Abstract

Price volatility, an indicative measure of price uncertainty, is an important factor influencing fisheries cost, income, food security, and pressure on fish stocks. An increase in price volatility means that prices are varying more, making it more difficult to adjust the activities accordingly. This paper explores price volatility changes for the small pelagic fish—a key group for food security—related to the potential outcomes of climate change, such as tropical widening. With the tropicalization of temperate and polar marine ecosystems due to species composition changes, one would expect that overall price volatility for the small pelagics may be reduced over time because volatility in the tropical region is on average the lowest. However, we find an empirical evidence that price volatility for small pelagic species has increased relatively in the tropical and sub-polar regions beyond what can be explained by changes in landing levels and the variation in the landings.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

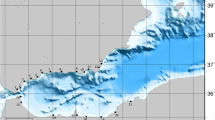

Climate change affects marine fisheries directly and indirectly. Direct outcomes include changes in marine species range, timing of reproduction, eggs and larvae dispersion, abundance, and individual maximum size (Hollowed et al. 2013; Laffoley and Baxter 2016). Indirect consequences include uncertainty in the landings (Brander 2015) as well as in the price received for the landed fish (Dahl and Oglend 2014), and income impacts on fishers’ livelihoods and coastal communities (Asche et al. 2018; Selig et al. 2019). Price volatility, as a measure of price uncertainty, is a key factor informing about fisheries income, food security, and pressure on pelagic fish stocks. Furthermore, prices can be informative measures of changes in ecological conditions even in settings where it is difficult to tease out these relationships from quantity data due to contaminated control variables (Smith et al. 2017). The importance of fisheries production for livelihoods has led to a number of studies investigating the economic consequences of climate change (Allison et al. 2009; Sumaila et al. 2011; Porter et al. 2014; Lam et al. 2016; Blasiak et al. 2017), but so far, little attention has been given to information that can be obtained from price volatility. Here, we investigate whether price volatility has increased in three regions for catches of small pelagic fish—an important resource for food and feed. Comparing volatility between two periods (before and after 1979), an increase in price volatility is found for the tropical region as well as the sub-polar region (Fig. 1). Moreover, the variation in landings influences price volatility more than average landing levels. Consequently, a higher degree of economic uncertainty for small pelagic fisheries may be expected in the future with larger stock and catch variation given the projected increase in the intensity and frequency of extreme events influencing fish stocks due to climate change.

Small pelagics, such as sardines, herrings, and anchovies, are short-lived fish highly dependent on oceanographic conditions (Lehodey et al. 2006; Cochrane et al. 2009; Merino et al. 2010). As such, they are vulnerable to impacts of potential changes in fisheries pattern due to climate change. The group is important to both fisheries and aquaculture activities—small pelagics comprise 30% of global landings, and a significant share is reduced to fish oil and meal used in aquafeeds (Deutsch et al. 2007; Tacon and Metian 2008, 2015; FAO 2019). Moreover, in recent years, fish oil has also become popular as a human nutritional supplement (Misund et al. 2017). Therefore, they are a key seafood group for food security (Allison et al. 2009; Smith et al. 2010).

Among the several possible outcomes from climate change, expansion or contraction of the marine species spatial distribution is of particular interest (Allison et al. 2009; Sumaila et al. 2011; Fossheim et al. 2015; Rutterford et al. 2015; Fenichel et al. 2016; Pecl et al. 2017). In fact, Staten et al. (2018) suggest a poleward expansion of the tropics in recent decades, i.e., a tropical widening. Moreover, predictions that the temperature increase in the polar and sub-polar regions will exceed the global average increase (Barange et al. 2006) suggest not only an intensive local species reduction, in worst cases extinction in the sub-polar regions, tropics, and semi-enclosed seas, but also high species invasion intensity in the polar region (Cheung et al. 2009). This may be seen as a tropicalization of temperate marine ecosystems due to species composition changes (Laffoley and Baxter 2016). If this occurs, one would expect that overall price volatility may be reduced over time, because volatility in the tropical region is on average the lowest (Fig. 1).

