Abstract

The aim of this study is to explore the nexus among CO2 emissions, energy use, and GDP in Russia using annual data ranging from 1970 to 2017. We first conduct time-series analyses (stationarity, structural breaks, and cointegration tests). Then, we present a new D2C algorithm, and we run a Machine Learning experiment. Comparing the results of the two approaches, we conclude that economic growth causes energy use and CO2 emissions. However, the critical analysis underlines how the variance decomposition justifies the qualitative approach of using economic growth to immediately implement expenses for the use of alternative energies able to reduce polluting emissions. Finally, robustness checks to validate the results through a new D2C algorithm are performed. In essence, we demonstrate the existence of causal links in sub-permanent states among these variables.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic growth affects the way a country uses energy and in return is likely to increase the rate of carbon dioxide (CO2) emissions in the atmosphere. It comes as a result of development and increases in industries, which consume more and more energy (Malik & Lan, 2016). As the country grows its industries and manufacturing, the rate of energy used increases on a daily basis. The majority of these companies require the energy of whatever form to run and operate. Moreover, industrialization and manufacturing play an important role in increasing Gross Domestic Product (GDP) (Dong et al., 2017).

The huge reserves of oil and natural gas present in the area allow Russia to play the role of supplementary energy, a key player in the international energy chessboard. Russia and the producing countries of Central Asia represent an element of particular dynamism as regards the geopolitics of natural resources’ procurement. In this perspective, it is plausible that Russia and the countries of the Caspian area will continue to shift their attention to the East, strengthening production capacity and gas pipelines in a Chinese rather than a European way (Magazzino, 2016b, c). Indeed, due to the gas agreements, a strategic alliance between Russia and China is being strengthened. In parallel, the development of intense energy cooperation with Russia also assumes a strategic connotation for China, Japan, and South Korea, as it allows them to reduce the condition of vulnerability, connected to the high dependence on energy imports. The combination of investments and new mining and processing technologies, linked to the involvement of Chinese, Japanese and Korean companies in energy partnerships and joint ventures, will allow Russia to achieve the objectives set by the “2030 Strategy” on the amount of reserves available for marketing. Finally, Russia is also aiming at the development of the Eastern carrier to pursue internal policy purposes, promoting growth economic development of the Russian Far East through industrial energy development (Handerson, 2014). However, if the demand does not increase enough, the price suffers, with the risk of having to decrease the supply. This is a nightmare for those producers who base a significant part of their public budget on oil revenues: Gulf Cooperation Council (GCC) countries, North Africa and Russia above all.

Russia’s methane emissions increased by 40% during 2020. A spectacular growth compared to the previous year, by a country that already occupied the first place in the ranking of states that emit the largest quantities of this climate-altering gas. Russia thus confirms itself as the country with the greatest problem in the world in containing methane emissions. In 2020 there were 14 million tons, 20% of global emissions of this gas with a climate-changing power 84 times greater than CO2 in the first 20 years in which it is found in the atmosphere. Methane is responsible for about 25% of anthropogenic greenhouse gas emissions. Russia has almost 17% of the world’s “proved” natural gas reserves: 31.3 trillion cubic meters. It produces roughly 600 billion cubic meters/year (BP, 2021). The only way Russia can export more is to diversify its customers, China first. As regards the supply of natural gas, some large producers (Russia and Iran), while exporting significantly, will have to deal primarily with a very strong internal demand characterized by highly inefficient end uses.

With a view to diversifying sources, the development of new nuclear generation capacity is subject to significant uncertainties, due to the need for prolonged public support in the development phase and regulated prices to repay the investment in a predictable way, as well as to the opposition of some sectors of public opinion. These characteristics make it extremely easier to develop new nuclear capacity in emerging countries and in Russia, where, in fact, most of the new reactors built in the coming decades will be concentrated (WNA, 2021).

The main scope of the paper is to examine the nexus among CO2 emissions, energy use, and GDP in the case of Russia. Despite both the huge amount of papers on the EKC hypothesis and the fact that Russia represents one of the main polluters on a global scale, few studies are present in the literature for this country. We aim to derive possible ways through which the country can control its CO2 emissions in the atmosphere and, at the same time, enhance the economic growth process (Dogan & Seker, 2016a). We also analyze the eventual existence of policies available to help control the energy consumption of industries. However, the policies might play a critical role in minimizing CO2 emissions in the atmosphere without interfering with the economic development of the country (Iftikhar et al., 2016). It is highly crucial because the nature of energy consumed by industries in a country determines the amount of CO2 released into the atmosphere. Russia is a promising case study of economic drivers of environmental pollution, since it is a resource-abundant state with a vast territory and remarkable environmental pressure in several industrial centers.

This is a qualitative and quantitative research that concentrates on the case of Russia. The common knowledge is that any growth in economy attributed to industrialization and manufacturing increases energy consumption and, hence, CO2 emissions (Dogan & Seker, 2016b). The increase in CO2 emissions is likely to increase climatic changes: specifically, global warming. In this manner, it is critical to understand what climate, economic and environment-related organizations say about Russian economic growth, and how it affects energy consumption and CO2 emissions levels (Berardi, 2015). The empirical approach aims to investigate the nexus among CO2 emissions, energy use, and ta GDP in Russia using annual data for years 1990–2017, showing results of stationarity and structural breaks tests, the Johansen and Juselius (JJ) cointegration approach, and the Toda and Yamamoto (TY) causality test. Furthermore, as a robustness check, we compare previous findings with results from a Machine Learning experiment. To the best of our knowledge, this is the first study that adopts an ML approach to analyze the Russian case. In addition, we wrote a new Causal Direction from Dependency (D2C) algorithm.

