655:759–765

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl Energy 162:733–741

Bildirici ME (2013) Economic growth and biomass energy. Biomass Bioenerg 50:19–24

Bildirici ME, Kayicki F (2012) Economic growth and electricity consumption in former Soviet Republics. Energy Economics 34:747–753

Bildirici M, Bakirtas T (2014) The relationship mong oil, natural gas and coal consumption and economic growth in BRICTS (Brazil, Russian, India, China, Turkey and South Africa) countries. Energy, 65(C):134–144

Chen W, Lei Y (2018) The impacts of renewable energy and technological innovation on environment-energy-growth nexus: New evidence from a panel quantile regression. Renewable Energy 123:1–14

Cheng W (1999) Causality between energy consumption and economic growth in India: an application of Cointegration and Error-Correction Modeling. Indian Econ Rev 1:39–49

Destek MA, Aslan A (2017) Renewable and non-renewable energy consumption and economic growth in emerging economies: Evidence from bootstrap panel causality. Renewable Energy 111:757–763

Dlamini J, Balcilar M, Gupta R, Inglesi-Lotz R (2015) Revisiting the causal realtionship between electricity consumption and economic growth in South Africa: a bootstrap rolling window appraoch. Int J Econ Policy Emerg Econ 8(2):169–190

Dlamini J, Balcilar M, Gupta R, Inglesi-Lotz R (2016) Revisiting the causal realtionship between energy consumption and economic growth in South Africa: a bootstrap rolling window appraoch. Energy Sources, Part B 11(7):739–745

Esso JL (2010) The energy consumption-growth nexus on seven Sub-Sahara African countries. Econ Bull 30:1191–1209

International Energy Agency (2022), Renewable energy market update. Outlook for 2022 and 2023. Available from: https://iea.blob.core.windows.net/assets/d6a7300d-7919-4136-b73a-3541c33f8bd7/RenewableEnergyMarketUpdate2022.pdf

Jian J, Fan X, He P, Xiong X, Shen H (2019) The effects of energy consumption, economic growth and financial development on CO2 emissions in China: A VECM approach. Sustainability 11:1–16

Khobai H, Le Roux P (2018) The relationship between energy consumption, economic growth and carbon dioxide emission: The case of South Africa. Int J Energy Econ Policy 7(3):102–109

Kumar RR, Stauvermann PJ, Loganathan N, Kumar RD (2015) Exploring the role of energy, trade and financial development in explaining economic growth in South Africa: A revisit. Renew Sustain Energy Rev 52:1300–1311

Li X, Moret S, Baldi F, Marechal F (2019) Are renewables really that expensive? the impact of uncertainty on the cost of the energy transition. Comput Aided Comput Eng 46:1753–1758

Lin B, Wessel P (2014) Energy consumption and economic growth in South Africa re-examined: a nonparametric testing approach. Renew Sustain Energy Rev 40:840–850

Magazzino C, Bekun FV, Etokakpan MU, Uzuner G (2021) Modeling the dynamic nexus among coal consumption, pollutant emissions and real income: Empirical evidence from South Africa. Environ Sci Pollut Res 27:8772–8782

Mahfouh S, Amar B (2014) The importance of electricity consumption in economic growth: The example of African nations. J Energy Develop 40(1/2):99–110

Mata A (2020) Does electricity consumption impact financial development? Wavelet Anal Future Bus J 6(1):1–8

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32(6):1374–1382

Mutascu M (2018) A time-frequency analysis of trade openess and CO2 emissions in France. Energy Policy 115:443–455

Nyoni B, Phiri A (2018) The electricity-growth nexus in South Africa: evidence from asymmetric cointegration and co-feature analysis. Int J Energy Econ Policy 8:80–88

Nyoni B, Phiri A (2020) Renewable energy-economic growth nexus in South Africa: linear, nonlinear or non-existent? Int J Energy Econ Policy 10:635–644

Odhiambo N (2009) Electricity consumption and economic growth in South Africa: a trivaraite causality test. Energy Economics 31(2):635–640

Odhiambo N (2010) Energy consumption, prices and economic growth in three SSA countries: a comparative study. Energy Policy 38(5):2467–2469

Phiri A, Nyoni B (2016) Re-visiting the electricity-growth nexus in South Africa. Stud Bus Econmics 11(1):97–111

Rahut D, Ali A, Behera B (2017) Domestic use of dirty energy and its effects on human health: empirical evidence from Bhutan. Int J Sustain Energ 36(10):983–993

Raihan, S., Wen, Y., Zeng, B. (2005), Wavelet: A new tool for business cycle analysis. Working Paper 2005–050A, Federal Reserve Bank of St. Louis.

Ranjbar O, Chang T, Nel E, Gupta R (2017) Energy consumption and economic growth nexus South Africa: Asymmetric frequency domain approach. Energy Sources Part B 12(1):24–31

Romer PM (1994) The origins of endogenous growth. J Econ Perspect 8(1):3–22

Sahoo B, Behera D, Rahut D (2022) Decarbonization: Examining the role of environmental innovation versus renewable energy use. Environ Sci Pollut Res 29:48704–48719

Shakouri B, Yazdi SK (2017) Causality between renewable energy, energy consumption, and economic growth. Energy Sources Part B 12(1):838–845

Ting MB, Byrne R (2020) Eskom and the rise of renewables: regime-resistance, crisis and the strategy of incumbency in South Africa’s electricity system. Energy Res Soc Sci 60:e101333

Torrence C, Compo GP (1998) A practical guide to wavelet analysis. Bull Am Meteor Soc 79(1):61–78

Wang Q, Wang L (2020) Renewable energy consumption and economic growth in OCED countries: a nonlinear panel data analysis. Energy 107:e118200

Wolde-Rufael Y (2005) Energy demand and economic growth: the African experience. J Policy Model 27:891–903

Wolde-Rufael Y (2009) Energy consumption and economic growth: the experience of African countries revisited. Energy Econ 31:217–234

Ziramba E (2008) The demand for residential electricity in South Africa. Energy Policy 36(9):3460–3466

Ziramba E (2009) Disaggregate energy consumption and industrial production in South Africa. Energy Policy 37(6):2214–2220

Ziramba E (2013) Hydroelectricity consumption and economic growth nexus: Time series experience of three African countries. Eur Sci J 9(1):85–96

Ziramba E (2015) Causal dynamics between oil consumption and economic growth in South Africa. Energy Sources Part B 10(3):250–256

Funding

Open access funding provided by Nelson Mandela University. No funding was recievd for the resrach.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest

The authors have no compteing inrest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Phiri, A., Nyoni, B. Clean versus dirty electricity generation and economic growth in South Africa: time–frequency study. Econ Change Restruct 56, 2801–2824 (2023). https://doi.org/10.1007/s10644-023-09520-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-023-09520-w