However, extreme events are predicted to become more frequent and intense, including the El Niño phenomena (Easterling 2000; Hansen et al. 2012; Cai et al. 2014; Laffoley and Baxter 2016). This will contribute to more variation in fish stocks and landings. This feature indicates that climate change may cause higher stock, landings, and price volatility over time as the geographical range shifts. In fact, several studies note the importance of looking at variability in addition to changes in mean levels to obtain a more complete picture of the effects of climate change (Katz and Brown 1992; Brander 2007; Wernberg et al. 2013). Evidence of accelerated global warming in the last two decades with respect to the relatively stable prior period (Hansen et al. 2012) and evidence of tropical widening from 1979 (Staten et al. 2018) provide an opportunity to investigate the relative strength of the price volatility hypotheses for the three climate regions, namely, sub-polar, temperate, and tropical dummies, before and after 1979.

2 Methods

Price volatility describes the degree of variation in prices, which is a result of the underlying characteristics of its production and market. For fisheries, and in particular small pelagic fish, production depends in large on the environmental conditions, and price volatility will mainly be a function of the amount of fish caught and its variation. Moreover, Tveterås et al. (2012) indicates a highly integrated market for pelagic fisheries (Tveterås et al. 2012). This means that the market substitution among the pelagic fish and other products (e.g., fishmeal and soybean meal—see Asche and Tveterås 2004) limits the market effect on price volatility. Thus, the hypothesis testing in this paper will account for the main variables influencing supply, i.e., amount of fish caught and its variation. As there is a global market, no attempt will be made to distinguish between regional markets.

Data on small pelagic fish (< 30 cm), ex-vessels’ value (US$), and quantity (kg) from large marine ecosystem (LME) (Pauly and Zeller 2015) was used to estimate yearly prices (value divided by quantities) from 1950 to 2006. Large marine ecosystems are areas defined by its ecological and oceanographic characteristics rather than just political or economic criteria (Sherman and Hempel 2009). Each large marine ecosystem was classified by climate region: tropical, temperate, and sub-polar regions (Table 1). Table 2 gives the average volatility, the mean of standard deviations of log-returns for each series in the group. Moreover, Table 2 shows a descriptive analysis of the data set by climate regions, including the number of series available, the number of full-sample series available, and the mean quantity caught by fisheries and its coefficient of variation. For six LMEs, the data for small pelagic (< 30 cm) was not available online or the time series have missing data.Footnote 1

Thus, the effect of variables that vary across the three groups, such as the harvested quantity and the coefficient of variation of the harvested quantity (the standard deviation divided by the mean of the harvested quantity) was tested using regression analysis. The large marine ecosystem time series having no more than 8 missing observations were used in this analysis (see Table 2). The log-linear regression to be estimated is given as:

where volatilityi is the standard deviations of log-returns for each LME time series i, and Di,j is a dummy variable taking a unit value if the LMEi belongs to group j before and after 1979 (models using 1979 and 1980 as the start of the second period were tested and provided similar results). Considering n is the number of LMEs in each group j, then p = n − 1 and μ is the volatility of the remaining reference group.

The vector Xi,k contains additional explanatory variables. These are the harvested quantity in the LMEj and the coefficient of variation of the harvest. The null hypothesis—no differences in volatility between the LME climate region groups (sub-polar, temperate, and tropical) before and after 1979—was tested using the Wald test.

3 Results and discussion

Before 1979, price volatility in the tropical region was significantly lower than the other two regions, while there was no statistical difference between the temperate and the sub-polar region (Table 3). Price volatility remains at the same level with no statistical difference in the temperate region in both periods, but it increases in the two other regions. The tropical region’s price volatility increases so much that it is not statistically different from the temperate region after 1979. The price volatility in the sub-polar region increases so that it is significantly higher than the price volatility in the tropical and temperate regions after 1979. Hence, price volatility has increased in two of the three regions. The fact that the price volatility in the temperate region does not change also implies that the significant shift in the use of many small pelagics towards feed for the rapidly growing aquaculture industry for fishmeal (Tacon and Metian 2008, 2015) and also for human nutritional supplements (Misund et al. 2017) has not fundamentally changed the price volatility for the small pelagics.

