Abstract

Prior research has investigated how narcissistic executives affect firm policies and outcomes and how these executives influence colleagues and followers. However, almost no research exists concerning the impact of narcissistic executives on external agents. We examine the case of credit ratings—where analysts are required to assess management competence and where undue management influence is a concern—to determine whether narcissistic CEOs exert an effect on their firm’s rating. Using the size of the CEO’s personal signature to measure narcissism, we find that CEO narcissism is associated with worse credit ratings. This effect is attenuated when firms face greater financial constraints, higher industry competition, and more concentrated institutional ownership. Our study contributes to the growing body of literature on CEO narcissism and suggests that these manipulative individuals are unable to exert an obvious upward influence on credit rating agencies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

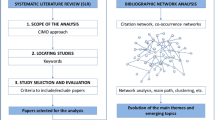

Extensive research has investigated the effects of executive narcissism on colleagues and followers inside the firm, but there is almost no prior evidence concerning the effects of narcissism on external agents. We examine the external impact of CEO narcissism in the unique context of corporate credit ratings. The credit rating setting is interesting for several reasons. First, credit rating agencies (CRAs) play a vital role in the economy by acting as information intermediaries (Ahn et al., 2019; Ashbaugh-Skaife et al., 2006; Becker & Milbourn, 2011; Cheng & Subramanyam, 2008; Francis et al., 2005; Kisgen, 2019; Scalet & Kelly, 2012), but recently, their independence and potential for undue influence from management has been called into question (Bonsall et al., 2017b; Bruno et al., 2016; Cornaggia & Cornaggia, 2013; Jiang et al., 2012; Manns, 2013). Second, prior research indicates that narcissistic executives engage in a multitude of behaviors aimed at positively influencing outsiders’ perceptions, particularly regarding financial metrics (e.g., Abdel-Meguid et al., 2021; Ham et al., 2017; Olsen et al., 2014). Third, credit analysts’ tasks are particularly well structured in terms of the quantitative analyses they conduct, the financial information they examine, and the combination of evidence to form an overall conclusion (Bonsall et al., 2017b; S&P, 2019). Fourth, credit analysts are specifically instructed in their rating criteria to form opinions of management’s competence and personality (S&P, 2019). This fourth aspect is especially important because it is closely related to the potential assessment of CEO narcissism and most likely subject to potential influence and/or bias.

As an extension of upper echelon theory (Hambrick, 2007; Hambrick & Mason, 1984), a strand of literature has documented that the behaviors and personal attributes of top managers—in particular CEOs—are important determinants of firm credit ratings. Prior research consistently documents that managerial expertise is a major factor in the process of credit assessment. In particular, prior research has focused on managerial ability (Bonsall et al., 2017a; Cornaggia et al., 2017), CEO general ability (Ma et al., 2020), risk-taking incentives (Kuang & Qin, 2013), political ideology (Bhandari & Golden, 2021; Greiner et al., 2023), and legal expertise (Pham et al., 2023). In line with these findings, Standard & Poor (S&P) (2019) emphasizes in their summary of rating criteria that management—particularly managers’ strategic competence—is a key component in determining a firm’s credit rating.

A growing body of literature has documented that executive narcissism influences corporate policies and firm performance, with the findings generally being mixed (in “The characteristics of narcissism” and “The consequences of CEO narcissism,” we provide a detailed review; see also Cragun et al., 2020 for a recent survey of this literature). On the one hand, a number of studies have highlighted the unethical aspects of narcissism that may harm their firms. Specifically, narcissistic executives have been found to be associated with more earnings management and potential fraud (Ham et al., 2017; Olsen et al., 2014; Rijsenbilt & Commandeur, 2013), greater exposure to lawsuits (O’Reilly et al., 2018), the creation of hostile or toxic work environments (Blair et al., 2008; Nevicka et al., 2018), and overinvestment (Ham et al., 2018). Relatedly, prior research shows that CEO narcissism is associated with higher variability in financial performance (Chatterjee & Hambrick, 2007). These findings would lead us to expect a negative relation between CEO narcissism and credit ratings. On the other hand, some narcissistic behavior could extract economic benefits for firms. For example, narcissistic CEOs might reduce tax payments (Olsen & Stekelberg, 2016), invest more in innovation (Ham et al., 2018; Kashmiri et al., 2017), and increase ESG scores (Dabbebi et al., 2022; Larcker et al., 2021; Petrenko et al., 2016). In addition, importantly, narcissists are adept at creating unreasonably positive perceptions of their competence and capability in colleagues and followers (Deluga, 1997; Goncalo et al., 2010; Maccoby, 2003; Nevicka et al., 2011; Spangler et al., 2012). With specific reference to executives, research has found narcissism to be associated with non-GAAP window-dressing (Abdel-Meguid et al., 2021) and real activities manipulation to increase reported performance (Olsen et al., 2014). Ham et al. (2023) find experimental evidence that highly narcissistic individuals tend to use persuasion strategies to positively affect the perception of firms by sell-side financial analysts; in addition, they report archival evidence consistent with the view that executive narcissism is positively associated with firm overvaluation by analysts. This prior evidence leads us to contemplate the possibility that narcissistic CEOs may preside over riskier firms but may yet convince credit analysts of their superior competence and ability. Therefore, whether CEO narcissism exerts a positive influence on credit ratings or whether credit analysts “see through” CEO personality, thanks to the well-specified, mainly quantitative nature of their task, is an empirical question.

Our analysis focuses on U.S. firms with available data for the period from 1992 to 2016. Using ordered logit regressions, our main results show that firms with narcissistic CEOs receive lower credit ratings. We also find that the association between CEO narcissism and credit ratings is weaker in contexts with constrained managerial discretion.

Our results provide two main contributions to the business ethics literature. First, our research extends prior studies on the consequences of executive narcissism. These papers emphasize the ethical issues related to narcissism; in particular, they show that narcissistic executives employ manipulative strategies to affect stakeholders (Abdel-Meguid et al., 2021; Capalbo et al., 2018; Ham et al., 2017, 2023; Olsen et al., 2014). Within this stream of the literature, scant research (with generally mixed results) explores whether external agents are affected by narcissists’ actions (Ham et al., 2023; Judd et al., 2017; Marquez-Illescas & Zhou, 2022). However, to fully understand the consequences of executive narcissism, it is important to examine its consequences on external agents, in addition to the consequences on corporate actions. Our analysis identifies new evidence on the effects of narcissism, focusing on the unique setting of credit ratings. Second, we add to the prior literature regarding the behavior of CRAs. These institutions are of paramount relevance in the economy. The major role played by CRAs in the global financial crisis of 2007–2009 substantially increased the interest of business ethics research in their behavior (Attig et al., 2013; Booth & de Bruin, 2021; Scalet & Kelly, 2012; Schoen, 2017; Tang et al., 2020). We contribute to this line of research by showing that credit ratings appear to be unaffected by the potential undue influence of narcissistic CEOs on CRAs.

The remainder of this paper is organized as follows: “Literature review” reviews the previous literature on narcissism and credit ratings. “Research questions” develops the hypotheses. “Research design” describes the research design. “Data” presents the sample selection and main empirical results. “Empirical results” provides additional analyses and robustness tests. “A game theory model of CEO narcissism, unethical behavior, and credit ratings” presents a game theory model with a potential explanation of our main results. “Discussion” discusses our results, and “Conclusion” concludes the paper.

Literature Review

The Characteristics of Narcissism

Narcissism is a prominent personality trait in psychology research (Campbell et al., 2002; Emmons, 1987; Raskin & Hall, 1979; Raskin & Terry, 1988; Resick et al., 2009; Wallace & Baumeister, 2002; Wink, 1991). Narcissism has gained more attention in various fields of business research since Chatterjee and Hambrick (2007) examined how narcissistic CEOs influence firm development and performance.Footnote 1 In the Diagnostic and Statistical Manual for Mental Disorders (DSM), the American Psychiatric Association (APA, 2013) describes narcissism as “a multifaceted personality trait that combines grandiosity, attention seeking, an unrealistically inflated self-view, a need for that self-view to be continuously reinforced through self-regulation, and a general lack of regard for others.” Although this definition from the DSM originates in clinical use, it has also been widely used in non-clinical research (Cragun et al., 2020; Raskin & Terry, 1988). An alternative and commonly used definition of narcissism is given by Emmons (1987), who argues that narcissism can be represented by four latent factors: (1) authoritativeness/leadership; (2) self-absorption/self-admiration; (3) superiority/arrogance; and (4) entitlement/exploitativeness. Raskin and Terry (1988) further refine this definition by using seven latent factors: (1) authoritativeness, (2) self-sufficiency, (3) entitlement, (4) superiority, (5) exhibitionism, (6) vanity, and (7) exploitativeness. As in these psychology studies and other recent business research, we focus on narcissism as a stable personality trait rather than a mental disease or psychological disorder (e.g., Chatterjee & Hambrick, 2007; Ham et al., 2018).

