Abstract

With the increasing demand for energy-saving technologies, neodymium-iron-boron magnets have been widely utilized in high-efficiency motors. However, the reserves of neodymium, which is a rare earth element (REE), are limited; thus, a strategy for scaling up the REE supply is highly required. In this study, a scenario assessment was conducted to evaluate the effect of material recycling of neodymium from final product waste. Domestic substance flow analysis of neodymium was conducted by focusing on the waste flow of the final product. Moreover, the demand and waste of neodymium until 2050 were forecasted using various multivariate analysis methods. The results showed that the domestic waste of neodymium was forecasted to be 3866–4217 tons/year by 2050. However, material recycling of neodymium from final product waste may cause an additional increase in production by “circular economy rebound”. Considering that CO2 reduction has also been a global challenge to prevent global warming, the rebound effect was calculated. Therefore, a scenario assessment was conducted to evaluate the influence of this rebound effect by estimating the CO2 reduction. The results of this study are expected to make a significant contribution to the establishment of a new strategy for neodymium recycling.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The demand for mineral resources, such as rare earth elements (REEs) and other critical materials, has been rapidly increasing owing to the growing population and industrial development. Recently, the requirement for a low-carbon society has led to a significant demand for energy-saving technologies such as batteries, high-efficiency motors, renewable energy sources, and fuel cells. Among these technologies, permanent magnets are often used to fabricate high-efficiency motors, with neodymium-iron-boron magnets (Nd2Fe14B sintered and bonded magnets; hereinafter referred to as NdFeB magnets) being the main type of permanent magnet in the market since their invention [1]. NdFeB magnets are used in hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), electric vehicles (EVs), and fuel cell vehicles (FCVs) (hereinafter referred to as xEVs), wind turbines, home appliances, computers, and many small consumer electronic devices [2]. Furthermore, they are indispensable for energy savings. Toward achieving the objectives of the Paris Agreement [3], the demand for NdFeB magnets is expected to increase significantly in the future.

Meanwhile, neodymium, used in NdFeB magnets, is one of the REEs, and its supply has a considerable impact on industrial development. In particular, the demand for REEs, including neodymium, has been rapidly increasing in recent years [4]. However, most REEs originate from China’s reserves, and scaling up REE production outside China has become a global issue. To date, the exploitation of new REE deposits, substitute materials, reduced use, recycling, urban/landfill mining, and similar efforts have been proposed to solve this problem [5,6,7,8].

In the past, various REE material recycling technologies have been developed for magnets, batteries, and fluorescent substances [8, 9]. Neodymium is also recycled as scrap in Japan [10]. However, its recycling from final product waste has not yet been commercialized. To date, various studies have considered the circular economy and substance flow analysis (SFA) of REEs using dynamic models to determine the flow and stock that are effective in estimating the recycling potential. For neodymium, Du and Graedel [11] succeeded in estimating global stocks in 2011, and numerous studies on SFA were conducted in Europe [12], Korea [13], China [14], and Japan [15]. These studies have classified the flow of neodymium worldwide and by region, contributing to the analysis of its recycling potential [16].

In contrast, stock volume alone is not sufficient to assess the commercial potential of material recycling of final product waste. This is because not all the discarded final products can be used. Furthermore, the amount of material that can be recycled is limited. The amount cannot be estimated without analyzing the process by which each final product is treated during final disposal. In practice, the process after the final product has been disposed of is complicated because of multiple domestic and foreign stakeholders (such as collecting, used product trading, dismantling, and recycling contractors) contribute to the process. Clarification of the waste flow among different stakeholders is thus necessary to analyze the potential for material recycling more realistically.

Meanwhile, material recycling can contribute to CO2 reduction because the resources can be obtained without a mining process. Therefore, NdFeB magnets can contribute to CO2 reduction by energy savings, but at the same time, its recycling can reduce CO2 caused by mining and manufacturing. However, a recent study revealed that commercializing recycling from the final product waste may increase the overall production of the final product, which can offset its benefit [17]. This is called the “circular economy rebound” (hereinafter referred to as rebound effect), and it occurs when recycling, which has lower per-unit- CO2 emissions, also causes increased levels of production, decreasing the benefit of CO2 reduction. Therefore, analyzing the rebound effect of the recycling amount, as well as the effect of CO2 reduction, is also necessary to evaluate the true potential of material recycling. This evaluation will be more effective by scenario assessment considering the waste flow and rebound effect based on the future forecast of final product-specific demand and waste volume based on economic and population changes.

Therefore, in this study, a domestic SFA of neodymium was conducted based on the final product REE content, production and sales, import and export, and disposal and sale after disposition. Information was collected from public reports and interviews, and the waste flow was then analyzed in detail. The demand for neodymium was forecasted by the final product until 2050, using various multivariate analysis methods, such as logistic regression analysis and multiple regression analysis. The amount of neodymium waste was also estimated using the SFA results noted above, and medium- to long-term changes in the amount of material that can be recycled were forecasted. Finally, various scenarios considering which final product to recycle and its rebound effect were proposed, and these were comparatively evaluated using the amount of CO2 that can be reduced. The SFA method and future forecast used has been done in past studies, but the novelty of this study lies in the assessment of future scenarios considering the relationship between real recycling potential and the rebound effect. This was achieved by detailed SFA of domestic waste flow. In other words, domestic waste flow between multiple domestic and foreign stakeholders focusing on specific mineral resources has not been taken into consideration in past SFA studies. Therefore, the main novelty/originality is detail analysis of waste flow achieved by original assessment and interviews.

In recent years, to encourage the recycling of REEs, measures are being taken on a global scale involving the creation of international standards for environmentally conscious design of products that are easy to disassemble and separate, and communication of REE contents that are contained within the final products. The results obtained in this study can contribute to creating recycling strategies as well as international standards by realistic evaluation of material recycling potential, which has not yet been studied in the past.