Other potential factors influencing price volatility are harvest levels and its coefficient of variation. Harvest level influences volatility positively although with a very small numerical effect. This is somewhat surprising, as usually higher volumes in a market is expected to reduce price volatility, as indicated in Oglend and Sikveland (2008) and Marvasti and Lamberte (2016). However, the particular production process for small pelagics, which is largely due to natural variation rather than more producers as in a traditional industry that spreads risks, goes a long way to explain this result. Dahl and Oglend (2014) show that small pelagics is the seafood species group with the highest price volatility, and its price volatility is higher than all other foods, underscoring this unpredictability. The strong impact of the variation in landings as measured by the CV variable further highlights the importance of looking at variation in itself. Variation in the quantity landed is much more important than how much is landed for price volatility.

The consequences of higher economic uncertainty for fisheries reflected by higher price volatility are different from consequences of higher average (Porter et al. 2014). An increase in price volatility means that prices are varying more, making it more difficult to adjust activities accordingly. This is critical for activities such as fisheries, where fishers have limited flexibility due to a given number of vessels. Moreover, higher price volatility means higher risks and costs associated with the activities, and less stable revenue for fisheries and aquaculture industries. Given most fishers as risk averse (Eggert and Martinsson 2004; Smith and Wilen 2005), they will have less incentive to invest in the activity.

Other factors that influence price volatility are governance and the degree of market integration. Efficient fisheries management provides more individual control over catches and contributes not only to a more predictable revenue (Holland et al. 2017) but also to healthier fish stocks and improved quality of the fish. Although several small pelagic stocks are considered overexploited, fisheries management has improved in the last decades. More fisheries, including the Peruvian anchoveta, have been managed by catch share systems, which tend to be more efficient than open-access systems (Costello et al. 2008; Jardine and Sanchirico 2012; Birkenbach et al. 2017). However, our results indicate that while improvements in management may contribute to reduce harvest and price volatility, this has not been sufficient to counter the effects of stronger natural variability.

In addition, the degree of substitution of the small pelagics, among the different species and in relation to other alternatives for its different uses, i.e., integration among the markets, sets the limits of price variation due to changes in their supply (Asche and Tveterås 2004; Barange et al. 2006; Tveterås and Tveterås 2010; Misund et al. 2017). For instance, fishmeal, made mostly from small pelagics, has been a substitute in feed by soybean meal. As shown in Asche and Tveterås (2004) and Asche et al. (2013), both prices are highly integrated, which limits the market effect on price volatility.

The results in this paper show that price volatility for small pelagic species has increased in the tropical and sub-polar regions beyond what can be explained by changes in landing levels and the variation in landings. Hence, natural variation associated with climate change is impacting pelagic stocks. Given the important role of the small pelagics group in ecosystems as well as for livelihoods, a higher degree of uncertainty associated with small pelagics prices compounded by the uncertainty of the stock availability for fisheries is a challenge for decision-makers when considering the implications of climate change. This is particularly challenging in many poorer countries that are disproportionally dependent on small pelagic as a source for nutrients and protein (Allison et al. 2009; Hicks et al. 2019).

Notes

Gulf of California LME, New Zealand Shelf LME, and Iceland Shelf LME have 8, 3, and 1 missing observations, respectively. While East Central Australian Shelf LME, Canadian High Arctic - North Greenland LME, and Laptev to Chukchi Sea LME did not present data on the small pelagic fish.