The remainder of the study proceeds as follows: Sect. 2 provides a survey of the relevant literature; Sect. 3 contains the results of time-series analyses; Sect. 4 presents our new ML algorithm along with its findings. Finally, Sect. 5 concludes.

2 Literature review

Economic growth entails industrialization and increases in other economic activities. According to Panayotou (2016), several factors such as consumption of natural resources and environmental degradation can explain how, although economic growth has a variety of positive impacts in the society, it can result in a number of negative effects, such as increased carbon emission, global warming and other forms of pollution. Soytas and Sari (2009) indicate that carbon emissions increase with an acceleration of economic activities. As long as there is an increase in manufacturing and production, there is always a direct relationship with the emission in the air. In addition, CO2 emissions have a long-term impact. Magazzino et al. (2020a) investigate the connections among coal consumption, pollutant emissions, and real income for South Africa, with a feedback mechanism between GDP and CO2 emissions. Udemba et al. (2020) analyze the relationship among pollutant emission, energy consumption, Foreign Direct Investments (FDIs), and economic growth for China, showing a bidirectional causal flow (“feedback hypothesis”) between CO2 emissions and energy consumption. Magazzino (2017) shows empirical evidence in line with the “neutrality hypothesis” for the Asia–Pacific Economic Cooperation (APEC) countries. Magazzino (2016a) shows evidence in favour of the “growth hypothesis” for GCC countries, over the 1971–2006 years. Magazzino (2016b) finds that, for the South Caucasus countries and Turkey, the “neutrality hypothesis” holds. While Magazzino (2016c) illustrates how the causality link, for these countries, is different (“conservation hypothesis” for Armenia; “neutrality hypothesis” for Turkey). Magazzino (2016d) highlights a bidirectional causality for both CO2 emissions-GDP and CO2 emissions-energy consumption relationship in the case of Italy, with a time-series approach. Magazzino (2016e) clarifies that the causality nexuses are different for the GCC countries, which suggests caution in the adoption of unified energy and environmental policies. Magazzino (2015), with a study for Israel, discovers a unidirectional causal flow from GDP to CO2 emissions and energy use. Magazzino (2014), inspecting the nexus among GDP, CO2 emissions, and energy use in the Association of Southeast Asian Nations (ASEAN) countries through a PVAR (Panel Vector Auto-Regressions) model, shows a positive response of economic growth to energy use.

Ozturk and Acaravci (2010) ascertain the fact that an increase in economic growth increases CO2 emissions. In another research, Shvarts et al. (2016) indicate that Russian oil and petroleum energy consumption has drastically increased since 1990, due to an increase in economic growth. Ketenci (2018) finds empirical support for the Environmental Kuznets Curve (EKC) hypothesis in Russia, using an Auto-Regressive Distributed Lags (ARDL) bounds test. Pyzheva et al. (2021) study the relationship among population growth, environment, and economic and technological development for the municipalities of Angara-Yenisey Siberia, underlying that population size and gross product are positively associated with pollutant emissions.

Khan et al. (2020) empirical findings support the remittances-led emission hypothesis. In another research, Lelieveld et al. (2015) state that energy consumption in Russia increases with the amount of production. Economic growth results in higher demand for energy, which in turn increases the rate of consumption. The quantitative research details the consumption pattern of how Russia consumes energy and releases CO2 into the atmosphere. Ozturk (2015) explains that economic growth increases energy consumption in the country.

Tong et al. (2020) find a bi-directional (feedback) causal link between energy consumption and CO2 emissions. Zhao et al. (2021) illustrate that an increase in geopolitical risk has a negative effect on CO2 emissions in Russia.

Cowan et al. (2014) indicate that CO2 emissions depend on the amount of energy consumed by industries during the production process. It suggests that an increase in industrialization in a country leads to an increase in carbon emissions in the environment. Ahmad et al. (2017) point out that a higher increase in industrialization results in a decrease in the amount emitted.

Sebri and Ben-Salha (2014) argue that BRICS (Brazil, Russia, India, China, and South Africa) among other countries influence the global economy and energy consumption levels. They also relate the factors to residential consumption claiming that the emissions also have an impact on international global warming. They attribute this to the development of the main energy-intensive sectors such as transport and other industries.