Background

According to the US Geological Survey (USGS) Minerals Commodity Summaries 2019, global REE production was approximately 132,000 tons/year in 2017, which increased to 170,000 REO tons/year in 2018. Notably, China’s share of global production declined from 79% in 2017 to 71% in 2018, whereas production outside of China, such as that in the USA, Myanmar, and Burundi, increased in the same period [18]. Roskill reported that the world REE production was 155,800 REO tons/year in 2017 and 156,800 REO tons/year in 2018. China’s share of global production fell from 85% in 2017 to 80% in 2018, while US production increased, as indicated in the USGS report [19]. Furthermore, neodymium accounted for approximately 18% of all REE produced [19], the production of neodymium increased from 27,480 REO tons/year in 2017 to 27,900 REO tons/year in 2018. The main use of neodymium is as permanent magnet, which is a growing market [19].

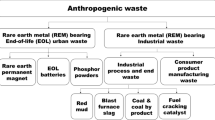

Presently, as there are few industrially applicable REE recycling technologies used for NdFeB rare earth magnets, extensive research on elemental technologies in REE recycling is being conducted [20]. There are three streams for material recycling with respect to NdFeB rare earth magnet recycling: swarf from magnet factories, small magnets from personal computers (PCs) as final product waste, and large magnets from xEVs and home appliances [21]. Of these, the reuse of large magnets is possible if deterioration is not pronounced; otherwise, reuse requires separation and purification steps to extract REE. Scrap generated at magnet factories, such as swarf, is also recycled in process [10]. Separation and purification methods can be broadly divided into pyrometallurgical and hydrometallurgical methods. Hydrometallurgical methods are problematic because they produce large amounts of chemicals and secondary wastewater. However, because they can handle low-grade, more complex systems containing many contaminants, they are suitable for the separation and recovery of REEs from final product waste [9, 21].

Evaluation of the potential of material recycling has been conducted in recent years, especially in Europe, in the form of studies related to the circular economy [22, 23]. Furthermore, a system to clarify the substance flow of critical raw materials (CRM) in final products, mainly in Europe, was discussed by the International Electrotechnical Commission. Several European standards have already been considered in this regard [24]. To clarify, recycling of REEs as well as various mineral resources by SFA is now an international topic of interest.

Method for evaluating the potential of neodymium recycling from final product waste

Considering the above background, this study begins by describing a method for evaluating the feasibility of recycling neodymium materials from final product waste. This method specifically consists of three steps: (1) performing SFA on the production, consumption, and disposal of neodymium in NdFeB magnets, and conducting a detailed flow analysis after disposal to estimate material recycling feasibility by final product; (2) forecasting medium- and long-term demand and waste volume of the final product, and analyzing medium- to long-term changes in the amount of material that can be recycled in the future by combining this with the results of the SFA; and (3) proposing several scenarios considering the target of final product to collect/recycle, and rebound effect. The relationship between the recycle potential and rebound effect is then analyzed by estimating the CO2 reduction of the proposed scenarios based on the results of (1) and (2).

Recently, a part of the final product waste has been drained from Japan to overseas by foreign collectors and recyclers. Therefore, the real potential of material recycling from final products must consider this loss. Moreover, the drive motor for xEVs and PCs uses NdFeB magnets almost exclusively, making it easy for collectors and dismantlers to separate the final waste products. However, if NdFeB magnets are used in home appliances and other industrial motors, communication across different sectors regarding the type of magnet included and REE content in the final product becomes critical. The scenarios in this study quantitatively demonstrate that the amount of neodymium that can be recycled may be increased via various activities including international standards, which accelerate the communication by material declaration for products (i.e., the new International Standard for materials declaration IEC 62474).

Method for domestic substance flow analysis for neodymium

Most of the demand for neodymium in Japan is for use in NdFeB magnets. In the present study, a neodymium SFA for 2018 was performed by estimating the production, consumption, and disposal processes of NdFeB magnets in Japan. Regarding the uncertainty of the neodymium-containing rate in each final product, production, consumption, and waste were estimated with maximum and minimum values.

REE ore mining for NdFeB magnet production

Japan imports rare earth materials such as metals, oxides, compounds, and ferroalloys, with China providing 60% of these, Vietnam 19%, and France 11%. Neodymium is imported along with rare earth metals and ferroalloys. In 2017, the imports of rare earth metals and ferroalloys were 7946 and 1287 tons/year, respectively. In 2017, the demand for didymium (a mixture of neodymium and praseodymium) and neodymium in Japan totaled 3784 tons/year, which are used in permanent magnets, catalysts, glass additives, and other similar products [25]. According to IMARC, the market for Japan’s NdFeB magnets in 2017 was 16,290 tons/year; assuming a molecular weight of 27%, this would constitute a market size of 4398 tons/year for neodymium [26]. According to a report by the Arumu Corp. that publishes data based on Japanese corporate information, the demand for NdFeB magnets was 12,000–13,330 tons/year in 2017, whereas the demand for neodymium was 3240–3600 tons/year [27]. Considering the total demand for didymium and neodymium reported by JOGMEC, most of the neodymium in Japan is used for NdFeB magnets.

NdFeB magnet production usually involves processes such as alloy formation, powder preparation, molding, sintering, processing, surface treatment, and magnetization. Specifically, mined Nd2O3 is dissolved in fluoride-based molten salt (e.g., NdF3-LiF), and then pure liquid Nd is produced by electrolysis. Thereafter, with strip casting, a mixture of Nd, Fe, and B is melted in an induction furnace. The molten substance is then poured over a fast spinning drum. The strip-casted NdFeB flakes are milled, compressed, vacuum-sintered, and sliced into a rough shape, followed by grounding and polishing into a final form, most commonly using the centerless grinding method [28]. Although most NdFeB magnets are manufactured in Japan, everything from mining to electrolysis is performed in countries where the mining occurs. Dissolution is mainly performed in Japan, while grinding and polishing are performed in Japan and Southeast Asia [29]. The average loss rate is estimated to be approximately 15–20% in Japan [28]. NdFeB permanent magnets contain approximately 31–32 wt% of REEs and 27% neodymium [8]. In this study, the SFA from REE mining until magnet production was conducted considering that 12,670–14,670 tons of neodymium were used as NdFeB magnets in 2018 [30].