References

Allison EH et al (2009) Vulnerability of national economies to the impacts of climate change on fisheries. Fish Fish 10(2):173–196

Asche F, Tveterås S (2004) On the relationship between aquaculture and reduction fisheries. J Agric Econ 55(2):245–265

Asche F, Oglend A, Tveteras S (2013) Regime shifts in the fish meal/soybean meal price ratio. J Agric Econ 64(1):97–111

Asche F et al (2018) Three pillars of sustainability in fisheries. Proc Natl Acad Sci U S A 115(44):11221–11225

Barange M, Hannesson R, Herrick SF Jr (2006) In: Barange M, Hannesson R, Herrick SF Jr (eds) Climate change and the economics of the world’s fisheries: examples of small pelagic stocks. King’s Lynn: Edward Elgar Publishing Limited

Birkenbach A, Kaczan D, Smith MD (2017) Catch shares slow the race to fish. Nature 544(7649):223–226.

Blasiak R et al (2017) Climate change and marine fisheries: least developed countries top global index of vulnerability. PLoS One 12(6):e0179632

Brander KM (2007) Global fish production and climate change. Proc Natl Acad Sci U S A 104(50):19709–19714

Brander K (2015) Improving the reliability of fishery predictions under climate change. Curr Clim Chang Rep 1(1):40–48isheries

Cai W et al (2014) Increasing frequency of extreme El Niño events due to greenhouse warming. Nat Clim Chang 4:111–116

Cheung WWL et al (2009) Projecting global marine biodiversity impacts under climate change scenarios. Fish Fish 10(3):235–251

Cochrane K, de Young C, Soto D, Bahri T (2009) Climate change implications for fisheries and aquaculture: overview of current scientific knowledge, Rome

Costello C, Gaines SD, Lynham J (2008) Can catch shares prevent fisheries collapse? Science 321:1678–1680

Dahl RE, Oglend A (2014) Fish price volatility. Mar Resour Econ 29(4):305–322

Deutsch L et al (2007) Feeding aquaculture growth through globalization: exploitation of marine ecosystems for fishmeal. Glob Environ Chang 17(2):238–249

Easterling D (2000) Climate extremes: observations, modeling, and impacts. Science 289(September):2068–2074

Eggert H, Martinsson P (2004) Are commercial fishers risk-lovers? Land Econ 80(4):550–560

FAO (2019) Capture production 1950–2016. FishStatJ: Universal Software for Fishery Statistical Time Series. http://www.fao.org/fishery/statistics/software/fishstatj/en (August 13, 2015)

Fenichel EP et al (2016) Wealth reallocation and sustainability under climate change. Nat Clim Chang 6(3):237–244

Fossheim, M, Primicerio, R, Johannesen, E, Ingvaldsen, RB, Aschan, MM, Dolgov, AV (2015) Recent warming leads to a rapid borealization of fish communities in the Arctic. Nat Clim Chang 5(7): 673-677

Hansen J, Sato M, Ruedy R (2012) Perception of climate change. Proc Natl Acad Sci 109(37):E2415–E2423

Hicks CC et al (2019) Harnessing global fisheries to tackle micronutrient deficiencies. Nature 574(7776):95–98

Holland DS et al (2017) Impact of catch shares on diversification of fishers’ income and risk. Proc Natl Acad Sci 114(35):9302–9307

Hollowed AB et al (2013) Projected impacts of climate change on marine fish and fisheries. ICES J Mar Sci 70(5):1023–1037

Jardine SL, Sanchirico JN (2012) Catch share programs in developing countries: a survey of the literature. Mar Policy 36(6):1242–1254.

Katz RW, Brown BG (1992) Extreme events in a changing climate: variability is more important than averages. Clim Chang 21(3):289–302.

Laffoley, D and Baxter, JM (2016). Explaining ocean warming: Causes, scale, effects and consequences. Full report. Gland, Switzerland: IUCN. 456 pp.