Psychology research has shown that the appeal of narcissistic leaders is a paradox. Narcissism is commonly associated with conceit, arrogance, and disregard for others (Nevicka et al., 2011; Wink, 1991). Narcissistic individuals lack empathy for others’ concerns and view other individuals as inferior (Morf & Rhodewalt, 2001). However, when faced with uncertainty, narcissists are more desired as leaders than their non-narcissistic peers (Nevicka et al., 2013). In a group setting, narcissistic leaders are likely to be overly dominant, yet they emerge as leaders because they are perceived to be effective, visionary, and charismatic (Deluga, 1997; Nevicka et al., 2011; Rosenthal & Pittinsky, 2006). Narcissists evaluate their performance with an upward bias, and such distorted self-perception reinforces the need for positive feedback from others (John & Robins, 1994; Morf & Rhodewalt, 2001). Moreover, narcissists are keen on risky projects in pursuit of attention and prompt payoffs (Campbell et al., 2004).

The Consequences of CEO Narcissism

A growing body of research in management, accounting, and finance has examined the consequences of CEO narcissism. The results of this stream of research are mixed, with the majority of the studies finding that CEO narcissism is associated with a variety of unfavorable firm outcomes (Cragun et al., 2020). Narcissistic CEOs’ appetite for bold actions leads to extreme firm performance (Chatterjee & Hambrick, 2007). In addition, they are prone to overinvest in R&D and M&A; yet firms led by these individuals experience lower profitability and operating cash flows (Ham et al., 2018). In general, a wide body of research shows that narcissistic CEOs are likely to engage in unethical conduct (e.g., Amernic & Craig, 2010; Blickle et al., 2006; Buchholz et al., 2020; Duchon & Drake, 2009; Harris et al., 2022; Rijsenbilt & Commandeur, 2013); they engage in accrual-based and real earnings management to achieve their goals (Buchholz et al., 2020; Capalbo et al., 2018; Ham et al., 2017; Olsen et al., 2014). Indeed, narcissistic executives are more likely to commit white-collar crime (Blickle et al., 2006). In financial disclosures, narcissistic CEOs use an overly optimistic tone (Buchholz et al., 2018; Marquez-Illescas et al., 2018). Aiming to outperform their peers, they report higher non-GAAP earnings (Abdel-Meguid et al., 2021). During the M&A process, the narcissism of the acquirer CEO and that of the target CEO can interact, leading to a lower probability of deal completion (Aktas et al., 2016). Narcissistic CEOs also have a higher probability of engaging in corporate tax sheltering (Olsen & Stekelberg, 2016). Highly narcissistic CEOs pursue challenging tasks to fulfill their inner need for praise and admiration, which may increase their vulnerability to lawsuits and the probability of committing fraud (O’Reilly et al., 2018; Rijsenbilt & Commandeur, 2013). Despite their destructive influence on firm performance, narcissistic CEOs receive higher total compensation (Ham et al., 2018; Larcker et al., 2021; O’Reilly et al., 2014). Their investment strategies are often driven by the goal of gaining admiration (Gerstner et al., 2013; Kashmiri et al., 2017; Zhang et al., 2017). By exerting power over board selection, narcissistic CEOs select new directors who also exhibit narcissistic tendencies (Zhu & Chen, 2015b). Because of their inflated self-perception, they rely more on their prior experience on boards in other firms, demonstrating superiority by resisting opinions from directors and adopting contrary strategies (Zhu & Chen, 2015a).

Other papers have identified the benefits of narcissism. Narcissistic CEOs have a positive effect on firm corporate social responsibility (CSR) and ESG performance/disclosure (Al-Shammari et al., 2019; Dabbebi et al., 2022; Larcker et al., 2021; Petrenko et al., 2016). In addition, they are generally viewed as charismatic (Deluga, 1997), creative (Goncalo et al., 2010), and visionary (Maccoby, 2003), often emerging as effective leaders in group settings (Nevicka et al., 2011; O’Reilly et al., 2014). Narcissistic CEOs usually hold bold visions (Galvin et al., 2010) and are not afraid to make tough decisions (Rosenthal & Pittinsky, 2006), which can be desirable during periods of economic crisis or recession. Narcissistic CEOs are usually resilient and can help firms quickly recover in the postcrisis period (Patel & Cooper, 2014). They are also associated with new product innovation and radical moves in product portfolios (Kashmiri et al., 2017). Additionally, even some of the “negative” behaviors, such as earnings management, non-GAAP window-dressing, and tax avoidance, could be seen as positively affecting stakeholder views and reaping economic rewards for the firm.

To fully understand the consequences of executive narcissism, it is important to examine the effects of narcissism on external agents. The literature, as described earlier, concentrates on the actions associated with narcissism. However, a gap exists in the literature because only scant research examines whether the perception of external agents is affected by executive narcissism. To the best of our knowledge, only three papers have examined this issue, focusing on analysts and auditors (Ham et al., 2023; Judd et al., 2017; Marquez-Illescas & Zhou, 2022); these studies have obtained mixed results. Marquez-Illescas and Zhou (2022) find that CEO narcissism appears to resolve uncertainty among equity analysts, facilitating more accurate earnings forecasts and lower forecast dispersion, partly because narcissists issue more frequent earnings guidance. This suggests that narcissistic CEOs have a positive effect on a firm’s information environment. On the other hand, Judd et al. (2017) find that audit fees are positively associated with CEO narcissism, suggesting that auditors either perform additional work or believe they face higher risk when auditing firms with more narcissistic CEOs. It is important to note, however, that, although auditors are technically external agents, they have access to internal firm systems and information not available to typical stakeholders. CRAs are subject to the same information constraints as financial analysts, investors, and regulators and are at a disadvantage compared with auditors. Ham et al. (2023) find experimental evidence that narcissistic executives tend to put in place coercive tactics and impression management strategies to increase the firm valuation given by sell-side financial analysts. Importantly, they also report archival evidence that CFO narcissism is positively associated with analysts’ overvaluation of a firm. Therefore, Ham et al. (2023) suggest that narcissistic executives are effective in influencing the perception of analysts. We note that one important difference between equity analysts and CRAs is that the task of CRAs is particularly well specified and mainly quantitative nature (see, e.g., S&P, 2019).

Measurement of Narcissism

In this paper, we measure CEO narcissism based on the area-per-letter of the CEO signature. This approach has been increasingly used in recent accounting, finance, and management research (Chou et al., 2021; Church et al., 2020; Davidson et al., 2015; Ham et al., 2017, 2018; Khoo et al., 2024; Seybert, 2013). The premise of our narcissism measure is that the size of the signature can be seen as a projection of the ego of the individual. Psychology research has consistently reported evidence in line with this concept. Zweigenhaft and Marlowe (1973) are, to the best of our knowledge, among the first to record a significant and positive relationship between signature size and self-esteem in an experimental setting. Reviewing prior literature on the characteristics of signatures, Zweigenhaft (1977) argues that the evidence repeatedly points to a positive association between the size of the signature and self-esteem as well as feelings of success and status. Jorgenson (1977) finds that signature size is positively associated with the personality trait of dominance. More recently, Koole and Pelham (2003) confirm a positive association between signature size and self-esteem. In sum, psychology research supports the view that the size of a signature is related to the attributes of narcissism.Footnote 2

An alternative and widely used measure of narcissism in the psychology literature is the Narcissistic Personality Inventory (NPI) (Ames et al., 2006; Emmons, 1987; Raskin & Hall, 1979; Raskin & Terry, 1988). The original form of the NPI has a scale of 40 pairs of items (NPI-40) and there is a revised short version of 16 items (NPI-16)Footnote 3 (Ames et al., 2006; Raskin & Hall, 1979; Raskin & Terry, 1988). Specifically, the NPI-40 measures seven subscales: authoritativeness, self-sufficiency, entitlement, superiority, exhibitionism, vanity, and exploitativeness (Raskin & Hall, 1979; Raskin & Terry, 1988). After choosing the NPI item that best describes their personality, a participant will receive a score based on their choices. The scores range from 0 to 40. A higher score indicates that the participant has a higher level of narcissism.