NdFeB magnets are mainly used in permanent magnet motors for xEVs, wind turbines, home appliances, computers, and many small consumer electronic devices. Based on Japan Electronics and Information Technology Industries Association (JEITA) data [31] that analyzed the equipment using permanent magnets in Japan and a study that involved carrying out SFA on neodymium in Japan [15], in the present study, a number (i) was assigned to each of the categories of the specific final product to be subjected to SFA (where i = 1–10, 1: vehicle conventional motor, 2: xEVs motor, 3: air conditioner (room) motor, 4: air conditioner (building) motor, 5: refrigerator motor, 6: washing machine motor, 7: wind turbine motor, 8: other industrial motor, 9: voice coil motor in hard disk drive (HDD), 10: others. In addition, the amount of neodymium used in the production stage of each final product (Pi) per year was estimated using Eq. (1). In this equation, (γi) is the permanent magnet use rate in the final product, (Ni) ton/unit is the amount of neodymium contained in each final product, and (JPi) unit/year is the production of the final product in 2018 [16].

Table 1 lists the values of γi and Ni used in Eq. (1). These data were collected from interviews with three to four Japanese companies for each final product. The collected data and published data were compared [2, 16, 32}. Because no significant difference was observed, the original data were used.

Moreover, for the production volume of vehicles and home appliances, data from the yearbook of current production statistics by the Ministry of Economy, Trade, and Industry in Japan [33] were used. For wind turbine motors (JP7), the wind power capacity value from the IRENA report [34, 35] with the ratio of direct drive for wind power in Asia estimated to be 27.4%, was used [36]. For other industrial motors (JP8), the value of NdFeB magnets was estimated by subtracting the number of NdFeB magnets used in automotive and home appliances motors from the number of NdFeB magnets used in non-HDD motors (in Japan, 46–50% of NdFeB magnets were used for non-HDD motors [37, 38]). For voice coil motors (JP9), considering that approximately 40% of the world’s HDD production volume [39] is by Japanese companies [40], the NdFeB magnet production volume was estimated based on the assumption that all HDDs produced by Japanese companies use Japanese NdFeB magnets. The category “others” (JP10) was estimated by subtracting (P1–9) from the amount of neodymium used for all NdFeB magnets produced in Japan.

Consumption in final product and disposal

The amount of neodymium in each category of the final product (Ci) tons/year in the consumption (sales) of the final product was estimated using Eq. (2). In this equation, (γi) is the permanent magnet usage rate in the final product, (Ni) tons/unit is the amount of neodymium contained in each final product, and (JCi) unit/year is the consumption of the final product in 2018 [16].

The values shown in Table 1 were used for (γi) and (Ni) in Eq. (2). For the consumption of automobiles and home appliances (JC1–6), data from the yearbook of METI were used [33] in Eq. (1). For wind turbine motors (JC7), the same values as those for JP7 were used, assuming that domestic production and consumption were almost the same. For other industrial motors (JC8), 10 domestic motor companies were interviewed, and the ratio of unit sales to unit motor production in Japan was found to be 68.4%; hence, 0.684 was multiplied by (JC8). For voice coil motors (JC9), the domestic sales volume of PCs in Japan was used [41]. For others (JC10), which was similar to (JC8), (JC10) was multiplied by 0.684.

The amount of neodymium in each category of the final product (Di) per year disposed in 2018 was estimated using a Weibull distribution. Specifically, Eq. (2) was used to obtain the consumption of each final product from 1995 to 2018. Then, consumption and waste amounts were made to conform to the Weibull distribution, allowing the estimation of the annual waste amounts. The Weibull distribution is a continuous probability distribution and is widely used in reliability engineering and other fields because of its versatility and relative simplicity. Recently, it has been used to estimate the annual amount of waste using the shape parameter (m) (also known as the Weibull slope) and scale parameter (η) [15, 42]. In this study, product life and parameters were used from past studies, as shown in Table 2 [15].

However, because the product life and parameter data of the wind turbine motor and other industrial motors are not known, little difference between motors used for automobiles and home appliances was assumed, and thus, the average values were used.

These parameters may change until 2050 owing to lifestyle transitions. However, since large uncertainty can be assumed in this transition, in this study, these parameters are hypothesized to remain unchanged until 2050.

Waste flow of final product

After the final products are discarded, they are treated by used product traders, collectors, dismantlers, recyclers, and scrap companies. Because the government has made the waste flows of automobiles, home appliances, and PCs in public, the waste flow of neodymium is estimated by multiplying (γi) and (Ni) used in Eq. (1).

For conventional waste vehicle motor processes and the ratio of reuse (domestic or overseas) and scrap (domestic or overseas), company reports [43], and the Japan Automobile Recycling Promotion Center data book of 2018 [44] were used. After vehicles are disposed of by consumers, some are sold by used-car dealers both domestically and overseas. The remaining cars are ultimately crushed by chloro-fluorocarbon (CFC) recovery operators and dismantlers, and finally disposed of as end-of-life (EOL) scrap. To find the treatment of vehicle conventional motors after they are disposed, interviews were conducted with 26 domestic vehicle dismantlers (selected from a wide range of companies). As a result, it was revealed that conventional vehicles are not dismantled or traded; thus, neodymium is disposed through the same process as that of scrapped vehicles.

The xEVs are considered the same as that of a normal vehicle until the car is used and then sold (both domestic and overseas) by a used-car dealer, so the same ratio as that of a normal vehicle was used. However, for other xEV motors, 26 domestic dismantlers were interviewed to determine the ratio of reuse (domestic or overseas) and scrap (domestic or overseas) contained in xEV motors that had been dismantled. As a result, each average ratio was reuse (domestic 54%, overseas 15%), and scrap (domestic 3%, overseas 27%).