Danish et al. (2019) find that the abundance of natural resources mitigates CO2 emissions in Russia. Sharmina (2017) illustrates that even if Russias’ CO2 emissions peak in 2017, a reduction rate of at least 9% per year between 2020 and 2030 is required to meet a 2 °C budget constraint. Yang et al. (2017) show empirical evidence that supports the EKC hypothesis under a business-as-usual scenario for Russia. Pao and Tsai (2011) address the impact of both economic growth and financial development on environmental degradation using a panel cointegration technique, showing that EKC is not supported for Russia. This result is in contrast with that provided by Halicioğlu and Ketenci (2016). While Chang (2015) illustrates that the EKC in BRICS countries follows a U-shape. Wu et al. (2015) highlight that economic growth has a decreasing effect on the CO2 emissions in Russia. Zhang et al. (2019) indicate that the international cooperation between BRICS countries and advanced economies may support the abatement of the emissions. Li and Jinag (2019) show that improving energy efficiency is the most significant contributor to decreasing Russia’s carbon emissions.

In order to curb energy wastage and overconsumption of energy in Russia, there are policies that help in conserving energy use. According to Pao et al. (2011), energy policies have made a great impact on the consumption of energy in relation to the kind of energy consumed and how to emit CO2 effectively. In another research, Kholod and Evans (2016) indicate the choice of low-emission vehicles that should be used in Russia compared to those with traditional combustion. The policy is meant to conserve the environment, use environmentally friendly sources of energy, and maximize renewable energy, which can be used more effectively to power both industrial and residential energy demands. It is supported by the survey carried out in Brazil and Russia, which outlined that coal and oil accounted for 14 and 19%, respectively (Rüstemoğlu & Andrés, 2016). In addition, the research also shows power production trends between 1992 and 2011. Øverland and Kjærnet (2016) underline the specific reforms which have been put in place in the Russian energy system to help in conforming to the international guidelines and policies. One of the reforms outlined indicates the use of renewable energy, the introduction of solar energy, and determining the analytical digest of energy consumption in the country in order to help transform the energy consumption trend in the country and also control the carbon emissions rate in the environment. It further states that the main reason for the policies is to provide a framework for regulating energy consumption and also ensure proper emission of pollutants in the environment. It is important in understanding the proper use of energy, relevant sources of energy, and accurate disposal or emissions of wastes and chemicals in the country. Sasana and Ghozali (2017) show that poor fuels and poor quality sources of energy should be used. Due to the fact that economic growth results in high energy consumption, the surest way to control CO2 emissions is by ensuring that the fuel or source of energy used is acceptable, of high quality, and environmentally friendly as opposed to low quality which pollutes the environment. The policies touch more on the relationship with other countries and the impacts it has on global warming. Kodjak (2015) links the policies to carbon emissions in G-20 nations’ policies and clean transportation. It also links with the US energy information which pushes for clean energy and minimal emissions of CO2 in the atmosphere. The tough policies to control energy consumption and emission in the atmosphere is probably one of the reasons why economic growth and increase in energy consumption in Russia do not register a significant increase in the CO2 emitted into the atmosphere.

The clear relationship is that economic growth has a significant impact on energy consumption, which in turn increases the amount of CO2 emissions in the atmosphere. It is because of the increase in industrialization and the use of machines and transport vessels such as vehicles that require sources of energy in order to operate (Korppoo & Kokorin, 2017). The most important finding is that consumption also relies on domestic use. It is directly linked to unsafe, unclean, and poor-quality sources of energy such as coal (Wang et al., 2016). The study, in this case, found out that the increase in the rate of carbon-related sources of energy such as coal, petroleum, and other fossil fuel has a direct impact on the amount of CO2 emitted in the environment (Zaman et al., 2017). The rate of consumption, however, relies on economic growth, such as an increase in per capita income, GDP, and production regardless of the source of energy (Tang & Tan, 2015).

It is very interesting that without the notion of carbon element, the emission of carbon dioxide ceases to have a significant relationship with economic growth. Policies have also made the companies and residents settle on safe energy sources such that they do not have to emit more carbon dioxide in the atmosphere, causing global warming and harsh climatic change, but embark on safe energy that helps in conserving the atmosphere (Ahmad et al., 2016). The member countries, in this case, must respect the properly laid framework for conserving the environment so as to avoid engaging in productive activities which release pollutants (Ziaei, 2015). Among the acceptable sources of energy, in this case, including natural sources of green energy such as sunlight, geothermal, wind, and water, among others which do not release any trace of carbon dioxide in the atmosphere (Goldthau, 2016). In this case, an insignificant relationship between CO2 emissions and economic growth is due to tougher regulations in Russia that regulate the use of fossil fuel as a source of energy in the country.

3 Time-series analyses

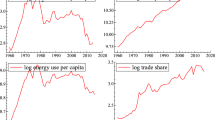

The lack of consistent and reliable data is a known problem when dealing with statistical studies in Russia (Pyzhev et al., 2020). In Table 1 we show the relevant data information. The parameterization of the variables object of the study is the following: CO2 is CO2 emissions (in metric tons per capita); PCGDP is per capita GDP (in 2000 US$), and PCEU is per capita energy use (in kg of oil equivalent). To ensure the asymptotic properties, we derived the logarithmic transformations of each variable.

In Table 2, an exploratory data analysis is given. We can see that the mean presents a positive value for all variables, and also 10-Trim values are near the mean. Finally, the Inter-Quartile Range shows the absence of outliers.