Measuring narcissism using signature size has at least two advantages relative to a questionnaire-based measure in our setting. First, signature size is widely available for publicly listed U.S. firms. The sources of signatures include company annual reports and letters to shareholders. Most companies make digital copies of their proxy statements, which are available on their websites or other databases (such as Mergent Online). This makes it easy to gain access to the documents and allows researchers to measure CEO signature sizes. Second, the size of the signature is an “unobtrusive”Footnote 4 measure of narcissism; that is, it does not require the direct involvement of the CEO. Using an unobtrusive measure allows researchers to observe from a distance and utilize the physical evidence executives leave in public documents. These information sources provide evidence of individuals’ values, cognition, and psychological traits (Hill et al., 2014). Chatterjee and Hambrick (2007, p. 362) argue that “unobtrusive measures eliminate problems of reactivity, demand characteristics, and researchers’ expectations that can weaken other methods.”

It is important to note that the signature size measure has been repeatedly validated in laboratory experiments. Specifically, several prior studies document a positive relation between signature size and NPI-40 scores (Chou et al., 2021; Church et al., 2020; Ham et al., 2017, 2018).Footnote 5 This positive correlation demonstrates that individuals with larger signatures are likely to exhibit narcissistic traits. In addition, both Ham et al., (2017, 2018) provide evidence that signature size does not capture overconfidence, eliminating the concern of an overconfidence confound. Moreover, CEO overconfidence and narcissism predict directionally inconsistent firm outcomes (Ham et al., 2018). Narcissism predicts higher R&D and M&A expenditures (but not capital expenditures), whereas overconfidence predicts higher capital expenditures (but not R&D and M&A expenditures).

There are other unobtrusive measures for CEO narcissism. Most notably, Chatterjee and Hambrick (2007, 2011) put forward a narcissism index (NI) with five indicators of narcissism, which include (1) the presence of CEO photograph in annual report, (2) CEO’s word usage (such as the frequency of first-person singular pronouns in interviews), (3) CEO’s prominence in company press releases, (4) CEO’s relative cash pay, which is CEO’s cash compensation divided by that of the second-highest paid executive in the firm, and (5) CEO’s relative non-cash pay, which is CEO’s non-cash compensation divided by that of the second-highest-paid executive in the firm. These measures have been employed by several CEO narcissism studies (Aktas et al., 2016; Capalbo et al., 2018; Olsen & Stekelberg, 2016; Olsen et al., 2014). Despite the extensive use of the narcissistic index (NI) in prior research, NI has been criticized because of its limited empirical validation and, relatedly, because it may reflect personality traits different from narcissism (e.g., Carey et al., 2015; Hill et al., 2014; Koch-Bayram & Biemann, 2020).Footnote 6

In summary, several measures of narcissism have been used in prior research. The NPI-40 is a long-established measure in psychological research and requires direct involvement of the participants (Emmons, 1987; Raskin & Terry, 1988). It is highly unlikely that a CEO would agree to provide their responses to such a measure, both because of their limited time and the potential risk and liability it may produce. To overcome such barriers, researchers have developed unobtrusive measures as proxies for narcissism, which include the NI and signature size measure (Chatterjee & Hambrick, 2007; Ham et al., 2017, 2018). In comparison to the NI, signature size has the advantage of being validated in an experimental setting and has been shown to have a significant and positive correlation with the NPI-40 (Chou et al., 2021; Church et al., 2020; Ham et al., 2017, 2018).

Credit Ratings

The Importance of Credit Ratings

CRAs are critical to the functioning of markets, providing information of paramount importance to legislators, regulators, issuers, and investors. The U.S. Securities and Exchange Commission (SEC) has designated certain CRAs as Nationally Recognized Statistical Rating Organizations (NRSROs),Footnote 7 of which there are currently 10.Footnote 8 Institutions, such as commercial banks, insurance companies, and pension funds, are regulated based on the ratings assigned by NRSROs. The managers from issuer firms refer to credit ratings when they make important decisions, including those related to capital structure (Kisgen, 2006). Credit ratings are highly relevant to both equity and debt market participants; accordingly, the prices of equities, credit default swaps, and bonds react strongly to changes in credit ratings (Chava et al., 2019; Dichev & Piotroski, 2001; Jorion et al., 2005; Norden & Weber, 2004). CRAs such as S&P, Moody’s, and Fitch rate the creditworthiness of corporations and governments; the ratings are categorized as investment grade (based on S&P, at BBB- or higher) and speculative grade (based on S&P, below BBB-).Footnote 9 There is a difference between short-term and long-term ratings. CRAs assess long-term (short-term) credit ratings according to the obligor’s capacity and willingness to meet long-term (short-term) financial commitments. Long term is usually defined as more than one year, while short term is less than one year. Firms with high credit ratings have a strong capacity to meet financial obligations, whereas those with low credit ratings are more vulnerable to default or bankruptcy.

The Determinants of Credit Ratings and Their Implications for Business Ethics

A branch of business ethics literature focuses on the behavior of CRAs. In particular, the interest in credit ratings by business ethics research has substantially increased after the global financial crisis of 2007–2009. It is widely accepted that the inappropriate behavior of CRAs and misleading ratings are among the main causes of the global financial crisis. Scalet and Kelly (2012) construct a conceptual framework that summarizes the incentives of CRAs’ unethical behaviors in the wake of the financial crisis. Similarly, Schoen (2017) examines the “erosion of ethics” during the financial crisis and role of CRAs. Other papers have investigated the determinants of credit ratings and reasons why the assessment of CRAs may be inaccurate. Tang et al. (2020) use a laboratory experiment and find evidence of a conflict of interest of CRAs, leading them to assign issuer-paid credit ratings that are upwardly biased. Relatedly, Attig et al. (2013) find that credit ratings tend to be relatively higher for firms with good social performance, suggesting that CRAs incorporate ethical aspects in their assessment of a firm’s debt. Booth and de Bruin (2021) note that the notion of credit risk might be different for CRAs relative to the beneficiaries of the ratings.

Within the finance literature, a wide body of research examines the quality of credit ratings and the reputation of CRAs, with strong implications for business ethics (Bar-Isaac & Shapiro, 2013; Becker & Milbourn, 2011; Bolton et al., 2012; DeHaan, 2017; Dimitrov et al., 2015; Frost, 2007). There has been criticism over the quality of credit ratings, in particular following the scandals of Enron in 2001, WorldCom in 2002, and the global financial crisis in 2007–2009 (Bolton et al., 2012; Frost, 2007). Whether CRAs are effectively disciplined by public criticism, regulatory reforms, or economic environment changes is still under debate (Bar-Isaac & Shapiro, 2013; Bruno et al., 2016; DeHaan, 2017; Dimitrov et al., 2015; Jorion et al., 2005). Evidence on the impact of regulatory reforms, such as Regulation FD (Jorion et al., 2005) and the Dodd–Frank Act (Dimitrov et al., 2015), on CRAs is mixed. Booms and recessions also affect rating quality. Rating quality tends to be lower in booms and higher in recessions or postcrisis periods (Bar-Isaac & Shapiro, 2013; DeHaan, 2017). Bonsall et al. (2017b) investigate a very particular circumstance—that of high uncertainty borrowers—and find that, as information uncertainty increases, issuer-paid ratings improve relative to investor-paid ratings. The authors attribute this in part to the resources and vastly more in-depth and well-specified nature of credit analysis procedures in large CRAs. Ahn et al. (2019) examine the private communication dynamics between CRAs and managers with respect to negative firm-specific information. Informed CRAs adjust their ratings with this confidential information before the public disclosure of bad news and are less likely to react to negative information (Ahn et al., 2019).