For home appliances, the ratio of reused products through collectors, recycle shops, or traders (domestic or overseas) to those treated as final product waste by collectors and dismantlers (domestic or overseas) was calculated based on the METI and MOE reports [45].

For voice coil motors of HDDs, the ratio of reused products through collectors, recycle shops, or traders (domestic or overseas) to those treated as final product waste by collectors and dismantlers (domestic or overseas) was calculated based on the METI report [46].

Data regarding the flow of waste for wind turbine motors, other industrial motors, and others could not be obtained. Five domestic dismantlers were interviewed, which revealed that most of these motors were not dismantled and were instead treated as final product waste. In this study, as the ratio of domestic to overseas final product waste that is processed is unknown, all discarded neodymium was assumed to be domestic final product waste.

The estimated ratio of reuse (domestic or overseas) and scrap (domestic or overseas) for each final product based on the above data is shown in Table 3 (“others” includes wind turbine motors, other industrial motors, and others).

Method for future demand forecast of neodymium until 2050

Japanese production and waste by 2050 were forecasted, as described in Method for domestic substance flow analysis for neodymium. The production and waste of neodymium were calculated by multiplying the permanent magnet consumption rate in the final product (γi), and the amount of neodymium contained in each final product (Ni) tons/unit (Table 1) considering the production and waste of the final product. In this section, the forecasting methods are discussed. As described in Section Method for domestic substance flow analysis for neodymium, the future demand and waste were estimated with maximum and minimum values regarding the uncertainty of the neodymium-containing rate in each final product. Moreover, considering the uncertainty of future forecasts, two cases were prepared: (1) a high development case, which reflected a stable increase in production and sales for each final product; and (2) a low development case, which reflected that the increase in production and sales was relatively low compared with the high development case. These forecasts are based on the analysis of past trends using various multivariate analysis methods, such as logistic regression analysis and multiple regression analysis. However, future changes do not always reflect past trends. The introduction of neodymium material recycling may have a rebound effect on the production of final products. Therefore, scenario assessment is necessary, as will be described in Section Method for scenario assessment until 2050.

Vehicles

The level of production and waste of automobiles until 2050 was first determined by predicting future automobile ownership numbers. The ownership numbers per capita were forecasted using a logistic regression model using real GDP [47] in USD/year as variable X. Equation (3) was used to estimate the number of vehicles owned per capita, using (S) and the maximum value of S (Smax). Future automobile ownership numbers were forecasted by multiplying (S) by the population forecasts for Japan [48]. In this equation, (A) and (B) were estimated to be − 2.27 and 1.09 × 10–4, respectively. The F value of the logistic regression model was 2.20 × 10–11, which is lower than the significance level of 0.05. Therefore, the logistic regression model proved to be statistically superior.

(Smax) refers to the population of major age groups by 2050 as obtained from the population statistics of the National Institute of Population and Social Security Research [49]. Because 29% of the Japanese population is either 18 years of age or younger and does not possess a driver’s license or are 80 years of age or older and do not actively drive, in the high development case, these age groups were excluded from the total population; therefore, the remaining 71% of the population was considered. In other words, in Japan, it is assumed that the rate of vehicle ownership increases with an increase in real GDP per capita; hence, one can draw a logistic growth curve to approximate the maximum population that can drive. For low development cases, it is hypothesized that 90% of the population that have a driver's license (64% of the population in 2050) will actively drive.

Moreover, using Eq. (4), the consumption of the final product (JCi) unit/year in year (t) was estimated using (JCi,t), population (POt), and the number of owned vehicles per capita (St). The amount of waste in the final product (Wi,t) was obtained from the Weibull distribution using the parameters listed in Table 2.

The production of the final product (JPi,t) unit/year in year (t) is the value obtained by adding (JEi,t) units/year of exports from Japan to (JCi,t) obtained from Eq. (4). Forecasts of (JEi,t) units/year up to 2050 are based on the number of Japanese automobile exports to 17 major export destinations [50], as well as multiple regression models based on the country’s population [48] and real GDP per capita [46]. While Japan imports cars from overseas, this represented less than 7% of Japan’s total consumption in 2018, and therefore, was not included in this study [51].

Production of xEVs up to 2050 was estimated based on the policies of the METI [52]; xEV sales were assumed to represent 100% of the total vehicle sales by 2035. Therefore, 100% was used for the high and low development cases.

The number of vehicles disposed until 2050, including xEVs, was forecasted using a Weibull distribution curve using the parameters listed in Table 2.

Home appliances

For home appliance consumption, a single regression analysis was applied to forecast the increase and growth rate to forecast the decrease in product consumption by 2050. With increasing room air conditioner consumption [33], future forecasts of high development cases are based on a single regression analysis using Japan’s real GDP projections in the IPCC SRES-B2 scenario [53] and the consumption from 1995 to 2017. For low development cases, using population [48] and household forecast [49] values for Japan until 2050, the consumption of room air conditioners was forecasted to decrease at the same rate as the negative growth rate of households. The building room air conditioners did not show a superior F value in the single regression model. Therefore, it was assumed that there would be no change between the 2018 and 2050 values. With refrigerator and washing machine consumption waning, a single regression analysis that uses real GDP was not found to be realistic. Therefore, refrigerator and washing machine consumption were forecasted to decrease at the same rate as the negative growth rate of households in both cases.

Home appliance production was calculated based on the ratio of imported units to domestic sales. According to the World Trade Atlas, imported products make up a growing proportion of home appliances purchased in Japan. In this study, an approximate value of the ratio of the consumption made up of imports from 1999 to 2017 was obtained, and the logarithmic approximation curve showed the highest determination coefficient R2. Using this approximation, the consumption/import ratio until 2050 was calculated, and the production estimated by multiplying this ratio by the consumption by 2050. The number of units discarded until 2050 was calculated based on the Weibull distribution using the parameters listed in Table 2.