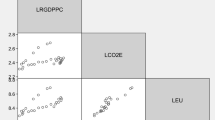

The correlation analysis shows that the variables are strongly positively correlated. The correlation coefficient between CO2 emissions and GDP = 0.7430; the correlation coefficient between CO2 emissions and energy use is equal to 0.7859; while the correlation coefficient between GDP and energy use is 0.6796 (all significant at 5% level of significance).

Then, according to Engle and Granger (1987), we check if a linear combination of our non-stationary series can be stationary. First of all, we ought to analyze the stationarity properties of the series. Here, we use the Augmented Dickey and Fuller (ADF, 1979), the Elliott, Rothenberg, and Stock (ERS, 1996), the Phillips and Perron (PP, 1988), and the Kwiatkowski, Phillips, Schmidt, and Shin (KPSS, 1992) tests. The results clearly indicate that all three analyzed series are non-stationary at levels, while are stationary at first-differences, or I(1).

The results shown in Table 3 advise us to check if one or more of the variables presents structural breaks. Indeed, all tests failed to reject the null hypothesis for all the variables at a 5% significance level. So, the Zivot and Andrews (ZA, 1992), and the Clemente, Montañés and Reyes (CMR, 1998) tests were performed (Table 4).

The test results confirm the economic theory: where there are structural breaks, shocks have occurred. In particular, the results are attributable to three major economic and financial crises that had repercussions on economic growth and also on the use of energy and CO2 emissions. The first shock is attributable to the 1998 crisis. This was caused by an overvalued ruble exchange rate (which since 1995 had been anchored inside a “creeping corridor” with the dollar, and given the greater Russian inflation it suffered a real appreciation), drugged by high-interest rates—both imposed by the International Monetary Fund in an anti-inflationary view—which, however, were not compatible with the public budget, on which the high interest on the public debt weighed. Other determinants of the crisis were the opening to foreign investors of the purchase of government bonds (whose yield reached 70% with a relatively stable and therefore particularly attractive exchange rate), the continuous drain on capital flight, of the order in size around 5 billion dollars a year; the difficulty of collecting taxes; the contagion of the Asian financial crisis of 1997, as well as the fall in 1998 of the oil price.

The second shock is dated 2007–2008. In fact, since the autumn of 2008, the US international crisis has also affected Russia, causing the stock market collapse and then industrial production. Following the stock market decline and capital flight in July–August 2008 due to the crisis in the Caucasus, Standard & Poor’s on September 19 reduced Russia’s sovereign rating from “positive” to “stable”, and then to “negative”. Fitch Ratings, on February 4, 2009, lowered the Russian rating to BBB. From 5.4% at mid-year, production fell to 4.9% in the first ten months, to 3.7% at the end of November, and 2.1% at the end of the year. The production drop was particularly noticeable in November, with a drop of over 10%.

The third shock is related to the 2014 crisis. It began with the oil price crisis in 2014 and subsequently was fueled by economic sanctions due to the war with Ukraine.

The results just obtained suggest the use of the Johansen and Juselius approach (1990). These cointegration tests are useful for finding the long-term relationship among variables. The selection of the lag order was chosen based on the Final Prediction Error (FPE), the Akaike Information Criterion (AIC), the Schwarz’s Bayesian Information Criterion (SBIC), and the Hannan and Quinn Information Criterion.

As we can see from the trace test in Table 5, the null hypothesis of non-cointegration is rejected at a 5% level of significance. The results indicate the presence of one cointegrating relation. These results of the Johansen and Juselius procedure, sensitive to long-term structural breaks, recommend using the decomposition of generalized variance (GVDC) in Table 6.

From the results obtained, we can see a long-term relationship between our checks. In particular, we can see how real GDP per capita has a strong impact on energy use over time. However, a shock to GDP per capita affects both CO2 emissions and energy use for some periods. Therefore, we can state that, although there is a long-term causal relationship between the variables considered, the use of tools that optimize hypothetical shocks is necessary. Indeed, towards the end of the years taken into consideration, this situation ceases to exist very quickly. These results confirmed the qualitative analysis previously carried out. Economic growth has a significant impact on energy consumption, which in turn increases the amount of CO2 emissions in the atmosphere. However, a shock on aggregate demand reduces the possibility of using alternative energy sources that emit less CO2. Thus, the link between the variables covered by this paper would coincide with the use of coal energy. It turns out to be less expensive but more polluting.

Since a scientific model needs a test capable of validating the results, we illustrate—in the next paragraph—an experiment in ML. It represents a novelty in this type of literature debate.

4 A machine learning approach: D2C algorithm

According to Spirtes et al. (2000), Pearl (2000), Pourret et al. (2008), Koller and Friedman (2009), Magazzino et al. (2020b, 2021a, b, c, d), and Mele and Magazzino (2020) statistical dependence is a necessary but not sufficient condition for causality. In contrast, models of causality inference based on automated algorithms have proved to be accurate in reconstructing causality models in many applications. Starting from this assumption, we use an ML D2C model. It implements a supervised ML approach to analyze the existence of a direct causal relationship between n > 2 variables. This approach uses the asymmetry of some conditional relationships in Markov networks of two causally connected variables. Our D2C algorithm provides for the existence of a direct causal link between two variables in a multivariate setting creating a set of features of the relationship based on asymmetric descriptors of the multivariate dependence. The need to use this model is to verify if the econometric model has obtained adequate results for our conclusions. We use the same dataset built for the previous analysis in time series.Footnote 1

To analyze the causal link between our variables, we perform the following mathematical steps:

To analyze Px(y) in the causal model we have:

A graphical representation is given in Fig. 1.

where s is the time series.