Our paper focuses on CEO narcissism. Therefore, it is also related to prior research on the effects of managerial characteristics on firms’ credit ratings. Using CEO risk-taking incentives (CEO Delta and Vega), Kuang and Qin (2013) document that an increase in managerial risk-taking incentives can cause an increase in firm default risk and lead to lower firm credit ratings. Cornaggia et al. (2017) and Bonsall et al. (2017a) find that managerial ability is positively associated with credit ratings. Ma et al. (2020) show that managers with general, transferrable skills are assigned lower credit ratings. Bhandari and Golden (2021) provide evidence that CEO political ideology and conservatism are important factors in CRAs’ assessments.Footnote 10

Research Questions

The Relation Between CEO Narcissism and Credit Ratings

When CRAs start their assessment, an issuer’s business and financial risk profile form the basis of a company’s credit rating analysis (S&P, 2019, 2021); it is important to note that CRAs’ task is generally clearly specified and mainly quantitative in nature.Footnote 11 A company’s business risk profile describes the market in which the company is actively engaging and gives details about the company’s industry risk, country risk, and competitive position. The financial risk profile specifies the company’s use of leverage and cash flow. The two risk profiles are called “anchor” by S&P. After building the anchor rating, additional rating factors, such as diversification, capital structure, financial policy, liquidity, and management/governance, would alter the anchor in two directions, either up or down.Footnote 12 A firm’s management and financial policy are two key components in the process of a credit assessment (S&P, 2019, 2021). The two components are closely connected. CRAs acquire both qualitative and quantitative information to assess a company’s management (Bhandari & Golden, 2021). The evaluation of management is mainly about the company’s top executives, especially their competence and ability to manage risks. Strong management indicates that a corporation has the capacity to oversee strategic and operational risks and would, in turn, strengthen the credit profile. Financial policies reflect managers’ appetite for incremental risks or plans to reduce leverage. Therefore, management’s financial policies can significantly influence a company’s financial risk profile, consequently affecting the company’s credit rating (Bhandari & Golden, 2021; S&P, 2019).

On the one hand, CRAs could perceive companies led by narcissistic CEOs as riskier for two reasons. First, as described earlier, the literature has found that CEO narcissism is associated with unethical actions, which might make the firm riskier, such as accounting misreporting (Abdel-Meguid et al., 2021; Buchholz et al., 2020; Ham et al., 2017; Olsen et al., 2014), tax avoidance activities (Olsen & Stekelberg, 2016), overinvestment (Ham et al., 2018), greater exposure to lawsuits (O’Reilly et al., 2018), and the creation of hostile or toxic work environments (Blair et al., 2008; Nevicka et al., 2018). Second, narcissistic CEOs are more risk-loving and pursue riskier corporate financial policies than non-narcissistic CEOs. Narcissists are willing to take more risks than non-narcissists (Campbell et al., 2004), and this inclination for risky and bold actions can lead to more extreme firm performance (Chatterjee & Hambrick, 2007).

On the other hand, as previously mentioned, narcissists are adept at influencing others and generating abnormally positive perceptions of their own competence and ability (Deluga, 1997; Goncalo et al., 2010; Maccoby, 2003; Nevicka et al., 2011; Spangler et al., 2012). In addition, many of the earnings management and window-dressing behaviors shown in prior research are presumably aimed at positively influencing external stakeholders. Because prior papers are concerned about the bias and undue influence of managers on credit analysts, it seems reasonable to think that both the financial policy and management components of the credit risk analysis could be upwardly biased by narcissistic CEOs. These effects not only obscure the true underlying performance, but they also inflate perceptions of management competence and the ability that credit analysts are explicitly instructed to assess (S&P, 2019).

A related question is whether CRAs are aware of CEO narcissism. It is important to note that narcissism can be externally observed. Observer ratings of personality often closely approximate self-ratings (Mount et al., 1994). For example, O’Reilly et al. (2014) survey employees from various firms to rate their CEOs’ personality traits and evaluate CEO narcissism, finding that employee ratings predict various firm outcomes. Credit rating analysts may identify signs of CEO narcissism from press releases or portrayals, word usages, and other publicly available sources. However, it is unclear whether and how analysts’ perceptions of narcissism will counterbalance or outweigh the abnormally positive impressions that narcissistic CEOs seek to create.

Because of the opposing theoretical arguments regarding the relation between CEO narcissism and credit ratings, we state our main research question in exploratory form without making directional predictions:

RQ1. Does CEO narcissism impact firm credit ratings?

The Moderating Role of Managerial Discretion in the Relationship Between CEO Narcissism and Credit Ratings

After examining our main research question, we investigate whether the relationship between CEO narcissism and credit ratings is moderated by managerial discretion. The purpose of this analysis is to identify situations in which the effects of narcissism on credit ratings may be mitigated. We concentrate on managerial discretion because we believe it is central in allowing the consequences of narcissism to manifest. Specifically, we argue that constraints on the discretion of managers limit their ability to influence firm outcomes. Therefore, we expect the individual characteristics of CEOs to play a less important role in the presence of constraints to managerial discretion. If CRAs anticipate this effect, we expect that any effect of CEO narcissism on credit ratings will be attenuated by constraints to managerial discretion. We focus on three features of the economic environment that, in line with prior research, may affect managerial discretion: the presence of financial constraints, the intensity of industry competition, and institutional ownership concentration.

First, financially constrained firms exhibit restrictions on their external funding and cash reserves. In this case, managers are disciplined by the debt market, which implies that they should use their funding in a more conservative manner. Corporate policy dictates greater cash holdings and limited ability to pursue risky projects (Almeida et al., 2004). Prior research suggests that the presence of financial constraints reduces agency costs and prevents managers from investing in unprofitable projects (Griffin et al., 2018; Jensen, 1986).

Second, market competition can discipline managers by reducing managerial slack. Managers in competitive industries are pressured to reduce slack and maximize firm profits so that the firm can stay in business (Giroud & Mueller, 2011). Firms that face increased competitive pressure must either cut costs or face a higher probability of liquidation (Giroud & Mueller, 2011; Hart, 1983; Schmidt, 1997). Consistent with this notion, CEOs have a higher turnover frequency in more competitive industries (Dasgupta et al., 2018; DeFond & Park, 1999).

Third, firms with strong corporate governance can alleviate agency problems and reduce default risk. A common approach to assessing the strength of corporate governance is to examine institutional ownership concentration (Shleifer & Vishny, 1997). Large investors, such as institutional investors, have the financial means and power to monitor firm management. Such control may reduce the propensity for risky investments and opportunistic behavior. Consistent with the monitoring role of institutional investors, institutional ownership concentration is positively related to the pay-for-performance sensitivity of managerial compensation (Hartzell & Starks, 2003). Therefore, in line with the literature, we expect institutional ownership concentration to increase the strength of corporate governance (Chung & Zhang, 2011).

To sum up, based on the above arguments, we argue that the presence of financial constraints, the intensity of industry competition, and institutional ownership concentration limit managerial discretion. Our second research question examines whether managerial discretion moderates the relationship between CEO narcissism and credit ratings.

RQ2. What are the effects of managerial discretion on the relationship between CEO narcissism and credit ratings?

Research Design

Measuring CEO Narcissism

We use the area-per-letter signature size of each CEO as our measure of CEO narcissism. Following the literature on measuring signatures (Ham et al., 2017, 2018; Zweigenhaft & Marlowe, 1973), we draw a rectangle around each CEO’s signature. Each side of the rectangle touches the most extreme endpoint of the signature. After drawing the rectangle, we measure the area of the rectangle. The area of the rectangle is computed as the product of the length and width (in centimeters). To control for the length of CEO names, we follow Ham et al. (2017, 2018) and scale the area of each signature by the number of letters in CEO names (area-per-letter signature size).

We employ area-per-letter CEO signature size as the proxy for CEO narcissism for several reasons. First, CEO signatures are easy to obtain from a company’s annual reports, thus making them available for a large sample of firms. Second, signature size is an unobtrusive measure that eliminates problems of reactivity, demand characteristics, and researchers’ expectations that are typically related to questionnaire-based measures. Third, the narcissism measure based on signature size has been repeatedly validated in laboratory experiments (Chou et al., 2021; Ham et al., 2017, 2018). See also our discussion in “Measurement of narcissism.”

We obtain CEO signatures from firm annual reports and from letters to shareholders (which are gathered through Mergent Online). After downloading the company’s annual reports, we measure signature size using software. The software used to measure signature size is FOXIT PDF Editor. Following Ham et al. (2017, 2018), using the rectangle tool in FOXIT, we first draw a rectangle and wrap it around a CEO signature. Then, we adjust the rectangle to let each of the four sides of the rectangle touch the most extreme points of the signature. We use the area tool in FOXIT to compute the area of the rectangle in square centimeters. The area tool measures the area of the rectangle and provides the results.