Hard disk drives

HDD production has been declining since 2010 [39]. Therefore, in this study, as with home appliances, HDD production volume was forecasted to decrease at the same rate as the negative growth that has continued since 2010 for both high and low development cases.

HDD consumption was forecasted using PC consumption, as with SFA. Although PC consumption has been declining in recent years, the growth rate has not been constant, and single regression analysis did not indicate superior values. Therefore, the consumption of Japanese PCs was assumed to decrease in proportion to the worldwide production of HDDs, and the same growth rate was forecasted as for HDDs to 2050. The number of units discarded until 2050 was calculated based on the Weibull distribution using the parameters listed in Table 2.

Wind turbine motors, other industrial motors, and others

The forecasts of wind turbine motor production and consumption are believed to be influenced not by the population or GDP trends, but rather by political will. Thus, the wind energy capacity noted in the Stated Policies Scenario of the World Energy Outlook 2019 was used for the forecasts [54] for both high and low development cases.

As with air conditioners, future production and consumption forecasts for other industrial motors are the result of a single regression analysis using the predicted value of Japan’s real GDP in the IPCC SRES-B2 scenario [53] and consumption from 1999 to 2017. The number of units to be discarded until 2050 was estimated based on the Weibull distribution using the parameters listed in Table 2.

For other uses (others), none of the methods mentioned above were considered valid, and as final products using neodymium make up only 0.1% of all such products, the mean value from 1999 to 2017 was assumed to remain unchanged until 2050.

Method for scenario assessment until 2050

Material recycling of neodymium from final product waste contributes to both the expansion of neodymium supply and CO2 reduction. In this study, several scenarios considering which final product to recycle and its rebound effect were proposed to comparatively evaluate the impact of material recycling. This evaluation was performed by estimating the effect of neodymium supply and CO2 reduction under different scenarios.

Remanufacturing NdFeB magnets, which are dismantled and collected from final product waste, is an efficient way to reuse neodymium, but the final product is limited to vehicles and HDD. Moreover, as described in the background, when information on the types of magnets included in final products is communicated between different sectors, according to international standards, the final products except “others” can be separated and dismantled, thus fulfilling the maximum potential of a recycled material.

However, as mentioned in Introduction, material recycling of neodymium from the final product may cause increased levels of production, reducing the benefit of CO2 reduction. Therefore, it is necessary to evaluate the recycling rate, which must be achieved to reduce CO2 under the rebound effect. In this study, this rebound effect is estimated based on the hypothesis that production increases proportionally with the recycling rate using Eq. (5). In this equation, the additional neodymium production (i.e., the rebound effect) for the final product (i) in year (t) is described as (APi,t) in tons/year, which is estimated by multiplying the recycle rate (Ri,t) by the rebound effect coefficient (at). In other words, the rebound effect coefficient (at) describes the ratio of the amount of additional neodymium production (i.e., the rebound effect) to the material recycling rate based on the hypothesis that the rebound effect will increase with the material recycling.

CO2 emissions from the NdFeB magnet were obtained from published data [28]. In this study, a 27.0 kg CO2-eq/kg from NdFeB magnets was used for the CO2 emission from the production, while 3.3 kg CO2-eq/ kg is used for recycling (via hand picking). CO2 reduction is simply estimated by subtracting CO2 emissions (tons/year) with recycling from the CO2 emissions (tons/year) without recycling, using Eq. (6). In this equation, the CO2 reduction (CRt) tons/year is estimated using neodymium production for the final product (Pi,t) tons/year obtained by Eq. (1) and waste neodymium from the final product (Wi,t) tons/year obtained in REE ore mining for NdFeB magnet production. For both production and waste of final products, the average of the maximum and minimum values in the low development case were used.

Meanwhile, CO2 reduction considering the rebound effect (CRRt) tons/year was estimated using neodymium production for the final product (Pi,t) tons/year, additional production (APi,t) tons/year, and waste of the final product considering the additional production (WRi,t) tons/year using Eq. (7).

(CRt) is the potential of CO2 reduction when real CO2 reduction considering the rebound effect is described by (CRRt). In this study, the relationship between the recycling rate and rebound effect is estimated by (Et), using Eq. (8). This equation describes the ratio of the real CO2 reduction to the CO2 reduction potential.

In this study, three scenarios with different final products to recycle and rebound effect coefficients (at) are proposed. To compare the relationship between the recycling rate and rebound effect, Et is estimated for each scenario. The details of the scenarios are shown in Table 4.

Potential of neodymium material recycling from final product waste

Using the methods described in Method for evaluating the potential of neodymium recycling from final product waste, the results of Japan’s domestic SFA on neodymium in 2018 are described in this section. In addition, by forecasting future neodymium production and waste until 2050, the results of the analysis of how domestic substances flow will change are detailed. These results are then used to describe the evaluation of the rebound effect for various scenarios. Finally, the results of the neodymium recycling rate and CO2 reduction considering the rebound effect are described.

Domestic substance flow analysis of neodymium

Figure 1 shows the results of Japan’s domestic SFA on neodymium in 2018, based on the methods described in Method for domestic substance flow analysis for neodymium. The minimum and maximum values of the final product production, consumption, and waste are shown in Table 1.

Currently, documentation is not available that comprehensively discloses the percentage of final products that use NdFeB magnets produced in Japan. However, from the review of past materials [37, 38], it was determined that for the minimum and maximum values mentioned above, the maximum values were the closest to the actual values. As such, in the SFA shown in Fig. 1, the maximum values for high development cases are indicated for home appliances, HDD, and wind turbine motor production, consumption, and waste.

Moreover, with regard to “Flow 1” and “Flow 2” in the waste flow, the composition of final products is shown in Figs. 2a, b.

Figure 1 shows that the amount of neodymium in the production of the final product is 3605 tons/year. The combined use of conventional vehicles and xEVs is 1,520 tons/year, which accounts for the largest proportion.