Now, we are able to build the identifiability algorithm. It is summarized by Fig. 2 and by the sub-assembly Fig. 3. An algorithm represented in the figures can determine the identifiability of any causal effect. Besides, it can generate an interventional distribution. It is necessary in the case of an identifiable effect.

Sub-graph about Fig. 1.

According to Shpitser and Pearl (2006), we can analyze the sub-graph in Fig. 3. So, we can write the algorithm:

V = n vector

If we use (11) on Z and J to n time, the result is:

Now, for transparency, we report the main Phyton commands for our dataset:

Table 7 shows six scenarios applied to different ITE scales compared to random noises. ε is positive throughout the analyzed time series (27 years). The baseline is highlighted in the table with the asterisk, and has six significant values. They coincide with the selection set by the user.

The results obtained in Table 7 are very appealing. We generated six scenarios with three different ITEs in four processes. The number of repetitions obtained by the algorithm (R) is never < 500. The significant scenarios (in Table 7) respect the assumption of d-separation. In other words, the conditional distribution of each row of the algorithm is dependent on all the nodes preceding V (Eq. 8) in an unsupervised data sorting. In our case, the d-separation factor is recorded in the Selection processes. The non-significant ITEs, on the other hand, are the result nodes that can be separated by V and, therefore, eliminated by the algorithm. Thus, they are independently conditioned by V.

Subsequently, we obtain the results of the causal relationship among the variables through ML training (8, 9, 10, 11, 12, 13).

The results obtained through the D2C algorithm are very interesting. Tables 8, 9, 10, 11, 12 and 13 present the causal links conditioned, essentially, by the values of the substrates. Indeed, if they were not present, the analysis would not have required the two main indicators of predictive causality (Causal Effect and Causal Effect with Local Centering). For each estimation process, the significant ITE results in the Selection analysis were re-elaborated (Table 7). In fact, the ML experiment took different times to learn the behaviour of the variables. According to Chen et al. (2017), R-learning has generated values between 14.2 and 20.2 s, highlighting a causal link in sub-material layers. In particular, our experiment has tried to explain the relationship existing between Y and K (CO2 towards energy use) by analyzing the possible combinations of y1, …, yn and k1, …, kn in our historical series. The relation exists, therefore, in the sub-sedentary layer, and we can observe this result by comparing the values about Causal Effect with Local Centering. In y → K this value is higher than the other combinations of causality.

Concerning the causality effects, the results show that the variable x predominantly causes y and k. This result has ambivalent explanations. On one hand, more significant economic growth coincides with a higher demand for energy and, therefore, more production of CO2. Conversely, if we analyze only the link between x and y and vice versa, the causal value is lower. This result can be interpreted in two ways. First of all, the causal relationship expressed by the substrates would confirm the hypothesis of an economy based on the dissipative link. In this context, the energy demand could represent a fulcrum of the economic growth process, which, when it generates externalities (such as CO2), requires corrective measures. Economists would trace this process back to a complex adaptive system under its tendency to grow and evolve in a self-organized way. From this point, we can connect the second interpretation of our results. More significant economic growth requires investments in education and training. A population with higher levels of education will require a more sustainable economy over time. Besides, increased CO2 emissions involve health problems, so the population will require policymakers to intervene towards cleaner energy. Finally, we can conclude by stating that the experiment in ML, compared with time-series results, obtained similar values but with greater details. Our algorithm was able, through self-learning, to study the relational sub-layers invisible to standard econometric analysis.

5 Conclusions and policy implications

In 2017, the Paris Climate Agreement came into force. It is aimed at implementing the United Nations Framework Convention on Climate Change and at maintaining an average global temperature growth below 2° C. Although the agreement does not contain specific obligations for countries on greenhouse gas emissions since the beginning of its implementation, many studies have recorded the stabilization of global CO2 emissions deriving from the combustion of fossil fuels and industrial processes. The main practical conclusion of these studies is that stabilization and even the reduction of greenhouse gas emissions are possible without damaging economic growth. Therefore, in the current study, we inspected the link among CO2 emissions, energy use, and economic growth in Russia. In particular, the novelty of this paper is the combination of traditional time-series analyses together with the development of a new ML model, through a D2C algorithm. It is an important experiment because, to the best of our knowledge, in the related literature no ML experiments have been conducted for the Russian case. The econometric model appears with a test that anticipates the ML model. There is a direct relationship among the selected variables. The primary variable, in this case, is economic growth, which leads to a substantial increase in energy consumption, hence an increase in the emission of CO2 in the atmosphere. However, due to the hazardous impacts of CO2 emissions, the strict regulations which promote the use of clean energy as opposed to fossil fuel, economic growth, and energy consumption do not seem to have a direct impact on the amount of CO2 emissions levels. In this case, economic growth increases the consumption of energy, and therefore, the country should concentrate on producing and consuming green energy. The policy would make it easier to control carbon emissions, hence conserving the environment. In this paper, therefore, we have studied the relationship between carbon dioxide emissions, economic growth, and energy use through two different approaches. In the qualitative one, there emerged the existence of a direct relationship between energy consumption policies and carbon dioxide emission policies that regulate gas consumption and emissions. Besides, we have seen how economic growth and CO2 emissions are linked to the use of coal for energy. Indeed, lower economic growth could encourage the use of easily accessible and low-cost resources.