Lam VWY, Cheung WWL, Reygondeau G, Sumaila UR (2016) Projected change in global fisheries revenues under climate change. Sci Rep (Nature) 6:32607

Lehodey P et al (2006) Climate variability, fish, and fisheries. J Clim 19(20):5009–5030

Marvasti A, Lamberte A (2016) Commodity price volatility under regulatory changes and disaster. J Empir Financ 38:355–361

Merino G, Barange M, Mullon C (2010) Climate variability and change scenarios for a marine commodity: modelling small pelagic fish, fisheries and fishmeal in a globalized market. J Mar Syst 81(1–2):196–205

Misund B, Oglend A, Pincinato RBM (2017) The rise of fish oil: from feed to human nutritional supplement. Aquac Econ Manag 21(2)

Oglend A, Sikveland M (2008) The behaviour of salmon price volatility. Mar Resour Econ 23(4):507–526

Pauly D, Zeller D (2015) Sea around us concepts, design and data. www.seaaroundus.org (July 20, 2015)

Pecl G et al (2017) Biodiversity redistribution under climate change: impacts on ecosystems and human well-being publication details. Science 355(6332):1–9

Porter JR et al (2014) Food security and food production systems. In: Climate Change 2014: Impacts, Adaptation, and Vulnerability. Cambridge University Press, pp 485–533 http://curis.ku.dk/ws/files/131829514/Chapter_7._Food_security....pdf

Rutterford LA et al (2015) Future fish distributions constrained by depth in warming seas. Nat Clim Chang 5(June):569–574 http://www.nature.com/doifinder/10.1038/nclimate2607

Selig ER et al (2019) Mapping global human dependence on marine ecosystems. Conserv Lett 12(2):1–10

Sherman, K. and Hempel, G. (Editors) 2009. The UNEP Large Marine Ecosystem Report: A perspective on changing conditions in LMEs of the world’s Regional Seas. UNEP Regional Seas Report and Studies No. 182. United Nations Environment Programme. Nairobi, Kenya.

Smith MD, Wilen JE (2005) Heterogeneous and correlated risk preferences in commercial fishermen: the perfect storm dilemma. J Risk Uncertain 31(1):53–71

Smith MD et al (2010) Sustainability and global seafood. Science 327(February):784–786

Smith MD et al (2017) Seafood prices reveal impacts of a major ecological disturbance. Proc Natl Acad Sci 114(7):1512–1517

Staten PW et al (2018) Re-examining tropical expansion. Nat Clim Chang 8(9):768–775.

Sumaila UR et al (2011) Climate change impacts on the biophysics and economics of world fisheries. Nat Clim Chang 1(9):449–456.

Tacon AGJ, Metian M (2008) Global overview on the use of fish meal and fish oil in industrially compounded aquafeeds: trends and future prospects. Aquaculture 285(1–4):146–158.

Tacon AGJ, Metian M (2015) Feed matters: satisfying the feed demand of aquaculture. Rev Fish Sci Aquac 23(1):1–10

Tveterås S, Tveterås R (2010) The global competition for wild fish resources between livestock and aquaculture. J Agric Econ 61(2):381–397

Tveterås S et al (2012) Fish is food-the FAO’s fish price index. PLoS One 7(5):1–10

Wernberg T et al (2013) An extreme climatic event alters marine ecosystem structure in a global biodiversity hotspot. Nat Clim Chang 3(1):78–82.

Funding

Open Access funding provided by University Of Stavanger. This work was supported by the Norwegian Research Council – project 254886. The funders had no role in study design, data collection and analysis, decision to publish, or preparation of the manuscript.

Author information

Authors and Affiliations

Contributions

RBMP, FA, and AO designed the study; RBMP performed the analysis; RBMP, FA, and AO analyzed the results and reviewed the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Pincinato, R.B.M., Asche, F. & Oglend, A. Climate change and small pelagic fish price volatility. Climatic Change 161, 591–599 (2020). https://doi.org/10.1007/s10584-020-02755-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-020-02755-w