Figures 1, 2a show that the amount of neodymium reused as final products is 573–587 tons/year in 2018, of which 49% is based on conventional vehicles and xEVs. The results of this study revealed that the laws in Japan that promote the recycling of vehicles, home appliances, and PCs are effectively implemented; as a result, most of these final products are reused.

Moreover, Figs. 1, 2b show that 655 tons/year of post-dismantling scrap neodymium is generated in 2018. Approximately 47% of this was found to be made up of “other industrial motors,” “others,” and “wind turbines,” products for which motors cannot be easily removed and NdFeB magnets cannot be separated.

NdFeB magnets are used for all xEVs motors and HDDs. Therefore, collectors and dismantlers can easily separate the final product using NdFeB magnets. Furthermore, when information on the types of magnets included in the final product is communicated between different sectors, according to international standards, it becomes feasible to separate and disassemble all remaining final products except “others.” This results in the increase in material recycling rate in Flow 2 from 13% (xEVs motors and HDD) to 89% (all final products except “others”).

Future production and waste forecast of neodymium until 2050

Figures 3 shows final product waste forecast for neodymium until 2050 based on the methods described in Method for future demand forecast of neodymium until 2050. The maximum and minimum values were estimated for both figures regarding the data uncertainty, but only the maximum value is shown.

From the estimation, the amount of neodymium used in the production of the final product will increase until 2050. Although there is a decrease in neodymium usage in conventional vehicles, home appliances, and HDDs, the increased usage of xEVs and other industrial motors will compensate for this, resulting in an increase of 6801 tons/year for high development (maximum) cases, and 6469 tons/year for low development (maximum) cases by 2050. For both cases, the main usage of neodymium in 2050 is assumed to be xEVs (65–67%), other industrial motors (15–16%), and conventional vehicles (10%). As shown in Fig. 3, by 2050, the amount of neodymium in the waste from the final product will increase to 4217 tons/year for the high development case, and 3,866 tons/year for the low development case; xEVs (72–82%), conventional vehicles (9–11%), air conditioners (11–12%), and other industrial motors (21%) will account for 91%. These results reveal that fulfilling the Japanese demand for neodymium using primary resources alone will be difficult in 2050, considering that the production of neodymium was 27,900 REO tons/year in 2018, and that China is the main consumer in the world. Therefore, material recycling of neodymium from xEVs will be extremely important, which will cover 72%-82% of the waste from final product, and at the same time, material recycling from other industrial motors will also be important since it covers 21% of waste.

Scenario assessment of neodymium recycling and CO2 reduction

As described in Method for scenario assessment until 2050, the ratio of real CO2 reduction to the CO2 reduction potential of neodymium recycling (Et) is estimated for the three scenarios defined in Table 4. The results of Et by the three different maximum recycle rates (0.3, 0.6, and 0.9) in 2050 is shown in Fig. 4. The maximum recycling rate in 2050 indicates that recycling starts from 2020, and the recycling rate will increase linearly until 2050 up to the maximum value.

As a result, Et is assumed to decrease at the beginning of recycling until 2023–2025. However, after this decrease, Et is assumed to increase until 2050. This tendency was the same for the three scenarios. The reason for this tendency is that the influence of the rebound effect on CO2 reduction will be larger than the benefit of neodymium recycling at the beginning of the process. This indicates that the benefit of CO2 reduction will not increase unless the recycling rate will be larger than a certain amount if the rebound effect occurs. Figure 4 shows the level of recycle rate that must be achieved to reduce CO2 under the rebound effect.

By comparing the (Et) of scenarios 1 and 2, (Et) of scenario 2 starts to increase from 2023, whereas scenario 1 starts from 2025. This may be because the final products to collect/recycle in scenario 2 are much larger than those in scenario 1. However, the maximum value of Et in 2050 for scenario 2 is smaller than that in scenario 1. This is also the influence of the rebound effect, which reduces the benefit of CO2 reduction. This tendency can be observed by comparing the Et values of scenarios 1 and 3. (Et) of Scenario 3 was smaller than that of Scenario 1 because of the higher rebound effect coefficient (at).

Conclusion

In this study, a domestic SFA of neodymium was performed, and this process was analyzed in detail after the disposal of various products. The final product-specific neodymium production and waste until 2050 were also forecasted. The results were combined with the SFA results to predict the amount of neodymium that can be recycled over the medium- to long-term. Finally, several scenarios were proposed, and the relationship between the target of the final product and the collect/recycle and rebound effects were evaluated. As a result, 1317 tons/year of neodymium disposed as a final product in 2018 was assumed to increase to 3866–4217 tons/year by 2050. From the scenario assessment, the influence of the rebound effect clarified that the benefit of CO2 reduction will not increase unless the recycling rate is large.

The results of the study showed that the recycling capacity varies according to international standards, but the rebound effect must be considered. This study is expected to contribute significantly to the establishment of relevant recycling strategies and international standards in the future.

However, the limitations of this study are the uncertainties that lie in the SFA, future forecast, and rebound effect. Future research should propose a suitable method to solve these uncertainties. Further, economic/social system evaluations and legislation are also important in the actual implementation of material recycling. Moving forward, developing a methodology for comprehensively evaluating such issues will contribute to the realization of neodymium recycling.