On the contrary, continuous economic growth reduces the overall CO2 emissions in terms of quality. We obtained the same results through quantitative analysis. In particular, after conducting numerous stationary tests, we have analyzed in detail the decomposition of generalized variance, and we can see a long-term relationship between our checks. However, a shock to GDP per capita affects both CO2 emissions and energy use for some periods. This result confirms the qualitative analysis suggesting long-term structural investments capable of replacing conventional energy sources with alternative ones. In this way, CO2 emissions will be reduced even in the presence of hypothetical shocks.

The Russian economy highly depends both on natural resources prices and on energy consumption. The high volatility of commodity prices could make the economy’s growth unstable (as an exporting country), exposing it to exogenous shocks. Furthermore, as an emerging economy country, Russia needs the energy to support the economic transition process. To this extent, policymakers should consider a mix of energy resources to design a strategy to enhance environmental quality without having a negative impact on growth. Indeed, more pollution adversely impacts human health, water, and agricultural production. The Russian government could reduce polluting emissions while preserving the growth rate of the economy by trying—at least in the medium-long term—to make its public budget less dependent on the prices of raw materials, also by looking at what has been done by some countries of the Persian Gulf (i.e., Saudi Arabia, United Arab Emirates, and Qatar).

Further research may explore this topic using a different source of emission (i.e., NOx, SO2, CO, PM10), also in a forecasting perspective.

Notes

We test the results obtained with the time-series methodology through a different model. This choice is consistent with the definition of a scientific experiment. Indeed, an experiment is correct when it can be tested through a different method and reproducible by all researchers. Therefore, we will use an algorithm in ML that can generate causal effects between the variables. As we explain in this section, we use a D2C algorithm on Proportion-based causality using the Phyton software and the same dataset of the time-series analysis. However, since an algorithm in ML needs many variables (remembering that the data is not interpreted as a time-series), we will carry out mathematical transformations.

References

Ahmad, A., Zhao, Y., Shahbaz, M., Bano, S., Zhang, Z., Wang, S., & Liu, Y. (2016). Carbon emissions, energy consumption and economic growth: An aggregate and disaggregate analysis of the Indian economy. Energy Policy, 96, 131–143.

Ahmad, N., Du, L., Lu, J., Wang, J., Li, H. Z., & Hashmi, M. Z. (2017). Modelling the CO2 emissions and economic growth in Croatia: Is there any environmental Kuznets curve? Energy, 123, 164–172.

Berardi, U. (2015). Building energy consumption in US, EU, and BRIC countries. Procedia Engineering, 118, 128–136.

British Petroleum (BP), 2021. Statistical Review of World Energy, BP.

Chang, M.-C. (2015). Room for improvement in low carbon economies of G7 and BRICS countries based on the analysis of energy efficiency and environmental Kuznets curves. Journal of Cleaner Production, 99, 140–151.

Clemente, J., Montañés, A., & Reyes, M. (1998). Testing for a unit root in variables with a double change in the mean. Economics Letters, 59, 175–182.

Chen, S., Tian, L., Cai, T., & Yu, M. (2017). A general statistical framework for subgroup identification and comparative treatment scoring. Biometrics, 73(4), 1199–1209.

Cowan, W. N., Chang, T., Inglesi-Lotz, R., & Gupta, R. (2014). The nexus of electricity consumption, economic growth and CO2 emissions in the BRICS countries. Energy Policy, 66, 359–368.

Danish, B., & M.A., Mahmood, N., Zhang, J.W.,. (2019). Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Science of the Total Environment, 678, 632–638.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431.

Dogan, E., & Seker, F. (2016a). Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renewable Energy, 94, 429–439.

Dogan, E., & Seker, F. (2016b). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085.

Dong, K., Sun, R., & Hochman, G. (2017). Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy, 141, 1466–1478.

Elliott, G., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64, 813–836.

Engle, R. F., & Granger, C. W. J. (1987) Co-integration and error correction: Representation, estimation, and testing. Econometrica, 55(2), 251–276. https://doi.org/10.2307/1913236

Goldthau, A. (2016). The handbook of global energy policy. Wiley.

Halicioglu, F., & Ketenci, N. (2016). The impact of international trade on environmental quality: The case of transition countries. Energy, 109, 1130–1138.

Handerson, J. (2014). Russian energy policy—The shift East and its implications for Europe. In Dreyer, I., & Stang, G., (Eds.), Energy moves and power shifts: EU Foreign policy and global energy security, EU Institute for Security Studies, 18, February (pp. 74–75).

Iftikhar, Y., He, W., & Wang, Z. (2016). Energy and CO2 emissions efficiency of major economies: A non-parametric analysis. Journal of Cleaner Production, 139, 779–787.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169–210.

Ketenci, N. (2018). The environmental Kuznets curve in the case of Russia. Russian Journal of Economics, 4(3), 249–265.