For each CEO, we calculate narcissism based on the most recently available signature in the time period considered.Footnote 13 We take this approach to maximize the size of the sample. Specifically, in many years, a handwritten signature is not available, while in some years, the annual report is not available in Mergent Online; therefore, using CEO year-specific measures of narcissism would strongly decrease the sample size. Our approach is justified by the fact that narcissism is a stable personality trait that does not substantially change over time (Ham et al., 2017, 2018; Raskin & Terry, 1988). Thus, our focus is on between-CEO effects rather than within-CEO effects (Ham et al., 2018).

To control for possible changes in narcissism for a CEO over long time periods, we introduce the following adjustment. For CEOs with long tenure (10 or more than 10 years of tenure), we obtain three signatures at three stages of their tenure (at early, mid, and end of CEO tenure) and calculate the average of the three corresponding narcissism values. We then use this average as the value of narcissism of the CEO for all the years. We also replicated the analysis without this adjustment, and all the inferences in our main analysis remain unchanged.

Measuring Credit Ratings

In line with prior research, we use S&P Domestic Long-Term Issuer Credit Ratings, which are available in Compustat.Footnote 14 S&P’s long-term issuer credit ratings include AAA, AA+, AA, AA−, A+, A, A−, BBB+, BBB, BBB−, BB+, BB, BB−, B+, B, B−, CCC+, CCC, CCC−, CC, C, and D. We recode the ratings numerically in ascending order, where D = 1, … AAA = 22. Some prior studies translate the ratings the other way (AAA = 1, …D = 22) (Cheng & Subramanyam, 2008; Francis et al., 2005). We reverse the order to make it easier to interpret so that a higher score means better credit quality.

Relating CEO Narcissism and Credit Ratings

Our main empirical model is based on prior research on the determinants of credit ratings (e.g., Ashbaugh-Skaife et al., 2006; Bhandari & Golden, 2021; Cornaggia et al., 2017; Kuang & Qin, 2013).

All variables are defined in Appendix 1. RATING is a numerical score for S&P Domestic Long-Term Issuer Credit Rating. Because RATING is a ranked variable where a larger number indicates a better rating, we employ ordered logit regressions in our main analyses. The key independent variable of interest is SIGSIZE, which is our area-per-letter signature size measure for CEO narcissism. In line with the literature, we include a comprehensive set of control variables, as described.

First, we focus on firm-specific variables that are likely to be considered by CRAs when evaluating the creditworthiness of the firm. Firm size (SIZE) (Bhandari & Golden, 2021; Bonsall et al., 2017a) can be associated with default risk because larger firms tend to have better information environments and more resources that can be liquidated to satisfy creditors. Leverage (LEV) (Ashbaugh-Skaife et al., 2006; Bhandari & Golden, 2021) can be related to credit ratings because an excessive weight of liabilities in the capital structure increases default risk. The interest coverage ratio (INT_COV) (Attig et al., 2013; Cheng & Subramanyam, 2008) measures the business’s ability to service debt. The profitability of the firm is related to the ability of the firm to generate profits that can be used to service and repay debt; we capture the firm’s profitability with return on assets (ROA) and a loss indicator regarding whether the firm reported negative earnings and experienced a loss in the fiscal year (LOSS) (Ashbaugh-Skaife et al., 2006; Bhandari & Golden, 2021). Differences in firms’ asset structure, as measured by capital intensity (CAPINT) (Bonsall et al., 2017a; Pham et al., 2023), are related to credit risk because firms with greater fixed assets intensity have more resources that can be liquidated to meet debt obligations. We account for differences in firms’ debt structures, which are inherently related to default risk, by including an indicator variable (SUBORD) (Ashbaugh-Skaife et al., 2006; Kaplan & Urwitz, 1979) that equals 1 if the firm has subordinated debt and 0 otherwise. We also include an indicator variable for firms using a Big4 auditor (BIG4) (Bhandari & Golden, 2021) as a control for the effect that high-quality monitoring of accounting information can have on credit ratings. In addition, we employ a set of variables to measure performance volatility, which might increase the likelihood of defaults; specifically, we control for the volatility of ROA (SDROA), the volatility of a firm’s stock return (SDRET), and the volatility of a firm’s operating cash flow (SDOCF) (Bhandari & Golden, 2021). We also control for beta (BETA) (Bhojraj & Sengupta, 2003; Cheng & Subramanyam, 2008), which is a measure of systemic risk.

We further control for several CEO attributes that could affect credit ratings. CEO risk-taking incentives may have an effect on credit risk; in particular, we focus on the sensitivity of managerial wealth to the volatility of firm performance (LNVEGA) and the sensitivity of managerial wealth to firm performance (LNDELTA) (Bonsall et al., 2017a; Kuang & Qin, 2013; Ma et al., 2020). CEO demographic characteristics, such as their tenure and their compensation, can also be related to the risk-taking attitudes of the CEOs; accordingly, we include age (LNAGE), gender (GENDER), tenure (LNTENURE), and total compensation (LNSALARY) of the CEO (Bhandari & Golden, 2021; Kuang & Qin, 2013; Ma et al., 2020; Pham et al., 2023). Finally, we control for the measure of managerial ability (MASCORE) developed by Demerjian et al. (2012) because the literature shows that more able managers could positively affect the firm’s credit ratings (Bonsall et al., 2017a; Cornaggia et al., 2017).

The model also includes year and industry fixed effects to control for year- and industry-specific events that may affect credit ratings. In the present study, our industry classification is based on the Fama and French (FF) 48 industry classification.

Data

Sample Selection

We download firm annual reports and letters to shareholders from Mergent Online.Footnote 15 We obtain CEO signatures from the annual reports and letters to shareholders. We use S&P Domestic Long-Term Issuer Credit Rating from Compustat. We obtain firm-level data from Compustat and CRSP. We obtain institutional investor data from Thomson Reuters 13F and CEO information (age, gender, and salary) from Execucomp. We use CEO Delta and Vega data, as defined in Core and Guay (2002) and Coles et al. (2006).

Our sample period covers the years from 1992 to 2016. We choose this period because 1992 is the earliest year that Execucomp contains CEO records. We end our sample period in 2016 because S&P discontinued updates for the ratings database on Compustat in February 2017.

After merging all databases, the initial sample of CEOs consists of 11,040 firm-year observations. We collect the CEO signatures based on these observations. After merging the signatures, our final sample includes 6295 observations consisting of 1146 CEOs and 626 companies.

Descriptive Statistics

Table 1 presents the descriptive statistics for the variables used in our empirical analyses.Footnote 16 The average CEO signature size is 0.498 square centimeters. The credit rating average is 13.99, which implies that the average credit rating level in our sample is between BBB- and BBB. The mean (median) log of the total assets is 8.445 (8.326), indicating that firms in our sample are generally large because Execucomp covers mostly large firms. Leverage represents debt scaled by total assets. On average, firms report leverage of 28.6%. Additionally, 14.7% of our sample firms report a loss. The mean ROA is 4.7%. The mean of BIG4 is 90.7%, indicating that most of our sample firms are audited by Big 4 auditors.

A Pearson correlation matrix for the variables is presented in Table 2. The Pearson correlation coefficients between RATING and SIGSIZE are negative and statistically significant at the 1% level. The results provide initial support for the view that firms with narcissistic CEOs are likely to receive lower credit ratings. All the significant correlations between RATING and the other variables are below 0.6, indicating that our inferences should not be compromised by multicollinearity.

The correlation coefficients of the control variables are generally consistent with prior studies (Bhandari & Golden, 2021; Cheng & Subramanyam, 2008; Cornaggia et al., 2017). We find that RATING is negatively and significantly correlated with various measures of performance volatility, such as SDOCF, SDROA, SDRET, and BETA. RATING also has a negative and significant correlation with reported loss (LOSS) and complex debt structure (SUBORD). On the other hand, RATING is positively and significantly correlated with firm size (SIZE), ROA, CAPINT, interest coverage ratio (INTCOV), and managerial ability (MASCORE).