References

Sagawa M, Fujimura S, Togawa N, Yamamoto H, Matsuura Y (1984) New material for permanent magnets on a base of Nd and Fe. J Appl Phys 55(6):2083–2087. https://doi.org/10.1063/1.333572

Yang Y, Walton A, Sheridan R et al (2017) REE recovery from end-of-life NdFeB permanent magnet scrap: a critical review. J Sustain Met 3(1):122–149. https://doi.org/10.1007/s40831-016-0090-4

United Nations (2015) Paris agreement. https://unfccc.int/sites/default/files/english_paris_agreement.pdf. Accessed 5 Aug 2016

Moss R, Tzimas E, Willis P, Arendorf J, Thompson P, Chapman A, Morley N, Sims E, Bryson R, Peason J, Tercero-Espinoza L, Sartorius C, Ostertag K (2013) Critical metals in the path towards the decarbonisation of the EU energy sector. Assessing rare metals as supply-chain bottlenecks in low-carbon energy technologies, p. 242 (JRC. Report EUR 25994 EN). https://setis.ec.europa.eu/sites/default/files/reports/JRC-report-Critical-Metals-Energy-Sector.pdf. Accessed 8 Apr 2018

Binnemans K, Jones PT (2015) Rare earths and the balance problem. J Sustain Met 1(1):29–38. https://doi.org/10.1007/s40831-014-0005-1

Hitachi Ltd (2010) Hitachi develops recycling technologies for rare earth metals. http://www.hitachi.com/New/cnews/101206.html. Accessed 2 Jan 2017

Aarden SG (2012) Improving reuse recycling. TNO, Delft, The Netherlands. https://cmi.ameslab.gov/research/improving-reuse-recycling. Accessed 5 Sept 2018

Yang Y, Walton A, Sheridan R, Güth K, Gauß R, Gutfleisch O, Buchert M, Steenari B-M, Van Gerven T, Jones PT, Binnemans K (2016) REE recovery from end-of-life NdFeB permanent magnet scrap: a critical review. J Sustain Met. https://doi.org/10.1007/s40831-016-0090-4

Binnemans K, Jones PT, Blanpain B, Gerven TV, Pontikes Y (2013) Towards zero-waste valorisation of rare-earth-containing industrial process residues: a critical review. J Clean Prod 99:17–38. https://doi.org/10.1016/j.jclepro.2015.02.089

Tanaka M, Oki T, Koyama K, Narita H, Oishi T (2013) Recycling of rare earths from scrap. In: Bunzuli JCG, Pecharsky VK (eds) Handbook on the physics and Chemstry of rare earths 43. Elsivier, Amsterdam, pp 159–211 (Chapter 255)

Du X, Graedel TE (2011) Global rare earth stocks in NdFeB permanent magnets. J Ind Ecol 15(6):836–843. https://doi.org/10.1111/j.1530-9290.2011.00362.x

Guyonnet D, Planchon M, Rollat A, Escalon V, Tuduri J, Charles N, Vaxelaire S, Dubois D, Fargier H (2015) Material flow analysis applied to rare earth elements in Europe. J Clean Prod 107:215–228. https://doi.org/10.1016/j.jclepro.2015.04.123

Swain B, Kang L, Mishra C, Ahn J, Hong HS (2015) Materials flow analysis of neodymium, status of rare earth metal in the Republic of Korea. Waste Manage 45:351–360. https://doi.org/10.1016/j.wasman.2015.07.020

Chen W, Nie Z, Wang Z, Gong X, Sun B, Gao F, Liu Y (2018) Substance flow analysis of neodymium based on the generalized entropy in China. Resour Conserv Recycl 133:438–443. https://doi.org/10.1016/j.resconrec.2018.02.019

Sekine N, Daigo I, Goto Y (2016) Dynamic substance flow analysis of neodymium and dysprosium associated with neodymium magnets in Japan. J Ind Ecol. https://doi.org/10.1111/jiec.12458

Morimoto S, Sanematsu K, Ozaki K, Ozawa A, Seo Y (2019) Methodological study of evaluating the traceability of neodymium based on the global substance flow analysis and Monte Carlo simulation. Resour Policy 63:101448. https://doi.org/10.1016/j.resourpol.2019.101448

Zink T, Geyer R (2017) Circular economy rebound. J Ind Ecol 21(3):593–602. https://doi.org/10.1111/jiec.12545

US Geological Survey (USGS) (2019) Mineral commodity summaries. https://www.usgs.gov/centers/nmic/mineral-commodity-summaries. Accessed 19 Oct 2019

Roskill (2018) Rare earths: global industry, markets and outlook. Roskill information services Ltd

Tunsu C, Petranikova M, Gergoric M, Ekberg C, Retegan T (2015) Reclaiming rare earth elements from end-of-life products: a review of the perspectives for urban mining using hydrometallurgical unit operations. Hydrometallurgy 156:239–258. https://doi.org/10.1016/j.hydromet.2015.06.007

Xie F, Zhang TA, Dreisinger D, Doyle F (2014) A critical review on solvent extraction of rare earths from aqueous solutions. Miner Eng 56:10–28. https://doi.org/10.1016/j.mineng.2013.10.021

Joint Research Centre (2017) Critical raw materials and the circular economy, JRC science for policy report, EUR 28832 EN. https://publications.jrc.ec.europa.eu/repository/bitstream/JRC108710/jrc108710-pdf-21-12-2017_final.pdf. Accessed 14 Nov 2019

Joint Research Centre (2018) Towards recycling indicators based on eu flows and raw materials system analysis data, JRC technical report. , EUR, p. 29435 EN. https://publications.jrc.ec.europa.eu/repository/bitstream/JRC112720/kj-na-29435-en-n_recycling_report.pdf. Accessed 14 Nov 2019

Cormenier T, Patra M, Garnier C (2018) European CEN-CENELEC standardization on material efficiency for longer lifespan within the circular economy. ELTEEE. https://doi.org/10.13140/RG.2.2.14218.11206

Japan oil, gas and Metals National Corporation (JOGMEC) (2019) Mineral resource material flow 2018. JOGMEC. http://mric.jogmec.go.jp/wp-content/uploads/2019/03/material_flow2018.pdf. Accessed 11 Dec 2019

IMARC group (2017) Global magnet market report. Industry trend, magnet types, major market, manufacturing and applications, 2016th edn. IMARC Services Private Limited

Arumu Corp (2018) Kogyo Reametaru. Arumu Corporation

Sprecher B, Xiao Y, Walton A, Speight J, Harris R, Kleijn R, Visser G, Kramer GJ (2014) Life cycle inventory of the production of rare earths and the subsequent production of NdFeB rare earth permanent magnets. Environ Sci Technol 48(7):3951–3958. https://doi.org/10.1021/es404596q