Khan, Z. U., Ahmad, M., & Khan, A. (2020). On the remittances-environment led hypothesis: Empirical evidence from BRICS economies. Environmental Science and Pollution Research, 27, 16460–16471.

Kholod, N., & Evans, M. (2016). Reducing black carbon emissions from diesel vehicles in Russia: An assessment and policy recommendations. Environmental Science & Policy, 56, 1–8.

Kodjak, D. (2015). Policies to reduce fuel consumption, air pollution, and carbon emissions from vehicles in G20 nations. The International Council on Clean Transportation.

Koller, D., & Friedman, N. (2009). Probabilistic graphical models. MIT Press.

Korppoo, A., & Kokorin, A. (2017). Russia’s 2020 GHG emissions target: Emission trends and implementation. Climate Policy, 17(2), 113–130.

Kwiatkowski, D., Phillips, P. C. B., Schmidt, P., & Shin, Y. (1992). Testing the null hypothesis of stationarity against the alternative of a unit root. Journal of Econometrics, 54, 159–178.

Lelieveld, J., Evans, J. S., Fnais, M., Giannadaki, D., & Pozzer, A. (2015). The contribution of outdoor air pollution sources to premature mortality on a global scale. Nature, 525, 367–371.

Magazzino, C. (2014). A panel VAR approach of the relationship among economic growth, CO2 emissions, and energy use in the ASEAN-6 countries. International Journal of Energy Economics and Policy, 4(4), 546–553.

Magazzino, C. (2015). Economic growth, CO2 emissions, and energy use in Israel. The International Journal of Sustainable Development and World Ecology, 22(1), 89–97.

Magazzino, C. (2016a). CO2 emissions, economic growth and energy use in the Middle East countries: A panel VAR approach. Energy Sources, Part b: Economics, Planning, and Policy, 11(10), 960–968.

Magazzino, C. (2016b). Economic growth, CO2 emissions and energy use in the South Caucasus and Turkey: A PVAR analyses. International Energy Journal, 16(4), 153–162.

Magazzino, C. (2016c). The relationship among real GDP, CO2 emissions, and energy use in South Caucasus and Turkey. International Journal of Energy Economics and Policy, 6(4), 672–683.

Magazzino, C. (2016d). The relationship between CO2 emissions, energy consumption and economic growth in Italy. International Journal of Sustainable Energy, 35(9), 844–857.

Magazzino, C. (2016e). The relationship between real GDP, CO2 emissions and energy use in the GCC countries: A time-series approach. Cogent Economics & Finance, 4, 1.

Magazzino, C. (2017). The relationship among economic growth, CO2 emissions, and energy use in the APEC countries: A panel VAR approach. Environment Systems and Decisions, 37(3), 353–366.

Magazzino, C., Bekun, F. V., Etokakpan, M. U., & Uzuner, G. (2020). Modeling the dynamic nexus among coal consumption, pollutant emissions and real income: Empirical evidence from South Africa. Environmental Science and Pollution Research, 27, 8772–8782.

Magazzino, C., Mele, M., & Schneider, N. (2020). The relationship between municipal solid waste and greenhouse gas emissions: Evidence from Switzerland. Waste Management, 113, 508–520.

Magazzino, C., Mele, M., & Morelli, G. (2021a). The relationship between renewable energy and economic growth in a time of Covid-19: A machine learning experiment on the Brazilian economy. Sustainability, 13(3), 1285.

Magazzino, C., Mele, M., Morelli, G., & Schneider, N. (2021b). The nexus between information technology and environmental pollution: Application of a new machine learning algorithm to OECD countries. Utilities Policy, 72, 101256.

Magazzino, C., Mele, M., & Schneider, N. (2021c). A Machine Learning approach on the relationship among solar and wind energy production, coal consumption, GDP, and CO2 emissions. Renewable Energy, 167, 99–115.

Magazzino, C., Mele, M., Schneider, N., & Shahbaz, M. (2021d). Can biomass energy curtail environmental pollution? A quantum model approach to Germany. Journal of Environmental Management, 287, 112293.

Malik, A., & Lan, J. (2016). The role of outsourcing in driving global carbon emissions. Economic Systems Research, 28(2), 168–182.

Mele, M., & Magazzino, C. (2020). A machine learning analysis of the relationship among iron and steel industries, air pollution, and economic growth in China. Journal of Cleaner Production, 277, 123293.

Øverland, I., & Kjærnet, H. (2016). Russian renewable energy: The potential for international cooperation. Routledge.

Ozturk, I., & Acaravci, A. (2010). CO2 emissions, energy consumption and economic growth in Turkey. Renewable and Sustainable Energy Reviews, 14(9), 3220–3225.

Ozturk, I. (2015). Sustainability in the food-energy-water nexus: Evidence from BRICS countries. Energy, 93, 999–1010.

Panayotou, T. (2016). Economic growth and the environment. In N. Haenn, A. Harnish, & R. Wilk (Eds.), The Environment in Anthropology (pp. 140-148). New York University Press, New York. https://doi.org/10.18574/9781479862689-016

Pao, H. T., & Tsai, C. M. (2011). Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy, 36, 685–693.