Empirical Results

CEO Narcissism and Credit Ratings (RQ1)

Table 3 column (1) reports the baseline regression results for the relationship between CEO narcissism and firm credit ratings. The results show that the coefficient estimate on SIGSIZE is negative and statistically significant at the 1% level (coefficient = − 0.661, Z-statistic = − 2.82), hence answering the exploratory question posed in RQ1 and providing evidence that CEO narcissism significantly negatively impacts firm credit ratings.

The results on the firm-level control variables are mostly consistent with prior research (Bhandari & Golden, 2021; Cheng & Subramanyam, 2008; Cornaggia et al., 2017). Firm-level variables that capture financial risk, such as SIZE, ROA, CAPINT, and INTCOV (LEV, SUBORD), are positive (negative) and significantly associated with credit ratings. LOSS has an insignificant coefficient. The variables (SDOCF, SDROA, SDRET, and BETA) that measure performance volatility are negative and significantly related to credit ratings.

Our CEO-level control variables include CEO age, gender, salary, and risk incentives (DELTA and VEGA). The coefficients for CEO age, gender, and tenure are insignificant. CEO DELTA is insignificant but negative, and CEO VEGA is positive and significant. The results for CEO DELTA and VEGA are consistent with Bhandari and Golden (2021). CEO salary is positively and significantly associated with credit ratings. CEO performance may be positively related to both salary and credit ratings. In addition, consistent with Cornaggia et al. (2017) and Bonsall et al. (2017a), MASCORE is positively associated with credit ratings.

In Table 3 column (2), we include the results for the baseline regression with reduced credit rating categories. Instead of using the original categories (22 in total), we group the ratings using the letters without the ± signs. As a result, we have 10 rating categories (AAA, AA, A, BBB, BB, B, CCC, CC, C, and D). We denote this variable as RATING_2. The coefficient for SIGSIZE is again negative and significant at the 5% level (coefficient = − 0.641, Z-statistic = − 2.54).

Following Ashbaugh-Skaife et al. (2006), Cornaggia et al. (2017), and Bhandari and Golden (2021), we use another alternative measure of credit ratings. The results are reported in Table 3 column (3). We employ a dummy variable (INVESTMENT_GRADE) that is equal to 1 if the long-term issuer credit ratings are in the top group (BBB- and above) and 0 otherwise. We run a logistic regression of this measure on CEO narcissism. The coefficient on SIGSIZE is negative and significant at the 5% level (coefficient = − 0.654, Z-statistic = − 2.12). The results for the control variables are comparable to those previously reported. This analysis provides further evidence that CEO narcissism negatively impacts credit ratings.

It is also interesting to examine the marginal effects with respect to narcissism, which measures the derivative of the expected probability of a credit rating outcome relative to our narcissism measure. We report these results in Appendix 3. Notably, the sign of the marginal effects is positive for ratings worse than or equal to BBB as well as for ratings better or equal to BBB+. Almost all marginal effects are significantly different from 0.

Cross-sectional Analyses (RQ2)

We perform a set of cross-sectional analyses to examine our second research question (RQ2) and present the results in Table 4. The purpose of these tests is to investigate whether managerial discretion affects the relationship between CEO narcissism and credit ratings. We use three measures of constraints on managerial discretion: financial constraints, market competition, and institutional investors’ ownership and breadth. Based on our arguments in “The moderating role of managerial discretion in the relationship between CEO narcissism and credit ratings,” we expect that constraints on managerial discretion attenuate the relationship between CEO narcissism and credit ratings.

Financial Constraints

We use the KZ index (Kaplan & Zingales, 1997) and WW index (Whited & Wu, 2006) to proxy for the firm’s financial constraints. We explain the calculation of the KZ index and WW index in Appendix 1. We employ two indicator variables, FINCON1 and FINCON2, to proxy for above-median levels of financially constrained firms.

The results are presented in Table 4 (columns 1 and 2). In column 1, we find that the coefficient estimate of FINCON1 × SIGSIZE is positive and significant (coefficient = 0.700, Z-statistic = 1.74). In column 2, we find that the coefficient estimate of FINCON2 × SIGSIZE is also positive and significant (coefficient = 0.864, Z-statistic = 2.45). These results provide evidence that, in financially constrained firms, the relationship between CEO narcissism and credit ratings is attenuated. This is in line with the interpretation that, because of the lower discretion they can use, narcissistic CEOs are perceived by CRAs as less risky when they are financially constrained.

Market Competition

We use the Herfindahl–Hirschman Index (HHI) and Lerner index to measure industry competitiveness. We employ two indicator variables—MC1 and MC2—to indicate higher levels of industry competition. We explain the calculation of the HHI in Appendix 1. A low (high) HHI indicates relatively high (low) competition. MC1 is an indicator variable that equals 1 if a firm’s HHI is below the sample year median and 0 otherwise. Table 4 (column 3) presents the results. The coefficient estimate on the interaction term MC1 × SIGSIZE is positive and significant (coefficient = 0.620, Z-statistic = 1.68), which is in line with our expectations.

In addition to the HHI, we employ the Lerner index as another measure of firm competition. Specifically, we employ a modified, industry-adjusted Lerner index to capture firm-specific market power. The Lerner index (LI)Footnote 17 originates in economics and captures a firm’s ability to set its product prices above their marginal costs (Babar & Habib, 2021; Lerner, 1934). Under perfect competition, a firm tends to make no profits and is inclined to set the selling price very close to the marginal cost (Babar & Habib, 2021). Because of such pricing power, the LI is also referred to as the price cost margin (PCM). However, industry-wide factors unrelated to competition could also influence a firm’s pricing power (Datta et al., 2011, 2013; Gaspar & Massa, 2006; Peress, 2010). To capture firm-specific market pricing power, following prior studies, we employ a modified, industry-adjusted LI (IPCM) to control for structural differences across industries (Datta et al., 2011, 2013; Gaspar & Massa, 2006; Peress, 2010). IPCM is the difference between a firm’s LI and the value-weighted industry PCM. We specify the calculation of the IPCM in Appendix 1. The results are presented in Table 4 (column 4). A lower IPCM means that the firm has weaker market power and stronger competition. MC2 is an indicator variable equal to 1 if IPCM is below sample median and 0 otherwise. The coefficient estimate on the interaction term MC2 × SIGSIZE is positive and significant (coefficient = 0.585, Z-statistic = 1.70), which is again in line with our expectations.

The results for both measures of competition are consistent with the notion that product market competition can act as a disciplining mechanism for managers. In a highly competitive environment, managerial discretion is limited and the negative effect of narcissistic CEOs on credit ratings is attenuated.

Institutional Breadth and Concentration

We employ two indicator variables (CGOV1 and CGOV2) to represent more concentrated institutional ownership. We use the institutional ownership concentration (IOC) ratio and institutional ownership breadth (IOB) to proxy for the extent of institutional concentration. The IOC conveys information about institutional ownership distribution. The IOC is the sum of squares of percentage institutional ownership each quarter. The IOB is the number of institutions owning the stock during the quarter. The institutional-level data are provided at quarterly frequency by Thomson Reuters 13F. We use year-end institutional-level data in our sample. More details on the calculation of the IOC can be found in Appendix 5. We use an indicator variable CGOV1 to measure below-median institutional breadth, where CGOV1 equals 1 if IOB is below the sample year median and 0 otherwise. We employ an indicator variable CGOV2 to measure above-median institutional concentration, where CGOV2 equals 1 if IOC is above-median and 0 otherwise.

The results are reported in Table 4 (columns 5 and 6). The coefficients on the interaction terms CGOV1 × SIGSIZE and CGOV2 × SIGSIZE are positive and significant (coefficient = 0.665, Z-statistic = 1.65 for CGOV1; coefficient = 0.520, Z-statistic = 1.70 for CGOV2), thus supporting our expectations. This is in line with the interpretation that, in firms with high levels of IOC, managerial discretion is lower because of the monitoring role of institutional investors. As a result, the association between CEO narcissism and credit ratings is attenuated.Footnote 18

Interaction Plots

To sum up, the results in Table 4 indicate that, in firms where there are constraints on managerial discretion, the relation between CEO narcissism and credit ratings is attenuated.

In the prior paragraphs, we have interpreted the results in Table 4 based on the coefficients of the interaction terms between our measure of CEO narcissism and the measures of constraints on managerial discretion. We also employ interaction plots to interpret the moderating role of managerial discretion in the relationship between CEO narcissism and credit ratings. The plots are presented and discussed in detail in Appendix 4.