Clean Japan Center (CRC) (2009) Siyouzumi seihin karano neojimujisyaku no kaisyu risaikuru sisutemu ni kansuru chyousa kenkyu. https://hojo.keirin-autorace.or.jp/seikabutu/seika/20nx_/bhu_/Folder_1/20-113-koho-01.pdf. Accessed 14 Nov 2010

Arumu Corp (2019) Kogyo Reametaru. Arumu Corporation

Japan electronics and information technology industries association (JEITA) (2009) Eikyu Jisyaku renkan hyo, 4th edn. JEITA

Zhou B, Li Z, Chen C (2017) Global potential of rare earth resources and rare earth demand from clean technologies. Minerals 7(11):203. https://doi.org/10.3390/min7110203

Ministry of Economy, Trade and Industry (METI) Japan (2019) Yearbook of current production statistics. http://www.meti.go.jp/english/statistics/index.html. Accessed 3 Oct 2019

International Renewable Energy Agency (2019) Renewable energy statistics 2019. https://www.irena.org/publications/2019/Jul/Renewable-energy-statistics-2019. Accessed 12 June 2019

Mizuno E (2014) Overview of wind energy policy and development in Japan. Renew Sustain Energy Rev. https://doi.org/10.1016/j.rser.2014.07.184

Hernández CV et al (2017) JRC wind energy status report, JRC Science for Policy Report 2016 edition. https://setis.ec.europa.eu/sites/default/files/reports/wind_energy_status_report_2016.pdf. Accessed 5 Oct 2019

Doi Y (2011) Neojimu shyoketsu jisyaku no kaihatsu douko. In: Proceeding from 19th Advanced electronics and mechatronic devices an components exhibition and symposium

Harimoto D et al. (2007) Development of high performance Nd-Fe-B sintered magnets, Hitachi metals technical review 23, (69–72). https://ci.nii.ac.jp/naid/40015365515. Accessed 5 Oct 2019

The international disk drive equipment and materials association Japan (2019) IDEMA Japan news. http://www.idema.gr.jp/common/pdf/news/tenbo2019.pdf. Accessed 5 Dec 2019

Kamijo H (2014) Dendojidousyakanrenbuzai no reametarusiyoujittai. JOGMEC. http://mric.jogmec.go.jp/public/kouenkai/2014-08/briefing_140829_02.pdf. Accessed 29 Nov 2019

Japan electronics and information technology industries association (JEITA) (2018) Domestic personal computer sales statistics. https://www.jeita.or.jp/japanese/stat/pc/2016/. Accessed 29 Nov 2019

Yuya N (2017) CO2 reduction potentials through the market expansion and lifetime extension of used cars. J Econ Struct 6(1). https://doi.org/10.1186/s40008-017-0080-0

Fujii K. (2017) Jidousya risaikuru no genjyo. ARC report (RS-2021). https://arc.asahi-kasei.co.jp/report/arc_report/pdf/rs-1021.pdf. Accessed 12 Oct 2018

Japan Automobile Recycling Promotion Center (JARPC) (2019) Automobile recycle data book 2018. https://www.jarc.or.jp/data/databook/ . Accessed 29 Nov 2019

Ministry of Economy, Trade and Industry (METI) and Ministry of the Environment (MOE) Japan (2018) Kaden risaikuluhou ni motoduku risaikuru no jissijyoukyounitsuite. https://www.env.go.jp/council/03recycle/y032-37/mat02.pdf. Accessed 5 Nov 2019

Ministry of Economy, Trade and Industry (METI) Japan (2012) Reametaru no risaikuru wo torimaku jyoukyounitsuite. http://www.env.go.jp/council/former2013/03haiki/y0326-07/mat03.pdf. Accessed 4 Feb 2019

OECD (2019) OECD data, Real GDP long-term forecast. https://data.oecd.org/gdp/real-gdp-long-term-forecast.html. Accessed 23 May 2019

United Nations (2019) World population prospects 2019. Department of economics and social affairs population dynamics. United Nations. https://population.un.org/wpp/Download/Standard/Population/. Accessed 23 May 2019

National Institute of Population and Social Security Research (2019) Population and social security in Japan. ISSN: 2186–0297 IPSS Research Report Number 85. http://www.ipss.go.jp/s-info/e/pssj/pssj2019.pdf. Accessed 6 Aug 2018

Japan automobile manufactures association, Inc (2019) Active Matrix Database System. http://jamaserv.jama.or.jp/newdb/eng/index.html. Accessed 12 Aug 2018

Shinichirou M, Yanfei C, Norio M, Kiyotaka T (2020) Methodological study of evaluating future lightweight vehicle scenarios and CO2 reduction based on life cycle assessment. Sustainability 12(14):5713. https://doi.org/10.3390/su12145713

The Japan Times. Japan plans to ban sales of new gasoline cars in mid-2030s (2020). https://www.japantimes.co.jp/news/2020/12/03/business/economy-business/japan-gasoline-cars-ban/. Accessed 20 Jan 2021

Intergovernmental Panel on Climate Change (2000) Emission scenarios. https://www.ipcc.ch/site/assets/uploads/2018/03/emissions_scenarios-1.pdf. Accessed 1 June 2011

International Energy Agency (2019) World energy outlook2019. https://www.iea.org/reports/world-energy-outlook-2019. Accessed 10 Jan 2020

Acknowledgements

This study was supported by a project commissioned by the New Energy and Industrial Technology Development Organization.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Morimoto, S., Kuroki, H., Narita, H. et al. Scenario assessment of neodymium recycling in Japan based on substance flow analysis and future demand forecast. J Mater Cycles Waste Manag 23, 2120–2132 (2021). https://doi.org/10.1007/s10163-021-01277-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10163-021-01277-6