Pao, H. T., Yu, H. C., & Yang, Y. H. (2011). Modeling the CO2 emissions, energy use, and economic growth in Russia. Energy, 36(8), 5094–5100.

Pearl, J. (2000). Causality: Models, reasoning, and inference. Cambridge University Press.

Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75, 335–346.

Pourret, O., Nam, P., & Marcot, B. (2008). Bayesian networks: A practical guide to applications. Wiley.

Pyzhev, A., Gordeev, R., & Vaganov, E. (2020). Reliability and integrity of forest sector statistics—a major constraint to effective forest policy in Russia. Sustainability, 13, 86.

Pyzheva, Y. I., Zander, E. V., & Pyzhev, A. I. (2021). Impacts of energy efficiency and economic growth on air pollutant emissions: Evidence from Angara-Yenisey Siberia. Energies, 14, 6138.

Rüstemoğlu, H., & Andrés, A. R. (2016). Determinants of CO2 emissions in Brazil and Russia between 1992 and 2011: A decomposition analysis. Environmental Science & Policy, 58, 95–106.

Sasana, H., & Ghozali, I. (2017). The impact of fossil and renewable energy consumption on the economic growth in Brazil, Russia, India, China and South Africa. International Journal of Energy Economics and Policy, 7(3), 194–200.

Sebri, M., & Ben-Salha, O. (2014). On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: Fresh evidence from BRICS countries. Renewable and Sustainable Energy Reviews, 39, 14–23.

Sharmina, M. (2017). Low-carbon scenarios for Russia’s energy system: A participative backcasting approach. Energy Policy, 104, 303–315.

Shpitser, I., & Pearl, J. (2006). Identification of conditional interventional distributions. In: Decherand, R., & Richardson, T. S., (Eds.), Proceedings of the 22nd conference on uncertainty in artificial intelligence (pp. 437–444). AUA IPress.

Shvarts, E. A., Pakhalov, A. M., & Knizhnikov, A. Y. (2016). Assessment of environmental responsibility of oil and gas companies in Russia: The rating method. Journal of Cleaner Production, 127, 143–151.

Soytas, U., & Sari, R. (2009). Energy consumption, economic growth, and carbon emissions: Challenges faced by an EU candidate member. Ecological Economics, 68(6), 1667–1675.

Spirtes, P., Glymour, C., & Scheines, R. (2000). Causation. Springer.

Tang, C. F., & Tan, B. W. (2015). The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy, 79, 447–454.

Tong, T., Ortiz, J., Xu, C., & Li, F. (2020). Economic growth, energy consumption, and carbon dioxide emissions in the E7 countries: A bootstrap ARDL bound test. Energy, Sustainability, and Society, 10, 20.

Udemba, E., Magazzino, C., & Bekun, F. V. (2020). Modeling the nexus between pollutant emission, energy consumption, foreign direct investment and economic growth: New insights from China. Environmental Science and Pollution Research, 27, 17831–17842.

Wang, S., Li, Q., Fang, C., & Zhou, C. (2016). The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Science of the Total Environment, 542, 360–371.

World Nuclear Association (WNA). (2021). Nuclear Power in Russia, WNA, December.

Wu, L., Liu, S., Liu, D., Fang, Z., & Xu, H. (2015). Modelling and forecasting CO2 emissions in the BRICS (Brazil, Russia, India, China, and South Africa) countries using a novel multi-variable grey model. Energy, 79, 489–495.

Yang, X., Lou, F., Sun, M., Wang, R., & Wang, Y. (2017). Study of the relationship between greenhouse gas emissions and the economic growth of Russia based on the Environmental Kuznets Curve. Applied Energy, 193, 162–173.

Zaman, K., Moemen, M. A. E., & Islam, T. (2017). Dynamic linkages between tourism transportation expenditures, carbon dioxide emission, energy consumption and growth factors: Evidence from the transition economies. Current Issues in Tourism, 20(16), 1720–1735.

Zhang, Z., Xi, L., Bin, S., Yuhuan, Z., Song, W., Ya, L., Hao, L., Yonfeng, Z., Ashfaq, A., & Guang, S. (2019). Energy, CO2 emissions, and value added flows embodied in the international trade of the BRICS group: A comprehensive assessment. Renewable and Sustainable Energy Reviews, 116, 109432.

Zhao, W., Zhong, R., Sohail, S., Majeed, M. T., & Ullah, S. (2021). Geopolitical risks, energy consumption, and CO2 emissions in BRICS: An asymmetric analysis. Environmental Science and Pollution Research, 28, 39668–39679. https://doi.org/10.1007/s11356-021-13505-5

Ziaei, S. M. (2015). Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renewable and Sustainable Energy Reviews, 42, 752–759.

Zivot, E., & Andrews, D. (1992). Further evidence on the Great Crash, the oil price shock, and the unit-root hypothesis. Journal of Business and Economics Statistics, 10, 251–270.

Funding

Open access funding provided by Università degli Studi Roma Tre within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Magazzino, C., Mele, M. A new machine learning algorithm to explore the CO2 emissions-energy use-economic growth trilemma. Ann Oper Res (2022). https://doi.org/10.1007/s10479-022-04787-0

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-022-04787-0