The results show that the marginal effects (slopes) of credit ratings with respect to narcissism are negative and significantly different from 0 when there are no constraints on managerial discretion (FINCON1 = 0, FINCON2 = 0, MC1 = 0, MC2 = 0, CGOV1 = 0, CGOV2 = 0). In the presence of constraints on managerial discretion (FINCON1 = 1, FINCON2 = 1, MC1 = 1, MC2 = 1, CGOV1 = 1, CGOV2 = 1), the slopes are negative but with a lower significance level (only significantly different from 0 when MC2 = 1) and substantially lower in magnitude than when there are no constraints on managerial discretion. These findings further support the interpretation that constraints on managerial discretion mitigate the strength of the relationship between CEO narcissism and credit ratings.

Addressing Potential Endogeneity Issues

In this section, we examine endogeneity concerns. One potential source of endogeneity in our sample is related to the selection of CEOs. Specifically, it is possible that firms that hire narcissistic CEOs are systematically different from others. We address potential endogeneity issues in two main ways. First, we estimate our main model using a change specification. Second, we use a propensity score matching approach. The results of both tests are consistent with those reported in the main analysis.

Changes Specification

The purpose of a change analysis is to test the causal link between CEO narcissism and a firm’s credit rating (Bhandari & Golden, 2021). A negative association between a change in CEO narcissism and a change in credit ratings suggests a causal relationship. Therefore, we estimate our empirical credit rating model in change form to examine whether changes in CEO narcissism are associated with changes in RATING.

In Eq. (2), \(\Delta\) denotes a change in the given variable between year t − 1 and year t. We take the first difference of all the continuous variables in our model. All variables are defined in Appendix 1. Control variables without any change in any of the sample observations are omitted for this analysis (e.g., BIG4 and GENDER). To capture the change in credit ratings, we construct a new variable UPGRADE, which equals 1 if the credit rating is upgraded from the previous year, 0 if there is no change from the previous year, and − 1 if the credit rating is downgraded from the previous year.

Table 5 provides the ordered logit regression results of Eq. (2). The dependent variable is UPGRADE. In column (1), we use all the observations with available data in this analysis, including those for which the CEO does not change. In column (2), we restrict the sample to the observations for which there is a change in the CEO. The coefficient estimate on ΔSIGSIZE is negative and highly significant in both columns. In column (1), the coefficient estimate on ΔSIGSIZE is negative and significant (coefficient = − 1.899, Z-statistic = − 3.12) at the 1% level. The coefficient estimate on ΔSIGSIZE is negative and significant (coefficient = − 2.504, Z-statistic = − 2.83) at the 1% level. We note that, in column (2), the coefficient on CEO narcissism is highly significant, despite the substantial decrease in the number of observations. Our results indicate that an increase in CEO narcissism is associated with a lower probability of upgrading. In general, these results support our prior findings and confirm that firms with narcissistic CEOs tend to receive lower credit ratings.

Propensity Score Matching

We conduct a propensity score matching (PSM) analysis to control for the observable differences between CEOs with high levels of narcissism and other CEOs. We construct a dummy variable that equals 1 if the narcissism of the CEO (SIGSIZE) is above the 75th percentile of the distribution in a year and 0 otherwise. We construct a matching sample using a one-to-one matching approach with replacement, requiring a maximum caliper distance of 0.01. We then rerun the ordered logit regression, using the observations for which the dummy variable is equal to 1 and the matched observations. We report the results in Table 6.

In column (1), we use the following three matching variables: firm size (SIZE), leverage (LEV), and ROA. In column (2), we use all the control variables as matching variables. The two matching methods yield results that resemble those of the main analysis, further alleviating endogeneity concerns.

Other robustness Tests

We conduct several additional tests (not tabulated) to check the robustness of our results.

First, we address potentially correlated omitted variables using the bounding technique, here in the spirit of Altonji et al. (2005) and as proposed by Oster (2019).Footnote 19 It may be difficult to completely rule out the possibility of an omitted variable bias; however, this method can help quantify the impact of unobservable factors on our main results (Oster, 2019). In Oster’s (2019) model, \(\delta\) captures the proportional importance that unobservable factors have relative to observable factors to drive the coefficient on the variable of interest (in our case, the measure of CEO narcissism) to 0. We rerun our baseline regression with an OLS estimation and assume that our equations are misspecifiedFootnote 20 by 30% (Altonji et al., 2005; Oster, 2019). Accordingly, we set \({R}_{\text{max}}^{2}={\text{min}}\left(1.3{\widetilde{R}}^{2}, 1\right)\); this corresponds to an \({R}_{\text{max}}^{2}\) equal to 0.9407. We compute the coefficient estimate of CEO narcissism when \(\delta =1\) and \(\delta =-1\). A positive (negative) \(\delta\) indicates that the unobservable factors have a similar (opposite) effect on our results as the observable factors. When \(\delta =1\), the model bounds suggest that the estimated coefficient of CEO narcissism will increase from − 0.6509 by 27.42%. When \(\delta =-1\), the estimated coefficient is expected to decrease from − 0.6509 by 24.45%. Hence, the reasonable range in which the “true” coefficient lies is between [− 0.8225 and − 0.4724]. This interval does not include 0, which suggests that unobservable factors need to have a larger impact on the observables to drive the coefficient for CEO narcissism to 0. In addition, the implied estimate of \(\delta\) when setting the coefficient to 0 is around 3.44; this indicates that the impact of unobservable factors needs to be at least 3.44 times the impact of observable factors to drive the coefficient on CEO narcissism to 0 in our specification. Based on these tests, we conclude that our results are unlikely to be driven by correlated omitted variables.

Second, to alleviate the concern that our results may be influenced by a time series dependence in the error terms, we assess the significance of the coefficients by following Fama and MacBeth (1973).Footnote 21 The coefficient estimate on SIGSIZE is negative and significant (coefficient = − 0.645, Z-statistic = − 5.98) at the 1% level. The coefficients of the control variables are consistent with our prior findings.

Third, following Ham et al. (2018), we exclude the early years of CEOs’ tenure. The purpose of this test is to further address the concern that the analysis results may be because of narcissistic CEOs being drawn to certain types of firms. If our findings were driven only by the initial match between narcissistic CEOs and firms with lower credit ratings, we should expect to observe—here when excluding the early years of tenure—a substantial decrease in the strength of the association between CEO narcissism and credit ratings. In these new tests, the coefficient on SIGSIZE remains negative and significant at the 1% level (coefficient = − 0.864, Z-statistic = − 3.10). This alleviates concerns related to the matching between CEOs and firms in our sample.

Fourth, we collapse our data at the manager-firm level to make sure we capture the CEO effect rather than the firm effect. For each CEO–firm pair in our sample, we take the mean value for each dependent and independent variable across all years the CEO is in office. We then estimate each of our primary models, including only one observation for each CEO–firm pair in the dataset. Then, we regress the mean value of RATING on the mean values of SIGSIZE and other control variables. We include the continuous variables in the regression and exclude the indicator variables (e.g., LOSS and SUBORD) that have values of 0 or 1. Our conclusion remains unchanged. In particular, the coefficient on the mean SIGSIZE is negative and significantly different from 0.

Fifth, we re-estimate t-statistics based on standard errors clustered by CEO. The results are consistent with the main analysis. The coefficient on SIGSIZE is negative and significant (coefficient = − 0.628, Z-statistic = − 2.91) at the 1% level.

Finally, we include four additional control variables in our main model that might affect credit ratings: firm age, R&D intensity (calculated as the ratio of R&D expenditure to sales), and two measures of M&A activity. The two measures of M&A activity are expenditure on acquisitions scaled by total assets and the firm-level index of takeover susceptibility, as developed by Cain et al. (2017). We obtain data for firm age, R&D intensity, and M&A expenditures from Compustat. In this additional analysis, the number of observations is reduced to 5276. Our conclusions remain unchanged. The coefficient on SIGSIZE is negative and significant at the 1% level (coefficient = − 0.725, Z-statistic = − 2.75).

A Game Theory Model of CEO Narcissism, Unethical Behavior, and Credit Ratings

In our main empirical analysis, we have demonstrated a negative relationship between CEO narcissism and credit ratings: an increase in CEO narcissism results in a reduction in credit ratings. In this section, we consider a game theory model that focuses on the unethical aspects of narcissism to explain our main result. The model, which is formally presented in the electronic supplementary materials, describes the interaction between CEO narcissism, CRAs, and equity analysts.

We note that the interaction between CEO narcissism and credit ratings/CRAs is a partial story. CRAs only focus on debt/the downside of the firm. In order to gain a complete understanding, we also need to consider the effect of CEO narcissism on equity ratings/equity analysts, who consider the upside of the firm.

It is interesting to note that Ham et al. (2023) provide an opposite finding in the case of equity analysts’ ratings; they find a positive relationship between CEO narcissism and equity analysts’ ratings. In this section, we consider two possible reasons (two frameworks) for these opposing findings.

The first framework (not presented in the model) is based on risk-shifting and reflects the reactions of fully rational CRAs and equity analysts to discovering CEO narcissism (effectively, this framework focuses on the efficient market hypothesis, in which the market value of the firm is close to true fundamentals). In the risk-shifting framework, the idea is that CEO narcissism may result in more risk-taking, as documented by the literature. This increases the downside risk (hence leading to a reduction in credit ratings), but it may increase the potential upside if the risk-taking actions succeed and lead to an increase in equity ratings. Note that this is a pure risk-shifting story that is not directly related to unethical behavior. Effectively, CEO narcissism results in credit rating downgrades and equity analysts’ upgrades because of risk- and wealth-transfer between bondholders and equity-holders.

Our second framework (this case is analyzed formally in our game theory model in the supplementary materials) involves equity analysts’ irrationality, psychology, and emotions along with issues of unethical behavior on the part of the narcissistic CEO. The idea is that an increase in narcissism may result in the CEO being induced to engage in unethical actions, which might make the firm risker. These actions include accounting misreporting, tax avoidance activities, overinvestment, and the creation of hostile or toxic work environments (Germain, 2018; Ham et al., 2017, 2018; Olsen & Stekelberg, 2016).

CRAs continue to be rational because they have a well-specified and mainly quantitative task: Now, the credit rating downgrade is because of the consequences of unethical actions. Indeed, CRAs employ specific and explicit “rational” “tick-box” tools to examine the stability, security, and creditworthiness of companies and the bonds that they issue. However, in this framework, we consider the possibility that equity analysts are different from CRAs. Equity analysts may be more impulsive, emotional, and irrational, and they may be unduly influenced, and bamboozled by the pressure exerted and impressions given out by narcissistic CEOs. Although CRAs remain independent, in analyzing the company accounts and finances “from a distance,” equity analysts are often in communication with narcissistic CEOs, so they may be unduly influenced. Our analysis is supported by the findings of Ham et al. (2023), who demonstrate that narcissistic CEOs can positively influence external stakeholders’ perceptions of the firm.

Thus, in this framework, the opposing reactions to CEO narcissism are caused by a conflict of CRAs and equity analysts’ personality types related to the different tasks. Rational, careful, analytical CRAs recognize the risks associated with unethical actions taken by narcissists, hence downgrading the credit rating. In contrast, the more easily influenced equity analysts react positively to the behaviors of narcissistic CEOs, believing the “hype” and upgrading the equity rating.

Note that, contrary to the first framework, the efficient market hypothesis breaks down. Because of our assumptions of CRA rationality and equity analysts’ irrationality, the market value of debt is an accurate reflection of the fundamental value of debt, but equity may be vastly overvalued. Therefore, the total market value of the firm (market value of debt plus market value of equity) can be vastly in excess of fundamental value.

In summary, in the framework considered by our model, CEO narcissism causes unethical actions, and the opposing reactions to narcissism (credit rating downgrades and equity upgrades) occur because of opposing reactions from rational, careful, analytical, independent CRAs and irrational, emotional, easily influenced equity analysts.

In the supplementary materials, we consider this framework in a formal game-theoretic analysis.

Discussion

Our main analysis (RQ1) examines the relation between CEO narcissism and credit ratings. The results show that CEO narcissism is negatively associated with credit ratings. These findings are consistent with the view that CRAs view firms led by narcissistic CEOs as riskier because narcissists tend to put in place unethical strategies that can harm the firm and/or increase the variability of the firm’s performance; they are also consistent with the notion that narcissists tend to be less risk averse. We have also developed a game theory model to illustrate a potential explanation of our main results. In further analyses (RQ2), we examine the cross-sectional variation of our main findings. We show that limits on managerial discretion, which we examine using the presence of financial constraints, the intensity of market competition, and institutional ownership, attenuate the negative relation between managerial discretion and CEO. This supports the view that constraints on managerial discretion hinder narcissists’ ability to influence firm outcomes.

In this section, we provide a discussion of the theoretical contributions in “Theoretical contributions,” describe the practical implications of our research in “Practical implications,” and reflect on the limitations of the study as well as potential avenues for future research in “Limitations and suggestions for future research.”

Theoretical Contributions

Our results contribute to the business ethics literature in two main ways. First, our research adds to the emerging literature on the effects of CEO narcissism. The studies in this stream of the literature emphasize the ethical issues related to narcissism. In particular, they find that narcissistic executives engage in window-dressing and earnings management in an attempt to influence stakeholder perceptions (Abdel-Meguid et al., 2021; Capalbo et al., 2018; Ham et al., 2017, 2023; Olsen et al., 2014). More generally, narcissists employ manipulative tactics to inflate perceptions of their own competence and ability (Deluga, 1997; Goncalo et al., 2010; Maccoby, 2003; Nevicka et al., 2011; Spangler et al., 2012). Our results add to this line of the literature by showing that credit ratings are lower, despite these attempts. They are in line with the interpretation that the well-specified, mainly quantitative nature of credit analysts’ tasks (S&P, 2019) helps these agents avoid the manipulative strategies of narcissists. Importantly, almost no research has examined whether the perception of external agents is affected by executive narcissism. To the best of our knowledge, only three papers have examined this issue, focusing on analysts and auditors (Ham et al., 2023; Judd et al., 2017; Marquez-Illescas & Zhou, 2022); these studies show mixed results. Interestingly, our results are in contrast with those of Ham et al. (2023), which show that equity analysts are influenced by narcissistic executives. This contrast is in line with the differences in the tasks of equity analysts relative to CRAs. We also note that the detrimental effects of CEO narcissism that we document are consistent with narcissism being a prominent trait of destructive leadership (e.g., Einarsen et al., 2007; Krasikova et al., 2013; Shaw et al., 2011).

Second, we expand upon prior research regarding credit ratings, in which concerns have been raised that top rating agencies may suffer from bias or undue influence from management. Prior business ethics research highlights the conflict of interest of CRAs and inappropriate influence that clients exercise over rating agents (Attig et al., 2013; Booth & de Bruin, 2021; Scalet & Kelly, 2012; Schoen, 2017; Tang et al., 2020). The unethical behaviors of credit rating agents have come under substantially increased scrutiny since the 2007–2009 financial crisis. We contribute to this research by showing that, in a setting where influence from clients is especially likely, credit ratings appear unencumbered by inflated perceptions of narcissistic CEOs and their firms. Relatedly, we add to the finance-based stream of research, here drawing from upper echelons theory and strictly linked to business ethics research, which shows how the characteristics of executives affect credit ratings (Ahn et al., 2019; Bonsall et al., 2017a; Bruno et al., 2016; Cornaggia & Cornaggia, 2013; Jiang et al., 2012; Manns, 2013). In sum, our results add to the understanding of the potentially inappropriate/unethical behavior of CRAs in a context with a strong conflict of interest with clients.

Practical Implications

The findings of the present study underscore the need for organizations to incorporate considerations on the personality traits of CEOs and senior executives. By enhancing organizations’ awareness of the potential negative consequences of narcissistic tendencies on corporate outcomes, organizations can cultivate a more ethical and responsible leadership culture. It is important for boards of directors to actively assess and monitor CEO traits, including narcissism, during the hiring process and throughout their tenure. Our results also show that the negative association between CEO narcissism and credit ratings is stronger when managerial discretion is higher. This finding implies that corporate governance mechanisms that constrain CEO managerial discretion may reduce the negative consequences of narcissism in credit markets. Overall, the conclusions of the present study suggest a multifaceted approach that combines proactive governance measures and ethical leadership development to address the impact of CEO narcissism on organizations.

Limitations and Suggestions for Future Research

We acknowledge that our analysis has limitations. In particular, we focus on three limitations that could also represent opportunities for future research avenues.